FEDERAL COURT OF AUSTRALIA

Australian Securities and Investments Commission v Mayfair Wealth Partners Pty Ltd (No 2) [2021] FCA 247

ORDERS

DATE OF ORDER: |

THE COURT DECLARES THAT:

1. During the period from 3 July 2019 to 16 April 2020 (Relevant Period), the Defendants represented to consumers that promissory notes called “M+ Fixed Income Notes” and “M Core Fixed Income Notes” (the Mayfair Products) were comparable to, and of similar risk profile to, bank term deposits (Bank Term Deposit Representations), when the Mayfair Products expose investors to significantly higher risk than bank term deposits, including by reason of the fact that:

(a) the Mayfair Products lack the prudential regulations that apply to bank term deposits; and

(b) accordingly, the Mayfair Products are not comparable to bank term deposits,

and, as a consequence, the Defendants, in trade or commerce:

(a) engaged in conduct that was misleading or deceptive, or likely to mislead or deceive, in relation to financial services, in contravention of s 1041H(1) of the Corporations Act 2001 (Corporations Act) and s 12DA(1) of the Australian Securities and Investments Commission Act 2001 (ASIC Act);

(b) in connection with the supply or possible supply of financial services, made a false or misleading representation that the Mayfair Products were of a particular standard, quality, value or grade, in contravention of s 12DB(1)(a) of the ASIC Act; and

(c) in connection with the supply or possible supply of financial services, made a false or misleading representation that the Mayfair Products had performance characteristics or benefits, in contravention of s 12DB(1)(e) of the ASIC Act.

2. During the Relevant Period the Defendants represented to consumers that, on maturity of the Mayfair Products, the principal would be repaid in full (Repayment Representations), when investors in the Mayfair Products might not receive capital repayments at maturity because the Defendants had the contractual right to elect to extend the time for repayment to investors for an indefinite period of time, including where the Defendants did not have sufficient funds to repay investments at maturity, which right the Defendants have in fact exercised and, as a consequence, the Defendants, in trade or commerce:

(a) engaged in conduct that was misleading or deceptive, or likely to mislead or deceive, in relation to financial services, in contravention of s 1041H(1) of the Corporations Act and s 12DA(1) of the ASIC Act;

(b) in connection with the supply or possible supply of financial services, made a false or misleading representation that the Mayfair Products were of a particular standard, quality, value or grade, in contravention of s 12DB(1)(a) of the ASIC Act; and

(c) in connection with the supply or possible supply of financial services, made a false or misleading representation that the Mayfair Products had performance characteristics or benefits, in contravention of s 12DB(1)(e) of the ASIC Act.

3. During the Relevant Period the Defendants represented to consumers that the Mayfair Products were specifically designed for investors seeking certainty and confidence in their investments and therefore carried no risk of default (No Risk of Default Representations), when there was a risk that investors could lose some or all of their principal investment and, as a consequence, the Defendants, in trade or commerce:

(a) engaged in conduct that was misleading or deceptive, or likely to mislead or deceive, in relation to financial services, in contravention of s 1041H(1) of the Corporations Act and s 12DA(1) of the ASIC Act;

(b) in connection with the supply or possible supply of financial services, made a false or misleading representation that the Mayfair Products were of a particular standard, quality, value or grade, in contravention of s 12DB(1)(a) of the ASIC Act; and

(c) in connection with the supply or possible supply of financial services, made a false or misleading representation that the Mayfair Products had performance characteristics or benefits, in contravention of s 12DB(1)(e) of the ASIC Act.

4. During the Relevant Period the First, Third and Fourth Defendants represented to consumers that the M Core Fixed Income Notes were fully secured financial products (Security Representations), when funds invested in M Core Fixed Income Notes were:

(a) lent to Eleuthera Group Pty Ltd and not secured by first-ranking, unencumbered asset security or on a dollar-for-dollar basis or at all;

(b) used to pay deposits on properties prior to any security interest being registered; and

(c) used to purchase assets that were not secured by first-ranking, unencumbered asset security,

and, as a consequence, the First, Third and Fourth Defendants, in trade or commerce:

(d) engaged in conduct that was misleading or deceptive, or likely to mislead or deceive, in relation to financial services, in contravention of s 1041H(1) of the Corporations Act and s 12DA(1) of the ASIC Act;

(e) in connection with the supply or possible supply of financial services, made a false or misleading representation that the Mayfair Products were of a particular standard, quality, value or grade, in contravention of s 12DB(1)(a) of the ASIC Act; and

(f) in connection with the supply or possible supply of financial services, made a false or misleading representation that the Mayfair Products had performance characteristics or benefits, in contravention of s 12DB(1)(e) of the ASIC Act.

THE COURT ORDERS THAT:

5. The matter be listed for a case management hearing on a date to be fixed.

6. Liberty to apply.

7. Costs reserved.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ANDERSON J:

INTRODUCTION

1 The Plaintiff (ASIC) has, by way of its originating process dated 3 April 2020, commenced proceedings under:

(a) ss 1101B, 1041H(1) and 1324 of the Corporations Act 2001 (Cth) (Corporations Act);

(b) ss 12DA(1), 12DB(1)(a), 12DB(1)(e), 12GBA, 12GD, 12GLA(2)(c), 12GLA(2)(d) and 12GLB of the Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act); and

(c) s 21 of the Federal Court of Australia Act 1976 (Cth) (FCA Act).

2 The originating process was accompanied by a concise statement dated 3 April 2020 which identified the claims ASIC makes against the Defendants.

3 The Defendants are the issuers and promoters of promissory notes called “M+ Fixed Income Notes” and “M Core Fixed Income Notes” (collectively, the Mayfair Products).

4 The First Defendant, Mayfair Wealth Partners Pty Ltd trading as Mayfair Platinum (Mayfair), promotes the Mayfair Products to investors in Australia by a number of means including brochures, emails and websites.

5 The Second Defendant (M101 Holdings) is the issuer of the M+ Fixed Income Notes (M+ Notes).

6 The Third Defendant (M101 Nominees) is the issuer of the M Core Fixed Income Notes (the Core Notes). On 13 August 2020, this Court made ex parte interim orders appointing Mr Said Jahani and Mr Philip Campbell-Wilson as joint and several provisional liquidators of M101 Nominees. Final orders for the winding up of M101 Nominees were made on 29 January 2021 in proceeding VID 524 of 2020 (the Winding Up Proceeding).

7 The Fourth Defendant, Online Investments Pty Ltd trading as Mayfair 101 (Mayfair 101), participated in the marketing of the Mayfair Products. Online Investments Pty Ltd is also the holding company of Mayfair and operates a website (www.termdepositguide.com) which promotes and markets the Mayfair Products.

8 Mr James Mawhinney (Mr Mawhinney) is and was at all relevant times the sole director of each of the Defendants. Mr Mawhinney was not a party to this proceeding. In addition, Mr Mawhinney was at all relevant times:

(a) the sole shareholder of the Fourth Defendant, Online Investments Pty Ltd, which at all relevant times was the sole shareholder of the First Defendant, Mayfair, and the Second Defendant, M101 Holdings; and

(b) the sole shareholder of Mayfair Group Pty Ltd, which at all relevant times was the sole shareholder of the Third Defendant, M101 Nominees.

9 Mr Mawhinney was the directing mind and will, and the ultimate beneficiary, of each of the Defendants.

10 ASIC alleges that the Defendants engaged in conduct that was misleading or deceptive or likely to mislead or deceive (in contravention of s 1041H(1) of the Corporations Act and/or s 12DA(1) of the ASIC Act) and/or made false or misleading representations (in contravention of ss 12DB(1)(a) and (e) of the ASIC Act) that:

(a) the Mayfair Products were comparable to, and of similar risk profile to, bank term deposits (Bank Term Deposits Representation), when the Mayfair Products expose investors to significantly higher risk than bank term deposits, including by reason of the fact that the Mayfair Products lack the prudential regulations that apply to bank term deposits, and accordingly the Mayfair Products are not comparable to bank term deposits;

(b) on maturity of the Mayfair Products, the principal would be repaid in full (Repayment Representation), when investors in the Mayfair Products might not receive capital repayments at maturity because the Defendants had the contractual right to elect to extend the time for repayment to investors for an indefinite period of time, including where the Defendants did not have sufficient funds to repay investments at maturity, which right the Defendants have in fact exercised;

(c) the Mayfair Products carried no risk of default (No Risk of Default Representation), when in fact there was a risk that investors could lose some or all of their principal investment; and

(d) that the Core Notes were fully secured financial products (Security Representation), when they were not.

11 On 16 April 2020, ASIC applied for various interlocutory injunctions. On that day, I made orders restraining the Defendants from using certain phrases in relation to advertisements related to the Defendants’ marketing of the Mayfair Products, and also required those entities to add certain notices on their websites and provide the notices to prospective investors: see Australian Securities and Investments Commission v Mayfair Wealth Partners Pty Ltd [2020] FCA 494.

12 On 13 August 2020, ASIC filed an amended originating process in which it sought various declarations, pecuniary penalties, injunctions and other orders against the Defendants.

13 On 15 February 2021, the proceeding was listed for trial. Ms van Proctor of counsel appeared for ASIC. There was no appearance for the Defendants. The Defendants’ solicitors in correspondence dated 29 January 2021 informed the Court that the Defendants would be unrepresented at the hearing and on that basis the matter would proceed undefended. The solicitors further advised that “evidence in the Mayfair Proceeding be evidence in this proceeding [the Winding Up Proceeding] in relation to the permanent injunctions sought against Mr Mawhinney”. As a consequence, the matter proceeded before me undefended. I am satisfied that Mr Mawhinney, and his solicitors, were aware that the matter was listed for trial before me on 15 February 2021.

14 On 15 February 2021, I granted leave for ASIC to file a further amended originating application.

15 For the reasons that follow, I will make the declarations and orders sought by ASIC.

EVIDENCE

16 ASIC tendered in evidence a Court Book (Exhibit A1) which included the following affidavits:

(a) affidavits of Lisa Saunders dated 15 April 2020 (First Saunders Affidavit), 15 April 2020 (Second Saunders Affidavit), 20 August 2020 (Third Saunders Affidavit) and 10 December 2020 (Fourth Saunders Affidavit);

(b) affidavit of John Booth dated 22 July 2020 (Booth Affidavit);

(c) affidavit of Theo Wiggill dated 15 January 2021 (Wiggill Affidavit);

(d) affidavit of John Donald dated 21 December 2020 (Donald Affidavit);

(e) affidavit of Richard McMahon dated 12 August 2020 (McMahon Affidavit);

(f) affidavits of Jason Tracy dated 14 August 2020 (Tracy Affidavit) and 11 December 2020 (Second Tracy Affidavit);

(g) affidavit of Kerrie Campbell dated 21 August 2020 (Campbell Affidavit); and

(h) affidavit of Nora Fairbanks dated 21 January 2021 (Fairbanks Affidavit).

17 ASIC also tendered as part of the Court Book the report provided by the provisional liquidators of M101 Nominees for the purposes of the Winding Up Proceeding (Provisional Liquidators’ Report). The Provisional Liquidators’ Report was annexed to a statement of a witness in this proceeding of Ms Jaime Asher. At the trial of this proceeding, Ms Van Proctor tendered the Provisional Liquidators’ Report (together with other documents which were attached to Ms Asher’s statement). The bundle of documents annexed to Ms Asher’s statement was Exhibit A3.

18 On 2 February 2021, in the Winding Up Proceeding, I ordered that evidence filed in this proceeding is evidence in the Winding Up Proceeding in relation to ASIC’s application in the Winding Up Proceeding for certain injunctions against Mr Mawhinney.

19 At the hearing, ASIC called evidence from Mr Robert Charadia and Ms Jaime Asher, who were investors in the Mayfair Products. I will refer to certain aspects of the evidence further below. However, I should state here that both Mr Charadia and Ms Asher gave compelling evidence. I accept their evidence as to the manner in which they were misled by the marketing and promotional material presented to them by the Defendants. The evidence of Mr Charadia and Ms Asher provides an additional foundation for the findings which I make below.

BACKGROUND

20 The Defendants are part of a broader group of companies (the Mayfair 101 Group) with a common director, Mr Mawhinney. Mr Mawhinney is the sole director of each of the Defendants, namely Mayfair, M101 Holdings, M101 Nominees, and Online Investments Pty Ltd. The Mayfair 101 Group raised money through various investment products, and used that money to acquire real estate and invest in private equity ventures, often indirectly through loans to related entities.

21 During the period from 3 July 2019 to 16 April 2020 (Relevant Period), the Mayfair Products were marketed and promoted by the Defendants in a number of ways, including via:

(a) Mayfair’s websites, www.mayfairplatinum.com.au and www.mayfair101.com;

(b) the website www.termdepositguide.com; and

(c) newspaper advertising and online advertising, including the use of “sponsored link internet advertising” using (what are referred to as) specific “adwords”.

22 ASIC contends that the Mayfair Products were marketed to wholesale but inexperienced investors, at least a substantial subset of whom were unlikely to understand the significant risk associated with the Mayfair Products.

23 ASIC contends that the promotion engaged in by the Defendants gave rise to a number of misrepresentations.

LEGAL PRINCIPLES

24 Section 1041H(1) of the Corporations Act provides:

A person must not, in this jurisdiction, engage in conduct, in relation to a financial product or a financial service, that is misleading or deceptive or is likely to mislead or deceive.

25 Section 1041H(2)(a) of the Corporations Act provides that “[t]he reference in [s 1041H(1)] to engaging in conduct in relation to a financial product includes (but is not limited to) … dealing in a financial product”. “Dealing” in a financial product includes “issuing a financial product” “whether engaged in as principal or agent”: Corporations Act, s 766C(1)(b).

26 Section 12DA(1) of the ASIC Act provides:

A person must not, in trade or commerce, engage in conduct in relation to financial services that is misleading or deceptive or is likely to mislead or deceive.

27 Section 12BAB(1)(b) of the ASIC Act relevantly provides that “a person provides a financial service if they … deal in a financial product”. The meaning of “dealing in a financial product” includes “issuing a financial product”: ASIC Act, s 12BAB(7)(b).

28 A “financial product” is defined in s 12BAA and includes a “facility through which, or through the acquisition of which, a person … makes a financial investment” or “manages financial risk”: ASIC Act, s 12BAA(1)(a) and (b).

29 Section 1041H of the Corporations Act and s 12DA of the ASIC Act are in analogous terms and the same principles are applicable to both provisions: Australian Securities and Investments Commission v Dover Financial Advisers Pty Ltd [2019] FCA 1932; 140 ACSR 561 (Dover) at [92] (citing Selig v Wealthsure Pty Ltd [2015] HCA 18; 255 CLR 661 at [4]).

30 Sections 12DB(1)(a) and 12DB(1)(e) of the ASIC Act provide:

A person must not, in trade or commerce, in connection with the supply or possible supply of financial services, or in connection with the promotion by any means of the supply or use of financial services:

(a) make a false or misleading representation that services are of a particular standard, quality, value or grade; or

…

(e) make a false or misleading representation that services have sponsorship, approval, performance characteristics, uses or benefits …

31 In Dover, O’Bryan J stated at [120]:

A contravention of [s 12DB(1)] of the ASIC Act attracts pecuniary penalties. Under s 12GBA, the Court may order the contravening party and (amongst others) a person knowingly concerned in the contravention to pay a pecuniary penalty.

32 The expression “financial services”, as used in s 12DB, has the same meaning and application discussed immediately above with respect to s 12DA(1).

33 Sections 1041H and 12DA(1) “prohibit conduct that is misleading or deceptive or likely to mislead or deceive, whereas s 12DB(1)(i) prohibits the making of a false or misleading representation”: Dover at [94]. Conduct “that contravenes ss 1041H and 12DA may involve, but need not involve, the making of a false or misleading representation”: ibid.

34 In the present case, though, the allegations do concern the making of allegedly false, misleading or deceptive representations.

35 In Australian Securities and Investments Commission v MLC Nominees Pty Ltd [2020] FCA 1306; 147 ACSR 266, Yates J stated at [47]:

Although the [statutory language refers to] “misleading or deceptive conduct” and “false or misleading representations”, the cases establish that there is no material difference between these expressions in terms of their legal application: Australian Competition and Consumer Commission v Dukemaster Pty Ltd [2009] FCA 682 at [14]; Australian Competition and Consumer Commission v Coles Supermarkets Australia Pty Ltd [2014] FCA 634; 317 ALR 73 at [40]; Australian Securities and Investments Commission v Westpac Banking Corporation [2018] FCA 751; 266 FCR 147 at [2263].

36 In Dover at [98]-[101], O’Bryan J said:

The applicable principles concerning the statutory prohibition of misleading or deceptive conduct (and closely related prohibitions) in the Australian Consumer Law, the Corporations Act and the ASIC Act are well known. The central question is whether the impugned conduct, viewed as a whole, has a sufficient tendency to lead a person exposed to the conduct into error (that is, to form an erroneous assumption or conclusion about some fact or matter): Parkdale Custom Built Furniture Pty Ltd v Puxu Pty Ltd (1982) 149 CLR 191 (Puxu) at 198 per Gibbs CJ; Taco Co of Australia Inc v Taco Bell Pty Ltd (1982) 42 ALR 177 (Taco Bell) at 200; Campomar at [98]; ACCC v TPG Internet Pty Ltd (2013) 250 CLR 640 (TPG Internet) at [39] per French CJ, Crennan, Bell and Keane JJ; Campbell at [25] per French CJ. A number of subsidiary principles, directed to the central question, have been developed:

(a) First, conduct is likely to mislead or deceive if there is a real or not remote chance or possibility of it doing so: see Global Sportsman Pty Ltd v Mirror Newspapers Pty Ltd (1984) 2 FCR 82 (Global Sportsman) at 87; Noone (Director of Consumer Affairs Victoria) v Operation Smile (Australia) Inc (2012) 38 VR 569 at [60] per Nettle JA (Warren CJ and Cavanough AJA agreeing at [33]).

(b) Second, it is not necessary to prove an intention to mislead or deceive: Hornsby Building Information Centre Pty Ltd v Sydney Building Information Centre Ltd (1978) 140 CLR 216 at 228 per Stephen J (with whom Barwick CJ and Jacobs J agreed) and at 234 per Murphy J; Puxu at 197 per Gibbs CJ.

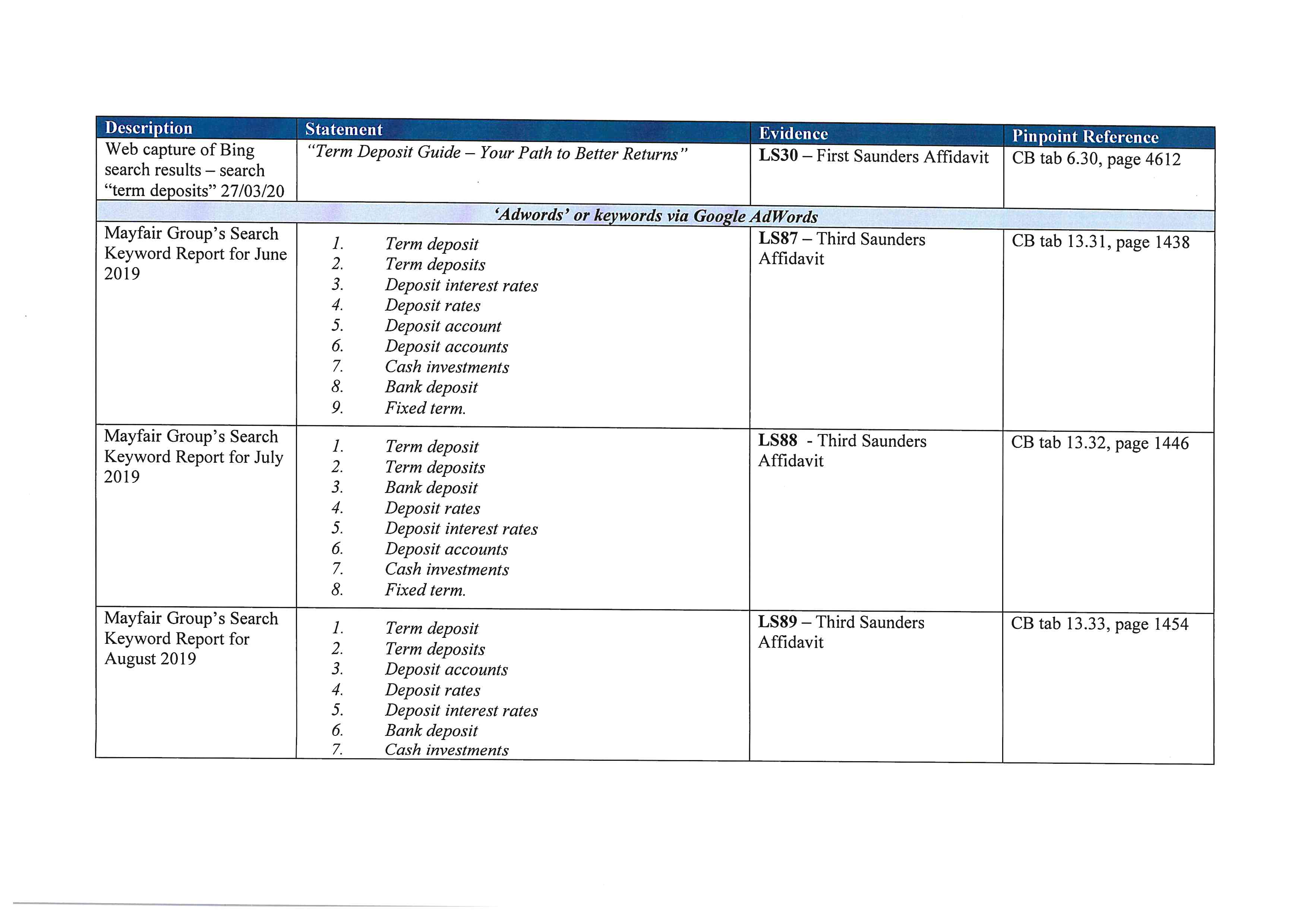

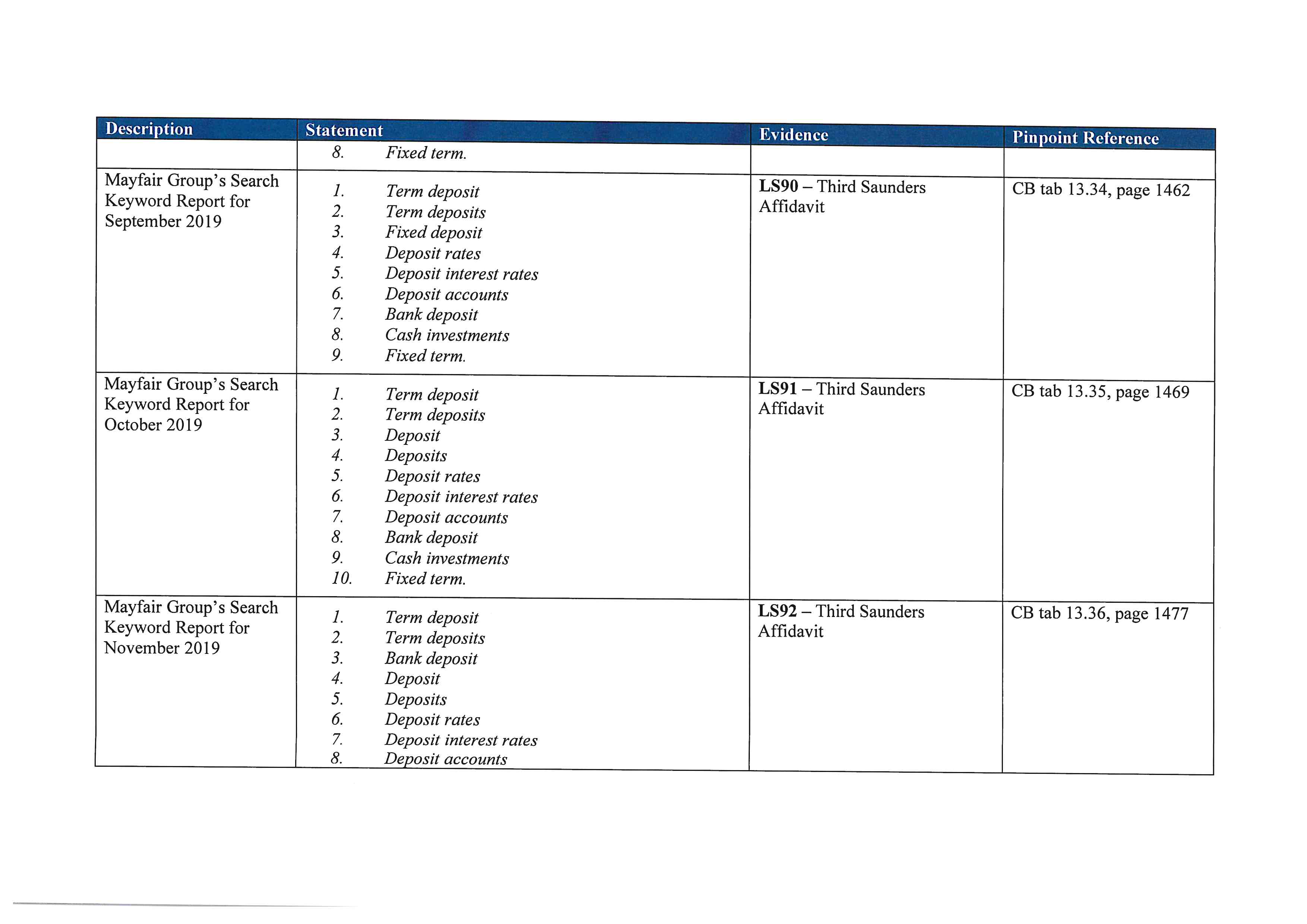

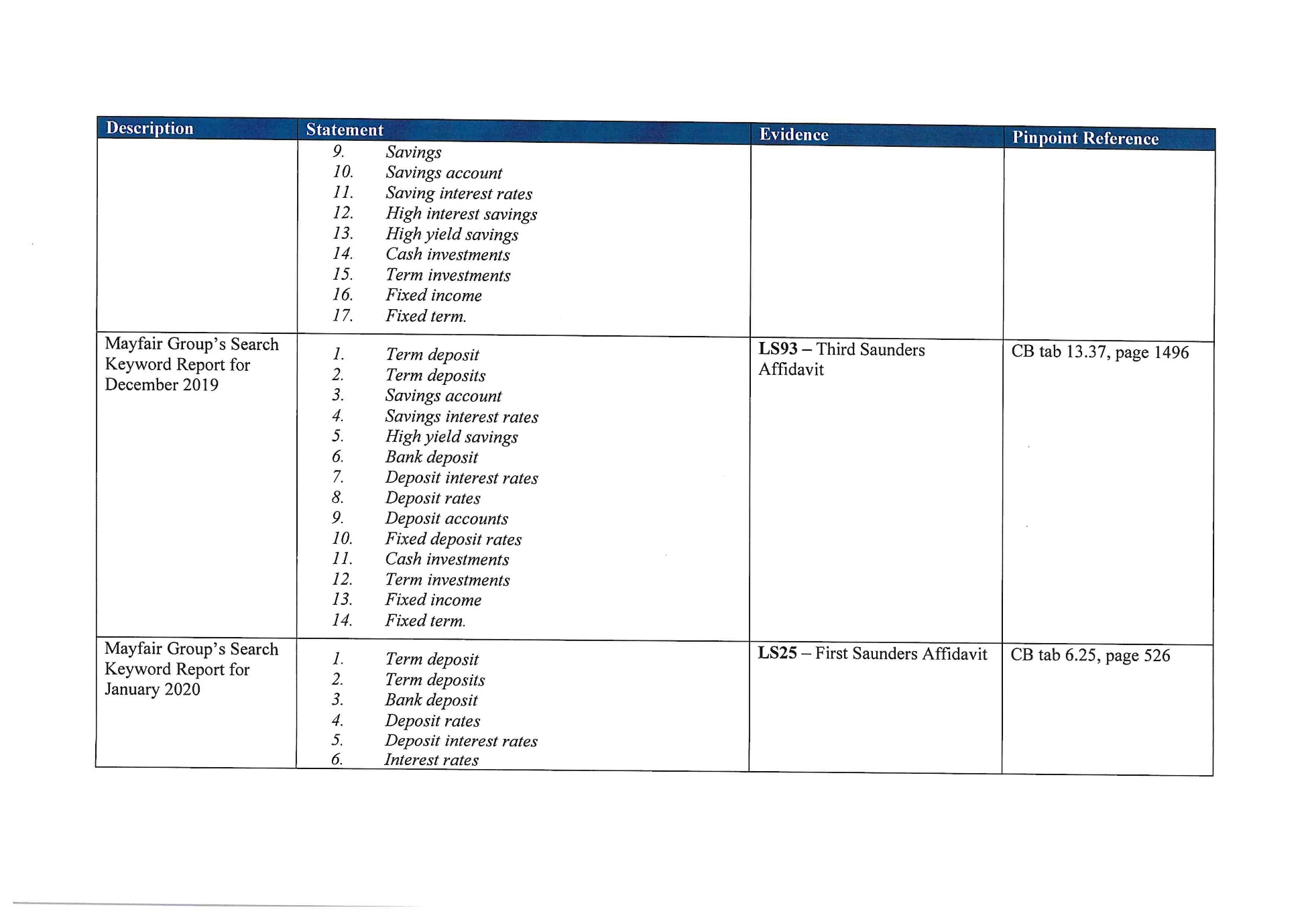

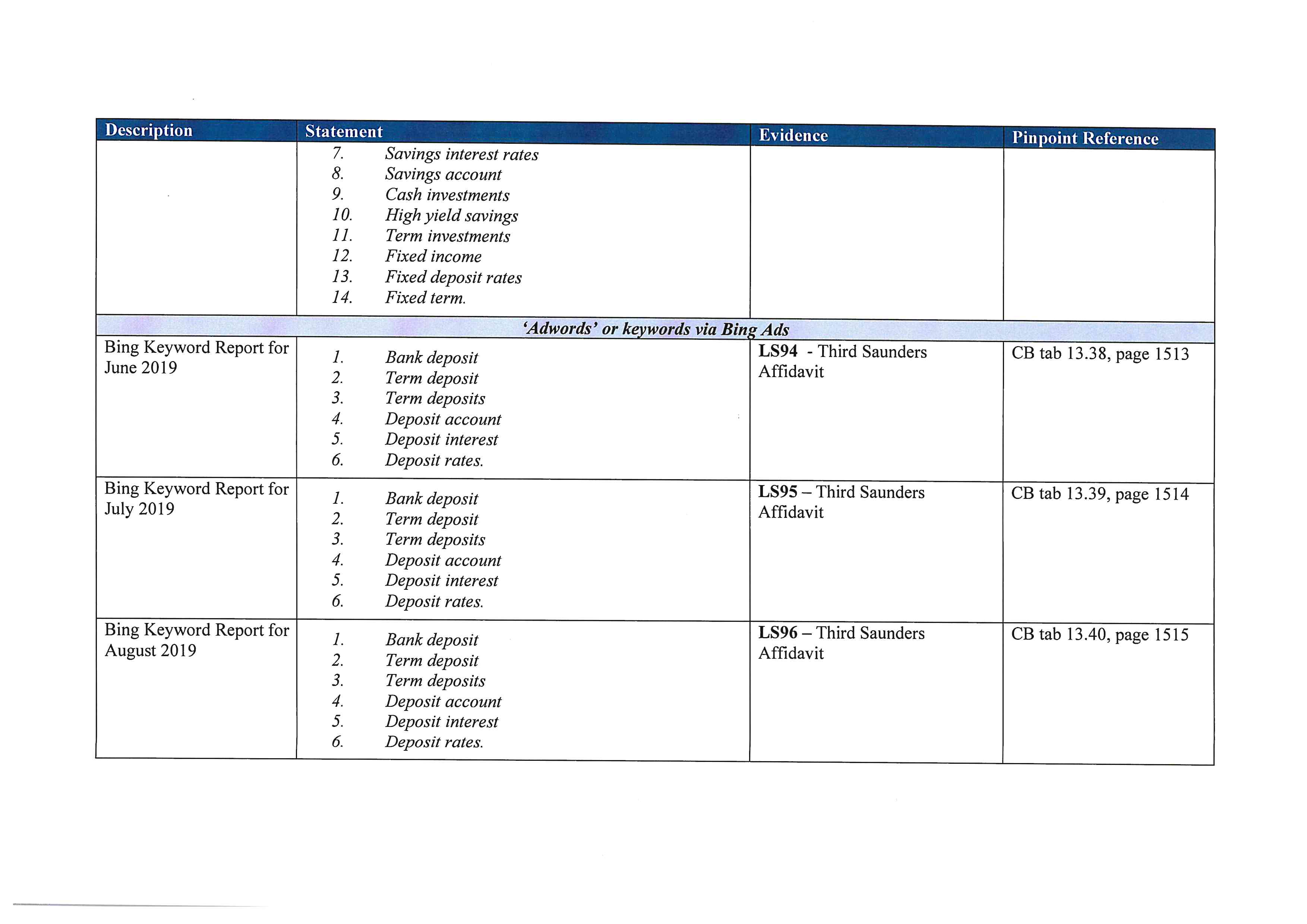

(c) Third, it is unnecessary to prove that the conduct in question actually deceived or misled anyone: Puxu at 198 per Gibbs CJ. Evidence that a person has in fact formed an erroneous conclusion is admissible and may be persuasive but is not essential. Such evidence does not itself establish that conduct is misleading or deceptive within the meaning of the statute. The question whether conduct is misleading or deceptive is objective and the Court must determine the question for itself: see Taco Bell at 202 per Deane and Fitzgerald JJ.

(d) Fourth, it is not sufficient if the conduct merely causes confusion: Puxu at 198 per Gibbs CJ and 209-210 per Mason J; Taco Bell at 202 per Deane and Fitzgerald JJ; Campomar at [106].

In assessing whether conduct is likely to mislead or deceive, the courts have distinguished between two broad categories of conduct, being conduct that is directed to the public generally or a section of the public, and conduct that is directed to an identified individual. As explained by the High Court in Campomar, the question whether conduct in the former category is likely to mislead or deceive has to be approached at a level of abstraction, where the Court must consider the likely characteristics of the persons who comprise the relevant class of persons to whom the conduct is directed and consider the likely effect of the conduct on ordinary or reasonable members of the class, disregarding reactions that might be regarded as extreme or fanciful (at [101]-[105]). In Google Inc v ACCC (2013) 249 CLR 435, French CJ and Crennan and Kiefel JJ (as her Honour then was) confirmed that, in assessing the effect of conduct on a class of persons such as consumers who may range from the gullible to the astute, the Court must consider whether the “ordinary” or “reasonable” members of that class would be misled or deceived (at [7]). In the case of conduct directed to an identified individual, it is unnecessary to approach the question at an abstract level; the Court is able to assess whether the conduct is likely to mislead or deceive in light of the objective circumstances, including the known characteristics of the individual concerned. However, in both cases, the relevant question is objective: whether the conduct has a sufficient tendency to induce error. Even in the case of an express representation to an identified individual, it is not necessary (for the purposes of establishing liability) to show that the individual was in fact misled. As observed by French CJ in Campbell at [25]:

Characterisation is a task that generally requires consideration of whether the impugned conduct viewed as a whole has a tendency to lead a person into error. It may be undertaken by reference to the public or a relevant section of the public. In cases of misleading or deceptive conduct analogous to passing off and involving reputational issues, the relevant section of the public may be defined, according to the nature of the conduct, by geographical distribution, age or some other common attribute or interest. On the other hand, characterisation may be undertaken in the context of commercial negotiations between individuals. In either case it involves consideration of a notional cause and effect relationship between the conduct and the state of mind of the relevant person or class of persons. The test is necessarily objective. (citations omitted)

The question whether conduct is misleading or deceptive, and thereby contravenes the statutory prohibition, is logically anterior to the question whether any person has suffered loss or damage by reason of the conduct: Campbell at [24] per French CJ; TPG Internet at [49]. As observed by French CJ in Campbell (at [28]):

Determination of the causation of loss or damage may require account to be taken of subjective factors relating to a particular person’s reaction to conduct found to be misleading or deceptive or likely to mislead or deceive. A misstatement of fact may be misleading or deceptive in the sense that it would have a tendency to lead anyone into error. However, it may be disbelieved by its addressee. In that event the misstatement would not ordinarily be causative of any loss or damage flowing from the subsequent conduct of the addressee.

Similarly, where proceedings are brought by an enforcement agency, the Court has frequently imposed pecuniary penalties and other forms of relief for contraventions of the prohibition of misleading or deceptive conduct while expressly recognising that the conduct may not have caused loss: see for example Singtel Optus Pty Ltd v ACCC (2012) 287 ALR 249 at [57]; ASIC v GE Capital Finance Australia [2014] FCA 701 at [90]; ASIC v Huntley Management Ltd (2017) 122 ACSR 163; [2017] 35 ACLC 17-035; FCA 770 at [36]-[39].

37 I respectfully adopt as correct this summary of applicable principles by O’Bryan J in Dover.

38 ASIC makes the following further submissions in relation to the applicable legal principles.

39 ASIC submits that words used in advertising or promotional material are in many cases capable of conveying different meanings. ASIC submits that the question is whether the meaning said to be false or misleading is reasonably open and may be drawn by a significant number of persons to whom the presentation was addressed: citing Australian Competition and Consumer Commission v TPG Internet Pty Ltd [2020] FCAFC 130; 381 ALR 507 at [23] and Trivago N.V. v Australian Competition and Consumer Commission [2020] FCAFC 185; 384 ALR 496 at [192]. The class of persons by reference to which the effect of the relevant conduct is to be assessed may be quite large. In particular, the relevant class may cover a wide range of people whose personal capacity, knowledge and experience may vary quite significantly. Where the statement is made to the public or a section of the public, the Court considers its effect upon ordinary or reasonable members of the class in question, all of whom are presumed to take reasonable care to protect their own interests: citing Australian Securities and Investments Commission v Vocation Limited (in liq) [2019] FCA 807; 371 ALR 155 at [632].

40 A relevant representation may be as to a present state of affairs, or be as to a future matter. Where the representation is as to a future matter, s 12BB of the ASIC Act and s 769C of the Corporations Act apply. Section 12BB(1) of the ASIC Act provides:

If … a person makes a representation with respect to any future matter (including the doing of, or the refusing to do, any act)[,] and the person does not have reasonable grounds for making the representation[,] the representation is taken, for the purposes of Subdivision D (sections 12DA to 12DN), to be misleading.

41 Section 12BB(2) of the ASIC Act provides:

For the purposes of applying [s 12BB(1)] in relation to a proceeding concerning a representation made with respect to a future matter by:

(a) a party to the proceeding; or

(b) any other person;

the party or other person is taken not to have had reasonable grounds for making the representation, unless evidence is adduced to the contrary.

42 Section 769C of the Corporations Act provides:

For the purposes of [Chapter 7], or of a proceeding under [Chapter 7], if … a person makes a representation with respect to any future matter (including the doing of, or refusing to do, any act)[,] and the person does not have reasonable grounds for making the representation[,] the representation is taken to be misleading.

43 ASIC submits that these provisions raise the presumption that a representation with respect to any future matter without reasonable grounds is misleading (and that evidence must be adduced to establish reasonable grounds).

44 I accept as correct the above submissions by ASIC on the applicable legal principles.

ASIC’S SUBMISSIONS

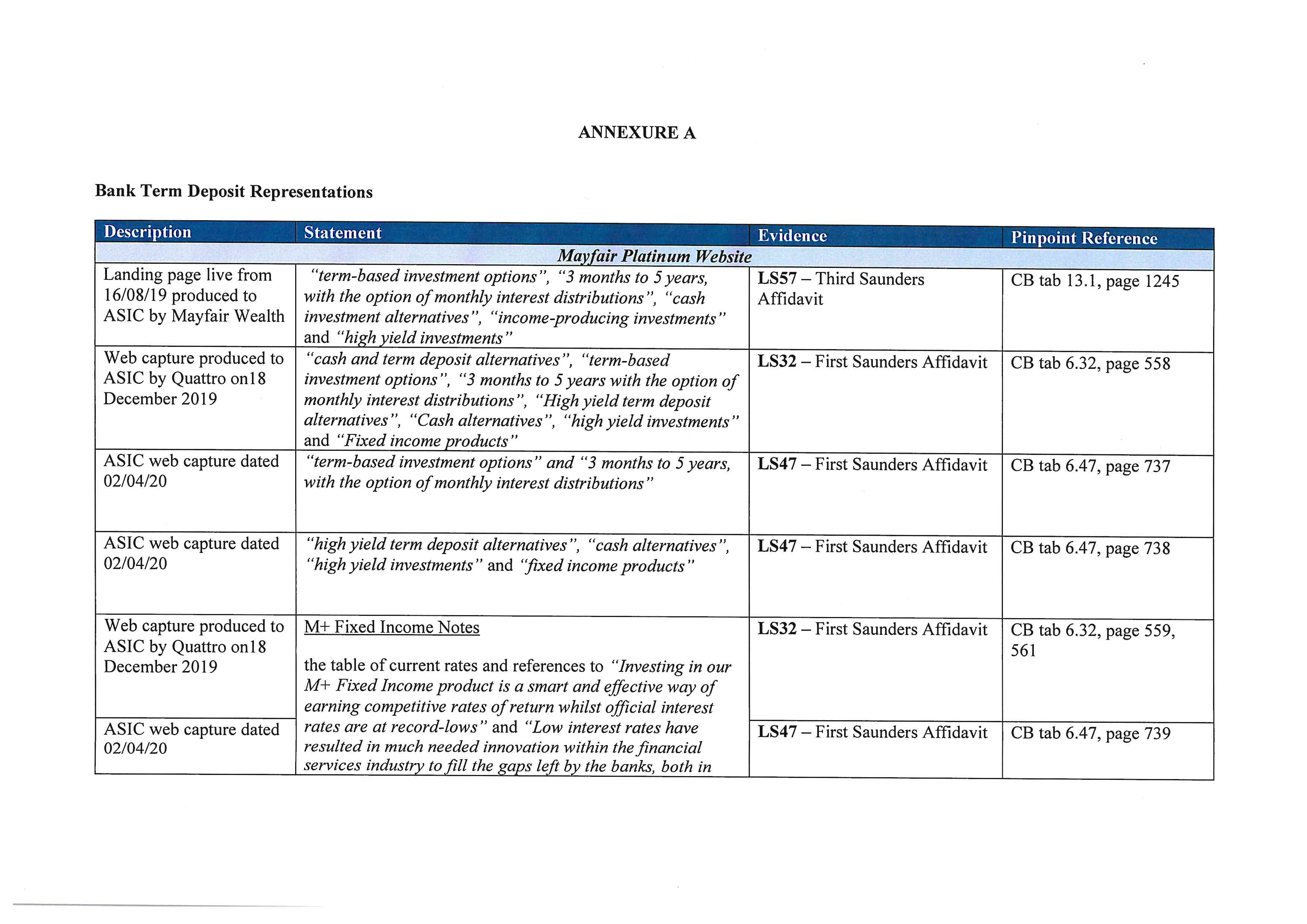

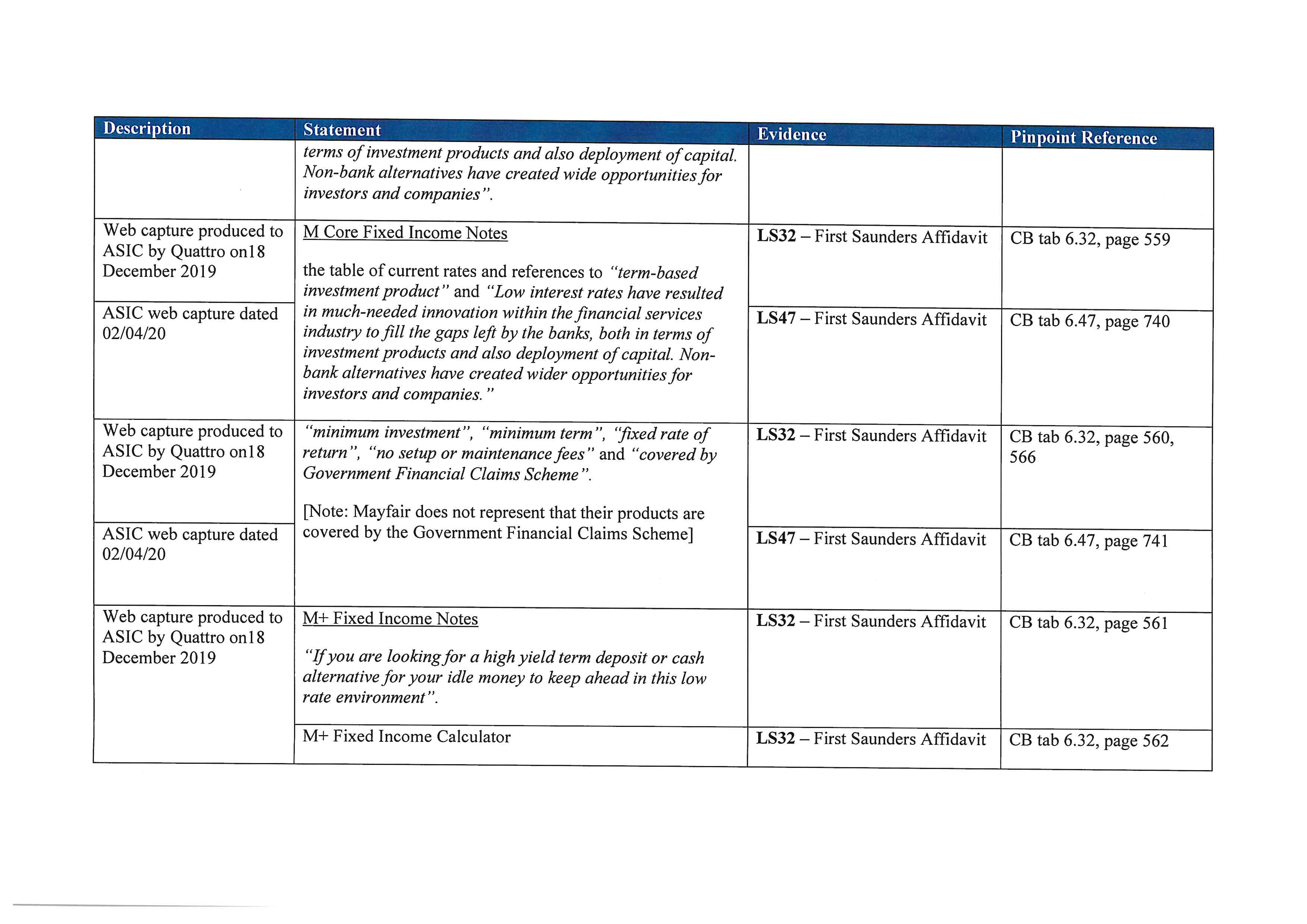

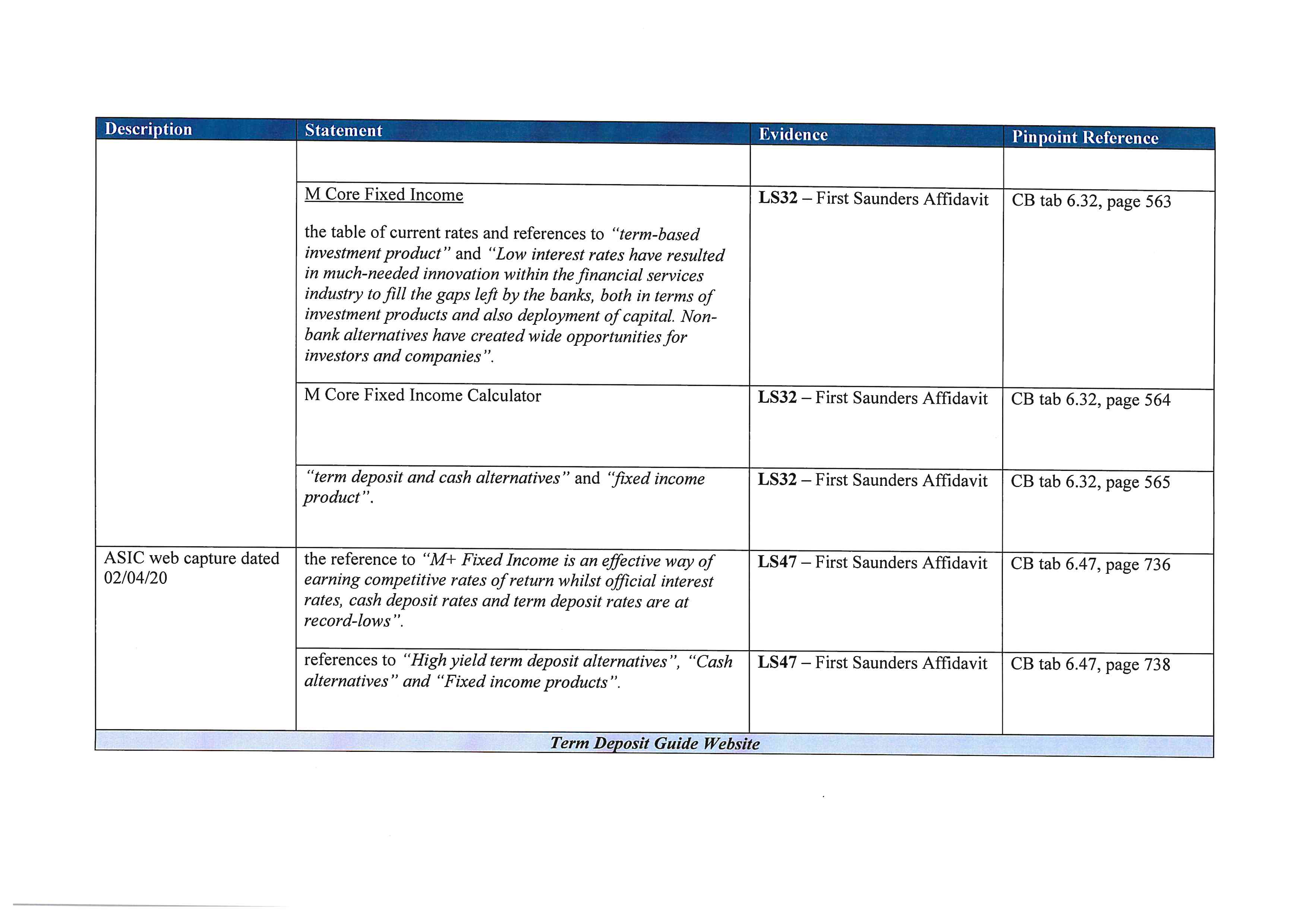

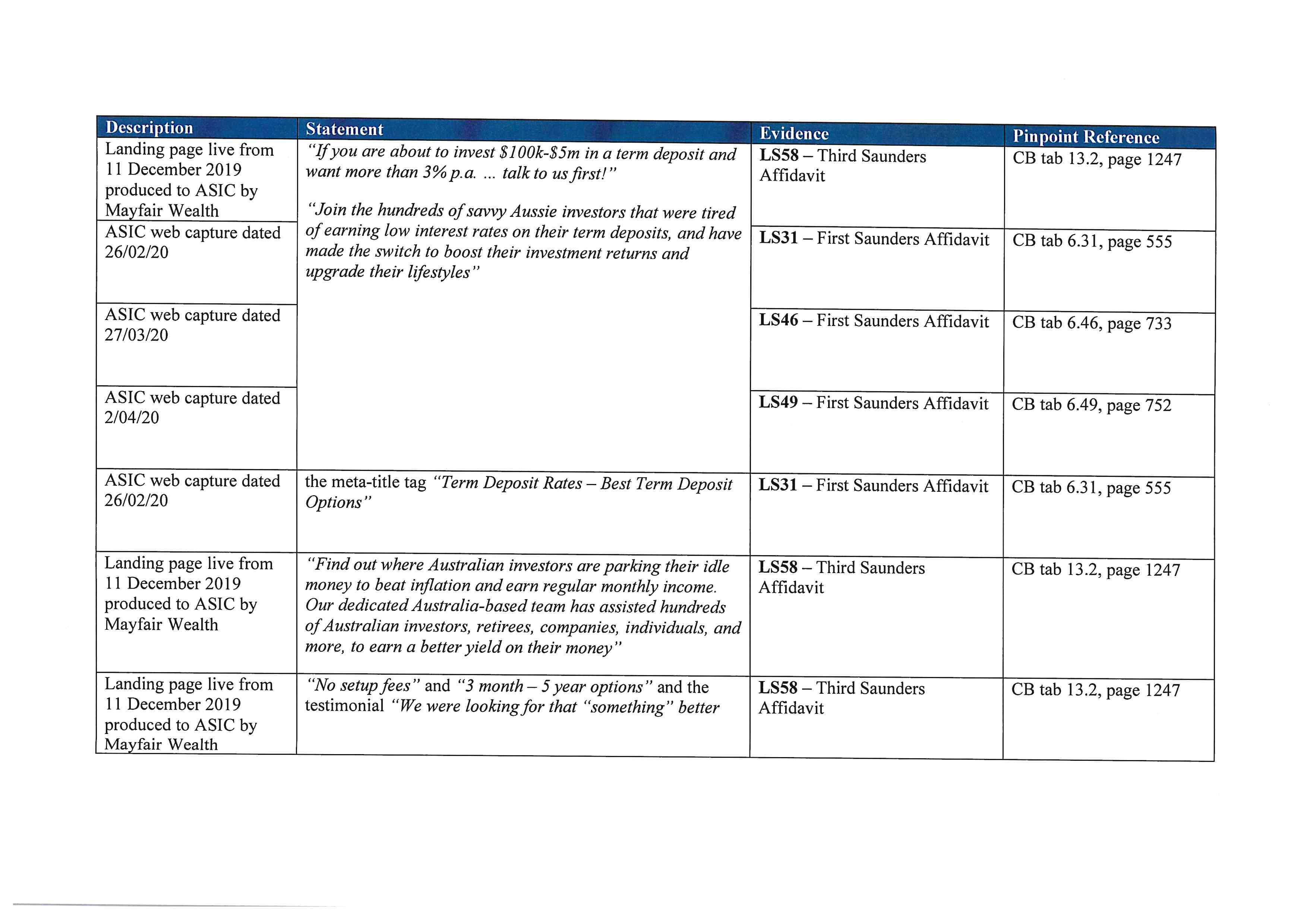

Bank Term Deposits Representation

45 ASIC submits that the statements made by the Defendants in the marketing and promotional material (including the application forms for the Mayfair Products) conveyed, separately and together, an impression that the Mayfair Products were comparable to, and of similar risk profile to, bank term deposits.

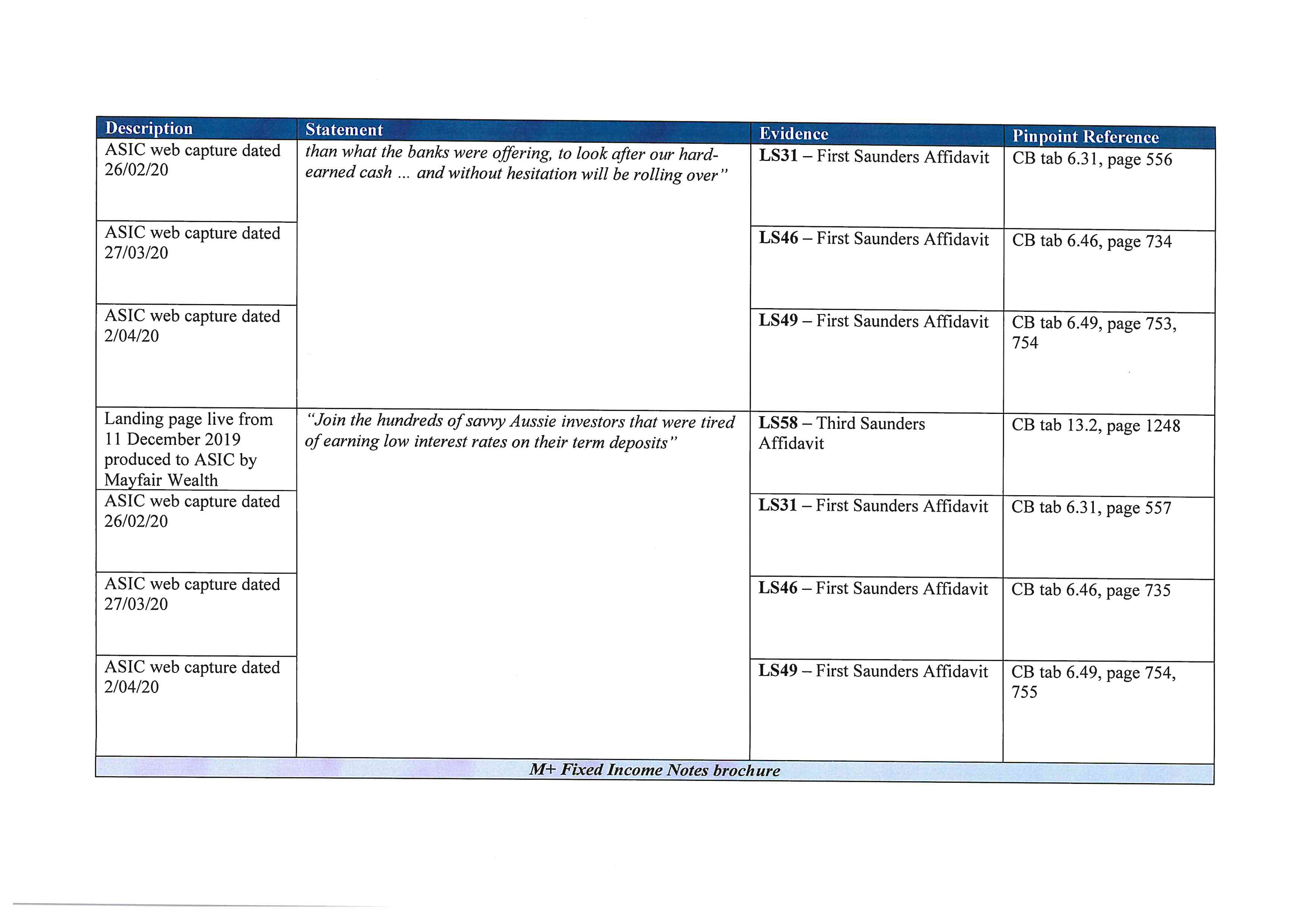

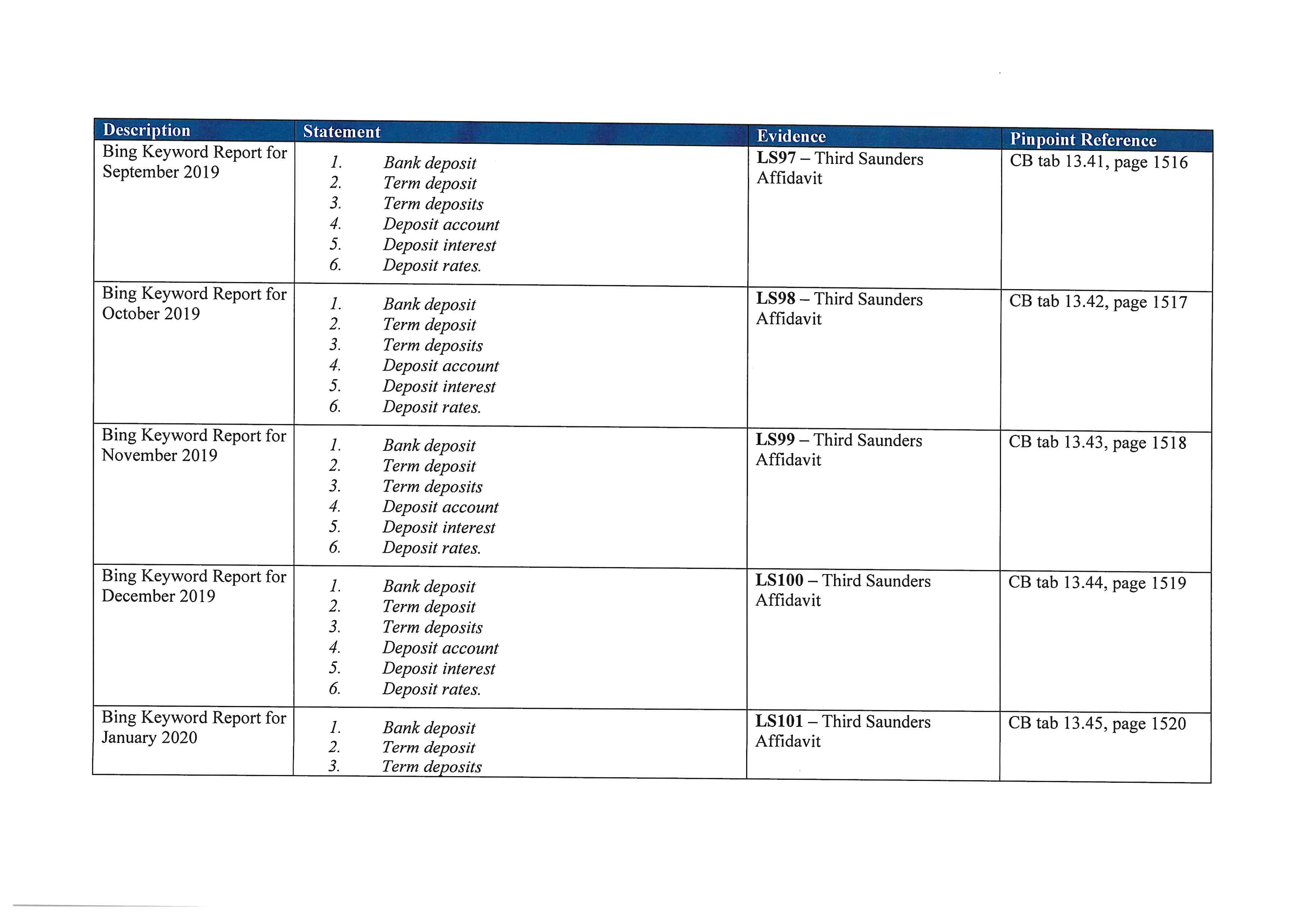

46 ASIC submits that the Bank Term Deposits Representation was implied by, inter alia, the following:

(a) the combination of words used in the marketing material, such as “term deposit alternative”, “term investment”, “fixed term”, “certainty” and “confidence”;

(b) images used in the marketing material that replicate those found on bank websites marketing bank term deposits; and

(c) sponsored link internet advertising conducted via the Google “AdWords” program and Bing “Ads” program, which included the use of:

(i) “meta-title tags” such as “term deposit rates – best term deposit options”;

(ii) domain names such as “term deposit guide”; and

(iii) “adwords” for sponsored searches, including “bank deposits” and “term deposits”.

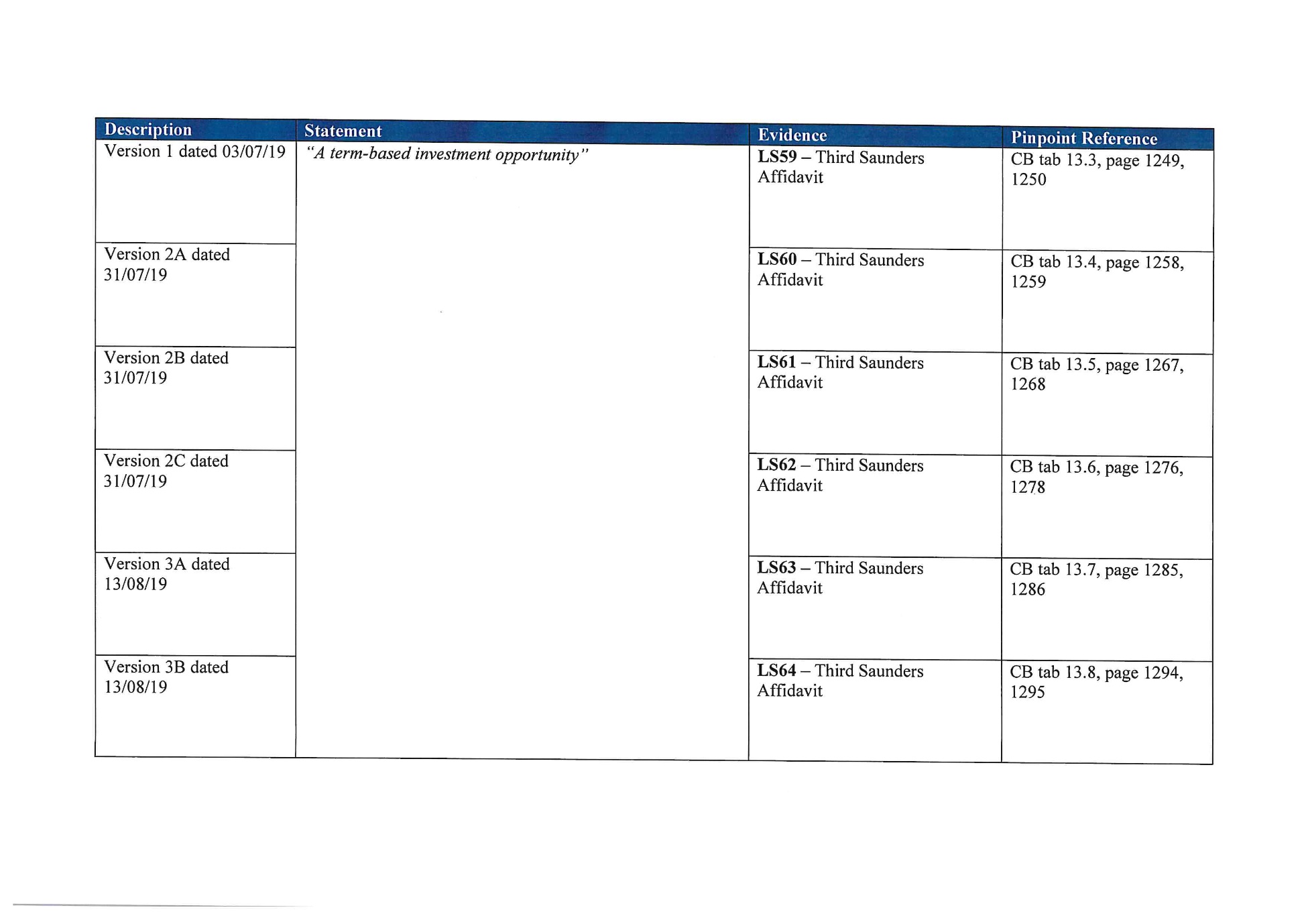

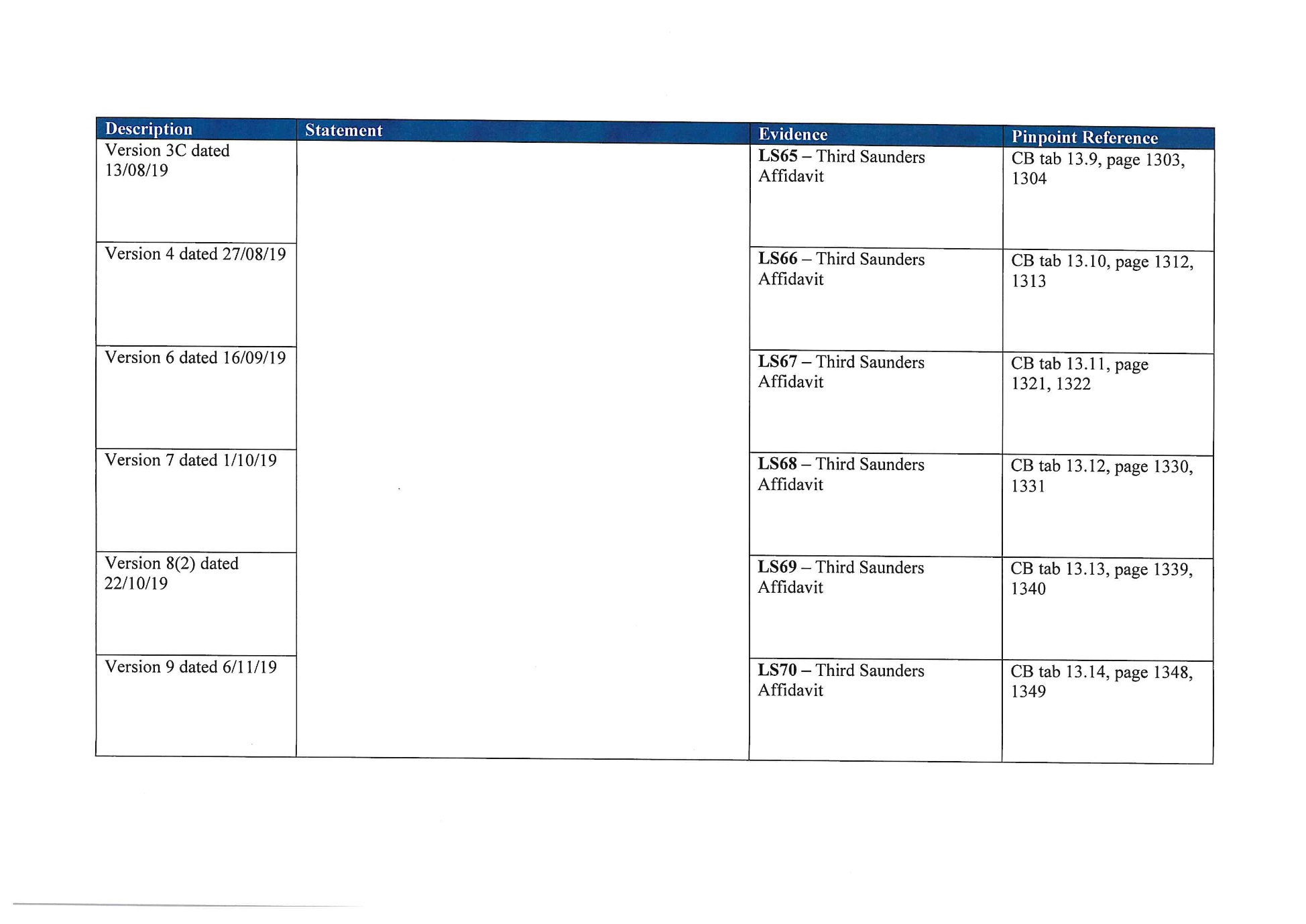

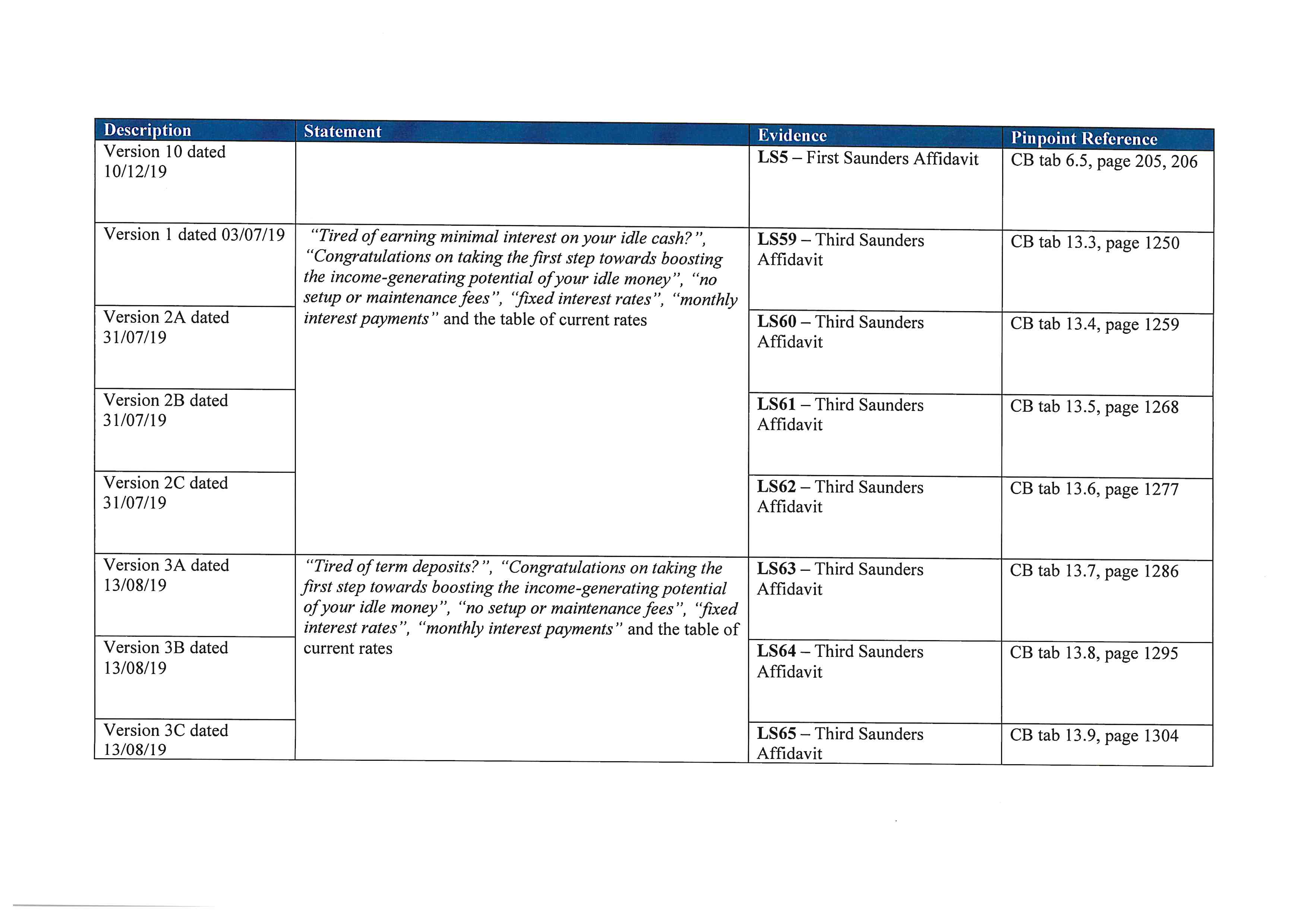

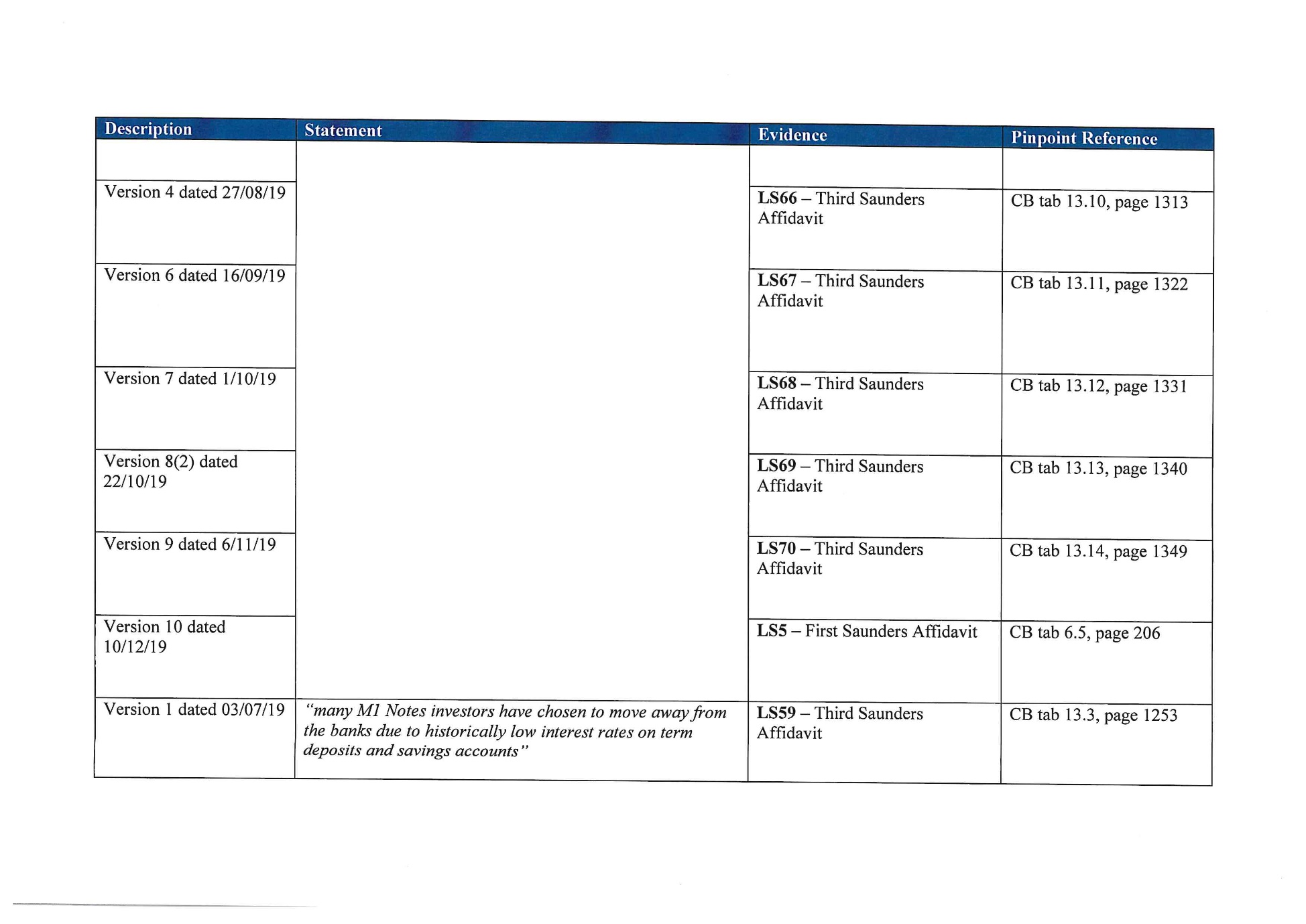

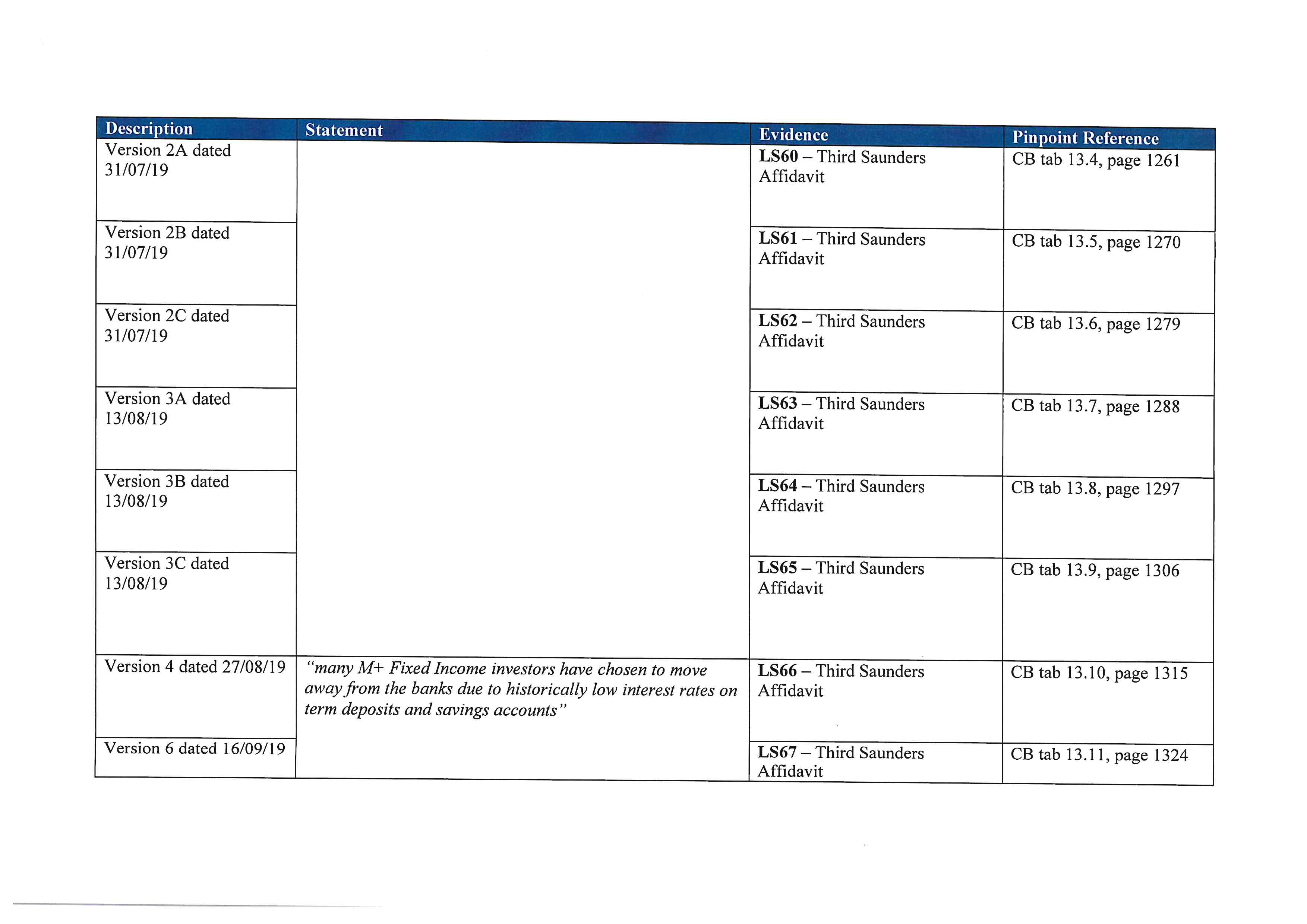

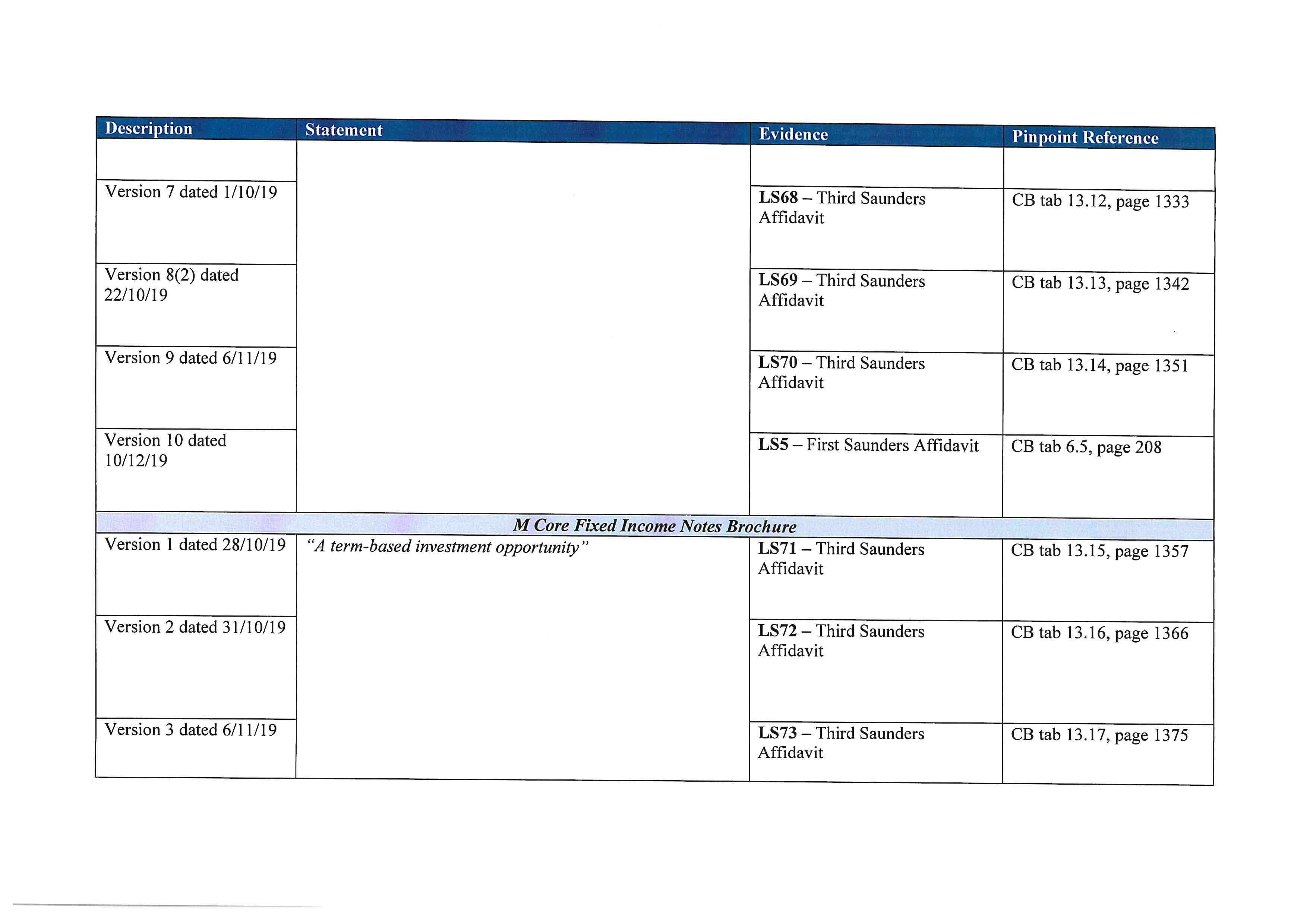

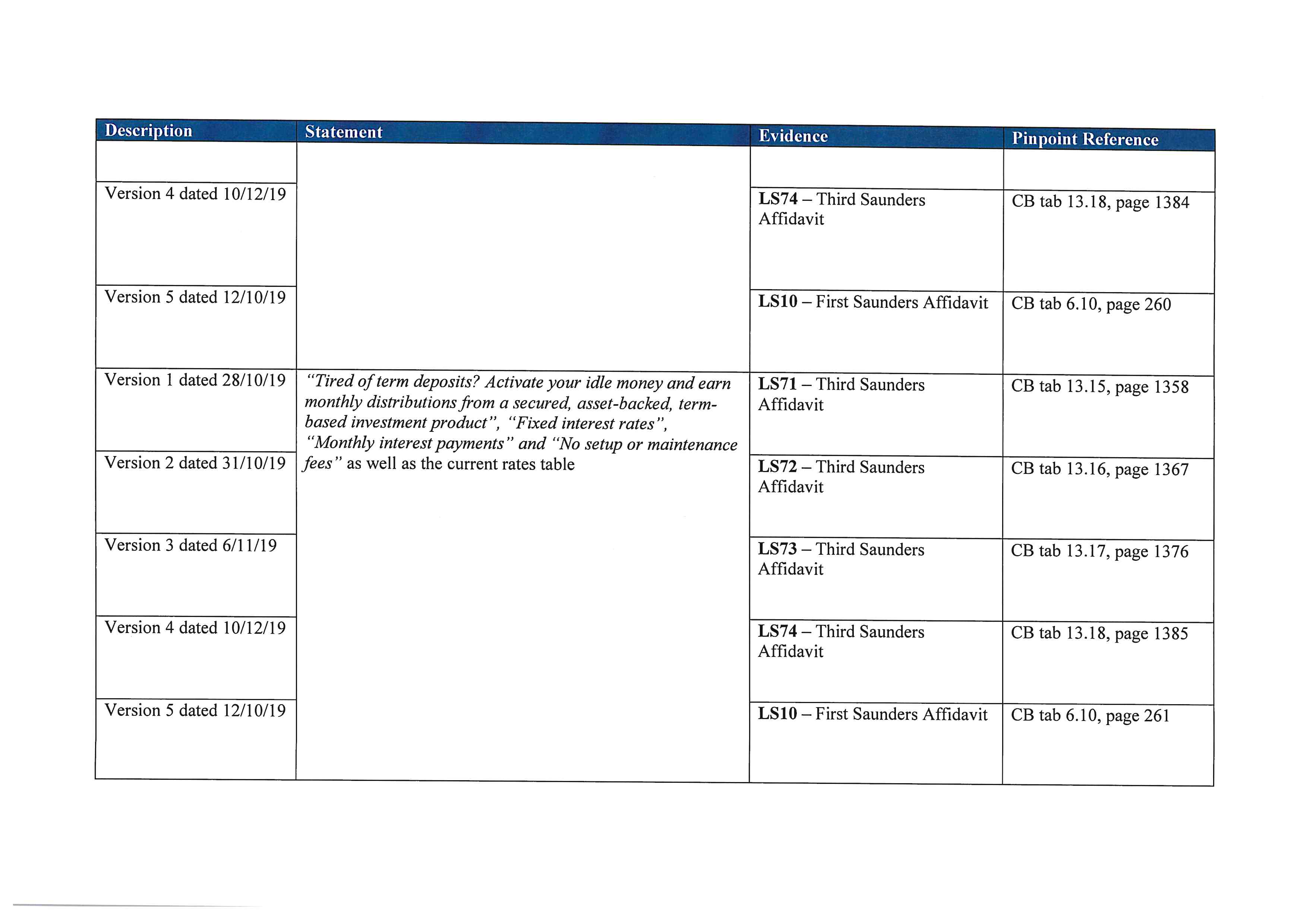

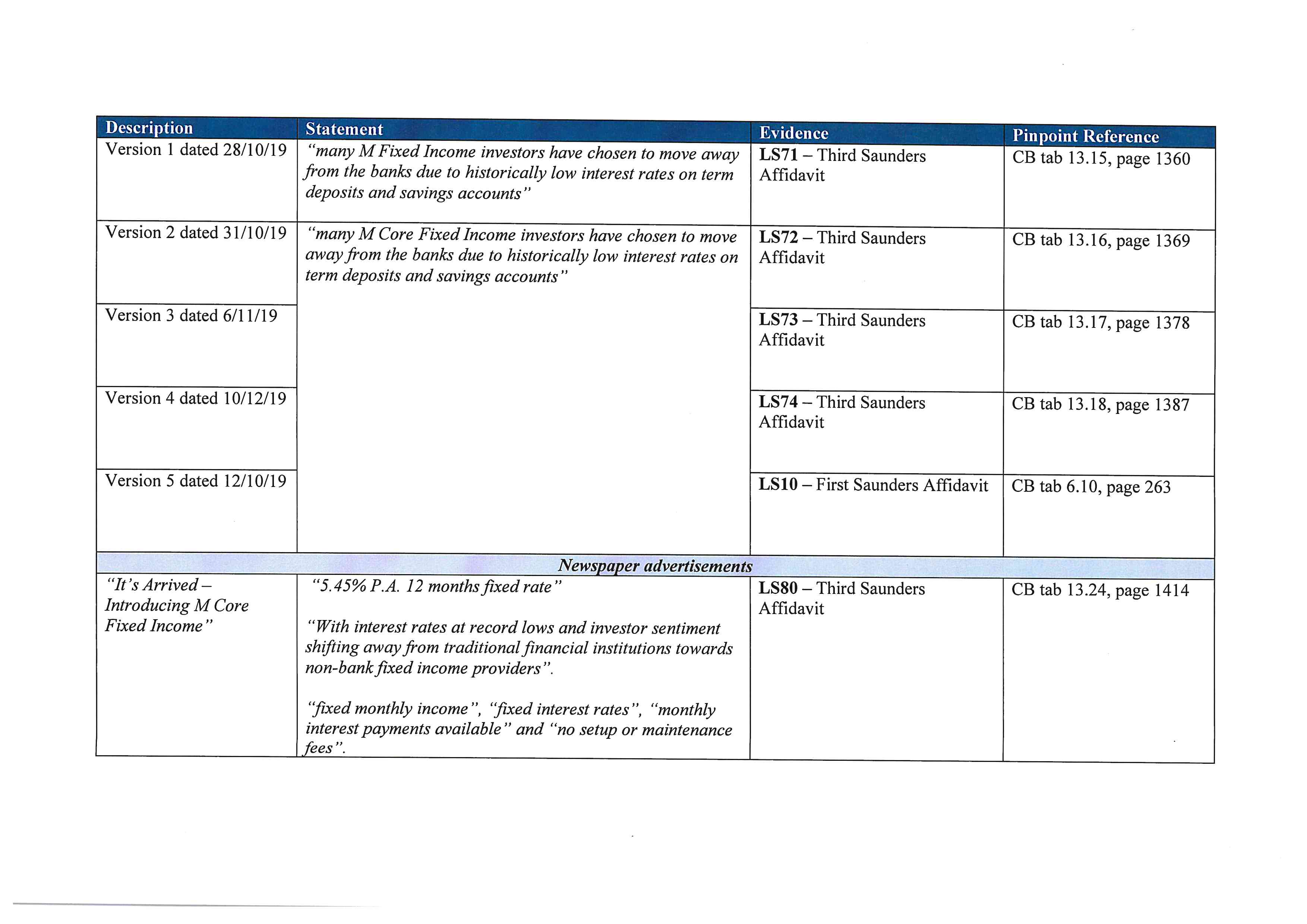

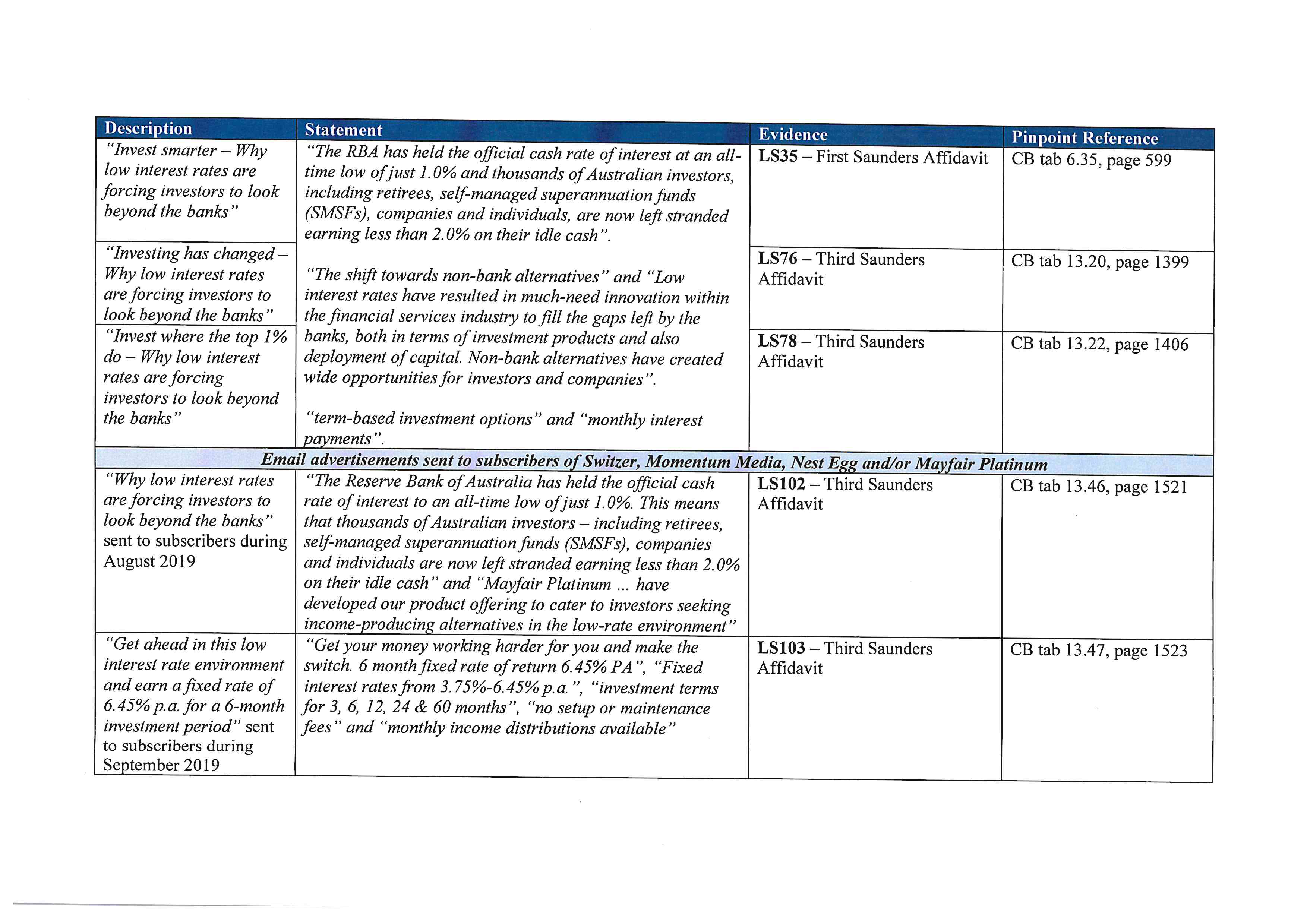

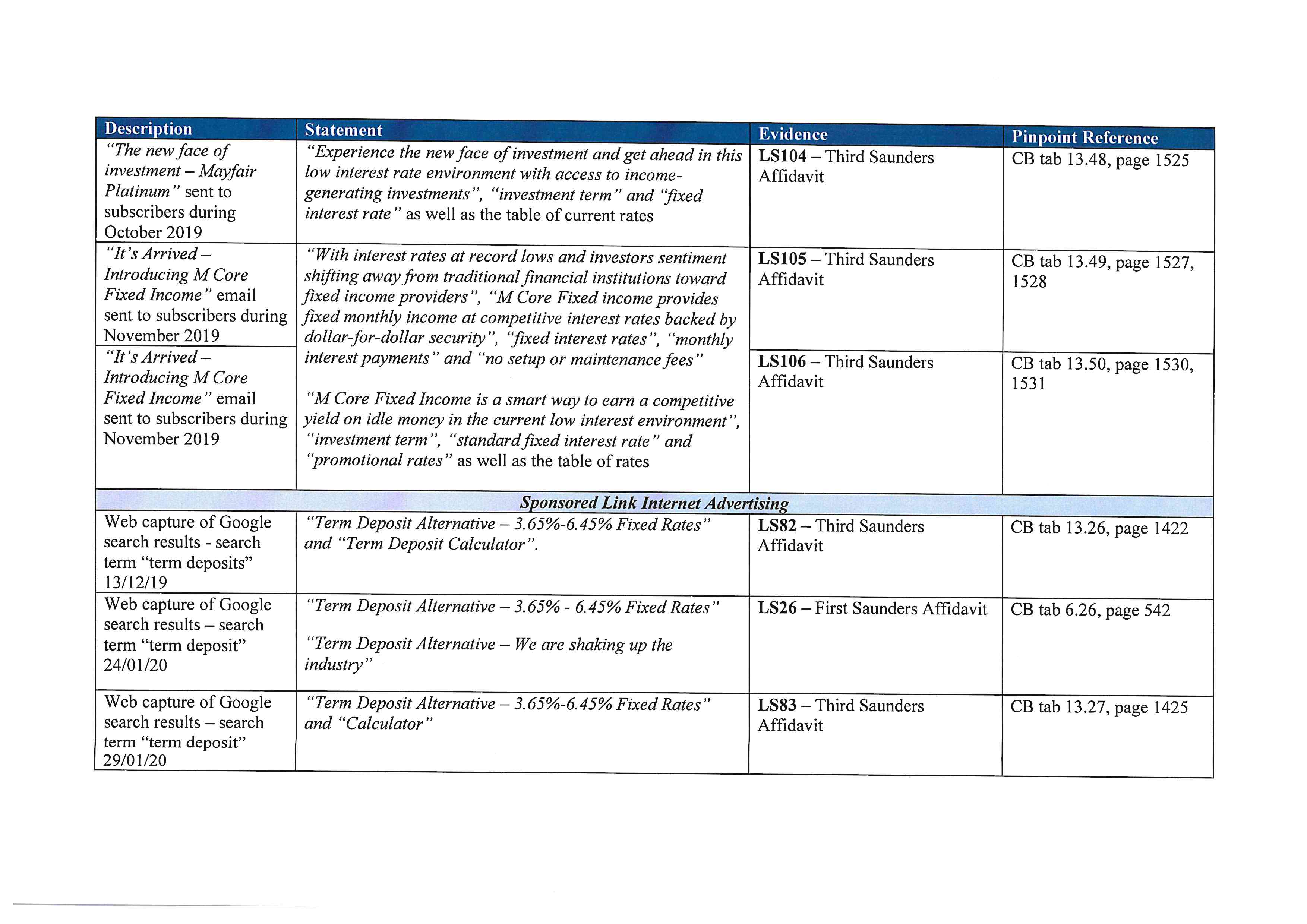

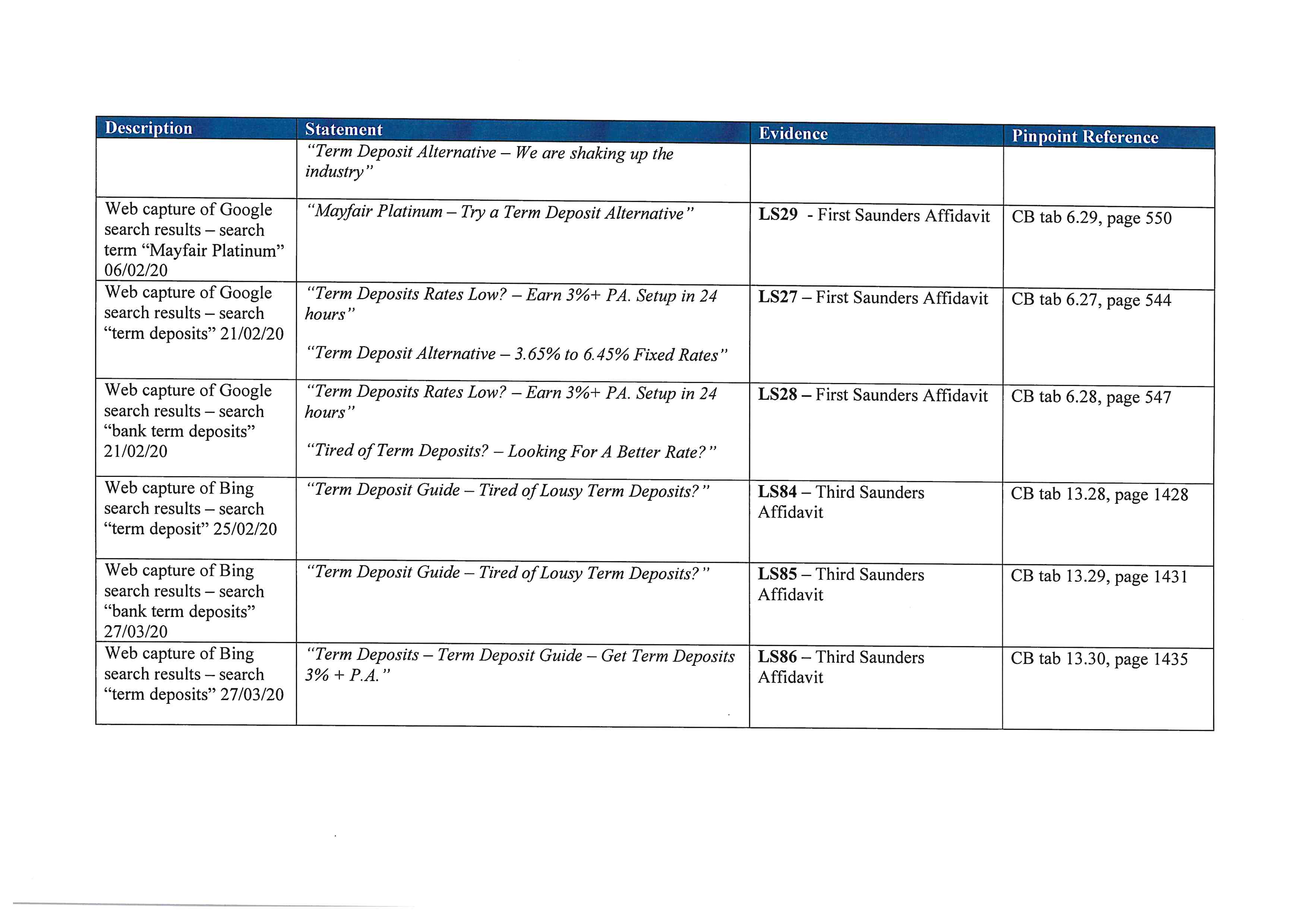

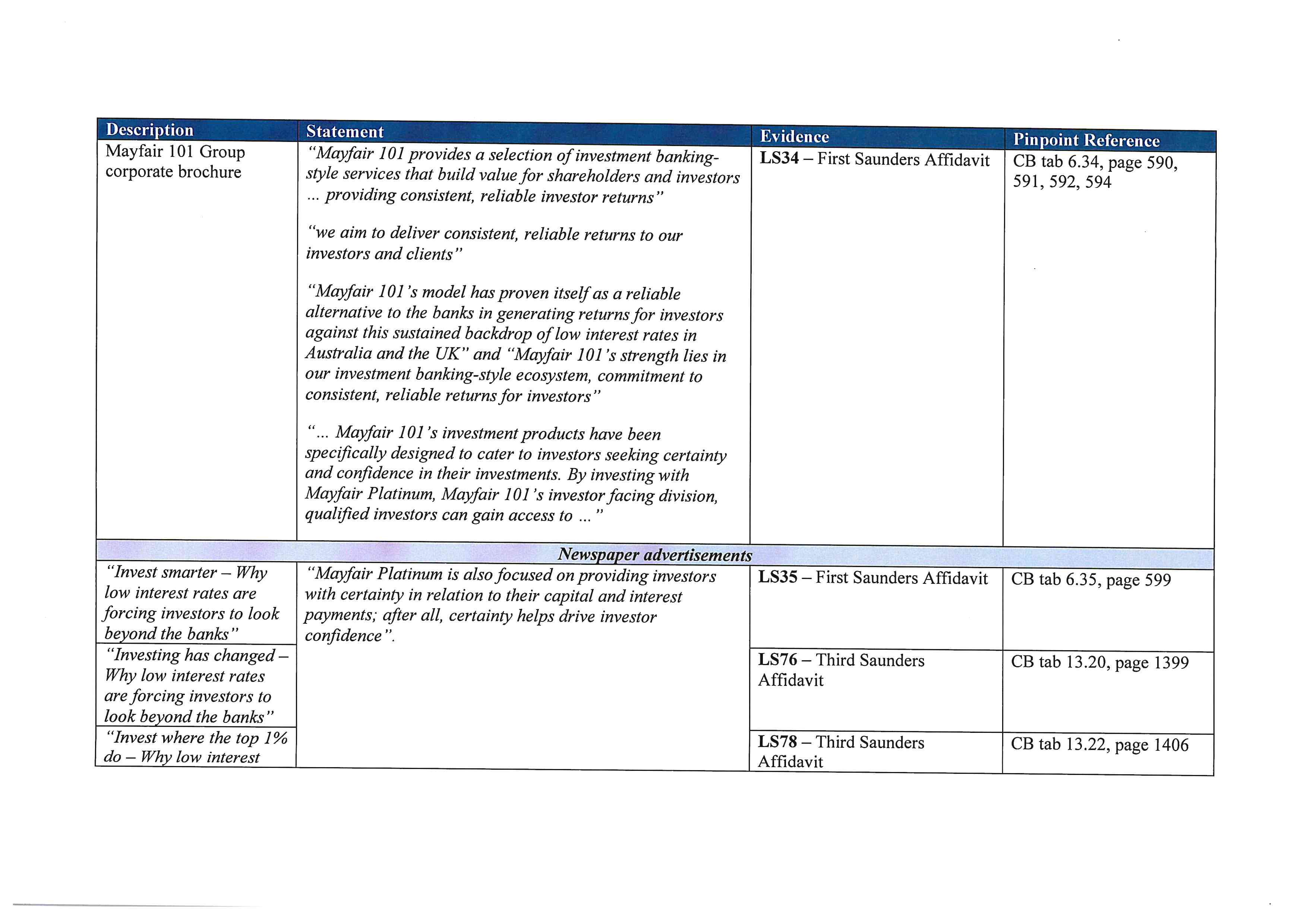

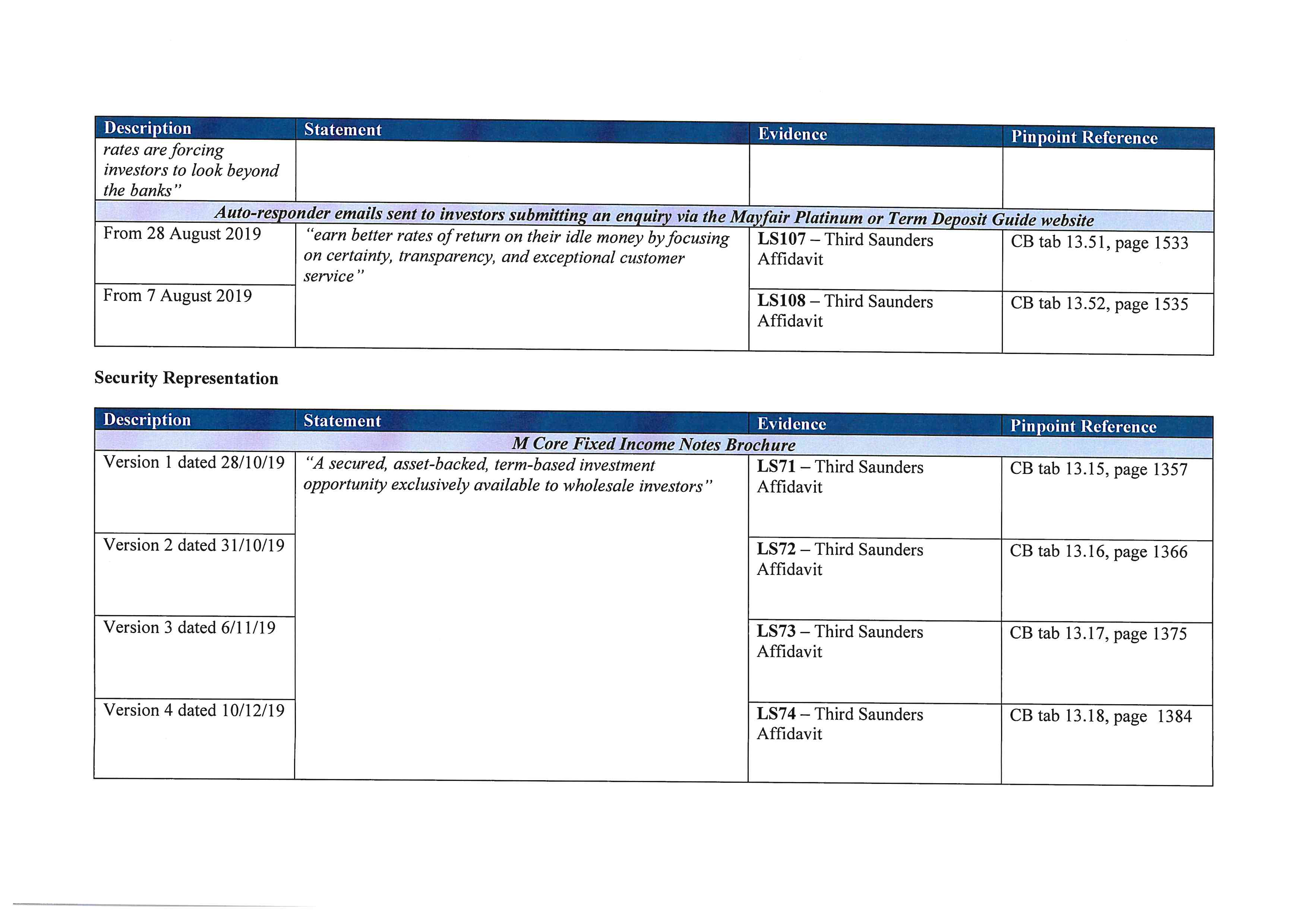

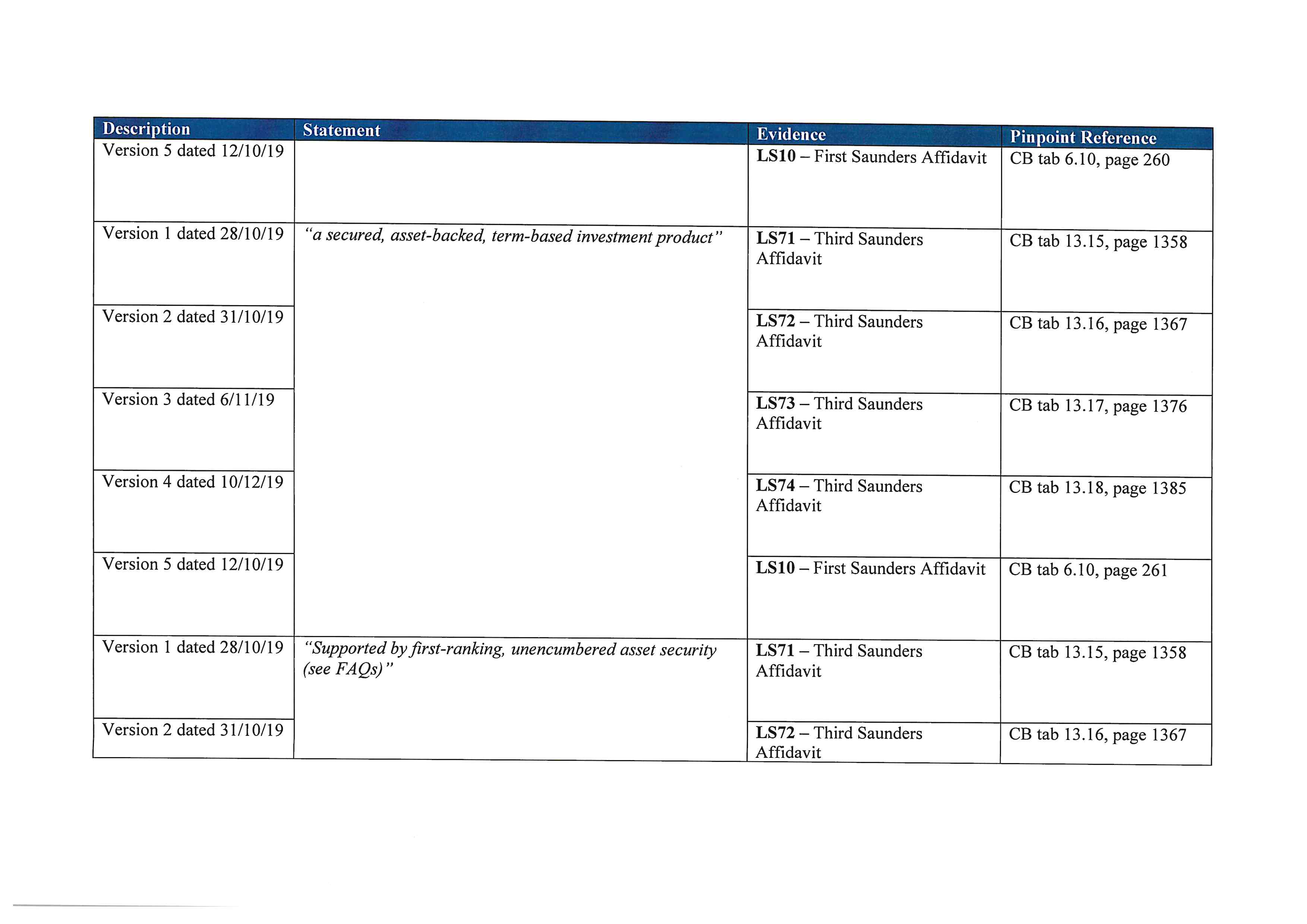

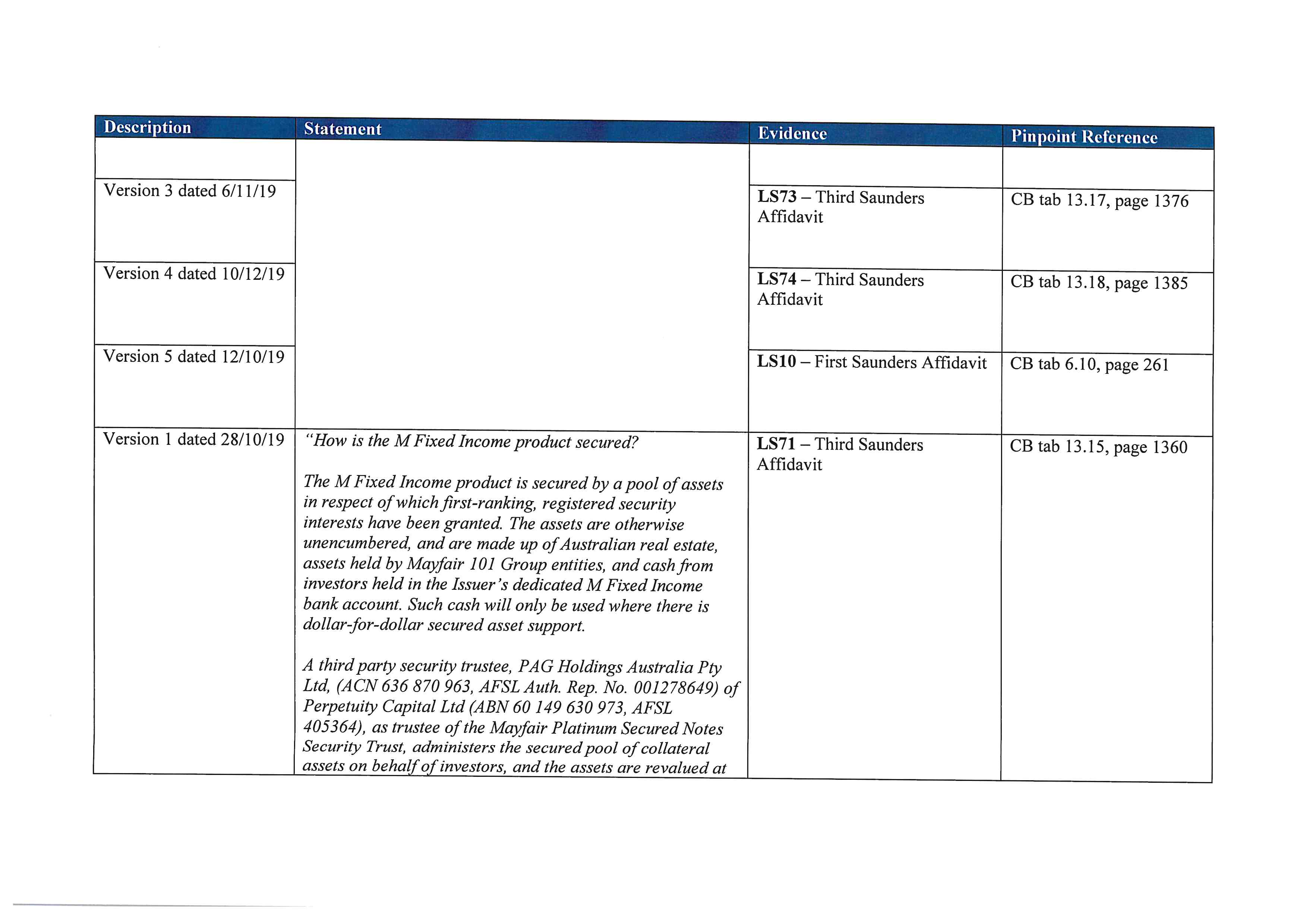

47 The statements and images relied upon by ASIC are conveniently summarised as an annexure to ASIC’s amended submissions dated 9 February 2021. For clarity, that annexure is attached as Annexure A to these Reasons for Judgment, which sets out the statements and images relied upon by ASIC.

48 ASIC submits that the Bank Term Deposits Representation was made:

(a) in relation to financial products, being the Mayfair Products, which are promissory notes;

(b) by Mayfair in promoting the Mayfair Products, by M101 Holdings in the application form for the M+ Notes, by M101 Nominees in the application form for the Core Notes and by Mayfair 101 in promoting the Mayfair Products.

49 ASIC submits that the representation concerned the future performance of the Mayfair Products and was therefore as to a future matter. ASIC further submits that the Defendants have adduced no evidence to support a contention that they had reasonable grounds for making the representation. ASIC submits that there were no such reasonable grounds.

50 ASIC submits the Mayfair Products exposed investors to significantly higher risk than bank term deposits, including by reason of the fact that the Mayfair Products are debentures, and lack the prudential regulations that apply to bank term deposits. ASIC submits that, accordingly, the Mayfair Products are not comparable to bank term deposits.

51 ASIC submits that the making of the Bank Term Deposits Representation therefore constituted, under the relevant provisions set out above:

(a) misleading or deceptive conduct;

(b) a false or misleading representation that the Mayfair Products are of a particular standard, quality, value or grade; and

(c) a false or misleading representation that the Mayfair Products have performance characteristics, uses or benefits equivalent or comparable to bank term deposits.

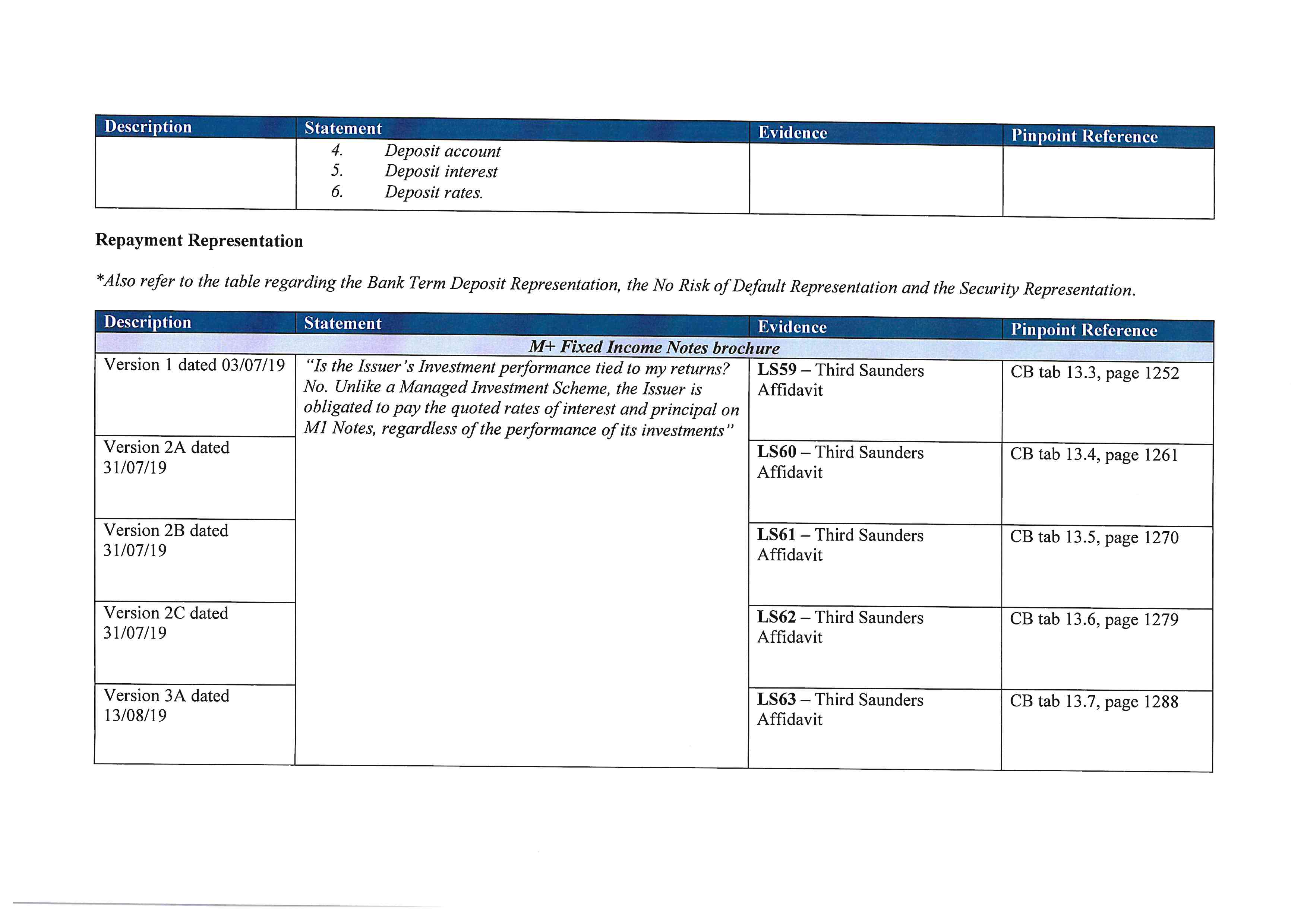

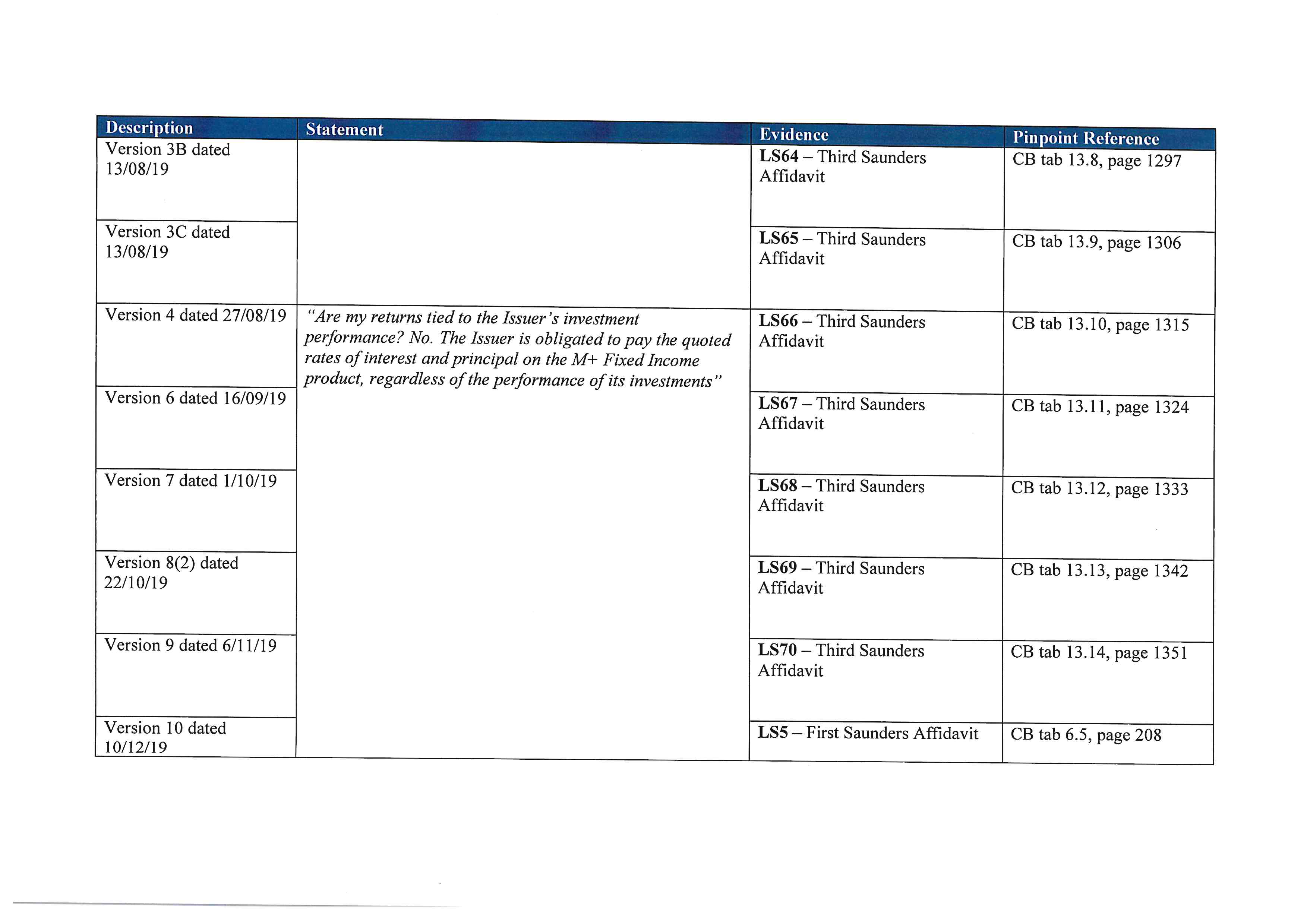

Repayment Representation

52 ASIC submits that the statements made by the Defendants in the relevant promotional material conveyed, separately and together, an impression that, on maturity of the Mayfair Products, the principal would be repaid in full. ASIC contends that the Repayment Representation was implied by:

(a) statements such as: “The Issuer is obligated to pay the quoted rates of interest and principal on the M+ Fixed Income product, regardless of the performance of its investments”, “Mayfair 101’s investment products have been specifically designed to cater to investors seeking certainty and confidence in their investments” and “Mayfair Platinum is … focused on providing investors with certainty in relation to their capital and interest payments; after all, certainty helps drive investor confidence”; and

(b) the impression conveyed (as set out above) that the Mayfair Products were comparable to bank term deposits.

53 The statements relied upon by ASIC are set out in Annexure A to these Reasons for Judgment.

54 ASIC submits that the Repayment Representation was made:

(a) in relation to financial products, being the Mayfair Products, which are promissory notes;

(b) by Mayfair in promoting the Mayfair Products, by M101 Holdings in the application form for the M+ Notes, by M101 Nominees in the application form for the Core Notes and by Mayfair 101 in promoting the Mayfair Products.

55 ASIC submits that the representation concerned the future performance of the Mayfair Products and was therefore a representation as to a future matter. The Defendants have adduced no evidence to support a contention that they had reasonable grounds for making the representation. ASIC submits that there were no such reasonable grounds.

56 ASIC submits that the evidence establishes that investors in the Mayfair Products might not receive capital repayments at maturity because the Defendants had the contractual right to elect to extend the time for repayment to investors for an indefinite period of time, including where the Defendants did not have sufficient funds to repay investments at maturity, which right the Defendants have in fact exercised.

57 ASIC submits that the making of the Repayment Representation therefore constituted:

(a) misleading or deceptive conduct;

(b) a false or misleading representation that the Mayfair Products are of a particular standard, quality or value; and

(c) a false or misleading representation that the Mayfair Products have performance characteristics, uses or benefits (being repayment of the principal in full).

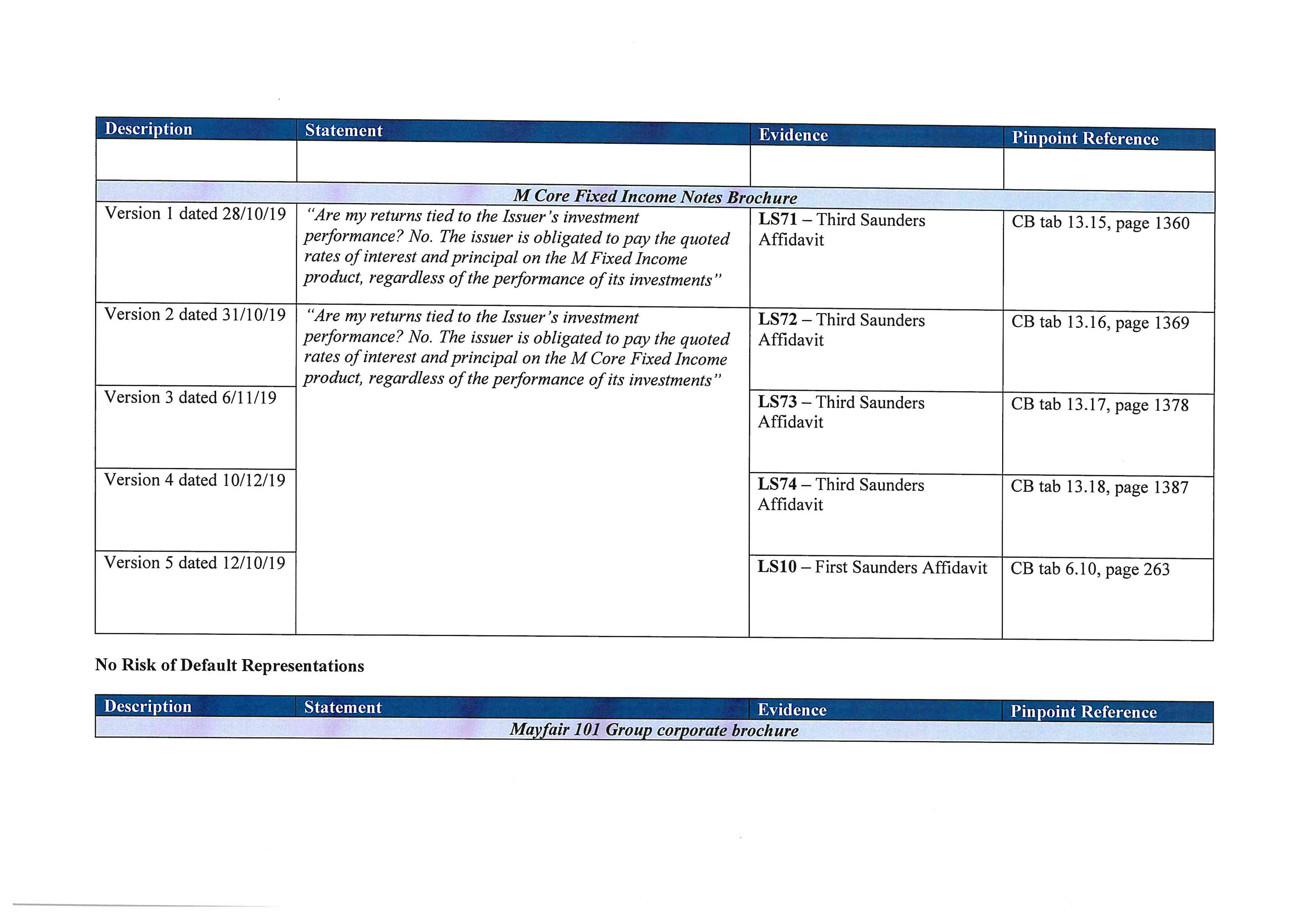

No Risk of Default Representation

58 ASIC submits that the statements made by the Defendants conveyed, separately and together, an impression that the Mayfair Products carried no risk of default. The No Risk of Default Representation was implied by statements in certain marketing material, which was to the effect that the Mayfair Products were specifically designed for investors seeking “certainty and confidence in their investments”, that “Mayfair Platinum is … focussed on providing investors with certainty in relation to their capital and interest payments”, and the impression conveyed (as set out above) that the Mayfair Products are comparable to bank term deposits.

59 The statements relied upon by ASIC are set out in Annexure A to these Reasons for Judgment.

60 ASIC submits that the use of the words “certainty” and “confidence” is likely to have conveyed to at least some consumers that their principal investment would definitely be repaid in full at maturity and that the investments carried no risk. ASIC submits that, in fact, the true position is that:

(a) the Defendants had the contractual right to suspend redemptions of investments at maturity for an indefinite period of time because the Defendants did not have sufficient funds to repay the debts;

(b) that right has now been exercised;

(c) such a right, coupled with the uncertainty of the financial position of the Defendants, exposes investors to the real risk that investors could lose some or all of their principal investment.

61 ASIC submits that those circumstances mean that the Mayfair Products cannot sensibly be said to give investors certainty. On the contrary, ASIC submits that the products have been “specifically designed” to produce a result that is quite uncertain for investors.

62 ASIC submits that the No Risk of Default Representation was made:

(a) in relation to financial products, being the Mayfair Products, which are promissory notes;

(b) by Mayfair in promoting the Mayfair Products, by M101 Holdings in the application form for the M+ Notes, by M101 Nominees in the application form for the Core Notes, and by Mayfair 101 in promoting the Mayfair Products.

63 ASIC submits that the representation concerned the future performance of the Mayfair Products and was therefore as to a future matter. The Defendants have adduced no evidence to support a contention that they had reasonable grounds for making the representation. ASIC submits that there were no such reasonable grounds.

64 ASIC submits that the evidence establishes that there was a risk that investors could lose some or all of their principal investment, and in fact are likely to do so.

65 ASIC submits that the making of the No Risk of Default Representation therefore constituted:

(a) misleading or deceptive conduct;

(b) a false or misleading representation that the Mayfair Products are of a particular standard, quality or value; and

(c) a false or misleading representation that the Mayfair Products have performance characteristics, uses or benefits (ie that they carried no risk of default).

Security Representation

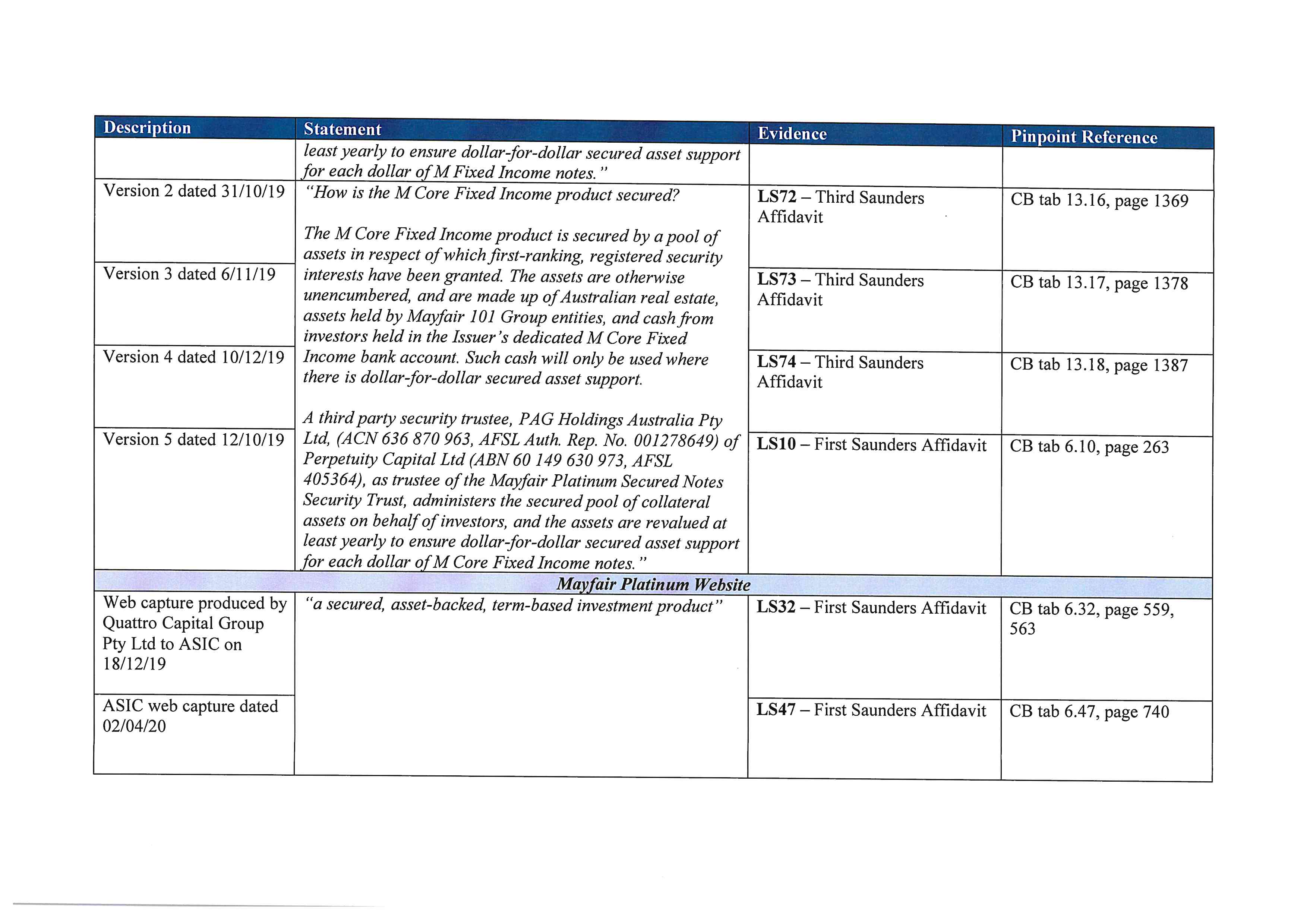

66 ASIC submits that the statements made by the First Defendant (ie Mayfair) and the Third Defendant (ie M101 Nominees) also conveyed, separately and together, an impression that the Core Notes were fully secured financial products. ASIC submits that the Security Representation was made expressly by statements in the marketing and promotional material for the Core Notes which included a key feature that the Core Notes were:

(a) “supported by first-ranking, unencumbered asset security”;

(b) “secured by a pool of assets in respect of which first-ranking, registered security interests have been granted. The assets are otherwise unencumbered, and are made up of Australian real estate, assets held by Mayfair 101 Group entities, and cash from investors held in the Issuer’s dedicated M Core Fixed Income bank account. Such cash will only be used where there is dollar-for-dollar secured asset support”;

(c) “the assets are revalued at least yearly to ensure dollar-for-dollar secured asset support for each dollar of M Core Fixed Income notes.”

67 The statements relied upon by ASIC are set out in Annexure A to these Reasons for Judgment.

68 ASIC relies upon the expert report prepared by Mr Jason Tracy of Deloitte (Expert Report) which contains his expert opinion, relevantly, about the following matters relating to the Security Representation:

(a) whether the debts owed to Core Note investors were “secured”, and, if so, what form did that security take and over what assets was there security;

(b) the value of that security; and

(c) the financial capacity of the related entities to repay the loans received from M101 Nominees being unknown.

69 The Expert Report was annexed to the Tracy Affidavit (being an affidavit of Mr Tracy affirmed 14 August 2020 and filed in this proceeding) and the Second Tracy Affidavit (being an affidavit of Mr Tracy affirmed 11 December 2020 and filed in this proceeding).

70 ASIC relies upon [2.11] – [2.14] of the Expert Report which concludes as follows with regard to the security in place:

2.11 While various security arrangements have been entered into between [the Security Trustee] as security trustee, M101 Nominees and the various trustees, it would appear, with one exception, that [the security trustee] does not have direct first mortgage security over the real properties held in the various trusts at 31 December 2019 and 20 March 2020.

2.12 It also appears that deposits were paid on properties in instances where there was no security registered on the PPSR in favour of [the security trustee] at the time of the deposit being paid, including at 31 December 2019 and 20 March 2020.

2.13 Further, in relation to the two related party loans, one of the loans appears to have had no security registered on the PPSR at 31 December 2019 and 20 March 2020, while the other appears to have a prior registered third party security at 20 March 2020.

2.14 Given the conclusions reached in Sections 2.11 to 2.13, in my opinion, there are a significant number of instances where Core Note investor security was not first ranking and the assets were not otherwise unencumbered at 31 December 2019 and 20 March 2020

71 ASIC relies upon [2.4] of the Expert Report which states:

In summary, it would appear that Core Note investor funds were not and are not generally supported by first-ranking, unencumbered asset security at 31 December 2019 and 20 March 2020.

72 ASIC relies upon the Expert Report which also sets out further concerns regarding the asset security values at [2.25] and [2.26]:

2.25 In the absence of a funds flow showing the receipt of Core Note investor funds and payment from the M101 Nominees bank account, it is unclear whether all the funds from Core Note investors have flowed to secured assets.

2.26 I have a number of concerns regarding the asset security values for Core Note investors:

(a) There is a risk that prior registered security holders may be able to escalate their facilities and appoint receivers. In the event this happens, asset values and the recovery of funds to Core Note investors could be negatively impacted.

(b) There is a risk given [Mayfair] was active in acquiring a large number of properties from October 2019 to April 2020 that these entities established a market price in an otherwise illiquid and small property market at Mission Beach. Consequently, there is a risk that the contract price in each sale contract is above market price in today’s terms, negatively impacting the asset security values and recovery of funds to Core Note investors.

(c) The deposits paid on the properties not settled totalling $5,852,387 at 20 March 2020 may be at risk of forfeiture due to failure to complete, especially if significant additional funds of $86,483,036 cannot be sourced to settle these transactions. It is unclear to me where these additional funds would come from.

(d) The financial capacity of the related entities to repay the loans received from M101 Nominees is unclear in the absence of financial information outlining their financial position, historical and forecast performance.

(e) The basis of the 4% uplift totalling $2,983,400 at 20 March 2020 applied by M101 Nominees to the carrying value of the 119 real property assets, including Dunk Island[,] is not well supported by the documents made available to me. If this amount is excluded, there would appear to be a deficiency of $2,732,540 to Core Note investors, assuming full recovery of all other secured assets in line with M101 Nominees report to [the security trustee] at 20 March 2020.

73 ASIC relies upon the results of the investigations of the provisional liquidators (and now liquidators) of M101 Nominees which are set out in the Provisional Liquidators’ Report. ASIC referred in particular to [2] and [3] of the Provisional Liquidators’ Report:

Despite clearly advertising to potential investors that their investment would be supported by ‘first ranking, registered security’ and ‘the assets are otherwise unencumbered’[,] in my opinion this did not occur. In reality the majority of the funds invested were provided to a related entity, Eleuthera Group Pty Ltd (“Eleuthera Pty Ltd”) on an unsecured loan basis for a term of 10 years at a rate of 8% p.a. [M101 Nominees] did not hold any security over the assets of Eleuthera.

As part of the investment agreement with [the Core Notes] noteholders, a Security Trustee was appointed to protect investors’ rights and was responsible for taking security over various related entities/trusts which held assets that were purchased largely from the funds advanced by [M101 Nominees] via Eleuthera. Despite the Security Trustee taking an [all present and after-acquired property (AllPAP)] over a number of entities/trusts, I note that in all instances except one, the AllPAP specifically excluded any real estate property. Effectively, the registered AllPAP secured little to no assets for [Core Notes] noteholders given the primary asset of these entities/trust [sic] was real estate property.

74 ASIC relies upon the fact that none of the matters which are the subject of the Expert Report, or the Provisional Liquidators’ Report, have been contradicted or answered by the Defendants. That evidence is unchallenged.

75 ASIC submits that the Security Representation was made:

(a) in relation to financial products, being the Core Notes, which are promissory notes; and

(b) by Mayfair in promoting the Mayfair Products and by M101 Nominees in the application form for the Core Notes.

76 ASIC submits that the representation concerned the future performance of the Core Notes and was therefore a representation as to a future matter. The Defendants have adduced no evidence to support a contention that they had reasonable grounds for making the representation. ASIC submits that there were no such reasonable grounds.

77 ASIC submits that the expert evidence demonstrates that the Core Notes were not fully secured.

78 ASIC submits that the making of the Security Representation therefore constituted:

(a) misleading or deceptive conduct;

(b) a false or misleading representation that the Core Notes are of a particular standard, quality, value or grade; and

(c) a false or misleading representation that the Core Notes have performance characteristics, uses or benefits (ie that the Mayfair Products were fully secured).

CONSIDERATION

79 As I have mentioned above, the trial was undefended. As a consequence, there was no challenge to the evidence tendered by ASIC. There was no evidence tendered by the Defendants.

80 I directed that ASIC file a document which identified the precise pages of the Court Book which ASIC tendered in evidence in support of the relief claimed. ASIC filed such a document on 9 February 2021. I have read and considered the specific Court Book references identified by ASIC as comprising the evidence on which ASIC relies in these proceedings.

81 As this matter proceeded before me undefended, and there was no challenge to the evidence tendered by ASIC, I do not propose to set out in detail the substance of all of the extensive evidence relied upon by ASIC. In the circumstances, that would serve no purpose. I have identified above the evidence to which I have had regard in making the findings set out below. It is sufficient to set out below some examples of the evidence relied on by ASIC.

Examples of the evidence relied on by ASIC as to the representations

The Mayfair Platinum Website

82 ASIC referred to an annexure to the First Saunders Affidavit, which was an extract from the “Mayfair Platinum Website”. An extract of that website produced to ASIC on 18 December 2019 stated:

Cash and term deposit alternatives

Mayfair Platinum offers income-producing investment opportunities for wholesale investors involving exposure to opportunities that are typically reserved for investment banks, stockbrokers, family offices and the ultra-wealthy.

Qualified investors can access term-based investment options starting from AU$100,000 and ranging from 3 months to 5 years, with the option of monthly interest distributions.

(Bold text in the original.)

83 An extract of the Mayfair Platinum website retrieved by ASIC on 2 February 2020 stated that investors could:

Gain exclusive access to

• High yield term deposit alternatives

• Cash alternatives

• Income-producing investments

• High-yield investments

• Growth companies & sectors

• Fixed income products

• Managed funds

• Pre-IPO opportunities

• Retail bond opportunities

• Emerging markets

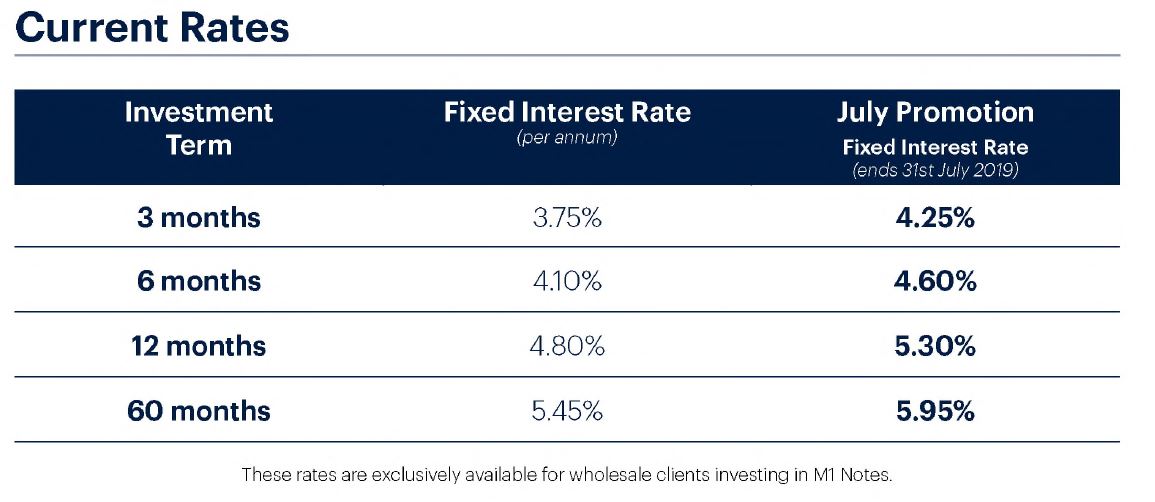

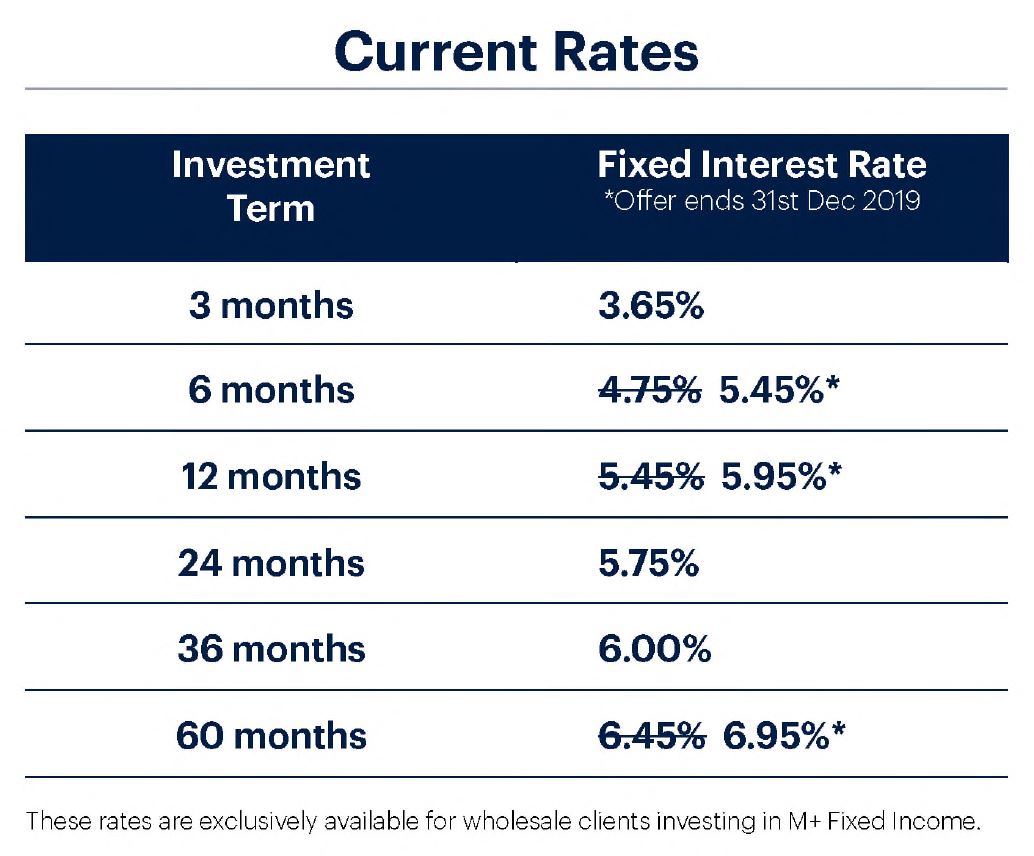

84 In respect of the M+ Notes product, the Mayfair Platinum website included the following table:

85 The following words appeared adjacent to that table:

Take the first step towards boosting your income-generating potential for your idle money.

Investing in our M+ [Notes] product is a smart and effective way of earning competitive rates of return whilst official interest rates are at record-lows.

Low interest rates have resulted in much-needed innovation within the financial services industry to fill the gaps left by the banks, both in terms of investment products and also deployment of capital. Non-bank alternatives have created wide opportunities for investors and companies.

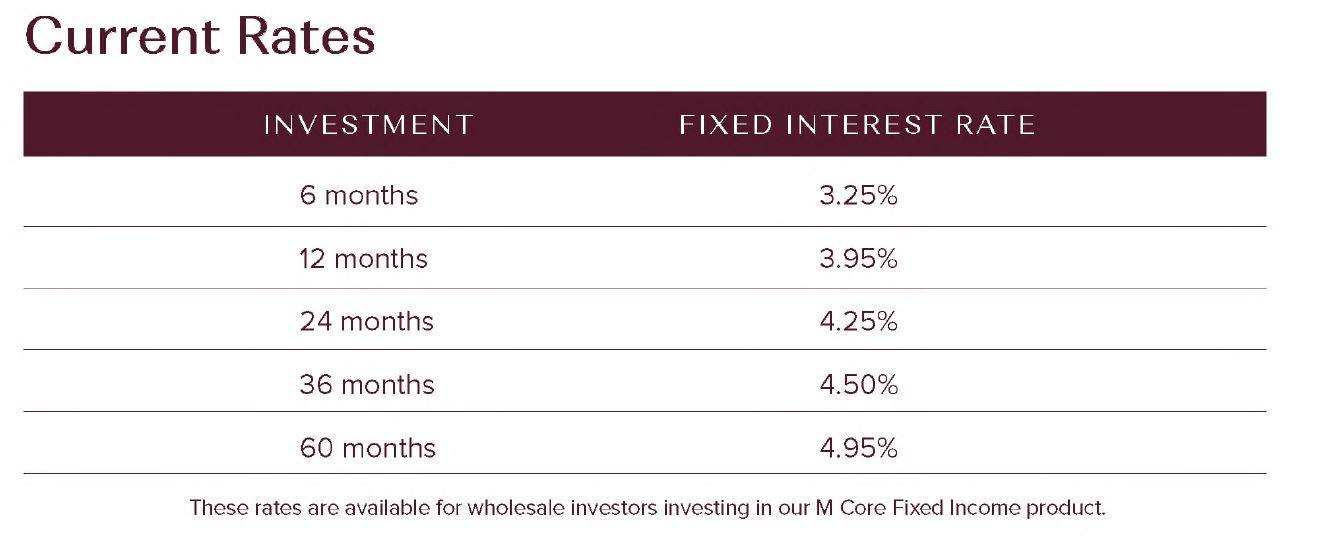

86 In respect of the Core Notes product, the Mayfair Platinum website included the following table:

87 The following words appeared adjacent to that table:

Activate your idle money and earn monthly distributions from a secured, asset backed, term-based investment product.

We invite you to invest in [the Core Notes], a secured, asset backed term-based investment product offered by a forward-thinking group that is working to drive positive change in the financial services and investment industry.

Low interest rates have resulted in much-needed innovation within the financial services industry to fill the gaps left by the banks, both in terms of investment products and also deployment of capital. Non-bank alternatives have created wide opportunities for investors and companies.

88 The pages on the Mayfair Platinum website dedicated to the M+ and Core Notes products contained an “Income Calculator”. Users could insert the proposed “investment amount” per annum and the proposed “investment term”, and, depending on the relevant interest rate applied, the “Income Calculator” calculated the purported “monthly distribution” and “total interest earnt” over the term. In fine print below the “Income Calculator”, the following text appeared:

Note: The results from this calculator should be used as an indication only, as they may not represent actual returns exactly. Information such as interest rates quoted, timing of interest payments, and default figures used in the relevant assumptions are subject to change.

89 The above examples are illustrative of other instances of the Mayfair Platinum website using expressions such as “High yield term deposit alternatives”, “Cash alternatives” and “Fixed income products”. ASIC’s evidence referred to and relied upon a number of such instances.

The “Term Deposit Guide” website

90 Another website operated by Online Investments Pty Ltd was “www.termdepositguide.com.au”. An extract of that website dated 11 December 2019 produced to ASIC shows that the website stated from 11 December 2019:

If you are about to invest $100k-$5m in a term deposit and want more than 3% p.a....talk to us first!

Join the hundreds of savvy Aussie investors that were tired of earning low interest rates on their term deposits, and have made the switch to boost their investment returns and upgrade their lifestyles.

…

Find out where Australian investors are parking their idle money to beat inflation and earn regular monthly income. Our dedicated Australia-based team has assisted hundreds of Australian investors, retirees, companies, individuals and more, to earn a better yield on their money. See if you qualify today!

(Bold text in the original.)

The M+ Notes brochure

91 There were various versions of the brochure for the M+ Notes product (dated between 3 July 2019 and 10 December 2019). Those brochures described the M+ notes as a “term-based investment opportunity exclusively available to wholesale investors”. A version of the brochure dated 3 July 2019 stated:

Tired of earning minimal interest on your idle cash?

Congratulations on taking the first step towards boosting the income-generating potential of your idle money.

Investing in [the M+] Notes is a smart and effective way of earning competitive rates of return whilst official interest rates are at record-lows.

We invite you to invest in [the M+] Notes and be part of a forward-thinking group that is driving positive change in the financial services and investment industry.

(Bold text in the original.)

92 The version of the brochure dated 3 July 2019 included the following table:

93 The version of the brochure dated 10 December 2019 included the following table:

94 Above this table, the version of the brochure dated 10 December 2019 stated:

Tired of term deposits?

Congratulations on taking the first step towards boosting the income-generating potential of your idle money.

Investing in our M+ Fixed Income product is a smart and effective way of earning competitive rates of return whilst official interest rates are at record-lows.

We invite you to invest in M+ Fixed Income and be part of a forward-thinking group that is driving positive change in the financial services and investment industry.

(Bold text in the original.)

95 The brochure included a section titled “Frequently Asked Questions”. The version of the brochure dated 10 December 2019 included the following:

Why should I choose Mayfair Platinum?

The Mayfair 101 group was established in 2009 and has assets spanning 11 countries across a diverse range of sectors, including financial services, wealth management, technology, property and emerging markets. Our capital management strategy provides considerable geographic, industry & sector, business maturity, and currency diversification, which is a key reason why investors entrust their funds with us.

Is Mayfair Platinum regulated?

Yes. Mayfair Wealth Partners Pty Ltd (t/a Mayfair Platinum) is a corporate authorised representative (#00176207) of Quattro Capital Pty Ltd, which holds an Australian Financial Services Licence (#334653).

How can you pay fixed interest rates higher than the banks?

The interest rates we offer our investors are facilitated by the Mayfair 101 group’s capital management strategy. The group carefully selects opportunities to invest in that provide strong yields, capital growth, and refinancing opportunities that enable us to support principle [sic] and interest repayments to our investors.

Is the Issuer a bank?

No. However, many M+ Fixed Income investors have chosen to move away from the banks due to historically low interest rates on term deposits and savings accounts. We operate by accessing capital from third parties (our investors), paying our investors for access to that capital, and utilising that capital to grow the Mayfair 101 group.

Are my returns tied to the Issuer's investment performance?

No. The Issuer is obligated to pay the quoted rates of interest and principal on the M+ Fixed Income product, regardless of the performance of its investments.

…

What are the risks?

Investors should be mindful that, like all investments, there are risks associated with investing in our M+ Fixed Income product. Risks to take into consideration include general investment, lending, liquidity, interest rate, cyber, related party transactions and currency risks.

Can I withdraw my money out early if I need to?

Yes, although redemptions are subject to liquidity and other applicable terms. Please note this may be subject to a 1.5% early withdrawal and liquidity fee. Please provide 30 days’ notice in writing for amounts up to $1m. For amounts above $1m simply email your Client Relationship Manager and they will advise a repayment schedule within 2 business days.

Is the M+ Fixed Income product covered by the Australian Government’s Financial Claims Scheme (FCS)?

The Australian Government’s Financial Claims Scheme (FCS) (or ‘Government Guarantee’) doesn't cover investments made in our M+ Fixed Income product. The Financial Claims Scheme has a limit of $250,000 per account holder per bank, and the banks have a bailout limit of just $20b per bank. Be mindful that bank investments above $250,000 aren’t covered by the Financial Claims Scheme, which is a reason why M+ Fixed Income is worth considering for larger investment amounts.

The Core Notes brochure

96 There were various versions of the brochure issued in relation to the Core Notes product. The title page of the brochures dated between 28 October 2019 and 12 December 2019 described the Core Notes as a “secured, asset-backed, term-based investment opportunity exclusively available to wholesale investors”.

97 The versions of the Core Notes brochure dated between October 2019 and December 2019 stated:

Tired of term deposits?

Activate your idle money and earn monthly distributions from a secured, asset-backed, term-based investment product.

Investing in our M Core Fixed Income product is a smart and effective way of earning competitive rates of return and monthly income whilst interest rates are at record lows. We invite you to invest in M Core Fixed Income, a secured, asset- backed term-based investment product offered by a forward-thinking group that is working to drive positive change in the financial services and investment industry.

(Bold text in the original.)

98 The brochures contained a table of “Current Rates”. The table which appeared in the brochure dated 12 December 2019 was as follows:

99 The various versions of the Cores Notes brochure contained answers to “Frequently Asked Questions” which were substantively the same. In this respect, the version of the brochure dated 28 October 2019 relevantly stated the following:

How is the M Fixed Income product secured?

The M Fixed Income product is secured by a pool of assets in respect of which first-ranking, registered security interests have been granted. The assets are otherwise unencumbered, and are made up of Australian real estate, assets held by Mayfair 101 Group entities, and cash from investors held in the Issuer’s dedicated M Fixed Income bank account. Such cash will only be used where there is dollar-for-dollar secured asset support.

A third party security trustee, PAG Holdings Australia Pty Ltd, (ACN 636 870 963, AFSL Auth. Rep. No. 001278649) of Perpetuity Capital Pty Ltd (ABN 60 149 630 973, AFSL 405364), as trustee of the Mayfair Platinum Secured Notes Security Trust, administers the secured pool of collateral assets on behalf of investors, and the assets are revalued at least yearly to ensure dollar-for-dollar secured asset support for each dollar of M Fixed Income notes.

…

Is Mayfair Platinum regulated?

Yes. Mayfair Wealth Partners Pty Ltd (t/a Mayfair Platinum) is a corporate authorised representative (#00176207) of Quattro Capital Pty Ltd, which holds an Australian Financial Services Licence (#334653).

How can you pay fixed interest rates higher than the banks?

The interest rates we offer our investors are facilitated by the Mayfair 101 group’s capital management strategy. The group carefully selects opportunities to invest in that provide strong yields, capital growth, and refinancing opportunities that enable us to support principle [sic] and interest repayments to our investors.

Are my returns tied to the Issuer’s investment performance?

No. The Issuer is obligated to pay the quoted rates of interest and principal on the M Fixed Income product, regardless of the performance of its investments.

Is the Issuer a bank?

No. However, many M Fixed Income investors have chosen to move away from the banks due to historically low interest rates on term deposits and savings accounts. We operate by accessing capital from third parties (our investors), paying our investors for access to that capital, and utilising that capital to grow the Mayfair 101 group.

…

What are the risks?

Investors should be mindful that, like all investments, there are risks associated with investing in our M Fixed Income product. Risks to take into consideration include general investment, lending, liquidity, asset, interest rate, cyber, related party transactions and currency risks.

…

Can I withdraw my money out early if I need to?

Yes, although redemptions are subject to liquidity and other applicable terms. Please note this may be subject to a 1.5% early withdrawal and liquidity fee. Please provide 30 days’ notice in writing for amounts up to A$1m. For amounts above A$1m simply email your Client Relationship Manager and they will advise a repayment schedule within 2 business days.

Is the M Fixed Income product covered by the Australian Government’s Financial Claims Scheme (FCS)?

The Australian Government’s Financial Claims Scheme (FCS) (or ‘Government Guarantee’) doesn’t cover investments made in our M Fixed Income product. The Financial Claims Scheme has a limit of A$250k for each account holder per bank, and the banks have a bailout limit of just A$20b per bank. Be mindful that bank investments above A$250k aren’t covered by the Financial Claims Scheme, which is a reason why M Fixed Income is worth considering for larger investment amounts.

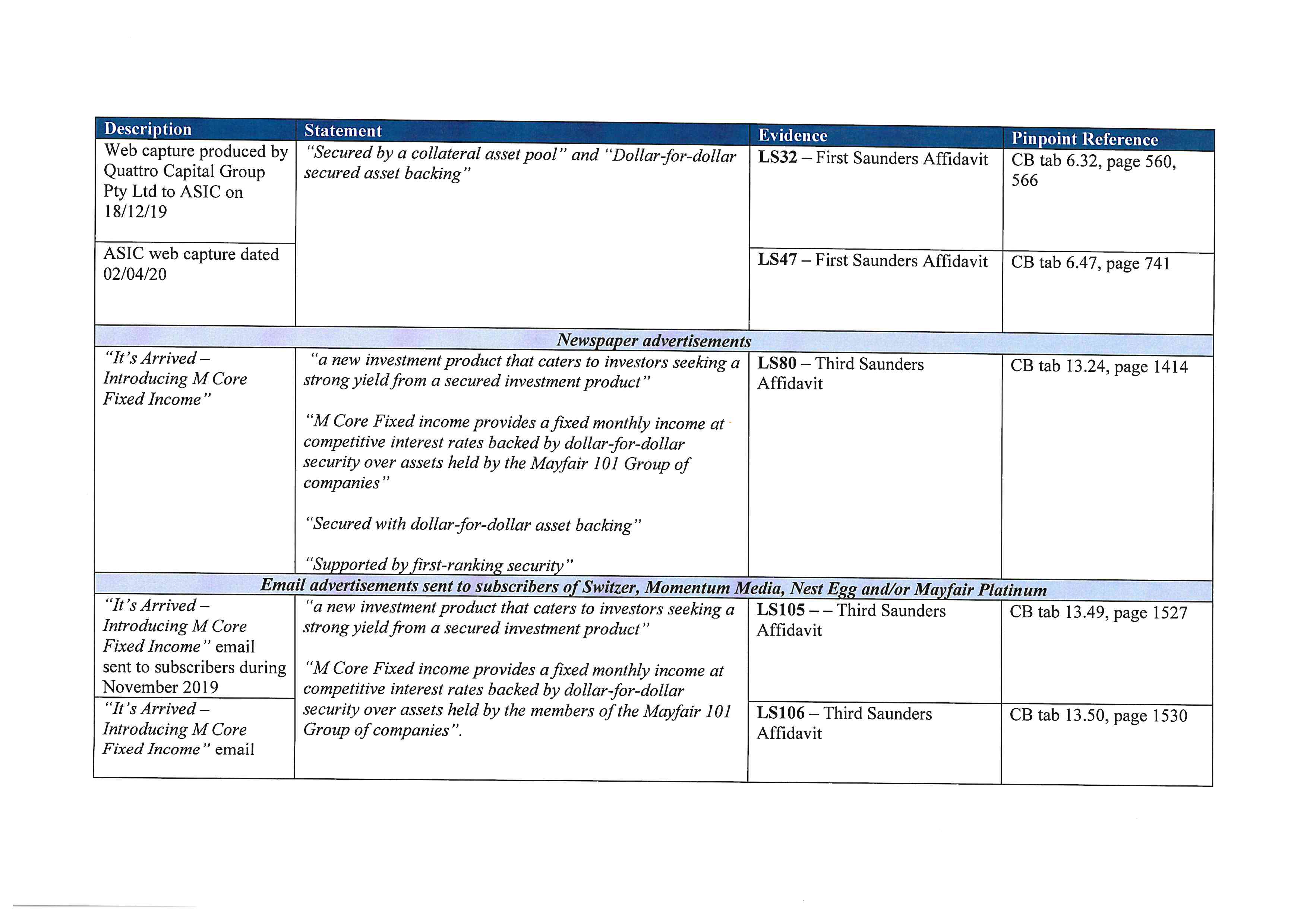

Newspaper advertisements

100 Mayfair Platinum published a newspaper advertisement in relation to the Core Notes. The advertisement stated:

5.45%P.A 12 MONTHS FIXED RATE

IT’S ARRIVED

Introducing M Core Fixed Income

The Mayfair 101 Group is delighted to announce the release of a new investment product that caters to investors seeking a strong yield from a secured investment product. With interest rates at record lows and investor sentiment shifting away from traditional financial institutions towards non-bank fixed income providers, Mayfair Platinum is delighted to make this new product available to Australian wholesale investors (not available to retail investors).

101 The advertisement continued:

M Core Fixed Income provides a fixed monthly income at competitive interest rates backed by dollar-for-dollar security over assets held by the Mayfair 101 Group of companies.

102 The advertisement stated that the “key features” of the Core Notes were as follows:

• Secured with dollar-for-dollar asset backing

• Supported by first-ranking security

• AU $250k minimum investment

• Fixed interest rates

• Monthly interest payments available

• No setup or maintenance fees

• Dedicated Client Relationship Manager

• Individual, Company, Trust & Self-Managed Superannuation Fund (SMSF) compatible

• Available exclusively to Australian wholesale investors

• Early redemption available (subject to liquidity and other applicable terms)

103 The Third Saunders Affidavit records that the above advertisement was published in the following newspapers between 22 November 2019 and 18 December 2019:

(a) in the Australian Financial Review, on 22 November 2019, 25 November 2019, 27 November 2019, 3 December 2019 and 4 December 2019;

(b) in the Cairns Post, on 26 November 2019, 4 December 2019 and 10 December 2019;

(c) in Brisbane’s The Courier Mail, on 2 December 2019 and 10 December 2019;

(d) in The Sydney Morning Herald, on 25 November 2019, 4 December 2019 and 10 December 2019; and

(e) in The West Australian, on 27 November 2019 and 18 December 2019.

104 There were a number of other advertisements distributed by email. By way of example, in November 2019, an advertisement was sent to subscribers to “Switzer”, “Momentum Media/Nest Egg” and Mayfair Platinum. That advertisement stated in relation to the Core Notes product (among other things):

The Mayfair 101 Group is delighted to announce the release of a new investment product that caters to investors seeking a strong yield from a secured investment product.

With interest rates at record lows and investor sentiment shifting away from traditional financial institutions toward fixed income providers, Mayfair Platinum is delighted to make this new product available to Australian wholesale investors.

…

M Core Fixed Income provides a fixed monthly income at competitive interest rates backed by dollar-for-dollar security over assets held by the members of the Mayfair 101 Group of companies.

Key features include:

• Supported by first-ranking, otherwise unencumbered asset security

• A$250k minimum investment

• Fixed interest rates

• Monthly interest payments

• No setup or maintenance fees

• Dedicated Client Relationship Manager

• Individual, Company, Trust & Self-Managed Superannuation Fund (SMSF) compatible

• Available exclusively to wholesale investors

• Early redemption available (subject to liquidity and other applicable terms)[.]

(Bold text in the original.)

Sponsored link advertising

105 ASIC relied on evidence concerning the search results retrieved by the website www.google.com (Google) (and other similar search engines), when users searched for terms such as “term deposits”, “term deposit” and “bank term deposits”.

106 By way of example, a search for the phrase “term deposits” using Google (which was conducted by ASIC on 13 December 2019) retrieved a range of search results. However, the first search result listed was a hyperlink to Mayfair Platinum’s website. Moreover, a search for the phrase “term deposit” (conducted by ASIC on 24 January 2020) retrieved, as the first and second listed search results respectively, a link to the Mayfair Platinum website and a link to the Mayfair 101 website. A similar search was conducted by ASIC on 21 February 2020, and the first listed search result was a link to “www.termdepositguide.com” and the second listed search result was a link to the Mayfair Platinum website. The fourth listed search result was a link to the Commonwealth Bank’s term deposit product.

107 On 30 January 2020, ASIC issued to Mayfair two statutory notices, requesting information and books in relation to the marketing and promotion of the M+ Notes or the Core Notes. The response to those notices stated that Mayfair submitted keywords to certain internet platforms “as suggestions for triggering text advertisements to appear in internet search results”. The response noted that “which advertisements are displayed are ultimately at the platform operator’s (Google’s or Microsoft’s) discretion (based on the results of the relevant … algorithm)”. The response stated that:

The keywords (individual, and in different combinations and syntaxes) which the Mayfair 101 Group provided to [Google and Microsoft-related platforms] for sponsored link advertising in respect of [the Core Notes and the M+ Notes (among others)] during the [period 1 March 2017 to 30 January 2020 and 22 June 2019 to 30 January 2020] were numerous - over 1 million, leading to advertisements for [websites promoting those products] appearing over 13 million times in internet search results.

108 The response to ASIC also produced certain reports. Those reports set out the “keywords” submitted to Google and Microsoft, and which were to be used in the above manner. As a consequence, the evidence discloses that those keywords directed internet users to websites promoting the Core Notes and the M+ Notes. Those keywords included (among many others) keywords such as: “best term deposits”, “bank of Melbourne term deposits”, “national Australia bank term deposit”, “term deposit”, and “term deposit rates”.

109 In these circumstances, it is tolerably clear that the Defendants’ marketing strategy was addressed to persons searching for a term deposit in order to divert them to the Defendants’ websites. Those websites had labels (which were referred to as “meta-title tags”) which included words such as “best term deposit”.

Evidence concerning the Core Notes product

Expert report of Mr Jason Tracy of Deloitte

110 ASIC filed and relied upon an expert report of Mr Jason Tracy dated 12 June 2020. Mr Tracy is a Partner at Deloitte Financial Advisory Pty Ltd (Deloitte).

111 Mr Tracy is a Chartered Accountant, having been admitted as a member of Chartered Accountants Australia and New Zealand. He is also a Registered Liquidator. Mr Tracy has in excess of 20 years’ experience in the external administration of corporate entities and the assessment of entities on behalf of financial institutions and other debt providers. Mr Tracy has experience in providing expert evidence in matters concerning the financial performance and position of corporate and other entities, as well as insolvency-related matters.

112 Mr Tracy was asked to give his opinion on (among other things) whether the debts owed to the Core Note investors (being the holders of the relevant notes issued by M101 Nominees) are secured and, if so: (a) what form does that security take; (b) over what assets is there security; and (c) what is the value of that security.

113 It is apparent from Mr Tracy’s report that he was given a raft of documentation, including underlying contractual documents, which were produced to ASIC in the course of ASIC’s investigation.

114 On the question of whether the Core Notes were secured and supported by “first ranking, unencumbered asset security”, Mr Tracy’s 12 June 2020 report stated:

While various security arrangements have been entered into between [a Security Trustee], M101 Nominees and [certain] trustees, it would appear, with one exception, that [the Security Trustee] does not have direct first mortgage security over the real properties held in the various trusts at 31 December 2019 and 20 March 2020.

It also appears that deposits were paid on properties in instances where there was no security registered on the PPSR in favour of [the Security Trustee] at the time of the deposit being paid, including at 31 December 2019 and 20 March 2020.

Further, in relation to … two related party loans, one of the loans appears to have had no security registered on the PPSR at 31 December 2019 and 20 March 2020, while the other appears to have a prior registered third party security at 20 March 2020.

… [I]n my opinion, there are a significant number of instances where Core Note investor security was not first ranking and the assets were not otherwise unencumbered at 31 December 2019 and 20 March 2020.

…

In summary, it would appear that Core Note investor funds were not and are not generally supported by first-ranking, unencumbered asset security at 31 December 2019 and 20 March 2020.

(Emphasis added.)

115 That conclusion was supported by a comprehensive and sophisticated analysis of the complex arrangements established by M101 Nominees. In this respect, by way of summary, Mr Tracy’s report dated 12 June 2020 stated the following.

116 Mr Tracy stated that the Mayfair Platinum Group comprises a number of corporate and trust entities associated with Mr James Mawhinney. The principal activities of the Mayfair Platinum Group include raising monies from “wholesale investors” through issuing the Core Notes. The monies raised by way of the Core Notes were ultimately directed towards (a) the acquisition of real property assets in Mission Beach, Queensland; (b) making deposits on real properties; and (c) providing loans to related parties.

117 Mr Tracy stated that the Core Notes “were promoted to investors as “a secured, asset backed, term-based investment”, with a key feature being that they were supported by “first ranking, unencumbered asset security” …” (internal quotations in the original).

118 Mr Tracy noted that, as at 20 March 2020, it appeared that Core Notes investors’ funds had been directed towards the acquisition of (a) 119 real properties, including Dunk Island in Queensland; (b) paying deposits on 111 real properties not settled; and (c) providing two loans to related parties.

119 Mr Tracy undertook a detailed review of the structure of the various entities associated with Mr Mawhinney. Mr Tracy records the following in relation to these various entities.

120 In respect of Sunseeker Holdings Pty Ltd (Sunseeker Holdings), Mr Mawhinney was the sole director and shareholder. Sunseeker Holdings is the trustee of the “Sunseeker Trust” and holds units issued by various trusts (which are referred to below).

121 In respect of M101 Nominees, as indicated earlier in these reasons, it was the issuer of the Core Notes.

122 In respect of Eleuthera Group Pty Ltd (Eleuthera), Mr Mawhinney was the sole director. The shareholders in this entity were Online Investments Pty Ltd (which held 95% of the shares) and Schammer Pty Ltd (which held 5% of the shares). Mr Mawhinney is the sole director and shareholder of Online Investments Pty Ltd. (Mr Mawhinney is not a director or shareholder of Schammer Pty Ltd.) Mr Tracy states that the activities of Eleuthera are unknown, but it borrowed money from M101 Nominees (which is referred to in more detail below).

123 In respect of Mainland Property Holdings Pty Ltd (MPH), Mr Mawhinney was its sole director. Sunseeker Holdings is its sole shareholder. It is the trustee of the “Mission Beach Property Trust” (MBPT).

124 There are then a series of entities which are called Mainland Property Holdings No 2 Pty Ltd and Mainland Property Holdings No 3 Pty Ltd (etc), which are sequentially numbered up to Mainland Property Holdings No 12 Pty Ltd. Each of the entities – ie Mainland Property Holdings No 2 Pty Ltd through to Mainland Property Holdings No 12 Pty Ltd – had the same structure. Mr Mawhinney was the relevant entity’s director, Sunseeker Holdings was the relevant entity’s shareholder, and the relevant entity was the trustee of a trust that was named “Mission Beach Property Trust”, with those trusts numbered 2 to 12. By way of example, Mainland Property Holdings No 3 Pty Ltd was the trustee of the “Mission Beach Property Trust 3” and Mainland Property Holdings No 4 Pty Ltd was the trustee of the “Mission Beach Property Trust 4” (etc).

125 In respect of Mayfair Asset Holdings Pty Ltd, Mr Mawhinney was the sole director and Sunseeker Holdings was its sole shareholder. It was the trustee of the “Mayfair Island Trust”.

126 In respect of Jarrah Lodge Holdings Pty Ltd, Mr Mawhinney was the sole director and shareholder. It acted as the trustee of the “Jarrah Lodge Unit Trust No 1”.

127 In Mr Tracy’s report dated 12 June 2020, Mr Tracy refers to these entities collectively as the “Mayfair Platinum Group”. In respect of these entities, Mr Tracy stated that:

(a) As at 20 March 2020, entities in the Mayfair Platinum Group had purchased and settled on a total of 119 real property assets, with a total value of $54,085,011. These properties are all located within the Mission Beach region of Queensland, specifically: Dunk Island; Mission Beach (30 properties); Mission Beach South (49 properties); Wongaling Beach (35 properties); El Arish (2 properties); Bali Hay (1 property); and Bingil Bay (1 property).

(b) In addition to these settled real property assets, entities in the Mayfair Platinum Group appear to have paid deposits on a further 111 real properties, collectively valued at $92,335,423. Deposits paid totalled $5,852,387, resulting in an additional funding requirement of $86,483,036 to settle these real property assets.

(c) As at 20 March 2020, M101 Nominees had lent $1,257,108 to Eleuthera and $8,258,325 to the trustee of the Jarrah Lodge Unit Trust No 1.

128 To assess the security positon, Mr Tracy reviewed various documents made available to him by ASIC and searches undertaken by Mr Tracy’s staff at Deloitte. As to the security, Mr Tracy’s 12 June 2020 stated the following:

(a) In respect of the cash held in M101 Nominees’ bank account, as at 31 December 2019 and 20 March 2020, this cash appeared to be secured. That is, this cash was the subject of security deeds which granted security to the relevant security trustee by M101 Nominees in respect of the cash held. The cash held in M101 Nominees’ bank account at 31 December 2019 was $5,274,908. However, as at 20 March 2020, the cash held in M101 Nominees’ bank account had reduced to $572,561. Mr Tracy stated in respect of this cash that, “[g]iven the security was in place prior to 31 December 2019 and 20 March 2020, it appears to me that this asset is secured”, but Mr Tracy noted that he did “not have bank statements to verify the bank account balances at those dates”.

(b) In respect of a loan to Eleuthera by M101 Nominees, Mr Tracy stated that this loan was “not secured at 31 Dec 2019 or 20 Mar 2020”. Mr Tracy stated that his “searches of the PPSR have not identified any security interest registered against Eleuthera in favour of [the Security Trustee]”, but he “identified interests registered in favour of Fuji Xerox Australia Pty Ltd and Fuji Xerox Finance Ltd”. Mr Tracy concluded this loan “does not appear to be secured”. Mr Tracy stated:

The loan agreement between M101 Nominees and Eleuthera (a related party) is titled Facility Agreement. The facility agreement does not detail any information relating to proposed security arrangement in respect to the loan, nor does it detail the purpose of the loan. The loan commenced on 18 October 2019, has a limit of $250m, attracts an interest rate of 8.0% per annum and is for an initial term of 10 year with an option to extend. Full repayment is due before the expiry date, unless otherwise agreed in writing between the lender and the borrower.

As an aside, it should be noted that the “Facility Agreement” between Eleuthera and M101 Nominees was annexed to an affidavit of Ms Dayle Buckley of ASIC dated 5 August 2020. The Facility Agreement does not appear to make provision for security to be granted to M101 Nominees in return for M101 Nominees’ loan to Eleuthera. The word “Facility” is defined in the Facility Agreement as “the facility provided to the Borrower by the Lender pursuant to this Agreement for an unsecured loan by the Lender to the Borrower up to the Facility Limit”.

(c) In respect of “[r]eal properties and deposits paid on properties but not settled”, Mr Tracy concluded as follows:

While various security arrangements have been entered into between [the] security trustee, M101 Nominees and the various trustees, it would appear, with one exception, that [the security trustee] does not have direct first mortgage security over the real properties held in the various trusts at 31 December 2019 and 20 March 2020.

It also appears that deposits were paid on properties in instances where there was no security registered on the PPSR in favour of [the security trustee] at the time of the deposit being paid, including at 31 December 2019 and 20 March 2020.

Mr Tracy continued: