FEDERAL COURT OF AUSTRALIA

Australian Competition and Consumer Commission v Productivity Partners Pty Ltd (trading as Captain Cook College) (No 3) [2021] FCA 737

ORDERS

DATE OF ORDER: | 2 july 2021 |

THE COURT ORDERS THAT:

1. Within 14 days of these orders the parties bring in agreed or competing orders reflecting the Court’s findings, and on costs and the further conduct of the proceeding.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

[1] | |

B. THE VET FEE-HELP SCHEME | [9] |

C. THE ACCC’S SYSTEMIC UNCONSCIONABILITY CASE | [27] |

D. APPLICABLE LEGAL PRINCIPLES | [46] |

D.1 Statutory unconscionability: s 21 of the ACL | [46] |

D.1(a) Statutory unconscionability per se | [47] |

D.1(b) Systemic unconscionability | [71] |

D.2 False, misleading or deceptive conduct and representations: ss 18 and 29 of the ACL | [78] |

D.3 Unsolicited consumer agreements: ss 69, 78-79 of the ACL | [89] |

D.4 Knowingly concerned: s 224 of the ACL | [96] |

D.5 Conduct on behalf of a body corporate: s 139B, of the Competition and Consumer Act | [109] |

E. THE KEY PEOPLE | [116] |

F. THE WITNESSES | [137] |

G. BACKGROUND TO THE COLLEGE | [145] |

H. RECRUITMENT BY COURSE ADVISORS | [148] |

I. THE EARLIER PERIOD: ENROLMENT AND WITHDRAWAL PROCESSES | [152] |

I.1 Enrolment process | [152] |

I.2 Campus driven withdrawals | [164] |

J. THE EARLIER PERIOD: RELEVANT EVENTS | [178] |

J.1 Sero campus health check | [178] |

J.2 Course advisor misconduct | [189] |

J.3 Unsuitable enrolment risk | [205] |

J.4 Low conversion rates due to uncontactable students | [221] |

J.5 Concern about the college’s poor financial performance and its causes | [224] |

K. THE CATALYSTS FOR CHANGES TO THE ENROLMENT PROCESS | [236] |

K.1 Papers for the Management Meeting on 19 August 2015 | [236] |

K.2 Emails between Mr Cook and Ms Edwards on 18 August 2015 | [244] |

K.3 Management Meeting, 19 August 2015 at 8.00 am | [249] |

K.4 Enrolment/Admissions process meeting, 19 August 2015 at 10.00 am | [261] |

K.5 Distance Campus Management & Leadership Team Meeting, 19 August 2015 at 1.00 pm | [276] |

K.6 Mr Cook’s report of 20 August 2015 | [278] |

L. SUMMARY OF POSITION AT THE END OF THE EARLIER PERIOD | [281] |

M. THE RELEVANT PERIOD: ENROLMENT AND WITHDRAWAL PROCESSES | [285] |

M.1 Inbound QA call | [287] |

M.2 Abolition of the campus driven withdrawal process | [314] |

N. THE RELEVANT PERIOD: CONSEQUENCES OF THE PROCESS CHANGES | [324] |

N.1 September 2015 | [324] |

N.2 October 2015 | [343] |

N.3 November 2015 | [356] |

N.4 Candice Stevens | [374] |

N.5 Jo Solly | [391] |

N.6 December 2015 | [394] |

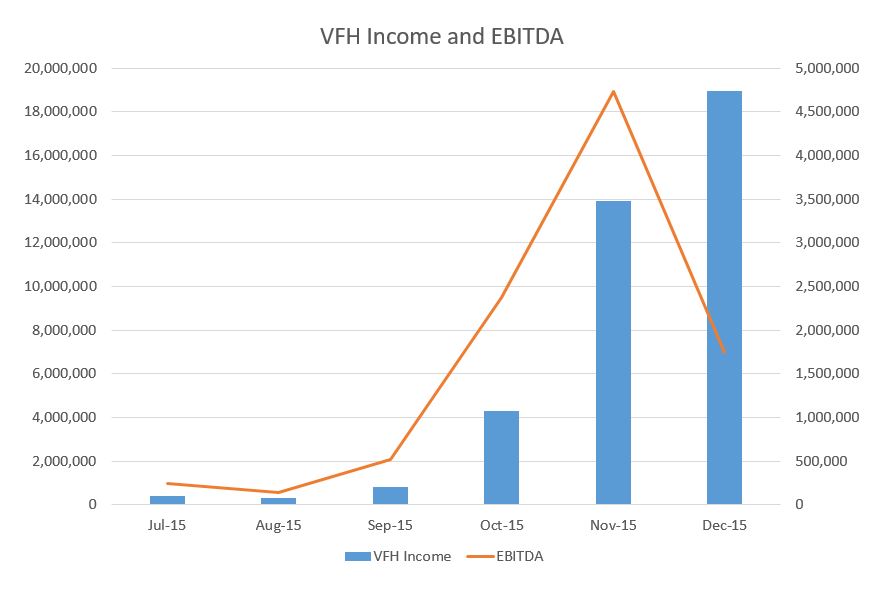

N.7 Summary of increased income and EBITDA, July – December 2015 | [403] |

N.8 January – March 2016 | [407] |

N.9 April 2016 and thereafter | [413] |

O. COMPLAINTS HANDLING AND CA MONITORING | [417] |

O.1 Looma investigation | [424] |

O.2 Umair Butt investigation | [427] |

O.3 Adil Ganchi investigation | [432] |

O.4 Ramesh Gaire investigation | [439] |

O.5 Walgett investigation | [443] |

O.6 Harpreet Kaur (or ‘puppet art’) investigation | [452] |

P. LOGIN AND COMMUNICATION DATA | [461] |

P.1 Mr O’Donnell’s analysis of communication with students | [461] |

P.2 Ms Thompson’s analysis of enrolments, fees and engagement | [472] |

P.3 Summary of findings on login and communication data | [487] |

Q. CONCLUSIONS ON THE SYSTEM CASE AGAINST THE COLLEGE | [493] |

R. WAS MR WILLS ‘KNOWINGLY CONCERNED’ IN THE IMPUGNED CONDUCT? | [539] |

R.1 The case against Mr Wills | [539] |

R.2 Mr Wills’s overall role | [542] |

R.3 Mr Wills’s knowledge and involvement | [548] |

R.4 Conclusion on Mr Wills being knowingly concerned | [555] |

S. SITE’S KNOWING INVOLVEMENT | [577] |

T. INDIVIDUAL CONSUMER COMPLAINTS | [586] |

T.1 Consumer A | [593] |

T.1(a) Facts | [593] |

T.1(b) Consideration | [617] |

T.2 Consumer B | [630] |

T.2(a) Facts | [630] |

T.2(b) Consideration | [655] |

T.3 Consumer C | [670] |

T.3(a) Facts | [670] |

T.3(b) Consideration | [691] |

T.4 Consumer D | [700] |

T.4(a) Facts | [700] |

T.4(b) Consideration | [721] |

T.5 Consumer E | [732] |

T.5(a) Facts | [732] |

T.5(b) Consideration | [752] |

U. CONCLUSION | [761] |

A. INTRODUCTION

1 This case principally concerns the statutory proscription of unconscionable conduct in s 21 of the Australian Consumer Law (ACL) in the context of the Commonwealth’s VET FEE-HELP scheme. That is a scheme to assist students fund their enrolment in vocational education and training (VET) courses.

2 The ACCC alleges that the first respondent, Productivity Partners Pty Ltd trading as Captain Cook College (also referred to as the college), engaged in a system of conduct, or a pattern of behaviour, that was, in all the circumstances, unconscionable in contravention of the statutory prohibition. It alleges that the second respondent, Site Group International Ltd, and the fourth respondent, Blake Wills, were directly or indirectly knowingly concerned in, or a party to, the college’s contravention. I will generally refer to Blake Wills as Mr Wills unless the context requires otherwise.

3 Productivity Partners was a wholly owned subsidiary of Site. Mr Wills was, relevantly, Site’s Chief Operating Officer. He was also the acting Chief Executive Officer of the college in November 2015 to January 2016. The ACCC also alleges the knowing concern of the third respondent, Ian Cook, in the college’s alleged contravention but Mr Cook settled the case against him with the ACCC. Mr Cook was the CEO of the college.

4 In addition to its case of systemic unconscionable conduct contrary to s 21 of the ACL, the ACCC asserts a case specifically in reliance on the evidence of five consumer witnesses who are referred to as consumer A through to consumer E. The ACCC alleges that the conduct of course advisors (referred to as CAs or agents) in recruiting each of the individual consumers, which conduct is admitted by the college to be unconscionable in contravention of s 21 of the ACL and misleading or deceptive, or likely to mislead or deceive, in contravention of s 18(1) of the ACL, and/or included false or misleading representations in contravention of s 29(1)(i) or (m) of the ACL, is to be attributed to the college such that the college is taken to have contravened ss 18, 21 and 29 of the ACL.

5 The ACCC also alleges that the agreements by which the individual consumers were enrolled in the college constituted unsolicited consumer agreements within the meaning of s 69(1) of the ACL and as such contravened s 79 of the ACL on the basis that each agreement did not contain a notice that conspicuously and prominently informed the consumer of their right to terminate the agreement or a notice which they could use to terminate the agreement. There are also allegations that the unsolicited consumer agreements were negotiated by telephone and, in contravention of s 78(2) of the ACL, they were provided to the consumers electronically without consumer consent.

6 The conduct of which the ACCC complains occurred in the second half of 2015 and in early 2016. That is accordingly the applicable period for the purposes of identifying the relevant statutory and regulatory context.

7 There are a number of other cases that have adjudicated allegations of unconscionable conduct by colleges or their sales agents in enrolling students under the scheme. These include Unique International College Pty Ltd v ACCC [2018] FCAFC 155; 266 FCR 631 (an appeal from ACCC v Unique International College Pty Ltd [2017] FCA 727), ACCC v Cornerstone Investment Aust Pty Ltd (in liq) (No 4) [2018] FCA 1408 (Empower) and ACCC v Australian Institute of Professional Education Pty Ltd (in liq) (No 3) [2019] FCA 1982 (AIPE), to which further reference will be made. The other cases are ACCC v Get Qualified Australia Pty Ltd (in liq) (No 2) [2017] FCA 709; [2017] ATPR 42-548 and ACCC v Acquire Learning & Careers Pty Ltd [2017] FCA 602.

8 Given the volume of evidence in this case, and contrary to my usual practice, I have decided to include in these reasons for judgment references to the evidence, both documentary (court book volumes A to G) and oral (transcript references – T). Those references are intended as an aide memoire to assist anyone who might find that they need to refer to the evidence. The references do not purport to be complete or exhaustive; they should not be taken as a complete record of everything that I have had regard to in stating the findings in respect of which the references are given. In that sense, they do not form part of my reasons for judgment.

B. THE VET FEE-HELP SCHEME

9 The nature of the VET FEE-HELP (VFH) scheme – the Vocational Education and Training Fee Higher Education Loan Program – is helpfully summarised by the Full Court in Unique (at [5]-[9]). Drawing heavily on that summary, the following key aspects of the scheme can be identified.

10 The Higher Education Support Act 2003 (Cth) (HES Act) established the Higher Education Loan Program (HELP), which consisted of five income contingent loan schemes through which the Commonwealth provided financial assistance to students by providing loans so that the students did not have to meet the cost of study upfront.

11 The Commonwealth introduced the VFH scheme in 2007. The scheme has been amended from time to time. From 2009, the scheme provided for the Commonwealth to pay, in full, tuition fees for any approved course, on the basis that the amounts paid would be treated as a loan to the student, such loan to be repayable through the taxation system once a student earned above a specified income threshold. In the applicable period, that threshold was approximately $54,000. Approved course providers needed to have arrangements with an institution that offered a “higher education award” (such as a degree). The scheme was designed at that time to be a pathway into further higher education.

12 In early 2012, the Commonwealth foreshadowed substantial reforms to the scheme. Those reforms were then implemented through legislation enacted in the second half of 2012. The Explanatory Memorandum to the HES Amendment (Streamlining and other measures) Bill 2012 (Cth) explained that the intention was to broaden the demographic of students who qualified for assistance through the scheme. The liberalisation of the scheme was for the express purpose of addressing low participation rates from identified demographic groups including Indigenous Australians, people from non-English speaking backgrounds, with disability, from regional and remote areas, from low socio-economic backgrounds, and people not currently engaged in employment.

13 One of the changes made by the 2012 legislation was to remove the need for a course to count towards a course at a higher education institution. This was consistent with the rationale for the changes expressed in the Explanatory Memorandum. Participation in vocational training was seen as an end in itself, and not only a pathway to higher education.

14 The conditions for a student’s entitlement to VFH assistance were set out in cl 43 of Sch 1A to the HES Act. Generally speaking, the eligibility criteria for a person to be entitled to VFH assistance were that the person:

(1) was an Australian citizen or the holder of a permanent humanitarian visa;

(2) had not exhausted their lifetime FEE-HELP loan limit;

(3) was enrolled in a VET unit of study, and remained enrolled at the end of the relevant census date;

(4) met the tax file number (TFN) requirements in cl 80 (which required the person to have notified the VET provider of their TFN, or to have certified that they had applied to the Commissioner of Taxation for a TFN); and

(5) on or before the census date, had completed a request for Commonwealth assistance form.

15 Section 104-20 of the Act provided that the FEE-HELP life-time limit for a student (other than for medicine, dentistry and veterinary science in respect of which a higher limit applied) was $80,000 in total. That limit was indexed with the result that in the 2015 financial year it was $97,728.

16 Clause 55 of Sch 1A relevantly provided that the Commonwealth must lend to the student the amount of the VFH assistance and pay the amount lent to the provider in discharge of the student’s liability to pay their VET tuition fee for the unit of study. Under s 137-18 of the HES Act, if the Commonwealth made a payment pursuant to cl 55 of Sch 1A, the amount of the student’s VFH debt was 120% of the loan, i.e., there was a 20% “loan fee”. The VFH debt was incurred immediately after the census date for the unit.

17 The “census date” for a VET unit of study means the date determined under cl 67 of Sch 1A: Sch 1, cl 1. Clause 67 of Sch 1A provided that a VET provider must for each VET unit of study it provides or proposes to provide, determine a particular date to be the census date for the unit. That date was to be determined in accordance with the VET Guidelines. By cl 99 of Sch 1A, the Minister could by legislative instrument make VET Guidelines.

18 Clause 7.4.1 of the VET Guidelines that applied from time to time provided that the date determined to be the census date must not occur less than 20% of the way between the VET unit of study commencement date and the completion date. For a 28-week unit of study, the first census date could therefore be less than six weeks after the commencement date, and for a 52-week unit of study it could be less than 11 weeks after the commencement date.

19 A VET provider was required to repay any VET tuition fees paid by a student in respect of a VET unit of study if the student withdrew on or before the census date: cl 8.4 of the VET Guidelines. It follows that a consumer could withdraw from a VET unit of study on or before the census date without incurring any financial liability to the VET provider or to the Commonwealth.

20 Clause 64 of Sch 1A to the HES Act provided that a VET provider must give such notices as are required by the VET Guidelines to a person who is enrolled with the provider for a VET unit of study and who is seeking Commonwealth assistance. Such a notice was referred to in the Guidelines from time to time as a Commonwealth Assistance Notice, or CAN. By chapter 9 of the Guidelines, a CAN was required to include, amongst other things, the census date(s) of the VET unit(s) of study, the VET tuition fee amount(s) of the units(s) of study and the amount(s) of the VFH loan fee. It was required to be given within 28 days of the census date indicated in the notice.

21 Typically, the college would send a student a Confirmation of Enrolment (COE) letter at the same time that it sent the CAN, which was after the first census date to confirm that the student was enrolled with the college and had incurred the first part of their VFH debt. [D15, D79] Thus, COE and CAN are at times used interchangeably and are often expressed in the documents as “COE/CAN” or “COECAN”.

22 The scheme gave rise to an obvious risk, being the risk of unsuitable or otherwise insufficiently interested or committed consumers being too easily or casually, or unconscionably or deceptively, signed up as students, progressing through their census dates thereby incurring debts to the Commonwealth and the VET provider being paid its tuition fees, and the students not otherwise engaging with the course in any meaningful way or receiving any meaningful benefit. As Bromwich J explained in AIPE:

[72] … If a person who had been approved for a VET FEE-HELP debt was enrolled as a student with a VET provider as at the census date, but did not in fact ever partake in the course, that provider would get the revenue benefit of the course fees from the Commonwealth, but would not have to incur the variable costs of providing the course to that person, including any related support. That would happen irrespective of whether the person who was enrolled was a bona fide or genuine student or not.

[73] To the extent that the outcome of enrolling consumers who were not bona fide or genuine students was able to be maximised across a large enough pool of individuals, the VET provider would obtain revenue for those consumers without needing to employ staff to provide the services that were needed for bona fide or genuine students who did partake of study. This feature therefore created a significant, and reasonably obvious, windfall profit opportunity to a VET provider who wished to exploit it, or was even prepared to let it occur without correction.

[74] There was nothing in the express terms of the VET FEE-HELP scheme that prohibited a VET provider from engineering such a windfall profit outcome, and a corresponding debt being incurred by someone who was never a bona fide or genuine student.

23 Schedule 1A of the HES Act also governed the re-crediting of a student’s VFH balance. Clause 51 provided for the re-crediting of a student’s VFH balance for a unit of study if the VET provider ceased to provide the course of which the unit formed a part. That clause has no present relevance, save that cl 46(1) provided that save where cl 51 applied, cl 46 would apply. It then provided as follows:

(2) A *VET provider must, on the *Secretary’s behalf, re‑credit a person’s *FEE-HELP balance with an amount equal to the amounts of *VET FEE‑HELP assistance that the person received for a *VET unit of study if:

(a) the person has been enrolled in the unit with the provider; and

(b) the person has not completed the requirements for the unit during the period during which the person undertook, or was to undertake, the unit; and

(c) the provider is satisfied that special circumstances apply to the person (see clause 48); and

(d) the person applies in writing to the provider for re‑crediting of the HELP balance; and

(e) either:

(i) the application is made before the end of the application period under clause 49; or

(ii) the provider waives the requirement that the application be made before the end of that period, on the ground that it would not be, or was not, possible for the application to be made before the end of that period.

Note: A VET FEE-HELP debt relating to a VET unit of study will be remitted if the HELP balance in relation to the unit is re-credited: see section 137-18.

24 That provision has some bearing on the question of campus driven withdrawals which is dealt with in detail later in these reasons. For present purposes the following observations can be made. First, the provision sets out when a VET provider “must” withdraw a student and re-credit them; that is to say, it sets minimum standards for withdrawal and re-crediting and does not prevent a VET provider from having a withdrawal policy that is more protective of or generous to students. Secondly, it applies only to withdrawals after census. That follows from it being with respect to re-crediting a student; no re-crediting of a student can arise if they have not yet progressed through census and incurred the debt.

25 Clause 4.3.1 of the VET Guidelines made a VET provider subject to the Standards for NVR Registered Training Organisations. The relevant such standards were the Standards for Registered Training Organisations (RTOs) 2015 (Cth) dated 20 October 2014 made as a legislative instrument under ss 185(1) and 186(1) of the National Vocational Education and Training Regulator Act 2011 (Cth).

26 Clause 4.8 of the VET Guidelines set out quality and accountability requirements with regard to barriers to withdrawal. Clause 4.8.1 provided that the purpose of those requirements was to allow students to withdraw from a VET unit of study on or before the census date. Clause 4.8.2 provided that a VET provider “must not have financial, administrative or other barriers that would result in a student not being able to withdraw from a VET unit of study on or before the census date” (emphasis added). One such barrier might be considered to be if the student did not know that they were to incur a VFH debt and the VET provider was unable to contact them to tell them, and to confirm that they really did want to pursue the course and incur the debt.

C. THE ACCC’S SYSTEMIC UNCONSCIONABILITY CASE

27 The ACCC’s case is that the college changed its enrolment and withdrawal processes when it knew, or ought to have known, that the changes would significantly reduce protections for consumers and would lead to a materially increased risk of both unsuitable consumers being enrolled in its online courses and of misconduct by its sales agents (the CAs) and would materially diminish the prospect of this being identified. It says that the changes were calculated to increase the college’s profits by increasing the number and proportion of consumers enrolled by the college and who passed a census date. It says that as a consequence of the changes, the college claimed and retained very significant increased revenue from the Commonwealth, and that the vast majority of consumers did not receive any vocational benefit despite incurring a substantial debt.

28 The ACCC’s case is that the changes to the enrolment and withdrawal processes amounted to a system of conduct or pattern of behaviour as referred to in s 21(4)(b) of the ACL, and was thus systemic unconscionable conduct proscribed by s 21(1).

29 Since the ACCC’s case relies on the effects brought about by changes to enrolment and withdrawal processes, and the college’s knowledge of the likelihood of those effects, it is necessary to identify what those processes were prior to the changes in question. The period in respect of which the prior processes operated was the period 1 November 2014 to 6 September 2015, which is referred to as the earlier period.

30 The case concerning the systemic conduct relates to consumers who became enrolled in an online course at the college in the period 7 September to 18 December 2015, which is described as the relevant period. This is the period from when the college commenced the implementation of the process changes to when the college ceased taking new enrolments because of a cap imposed on it by the Commonwealth Government as to the VFH fees it could charge in the 2016 calendar year.

31 During both the earlier period and the relevant period, the college contracted third parties, referred to as course advisors (CAs), to undertake marketing of its courses (including online courses) to consumers, and to recruit consumers for enrolment into its courses as students. The CAs were remunerated by way of a commission in respect of each consumer recruited if that consumer passed a census date in respect of a unit of study in a course for which the consumer was enrolled.

32 During the relevant period the college offered the following qualifications: Diploma of Business, Diploma of Project Management, Diploma of Information Technology and Diploma of Human Resources Management. The last-mentioned diploma, namely the Diploma of Human Resources Management, was new in the relevant period having not been offered in the earlier period. There were two diplomas offered in the earlier period that were not offered in the relevant period, namely the Diploma of Management and the Advanced Diploma of Management.

33 There are three different elements to the conduct of the college that the ACCC says were unconscionable, namely changes to the enrolment process, changes to the withdrawal process (in particular, abolishing something referred to as campus driven withdrawals, to which I will return), and the college claiming and/or retaining the vastly increased VFH revenue which was generated by the college’s implementation of the process changes.

34 The ACCC’s case is that the changes to the enrolment process increased the risk of enrolling unsuitable consumers and also the risk of misconduct by course advisors towards the consumers that they were enrolling, and the risk that this would not be identified prior to enrolment. It is said that this was or ought to have been known to the college, or it was reasonably foreseeable.

35 The ACCC’s case with regard to abolishing the campus driven withdrawals is that it increased the risk of unsuitable consumers, or consumers who had been subjected to CA misconduct in the enrolment process, remaining enrolled in a course. It is said that this was or ought to have been known to the college, or it was reasonably foreseeable.

36 The ACCC’s case with regard to claiming and/or retaining the increased revenue which was generated by the process changes is that the process changes were motivated by the college’s desire to increase the number of consumer enrolments, and therefore its revenue and profit, and that those consequences occurred. It is said that thousands of consumers were enrolled, many of whom were not engaged at all with their courses and who should never have been enrolled in the first place. It is said that it was improper for the college to have claimed revenue for those consumers, or to have retained revenue paid by the Commonwealth for them. It is said that one of the most egregious aspects of the college’s conduct, given its developing knowledge over time of the results of the process changes and what it knew about the low level of engagement by consumers with their courses in the first unit of study, was that the college claimed additional revenue as consumers who became enrolled during the relevant period progressed through their second and any applicable subsequent census dates.

37 It is necessary to identify in more detail certain aspects of the pleaded case.

38 The second further amended statement of claim, which for ease of reference I will refer to simply as the statement of claim or SOC, (at [112]) identifies the college’s profit maximising purpose of the process changes. In that regard, it is pleaded that the college’s substantial purpose in implementing the process changes was to increase the number of CAs that referred consumers to the college for enrolment, and the number of consumers that those CAs referred to the college; to increase the number of consumers who became enrolled in online courses and remained enrolled past their census dates; and thereby to increase the revenue the college earned from tuition fees paid by the Commonwealth, which in turn made VFH loans to such consumers.

39 The statement of claim (at [114]) identifies CA misconduct in the course of engaging with consumers while conducting marketing and recruitment activities as including the following kinds of conduct:

(1) making false and misleading statements to consumers to the effect that the online courses were free;

(2) failing to properly inform consumers that they would incur VFH debts if they enrolled in online courses and/or the circumstances in which the debts would have to be repaid;

(3) pressuring consumers to enrol in an online course;

(4) offering consumers inducements, such as free laptops, to enrol in an online course;

(5) completing consumers’ enrolment documents, including the pre-enrolment questionnaire, for them; and

(6) coaching consumers during the course of the inbound quality assurance call, i.e., a telephone call between a college employee and the consumer immediately after the consumer’s enrolment documents were electronically submitted to the college by the CA for the purpose of checking whether the consumer was “genuine” and understood the commitment they were making.

40 The statement of claim (at [114]) then pleads that if the college did not have in place processes by which it could detect CA misconduct there was a risk that consumers who had been subjected to CA misconduct would become enrolled in an online course and remain enrolled past the census date or dates in the course, and thereby incur a VFH debt. That risk is referred to as CA misconduct risk.

41 The statement of claim (at [116]) pleads that there was a real risk that course advisors would recruit for enrolment in the online courses consumers who would not be contactable by the college, and/or who would have no or minimal engagement with their online course, and/or who did not in fact wish to enrol in an online course, and/or who are otherwise not suitable for enrolment including by reason of lacking sufficient language, literacy and numeracy (LLN) skills. That risk is referred to as unsuitable enrolment risk. It is pleaded that if the college did not have in place processes to ensure consumers of the kinds referred to were either not enrolled in an online course, or were withdrawn prior to passing a census date, such consumers would become enrolled in an online course and remain enrolled past the census date or dates in the course, and thereby incur a significant VFH debt.

42 The statement of claim (at [118]-[119]) pleads that elements of the enrolment and withdrawal processes in the earlier period, namely an outbound quality assurance call and campus driven withdrawals, provided means by which the college could mitigate the CA misconduct risk and the unsuitable enrolment risk and thereby protect unsuitable consumers from incurring VFH debts. It was then pleaded (at [120]) that the process changes materially reduced the college’s ability to mitigate the CA misconduct risk and the unsuitable enrolment risk.

43 The statement of claim (at [122]) pleads that primarily as a result of the process changes, when compared to the earlier period, as regards consumers who became enrolled in the relevant period there were the following process changes results:

(1) a substantial increase in the number of consumers who became enrolled in an online course;

(2) a substantial increase in the number and proportion of consumers who passed at least one census date in their online course;

(3) a substantial increase in the number and proportion of consumers who incurred a VFH debt but who did not complete any unit of competency or the online course as a whole;

(4) a substantial increase in the number and proportion of consumers who incurred a VFH debt but who did not engage in their online course or were not contactable;

(5) a substantial increase in the VFH revenue claimed by the college; and

(6) an increase in the proportion of consumers who made a complaint to the college, or on whose behalf complaints were made to the college, in respect of the conduct of course advisors.

44 The above elements were brought together in the pleading (at [124]) of the college’s unconscionable conduct as follows (the quotation being in certain respects paraphrased or the terminology made consistent with terminology otherwise employed in these reasons for judgment):

By its conduct in (i) implementing the process changes in respect of consumers who became enrolled in courses during the relevant period (which implementation, for some consumers extended beyond the relevant period), and (ii) in the period up to and including September 2016 (when the last census date for a consumer who became enrolled during the relevant period was processed by the college) claiming (which for the avoidance of doubt includes making an ongoing claim to entitlement to) the VFH revenue in respect over 90% of the consumers who became enrolled in an online course during the relevant period and passed one or more census dates and/or retaining such VFH revenue as was paid by the Commonwealth, in circumstances where:

(a) the college had the profit maximising purpose;

(b) the college was aware, or ought to have been aware, of:

(i) the CA misconduct risk;

(ii) the unsuitable enrolment risk; and

(iii) the fact that the process changes would reduce its ability to mitigate the CA misconduct risk and the unsuitable enrolment risk, when compared to its prior processes being the outbound QA call and the campus driven withdrawals,

and/or each of those matters was reasonably foreseeable at the commencement of, and/or during, the period when the process changes were implemented;

(c) the implementation of the process changes resulted in the process changes results;

(d) the college knew, or alternatively ought to have known, of the process changes results;

(e) further or alternatively, at the commencement of and/or during the period when the process changes were implemented, the college knew or ought to have known that the process changes would likely lead to the process changes results or results of the type of the process changes results and/or the process changes results were reasonably foreseeable,

the college engaged in a system of conduct, or a pattern of behaviour that was, in all the circumstances, unconscionable in contravention of s 21 of the ACL.

45 Before turning to the evidence, it is convenient to identify the relevant legal principles.

D. APPLICABLE LEGAL PRINCIPLES

D.1 Statutory unconscionability: s 21 of the ACL

46 Relevant provisions of the ACL are the following:

21 Unconscionable conduct in connection with goods or services

(1) A person must not, in trade or commerce, in connection with:

(a) the supply or possible supply of goods or services to a person (other than a listed public company); or

(b) the acquisition or possible acquisition of goods or services from a person (other than a listed public company);

engage in conduct that is, in all the circumstances, unconscionable.

(2) This section does not apply to conduct that is engaged in only because the person engaging in the conduct:

(a) institutes legal proceedings in relation to the supply or possible supply, or in relation to the acquisition or possible acquisition; or

(b) refers to arbitration a dispute or claim in relation to the supply or possible supply, or in relation to the acquisition or possible acquisition.

(3) For the purpose of determining whether a person has contravened subsection (1):

(a) the court must not have regard to any circumstances that were not reasonably foreseeable at the time of the alleged contravention; and

(b) the court may have regard to conduct engaged in, or circumstances existing, before the commencement of this section.

(4) It is the intention of the Parliament that:

(a) this section is not limited by the unwritten law relating to unconscionable conduct; and

(b) this section is capable of applying to a system of conduct or pattern of behaviour, whether or not a particular individual is identified as having been disadvantaged by the conduct or behaviour; and

(c) in considering whether conduct to which a contract relates is unconscionable, a court’s consideration of the contract may include consideration of:

(i) the terms of the contract; and

(ii) the manner in which and the extent to which the contract is carried out;

and is not limited to consideration of the circumstances relating to formation of the contract.

22 Matters the court may have regard to for the purposes of section 21

(1) Without limiting the matters to which the court may have regard for the purpose of determining whether a person (the supplier) has contravened section 21 in connection with the supply or possible supply of goods or services to a person (the customer), the court may have regard to:

(a) the relative strengths of the bargaining positions of the supplier and the customer; and

(b) whether, as a result of conduct engaged in by the supplier, the customer was required to comply with conditions that were not reasonably necessary for the protection of the legitimate interests of the supplier; and

(c) whether the customer was able to understand any documents relating to the supply or possible supply of the goods or services; and

(d) whether any undue influence or pressure was exerted on, or any unfair tactics were used against, the customer or a person acting on behalf of the customer by the supplier or a person acting on behalf of the supplier in relation to the supply or possible supply of the goods or services; and

(e) the amount for which, and the circumstances under which, the customer could have acquired identical or equivalent goods or services from a person other than the supplier; and

(f) the extent to which the supplier’s conduct towards the customer was consistent with the supplier’s conduct in similar transactions between the supplier and other like customers; and

(g) the requirements of any applicable industry code; and

(h) the requirements of any other industry code, if the customer acted on the reasonable belief that the supplier would comply with that code; and

(i) the extent to which the supplier unreasonably failed to disclose to the customer:

(i) any intended conduct of the supplier that might affect the interests of the customer; and

(ii) any risks to the customer arising from the supplier’s intended conduct (being risks that the supplier should have foreseen would not be apparent to the customer); and

(j) if there is a contract between the supplier and the customer for the supply of the goods or services:

(i) the extent to which the supplier was willing to negotiate the terms and conditions of the contract with the customer; and

(ii) the terms and conditions of the contract; and

(iii) the conduct of the supplier and the customer in complying with the terms and conditions of the contract; and

(iv) any conduct that the supplier or the customer engaged in, in connection with their commercial relationship, after they entered into the contract; and

(k) without limiting paragraph (j), whether the supplier has a contractual right to vary unilaterally a term or condition of a contract between the supplier and the customer for the supply of the goods or services; and

(l) the extent to which the supplier and the customer acted in good faith.

D.1(a) Statutory unconscionability per se

47 It is to be noted that s 21(4)(a) draws a distinction between the notion of unconscionable conduct proscribed by the section and that which is proscribed by “the unwritten law”. The latter is clearly enough a reference to the notion of unconscionability in equity which is proscribed by s 20 of the ACL. It is because of this distinction that when referring to the statutory proscription in s 21, I will refer to statutory unconscionability.

48 The ACCC’s case draws particular attention to s 21(4)(b), i.e., that the prohibition against unconscionable conduct in s 21 “is capable of applying to a system of conduct or pattern of behaviour”. This is what the ACCC refers to as systemic unconscionability. As will be seen, the ACCC alleges that the college applied a particular system of enrolment of consumers as students which was unconscionable contrary to the statutory proscription.

49 In ASIC v Kobelt [2019] HCA 18; 267 CLR 1 the High Court considered statutory unconscionability in the context of s 12CB of the Australian Securities and Investments Commission Act 2001 (Cth) (the ASIC Act). Sections 12CB and 12CC of the ASIC Act are materially the same as ss 21 and 22 of the ACL. It was accepted that the High Court’s treatment of statutory unconscionability in the context of the ASIC Act is equally applicable to the ACL. See also Kobelt at [87] per Gageler J in that regard.

50 The result in Kobelt was that the appeal from the Full Court was dismissed. Kiefel CJ and Bell, Gageler and Keane JJ joined in that result in a joint judgment by Kiefel CJ and Bell J and separate judgments by Gageler J and Keane J. Nettle, Gordon and Edelman JJ were in dissent.

51 Kiefel CJ and Bell J said (at [14]) that “unconscionable” in s 12CB(1) is to be understood as bearing its ordinary meaning. It was said that the proscription is of conduct that objectively answers the description of being against conscience. It was said that the values that inform the relevant standard of conscience “include” those identified by Allsop CJ in Paciacco v Australia & New Zealand Banking Group Ltd [2015] FCAFC 50; 236 FCR 199 at [296], namely: certainty in commercial transactions, honesty, the absence of trickery or sharp practice, fairness when dealing with customers, the faithful performance of bargains and promises freely made, and the protection of those whose vulnerability as to the protection of their own interests places them in a position that calls for a just legal system to respond for their protection, especially from those who would victimise, predate or take advantage. Their Honours identified (at [15]) that the appeal was concerned with the application of the last mentioned value, namely the protection of those in a vulnerable position from predation by others.

52 Kiefel CJ and Bell J (at [15]) and Keane J (at [118]), in both instances with reference to Kakavas v Crown Melbourne Ltd [2013] HCA 25; 250 CLR 392 at [124] and [161] respectively and Thorne v Kennedy [2017] HCA 49; 263 CLR 85 at [38], identified that a conclusion of unconscionable conduct requires not only that the innocent party be subject to special disadvantage, but that the other party must also unconscientiously take advantage of that special disadvantage. This has variously been described as requiring “victimisation”, “unconscientious conduct”, or “exploitation”: Thorne v Kennedy at [38]. Kiefel CJ and Bell J also explained (at [47]) that the conclusion that someone has engaged in conduct that contravenes the statutory norm of conscience is an evaluative judgment.

53 Kiefel CJ and Bell J (at [48]) said that the appeal in that case “does not provide the occasion to consider any suggestion that statutory unconscionability no longer requires consideration of (i) special disadvantage, or (ii) any taking advantage of that special disadvantage” (emphasis added).

54 It was a necessary part of Kiefel CJ and Bell J’s process of reasoning (at [79]) to the conclusion that the appeal should be dismissed that no feature of Mr Kobelt’s conduct in the supply of book-up credit (being the system of conduct in question) to his Anangu customers exploited or otherwise took advantage of the customers’ lack of education and financial acumen, i.e., their vulnerability or special disadvantage.

55 Gageler J (at [82]-[83]) explained that s 12CB of the ASIC Act does something more than s 12CA, i.e., also s 21 of the ACL does something more than s 20. The section’s prohibition against engaging in conduct “that is, in all the circumstances unconscionable” is expressed to be “not limited by the unwritten law … relating to unconscionable conduct”. His Honour reasoned that those words make it clear that the statutory conception of unconscionable conduct is unconfined to conduct that is remediable on that basis by a court exercising jurisdiction in equity.

56 Endorsing the view adopted by the Full Court in ACCC v Lux Distributors Pty Ltd [2013] FCAFC 90; ATPR 42-447 at [23] and [41], Gageler J (at [87]) reasoned that the correct perspective is that s 12CB (i.e., also s 21 of the ACL) operates to prescribe a normative standard of conduct. The function of a court is to recognise and administer that normative standard of conduct. That must be done in the totality of the circumstances taking account of each of the considerations identified in s 12CC (i.e., also s 22 of the ACL) if and to the extent that those considerations are applicable in the circumstances.

57 With regard to the content of the normative standard, Gageler J (at [88]) reasoned that the appropriation in statutory unconscionability of the terminology of courts administering equity serves to signify the gravity of the conduct necessary to be found by a court in order to be satisfied of a breach of that standard. In that regard, unconscionability “is not a slight matter, and behaviour is only unconscionable where there is some real and substantial ground based on conscience for preventing a person from relying on what are, in terms of the general law, that person’s legal rights” (quoting from Burt v Australia & New Zealand Banking Group Ltd (1994) ATPR (Digest) 46‑123 at 53,598 per Bryson J in the Supreme Court of NSW).

58 Gageler J (at [89]) reasoned that Parliament’s appropriation of the terminology of “unconscionable conduct” from equity but shorn of the constraints of the unwritten law is indicative of an intention that conduct of the requisite gravity need not be found only in a fact-pattern which fits within the equitable paradigm of a stronger party to a transaction exploiting some special disadvantage which operates to impair the ability of a weaker party to form a judgement as to his or her best interests. Nevertheless, his Honour reasoned (at [90]) that the normative standard of statutory unconscionability does not dilute the gravity of the equitable conception of unconscionable conduct so as to produce a form of “equity-lite”. Further, “[t]he appropriation of the terminology of equity does not allow a court to adopt a process of reasoning which starts with the equitable conception of unconscionable conduct, involving exploitation of a special advantage, and then uses considerations identified in s 12CC [i.e., also s 22 of the ACL] to water down the court’s assessment of what amounts to a special disadvantage or to allow the court to arrive more easily at an assessment that conduct amounts to exploitation.”

59 Gageler J (at [92]) went on to say that conduct proscribed by the section as unconscionable is conduct that is so far outside societal norms of acceptable commercial behaviour as to warrant condemnation as conduct that is offensive to conscience. Also (at [93]), the notion of offensive to conscience is informed by a sense of what is right and proper according to values which can be recognised by the court to prevail within the contemporary Australian society. Those values are not entirely confined to, or entirely removed from, values which historically informed courts administering equity in the development of the unwritten law of unconscionable conduct. Those values include respect for the dignity and autonomy and equality of individuals.

60 It was a central component of Gageler J’s reasoning (at [111]) to the conclusion that the appeal should be dismissed that Mr Kobelt’s provision of his book-up system to his Anangu customers could not be characterised as involving exploitation of those customers’ vulnerability.

61 Similarly, Keane J (at [115]) concluded that the appeal should be dismissed for the reason that it had not been established that Mr Kobelt exploited his customers’ socio-economic vulnerability in order to extract financial advantage from them.

62 Keane J (at [117]) made the important point that the purpose of the proscription against statutory unconscionability is to regulate commerce, and that the pursuit by those engaged in commerce for their own advantage is an omnipresent feature of legitimate commerce. Thus, to say that Mr Kobelt was pursuing his own commercial interests with a view to profit is to state the obvious, but also to say very little as to whether he engaged in unconscionable conduct.

63 As already indicated, Keane J (at [118]) held that a finding of unconscionable conduct requires the unconscientious taking advantage of a special disadvantage, which was also described as victimisation or exploitation. His Honour (at [119]) reasoned that exploitation or victimisation is a characteristic of statutory unconscionability. This is consistent with his Honour’s reasoning (at [115]) that the appeal should be dismissed because it had not been established that Mr Kobelt exploited his customers’ socio-economic vulnerability in order to extract financial advantage from them.

64 Keane J (at [121]) reasoned that the statement in s 12CB(4)(b) (i.e., also s 21(4)(b) of the ACL) that it is the intention of the Parliament that the section is capable of applying to a system of conduct or pattern of behaviour, whether or not a particular individual is identified as having been disadvantaged by the conduct or behaviour. This does not mean that it is not an essential characteristic of statutory unconscionability within the meaning of the statute that it involve a calculated taking of advantage of a weakness or vulnerability. Subsection (4)(b), in dispensing with the need for proof of disadvantage to any particular individual, allows a system of conduct or pattern of behaviour to be found to be unconscionable within the meaning of the statute even though the extent of the disadvantage cannot be quantified in the case of any individual.

65 Like Gageler J’s reference to a normative standard, Keane J (at [122]) held that the purpose of s 12CB (i.e., also s 21 of the ACL) is to establish a statutory norm of conduct.

66 From the above analysis it is apparent that all the judges in the majority regarded statutory unconscionability as setting a normative standard of conduct and that conduct in breach of that standard must be well outside the bounds of what is generally seen to be moral, right or acceptable commercial behaviour; it is not “equity-lite”; it is conduct that on some real and substantial ground is offensive to conscience.

67 It is not clear, to me at least, whether by “no longer” (at [48], quoted at [53] above), Kiefel CJ and Bell J meant that it was not necessary to decide whether, in contrast to non-statutory unconscionability, statutory unconscionability requires both special disadvantage and the taking advantage of that special disadvantage, or whether, in contrast to what the position was with regard to statutory unconscionability up until then, statutory unconscionability requires both those elements. The question thus remained whether it was only Keane J, or also Kiefel CJ and Bell J and hence a majority, who at least until then regarded the two identified elements as being requirements of statutory unconscionability.

68 That question has since been answered by the Full Court of this Court in ACCC v Quantum Housing Group Pty Ltd [2021] FCAFC 40; 388 ALR 577 at [93] per Allsop CJ, Besanko and McKerracher JJ: neither general disadvantage in the equitable sense, nor taking advantage or exploitation of some vulnerability, disability or disadvantage of the person or persons to whom the conduct was directed is a necessary aspect of unconscionability within s 21 of the ACL.

69 In Quantum, the Full Court (at [55]-[56]) agreed with Gageler J (at [87]) that the correct perspective is that s 12CB (and s 21 of the ACL) operates to prescribe a normative standard of conduct which a court exercising jurisdiction in a matter arising under the section is to recognise and administer; the court needs to administer that standard in the totality of the circumstances taking account of each of the considerations identified in s 12CC (i.e., also s 22 of the ACL) if and to the extent that those considerations are applicable in the circumstances. Also, an allegation of unconscionability is a serious allegation; it is sufficient to warrant censure for the purposes of deterrence by the imposition of a civil penalty; and, being penal in character, tends against too loose or diffuse a construction: Quantum at [88].

70 Assessing statutory unconscionability, like unconscionability in equity, “calls for a precise examination of the particular facts, a scrutiny of the exact relations established between the parties … Such cases do not depend upon legal categories susceptible of clear definition and giving rise to definite issues of fact readily formulated which, when found, automatically determine [the outcome]”: Jenyns v Public Curator (Qld) [1953] HCA 2; 90 CLR 113 at 118-119. As it was said by Lord Stowell in The Juliana (1822) 2 Dods 504 at 522: “A court of law works its way to short issues, and confines its views to them. A court of equity takes a more comprehensive view, and looks to every connected circumstance that ought to influence its determination upon the real justice of the case.” See ASIC v Australia and New Zealand Banking Group Ltd [2019] FCA 1284; 139 ACSR 52 at [2] per Allsop CJ; Ali v ACCC [2021] FCAFC 109 at [10)-[11] per Allsop CJ, Besanko and Perram JJ.

D.1(b) Systemic unconscionability

71 In Unique, the ACCC sought to establish systemic unconscionability by the Registered Training Organisation (RTO) in question by extrapolating from the experience of six individual consumers, or students, to conclusions with regard to the “system” or “pattern of behaviour” adopted by the RTO. The Full Court (at [84]) characterised the primary judge as having drawn from his Honour’s factual findings in relation to the six individual consumers four features of the ACCC’s factual case that his Honour accepted could constitute a system of conduct or pattern of behaviour, namely:

(a) the strategy of targeting disadvantaged people by reference to indigeneity, remoteness and social disadvantage (whether deliberate in its original conception or not);

(b) the use of gifts of laptops or iPads to students signing (or loan computers after 31 March 2015);

(c) the use of incentives to staff to encourage them to sign up students; and

(d) the holding of sign-up meetings.

72 His Honour concluded that the system was unconscionable as follows (as quoted by the Full Court at [88]):

The next question is whether this system was unconscionable. I do not think that (b) to (d) by themselves would necessarily be unconscionable. With the correct student cohort and management practices this style of operation may well have been permissible. However, when the practices in (b) to (d) are deployed against a targeted group of disadvantaged persons very different issues arise. In terms of s 22(1), it seems to me relevant to note in an assessment of the system that the targeted cohort consisted of people who were unlikely to understand the documentation involved (s 22(1)(c)) and that the use of the gift of a free (or ‘lent’) computer was apt to confuse this particular cohort into thinking a very bad deal was a good one – in my opinion an unfair tactic within the meaning of s 22(1)(d). The effect of the system in (b) to (d) was to supercharge the exploitation of the disadvantaged group which was being targeted (and also Unique’s remarkable profits). The system was unconscionable within the meaning of s 21.

73 The appeal against the primary judge’s finding of systemic unconscionability was successful on the basis that there was an error in extrapolating from the experience of six consumers to conclusions with regard to there being a system or pattern of behaviour in the absence of persuasive evidence about how six consumers could be said to be representative of the experience of 3,600 consumers enrolled in the relevant period at 428 different locations: Unique at [111], [161]-[162].

74 In Unique (at [103]-[104]) the Full Court referred to the extension of s 21 by para (4)(b) to a “system of conduct or pattern of behaviour” which is unconscionable as removing the necessity for revealed disadvantage “to any particular individual”. Although that was said prior to the judgment in Kobelt, there is nothing in the latter that is inconsistent with that statement. The Full Court also explained that a “system” connotes an internal method of working and that a “pattern” connotes the external observation of events. The Court observed as follows (at [104]):

The notion of unconscionability is a fact-specific and context-driven application of relevant values by reference to the concept of conscience …. It is an assessment of human conduct. A system of conduct requires, to a degree, an abstraction of a generalisation as to method or structure of working or of approaching something. If s 21(4)(b) is to be engaged, it is the system that is to be unconscionable. Nevertheless, the concept of unconscionability (even of a system) is a characterisation related to human conduct by reference to conscience, informed by values taken from the statute.

75 Later (at [150]), after an exhaustive analysis of previous system cases the Full Court explained that whether or not someone has engaged in conduct that reveals a “system” or “pattern of behaviour” will be highly fact-specific, and will rely to a significant extent on the forensic exercise the regulator chooses to undertake to prove the existence of the system, as well as any forensic exercise the respondent undertakes by way of answer. The same is true of the characterisation of conduct as unconscionable.

76 The present case is materially different from Unique in that the ACCC has expressly not sought to rely on the evidence of consumers A to E as being representative of the experience of consumers more broadly and from that to draw conclusions about the college’s system or pattern of behaviour. Rather, the ACCC relies on direct evidence of the college’s generalised policies and practices as constituting a system or pattern of behaviour which, in the particular circumstances, was, so the ACCC submits, unconscionable.

77 An assessment or conclusion whether conduct is “unconscionable” with reference to the statutory norm is a conclusion founded upon “all the circumstances”. The result is that it is wrong to approach a system case by seeking to isolate each integer of the system and reach a conclusion whether each is unconscionable in isolation. Clearly, it is the system as a whole as constituted by, potentially, many inter-related integers that is to be assessed. See NRM Corporation Pty Ltd v ACCC [2016] FCAFC 98 at [180]-[185] per Flick, Murphy and Griffiths JJ.

D.2 False, misleading or deceptive conduct and representations: ss 18 & 29 of the ACL

78 Section 18 of the ACL, as is well-known, provides that a person must not, in trade or commerce, engage in conduct that is misleading or deceptive or is likely to mislead or deceive.

79 Section 29(1) of the ACL relevantly provides that a person must not, in trade or commerce, in connection with the supply or possible supply of goods or services, make a “false or misleading representation” that goods or services have benefits (s 29(1)(g)) or with respect to the price of goods or services (s 29(1)(i)).

80 I recently had cause to identify relevant framework principles in Allergan Australia Pty Ltd v Self Care IP Holdings Pty Ltd [2020] FCA 1530 at [417]-[425] from where the following summary is drawn.

81 Although s 18 takes a different form to s 29, the prohibitions are similar in nature. Section 18 uses the phrase “misleading or deceptive” whereas s 29 uses the phrase “false or misleading”, but there is no material difference between the two expressions: ACCC v Coles Supermarkets Australia Pty Ltd [2014] FCA 634; 317 ALR 73 at [40] per Allsop CJ; ACCC v TPG Internet Pty Ltd [2020] FCAFC 130; 381 ALR 507 (TPG FCAFC) at [21] per Wigney, O’Bryan and Jackson JJ.

82 For the inquiry under s 18, it is necessary to identify the impugned conduct and then to consider whether that conduct, considered as a whole and in context, is misleading or deceptive or likely to mislead or deceive: Coles at [38], citing Google Inc v ACCC [2013] HCA 1; 249 CLR 435 at [89], [102] and [118] and Campomar Sociedad Limitada v Nike International [2000] HCA 12; 202 CLR 45 at [100]-[101]. The inquiry then shifts to whether that conduct, considered as a whole and in context, is misleading or deceptive or likely to mislead or deceive.

83 Conduct is misleading or deceptive or likely to mislead or deceive if it has the tendency to lead into error, i.e., that there is a sufficient causal link between the conduct and the likely error on the part of persons exposed to the conduct: Coles at [39], citing ACCC v TPG Internet Pty Ltd [2013] HCA 54; 250 CLR 640 (TPG HCA) at [39]. Conduct causing confusion and wonderment is not necessarily coextensive with misleading or deceptive conduct: Google at [8]; Campomar at [106].

84 Conduct is likely to mislead or deceive if there is a real and not remote chance or possibility that a person is likely to be misled or deceived: Global Sportsman Pty Ltd v Mirror Newspapers Pty Ltd [1984] FCA 167; 2 FCR 82 at 87 per Bowen CJ, Lockhart and Fitzgerald JJ; Butcher v Lachlan Elder Realty Pty Ltd [2004] HCA 60; 218 CLR 592 at [112] per McHugh J; TPG FCAFC at [22(a)].

85 It is not necessary to prove an intention to mislead or deceive: Yorke v Lucas [1985] HCA 65; 158 CLR 661 at 666 per Mason ACJ, Wilson, Deane and Dawson JJ; Google at [9]. However, where there is an intention to deceive, the court may more readily infer that the intention has been or in all probability will be effective: Campomar at [33].

86 It is necessary to view the conduct as a whole and in its proper context. This will or may include consideration of the type of market, the manner in which the goods are sold, and the habits and characteristics of purchasers in such a market: Coles at [41]; see generally TPG HCA at [52]; Parkdale Custom Built Furniture Pty Ltd v Puxu Pty Ltd [1982] HCA 44; 149 CLR 191 at 199 per Gibbs CJ.

87 The court must consider the likely characteristics of the persons who comprise the relevant class of persons to whom the conduct is directed and consider the likely effect of the conduct on ordinary or reasonable members of the class, disregarding reactions that might be regarded as extreme or fanciful: Campomar at [101]-[105]; Kraft Foods Group Brands LLC v Bega Cheese Ltd [2020] FCAFC 65; 377 ALR 387 at [236] per Foster, Moshinsky and O’Bryan JJ. In assessing the effect of conduct on a class of persons such as consumers who may range from the gullible to the astute, the court must consider whether the “ordinary” or “reasonable” members of that class would be misled or deceived: Coles at [43], citing Campomar at [105]. See also Google at [7]; Kraft at [236].

88 The presence or absence of evidence that someone was actually misled or deceived is relevant to an evaluation of all the circumstances relating to the impugned conduct: Coles at [45]. However, it is unnecessary to prove that the conduct in question actually deceived or misled anyone: Google at [6].

D.3 Unsolicited consumer agreements: ss 69, 78-79 of the ACL

89 Part 3-2 of the ACL governs the “consumer transactions”. Division 2 of that part then deals with “unsolicited consumer agreements” as a subset of consumer transactions and imposes obligations on “dealers” in relation to “unsolicited consumer agreements”.

90 Section 71 defines a dealer as follows:

A dealer is a person who, in trade or commerce:

(a) enters into negotiations with a consumer with a view to making an agreement for the supply of goods or services to the consumer; or

(b) calls on, or telephones, a consumer for the purpose of entering into such negotiations;

whether or not that person is, or is to be, the supplier of the goods or services.

91 Under paragraph (a) of that definition the college was a dealer. It was also a supplier of services. The CAs were also dealers but they were not suppliers of the services for which the consumers contracted. I do not understand those matters to be controversial.

92 Section 69 relevantly defines an unsolicited consumer agreement as follows:

(1) An agreement is an unsolicited consumer agreement if:

(a) it is for the supply, in trade or commerce, of goods or services to a consumer; and

(b) it is made as a result of negotiations between a dealer and the consumer:

(i) in each other’s presence at a place other than the business or trade premises of the supplier of the goods or services; or

(ii) by telephone;

whether or not they are the only negotiations that precede the making of the agreement; and

(c) the consumer did not invite the dealer to come to that place, or to make a telephone call, for the purposes of entering into negotiations relating to the supply of those goods or services (whether or not the consumer made such an invitation in relation to a different supply); and

(d) the total price paid or payable by the consumer under the agreement:

(i) is not ascertainable at the time the agreement is made; or

(ii) if it is ascertainable at that time—is more than $100 or such other amount prescribed by the regulations.

93 Section 70(1) provides that in a proceeding relating to a contravention or possible contravention of Div 2 of Pt 3-2 of the ACL, an agreement is presumed to be an unsolicited consumer agreement if a party to the proceeding alleges that the agreement is such an agreement and no other party to the proceeding proves that the agreement is not such an agreement. That is to say, because the ACCC alleges that the enrolment agreements struck with the individual consumers A to E are unsolicited consumer agreements, the onus is on the respondents to prove that they are not unsolicited consumer agreements.

94 Section 77 deals with the liability of suppliers for contraventions by dealers, i.e., the possible liability of the college for the conduct of the CAs, as follows:

If:

(a) a dealer contravenes a provision of this Subdivision in relation to an unsolicited consumer agreement; and

(b) the dealer is not, or is not to be, the supplier of the goods or services to which the agreement relates;

the supplier of the goods or services is also taken to have contravened that provision in relation to the agreement.

95 The particular contraventions that the ACCC alleges against the college are of the prohibitions in ss 78(2) and 79(1)(b) and (c) of the ACL. Those provisions are relevantly as follows:

78 Requirement to give document to the consumer

(1) …

(2) If an unsolicited consumer agreement was negotiated by telephone, the dealer who negotiated the agreement must, within 5 business days after the agreement was made or such longer period agreed by the parties, give to the consumer under the agreement:

(a) personally; or

(b) by post; or

(c) with the consumer’s consent—by electronic communication;

a document (the agreement document) evidencing the agreement.

Note: A pecuniary penalty may be imposed for a contravention of this subsection.

(3) An unsolicited consumer agreement was negotiated by telephone if the negotiations that resulted in the making of the agreement took place by telephone (whether or not other negotiations preceded the making of the agreement).

79 Requirements for all unsolicited consumer agreements etc.

The supplier under an unsolicited consumer agreement must ensure that the agreement, or (if the agreement was negotiated by telephone) the agreement document, complies with the following requirements:

(a) …

(b) its front page must include a notice that:

(i) conspicuously and prominently informs the consumer of the consumer’s right to terminate the agreement; and

(ii) conspicuously and prominently sets out any other information prescribed by the regulations; and

(iii) complies with any other requirements prescribed by the regulations;

(c) it must be accompanied by a notice that:

(i) may be used by the consumer to terminate the agreement; and

(ii) complies with any requirements prescribed by the regulations; …

D.4 Knowingly concerned: s 224 of the ACL

96 Section 224 of the ACL deals with pecuniary penalties. Section 224(1)(e) provides that if a court is satisfied that a person has been “in any way, directly or indirectly, knowingly concerned in, or party to, the contravention by a person” of a provision of, relevantly, Pt 2-2 (which is about unconscionable conduct and includes s 21), the court may impose a pecuniary penalty in respect of each act or omission by the person to which the section applies, as the court determines to be appropriate. The ACCC relies on this provision in contending that Mr Wills is liable with the college for any contraventions by it of the proscription against statutory unconscionability in s 21.

97 The ACCC also refers to para (c) of the definition of “involved” in s 2 of the ACL which provides that a person is involved in a contravention of a provision of the ACL or in conduct that constitutes such a contravention if the person “has been in any way, directly or indirectly, knowingly concerned in, or party to, the contravention”. That wording is the same as the wording in s 224(1)(e) and does not appear to take the matter any further.

98 There are two requirements that must be established before it can be concluded that a person was knowingly concerned in, or party to, a contravention.

99 First, the person must have had actual knowledge of all the essential facts constituting the contravention: Yorke v Lucas at 669-670. That is not imputed or constructive knowledge but, rather, actual knowledge: Young Investments Group Pty Ltd v Mann [2012] FCAFC 107; 293 ALR 537 at [11] per Emmett, Bennett and McKerracher JJ. However, it is not necessary that the person knew that those matters constituted a contravention: Rafferty v Madgwicks [2012] FCAFC 37; 203 FCR 1 at [254] per Kenny, Stone and Logan JJ. The requisite actual knowledge must be present at the time of the contravention; a later acquisition of knowledge of the essential matters is not sufficient: ASIC v Australian Investors Forum Pty Ltd (No 2) [2005] NSWSC 267; 53 ACSR 305 at [113]-[118] per Palmer J; ASIC v ActiveSuper Pty Ltd (in liq) [2015] FCA 342; 235 FCR 181 at [405] per White J.

100 Actual knowledge may be inferred from “a combination of suspicious circumstances and a failure to make an inquiry” – which is sometimes referred to as “wilful blindness”, but “knowledge must be the only rational inference available”: Pereira v Director of Public Prosecutions [1988] HCA 57; 82 ALR 217 at 220 per Mason CJ, Dean, Dawson, Toohey and Gaudron JJ. It has also been said that “actual knowledge may be inferred from ignorance dishonestly and deliberately maintained or wilful blindness”: Lloyd v Belconnen Lakeview Pty Ltd [2019] FCA 2177; 377 ALR 234 at [321] per Lee J.

101 In a case such as the present which, relevantly, involves a case asserting knowing concern in unconscionable conduct, it is necessary to show that the person said to be knowingly concerned knew of all the circumstances by which the conduct is ultimately found to have been unconscionable in contravention of the statutory norm: Stefanovski v Digital Central Australia (Assets) Pty Ltd [2018] FCAFC 31; 368 ALR 607 at [71] per McKerracher, Robertson and Derrington JJ.

102 Secondly, the person must have engaged in conduct (by act or omission) which can properly be said to “implicate” them in the contravention or which shows a “practical connection” between them and the contravention: ActiveSuper at [407]-[410]; Ashbury v Reid [1961] WAR 49 at 51; Trade Practices Commission v Australia Meat Holdings Pty Ltd [1988] FCA 338; 83 ALR 299 at 357 per Wilcox J. It is not necessary that the person physically do anything to further the contravention; it is sufficient if the person, by what they said and agreed to do, in fact became associated with and thus involved, in the relevant sense, in the conduct constituting the contravention: R v Tannous (1988) 10 NSWLR 303 at 308 per Lee J, Street CJ and Finlay J agreeing; Leighton Contractors Pty Ltd v CFMEU [2006] WASC 144; 154 IR 228 at [29] per Le Miere J; Qantas Airways Ltd v TWUA [2011] FCA 470; 280 ALR 503 at [324]-[325] per Moore J; Fair Work Ombudsman v Priority Matters Pty Ltd [2017] FCA 833 at [118]-[119] per Flick J; Termite Resources NL (in liq) v Meadows [2019] FCA 354; 370 ALR 191 at [717] per White J.

103 It is submitted on behalf of Mr Wills that it is necessary for the ACCC to establish that he “participated” in the essential elements constituting the contravention. That is to say, it is not only the requirement of knowledge that must go to the essential elements of the contravention but also the requirement of participation. The submission was based on the following statement in ACCC v Geowash Pty Ltd (subject to a deed of company arrangement) (No 3) [2019] FCA 72; 368 ALR 441 at [766]:

The person must have knowledge of the essential matters which constitute the contravening conduct and have been an intentional participant in the essential elements constituting the contravention: Yorke v Lucas [1985] HCA 65; (1985) 158 CLR 661 at 667. These matters are related because intentional participation is based upon knowledge of the essential elements: Australian Competition and Consumer Commission v IMB Group Pty Ltd [2003] FCAFC 17 at [133].

(Emphasis added.)

104 It is noted that the decision in Geowash was recently upheld on appeal, although the findings on “knowingly concerned” were not the subject of appeal. That may be because the critical finding that is relevant to the present discussion, namely that one of the individuals in that case, Mr Cameron, was not knowingly concerned in certain conduct because he did not participate in it, was in the appellants’ favour so they had no interest in challenging it (Geowash at [772]-[777]). The result is that the issues raised here were not addressed by the Full Court: Ali v ACCC [2021] FCAFC 109.

105 It is not clear to me that the proposition that it is a requirement of establishing knowing concern in a contravention that the person participated in each element of the contravention is correct or consistent with the authorities. Such a proposition is not borne out by the authorities cited. In Yorke v Lucas, the Court identified (at 666) that there were two bases on which it was contended that the relevant person, Mr Lucas, was liable for the contravention of s 52 of the Trade Practices Act 1974 (Cth) (i.e., the old misleading and deceptive conduct provision) by the company. The first one was that he had “aided, abetted, counselled or procured” the contravention within the meaning of para (a) of s 75B, and the other was that he was “directly or indirectly, knowingly concerned in, or party to” the contravention within the meaning of para (c) of that section. The latter paragraph has its modern equivalence in s 224(1)(e), being the provision on which the ACCC relies in this case.

106 From the foot of page 666 to the foot of page 669 the Court discussed para (a), i.e., the aiding and abetting provision. The reference in Geowash to page 667 is accordingly a reference to a discussion about aiding and abetting and not about “knowingly concerned”. It does not support the proposition contended for by Mr Wills. In any event, at 670 the Court in Yorke v Lucas concluded that the proper construction of para (c) “requires a party to a contravention to be an intentional participant, the necessary intent being based upon knowledge of the essential elements of the contravention.” That construction does not require that the person be an intentional participant in each essential element.

107 The other authority cited in Geowash is ACCC v IMB Group [2003] FCAFC 17 at [133]. There it was said that “a person must be an intentional participant in the contravention, the necessary intent being based upon knowledge of the essential elements of the contravention”. That statement is exactly the same as the statement in Yorke v Lucas just referred to and does not support the proposition contended for.

108 In the circumstances, I reject the submission on behalf of Mr Wills that for a person to be knowingly concerned in the contravention of another it must be shown that they participated in the essential elements constituting the contravention.

D.5 Conduct on behalf of a body corporate: s 139B, Competition and Consumer Act

109 The ACCC relies on s 139B of the Competition and Consumer Act 2010 (Cth) (C&C Act) as regards the attribution of the state of mind of each of Mr Cook, Ms Edwards and Mohammed Akbery (also referred to as Mr Akbery) to the college (i.e. Productivity Partners), and the attribution of the state of mind of Mr Wills to Site. That is on the basis that each of Mr Cook, Ms Edwards and Mr Akbery was an employee of the college and Mr Wills was an employee of Site. The ACCC also relies on this section in respect of each CA who signed up consumers A to E and to say that each of their conduct was on behalf of the college as an agent.

110 The section relevantly provides as follows:

139B Conduct of directors, employees or agents of bodies corporate

(1) If, in a proceeding under this Part or the Australian Consumer Law in respect of conduct that is engaged in by a body corporate and to which this Part or the Australian Consumer Law applies, it is necessary to establish the state of mind of the body corporate, it is sufficient to show:

(a) that a director, employee or agent of the body corporate engaged in that conduct within the scope of the actual or apparent authority of the director, employee or agent; and

(b) that the director, employee or agent had that state of mind.

(2) Any conduct engaged in on behalf of a body corporate:

(a) by a director, employee or agent of the body corporate within the scope of the actual or apparent authority of the director, employee or agent; or

(b) …

is taken, for the purposes of this Part or the Australian Consumer Law, to have been engaged in also by the body corporate.

111 Section 139B is materially the same as ss 84(1) and (2) of the Act. When s 139B was inserted into the Act as part of the ACL reforms (by the Trade Practices Amendment (Australian Consumer Law) Bill (No 2) 2010 (Cth)), the Explanatory Memorandum accompanying the Bill stated (at [18.35]) that s 139B “reflects section 84” of the Act. It follows that authorities as to the meaning and scope of ss 84(1) and (2) therefore provide guidance as to the meaning and scope of s 139B. See Empower at [280].

112 The short point for present purposes is that the state of mind (s-s (1)) and the conduct (s-s (2)) of a director, employee or agent of a company will be attributed to the company if the person engaged in the impugned conduct on behalf of the corporation within the scope of their actual or apparent authority. Thus, contrary to the position in the general law that the conduct and state of mind of a person will not be attributed to the company unless the person was the “directing mind and will” of the company (as explained in, for example, Tesco Supermarkets Ltd v Nattrass [1972] AC 153 and Meridian Global Funds Management Asia Ltd v Securities Commission [1995] 2 AC 500), for the purposes of contraventions of the ACL, it is sufficient if the person was the agent of the company acting within the scope of their actual or apparent authority: Walplan Pty Ltd v Wallace [1985] FCA 479; 8 FCR 27 at 36-37 per Lockhart J, Sweeney and Neaves JJ agreeing.