Federal Court of Australia

Westpac Banking Corporation v Forum Finance Pty Limited [2021] FCA 807

ORDERS

WESTPAC BANKING CORPORATION ABN 33 007 457 141 Applicant | ||

AND: | First Respondent MR BASILE PAPADIMITRIOU Second Respondent VINCENZO FRANK TESORIERO Third Respondent | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1A. Prayers for relief 7 and 8 in the amended interlocutory application dated 8 July 2021 be determined separately and on a final basis before the balance of the relief sought in that application.

Winding up of the first respondent

1. Pursuant to s 461(1)(k) of the Corporations Act 2001 (Cth) (Act), the first respondent be wound up on the basis that the Court is of the opinion that it is just and equitable that the first respondent be wound up.

2. Pursuant to s 472(1) of the Act, Jason Preston and Jason Ireland of McGrathNicol, Level 12, 20 Martin Place, Sydney NSW 2000, are appointed jointly and severally as liquidators of the first respondent (Liquidators).

3. Compliance with r 5.6 of the Federal Court (Corporations) Rules 2000 (Cth) be dispensed with.

4. The Liquidators have liberty to apply for directions in relation to the conduct of the liquidation.

5. The Liquidators have access to all documents of the first respondent seized in accordance with the search orders made against the first respondent by order 7 of the orders made by Justice Lee on 28 June 2021.

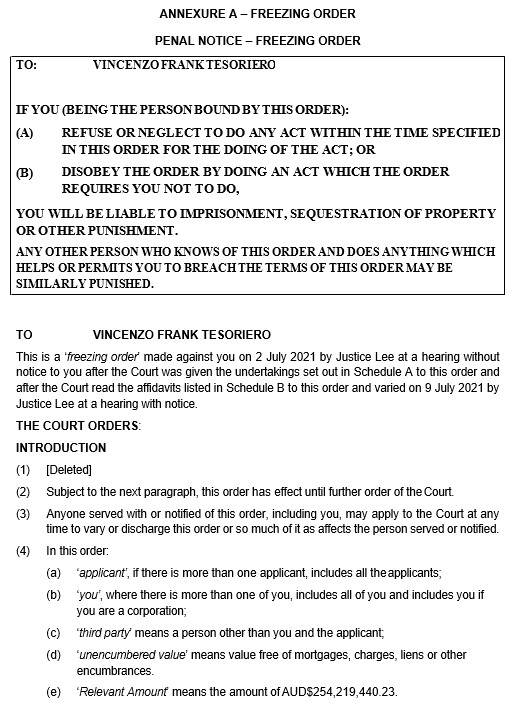

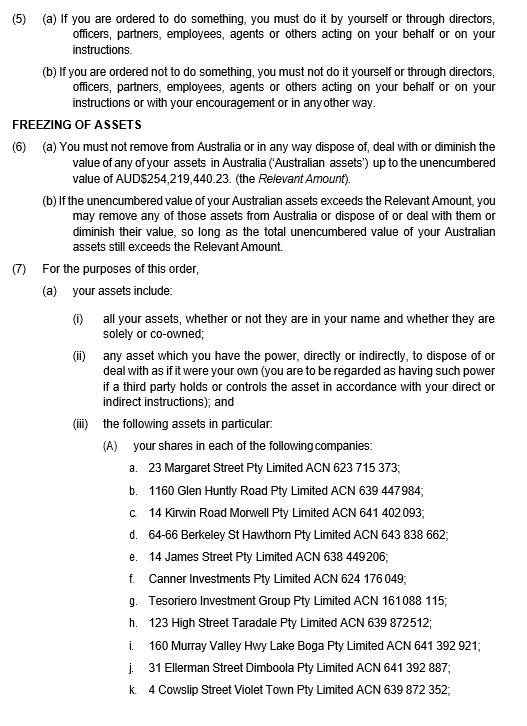

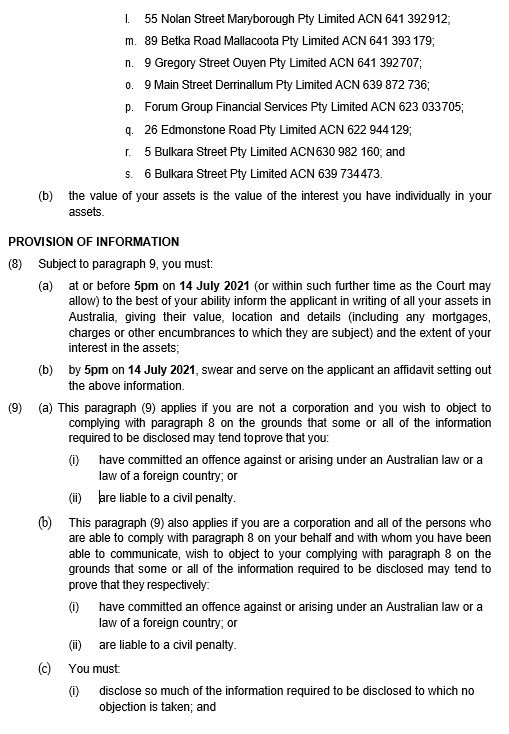

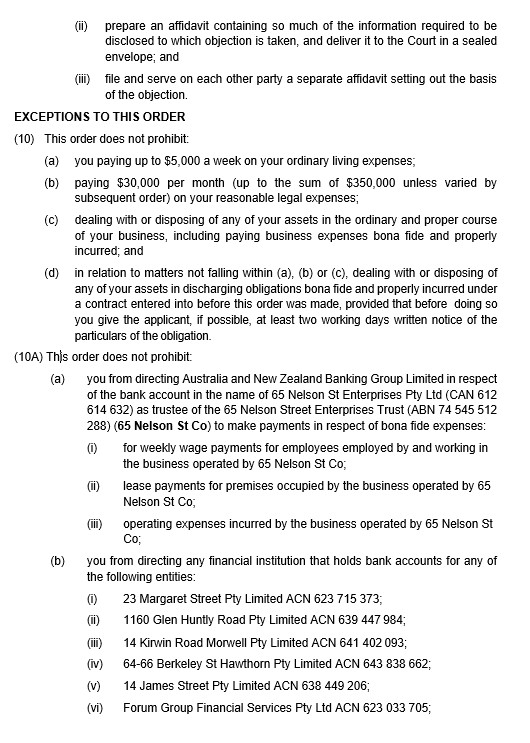

Freezing orders

6. The freezing order made against the first respondent by order 4 of the orders made by Justice Lee on 2 July 2021 in relation to the interlocutory application dated 28 June 2021 (the 2 July Orders) be extended until 5pm (AEST) on 16 July 2021.

7. The freezing order made against the second respondent by order 5 of the 2 July Orders be extended until further order.

8. The freezing order made against the third respondent by order 4 of the orders made by Justice Lee on 2 July 2021 in relation to the interlocutory application dated 2 July 2021 be varied in the form of Annexure A and be extended and apply until further order.

Orders sought by the Receivers

9. The freezing order made by Justice Lee on 28 June 2021 in the form of Annexure A be varied by adding:

“(10) This order does not prohibit:

…

(d) without limiting subparagraphs (b) and (c), dealing with the bank account in the name of Forum Group Pty Ltd with BSB 082-080 Account Number 12-178-2934 held with National Australia Bank Ltd by discharging business expenses of Forum Group Pty Ltd bona fide and properly incurred not limited to obligations bona fide and properly owing to Octet Finance Pty Ltd ACN 124 477 916.

10. The freezing order made by Justice Lee on 28 June 2021 in the form of annexure B be varied by adding:

“(10) This order does not prohibit:

…

(e) without limiting subparagraphs (b) and (c), dealing with the bank account in the name of Forum Group Pty Ltd with BSB 082-080 Account Number 12- 178-2934 held with National Australia Bank Ltd by discharging business expenses of Forum Group Pty Ltd bona fide and properly incurred not limited to obligations bona fide and properly owing to Octet Finance Pty Ltd ACN 124 477 916.

Search Orders

11. The time for compliance by the Independent Computer Experts with order 14 of the 2 July Orders be extended insofar as it applies for the Sydney Premises as follows:

a. the Independent Computer Expert provide an interim report to the Independent Solicitor of whether any Listed Things (as defined in the search orders in the 28 June Orders) were or had been located on any of the electronic copies by 5pm on 12 July 2021;

b. the Independent Computer Expert provide a final report to the Independent Solicitor of whether any Listed Things were or had been located on any of the electronic copies (but not including the Our Kloud Servers) by 5pm on 19 July 2021;

c. the Independent Computer Expert provide a further report to the Independent Solicitor of whether any Listed Things were or had been located on the Our Kloud Servers as soon as practicable; and

d. return as soon as practicable to the Independent Solicitor all of the electronic copies.

Access to documents

12. Upon the applicant by its counsel giving the usual undertaking as to damages, until further order, the first and second respondents are restrained from deleting or altering (other than in the ordinary course of business) any data held for or on behalf of the first respondent which is stored on servers hosted by Our Kloud Pty Ltd (ACN 603 675 529).

13. The first and second respondents have first access to any documents delivered to the Court from the Brisbane search until 5pm (AEST) on 13 July 2021.

14. Any application by any person to prevent access by the applicant to any hard copy documents delivered to the Court as a result of any of the search orders in these proceedings is to be made and notified to the Associate to Lee J by 4pm on 13 July 2021.

15. The applicant is to have access from 5pm (AEST) on 13 July 2021 to any hard copy documents delivered to the Court as a result of any of the search orders in these proceedings that is not the subject of any application made in accordance with Order 14.

Other

16. These orders are to be entered forthwith.

17. The second and third respondents file notice of appearance by no later than 5pm Monday 12 July 2021.

18. The applicant file and serve any application to further amend its originating application by 26 July 2021.

19. The applicant serve the statement of claim it would file if leave were granted to amend the originating application by 26 July 2021.

20. The matter otherwise be relisted for further case management on a date to be fixed as soon as practicable after 2 August 2021 before the docket judge.

21. The parties have liberty to apply on notice to the other parties.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

(Revised from the Transcript)

LEE J:

A INTRODUCTION

1 This application for the appointment of a liquidator and related relief arises in singular circumstances.

2 The evidence on this application indicates that in late May, the first of a series of events occurred which ultimately led to Westpac Banking Corporation (Westpac) making a sobering discovery: a routine call between a Westpac employee and one of its customers identified an apparent anomaly with a lease finance facility in the customer’s name. A couple of weeks later, Westpac discovered that equipment contracts provided to it, as having been entered into between the customer and the first respondent, Forum Finance Pty Limited (Forum Finance), were of doubtful veracity.

3 This initial discovery led to a cascading series of events and investigations, and immediately prior to the commencement of this proceeding on an urgent basis in late June, Westpac formed the view that in a little under three years, it had paid the staggering sum of in excess of $254 million to Forum Finance in Australia pursuant to equipment contracts with seven customers, the substantial bulk of which have, it appears on the unchallenged evidence before me, been identified by the relevant customer as a forgery.

4 If this is not bad enough, further inquiries revealed an amount of NZ$42 million has been paid to a related entity of Forum Finance by Westpac New Zealand in relation to a contract also thought by Westpac to be fraudulent (although no relief is presently sought by Westpac in relation to those transactions in this proceeding).

5 During this period of payments, the evidence discloses that Forum Finance had, at least for some time, two directors. The first is Basile Papadimitriou (also known as Mr Papas), who has been a director since incorporation of the company in 2011. The other director was Vincenzo Tesoriero, who was appointed in April 2017. Although Mr Tesoriero continues to be listed as a director of Forum Finance in the records of the Australian Securities and Investments Commission, I am informed by senior counsel acting on his behalf that he attempted to resign on 15 April 2020; although it appears that the requisite documents have not yet been lodged with the regulator. It is unnecessary to make a finding in relation to the position of Mr Tesoriero at this time. It suffices to note for present purposes that Mr Papas and Mr Tesoriero are the second and third respondents to this proceeding, respectively.

6 In this proceeding to date, Forum Finance, Mr Papas and Mr Tesoriero have not provided any explanation, cogent or otherwise, for what appears to have happened and it looks as though Forum Finance, at least, does not propose to provide any explanation.

B Procedural Developments

7 This matter was originally listed before me today, as the Duty Judge, as an application for the appointment of a provisional liquidator. That changed this morning, when Mr Martin, who appeared on behalf of Forum Finance, consented to an order that Forum Finance be liquidated and that appropriate liquidators be appointed: see T7.33–6 and T25.19. Prior to this concession, it would have been necessary for the Court to make a series of interlocutory findings on an interlocutory application pending a final hearing as to whether Forum Finance should be liquidated. The position taken by Forum Finance today, if I may say so, is a sensible one, which has had the effect of saving considerable time.

8 As a consequence, by consent, I made an order that prayers for relief 7 and 8 in the amended interlocutory application dated 8 July 2021 (seeking the winding up of Forum Finance and the appointment of liquidators) be determined separately and on a final basis before the balance of the relief sought in that application.

9 Importantly, a consequence of this forensic decision is that no other evidence will emerge which might cast a different or qualifying light on the picture that is painted from the evidence that has been read before me on a final basis today. As a general proposition, unchallenged evidence which is not inherently incredible ought to be accepted by the tribunal of fact: Precision Plastics Pty Ltd v Demir (1975) 132 CLR 362 (at 370–1 per Gibbs J, with whom Stephen J agreed and Murphy J generally agreed). However, it can be rejected if it is contradicted by facts otherwise established by the evidence or particular circumstances point to its rejection: Ashby v Slipper [2014] FCAFC 15; (2014) 219 FCR 322 (at 347 [77] per Mansfield and Gilmour JJ). There is no such contradiction nor countervailing circumstances present here.

10 The evidence adduced before me was not inherently unbelievable and should be accepted. The position that emerges from the affidavit material and accompanying documents is alarming. It is not an overstatement to remark that it appears Forum Finance has, by some means or another, been involved in a long-running, calculated and elaborate fraud ranking high in the catalogue of corporate misfeasance.

11 As I have said, the Court has not heard from the man who appears to be primarily responsible, at least until recent times, for the conduct of the affairs of Forum Finance; the apparently peripatetic Mr Papas, who left Australia for Europe for reasons not established on the evidence (but coincident with when things started to unravel with Westpac). In addition to no details emerging as to any likely defence to the serious allegations made by Westpac, Mr Papas has not, despite two court deadlines, complied with a disclosure order (as that term is defined in s 128A of the Evidence Act 1995 (Cth)); nor has he caused Forum Finance to provide details of its assets and liabilities.

C THE APPLICATION

12 Westpac puts its application for the appointment of a liquidator on two grounds: first, that Forum Finance should be wound up on the ground of insolvency; and secondly, that Forum Finance should be wound up on the basis that it is just and equitable to do so. For reasons I will explain, it is unnecessary for me to form a final view in relation to the solvency or otherwise of Forum Finance; although, given the nature of the evidence advanced there must, at the very least, be real concerns as the company’s financial position generally and, more particularly, its capacity to pay its debts as they fall due.

13 A court may order a winding up if it is of the opinion that it is just and equitable that a company be wound up: see s 461(1)(k) of the Corporations Act 2001 (Cth) (Act). That provision has been said to authorise the court to apply broad equitable considerations. Winding up on the just and equitable ground has a long history stemming from s 5(8) of the Joint Stock Companies Winding Up Act 1848 (UK). It appears that until the end of the 19th Century it was thought that winding up on a just and equitable ground only covered situations which were comparable to those envisaged in preceding subsections of that Act. That idea, expressed by Lord Cottenham LC in Ex parte Spackman (1849) 1 Mac & G 170; (1849) 41 ER 1228 (at 1229–30), was later abandoned, but courts still tended to limit the breadth of the section by subdividing its application into relevantly narrow categories.

14 The flaw in this approach was made clear by the House of Lords in Re Westbourne Galleries Ltd [1973] AC 360 (at 374 per Lord Wilberforce, with whom Viscount Dilhorne, Lord Pearson and Lord Salmon agreed, and at 383–4 per Lord Cross of Chelsea). In that case, their Lordships stressed that the provision confers upon a court a discretionary power of very wide character and that courts should be ready to apply it to new situations falling outside previous illustrations. However, given the seriousness of the remedy, the discretion must be exercised judicially.

15 This is quite an unusual application because the winding up is consented to by the company. Of course, if a company by special resolution so resolves, it can agree to be wound up by the Court: see s 461(1)(a) of the Act. At least in my experience, this is rarely done because the members could adopt the alternative course of a voluntary winding up. But as Barrett J explained in Hillig v Darkinjung Local Aboriginal Land Council [2006] NSWSC 1371; (2006) 205 FLR 450 (at 458 [35]), the body of shareholders have a statutory right to decide that the company should be wound up by the court, being a right exercisable by whatever procedures are sufficient to cause a special resolution to be passed. Although this course has not been undertaken (formally or otherwise), the fact of express consent, through the company’s counsel, to orders being made by the court on the application of a third party does seem to me to inform the ultimate consideration of whether it is just and equitable for the company to be wound up.

16 There is no point traversing the various non-exclusive categories where such orders have been made. They include, for example, where a company cannot be carried on consistently with candid and straightforward dealings with the public: see Australian Securities and Investments Commission v Austimber Pty Ltd [1999] FCA 566; (1999) 17 ACLC 893 (at 895 per Merkel J), citing Re Producer’s Real Estate v Finance Co Ltd [1936] VLR 235 (at 246 per Mann CJ). Other examples include where there is a lack of propriety in the management and conduct of a company’s affairs and there are public interest considerations which make it desirable that a company, however solvent, be wound up (although most of the examples falling into this category generally relate to applications made on behalf of a regulator).

17 As I have noted, both Mr Papas and Mr Tesoriero have not sought to be heard; nor have they sought to challenge any of the evidence read on this application. At present, it is only necessary to make factual findings for the purposes of determining the separate question as to whether Forum Finance should be wound up, but on the evidence, I have no confidence at all in the ability of Mr Papas to discharge his obligations as a director of Forum Finance in a way which is consistent with the legitimate conduct of the affairs of the company (if the company was to continue to trade in some form).

18 I have already mentioned the fact that Mr Papas is presently overseas. He has previously failed to apprise his solicitor of his whereabouts at a level of specificity other than that he is somewhere on the continent of Europe, although it is now said that he either is in, or presently en route to, the Greek capital of Athens. Delphic details of a proposed return to Australia have been provided orally, but no itinerary or corroborative material showing details of a suggested Japan Airlines flight have been provided. It may be that Mr Papas returns to Australia tomorrow, although at present, this is not entirely clear.

19 Forum Finance has two named directors: one of whom does not consider himself a director; and the other is currently not being candid, even with his solicitor, as to his whereabouts and has apparently let the company engage in fraudulent transactions. To use considerable understatement, this is a suboptimal state of affairs. Indeed it is a state of affairs that should not continue. In circumstances where the relevant provision of the Act confers upon a court a discretionary power of very wide character, the company agrees to orders it should be wound up on a just and equitable ground, and no shareholder or officer of the company opposes such a course, I am amply satisfied that such an order should be made.

D THE LIQUIDATORS

20 We then come to the question of the identity of the liquidators to be appointed. There are two competing proposals; although, of course, it is a matter for the Court as to the liquidator that should ultimately be appointed.

21 Westpac proposes the appointment of two registered liquidators from McGrathNicol, being Mr Jason Preston and Mr Jason Ireland. Forum Finance (by which I infer Mr Papas) proposes the appointment of Mr Rahul Goyal and Mr Scott Langdon of KordaMentha. I have no doubt, given the identity of the firms for which these proposed liquidators work, all proposed appointees are fit and proper persons to discharge the role with a high degree of competence.

22 The factors relied upon by Mr Martin to support the appointment of the KordaMentha liquidators are as follows: (1) KordaMentha has a presence and office in New Zealand and there is at least some suggestion that work will need to be done in relation to the liquidation in that country; (2) the fees charged by the two partners of KordaMentha are less than McGrathNicol; and (3) KordaMentha are well known to Westpac, having acted for them on many occasions. Mr Martin also points to the conduct of Forum Finance in consenting to the liquidation, which has been consistent with facilitating the prompt and inexpensive resolution of this aspect of the proceeding.

23 Mr Giles SC, who appears on behalf of Westpac, indicates that: (1) McGrathNicol also has a presence in New Zealand; (2) one of the liquidators chosen (Mr Preston), is the chairman of McGrathNicol, and his seniority gives Westpac a degree of comfort in relation to the appointment of that firm; and (3) Westpac reposes particular confidence in McGrathNicol discharging its role because, among other things, it has a global affiliation with other firms.

24 To be frank, consistent with what I have said concerning competence, I do not think that there is anything that separates the proposed nominees on the grounds of their ability to conduct the work both in Australia and New Zealand. Although there is reason to think that KordaMentha may be less expensive than McGrathNicol, this is a fairly marginal difference. The prevailing rate for partners of insolvency firms doing this work has reached a stage (one might be forgiven to think somewhat remarkably) where a practitioner can charge $847 (inclusive of GST) in the case of McGrathNicol and $797.50 (inclusive of GST) in the case of KordaMentha.

25 The key difference is that in the context of the proposed provisional liquidation it appears Westpac and McGrathNicol have come to at least a preliminary arrangement that an indemnity be provided in the amount of $250,000 for the purposes of initial inquiries being undertaken. Mr Martin makes the valid point that, in the limited time available, no evidence has been adduced by Westpac to the effect that a similar commercial arrangement could not be struck with any other reputable liquidator. This point is well made, however, in circumstances where it is Westpac that is footing the bill initially, it is fair that it do so in circumstances where it has the comfort of reposing confidence in the particular liquidators appointed.

26 Finally, I note that leave was given for a further creditor, Societe Generale, to provide submissions on the identity of the liquidators to be appointed (although no evidence was read to support the fact that Societe Generale was a creditor, this was not put in dispute). Societe Generale also indicated its preference for the liquidators suggested by Westpac.

27 In all the circumstances, I propose to appoint Messrs Jason Preston and Jason Ireland of McGrathNicol as liquidators of Forum Finance and will make orders accordingly.

I certify that the preceding twenty-seven (27) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Lee. |

Associate: