FEDERAL COURT OF AUSTRALIA

Deputy Commissioner of Taxation v Raptis [2021] FCA 1192

ORDERS

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The application for interlocutory relief be returnable immediately.

Freezing Orders

2. Upon the Applicant, by her Counsel, giving the undertakings set out in Schedule A to each of the following annexures, a freezing order be made:

(a) against the First Respondent in form of Annexure A to these orders;

(b) against the Second Respondent in form of Annexure B to these orders;

(c) against the Third Respondent in form of Annexure C to these orders;

(d) against the Fourth Respondent in form of Annexure D to these orders;

(e) against the Fifth Respondent in form of Annexure E to these orders;

(f) against the Sixth Respondent in form of Annexure F to these orders;

(g) against the Seventh Respondent in form of Annexure G to these orders;

(h) against the Eighth Respondent in form of Annexure H to these orders;

(i) against the Ninth Respondent in form of Annexure I to these orders;

(j) against the Tenth Respondent in form of Annexure J to these orders;

(k) against the Eleventh Respondent in form of Annexure K to these orders; and

(l) against the Twelfth Respondent in form of Annexure L to these orders.

Service

3. Pursuant to rule 17.04 of the Federal Court Rules 2011 (Cth) (Rules), service on the Respondents of the Interlocutory Application for interim relief be dispensed with.

4. Pursuant to rules 10.43 and 10.44 of the Rules, the Applicant have leave to serve the Third Respondent in the United Kingdom in accordance with the Convention on the Service Abroad of Judicial and Extrajudicial Documents in Civil or Commercial Matters done at the Hague on 15 November 1965 with:

(a) the originating application;

(b) the interlocutory application;

(c) the affidavit of Vasilee Zarogiannis affirmed on 1 October 2021 (Zarogiannis Affidavit) and exhibit VZ-1;

(d) the affidavit of Andrew John Chambers sworn on 1 October 2021 and exhibit AJC-1;

(e) the applicant’s outline of submissions dated 1 October 2021; and

(f) these orders;

(the Documents).

5. Pursuant to rules 10.49 and 1.34 of the Rules, leave be granted to serve the Documents on the Third Respondent in the manner set out in Annexure C.

6. Pursuant to rule 10.24 and 10.27 of the Rules, leave be granted to serve the Documents on the Respondents in the manner set out in Annexures A, B and D to L respectively.

7. The Court directs that, upon the undertaking of the Applicant to provide a paper copy of the exhibit to any supporting affidavit within three business days of a request by a Respondent to do so, service of any exhibit may be effected by:

(a) in the case of service by post, providing a copy on a USB drive; or

(b) in the case of service by email, by making it available for download by electronic link.

Other matters

8. The proceeding be listed for a case management hearing at a date to be fixed by the Registry of the Federal Court of Australia on or after 14 October 2021.

9. These orders be entered forthwith.

10. The costs of this application be reserved.

11. Any party affected by these orders has liberty to apply on 24 hours' notice.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ANNEXURE A

No. QUD 310 of 2021

Federal Court of Australia

District Registry: Queensland

Division: General

Deputy Commissioner of Taxation

Applicant

James Raptis and others named in the schedule

Respondent

PENAL NOTICE

TO: James Raptis IF YOU (BEING THE PERSON BOUND BY THIS ORDER): (A) REFUSE OR NEGLECT TO DO ANY ACT WITHIN THE TIME SPECIFIED IN THIS ORDER FOR THE DOING OF THE ACT; OR (B) DISOBEY THE ORDER BY DOING AN ACT WHICH THE ORDER REQUIRES YOU NOT TO DO, YOU WILL BE LIABLE TO IMPRISONMENT, SEQUESTRATION OF PROPERTY OR OTHER PUNISHMENT. ANY OTHER PERSON WHO KNOWS OF THIS ORDER AND DOES ANYTHING WHICH HELPS OR PERMITS YOU TO BREACH THE TERMS OF THIS ORDER MAY BE SIMILARLY PUNISHED. |

TO: James Raptis

This is a 'freezing order' made against you on 1 October 2021 by Justice Collier at a hearing without notice to you after the Court was given the undertakings set out in Schedule A to this order and after the Court read the affidavits listed in Schedule B to this order.

THE COURT ORDERS THAT:

INTRODUCTION

1.

(a) The application for this order is made returnable immediately.

(b) The time for service of this order, the application, supporting affidavits, the applicant's outline of submissions and originating process is abridged and service is to be effected by:

(i) emailing the abovementioned documents to:

A. Brendan.Balasekeran@bdo.com.au;

B. i.hughes@hopgoodganim.com.au; and

C. andrew.johnson@greystoneslaw.com.au,

by 4.00 pm on 4 October 2021;

(ii) posting the abovementioned documents by express post to:

A. Raptis Group Limited, Level 7, 10 Eagle Street, Brisbane QLD 4000;

B. 143 Commodore Drive, Surfers Paradise QLD 4217;

C. Greystones Lawyers and Corporate Advisors, PO Box 12203, Brisbane, QLD 4000;

D. BDO, Level 10, 12 Creek Street, Brisbane, QLD 4000; and

E. HopgoodGanim Lawyers, Level 8, Waterfront Place, 1 Eagle Street, Brisbane QLD 4000,

by 4.00 pm on 4 October 2021;

2. Subject to the next paragraph, this order has effect up to and including the next hearing date ("the Return Date").

3. Anyone served with or notified of this order, including you, may apply to the Court at any time to vary or discharge this order or so much of it as affects the person served or notified.

4. In this order:

(a) 'applicant', if there is more than one applicant, includes all the applicants;

(b) 'you', where there is more than one of you, includes all of you and includes you if you are a corporation;

(c) 'third party' means a person other than you and the applicant;

(d) 'unencumbered value' means value free of mortgages, charges, liens or other encumbrances.

5.

(a) If you are ordered to do something, you must do it by yourself or through directors, officers, partners, employees, agents or others acting on your behalf or on your instructions.

(b) If you are ordered not to do something, you must not do it yourself or through directors, officers, partners, employees, agents or others acting on your behalf or on your instructions or with your encouragement or in any other way.

FREEZING OF ASSETS

6.

(a) You must not remove from Australia or in any way dispose of, deal with or diminish the value of any of your assets in Australia ('Australian assets') up to the unencumbered value of AUD$23,815,519.60 ('the Relevant Amount').

(b) If the unencumbered value of your Australian assets exceeds the Relevant Amount, you may remove any of those assets from Australia or dispose of or deal with them or diminish their value, so long as the total unencumbered value of your Australian assets still exceeds the Relevant Amount.

7. For the purposes of this order,

(a) your assets include:

(i) all your assets, whether or not they are in your name and whether they are solely or co-owned;

(ii) any asset which you have the power, directly or indirectly, to dispose of or deal with as if it were your own (you are to be regarded as having such power if a third party holds or controls the asset in accordance with your direct or indirect instructions); and

(iii) the following assets in particular:

A. Lexus 2018 LS500H Sedan (VIN JTHBYLFF105001528) (registration CC100);

B. any shares held by you in the following companies:

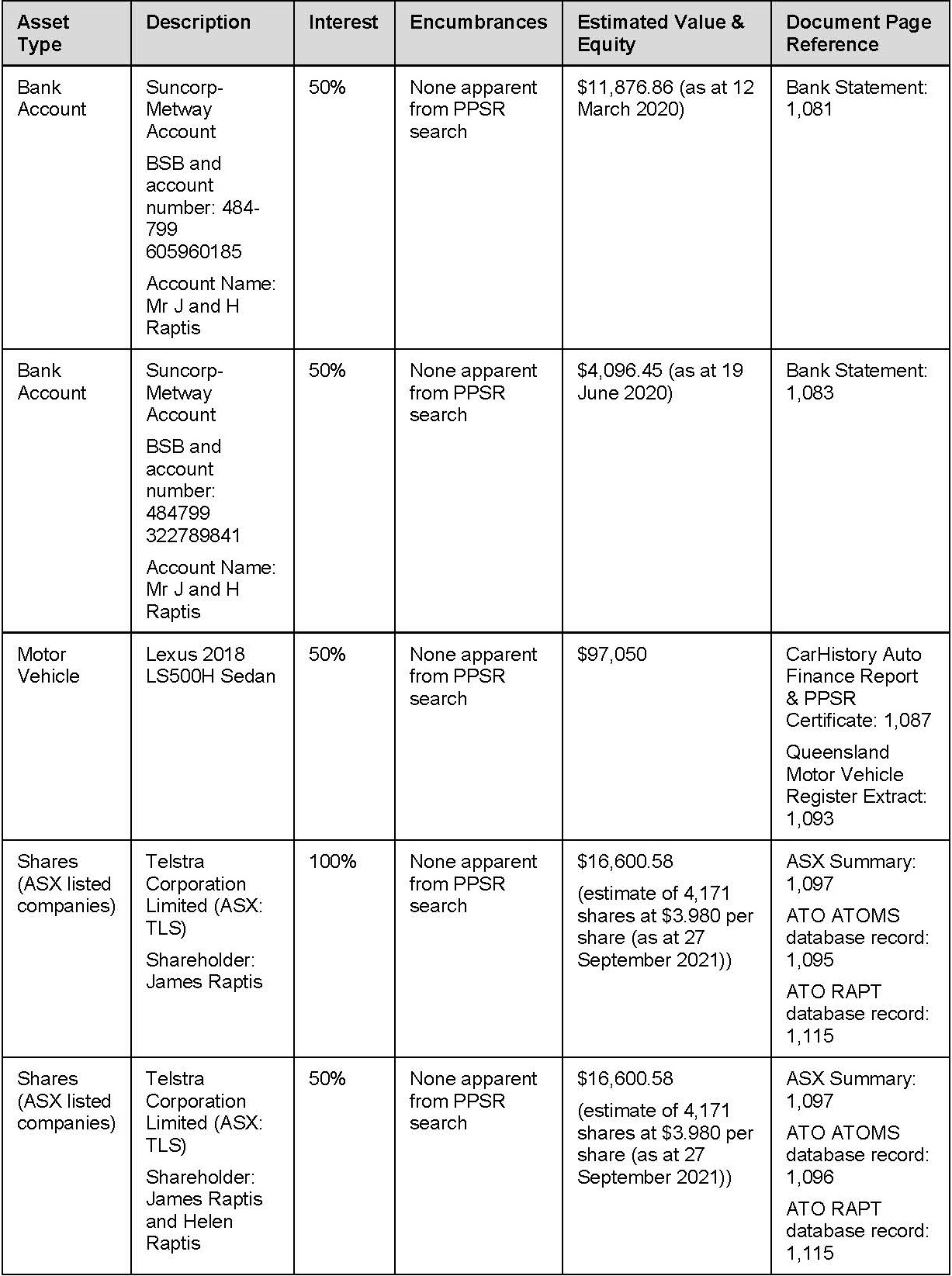

• CVC Limited (ASX: CVC): and

• Telstra Corporation Limited (ASX: TLS); and

C. any money in the following bank accounts:

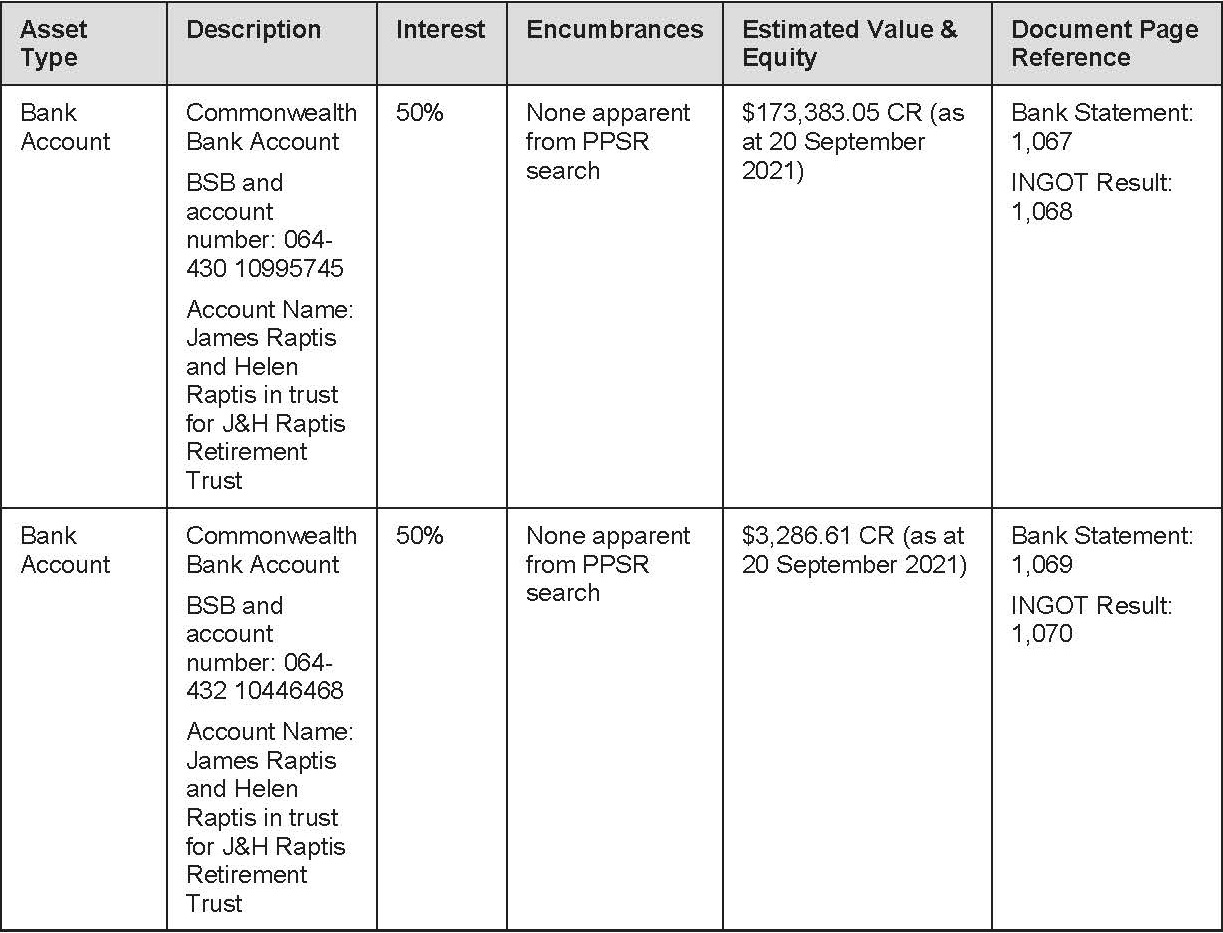

• CBA bank account BSB 064430 account number 10995745 in the name of James Raptis and Helen Raptis in trust for J&H Raptis Retirement Trust;

• CBA bank account BSB 064432 account number 10446468 in the name of James Raptis and Helen Raptis in trust for J&H Raptis Retirement Trust;

• NAB bank account BSB 084034 account number 508427988 in the name of James Raptis and Helen Raptis;

• ANZ bank account BSB 014141 account number 9076 84623 in the name of James Raptis and Helen Raptis;

• Bank of Queensland bank account BSB 124394 account number 22857313 in the name of James Raptis;

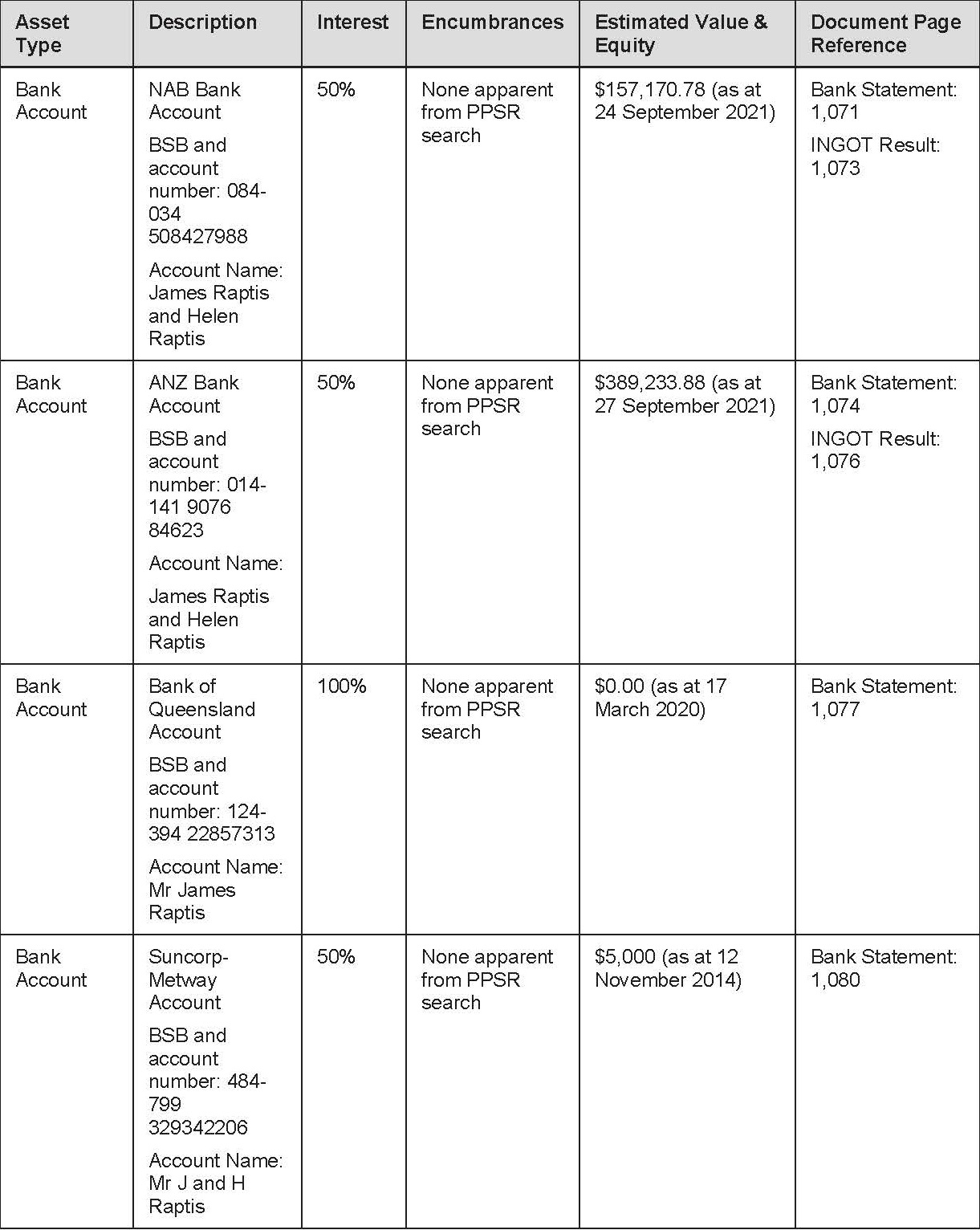

• Suncorp-Metway bank account BSB 484799 account number 322789841 in the name of James Raptis and Helen Raptis;

• Suncorp-Metway bank account BSB 484799 account number 605960185 in the name of James Raptis and Helen Raptis; and

• Suncorp-Metway bank account BSB 484799 account number 329342206 in the name of James Raptis and Helen Raptis.

(b) the value of your assets is the value of the interest you have individually in your assets.

PROVISION OF INFORMATION

8. Subject to paragraph 9, you must:

(a) at or before the further hearing on the Return Date (or within such further time as the Court may allow) to the best of your ability inform the applicant in writing of all your assets in Australia, giving their value, location and details (including any mortgages, charges or other encumbrances to which they are subject) and the extent of your interest in the assets;

(b) within 10 working days after being served with this order, swear and serve on the applicant an affidavit setting out the above information.

9.

(a) This paragraph 9 applies if you are not a corporation and you wish to object to complying with paragraph 8 on the grounds that some or all of the information required to be disclosed may tend to prove that you:

(i) have committed an offence against or arising under an Australian law or a law of a foreign country; or

(ii) are liable to a civil penalty.

(b) This paragraph 9 also applies if you are a corporation and all of the persons who are able to comply with paragraph 8 on your behalf and with whom you have been able to communicate, wish to object to your complying with paragraph 8 on the grounds that some or all of the information required to be disclosed may tend to prove that they respectively:

(i) (have committed an offence against or arising under an Australian law or a law of a foreign country; or

(ii) are liable to a civil penalty.

(c) You must:

(i) disclose so much of the information required to be disclosed to which no objection is taken; and

(ii) prepare an affidavit containing so much of the information required to be disclosed to which objection is taken, and deliver it to the Court in a sealed envelope; and

(iii) file and serve on each other party a separate affidavit setting out the basis of the objection.

EXCEPTIONS TO THIS ORDER

10. This order does not prohibit you from:

(a) paying up to AUD$10,000 a week on your ordinary living expenses;

(b) paying your reasonable legal expenses;

(c) dealing with or disposing of any of your assets in the ordinary and proper course of your business, including paying business expenses bona fide and properly incurred; and

(d) in relation to matters not falling within (a), (b) or (c), dealing with or disposing of any of your assets in discharging obligations bona fide and properly incurred under a contract entered into before this order was made, provided that before doing so you give the applicant, if possible, at least two working days written notice of the particulars of the obligation.

11. You and the applicant may agree in writing that the exceptions in the preceding paragraph are to be varied. In that case the applicant or you must as soon as practicable file with the Court and serve on the other a minute of a proposed consent order recording the variation signed by or on behalf of the applicant and you, and the Court may order that the exceptions are varied accordingly.

12.

(a) This order will cease to have effect if you:

(i) pay the sum of AUD$23,815,519.60 into Court; or

(ii) pay that sum into a joint bank account in the name of your lawyer and the lawyer for the applicant as agreed in writing between them; or

(iii) provide security in that sum by a method agreed in writing with the applicant to be held subject to the order of the Court.

(b) Any such payment and any such security will not provide the applicant with any priority over your other creditors in the event of your insolvency.

(c) If this order ceases to have effect pursuant 12(a) above, you must as soon as practicable file with the Court and serve on the applicant notice of that fact.

COSTS

13. The costs of this application are reserved to the Court hearing the application on the Return Date.

PERSONS OTHER THAN THE APPLICANT AND RESPONDENT

14. Set off by banks

This order does not prevent any bank from exercising any right of set off it has in respect of any facility which it gave you before it was notified of this order.

15. Bank withdrawals by the respondent

No bank need inquire as to the application or proposed application of any money withdrawn by you if the withdrawal appears to be permitted by this order.

16. Notices under s 260-5 of Schedule 1 to the Taxation Administration Act 1953 (Cth)

Nothing in this order shall prevent any third party complying with the terms of a notice issued by the Commissioner of Taxation to the third party pursuant to section 260-5 of Schedule 1 to the Taxation Administration Act 1953 (Cth) in respect of any money which the third party may owe or may later owe to you.

SCHEDULE A

UNDERTAKINGS GIVEN TO THE COURT BY THE APPLICANT

1. The applicant undertakes to submit to such order (if any) as the Court may consider to be just for the payment of compensation (to be assessed by the Court or as it may direct) to any person (whether or not a party) affected by the operation of the order.

2. As soon as practicable, the applicant will file and serve upon the respondent copies of:

(a) this order;

(b) the application for this order for hearing on the return date;

(c) the following material in so far as it was relied on by the applicant at the hearing when the order was made:

(i) affidavits (or draft affidavits);

(ii) exhibits capable of being copied;

(iii) any written submission; and

(iv) any other document that was provided to the Court.

(d) a transcript, or, if none is available, a note, of any exclusively oral allegation of fact that was made and of any exclusively oral submission that was put, to the Court;

(e) the originating process, or, if none was filed, any draft originating process produced to the Court.

3. As soon as practicable, the applicant will cause anyone notified of this order to be given a copy of it.

4. The applicant will pay the reasonable costs of anyone other than the respondent which have been incurred as a result of this order, including the costs of finding out whether that person holds any of the respondent’s assets.

5. If this order ceases to have effect the applicant will promptly take all reasonable steps to inform in writing anyone to who has been notified of this order, or who he has reasonable grounds for supposing may act upon this order, that it has ceased to have effect.

6. The applicant will not, without leave of the Court, use any information obtained as a result of this order for the purpose of any civil or criminal proceedings, either in or outside Australia, other than this proceeding.

7. The applicant will not, without leave of the Court, seek to enforce this order in any country outside Australia or seek in any country outside Australia an order of a similar nature or an order conferring a charge or other security against the respondent or the respondent’s assets.

SCHEDULE B

AFFIDAVITS RELIED ON

Name of deponent | Date affidavit made | |

(1) | Vasilee Zarogiannis | 1 October 2021 |

(2) | Andrew John Chambers | 1 October 2021 |

|

|

NAME AND ADDRESS OF APPLICANT'S LAWYERS

The applicant's lawyers are: K&L Gates

Level 25 South Tower, 525 Collins Street

Melbourne VIC 3000

Tel: +61 3 9205 2000

Tel: +61 3 9640 4269 (after office hours)

Fax: +61 3 9205 2055

Email: Andrew.Chambers@klgates.com

Ref: TTRO.AJC.7390795.00090

No. QUD 310 of 2021

Federal Court of Australia

District Registry: Queensland

Division: General

Deputy Commissioner of Taxation

Applicant

James Raptis and others named in the schedule

Respondents

PENAL NOTICE

TO: Northernson Pty Limited ACN 090 704 902 as trustee for the Northernson Trust IF YOU (BEING THE PERSON BOUND BY THIS ORDER): (A) REFUSE OR NEGLECT TO DO ANY ACT WITHIN THE TIME SPECIFIED IN THIS ORDER FOR THE DOING OF THE ACT; OR (B) DISOBEY THE ORDER BY DOING AN ACT WHICH THE ORDER REQUIRES YOU NOT TO DO, YOU WILL BE LIABLE TO IMPRISONMENT, SEQUESTRATION OF PROPERTY OR OTHER PUNISHMENT. ANY OTHER PERSON WHO KNOWS OF THIS ORDER AND DOES ANYTHING WHICH HELPS OR PERMITS YOU TO BREACH THE TERMS OF THIS ORDER MAY BE SIMILARLY PUNISHED. |

TO: Northernson Pty Limited ACN 090 704 902 as trustee for the Northernson Trust

This is a 'freezing order' made against you on 1 October 2021 by Justice Collier at a hearing without notice to you after the Court was given the undertakings set out in Schedule A to this order and after the Court read the affidavits listed in Schedule B to this order.

THE COURT ORDERS:

INTRODUCTION

1.

(a) The application for this order is made returnable immediately.

(b) The time for service of this order, the application, supporting affidavits, the applicant's outline of submissions and originating process is abridged and service is to be effected by:

(i) emailing the abovementioned documents to:

A. Brendan.Balasekeran@bdo.com.au;

B. i.hughes@hopgoodganim.com.au; and

C. andrew.johnson@greystoneslaw.com.au,

by 4.00 pm on 4 October 2021;

(ii) posting the abovementioned documents by express post to:

A. Raptis Group Limited, Level 7, 10 Eagle Street, Brisbane QLD 4000;

B. 143 Commodore Drive, Surfers Paradise QLD 4217;

C. Greystones Lawyers and Corporate Advisors, PO Box 12203, Brisbane, QLD 4000;

D. BDO, Level 10, 12 Creek Street, Brisbane, QLD 4000; and

E. HopgoodGanim Lawyers, Level 8, Waterfront Place, 1 Eagle Street, Brisbane QLD 4000,

by 4.00 pm on 4 October 2021.

2. Subject to the next paragraph, this order has effect up to and including the next hearing date ("the Return Date").

3. Anyone served with or notified of this order, including you, may apply to the Court at any time to vary or discharge this order or so much of it as affects the person served or notified.

4. In this order:

(a) 'applicant', if there is more than one applicant, includes all the applicants;

(b) 'you', where there is more than one of you, includes all of you and includes you if you are a corporation;

(c) 'third party' means a person other than you and the applicant;

(d) 'unencumbered value' means value free of mortgages, charges, liens or other encumbrances.

5.

(a) If you are ordered to do something, you must do it by yourself or through directors, officers, partners, employees, agents or others acting on your behalf or on your instructions.

(b) If you are ordered not to do something, you must not do it yourself or through directors, officers, partners, employees, agents or others acting on your behalf or on your instructions or with your encouragement or in any other way.

FREEZING OF ASSETS

6.

(a) You must not remove from Australia or in any way dispose of, deal with or diminish the value of any of your assets in Australia ('Australian assets') up to the unencumbered value of AUD$83,205,597.96 ('the Relevant Amount').

(b) If the unencumbered value of your Australian assets exceeds the Relevant Amount, you may remove any of those assets from Australia or dispose of or deal with them or diminish their value, so long as the total unencumbered value of your Australian assets still exceeds the Relevant Amount.

7. For the purposes of this order,

(a) your assets include:

(i) all your assets, whether or not they are in your name and whether they are solely or co-owned;

(ii) any asset which you have the power, directly or indirectly, to dispose of or deal with as if it were your own (you are to be regarded as having such power if a third party holds or controls the asset in accordance with your direct or indirect instructions); and

(iii) the following assets in particular:

A. the property known as 141-143 Commodore Drive, Surfers Paradise QLD 4217 (Title References 15888143 and 15888144) or, if it has been sold, the net proceeds of the sale;

B. any money in any bank accounts, including but not limited to National Australia Bank Limited bank account BSB 084-004 account number 550080244 in the name of Northernson Pty Limited; and

(b) the value of your assets is the value of the interest you have individually in your assets.

PROVISION OF INFORMATION

8. Subject to paragraph 9, you must:

(a) at or before the further hearing on the Return Date (or within such further time as the Court may allow) to the best of your ability inform the applicant in writing of all your assets in Australia, giving their value, location and details (including any mortgages, charges or other encumbrances to which they are subject) and the extent of your interest in the assets;

(b) within 10 working days after being served with this order, swear and serve on the applicant an affidavit setting out the above information.

9.

(a) This paragraph (9) applies if you are not a corporation and you wish to object to complying with paragraph 8 on the grounds that some or all of the information required to be disclosed may tend to prove that you:

(i) have committed an offence against or arising under an Australian law or a law of a foreign country; or

(ii) are liable to a civil penalty.

(b) This paragraph (9) also applies if you are a corporation and all of the persons who are able to comply with paragraph 8 on your behalf and with whom you have been able to communicate, wish to object to your complying with paragraph 8 on the grounds that some or all of the information required to be disclosed may tend to prove that they respectively:

(i) (have committed an offence against or arising under an Australian law or a law of a foreign country; or

(ii) are liable to a civil penalty.

(c) You must:

(i) disclose so much of the information required to be disclosed to which no objection is taken; and

(ii) prepare an affidavit containing so much of the information required to be disclosed to which objection is taken, and deliver it to the Court in a sealed envelope; and

(iii) file and serve on each other party a separate affidavit setting out the basis of the objection.

EXCEPTIONS TO THIS ORDER

10. This order does not prohibit you from:

(a) paying your reasonable legal expenses;

(b) dealing with or disposing of any of your assets in the ordinary and proper course of your business, including paying business expenses bona fide and properly incurred; and

(c) in relation to matters not falling within (a) or (b), dealing with or disposing of any of your assets in discharging obligations bona fide and properly incurred under a contract entered into before this order was made, provided that before doing so you give the applicant, if possible, at least two working days written notice of the particulars of the obligation.

11. You and the applicant may agree in writing that the exceptions in the preceding paragraph are to be varied. In that case the applicant or you must as soon as practicable file with the Court and serve on the other a minute of a proposed consent order recording the variation signed by or on behalf of the applicant and you, and the Court may order that the exceptions are varied accordingly.

12.

(a) This order will cease to have effect if you:

(i) pay the sum of AUD$83,205,597.96 into Court; or

(ii) pay that sum into a joint bank account in the name of your lawyer and the lawyer for the applicant as agreed in writing between them; or

(iii) provide security in that sum by a method agreed in writing with the applicant to be held subject to the order of the Court.

(b) Any such payment and any such security will not provide the applicant with any priority over your other creditors in the event of your insolvency.

(c) If this order ceases to have effect pursuant 12(a) above, you must as soon as practicable file with the Court and serve on the applicant notice of that fact.

COSTS

13. The costs of this application are reserved to the Court hearing the application on the Return Date.

PERSONS OTHER THAN THE APPLICANT AND RESPONDENT

14. Set off by banks

This order does not prevent any bank from exercising any right of set off it has in respect of any facility which it gave you before it was notified of this order.

15. Bank withdrawals by the respondent

No bank need inquire as to the application or proposed application of any money withdrawn by you if the withdrawal appears to be permitted by this order.

16. Notices under s 260-5 of Schedule 1 to the Taxation Administration Act 1953 (Cth)

Nothing in this order shall prevent any third party complying with the terms of a notice issued by the Commissioner of Taxation to the third party pursuant to section 260-5 of Schedule 1 to the Taxation Administration Act 1953 (Cth) in respect of any money which the third party may owe or may later owe to you.

SCHEDULE A

UNDERTAKINGS GIVEN TO THE COURT BY THE APPLICANT

1. The applicant undertakes to submit to such order (if any) as the Court may consider to be just for the payment of compensation (to be assessed by the Court or as it may direct) to any person (whether or not a party) affected by the operation of the order.

2. As soon as practicable, the applicant will file and serve upon the respondent copies of:

(a) this order;

(b) the application for this order for hearing on the return date;

(c) the following material in so far as it was relied on by the applicant at the hearing when the order was made:

(i) affidavits (or draft affidavits);

(ii) exhibits capable of being copied;

(iii) any written submission; and

(iv) any other document that was provided to the Court.

(d) a transcript, or, if none is available, a note, of any exclusively oral allegation of fact that was made and of any exclusively oral submission that was put, to the Court;

(e) the originating process, or, if none was filed, any draft originating process produced to the Court.

3. As soon as practicable, the applicant will cause anyone notified of this order to be given a copy of it.

4. The applicant will pay the reasonable costs of anyone other than the respondent which have been incurred as a result of this order, including the costs of finding out whether that person holds any of the respondent’s assets.

5. If this order ceases to have effect the applicant will promptly take all reasonable steps to inform in writing anyone to who has been notified of this order, or who he has reasonable grounds for supposing may act upon this order, that it has ceased to have effect.

6. The applicant will not, without leave of the Court, use any information obtained as a result of this order for the purpose of any civil or criminal proceedings, either in or outside Australia, other than this proceeding.

7. The applicant will not, without leave of the Court, seek to enforce this order in any country outside Australia or seek in any country outside Australia an order of a similar nature or an order conferring a charge or other security against the respondent or the respondent’s assets.

SCHEDULE B

AFFIDAVITS RELIED ON

Name of deponent | Date affidavit made | |

(1) | Vasilee Zarogiannis | 1 October 2021 |

(2) | Andrew John Chambers | 1 October 2021 |

|

|

NAME AND ADDRESS OF APPLICANT'S LAWYERS

The applicant's lawyers are: K&L Gates

Level 25 South Tower, 525 Collins Street

Melbourne VIC 3000

Tel: +61 3 9205 2000

Tel: +61 3 9640 4269 (after office hours)

Fax: +61 3 9205 2055

Email: Andrew.Chambers@klgates.com

Ref: TTRO.AJC.7390795.00090

ANNEXURE C

No. QUD 310 of 2021

Federal Court of Australia

District Registry: Queensland

Division: General

Deputy Commissioner of Taxation

Applicant

James Raptis and others named in the schedule

Respondents

PENAL NOTICE

TO: Sevinhand Company Limited (company number 02100771) IF YOU (BEING THE PERSON BOUND BY THIS ORDER): (A) REFUSE OR NEGLECT TO DO ANY ACT WITHIN THE TIME SPECIFIED IN THIS ORDER FOR THE DOING OF THE ACT; OR (B) DISOBEY THE ORDER BY DOING AN ACT WHICH THE ORDER REQUIRES YOU NOT TO DO, YOU WILL BE LIABLE TO IMPRISONMENT, SEQUESTRATION OF PROPERTY OR OTHER PUNISHMENT. ANY OTHER PERSON WHO KNOWS OF THIS ORDER AND DOES ANYTHING WHICH HELPS OR PERMITS YOU TO BREACH THE TERMS OF THIS ORDER MAY BE SIMILARLY PUNISHED. |

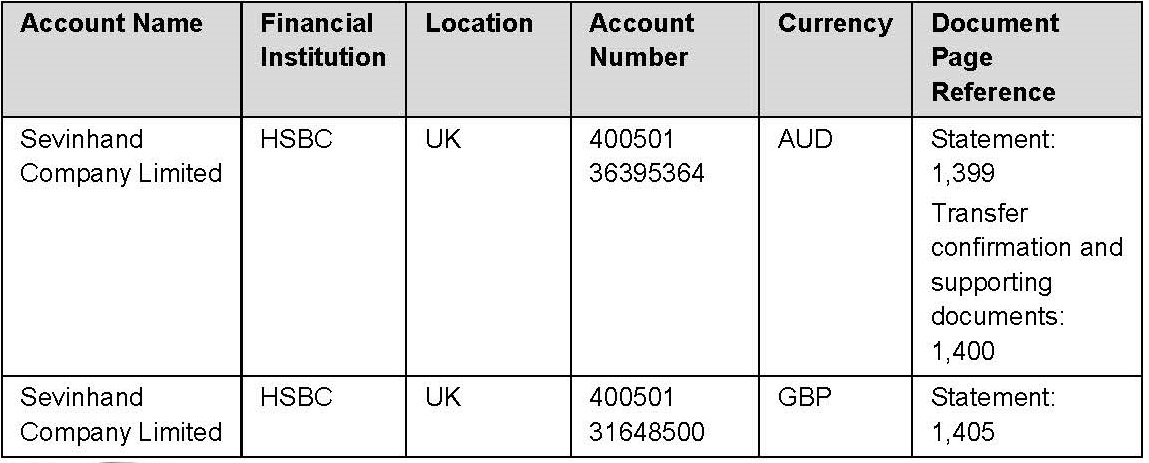

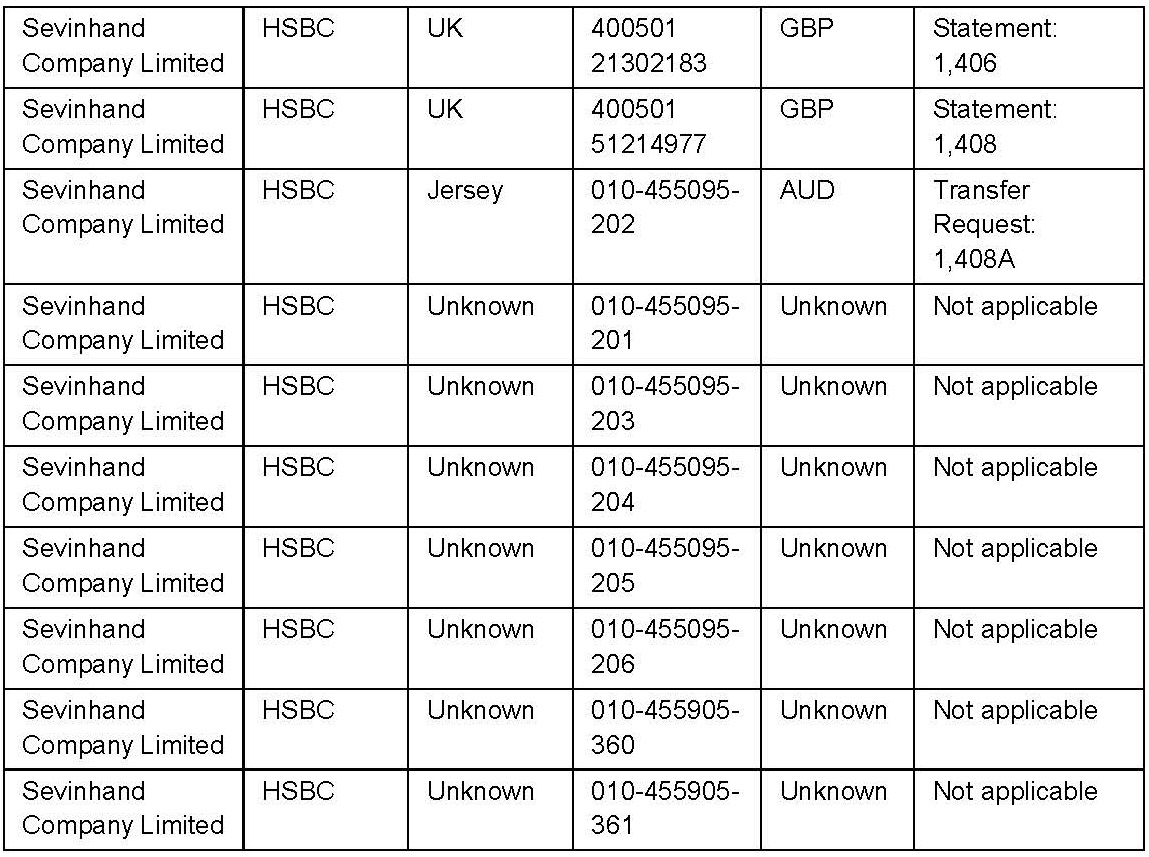

TO: Sevinhand Company Limited (company number 02100771)

This is a 'freezing order' made against you on 1 October 2021 by Justice Collier at a hearing without notice to you after the Court was given the undertakings set out in Schedule A to this order and after the Court read the affidavits listed in Schedule B to this order.

THE COURT ORDERS:

INTRODUCTION

1.

(a) The application for this order is made returnable immediately.

(b) The time for service of this order, the application, supporting affidavits, the applicant's outline of submissions and originating process is abridged and service is to be effected by:

(i) emailing the abovementioned documents to:

A. brendan.balasekeran@bdo.com.au;

B. i.hughes@hopgoodganim.com.au;

D. markturner@lubbockfine.co.uk;

E. hasmukhvara@lubbockfine.co.uk;

F. andrew.johnson@greystoneslaw.com.au; and

G. paul.jones@spglawyers.com.au;

by 4.00 pm on 4 October 2021;

(ii) posting the abovementioned documents by express post to:

A. Raptis Group Limited, Level 7, 10 Eagle Street, Brisbane QLD 4000;

B. 141-143 Commodore Drive, Surfers Paradise QLD 4217;

C. Greystones Lawyers and Corporate Advisors, PO Box 12203, Brisbane, QLD 4000;

D. Short Punch & Greatorix, PO Box 5164, Gold Coast Mail Centre QLD 9726;

E. BDO, Level 10, 12 Creek Street, Brisbane, QLD 4000;

F. HopgoodGanim Lawyers, Level 8, Waterfront Place, 1 Eagle Street, Brisbane QLD 4000,

by 4.00 pm on 4 October 2021;

(iii) posting the documents by international express post or courier to:

A. Paternoster House, 65 St. Paul's Churchyard, London, England, EC4M 8AB;

B. 1 Princeton Mews, 167-169 London Road, Kingston Upon Thames, Surrey, KT2 6PT;

by 4.00 pm on 4 October 2021.

2. Subject to the next paragraph, this order has effect up to and including the next hearing date ("the Return Date").

3. Anyone served with or notified of this order, including you, may apply to the Court at any time to vary or discharge this order or so much of it as affects the person served or notified.

4. In this order:

(a) 'applicant', if there is more than one applicant, includes all the applicants;

(b) 'you', where there is more than one of you, includes all of you and includes you if you are a corporation;

(c) 'third party' means a person other than you and the applicant;

(d) 'unencumbered value' means value free of mortgages, charges, liens or other encumbrances.

5.

(a) If you are ordered to do something, you must do it by yourself or through directors, officers, partners, employees, agents or others acting on your behalf or on your instructions.

(b) If you are ordered not to do something, you must not do it yourself or through directors, officers, partners, employees, agents or others acting on your behalf or on your instructions or with your encouragement or in any other way.

FREEZING OF ASSETS

6.

(a) You must not remove from Australia or in any way dispose of, deal with or diminish the value of any of your assets in Australia ('Australian assets') up to the unencumbered value of AUD$26,468,384.17 ('the Relevant Amount').

(b) If the unencumbered value of your Australian assets exceeds the Relevant Amount, you may remove any of those assets from Australia or dispose of or deal with them or diminish their value, so long as the total unencumbered value of your Australian assets still exceeds the Relevant Amount.

7. For the purposes of this order,

(a) your assets include:

(i) all your assets, whether or not they are in your name and whether they are solely or co-owned;

(ii) any asset which you have the power, directly or indirectly, to dispose of or deal with as if it were your own (you are to be regarded as having such power if a third party holds or controls the asset in accordance with your direct or indirect instructions); and

(iii) the following assets in particular:

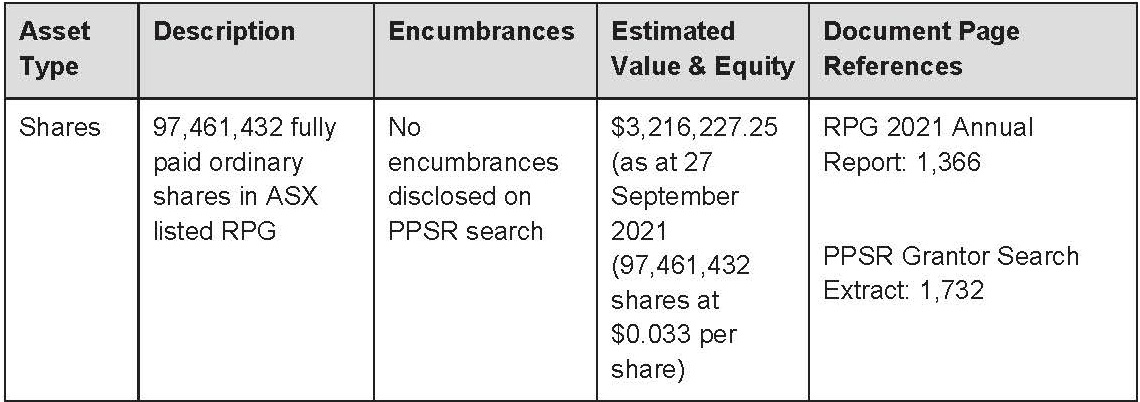

A. all shares owned by you in Raptis Group Limited ACN 010 472 858 (ASX: RPG);

B. registered mortgage number 711903418 over the property known as 141-143 Commodore Drive, Surfers Paradise QLD 4217 (Title References 15888143 and 15888144);

C. fixed and floating charge dated 3 September 2008 granted by Northernson Pty Limited ACN 090 704 902 as trustee for the Northernson Trust (registered on the Personal Property Securities Register bearing registration number 201112200093681);

D. any money in any bank accounts.

(b) the value of your assets is the value of the interest you have individually in your assets.

PROVISION OF INFORMATION

8. Subject to paragraph 9, you must:

(a) at or before the further hearing on the Return Date (or within such further time as the Court may allow) to the best of your ability inform the applicant in writing of all your assets in Australia, giving their value, location and details (including any mortgages, charges or other encumbrances to which they are subject) and the extent of your interest in the assets;

(b) within 10 working days after being served with this order, swear and serve on the applicant an affidavit setting out the above information.

9.

(a) This paragraph 9 applies if you are not a corporation and you wish to object to complying with paragraph 8 on the grounds that some or all of the information required to be disclosed may tend to prove that you:

(i) have committed an offence against or arising under an Australian law or a law of a foreign country; or

(ii) are liable to a civil penalty.

(b) This paragraph 9 also applies if you are a corporation and all of the persons who are able to comply with paragraph 8 on your behalf and with whom you have been able to communicate, wish to object to your complying with paragraph 8 on the grounds that some or all of the information required to be disclosed may tend to prove that they respectively:

(i) (have committed an offence against or arising under an Australian law or a law of a foreign country; or

(ii) are liable to a civil penalty.

(c) You must:

(i) disclose so much of the information required to be disclosed to which no objection is taken; and

(ii) prepare an affidavit containing so much of the information required to be disclosed to which objection is taken, and deliver it to the Court in a sealed envelope; and

(iii) file and serve on each other party a separate affidavit setting out the basis of the objection.

EXCEPTIONS TO THIS ORDER

10. This order does not prohibit you from:

(a) paying your reasonable legal expenses;

(b) dealing with or disposing of any of your assets in the ordinary and proper course of your business, including paying business expenses bona fide and properly incurred; and

(c) in relation to matters not falling within (a) or (b), dealing with or disposing of any of your assets in discharging obligations bona fide and properly incurred under a contract entered into before this order was made, provided that before doing so you give the applicant, if possible, at least two working days written notice of the particulars of the obligation.

11. You and the applicant may agree in writing that the exceptions in the preceding paragraph are to be varied. In that case the applicant or you must as soon as practicable file with the Court and serve on the other a minute of a proposed consent order recording the variation signed by or on behalf of the applicant and you, and the Court may order that the exceptions are varied accordingly.

12.

(a) This order will cease to have effect if you:

(i) pay the sum of AUD$26,468,384.17 into Court; or

(ii) pay that sum into a joint bank account in the name of your lawyer and the lawyer for the applicant as agreed in writing between them; or

(iii) provide security in that sum by a method agreed in writing with the applicant to be held subject to the order of the Court.

(b) Any such payment and any such security will not provide the applicant with any priority over your other creditors in the event of your insolvency.

(c) If this order ceases to have effect pursuant 12(a) above, you must as soon as practicable file with the Court and serve on the applicant notice of that fact.

COSTS

13. The costs of this application are reserved to the Court hearing the application on the Return Date.

PERSONS OTHER THAN THE APPLICANT AND RESPONDENT

14. Set off by banks

This order does not prevent any bank from exercising any right of set off it has in respect of any facility which it gave you before it was notified of this order.

15. Bank withdrawals by the respondent

No bank need inquire as to the application or proposed application of any money withdrawn by you if the withdrawal appears to be permitted by this order.

16. Notices under s 260-5 of Schedule 1 to the Taxation Administration Act 1953 (Cth)

Nothing in this order shall prevent any third party complying with the terms of a notice issued by the Commissioner of Taxation to the third party pursuant to section 260-5 of Schedule 1 to the Taxation Administration Act 1953 (Cth) in respect of any money which the third party may owe or may later owe to you.

SCHEDULE A

UNDERTAKINGS GIVEN TO THE COURT BY THE APPLICANT

1. The applicant undertakes to submit to such order (if any) as the Court may consider to be just for the payment of compensation (to be assessed by the Court or as it may direct) to any person (whether or not a party) affected by the operation of the order.

2. As soon as practicable, the applicant will file and serve upon the respondent copies of:

(a) this order;

(b) the application for this order for hearing on the return date;

(c) the following material in so far as it was relied on by the applicant at the hearing when the order was made:

(i) affidavits (or draft affidavits);

(ii) exhibits capable of being copied;

(iii) any written submission; and

(iv) any other document that was provided to the Court.

(d) a transcript, or, if none is available, a note, of any exclusively oral allegation of fact that was made and of any exclusively oral submission that was put, to the Court;

(e) the originating process, or, if none was filed, any draft originating process produced to the Court.

3. As soon as practicable, the applicant will cause anyone notified of this order to be given a copy of it.

4. The applicant will pay the reasonable costs of anyone other than the respondent which have been incurred as a result of this order, including the costs of finding out whether that person holds any of the respondent’s assets.

5. If this order ceases to have effect the applicant will promptly take all reasonable steps to inform in writing anyone to who has been notified of this order, or who he has reasonable grounds for supposing may act upon this order, that it has ceased to have effect.

6. The applicant will not, without leave of the Court, use any information obtained as a result of this order for the purpose of any civil or criminal proceedings, either in or outside Australia, other than this proceeding.

7. The applicant will not, without leave of the Court, seek to enforce this order in any country outside Australia or seek in any country outside Australia an order of a similar nature or an order conferring a charge or other security against the respondent or the respondent’s assets.

SCHEDULE B

AFFIDAVITS RELIED ON

Name of deponent | Date affidavit made | |

(1) | Vasilee Zarogiannis | 1 October 2021 |

(2) | Andrew John Chambers | 1 October 2021 |

NAME AND ADDRESS OF APPLICANT'S LAWYERS

The applicant's lawyers are: K&L Gates

Level 25 South Tower, 525 Collins Street

Melbourne VIC 3000

Tel: +61 3 9205 2000

Tel: +61 3 9640 4269 (after office hours)

Fax: +61 3 9205 2055

Email: Andrew.Chambers@klgates.com

Ref: TTRO.AJC.7390795.00090

ANNEXURE D

No. QUD 310 of 20

Federal Court of Australia

District Registry: Queensland

Division: General

Deputy Commissioner of Taxation

Applicant

James Raptis and others named in the schedule

Respondents

PENAL NOTICE

TO: Hanslow Holdings Pty Ltd ACN 600 765 213 IF YOU (BEING THE PERSON BOUND BY THIS ORDER): (A) REFUSE OR NEGLECT TO DO ANY ACT WITHIN THE TIME SPECIFIED IN THIS ORDER FOR THE DOING OF THE ACT; OR (B) DISOBEY THE ORDER BY DOING AN ACT WHICH THE ORDER REQUIRES YOU NOT TO DO, YOU WILL BE LIABLE TO IMPRISONMENT, SEQUESTRATION OF PROPERTY OR OTHER PUNISHMENT. ANY OTHER PERSON WHO KNOWS OF THIS ORDER AND DOES ANYTHING WHICH HELPS OR PERMITS YOU TO BREACH THE TERMS OF THIS ORDER MAY BE SIMILARLY PUNISHED. |

TO: Hanslow Holdings Pty Ltd ACN 600 765 213

This is a 'freezing order' made against you on 1 October 2021 by Justice Collier at a hearing without notice to you after the Court was given the undertakings set out in Schedule A to this order and after the Court read the affidavits listed in Schedule B to this order.

THE COURT ORDERS:

INTRODUCTION

1.

(a) The application for this order is made returnable immediately.

(b) The time for service of this order, the application, supporting affidavits, the applicant's outline of submissions and originating process is abridged and service is to be effected by:

(i) emailing the abovementioned documents to:

A. Brendan.Balasekeran@bdo.com.au;

B. i.hughes@hopgoodganim.com.au; and

C. andrew.johnson@greystoneslaw.com.au,

by 4.00 pm on 4 October 2021;

(ii) posting the abovementioned documents by express post to:

A. Raptis Group Limited, Level 7, 10 Eagle Street, Brisbane QLD 4000;

B. 143 Commodore Drive, Surfers Paradise QLD 4217;

C. Greystones Lawyers and Corporate Advisors, PO Box 12203, Brisbane, QLD 4000;

D. BDO, Level 10, 12 Creek Street, Brisbane, QLD 4000; and

E. HopgoodGanim Lawyers, Level 8, Waterfront Place, 1 Eagle Street, Brisbane QLD 4000,

by 4.00 pm on 4 October 2021.

2. Subject to the next paragraph, this order has effect up to and including the next hearing date ("the Return Date").

3. Anyone served with or notified of this order, including you, may apply to the Court at any time to vary or discharge this order or so much of it as affects the person served or notified.

4. In this order:

(a) 'applicant', if there is more than one applicant, includes all the applicants;

(b) 'you', where there is more than one of you, includes all of you and includes you if you are a corporation;

(c) 'third party' means a person other than you and the applicant;

(d) 'unencumbered value' means value free of mortgages, charges, liens or other encumbrances.

5.

(a) If you are ordered to do something, you must do it by yourself or through directors, officers, partners, employees, agents or others acting on your behalf or on your instructions.

(b) If you are ordered not to do something, you must not do it yourself or through directors, officers, partners, employees, agents or others acting on your behalf or on your instructions or with your encouragement or in any other way.

FREEZING OF ASSETS

6.

(a) You must not remove from Australia or in any way dispose of, deal with or diminish the value of any of your assets in Australia ('Australian assets') up to the unencumbered value of AUD$23,815,519.60 ('the Relevant Amount').

(b) If the unencumbered value of your Australian assets exceeds the Relevant Amount, you may remove any of those assets from Australia or dispose of or deal with them or diminish their value, so long as the total unencumbered value of your Australian assets still exceeds the Relevant Amount.

7. For the purposes of this order,

(a) your assets include:

(i) all your assets, whether or not they are in your name and whether they are solely or co-owned;

(ii) any asset which you have the power, directly or indirectly, to dispose of or deal with as if it were your own (you are to be regarded as having such power if a third party holds or controls the asset in accordance with your direct or indirect instructions); and

(iii) the following assets in particular:

A. all shares owned by you in Raptis Group Limited ACN 010 472 858 (ASX: RPG); and

B. any money in any bank accounts.

(b) the value of your assets is the value of the interest you have individually in your assets.

PROVISION OF INFORMATION

8. Subject to paragraph 9, you must:

(a) at or before the further hearing on the Return Date (or within such further time as the Court may allow) to the best of your ability inform the applicant in writing of all your assets in Australia, giving their value, location and details (including any mortgages, charges or other encumbrances to which they are subject) and the extent of your interest in the assets;

(b) within 10 working days after being served with this order, swear and serve on the applicant an affidavit setting out the above information.

9.

(a) This paragraph 9 applies if you are not a corporation and you wish to object to complying with paragraph 8 on the grounds that some or all of the information required to be disclosed may tend to prove that you:

(i) have committed an offence against or arising under an Australian law or a law of a foreign country; or

(ii) are liable to a civil penalty.

(b) This paragraph 9 also applies if you are a corporation and all of the persons who are able to comply with paragraph 8 on your behalf and with whom you have been able to communicate, wish to object to your complying with paragraph 8 on the grounds that some or all of the information required to be disclosed may tend to prove that they respectively:

(i) (have committed an offence against or arising under an Australian law or a law of a foreign country; or

(ii) are liable to a civil penalty.

(c) You must:

(i) disclose so much of the information required to be disclosed to which no objection is taken; and

(ii) prepare an affidavit containing so much of the information required to be disclosed to which objection is taken, and deliver it to the Court in a sealed envelope; and

(iii) file and serve on each other party a separate affidavit setting out the basis of the objection.

EXCEPTIONS TO THIS ORDER

10. This order does not prohibit you from:

(a) paying your reasonable legal expenses;

(b) dealing with or disposing of any of your assets in the ordinary and proper course of your business, including paying business expenses bona fide and properly incurred; and

(c) in relation to matters not falling within (a) or (b), dealing with or disposing of any of your assets in discharging obligations bona fide and properly incurred under a contract entered into before this order was made, provided that before doing so you give the applicant, if possible, at least two working days written notice of the particulars of the obligation.

11. You and the applicant may agree in writing that the exceptions in the preceding paragraph are to be varied. In that case the applicant or you must as soon as practicable file with the Court and serve on the other a minute of a proposed consent order recording the variation signed by or on behalf of the applicant and you, and the Court may order that the exceptions are varied accordingly.

12.

(a) This order will cease to have effect if you:

(i) pay the sum of AUD$23,815,519.60 into Court; or

(ii) pay that sum into a joint bank account in the name of your lawyer and the lawyer for the applicant as agreed in writing between them; or

(iii) provide security in that sum by a method agreed in writing with the applicant to be held subject to the order of the Court.

(b) Any such payment and any such security will not provide the applicant with any priority over your other creditors in the event of your insolvency.

(c) If this order ceases to have effect pursuant 12(a) above, you must as soon as practicable file with the Court and serve on the applicant notice of that fact.

COSTS

13. The costs of this application are reserved to the Court hearing the application on the Return Date.

PERSONS OTHER THAN THE APPLICANT AND RESPONDENT

14. Set off by banks

This order does not prevent any bank from exercising any right of set off it has in respect of any facility which it gave you before it was notified of this order.

15. Bank withdrawals by the respondent

No bank need inquire as to the application or proposed application of any money withdrawn by you if the withdrawal appears to be permitted by this order.

16. Notices under s 260-5 of Schedule 1 to the Taxation Administration Act 1953 (Cth)

Nothing in this order shall prevent any third party complying with the terms of a notice issued by the Commissioner of Taxation to the third party pursuant to section 260-5 of Schedule 1 to the Taxation Administration Act 1953 (Cth) in respect of any money which the third party may owe or may later owe to you.

SCHEDULE A

UNDERTAKINGS GIVEN TO THE COURT BY THE APPLICANT

1. The applicant undertakes to submit to such order (if any) as the Court may consider to be just for the payment of compensation (to be assessed by the Court or as it may direct) to any person (whether or not a party) affected by the operation of the order.

2. As soon as practicable, the applicant will file and serve upon the respondent copies of:

(a) this order;

(b) the application for this order for hearing on the return date;

(c) the following material in so far as it was relied on by the applicant at the hearing when the order was made:

(i) affidavits (or draft affidavits);

(ii) exhibits capable of being copied;

(iii) any written submission; and

(iv) any other document that was provided to the Court.

(d) a transcript, or, if none is available, a note, of any exclusively oral allegation of fact that was made and of any exclusively oral submission that was put, to the Court;

(e) the originating process, or, if none was filed, any draft originating process produced to the Court.

3. As soon as practicable, the applicant will cause anyone notified of this order to be given a copy of it.

4. The applicant will pay the reasonable costs of anyone other than the respondent which have been incurred as a result of this order, including the costs of finding out whether that person holds any of the respondent’s assets.

5. If this order ceases to have effect the applicant will promptly take all reasonable steps to inform in writing anyone to who has been notified of this order, or who he has reasonable grounds for supposing may act upon this order, that it has ceased to have effect.

6. The applicant will not, without leave of the Court, use any information obtained as a result of this order for the purpose of any civil or criminal proceedings, either in or outside Australia, other than this proceeding.

7. The applicant will not, without leave of the Court, seek to enforce this order in any country outside Australia or seek in any country outside Australia an order of a similar nature or an order conferring a charge or other security against the respondent or the respondent’s assets.

SCHEDULE B

AFFIDAVITS RELIED ON

Name of deponent | Date affidavit made | |

(1) | Vasilee Zarogiannis | 1 October 2021 |

(2) | Andrew John Chambers | 1 October 2021 |

|

|

NAME AND ADDRESS OF APPLICANT'S LAWYERS

The applicant's lawyers are: K&L Gates

Level 25 South Tower, 525 Collins Street

Melbourne VIC 3000

Tel: +61 3 9205 2000

Tel: +61 3 9640 4269 (after office hours)

Fax: +61 3 9205 2055

Email: Andrew.Chambers@klgates.com

Ref: TTRO.AJC.7390795.00090

ANNEXURE E

No. QUD 310 of 20

Federal Court of Australia

District Registry: Queensland

Division: General

Deputy Commissioner of Taxation

Applicant

James Raptis and others named in the schedule

Respondents

PENAL NOTICE

TO: Kingsriver Services Pty Ltd ACN 159 328 926 IF YOU (BEING THE PERSON BOUND BY THIS ORDER): (A) REFUSE OR NEGLECT TO DO ANY ACT WITHIN THE TIME SPECIFIED IN THIS ORDER FOR THE DOING OF THE ACT; OR (B) DISOBEY THE ORDER BY DOING AN ACT WHICH THE ORDER REQUIRES YOU NOT TO DO, YOU WILL BE LIABLE TO IMPRISONMENT, SEQUESTRATION OF PROPERTY OR OTHER PUNISHMENT. ANY OTHER PERSON WHO KNOWS OF THIS ORDER AND DOES ANYTHING WHICH HELPS OR PERMITS YOU TO BREACH THE TERMS OF THIS ORDER MAY BE SIMILARLY PUNISHED. |

TO: Kingsriver Services Pty Ltd ACN 159 328 926

This is a 'freezing order' made against you on 1 October 2021 by Justice Collier at a hearing without notice to you after the Court was given the undertakings set out in Schedule A to this order and after the Court read the affidavits listed in Schedule B to this order.

THE COURT ORDERS:

INTRODUCTION

1.

(a) The application for this order is made returnable immediately.

(b) The time for service of this order, the application, supporting affidavits, the applicant's outline of submissions and originating process is abridged and service is to be effected by:

(i) emailing the abovementioned documents to:

A. mcory@raptis.com;

B. Brendan.Balasekeran@bdo.com.au;

C. i.hughes@hopgoodganim.com.au; and

D. andrew.johnson@greystoneslaw.com.au,

by 4.00 pm on 4 October 2021;

(ii) posting the abovementioned documents by express post to:

A. 79 Santa Cruz Boulevard, Clear Island Waters, QLD 4226;

B. Raptis Group Limited, Level 7, 10 Eagle Street, Brisbane QLD 4000;

C. 143 Commodore Drive, Surfers Paradise QLD 4217;

D. Greystones Lawyers and Corporate Advisors, PO Box 12203, Brisbane, QLD 4000;

E. BDO, Level 10, 12 Creek Street, Brisbane, QLD 4000; and

F. HopgoodGanim Lawyers, Level 8, Waterfront Place, 1 Eagle Street, Brisbane QLD 4000,

by 4.00 pm on 4 October 2021.

2. Subject to the next paragraph, this order has effect up to and including the next hearing date ("the Return Date").

3. Anyone served with or notified of this order, including you, may apply to the Court at any time to vary or discharge this order or so much of it as affects the person served or notified.

4. In this order:

(a) 'applicant', if there is more than one applicant, includes all the applicants;

(b) 'you', where there is more than one of you, includes all of you and includes you if you are a corporation;

(c) 'third party' means a person other than you and the applicant;

(d) 'unencumbered value' means value free of mortgages, charges, liens or other encumbrances.

5.

(a) If you are ordered to do something, you must do it by yourself or through directors, officers, partners, employees, agents or others acting on your behalf or on your instructions.

(b) If you are ordered not to do something, you must not do it yourself or through directors, officers, partners, employees, agents or others acting on your behalf or on your instructions or with your encouragement or in any other way.

FREEZING OF ASSETS

6.

(a) You must not remove from Australia or in any way dispose of, deal with or diminish the value of any of your assets in Australia ('Australian assets') up to the unencumbered value of AUD$23,815,519.60 ('the Relevant Amount').

(b) If the unencumbered value of your Australian assets exceeds the Relevant Amount, you may remove any of those assets from Australia or dispose of or deal with them or diminish their value, so long as the total unencumbered value of your Australian assets still exceeds the Relevant Amount.

7. For the purposes of this order:

(a) your assets include:

(i) all your assets, whether or not they are in your name and whether they are solely or co-owned;

(ii) any asset which you have the power, directly or indirectly, to dispose of or deal with as if it were your own (you are to be regarded as having such power if a third party holds or controls the asset in accordance with your direct or indirect instructions); and

(iii) in particular, any money in any bank accounts, including but not limited to Westpac Banking Corporation bank account BSB 034239 account number 342964 in the name of Kingsriver Services Pty Ltd.

(b) the value of your assets is the value of the interest you have individually in your assets.

PROVISION OF INFORMATION

8. Subject to paragraph 9, you must:

(a) at or before the further hearing on the Return Date (or within such further time as the Court may allow) to the best of your ability inform the applicant in writing of all your assets in Australia, giving their value, location and details (including any mortgages, charges or other encumbrances to which they are subject) and the extent of your interest in the assets;

(b) within 10 working days after being served with this order, swear and serve on the applicant an affidavit setting out the above information.

(a) This paragraph 9 applies if you are not a corporation and you wish to object to complying with paragraph 8 on the grounds that some or all of the information required to be disclosed may tend to prove that you:

(i) have committed an offence against or arising under an Australian law or a law of a foreign country; or

(ii) are liable to a civil penalty.

(b) This paragraph 9 also applies if you are a corporation and all of the persons who are able to comply with paragraph 8 on your behalf and with whom you have been able to communicate, wish to object to your complying with paragraph 8 on the grounds that some or all of the information required to be disclosed may tend to prove that they respectively:

(i) (have committed an offence against or arising under an Australian law or a law of a foreign country; or

(ii) are liable to a civil penalty.

(c) You must:

(i) disclose so much of the information required to be disclosed to which no objection is taken; and

(ii) prepare an affidavit containing so much of the information required to be disclosed to which objection is taken, and deliver it to the Court in a sealed envelope; and

(iii) file and serve on each other party a separate affidavit setting out the basis of the objection.

EXCEPTIONS TO THIS ORDER

10. This order does not prohibit you from:

(a) paying your reasonable legal expenses;

(b) dealing with or disposing of any of your assets in the ordinary and proper course of your business, including paying business expenses bona fide and properly incurred; and

(c) in relation to matters not falling within (a) or (b), dealing with or disposing of any of your assets in discharging obligations bona fide and properly incurred under a contract entered into before this order was made, provided that before doing so you give the applicant, if possible, at least two working days written notice of the particulars of the obligation.

11. You and the applicant may agree in writing that the exceptions in the preceding paragraph are to be varied. In that case the applicant or you must as soon as practicable file with the Court and serve on the other a minute of a proposed consent order recording the variation signed by or on behalf of the applicant and you, and the Court may order that the exceptions are varied accordingly.

12.

(a) This order will cease to have effect if you:

(i) pay the sum of AUD$23,815,519.60 into Court; or

(ii) pay that sum into a joint bank account in the name of your lawyer and the lawyer for the applicant as agreed in writing between them; or

(iii) provide security in that sum by a method agreed in writing with the applicant to be held subject to the order of the Court.

(b) Any such payment and any such security will not provide the applicant with any priority over your other creditors in the event of your insolvency.

(c) If this order ceases to have effect pursuant 12(a) above, you must as soon as practicable file with the Court and serve on the applicant notice of that fact.

COSTS

13. The costs of this application are reserved to the Court hearing the application on the Return Date.

PERSONS OTHER THAN THE APPLICANT AND RESPONDENT

14. Set off by banks

This order does not prevent any bank from exercising any right of set off it has in respect of any facility which it gave you before it was notified of this order.

15. Bank withdrawals by the respondent

No bank need inquire as to the application or proposed application of any money withdrawn by you if the withdrawal appears to be permitted by this order.

16. Notices under s 260-5 of Schedule 1 to the Taxation Administration Act 1953 (Cth)

Nothing in this order shall prevent any third party complying with the terms of a notice issued by the Commissioner of Taxation to the third party pursuant to section 260-5 of Schedule 1 to the Taxation Administration Act 1953 (Cth) in respect of any money which the third party may owe or may later owe to you.

SCHEDULE A

UNDERTAKINGS GIVEN TO THE COURT BY THE APPLICANT

1. The applicant undertakes to submit to such order (if any) as the Court may consider to be just for the payment of compensation (to be assessed by the Court or as it may direct) to any person (whether or not a party) affected by the operation of the order.

2. As soon as practicable, the applicant will file and serve upon the respondent copies of:

(a) this order;

(b) the application for this order for hearing on the return date;

(c) the following material in so far as it was relied on by the applicant at the hearing when the order was made:

(i) affidavits (or draft affidavits);

(ii) exhibits capable of being copied;

(iii) any written submission; and

(iv) any other document that was provided to the Court.

(d) a transcript, or, if none is available, a note, of any exclusively oral allegation of fact that was made and of any exclusively oral submission that was put, to the Court;

(e) the originating process, or, if none was filed, any draft originating process produced to the Court.

3. As soon as practicable, the applicant will cause anyone notified of this order to be given a copy of it.

4. The applicant will pay the reasonable costs of anyone other than the respondent which have been incurred as a result of this order, including the costs of finding out whether that person holds any of the respondent’s assets.

5. If this order ceases to have effect the applicant will promptly take all reasonable steps to inform in writing anyone to who has been notified of this order, or who he has reasonable grounds for supposing may act upon this order, that it has ceased to have effect.

6. The applicant will not, without leave of the Court, use any information obtained as a result of this order for the purpose of any civil or criminal proceedings, either in or outside Australia, other than this proceeding.

7. The applicant will not, without leave of the Court, seek to enforce this order in any country outside Australia or seek in any country outside Australia an order of a similar nature or an order conferring a charge or other security against the respondent or the respondent’s assets.

SCHEDULE B

AFFIDAVITS RELIED ON

Name of deponent | Date affidavit made | |

(1) | Vasilee Zarogiannis | 1 October 2021 |

(2) | Andrew John Chambers | 1 October 2021 |

|

|

NAME AND ADDRESS OF APPLICANT'S LAWYERS

The applicant's lawyers are: K&L Gates

Level 25 South Tower, 525 Collins Street

Melbourne VIC 3000

Tel: +61 3 9205 2000

Tel: +61 3 9640 4269 (after office hours)

Fax: +61 3 9205 2055

Email: Andrew.Chambers@klgates.com

Ref: TTRO.AJC.7390795.00090

ANNEXURE F

No. QUD 310 of 2021

Federal Court of Australia

District Registry: Queensland

Division: General

Deputy Commissioner of Taxation

Applicant

James Raptis and others named in the schedule

Respondents

PENAL NOTICE

TO: Philadelphia Developments Pty Ltd ACN 614 829 551 as trustee for the Main Beach Raptis Trust IF YOU (BEING THE PERSON BOUND BY THIS ORDER): (A) REFUSE OR NEGLECT TO DO ANY ACT WITHIN THE TIME SPECIFIED IN THIS ORDER FOR THE DOING OF THE ACT; OR (B) DISOBEY THE ORDER BY DOING AN ACT WHICH THE ORDER REQUIRES YOU NOT TO DO, YOU WILL BE LIABLE TO IMPRISONMENT, SEQUESTRATION OF PROPERTY OR OTHER PUNISHMENT. ANY OTHER PERSON WHO KNOWS OF THIS ORDER AND DOES ANYTHING WHICH HELPS OR PERMITS YOU TO BREACH THE TERMS OF THIS ORDER MAY BE SIMILARLY PUNISHED. |

TO: Philadelphia Developments Pty Ltd ACN 614 829 551 as trustee for the Main Beach Raptis Trust

This is a 'freezing order' made against you on 1 October 2021 by Justice Collier at a hearing without notice to you after the Court was given the undertakings set out in Schedule A to this order and after the Court read the affidavits listed in Schedule B to this order.

THE COURT ORDERS:

INTRODUCTION

1.

(a) The application for this order is made returnable immediately.

(b) The time for service of this order, the application, supporting affidavits, the applicant's outline of submissions and originating process is abridged and service is to be effected by:

(i) emailing the abovementioned documents to:

A. Brendan.Balasekeran@bdo.com.au;

B. i.hughes@hopgoodganim.com.au; and

C. andrew.johnson@greystoneslaw.com.au,

by 4.00 pm on 4 October 2021;

(ii) posting the abovementioned documents by express post to:

A. Nexia Sydney, Level 16, 1 Market Street, Sydney NSW 2000;

B. Raptis Group Limited, Level 7, 10 Eagle Street, Brisbane QLD 4000;

C. 143 Commodore Drive, Surfers Paradise QLD 4217;

D. Greystones Lawyers and Corporate Advisors, PO Box 12203, Brisbane, QLD 4000;

E. BDO, Level 10, 12 Creek Street, Brisbane, QLD 4000; and

F. HopgoodGanim Lawyers, Level 8, Waterfront Place, 1 Eagle Street, Brisbane QLD 4000,

by 4.00 pm on 4 October 2021.

2. Subject to the next paragraph, this order has effect up to and including the next hearing date ("the Return Date").

3. Anyone served with or notified of this order, including you, may apply to the Court at any time to vary or discharge this order or so much of it as affects the person served or notified.

4. In this order:

(a) 'applicant', if there is more than one applicant, includes all the applicants;

(b) 'you', where there is more than one of you, includes all of you and includes you if you are a corporation;

(c) 'third party' means a person other than you and the applicant;

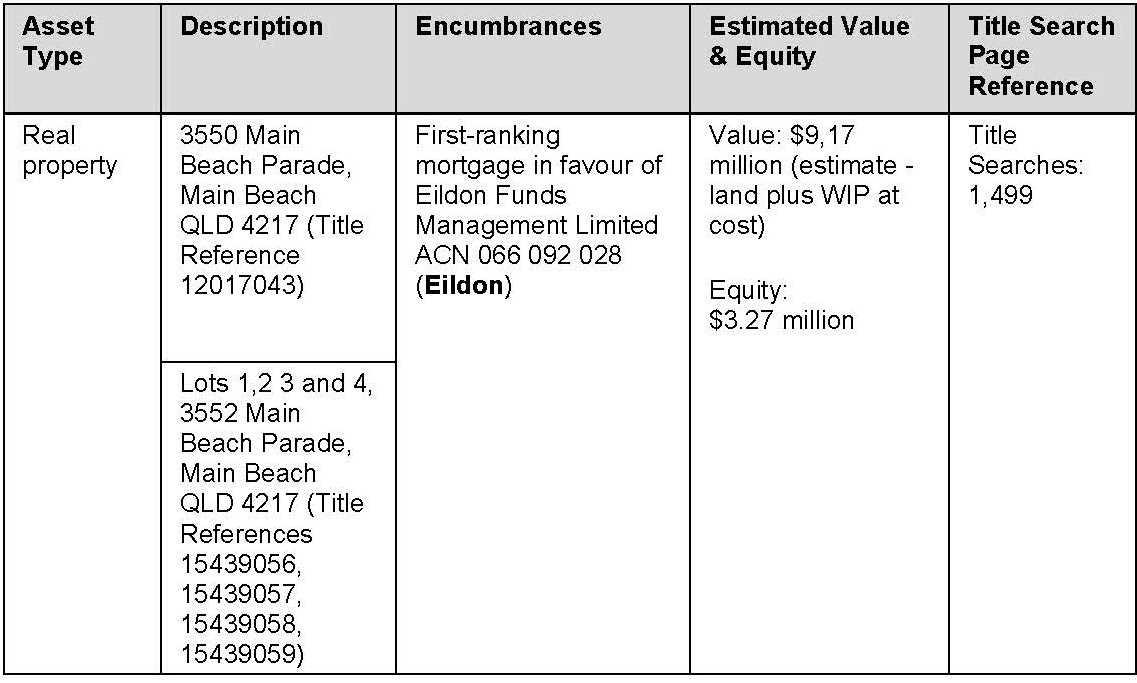

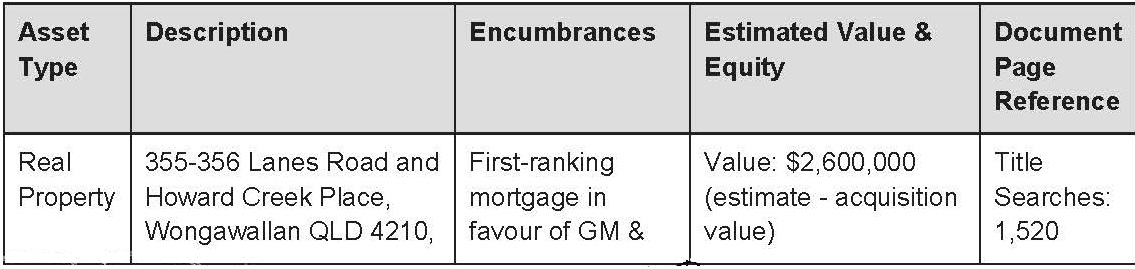

(d) 'properties' means the properties known as 3350 and 3552 Main Beach Parade, Main Beach, QLD 4217 (Lots 1, 2, 3 and 4 of Building Unit Plan 1943 and Lot 508 of Crown Plan M7382) (Title References 15439056, 15439057, 15439058, 15439059 and 12017043) or, if any of them (or any part thereof) have been sold, the net proceeds of the sale;

(e) 'unencumbered value' means value free of mortgages, charges, liens or other encumbrances.

5.

(a) If you are ordered to do something, you must do it by yourself or through directors, officers, partners, employees, agents or others acting on your behalf or on your instructions.

(b) If you are ordered not to do something, you must not do it yourself or through directors, officers, partners, employees, agents or others acting on your behalf or on your instructions or with your encouragement or in any other way.

FREEZING OF ASSETS

6.

(a) You must not remove from Australia or in any way dispose of, deal with or diminish the value of any of the properties ('Australian assets') up to the unencumbered value of AUD$23,815,519.60 ('the Relevant Amount').

(b) If the unencumbered value of your Australian assets exceeds the Relevant Amount, you may remove any of those assets from Australia or dispose of or deal with them or diminish their value, so long as the total unencumbered value of your Australian assets still exceeds the Relevant Amount.

PROVISION OF INFORMATION

7. Subject to paragraph 9, you must:

(a) at or before the further hearing on the Return Date (or within such further time as the Court may allow) to the best of your ability inform the applicant in writing of all your assets in Australia, giving their value, location and details (including any mortgages, charges or other encumbrances to which they are subject) and the extent of your interest in the assets;

(b) within 10 working days after being served with this order, swear and serve on the applicant an affidavit setting out the above information.

8. For the purposes of this order,

(a) your assets include:

(i) all your assets, whether or not they are in your name and whether they are solely or co-owned;

(ii) any asset which you have the power, directly or indirectly, to dispose of or deal with as if it were your own (you are to be regarded as having such power if a third party holds or controls the asset in accordance with your direct or indirect instructions).

(b) the value of your assets is the value of the interest you have individually in your assets.

(a) This paragraph 9 applies if you are not a corporation and you wish to object to complying with paragraph 7 on the grounds that some or all of the information required to be disclosed may tend to prove that you:

(i) have committed an offence against or arising under an Australian law or a law of a foreign country; or

(ii) are liable to a civil penalty.

(b) This paragraph 9 also applies if you are a corporation and all of the persons who are able to comply with paragraph 7 on your behalf and with whom you have been able to communicate, wish to object to your complying with paragraph 7 on the grounds that some or all of the information required to be disclosed may tend to prove that they respectively:

(i) have committed an offence against or arising under an Australian law or a law of a foreign country; or

(ii) are liable to a civil penalty.

(c) You must:

(i) disclose so much of the information required to be disclosed to which no objection is taken; and

(ii) prepare an affidavit containing so much of the information required to be disclosed to which objection is taken, and deliver it to the Court in a sealed envelope; and

(iii) file and serve on each other party a separate affidavit setting out the basis of the objection.

EXCEPTIONS TO THIS ORDER

10. This order does not prohibit you from:

(a) paying your reasonable legal expenses;

(b) dealing with or disposing of any of your assets in the ordinary and proper course of your business, including paying business expenses bona fide and properly incurred; and

(c) in relation to matters not falling within (a) or (b), dealing with or disposing of any of your assets in discharging obligations bona fide and properly incurred under a contract entered into before this order was made, provided that before doing so you give the applicant, if possible, at least two working days written notice of the particulars of the obligation.

11. You and the applicant may agree in writing that the exceptions in the preceding paragraph are to be varied. In that case the applicant or you must as soon as practicable file with the Court and serve on the other a minute of a proposed consent order recording the variation signed by or on behalf of the applicant and you, and the Court may order that the exceptions are varied accordingly.

12.

(a) This order will cease to have effect if you:

(i) pay the sum of AUD$23,815,519.60 into Court; or

(ii) pay that sum into a joint bank account in the name of your lawyer and the lawyer for the applicant as agreed in writing between them; or

(iii) provide security in that sum by a method agreed in writing with the applicant to be held subject to the order of the Court.

(b) Any such payment and any such security will not provide the applicant with any priority over your other creditors in the event of your insolvency.

(c) If this order ceases to have effect pursuant 12(a) above, you must as soon as practicable file with the Court and serve on the applicant notice of that fact.

COSTS

13. The costs of this application are reserved to the Court hearing the application on the Return Date.

PERSONS OTHER THAN THE APPLICANT AND RESPONDENT

14. Set off by banks

This order does not prevent any bank from exercising any right of set off it has in respect of any facility which it gave you before it was notified of this order.

15. Bank withdrawals by the respondent

No bank need inquire as to the application or proposed application of any money withdrawn by you if the withdrawal appears to be permitted by this order.

16. Notices under s 260-5 of Schedule 1 to the Taxation Administration Act 1953 (Cth)

Nothing in this order shall prevent any third party complying with the terms of a notice issued by the Commissioner of Taxation to the third party pursuant to section 260-5 of Schedule 1 to the Taxation Administration Act 1953 (Cth) in respect of any money which the third party may owe or may later owe to you.

SCHEDULE A

UNDERTAKINGS GIVEN TO THE COURT BY THE APPLICANT

1. The applicant undertakes to submit to such order (if any) as the Court may consider to be just for the payment of compensation (to be assessed by the Court or as it may direct) to any person (whether or not a party) affected by the operation of the order.

2. As soon as practicable, the applicant will file and serve upon the respondent copies of:

(a) this order;

(b) the application for this order for hearing on the return date;

(c) the following material in so far as it was relied on by the applicant at the hearing when the order was made:

(i) affidavits (or draft affidavits);

(ii) exhibits capable of being copied;

(iii) any written submission; and

(iv) any other document that was provided to the Court.

(d) a transcript, or, if none is available, a note, of any exclusively oral allegation of fact that was made and of any exclusively oral submission that was put, to the Court;

(e) the originating process, or, if none was filed, any draft originating process produced to the Court.

3. As soon as practicable, the applicant will cause anyone notified of this order to be given a copy of it.

4. The applicant will pay the reasonable costs of anyone other than the respondent which have been incurred as a result of this order, including the costs of finding out whether that person holds any of the respondent’s assets.

5. If this order ceases to have effect the applicant will promptly take all reasonable steps to inform in writing anyone to who has been notified of this order, or who he has reasonable grounds for supposing may act upon this order, that it has ceased to have effect.

6. The applicant will not, without leave of the Court, use any information obtained as a result of this order for the purpose of any civil or criminal proceedings, either in or outside Australia, other than this proceeding.

7. The applicant will not, without leave of the Court, seek to enforce this order in any country outside Australia or seek in any country outside Australia an order of a similar nature or an order conferring a charge or other security against the respondent or the respondent’s assets.

SCHEDULE B

AFFIDAVITS RELIED ON

Name of deponent | Date affidavit made | |

(1) | Vasilee Zarogiannis | 1 October 2021 |

(2) | Andrew John Chambers | 1 October 2021 |

|

|

NAME AND ADDRESS OF APPLICANT'S LAWYERS

The applicant's lawyers are: K&L Gates

Level 25 South Tower, 525 Collins Street

Melbourne VIC 3000

Tel: +61 3 9205 2000

Tel: +61 3 9640 4269 (after office hours)

Fax: +61 3 9205 2055

Email: Andrew.Chambers@klgates.com

Ref: TTRO.AJC.7390795.00090

ANNEXURE G

No. QUD 310 of 2021

Federal Court of Australia

District Registry: Queensland

Division: General

Deputy Commissioner of Taxation

Applicant

James Raptis and others named in the schedule

Respondents

PENAL NOTICE

TO: Rosea Pty Limited ACN 119 837 455 IF YOU (BEING THE PERSON BOUND BY THIS ORDER): (A) REFUSE OR NEGLECT TO DO ANY ACT WITHIN THE TIME SPECIFIED IN THIS ORDER FOR THE DOING OF THE ACT; OR (B) DISOBEY THE ORDER BY DOING AN ACT WHICH THE ORDER REQUIRES YOU NOT TO DO, YOU WILL BE LIABLE TO IMPRISONMENT, SEQUESTRATION OF PROPERTY OR OTHER PUNISHMENT. ANY OTHER PERSON WHO KNOWS OF THIS ORDER AND DOES ANYTHING WHICH HELPS OR PERMITS YOU TO BREACH THE TERMS OF THIS ORDER MAY BE SIMILARLY PUNISHED. |

TO: Rosea Pty Limited ACN 119 837 455