FEDERAL COURT OF AUSTRALIA

Scott (Trustee), in the matter of Stolyar (Bankrupt) v Stolyar [2022] FCA 691

ORDERS

ANDREW SCOTT IN HIS CAPACITY AS THE TRUSTEE OF THE BANKRUPT ESTATES OF IAN STOLYAR AND BETH NGOC NGUYEN Applicant | ||

AND: | Respondent | |

DATE OF ORDER: | 16 June 2022 |

THE COURT ORDERS THAT:

1. By 14 July 2022 the parties are to confer and provide draft orders to the Associate to Markovic J giving effect to these reasons including in relation to the question of costs of the proceeding.

2. If the parties cannot agree on the form of proposed orders as contemplated by Order 1:

(a) by 14 July 2022 they are each to provide the Associate to Markovic J with a form of proposed orders giving effect to these reasons including in relation to the question of costs and submissions, not exceeding 10 pages in length; and

(b) the proceeding will be listed on a mutually convenient date for case management hearing in order to resolve the form of orders.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

[4] | |

[8] | |

[8] | |

[19] | |

[26] | |

[26] | |

[42] | |

[47] | |

4.1 The respondents, Ian, Beth, entities related to them and other relevant events | [48] |

[48] | |

[65] | |

[79] | |

[81] | |

[83] | |

[85] | |

[86] | |

[89] | |

[92] | |

[93] | |

4.2 2001–2003: Ian, Beth and Bethian purchase and sell various properties | [96] |

[96] | |

[107] | |

[112] | |

[112] | |

[119] | |

[128] | |

[135] | |

[165] | |

[166] | |

[168] | |

[176] | |

[197] | |

[200] | |

[201] | |

5.2.2 A balcony off the living room? A double garage or a car stacker? | [221] |

[226] | |

[247] | |

[248] | |

[264] | |

[279] | |

[280] | |

[290] | |

[293] | |

5.3.2 Did Faina give any consideration for the transfer of 11/2 Ocean Street? | [299] |

[306] | |

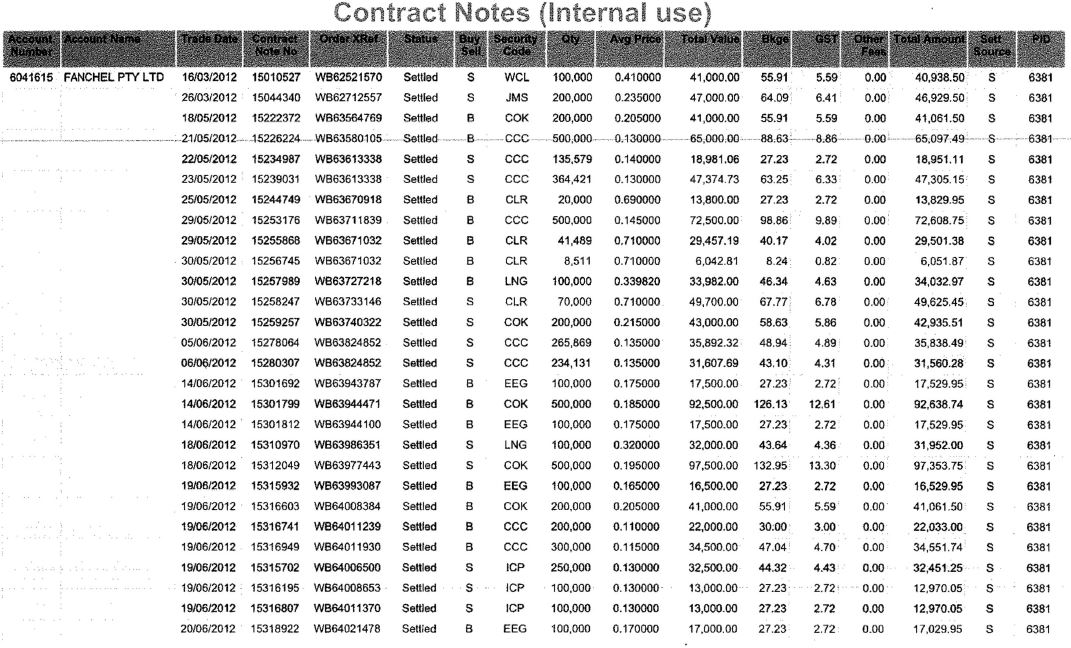

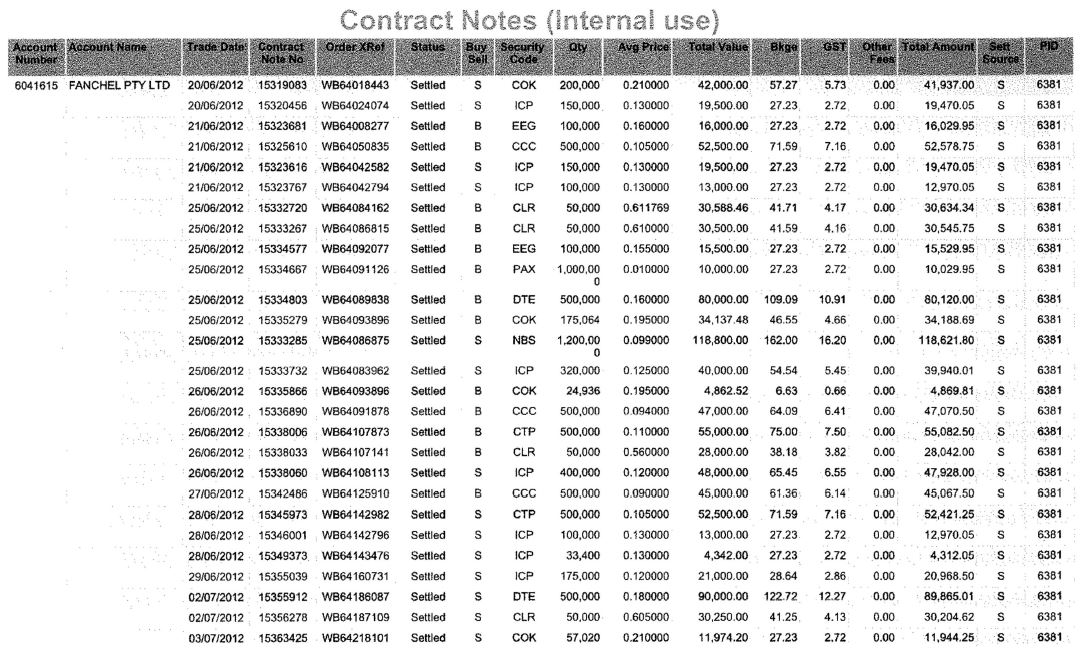

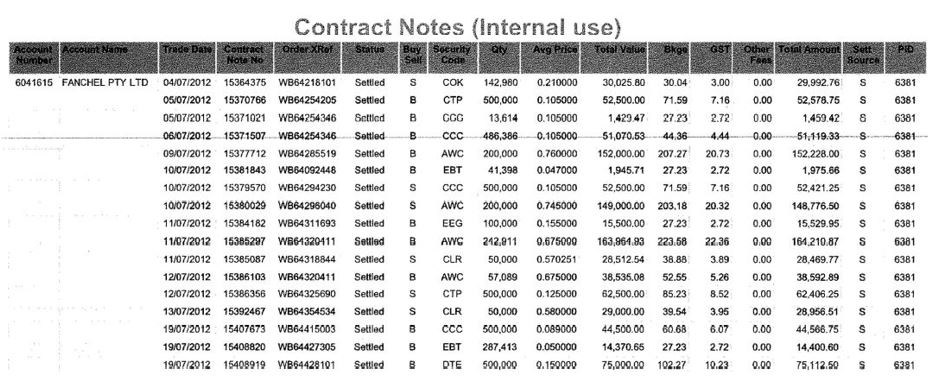

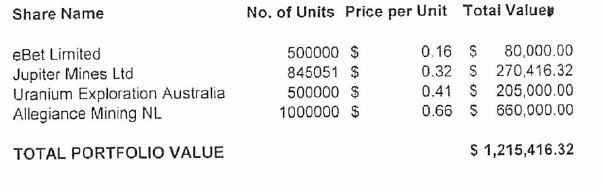

5.4 The Transferred Shares, the Share Arrangement and the Loan Adjustment | [308] |

[316] | |

[330] | |

[330] | |

[363] | |

[395] | |

[415] | |

5.5.1 Ian and Faina’s evidence about the purchase of the Point Piper Property | [416] |

5.5.2 The grant of a mortgage to Faina over the Point Piper Property | [450] |

[462] | |

[465] | |

[499] | |

[502] | |

[504] | |

[512] | |

[513] | |

[515] | |

5.6.3.2 Were the May Deposits loans to Ian and Beth or Beth? | [558] |

[566] | |

[568] | |

[578] | |

[583] | |

[583] | |

[587] | |

[598] |

REASONS FOR JUDGMENT

MARKOVIC J:

1 The applicant, Andrew Scott, is the trustee in bankruptcy (Trustee) of the estates of Ian Stolyar and Beth Nguyen (also known as Beth Stolyar). They married on 24 December 2001. Without intending any disrespect and for ease I will refer to Ian Stolyar and Beth Stolyar as Ian and Beth respectively. Ian and Beth became bankrupt on 29 September 2016. The commencement of their bankruptcies is 3 October 2014.

2 The first respondent, Faina Stolyar (who without intending any disrespect and for ease, I will refer to in these reasons as Faina) is Ian’s mother. The second respondent, Fanchel Pty Ltd, is a company of which Faina is the sole director and shareholder. I will refer to Faina and Fanchel collectively as the respondents.

3 The Trustee seeks to recover several properties, or interests in those properties, that he contends are held by the respondents on trust for Ian or Ian and Beth, or otherwise have been transferred by them in a manner that is void against the Trustee as a result of transactions entered into between 2007 and 2015. The Trustee also makes a monetary claim against Faina on the basis that she received a transfer of property (being a chose in action) that is rendered void by s 120 and/or s 121 of the Bankruptcy Act 1966 (Cth).

1. A summary of the Trustee’s claim

4 The Trustee’s claim is set out in his further amended originating application filed on 20 April 2021 and his amended statement of claim filed on 23 March 2021. The Trustee seeks relief in relation to the following five transactions:

(1) the acquisition by Faina of:

(a) the property known as 27/26 Ocean Street North Bondi, New South Wales being folio reference 27/SP74191 (27/26 Ocean Street) on 20 July 2007;

(b) the property known as 701/152-162 Campbell Parade, Bondi Beach, New South Wales being folio reference 27/SP81899 (Campbell Parade Property) on 18 May 2009;

(c) the property known as 11/2 Ocean Street, Bondi, New South Wales being folio reference 11/SP9328 (11/2 Ocean Street) on 20 March 2013; and

(d) the property known as 2C Dumaresq Road, Rose Bay, New South Wales being folio reference A/33652 (Rose Bay Property) on 18 May 2015; and

(2) adjustments to Ian and Faina’s loan accounts with Fanchel or, in the alternative, in relation to the transfer or payment to Faina of the proceeds of sale of three parcels of shares.

5 More particularly the Trustee seeks the following relief:

(1) a declaration that Faina holds the legal title to 27/26 Ocean Street on trust for the Trustee either as to the whole or, in the alternative, in respect of such portion as equals the proportion of its total purchase price which was provided by Ian and Beth or Ian (as the case may be) and related orders for the transfer of its legal title to the Trustee and for an accounting of any profits earned on it to the Trustee;

(2) a declaration that Faina holds the legal title to the Campbell Parade Property on trust for the Trustee as to the whole or, in the alternative, in respect of such portion as equals the proportion of its total purchase price which was provided by Ian and Beth or Ian (as the case may be) and related orders for the transfer of its legal title to the Trustee and for an accounting of the relevant proportion of any profits earned on it to the Trustee;

(3) in relation to 11/2 Ocean Street:

(a) a declaration that Faina holds its legal title on trust for the Trustee and related orders for the transfer of its legal title to the Trustee and an accounting of any profits earned by Faina on the property to the Trustee; or

(b) in the alternative, a declaration that its transfer by Ian to Faina is void against the Trustee and an order that Faina transfer the legal title of that property to the Trustee;

(4) in relation to the changes to Faina’s and Ian’s loan accounts with Fanchel:

(a) a declaration that the acceptance by Fanchel of an additional indebtedness of $8,328,159 to Faina (Additional Receivable) effected by way of entry into Fanchel’s books in or about mid November 2013 is taken to be a transfer of that receivable from Ian to Faina and is void against the Trustee; a declaration that to the extent the Additional Receivable remains outstanding it is owed to the Trustee and not to Faina; and an order for the tracing of any payments received by Faina in respect of the Additional Receivable; or

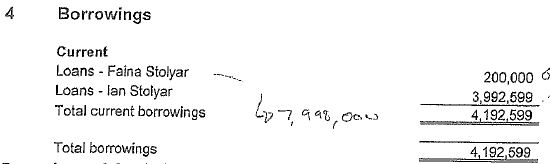

(b) in the alternative, a declaration that the forgiveness of Fanchel’s indebtedness to Faina in the amount of $3,992,559 as effected by way of entry into Fanchel’s books in or about mid November 2013 is void against the Trustee and an order that Fanchel pay the Trustee $3,992,559 and interest pursuant to s 51A(1)(a) of the Federal Court of Australia Act 1976 (Cth) from the filing of the amended application on 5 November 2019 until the date of judgment or earlier payment;

(5) in the alternative to (4) above:

(a) a declaration that the transfer by Ian of the proceeds of sale of shares in Westside Corporation Ltd (WCL) to Faina on or about 29 and 30 September 2014 is void as against the Trustee and an order that Faina pay the Trustee $523,285.20;

(b) an order that the respondents jointly and severally pay the proceeds of sale of shares in eBet Limited totalling $3,537,340.95 (eBet Proceeds) to the Trustee and interest pursuant to s 51A(1)(a) of the Federal Court Act on that amount from 16 December 2016 to the date of judgment or earlier payment or, in the alternative, an order that Fanchel pay the eBet Proceeds to the Trustee and interest on that sum pursuant to s 51A(1)(a) of the Federal Court Act from 16 December 2016 to the date of judgment or earlier payment;

(c) an order that Fanchel account to the Trustee in respect of the proceeds of sale of shares in Gullewa Ltd (GUL) and interest on that sum pursuant to s 51A(1)(a) of the Federal Court Act from 14 September 2018 to the date of judgment or earlier payment or, in the alternative, an order that Fanchel pay to the Trustee the proceeds of sale of shares in GUL and interest on that sum pursuant to s 51A(1)(a) of the Federal Court Act from 14 September 2018 to the date of judgment or earlier payment;

(6) in relation to the Rose Bay Property:

(a) a declaration that Faina held the legal title to the Rose Bay Property on trust for the Trustee in the proportion equal to the proportion of its total purchase price which was provided by Ian and Beth (or Ian and Beth and Beth, as the case may be) and related orders that Faina account to the Trustee for the applicable proportion of profits earned by her from the Rose Bay Property, if any; an order that Faina pay to the Trustee the said proportion of the sale proceeds of the Rose Bay Property and interest pursuant to s 51A(1)(a) of the Federal Court Act from 29 April 2020 until the date of judgment or earlier payment; and a declaration that the obligation to pay the proportion of the profits earned by her is secured by charge upon the property known as 3/10 Longworth Avenue, Point Piper, New South Wales (Longworth Avenue Property); and

(b) in addition, an order that Faina pay the Trustee $332,500 and interest pursuant to s 51A(1)(a) of the Federal Court Act from 19 December 2013 or such other date as the Court sees fit until the date of judgment or earlier repayment;

(7) in the alternative to the relief in (6) above:

(a) in relation to the contribution by Ian and Beth to the purchase of the Rose Bay Property, a declaration that their contribution is void against the Trustee, an order that Faina pay $3,932,000 to the Trustee and, in respect of $3.6 million of that sum, interest upon it pursuant to s 51A(1)(a) of the Federal Court Act from the filing of the amended application until the date of judgment or earlier payment, a declaration that the Longworth Avenue Property is subject to an equitable charge securing payment of the amount payable to the Trustee; and

(b) in respect of the remaining $332,500 and interest pursuant to s 51A(1)(a) of the Federal Court Act from the 19 December 2013 or such other date as the Court sees fit until the date of judgment or earlier payment;

(8) in the further alternative to (6), to the extent it relates to the sum of $3.6 million, and (7) above, an order that Faina pay the Trustee $3,932,000 and interest pursuant to s 51A(1)(a) of the Federal Court Act from 19 December 2013 until the date of judgment or earlier payment;

(9) in the further alternative to (6), to the extent it relates to the sum of $3.6 million, (7) and (8) above:

(a) a declaration that the payment of $3,932,500 to Faina from the sale proceeds of 5/6 Buckhurst Avenue, Point Piper, New South Wales (Point Piper Property) is void against the Trustee;

(b) an order that Faina pay $3,932,500 to the Trustee and interest pursuant to 51A(1)(a) of the Federal Court Act from the filing of the amended application until the date of judgment or earlier repayment; and

(c) declarations that the Campbell Parade Property and the Longworth Avenue Property are subject to equitable charges securing the payment of the amount payable to the Trustee (or, in the alternative, so much of the said $3,932,500 paid to Faina as is held to have been applied towards each of those properties);

(10) in relation to the May Deposits (see [502(2)] below) and in the alternative to (6) above, an order that Faina pay the Trustee $760,002.97 and interest pursuant to s 51A(1)(a) of the Federal Court Act from 11 May 2015 until the date of judgment or earlier repayment; and

(11) in the further alternative to (6) and (10) above:

(a) a declaration that the payment of the May Deposits to Faina at the direction of Ian and Beth (or in the alternative Beth) is void against the Trustee;

(b) an order that Faina pay the Trustee $760,002.97 and interest pursuant to s 51A(1)(a) of the Federal Court Act from the date of filing of the amended application until the date of judgment or earlier repayment; and

(c) a declaration that the Longworth Avenue Property is subject to an equitable charge securing the payment of the amount payable to the Trustee (including interest).

6 The factual background to the Trustee’s claim is detailed, spanning events over a lengthy period and numerous transactions. However, at its simplest, the claim can be summarised as follows:

(1) between 2007 and 2015, Ian and Beth went from being wealthy property owners and share investors, at one stage holding well over $10 million in net assets, to being bankrupt, with no material explanation for the loss of that wealth;

(2) conversely, during that same period Faina went from being an unemployed widow living on a pension to owning a substantial property portfolio and, via Fanchel, a substantial share portfolio;

(3) the Trustee contends that the drastic changes in wealth are attributable to Ian and Beth transferring their wealth into assets held in Faina’s name. It is those assets that he now seeks to recover; and

(4) the respondents deny that to be so, and claim that Faina’s wealth has grown out of her own resources.

7 Despite the simplicity of the summary set out above, the Trustee’s case is, at least at a factual level, far from simple. As I have already observed the transactions in question took place over a lengthy period and it has been necessary both for the Trustee, to attempt to make good his claims, and for the Court, to consider the claims, to review a large volume of material. Before proceeding to do so it is convenient to set out the applicable statutory framework and legal principles on which the Trustee relies.

2. Statutory framework and legal principles

2.1 Void transactions and resulting trusts

8 The Trustee seeks relief in relation to the five transactions identified above either because each transaction is void against him pursuant to s 120 or s 121 of the Bankruptcy Act or on the basis that each asset or a proportion of it, based on the contribution to its acquisition by Ian or Ian and Beth, is held on a resulting trust for him or, in one case, on an express trust.

9 Section 120 of the Bankruptcy Act concerns undervalued transactions it relevantly provides:

Transfers that are void against trustee

(1) A transfer of property by a person who later becomes a bankrupt (the transferor) to another person (the transferee) is void against the trustee in the transferor’s bankruptcy if:

(a) the transfer took place in the period beginning 5 years before the commencement of the bankruptcy and ending on the date of the bankruptcy; and

(b) the transferee gave no consideration for the transfer or gave consideration of less value than the market value of the property.

…

(3) Despite subsection (1), a transfer is not void against the trustee if:

(a) in the case of a transfer to a related entity of the transferor:

(i) the transfer took place more than 4 years before the commencement of the bankruptcy; and

(ii) the transferee proves that, at the time of the transfer, the transferor was solvent; or

(b) in any other case:

(i) the transfer took place more than 2 years before the commencement of the bankruptcy; and

(ii) the transferee proves that, at the time of the transfer, the transferor was solvent.

…

(7) For the purposes of this section:

(a) transfer of property includes a payment of money; and

(b) a person who does something that results in another person becoming the owner of property that did not previously exist is taken to have transferred the property to the other person; and

(c) the market value of property transferred is its market value at the time of the transfer.

10 Section 121 of the Bankruptcy Act concerns transfers to defeat creditors. It relevantly provides:

Transfers that are void

(1) A transfer of property by a person who later becomes a bankrupt (the transferor) to another person (the transferee) is void against the trustee in the transferor’s bankruptcy if:

(a) the property would probably have become part of the transferor’s estate or would probably have been available to creditors if the property had not been transferred; and

(b) the transferor’s main purpose in making the transfer was:

(i) to prevent the transferred property from becoming divisible among the transferor’s creditors; or

(ii) to hinder or delay the process of making property available for division among the transferor’s creditors.

Showing the transferor’s main purpose in making a transfer

(2) The transferor’s main purpose in making the transfer is taken to be the purpose described in paragraph (1)(b) if it can reasonably be inferred from all the circumstances that, at the time of the transfer, the transferor was, or was about to become, insolvent.

Other ways of showing the transferor’s main purpose in making a transfer

(3) Subsection (2) does not limit the ways of establishing the transferor’s main purpose in making a transfer.

Transfer not void if transferee acted in good faith

(4) Despite subsection (1), a transfer of property is not void against the trustee if:

(a) the consideration that the transferee gave for the transfer was at least as valuable as the market value of the property; and

(b) the transferee did not know, and could not reasonably have inferred, that the transferor’s main purpose in making the transfer was the purpose described in paragraph (1)(b); and

(c) the transferee could not reasonably have inferred that, at the time of the transfer, the transferor was, or was about to become, insolvent.

11 There was no dispute about the principles applicable to establishing an express trust or a resulting trust.

12 To establish the existence of an express trust there must be an intention to create a trust, a clear identification of the trust property and reasonable certainty as to the identification of the beneficiaries: see Korda v Australian Executor Trustees (SA) Ltd (2015) 255 CLR 62 at [7] (French CJ), [109] (Gageler J) and [204] (Keane J).

13 For a resulting trust, in El-Debel v Micheletto (Trustee) [2021] FCAFC 117 at [7] a Full Court of this Court (Markovic, Derrington and Colvin JJ) set out a summary of the principles as follows:

The legal reasoning by the primary judge as to the principles to be applied in determining whether property was held on resulting trust was accepted as being correct by all parties to the appeals. For present purposes they may be stated briefly by adopting the key passages from the uncontested formulations of the primary judge at [78], namely:

(1) A presumption of a resulting trust arises where one person provides the purchase price of property which is conveyed into the name of another person.

(2) In deciding whether a presumption of a resulting trust has been rebutted the Court must reach a conclusion on the whole of the evidence.

(3) The presumption of a resulting trust may be rebutted by evidence which manifests an intention to the contrary, but should not give way to slight circumstances.

(4) The extent of the beneficial interest of the parties arising by reason of a resulting trust must be determined when the property was purchased.

(5) It is the intention of the person who provides part of the purchase price that is relevant when considering whether the presumption may be displaced by contrary evidence.

(6) If part of the purchase price is provided by being borrowed on a mortgage, the presumption of a resulting trust is applied by treating the monies raised by the mortgage as a contribution by the person who is liable to repay that money.

14 More particularly, the Trustee relied on the following two formulations of where a resulting trust is presumed to arise.

15 First, in HCK China Investments Limited v Solar Honest Limited [1999] FCA 1156; 165 ALR 680 at [260] where Hely J, citing In re Vandervell’s Trusts (No 2) [1974] 1 Ch 269 at 294, relevantly said:

In re Vandervell’s Trusts (No 2) [1974] 1 Ch 269 at 294 establishes two categories of resulting trust:

1. where the settlor transfers the legal estate in property to another otherwise than for valuable consideration. If, by construing the document transferring the legal estate, it is possible to discern whether the settlor intended for the transferee to take the beneficial estate, then such intention is conclusive. However, if the document is silent as to the settlor’s intentions, a presumption of resulting trust in favour of the settlor arises.

…

16 Secondly, where a person funds all or part of the purchase price of a property but causes it to be registered or conveyed into the name of another person. In that case the property is presumed to be held on trust for the person providing the funding to an extent reflecting his or her proportionate contribution to the property: see Calverley v Green (1984) 155 CLR 242 at 246-247. Where that occurs contributions by way of borrowings are taken to be contributed by the person or persons liable to repay the loan: see Calverley at 251 (Gibbs CJ), 257-258 (Mason and Brennan JJ) and 267-268 (Deane J).

17 The exception to these presumptions is where the person transferring the property or funding its purchase does so in favour of his or her wife, child or other person to whom he or she stands in loco parentis: see Calverley at 247. In that case a presumption of advancement arises such that it is to be presumed that the transfer is way by of a gift. This presumption has been held to extend to advances by mothers in favour of their adult children and to an advance in favour of a child and a third party: see Nelson v Nelson (1995) 184 CLR 538 at 548-9 (Deane and Gummow JJ), 576 (Dawson J), 585-6 (Toohey JJ) and 601 (McHugh J); “Lamplugh v Lamplugh (1709) 1 P Wms 111; 24 ER 316.

18 As set out above, the presumption of resulting trust may be rebutted by evidence to the contrary. I pause to note that in this case the respondents did not lead any such evidence in relation to any of the transactions where the Trustee contended that the asset, or a portion of it, was held on trust by one or both of the respondents for Ian or Ian and Beth. Instead, the respondents deny that the transactions occurred in the manner alleged by the Trustee. That being so, if the Trustee’s contentions in relation to the purchase of assets by Ian and/or Beth in Faina’s name are accepted it will follow that those assets (or any of them, as the case may be) are held by Faina on resulting trust for the Trustee in whom Ian’s and Beth’s interests are vested pursuant to s 58 of the Bankruptcy Act.

19 As will become evident from the facts set out below, the Trustee relies substantially upon records obtained by him as a result of compulsory processes available under the Bankruptcy Act or pursuant to the Court’s powers to compel production of documents. He has not been able to adduce evidence from witnesses who could speak directly about the transactions the subject of this proceeding. Accordingly, in some cases the Trustee asks the Court to make findings which depend on a process of inferential reasoning rather than direct evidence.

20 In Quintis Ltd (Subject to Deed of Company Arrangement) v Certain Underwriters at Lloyd’s London Subscribing to Policy Number B0507N16FA15350 [2021] FCA 19; 385 ALR 639 at [105]-[106] Lee J said the following about inferential reasoning:

105 However, it is also true that where there is no direct evidence of a fact that a party bearing the onus of proof seeks to prove, “it is not possible to attain entire satisfaction as to the true state of affairs”: Girlock (Sales) Pty Ltd v Hurrell (1982) 149 CLR 155 (at 169 per Mason J). However, in such a case, the law does not require proof to the “entire satisfaction” of the tribunal of fact: see Transport Industries Insurance Co Ltd v Longmuir [1997] 1 VR 125 (at 141 per Tadgell JA, with whom Winneke P and Phillips JA agreed). Indeed, a party may advance a case relying on circumstantial evidence, on the basis that collectively viewed, a combination of proven facts can provide a sufficient basis for inferring the ultimate fact to be proved. A comprehensive statement as to the sufficiency of circumstantial evidence in a civil case to support proof by inference from directly proved facts was given by the High Court in Bradshaw v McEwans Pty Ltd (1951) 217 ALR 1 (at 5 per Dixon, Williams, Webb, Fullagar and Kitto JJ):

Of course as far as logical consistency goes many hypotheses may be put which the evidence does not exclude positively. But this is a civil and not a criminal case. We are concerned with probabilities, not with possibilities. The difference between the criminal standard of proof in its application to circumstantial evidence and the civil is that in the former the facts must be such as to exclude reasonable hypotheses consistent with innocence, while in the latter you need only circumstances raising a more probable inference in favour of what is alleged. In questions of this sort, where direct proof is not available, it is enough if the circumstances appearing in evidence give rise to a reasonable and definite inference: they must do more than give rise to conflicting inferences of equal degrees of probability so that the choice between them is mere matter of conjecture. But if circumstances are proved in which it is reasonable to find a balance of probabilities in favour of the conclusion sought then, though the conclusion may fall short of certainty, it is not to be regarded as a mere conjecture or surmise …

(Citations omitted).

106 Furthermore, in assessing a circumstantial case, the question of whether an inference is open and can be drawn as a matter of probability is to be determined by considering the combined weight of all the relevant established facts, rather than by considering each fact sequentially and in isolation: Marriner v Australian Super Developments Pty Ltd [2016] VSCA 141 (at [75] per Tate ACJ, Kyrou and Ferguson JJA). Indeed, as the Full Court of this Court recently stated in Australian Broadcasting Corporation v Chau Chak Wing [2019] FCAFC 125; (2019) 271 FCR 632 (at 674 [134] per Besanko, Bromwich and Wheelahan JJ):

In assessing a circumstantial case, it is important to bear in mind that the facts ultimately to be proven are those that are in issue, and not necessarily all the circumstantial facts themselves. As Dawson J observed in Shepherd v The Queen (1990) 170 CLR 573 at 580, “[T]he probative force of a mass of evidence may be cumulative, making it pointless to consider the degree of probability of each item of evidence separately.” This invites consideration of the combined weight of circumstantial facts, for it is the essence of a circumstantial case that the combined force of its components should be considered, and proof of some circumstantial facts may be affected by the court’s assessment of other circumstantial facts: Chamberlain v The Queen (No 2) (1984) 153 CLR 521 at 535 (Gibbs CJ and Mason J). Courts may fall into error by compartmentalising circumstantial facts, rather than standing back and assessing the broader picture.

21 In In the matter of Hillsea Pty Limited [2019] NSWSC 1152 at [16]-[21] Black J set out the principles which he considered he should have regard to in assessing the affidavit and oral evidence relied on before him, including relevantly as follows:

16. I should have regard to the fallibility of human memory, particularly when disputes intervene, in determining these proceedings. In an often quoted observation in Watson v Foxman (1995) 49 NSWLR 315 at 319, McLelland CJ in Eq observed that:

“... human memory of what was said in a conversation is fallible for a variety of reasons, and ordinarily the degree of fallibility increases with the passage of time, particularly where disputes or litigation intervene, and the processes of memory are overlaid, often subconsciously, by perceptions of self-interest as well as conscious consideration of what should have been said or could have been said. All too often what is actually remembered is little more than an impression from which plausible details are then, again often subconsciously, constructed. All this is a matter of ordinary human experience.”

17. In Effem Foods Pty Ltd v Lake Cumbeline Pty Ltd (1999) 161 ALR 599 at [15], the High Court similarly approved an observation at first instance in that case that:

“[Given the lapse of time] between the events and conversations raised in evidence and the hearing of the evidence before me, the only safe course is to place primary emphasis on the objective factual surrounding material and the inherent commercial probabilities, together with the documentation tendered in evidence. In circumstances where the events took place so long ago, it must be an exceptional witness whose undocumented testimony can be unreservedly relied on. The witnesses in this case unfortunately did not come within that exceptional class. The discussions referred to in evidence were capable of bearing quite opposed meanings depending on subtle differences of nuance and emphasis, and a proper appreciation of the significance of those matters must necessarily be considerably diminished over such a long period of time.”

18. In Fox v Percy [2003] HCA 22; (2003) 214 CLR 118 at 129, Gleeson CJ, Gummow and Kirby JJ observed that:

“Considerations such as these have encouraged judges, both at trial and on appeal, to limit their reliance on the appearances of witnesses and to reason to their conclusions, as far as possible, on the basis of contemporary materials, objectively established facts and the apparent logic of events. This does not eliminate the established principles about witness credibility; but it tends to reduce the occasions where those principles are seen as critical.”

…

20. I summarised the applicable principles in Re Kit Digital Australia Pty Ltd (in liq) [2014] NSWSC 1547 at [7], as follows:

“It is important in this context to have regard to the fallibility of human memory which increases with the passage of time, particularly where disputes or litigation intervene: Watson v Foxman (1995) 49 NSWLR 315 at 318-319 per McLelland CJ in Eq; Hoy Mobile Pty Ltd v Allphones Retail Pty Ltd (No 2) [2008] FCA 810 at [41] per Rares J; Varma v Varma [2010] NSWSC 786 at [424]-[425] per Ward J. To the extent that credit issues need to be determined in respect of particular conversations, I have also had regard to the fact that objective evidence is likely to be the most reliable basis for determining them. I summarised the relevant principles in Re Colorado Products Pty Ltd (in prov liq) [2014] NSWSC 789 at [10], where I noted that the credibility of a witness and his or her veracity may be tested by reference to the objective facts proved independently of the testimony given, in particular by reference to the documents in the case, by paying particular regard to the witness’s motives and the overall probabilities: Armagas Ltd v Mundogas SA [1985] 1 Ll R 1 at 57; Camden v McKenzie [2007] QCA 136; [2008] 1 Qd R 39 at [34]; Craig v Silverbrook [2013] NSWSC 1687 at [141]; State of New South Wales v Hunt [2014] NSWCA 47 at [56].”

22 Those principles are equally applicable here in assessing the affidavit evidence relied on by the respondents.

23 The Trustee made detailed submissions about the credit of the respondents’ witnesses which I address below. It was not in dispute that where a witness is not believed on a particular topic or issue, an inference may be drawn that the truth would be harmful to them. Further, the rejection of a witness’s evidence on a particular topic may be relevant to the Court’s assessment of other evidence on the same topic.

24 In Steinberg v Federal Commissioner of Taxation (1975) 134 CLR 640 the High Court (Barwick CJ, Gibbs and Stephen JJ) considered various transactions related to three parcels of land situated in Western Australia. In summary, in issue was the characterisation of those transactions insofar as that determined the basis upon which the owners of the land were liable to pay tax. At first instance the principal witness was the appellant, Mr Steinberg, whose evidence was rejected in relation to the purpose for which shares were acquired in a company that held one of the parcels of land. On appeal one of the questions that arose was whether Mason J was right to conclude that the shares in that company were acquired for the main or dominant purpose of profit making by sale as opposed to the stated purpose given by Mr Steinberg in his evidence which his Honour rejected.

25 On that question at 694 Gibbs J found that the reasons given by Mason J for rejecting Mr Steinberg’s evidence were completely convincing. His Honour said:

… The fact that a witness is disbelieved does not prove the opposite of what he asserted: Scott Fell v Lloyd (33); Hobbs v Tinling (CT) & Co Ltd (34). It has sometimes been said that where the story of a witness is disbelieved, the result is simply that there is no evidence on the subject (Jack v Smail (1906)(35); Malzy v Eichholz (36); Ex parte Bear; Re Jones (37), but although this is no doubt true in many cases it is not correct as a universal proposition. There may be circumstances in which an inference can be drawn from the fact that the witness has told a false story, for example, that the truth would be harmful to him; and it is no doubt for this reason that false statements by an accused person may sometimes be regarded as corroboration of other evidence given in a criminal case: Eade v The King (38); Tripodi v The Queen (39). Moreover, if the truth must lie between two alternative states of fact, disbelief in evidence that one of the state of facts exists may support the existence of the alternative state of facts: Lee v Russell (40) …

(Footnotes omitted. Emphasis added.)

26 The Trustee relied on five affidavits sworn by him on, or dated, 31 May 2019, 17 April 2020, 27 May 2020, 8 February 2021 and 29 April 2021. He was cross-examined.

27 The Trustee was a considered witness. When cross-examined he was frank in his responses and was prepared to accept propositions put to him which might be contrary to his case.

28 The respondents principally relied on evidence given by Ian who swore two affidavits, the first on 16 October 2020 and the second, by which Ian sought to correct and expand upon some of the evidence given in his first affidavit, on 16 April 2021. Ian was cross-examined over a period of four days.

29 Having observed Ian give evidence over a number of days I formed the view that he was in many respects an unsatisfactory witness and as set out below, in more instances than not, his account of what occurred cannot be accepted. His credibility was undermined by at least the following.

30 First, Ian asserted, particularly in his affidavits, that he was able to recall events which took place many years ago. His recollection was supportive of the positive case the respondents sought to advance in answer to the Trustee’s claims. When challenged, he maintained his position, which he was of course entitled to do. However, on a number of occasions, as set out in further detail below, the contemporaneous documents obtained by the Trustee showed Ian’s recollection to be defective or wrong. Surprisingly, even when presented with documentary evidence which demonstrated that his recollection must be wrong, Ian refused to concede that to be so. Instead, on some occasions, he attempted to provide lengthy explanations, not previously the subject of evidence, in an attempt to justify his position.

31 Secondly, it became apparent that Ian was prepared to give evidence without any proper foundation, documentary or otherwise. In my opinion, he did so because it suited the respondents’ case.

32 Thirdly, on numerous occasions Ian deflected questions or was evasive in responding to them, from time to time arguing with the cross-examiner or seeking to answer a question by posing his own question.

33 Fourthly, putting to one side those errors in Ian’s first affidavit which were the subject of correction in his second affidavit, Ian’s affidavits were replete with errors, as demonstrated in the course of his cross-examination by objective documentary evidence.

34 Added to these matters was the apparent collusion as between Ian and Faina in the preparation of their evidence, a matter on which I make further comment below in the context of Faina’s evidence.

35 The respondents also relied on evidence given by:

(1) Faina who swore an affidavit on 23 October 2020 in which she set out her personal history and otherwise responded to evidence given by the Trustee; and

(2) Beth who swore an affidavit on 23 October 2020 in which she responded to one aspect of the Trustee’s evidence and gave evidence in relation to the advance of funds by members of her family to enable completion of the purchase of the Rose Bay Property.

Both Faina and Beth were cross-examined.

36 Faina gave evidence after Ian. She remained in the courtroom during Ian’s lengthy cross-examination which, as a party to the proceeding, she was entitled to do. However, having done so, by the time Faina gave evidence and was cross-examined she necessarily had the benefit of having heard Ian’s cross-examination and his answers to the questions put to him.

37 English is not Faina’s first language. As further described below, Faina came to Australia from Ukraine in the 1970s and often spoke to Ian in Russian, which I assume is her first language. Notwithstanding that and my observation that at times Faina had difficulty understanding questions put to her and providing a clear answer, she did not wish to have an interpreter to assist her with her evidence. I was satisfied in the circumstances that Faina had a sufficient command of English to proceed with the cross-examination without that assistance.

38 One troubling aspect of Faina’s evidence (and it follows also of Ian’s) was that it became apparent that she and Ian colluded in the preparation of their evidence. That was most stark in relation to the evidence they each gave about the acquisition of the Campbell Parade Property as described below. The effect of having done so led me to question the reliability of Faina as a witness.

39 That Faina was an unreliable witness was also highlighted by her limited recollection of events, including more significant events such as when she last lodged a tax return; that for the purposes of the proceeding steps were taken to attempt to recover copies of tax returns lodged by her; what she told social security officers about her income and assets in 2007; and that in 2016 Fanchel received $3.3 million for its shares in eBet that had previously been transferred to it at Ian’s request because he needed money.

40 Finally, it was clear that Faina’s reliance on Ian was not limited to dealing with her financial affairs, as described below, but extended to the conduct of the proceeding. At times when asked a question in cross-examination about events she responded by telling the cross-examiner that he should ask Ian.

41 Beth gave evidence on only a few discrete topics. That was somewhat surprising. There were a number of matters about which one might have expected that Beth could give corroborating evidence including in relation to her financial position in the period from 2007 to 2015 and what occurred at meetings at which she was apparently present. She did not give any evidence in relation to these issues.

42 There was extensive documentary evidence relied on by the parties which was necessitated by the period of time over which the relevant transactions took place, the need to view the transactions in context and the need to unravel and understand the flow of funds for the acquisition, and in some cases divestment, of assets.

43 The Trustee was a stranger to the transactions the subject of the proceeding. Many of the documents on which he relied and which were included in the court book were gathered by him as a result of his ongoing investigations which have included:

(1) issuing notices pursuant to s 77 and s 77A of the Bankruptcy Act to Ian and Beth, their associated entities and accountants and conveyancers pertaining to Ian and Beth’s interests in real property in New South Wales;

(2) conducting examinations pursuant to s 81 of the Bankruptcy Act (Public Examinations) of Ian, Beth and Faina;

(3) seeking leave from the Court to issue, in the course of the Public Examinations, summonses for production of documents to 36 persons and entities including:

(a) conveyancers instructed to act in property matters associated with either Ian and Beth or Faina;

(b) accountants who acted for Ian and Beth, the respondents and/or their associated entities;

(c) financial institutions through which Ian and Beth, the respondents and/or their associated entities conducted their financial affairs;

(d) share registers and brokers through which Ian and Beth and the respondents traded in Australian equities; and

(e) the solicitors who acted for Royal Guardian Mortgage Management Pty Ltd in a proceeding commenced by it against Ian and Beth in the Supreme Court of New South Wales and a subsequent proceeding in the New South Wales Court of Appeal;

(4) notices issued by the Official Receiver at the request of the Trustee pursuant to s 77C of the Bankruptcy Act to entities associated with Ian and Beth; and

(5) attending Faina’s properties with the Official Receiver pursuant to s 77AA of the Bankruptcy Act at which time various documents and electronic devices were seized by the Official Receiver.

44 The respondents submitted that notwithstanding the volume of evidence there remain many documentary lacunae, particularly for crucial transactions. It is not possible to address this submission at a level of generality save to make the following brief observations.

45 It is unsurprising that the Trustee, as a stranger to the transactions the subject of this proceeding, was, despite his extensive investigations, unable to piece together some aspects of them or that he encountered gaps in the evidence. The Trustee has obligations and duties under the Bankruptcy Act. He was required to carry out his investigations having regard to those obligations and duties and with the benefit of the powers conferred on him by that Act. That is what he did.

46 The Trustee frankly accepted that he did not know “all of the flow of funds”, that there were characterisation difficulties with “some flows of the funds” and that there may be bank accounts in relation to the matter, beyond the 100 or so identified, about which he did not know. However, that does not mean that he cannot establish the claims he makes against the respondents. The onus remains on the Trustee to prove his case. Gaps in the evidence, documentary or otherwise, pose hurdles for the Trustee which he must overcome. Whether he has done so is considered below.

47 In this part of the reasons I set out the background facts insofar as they are relevant to understanding the transactions the subject of the proceeding.

4.1 The respondents, Ian, Beth, entities related to them and other relevant events

48 Faina was born in 1941 in Odessa, Ukraine. She married Anchel Stolyar (who for ease and without intending any disrespect I will refer to as Anchel) in about 1964 in Ukraine. In August 1979, Faina and Anchel moved to Australia with their son Ian.

49 Faina and Anchel both worked: Anchel worked six days a week in a factory and five nights a week helping Faina in a cleaning job; and Faina worked two jobs seven days and nights each week. However, at some time prior to 2001 Faina ceased paid employment to care for Anchel who had become ill.

50 In 1980, Faina and Anchel purchased an apartment at 6/4 Empress Street, Hurstville New South Wales (Hurstville Property) for $40,000. The purchase of the Hurstville Property was financed by a loan from the Commonwealth Bank of Australia (CBA) secured by a first registered mortgage over that property. By 1982, Faina and Anchel had repaid that loan and the CBA’s mortgage over the Hurstville Property was discharged.

51 In 1985 Faina and Anchel purchased an apartment at 5/41 Francis Street, Bondi, New South Wales (Francis Street Property) for $108,000. The purchase price was funded in part by savings and in part by a loan from the CBA of approximately $60,000 or $70,000 secured by a first registered mortgage over that property. Faina and Anchel paid off their loan within about two years.

52 In or about 1983, when Ian was 16 years old, he developed an interest in share trading. Faina and Anchel agreed to give Ian some money so that he could invest in shares on their behalf. They told him that from time to time they would give him funds to buy shares in Faina’s name.

53 Faina told Ian to invest in inexpensive shares at a cost of 1 or 2 cents per share and to take any profit earned and invest that money in another company’s shares. Faina also insisted that, before Ian bought or sold any shares, he first discuss with her what he proposed to do and then only do so if she agreed. That said, it seems that while Faina wanted to monitor Ian’s share trading, she knew little if anything about the stock market and share trading and relied upon Ian’s advice about what shares should be bought and when they should be sold.

54 According to Faina nothing has changed; she still relies on Ian’s guidance when it comes to share trading but, as has always been the case, before buying or selling any shares on her behalf, Ian first discusses the proposed trade with her and only acts on her instructions.

55 In 1988, Faina and Anchel sold the Hurstville Property for $120,000 and deposited the sale proceeds into a bank account. They placed some of those funds into term deposits from time to time.

56 From about 1988 onwards, Faina and Anchel provided Ian with larger sums of money with which to buy shares, still only in Faina’s name and not without Ian first having discussed with Faina what he proposed to purchase.

57 In 1992, following an earlier claim, Anchel received a lump sum payment of $102,000 from the German Government as compensation for having been imprisoned in a Nazi concentration camp from 1941 to 1945 (German Compensation Payment). The German Compensation Payment was deposited into an account in Anchel’s name which had been opened for that purpose (Anchel Stolyar Account). From approximately 1993 until his death, in addition to the German Compensation Payment, Anchel received a monthly compensation payment of approximately $500 from the German Government which was also deposited into the Anchel Stolyar Account.

58 Two further amounts were deposited in the Anchel Stolyar Account: in 1993 Anchel’s superannuation benefit of $110,000; and in 1999 a damages payout of $125,000 from a medical negligence claim made by Anchel.

59 In about 1997 or 1998 Faina received her superannuation benefit of between $60,000 and $70,000. Faina recalls that this money was used to purchase shares in her name.

60 On 31 December 2000 Faina’s brother suddenly passed away. At the time Anchel was also very ill. Following her brother’s death Faina contemplated changing her surname from her married name back to her maiden name, Lutsker, so she could feel more connected to him. In about early 2001 Faina told Ian that she wanted any new shares that he purchased on her behalf to be bought in her maiden name. Ian was not in favour of Faina changing her surname. Accordingly, while he bought some shares in Faina’s maiden name, he also continued to buy shares in her married name.

61 On 1 June 2001 Anchel passed away and Faina became the sole registered proprietor of the Francis Street Property and the beneficiary of the funds in the Anchel Stolyar Account, the balance of which she transferred into a bank account in her name, and of her and Anchel’s other joint assets.

62 The Trustee believes that as at March 2002 Faina was receiving a widow’s pension of approximately $402.70 per fortnight. That belief is borne out by:

(1) a Centrelink statement dated 20 March 2002 addressed to Faina which records that on 27 March 2002 Faina received a payment for the period 13 March 2002 to 26 March 2002 of $402.70;

(2) the fact that on 10 April 2002 Faina received a total allowance of $404.80; and

(3) a loan application dated 10 December 2002 made jointly by Beth and Faina (referred to in detail at [119]-[121] below) in which Faina’s gross annual income is recorded as $10,540.

63 Since Anchel passed away, Faina has relied upon Ian to assist her with her financial and property matters including: buying and selling shares on her behalf and the opening of share trading accounts; purchasing real estate, leasing her investment properties, preparing her personal and company tax returns and financial statements; and undertaking electronic banking on her behalf, with Ian having authority to operate Faina’s bank accounts electronically. Faina does not know how to use a computer. Faina trusts Ian and thus generally does not review any documentation relating to financial matters in any great detail but relies upon what Ian tells her.

64 As Faina’s English is not as good as Ian’s she often discusses matters with him in Russian.

65 Ian was born on 9 February 1967 in Odessa, Ukraine. He moved to Australia in August 1979 with his parents.

66 As outlined above, Ian developed an interest in share trading in about 1983 when he was 16 years old. To assist him with that interest Faina permitted him to trade on the Australian Stock Exchange (ASX) with money from her savings account. Ian described the way it worked as follows: he first discussed with Faina the shares he proposed to buy; he then engaged a stockbroker to carry out the transaction; the shares were only ever bought in Faina’s name; any profit made from trading those shares was either returned to Faina or used by Ian to buy more shares on her behalf; and any loss made from trading Faina’s shares ultimately sat with her, although Ian would subsequently attempt to recover that loss through further share trades.

67 From 1986 to 1988 Ian studied economics at the University of New South Wales and in 1989 he obtained a Bachelor of Economics.

68 From 1990 to 1992 Ian undertook a Masters of Commerce specialising in Finance at the University of New South Wales. In 1993 he obtained his Masters of Commerce.

69 From 1989 to 1992 Ian was employed by the CBA first as a graduate trainee in the personal lending section and progressing to the role of assistant manager.

70 In about June 1992 Ian entered into a contract to purchase 11/2 Ocean Street for $230,000. That purchase was funded in part by a loan of $200,000 from the CBA which was secured by a first registered mortgage over the property.

71 Between 1992 and 2001 Ian held the following positions:

(1) 1992 to 1995 – credit analyst with Standard Charter Bank;

(2) 1995 to 2000 – senior underwriter with CGU; and

(3) 2000 to 2001 – credit manager with Rams Home Loans.

72 In 2001 Ian joined Royal Guardian as a senior manager in the Commercial and Credit Division.

73 Since the opening of Star City Casino in 1995 Ian has been a member of the Sovereign Room, a “high rollers” room.

74 Once Ian started earning money he began to trade shares in his own name. Over time and, commensurate with his earnings and his ability to obtain a loan or line of credit, his share trades became more frequent and larger in amount.

75 On an increasingly regular basis Ian also continued to trade shares in Faina’s name, both in her maiden name from approximately 2004, and in her married name. As before, when trading shares on behalf of Faina, Ian first discussed the proposed trades with her, he used her money to buy the shares and either deposited the proceeds of a sale of shares into one of her bank accounts or left them in one of her share trading accounts with a view to imminent reinvestment. According to Ian this practice continues to date.

76 Since moving out of home, Ian has met with Faina on a weekly basis, usually on a Tuesday or Wednesday, to see her generally and to discuss with her any issues that have arisen in relation to her financial affairs including: share trading; the purchase of real property, investment or otherwise; the leasing of investment properties; other business or investment opportunities; the completion and lodgement of her personal tax returns and the completion and lodgement of her company tax returns and financial statements. If any matter arose before Ian saw Faina he would discuss the matter with her over the telephone.

77 Faina has relied on Ian to assist her with, or undertake on her behalf, the activities described above because she only has a basic command and comprehension of English, she is not computer literate and, beyond making a profit, she has no real interest in share trading or property investment.

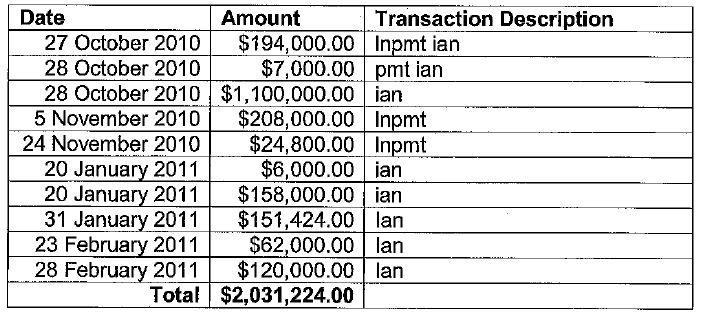

78 Since the commencement of electronic banking in the 1990s Ian has also had the authority to operate electronic bank accounts held in Faina’s name and in the names of Fanchel and Stoligor Investments Pty Ltd. However, Ian only effected transactions with his mother’s knowledge and consent. For well over a decade it has been Ian’s usual practice to include a reference such as “Ian” or an abbreviated form thereof for transactions which he has undertaken on Faina’s behalf so that, upon review of her bank statements, Faina knows that it was Ian who carried out a particular transaction. Ian said that he has never used those references to indicate a repayment or payment of money by him or by Beth and him.

79 Beth was born in Ho Chi Minh City, Vietnam in 1974. She moved to Australia in 1982. As set out above, she married Ian in December 2001.

80 In January 2001 Beth commenced working full time at Royal Guardian. She was promoted to the position of general manager in or around February 2002. Beth ceased employment with Royal Guardian in 2006.

81 Fanchel was incorporated on 14 December 2007. As set out above, Faina is its sole director, secretary and shareholder. Fanchel was initially incorporated for the purposes of share trading but is now an investment company.

82 Based on his investigations the Trustee has identified two accounts opened by Fanchel on 9 April 2008: account no. 24-0404 with Westpac Banking Corporation (Fanchel Transaction Account) with an opening deposit of $300,000; and a term deposit with Westpac with an opening deposit of $3 million (Fanchel Term Deposit Account).

4.1.5 Bethian Enterprises Pty Ltd

83 Bethian Enterprises Pty Limited was registered on 23 May 2001. Ian was a director and shareholder holding one ordinary and one “B” class share and Beth was a director, its secretary and a shareholder holding one ordinary and one “A” class share.

84 Bethian was incorporated for the purpose of receiving and subsequently distributing to Ian and Beth commissions they received as a result of their efforts whilst employed by Royal Guardian.

85 Dibelle Finance was a business name registered in the name of Denise Chahine. It was accredited as a broker with Royal Guardian which entitled it to receive commissions. Ms Chahine was a beautician and a good friend of Beth’s. It was common ground that Ms Chahine is deceased.

4.1.7 Dibelle Financial Services Pty Ltd

86 Dibelle Financial Services Pty Ltd (DFS) was registered on 21 October 2004. Faina was its sole director, secretary and shareholder. DFS conducted a broking business referring potential borrowers to Royal Guardian. It earned a commission when the referral resulted in the provision of a loan.

87 At the time of its incorporation, Faina, in her capacity as a director of DFS, signed two declarations of trust the terms of which were identical save for the identity of the beneficiary in each case. They relevantly provided:

I, FAINA LUTSKER of 501/40-44 Ocean Street, Bondi, New South Wales 2026, the holder of 2 Ordinary Shares in DIBELLE FINANCIAL SERVICES PTY LIMITED (ACN: 111 481 719), ACKNOWLEDGE AND DECLARE that I hold 1 Share and all dividends and other benefits accrued and accruing in respect thereof for IAN STOLYAR of 4/31A Carabella Street, Kirribilli and I agree to transfer pay and deal with the said shares and dividends and other benefits in respect thereof and to exercise any voting power conferred thereby in such manner as the said Ian Stolyar from time to time directs.

The nominated beneficiary in the second declaration of trust was Beth.

88 According to Ian, he engaged an accountant, Anthony Kalogerou of Court & Co, to prepare the documents required for the incorporation of DFS. On 21 October 2004 Faina attended a meeting with Mr Kalogerou to sign those documents. It was at that meeting, which Ian did not attend, that Faina signed the two declarations of trust. Ian said that he did not instruct Mr Kalogerou to prepare the declarations of trust, he was unaware that Faina signed them at the time and that he first became aware of their existence when Royal Guardian served its evidence in the proceeding it commenced against him and Beth in the Supreme Court, which is described at [93]-[95] below.

4.1.8 Vietruss Pty Ltd and the Canchel Limited Partnership

89 Vietruss Pty Ltd was registered on 1 February 2005. Ian was its sole director and Beth was its sole shareholder. Vietruss was established for the purpose of becoming the general partner in the Canchel Limited Partnership.

90 On 8 February 2005, Vietruss as the general partner and Ian as the limited partner entered into a limited partnership in the name of the Canchel Partnership. The intended business of the Canchel Partnership was mortgage management. However, it was not used for that purpose but was used for share trading.

91 A deed of partnership between Vietruss and Ian provides that Vietruss is entitled to 1% and Ian is entitled to 99% of the Canchel Partnership’s profits.

4.1.9 Stoligor Investments Pty Ltd

92 Stoligor was registered on 24 June 2009. Ian was its sole director and Faina was its sole shareholder.

4.1.10 The Royal Guardian Proceeding

93 On 29 April 2010 Royal Guardian as plaintiff commenced proceeding no 2010/105936 in the Supreme Court against Beth and Ian as first and second defendants respectively (Royal Guardian Proceeding) for breach of contract and breach of the Corporations Act 2001 (Cth) arising out of their employment with it. Royal Guardian alleged that Ian and Beth, either directly or via their associated entities, received approximately $2 million in commissions in breach of their duty owed to Royal Guardian and that they were liable to account to it for that amount. Ian and Beth cross-claimed alleging breaches of their employment agreements with Royal Guardian.

94 The Royal Guardian Proceeding was listed for hearing in May 2013. On 28 May 2014 judgment was given for Ian and Beth both in relation to Royal Guardian’s claim against them and on their cross-claim: see Royal Guardian Mortgage Management Pty Ltd v Nguyen [2014] NSWSC 665.

95 Royal Guardian appealed and on 29 April 2016, among others, an order was made allowing the appeal: see Royal Guardian Mortgage Management Pty Ltd v Nguyen [2016] NSWCA 88.

4.2 2001–2003: Ian, Beth and Bethian purchase and sell various properties

4.2.1 Bethian acquires the Carey Street Property

96 In about June 2001 Bethian entered into a contract to purchase the property known as 702/5 Carey Street, Drummoyne, New South Wales (Carey Street Property) for $795,000. Settlement of the purchase of that property took place on 2 August 2001. According to Ian, its purchase was funded by a loan of $500,000 from Perpetual Trustees Victoria Ltd, secured by way of first registered mortgage over the property (Bethian Loan), with the balance of the purchase price being paid by Faina.

97 In cross-examination Ian maintained his evidence that Faina advanced the balance of the purchase price for the Carey Street Property as well as additional funds to cover stamp duty and legal costs, as he recalled in the sum of $300,000. He said that Faina provided those funds as a loan to him and Beth and that they were repaid from Bethian’s earnings from Royal Guardian. In cross-examination Faina also said that she recalled loaning $300,000 to Ian and Beth to help them purchase the Carey Street Property.

98 The contemporaneous documents are contrary to Ian and Faina’s evidence about the source of the funds for payment of the balance of the purchase price for the Carey Street Property.

99 First, by Royal Guardian loan application dated 29 May 2001 (May 2001 Loan Application) Ian sought a loan of $424,000 for two stated purposes: as to $315,000 for a refinance; and as to $109,000 for an “investment purchase”. The May 2001 Loan Application included:

(1) as part of Ian’s “personal financial statement” a property situated at Birrell Street, Bondi that was subject to a loan from “Wizard” for $315,000. The initials “TBPO”, which Ian explained meant “to be paid out”, appeared next to that entry; and

(2) in “income details” income from a “new purchase” of $18,200 per annum. That equated to a half share of the anticipated rental income from the Carey Street Property as disclosed in the loan application made by Bethian pursuant to which the Bethian Loan was approved.

100 Ian did not accept that the only property being purchased at the time of the May 2001 Loan Application was the Carey Street Property and that the purpose of seeking the loan amount of $109,000 in the May 2001 Loan Application was to finance that property. He gave that evidence notwithstanding that after the May 2001 Loan Application was approved the first drawdown of the approved amount was made on 1 August 2001, the same date on which the Bethian Loan was drawn down.

101 Ian gave two reasons for seeking the sum of $109,000 in the May 2001 Loan Application for investment purposes. First he said that at the time he and Beth had also found a property at 97 Broughton Street, Kirribilli, New South Wales (Broughton Street Property) which was purchased in 2001, implying that was why the additional amount of $109,000 was sought. When it was suggested to Ian that the purchase of the Broughton Street Property did not settle until November 2001, he gave a second and different reason for seeking that part of the loan. He said that in about May or June 2001 he and Beth decided to get married, they were looking for a house and so needed money for a deposit in case they found one. I do not accept either of these explanations. The first is proved to be wrong given the timing of the May 2001 Loan Application, the first drawdown of the amount advanced upon its approval and the purchase of the Broughton Street Property. The second, in light of the other available evidence, is in my view, an attempt by Ian to provide an alternate explanation upon his first being shown to be wrong and is implausible.

102 Secondly, a facsimile dated 31 July 2001 from Galilee & Associates to First Australian Title in relation to a loan from Interstar to Beth directed, among others, a payment of $130,881.10 to Birkenhead Investments Pty Limited, the vendor of the Carey Street Property. Ian did not dispute that these funds obtained by Beth were used for the purchase of the Carey Street Property.

103 Thirdly, a bank statement for National Australia Bank (NAB) account no. 53-059-3587 in the name of Bethian for the period 6 June 2001 to 15 November 2001 shows a withdrawal of $93,618.81 on 2 August 2001. Ultimately Ian conceded that there was no explanation for that withdrawal other than for the the purchase of the Carey Street Property.

104 Ian accepted that Bethian and Beth had contributed $724,499.91 to the purchase of the Carey Street Property.

105 Insofar as the balance of the purchase price and any associated costs are concerned, the only inference to be drawn from the contemporaneous documents is that the loan of $109,000 was obtained for the acquisition of the Carey Street Property and, I infer, the funds so obtained applied for that purpose. The balance of the purchase price (and other costs such as stamp duty and legal costs) was clearly not provided by Faina. Ian’s and Faina’s evidence to that effect is rejected.

106 Given that finding the respondents cannot rely on this purported advance by Faina to demonstrate her financial capacity as at June 2001.

4.2.2 Ian and Beth acquire three further properties

107 In or about October 2001, Ian and Beth entered into a contract to purchase the Broughton Street Property for $760,000. That purchase settled on 21 November 2001. According to Ian, in order to acquire the Broughton Street Property he and Beth obtained a loan from the NAB in the amount of $600,000, secured by way of a first registered mortgage over the property and the balance of the purchase moneys came from three sources: an increase in the CBA mortgage secured against 11/2 Ocean Street; an increase of $110,000 in a mortgage secured against a property situated in Bankstown which was owned by Beth; and the proceeds of sale from a car he owned.

108 In or about February 2002, Ian and Beth entered into a contract to purchase a property at 501/40-44 Ocean Street, Bondi, New South Wales (501/40 Ocean Street) for $610,000, which settled on 4 April 2002. The purchase of 501/40 Ocean Street was funded by a loan of $480,000 from the CBA secured by way of a first registered mortgage over that property and the balance was funded from his and Beth’s savings.

109 In or about November 2002, Ian and Beth entered into a contract to purchase a property at 4/31A Carabella Street, Kirribilli, New South Wales (Carabella Street Property) for $2.75 million, which settled on 17 January 2003. The purchase of the Carabella Street Property was funded as to $1,787,500 by a loan from Permanent Trustee Company Limited secured by a first registered mortgage over the property, as to $500,000 by a loan from Royal Guardian to Beth and Faina and as to the balance by a redraw of the loan for the Broughton Street Property.

110 On 30 June 2003 Ian and Beth sold the Broughton Street Property for $910,000.

111 In or about November 2003, Ian and Beth entered into a contract to purchase a property at 8/2-4 Benelong Crescent, Bellevue Hill, New South Wales (Benelong Crescent Property) for $2,080,000, which settled on 24 December 2003. That purchase was funded by Ian and Beth drawing down on their home loans.

4.3 2002 financial disclosures

4.3.1 Ian and Beth’s financial disclosure

112 On 2 December 2002 Ian and Beth completed a Royal Guardian loan application seeking a loan of $2 million for the purchase of an investment property (December 2002 Loan Application), which I infer was the Carabella Street Property.

113 In the December 2002 Loan Application Ian and Beth disclosed under the heading “personal financial statement” assets totalling $5,406,000 and liabilities totalling $1,408,000 giving them a net asset position of $3,998,000.

114 The following assets were included in the December 2002 Loan Application:

(1) real property with assigned market values as follows:

(a) Broughton Street Property $1.5 million;

(b) 11/2 Ocean Street $650,000;

(c) 501/40 Ocean Street $750,000;

(d) Carey Street Property $1.2 million; and

(2) as one of Ian and Beth’s “other assets” a private lending portfolio valued at $240,000.

115 The following liabilities were included in the December 2002 Loan Application:

(1) a combined “current loan amount” on the first three properties referred to at [114(a)-(c)] above of $980,000; and

(2) a “current loan amount” on the Carey Street Property of $500,000.

116 Ian suggested that the asset values included in the December 2002 Loan Application were inflated. In particular he said that:

(1) he had purchased 11/2 Ocean Street in or about June 1992 and at the time of settlement had no equity in the property;

(2) as at 2002 Bethian essentially had no equity in the Carey Street Property;

(3) as at 2002 he and Beth essentially had no equity in the Broughton Street Property and sold it less than two years later; and

(4) as at 2002 he and Beth only had a small amount of equity in 501/40 Ocean Street.

117 While no independent valuations were provided, I would accept Ian’s evidence as to inflated values for real property assets included in the December 2002 Loan Application at least in relation to the Broughton Street Property which sold only six months later for significantly less than its claimed value and the Carey Street Property which had been purchased for one third less than its claimed value only one year prior. However, that Ian was prepared to inflate values in a document such as this does not reflect well on him. Further, despite the inaccuracies, it is apparent that Ian and Beth held a significant number of assets and had a net asset position of several million dollars.

118 As at 2002 Ian and Beth were both employed by Royal Guardian. According to the December 2002 Loan Application they each earned a gross income of $125,000.

4.3.2 Faina and Beth’s financial disclosure

119 On 10 December 2002 Faina and Beth completed a Royal Guardian loan application for a loan of $500,000 for the stated purpose of raising funds for a share portfolio (Joint 2002 Loan Application), although according to Ian the true purpose of the loan was to partially fund the acquisition of the Carabella Street Property (see [109] above). Under the heading “personal financial statement” Faina and Beth listed total combined assets of $4,678,000 and total combined liabilities of $760,000. Putting to one side cars and personal effects, the remaining assets and their assigned market values included in the Joint 2002 Loan Application were:

(1) Broughton Street Property $1.2 million;

(2) 501/40 Ocean Street $750,000;

(3) Francis Street Property $675,000;

(4) Carey Street Property $1.2 million;

(5) Savings and term deposits $128,000;

(6) Share portfolio $260,000;

(7) Private lending portfolio $240,000.

120 Faina said that of the assets listed in the Joint 2002 Loan Application she owned the Francis Street Property, the savings and term deposits, the share portfolio and the private lending portfolio.

121 The private lending portfolio which Faina said formed part of her assets was operated by Reserve Capital Mortgage Corporation Pty Ltd (RCMC), a company of which Ian and Beth were directors, Beth was secretary and Ian and Beth were shareholders. This was the same “private lending portfolio” referred to as an asset in the December 2002 Loan Application (see [114(2)] above).

122 In cross-examination Beth explained that:

(1) RCMC was a facility to assist borrowers with short term urgent finance;

(2) people would come to them seeking short term finance. In order for Ian and Beth to win their mortgage business they would have to find a way to assist them with their short term needs. Accordingly, they loaned those clients money but only where they could be satisfied that they would be repaid by way of a refinance with Royal Guardian, for whom Beth worked at the time;

(3) insofar as any refinance with Royal Guardian was concerned, Beth earned a bonus based on a percentage of the loan amount and, subject to the time at which the refinance was effected, a profit share; and

(4) RCMC was a “face”, it did not really do anything, they loaned money under it, the money which was lent came from Faina and was then repaid to RCMC.

123 Examples of letters addressed to RCMC by which the signatory acknowledged, among other things, that they owed RCMC a specified amount, the date by which that amount would be repaid and how it was to be repaid were in evidence before me. For example one of those letters dated 21 November 2002 relevantly provides:

We, XXX as directors and shareholders of Cmetric Pty Ltd of 19 Bennet Ave, Five Dock NSW 2044 owe Reserve Capital Mortgage Corporation Pty Ltd $22,000 which includes interest and costs by 21 January 2003.

Furthermore, I agree that Reserve Capital Mortgage Corporation Pty Ltd may put a caveat over our property at 66 Annandale Street, Annandale NSW 2038 (Lot 68 DP 1341 S35) until the loan amount is fully repaid.

I also authorise Royal Guardian Mortgage Management Pty Ltd to deduct the above amount from the sale proceeds of 66 Annandale Street, Annandale NSW 2038.

124 When asked why the private lending portfolio apparently owned by Faina was also included in the December 2002 Loan Application, Beth said that, although the money belonged to Faina, she was going to “gift it” to Ian and Beth. It was included to explain to the lender where the funds were coming from to complete the purchase and when the lender asked for proof of funds and was informed that the private lending portfolio actually belonged to Faina it asked them to obtain “a gift letter”, which they did.

125 A letter dated 18 December 2002 from Faina addressed “to whom it may concern” provides:

This letter is to confirm that I will be giving my son Ian Stolyar of 97 Broughton Street, Kirribilli NSW 2061 $250,000 for him to complete the purchase of 4/321A Carabella Street, Kirribilli NSW 2061.

I confirm that this gift is unconditional and non-repayable.

By its own terms this letter could not be the “gift letter” referred to by Beth. It concerns a gift of $250,000, not $240,000 which was the stated value of the private lending portfolio, and the provision of that amount in cash to Ian.

126 Putting that to one side, for the following reasons I do not accept that the “private lending portfolio” was an asset of Faina’s.

127 First, the contemporaneous documents demonstrate the loans were made by, and were repayable to, RCMC. Secondly, Faina was neither an officer nor shareholder of RCMC. Thirdly, a facsimile dated 5 December 2002 from Jo Donovan, Royal Guardian, to “Underwriting Department Origin” in relation to a proposed loan to purchase a property in Kirribilli (presumably in support of the December 2002 Loan Application) states that one of the three sources of funds to complete the purchase was “repayment of current outstanding private loans owed to the applicants”, namely Ian and Beth. Fourthly, there was no evidence to support the assertion that the funds advanced belonged to or came from Faina or to support Beth’s evidence that Faina gifted the private lending portfolio to her and Ian.

4.4 Faina’s financial position: 2003-2007

128 As at 2002 Faina was receiving a widow’s pension. She continued to do so in the financial years ended 30 June 2003, 2004, 2005 and 2006.

129 As at 2002 Faina also owned the Francis Street Property and had, after her husband’s death in 2001, inherited his share of their unspecified joint assets and the unspecified balance in the Anchel Stolyar Account.

130 Putting to one side real property assets, motor vehicles and “marketable personal effects”, the Joint 2002 Loan Application suggested that Faina and Beth had between them liquid assets valued at $628,000. Those assets comprised:

(1) savings of $28,000;

(2) term deposits of $100,000;

(3) share portfolio of $260,000; and

(4) private lending portfolio of $240,000.

131 The Joint 2002 Loan Application does not specify to whom each of those assets belong. However, as I have already found to be the case, the private lending portfolio was a business undertaken by RCMC, the shareholders of which were Ian and Beth. That leaves assets valued at $388,000.

132 It is difficult to accept that Faina owned assets of that value at that time given that:

(1) as records obtained by the Trustee from Centrelink disclose, Faina received a carer’s allowance from 1992 until Anchel’s death in 2001 and thereafter until 4 September 2007 she received a widow’s pension;

(2) welfare entitlements were subject to asset tests which changed each year. As at 1 July 2002 the allowable maximum amount of assets to qualify for Faina’s widow’s pension was $145,250;

(3) in cross-examination Faina accepted that from time to time, while in receipt of the widow’s pension, she was required to provide updated disclosure of her assets and would attend Centrelink’s offices to do so. She agreed that she provided a full disclosure of her financial position and showed them bank statements and statements of her shareholdings;

(4) in the documents obtained by the Trustee from Centrelink there is a record that Faina telephoned on 15 March 2002 about “6mthly wda rvw form” which I understand to be a reference to a six monthly widow’s allowance review form. The records indicate that Faina said she would return it by the following week; and

(5) while there is no record of what Faina told Centrelink at the time of the regular reviews, given that she continued to receive the widow’s allowance until 2007, I would infer that the value of the assets she owned (other than her own home) remained under the allowable threshold.

133 That conclusion is supported by other evidence given by Faina. In an affidavit affirmed on 24 October 2012 for the purpose of the Royal Guardian Proceeding Faina said that the Francis Street Property was her only asset and the only thing she had left; and at the Public Examinations she gave evidence that at the time of her husband’s death the only asset she owned was the Francis Street Property. While I would readily accept that Faina had assets other than the Francis Street Property, their combined value was not as stated in the Joint 2002 Loan Application and I would infer that she regarded her most significant asset to be the Francis Street Property.