Federal Court of Australia

Australian Securities and Investments Commission v Bank of Queensland Limited [2021] FCA 957

ORDERS

AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff | ||

AND: | BANK OF QUEENSLAND LIMITED (ABN 32 009 656 740) Defendant | |

DATE OF ORDER: |

THE COURT MAKES THE FOLLOWING DECLARATIONS AND ORDERS:

First BOQ Contract

Declarations

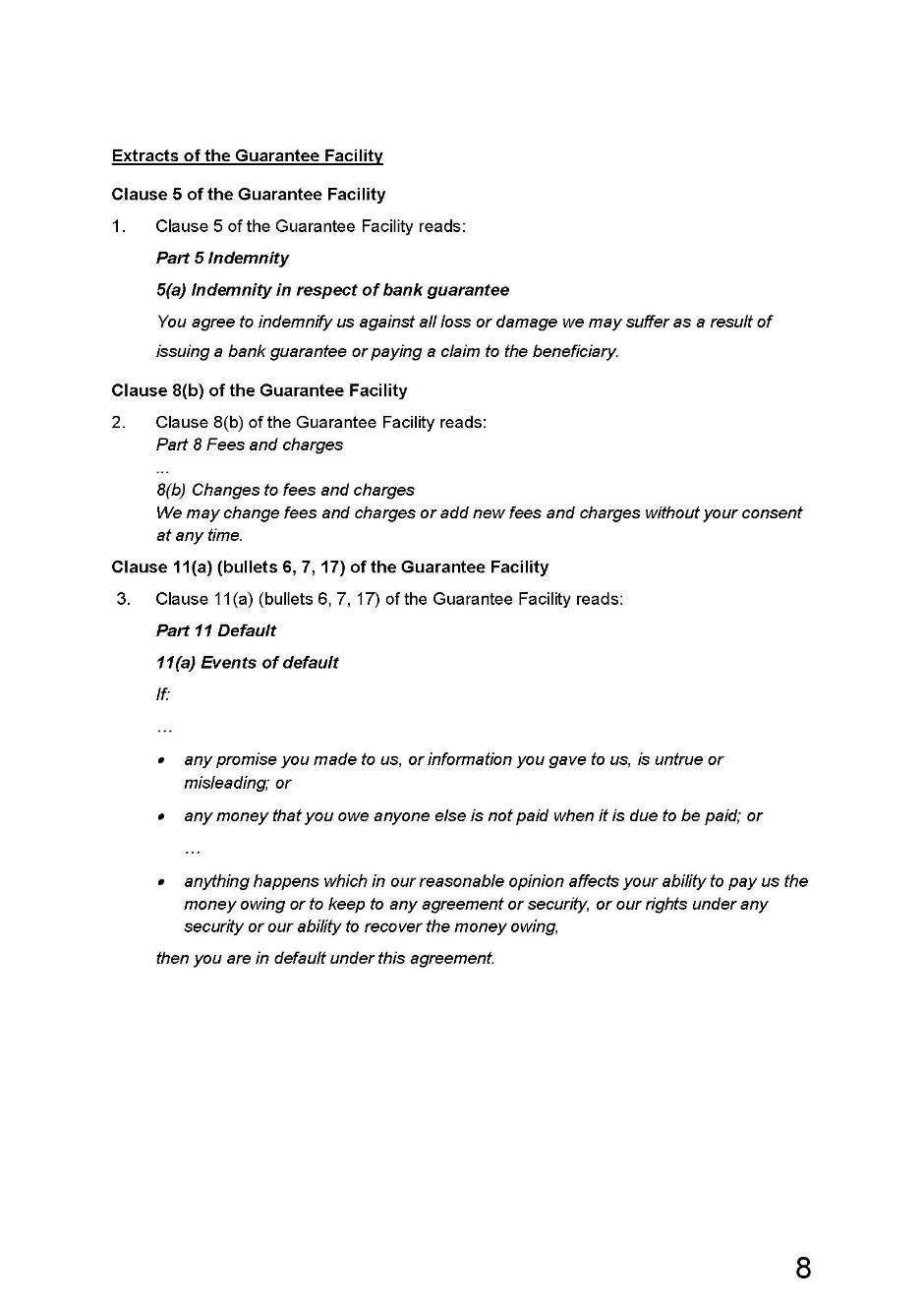

1. Pursuant to s 12GND of the Australian and Securities Investments Commission Act 2001 (Cth) (Act), each of clauses 5, 8(b) and 11(a) (bullets 6, 7 and 17) of the Guarantee Facility General Conditions dated September 2016 (Guarantee) that comprises part of the small business contract between the defendant and the First BOQ Party (as identified in a confidential schedule provided to the defendant) dated 16 August 2017 (First BOQ Contract) is an unfair term within the meaning of s 12BG of the Act.

2. Pursuant to s 12GNB of the Act or alternatively s 21 of the FCA, each of clauses 5, 8(b) and 11(a) (bullets 6, 7 and 17) of the Guarantee that comprises part of the First BOQ Contract is void ab initio.

Order

3. Pursuant to s 12GNB of the Act, the First BOQ Contract be varied, with effect from the date of the contract, by replacing clauses 5, 8,11(a) and 20(a) of the Guarantee that comprises part of the First BOQ Contract with the clauses specified in the schedule to these orders.

Second BOQ Contract

Declarations

4. Pursuant to s 12GND of the Act, each of clauses 5, 8(b) and 11(a) (bullets 6, 7 and 17) of the Guarantee that comprises part of the small business contract between the defendant and the Second BOQ Party (as identified in a confidential schedule provided to the defendant) dated 20 February 2017 (Second BOQ Contract) is an unfair term within the meaning of s 12BG of the Act.

5. Pursuant to s 12GNB of the Act or alternatively s 21 of the FCA, each of clauses 5, 8(b) and 11(a) (bullets 6, 7 and 17) of the Guarantee that comprises part of the Second BOQ Contract is void ab initio.

Order

6. Pursuant to s 12GNB of the Act, the Second BOQ Contract be varied, with effect from the date of the contract, by replacing clauses 5, 8, 11(a) and 20(a) of the Guarantee that comprises part of the Second BOQ Contract with the clauses specified in the schedule to these orders.

Third BOQ Contract

Declarations

7. Pursuant to s 12GND of the Act, each of clauses 8(b), 9(c), 10(c) and 13(a) (bullets 5, 6 and 15) of the Business Term Loan General Conditions dated September 2016 (Term Loan) that comprises part of the small business contract between the defendant and the Third BOQ Party (as identified in a confidential schedule provided to the defendant) dated 30 June 2017 (Third BOQ Contract) is an unfair term within the meaning of s 12BG of the Act.

8. Pursuant to s 12GNB of the Act or alternatively s 21 of the FCA, each of clauses 8(b), 9(c), 10(c) and 13(a) (bullets 5, 6 and 15) of the Term Loan that comprises part of the Third BOQ Contract is void ab initio.

Order

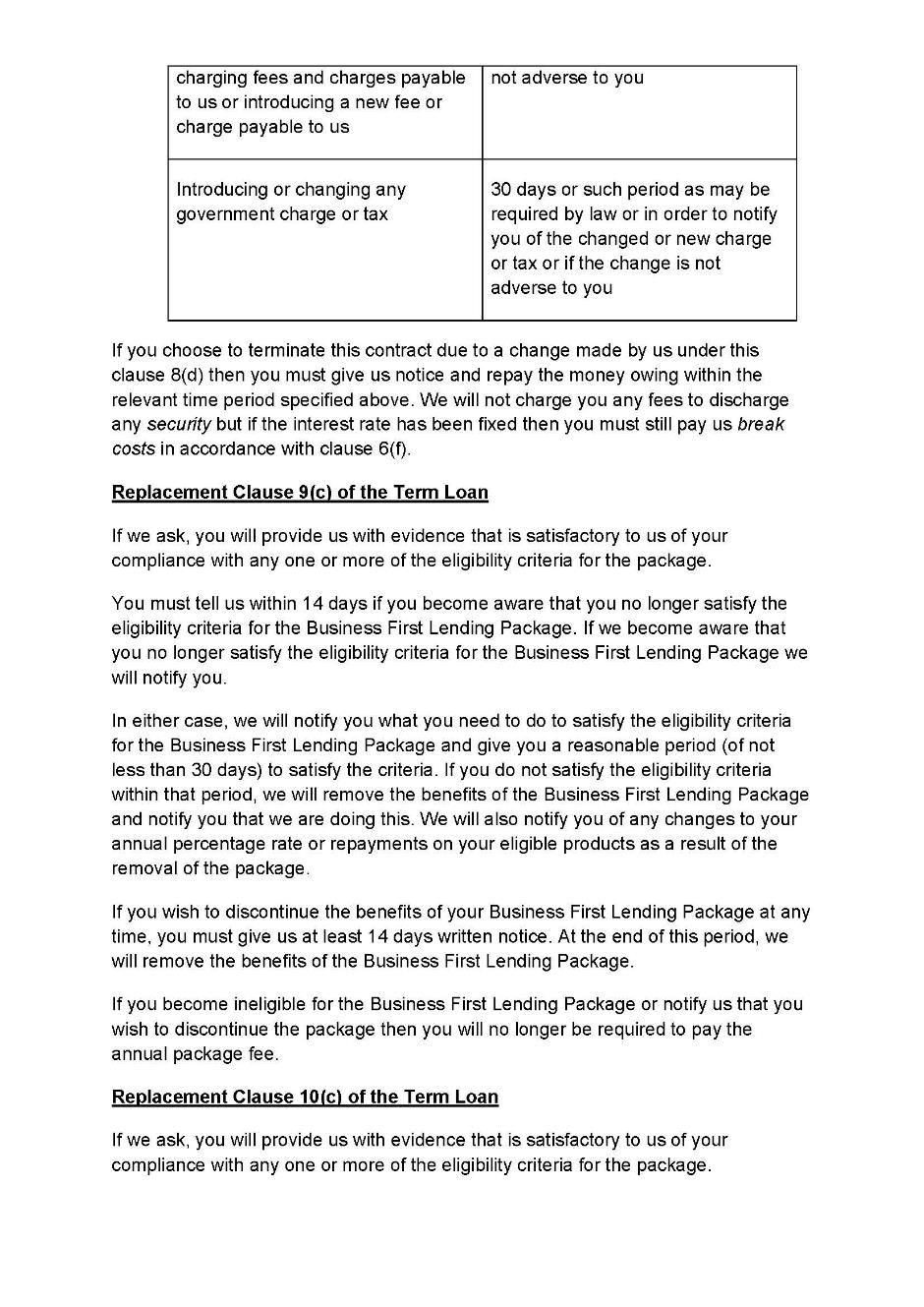

9. Pursuant to s 12GNB of the Act, the Third BOQ Contract be varied, with effect from the date of the contract, by replacing clauses 8, 9(c), 10(c), 13(a) and 22(a) of the Term Loan that comprises part of the Third BOQ Contract with the clauses specified in the schedule to these orders.

Fourth BOQ Contract

Declarations

10. Pursuant to s 12GND of the Act, each of clauses 8(b), 9(c), 10(c) and 13(a) (bullets 5, 6 and 15) of the Term Loan that comprises part of the small business contract between the defendant and the Fourth BOQ Party (as identified in a confidential schedule provided to the defendant) dated 27 July 2017 (Fourth BOQ Contract) is an unfair term within the meaning of s 12BG of the Act.

11. Pursuant to s 12GNB of the Act or alternatively s 21 of the FCA, each of clauses 8(b), 9(c), 10(c) and 13(a) (bullets 5, 6 and 15) of the Term Loan that comprises part of the Fourth BOQ Contract is void ab initio.

Order

12. Pursuant to s 12GNB of the Act, the Fourth BOQ Contract be varied, with effect from the date of the contract, by replacing clauses 8, 9(c), 10(c) and 13(a) and 22(a) of the Term Loan that comprises part of the Fourth BOQ Contract with the clauses specified in the schedule to these orders.

Fifth BOQ Contract

Declarations

13. Pursuant to s 12GND of the Act, each of clauses 17.1(c), 17.1(d), 17.1(e), 17.1(g), 17.2, 22(e), 22(l), 22(t), 25.2, 35.1, 39.1(a), 39.1(g), 39.1(h), 39.1(i) and 39.1(j) of the Commercial Rate Loan Facility General Conditions dated September 2016 (Commercial Rate Loan) that comprises part of the small business contract between the defendant and the Fifth BOQ Party (as identified in a confidential schedule provided to the defendant) dated 29 March 2019 (Fifth BOQ Contract) is an unfair term within the meaning of s 12BG of the Act.

14. Pursuant to s 12GNB of the Act or alternatively s 21 of the FCA, each of clauses 17.1(c), 17.1(d), 17.1(e), 17.1(g), 17.2, 22(e), 22(l), 22(t), 25.2, 35.1, 39.1(a), 39.1(g), 39.1(h), 39.1(i) and 39.1(j) of the Commercial Rate Loan that comprises part of the Fifth BOQ Contract is void ab initio.

Order

15. Pursuant to s 12GNB of the Act, the Fifth BOQ Contract be varied, with effect from the date of the contract, by replacing clauses 17, 22, 25.2, 35.1, 39 and 62 of the Commercial Rate Loan that comprises part of the Fifth BOQ Contract with the clauses specified in the schedule to these orders.

Sixth BOQ Contract

Declarations

16. Pursuant to s 12GND of the Act, each of clauses 17.1(c), 17.1(d), 17.1(e), 17.1(g), 17.2, 22(e), 22(l), 22(t), 25.2, 35.1, 39.1(a), 39.1(g), 39.1(h), 39.1(i), and 39.1(j) of the Commercial Rate Loan that comprises part of the small business contract between the defendant and the Sixth BOQ Party (as identified in a confidential schedule provided to the defendant) dated 24 September 2018 (Sixth BOQ Contract) is an unfair term within the meaning of s 12BG of the Act.

17. Pursuant to s 12GNB of the Act or alternatively s 21 of the FCA, each of clauses 17.1(c), 17.1(d), 17.1(e), 17.1(g), 17.2, 22(e), 22(l), 22(t), 25.2, 35.1, 39.1(a), 39.1(g), 39.1(h), 39.1(i) and 39.1(j) of the Commercial Rate Loan that comprises part of the Sixth BOQ Contract is void ab initio.

Order

18. Pursuant to s 12GNB of the Act, the Fifth BOQ Contract be varied, with effect from the date of the contract, by replacing clauses 17, 22, 25.2, 35.1, 39 and 62 of the Commercial Rate Loan that comprises part of the Sixth BOQ Contract with the clauses specified in the schedule to these orders.

Seventh BOQ Contract

Declarations

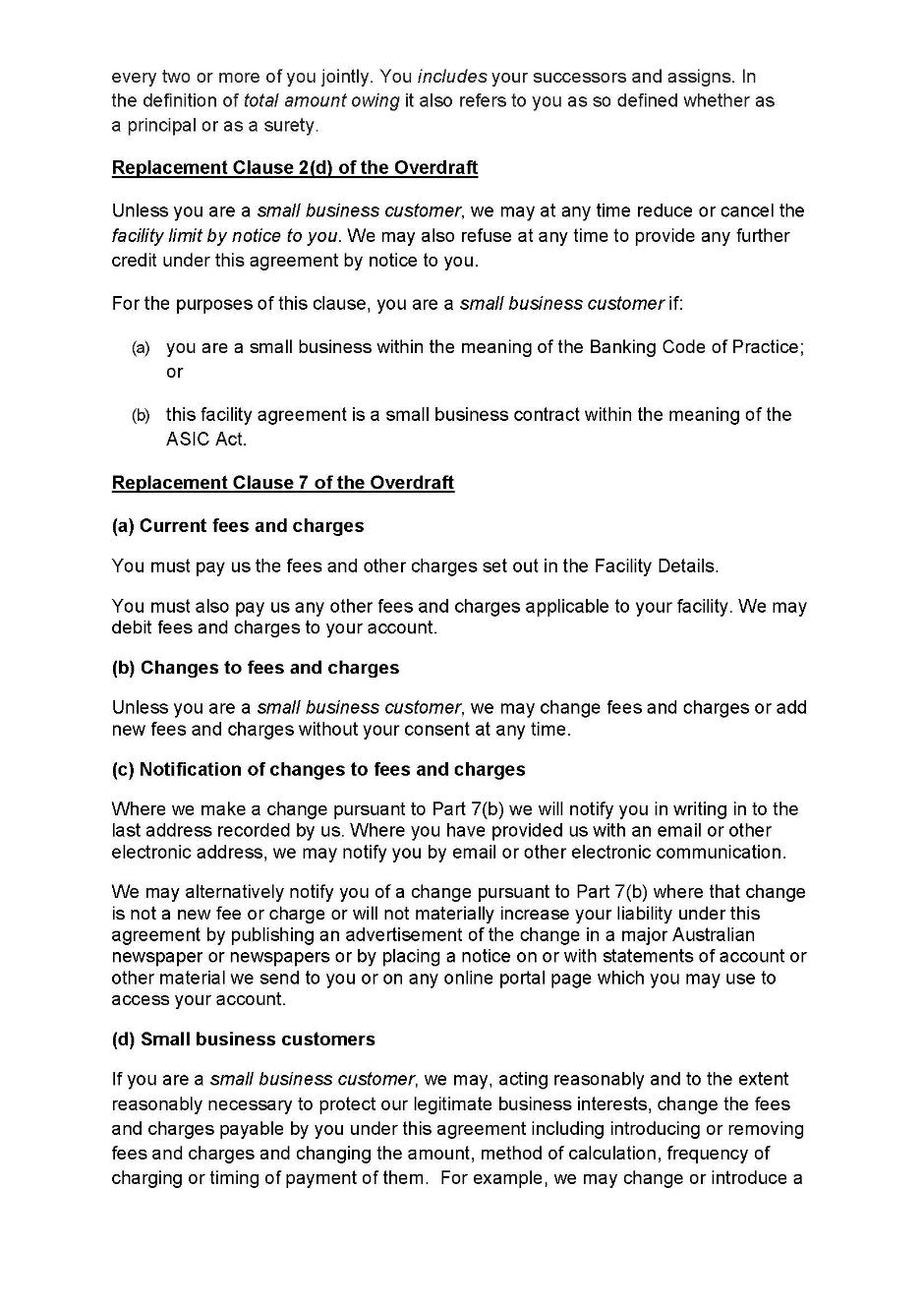

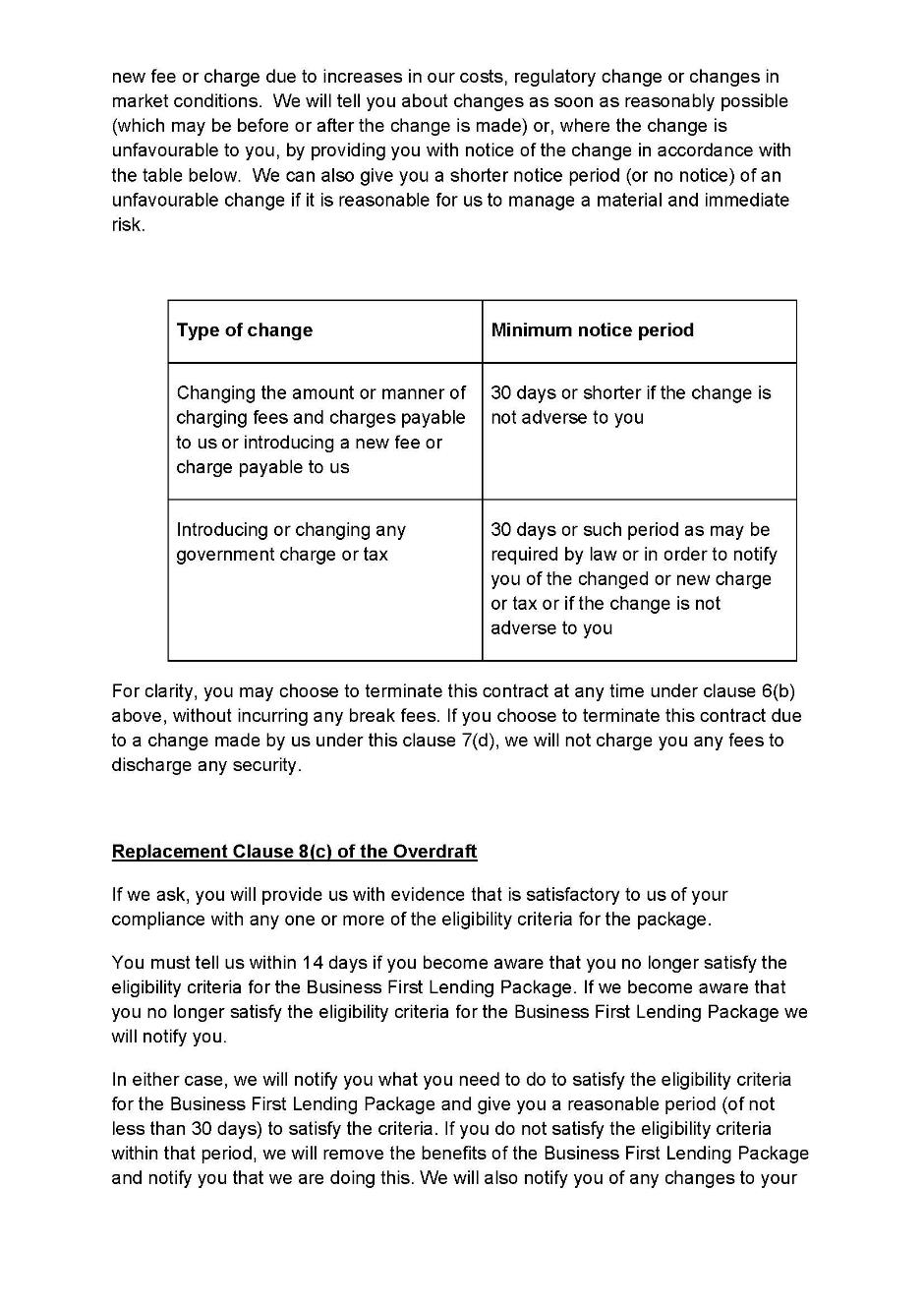

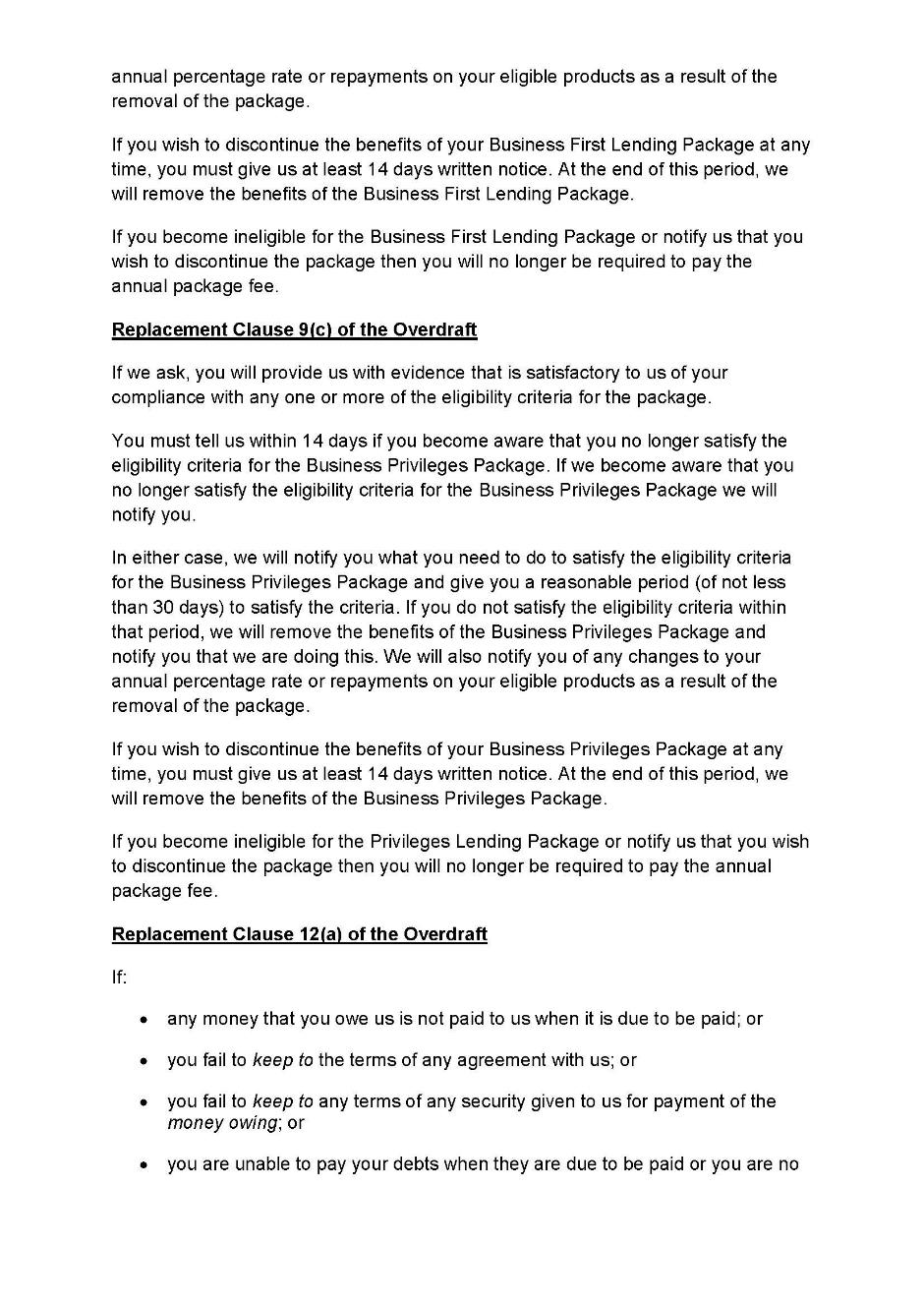

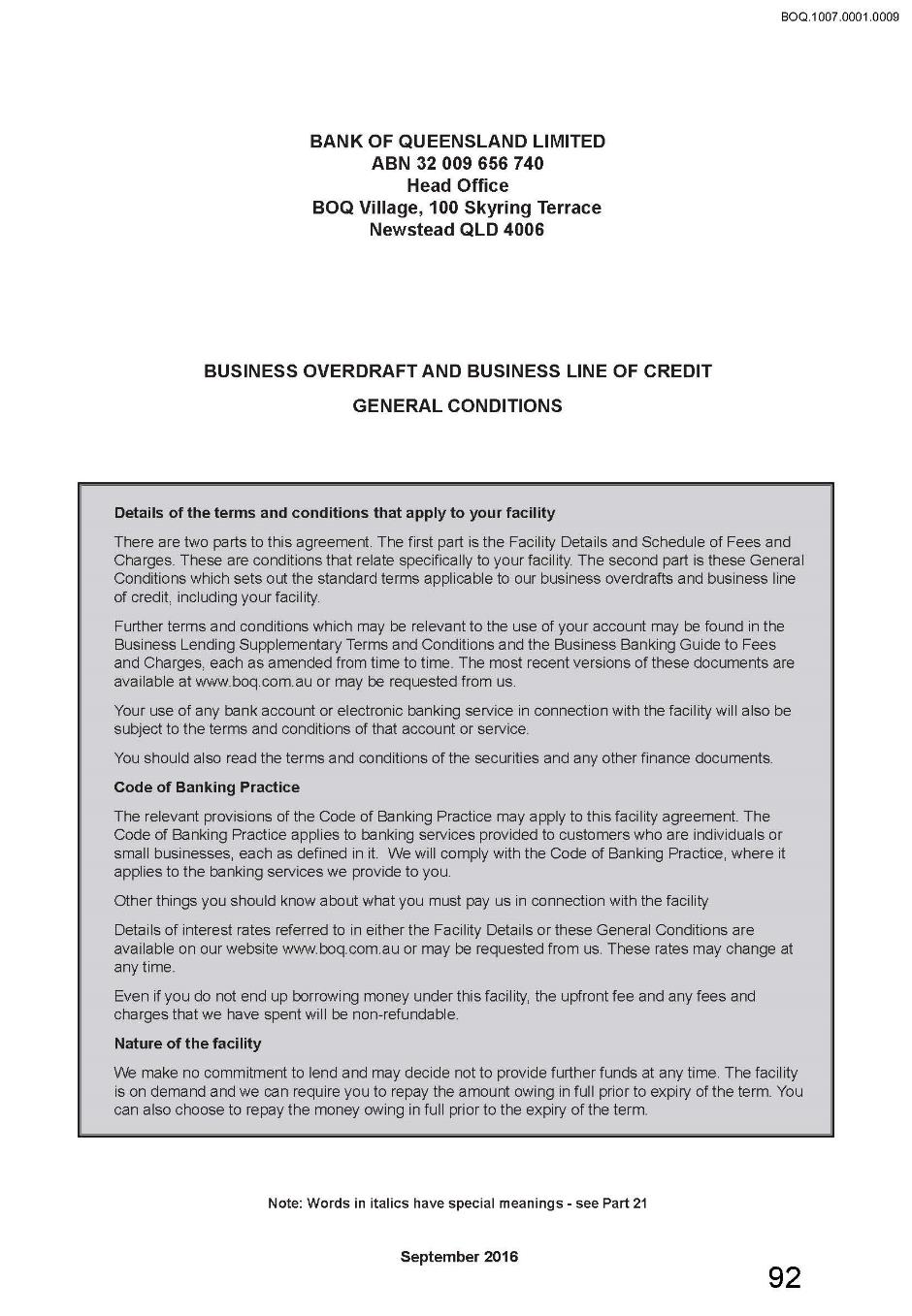

19. Pursuant to s 12GND of the Act, each of clauses 2(d), 7(b), 8(c), 9(c), 12(a) (bullets 5, 6 and 15) and 13 of the Business Overdraft and Business Line of Credit General Conditions dated September 2016 (Overdraft) that comprises part of the small business contract between the defendant and the Seventh BOQ Party (as identified in a confidential schedule provided to the defendant) dated 24 August 2017 (Seventh BOQ Contract) is an unfair term within the meaning of s 12BG of the Act.

20. Pursuant to s 12GNB of the Act or alternatively s 21 of the FCA, each of clauses 2(d), 7(b), 8(c), 9(c), 12(a) (bullets 5, 6 and 15) and 13 of the Overdraft that comprises part of the Seventh BOQ Contract is void ab initio.

Order

21. Pursuant to s 12GNB of the Act, the Seventh BOQ Contract be varied, with effect from the date of the contract, by replacing clauses 2(d), 7, 8(c), 9(c), 12(a), 13 and 21(a) of the Overdraft that comprises part of the Seventh BOQ Contract with the clauses specified in the schedule to these orders.

Eighth BOQ Contract

Declarations

22. Pursuant to s 12GND of the Act, each of clauses 2(d), 7(b), 8(c), 9(c), 12(a) (bullets 5, 6 and 15) and 13 of the Overdraft, as defined in the Concise Statement, that comprises part of the small business contract between the defendant and the Eighth BOQ Party (as identified in a confidential schedule provided to the defendant) dated 4 February 2019 (Eighth BOQ Contract) is an unfair term within the meaning of s 12BG of the Act.

23. Pursuant to s 12GNB of the Act or alternatively s 21 of the FCA, each of clauses 2(d), 7(b), 8(c), 9(c), 12(a) (bullets 5, 6 and 15) and 13 of the Overdraft that comprises part of the Eighth BOQ Contract is void ab initio.

Order

24. Pursuant to s 12GNB of the Act, the Eighth BOQ Contract be varied, with effect from the date of the contract, by replacing clauses 2(d), 7, 8(c), 9(c), 12(a), 13 and 21(a) of the Overdraft that comprises part of the Eighth BOQ Contract with the clauses specified in the schedule to these orders.

Ninth BOQ Contract

Declarations

25. Pursuant to s 12GND of the Act, each of clauses 10.1(c), 10.1(d), 10.1(e), 10.1(f), 10.1(h), 10.2, 13(e), 13(l), 13(t), 16.2, 28, 32.1(a), 32.1(h), 32.1(i), 32.1(j) and 32.1(k), 6.1 of Part C and 4.5 of Part E of the Facility General Conditions dated November 2016 (General Conditions) that comprises part of the small business contract between the defendant the Ninth BOQ Party (as identified in a confidential schedule provided to the defendant) dated 4 February 2019 (Ninth BOQ Contract) is an unfair term within the meaning of s 12BG of the Act.

26. Pursuant to s 12GNB of the Act or alternatively s 21 of the FCA, each of clauses 10.1(c), 10.1(d), 10.1(e), 10.1(f), 10.1(h), 10.2, 13(e), 13(l), 13(t), 16.2, 28, 32.1(a), 32.1(h), 32.1(i), 32.1(j) and 32.1(k), 6.1 of Part C and 4.5 of Part E of the General Conditions that comprises part of the Ninth BOQ Contract is void ab initio.

Order

27. Pursuant to s 12GNB of the Act, the Ninth BOQ Contract be varied, with effect from the date of the contract, by replacing clauses 10, 13, 16.2, 28, 32, and 54 of Part A, 6.1 of Part C and 4.5 of Part E of the General Conditions that comprises part of the Ninth BOQ Contract with the clauses specified in the schedule to these orders.

Tenth BOQ Contract

Declarations

28. Pursuant to s 12GND of the Act, each of clauses 10.1(c), 10.1(d), 10.1(e), 10.1(f), 10.1(h), 10.2, 13(e), 13(l), 13(t), 16.2, 28, 32.1(a), 32.1(h), 32.1(i), 32.1(j) and 32.1(k), 6.1 of Part C and 4.5 of Part E of the General Conditions that comprises part of the small business contract between the defendant and the Tenth BOQ Party (as identified in a confidential schedule provided to the defendant) dated 20 November 2018 (Tenth BOQ Contract) is an unfair term within the meaning of s 12BG of the Act.

29. Pursuant to s 12GNB of the Act or alternatively s 21 of the FCA, each of clauses 10.1(c), 10.1(d), 10.1(e), 10.1(f), 10.1(h), 10.2, 13(e), 13(l), 13(t), 16.2, 28, 32.1(a), 32.1(h), 32.1(i), 32.1(j) and 32.1(k), 6.1 of Part C and 4.5 of Part E of the General Conditions that comprises part of the Tenth BOQ Contract is void ab initio.

Order

30. Pursuant to s 12GNB of the Act, the Ninth BOQ Contract be varied, with effect from the date of the contract, by replacing clauses 10, 13, 16.2, 28, 32 and 54 of Part A, 6.1 of Part C and 4.5 of Part E of the General Conditions that comprises part of the Tenth BOQ Contract with the clauses specified in the schedule to these orders.

Eleventh BOQ Contract

Declarations

31. Pursuant to s 12GND of the Act, each of clauses 10.1(c), 10.1(d), 10.1(e), 10.1(f), 10.1(h), 10.2, 13(e), 13(l), 13(t), 16.2, 28, 32.1(a), 32.1(h), 32.1(i), 32.1(j) and 32.1(k), 6.1 of Part C and 4.5 of Part E of the General Conditions that comprises part of the small business contract between the defendant and the Eleventh BOQ Party (as identified in a confidential schedule provided to the defendant) dated 20 November 2018 (Eleventh BOQ Contract) is an unfair term within the meaning of s 12BG of the Act.

32. Pursuant to s 12GNB of the Act or alternatively s 21 of the FCA, each of clauses 10.1(c), 10.1(d), 10.1(e), 10.1(f), 10.1(h), 10.2, 13(e), 13(l), 13(t), 16.2, 28, 32.1(a), 32.1(h), 32.1(i), 32.1(j) and 32.1(k), 6.1 of Part C and 4.5 of Part E of the General Conditions that comprises part of the Eleventh BOQ Contract is void ab initio.

Order

33. Pursuant to s 12GNB of the Act, the Ninth BOQ Contract be varied, with effect from the date of the contract, by replacing clauses 10, 13, 16.2, 28, 32 and 54 of Part A, 6.1 of Part C and 4.5 of Part E of the General Conditions that comprises part of the Eleventh BOQ Contract with the clauses specified in the schedule to these orders.

General - Guarantee

Declarations

34. Pursuant to s 12GND of the Act, any term in the same form as any of clauses 5, 8(b) and 11(a) (bullets 6, 7 and 17) of the Guarantee in any small business contract entered into or amended or renewed on or after 12 November 2016 between the defendant and any of its customers, which incorporates the Guarantee and meets the definition of a small business contract within the meaning of s 12BF(4) of the Act and which is a standard form contract within the meaning of s 12BK of the Act and is a contract for a financial product or a contract for the supply or possible supply of financial services within the meaning of the Act is an unfair term within the meaning of s 12BG of the Act and void pursuant to s 12BF(1) of the Act (Unfair Guarantee Term).

35. Pursuant to s 12GNB of the Act or alternatively s 21 of the FCA, any Unfair Guarantee Term is void ab initio.

Order

36. Pursuant to s 12GNB of the Act, in any small business contract entered into or amended or renewed on or after 12 November 2016 between the defendant and any of its customers which incorporates the Guarantee and which meets the definition of a small business contract within the meaning of s 12BF(4) of the Act and which is a standard form contract within the meaning of s 12BK of the Act and is a contract for a financial product or a contract for the supply or possible supply of financial services within the meaning of the Act, is varied with effect from the date of the contract, by replacing clauses 5, 8, 11(a) and 20(a)of the Guarantee with the clauses specified in the schedule to these orders.

General - Term Loan

Declarations

37. Pursuant to s 12GND of the Act, any term in the same form as any of clauses 8(b), 9(c), 10(c), 13(a) (bullets 5, 6 and 15) of the Term Loan in any small business contract entered into or amended or renewed on or after 12 November 2016 between the defendant and any of its customers, which incorporates the Term Loan and meets the definition of a small business contract within the meaning of s 12BF(4) of the Act and which is a standard form contract within the meaning of s 12BK of the Act and is a contract for a financial product or a contract for the supply or possible supply of financial services within the meaning of the Act is an unfair term within the meaning of s 12BG of the Act and void pursuant to s 12BF(1) of the Act (Unfair Term Loan Term).

38. Pursuant to s 12GNB of the Act or alternatively s 21 of the FCA, any Unfair Term Loan Term is void ab initio.

Order

39. Pursuant to s 12GNB of the Act, any small business contract entered into or amended or renewed on or after 12 November 2016 between the defendant and any of its customers which incorporates the Term Loan and which meets the definition of a small business contract within the meaning of s 12BF(4) of the Act and which is a standard form contract within the meaning of s 12BK of the Act and is a contract for a financial product or a contract for the supply or possible supply of financial services within the meaning of the Act, is varied with effect from the date of the contract, by replacing clauses 8, 9(c), 10(c) and 13(a) and 22(a) of the Term Loan with the clauses specified in the schedule to these orders.

General - Commercial Rate Loan

Declarations

40. Pursuant to s 12GND of the Act, any term in the same form as any of clauses 17.1(c), 17.1(d), 17.1(e), 17.1(g), 17.2, 22(e), 22(l), 22(t), 25.2, 35.1, 39.1(a), 39.1(g), 39.1(h), 39.1(i) and 39.1(j) of the Commercial Rate Loan in any small business contract entered into or amended or renewed on or after 12 November 2016 between the defendant and any of its customers, which incorporates the Commercial Rate Loan and meets the definition of a small business contract within the meaning of s 12BF(4) of the Act and which is a standard form contract within the meaning of s 12BK of the Act and is a contract for a financial product or a contract for the supply or possible supply of financial services within the meaning of the Act is an unfair term within the meaning of s 12BG of the Act and void pursuant to s 12BF(1) of the Act (Unfair Commercial Rate Loan Term).

41. Pursuant to s 12GNB of the Act or alternatively s 21 of the FCA, any Unfair Commercial Rate Loan Term is void ab initio.

Order

42. Pursuant to s 12GNB of the Act, any small business contract entered into or amended or renewed on or after 12 November 2016 between the defendant and any of its customers which incorporates the Commercial Rate Loan and which meets the definition of a small business contract within the meaning of s 12BF(4) of the Act and which is a standard form contract within the meaning of s 12BK of the Act and is a contract for a financial product or a contract for the supply or possible supply of financial services within the meaning of the Act, is varied with effect from the date of the contract, by replacing clauses 17, 22, 25.2, 35.1, 39 and 62 of the Commercial Rate Loan with the clauses specified in the schedule to these orders.

General - Overdraft

Declarations

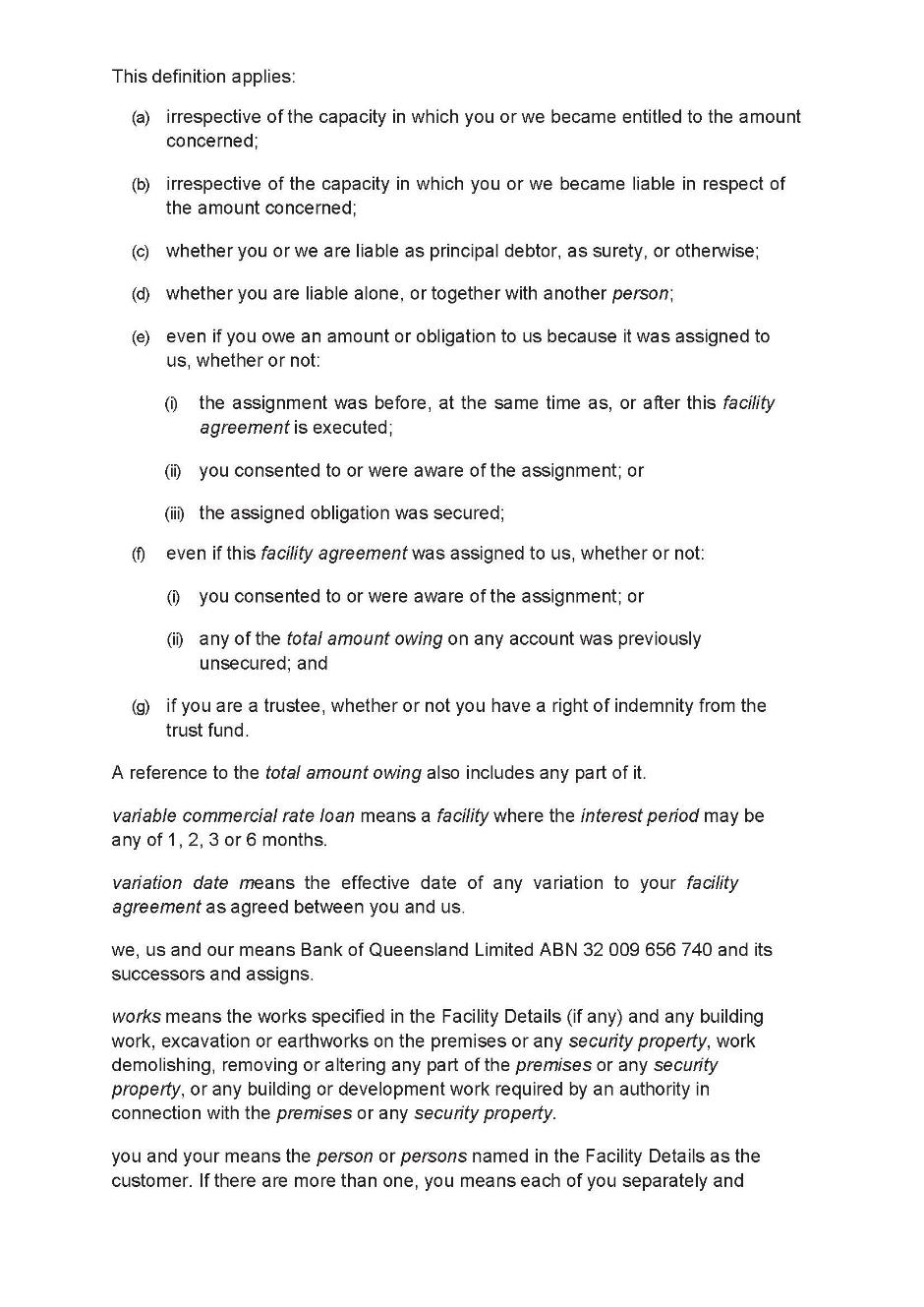

43. Pursuant to s 12GND of the Act, any term in the same form as any of clauses 2(d), 7(b), 8(c), 9(c), 12(a) (bullets 5, 6 and 15) and 13 of the Overdraft in any small business contract entered into or amended or renewed on or after 12 November 2016 between the defendant and any of its customers, which incorporates the Overdraft and meets the definition of a small business contract within the meaning of s 12BF(4) of the Act and which is a standard form contract within the meaning of s 12BK of the Act and is a contract for a financial product or a contract for the supply or possible supply of financial services within the meaning of the Act is an unfair term within the meaning of s 12BG of the Act and void pursuant to s 12BF(1) of the Act (Unfair Overdraft Term).

44. Pursuant to s 12GNB of the Act or alternatively s 21 of the FCA, any Unfair Overdraft Term is void ab initio.

Order

45. Pursuant to s 12GNB of the Act, any small business contract entered into or amended or renewed on or after 12 November 2016 between the defendant and any of its customers which incorporates the Overdraft and which meets the definition of a small business contract within the meaning of s 12BF(4) of the Act and which is a standard form contract within the meaning of s 12BK of the Act and is a contract for a financial product or a contract for the supply or possible supply of financial services within the meaning of the Act, is varied with effect from the date of the contract, by replacing clauses 2(d), 7, 8(c), 9(c), 12(a), 13 and 21(a) of the Overdraft with the clauses specified in the schedule to these orders.

General Conditions

Declarations

46. Pursuant to s 12GND of the Act, any term in the same form as any of clauses 10.1(c), 10.1(d), 10.1(e), 10.1(f), 10.1(h), 10.2, 13(e), 13(l), 13(t), 16.2, 28, 32.1(a), 32.1(h), 32.1(i), 32.1(j) and 32.1(k), 6.1 of Part C and 4.5 of Part E of the General Conditions in any small business contract entered into or amended or renewed on or after 12 November 2016 between the defendant and any of its customers, which incorporates the General Conditions and meets the definition of a small business contract within the meaning of s 12BF(4) of the Act and which is a standard form contract within the meaning of s 12BK of the Act and is a contract for a financial product or a contract for the supply or possible supply of financial services within the meaning of the Act is an unfair term within the meaning of s 12BG of the Act and void pursuant to s 12BF(1) of the Act (Unfair General Conditions Term).

47. Pursuant to s 12GNB of the Act or alternatively s 21 of the FCA, any Unfair General Conditions Term is void ab initio.

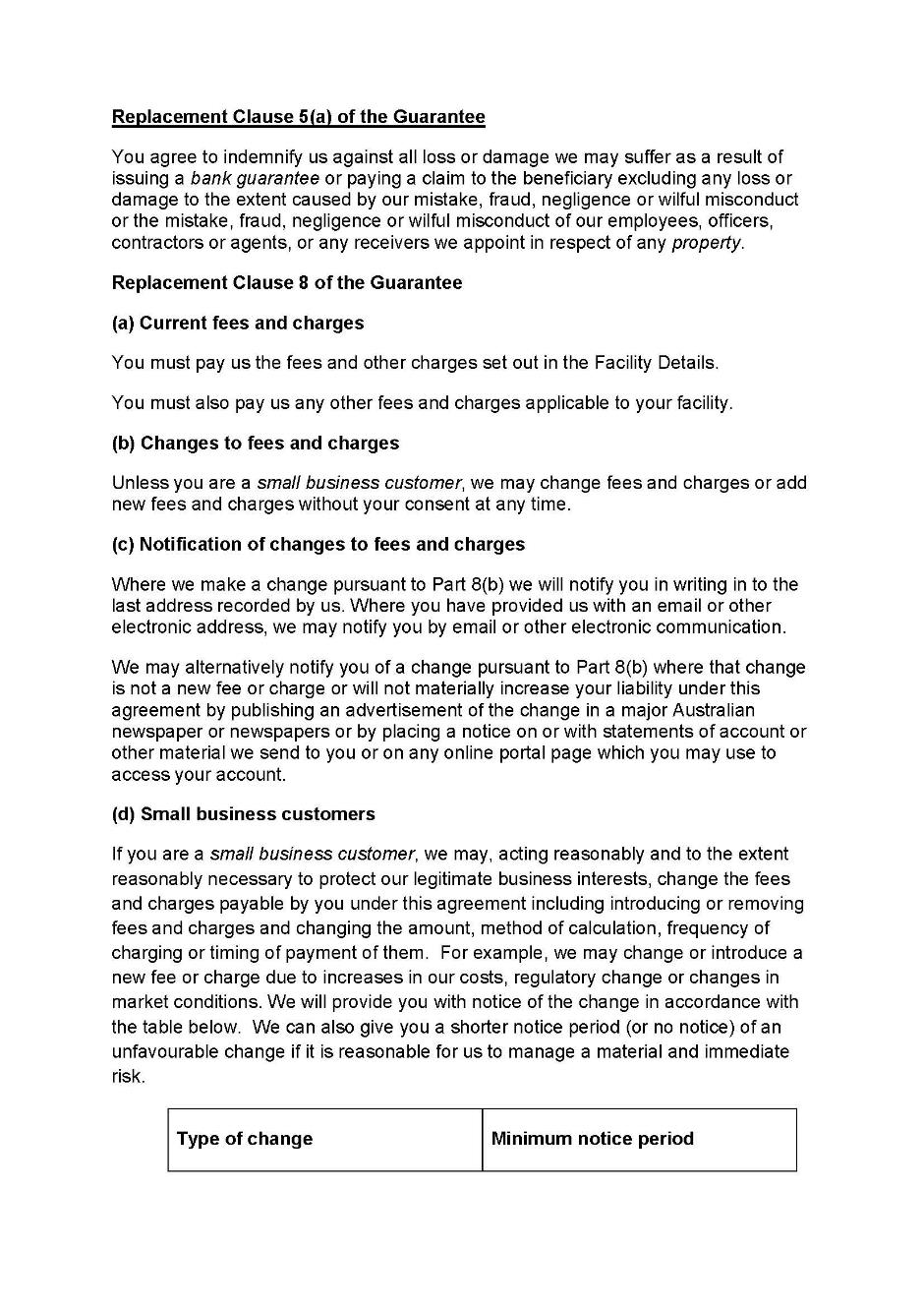

Order

48. Pursuant to s 12GNB of the Act, any small business contract entered into or amended or renewed on or after 12 November 2016 between the defendant and any of its customers which incorporates the General Conditions and which meets the definition of a small business contract within the meaning of s 12BF(4) of the Act and which is a standard form contract within the meaning of s 12BK of the Act and is a contract for a financial product or a contract for the supply or possible supply of financial services within the meaning of the Act, is varied with effect from the date of the contract, by replacing clauses 10, 13, 16.2, 28, 32 and 54 of Part A, 6.1 of Part C and 4.5 of Part E of the General Conditions with the clauses specified in the schedule to these orders.

Costs

49. The defendant pay the plaintiff's costs on the ordinary basis.

Undertaking

50. The defendant file and serve within seven days of this order an undertaking to the Court in the following terms:

The defendant hereby undertakes to the Court not to use or rely upon any of the terms set out in Schedule 1 of the Statement of Agreed Facts filed by the parties on 23 October 2020 in any small business contract incorporating the Standard Form Terms (as that term is defined in the Statement of Agreed Facts). For the avoidance of doubt, a copy of Schedule 1 of the Statement of Agreed Facts is at Annexure A to this undertaking.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

Schedule to the Orders

BANKS-SMITH J:

1 The plaintiff (ASIC) seeks a range of declarations and orders relating to certain contracts used by the defendant (Bank) which contain terms that ASIC alleges are unfair within the meaning of s 12GB of the Australian and Securities Investments Commission Act 2001 (Cth) (Act) and so are void pursuant to s 12BF(1) of the Act.

2 The Bank accepts that the impugned terms are unfair. The parties filed joint submissions and have jointly proposed declarations and orders for the purpose of resolving the proceedings. The orders sought include orders varying the terms said to be unfair.

3 Since 2019 the Bank has used certain general conditions for small business lending contracts. Various terms in those general conditions, relating to matters such as indemnities, events of default and unilateral variations, are impugned.

4 ASIC does not allege that the Bank has relied upon the impugned terms in a manner that is unfair, or that has caused any customers to suffer loss or damage. The Bank has indicated it is willing to provide an undertaking that it will not use or rely upon any of the impugned terms.

5 The question for the Court is whether it is appropriate to make the orders and declarations sought.

ASIC v Bendigo and Adelaide Bank Limited

6 At the outset it is to be acknowledged that a similar application relating to unfair terms in small business lending contracts was brought by ASIC in Australian Securities and Investments Commission v Bendigo and Adelaide Bank Limited [2020] FCA 716 (Gleeson J) (ASIC v Bendigo). It is apparent that submissions were filed in that proceeding that were similar to the joint submissions filed in this proceeding, and that similar relief was sought. Therefore, and unsurprisingly, there is a degree of consistency between her Honour's reasons and aspects of these reasons.

Regulatory context

7 Division 2 of Part 2 of the Act is headed 'Unconscionable conduct and consumer protection in relation to financial services'.

8 Subdivision BA of Division 2 is headed 'Unfair contract terms'. The relevant provisions upon which ASIC relies fall within that subdivision: s 12BF - unfair terms of consumer contracts and small business contracts; s 12BG - meaning of unfair; s 12BH - examples of unfair terms; and s 12BK - standard form contracts.

9 Subdivision G of Division 2 is headed 'Enforcement and remedies'. The powers of the Court to make the orders and declarations sought are said to arise under s 12GNB - orders to redress loss or damage suffered by non-party consumers; and s 12GNC - kinds of orders that may be made to redress loss or damage suffered by non-party consumers.

10 The various statutory provisions were collected by Gleeson J in ASIC v Bendigo at [9]-[14], and I acknowledge that the following summary largely adopts her Honour's summary of those provisions.

11 Section 12BF relevantly provides:

(1) A term of a … small business contract is void if:

(a) the term is unfair; and

(b) the contract is a standard form contract; and

(c) the contract is:

(i) a financial product; or

(ii) a contract for the supply, or possible supply, of services that are financial services.

(2) The contract continues to bind the parties if it is capable of operating without the unfair term.

…

(4) A contract is a small business contract if:

(a) at the time the contract is entered into, at least one party to the contract is a business that employs fewer than 20 persons; and

(b) either of the following applies:

(i) the upfront price payable under the contract does not exceed $300,000;

(ii) the contract has a duration of more than 12 months and the upfront price payable under the contract does not exceed $1,000,000.

(5) In counting the persons employed by a business for the purposes of paragraph (4)(a), a casual employee is not to be counted unless he or she is employed by the business on a regular and systematic basis.

(6) For the purposes of subsection (4) and despite subsection 12BI(3), in working out the upfront price payable under a contract under which credit is or is to be provided, disregard any interest payable under the contract.

12 Section 12BK(1) provides that if a party to a proceeding alleges that a contract is a standard form contract, it is presumed to be a standard form contract unless another party to the proceeding proves otherwise.

13 Relevantly, s 12BAA(7)(k) provides that, subject to subsection (8), a 'credit facility (within the meaning of the regulations)' is a financial product for the purposes of Division 2.

14 Regulation 2B(1) of the Australian Securities and Investments Commission Regulations 2001 (Cth) (Regulations) provides that the provision of credit for any period is a 'credit facility' for the purposes of s 12BAA(7)(k). By reg 2B(3)(a), 'credit' means a contract, arrangement or understanding under which payment of a debt owed by one person (a debtor) to another person (a credit provider) is deferred or a debtor incurs a deferred debt to a credit provider. By reg 2B(3)(b)(i) and (ix), 'credit' includes any form of financial accommodation and a financial benefit arising from or as a result of a loan.

15 Section 12BG deals with when a term will be 'unfair' and provides that:

(1) A term of a contract referred to in subsection 12BF(1) is unfair if:

(a) it would cause a significant imbalance in the parties' rights and obligations arising under the contract; and

(b) it is not reasonably necessary in order to protect the legitimate interests of the party who would be advantaged by the term; and

(c) it would cause detriment (whether financial or otherwise) to a party if it were to be applied or relied on.

(2) In determining whether a term of a contract is unfair under subsection (1), a court may take into account such matters as it thinks relevant, but must take into account the following:

(b) the extent to which the term is transparent;

(c) the contract as a whole.

(3) A term is transparent if the term is:

(a) expressed in reasonably plain language; and

(b) legible; and

(c) presented clearly; and

(d) readily available to any party affected by the term.

(4) For the purposes of paragraph (1)(b), a term of a contract is presumed not to be reasonably necessary in order to protect the legitimate interests of the party who would be advantaged by the term, unless that party proves otherwise.

16 Section 12BH provides some examples of the kind of terms that may be unfair including, relevantly:

(a) a term that permits, or has the effect of permitting, one party (but not another party) to avoid or limit performance of the contract;

(b) a term that permits, or has the effect of permitting, one party (but not another party) to terminate the contract;

(c) a term that penalises, or has the effect of penalising, one party (but not another party) for a breach or termination of the contract;

(d) a term that permits, or has the effect of permitting, one party (but not another party) to vary the terms of the contract;

…

(g) a term that permits, or has the effect of permitting, one party unilaterally to vary financial services to be supplied under the contract;

(h) a term that permits, or has the effect of permitting, one party unilaterally to determine whether the contract has been breached or to interpret its meaning;

(i) a term that limits, or has the effect of limiting, one party's vicarious liability for its agents;

…

(k) a term that limits, or has the effect of limiting, one party's right to sue another party;

…

(m) a term that imposes, or has the effect of imposing, the evidential burden on one party in proceedings relating to the contract.

17 Turning to enforcement and remedies, s 12GNB(1) of the Act relevantly provides:

Without limiting the generality of section 12GD, if:

(a) a person:

…

(ii) is a party to a contract who is advantaged by a term (the declared term) of the contract in relation to which the Court has made a declaration under section 12GND; and

(b) the contravening conduct or declared term caused, or is likely to cause, a class of persons to suffer loss or damage; and

(c) the class includes persons who are non-party consumers in relation to the contravening conduct or declared term;

the Court may, on the application of ASIC, make such order or orders (other than an award of damages) as the Court thinks appropriate against a person referred to in subsection (2) of this section.

18 Section 12GNB(3) relevantly provides:

(3) The Court must not make an order under subsection (1) unless the Court considers that the order will:

…

(b) prevent or reduce the loss or damage suffered, or likely to be suffered, by the non-party consumers in relation to the contravening conduct or declared term.

19 Section 12GNC relevantly provides:

Without limiting subsection 12GNB(1), the orders that the Court may make under that subsection against a person (the respondent ) include all or any of the following:

(a) an order declaring the whole or any part of a contract made between the respondent and a non-party consumer referred to in that subsection, or a collateral arrangement relating to such a contract:

(i) to be void; and

(ii) if the Court thinks fit - to have been void ab initio or void at all times on and after such date as is specified in the order (which may be a date that is before the date on which the order is made);

(b) an order:

(i) varying such a contract or arrangement in such manner as is specified in the order; and

(ii) if the Court thinks fit - declaring the contract or arrangement to have had effect as so varied on and after such date as is specified in the order (which may be a date that is before the date on which the order is made);

Authorities on unfairness

20 There is now a body of useful authorities which consider unfair terms in contracts. The relevant provisions under the Act were considered in Australian Competition and Consumer Commission v CLA Trading Pty Ltd [2016] FCA 377 (Gilmour J). The Australian Consumer Law (ACL), which appears as Schedule 2 to the Competition and Consumer Act 2010 (Cth), has a corresponding legislative regime to that under the Act. Chapter 2 of the ACL is headed 'General Protections' and includes statutory provisions addressing misleading or deceptive conduct (Part 2-1), unconscionable conduct (Part 2-2) and unfair contract terms (Part 2-3). Section 24, which falls within Part 2.3, is headed 'unfair terms' and is in identical terms to s 12BG of the Act.

21 The meaning and application of the various elements of s 24 of the ACL have been considered in a number of cases, including Australian Competition and Consumer Commission v Chrisco Hampers Australia Limited [2015] FCA 1204; (2015) 239 FCR 33 (Edelman J); Australian Competition and Consumer Commission v JJ Richards & Sons Pty Ltd [2017] FCA 1224 (Moshinsky J); and Australian Competition and Consumer Commission v Ashley & Martin Pty Ltd [2019] FCA 1436 (Banks-Smith J).

22 In ASIC v Bendigo Gleeson J summarised the relevant principles, adopting in part the submission of the parties in that matter and referring in particular to the above cases at [17]-[36]. Those authorities relating to the ACL may be applied to the corresponding s 12BG of the Act. Her Honour's summary was adopted as a whole by the parties in this matter. It is not necessary to repeat that summary, but these reasons should be taken to repeat and apply the principles as summarised by her Honour.

23 I should add that in addition to the matters set out in ASIC v Bendigo, in relation to transparency and s 12BG(2)(b) of the Act, it is accepted that some terms in contracts may be inherently unfair, regardless of how comprehensively they may be drawn to the customer's attention: Australian Competition and Consumer Commission v CLA Trading at [54]. See also Jackson J's more recent consideration of transparency in the context of s 24(2)(a) of the ACL in Australian Competition and Consumer Commission v Smart Corporation Pty Ltd (No 3) [2021] FCA 347 at [69]-[72].

Agreed facts

24 The parties filed a statement of agreed facts made jointly by them for the purposes of s 191 of the Evidence Act 1995 (Cth).

25 The following matters are agreed.

Parties

26 ASIC is the statutory authority responsible for enforcing the Act.

27 The Bank is a publicly listed entity and the holder of an Australian Financial Services Licence.

28 The Bank is a leading regional bank with branches in every state and territory of Australia except South Australia. In the financial year ended 31 August 2019 it had statutory net profit after tax of $298 million, gross loans and advances of $46,216 million, and a market capitalisation of $3.721 billion. It is a top 100 listed company on the Australian Securities Exchange.

The Bank's standard form contracts

29 Since November 2016, the Bank used the following general conditions for small business lending contracts:

(a) Guarantee Facility General Conditions dated September 2016 (Guarantee);

(b) Business Term Loan General Conditions dated September 2016 (Term Loan);

(c) Commercial Rate Loan Facility General Conditions dated September 2016 (Commercial Rate Loan);

(d) Business Overdraft and Business Line of Credit General Conditions dated September 2016 (Overdraft); and

(e) Facility General Conditions dated November 2016 (General Conditions).

(together, Standard Form Terms)

30 Between 16 November 2016 and 30 June 2019, the Bank entered into:

(a) 1,128 standard form contracts with businesses which incorporated one or more of the Standard Form Terms for which the upfront price payable under the contract did not exceed $300,000; and

(b) 1,319 standard form contracts with businesses which incorporated one or more of the Standard Form Terms for which the contract had a duration of more than 12 months and the upfront price payable under the contract exceeded $300,000 but did not exceed $1 million.

(together, Standard Form Contracts)

31 As at 30 June 2019, the Bank had on foot:

(a) 938 active standard form contracts with businesses which incorporated one or more of the Standard Form Terms for which the upfront price payable under the contract did not exceed $300,000; and

(b) 1,148 active standard form contracts with businesses which incorporated one or more of the Standard Form Terms for which the contract had a duration of more than 12 months and the upfront price payable under the contract exceeded $300,000 but did not exceed $1 million.

32 At least some, and likely a significant number, of the counterparties to the Standard Form Contracts are businesses that employed fewer than 20 persons at the time of entry into the Standard Form Contract. It is not known how many of the Standard Form Contracts are small business contracts within the meaning of s 12BF(4) of the Act because the Bank does not store data in relation to numbers of employees as part of its lending process.

33 Accordingly, at least some, and likely a significant number, of the Standard Form Contracts are small business contracts within the meaning of s 12BF(1) and s 12BF(4) of the Act.

34 Each Standard Form Contract is a standard form contract within the meaning of s 12BF(1)(b) and s 12BK of the Act.

35 Each Standard Form Contract is a credit facility within the meaning of s 12BAA(7)(k) of the Act and the Regulations and a financial product within the meaning of s 12BF(1)(c)(i) of the Act.

The eleven BOQ contracts

36 The originating process identifies eleven particular contracts made between customers and the Bank. They are defined as the First BOQ Contract, Second BOQ Contract and so on, and fall within the group of Standard Form Contracts. They are referred to collectively as the Schedule Contracts (ASIC has disclosed the parties to those contracts to the Bank by way of a confidential schedule but their identity is otherwise confidential).

37 Each of the Schedule Contracts is a small business contract within the meaning of s 12BF(1) and s 12BF(4) of the Act, for the following reasons:

(a) the First BOQ Contract is a guarantee facility that incorporates the terms of the Guarantee with a limit of $20,000 for five years. At the time of entry into the contract, the other party to the contract conducted a business that had 17 employees (and ASIC's senior counsel noted that in International Litigation Partners Pte Ltd v Chameleon Mining NL (Receivers and Mangers Appointed) [2012] HCA 45; (2012) 246 CLR 455 at [28], the High Court found, although in the context of cognate corporations legislation, that a bank guarantee is relevantly a credit facility, because it is financial accommodation);

(b) the Second BOQ Contract is a guarantee facility that incorporates the terms of the Guarantee with a limit of $13,441 for five years. At the time of entry into the contract, the other party to the contract conducted a business that had five employees;

(c) the Third BOQ Contract is a business term loan that incorporates the terms of the Term Loan for $800,000 with a term of 15 years. At the time of entry into the contract, the other party to the contract conducted a business that had no employees;

(d) the Fourth BOQ Contract is a business term loan that incorporates the terms of the Term Loan for $464,000 with a term of 25 years. At the time of entry into the contract, the other parties to the contract conducted a business that had no employees;

(e) the Fifth BOQ Contract is a commercial rate loan that incorporates the terms of the Commercial Rate Loan for $800,000 with a term of three years. At the time of entry into the contract, the other party to the contract conducted a business that had one employee;

(f) the Sixth BOQ Contract is a commercial rate loan that incorporates the terms of the Commercial Rate Loan for $650,000 with a term of five years. At the time of entry into the contract, the other party to the contract conducted a business that had two employees;

(g) the Seventh BOQ Contract is an overdraft facility that incorporates the terms of the Overdraft for $50,000. At the time of entry into the contract, the other party to the contract conducted a business that had three employees;

(h) the Eighth BOQ Contract is an overdraft facility that incorporates the terms of the Overdraft for $600,000. At the time of entry into the contract, the other parties to the contract conducted a business that had three employees;

(i) the Ninth BOQ Contract is a bank guarantee that incorporates the terms of the General Conditions for $7,218.75 for 60 months. At the time of entry into the contract, the other party to the contract conducted a business that had three employees;

(j) the Tenth BOQ Contract is a bank guarantee that incorporates the terms of the General Conditions for $4,166.67 for 60 months. At the time of entry into the contract, the other party to the contract conducted a business that had two employees; and

(k) the Eleventh BOQ Contract is an overdraft facility that incorporates the terms of the General Conditions for $25,000 repayable on demand. At the time of entry into the contract, the other parties to the contract conducted a business that had four employees.

38 Each of the Schedule Contracts is a standard form contract within the meaning of s 12BF(1)(b) and s 12BK of the Act.

39 Each of the Schedule Contracts is a credit facility within the meaning of s 12BAA(7)(k) of the Act and the Regulations and a financial product within the meaning of s 12BF(1)(c)(i) of the Act.

Identified unfair terms

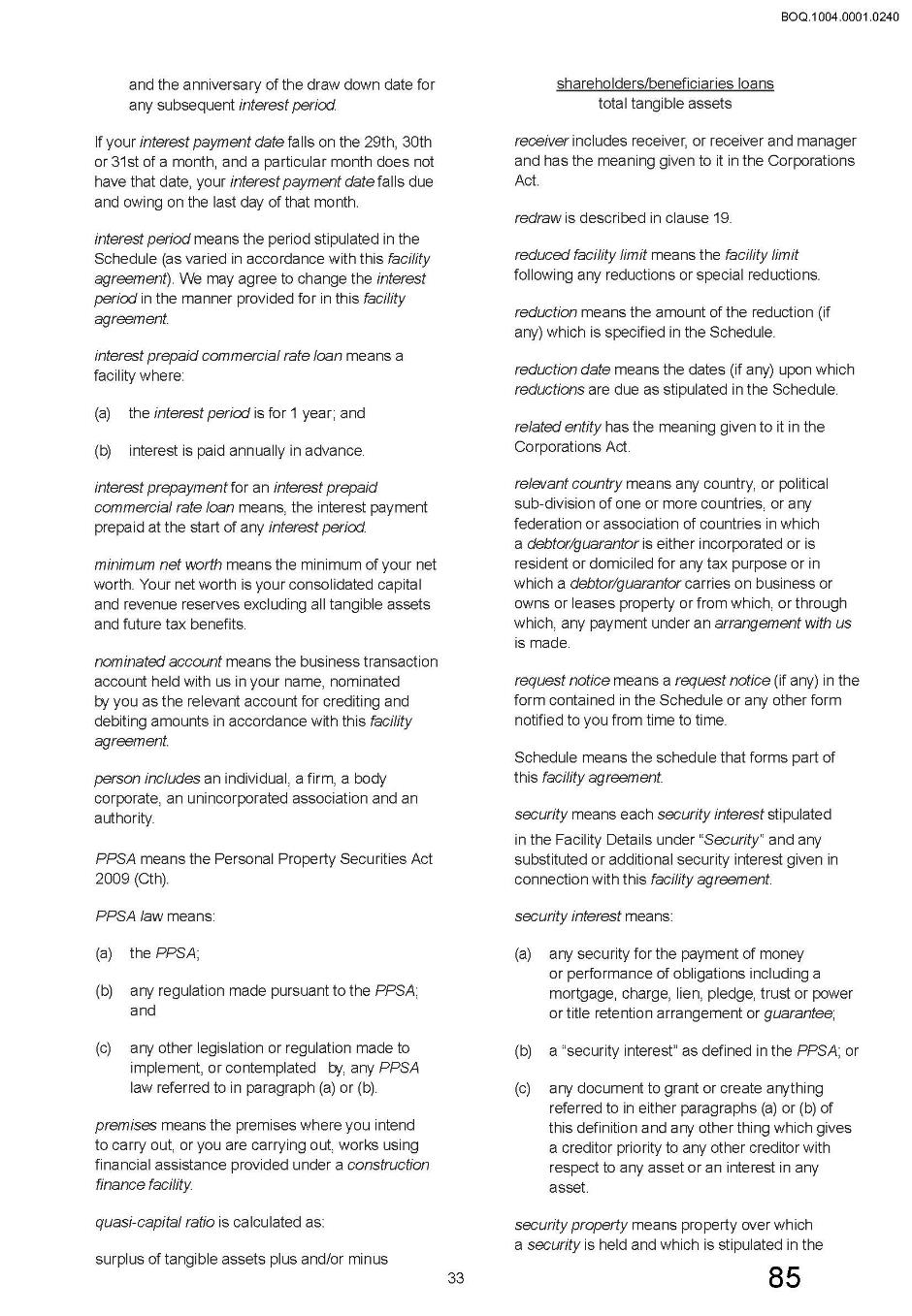

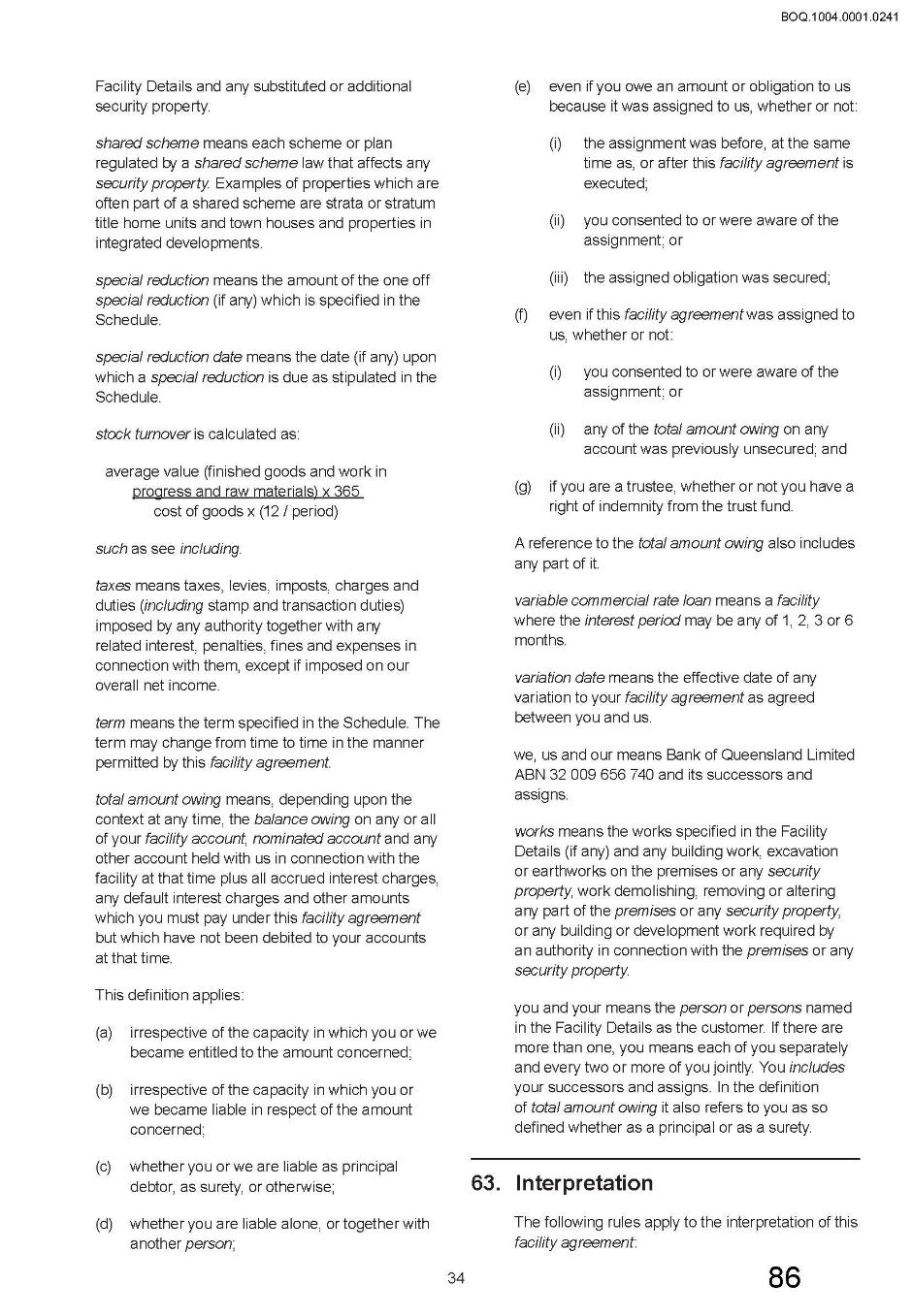

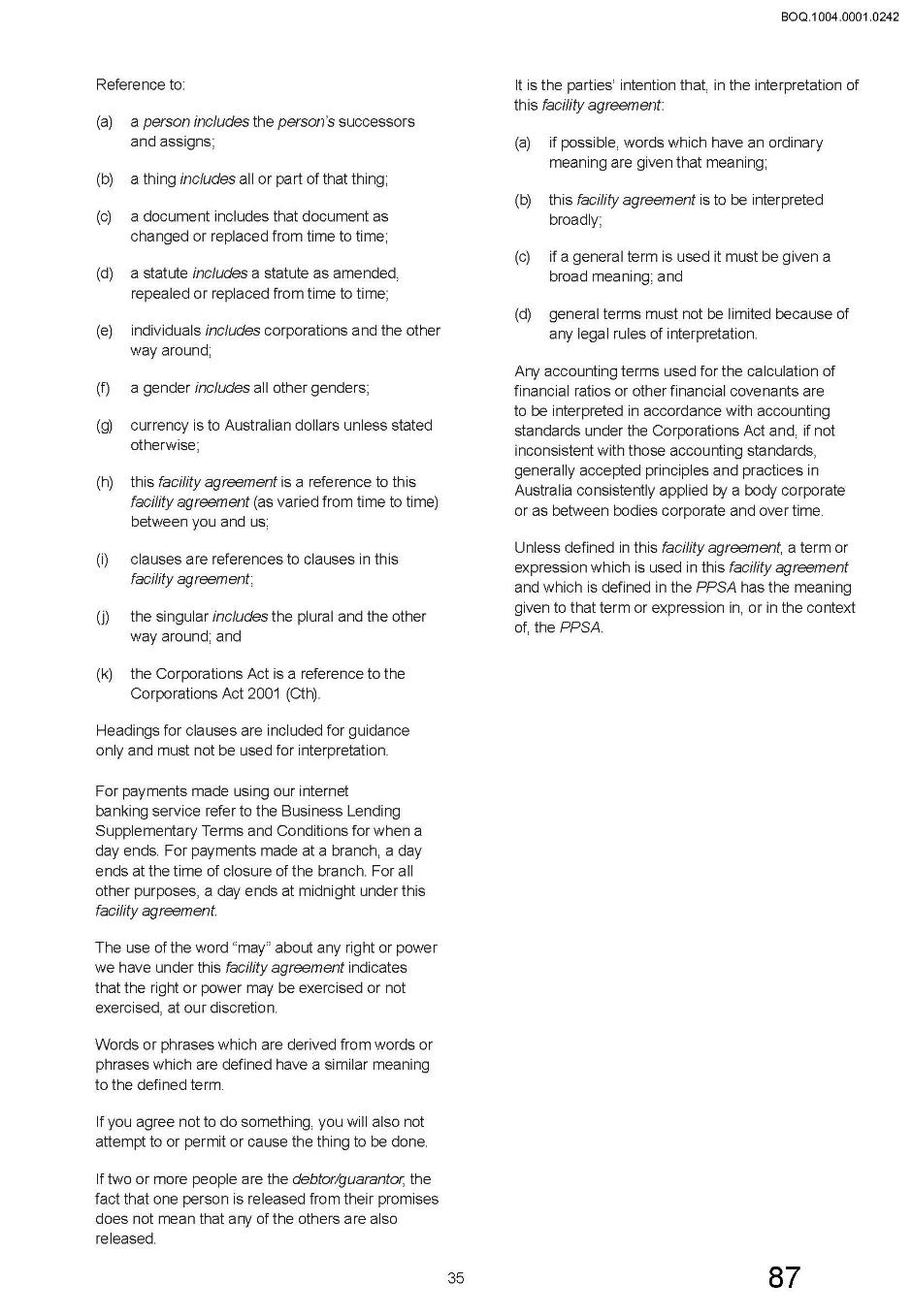

40 Annexure A to these reasons contains the relevant impugned clauses extracted from each of the Guarantee, Term Loan, Commercial Rate Loan, Overdraft and General Conditions. A sample copy of the Guarantee is contained in Annexure B to these reasons. A sample copy of the Term Loan is contained in Annexure C. A sample copy of the Commercial Rate Loan is contained in Annexure D. A sample copy of the Overdraft is contained in Annexure E. A sample copy of the General Conditions is contained in Annexure F. Those annexures bear pagination from the statement of agreed facts which is not part of the source documents and may be ignored for present purposes.

41 The Standard Form Terms include:

(a) indemnification clauses that apply to losses not caused by a customer's default and that have the effect of limiting the Bank's vicarious liability for its agents (Guarantee clause 5; Commercial Rate Loan clauses 17.1(c), 17.1(d),17.1(e), 17.1(g) and 17.2; General Conditions clauses 10.1(c), 10.1(d), 10.1(e), 10.1(f), 10.1(h) and 10.2 and clause 4.5 of Part E);

(b) event of default clauses that allow the Bank to unilaterally determine whether a default has occurred (Guarantee clause 11(a) (bullet 17); Term Loan clause 13(a) (bullet 15); Commercial Rate Loan clause 22(l); Overdraft clause 12(a) (bullet 15); General Conditions clause 13(l));

(c) event of default clauses that do not permit the customer to remedy a default capable of remedy and which create defaults based on events which may or may not involve any material change in credit risk (Guarantee clause 11(a) (bullets 6, 7, 17); Term Loan clause 13(a) (bullets 5, 6, 15); Commercial Rate Loan clauses 22(e), 22(l), 22(t); Overdraft clause 12(a) (bullets 5, 6, 15); General Conditions clauses 13(e), 13(l), 13(t));

(d) event of default clauses that create defaults based on events that may or may not involve any material change in credit risk (Guarantee clause 11(a) (bullets 6, 7, 17); Term Loan clause 13(a) (bullets 5, 6, 15); Commercial Rate Loan clauses 22(e), 22(l), 22(t); Overdraft clause 12(a) (bullets 5, 6, 15); General Conditions clauses 13(e), 13(l), 13(t));

(e) unilateral variation clauses which permit the Bank to vary the upfront price of the contract, the financial services to be supplied under the contract and other terms of the contract (Guarantee clause 8(b), Term Loan clauses 8(b), 9(c) and 10(c), Commercial Rate Loan clauses 25.2, 39.1(a), 39.1(g), 39.1(h), 39.1(i), 39.1(j); Overdraft clauses 2(d), 7(b), 8(c) 9(c) and 13; General Conditions clauses 16.2, 32.1(a), 32.1(h), 32.1(i), 32.1(j) and 32.1(k) and clause 6.1 of Part C); and

(f) conclusive evidence clauses that have the effect of imposing an evidential burden on the customer in proceedings relating to the contract (Commercial Rate Loan clause 35.1; General Conditions clause 28). These clauses also have the effect of allowing the Bank, but not the customer, to terminate the contract if the customer does not pay an amount stated in a certificate by a stated date.

It is accepted that the clauses are unfair

42 The parties agree that each of the clauses identified in [41] above is unfair within the meaning of s 12BG of the Act (and therefore void as a result of s 12BF(1) of the Act) for the following reasons:

(a) each clause causes a significant imbalance in the parties' rights and obligations arising under the relevant Schedule Contract and in the Standard Form Contracts because it provides rights and entitlements to the Bank without incorporating commensurate or ameliorating rights or entitlements for the customer;

(b) it is not reasonably necessary in order to protect the legitimate interests of the Bank; and

(c) it would cause detriment to the relevant counterparty if relied upon.

The Bank has not used impugned clauses in unfair manner

43 Since the commencement of these proceedings, the Bank has used three of the impugned terms in the manner set out below:

(a) pursuant to clause 8(b) of the Guarantee, the Bank increased the 'agreed credit advance fee' from 2.50% p.a. to 2.95% p.a. effective 24 January 2020. The Bank gave written notice to existing customers on 17 December 2019;

(b) pursuant to clause 8(b) of the Business Term Loan, the Bank increased the 'service fee' from $20 per month to $25 per month effective on the next payment date on or after 31 January 2020. The Bank provided written notice to existing customers on 18 December 2019; and

(c) pursuant to clause 39.1(j) of the Commercial Rate Loan, the Bank increased the Security Release Fee from $320 to $350 effective on 10 February 2020. The Bank placed a notice in The Australian on 10 January 2020.

44 However, ASIC does not contend that the Bank has deployed these terms unfairly. Further, ASIC does not allege that the Bank has relied upon any of the clauses in the Standard Form Contracts in a manner that is unfair, or that has caused any customers detriment or to suffer loss or damage. This application is preventative in nature.

Agreement as to unfairness

45 The following paragraphs reflect the joint submissions of the parties and their agreement as to the unfairness of the respective clauses.

46 The impugned terms in the Standard Form Terms fall broadly into four categories, being: indemnification clauses; event of default clauses; unilateral variation or termination clauses; and conclusive evidence clauses. Expressed generally, each of the impugned terms is said to be unfair within the meaning of s 12BG of the Act because each term:

(a) causes a significant imbalance in the parties' rights and obligations arising under the contract because it provides rights and entitlements to the Bank without incorporating commensurate or ameliorating rights or entitlements for the customer;

(b) is not reasonably necessary in order to protect the legitimate interests of the Bank; and

(c) would cause detriment to the customer if relied upon.

47 For the purpose of establishing that the terms are not reasonably necessary to protect the legitimate interest of the Bank, ASIC relies on the presumption at s 12BG(4), and the Bank does not seek to rebut that presumption.

Indemnification clauses

48 Clause 5 of the Guarantee; clauses 17.1(c), 17.1(d), 17.1(e), 17.1(g) and 17.2 of the Commercial Rate Loan; and clauses 10.1(c), 10.1(d), 10.1(e), 10.1(f), 10.1(h) and 10.2 and clause 4.5 of Part E of the General Conditions are indemnification clauses which on a proper construction, can be relied on by the Bank to make the customer liable for liability, loss or costs suffered or incurred by the Bank that:

(a) the customer has not caused; and/or

(b) has been caused by the Bank's, mistake, error or negligence; and/or

(c) could have been avoided or mitigated by the Bank.

49 In the case of the Commercial Rate Loan and the General Conditions, this indemnification extends to the Bank's servants and agents (by clauses 17.2 and 10.2 respectively).

50 These terms create a significant imbalance in the parties' rights and obligations in that:

(a) the customer has no corresponding rights;

(b) the circumstances in which the liability, loss or costs may be incurred are not within the customer's control; and

(c) the Bank controls at least some of the circumstances in which the liability, loss or costs may be incurred and can avoid or mitigate that liability, loss or costs.

51 These terms would cause detriment to the customer if applied or relied upon because in the above circumstances the customer may be required to pay monies to the Bank in which the liability, loss or costs incurred are not within the customer's control, and may not have been caused by the customer, and may have been caused by the mistake, error or negligence of the Bank or its agents, and could have been avoided or mitigated by the Bank or its agents.

52 When regard is had to each of the Guarantee, the Commercial Rate Loan and the General Conditions as a whole, there is nothing otherwise within the terms of those documents which mitigates the unfairness of the impugned terms.

53 I note that similar terms were found to be unfair by Gleeson J in ASIC v Bendigo at [49]-[53].

Event of default clauses

54 Each of clause 11(a) (bullets 6, 7 and 17) of the Guarantee; clause 13(a) (bullets 5, 6 and 15) of the Term Loan; clause 12(a) (bullets 5, 6 and 15) of the Overdraft; clauses 22(e), 22(l) and 22(t) of the Commercial Rate Loan; and clauses 13(e), 13(l) and 13(t) of the General Conditions are event of default clauses which are impugned.

55 The significant imbalance in the event of default impugned terms is created:

(a) first, by the disproportionately severe default consequences set out at [56]-[57] below;

(b) secondly, because none of the event of default clauses permit the customer to remedy a default which may be capable of remedy;

(c) thirdly, because each of the clauses creates a default based on events that may not involve any credit risk to the Bank (for example by providing misleading or untrue information such as a director's date of birth or by failing to keep to an agreement with a third party); and

(d) fourth, in relation to the following clauses, because they create an event of default in the circumstances set out below:

(i) an untrue or misleading statement being made or repeated by the customer (or its guarantors) which can in the context of the contract be insignificant (for example an error as to a director's date of birth): Guarantee clause 11(a) (bullet 6); Term Loan clause 13(a) (bullet 5); Overdraft clause 12(a) (bullet 5); Commercial Rate Loan clause 22(e); General Conditions clause 13(e);

(ii) the Bank unilaterally forms an opinion that something has happened where the Bank's opinion may be wrong or it may also be reasonable to hold the opposite opinion and the customer has no entitlement to rectify any matter on which the Bank's opinion is based: Guarantee clause 11(a) (bullet 17); Term Loan clause 13(a) (bullet 15); Overdraft clause 12(a) (bullet 15); Commercial Rate Loan clause 22(l); General Conditions clause 13(l).

56 Default consequences under the Guarantee, the Term Loan and the Overdraft include:

(a) the Bank is entitled to make the outstanding sum due under the facility with the customer payable immediately and on demand: Guarantee clauses 11(b), 13(a); Term Loan clause 13(b); Overdraft clause 12(b). In the case of the Guarantee, the Bank is permitted to claim the outstanding sum including the face value of all current bank guarantees: clause 11(b);

(b) the Bank is entitled to pay out any security interest that has priority to its security on any property and add that amount to the money the customer owes the bank: Guarantee clause 17(g); Term Loan clause 19(g); Overdraft clause 18(g);

(c) in the case of the Term Loan, the customer might be liable for an unspecified amount of break costs. It is not clear from the terms of the Term Loan how those costs are calculated: clause 6(f)(c). BOQ submits that, to calculate break costs, the Bank applies a formula to determine the cost incurred to re-arrange its own funding as a result of the break cost event. The customer does not know what formula is used and cannot calculate the break costs themselves, but can contact the Bank to find out the amount of any break costs without incurring an administration fee;

(d) the Bank is entitled to enforce its rights under the agreement or any security: Guarantee clause 11(b); Term Loan clause 13(b); Overdraft clause 12(b). The customer indemnifies the Bank and may be held liable for all costs (including the Bank's legal costs) of enforcing the agreement or any security: Guarantee clauses 11(b), 14; 17(c); Term Loan clauses 13(b), 16, 19(c); Overdraft clauses 12(b), 15, 18(c). Those costs are of an unspecified amount and are incurred in circumstances where the customer has no control over how they are incurred. Further, the customer is liable to the Bank whether or not the Bank has actually paid any money: Guarantee clause 17(c), Term Loan clause 19(c); Overdraft clause 18(c);

(e) the Bank is entitled to debit any account the customer holds with the Bank to satisfy the amounts payable as set out in subparagraphs (a) to (d) above: Guarantee clauses 6(a), 17(b); Term Loan clause 18(b); Overdraft clause 18(b);

(f) there is no right of set-off for the customer but there is for the Bank: Guarantee clause 13(a); Term Loan clause 15(a); Overdraft clause 14(a);

(g) the customer is automatically in default under every other agreement with the Bank, potentially triggering additional payments: Guarantee clause 11(b), Term Loan clause 13(b), Overdraft clause 12(b);

(h) in the case of the Guarantee, the Bank is entitled to terminate any of its obligations under the facility: clause 12(b);

(i) the customer does not have any right to prevent any of the above by demonstrating that it has remedied (or will remedy) any default that can be remedied or that there is no credit risk to the Bank; and

(j) the Bank may be required to give notice before the exercise of any of these powers but it is not clear in what circumstances that will be so or how much notice will be given: Guarantee clause 11(b), Term Loan clause 13(b), Overdraft clause 12(b).

57 Default consequences under the Commercial Rate Loan and the General Conditions include:

(a) the Bank is entitled to make the outstanding sum due under the facility with the customer payable immediately and on demand: Commercial Rate Loan clause 23.1; General Conditions clauses 5.1, 14.1;

(b) the Bank is entitled to pay out any security interest that has priority to its security on any property and add that amount to the money the customer owes the Bank: Commercial Rate Loan clause 50; General Conditions clause 43;

(c) the customer might also be liable for an unspecified amount of break costs. It is not clear from the terms of the Commercial Rate Loan or the General Conditions respectively how those costs are calculated: Commercial Rate Loan clause 20.1(c), General Conditions clause 11.1(e). BOQ submits that, to calculate break costs, the Bank applies a formula to determine the cost incurred to re-arrange its own funding as a result of the break cost event: Commercial Rate Loan clauses 20.2-20.9, General Conditions clauses 11.2-11.9. The customer does not know what formula is used and cannot calculate the break costs themselves, but can contact the Bank to find out the amount of any break costs without incurring an administration fee: Commercial Rate Loan clause 20.12, General Conditions clause 11.12;

(d) the Bank is entitled to enforce its rights under the agreement or any security: Commercial Rate Loan clause 23.4(c); General Conditions clause 14.4(d). The customer indemnifies the Bank and may be held liable for all costs (including the Bank's legal costs) of enforcing the agreement or any security: Commercial Rate Loan clauses 15.1, 17.1(c), 23.4(d); General Conditions clauses 8.1(a), 10.1(c) 14.4(e). Those costs are of an unspecified amount and are incurred in circumstances where the customer has no control over how they are incurred. Further, the customer is liable to the Bank whether or not the Bank has actually paid any money: Commercial Rate Loan clause 45, General Conditions clause 38;

(e) the Bank is entitled to debit any account the customer holds with the Bank to satisfy the amounts payable as set out in subparagraphs (a) to (d) above without notice to the customer: Commercial Rate Loan clauses 4.2, 15.2, 23.4(f); General Conditions clauses 4.2, 8.2, 14.4(g);

(f) the Bank is entitled to refuse to make any undrawn portion of the facility limit available: Commercial Rate Loan: clause 24.3(g); General Conditions clause: clause 14.4(h), (i);

(g) the Bank is entitled to terminate any of its obligations under the facility: Commercial Rate Loan clause 23.4(h); General Conditions clause 14.4(i).

(h) there is no right of set-off for the customer but there is for the Bank: Commercial Rate Loan clause 33; General Conditions clause 26;

(i) the customer does not have any right to prevent any of the above by demonstrating that it has remedied (or will remedy) any default that can be remedied or that there is no credit risk to the Bank; and

(j) the Bank may be required to give notice before the exercise of any of these powers but it is not clear in what circumstances that will be so or how much notice will be given: Commercial Rate Loan clause 23, General Conditions clause 14.

58 Each of the impugned event of default clauses would cause detriment to the customer if relied upon within the meaning of s 12BG(1) because of the relevant default consequences outlined above.

59 The impugned event of default terms fall within the list of examples of terms set out in s 12BH(1) that may be unfair: see s 12BH(1)(b) and (h). When regard is had to each of the Guarantee, Term Loan, the Overdraft, the Commercial Rate Loan and the General Conditions as a whole, there is nothing otherwise within the terms of those documents which mitigates the unfairness of the impugned terms.

60 ASIC had initially submitted that the event of default clauses were not transparent, but at the hearing indicated it no longer submitted that was the case, having regard to the findings of Gleeson J in ASIC v Bendigo Bank at [63]-[65] to the effect that similar clauses did not lack transparency. I would follow Gleeson J's reasons and in this case am not persuaded that the relevant clauses lack transparency.

Unilateral variation or termination clauses

61 Clause 8(b) of the Guarantee; clauses 8(b), 9(c) and 10(c) of the Term Loan; clauses 2(d), 7(b), 8(c), 9(c), 13 of the Overdraft, clauses 25.2, 39.1(a), 39.1(g), 39.1(h), 39.1(i) and 39.1(j) of the Commercial Rate Loan; and clauses 16.2, 32.1(a), 32.1(h), 32.1(i), 32.1(j), 32.1(k) and clause 6.1 of Part C of the General Conditions are unilateral variation or termination clauses which permit the Bank to vary the upfront price of the contract, the financial services to be supplied under the contract and other terms of the contract.

62 These terms create a significant imbalance in the parties' rights and obligations because:

(a) some terms allow the Bank to vary the financial services or permit the Bank to reduce the amount of funds that the customer would otherwise be able to utilise without any notice to the customer: Overdraft clauses 2(d), 13; Commercial Rate Loan clauses 25.2, 39.1(a); General Conditions clauses 16.2, 32.1(a);

(b) they permit the Bank to unilaterally vary the contract and the obligations of the parties at will; and

(c) the customer has no corresponding rights.

63 Terms which allow the Bank to cancel any part of the facility would cause the customer detriment if relied upon because they reduce the amount of funds available to the customer. If the customer wishes to terminate the facility as a result of the Bank relying on one of these terms, unspecified fees and break costs may be payable (although the Bank submits that a customer may contact the Bank to find out the amount of any break costs without incurring an administration fee, as noted at [56(c)] and [57(c)] above): see for example Commercial Rate Loan 39.1(a) read together with clause 18-20; General Conditions clause 16.2, 32.1 read together with clause 11. That would have the effect of imposing a termination fee regardless of the reason for termination.

64 Terms which allow the Bank unilaterally to vary the terms of the contract, unless used to benefit the customer (for example, to reduce fees and charges or interest payable) would cause detriment if relied upon because:

(a) if the customer accepts the change, it will incur higher fees and charges (or some other consequence which is detrimental to it); and

(b) if the customer elects to terminate unspecified fees and break costs may be payable (noting the Bank's submission, again, that the customer may contact the Bank to find out the amount of any break costs without incurring an administration fee, as noted at [56(c)] and [57(c)] above): see for example Term Loan clause 6(f), Commercial Rate Loan clauses 18-20, General Conditions clause 11. That would have the effect of imposing a termination fee regardless of the reason for termination.

65 These terms fall within the list of examples of terms set out in s 12BH(1) that may be unfair: see s 12BH(1)(a), (b), (d) and (g). When regard is had to each of the Guarantee, Term Loan, the Overdraft, the Commercial Rate Loan and the General Conditions as a whole, there is nothing otherwise within the terms of those documents which mitigates the unfairness of the impugned terms.

66 I note that similar terms were found to be unfair by Gleeson J in ASIC v Bendigo at [66]-[69].

Conclusive evidence clauses

67 Clause 35.1 of the Commercial Rate Loan and clause 28 of the General Conditions have the effect of imposing an evidential burden on the customer in proceedings relating to the contract. These clauses also have the effect of allowing the Bank but not the customer to terminate the contract if the customer does not pay an amount stated in a certificate created by the Bank by a stated date, in circumstances where the certificate created by the Bank is conclusive evidence of the amount claimed unless the customer is able to prove that the certificate is incorrect.

68 These terms create a significant imbalance in the parties' rights and obligations because:

(a) the terms allow the Bank to impose, by the issuing of a certificate, an evidential burden on the customer about matters upon which the Bank is best placed to provide primary evidence;

(b) the Bank has no additional duty; and

(c) the customer has no corresponding right.

69 Each of the terms would cause detriment if relied upon because it requires the customer to disprove matters about which the Bank is best placed to provide primary evidence. Further, it would cause detriment if relied upon in circumstances where the certificate was wrong but the customer could not or did not seek to disprove it.

70 These terms fall within the list of examples of terms set out in s 12BH(1) that may be unfair: see s 12BH(1)(l) and (m). When regard is had to the Commercial Rate Loan and the General Conditions as a whole, there is nothing otherwise within those documents which mitigates the unfairness of these terms.

71 Again, similar terms were found to be unfair by Gleeson J in ASIC v Bendigo at [75]-[78].

Section 12BG(2)

72 I should add that under s 12BG(2), the Court is obliged to take into account the extent to which it considers a term is transparent in determining whether a term of a contract is unfair and must take into account the contract as a whole. Save for the submission referred to at [60] above, ASIC did not submit that any of the other impugned terms the subject of these proceedings lacked transparency. The parties jointly submitted that in any event, regardless of whether the terms were transparent, the terms were unfair.

73 Although I have received no submissions addressing transparency in the context of the other impugned terms, and there might be room for different views were the matters to be fully argued in other matters, I have reviewed all of the impugned terms, having regard to the particular clauses, the contracts as a whole and, in particular, the matters drawn to my attention by way of counsel's submissions with reference to the aide memoire (see [74] below). In my view, to the extent any issues of transparency might arise, their effect has been addressed in the course of determining whether the various terms are unfair, having regard to the elements of s 12BG(1). Therefore, I am satisfied that the extent of any transparency has been considered, and I am not persuaded that any particular term lacks transparency within the meaning of s 12BG(3). That does not detract from the overarching findings that the impugned terms are unfair, the objective question of the three criteria in s 12BG(1) having been satisfied in any event.

Conclusion

74 I am satisfied that each of the impugned terms is unfair. I accept the joint submissions in that regard. I should add that in addition to the joint written submissions, senior counsel for ASIC orally addressed a detailed aide memoire (that was accepted by way of submission), taking the Court to what were described as paradigm examples of unfair clauses. That exercise assisted greatly in revealing the reasons why the joint submissions should be accepted.

Relief

Declarations that terms unfair

75 Section 12GND(2), read with s 12GND(3), empowers the Court to declare that a term of a small business contract, that is a standard form contract and a financial product, is an unfair term, on application by ASIC: ASIC v Bendigo at [84]. I am satisfied that the matters required to be established to enliven the Court's power to make declarations as set out in s 12GND(2) and (3) of the Act have been made out.

76 In ASIC v Bendigo, Gleeson J was satisfied that the requirements for making a declaration pursuant to those provisions were satisfied in respect of each of the impugned terms because (at [88]):

(1) There is a significant legal controversy in this case which is being resolved. The proposed declarations relate to conduct that contravenes the Act and the matters in issue have been identified and particularised by the parties with precision.

(2) It is in the public interest for the ASIC to seek to have the proposed declarations made and for the proposed declarations to be made. ASIC, as the statutory authority responsible for enforcing the Act has a genuine interest in seeking the declaratory relief.

(3) The Bank is a proper contradictor because it is the respondent and is the subject of the proposed declarations. The Bank therefore has an interest in opposing the making of the proposed declarations.

77 Those same findings are applicable in this case.

78 Further, the declarations sought are appropriate because they serve to record the Court's disapproval of the contravening conduct, vindicate the claim by ASIC that the Bank had contravened the Act, assist ASIC to carry out the duties conferred upon it by the Act, and deter other corporations from entering into contracts containing unfair terms: ASIC v Bendigo at [90]; Australian Competition and Consumer Commission v Coles Supermarkets Australia Pty Ltd [2014] FCA 1405 (ACCC v Coles) at [78].

79 Finally, there is also utility in making the declarations because they serve to enliven the Court's power under s 12GNB to make orders that are sought: ASIC v Bendigo at [91].

Declarations that terms void

80 Pursuant to s 12BF(1), any term of a small business contract that is unfair is void. ASIC submits, in relation to each term found to be unfair, that it is appropriate, for all of the reasons given above at [75]-[79], for corresponding declarations to be made.

81 The parties submit that the power to make such a declaration is to be found in s 21 of the Federal Court of Australia Act 1976 (Cth).

82 The principles with respect to the grant of declaratory relief, and this Court's jurisdiction to make declarations under s 21 of the Federal Court of Australia Act, were recently extensively analysed and addressed by the Full Court in Clarence City Council v Commonwealth of Australia [2020] FCAFC 134 at [57]-[75]. The following summary of the factors that it is said must be present before there can be a declaratory order, from Young P AO, Declaratory Orders (2nd ed, Butterworths, 1984), is also useful and was cited in Clarence City Council at [68]:

1. There must exist controversy between the parties …;

2. The proceedings must involve a 'right' …;

3. The proceedings must be brought by a person who has a proper or tangible interest in obtaining the order, which is usually referred to as 'standing' or 'locus standi' …;

4. The controversy must be subject to the court's jurisdiction both within the court's own charter and also within the jurisdiction so far as private international law rules are concerned …;

5. The defendant must be a person having a proper or tangible interest in opposing the plaintiff's claim …;

6. The issue must be ripe … It must not be merely of academic interest, hypothetical or one whose resolution would be of no practical utility.

83 The express provision in s 12GND(5) that that section does not limit any other power to make declarations forecloses any argument that the power in that section limits the Court's jurisdiction under s 21.

84 The parties submit, in addition, that s 12GNB provides the Court with power to make such a declaration.

85 In ASIC v Bendigo the breadth of the orders that the Court can make under s 12GNB was referred to by Gleeson J at [100].

86 As is apparent from the terms of s 12GNC, relief can extend to orders declaring a contract or parts of a contract to be void, and to orders varying the terms of a contract in a specific manner.

87 I note in particular her Honour's reference at [101] to ACCC v Coles and the making of orders by consent in civil penalty proceedings brought by the Australian Competition and Consumer Commission. Relevantly, Gordon J said in ACCC v Coles:

[70] The applicable principles are well established. First, there is a well-recognised public interest in the settlement of cases under the Act: NW Frozen Foods Pty Ltd v Australian Competition & Consumer Commission (1996) 71 FCR 285 at 291. Second, the orders proposed by agreement of the parties must be not contrary to the public interest and at least consistent with it: Australian Competition & Consumer Commission v Real Estate Institute of Western Australia Inc (1999) 161 ALR 79 at [18].

[71] Third, when deciding whether to make orders that are consented to by the parties, the Court must be satisfied that it has the power to make the orders proposed and that the orders are appropriate: Real Estate Institute at [17] and [20] and Australian Competition & Consumer Commission v Virgin Mobile Australia Pty Ltd (No 2) [2002] FCA 1548 at [1]. Parties cannot by consent confer power to make orders that the Court otherwise lacks the power to make: Thomson Australian Holdings Pty Ltd v Trade Practices Commission (1981) 148 CLR 150 at 163.

[72] Fourth, once the Court is satisfied that orders are within power and appropriate, it should exercise a degree of restraint when scrutinising the proposed settlement terms, particularly where both parties are legally represented and able to understand and evaluate the desirability of the settlement: Australian Competition & Consumer Commission v Woolworths (South Australia) Pty Ltd (Trading as Mac's Liquor) [2003] FCA 530 at [21]; Australian Competition & Consumer Commission v Target Australia Pty Ltd [2001] FCA 1326 at [24]; Real Estate Institute at [20]-[21]; Australian Competition & Consumer Commission v Econovite Pty Ltd [2003] FCA 964 at [11] and [22] and Australian Competition & Consumer Commission v The Construction, Forestry, Mining and Energy Union [2007] FCA 1370 at [4].

[73] Finally, in deciding whether agreed orders conform with legal principle, the Court is entitled to treat the consent of Coles as an admission of all facts necessary or appropriate to the granting of the relief sought against it: Thomson Australian Holdings at 164.

88 As Gleeson J noted in ASIC v Bendigo, those principles also apply in cases of this kind.

89 Each counter-party to each Standard Form Contract in relation to which a declaration has been made pursuant to s 12GND is a non-party consumer for the purpose of s 12GNB(1)(c).

90 The parties jointly submit that the term 'suffer loss' in s 12GNB(1)(b) should not be read as importing a requirement that the Bank in relying on an impugned term has acted unfairly and improperly. However neither actual unfairness nor actual loss or damage is a precondition to the exercise of power under s 12GNB. The orders sought are preventative in nature. Importantly, the Court must not make the order unless it is satisfied that the order will prevent or reduce the loss or damage relevantly likely to be suffered by the non-party consumers in relation to the declared term: s 12GNB(3)(b).

91 Accordingly, and I accept, the Court need not be satisfied that any 'declared term' has actually caused a non-party consumer to suffer loss or damage as referred to in s 12GNB(1)(b), or of any of the matters in s 12GNB(3)(a).

92 In this case I am satisfied as to the matters in s 12GNB(3)(b). I accept the joint submissions that:

(a) each of the impugned terms is unfair within the meaning of s 12BG;

(b) reliance by the Bank on any of the impugned terms would cause or be likely to cause the counter-party to suffer loss or damage; and

(c) it is not necessary for the Court to make any findings as to the nature of the loss or damage likely to be suffered, but the loss or damage would likely be what is characterised as detriment in relation to each of the impugned terms in Annexure A to these reasons.

93 Having regard to the principles that I have discussed and the statutory terms, I am satisfied that the Court has power to make the declarations sought to the effect that the impugned terms are void ab initio, as set out specifically in the orders. I also accept the parties' submission that it is appropriate to make such declarations.

General orders

94 It is apparent from the agreed facts set out at [30]-[33] above that there are more small business contracts containing the terms that ASIC submits are unfair than are the subject of evidence in these proceedings. The parties submitted that in these circumstances it is appropriate for the declaratory relief sought in respect of the specific contracts in evidence to be extended to all small business contracts containing the impugned terms. The proposed orders are based on the form of declaratory and injunctive relief granted (by consent) by Moshinsky J in ACCC v JJ Richards & Sons. I am satisfied that such declarations are appropriate and accept the parties' submissions in that regard.

Varying the terms

95 The parties agree that orders should be made varying the various identified BOQ contracts and more generally varying the impugned clauses where utilised in standard form contracts. Orders to that effect can be made where appropriate under s 12GNB of the Act and having regard to s 12GNC(b). Orders were made by Gleeson J under s 12GNB varying the relevant contracts in ASIC v Bendigo.

96 Upon making the various declarations, each impugned term will be a 'declared term' under s 12GND: s 12GNB(1)(a)(ii).

97 The Bank is a person referred to in s 12GNB(2)(b): s 12GNB(1).

98 Each counter-party to each Standard Form Contract in relation to which a declaration has been made pursuant to s 12GND is a non-party consumer for the purpose of s 12GNB(1)(c).

99 As already noted, the Bank accepts that the impugned terms are terms which are likely to cause a class of persons, being those customers of BOQ who have small business contracts with BOQ which incorporate the Standard Form Terms, to suffer loss and damage: s 12GNB(1)(b). The Court need not be satisfied that any impugned term in relation to which a declaration has been made has actually caused a non-party consumer to suffer loss or damage: s 12GNB(1)(b). The orders sought are preventative in nature. The parties submit that the term 'suffer loss' in s 12GNB(1)(b) should not be read as importing a requirement that the Bank in relying on an impugned term has acted unfairly or improperly.

100 Again, the Court must not make the order unless it is satisfied that the order will prevent or reduce the loss or damage (relevantly) likely to be suffered by the non-party consumers in relation to the declared term: s 12GNB(3)(b).

101 In relation to the Guarantee, the parties agree that the matters in s 12GNB(3)(b) are satisfied because:

(a) each of clauses 5, 8(b) and 11(a) (bullets 6, 7 and 17) is unfair within the meaning of s 12BG;

(b) reliance by the Bank on any of those clauses would cause or be likely to cause the counter-party to suffer loss or damage in the form of the detriment referred to in [51], [56], [58] and [63]-[64] above; and

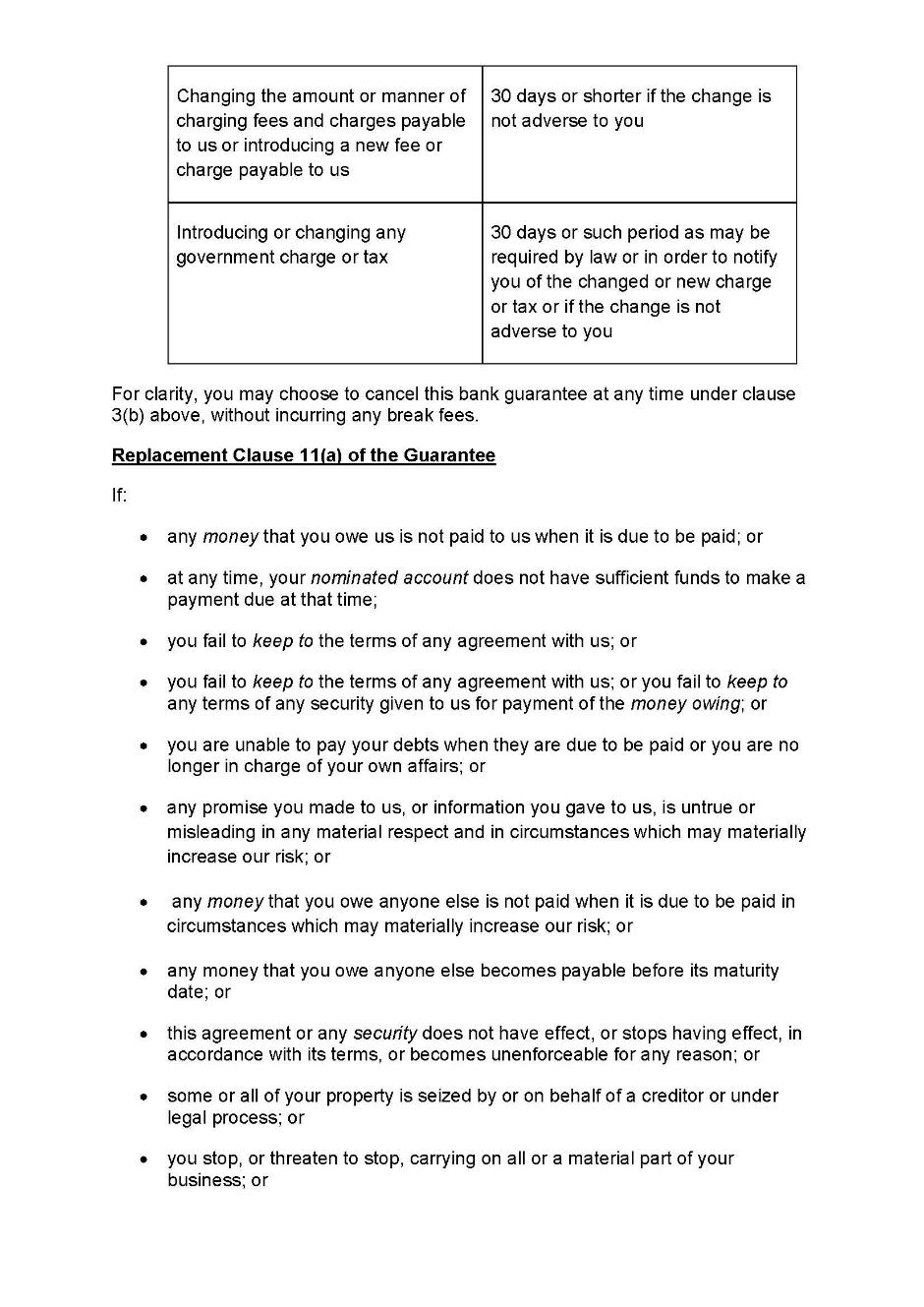

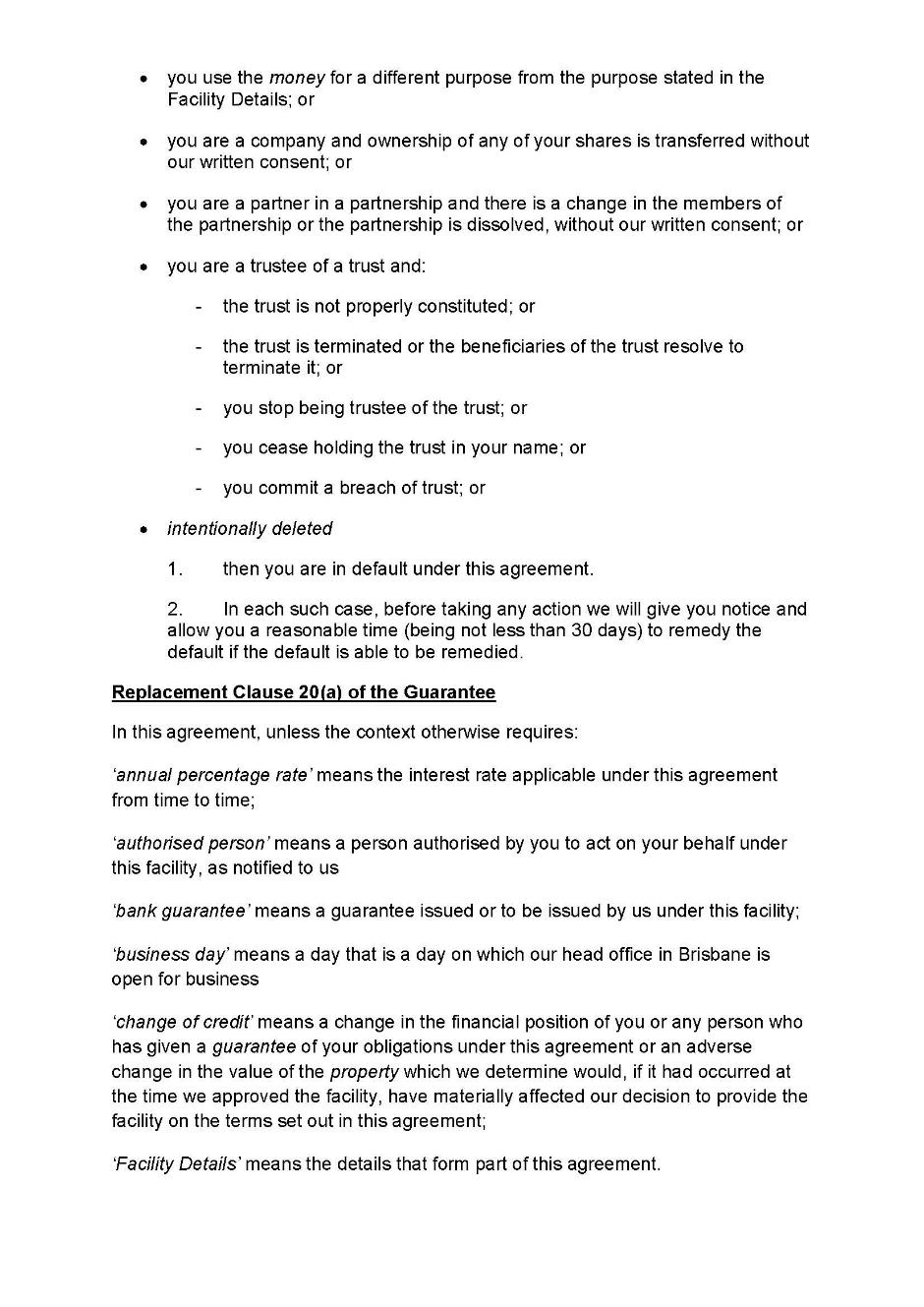

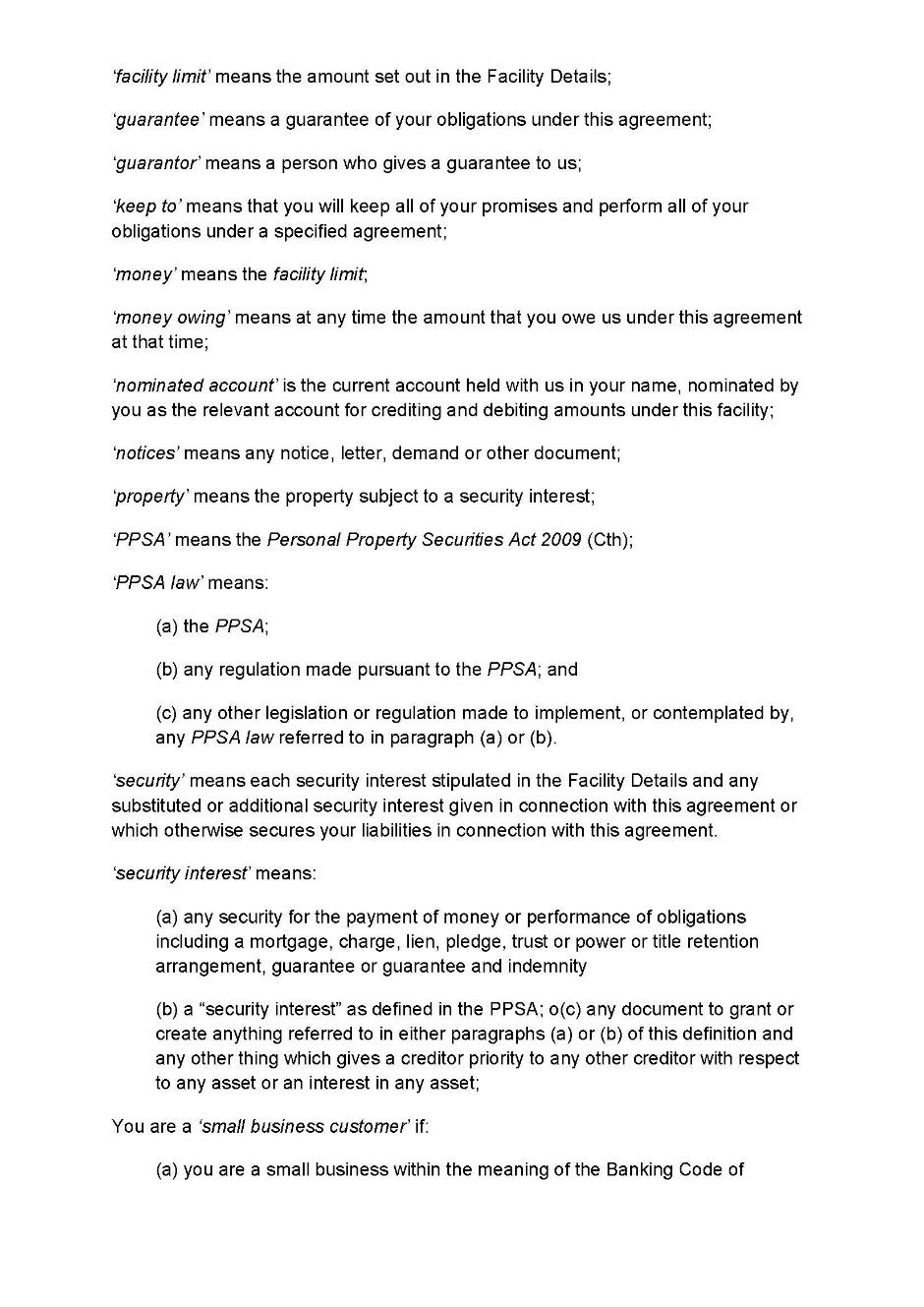

(c) the orders are drafted to vary clauses 5(a), 8, 11(a) such that they are no longer unfair within the meaning of the Act. This is largely because if the proposed variations are made the terms would not apply to small business contracts or would apply in a manner that is appropriately restricted. The orders are also drafted to vary clause 20(a) to incorporate a definition for 'small business customer'.

102 In relation to the Term Loan, the parties agree that the matters in s 12GNB(3)(b) are satisfied because:

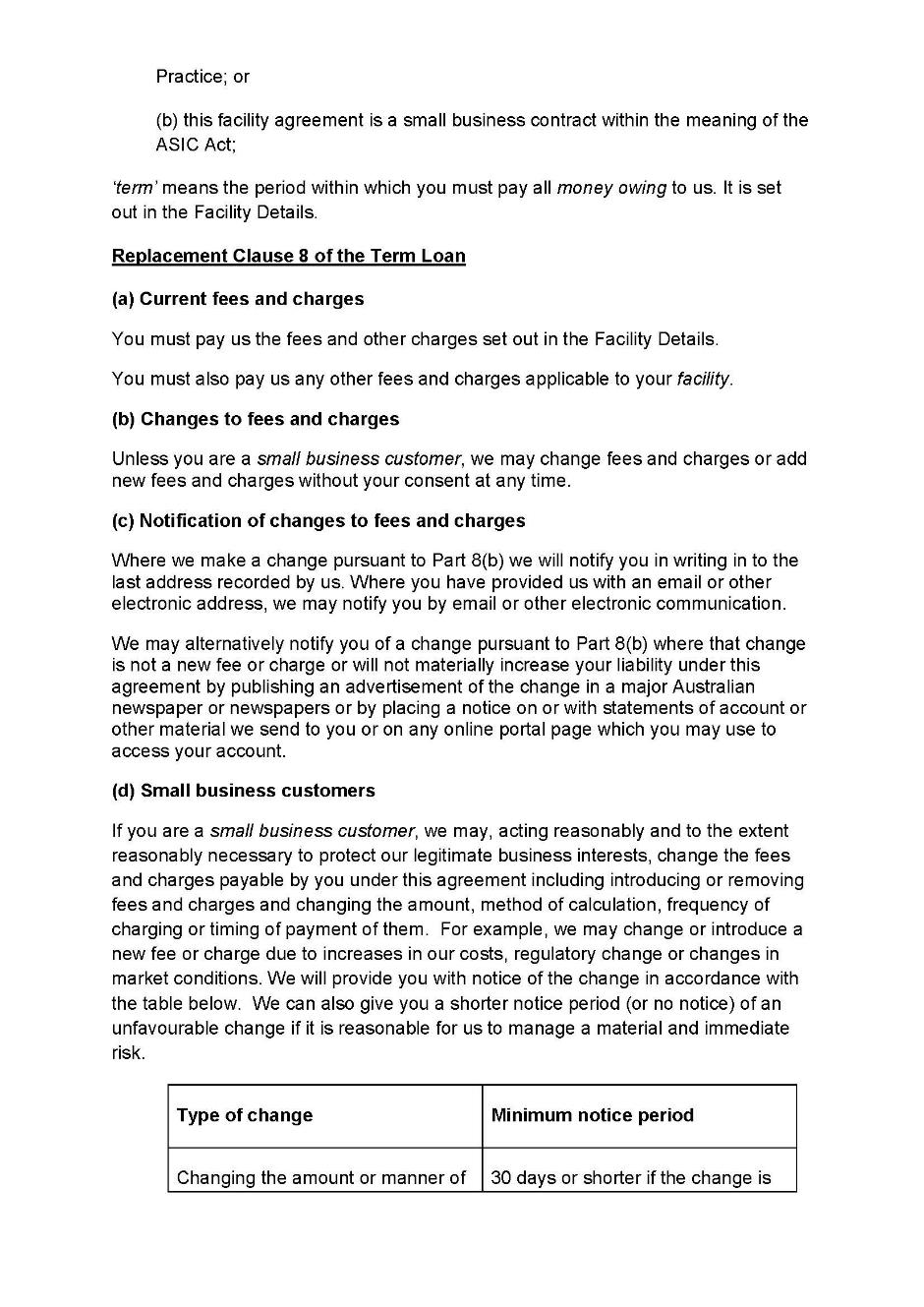

(a) each of clauses 8(b), 9(c), 10(c) and 13(a) (bullets 5, 6 and 15) is unfair within the meaning of s 12BG;

(b) reliance by the Bank on any of those clauses would cause or be likely to cause the counter-party to suffer loss or damage in the form of detriment referred to in [56], [58] and [63]-[64] above; and