FEDERAL COURT OF AUSTRALIA

Lindholm (liquidator), in the matter of Aviation 3030 Pty Ltd (in liq) [2021] FCA 1244

ORDERS

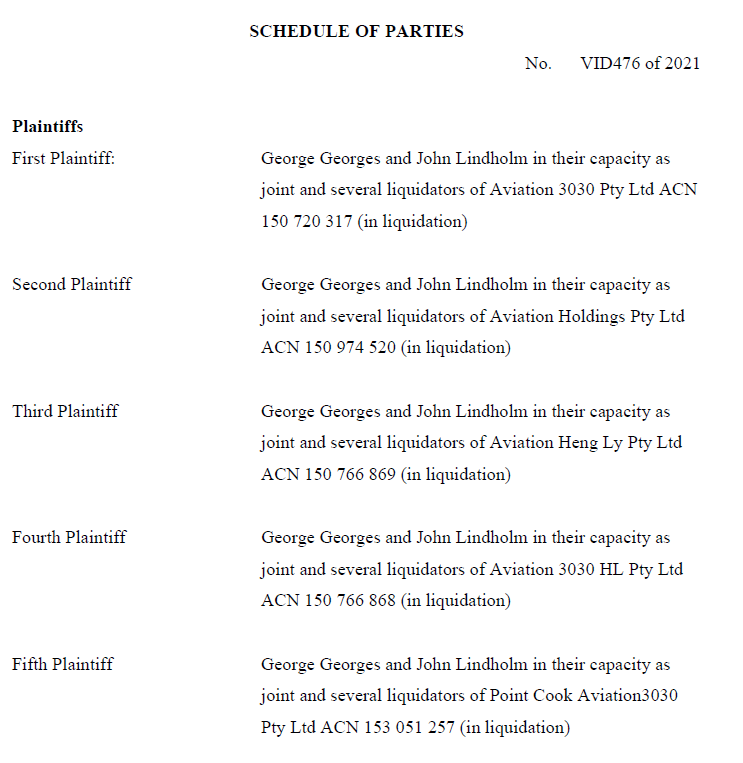

GEORGE GEORGES AND JOHN LINDHOLM OF KPMG IN THEIR CAPACITY AS JOINT AND SEVERAL LIQUIDATORS OF AVIATION 3030 PTY LTD (IN LIQUIDATION) (ACN 150 720 317) and others named in the Schedule Plaintiff | ||

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. Pursuant to s 477(2B) of the Corporations Act 2001 (Cth), Messrs Lindholm and Georges as joint and several Liquidators of the Aviation Entities have approval to enter into, and cause the Aviation Entities to enter into, the proposed deeds of settlement, which are exhibited at JRL-15 and JRL-16 to the second (confidential) affidavit of John Ross Lindholm dated 18 August 2021.

2. Pursuant to s 37AF of the Federal Court of Australia Act 1976 (Cth), the second (confidential) affidavit of John Ross Lindholm dated 18 August 2021 and the (confidential and privileged) advice of Hamish Austin QC and William Newland dated 22 September 2021:

(a) be placed in a sealed envelope marked: “Confidential – not to be accessed for inspection without order of a Judge or Registrar of the Court”;

(b) not be made available for inspection except so far as the Court otherwise orders; and

any application to inspect the affidavit or advice is to be referred to a Judge or Registrar of the Court with three business days’ notice thereof to be provided to the solicitors for the Plaintiffs.

3. The Plaintiffs be indemnified in respect of their costs of this application from the funds of the liquidation.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ANDERSON J:

INTRODUCTION

1 The plaintiffs, George Georges and John Lindholm of KPMG are the joint and several liquidators of a number of companies (Liquidators), which together operated an unregistered management investment scheme (Aviation Entities).

2 The Aviation Entities are Aviation 3030 Pty Ltd (in liquidation) (Aviation 3030) and five companies which hold shares in Aviation 3030 as trustees for unit trusts: Aviation 3030 Investment Pty Ltd, Aviation 3030 Holdings Pty Ltd, Aviation 3030 Heng Ly Pty Ltd, Aviation 3030 HL Pty Ltd and Point Cook Aviation 3030 Pty Ltd (Aviation Unit Trusts).

3 The Liquidators make application by way of originating process filed on 23 August 2021 (Originating Process) for approval by this Court to enter into, and cause the Aviation Entities to enter into, two proposed deeds of settlement (Proposed Deeds). The Proposed Deeds (together with one further deed which does not require Court approval), would settle as against four of seven defendants, proceeding VID174/2020, In the matter of Aviation 3030 Pty Ltd (in liq) (Proceeding). Court approval is required as the terms of the Proposed Deeds contain obligations which extend beyond three months and therefore enliven s 477(2B) of the Corporations Act 2001 (Cth) (Act).

4 The Liquidators, in support of the Originating Process, have filed three affidavits of Mr John Lindholm, being one of the two Liquidators (First, Second and Third Lindholm Affidavit (collectively Lindholm Affidavits)). The First and Second Lindholm Affidavits are dated 18 August 2021, and the Third Lindholm Affidavit is dated 30 September 2021.

5 A suppression order is sought pursuant to the terms of s 37AF of the Federal Court of Australia Act 1976 (Cth) (FCA Act) with respect to the Second Lindholm Affidavit in its entirety, including all annexures.

6 The Liquidators, on the basis of the matters deposed to in the Lindholm Affidavits, request that the Court make the following orders sought in the Originating Process:

(1) Pursuant to s 477(2B) of the Corporations Act 2001 (Cth), Messrs Lindholm and Georges as joint and several Liquidators of the Aviation Entities have approval to enter into, and cause the Aviation Entities to enter into, the proposed deeds of settlement, which is exhibited at JRL-15 and JRL-16 to the second (confidential) affidavit of John Ross Lindholm dated 18 August 2021.

(2) Pursuant to s 37AF of the Federal Court of Australia Act 1976 (Cth), the second (confidential) affidavit of John Ross Lindholm dated 18 August 2021:

(a) be placed in a sealed envelope marked: “Confidential – not to be accessed for inspection without order of a Judge or Registrar of the Court”;

(b) not be made available for inspection except so far as the Court otherwise orders; and

any application to inspect the affidavit is to be referred to a Judge or Registrar of the Court with three business days’ notice thereof to be provided to the solicitors for the Plaintiffs.

(3) The Plaintiffs be indemnified in respect of their costs of this application from the funds of the liquidation.

(4) Such further or other orders as this Honourable Court considers appropriate.

7 On 11 October 2021, I heard the Liquidators’ application. Ms Spencer Bruce of counsel appeared with Mr Roe of counsel for the Liquidators. On that day, I made the orders sought by the Liquidators. These are my reasons for doing so.

BACKGROUND

8 The relevant background facts deposed to in the Lindholm Affidavits are as follows.

9 Aviation 3030 was a land development company which raised funds from investors for the purchase and development of a property at Point Cook, Victoria (Land). Investors invested in Aviation 3030 by purchasing shares in Aviation 3030 or by purchasing units in the Aviation Unit Trusts.

10 The project was extremely successful. On 30 May 2011, Aviation 3030 entered into a sale contract to purchase the Land for $7.8 million. In September 2012, the Land was rezoned from a “Green Wedge Zone” to “Farming Zone”. In October 2018, Aviation 3030 entered into a contract (Dahua Contract) to sell the Land to a third party, Dahua Group Melbourne Number 4 Pty Ltd, for $135 million. A deposit of $27 million has already been paid to Aviation 3030, with settlement of the sale and the balance of $108 million due on 24 April 2023.

11 The issue that needs to be considered in this proceeding is which shareholders should receive these distributions and in what proportion should the distributions be made.

12 Prior to 17 March 2016, Aviation 3030 had issued 88 million shares to investors (minority investors) who purchased those shares and made capital contributions to the company as part of Aviation 3030's capital raising. On 17 March 2016, the Land having been rezoned favourably, and 76 million ordinary shares in Aviation 3030 were issued (Share Issue) to each of Lao Holdings Pty Ltd as trustee for the Lao Holdings Trust (Lao Shareholder) and Khay Suong Taing Aviation3030 as trustee for the Khay Suong Taing Aviation3030 No 1 Trust (Taing Shareholder).

13 Each of the recipients of the Share Issue (the Lao Shareholder and the Taing Shareholder) paid a nugatory price for the shares compared to arms-length investors who had previously purchased shares. The Share Issue also significantly diluted the holdings of the minority investors. The shares received as a result of the Share Issue by the Lao Shareholder (Lao Shares) and the Taing Shareholder (Taing Shares) now comprise approximately 63.6% of the issued share capital in Aviation 3030.

14 At the time of the Share Issue, the directors of Aviation 3030 were Hakly Lao, Chong Huy Taing and Terrence Grundy. Hakly Lao was the sole shareholder and director of the Lao Shareholder and a beneficiary of the Lao Holdings Trust. Chong Huy Taing was the son of the sole shareholder and the sole director of the Taing Shareholder, and also a beneficiary of the Khay Suong Taing Aviation3030 No 1 Trust.

Appointment of the Liquidators and commencement of the Proceeding

15 On 20 March 2019, following an Australian Securities & Investments Commission (ASIC) investigation, the Federal Court of Australia appointed the Liquidators, each being senior partners at KPMG, as joint and several liquidators of the Aviation Entities on just and equitable grounds: ASIC v Aviation 3030 Pty Ltd [2019] FCA 377.

16 On 19 June 2019, the Liquidators issued a statutory report to creditors. In October and November 2019, the Liquidators conducted seven days of public examinations. In late 2019 to early 2020, a careful review of the Aviation Entities’ affairs and documents was conducted by the Liquidators, Ashurst (being the Liquidators’ solicitors), and counsel.

17 On 12 March 2020 the Liquidators commenced proceedings in this Court. The Proceeding was brought against Hakly Lao, his mother Heng Kim Ou and the Lao Shareholder (Lao Parties) and against Chong Huy Taing, his father Khay Suong Taing, his mother Say Kim Taing and the Taing Shareholder (Taing Parties).

18 In the Proceeding, it was alleged that the Share Issue involved unreasonable director-related transactions pursuant to s 588FDA of the Act, and that the transaction is liable to be set aside under s 588FF of the Act; that Hakly Lao and Chong Huy Taing breached directors' duties in relation to the Share Issue, and that each of the other defendants had knowledge of, and were involved in, the breaches of directors' duties. The relief sought includes the Share Issue being set aside as void ab initio or otherwise cancelled, or compensation being provided to Aviation 3030 for the breaches of directors' duties.

The proposed settlement

19 The Proceeding is complex. The legal complexities are evident on the face of the Originating Process filed in the Proceeding together with the pleadings. In terms of evidence, there was a significant volume of material placed before the Court, with the plaintiffs alone calling eight lay witnesses and two expert witnesses. Evidence has been given viva voce, including by interpreter in the case of Khay Suong Taing.

20 Prior to the hearing of the Proceeding, the parties and their legal advisers had engaged in two court-ordered mediations which were ultimately unsuccessful. On 29 April 2021, having heard eight days of trial and aware that previous efforts had been made to mediate the matter, Anastassiou J stated that the outcome of the Proceeding “could be, but is not necessarily, binary”, and invited the parties to consider attending a further mediation. This was ordered by consent on 6 May 2021. As at that date, the matter had already run beyond its original estimate, and it was clear that the Proceeding would continue for some time. Anastassiou J adjourned the matter part-heard.

21 Over the following three months, the parties attempted to resolve the matter outside of Court. The parties engaged in extensive negotiations which began on 13 May 2021. Following that process, the Aviation Entities and the Taing Parties agreed to the Proposed Deeds. No settlement was reached with the Lao Parties in the course of those negotations.

22 The Liquidators now seek court approval under s 477(2B) of the Act to enter the Proposed Deeds and the associated suppression orders with the Aviation Entities and the Taing Parties.

APPLICATION FOR SUPPRESSION ORDERS

23 As a preliminary matter, it is necessary to address the second order sought in the Originating Process, being an application for suppression orders to be made under s 37AF of the FCA Act with respect to the Second Lindholm Affidavit.

24 Section 37AF(1)(b) of the Act provides that:

(1) The Court may, by making a suppression order or non-publication order on grounds permitted by this Part, prohibit or restrict the publication or other disclosure of: …

(b) information that relates to a proceeding before the Court and is: …

(i) information that comprises evidence or evidence about evidence; or …

(iv) information lodged with or filed in the Court.

25 In the present case, the Liquidators submit that the Second Lindholm Affidavit comprises relevant information of the kind described in (i) and/or (iv) above, which may be suppressed by this Court. Section 37AG of the FCA Act relevantly provides that one of the grounds for making an order under s 37AF is that “the order is necessary to prevent prejudice to the proper administration of justice”.

26 In the Liquidators’ submission, the orders sought are necessary to prevent prejudice to the proper administration of justice.

27 The Liquidators submit that the Proposed Deeds disclose a substantial part of the settlement that has been reached with respect to four out of the seven defendants, and the circumstances that have given rise to the agreement. As the proceeding will remain on foot with the Lao Parties, and in circumstances where the hearing of lay evidence has yet to be completed and written outlines of closing submissions have not yet been filed, the Liquidators submit that suppression orders should be made to avoid the disclosure of information relating to the settlement that has been reached with the other defendants.

28 As Lindgren J explained in Elderslie Finance Corporation Limited v Newpage Pty Ltd (No 6) (2007) 160 FCR 423 (Elderslie) at [43]-[44]:

[The] administration of justice, including the just and efficient winding up of a company, requires that proper compromises be facilitated rather than obstructed.

…

It would discourage the negotiation of compromises if liquidators knew that all their negotiations and compromise agreements were to be made public, a fortiori in a case [where] there is an ongoing claim by the liquidator and the company in liquidation to recover from another party.

29 In Vardy v Linz, in the matter of Bondi Pizza Pty Ltd (in liq) [2021] FCA 530, Halley J at [25] made a s 37AF suppression order, citing the above reasoning of Lindgren J in Elderslie, to prevent disclosure of a liquidator's settlement deed to the remaining defendant with whom no settlement had been reached. His Honour explained that this was “a necessary measure to prevent prejudice to the proper administration of justice pursuant to s 37AG(1)(a)”.

30 The Liquidators submit that the Second Lindholm Affidavit includes a forthright and detailed explanation of the commercial considerations taken into account by Mr Lindholm in agreeing to the proposed settlement, and the associated negotiations and steps taken. The Liquidators also rely upon the fact that the Court has been provided with confidential and privileged advice from independent counsel Hamish Austin QC and William Newland (Advice) which provides an assessment of the merits of the proposed settlement.

31 The Liquidators submit that whilst the Proposed Deeds only involve four of the seven defendants, the aforementioned material is necessarily directed to the Proceeding as a whole, including the merits of the claims of the Lao Parties. Accordingly, should the Second Lindholm Affidavit and the Advice be disclosed to the Lao Parties, that material would provide significant and unfair advantages to the Lao Parties which would not be available to ordinary litigants, as well as prejudicing the other shareholders in the Aviation Entities.

32 The Liquidators submit that in the event that the Court declines to make the order for approval sought in the Originating Process, the Proceeding would continue as against all defendants. In those circumstances, the provision of the confidential material (which includes a detailed assessment of the merits of the Proceeding and discusses commercial and strategic considerations) would plainly be prejudicial to the Liquidators’ continued conduct of the Proceeding.

33 The Liquidators submit that the both the Second Lindholm Affidavit and the Advice warrant a suppression order to be granted to prevent prejudice to the proper administration of justice. The Liquidators submit, with respect to the Advice, the advantages of the Court having the benefit of confidential advice from counsel are well-established: Re Estate Late Chow Cho-Poon [2013] NSWSC 844 at [107]-[116]; Prygodicz v Commonwealth of Australia (No 2) [2021] FCA 634 at [115].

34 The Liquidators submit that the disclosure of any of the confidential material would be contrary to public interest in the due and beneficial administration of Aviation 3030.

SUPPRESSION ORDER

35 I am satisfied that the Second Lindholm Affidavit and the Advice comprises evidence and information that relates to the Proceeding which is before the Court and is currently part heard before Anastassiou J. I am satisfied that the power under s 37AF of the FCA Act has been enlivened, and making a suppression order is necessary to prevent prejudice to the proper administration of justice: s 37AG(1)(a) FCA Act.

36 I am of this opinion because disclosure of the content of the Second Lindholm Affidavit and the Advice would disclose negotiations and commercial considerations which formed part of these negotiations which culminated in the Proposed Deeds which are the subject of this application. The Proposed Deeds also detail an assessment of the merits of the Proceeding and discusses commercial and strategic considerations taken into account by the Liquidators. I am of the view that, were a suppression order not be made on these documents, it would be significantly detrimental to the Liquidators’ position as the Proposed Deeds settle a substantial part of the Proceeding. If I approve the Proposed Deeds, it will settle the Proceeding as against four of the seven defendants, namely the Taing Parties, but the Proceeding will continue against the Lao Parties.

37 For these reasons, I made the suppression orders sought by the Liquidators on 11 October 2021.

APPLICATION UNDER SECTION 477(2B) OF THE ACT

38 The Liquidators make the following submissions in relation to the approval sought for the proposed settlement.

39 Section 477(2B) of the Act states as follows:

Except with the approval of the Court, of the committee of inspection or of a resolution of the creditors, a liquidator of a company must not enter into an agreement on the company's behalf (for example, but without limitation, a lease or an agreement under which a security interest arises or is created) if:

(a) without limiting paragraph (b), the term of the agreement may end; or

(b) obligations of a party to the agreement may, according to the terms of the agreement, be discharged by performance;

more than 3 months after the agreement is entered into, even if the term may end, or the obligations may be discharged, within those 3 months.

40 In this case, the Proposed Deeds contain obligations which extend beyond three months and therefore enliven s 477(2B) of the Act.

Principles

41 The Court’s role in considering an application under s 477(2B) of the Act was described by Gleeson J in Hurst, in the matter of Liquor National Pty Ltd (in liq) [2019] FCA 1581 (Hurst) in the following terms at [18]:

The Court’s task is to satisfy itself, having regard to the liquidator’s commercial judgment, that there is no error of law, grounds for suspecting bad faith or any other good reason to intervene: Corporate Affairs Commission v ASC Timber Pty Ltd (1998) 29 ACSR 109 at 118; Stewart, Re Newtronics Pty Ltd [2007] FCA 1375.

42 To similar effect, in Re Open Networks Pty Ltd [2013] NSWSC 1245, Brereton J observed at [7]:

[A]s I have from time to time pointed out, the focus of s 477(2B) is not the merits of the litigation nor even the merits of the liquidator’s judgment to enter into the relevant agreements, but the impact of the agreement on the duration of the liquidation. The essential focus of s 477(2B) is the potential for an agreement to protract the liquidation.

43 In Re Mudgee Dolomite & Lime Pty Ltd [2021] NSWSC 984, Ward CJ in Eq recently stated at [21]:

The test for approval under s 477(2B) as explained in Re Lewis at [16] includes, as a primary consideration, the impact of the agreement on the duration of the liquidation and whether that impact is reasonable. The settlement is to be made having regard to the purposes for which the liquidators’ powers exist and the Court in giving approval by way of permission for the liquidators to exercise their commercial judgment. Generally, approval is not refused unless some lack of good faith or error of law or substantial reason to doubt the liquidator’s prudence can be shown and the Court may refuse the approval if the terms of the proposed agreement are unclear.

44 In Re Lewis (as liquidators of Concrete Supply Pty Ltd (in liq) (2020) 145 ACSR 459 at [16] (Re Lewis), White J recently outlined the relevant principles which the Court applies when considering an application for approval at a more detailed level as follows:

(a) the Court makes its assessment having regard to the purposes for which liquidators’ powers exist, including the serving of the interests of those concerned in the winding up, the achievement of what is necessary for the proper realisation of the assets of the company, and assisting in its winding up: Re HIH Insurance Ltd [2004] NSWSC 5 at [15]; Re Stewart (in his capacity as official liquidator of Newtronics Pty Ltd (recs and mgrs apptd) (in liq)) [2007] FCA 1375 (Re Stewart) at [26(6)];

(b) a primary consideration is the impact of the agreement on the duration of the liquidation and whether that is, in all of the circumstances, reasonable in the interests of the liquidation: Re Opel Networks Pty Ltd [2013] NSWSC 1245 at [7]; Re One.Tel Ltd (2014) 99 ACSR 247; [2014] NSWSC 457 (Re One.Tel) at [30];

(c) the Court’s approval is not an endorsement of the proposed agreement but merely constitutes permission for liquidators to exercise their commercial judgment: Re Bell Group Ltd (in liq); Ex parte Woodings (as liquidator of Bell Group Ltd) (in liq)) [2009] WASC 235 (Re Bell) at [58];

(d) the Court does not refuse an approval unless there can be seen to be some lack of good faith, some error in law or principle or some real and substantial grounds for doubting the prudence of the liquidator’s conduct: Re Spedley Securities Ltd (in liq) (1992) 9 ACSR 83; 10 ACLC 1742 at 1745;

(e) a court may also refuse approval if the terms of the proposed agreement are unclear: Re United Medical Protection Ltd (No 4) (2002) 42 ACSR 218; 20 ACLC 1647; [2002] NSWSC 516 at [45];

(f) the role of the Court is to grant or deny approval to the liquidator’s proposal. It is not to develop some alternative proposal which might seem preferable: Corporate Affairs Commission v ASC Timber Pty Ltd (1998) 29 ACSR 109; 16 ACLC 1642 at 1649; and

(g) the Court does not simply “rubber stamp” whatever is put forward by a liquidator: Re Stewart, at [26(1)].

45 With respect to the final consideration elucidated by White J in relation to “rubber stamping” a liquidator’s requests, Gordon J similarly overserved in Re Stewart at [26(1)], that the Court does not simply “rubber stamp” whatever is put forward by a liquidator, but her Honour noted that the Court:

will not interfere unless there can be seen to be some lack of good faith, some error in law or principle, or real and substantial grounds for doubting the prudence of the liquidator's conduct.

46 In Hurst, Gleeson J (when her Honour was in this Court) stated at [16] that s 477(2B) requires the Court to assess whether entry into the agreement "is a proper exercise of power and not ill-advised or improper on the part of the liquidator, rather than involving the exercise of commercial judgment".

47 Additionally, while it is settled that s 477(2B) approval can be ordered retrospectively, the proper course is for approval to be sought in advance: Re Lewis at [22] and Dudley, in the matter of Freshwater Bay Investments Pty Limited (in liquidation) [2021] FCA 608 at [8]. In the present application, approval is being sought in advance and the Proposed Deeds are unexecuted.

The Proposed Settlement

48 The proposed settlement is set out in three agreements: the Proposed Deeds, (being a deed of settlement), a deed of share transfer and settlement (Share Transfer Deed), as well as a trust deed (Trust Deed) establishing the Aviation 3030 Settlement Trust (Trust). Court approval is required with respect to the former two deeds, but not the Trust Deed.

49 The structure and operation of the deeds are addressed in detail in the Second Lindholm Affidavit, the Advice, and in a non-confidential Circular to Creditors which was issued on 24 August 2021 (Circular). The Circular explained in detail the terms of the proposed settlement and notified all shareholders of Aviation 3030 of this application.

50 In summary, the ultimate economic effect of the proposed settlement is that, in exchange for wide releases from the Aviation entities to the Taing Parties, the Taing Shareholder will give up the economic benefit of 40 million of the 76 million shares in Aviation 3030. These shares will be transferred to the Trust and the benefit of those shares will then be transferred to the minority investors. The trustee will provide a tax indemnity in respect of capital gains tax attributable to the Share Transfer; or a Payment Direction, pursuant to which the Taing Shareholder will direct the Liquidators to pay to the minority investors an amount equal to 40/76 distribution, arising from the proportional holding of the Taing Shares, minus certain amounts relating to the Taing Parties' taxation liabilities which will accrue as a result of the Payment Direction.

51 The Liquidators have sought confidential and privileged advice from a range of sources with respect to the proposed settlement. This includes advice provided by Ashurst, trial counsel Christopher Caleo QC and Katherine Brazenor, and from independent counsel Hamish Austin QC and William Newland in the form of the Advice.

52 The Liquidators have also given consideration to a comprehensive list of other relevant matters as addressed in the Second Lindholm Affidavit.

53 The Liquidators submit that they have made the commercial judgment that the proposed settlement serves the interests of those concerned in the winding up and achieves what is necessary for the proper realisation of the assets of the Aviation Entities. They have done so on the basis of the matters deposed to in the Second Lindholm Affidavit, the advice provided by trial counsel and the Advice provided by independent counsel.

The proposed settlement does not increase the length of the liquidation

54 The primary consideration in applying s 477(2B) is whether an agreement entered into by a liquidator may unduly increase the length of the liquidation.

55 The Liquidators submit that the timing of the proposed settlement does not offend that consideration. The Liquidators submit that the timing of the proposed settlement is complementary to the timing of ongoing commercial arrangements in place prior to the liquidation. Aviation 3030's main asset is the Land and its associated right to completion of the Dahua Contract. Aviation 3030 entered into the Dahua Contract prior to the appointment of the Liquidators and the Dahua Contract is due to settle in April 2023. The result is that whether or not the proposed settlement is entered into, the liquidation of the Aviation Entities could not be completed prior to April 2023.

56 The Liquidators submit that the effect of the settlement is to achieve these commercial considerations in a manner that does not lengthen the liquidation. After settlement of the sale of the Point Cook property, the liquidators will elect between the Share Transfer and the Payment Direction, with strict timeframes for completion of either mechanism. The result is that no delay will arise as a result of the settlement agreement.

57 The Liquidators submit that following the selection of the Share Transfer or the Payment Direction, the Liquidators would then carry out the same administrative steps to finalise the liquidation of the Aviation Entities that they would take even if the proposed settlement is not entered into. This would entail calculating the surplus, making a s 488(2) application for approval to distribute a surplus and distributing the surplus in accordance with the shareholder register (subject to any payment directions provided to the Liquidator). If the Share Transfer is selected, the Tax Indemnity would be provided by the trustee and funded out of Trust assets, and would not delay the finalisation of the liquidation.

58 The Liquidators submits that the result is that the primary concern that underpins s 477(2B) of the Act, namely that an agreement entered into by a liquidator does not cause a liquidation to unduly linger, is not engaged on these facts. The proposed settlement will not protract the length of the liquidation.

Commercial basis for entering into the proposed settlement

59 The Liquidators submit that the commercial basis for entering into the proposed settlement, and the merits of that settlement, are addressed in detail in the Second Lindholm Affidavit and the Advice. Whilst the Liquidators accept that the Court is not to simply “rubber stamp” an agreement, the Court is equally not required to endorse the agreement; and is instead merely required to provide permission for liquidators to exercise their commercial judgment. The Liquidators submit that the assessment by the Court involves only determining that “entry into the agreement is a proper exercise of power and not ill-advised or improper on the part of the liquidator, rather than involving the exercise of commercial judgment”: Hurst at [16]. The Liquidators submit that the Second Lindholm Affidavit and the Advice provide a firm foundation for the Court to reach the requisite standard of satisfaction and approve the application.

The Liquidators submit that the proposed settlement results in the minority investors receiving the economic benefit of an additional 40 million shares, subject to various tax adjustments, in addition to the 88 million shares they currently hold. This equates to an additional 16.67% of the final distribution in the liquidation of Aviation 3030. The proposed settlement also reduces the proportional ownership of the shares that the Taing Parties would receive to an amount that is 50% lower than they would achieve if the Liquidators were unsuccessful in the Proceeding.

60 Adopting the Liquidators' estimate of $75 million being available for final distribution, an investor holding one million shares prior to the Proceeding would have received $312,500 (for which they would have paid between $98,000 and $350,000). Following the proposed settlement, that investor would receive at least $424,856, which would result in that investor profiting from their investment irrespective of how much they paid for the shares, a favourable outcome which would not have been otherwise guaranteed. This will be the case even if the Proceeding is entirely unsuccessful against the Lao Parties and neither compensation from the Lao Parties nor the cancellation of the Lao Shares are ordered.

61 The proposed settlement does not affect the Aviation Entities' claim against the Lao Parties. On one hand, this means that Aviation 3030 will still be put through the expense of running the rest of the trial against one of the two groups of defendants. On the other hand, the structure of the proposed settlement means there is effectively a “multiplier effect” on the upside received by the minority investors if the Lao Shares are cancelled or if equitable compensation is ordered. The minority investors' increased proportional share in the final liquidation as a result of the settlement means that they will receive a larger proportion of the benefit of the Proceeding if the Lao Shares are cancelled or compensation is ordered.

62 The Liquidators submit that the proposed settlement is the product of lengthy negotiations which have been conducted over three months and under the supervision of an experienced commercial mediator, in circumstances where the parties were also represented by both solicitors and counsel. All parties to the settlement had had the benefit of conducting eleven days of a trial, including openings, expert evidence and the majority of lay evidence. Mr Lindholm closely observed and received advice throughout the progress of the trial.

63 The Liquidators note that Mr Lindholm also consulted with representatives of the minority investors during the negotiations that lead to the proposed settlement, and took their views (and the extent to which those views are representative of the views of the minority investors as a whole) into account. The Liquidators issued the Circular on 24 August 2021, and any shareholders who responded to that Circular requesting further information (including the Lao Parties) were provided with a copy of the Originating Process and the First Lindholm Affidavit and were notified of the date of this hearing. At this time, no party has indicated their intention to seek leave to be heard on this application.

64 The Liquidators note that Mr Lindholm is a very experienced liquidator, and it is his evidence that the proposed settlement is in the best interests of the minority investors, the Aviation Entities, and the orderly liquidation of the Aviation Entities. He also deposes to the view that the benefits of having certainty in relation to the settlement with the Taing Parties, balanced against the probability of obtaining any better result through continued litigation, weigh in favour of the proposed settlement. In exercising his commercial judgment to agree to the settlement, Mr Lindholm has received, and carefully considered, privileged legal advice from solicitors, and multiple sets of senior and junior counsel, and brought to bear the weight of his thirty years' experience as a leading insolvency practitioner.

The terms of the proposed settlement are clear

65 One basis for refusing an application under s 477(2B) of the Act is that the terms of the agreement are unclear.

66 The Liquidators submit that in this case, the proposed settlement is (necessarily) complex, in part due to the deferred settlement of the Dahua Contract as well as the fact that the settlement does not resolve the Proceeding in its entirety. However, the documents have been carefully drafted to clearly set out how the settlement is to operate, what is to occur upon court approval if obtained, what is to occur upon settlement of the Property and how the obligations are to interact with the administrative processes of the liquidation. Illustrative calculations demonstrate how formulas for certain tax adjustments are to operate. Drafting safeguards have been introduced to ensure the settlement will work as intended.

There are no other reasons to refuse approval

67 The Liquidators submit that there are no other reasons to refuse approval under s 477(2B) of the Act.

68 On the basis of the Lindholm Affidavits and the Advice, there is not, and cannot be any suggestion of impropriety or bad faith in the Liquidators' proposed entry into the settlement agreements. The Liquidators have acted properly, with careful consideration of all relevant matters, and on the basis of both their commercial judgement and legal advice.

69 There is no error of law that arises on the terms of the proposed agreements, which have been carefully structured based upon confidential and privileged legal advice.

70 There is otherwise no “other good reason” for the Court to intervene so as to prevent the settlement being given effect. On the contrary, there are good reasons for the Court to grant the approval sought, including the strong public policy favouring settlements, and the deference ordinarily afforded to the commercial judgement of liquidators, particularly court appointed liquidators.

CONSIDERATION

71 I accept the Liquidators’ submissions that this is an appropriate case to authorise the approval of the Liquidators to enter into and cause the Aviation Entities to enter into, the proposed deeds of settlement which are exhibited at JRL-15 and JRL-16 to the Second Lindholm Affidavit. I am of that view for the reasons that follow.

72 I am satisfied, having read and considered the Lindholm Affidavits and the Advice, that authorising the Liquidators to enter into the proposed deeds of settlement will not adversely impact the duration of the liquidation and that the proposed settlement is in the interests of the liquidation. I accept Mr Lindholm’s evidence that the proposed settlement will not result in the liquidation being prolonged as the Dahua Contract (which was entered into prior to the liquidation) is not due to settle until April 2023. As a consequence, there will be no delay in the liquidation as a result of the settlement agreement.

73 I am satisfied, having read and considered the Lindholm Affidavits and the Advice, that entering into the deeds of settlement is a proper exercise of the Liquidators’ power and is a responsible exercise of the Liquidators’ commercial judgment.

74 The proposed settlement is the product of lengthy negotiations over a period of three months with the Liquidators being advised by their solicitors, trial counsel and independent counsel. Mr Lindholm has been closely involved in the trial being conducted before Anastassiou J and has observed and received legal advice throughout the progress of the trial.

75 The Liquidators have consulted with representatives of the minority investors during negotiations leading to the proposed settlement and have considered and taken into account the views of the minority investors. The Liquidators issued the Circular on 24 August 2021 which explained the economic outcome of the proposed settlement. No party has indicated their intention to oppose or to be heard on this application.

76 Mr Lindholm is a very experienced liquidator and his evidence is that the proposed settlement is in the best interests of the minority investors, the Aviation Entities, and the orderly liquidation of the Aviation Entities. Mr Lindholm’s evidence is that, in his view, the benefits of having certainty in relation to the settlement with the Taing Parties, balanced against the probability of obtaining any better result through continued litigation, weigh in favour of the proposed settlement. That is Mr Lindholm’s commercial judgment and there is no basis to suggest that there was any lack of good faith or some error in law or principle or any real or substantial grounds of doubting the prudence of Mr Lindholm’s commercial judgment.

77 I am satisfied that the terms of the proposed settlement are clear. Whilst the deeds of settlement are complex, I am satisfied that the deeds have been drafted with care to set out how the settlement is to operate, what is to occur upon court approval if obtained, what is to occur upon settlement of the Property, and how the obligations are to interact with the administrative processes of the liquidation.

78 Finally, there are no reasons to refuse to authorise the approval of the proposed settlement. On the basis of the Lindholm Affidavits and the Advice, there is no suggestion of any impropriety or bad faith in the Liquidators’ proposed entry into the deeds of settlement. I accept that the Liquidators have acted properly and with careful consideration of both their commercial judgment and legal advice which they have received.

DISPOSITION

79 For the reasons given, I will make the orders sought by the Liquidators in the Originating Process.

I certify that the preceding seventy-nine (79) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Anderson. |