Federal Court of Australia

Sovereign Point Pty Ltd v Gu (No 3) [2021] FCA 384

ORDERS

Applicant | ||

AND: | First Respondent AXF GROUP PTY LTD (IN LIQUIDATION) Second Respondent | |

DATE OF ORDER: | 20 april 2021 |

THE COURT ORDERS THAT:

1. The parties provide draft orders giving effect to these reasons within seven days.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

DAVIES J:

Introduction

1 This is an application by the first respondent (Mr Gu) for review of the decision of a registrar. The application is conducted as a hearing de novo of the applicant’s (Sovereign Point) interlocutory process for assessment of the compensation payable by Mr Gu to Sovereign Point, pursuant to an order of the Court made on 25 October 2019, following judgment entered against Mr Gu as a defaulting party pursuant to r 5.23(2)(c) of the Federal Court Rules 2011 (Cth).

2 The proceeding relates to a joint venture entered into between Sovereign Point and the second respondent (AXF Group) for the development and sale of an apartment complex in Doncaster, Melbourne. The development was undertaken by AXF Development (Sovereign Point) Pty Ltd (in liquidation) (Development Company) as trustee for the AXF Development (Sovereign Point) Unit Trust (SP Trust), a special purpose vehicle incorporated for the purpose of the project. Sovereign Point and AXF Group were the shareholders of the Development Company and the unitholders of the SP Trust. Mr Gu and Patrick Chan (Mr Chan) were the directors of the Development Company, Mr Gu (up to 23 May 2018) and Mr Chan were also the directors of Sovereign Point and Mr Gu was the sole director of AFX Group. The Development Company was placed into liquidation pursuant to an order of the Federal Court on 1 June 2018.

3 The joint venture was governed by a shareholder agreement between Sovereign Point and AXF Group and a development agreement between Sovereign Point (as owner of the land being developed) and the Development Company. Pursuant to the development agreement:

(a) the Development Company guaranteed Sovereign Point, as the land owner, a $1.65 million investment return payable within 30 days of final completion of the development (Owners Guaranteed Return) (clause 12);

(b) Sovereign Point was required to pay the Development Company a Development Fee (Development Fee) comprising the “development proceeds” (defined as the total receipts from the sale of the development) less the Owners Guaranteed Return (clause 13); and

(c) the development proceeds were to be applied and distributed first in discharging the facilities taken out to fund the development, secondly to pay the Owners Guaranteed Return (to itself) and, thirdly, in payment of the Development Fee (to the Development Company) (clause 15).

4 Once the Development Fee was paid to the Development Company, the Development Fee was to be distributed to Sovereign Point and AXF Group as the unitholders in the proportions of 40% and 60% respectively.

5 The majority of the apartments were sold in 2015 and the proceeds of sale were transferred directly to the Development Company. Between June 2015 and September 2017, numerous transfers were made from the Development Company’s bank accounts to AXF Group and various other third parties, including entities related to AXF Group. The transfers totalled $16,905,805 from one account and $4,812,747.33 from another.

6 Sovereign Point instituted these proceedings alleging that Mr Gu breached his statutory and fiduciary duties as a director of Sovereign Point by procuring unauthorised transfers of funds to an amount of $16,905,805 from the Development Company’s National Australia Bank business cheque account to AXF Group and other third parties between June 2015 to September 2017, and a further unauthorised transfer of $4,812,747.33 from another of the Development Company’s accounts with National Australia Bank to an unknown recipient in August 2015, or failing to cause AXF Group to repay the diverted funds to the Development Company upon becoming aware of the unauthorised transactions. Sovereign Point also alleged that Mr Gu breached his statutory and fiduciary duties as a director of Sovereign Point by causing certificates of title for certain apartments in the complex developed under the joint venture to be given, without authority of Sovereign Point, to a third party, Jhato Pty Ltd (Jhato), as security for money borrowed by Mr Gu for AXF Group.

7 On 25 October 2019, the Court ordered that there be judgment for Sovereign Point against Mr Gu for the relief claimed in the amended statement of claim in the nature of compensation pursuant to s 1317H of the Corporations Act 2001 (Cth). Section 1317H provides that a Court may order a person to compensate a company for damage suffered by the company if the person has contravened a corporation/scheme civil penalty provision in relation to the corporation and if damage resulted from the contravention. The parties have agreed on certain aspects relevant to the amount of compensation that should be awarded to Sovereign Point. This judgment deals only with those aspects that are in controversy.

Owners Guaranteed Return

8 The first disputed head of claim concerns the Owners Guaranteed Return. It was an agreed fact that Sovereign Point received $577,500 in cash plus property (apartment 310) with an agreed value of $1.44 million on account of the Owners Guaranteed Return. Mr Gu argued that Sovereign Point had accordingly received $367,500 in excess of the amount due to it for the Owners Guaranteed Return and that 60% of that excess payment needs to be credited against Sovereign Point’s claim for compensation. Sovereign Point, on the other hand, argued that it was still owed $352,500 in respect of the Owners Guaranteed Return by reason that:

(a) it had earlier paid a deposit of $144,000 to purchase apartment 310, which was not refunded to it; and

(b) only $720,000 comprising 60% of the value of apartment 310 should be deducted from the amount of compensation payable to it as, by accepting apartment 310, it was forgoing its 40% interest in the profits which would otherwise had been made from the sale of the apartment.

9 Mr Gu did not dispute that Sovereign Point had paid a deposit of $144,000 to acquire apartment 310, but argued that the evidence established that the deposit had been repaid. Mr Gu relied on the following evidence:

(a) the evidence of Robert Rafaniello, the Chief Operating Officer of AFX Group, who deposed that:

Early in the project, [Mr Chan] had selected two adjacent apartments in the complex to purchase for himself. In the construction phase, they were combined to make a single apartment, no. 310. This apartment had a list value of $1.44 million. [Mr Chan] paid a 10% cash deposit on the property. In or around mid-November, [Mr Chan] and I had a discussion about the settlement of this purchase and I provided him with the title. We discussed that he (or Sovereign Point Pty Ltd) was owed $1.65 million under the Development Agreement (by way of an “Owners Guaranteed Return”). I suggested that the purchase price for apartment 310, being $1.44 million, might be set off against this amount and therefore his 10% deposit could be returned to him. I suggested that he consult his accountant in relation to this. [Mr Chan’s] 10% deposit was refunded to him in cash and the total purchase price for apartment 310 ($1.44 million) was set off against the Owners Guaranteed Return ($1.65 million). The return of [Mr Chan’s] deposit money was confirmed by Holding Redlich to the Development company in an email dated 31 December 2015.

Now produced and shown to me and marked Tab 3 is a copy of the email.

I was not aware of exactly when the funds were returned to Patrick however it was confirmed by Sue in the following month that they were returned to Patrick. Settlement of the purchase was delayed due to Patrick’s lawyers resolving the logistics for the settlement. Settlement eventually occurred in June 2016.

Now produced and shown to me and marked Tab 4 is a copy of an email and letter sent by me at 1.34 pm on 18 May 2016 to Irene Ting of Woodlands Lawyers, Patrick's solicitor, in relation to the sale of apartment 310 to Patrick.

(b) an email from Mr Chan to Mr Rafaniello dated 10 October 2017, in response to an email from Mr Rafaniello of 28 August 2017, setting out what Mr Rafaniello claimed was owed to Sovereign Point. It was argued that Mr Chan’s response to Mr Rafaniello, “appeared” to acknowledge that the entire amount of $1.44 million had been offset against the Owners Guaranteed Return. Mr Chan’s email of 10 October 2017 relevantly stated:

I should also mention that the $100,000 paid to the objector and the balance owing of $21,000 for the owner guarantee money of $1,650,000 [apt 310 cost paid was $1,440.000, hence $21,000 in arrears].

This extra $121,000 should also be added to the Debt ….

10 Mr Chan, on the other hand, denied that the deposit was refunded.

11 I am not satisfied that the evidence did establish that the deposit was refunded to Sovereign Point. Critically, the contemporaneous documentary evidence, at its highest, only showed that the deposit plus accrued interest was transferred into the account of the Development Company:

(a) the document at tab 3 of Mr Rafaniello’s evidence, being an email from Lisa Cody of Holding Redlich to Mr Rafaniello, dated 31 December 2015, with the subject line “Lot 310, 5 Sovereign Point Court, Doncaster” read as follows:

Hi Rob

We arranged to transfer the sum of $149,478.73 into the account of AXF Development (Sovereign Point) Pty Ltd yesterday. Accordingly the funds should appear in the account today.

The funds are the deposit and accrued interested which totalled $150,093.73 less an amount of $615 on account of our costs associated with the sale of the property.

(b) the document at tab 4 of Mr Rafaniello’s evidence, being the letter from Mr Rafaniello to Irene Ting of Woodlands Lawyers, dated 18 May 2016 read as follows:

Dear Irene,

We are writing to advise the status of the Contract of Sale payments for Apartment 310, 5 Sovereign Point Court, Doncaster.

The Apartment purchase was entered into via an “Off the Plan” Contract of Sale as the Apartment was purchased prior to construction commencement.

The purchase price was for the full list price of $1,440,000 and a 10% deposit was paid.

The purchaser and/or nominee is a related entity to both the Land Owner and the Developer, who has a Development Agreement to develop the property.

We confirm that it is agreed that the balance of the payment under the Contract of Sale is to be made and offset against the distributions of funds to Sovereign Point Pty Ltd under the Development Agreement.

12 Holding Redlich’s email to Mr Rafaniello went no further than to provide some support for the assertion that the deposit plus accrued interest was transferred into the account of the Development Company. The second email does not “confirm” that the deposit was returned to Mr Chan, contrary to Mr Rafaniello’s evidence. There was no evidence at all to show that the Development Company in fact refunded the deposit to Sovereign Point. Mr Gu’s assertion that the deposit had been repaid did not rise above mere assertion of the fact and depended on the evidence of Mr Rafaniello. The email from Mr Chan to Mr Rafaniello takes the matter no further, as the email was directed to how much Sovereign Point was owed in 2017 and it was in that context that Mr Chan noted that “apt 310 cost paid was $1,440.000”. It is equally open to read those words consistent with the evidence that a value of $1.44 million was attributed to the apartment on account of the Owners Guaranteed Return. In view of the fact that the evidence of both Mr Rafaniello and Mr Gu was no more than unsupported mere assertion and given the absence of direct evidence of the repayment of the deposit to Sovereign Point, I am not prepared to read Mr Chan’s email in the way contended by Mr Gu.

13 I also do not accept Mr Gu’s claim to 60% of the amount that Sovereign Point received in excess of the amount of the Owners Guaranteed Return, there are two reasons. First, the excess amount was not a receipt from the sale of the apartment, as the apartment was not sold and hence not “development proceeds” comprising the development fee to which AFX Group as unitholder had a 60% entitlement. Secondly, nowhere in the evidence was there any indication that Sovereign Point was to reimburse or otherwise account to the Development Company for the excess amount. To the contrary, the evidence was to the effect that apartment 310 was transferred to Sovereign Point in satisfaction of the amount which remained owing by the Development Company to Sovereign Point in respect of the Owners Guaranteed Return.

14 Sovereign Point’s claim to 40% of the proceeds forgone because apartment 310 was not sold also lacks merit. Its entitlement was, as unitholder of the SP Trust, to 40% of the amount available for distribution to the unitholders out of the “Development Fee”, not to 40% of the “distribution proceeds” which were required to be dealt with in accordance with clauses 13 and 15 of the development agreement. As no attempt was made to quantify what profits would have flowed through and formed part of the distributable amount to unitholders, on the hypothesis that the apartment was sold for $1.44 million, Sovereign Point has failed to establish that it should receive any compensation referrable to this head of claim. Arguably, in any event, if it was to receive any compensation referrable to this head of claim, Sovereign Point’s claim would need to take the excess value received by it into account in quantification of this head of damage.

Sovereign Point’s Profit Entitlement for the Period to 30 June 2016

15 The next disputed head of claim is for the damage suffered by Sovereign Point by reason of the unauthorised transfers of money. Sovereign Point also relied on a tax invoice from the Development Company signed by Mr Gu to Sovereign Point dated 30 June 2016, which claimed a GST exclusive Development Fee payable to the Development Company of $52,884,622.91 (or GST inclusive amount of $58,173,085.20) calculated as follows:

PARTICULARS | GST EXCLUSIVE AMOUNT | GST AMOUNT | GST INCLUSIVE AMOUNT |

Development Fee for the “Imperial” Project | |||

Located at 5 Sovereign Point Court Doncaster VIC 3108 | |||

The Project Development Proceeds up to 30 June 2016 | $56,261,895.64 | $5,626,189.56 | $61,888,085.20 |

Minus - Owners Guaranteed Return | -$1,650,000.00 | -$165,000.00 | -$1,815,000.00 |

- Land Value at 1 July 2000 Treatment Pending at 30 June 2016 | -$1,727,272.73 | -$172, 727 .27 | -$1,900,000.00 |

Equals Development Fee up to 30 June 2016 | $52,884,622.91 | $5,288,462.29 | $58,173,085.20 |

TOTAL | $52,884,622.91 | $5,288,462.29 | $58,173,085.20 |

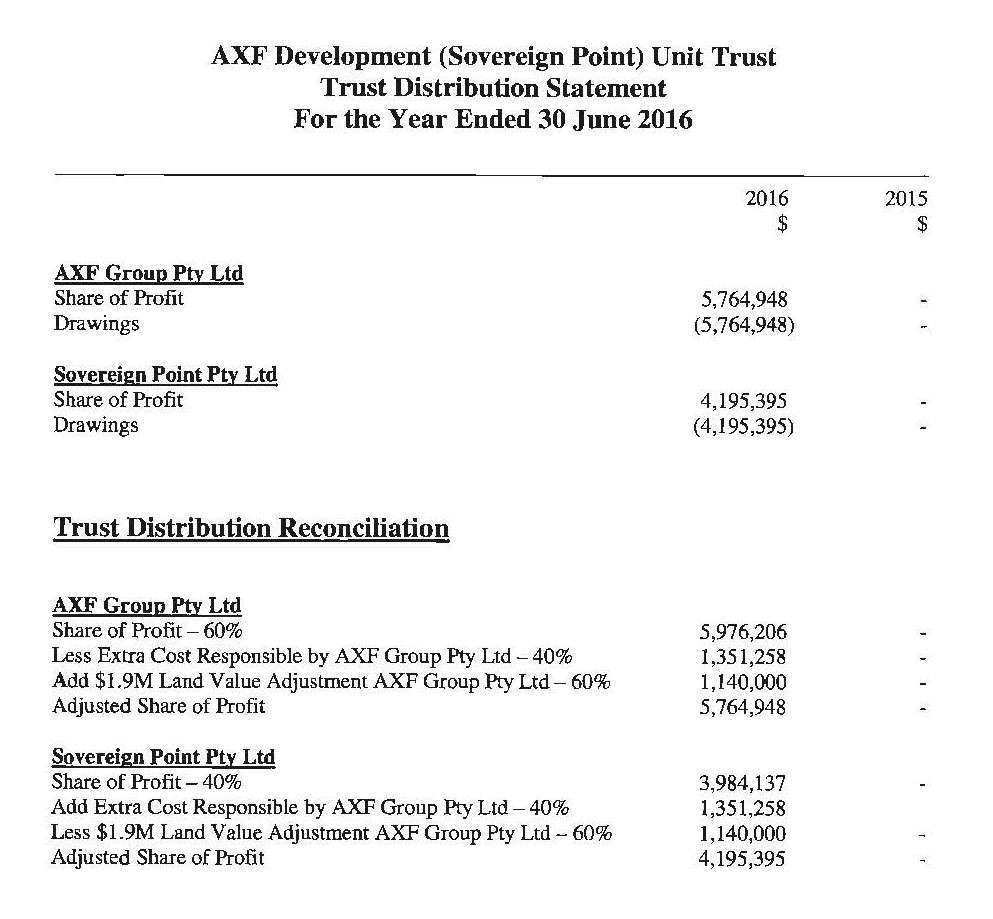

16 Sovereign Point also used as the basis for the calculation of this head of damage draft accounts for the Development Company, as trustee for the unit trust for the year ended 30 June 2016, shown as being prepared by the accountant for the Development Company. The trading statement in the draft accounts recorded a gross profit of $9,953,758, from Income itemised as “Development Fee” in the amount of $52,884,623, less Cost of Sales in the amount of $38,486,072, less Direct Expenses in the amount of $4,444,793. Of the gross profit of $9,953,758, AXF’s 60% share was recorded as being $5,764,948 and Sovereign Point’s 40% share was recorded as being $4,195,395. The draft accounts also included a trust account reconciliation as follows:

17 Sovereign Point argued that the item “Land Value at 1 July 2000, Treatment Pending at 30 June 2016”, making up part of the Development Fee as invoiced by the Development Company, should be excluded from the calculation of the Development Fee, because that item was not provided for in the contractual documents and was unexplained by Mr Gu in his evidence. If excluded, the GST exclusive fee would be $54,611,895 (after deducting the Owners Guaranteed Return). Sovereign Point also argued the item “extra cost responsible by AFX Group” of $3,378,144, which is recorded as one of the “Direct Expenses” and for which adjustment is made in the trust distribution reconciliation, is not an expense that should be taken into account in the calculation of Sovereign Point’s profit share, as such costs were recognised in the accounts as costs for which AFX Group was responsible.

18 Mr Gu argued that the Court should not accept the draft accounts into evidence or if they are admitted, place any weight on the draft accounts to substantiate the damages sought by Sovereign Point on the basis that they were only draft accounts, unaudited, not statutory accounts, the primary documents on which they were based were not provided and the author of the accounts was not called to give evidence. I reject the contention that the draft accounts should not be admitted into evidence and I am not persuaded that the draft accounts have no evidentiary value and cannot be relied upon. After all, it is evident that the item recorded as the Development Fee was based on the tax invoice from the Development Company, as the amounts correlate and it may reasonably be assumed that the costs of sale and direct costs, as recorded likewise, were also drawn from some primary documentation. The real issue is the weight to be attributed to those accounts. The present case is distinguishable from Shot One Pty Ltd (in liq.) & Anor v Day & Anor [2017] VSC 741, on which Mr Gu relied to submit that the draft accounts are either inadmissible or have no probative weight. The question in that case was whether the company’s general ledger and financial accounts, which recorded loan account entries, were probative evidence that could be relied on to prove the existence of a loan or the amount of indebtedness claimed by the plaintiffs. It was held “no” for reasons that included that that there were multiple versions of the financial statements for the relevant years presenting different and inconsistent treatment of the loan accounts. This is not such a case. Furthermore, the mere fact they were draft management accounts does not of itself cause them to lack probative value. Accordingly, I am prepared to give weight to them. Critically, Mr Gu did not put the accuracy of the accounts into issue.

19 That said, I accept Sovereign Point’s contention that the item “Land Value at 1 July 2000, Treatment Pending at 30 June 2016” does not, on its face, appear to be deductible from the computation of the Development Fee payable to the Development Company in accordance with the development agreement, as there is no contractual provision for the deduction of such an amount from the proceeds of sale in computing the amount of the developer’s fee. Moreover, although the accounts record as the amount of the development fees the same figure which appeared in the tax invoice, there is nothing in the evidence which suggests that the accountant took steps to verify whether or not that deduction was properly made. There also appears to be no contractual basis for the inclusion of the item “extra cost responsible by AFX Group” under “direct expenses”. No contractual basis was suggested by Mr Gu or evidence adduced by him explaining what this item related to and accordingly, the gross profit figure should be increased by $3,378,144. The flip side is that Sovereign Point’s 40% share of profit should not be adjusted as provided for in the trust distribution reconciliation.

20 I also reject Mr Gu’s contention that the amount that should be taken as owing to Sovereign Point based on those accounts is an amount $3,187,718. The basis for the contention is a note in the accounts which records a unitholder loan in the amount of $3,187,718 owed by the Development Company to Sovereign Point as a non-current financial liability. The contention left entirely unclear as to why it must follow that therefore is the amount of Sovereign Point’s entitlement as at 30 June 2016, when the entry relates to a loan and the issue here, is the profits of the development to which Sovereign Point was entitled as at 30 June 2016.

Value of Apartment 803

21 The next disputed head of claim concerns the claimed damage caused by Jhato holding the certificate of title for apartment 803, without authority of Sovereign Point, as security for money borrowed by Mr Gu for AXF Group. In issue is the date at which the apartment should be valued. Sovereign Point relies on a valuation as at 30 January 2020 in the amount of $2,485,000 whereas Mr Gu argued that the relevant value is the list price of the property as at August 2017 of $3.5 million. Mr Gu relied in support on an email from Robert Rafaniello to Mr Chan in August 2017 and signed by Mr Chan as to the payment of Sovereign Point’s profit share, to be satisfied in part by Sovereign Point retaining apartment 803 (new 2017 agreement). Part of Mr Gu’s defence in the proceeding relied on the doctrine of merger and the defence of accord and satisfaction and the claim that all the rights and obligations between Sovereign Point and the respondents which had accrued prior to August 2017 under the various agreements between them, or by virtue of any breaches of such agreements or breaches of duties, merged into the new 2017 agreement for the payment of Sovereign Point’s entitlement. In Sovereign Point Pty Ltd v Gu (No 2) [2020] FCA 1377 the Court considered the same evidence that is presently before it about the alleged new 2107 agreement in the context of an application by the respondents to set aside default judgment against them. The Court there accepted that an arguable case that a binding agreement was made in August 2017 was presented on the evidence. However, for the purposes of determining compensation, an arguable case is an insufficient basis upon which to accept the contention that there was, in fact, a binding agreement reached and that the apartment should thus be valued at the list price of $3.5 million agreed on in August 2017 and the evidence rose no higher that presenting an arguable case. The evidence was insufficient to establish as a fact that there was such an agreement. The argument was also premised on the misconception that Sovereign Point had the benefit of apartment 803 since August 2017 but, in fact, Sovereign Point did not get title to the apartment until late 2019, upon and following settlement with Jhato (which was also a respondent to these proceedings). Accordingly, the relevant valuation to adopt is the January 2020 valuation of $2,485,000. Sovereign Point accepts that 60% of that value is to be deducted from the compensation to which it is entitled.

Costs Claimed for Apartment 803

22 The final disputed head of claim concerns various costs and expenses claimed by Sovereign Point in connection with apartment 803. Mr Gu disputes that that such costs are losses arising out of the conduct or causes of action alleged against him and therefore that they are proper heads of damage for the purposes of assessing compensation under the Court’s judgment. It was also submitted that having accepted apartment 803 in compensation for his losses, Sovereign Point is not entitled now to add its subsequent costs of holding and owning the apartment to its claim for compensation. I agree with the last submission, with the caveat that would apply only to costs incurred by Sovereign Point in relation to apartment 803 following the transfer of the apartment to it. In my view, however, there is no warrant not to include in the damage suffered by Sovereign Point, such costs and expense incurred by it in relation to apartment 803 up to the point in time of the transfer of the apartment to it. The parties will need to identify what costs and expenses this covers, as this was left unclear in the evidence and the submissions.

Orders

23 The parties will need to submit a form of order giving effect to the reasons and will be given seven days to do so.

24 Sovereign Point also seeks an order for pre judgment interest pursuant to s 51A(1)(a) of the Federal Court of Australia Act 1976 (Cth) (Federal Court Act) and interest pursuant to s 52(1) of the Federal Court Act from the date of judgment. Such orders will be made together with an order that Mr Gu pay the costs of Sovereign Point with respect to this application.

I certify that the preceding twenty-four (24) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Davies. |

Associate: