Federal Court of Australia

Colonial Mutual Life Assurance Society Limited, in the matter of The Colonial Mutual Life Assurance Society Limited [2021] FCA 394

ORDERS

IN THE MATTER OF THE COLONIAL MUTUAL LIFE ASSURANCE SOCIETY LIMITED | ||

THE COLONIAL MUTUAL LIFE ASSURANCE SOCIETY LIMITED First Applicant AIA AUSTRALIA LIMITED Second Applicant | ||

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. Pursuant to section 194 of the Life Insurance Act 1995 (Cth) (Life Act), the scheme for the transfer of all of the life insurance business of The Colonial Mutual Life Assurance Society Limited, the First Applicant, to AIA Australia Limited, the Second Applicant, (Scheme) in the form of Annexure A to these orders, be confirmed without modification.

2. The Scheme take effect on and from 12:01 am (AEDT) on 1 April 2021.

3. The Applicants pay the costs of the proceedings of the Australian Prudential Regulation Authority (APRA) as agreed or, if agreement cannot be reached, as assessed.

4. There be liberty to apply.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

Annexure A

ALLSOP CJ:

1 On 18 November 2020, the first applicant, The Colonial Mutual Life Assurance Society Limited (CMLA), and the second applicant, AIA Australia Limited (AIAA), made an application to the Court under s 193 of the Life Insurance Act 1995 (Cth) for an order under s 194 of the Act confirming a scheme for the transfer of the whole of the life insurance business of CMLA (apart from certain specific excluded assets and liabilities) to AIAA (the Scheme). Pursuant to s 190(1) of the Act, no part of a life insurance business of a life company may be transferred to another life company except under a scheme confirmed by the Court.

2 On 16 December 2020, Gleeson J made orders pursuant to s 191(5) of the Act dispensing with the requirement for distribution of the approved summary of the Scheme (Scheme Summary) to every affected policy owner pursuant to s 191(2)(c), provided that the applicants carried out certain steps concerning publication and dissemination of the Scheme Summary (Dispensation Orders): Application by the Colonial Mutual Life Assurance Society Limited (ACN 004 021 809 & Anor [2020] FCA 1809 (Dispensation Judgment).

3 On 15 March 2021, I made orders confirming the Scheme. These are the reasons for making those orders.

Background to the Scheme

4 The background to and overview of the Scheme is set out at [8]–[18] of the Dispensation Judgment.

5 CMLA and AIAA are both life companies registered under s 21 of the Act. CMLA is wholly owned by the Commonwealth Bank of Australia (CBA), which is listed on the Australian Securities Exchange. CMLA has six Statutory Funds in respect of its life insurance business within the meaning of the Act, three of which are Unit-Linked Statutory Funds. Under s 31(b) of the Act, a life company that carries on life insurance business consisting of investment-linked benefits must maintain a statutory fund or statutory funds exclusively for that business so far as it is carried on in Australia. A reference to a Unit-Linked Statutory Fund in these reasons is a reference to such a fund.

6 CMLA’s life insurance business includes Life Cover, Total and Permanent Disability Cover, Income Protection, Trauma Cover and Consumer Credit Insurance (CCI). CMLA’s policies are issued across three key channels: Direct Life, being policies issued to customers directly online, through telemarketing or with the sale of banking products; Retail Advice, being policies sold indirectly through financial advisers; and Wholesale Life/Group Life, being policies issued to trustees of superannuation funds and corporate employers for the benefit of members and employees. The Direct Life and Retail Advice channels have been closed to new business since 9 November 2019 and 31 March 2020 respectively, meaning that no policies are issued to new customers. A separate group of life insurance policies issued by CMLA are known as Superannuation and Investments products, which include annuities and investment growth bonds.

7 AIAA is wholly-owned by AIA Company Limited. The ultimate holding company of AIAA is AIA Group Limited, a company incorporated in Hong Kong. AIAA provides life insurance coverage to over 2.9 million people in Australia, with approximately 1,200 employees in Australia. AIAA currently has two Statutory Funds within the meaning of the Act, one of which is a Unit-Linked Statutory Fund.

8 On 21 September 2017, CBA announced that it had sold its life insurance business in Australia, including CMLA, to AIA Group. The planned share sale of CMLA has been the subject of regulatory approval delays relating to the disposal by CMLA of its 37.5% stake in BoCommLife Insurance Company Limited. As a result of this delay, CBA and AIA Group have sought to implement an alternative approach to completing divestment of CBA’s life insurance business, involving:

(a) The entry by CBA, AIAA and CMLA into a joint cooperation agreement to jointly manage AIAA’s and CBA’s life insurance businesses, including that of CMLA (Joint Cooperation Agreement); and

(b) Implementation of the Scheme by CBA, AIAA and CMLA.

9 The sale of BoCommLife was completed in December 2020, with the proceeds distributed to CBA through a dividend.

10 On 29 and 30 October 2019, the Commonwealth Treasurer approved AIAA’s entry (as well as the entry of CBA, CMLA and other parties where required) into the Joint Cooperation Agreement under the Financial Sector (Shareholdings) Act 1998 (Cth), the Insurance Acquisitions and Takeovers Act 1991 (Cth) (IATA) and s 74(2) of the Foreign Acquisitions and Takeovers Act 1975 (Cth) (FATA).

11 The Joint Cooperation Agreement came into effect on 1 November 2019. From this date, AIAA obtained the full economic interests of CMLA (excluding its interest in BoCommLife). Under the terms of the Joint Cooperation Agreement, AIAA exercises direct management and oversight of CBA’s life insurance business, including the ability to appoint a majority of directors to CMLA. Mr Moss, a program manager at AIAA, gave evidence that in practice AIAA currently operates CMLA’s business jointly with its own life insurance business, and shares business functions, including actuarial teams, across the two businesses. The Joint Cooperation Agreement will terminate if the CMLA business is transferred to AIAA under the Scheme.

12 On 29 September 2020, AIAA, CMLA and CBA entered into a Transfer Deed which sets out the commercial arrangements between the parties in relation to the Scheme.

13 On 30 October 2020, the Commonwealth Treasurer decided pursuant to s 41 of the IATA that the Commonwealth Government had no objection to the proposed Scheme.

14 On 2 November 2020, the Australian Government informed the applicants’ solicitors that the Commonwealth had no objection to AIAA acquiring 100% of the interests in the assets of CMLA’s life insurance business, subject to particular conditions imposed under s 74(2) of the FATA.

15 On 22 December 2020, the Australian Prudential Regulation Authority (APRA) granted its approval of the form of the Scheme Summary, the Notice of Intention, the list of newspapers for publication of the Notice of Intention and the proposed public inspection sites.

Outline of the Scheme

16 The Scheme document is set out as Annexure A to the orders made on 15 March 2021, which are published with these reasons. The effect of the Scheme can be summarised as follows:

(a) All policies of CMLA as well as all assets of its Statutory Funds and Shareholder’s Fund (other than the CMLA’s interest in BoCommLife and certain other assets specified in the Scheme) will be transferred to AIAA.

(b) AIAA will assume all of the liabilities and obligations of CMLA in relation to its transferring business and be entitled to all the rights and benefits of CMLA in relation to the transferring business.

(c) AIAA will become the issuer of CMLA life insurance policies and CMLA policy owners will become AIAA policy owners;

(d) The rights and liabilities of CMLA policy owners will be the same as they would have been if the applications on which policies were based had been accepted by AIAA instead of CMLA and their policies had been issued by AIAA instead of CMLA; and

(e) Any person having a claim or obligation to CMLA under or in respect of a CMLA policy will have the same claim or obligation to AIAA irrespective of when the claim or obligation arose.

17 Clause 13.1 of the Scheme document provides that there will be no change to the terms and conditions of the policies of CMLA or AIAA as a result of the Scheme, except that references to CMLA will be changed to references to AIAA and references to a statutory fund of CMLA will change to be reference to the relevant statutory fund of AIAA.

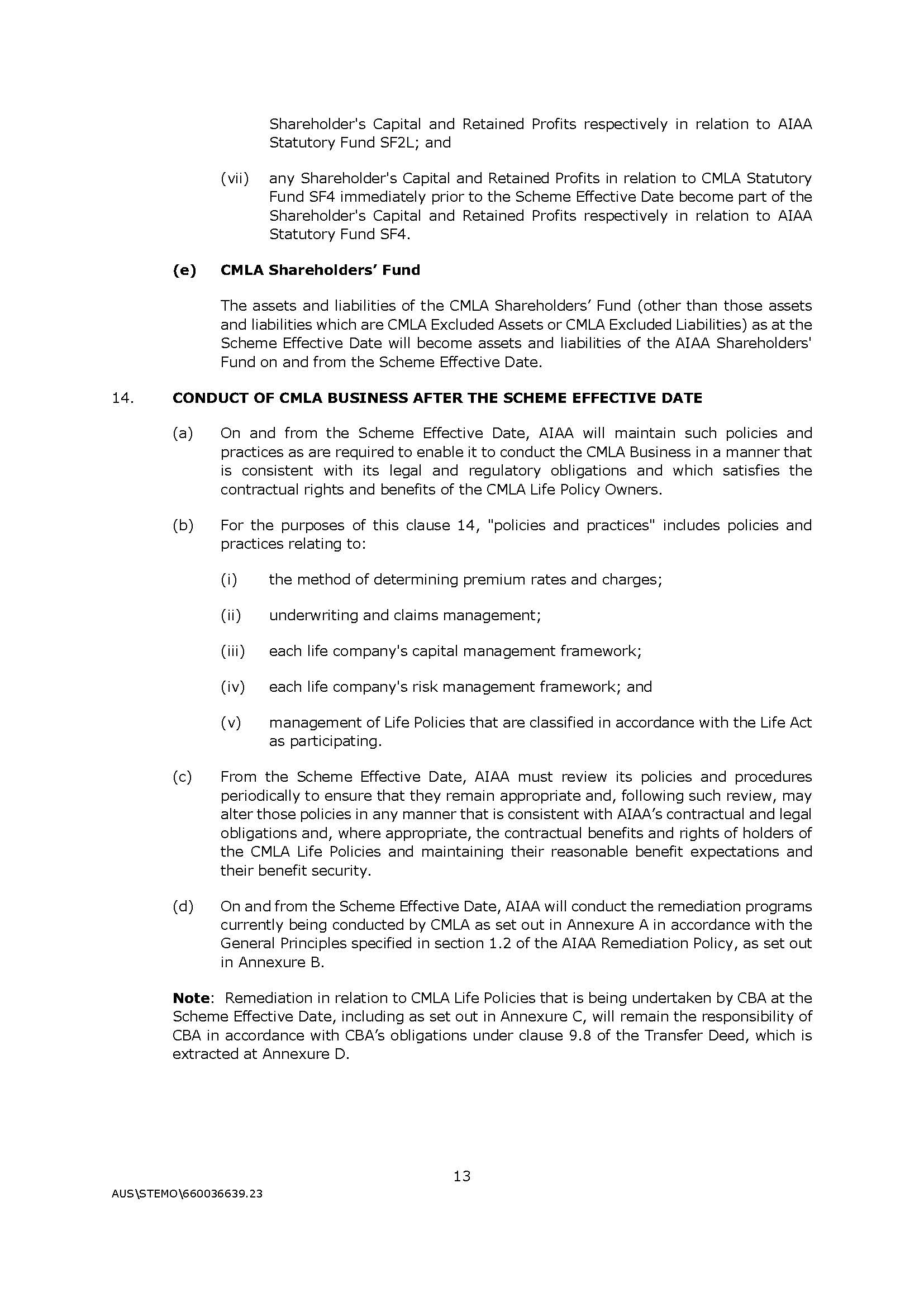

18 Clause 15 of the Scheme document provides that all costs associated with the Scheme will be paid for by AIAA and CMLA and not by the policy owners.

19 The Scheme Effective Date was specified as 1 April 2021.

20 As outlined above, both AIAA and CMLA maintain multiple Statutory Funds in accordance with the Act. Each Statutory Fund has distinct assets to be used for the benefit of policies within that Statutory Fund. The independent actuary for the Scheme, Mr Goodsall, explained in his Initial Report that, to manage equity across policy owner groups, including consideration of policy owner reasonable benefit expectations, within each Statutory Fund separate assets are maintained or managed at several levels including lines of business, product investment portfolios, strategic assets portfolios, asset shares and bonus pools for participating business. These are referred to as Sub-Funds. Sub-Funds are also maintained in respect of business transferred into CMLA from previous Part 9 schemes. Mr Goodsall noted at section 6.6 of his Initial Report that the existing Sub-Funds will continue in operation post-transfer, ensuring that equity between policy owner groups managed in different Sub-Funds will not be impacted by the Scheme.

21 Under the Scheme, CMLA’s three Unit-Linked Statutory Funds containing investment-linked policies (SF1L, SF2L and SF4) will be transferred “as-is” to AIAA to become new Unit-Linked Statutory Funds in AIAA. The structure of these Unit-Linked Statutory Funds, the statutory protections for policy owners and the Sub-Funds will remain unchanged.

22 The policies referable to CMLA’s other three conventional Statutory Funds (SF1, SF3 and SF5), as well as the underlying assets of these funds, will be transferred to AIAA’s Statutory Fund SF1. The existing Sub-Funds within these Statutory Funds will remain unaltered. According to Mr Goodsall, the practical effect of the combination of the three CMLA Statutory Funds into the AIAA SF1 should be that, from the policy owners’ perspective, the policies are managed as if they were still in a separate Statutory Fund.

23 Therefore, all six of CMLA’s Statutory Funds and AIAA’s SF1 are affected by the Scheme. CMLA also holds a Shareholder Fund (SHF), which is available to support all Statutory Funds if required. The transferring assets and liabilities of CMLA’s SHF will transfer to AIAA’s SHF under the Scheme. As AIAA’s Unit-Linked Statutory Fund (SF3) is not receiving any policies under the Scheme, it will not be affected by the Scheme within the meaning of the Act.

24 Thus, the relevant affected policy owners are the owners of policies referable to CMLA’s Statutory Funds and AIAA’s Statutory Fund No 1. As noted by Gleeson J at [27] of the Dispensation Judgment, the applicants have identified the following groups of persons to be “policy owners” for the purposes of the Scheme:

(1) individuals who hold a current contract for life insurance in their own name;

(2) superannuation trustees or employers who enter into policies in their own name for the benefit of members of the funds or employees, respectively (but not the members of the funds or the employees themselves);

(3) policy owners who are currently “on claim”, that is, policy owners who are being paid a benefit following a claim on a policy they hold; and

(4) owners of certain categories of recently lapsed or cancelled policies, being:

(a) policies that have lapsed or been cancelled as a result of a failure to pay the required premiums, but that can be reinstated within a particular period if the policy owner resumes payment of their premiums;

(b) policies that have paid a trauma or total and permanent disability benefit within the last 12 months, but whose policy owner has an entitlement to 'buy back' or reinstate an amount of life cover; and

(c) policies that have lapsed but are the subject of an unresolved dispute or ongoing litigation or remediation program.

25 The applicants identified a total of approximately 567,651 CMLA affected policy owners as at 1 October 2020 and approximately 250,455 AIAA affected policy owners as at 30 September 2020.

Principles

26 The object of the Act is to protect the interests of owners and prospective owners of life insurance policies in a manner consistent with the continued development of a viable, competitive and innovative life insurance industry: s 3(1). The regime for the supervision of the transfer or amalgamation of life insurance businesses by the Court, as set out in Part 9 of the Act, is one of the means adopted to achieve this object: Re Royal & Sun Alliance Life Assurance Ltd [2000] FCA 1259; 104 FCR 37 at [3].

27 Under s 194 of the Act, the Court has a discretion to refuse a scheme or confirm it with or without modification. Confirmation pursuant to s 194 is not a mere formality: MLC Lifetime Company Limited and MLC Limited (No 2) [2006] FCA 1367 at [5]. The Court must have regard to the object of protecting the interests of policy owners and ensure that the scheme will not be prejudicial to the interests of policy owners: Royal & Sun at [3]; In the Application of Commonwealth Insurance Holdings Ltd and The Colonial Mutual Life Assurance Society Ltd [2007] FCA 1012 at [12]–[14]; and National Mutual Life Association of Australasia Limited, the application of National Mutual Life Association of Australasia Limited and AMP Life Limited (No 2) [2016] FCA 1591 at [29]–[32].

Evidence

28 On 8 March 2021, I heard the substantive application for confirmation under s 194 of the Act. Mr Jackman SC appeared as senior counsel for the applicants. Mr Claxton appeared on behalf of APRA and informed the Court that APRA had no objection to the Scheme. A former policy owner, Mr Kanak, also appeared and made submissions. Mr Kanak raised an issue pertaining to remediation programs, responsibility for which was to be transferred to AIAA under the Scheme. At the conclusion of the confirmation hearing on 8 March 2021, I was not satisfied that the issue raised by Mr Kanak was properly addressed by the Scheme document in its proposed form. I listed the matter for a further day of hearing on 15 March 2021 to allow the applicants time to address my concerns.

29 The applicants relied upon the following affidavits, which were tendered and read into evidence as unsworn affidavits at the dispensation hearing and re-read (affirmed or sworn) at the confirmation hearing on 8 March 2021:

(a) Affidavit of Jeronimus (Jeroen) Paulus van Koert affirmed on 21 January 2021 (First van Koert Affidavit);

(b) Affidavit of Gregory Joseph Della affirmed on 21 January 2021 (First Della Affidavit);

(c) Affidavit of David Millington Goodsall sworn on 25 January 2021 (First Goodsall Affidavit); and

(d) Affidavit of Mark Jeffrey Moss affirmed on 25 January 2021 (First Moss Affidavit).

30 The following additional affidavits were read in support of the application at the confirmation hearing on 8 March 2021:

(a) Affidavit of Jeronimus (Jeroen) Paulus van Koert affirmed on 23 February 2021 (Second van Koert Affidavit)

(b) Affidavit of Gregory Joseph Della affirmed on 23 February 2021 (Second Della Affidavit)

(c) Affidavit of David Millington Goodsall sworn on 23 February 2021 (Second Goodsall Affidavit);

(d) Affidavit of Stephen Roberts Moore affirmed on 23 February 2021 (First Moore Affidavit);

(e) Affidavit of Stephen Roberts Moore affirmed on 24 February 2021 (Second Moore Affidavit);

(f) Affidavit of Mark Jeffrey Moss affirmed on 24 February 2021 (Second Moss Affidavit);

(g) Affidavit of Mark Jeffrey Moss affirmed on 3 March 2021 (Third Moss Affidavit).

31 For reasons which will become apparent, the applicant filed the following additional affidavits which were read in support of the application on the second day of the confirmation hearing on 15 March 2021:

(a) Affidavit of Justine Kiri Cameron sworn on 12 March 2021 (Cameron Affidavit);

(b) Affidavit of Adrienne Vaughan Renner sworn on 15 March 2021 (First Renner Affidavit);

(c) Supplementary Affidavit of Adrienne Vaughan Renner sworn on 15 March 2021 (Second Renner Affidavit).

32 Three actuaries gave evidence that was relied upon in support of the Scheme. Mr van Koert is Chief Actuary of AIAA and is responsible for providing the core actuarial services to the wider Australian Finance and Actuarial teams at AIAA. He is the appointed actuary of AIAA. Mr van Koert prepared two actuarial reports in support of the Scheme dated 17 November 2020 (Initial van Koert Report) and 23 February 2021 (Supplemental van Koert Report). Mr Della is an associate partner at Ernst & Young and the appointed actuary of CMLA. Mr Della also prepared two actuarial reports in support of the Scheme of the same dates (Initial Della Report and Supplemental Della Report, respectively). Mr Goodsall is a director of Synge & Noble, a consulting actuarial firm. Mr Goodsall, an independent actuary, prepared two actuarial reports also dated 17 November 2020 and 23 February 2021 (Initial Goodsall Report and Supplemental Goodsall Report, respectively). Mr Goodsall gave brief oral evidence on the first day of the confirmation hearing, which will be outlined in due course.

33 Mr Moss is the program manager at AIAA responsible for the management of the Scheme. Mr Moore is a solicitor employed by Ashurst, the solicitors on record for the applicants. Both Messrs Moss and Moore gave evidence on the applicants’ compliance with the Dispensation Orders made by Gleeson J in December 2020. Mr Moss also gave brief oral evidence at the first day of the confirmation hearing on CMLA’s remediation programs.

34 Ms Cameron is the Head of Legal at CMLA and AIAA. Ms Renner is the General Manager Retail Banking Services Remediation at CBA. Ms Cameron and Ms Renner gave evidence on the current customer remediation programs undertaken by the applicants and CBA, including a project in place to remunerate customers who had purchased CCI products from CBA for which CMLA is the insurer.

Compliance with the Dispensation Orders

35 Pursuant to the Dispensation Orders, s 191 of the Act and reg 9.02 of the Life Insurance Regulations 1995 (Cth), the applicants were required to:

(a) publish a Notice of Intention to make an application to the Court for confirmation of the Scheme in the Commonwealth Government Notices Gazette and a number of newspapers approved by APRA (Dispensation Order 3(a), s 191(2)(b) of the Act, reg 9.02(1) of the Regulations);

(b) make available on a dedicated webpage a copy of the Notice of Intention, Scheme document, Scheme Summary, and actuarial reports (Dispensation Order 3(b));

(c) include links to the dedicated webpage on the help and support page on AIAA’s website and the Life Insurance, Annuities and Investment Growth Bond product information pages of CBA’s website (Dispensation Order 3(c));

(d) establish dedicated email addresses specified in the Notice of Intention to receive enquiries about the Scheme (Dispensation Order 3(d));

(e) establish an online feedback form on the webpage to receive enquiries about the Scheme (Dispensation Order 3(e));

(f) mail out a copy of the formal notification letter enclosing the Scheme Summary to policy owners of CMLA policies and certain previous policy owners of CMLA life policies (Dispensation Orders 3(f)–(i));

(g) from 20 January 2021 to 12 February 2021, make a copy of the Scheme document, Scheme Summary, Notice of Intention and actuarial reports available for public inspection from 9:00am to 5:00pm each weekday at particular locations in each State and Territory (Dispensation Order 3(j), reg 9.02(4) of the Regulations);

(h) establish a Scheme Contact Centre with trained staff to handle calls about the Scheme (Dispensation Orders 3(k) and (l));

(i) provide on request a copy of the Scheme document, Scheme Summary, Notice of Intention and actuarial reports to any affected policy owners of AIAA or CMLA free of charge (Dispensation Order 3(m), s 191(4) of the Act); and

(j) provide a general overview of the Scheme to specific financial advisers, group insurance administrators and brokers and industry partners (Dispensation Order 3(n)).

36 The evidence filed by the applicants at the confirmation hearing shows that the Dispensation Orders and requirements under the Act and Regulations were largely complied with. The applicants brought to my attention a few minor instances of non-compliance with the Dispensation Orders, which are addressed in turn below. In each instance, I find that the non-compliance was of such a nature so as to not affect the exercise of my discretion to confirm the Scheme.

Scheme webpages and email addresses

37 Annexure SM-20 to the Second Moore Affidavit is a copy of the Notice of Intention as published in the Gazette. Copies of the tear sheets showing publication of the Notice of Intention in each of the specified newspapers were provided as Annexure MM-19 of the Second Moss Affidavit. Correspondence confirming the establishment of the Scheme Webpage is set out at Annexure MM-20 of the Second Moss Affidavit. The Scheme Webpage also included the online feedback form required under Dispensation Order 3(e). Screenshots of the established webpage were included as Annexure MM-21 to the Second Moss Affidavit. Mr Moss reports in the Third Moss Affidavit that from 18 January to 2 March 2021, there were 720 unique visitors to the Scheme Webpage; 31 unique downloads of the Notice of Intention; 50 unique downloads of the Scheme Document; 64 unique downloads of the Scheme Summary; and 56 downloads of the initial actuarial reports.

38 On and from 18 January 2021, the applicants included a link to the Scheme Webpage on the AIAA help and support webpage and the Life Insurance product information page on CBA’s website. However, a link to the Scheme Webpage was not included on the Annuities and Investment Growth Bond product information webpages on CBA’s website. This error was rectified by the applicants on 3 February 2021: see [15] of the Second Moss Affidavit. A report annexed to the Third Moss Affidavit shows that there were 2,008 unique visitors to either one or both of the CBA Annuities and Investment Growth Bond product information pages from 18 January 2021 to 3 February 2021 before the link was included on those webpages; 82 of those visitors returned to the webpages after the link was included. The identity of those visitors could not be ascertained. There were 3,575 unique visitors to the webpages from 3 February 2021 to 2 March 2021 after the links were established. The applicants submitted that this non-compliance with Dispensation Order 3(c) should not affect the Court’s consideration of whether to exercise its discretion to confirm the Scheme for the following reasons: the number of unique visitors to the webpages in the relevant timeframe is relatively small compared to the number of policy owners who were mailed copies of the formal notification letter and the Scheme Summary; there were several other avenues through which affected policy owners could obtain information about the Scheme; the non-compliance was only for a period of two weeks; and it is possible that not all of the unique visitors to the webpage were affected policy owners. I respectfully agree with the applicants’ submissions. It is unlikely that the non-compliance adversely affected policy owners.

39 The applicants established two dedicated email addresses which were specified in the Notice of Intention. In the Second Moss Affidavit, Mr Moss explained that shortly after 18 January 2021, it was discovered that one of the email addresses was not working properly. This issue was rectified on 20 January 2021. Mr Moss confirmed in the Second Moss Affidavit that no email enquiries were sent to the affected email address during the two days in which it was non-functional.

Mail out of formal notification letter

40 Mr Moss stated in the Second Moss Affidavit that the applicants successfully sent copies of the formal notification letter to approximately 506,000 individual policy owners and 67 group policy owners, being superannuation trustees or employers which hold life insurance policies for the benefit of their beneficiaries or employees. As at 2 March 2021, approximately 6,104 letters had been “returned to sender”: Annexure MM-48 to the Third Moss Affidavit. In response to those letters that had been “returned to sender”, Mr Moss at [18] of the Third Moss Affidavit explained that 3,948 SMS messages and emails had been sent to policy owners; 288 financial advisers had been contacted, representing approximately 817 policy owners; and 84 policy owners had updated their mailing address and had been sent a formal notification letter to that new address. Under CMLA’s returned mail procedure, the applicants were to attempt to locate a new mailing address for a CMLA affected policy owner from CMLA’s administration systems before attempting to contact the policy owner by another means. Mr Moss explained that this procedure was not followed due to the number of large letters that were returned. Instead, the applicants opted to attempt to contact the policy owners by SMS or email where such details existed or through their financial advisers. While this technically constitutes non-compliance with the Dispensation Order 3(h), which required the applicants to follow CMLA’s returned mail procedure, I do not consider that this would have adversely affected policy owners given the other effective measures taken to contact them.

41 A copy of the Scheme Summary was also included in “Welcome Packs” of 53 persons who became CMLA policy owners on or from 18 January 2021 to 2 March 2021 and 44 persons who were transferees of existing CMLA policies on and from 18 January 2021 to 2 March 2021: Third Moss Affidavit at [13].

42 Annexure MM-34 of the Second Moss Affidavit shows that, as at 18 January 2021, CMLA did not hold a record of a current mailing address for 30,517 policy owners. Dispensation Order 3(i) required CMLA to attempt to contact those policy owners in accordance with its returned mail procedure. As at 2 March 2021, 6,422 SMS messages and emails had been sent to those policy owners; 1,053 financial advisers had been contacted, representing approximately 8,835 policy owners; and 49 policy owners had updated their mailing address and had been sent a formal notification letter to their new address: Annexure MM-48 of the Third Moss Affidavit.

43 Mr Moss noted in the Third Moss Affidavit that, as at 3 March 2021, the CMLA product administration teams were still in the process of obtaining SMS and/or email addresses for approximately 172 CMLA policy owners from CBA administration systems.

Public inspection

44 Information about the public inspection period is set out in annexures to the First Moore Affidavit. Annexure SM-16 shows that during the public inspection period one person attended the inspection site in Hobart and one person attended the inspection site in Adelaide. No persons attended the inspection sites in the remaining States and Territories. Mr Moore explained at [19]–[22] of the First Moore Affidavit that Western Australia imposed a lockdown across Perth from 1 February 2021 to 5 February 2021, which would have prevented policy owners attending the Perth inspection site, being the office of the applicants’ solicitors, during that time. As a consequence, the Scheme document was not open for public inspection at the Perth inspection site for a period of at least 15 days within the period referred to in the Notice of Intention. I note that the Perth inspection site was open for 12 days and no persons attended the inspection site during the public inspection period before or after the lockdown. Mr Moore also explained at [22] of the First Moore Affidavit that no policy owners made a complaint to the solicitors for the applicants regarding their inability to inspect the documents, nor did any person attend the office following the end of the public inspection period up to 22 February 2021 in an attempt to inspect the documents. At [49]–[50] of the Second Moss Affidavit, Mr Moss stated that no affected policy owners made a complaint to the applicants regarding their inability to inspect the documents during the Perth lockdown. During the period of lockdown, policy owners could have obtained a copy of the Scheme documents by contacting the telephone numbers and email addresses set out in the Notice of Intention and by accessing the applicants’ websites. In these circumstances, I do not consider this failure to comply strictly with reg 9.02(4) of the Regulations to be fatal to the application: Re Armstrong Jones Life Assurance Limited [1997] FCA 377; 74 FCR 160 at 162; Royal & Sun 104 FCR at 40 [18] and 42 [33]; and MLC Lifetime [2006] FCA 1367 at [11]–[12].

45 Application to the Court for confirmation has been made after the period of public inspection in compliance with reg 9.03 of the Regulations: see Re Armstrong Jones 74 FCR 160 at 163; and Royal & Sun 104 FCR at 39 [11].

Establishment of a Scheme Contact Centre

46 Annexure MM-36 of the Second Moss Affidavit shows that a Scheme Contact Centre with a dedicated toll free phone number was established on 19 January 2021. Annexure MM-37 of the Second Moss Affidavit sets out the timeline and calendar for the training program for Scheme Contact Centre staff.

Requests for documents from affected policy owners

47 Section 191(4) of the Act requires the applicants to provide on request a copy of the Scheme document, the Scheme Summary, the Notice of Intention or the actuarial reports to any affected policy owners free of charge. At [23] of the Third Moss Affidavit, Mr Moss confirmed that the applicants received 24 requests for one or more of the documents listed above, and that those requests were complied with.

Provision of general overview to certain persons

48 In accordance with Dispensation Order 3(n), the applicants provided a general overview of the Scheme to certain financial advisers, financial advice licensees, group insurance administrators and brokers, and industry partners. The information provided to those persons is set out in Annexures MM-39 to MM-41 of the Second Moss Affidavit.

Feedback regarding the Scheme

49 Annexure MM-48 to the Third Moss Affidavit contains a report summarising the enquiries, complaints and feedback received by the applicants in relation to the Scheme as at 2 March 2021. Mr Moss summarised the report at [24]–[25] of the Third Moss Affidavit. Of the 1,284 enquiries received via the Scheme website and Scheme Call Centre, 589 were general enquiries regarding the Scheme and 45 were complaints or concerns regarding the Scheme. Two individuals indicated that they intended to attend the confirmation hearing. One individual, Mr Kanak, a former policy owner whose policy had expired in 2020, attended the confirmation hearing and made submissions. I will return to the issues raised by Mr Kanak concerning the applicants’ current remediation programs in due course.

Assessment of the Scheme

50 Mr van Koert’s Initial and Supplemental Reports considered the interests of AIAA policy owners immediately prior to the Scheme Effective Date (Existing AIAA Policy Owners), as well as the interests of underlying beneficiaries, including the members of superannuation funds or group insurance scheme members whose lives are insured under the policies. Likewise, Mr Della’s reports considered the interests of CMLA policy owners immediately prior to the Scheme Effective Date (Existing CMLA Policy Owners) and underlying beneficiaries. Messrs van Koert and Della both state in their Initial Reports that the development of their reports and the underlying analysis was undertaken collaboratively between the actuarial teams of CMLA and AIAA, as these teams regularly work in conjunction with each other under the Joint Cooperation Agreement. As a result of this collaboration, the structure of the reports and conclusions reached by Messrs van Koert and Della were largely common.

51 Mr van Koert concluded in his Initial Report that the proposed Scheme will not materially prejudice Existing AIAA Policy Owners, in particular Mr van Koert concluded that the Scheme will not adversely impact their contractual benefits and rights or reasonable benefit expectations, and the security of Existing AIAA Policy Owners’ benefits will continue to be appropriate post-transfer. Mr Della concluded in his Initial Report that the Scheme will not materially prejudice Existing CMLA Policy Owners, in particular the Scheme will not adversely impact the contractual benefits and rights or reasonable benefit expectations of Existing CMLA Policy Owners, and the security of Existing CMLA Policy Owners’ benefits will continue to be appropriate following the Scheme.

52 Messrs van Koert and Della both prepared Supplemental Reports, which considered developments since the writing of their Initial Reports, including updated financial information, business changes and changes to the external environment. Messrs van Koert and Della both stated that their conclusions in their Initial Reports were not affected by the information contained in their respective Supplemental Reports.

53 Mr Goodsall formed the following opinions in his Initial Report, based on his review of the proposed Scheme:

(a) The proposed Scheme will not materially prejudice the interests of policy owners of CMLA and AIAA;

(b) The security of benefits for policy owners of CMLA and AIAA is maintained;

(c) The changes to the contractual references contained in the Scheme are necessary to give effect to the Scheme and will not adversely affect the contractual rights or benefits of policy owners of CMLA or AIAA; and

(d) There will not be any adverse impact on reasonable benefit expectations of policy owners of CMLA and AIAA.

54 Mr Goodsall’s Supplemental Report considered the impact of the developments set out in the Supplemental van Koert and Della Reports. Mr Goodsall stated that these developments did not affect the opinions reached in his Initial Report.

Policy owner benefit expectations

55 In assessing policy owner benefit expectations, Mr Goodsall considered the applicants’ product and pricing strategies, claims management, investment management, management of participating business/bonus philosophy, and administration systems. Having considered the impact of the Scheme, Mr Goodsall concluded that there is no material adverse impact on policy owner benefit expectation as a result of the Scheme. Mr Goodsall noted at section 6.5 of his Initial Report that the operation of the Joint Cooperation Agreement helps to mitigate the operational risk of the combination of the two businesses as they have been running under a combined management structure since 1 November 2019.

Product and pricing strategies

56 Mr Goodsall explained at section 6.11 of his Initial Report that CMLA and AIAA both have product and pricing policies that set out minimum and target pricing and profitability thresholds, requirements for achieving fair and reasonable outcomes for customers, and the process for the regular review of pricing.

57 Section 3.3 of the Initial van Koert Report and Initial Della Report outline the product and pricing strategies of CMLA and AIAA, noting that, following entry into the Joint Cooperation Agreement, the product and pricing teams of the different lines of business of CMLA and AIAA are being integrated. Messrs van Koert and Della report that the product management and pricing policies of AIAA and CMLA have been updated such that they are consistent and appropriate for the ongoing management of the combined business. Sections 4.5 and 4.6 of the Initial van Koert Report and Initial Della Report state that the Scheme is not expected to change the current product and pricing plans, governance framework, or product terms and conditions for the existing AIAA or CMLA business. Mr Goodsall concluded at section 6.11 of his Initial Report that CMLA and AIAA’s product management and pricing policies have been aligned to substantially maintain the current CMLA pricing criteria and customer outcomes for CMLA products so that there are no material changes to CMLA pricing thresholds and consideration of customer outcomes as a result of the Scheme.

58 Mr Goodsall noted at section 6.14 of his Initial Report that expenses for the combined business are anticipated to reduce over time compared to the separate businesses due to improved economies of scale, which may benefit some policy owners through lower pricing in the future. Mr van Koert also noted in his Initial Report that the structural changes brought about by the Scheme are expected to reduce expenses in the long term due to improved economies of scale, which may have a positive effect on policy owner premium rates in the future.

Management of Unit-Linked Business

59 Mr Goodsall noted at section 6.9 of his Initial Report that the existing assets and individual investment strategies for CMLA’s unit-linked products will be maintained under the Scheme. Mr Goodsall explained that CMLA and AIAA have consistent unit pricing and remuneration policies. Mr Goodsall also noted that the separate CMLA and AIAA unit pricing systems will continue to be used for their respective Unit-Linked Statutory Funds. Mr Goodsall therefore concluded that there is no adverse impact on the ongoing management of CMLA and AIAA unit-linked business as a result of the Scheme.

Bonus Philosophy for Participating Business

60 At section 6.10 of his Initial Report, Mr Goodsall explained that the relevant CMLA and AIAA policies provide for policy owners to participate in a share of profits in the Statutory Fund to which they belong. Depending on the product, the profits are distributed by a bonus, by an allocation of interest to a policy account balance or by cash. Subject to the Act and policy terms and conditions, the distributed amount is determined at the discretion of the insurer. Mr Goodsall explained that CMLA and AIAA determine distributions on the advice of their actuaries in accordance with bonus philosophy policies. As explained above, the Sub-Funds within each Statutory Fund will be maintained following the transfer. This ensures that the structures for maintaining equity between different policy owner groups and facilitating the determination of distributions to participating policies remain unchanged. The current asset portfolios and individual investment strategies will be maintained within each Sub-Fund. Mr Goodsall noted that the AIAA Dividend and Bonus Declaration Policy has similar provisions to the current CMLA Bonus Philosophy Policy and has been amended to accommodate CMLA post-transfer. At section 6.14 of his Initial Report, Mr Goodsall explained that, to avoid any excessive increases to expenses, the AIAA Policyholder Dividend and Bonus Declaration Policy has been amended to limit the expenses of both the CMLA and AIAA participating business to current levels plus future inflation increases. Consequently, Mr Goodsall concluded that participating policies are not subject to any change in the way expenses are allocated to them.

Claims management

61 In section 3.4 of the Initial van Koert Report and Initial Della Report, the actuaries noted that following the Joint Cooperation Agreement the claims teams of AIAA and CMLA are now under single management and are in the process of assessing and harmonising AIAA’s and CMLA’s claims practices and processes. Mr van Koert explained that this work will continue regardless of whether the Scheme is confirmed and will be complete by mid-2021. Mr van Koert stated that management intends to have a consistent approach for both businesses that maintains or improves the overall claims management for policy owners of each company. Mr Goodsall concluded at section 6.12 of his Initial Report that policy owner claim benefits and the conditions to be fulfilled to make a claim are not changed as a result of the Scheme. Mr Goodsall noted that the runoff of some CMLA business will result in a reducing level of claims that is expected to free up resources to service future claimants.

Customer service

62 Mr Goodsall noted at section 6.13 of his Initial Report that the IT systems used to administer CMLA policies will transfer to AIAA with the business and continue to be used to administer the CMLA policies. AIAA systems will continue to administer AIAA policies. Based on the operation of the Joint Cooperation Agreement to date, Mr Goodsall concluded that the service levels and customer experience are not expected to be impacted by the Scheme.

Benefit security

63 Policy owner benefit security relates to the insurer’s ability to pay policy benefits when due. In his Initial Report, Mr Goodsall considered the impact of the Scheme on the financial position of each Statutory Fund, as well as the applicants’ investment strategies, risk management frameworks and reinsurance, concluding that there is no material adverse impact on policy owner benefit security as a result of the Scheme.

Capital management and financial strength

64 Two preliminary comments can be made about the financial strength of AIAA post-implementation of the Scheme, referred to below as the Combined Entity. First, Messrs van Koert and Della noted in their Initial Reports that AIAA’s parent entity AIA Company is financially strong and the AIA Group has shown its continued commitment to the Australian market through its financial and business support, enabling strong growth by AIAA and its proposed acquisition of the CMLA business (excluding CMLA’s interest in BoCommLife). Second, Messrs van Koert and Della both stated at section 5.3.2 of their Initial Reports that the Combined Entity will have a more diversified risk profile as compared to the standalone entities, which benefits policy owner security since the profitability of one part of the business can provide support to another in the case of adverse experience.

65 As Mr Goodsall explained at sections 3.2 and 6.16 of his Initial Report, the financial strength of a life insurance company is generally measured through its capital position. The capital management of a life company is regulated by APRA under the Act and a series of prudential standards setting out required frameworks and minimum levels of capital to be held by life insurers. The APRA standards require a life insurer to hold a minimum amount of capital to meet the Prudential Capital Requirement (PCR), which consists of the Prescribed Capital Amount (PCA) and a discretionary supervisory capital adjustment which APRA may impose on individual insurers. The PCA is the minimum capital a life company is required to hold to meet liabilities in a range of adverse circumstances, which is determined in accordance with Life Prudential Standards issued by APRA. The Capital Base of a life company is its net assets less regulatory adjustments specified in the Life Prudential Standards. The capital position of a life company is the excess of the Capital Base over the PCA. This is referred to as the “capital in excess of PCA” and is indicated by the Capital Adequacy Multiple (CAM), which is the ratio of the Capital Base to the PCA. Insurers also hold further capital, referred to as a Target Surplus, to minimise the probability of not meeting the regulatory capital requirements.

66 Mr Goodsall noted in his Initial Report that CMLA and AIAA both have comprehensive capital management frameworks in place. At section 3.6 of the Initial van Koert Report, Mr van Koert explained that AIAA’s capital levels are managed in accordance with AAIA’s Capital Management Framework and AIAA’s Internal Capital Adequacy Assessment Process Summary Statement. This includes taking appropriate action to restore the capital position if capital levels drop below the targeted level of capital, as well as paying out sustainable dividends if capital levels exceed the targeted level of capital. At section 4.9, Mr van Koert explained that AIAA’s Capital Management Framework will continue unaffected post-transfer, and that AIAA’s policies are appropriate for the larger entity and can accommodate CMLA’s transferring business. Mr van Koert noted that in respect of Prudential Capital and Target Surplus requirements, capital margins and methodology will continue to apply for each portfolio of business in the Combined Entity immediately following the Scheme Effective Date. Over time and where appropriate, these are expected to be harmonised. Mr van Koert stated at section 5.3.3 of his Initial Report that there will be no change in applicable statutory capital requirements or standards as a result of the Scheme. The approaches to prudential capital management, Target Surplus, stress and scenario testing and dividend philosophy are materially the same for the applicants and provide security to the benefits in the Combined Entity. Mr van Koert concluded that AIAA’s capital management framework is appropriate for the management of the Combined Entity and can accommodate the existing CMLA business.

67 Mr Goodsall stated at section 6.16 of his Initial Report that he has compared the capital management frameworks of CMLA and AIAA and concluded that the current AIAA framework, which will apply to CMLA policies post-transfer, is suitable to the combined business. Mr Goodsall noted that the AIAA capital policies have been amended to provide for the integration of CMLA policies so that Prudential Capital, Target Surplus Requirements, capital margins and methodology will largely continue to apply for each portfolio of business after the transfer.

68 Mr Goodsall concluded that CMLA and AIAA each meet or exceed the APRA regulatory requirements and the Combined Entity will also meet or exceed the APRA regulatory requirements and AIAA’s Target Surplus requirements in each fund. The financial positions of each entity pre- and post-transfer are set out below. Mr Goodsall explained in his Initial Report that it is reasonable to consider the impact of the transfer on the financial security of the policy owners by comparing the actual financial position of each company with a pro-forma of the Combined Entity as if the transfer had occurred on 30 June 2020. Mr Goodsall concluded that, based on the financial information provided in the Initial Reports of Messrs van Koert and Della, the Scheme is expected to have no impact on the Unit-Linked Funds and a small improvement in the financial position for the Statutory Funds that combine to form AIAA SF1 in the Combined Entity.

69 Table 3 to the Initial van Koert Report shows that, as at 30 June 2020, the total AIAA entity had net assets of $2865m, a Capital Base of $522m, $197m in capital in excess of PCA and a CAM of 161%. AIAA’s SF1 had net assets of $933m, a Capital Base of $461m, capital in excess of PCA of $137m and a CAM of 142%. The AIAA SHF had net assets of $1,931m, a Capital Base of $60m, capital in excess of PCA of $60m and a CAM of >999%.

70 At section 4.10.1 of the Initial Della Report, Mr Della outlined CMLA’s financial position as at 30 June 2020 as follows:

(a) CMLA SF 1 had net assets of $248m, a Capital Base of $328m and capital in excess of PCA of $111m, producing a CAM of 152%.

(b) CMLA SF1L had net assets and a Capital Base of $6m, capital in excess of PCA of $4m and a CAM of 277%.

(c) CMLA SF2L had net assets and a Capital Base of $15m, capital in excess of PCA of $6m and a CAM of 167%.

(d) CMLA SF3 had net assets of $75m, a Capital Base of $100m, capital in excess of PCA of $31m and a CAM of 145%.

(e) CMLA SF4 had net assets and a Capital Base of $4m, capital in excess of PCA of $3m and a CAM of 474%.

(f) CMLA SF5 had net assets of $321m, a Capital Base of $460m, capital in excess of PCA of $134m and a CAM of 141%.

(g) The CMLA Statutory Funds in total had net assets of $669m, a Capital Base of $913m, capital in excess of PCA of $290m and a CAM of 147%.

(h) The CMLA SHF had net assets of $563m, a Capital Base of $750m, capital in excess of PCA of $248m and a CAM of 149%.

(i) The total CMLA entity, excluding its interest in BoCommLife, had net assets of $868m, a Capital Base of $1,113m, capital in excess of PCA of $488m and a CAM of 178%.

71 Mr Goodsall noted at sections 3.2 and 4.2 of his Initial Report that these figures for CMLA and AIAA included allowance for the risks resulting from the Covid-19 pandemic. Mr Goodsall stated that the figures showed that each Statutory Fund is well capitalised, noting that the Unit-Linked Funds have fewer risks than other funds and do not generally require large amounts of capital.

72 As explained above, at the Scheme Effective Date, the assets and liabilities of CMLA’s Statutory Funds 1, 3 and 5 will be transferred to AAIA’s Statutory Fund 1 and CMLA’s Statutory Funds 1L, 2L and 4 will be transferred to AAIA as-is to become new AIAA Statutory Funds 1L, 2L and 4. AAIA’s pre-existing Unit-Linked Fund SF3 will remain unchanged. Table 4 to the Initial van Koert Report shows the pro-forma capital position for the Combined Entity at the proposed transfer, as at 30 June 2020, as follows:

(a) AIAA SF1 (comprising of the former CMLA SF1, SF3 and SF5 and AIAA SF1) will have net assets of $1571m, a Capital Base of $1440m, capital in excess of PCA of $583m and a CAM of 168%.

(b) AIAA SF1L (formerly CMLA SF1L) will have net assets and a Capital Base of $6m, capital in excess of the PCA of $4m and a CAM of 277%

(c) AIAA SF2L (formerly CMLA SF2L) will have net assets and a Capital Base of $15m, capital in excess of $6m and a CAM of 167%.

(d) AIAA SF4 (formerly CMLA SF4) will have net assets and a Capital Base of $4m, capital in excess of PCA of $3m and a CAM of 474%.

(e) The AIAA Statutory Funds in total will have net assets of $1596m, a capital base of $1466m, capital in excess of PCA of $597m and a CAM of 169%.

(f) The AIAA SHF will have net assets of $959m, a Capital Base of $112m, capital in excess of PCA of $109m and a CAM of >999%.

(g) The Combined Entity in total will have net assets of $2555m, a Capital Base of $1,578m, $707m in capital in excess of PCA and a CAM of 181%.

73 Mr Goodsall noted that there was a reduction of $6m in the net assets of the combined AIAA SF1. However, the regulatory adjustments in the combined AIAA SF1 reduced by $98m and the PCA in the combined AIAA SF1 also reduced by $78m, resulting in an overall increase in the Capital Base of $91m and an overall increase in the capital in excess of PCA of $170m. The CAM therefore increased to 168% from 142% in the former AIAA SF1, 152% in CMLA SF1, 145% in CMLA SF3 and 141% in CMLA SF5. Mr Goodsall explained in section 6.16 of his Initial Report and in oral evidence that the PCA reduced because under the relevant prudential standards set by APRA, the combination of the assets and liabilities of the CMLA and AIAA Statutory Funds provides increased diversification of risk compared to the standalone funds.

74 Mr Goodsall also noted that there are large offsetting movements in the AIAA SHF from the Scheme, resulting in a net decrease in Shareholder’s Fund Base Capital of $147m. This reflects the payments that will be made by AIAA to complete the Scheme. Mr Goodsall noted that the purchase price for the Scheme has been satisfied through a series of payments and a capital return from CMLA, with a final payment expected to be made by AIAA shortly before the Scheme Effective Date. Mr van Koert explained at section 3.14 of his Initial Report that the payments have been funded by capital injections made by AIA Company into AIAA since 30 June 2020. Mr Goodsall noted that the payments, capital injections and capital return that have been or will be made after June 2020 to fund the transfer have been included in the pro-forma financial position of the Combined Entity post-transfer.

75 The Supplemental van Koert Report and Supplemental Della Report provide updated financial information for CMLA and AIAA as at 31 December 2020. Table 2 to the Supplemental van Koert Report shows the financial position of AIAA’s SF1 as at 31 December 2020 to include net assets of $879m, a Capital Base of $449m, capital in excess of PCA of $161m and a CAM of 156%. The AIAA SHF had net assets of $1885m, a Capital Base of $111m, capital in excess of PCA of $110m and a CAM of >999%. The total AIAA business had net assets of $2765m, $272m in capital in excess of PCA and a CAM of 195%. Table 1 to the Supplemental Della Report shows that at 31 December 2020:

(a) CMLA’s SF1 had net assets of $242m, a Capital Base of $302m, capital in excess of PCA of $112m and a CAM of 159%.

(b) CMLA’s SF1L had net assets and a Capital Base of $7m, $5m in capital in excess of PCA and a CAM of 320%.

(c) CMLA’s SF2L had net assets and a Capital Base of $17m, $8m in capital in excess of PCA and a CAM of 185%.

(d) CMLA’s SF3 had net assets of $114m, a Capital Base of $133m, $48m in capital in excess of PCA and a CAM of 156%.

(e) CMLA’s SF4 had net assets and a Capital Base of $4m, $3m in capital in excess of PCA and a CAM of 476%.

(f) CMLA’s SF5 had net assets of $308m, a Capital Base of $437m, $161m in capital in excess of PCA and a CAM of 158%.

(g) CMLA’s Statutory Funds in total had net assets of $692m, a Capital Base of $901m, $336 in capital in excess of PCA and a CAM of 160%.

(h) CMLA’s SHF had net assets and a Capital Base of $26m, $21m in capital in excess of PCA and a CAM of 486%.

(i) CMLA in total had net assets of $718m, a Capital Base of $927m, $357m in capital in excess of PCA and a CAM of 163%.

76 Table 3 to the Supplemental van Koert Report shows the pro-forma capital position of the Combined Entity post-Scheme as at 31 December 2020 as follows:

(a) AIAA’s SF1 (comprising of the former CMLA SF1, SF3 and SF5 and AIAA SF1) will have net assets of $1537m, a Capital Base of $1324m, $523m in capital in excess of PCA and a CAM of 165%.

(b) AIAA’s new SF1L, SF2L, and SF4 funds will be in the same financial position as the CMLA SF1L, SF2L and SF4 funds as at 30 December 2020.

(c) The AIAA Statutory Funds in total will have net assets of $1566m, a Capital Base of $1353m, capital in excess of PCA of $540m and a CAM of 166%.

(d) The AIAA SHF will have net assets of $1009m, a Capital Base of $165m, capital in excess of PCA of $164m and a CAM of >999%.

(e) The Combined Entity in total will have net assets of $2575m, a Capital Base of $1518m, $704m in capital in excess of PCA and a CAM of 187%.

77 Messrs van Koert and Della noted in their Supplemental Reports that the PCA for CMLA and AIAA pre-transfer have fallen since June 2020. In the case of CMLA, Mr Della stated that this is primarily due to the implementation of further internal reinsurance and in the case of AIAA Mr van Koert explained that it is due to the impact of repricing work. Messrs van Koert and Della also noted that the capital in excess of PCA in AIAA SF1 and the Combined Entity as a whole post-Scheme is lower than that predicted using the June 2020 figures. This has caused a 3% reduction in the CAM for both AAIA SF1 and the total Statutory Funds.

78 Messrs van Koert and Della both concluded that the updated financials continued to support their conclusions that each Statutory Fund of the Combined Entity as well as the Combined Entity in total will continue to satisfy regulatory capital requirements and are expected to have sufficient assets to meet AIAA’s Target Surplus. Likewise, in his Supplemental Report, Mr Goodsall concluded that the financial information contained in the Supplemental Reports of Messrs van Koert and Della support the opinions reached in his Initial Report.

79 Finally, Messrs van Koert and Della both reviewed the three year projections of the excess assets above PCR for the Statutory Funds on a standalone and combined basis for a range of scenarios, both positive and negative, and concluded (at sections 4.10.2 of their Initial Reports) that:

The results show that each statutory fund and the shareholder fund of the Combined Entity generates capital to sustain the company’s growth and meets or exceeds the regulatory capital requirement and AIAA’s Target Surplus requirements in each of the three years that have been projected.

The capital position of the Combined Entity is also projected to improve over the three years that have been projected. This means that the Combined Entity is anticipated to fund its own capital requirements over the projection period.

Investment strategy and asset allocation

80 At section 6.8 of his Initial Report, Mr Goodsall noted that both CMLA and AIAA manage assets in several Strategy Portfolios, each with its own investment strategy and asset allocations. The CMLA portfolios will be transferred into the new AIAA Statutory Fund structure and managed separately from the existing AIAA portfolios with no change to the investment objectives. At section 5.3.6 of the Initial van Koert Report, Mr van Koert noted that there will be no change in the investment objectives, strategic asset allocations or the management of underlying assets of either AIAA or CMLA’s strategy portfolios. Mr van Koert explained that AIAA’s investment and risk policies will apply to CMLA’s business from the Scheme Effective Date but that these will be amended prior to the Scheme so as to enable the current investment strategy of CMLA assets to continue.

Enterprise risk management

81 Section 4.7 of the Initial van Koert Report and Initial Della Report stated that the Risk Management Framework (RMF) practices and processes of each entity are being harmonised with the intent to have a consistent approach for both businesses. This harmonisation is not impacted by the Scheme. The applicants have already updated their respective Risk Appetite Statements so that they are consistent and will continue to be so for the Combined Entity. Messrs van Koert and Della both concluded that AIAA’s risk policies are appropriate for the larger entity post-transfer and can accommodate CMLA’s transferring business.

Reinsurance arrangements

82 At section 6.18 of his Initial Report, Mr Goodsall explained that CMLA and AIAA have similar reinsurance retention levels and resources for managing reinsurance programs. At the Scheme Effective Date, the rights and liabilities under the reinsurance arrangements to which CMLA is a party will become rights and liabilities of AIAA and AIAA will assume the position of CMLA under those reinsurance arrangements. Mr Goodsall concluded in his Initial Report that, while there will be some changes to parts of the reinsurance program, these are expected to be reasonable and consistent with the nature of the larger combined business.

83 At section 4.13 of the Initial van Koert Report, Mr van Koert concluded that existing reinsurance arrangements for AIAA will not be impacted by the transfer, apart from catastrophe cover reinsurance and an intercompany arrangement between AIAA and CMLA. At section 3.10 of the Initial van Koert Report, Mr van Koert explained that AIAA has catastrophe reinsurance cover through two arrangements: a shared reinsurance arrangement with other AIA Group entities where cover is provided by a panel of external reinsurers, and an arrangement with AIA Reinsurance Limited where AIAA is the sole reinsured party. AIAA also has an intercompany reinsurance arrangement under which AIAA reinsures a portion of its retail insurance business to CMLA. Mr van Koert explained that this provides capital benefits to both CMLA and AIAA through the transfer and diversification of risks across both companies. Mr van Koert noted at section 5.3.5 of his Initial Report that the winding up will result in the loss of capital benefits associated with the treaty, but he concluded that the Scheme will provide significantly larger capital benefits.

84 The existing reinsurance arrangements for CMLA’s in-force book will be maintained after the Scheme, with the exception of certain intercompany arrangements and pre-existing catastrophe cover. Section 4.14 of the Initial Della Report stated that CMLA has entered into separate novation deeds for reinsurance arrangements it has with foreign companies and has obtained all consents required to the Scheme under the reinsurance arrangements. Mr Della noted in his Initial Report the CMLA catastrophe cover was due for renewal on 31 December 2020. According to Mr van Koert, management’s intention was to review the applicants’ existing catastrophe cover prior to the Scheme and enter into a new arrangement such that cover will continue uninterrupted on the execution of the Scheme. In his Supplemental Report, Mr van Koert confirmed that management successfully entered into a new arrangement similar to AIAA’s, one suitable for both CMLA and the Combined Entity. This reinsurance arrangement will novate across to AIAA at the Scheme Effective Date, providing protection to Existing CMLA Policy Owners without increasing the catastrophe risk to Existing AIAA Policy Owners.

85 At section 3.10 of his Initial Report, Mr Della explained that in November 2019, CMLA entered into a significant reinsurance arrangement in respect of much of its in-force business. This included a payment to CMLA by the reinsurer to provide capital support, which is expected to be paid back over time through future reinsurance premiums. Mr Goodsall noted that this treaty will remain in place and the AIAA pricing policy has been amended to reflect the benefit already received by CMLA when assessing the ongoing profitability for reinsured CMLA policies.

86 Both Messrs van Koert and Della noted in their Initial Reports that CMLA does not have pandemic reinsurance cover and that it was management’s intention to review AIAA’s pandemic reinsurance cover with an objective to incorporate CMLA within this arrangement prior to the Scheme Effective Date. Mr Goodsall concluded in his Initial Report that this would offer increased reinsurance protection in respect of the CMLA business. Mr Della noted in his Supplemental Report that management concluded in late 2020 that there was limited benefit in procuring pandemic reinsurance for the CMLA business because CMLA already has material amounts of product-level reinsurance. Given the material levels of product-level reinsurance which already exists on the transferring CMLA business, Mr Della concluded that his conclusions as to the benefit security of Existing CMLA Policy Owners are unchanged. Mr van Koert at section 2.2 of his Supplemental Report noted that it was still the intention of management to incorporate CMLA within AIAA’s pandemic reinsurance arrangements and it will continue to investigate expanding AIAA’s pandemic reinsurance to incorporate the transferring CMLA business.

87 Section 2.2 of the Supplemental van Koert Report noted that a new intra-group reinsurance treaty was entered into to wind up the intercompany reinsurance arrangement between AIAA and CMLA at the Scheme Effective Date. Mr Goodsall concluded in his Supplemental Report that these developments in the reinsurance arrangements have no impact on the opinions given in his Initial Report.

Impact of Covid-19

88 Mr Goodsall in his Initial Report noted that the Covid-19 pandemic has had a significant impact on the applicants’ operations. Mr Goodsall stated that adjustments have been made to the operations of the business and reserves have been established at 30 June 2020 to provide for the expected adverse consequences. Messrs van Koert and Della stated in their Initial Reports at section 3.14.1 that they considered the impacts of the Covid-19 pandemic and examined the range of potential scenarios on the financial strength of CMLA and AIAA in considering their opinions.

89 Messrs van Koert and Della noted at section 2.3 of their Supplemental Reports that developments have generally been positive since their Initial Reports, so the conclusions in their Initial Reports were not adversely impacted by any pandemic-related developments.

Liabilities for remediation obligations

90 In correspondence with AIAA which was tendered as Exhibit A at the confirmation hearing, Mr Kanak, a former policy owner whose policy expired in 2020, queried how the rights of customers who had received remediation payments from CBA and CMLA, or who expected to receive such payments in the future, were preserved under the Scheme. Mr Kanak was particularly concerned about the rights of customers who were considered vulnerable by the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, such as customers who identified as Aboriginal or Torres Strait Islander or customers who were ABSTUDY students. Mr Kanak reiterated his concerns at the confirmation hearing on 8 March 2021. The issue raised by Mr Kanak raises broader concerns as to the continuation of remediation programs in relation to CMLA insurance products after the Scheme Effective Date.

91 The form of the Scheme document annexed to the applicants’ originating application contained no express reference to CMLA’s remediation programs. At the confirmation hearing, senior counsel for the applicants submitted that the remediation programs were dealt with in clause 13.3(c) and clause 14 of the Scheme. Clause 13(c) provided that the current liabilities of the CMLA statutory funds become liabilities of AIAA’s relevant statutory funds. Clause 14 dealt with the conduct of the CMLA business after the Scheme Effective Date, which, the applicants submitted, included the continuation of remediation programs. Clause 14(a) stated that AIAA will maintain such policies and practices as are required to enable to it to conduct the CMLA Business in a manner that is consistent with its legal and regulatory obligations and which satisfies the contractual rights and benefits of the CMLA Life Policy Owners.

92 The applicants also referred the Court to the actuarial evidence in which each of the actuaries noted (at section 4.4 of the Initial van Koert Report and Initial Della Report, and section 6.15 of the Initial Goodsall Report) that CMLA is currently implementing a number of remediation programs in respect of various breaches of financial services laws that occurred before the Joint Cooperation Agreement came into effect. The actuaries stated that the programs will continue to be implemented by AIAA under the Scheme. Mr van Koert noted at section 5.3.7 of his Initial Report that AIAA has the benefit of certain contractual indemnification or other contractual protections from CBA in respect of remediation costs, which he viewed as providing appropriate cover for the corresponding liabilities of the transferring CMLA business. Mr Goodsall noted in his Initial Report that costs that may arise as a consequence of the remediation programs will not be passed on to CMLA or AIAA policy owners but will be borne by the shareholders’ assets of AIAA. Mr Goodsall also gave oral evidence to the effect that he had received assurance from management that AIAA intended to continue the remediation programs. Mr Goodsall noted in his oral evidence that the remediation programs were subject to oversight by APRA and the Australian Securities and Investments Commission. Mr Goodsall also referred to the terms of the Transfer Deed entered into by CMLA, AIAA and CBA, which was tendered and marked as Exhibit B. Under clause 9.6 of the Transfer Deed, CBA undertook to fund any future remediation issues that arise in relation to practises of CMLA carried out prior to commencement of the Joint Cooperation Agreement, ensuring that AIAA policy owners would not be required to fund any remediation programs established in the future.

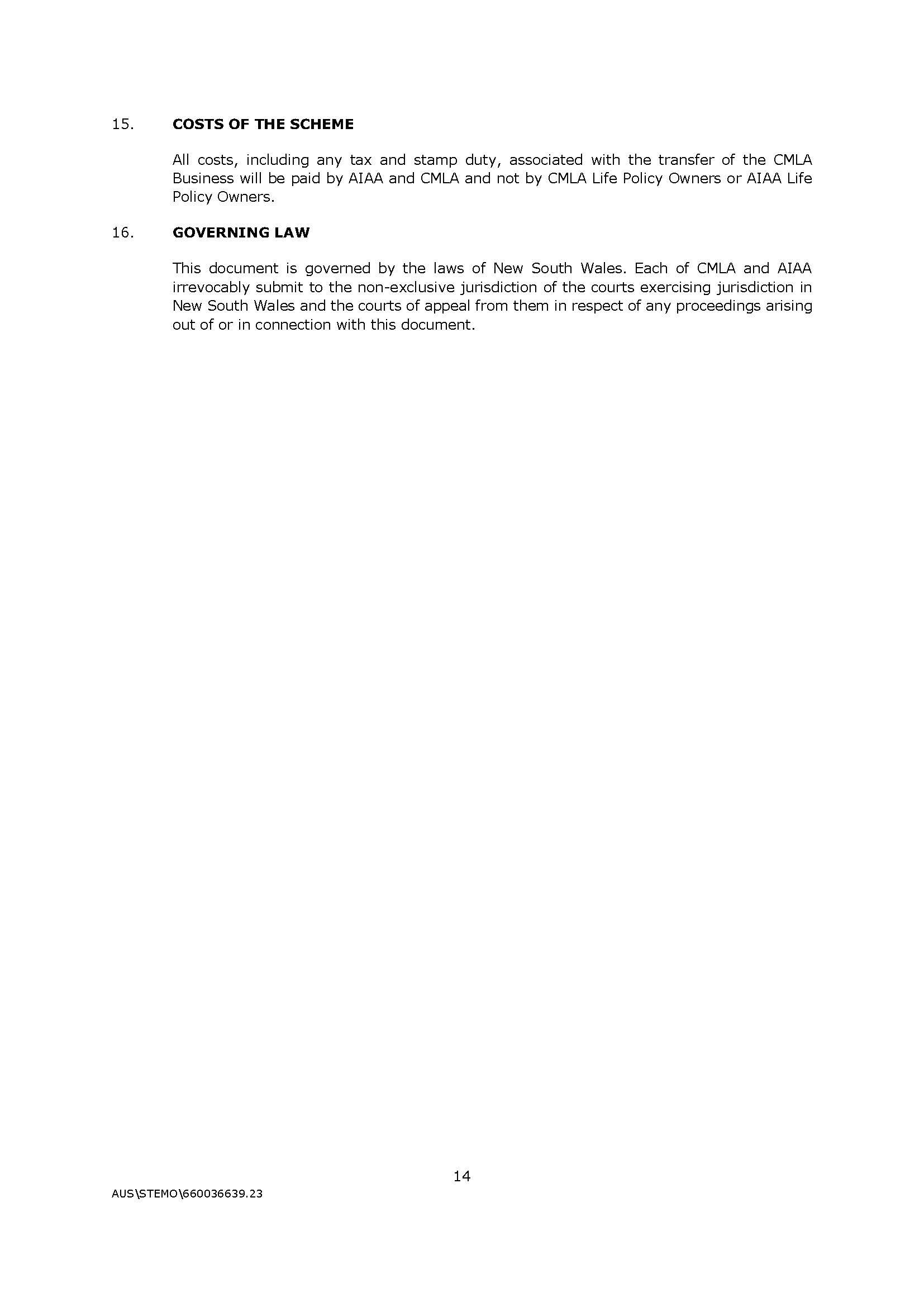

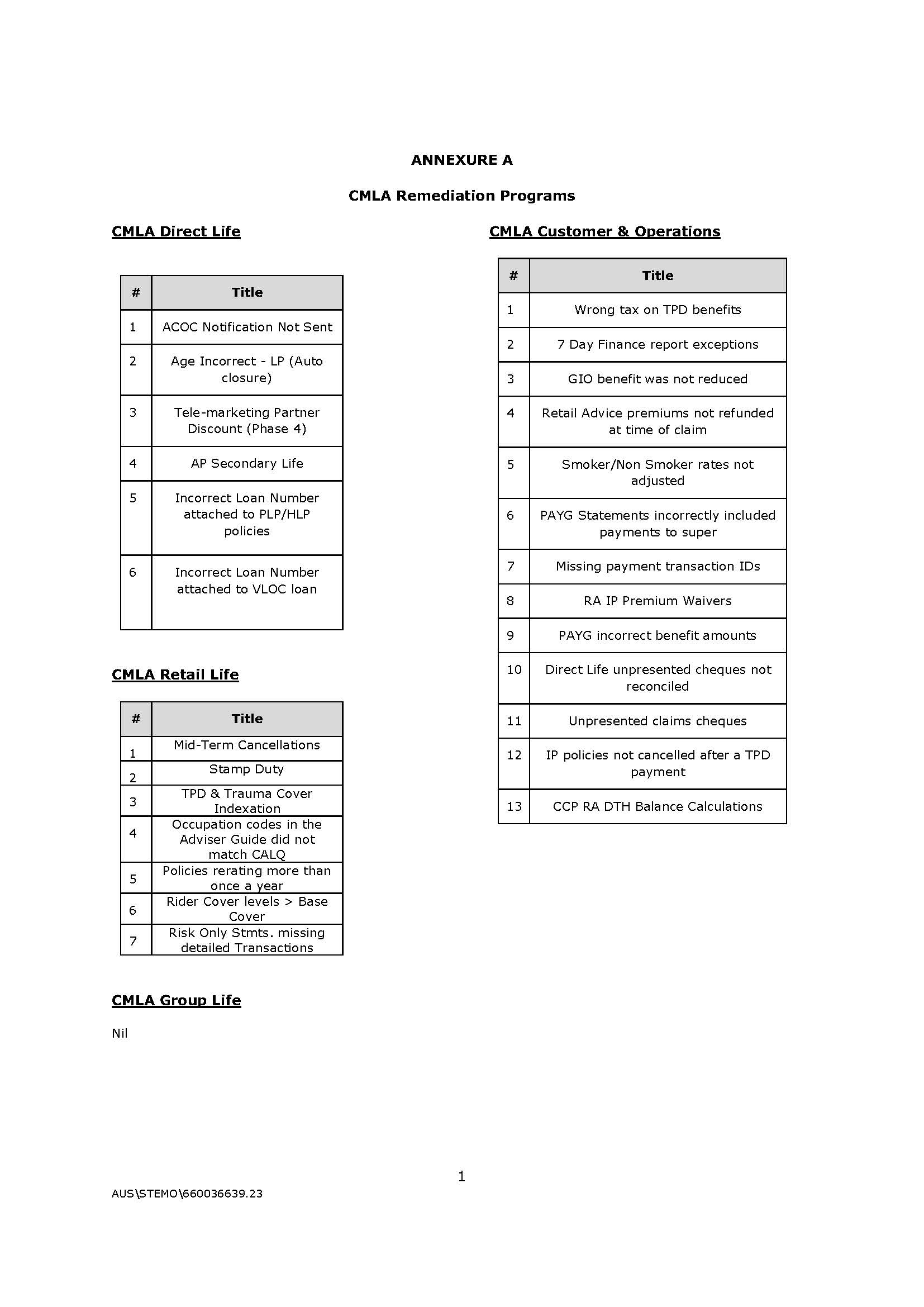

93 The applicants tendered a document containing a list of the 34 open remediation programs managed by CMLA and/or AIAA up to January 2021, which was marked as Exhibit C. Mr Moss gave brief oral evidence as to the nature of the 34 open remediation programs, explaining that the programs affected CMLA’s direct and retail lines of business, its Customer and Operations Team and its Superannuation and Investments business.

94 In her affidavit sworn on 12 March 2021, Ms Cameron gave further evidence in relation to CMLA’s current remediation programs as at 28 February 2021, including the issues being remediated, the number of policies impacted, the quantum of the remediation payments made and the current status of each remediation. Annexure JC-2 to Ms Cameron’s affidavit lists 39 remediation programs, including an additional five programs which were not included in Exhibit C because they were identified in February 2021. Annexure JC-2 shows that 12 of CMLA’s remediation programs are still ongoing, with payments still to be made to affected policy owners. The estimated completion dates of these programs vary from March 2021 to October 2021. The remaining 27 remediation programs were deemed “completed” in the sense that all steps required to contact and refund customers had been completed. Ms Cameron explained that these programs will be closed once further procedural steps have been taken including the approval by a relevant executive that all required actions have been completed appropriately.

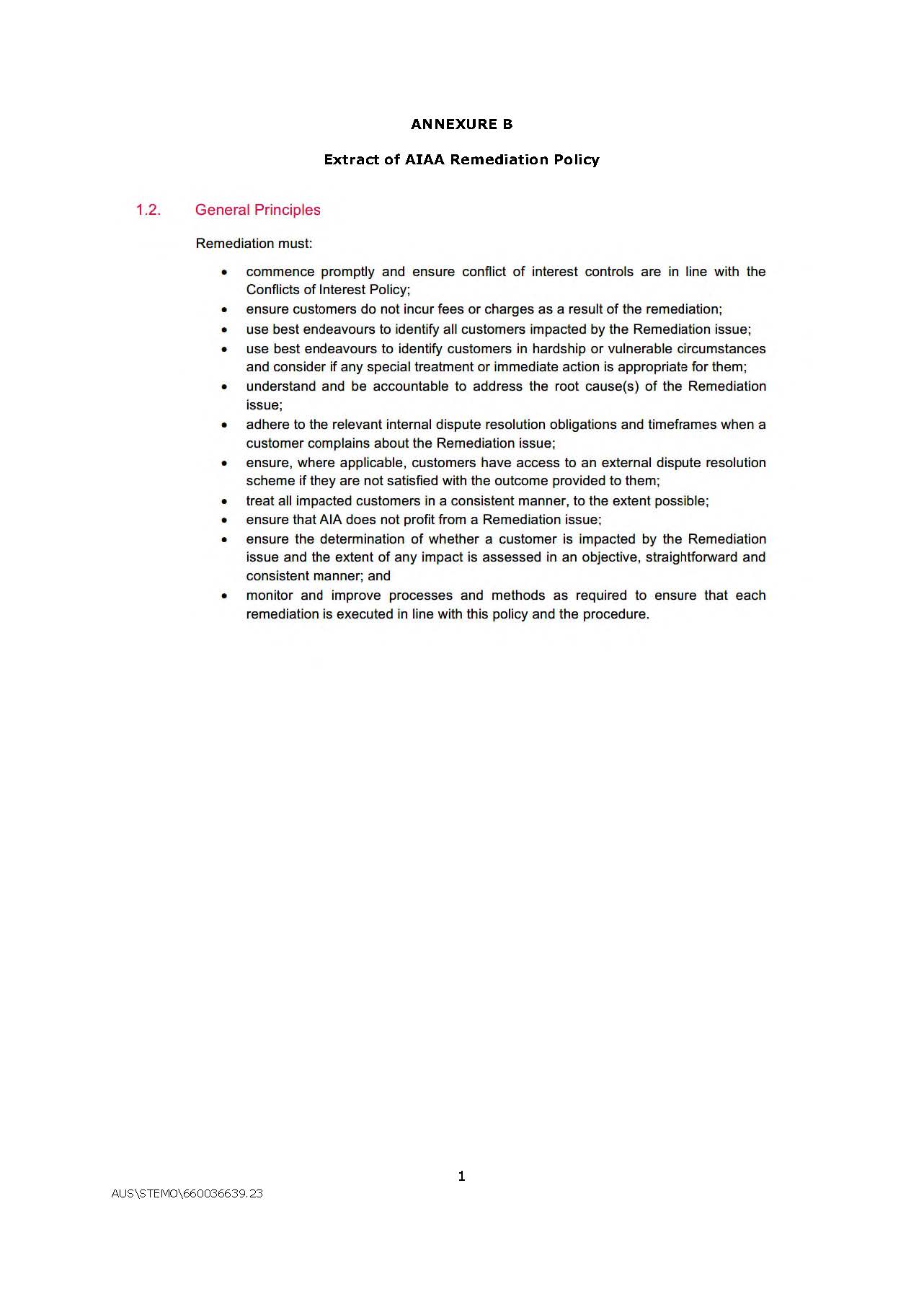

95 Ms Cameron explained that AIAA and CMLA had adopted the same remediation policy for the conduct of their respective remediation programs. Annexed to Ms Cameron’s affidavit is a copy of AIAA’s Remediation Policy. Ms Cameron confirmed that the remediation programs currently being conducted by CMLA, and the governance of those programs, will be continued by AIAA under the AIAA Remediation Policy following the Scheme Effective Date. As AIAA has adopted the same Remediation Policy as CMLA, the conduct and governance of the remediation programs will not be impacted by the Scheme.

96 Ms Cameron explained that she is assisting CBA in a review that it is conducting in relation to its customers who are recorded as going into hardship whilst they held a CCI policy issued by CMLA. Ms Cameron explained that whilst CMLA and AIAA are involved in assisting customers to make relevant claims and in assessing those claims, the review is being conducted by CBA and as such it is not included in the list of CMLA remediation programs in Annexure JC-2. Ms Renner gave further evidence in the First and Second Renner Affidavits about CBA’s broader CCI Program of Action, which includes the review referred to by Ms Cameron. Ms Renner explained that CBA is undertaking a number of remediation projects in relation to Retail Banking Services CCI products, for which CMLA is the insurer. Ms Renner stated that these projects are conducted in accordance with the CBA Group Customer Remediation Projects Policy. CBA will continue to conduct the projects in accordance with this policy and subject to CBA’s continuing engagement with the relevant regulators, regardless of whether the Scheme is confirmed.

97 Outside of its CCI business, Ms Renner explained that CBA is also conducting various remediation activities involving members of superannuation funds operated by Colonial FirstState Investments Limited (CFS), aspects of which involve CMLA policies that are held by or on behalf of those members. Those remediation activities will continue to be conducted by CBA in accordance with the CBA Group Customer Remediation Projects Policy.

98 In response to Mr Kanak’s queries, Ms Cameron explained that customers who identified as Aboriginal or Torres Strait Islander and ABSTUDY students who were impacted by an issue that relates to CMLA will be remediated in accordance with the AIAA Remediation Policy and will continue to be remediated following the Scheme Effective Date. Ms Renner stated in the First Renner Affidavit that members of these groups who fall within the scope of CBA’s remediation activities (such as those who held a CCI policy and fell into hardship but did not make a claim) will be able to participate or continue to participate in the projects regardless of whether the Scheme is confirmed. Ms Cameron explained that Mr Kanak personally received a one-off payment from CMLA in October 2020 in settlement of a complaint made by him to CMLA and the Australian Financial Complaints Authority. Ms Renner stated in the First Renner Affidavit that Mr Kanak was in scope for a remediation project offered by CBA (as opposed to CMLA), but no further action will be taken because Mr Kanak has already been refunded all premiums paid plus interest.

99 On the second day of the confirmation hearing, the applicants tendered an amended Scheme document which included the following new clause 14(d):

On and from the Scheme Effective Date, AIAA will conduct the remediation programs currently being conducted by CMLA as set out in Annexure A in accordance with the General Principles specified in section 1.2 of the AIAA Remediation Policy, as set out in Annexure B.

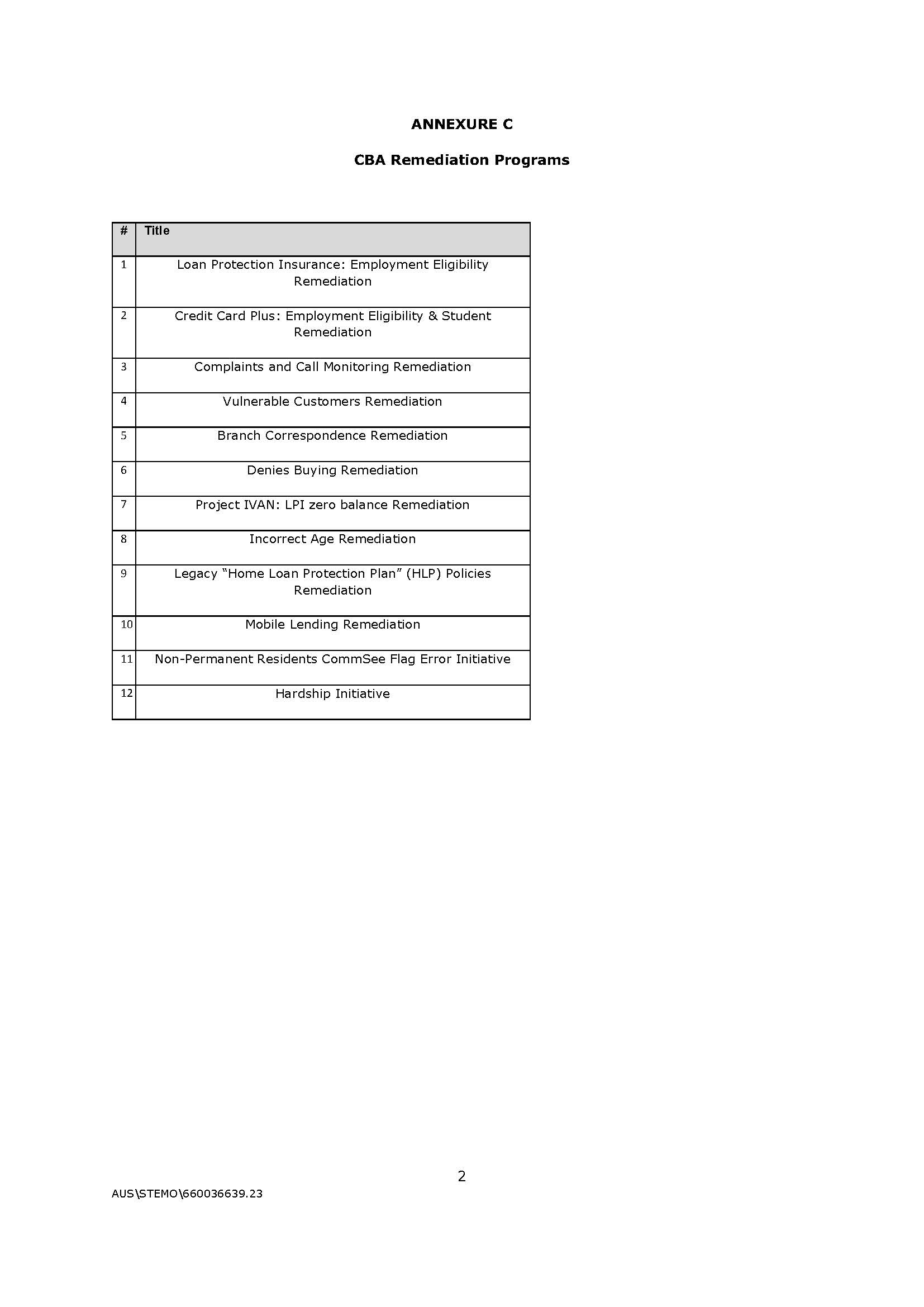

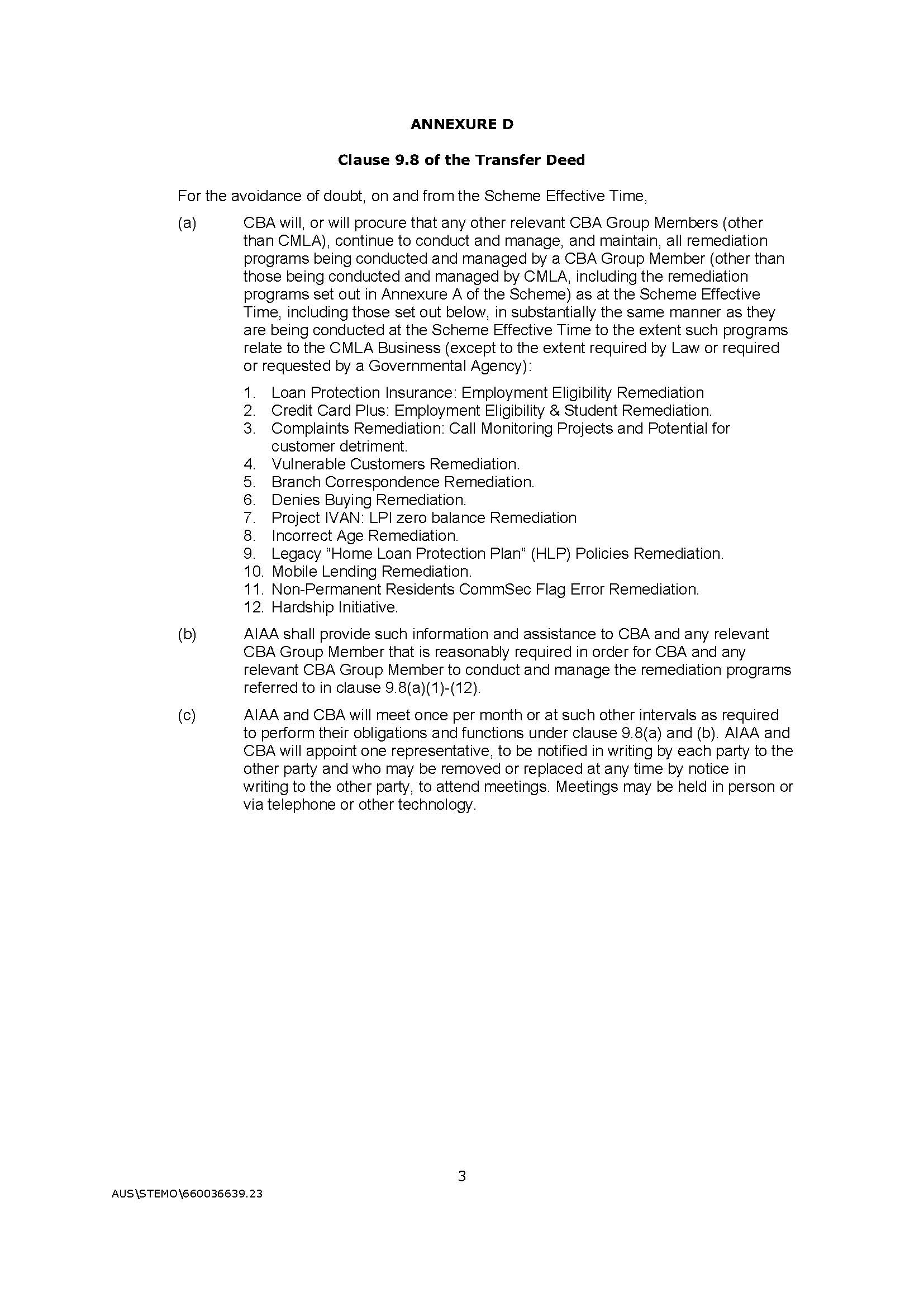

Annexure A lists the 39 open remediation programs referred to in Ms Cameron’s affidavit. Annexure C lists the 12 remediation programs currently being undertaken by CBA in relation to its CCI products. The applicants also added Annexure D, being a new clause 9.8 of the Transfer Deed, which provides that CBA will continue to conduct in substantially the same manner all remediation programs being conducted by a CBA Group Member as at the Scheme Effective Date, including those listed in Annexure C.

100 In the light of these amendments to the Scheme document and the Transfer Deed, contextualised by the evidence of Ms Cameron and Ms Renner, I am satisfied that customers of CMLA who are participating in, or will participate in, remediation activities in relation to CMLA or CBA products will not be adversely affected by the Scheme.

Disposition

101 On the basis of the evidence before the Court which I accepted and in particular the actuarial evidence presented to the Court and the evidence of the applicants’ substantial compliance with the procedural requirements in the Act, Regulations and Dispensation Orders, I was and am satisfied that the Scheme, with the inclusion of clause 14(d) and Annexures A, B, C and D tendered by the applicants on 15 March 2021, should be confirmed pursuant to s 194(1) of the Act.

I certify that the preceding one hundred and one (101) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Chief Justice Allsop. |

Associate: