Federal Court of Australia

Australian Securities and Investments Commission v Aware Financial Services Australia Limited [2022] FCA 146

ORDERS

AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff | ||

AND: | AWARE FINANCIAL SERVICES AUSTRALIA LIMITED (ACN 003 742 756) Defendant | |

DATE OF ORDER: |

THE COURT NOTES THAT:

A. In these declarations and orders, terms which are defined in the Statement of Agreed Facts and Admissions dated 2 December 2021 have the same meaning as they do in that document.

B. The Statement of Agreed Facts and Admissions may be inspected by a person pursuant to r 2.32(2)(d) of the Federal Court Rules 2011 (Cth).

THE COURT DECLARES THAT:

1. During the period between 21 August 2014 and 30 June 2018, the defendant, Aware Financial Services Australia Limited (ACN 003 742 756), in trade or commerce accepted payment from Advice Clients for the provision of Annual Review Services, which are financial services within the meaning of s 12DI(3)(a) of the Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act), when there were reasonable grounds for believing that Aware Financial Services Australia Limited would not be able to supply the financial services to all such clients within the period specified, and thereby contravened s 12DI(3) of the ASIC Act.

2. Aware Financial Services Australia Limited, by its conduct in each of:

(a) contravening s 12DI(3) of the ASIC Act as referred to in paragraph 1 above;

(b) failing to provide Annual Review Services to Advice Clients during the period between 21 August 2014 and 30 June 2018; and

(c) continuing and maintaining throughout the period between 21 August 2014 and 30 June 2018 internal procedures, measures and controls and operational and compliance systems that did not ensure compliance with representations made and obligations to all Advice Clients in respect of the Annual Review Services,

breached its obligation to do all things necessary to ensure that the financial services covered by its AFSL were provided efficiently, honestly and fairly, and thereby contravened s 912A(1)(a) of the Corporations Act 2001 (Cth).

3. Aware Financial Services Australia Limited, by its conduct in contravening s 12DI(3) of the ASIC Act, breached its general obligation as a financial service licensee to comply with financial services laws and thereby contravened s 912A(1)(c) of the Corporations Act.

4. Aware Financial Services Australia Limited, by failing to establish and maintain compliance measures that ensured between 21 August 2014 and 30 June 2018, as far as is reasonably practicable, that it complied with the provisions of the financial services laws, contravened s 912A(1)(b) of the Corporations Act.

THE COURT ORDERS THAT:

5. Within 14 days of this order, Aware Financial Services Australia Limited pay to the Commonwealth of Australia a pecuniary penalty of $20,000,000 in respect of its conduct declared to be in contravention of s 12DI(3) of the ASIC Act.

6. Pursuant to s 12GLB(1)(a) of the ASIC Act, within 30 days of this order, Aware Financial Services Australia Limited shall publish, at its own expense, a written adverse publicity notice (Written Notice) in terms set out in Annexure A to this order, by:

(a) for a period of no less than 90 days, maintaining a copy of the Written Notice, in font no less than 10 point, in an immediately visible area of https://aware.com.au/about/media-centre; and

(b) for a period of no less than 365 days, any person accessing the website http://retire.aware.com.au/secure will be diverted to a separate website on which a copy of the Written Notice, in font no less than 10 point, will be immediately visible, which the person may close to return to the usual portal landing page; and

(c) sending a copy of the Written Notice to each Advice Client who was a client of the defendant at any time between 21 August 2014 and 30 June 2018 – using an email or postal address known to Aware.

7. Aware Financial Services Australia Limited shall include an option on the Written Notices displayed on its websites for a member to state that they have read the Written Notice and do not wish for it to be displayed to them again. If that option is selected, the Written Notice will not be displayed to that member again.

8. Aware Financial Services Australia Limited pay the plaintiff’s costs of and incidental to this proceeding.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ANNEXURE A

Adverse Publicity Notice

The Federal Court of Australia has ordered Aware Financial Services Australia Limited (Aware Financial Services) (previously known as State Super Financial Services Australia Limited or StatePlus) to publish this notice. Aware Super Pty Ltd acquired Aware Financial Services on 6 June 2016.

On 17 February 2022, Justice Moshinsky of the Federal Court of Australia (in proceeding VID 551 of 2020) ordered Aware Financial Services to pay a pecuniary penalty of $20,000,000 for contravening Australia’s financial services laws.

The Court found that Aware Financial Services contravened these laws between 21 August 2014 and 30 June 2018 by accepting payments from Advice Clients when there were reasonable grounds to believe that it would not be able to supply those reviews to all such clients within an annual period. Advice Clients were (a) Bundled Clients who received written disclosure from Aware Financial Services on or after 1 April 2013 that they would be provided with an Annual Review Service; and/or (b) Unbundled Clients who entered into an ongoing advice service arrangement that included provision of an Annual Review Service.

In many cases, Aware Financial Services did not in fact provide the promised reviews. Between 21 August 2014 and 30 June 2018, approximately 25,300 clients paid fees to Aware Financial Services without receiving the appropriate number of annual reviews from Aware Financial Services.

After reporting this conduct to the Australian Securities and Investments Commission (ASIC), Aware Financial Services has remediated approximately $104.8 million in fees, interest and lost earnings to clients who did not receive and did not decline their annual review entitlements.

Aware Financial Services agrees that it failed to maintain an adequate standard of internal controls and compliance systems that may have avoided the potential harm to consumers. It has since made changes designed to uplift those controls and compliance systems in an effort to ensure this conduct does not recur.

Further Information

Aware Financial Services’ misconduct contravened the following financial service laws:

• section 12DI(3) of the Australian Securities and Investments Commission Act 2001 (Cth); and

• sections 912A(1)(a), (b) and (c) of the Corporations Act 2001 (Cth).

For further information about Aware Financial Services’ misconduct, see the following links:

• statement of facts agreed between Aware Financial Services and ASIC [hyperlink];

• Justice Moshinsky’s judgment on penalty [hyperlink]; and

• ASIC media release [hyperlink]

MOSHINSKY J:

Introduction

1 The defendant, Aware Financial Services Australia Limited, previously known as State Super Financial Services Australia Limited (Aware Financial Services), provided advice services under an Australian Financial Services Licence (AFSL) during the period 1 April 2013 to 30 June 2018 (the Relevant Period).

2 During the period 21 August 2014 to 30 June 2018 (the Penalty Period), Aware Financial Services accepted payment from certain clients for the provision of ongoing advice services, but did not provide those services.

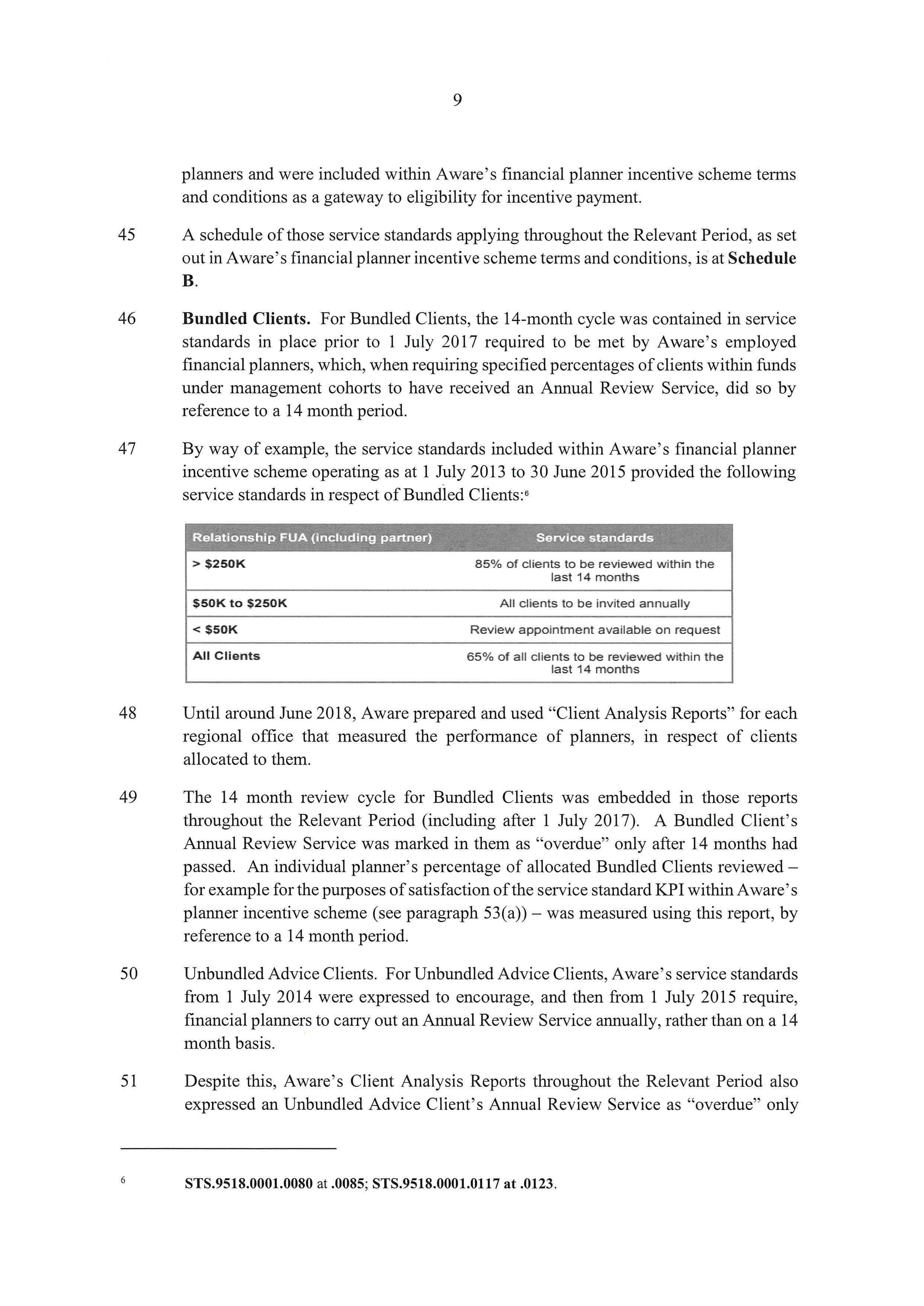

3 The number of clients affected by this conduct is large. During the Penalty Period, at least 25,300 clients paid Aware Financial Services fees for ongoing advice services, but did not receive at least one annual review service.

4 The magnitude of the effect of Aware Financial Services’ conduct is very significant. As discussed later in these reasons, in broad terms, clients paid approximately $50 million for annual review services that they did not receive.

5 The plaintiff (ASIC) commenced this proceeding by originating process and concise statement in August 2020. In its originating process, ASIC sought declarations that Aware Financial Services had contravened s 12DI(3) of the Australian Securities and Investments Commission Act 2001 (Cth) (the ASIC Act) and s 912A(1)(a), (b) and (c) of the Corporations Act 2001 (Cth). ASIC sought an order that Aware Financial Services pay a pecuniary penalty in respect of the contraventions of s 12DI(3), which is a pecuniary penalty provision. ASIC also sought an order that Aware Financial Services publish a notice pursuant to s 12GLB of the ASIC Act (adverse publicity order).

6 Subsequently, Aware Financial Services admitted that it had contravened s 12DI(3) of the ASIC Act and s 912A(1)(a), (b) and (c) of the Corporations Act, and the parties reached agreement on a statement of agreed facts for penalty hearing dated 2 December 2021 (the SOAF), a copy of which is annexed to these reasons.

7 The parties have reached agreement on proposed declarations, which are set out in minutes of proposed orders provided to the Court.

8 The parties have agreed to propose a pecuniary penalty of $20 million in respect of all of the contraventions of s 12DI(3) of the ASIC Act. It is also agreed that Aware Financial Services should be ordered to pay ASIC’s costs of the proceeding.

9 There is a relatively small disagreement between the parties as to the form of the adverse publicity order. While the parties are agreed that such an order should be made, there are four particular matters upon which the parties are not agreed.

10 The evidence before the Court comprises the SOAF and an affidavit of Ryan Fellstad dated 15 February 2022. Mr Fellstad is a Program Manager – Advice at Aware Super (which is described in the SOAF at paragraphs 10 and 11). Mr Fellstad’s affidavit is relevant to the issues concerning the form of the adverse publicity order.

11 In advance of the hearing, ASIC filed two outlines of submissions: the first deals with issues of penalty and relief; the second deals with the form of the adverse publicity order.

12 Aware Financial Services filed an outline of submissions in response to ASIC’s submissions. While the parties are largely agreed in their submissions as to penalty and relief, Aware Financial Services refers to certain matters in respect of which it does not agree with ASIC, or where it considers certain additional material should be brought to the Court’s attention. Aware Financial Services’ outline also addresses the points of disagreement between the parties as to the form of the adverse publicity order.

13 For the reasons that follow, I consider there to be a proper basis for making the proposed declarations. I also consider the proposed pecuniary penalty of $20 million to be appropriate and will make an order that Aware Financial Services pay this amount to the Commonwealth. The contravening conduct is, to my mind, very serious. The proposed penalty reflects the seriousness of the contraventions and should operate as a deterrent against such conduct being engaged in by Aware Financial Services or other companies in the future.

14 I will deal with the form of the adverse publicity order later in these reasons.

Applicable provisions and principles

Making of orders by agreement and declarations

15 The applicable principles as regards the making of orders by agreement and as regards declarations were summarised by Gordon J in Australian Competition and Consumer Commission v Coles Supermarkets Australia Pty Ltd [2014] FCA 1405 at [70]-[79] as follows:

2.3.1 Orders sought by agreement

…

70 The applicable principles are well established. First, there is a well-recognised public interest in the settlement of cases under the [Competition and Consumer Act 2010 (Cth)]: NW Frozen Foods Pty Ltd v Australian Competition & Consumer Commission (1996) 71 FCR 285 at 291. Second, the orders proposed by agreement of the parties must be not contrary to the public interest and at least consistent with it: Australian Competition & Consumer Commission v Real Estate Institute of Western Australia Inc (1999) 161 ALR 79 at [18].

71 Third, when deciding whether to make orders that are consented to by the parties, the Court must be satisfied that it has the power to make the orders proposed and that the orders are appropriate: Real Estate Institute at [17] and [20] and Australian Competition & Consumer Commission v Virgin Mobile Australia Pty Ltd (No 2) [2002] FCA 1548 at [1]. Parties cannot by consent confer power to make orders that the Court otherwise lacks the power to make: Thomson Australian Holdings Pty Ltd v Trade Practices Commission (1981) 148 CLR 150 at 163.

72 Fourth, once the Court is satisfied that orders are within power and appropriate, it should exercise a degree of restraint when scrutinising the proposed settlement terms, particularly where both parties are legally represented and able to understand and evaluate the desirability of the settlement: Australian Competition & Consumer Commission v Woolworths (South Australia) Pty Ltd (Trading as Mac’s Liquor) [2003] FCA 530 at [21]; Australian Competition & Consumer Commission v Target Australia Pty Ltd [2001] FCA 1326 at [24]; Real Estate Institute at [20]-[21]; Australian Competition & Consumer Commission v Econovite Pty Ltd [2003] FCA 964 at [11] and [22] and Australian Competition & Consumer Commission v The Construction, Forestry, Mining and Energy Union [2007] FCA 1370 at [4].

73 Finally, in deciding whether agreed orders conform with legal principle, the Court is entitled to treat the consent of Coles as an admission of all facts necessary or appropriate to the granting of the relief sought against it: Thomson Australian Holdings at 164.

2.3.2 Declarations

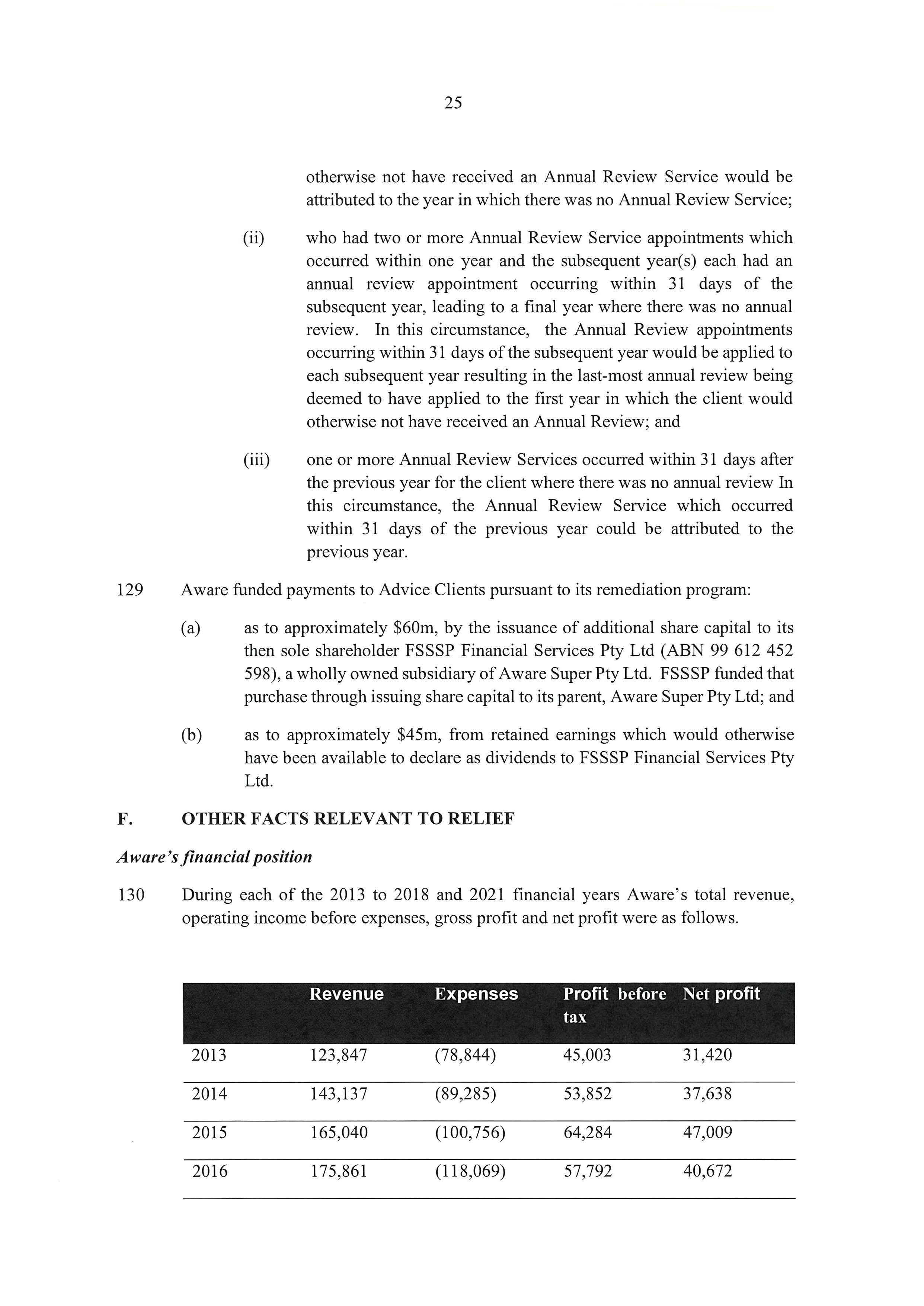

74 The Court has a wide discretionary power to make declarations under s 21 of the Federal Court Act: Forster v Jododex Australia Pty Ltd (1972) 127 CLR 421 at 437-8; Ainsworth v Criminal Justice Commission (1992) 175 CLR 564 at 581-2 and Tobacco Institute of Australia Ltd v Australian Federation of Consumer Organisations Inc (No 2) (1993) 41 FCR 89 at 99.

75 Where a declaration is sought with the consent of the parties, the Court’s discretion is not supplanted, but nor will the Court refuse to give effect to terms of settlement by refusing to make orders where they are within the Court’s jurisdiction and are otherwise unobjectionable: see, for example, Econovite at [11].

76 However, before making declarations, three requirements should be satisfied:

(1) The question must be a real and not a hypothetical or theoretical one;

(2) The applicant must have a real interest in raising it; and

(3) There must be a proper contradictor:

Forster v Jododex at 437-8.

77 In this proceeding, these requirements are satisfied. The proposed declarations relate to conduct that contravenes the ACL and the matters in issue have been identified and particularised by the parties with precision: Australian Competition & Consumer Commission v MSY Technology Pty Ltd (2012) 201 FCR 378 at [35]. The proposed declarations contain sufficient indication of how and why the relevant conduct is a contravention of the ACL: BMW Australia Ltd v Australian Competition & Consumer Commission [2004] FCAFC 167 at [35].

78 It is in the public interest for the ACCC to seek to have the declarations made and for the declarations to be made (see the factors outlined in ACCC v CFMEU at [6]). There is a significant legal controversy in this case which is being resolved. The ACCC, as a public regulator under the ACL, has a genuine interest in seeking the declaratory relief and Coles is a proper contradictor because it has contravened the ACL and is the subject of the declarations. Coles has an interest in opposing the making of them: MSY Technology at [30]. No less importantly, the declarations sought are appropriate because they serve to record the Court’s disapproval of the contravening conduct, vindicate the ACCC’s claim that Coles contravened the ACL, assist the ACCC to carry out the duties conferred upon it by the Act (including the ACL) in relation to other similar conduct, inform the public of the harm arising from Coles’ contravening conduct and deter other corporations from contravening the ACL.

79 Finally, the facts and admissions in Annexure 1 provide a sufficient factual foundation for the making of the declarations: s 191 of the Evidence Act; Australian Competition & Consumer Commission v Dataline.Net.Au Pty Ltd (2006) 236 ALR 665 at [57]-[59] endorsed by the Full Court in Australian Competition & Consumer Commission v Dataline.Net.Au Pty Ltd (2007) 161 FCR 513 at [92]; Hadgkiss v Aldin (No 2) [2007] FCA 2069 at [21]–[22]; Secretary, Department of Health & Ageing v Pagasa Australia Pty Ltd [2008] FCA 1545 at [77]-[79] and Ponzio v B & P Caelli Constructions Pty Ltd (2007) 158 FCR 543.

Section 12DI(3)

16 Section 12DI(3) of the ASIC Act provides:

(3) A person contravenes this subsection if:

(a) the person, in trade or commerce, accepts payment or other consideration for financial services; and

(b) at the time of acceptance, there are reasonable grounds for believing that the person will not be able to supply the financial services within the period specified by the person or, if no period is specified, within a reasonable time.

Note: Failure to comply with this subsection is an offence (see section 12GB).

17 As stated by Beach J in Australian Securities and Investments Commission v Commonwealth Bank of Australia [2020] FCA 790 at [40], the elements of a contravention of s 12DI(3) are:

(a) an accepted payment;

(b) the payment is accepted in trade or commerce;

(c) the payment is for financial services; and

(d) at the time of acceptance there are reasonable grounds for believing that the person will not be able to supply the financial services within the period specified by the person or, if no period is specified, within a reasonable time.

18 Section 12BAB of the ASIC Act sets out when, for the purposes of Div 2 of Pt 2 of that Act (which includes s 12DI), a person provides a financial service. It includes, at s 12BAB(1)(a), when the person provides financial product advice. It also includes providing a service that is otherwise supplied in relation to a financial product (s 12BAB(1)(g)).

Section 912A

19 Section 912A(1) of the Corporations Act relevantly provides:

(1) A financial services licensee must:

(a) do all things necessary to ensure that the financial services covered by the licence are provided efficiently, honestly and fairly; and

…

(b) comply with the conditions on the licence; and

(c) comply with the financial services laws;

20 In relation to s 912A(1)(a), a person who provides financial product advice provides a financial service for the purposes of Ch 7 of the Corporations Act (which includes s 912A): see s 766A(1)(a). Section 912A(1)(a) was considered by the Full Court in Australian Securities and Investments Commission v Westpac Securities Administration Ltd (2019) 272 FCR 170 at [169]-[175] per Allsop CJ, at [286], [289] per Jagot J, and at [421]-[427] per O’Bryan J; and by Beach J in Australian Securities and Investments Commission v AGM Markets Pty Ltd (in liq) (No 3) (2020) 275 FCR 57 at [505]-[528]. The expression “efficiently, honestly and fairly” is broad. There is no need for the purposes of the present proceeding to resolve any difference of views as to whether “efficiently, honestly and fairly” is a compendious expression.

21 In relation to s 912A(1)(c), “financial services law” means, relevantly, a provision of Ch 7 of the Corporations Act or a provision of Div 2 of Pt 2 of the ASIC Act: see Corporations Act, s 761A.

Pecuniary penalties

22 Pecuniary penalties for the contraventions of s 12DI are dealt with in s 12GBA, which provided at the relevant time that, if the Court is satisfied that a person has contravened s 12DI, the Court may order the person to pay to the Commonwealth such pecuniary penalty, in respect of each act or omission by the person to which the section applies, as the Court determines to be appropriate.

23 Section 12GBA(2) provided that, in determining the appropriate pecuniary penalty, the Court must have regard to all relevant matters including:

(a) the nature and extent of the act or omission and of any loss or damage suffered as a result of the act or omission;

(b) the circumstances in which the act or omission took place; and

(c) whether the person has previously been found by the Court in proceedings under Subdiv G (of Pt 2, Div 2) to have engaged in any similar conduct.

These factors are substantially the same as those referred to in s 76(1) of the Competition and Consumer Act 2010 (Cth) (formerly the Trade Practices Act 1974 (Cth)) save for the reference to proceedings under Subdiv G. Hence, the authorities dealing with that provision are of assistance in applying s 12GBA of the ASIC Act.

24 For each contravention of s 12DI, the maximum penalty payable under s 12GBA(3) was 10,000 penalty units. Over the Penalty Period, the value of a penalty unit was (at various times) $170, $180 and $210: see Crimes Act 1914 (Cth), s 4AA. Therefore, the maximum penalty for a contravention of s 12DI during the Penalty Period has ranged from $1.7 million to $2.1 million. In the present case, there were thousands of contraventions.

25 The principles applicable to the discretion to impose pecuniary penalties have been discussed in many cases and are well-established. I discussed the applicable principles in Australian Securities and Investments Commission v RI Advice Group Pty Ltd (No 3) [2022] FCA 84 at [18]-[24]. I draw on that discussion in the following paragraphs.

26 The principal purpose of a pecuniary penalty is to act as a personal and general deterrent: Re HIH Insurance Ltd (in prov liq) and HIH Casualty and General Insurance Ltd (in prov liq); Australian Securities and Investments Commission v Adler (2002) 42 ACSR 80 (Adler) at [125]-[126]. The penalty should be no greater than is necessary to achieve that objective: Australian Securities Commission v Donovan (1998) 28 ACSR 583. The penalty should be fixed with a view to ensuring that the amount is not such as to be regarded by the offender or others as an acceptable cost of doing business. In Singtel Optus Pty Ltd v Australian Competition and Consumer Commission (2012) 287 ALR 249, the Full Court of this Court held, at [63], that “those engaged in trade and commerce must be deterred from the cynical calculation involved in weighing up the risk of penalty against the profits to be made from contravention”.

27 The size of the penalty is a matter of discretion: Adler at [126]. The process of fixing the quantum is not an exact science: Australian Securities and Investments Commission v GE Capital Finance Australia, in the matter of GE Capital Finance Australia [2014] FCA 701 (GE Capital) at [75]. All of the circumstances must be weighed: GE Capital at [75]. The approach that should be adopted is one of “instinctive synthesis”: Markarian v The Queen (2005) 228 CLR 357; GE Capital at [75]. Attention should be paid to the maximum penalty fixed by the statute so as to compare the worst possible case with the one before the court: GE Capital at [75].

28 In relation to the applicable principles for a pecuniary penalty, I refer also to: Australian Securities and Investments Commission v Financial Circle Pty Ltd (2018) 131 ACSR 484 at [177]-[182] per O’Callaghan J; Australian Securities and Investments Commission v Westpac Banking Corporation [2019] FCA 2147 (ASIC v Westpac) at [253]-[272] per Wigney J; Australian Securities and Investments Commission v AMP Financial Planning Pty Ltd (No 2) (2020) 377 ALR 55 (ASIC v AMP) at [156]-[160] per Lee J; Australian Securities and Investments Commission v AGM Markets Pty Ltd (in liq) (No 4) (2020) 148 ACSR 511 (ASIC v AGM Markets) at [38]-[51] per Beach J; Australian Securities and Investments Commission v Westpac Securities Administration Ltd, in the matter of Westpac Securities Administration Ltd [2021] FCA 1008 at [17]-[25] per O’Bryan J.

29 In relation to the “course of conduct principle”, the relevant principles were set out by Wigney J in ASIC v Westpac at [264]-[268] and [290]-[292]; see also ASIC v AGM Markets at [50] per Beach J.

Pecuniary penalties proposed by the parties

30 The principles relating to the situation where pecuniary penalties are proposed by the parties have been settled by the High Court in Commonwealth v Director, Fair Work Building Industry Inspectorate (2015) 258 CLR 482 (FWBII). I summarised that authority in Australian Competition and Consumer Commission v Telstra Corporation Limited [2018] ATPR 42-593; [2018] FCA 571 at [24]-[27]. I draw on that summary in the following paragraphs.

31 In FWBII, the High Court held that, in the context of civil penalty provisions, it was open to the Court to receive submissions, including joint submissions, as to an appropriate penalty. Chief Justice French and Kiefel, Bell, Nettle and Gordon JJ (with whom Keane J agreed) stated at [46] that there is “an important public policy involved in promoting predictability of outcome in civil penalty proceedings” and that “the practice of receiving and, if appropriate, accepting agreed penalty submissions increases the predictability of outcome for regulators and wrongdoers”. Their Honours stated that, as was recognised in Trade Practices Commission v Allied Mills Industries Pty Ltd (No 4) (1981) 60 FLR 38; 37 ALR 256 and determined in NW Frozen Foods Pty Ltd v Australian Competition and Consumer Commission (1996) 71 FCR 285, “such predictability of outcome encourages corporations to acknowledge contraventions, which, in turn, assists in avoiding lengthy and complex litigation and thus tends to free the courts to deal with other matters and to free investigating officers to turn to other areas of investigation that await their attention”.

32 Their Honours stated, at [57], that in civil proceedings there is generally very considerable scope for the parties to agree on the facts and their consequences, and that there “is also very considerable scope for them to agree upon the appropriate remedy and for the court to be persuaded that it is an appropriate remedy”. In relation to civil penalty proceedings, their Honours stated at [58]:

Subject to the court being sufficiently persuaded of the accuracy of the parties’ agreement as to facts and consequences, and that the penalty which the parties propose is an appropriate remedy in the circumstances thus revealed, it is consistent with principle and, for the reasons identified in Allied Mills, highly desirable in practice for the court to accept the parties’ proposal and therefore impose the proposed penalty.

(Footnote omitted.)

33 Their Honours in FWBII also made observations, at [60]-[61], regarding submissions by a regulator in such a context.

34 It follows from the above that the questions to be determined in the present case include: first, whether the Court is sufficiently persuaded of the accuracy of the parties’ agreement as to facts and consequences; and secondly, whether the penalty that the parties propose is an appropriate remedy in the circumstances thus revealed.

Adverse publicity orders

35 Section 12GLB(1)(a) of the ASIC Act provided at the relevant time that the Court may, on ASIC’s application, make an adverse publicity order in relation to a person who has been ordered to pay a pecuniary penalty under s 12GBA. Its purpose is twofold: punitive and protective (in the sense of dispelling incorrect or false impressions and/or alerting consumers to the fact of contravening conduct): see Australian Securities and Investments Commission v Commonwealth Bank of Australia (No 2) [2021] FCA 966 at [7]-[17] per Lee J.

Application of principles in the present case

Context of the contravening conduct

36 The factual background relevant to the contraventions is set out in the SOAF, which I accept as correctly setting out the relevant facts.

37 During the Relevant Period, Aware Financial Services’ integrated financial planning business provided advice services to members of funds it managed as trustee: relevantly here the StatePlus Retirement Fund and the StatePlus Fixed Term Pension Plan. Those funds had not less than 63,000 member accounts during the Relevant Period. Provision of services by Aware Financial Services’ employed financial planners was an important part of Aware Financial Services’ business.

38 A member of the StatePlus Retirement Fund during the Relevant Period held either a ‘bundled product’ – one in which advice services were bundled with other services for a single fee (Bundled Clients) – or an ‘unbundled product’, where advice services were separately charged for if the member entered into a further agreement for them with Aware Financial Services. In each case, fees for advice services, charged or allocated as 0.75% per annum of the member’s funds under Aware Financial Services management, were paid monthly.

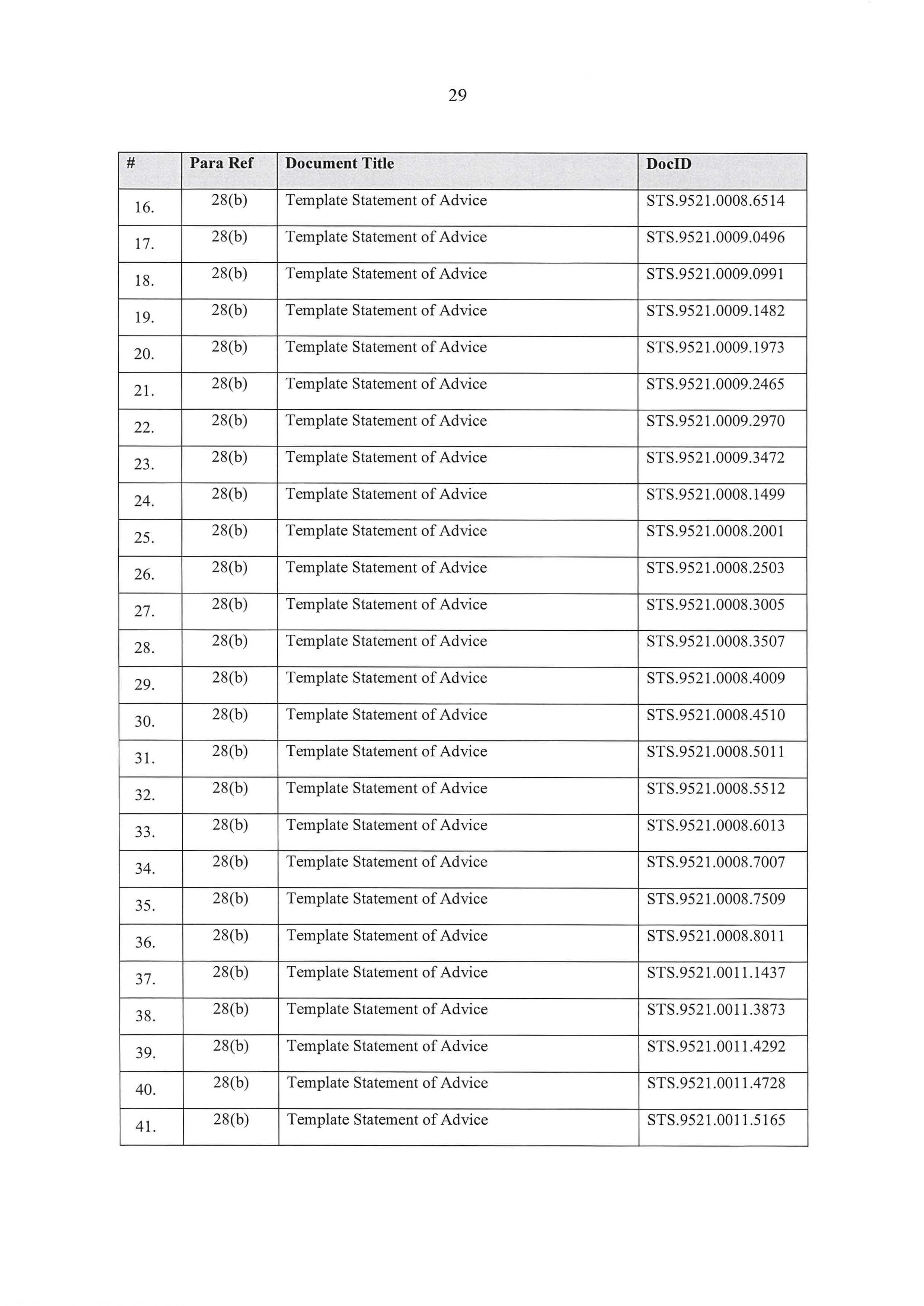

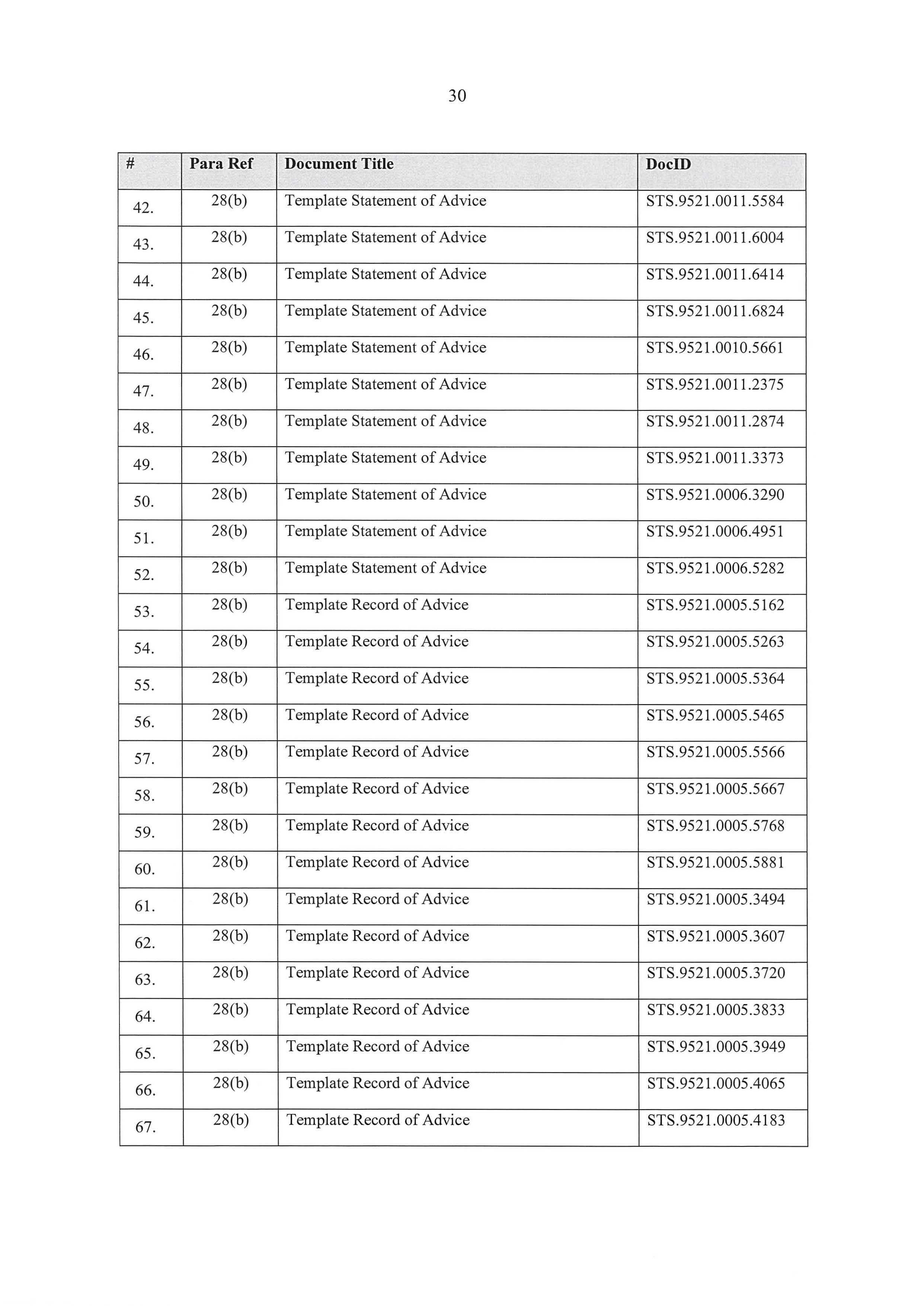

39 On and from the start of the Relevant Period, within statements of advice or records of advice from Aware Financial Services’ financial planners, Aware Financial Services represented to certain of its Bundled Clients that its planners would provide (unless declined) an annual ongoing review (Annual Review Service) to those clients, as an advice service, for which the investment fee was paid. Where fund members held an unbundled product and had agreed to receive ongoing advice services (Unbundled Advice Clients) it was a term of their agreement with Aware Financial Services that it would provide an Annual Review Service (unless declined).

40 In relation to Bundled Clients:

(a) An Annual Review Representation (as defined in the SOAF) was made in statements or records of advice provided to approximately 74% of Bundled Clients who had an open account for at least one year during the Relevant Period – which equates to approximately 40,000 Bundled Clients. The Annual Review Representation did not vary having regard to the amount of a member’s funds under management.

(b) From 1 April 2013 to early 2018, Aware Financial Services did not provide an Annual Review Service to approximately 27,500 Bundled Clients who had received an Annual Review Representation on or after 1 April 2013 (the Affected Bundled Clients). This involved a failure to provide approximately 39,681 Annual Review Services.

(c) At least 17,500 of those Affected Bundled Clients received an Annual Review Representation for the first time in the Relevant Period on or after 21 August 2013. All failures to provide an Annual Review Service to those Affected Bundled Clients occurred in the Penalty Period.

(d) 1,187 Bundled Clients, having received one or more Annual Review Representations, did not receive an Annual Review Service in a single annual period ending between early 2018 and August 2018.

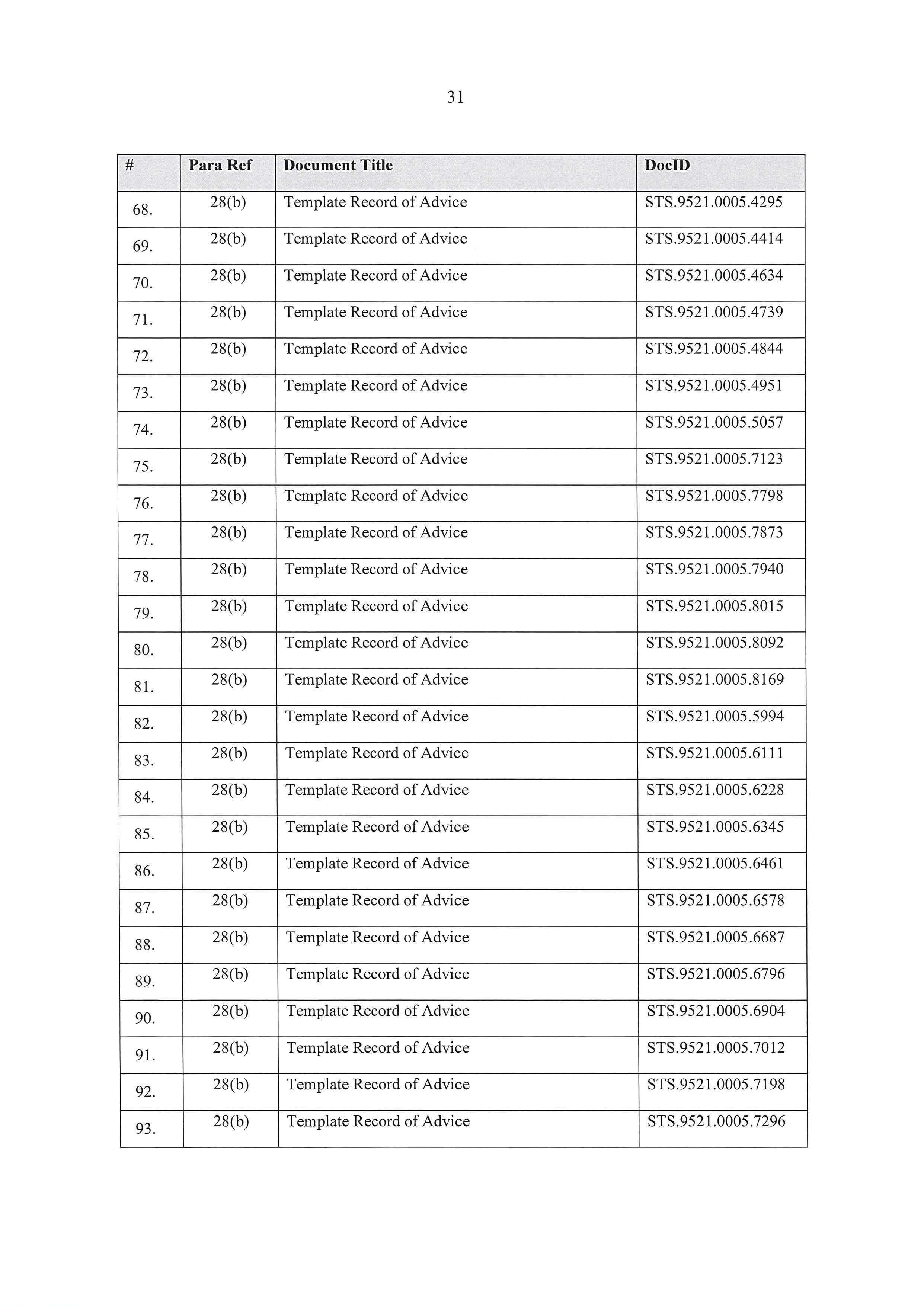

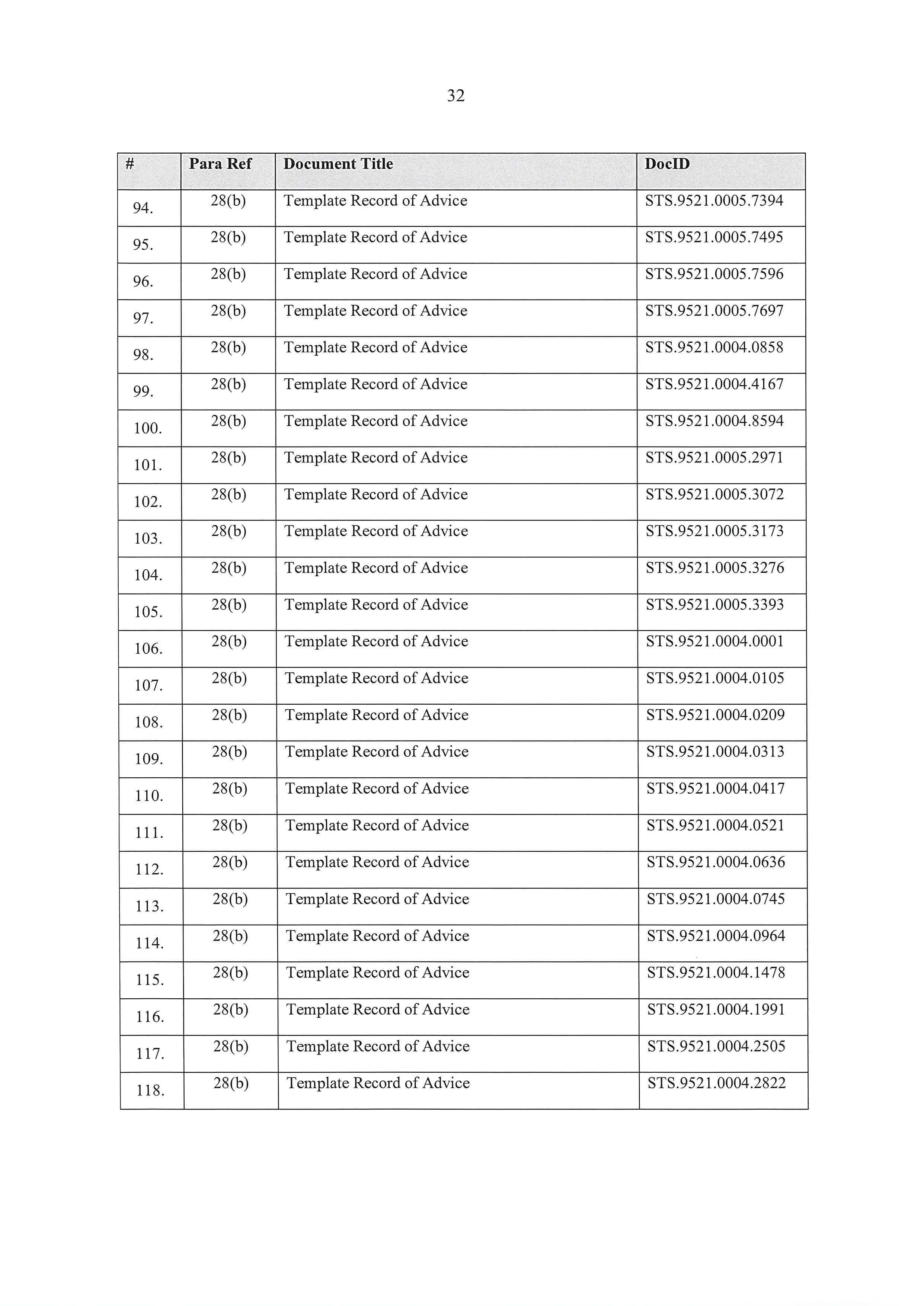

41 In relation to Unbundled Advice Clients:

(a) It was a term of ongoing advice services arrangements that Unbundled Advice Clients be provided an Annual Review Service, unless the client positively declined it.

(b) During the Relevant Period, Aware Financial Services did not provide at least one Annual Review Service to approximately 9,000 Unbundled Advice Clients (of approximately 17,000 such clients in that period). It failed to provide approximately 11,700 Annual Review Services in that period to those Unbundled Advice Clients.

(c) At least 7,800 of those Unbundled Advice Clients became an Unbundled Advice Client on or after 21 August 2013, and all failures to provide an Annual Review Service to them in the Relevant Period occurred in the Penalty Period.

42 Further, during the Relevant Period, Aware Financial Services maintained systems, procedures and controls that contributed to the non-delivery of Annual Review Services to its Advice Clients in that it:

(a) applied a 14-month, not annual, cycle to the provision of Annual Review Services;

(b) maintained service standards, procedures and financial incentives that did not require that all Advice Clients be provided with (or to have declined) an Annual Review Service annually;

(c) provided financial planner incentives for new business (being new advice revenue) that, having regard to paragraph (b) above, once the financial planner had provided annual reviews to the requisite percentage (where applicable) of Advice Clients, incentivised its financial planners to prioritise new clients over providing Annual Review Services to all Advice Clients;

(d) maintained internal prospect appointment targets or ratios that, if met, left insufficient remaining financial planner capacity across Aware Financial Services’ financial planning network to conduct Annual Review Service appointments with all Advice Clients;

(e) did not conduct financial planner serviceability and capacity planning requiring provision of an Annual Review Service to all Advice Clients until early 2018;

(f) had operational practices for the allocation of clients to and retention of clients by Aware Financial Services’ financial planners that permitted clients not to be allocated to financial planners for the provision of Annual Review Services; and

(g) failed to identify, until early 2017, that Annual Review Representations had been made on and from 1 April 2013, and failed to incorporate required provision of Annual Review Services into Aware Financial Services’ systems, procedures and policies.

43 Aware Financial Services progressively identified each of these matters on and from around June 2017 and took steps to address them.

44 The following matters should be noted from the factual summary provided above:

(a) Throughout the Relevant Period, Aware Financial Services accepted payment of fees monthly from Advice Clients by charging relevant member superannuation accounts (each such payment, an Accepted Payment).

(b) It did so in trade or commerce.

(c) Those fees included an amount for advice services.

(d) On and from the commencement of the Relevant Period, Aware Financial Services represented to approximately 74% of its Bundled Clients, and agreed as a term of the advice services agreement with its Unbundled Advice Clients, that ongoing annual reviews, would be provided by its financial planners to those clients, in consideration of payment of a fee for advice services.

(e) Despite this, Aware Financial Services maintained systems and procedures during the Relevant Period that gave rise to reasonable grounds for believing that an Annual Review Service would not be able to be provided within an annual period on many occasions to those Advice Clients.

(f) In essence, Aware Financial Services did not maintain systems, controls and processes that allowed it to provide timely financial services that it had said it would provide and was accepting money to provide, to all those to whom it was obliged to do so.

Contraventions of s 12DI(3)

45 Having regard to the matters referred to above, and in the SOAF generally, I find that, by accepting each Accepted Payment referred to in [44(a)] above during the Penalty Period, Aware Financial Services contravened s 12DI(3) of the ASIC Act.

46 I will therefore make a declaration in relation to s 12DI(3) substantially in the terms proposed by the parties. I will make the following declaration:

During the period between 21 August 2014 and 30 June 2018, the defendant, Aware Financial Services Australia Limited (ACN 003 742 756), in trade or commerce accepted payment from Advice Clients for the provision of Annual Review Services, which are financial services within the meaning of s 12DI(3)(a) of the Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act), when there were reasonable grounds for believing that Aware Financial Services Australia Limited would not be able to supply the financial services to all such clients within the period specified, and thereby contravened s 12DI(3) of the ASIC Act.

47 Each of the preconditions to the making of a declaration is present.

Contraventions of s 912A(1)(a), (b) and (c)

48 I find that, during the Penalty Period, Aware Financial Services contravened s 912A(1)(a) of the Corporations Act, in that it failed to do all things necessary to ensure that the financial services covered by its AFSL were provided efficiently, honestly and fairly, by its conduct in each of:

(a) contravening s 12DI(3) of the ASIC Act in the manner described above;

(b) failing to provide Annual Review Services at least once to no fewer than 25,300 Advice Clients in the Penalty Period; and

(c) continuing and maintaining throughout the Penalty Period systems, procedures and controls and operational and compliance systems that did not ensure compliance with representations made and obligations to all Advice Clients in respect of the Annual Review Services.

49 In relation to s 912A(1)(b), I note that, at all times during the Relevant Period, Aware Financial Services’ AFSL required that Aware Financial Services establish and maintain compliance measures that ensured, as far as is reasonably practicable, that it complied with the provisions of the financial services laws. I find that, by the conduct referred to in [48(c)] above, Aware Financial Services contravened s 912A(1)(b) by failing to establish and maintain compliance measures that ensured, as far as is reasonably practicable, that it complied with the provisions of the financial services laws during the Penalty Period.

50 In relation to s 912A(1)(c), I find that, by each occasion that Aware Financial Services contravened s 12DI(3) of the ASIC Act, Aware Financial Services breached its general obligation to comply with the financial services laws in contravention of s 912A(1)(c) of the Corporations Act.

51 I will therefore make declarations in relation to s 912A(1) substantially in the terms proposed by the parties. I will make the following declarations:

2. Aware Financial Services Australia Limited, by its conduct in each of:

(a) contravening s 12DI(3) of the ASIC Act as referred to in paragraph 1 above;

(b) failing to provide Annual Review Services to Advice Clients during the period between 21 August 2014 and 30 June 2018; and

(c) continuing and maintaining throughout the period between 21 August 2014 and 30 June 2018 internal procedures, measures and controls and operational and compliance systems that did not ensure compliance with representations made and obligations to all Advice Clients in respect of the Annual Review Services,

breached its obligation to do all things necessary to ensure that the financial services covered by its AFSL were provided efficiently, honestly and fairly, and thereby contravened s 912A(1)(a) of the Corporations Act 2001 (Cth).

3. Aware Financial Services Australia Limited, by its conduct in contravening s 12DI(3) of the ASIC Act, breached its general obligation as a financial service licensee to comply with financial services laws and thereby contravened s 912A(1)(c) of the Corporations Act.

4. Aware Financial Services Australia Limited, by failing to establish and maintain compliance measures that ensured between 21 August 2014 and 30 June 2018, as far as is reasonably practicable, that it complied with the provisions of the financial services laws, contravened s 912A(1)(b) of the Corporations Act.

52 Again, each of the requirements for the making of a declaration is satisfied.

Pecuniary penalty

53 As noted above, the parties jointly propose a pecuniary penalty of $20 million for all of the contraventions of s 12DI(3) of the ASIC Act during the Penalty Period.

54 I consider this to be an appropriate penalty. My reasons are as follows. In the discussion that follows, I refer to the mandatory considerations referred to in the legislation and the factors identified by French J in Trade Practices Commission v CSR Ltd [1991] ATPR 41-076; [1990] FCA 762.

Maximum penalty

55 The maximum penalty for each contravention has been referred to above.

56 As the discussion above indicates, the number of contraventions in the present case is very large, in the thousands. In cases such as the present case, involving agreement between the parties as to a very large number of contraventions, it is not helpful to make a finding as to the precise number of contraventions, or to calculate a maximum aggregate penalty by reference to such a number: Australian Building and Construction Commissioner v Construction, Forestry, Mining and Energy Union (2017) 254 FCR 68 at [143]-[145], citing Australian Competition and Consumer Commission v Coles Supermarkets Australia Pty Ltd (2015) 327 ALR 540 at [18], [82] and Australian Competition and Consumer Commission v Reckitt Benckiser (Australia) Pty Ltd (2016) 340 ALR 25 at [139]-[145].

The nature and extent of the contravening conduct and the circumstances in which it took place

57 These matters have been summarised above and are set out in detail in the SOAF. I note the following matters in particular.

58 At least 25,300 Advice Clients paid Aware Financial Services fees for ongoing advice service and did not receive at least one Annual Review Service during the Penalty Period.

59 The contravening conduct – accepting payment for annual reviews while reasonable grounds existed to believe that Aware Financial Services would not be able to provide them – is of a serious nature, extended over several years and arose through admitted failures of Aware Financial Services’ processes and controls.

60 The acts and omissions giving rise to contraventions involved a failure on behalf of Aware Financial Services to introduce and maintain adequate systems, procedures and controls, including for risk identification, until early to mid-2018.

61 Aware Financial Services also derived profits from the contravening conduct.

The amount of loss or harm that the contraventions caused

62 The affected clients suffered loss and damage in the sense that they did not receive the Annual Review Services that they paid for (although this loss has now been remediated through the payment of compensation).

63 Aware Financial Services has made remediation payments in connection with the non-provision of annual reviews to Advice Clients across the Relevant Period totalling approximately $105 million: approximately $80 million for 27,567 Bundled Clients; and approximately $24 million for 9,026 Unbundled Advice Clients. I note that these figures relate to the Relevant Period, as distinct from the Penalty Period, which is the period I am concerned with for present purposes.

64 Remediation payments commenced in or around March 2018.

65 There has been remediation for almost 52,000 failures to provide annual reviews (and to approximately 36,000 clients). This equates to approximately $2,000 in loss or damage (overpaid fees, plus interest and earnings) remediated per failure during the Relevant Period.

66 Even assuming, as a minimum, that only one failure to provide an annual review occurred for 25,300 Advice Clients who paid Aware Financial Services fees for Annual Review Services during the Penalty Period and did not receive at least one Annual Review Service, then loss or damage suffered by them (in the sense of the fees paid for no service) would be approximately $50 million (prior to remediation).

The size of the contravening entity and its financial position

67 Aware Financial Services was acquired (indirectly) by Aware Super Pty Limited (ABN 11 118 202 672, formerly FSS Trustee Corporation), as trustee for the First State Super Scheme (now Aware Super), in or around June 2016.

68 During the Relevant Period, Aware Financial Services was a superannuation trustee and registrable superannuation entity licensee in respect of the StatePlus Retirement Fund and StatePlus Fixed Term Pension Plan, and ran a financial services advice business, of a reasonable size.

69 As at 30 June 2018, Aware Financial Services was a superannuation trustee of the StatePlus Retirement Fund, which had total assets of $17.86 billion. The StatePlus Retirement Fund had no fewer than 63,000 member accounts in the Relevant Period. Aware Financial Services earned more than $197 million in revenue in the financial year ending 30 June 2018, and its annual net profit in the financial years ending 30 June 2014 to 30 June 2017 varied between $37.6 million and $47 million. It incurred a net loss of $26.5 million in the last financial year of the Relevant Period. In 2021, the net loss that it incurred increased to $36.5 million.

70 After the Relevant Period, Aware Financial Services’ business changed significantly.

71 After the Relevant Period:

(a) Aware Financial Services ceased being trustee and registrable superannuation entity licensee in respect of the StatePlus Retirement Fund;

(b) the members and assets of the StatePlus Retirement Fund were transferred by successor fund transfer effective June 2019 to the First State Super Scheme (now known as Aware Super); and

(c) the StatePlus Fixed Term Pension Plan was wound up effective May 2020.

72 From around May 2020, Aware Financial Services has conducted a financial planning business only. On 26 August 2020, Aware Financial Services applied to the Australian Prudential Regulation Authority to cancel its registrable superannuation entity licence as it was no longer the trustee of a superannuation entity and did not then hold superannuation assets.

73 Aware Financial Services’ annual revenue in the financial year ending 30 June 2021 was approximately $137 million, and (as noted above) it made a net loss of $36.5 million.

74 Whilst Aware Financial Services may have decreased in size, it still operates a significant financial advice business.

Whether the conduct was deliberate or systematic

75 ASIC does not submit that Aware Financial Services’ contravening conduct was deliberate.

76 In relation to whether or not the conduct was systematic, on the basis of the facts and matters referred to above and in the SOAF, I consider the conduct to be systematic, in the sense that the same contravening conduct took place over and over again, during an extended period of time.

Whether the contraventions arose out of the conduct of senior management or at a lower level

77 The s 12DI(3) contraventions arose out of conduct – failures in respect of systems, procedures and processes – within the responsibility of senior management, rather than the conduct of lower level employees.

Whether the company has a corporate culture conducive to compliance with the relevant provisions

78 In the period up to late 2016, Aware Financial Services’ risk and other systems did not discover or address the non-delivery of Annual Review Services to Advice Clients.

79 Aware Financial Services subsequently came under new management.

80 On or about 12 May 2017, Aware Financial Services gave its first breach notice to ASIC. While steps were taken to address the failings in the systems, it nevertheless took Aware Financial Services some time to correct the deficiencies in its systems, with the result that the contravening conduct continued until June 2018.

Co-operation

81 I accept that Aware Financial Services co-operated with ASIC during the course of ASIC’s investigation. About a year after the commencement of the proceeding, Aware Financial Services admitted the contraventions, thereby avoiding the need for a contested hearing.

Similar conduct in the past

82 Aware Financial Services has not previously been found by the Court to have engaged in any similar conduct.

Summary

83 In summary, in my view, the contraventions of s 12DI(3) of the ASIC Act by Aware Financial Services during the Penalty Period are very serious. The proposed penalty of $20 million reflects the seriousness of the contraventions and should operate as a deterrent, both in terms of specific deterrence and general deterrence. I note for completeness that in reaching this view, I have had regard to the course of conduct principle and the totality principle.

84 I will therefore make an order that, within 14 days, Aware Financial Services pay a pecuniary penalty of $20 million in respect of its conduct declared to contravene s 12DI(3) of the ASIC Act.

Adverse publicity order

85 There is no dispute that an adverse publicity order should be made, but there are four particular issues between the parties about the form of the order, including the notice. In relation to these four points, my views are as follows:

(a) In relation to whether the notice should be fully displayed on the relevant page of the website (as ASIC urges) or whether there should be a link to a PDF document (as Aware Financial Services urges), I prefer ASIC’s position.

(b) In relation to the period of time for the notice to be displayed, I consider 365 days to be appropriate.

(c) In relation to the fourth paragraph of the notice, I consider that it should refer to the Penalty Period, rather than the Relevant Period.

(d) In relation to the fifth paragraph of the notice, I consider that the additional words proposed by Aware Financial Services may be confusing to the reader, and are better omitted.

86 I will make the adverse publicity order proposed by the parties, taking into account the above matters.

87 I will also make the agreed order as to costs.

I certify that the preceding eighty-seven (87) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Moshinsky. |

Associate: