FEDERAL COURT OF AUSTRALIA

Australian Securities and Investments Commission v Theta Asset Management Limited [2020] FCA 1894

ORDERS

AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff | ||

AND: | THETA ASSET MANAGEMENT LIMITED (ACN 071 807 684) First Defendant ROBERT PATRICK MARIE Second Defendant | |

DATE OF ORDER: |

IN RELATION TO THE FIRST DEFENDANT, THETA ASSET MANAGEMENT LIMITED (IN LIQUIDATION), THE COURT DECLARES THAT:

1. Pursuant to section 1317E(1) of the Corporations Act 2001 (Cth) (the Act) the first defendant, Theta Asset Management Limited (in liquidation), contravened sub-section 601FC(1)(b) of the Act in issuing the Development Units Product Disclosure Statement (PDS) in that it was defective within the meaning of section 1022A of the Act in that it contained a misleading or deceptive statement to the effect that the distributions from the Sterling Income Trust (ARSN 158 828 105) (SIT) would be sufficient to enable investors, being retirees and seniors, who had entered into a Sterling New Life Lease (SNLL) to pay all of the rent due on their respective SNLL (Rental Payment Representation) and there was no or no clear, concise and effective disclosure of:

(a) the conflicts of interests that existed in relation to the SIT including those in respect of the various roles undertaken by Sterling First Limited (Sterling First) and its wholly owned subsidiaries (together Sterling Group) and the related transactions outlined in the financial statements for the SIT for the financial year ending 30 June 2016;

(b) the risks attached to the different classes of investment units in the SIT by reason of the competing rights and interests attached to each of those unit classes;

(c) the provision and extent of the income support provided by the Sterling Group to the SIT to enable it to meet its obligations as and when they fell due, in particular the targeted rates of return to investors in the SIT (Sterling income support) and the financial position of the Sterling Group;

(d) the allocation policy utilised by Sterling Corporate Services Pty Ltd (SCS), as investment manager of the SIT, to determine the investment mix of units in the SIT for each of the investors in the SIT who were retirees and seniors and who had entered into SNLLs (SNLL investors);

(e) the risks relating to the underlying investment of the Development Units, being loans issued to fund the building of residential homes in connection with SNLLs;

(f) the assumptions used and contingencies relied on in stating that the target distributions for the Development Units was 20%; and

(g) the inherent risks by reason of the matters outlined above of any investment in the SIT for SNLL investors who were looking for a stable and secure long term income stream to meet rental payments under their respective SNLL and capital preservation.

2. Pursuant to section 1317E(1) of the Act, the first defendant, Theta Asset Management Limited (in liquidation), contravened sub-section 601FC(1)(b) of the Act in issuing the Management Company Units PDS in that it was defective within the meaning of section 1022A of the Act in that it contained a misleading or deceptive statement, namely the Rental Payment Representation and there was no or no clear, concise and effective disclosure of:

(a) the conflicts of interests that existed in relation to the SIT including those in respect of the various roles undertaken by the Sterling Group and the related transactions outlined in the financial statements for the SIT for the financial year ending 30 June 2016;

(b) the risks attached to the different classes of investment units in the SIT by reason of the competing rights and interests attached to each of those unit classes;

(c) the provision and extent of the Sterling income support and the financial position of the Sterling Group;

(d) the allocation policy utilised by SCS, as investment manager of the SIT, to determine the investment mix of units in the SIT for each of the SNLL investors (SNLL unit allocation policy);

(e) the constraints on investors’ ability to redeem their investment;

(f) information relating to the underlying assets of the Management Company Units being shares in Sterling First, including its financial position, board constitution and shareholdings; and

(g) the inherent risks by reason of the matters outlined above of any investment in the SIT for SNLL investors who were looking for a stable and secure long term income stream to meet rental payments under their respective SNLL and capital preservation.

(h)

3. Pursuant to section 1317E(1) of the Act, the first defendant, Theta Asset Management Limited (in liquidation), contravened sub-section 601FC(1)(b) of the Act in issuing the Income Units PDS in that it was defective within the meaning of section 1022A of the Act in that there was no or no clear, concise and effective disclosure of:

(a) the conflicts of interests that existed in relation to the SIT including those in respect of the various roles undertaken by the Sterling Group and the related transactions outlined in the financial statements for the SIT for the financial year ending 30 June 2016;

(b) the risks attached to the different classes of investment units in the SIT by reason of the competing rights and interests attached to each of those unit classes;

(c) the provision and extent of the Sterling income support financial position of the Sterling Group;

(d) the SNLL unit allocation policy;

(e) the assumptions used and contingencies relied on in stating that the target distributions were 9.25% for Income Units;

(f) the terms of and attrition rates for the rental management agreements;

(g) the fact that income generated from the rental management agreements used to pay the returns to the Income Units was also the subject of a first ranking registered security interest under the Personal Property Securities Act 2009 (Cth) (PPSA) held by Macquarie Bank Limited; and

(h) the inherent risks by reason of the matters outlined above of any investment in the SIT for SNLL investors who were looking for a stable and secure long term income stream to meet rental payments under their respective SNLL and capital preservation.

(i)

4. Pursuant to section 1317E(1) of the Act, the first defendant, Theta Asset Management Limited (in liquidation), contravened sub-section 601FC(1)(b) of the Act in issuing the Income and Growth Units PDS in that it was defective within the meaning of section 1022A of the Act in that it contained a misleading and deceptive statement to the effect that the Sterling Group had provided a secured and enforceable guarantee of the payment of distributions to be made to unitholders (Sterling Guarantee Representation) and there was no or no clear, concise and effective disclosure of:

(a) the conflicts of interests that existed in relation to the SIT including those in respect of the various roles undertaken by the Sterling Group and the related transactions outlined in the financial statements for the SIT for the financial year ending 30 June 2016;

(b) the risks attached to the different classes of investment units in the SIT by reason of the competing rights and interests attached to each of those unit classes;

(c) the provision and extent of the Sterling income support and the financial position of the Sterling Group;

(d) the SNLL unit allocation policy;

(e) the differences and disparity in the risks attached to in Income Units as opposed to Growth Units;

(f) the allocation policy or statement regarding how investors’ funds were to be applied between Income Units and Growth Units;

(g) the assumptions used and contingencies relied on in stating that the target distributions were 9.25% for Income Units and 12% for Growth Units;

(h) the terms of and attrition rates for the rental management agreements;

(i) the fact that income generated from the rental management agreements used to pay the returns to the Income Units was also the subject of a first ranking registered security interest under the PPSA held by Macquarie Bank Limited; and

(j) the inherent risks by reason of the matters outlined above of any investment in the SIT for SNLL investors who were looking for a stable and secure long term income stream to meet rental payments under their respective SNLL and capital preservation.

(k)

5. Pursuant to section 1317E(1) of the Act, the first defendant, Theta Asset Management Limited (in liquidation), contravened sub-section 601FC(1)(b) of the Act in issuing the Revised Income and Growth Units PDS in that it was defective within the meaning of section 1022A of the Act in that it contained a misleading or deceptive statement to the effect that the SIT was a particularly suitable investment for investors looking for income and capital preservation and not capital growth (Suitability Representation) and there was no or no clear, concise and effective disclosure of:

(a) the conflicts of interests that existed in relation to the SIT including those in respect of the various roles undertaken by the Sterling Group and the related transactions outlined in the financial statements for the SIT for the financial year ending 30 June 2017;

(b) the risks attached to the different classes of investment units in the SIT by reason of the competing rights and interests attached to each of those unit classes;

(c) the provision and extent of the Sterling income support and the financial position of the Sterling Group;

(d) the SNLL unit allocation policy;

(e) the terms of and attrition rates for the rental management agreements;

(f) the fact that income generated from the rental management agreements used to pay the returns to the Income Units was also the subject of a first ranking registered security interest under the PPSA held by Macquarie Bank Limited;

(g) the concerns of the auditors of the SIT as to the financial viability of the SIT; and

(h) the inherent risks by reason of the matters outlined above of any investment in the SIT for SNLL investors who were looking for a stable and secure long term income stream to meet rental payments under their respective SNLL and capital preservation.

7. Pursuant to section 1317E(1) of the Act, the first defendant, Theta Asset Management Limited (in liquidation), contravened sub-section 601FC(l)(h) of the Act in that it failed to comply with the SIT compliance plan in that it:

(a) failed to take all steps necessary to monitor effectively the performance of SCS as the investment manager of the SIT and satisfy itself that SCS had carried out its contractual obligations adequately, that SCS had prepared and retained appropriate records to document the actions that it had taken as the SIT investment manager and that SCS had not contravened the personal advice provisions in the Act by its implementation of the SNLL unit allocation policy;

(b) issued defective PDS, being each of the SIT PDS;

(c) failed to ensure that the valuations and unit prices for the SIT were correct and calculated in a timely manner;

(d) failed to ensure that all redemptions were processed in a timely manner;

(e) failed to identify, document, assess, evaluate and effectively manage and control all conflicts of interest; and

(f) failed to ensure all financial statements of the SIT were completed and available for audit within 2 months of the relevant period and were lodged with the Australian Securities and Investments Commission (ASIC) on or before the lodgement date.

IN RELATION TO THE SECOND DEFENDANT, ROBERT PATRICK MARIE, THE COURT DECLARES THAT:

8. Pursuant to section 1317E(1) of the Act, the second defendant, Robert Patrick Marie, contravened s 601FD(1)(b) of the Act in that he failed to exercise the degree of care and diligence that a reasonable person would exercise if they were in his position as the managing director of Theta in authorising the issue of the Development Units PDS in that it was defective within the meaning of s 1022A of the Act in that it contained a misleading or deceptive statement, namely the Rental Payment Representation and there was no or no clear, concise and effective disclosure of:

(a) the conflicts of interests that existed in relation to the Sterling Group including those in respect of the various roles undertaken by the Sterling Group and the related transactions outlined in the financial statements for the SIT for the financial year ending 30 June 2016;

(b) the risks attached to the different classes of investment units in the SIT by reason of the competing rights and interests attached to each of those unit classes;

(c) the provision and extent of the Sterling income support and the financial position of the Sterling Group;

(d) the SNLL unit allocation policy;

(e) the risks relating to the underlying investment of the Development Units, being loans issued to fund the building of residential homes in connection with SNLL;

(f) the assumptions used and contingencies relied on in stating that the target distributions for the Development Units was 20%; and

(g) the inherent risks by reason of the matters outlined above of any investment in the SIT for SNLL investors who were looking for a stable and secure long term income stream to meet rental payments under their respective SNLL and capital preservation.

9. Pursuant to section 1317E(1) of the Act, the second defendant, Robert Patrick Marie, contravened s 601FD(1)(b) of the Act in that he failed to exercise the degree of care and diligence that a reasonable person would exercise if they were in his position as the managing director of Theta in authorising the issue of the Management Company Units PDS in that it was defective within the meaning of section 1022A of the Act in that it contained a misleading or deceptive statement, namely the Rental Payment Representation and there was no or no clear, concise and effective disclosure of:

(a) the conflicts of interests that existed in relation to the SIT including those in respect of the various roles undertaken by the Sterling Group and the related transactions outlined in the financial statements for the SIT for the financial year ending 30 June 2016;

(b) the risks attached to the different classes of investment units in the SIT by reason of the competing rights and interests attached to each of those unit classes;

(c) the provision and extent of the Sterling income support and the financial position of the Sterling Group;

(d) the SNLL unit allocation policy;

(e) the constraints on investors’ ability to redeem their investment;

(f) information relating to the underlying assets of the Management Company Units being shares in Sterling First, including its financial position, board constitution and shareholdings; and

(g) the inherent risks by reason of the matters outlined above of any investment in the SIT for SNLL investors who were looking for a stable and secure long term income stream to meet rental payments under their respective SNLL and capital preservation.

10. Pursuant to section 1317E(1) of the Act, the second defendant, Robert Patrick Marie, contravened s 601FD(1)(b) of the Act in that he failed to exercise the degree of care and diligence that a reasonable person would exercise if they were in his position as the managing director of Theta in authorising the issue of the Income Units PDS in that it was defective within the meaning of section 1022A of the Act in that there was no or no clear, concise and effective disclosure of:

(a) the conflicts of interests that existed in relation to the SIT including those in respect of the various roles undertaken by the Sterling Group and the related transactions outlined in the financial statements for the SIT for the financial year ending 30 June 2016;

(b) the risks attached to the different classes of investment units in the SIT by reason of the competing rights and interests attached to each of those unit classes;

(c) the provision and extent of the Sterling income support and the financial position of the Sterling Group;

(d) the SNLL unit allocation policy;

(e) the assumptions used and contingencies relied on in stating that the target distributions were 9.25% for Income Units;

(f) the terms of and attrition rates for the rental management agreements;

(g) the fact that income generated from the rental management agreements used to pay the returns to the Income Units was also the subject of a first ranking registered security interest under the PPSA held by Macquarie Bank Limited; and

(h) the inherent risks by reason of the matters outlined above of any investment in the SIT for SNLL investors who were looking for a stable and secure long-term income stream to meet rental payments under their respective SNLL and capital preservation.

11. Pursuant to section 1317E(1) of the Act, the second defendant, Robert Patrick Marie, contravened sub-section 601FD(1)(b) of the Act in that he failed to exercise the degree of care and diligence that a reasonable person would exercise if they were in his position as the managing director of Theta in authorising the issue of the Income and Growth Units PDS in that it was defective within the meaning of section 1022A of the Act in that it contained a misleading or deceptive statement, namely the Sterling Guarantee Representation and there was no or no clear, concise and effective disclosure of:

(a) the conflicts of interests that existed in relation to the SIT including those in respect of the various roles undertaken by the Sterling Group and the related transactions outlined in the financial statements for the SIT for the financial year ending 30 June 2016;

(b) the risks attached to the different classes of investment units in the SIT by reason of the competing rights and interests attached to each of those unit classes;

(c) the provision and extent of the Sterling income support and the financial position of the Sterling Group;

(d) the SNLL unit allocation policy;

(e) the differences and disparity in the risks attached to investments in Income Units as opposed to Growth Units;

(f) the allocation policy or statement regarding how investors’ funds were to be applied between Income Units and Growth Units;

(g) the assumptions used and contingencies relied on in stating that the target distributions were 9.25% for Income Units and 12% for Growth Units;

(h) the terms of and attrition rates for the rental management agreements;

(i) the fact that income generated from the rental management agreements used to pay the returns to the Income Units was also the subject of a first ranking registered security interest under the PPSA held by Macquarie Bank Limited; and

(j) the inherent risks by reason of the matters outlined above of any investment in the SIT for SNLL investors who were looking for a stable and secure long-term income stream to meet rental payments under their respective SNLL and capital preservation.

12. Pursuant to section 1317E(1) of the Act, the second defendant, Robert Patrick Marie, contravened sub-section 601FD(1)(b) of the Act in that he failed to exercise the degree of care and diligence that a reasonable person would exercise if they were in his position as the managing director of Theta in authorising the issue of the Revised Income and Growth Units PDS in that it was defective within the meaning of section 1022A of the Act in that contained a misleading or deceptive statement, namely the Suitability Representation, and there was no or no clear, concise and effective disclosure of:

(a) the conflicts of interests that existed in relation to the SIT including those in respect of the various roles undertaken by the Sterling Group and the related transactions outlined in the financial statements for the SIT for the financial year ending 30 June 2017;

(b) the risks attached to the different classes of investment units in the SIT by reason of the competing rights and interests attached to each of those unit classes;

(c) the provision and extent of the Sterling income support and the financial position of the Sterling Group;

(d) the SNLL unit allocation policy;

(e) the terms of and attrition rates for the rental management agreements;

(f) the fact that income generated from the rental management agreements used to pay the returns to the Income Units was also the subject of a first ranking registered security interest under the PPSA held by Macquarie Bank Limited;

(g) the concerns of the auditors of the SIT as to the financial viability of the SIT; and

(h) the inherent risks by reason of the matters outlined above of any investment in the SIT for SNLL investors who were looking for a stable and secure long-term income stream to meet rental payments under their respective SNLL and capital preservation.

13. Pursuant to section 1317E(1) of the Act, the second defendant, Robert Patrick Marie, contravened sub-section 601FD(1)(f)(i) of the Act in that he failed to take all necessary steps that a reasonable person in his position as the managing director of Theta would take if they were in his position to ensure that Theta complied with its statutory obligations pursuant to:

(a) sub-section 601FC(1)(b) of the Act in that Theta failed to exercise the degree of care and diligence that a reasonable person would exercise if they were in the position of Theta as each of SIT PDS issued by Theta was defective.

14. Pursuant to section 1317E(1) of the Act, the second defendant, Robert Patrick Marie, contravened sub-section 601FD(1)(f)(iv) of the Act in that he failed to take all necessary steps that a reasonable person in his position as the managing director of Theta would take if they were in his position to ensure that Theta complied with the SIT compliance plan in that Theta:

(a) failed to take all steps necessary to monitor effectively the performance of SCS as the investment manager of the SIT and satisfy itself that SCS had carried out its contractual obligations adequately, that SCS had prepared and retained appropriate records to document the actions that it had taken as the SIT investment manager and that SCS had not contravened the personal advice provisions in the Act by its implementation of the SNLL unit allocation policy;

(b) issued defective PDS, being each of the SIT PDS;

(c) failed to ensure that the valuations and unit prices for the SIT were correct and calculated in a timely manner;

(d) failed to ensure that all redemptions were processed in a timely manner;

(e) failed to identify, document, assess, evaluate and effectively manage and control all conflicts of interest; and

(f) failed to ensure all financial statements of the SIT were completed and available for audit within 2 months of the relevant period and were lodged with ASIC on or before the lodgement date.

AND THE COURT ORDERS THAT:

15. Pursuant to section 206C of the Act, the second defendant, Robert Patrick Marie, be disqualified from managing corporations for a period of four years from the date of this order in respect of the contraventions of the Act referred to in the declarations of contravention numbered [8] to [14].

Pecuniary Penalties

16. Pursuant to section 1317G of the Act:

(a) the first defendant, Theta, pay to the Commonwealth a pecuniary penalty of $2,000,000.00 in respect of the contraventions of the Act referred to in the declarations of contravention numbered [1] to [5] and [7].

(b) the second defendant, Robert Patrick Marie, pay to the Commonwealth a pecuniary penalty of $100,000.00 in respect of the contraventions of the Act referred to in the declarations of contravention numbered [8] to [14].

(c)

Costs

17. The first defendant and the second defendant pay the plaintiff’s costs of and incidental to the proceeding fixed in the amount of $300,000.00.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

TABLE OF CONTENTS

[1] | |

[8] | |

[12] | |

[15] | |

[18] | |

[21] | |

[24] | |

[29] | |

[34] | |

[36] | |

[41] | |

[50] | |

[60] | |

[61] | |

[67] | |

[73] | |

STATUTORY FRAMEWORK – DUTIES OF RESPONSIBLE ENTITIES AND OFFICERS OF RESPONSIBLE ENTITIES | [76] |

[76] | |

[102] | |

[102] | |

[115] | |

[127] | |

[138] | |

[138] | |

[142] | |

[146] | |

[152] | |

[157] | |

[161] | |

[165] | |

[168] | |

Constraints on investors’ ability to redeem their investment | [173] |

[179] | |

[183] | |

[187] | |

[191] | |

[196] | |

[203] | |

[210] | |

[217] | |

[224] | |

[231] | |

[265] | |

[266] | |

[267] | |

[271] | |

[271] | |

[274] | |

General principles and the factors relevant to the determination of penalty | [275] |

[284] | |

[284] | |

[290] | |

[295] | |

[301] | |

[303] | |

[307] | |

[308] | |

[313] | |

[314] | |

[315] | |

[316] | |

[323] | |

[325] | |

[331] | |

[340] | |

[349] | |

[353] | |

[355] | |

[364] | |

[366] |

MCKERRACHER J:

1 These are reasons for orders made on 19 November 2020, as amended by consent orders on 16 February 2021 which removed declarations 6 and 13(b). The subsequent amendment and explanation for it has contributed to some delay in publication of these reasons. The underlying legal and factual complexity is considerable as these detailed reasons reveal. In essence however, once again, many investors have lost substantial funds in a failed investment scheme by which misleading and irresponsible assurances were given about the returns under the scheme. The scheme induced mostly retired investors to sell their homes and invest proceeds in a fund for the purpose of obtaining assured high liquid returns on those investments. The assurances failed to eventuate. Significant personal losses were sustained with all the hardship that such an experience causes. These reasons take some of their content from the joint submissions of the plaintiff (ASIC) and the defendants, Theta Asset Management Ltd (in liquidation) and Mr Robert Patrick Marie as to liability and relief, including the appropriate pecuniary penalties to be imposed in relation to admitted contraventions by Theta of ss 601FC(1)(b) and 601FC(1)(h), and by Mr Marie of ss 601FD(1)(b), 601FD(1)(c) and 601FD(1)(f) of the Corporations Act 2001 (Cth). On careful consideration of the helpful and very detailed submissions I was satisfied that, for the reasons advanced by the parties, the declarations and orders sought were appropriate to be made.

2 The facts agreed between the parties are set out in the Statement of Agreed Facts (the SOAF) annexed to these reasons as Annexure A. For the purpose of this proceeding only, pursuant to s 191 of the Evidence Act 1995 (Cth), Theta and Mr Marie have made the admissions set out in the SOAF. The applicable dates of the various facts referred to in these reasons are those set out in the SOAF and in turn, mirrored where necessary in the declarations and orders made.

3 The High Court has recently reaffirmed the propriety and permissibility of a plaintiff regulator and a defendant making joint submissions on penalty. A court is not precluded from receiving and, if appropriate, accepting an agreed or other civil penalty submission: Commonwealth v Director, Fair Work Building Industry Inspectorate (2015) 258 CLR 482 (CFMEU v FWBII) (at [1] and [103]). The practice is usually of assistance to all concerned.

4 Equally, there is nothing in CFMEU v FWBII precluding the Court from receiving and, if appropriate, accepting a joint submission on liability, based on admissions of fact and proposed consent orders.

5 In all cases it remains the task of the Court to be satisfied that the orders sought are appropriate: CFMEU v FWBII (at [48] and [110]); Australian Securities and Investments Commission v Maxwell [2006] NSWSC 1052 (at [136]). In undertaking that task, a court will be mindful that not all of the evidence which would have been adduced on a contested hearing is before it and that the agreed position is likely to include aspects of compromise: Maxwell (at [145]); CFMEU v FWBII (at [109]).

6 Given ASIC’s position as a regulator that has a specific function in regulating the financial services industry, it is to be ‘expected’ that ASIC is in a position to provide informed submissions as to the ‘…level of penalty necessary to achieve compliance’ with the statutory obligations imposed by the Act: CFMEU v FWBII (at [60]). It is consistent with the purposes of civil penalty regimes that a regulator such as ASIC take an ‘active role’ in attempting to achieve the penalty which the regulator ‘considers appropriate’ and the terms of the regulator’s submissions are to be ‘treated as a relevant consideration’: CFMEU v FWBII (at [64]).

7 These reasons use, where relevant, terms as defined in the SOAF.

Theta and the Sterling Income Trust

8 Theta was the responsible entity of the Sterling Income Trust (ARSN 158 828 105), which was registered by Theta on 19 June 2012 as a retail managed investment scheme domiciled in Australia pursuant to s 601EB(1) of the Act, and originally named ‘Rental Express Investment Trust’ (SIT).

9 Theta had relevantly:

established and maintained a due diligence committee in respect of the issue of each Product Disclosure Statement (PDS) that it issued for the SIT (SIT Due Diligence Committee);

prepared, lodged with ASIC and amended from time-to-time a compliance plan for the SIT (SIT Compliance Plan); and

established and maintained a compliance committee for the purpose of seeking to ensure that the SIT complied with its legal obligations, ASIC regulatory guides and class orders, the constitution of the SIT as amended from time to time (SIT Constitution), the SIT Compliance Plan, and any current PDS of the SIT (SIT Compliance Committee).

10 Mr Marie was the managing director and only executive director of Theta and the chairman of the SIT Due Diligence Committee. He also attended meetings of the SIT Compliance Committee.

11 In his position as managing director of Theta, Mr Marie’s duties and responsibilities included authorising the issue of each PDS for the SIT and ensuring that each of them was not defective, ensuring that Theta complied with the SIT Compliance Plan and that Theta took all reasonable steps to ensure that it complied with its obligations under the Act.

12 Sterling Corporate Services Pty Ltd (ACN 158 361 507) (SCS), which was originally named Acquest Corporate Services Pty Ltd, was the Investment Manager of the SIT and a wholly owned subsidiary of Sterling First (Aust) Limited (ACN 610 352 826) (SFAL).

13 SCS and SFAL were part of a corporate group comprising various corporations that operated in the Western Australian property management market (Sterling Group).

14 A company within the Sterling Group, Rental Management Australia Pty Ltd (ACN 160 167 108) (RMA) was in the business of acquiring property management agreements (PMAs) and providing property management services under those PMAs.

15 The primary purposes of the SIT included funding the acquisition of PMAs by RMA and offering unitholders in the SIT exposure to Australian residential property, specifically through PMAs acquired by RMA.

16 Actual and potential investors in the SIT were given the opportunity to invest in the following unit classes:

(a) Income Units;

(b) Development Units;

(c) Management Company Units; and

(d) Growth Units,

(each a Unit Class and together, the Unit Classes).

17 The monies subscribed for each Unit Class were invested in several trusts that were described by Theta, as sub-trusts of the SIT, namely:

(a) a trust known as the Income Trust, which was originally named the RMA Holding Trust;

(b) a trust known as the Development Trust;

(c) a trust known as the Management Company Trust; and

(d) a trust known as the Growth Trust.

The 2012 Investment Management Agreement

18 On 5 November 2012, Theta and SCS executed an agreement establishing SCS as the investment manager of the SIT (2012 Investment Management Agreement).

19 The responsibilities of Theta pursuant to cl 3.2 and cl 3.3(b)(1) of the 2012 Investment Management Agreement included:

(a) reviewing, and providing written feedback to SCS regarding any PDS or promotional materials prepared by SCS in connection with the SIT;

(b) conducting all reasonable due diligence required under or in connection with any PDS or promotional materials (as directed by SCS and in conjunction with SCS’ legal advisor);

(c) preparing and maintaining the SIT Compliance Plan;

(d) establishing and maintaining the SIT Due Diligence Committee;

(e) establishing and maintaining the SIT Compliance Committee; and

(f) engaging a service provider as nominated by SCS to act as the custodian of the SIT.

20 By cl 4.4(b) of the 2012 Investment Management Agreement, Theta also had the power to vary any decision of SCS that, in Theta’s opinion, would contravene or be likely to contravene its duties and obligations under the law, the SIT Constitution, the SIT Compliance Plan, any PDS, or its Australian Financial Services Licence.

21 On 20 May 2016, Theta released:

(a) a PDS for the issue of Income Units (Income Units PDS);

(b) a PDS for the issue of Management Company Units (Management Company Units PDS); and

(c) a PDS for the issue of Development Units (Development Units PDS).

22 On 31 January 2017, Theta released a PDS for the issue of Income Units and Growth Units (Income and Growth Units PDS).

23 On 27 October 2017, Theta released a revised PDS for the issue of Income Units and Growth Units (Revised Income and Growth Units PDS).

Agreements related to the operation of the SIT

24 From 2013, the SIT operated with reference to a:

(a) Master Deed of Assignment dated 25 March 2013 between RMA and RMA in its capacity as trustee for the Income Trust (Income Trust MDA);

(b) Business Development Agreement dated 2 May 2013 between RMA as trustee for the Income Trust, Rental Management Australia Developments Pty Ltd (ACN 146 806 662) (RMAD) and Sterling First Group Pty Ltd (ACN 160 953 140) (SFG) (Income Trust BDA);

(c) Master Deed of Assignment dated 2017 between RMAD and SCS in its capacity as trustee for the Growth Trust (Growth Trust MDA); and

(d) Business Development Agreement dated February 2017 between RMA and RMAD (RMA BDA).

25 Pursuant to cll 2.1, 3.1, 3.2, 3.3, 3.4 and 4.1 of the Income Trust MDA:

(a) RMA assigned to the Income Trust all its rights, title and interests in the Income Rights (see below (at [27(a)]);

(b) RMA was prohibited from selling, or seeking to sell, any PMA for which the Income Trust had Income Rights to any person without the prior written consent of RMA, as the trustee of the Income Trust;

(c) RMA was required to sell a PMA, for which the Income Trust had the Income Rights, when directed to do so by RMA, as the trustee of the Income Trust;

(d) when RMA sold a PMA with the requisite consent from, or at the direction of, RMA as trustee of the Income Trust, the sale proceeds formed part of the Income Rights and were payable to the Income Trust;

(e) RMA was required to take all reasonable actions against third parties for any infringement of the Income Rights; and

(f) as consideration for the assignment of the Income Rights, RMA as the trustee of the Income Trust was entitled, out of the Income Rights it received, to:

(i) fund the acquisition of PMAs by RMA (such funding to be agreed at the time of purchase);

(ii) pay to RMA 55% of the base fees earned under the PMAs and 100% of the remaining fees earned under the PMAs;

(iii) pay for the replacement of PMAs through the organic growth process in accordance with the formula set out in the Income Trust BDA;

(iv) pay any interest owing to Bankwest (with which the Sterling Group had a facility agreement in 2013) in connection with any facility provided by Bankwest from time to time; and

(v) distribute any remaining funds to the SIT.

26 Pursuant to cll 2.1, 5.1(a) and 2.2 of the Income Trust BDA:

(a) RMAD was exclusively appointed to source and negotiate the acquisition of PMAs and rent rolls for the Income Trust;

(b) for each new PMA, the Income Trust was required to pay to RMAD the New RMA Cost (1.75 times the aggregate of the fee income in respect of a specific PMA, unless otherwise agreed); and

(c) SFAL, as guarantor, guaranteed to the Income Trust the due and punctual performance of all RMAD’s obligations pursuant to the Income Trust BDA.

27 Pursuant to cll 2.1, 3.1, 3.2, 3.3, 4.1, 7.1, 7.2, 7.3 and 7.4 of the Growth Trust MDA:

(a) RMAD assigned to the Growth Trust all its rights, title and interests in the Income Rights up to the Income Limit. For the purpose of the Growth Trust MDA, ‘Income Rights’ were defined as the right of RMAD to receive all amounts in respect of each rental management agreement entered into each month, being the RMA Cost or the SNLL RMA Cost as the case required less any RMA Rebate paid in that month (these capitalised terms were defined in the Growth Trust MDA);

(b) RMAD was required to provide the Growth Trust the amount up to the Income Limit no later than the 15th day of the month following receipt;

(c) if the actual entitlement of RMAD in respect of all rental management agreements entered into during a month, being the RMA Cost or the SNLL RMA Cost as the case required less any RMA Rebate paid in that month:

(i) was less than the Income Limit, the Growth Trust would receive only the actual amount;

(ii) was more than the Income Limit, RMAD would retain any amount over the Income Limit.

(d) RMAD undertook to the Growth Trust to use reasonable endeavours to perform its obligations under the Income Trust BDA and to maximise the amount to which RMAD was entitled in respect of each rental management agreement and to minimise the RMA Rebate;

(e) as consideration for the assignment of the Income Rights, the Growth Trust would pay RMAD the Price as set out in Sch 1 of the Growth Trust MDA;

(f) if the parties agreed to alter the Income Limit (subject to a Maximum Income Limit) as set out in Sch 1, there would be an adjustment to the Price, which was to be calculated by multiplying the increase or decrease by 12 and dividing it by 0.135; and

(g) if the Income Limit was:

(i) decreased, RMAD agreed to pay the adjustment amount to the Growth Trust;

(ii) increased, the Growth Trust agreed to pay the adjustment amount to RMAD.

28 Pursuant to cll 2.1, 4.4, 5.1, 5.2 and 5.3 of the RMA BDA:

(a) RMA exclusively appointed RMAD to source and negotiate the acquisition of PMAs and rent rolls for RMA;

(b) RMAD granted to RMA a right of first refusal in respect of any Option Deed associated with a new PMA opportunity;

(c) upon completion of the purchase of a rent roll or the acquisition of a stand-alone PMA by RMA, RMA was required to pay RMAD a fee in respect of that rent roll or PMA pursuant to the terms of the agreement; and

(d) for lost PMAs, RMAD was required to pay RMA, or such other entity as directed by RMA, the RMA Rebate as calculated according to the agreement.

Money flow between the SIT and the Sterling Group

29 The process by which monies invested in the SIT pursuant to the SIT PDS flowed between the SIT and the Sterling Group was as follows.

30 In relation to the Income Trust:

(a) individual investors purchased Income Units;

(b) those monies were invested in the Income Trust;

(c) RMA (as trustee of the Income Trust) used those funds:

(i) to pay for Income Rights assigned by RMA (in its own capacity), pursuant to the terms of the Income Trust MDA; and

(ii) to pay RMA (in its own capacity) 55% of the base fees earned under the PMAs and 100% of the remaining fees earned under the PMAs;

(d) RMA (in its own capacity) used the funds received from the assignment of Income Rights to:

(i) fund the acquisition of new rent rolls and PMAs; and

(ii) pay RMAD a fee to source and negotiate the acquisition of PMAs and rent rolls for the Income Trust, pursuant to the Income Trust BDA.

31 In relation to the Growth Trust:

(a) individual investors purchased Growth Units;

(b) those monies were invested in the Growth Trust;

(c) SCS (as trustee of the Growth Trust) used those funds to pay for Income Rights assigned by RMAD (in its own capacity), pursuant to the terms of the Growth Trust MDA;

(d) the Income Rights entitled the Growth Trust to 100% of the gross income of RMAD’s property management fee income up to a cap that equalled 13.5% of the value of the Income Rights acquired by the Growth Units, pursuant to the terms of the Growth Trust MDA; and

(e) a portion of the specific fees earned by RMAD for arranging the rent rolls and PMAs for RMA was invested in Growth Units.

32 In relation to the Management Company Trust:

(a) individual investors purchased Management Company Units;

(b) those monies were invested in the Management Company Trust; and

(c) SCS (as trustee of the Management Company Trust) used those funds to acquire ordinary shares and preference shares in SFAL.

33 In relation to the Development Trust:

(a) individual investors purchased Development Units;

(b) those monies were invested in the Development Trust; and

(c) SCS (as trustee of the Development Trust) used those funds to acquire subordinated debt mortgage loans.

34 Each Unit Class was referrable to a particular pool of assets and liabilities held within the SIT so that:

(a) an investor who invested in a specific Unit Class acquired an interest in, and therefore exposure to, a specific pool of assets relevant to that class;

(b) each Unit Class carried specific risks associated with the assets relevant to that Class;

(c) each Unit Class had a different risk profile; and

(d) the assets and liabilities of a specific Unit Class remained the assets and liabilities of the SIT as a whole.

35 By reason of the matters at [34], if a specific Unit Class were to become insolvent or suffer an adverse event, it was likely that all Unit Classes would be affected (Multi-Class Risk).

Specific Risks associated with Unit Classes

36 There were particular risks associated with each individual Unit Class.

37 The value of, and potential returns to be derived from the Income Units were dependent upon:

(a) the ability of RMA to effectively perform services under its PMAs;

(b) the level of fees received by RMA, which correlated directly to the level of rent collected;

(c) the actual rate of replacement of lost PMAs compared with the anticipated replacement rate;

(d) the actual vacancy rate compared with the anticipated vacancy rate;

(e) expenses related to the running of the Income Trust;

(f) the pricing structure under the Income Trust MDA which impacted upon RMA’s profitability;

(g) the ability of RMA to sell the Income Rights associated with its PMAs;

(h) the terms of and attrition rates of PMAs;

(i) the ability of RMA to recapitalise;

(j) the degree of competition in the real estate industry; and

(k) interest rates.

38 The value of, and potential returns to be derived from the Growth Units were dependent upon:

(a) RMAD being able to secure new PMAs for RMA, which in turn relied on RMA being able to pay RMAD;

(b) the level of fees received by RMAD from RMA;

(c) the number and value of the Income Rights growing as anticipated;

(d) the ability of the RMA and RMAD to identify suitable acquisitions and agree with the vendors on the terms of those acquisitions;

(e) specific expenses related to the running of the Growth Trust;

(f) the degree of competition in the real estate industry; and

(g) the ongoing performance and financial viability of RMA.

39 The value of, and potential returns to be derived from the Management Company Units were dependent upon the performance and ongoing financial viability of SFAL.

40 The value of, and potential returns to be derived from the Development Units were dependent upon:

(a) a range of construction and development risks;

(b) credit and credit assessment risks; and

(c) the repayment of moneys advanced and interest pursuant to loan agreements made by the Development Trust secured by second or lower-ranking securities.

41 In early 2016, Sterling Projects Pty Ltd (ACN 162 801 425) trading as Sterling New Life launched a product described as a Sterling New Life Lease (SNLL).

42 The SNLLs were marketed by Sterling Projects as:

(a) a product that would enable retirees and seniors to release cash for the purpose of living a more comfortable retirement; and

(b) a retirement village alternative, with a long-term secure residential lease of up to 40 years on a property owned by a third-party investor and located in the general community.

43 Properties subject to a SNLL were:

(a) owned by either Acquest Property Pty Ltd (as trustee for a trust known as the Residential Property Trust), or individual owners; and

(b) managed by RMA.

44 SCS was paid an application fee of 8.8% of an applicant’s investment amount inclusive of GST.

45 In entering into a SNLL, a lessee received security of tenure for 40 years by way of an initial five year lease plus seven five year options for the exclusive occupancy of the residence.

46 To enter into a SNLL, each lessee was required to choose between two options, namely:

(a) an investment in units in the SIT; or

(b) an investment in preference shares in Silverlink Investment Company Limited (ACN 623 500 407) or Silver Link Securities Pty Ltd (ACN 622 598 823), (companies within the Sterling Group).

47 Lessees applying for a SNLL who chose to invest in units in the SIT were required to:

(a) pay an application fee and an initial rent payment to a bank account nominated by SCS;

(b) pay the amount of their investment (less the application fee and the initial rent payment) to a bank account referable to a specific SIT PDS;

(c) make an application pursuant to the relevant SIT PDS to invest the amount of their investment (less the application fee and the initial rent payment) by the end of the application period; and

(d) authorise and direct SCS to deal with each distribution from the lessee’s units received by SCS into its bank account by:

(i) paying any rent that was due and which had not been paid;

(ii) reimbursing SCS for any rent paid to the lessor by SCS on behalf of the lessee during the period prior to the first distribution; and

(iii) reinvesting on behalf of the lessee the balance of any surplus remaining after the payment of (i) and (ii) into the same units as the current lessee’s units.

48 SCS was required to deal with the proceeds of the redemption of a SNLL investor’s units received by SCS into its bank account by:

(a) first, paying any rent that was due and which had not been paid;

(b) second, upon the term ending, paying any money payable by the tenant under the SNLL including any loss suffered or incurred by the landlord arising from the failure of the tenant to comply with its obligations; and

(c) third, to the extent of any surplus, paying that amount to the SNLL lessee.

49 From 25 May 2016 to 9 March 2018, SNLL investors invested a total of $10,975,121 in units in the SIT pursuant to the following SIT PDS:

(a) Income Units PDS;

(b) Development Units PDS;

(c) Income and Growth Units PDS; and

(d) Revised Income and Growth Units PDS.

50 The rent rolls and PMAs acquired by and held by RMA constituted the principal asset held by the Sterling Group.

51 By reason of this, the performance and ongoing financial viability of the Sterling Group, including SFAL and SCS, materially depended upon the performance and ongoing financial viability of RMA.

52 Relevantly, SCS was:

(a) a 100% subsidiary of SFAL and a member of the Sterling Group at all material times; and

(b) party to a Management Services Agreement dated 1 July 2016 between SCS and RMA and was obliged under this contract to provide management services to RMA including financial management, corporate administration, preparation of tax related statements, recruitment, training and management of staff, operational issues and other consulting services as deemed to be necessary.

53 By reason of these matters, SCS had a material incentive to conduct itself in a way that promoted the performance and ongoing financial viability of SFAL and other entities in the Sterling Group.

54 By reason of these matters, SCS had a material incentive to:

(a) encourage individual applicants to apply for a SNLL;

(b) encourage individual applicants to invest in the SIT at the same time that they applied for a SNLL; and

(c) delay the processing of redemptions when SNLL holders sought to redeem their units in the SIT.

55 The SIT had significant related party receivables, related party loans and related party expenses with various entities in the Sterling Group, including SCS, RMAD and SFG as disclosed in the consolidated financial report for the SIT and its controlled entities for the year ended 30 June 2016.

56 Relevantly also, SCS was:

(a) the Investment Manager of the SIT; and

(b) the trustee of the Growth Trust, Development Trust and the Management Company Trust.

57 Pursuant to the 2012 Investment Management Agreement, SCS in its capacity as Investment Manager was required to:

(a) manage the overall operations of the SIT;

(b) value the underlying investments of the SIT;

(c) process redemption requests in the SIT;

(d) prepare any PDS and other promotional material for the SIT on behalf of Theta; and

(e) provide regular reports to Theta in connection to the SIT, its assets, any conflicts of interest and other compliance matters.

58 As trustee of each of the Growth Trust, Development Trust and the Management Company Trust, SCS had a duty to act in the best interests of SIT unitholders.

59 By reason of the matters set out at [50]-[55] above, it was not possible for SCS to bring an impartial mind to the execution of its duties as set out at [57]-[58] above.

60 Each of the Income Units PDS, the Development Units PDS, the Income and Growth Units PDS and the Revised Income and Growth Units PDS included representations as to the targeted returns for each Unit Class as follows:

(a) in the Income Units PDS, the targeted returns for the Income Units were represented as 9.25% per annum (p.a.) in the context of historically paying a distribution of 9.25% p.a.;

(b) in the Development Units PDS, the targeted returns for the Development Units were represented as 20.00% p.a. in the context of historically paying a distribution of 20.00% p.a.; and

(c) in the Income and Growth Units PDS:

(i) the targeted returns for the Income Units were represented as 9.25% p.a. in the context of historically paying a distribution of 9.25% p.a.; and

(ii) the targeted returns for the Growth Units were represented as 12.00% p.a. (as the Growth Units were a new offering, no historical annual distribution was stated).

61 On or about 19 August 2015, Mr Kenneth Pratt (of SFG) sent a letter to Mr Marie (of Theta) and Mr Chris Chandran (of Pitcher Partners) dated 15 August 2015. In that letter, Mr Pratt represented to Theta that SFG would continue to support the financial operations of the SIT and the Income Trust, Development Trust and Management Company Trust through the rebate of the cost of lost PMAs, limited to the level that enabled the SIT to maintain a distribution yield of 9.25% p.a. and to meet its obligations as and when they fell due, for all financial periods subsequent to 30 June 2015.

62 On or about 14 March 2016, Mr Phil Lucks (of SFG) wrote a letter to Mr Marie and Mr Chandran. In that letter, Mr Lucks represented to Theta that SFG would continue to support the financial operations of the SIT and the Income Trust, Development Trust and Management Company Trust through the rebate of the cost of lost PMAs, limited to the level that enabled the SIT to maintain a distribution yield of 9.25% p.a. and to meet its obligations as and when they fell due, for all financial periods subsequent to 31 December 2015.

63 On or about 6 October 2016, Mr Ray Jones (of SFAL) wrote a letter to Mr Marie and Mr Chandran. In that letter, Mr Jones represented to Theta that SFAL would continue to support the financial operations of the SIT and the Income Trust through the rebate of the cost of lost PMAs, limited to the level that enabled the SIT to maintain a distribution yield of 9.25% p.a. and to meet its obligations as and when they fell due, for all financial periods subsequent to 30 June 2016.

64 On or about 21 September 2017, Mr Jones wrote another letter to Mr Marie and Mr Chandran. In that letter, Mr Jones represented to Theta that SFG would continue to support the financial operations of the SIT and its controlled entities, limited to the level that enabled the SIT to maintain the distribution yields listed below and to meet its obligations as and when they fell due, for all financial periods subsequent to 30 June 2017:

(a) Development Units – 20% p.a.;

(b) Income Units – 9.25% p.a.; and

(c) Growth Units – 12% p.a..

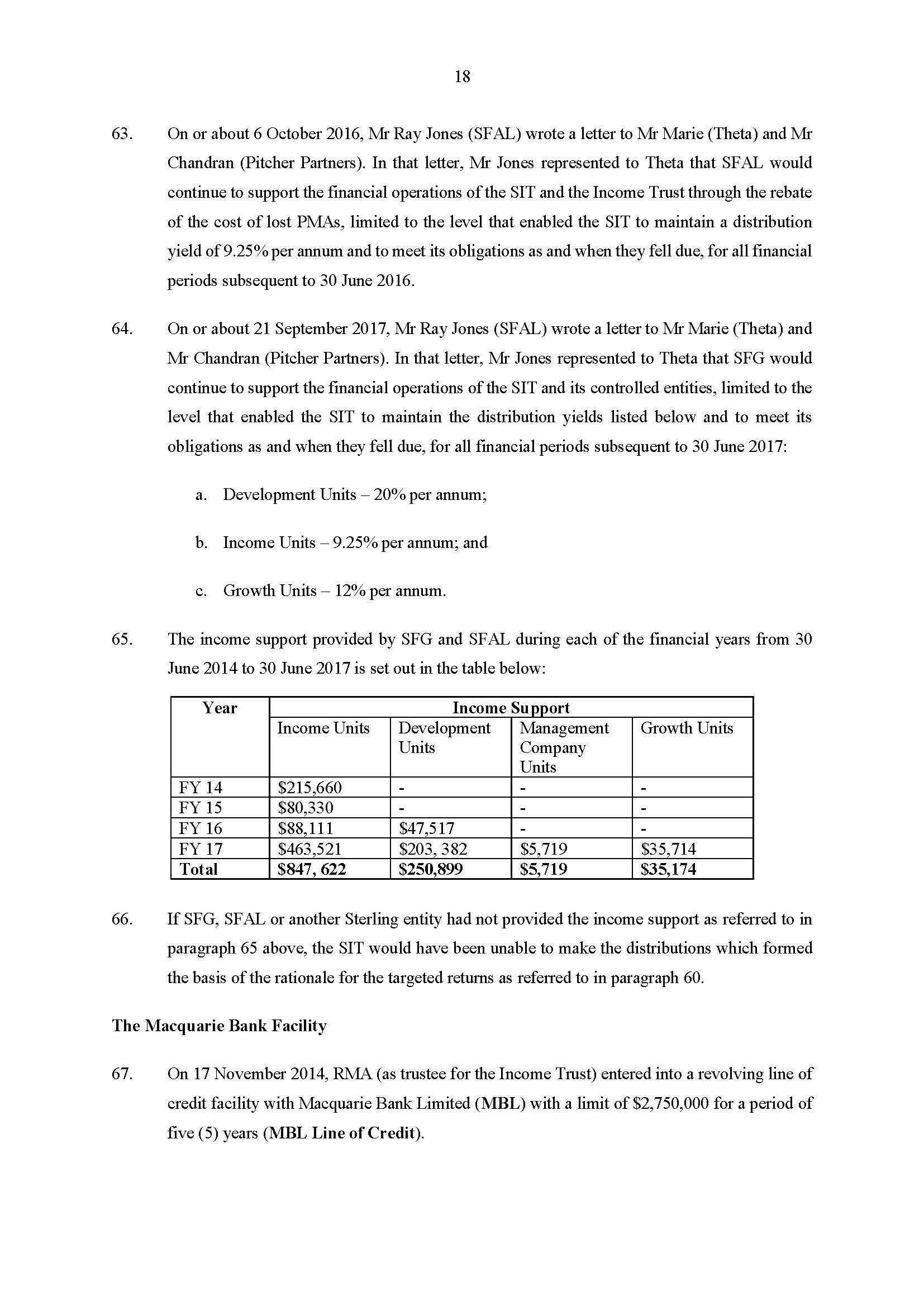

65 The income support provided by SFG and SFAL during each of the financial years from 30 June 2014 to 30 June 2017 is set out in the table below:

Income Support | ||||

Income Units | Development Units | Management Company Units | Growth Units | |

FY 14 | $215,660 | - | - | - |

FY 15 | $80,330 | - | - | - |

FY 16 | $88,111 | $47,517 | - | - |

FY 17 | $463,521 | $203,382 | $5,719 | $35,714 |

Total | $847, 622 | $250,899 | $5,719 | $35,174 |

66 If SFG, SFAL or another Sterling entity had not provided the income support as referred to in the table above, the SIT would have been unable to make the distributions which formed the basis of the rationale for the targeted returns referred to at [60] above.

67 On 27 November 2014, RMA (as trustee for the Income Trust) entered into a revolving line of credit facility with Macquarie Bank Limited (MBL) with a limit of $2,750,000 for a period of five years (MBL Line of Credit).

68 The MBL Line of Credit required RMA to provide a registered first ranking security over all the present and after-acquired assets and undertakings of RMA, acting alone and acting as trustee for the Income Trust, including without limitation all PMAs under which management fees were received by SFAL, Rental Management Australia (QLD) Pty Limited (ACN 158 361 507), Acquest Capital Pty Ltd (ACN 149 170 927) and Westbold Investments Pty Ltd (ACN 088 980 563).

69 On 8 February 2016:

(a) the limit of the MBL Line of Credit was increased to $2,875,000; and

(b) the security provided for in the original MBL Line of Credit was confirmed and RMA (as trustee for the Income Trust) agreed that MBL ranked in priority over the rights and claims of beneficiaries of the SIT and of RMA in its own capacity.

70 On 4 May 2016, MBL wrote a letter to the directors of RMA agreeing to increase the limit of the MBL Line of Credit to $3,008,000.

71 On 28 September 2017, MBL and RMA signed a Finance Agreement that provided:

(a) the limit of the MBL Line of Credit was increased to $3,283,000; and

(b) RMA granted MBL a registered first ranking security over the assets and undertakings (present and future) of RMA, including all PMAs under which management fees were received, Rental Management Australia (QLD), Acquest Capital and Westbold Investments.

72 By reason of this first ranking security, any monies owed to MBL pursuant to the MBL Line of Credit ranked in priority to any entitlements of the SIT unitholders in any winding up of the SIT.

ASIC Stop Orders and Pitcher Partners Auditor’s Report

73 On 9 August 2017, ASIC issued an interim stop order in relation to each of the Development Units PDS, the Management Company Units PDS and the Income and Growth Units PDS.

74 On 29 August 2017, ASIC issued a final stop order in relation to each of the Development Units PDS, the Management Company Units PDS and the Income and Growth Units PDS.

75 On 29 September 2017, Mr Chandran of Pitcher Partners prepared and signed an Independent Auditor’s Report. That report included a section at p 38 entitled ‘Emphasis of Matter’ in which it was stated that:

(a) the Sterling Group’s liabilities exceeded its assets by $524,350;

(b) the Sterling Group’s net liability position would increase to $9,737,564;

(c) ASIC had issued a final stop order dated 29 August 2017 in respect of the Sterling Group which prohibited the making of any offers, issues, sales or transfers of interests in connection to the SIT; and

(d) these events indicated that a material uncertainty existed that may cast significant doubt on the Sterling Group’s ability to continue as a going concern.

STATUTORY FRAMEWORK – DUTIES OF RESPONSIBLE ENTITIES AND OFFICERS OF RESPONSIBLE ENTITIES

76 Section 601FC(1)(b) of the Act imposes on a responsible entity of a managed investment scheme an obligation to exercise the degree of care and diligence that a reasonable person would exercise if they were in the responsible entity’s position.

77 Section 601FC(1)(b) provides:

601FC Duties of responsible entity

(1) In exercising its powers and carrying out its duties, the responsible entity of a registered scheme must:

…

(b) exercise the degree of care and diligence that a reasonable person would exercise if they were in the responsible entity’s position.

…

78 For present purposes, the alleged failure would be a failure to exercise the degree of care and diligence that a reasonable person would exercise if they were in the position of Theta with respect to the issue of each of the SIT PDS.

79 In order to establish a contravention of s 601FC(1)(b) with respect to the issue of each SIT PDS it would be necessary to demonstrate that:

(a) the PDS could properly be characterised as defective as that term is defined in s 1022A of the Act; and

(b) a person, exercising the degree of care that a reasonable person would exercise if they were in Theta’s position as the responsible entity of the SIT, would not have issued the PDS in the form that it was issued by Theta.

80 The statutory duty of care and diligence for an officer of a responsible entity is contained in s 601FD(1)(b) of the Act.

81 Section 601FD(1)(b) provides:

601FD Duties of officers of responsible entity

(1) An officer of the responsible entity of a registered scheme must:

…

(b) exercise the degree of care and diligence that a reasonable person would exercise if they were in the officer’s position;

…

82 In order to establish a contravention of s 601FD(1)(b) with respect to the issue of each SIT PDS it would be necessary to demonstrate that:

(a) the PDS could properly be characterised as defective as that term is defined in s 1022A of the Act; and

(b) a person, exercising the degree of care that a reasonable person would exercise if they were in Mr Marie’s position as the managing director and sole executive director of the responsible entity of the SIT, would not have caused or otherwise permitted Theta to issue the PDS in the form that it was issued by Theta.

83 Sub-section 601FD(1)(f)(i) of the Act imposes a specific duty on an officer of a responsible entity to ensure that the responsible entity complies with the Act.

84 84. Sub-section 601FD(1)(f)(i) is in these terms:

601FD Duties of officers of responsible entity

(1) An officer of the responsible entity of a registered scheme must:

…

(f) take all steps that a reasonable person would take, if they were in the officer’s position, to ensure that the responsible entity complies with:

(i) this Act;

…

85 Each of ss 601FC(1)(b), 601FD(1)(b) and 601FD(1)(f)(i) is a civil penalty provision.

86 The definition of defective in s 1022A of the Act is important.

87 The definition of defective is in these terms.

defective, in relation to a disclosure document or statement, means:

(a) there is a misleading or deceptive statement in the disclosure document or statement; or

(b) if it is a Product Disclosure Statement—there is an omission from the Product Disclosure Statement of material required by section 1013C, other than material required by section 1013B or 1013G; or

(c) if it is a Supplementary Product Disclosure Statement that is given for the purposes of section 1014E—there is an omission from the Supplementary Product Disclosure Statement of material required by that section; or

(d) if it is information required by paragraph 1012G(3)(a)—there is an omission from the information of material required by that paragraph; or

(e) if it is an offer document of a kind referred to in section 1019E—there is an omission from the document of material required by section 1019I; or

(f) if it is a supplementary offer document of a kind referred to in section 1019J—there is an omission from the document of material required by subsection 1019J(3).

88 For present purposes, the relevant definitions are those contained in s 1022A(1)(a) and s 1022A(1)(b), the latter of which focuses on s 1013C of the Act.

89 Section 1022A(1)(a) is enlivened if a PDS contains a misleading or deceptive statement.

90 Section 769C (in Ch 7 of the Act), provides:

769C Representations about future matters taken to be misleading if made without reasonable grounds

(1) For the purposes of this Chapter, or of a proceeding under this Chapter, if:

(a) a person makes a representation with respect to any future matter (including the doing of, or refusing to do, any act); and

(b) the person does not have reasonable grounds for making the representation;

the representation is taken to be misleading.

(2) Subsection (1) does not limit the circumstances in which a representation may be misleading.

(3) In this section:

proceeding under this Chapter has the same meaning as it has in section 769B.

91 Section 1022A(1)(a) falls within Ch 7 of the Act.

92 Section 1013C is relevantly in these terms:

1013C Product Disclosure Statement content requirements

(1) A Product Disclosure Statement:

(a) must include the following statements and information required by this Subdivision:

(i) the statements and information required by section 1013D; and

(ii) the information required by section 1013E; and

(iii) the information required by the other provisions of this Subdivision;

…

(3) The information included in the Product Disclosure Statement must be worded and presented in a clear, concise and effective manner.

…

93 Section 1013D(1)(f) of the Act provides that a product disclosure statement must include:

…

(f) information about any other significant characteristics or features of the product or of the rights, terms, conditions and obligations attaching to the product;

…

94 Section 1013E of the Act provides that:

1013E General obligation to include other information that might influence a decision to acquire

Subject to subsection 1013C(2) and sections 1013F and 1013FA, a Product Disclosure Statement must also contain any other information that might reasonably be expected to have a material influence on the decision of a reasonable person, as a retail client, whether to acquire the product.

95 For present purposes, in order to establish that a SIT PDS is defective, it would be necessary to establish that for each alleged defect or impugned statement that it fell within one or more of the matters identified in:

(a) s 1022A(1)(a), that is, it constitutes a ‘misleading or deceptive’ statement;

(b) s 1013D(1)(f), that is, no or no clear, concise and effective disclosure ‘about any other significant characteristics or features of the product or of the rights, terms, conditions and obligations attaching to the product’; and

(c) s 1013E, that is, no or no clear, concise and effective disclosure of ‘any other information that might reasonably be expected to have a material influence on the decision of a reasonable person, as a retail client, whether to acquire the product.’

96 The duty of a responsible entity to comply with the compliance plan for a managed investment scheme is imposed by s 601FC(1)(h) of the Act.

97 Section 601FC(1)(h) provides:

601FC Duties of responsible entity

(1) In exercising its powers and carrying out its duties, the responsible entity of a registered scheme must:

…

(h) comply with the scheme’s compliance plan;

…

98 The duty of an officer of a responsible entity to ensure that a responsible entity complies with the compliance plan for a scheme is imposed by s 601FD(1)(f)(iv).

99 Section 601FD(1)(f)(iv) provides:

601FD Duties of officers of responsible entity (1) An officer of the responsible entity of a registered scheme must:

1. An officer of the responsible entity of a registered scheme must:

…

(f) take all steps that a reasonable person would take, if they were in the officer’s position, to ensure that the responsible entity complies with:

…

(iv) the scheme’s compliance plan.

100 Each of s 601FC(1)(h) and s 601FD(1)(f)(iv) of the Act is a civil penalty provision

101 For completeness, it is to be noted that to the extent conduct in relation to disclosure documents is misleading or deceptive, no contravention of s 1041H(1) can arise by the operation of s 1041H(3) of the Act.

Misleading and Deceptive Statements

102 Theta stated inter alia in each of the:

(a) Development Units PDS at p 14 under the heading ‘Property Services’; and

(b) Management Company Units PDS at p 13 under the heading ‘Sterling New Life Leases’,

that the income each SNLL investor would receive from the SIT would be sufficient to enable each SNLL lessee to pay all of the rent due on their particular SNLL.

103 By the making of these statements, Theta represented, expressly and in writing, that the distributions from the SIT payable to each SNLL Investor would be sufficient for them to pay all of the rent due on their particular SNLL (Rental Payment Representation).

104 The ability of the SIT to make distributions equivalent to the rental liabilities incurred by each SNLL investor was dependent upon the performance of the underlying assets of the SIT, namely, PMAs held by the Income Trust.

105 However, at all material times, the income stream from the PMAs was uncertain due to:

(a) fluctuations in the property markets in connection with the PMAs;

(b) the potential for non-payment of rent by tenants;

(c) the potential for unpredicted vacancies by tenants;

(d) the potential for unpredicted loss of PMAs;

(e) the potential for replacement costs of PMAs being higher or lower than budgeted;

(f) the availability of funding to acquire PMAs to replace PMAs that had been lost;

(g) the capacity of entities within the Sterling Group to provide income subsidies;

(h) the potential for variations in the multiplier factor used to value the PMAs; and

(i) the maintenance of the stated distribution yields for each Unit Class.

106 By reason of these matters, Theta did not have reasonable grounds to make the Rental Payment Representation.

107 Accordingly, the Rental Payment Representation was:

(a) insofar as it was a representation as to a present matter or present matters, was misleading or deceptive, or likely to mislead or deceive; and

(b) insofar as it was a representation as to a future matter or future matters, was made without reasonable grounds.

108 By reason of these matters, each of the Development Units PDS and the Management Company Units PDS:

(a) contained material statements that were misleading or deceptive; and therefore

(b) was defective within the meaning of s 1022A(1)(a) of the Act.

109 At the time that Mr Marie signed and authorised or otherwise permitted the release of each of the Development Units PDS and the Management Company Units PDS, Mr Marie ought to have been aware that:

(a) the ability of the SIT to make distributions equivalent to the rental liabilities incurred by the SNLL was dependent upon the provision of income support by SFAL or another Sterling entity;

(b) the provision of income support by SFAL or another Sterling entity was dependent upon the ongoing performance and cashflow of the entities comprising the Sterling Group;

(c) it was necessary to determine the financial position of the Sterling Group in order to determine the reliability of income support;

(d) the limit on the MBL Line of Credit had been increased each year;

(e) Theta did not have reasonable grounds to represent that the ongoing performance and cashflow of the Sterling Group were assured; and

(f) the distributions from the SIT were not sufficiently certain so that each SNLL investor would be able to pay all of the rent due on his or her particular SNLL.

110 A reasonable person in Theta’s circumstances and a reasonable director of a responsible entity in Theta’s circumstances who occupied the offices held by Mr Marie, and had the same responsibilities as Mr Marie, would have, in acting with care and diligence:

(a) taken all steps necessary to ensure that they had sufficient knowledge of the operations of the SIT and the products offered in each of the SIT PDS to enable them to sufficiently carry out their responsibilities;

(b) taken all steps necessary to ensure that each of the SIT PDS did not contain any representations in relation to the SIT that were misleading or deceptive or likely to mislead or deceive;

(c) carefully reviewed each of the PDS to ensure that all representations contained therein were accurate;

(d) recognised that each of the Development Units PDS and the Management Company Units PDS contained the Rental Payment Representation;

(e) taken all steps necessary, including making reasonable enquiries with SCS, to determine the financial position of the Sterling Group;

(f) recognised that the ability of the SIT to make distributions equivalent to the rental liabilities incurred by the SNLL was dependent upon the provision of income support by SFAL or another Sterling entity;

(g) recognised that the provision of income support by SFAL or another Sterling entity was dependent upon the ongoing performance and cashflow of the entities comprising the Sterling Group;

(h) recognised that it was necessary to determine the financial position of the Sterling Group in order to determine the reliability of income support;

(i) recognised that the limit on the MBL Line of Credit had been increased each year;

(j) recognised that Theta did not have reasonable grounds to represent that the ongoing performance and cash flow of the Sterling Group were assured;

(k) recognised that the distributions from the SIT were not sufficiently certain so that each SNLL investor would be able to pay all of the rent due on his or her particular SNLL;

(l) recognised that the Rental Payment Representation was inaccurate, incomplete or misleading by reason of the fact that Theta did not have reasonable grounds to represent that distributions from the SIT were guaranteed or independent from the ongoing performance and cash flow of the Sterling Group;

(m) brought the inclusion of the Rental Payment Representation to the attention of the Due Diligence Committee, of which Mr Marie was chairman; and

(n) prior to authorising or otherwise permitting the release of each of the Development Units PDS and the Management Company Units PDS, taken all steps necessary to remove or correct the Rental Payment Representation as set out in each of the Development Units PDS and the Management Company Units PDS.

111 Each of Theta and Mr Marie failed to:

(a) take sufficient of the necessary steps in [110(a), [110(b)], [110(c)], [110(e)], [110(m)] and [110(n)] above; and

(b) take sufficient of the necessary steps in [110(d)] and [110(f)-(l)] above, required to obtain the knowledge to permit them to carry out the duties and responsibilities required by their position with care and diligence.

112 By reason of these matters, Theta contravened s 601FC(1)(b) of the Act in issuing each of the Development Units PDS and the Management Company Units PDS in that it failed to exercise the degree of care and diligence that a reasonable person would exercise if they were in Theta’s position.

113 At the time that Mr Marie signed and authorised or otherwise permitted the release of each of the Development Units PDS and the Management Company Units PDS, he ought to have been aware that:

(a) it was necessary for the proper discharge of his duties as an officer of Theta to satisfy himself that each of the Development Units PDS and the Management Company Units PDS did not contain representations that were misleading or likely to mislead or deceive actual or potential investors in the SIT, including investors who were lessees under SNLLs;

(b) ’if Theta released a PDS containing representations that were misleading or deceptive or likely to mislead or deceive, that PDS would be defective pursuant to s 1022A of the Act; and

(c) if Theta released a PDS containing representations that were misleading or deceptive or likely to mislead or deceive, Theta would contravene or risk contravening s 601FC(1)(b).

114 By reason of the matters in [102]-[111] and [113] above Mr Marie:

(a) contravened s 601FD(1)(b) of the Act, in that he failed to exercise the degree of care and diligence that a reasonable director of a responsible entity in Theta’s circumstances and who occupied the offices held by Mr Marie, and had the same responsibilities as Mr Marie, would exercise if they were in his position in authorising the issue of each of the Development Units PDS and the Management Company Units PDS to ensure that neither was defective within the meaning of s 1022A of the Act; and

(b) contravened s 601FD(1)(f)(i) of the Act, in that he failed to take all necessary steps that a reasonable director of a responsible entity in Theta’s circumstances and who occupied the offices held by Mr Marie, and had the same responsibilities as Mr Marie, would take if they were in his position to ensure that Theta complied with its statutory obligations pursuant to s 601FC(1)(b).

Sterling Guarantee Representations

115 Theta stated (amongst other things) in the Income and Growth Units PDS at:

(a) page 17 under the heading ‘Sterling Income Support Agreement’;

(b) page 18 under each of the headings ‘Income Distribution Risk: Income Units’ and ‘Income Distribution Risk: Growth Units’; and

(c) page 27 under the heading ‘Income Support Agreement between SIT, SCS and SCS as trustee for Sterling Capital Reserve Fund’;

that the Sterling Group had agreed to provide income support to the SIT if the distributions to holders of Income Units and/or Growth Units fell below their respective targeted distributions (Sterling Income Support Agreement);

116 The terms of the Sterling Income Support Agreement included:

(a) SCS must establish a fund to be known as the ‘Sterling Capital Reserve Fund’ (Reserve Fund), which must by 12 months from the date of the deed (31 January 2017) hold a balance equal to 1.5 times the amount required to pay the targeted distributions in respect of each of the Income Trust and the Growth Trust;

(b) the Reserve Fund provides a guarantee in support of the Sterling Income Support Agreement; and

(c) in the event that Sterling fails to meet its obligations under the Sterling Income Support Agreement, the SIT can draw the required funds from the Reserve Fund; and

(d) the SIT has the benefit of a General Security Agreement in respect of the Reserve Fund.

117 By making these statements, Theta represented, expressly or by necessary implication, that:

(a) the SIT had entered into the Sterling Income Support Agreement;

(b) the Sterling Group and/or SCS had provided the SIT with a secured and enforceable guarantee for the purpose of ensuring that the SIT had sufficient funds to pay the targeted distributions in respect of each of the Income Trust and the Growth Trust;

(c) the Sterling Group and/or SCS had established a Reserve Fund for the purpose of holding 1.5 times the amount required to pay the targeted distributions in respect of each of the Income Trust and the Growth Trust;

(d) the Reserve Fund provided a guarantee that could be drawn upon in the event that Sterling failed to meet its obligations; and

(e) the SIT had the benefit of a ‘General Security Agreement’ between the SIT and Sterling Group in respect of the Reserve Fund.

(together, Sterling Guarantee Representations).

118 At the time of the issue of the Income and Growth Units PDS:

(a) SFAL or another Sterling entity had not entered into an Income Support Agreement with the SIT;

(b) SFAL or another Sterling entity had not provided the SIT with a secured and enforceable guarantee for the purpose of ensuring that the SIT had sufficient funds to pay the targeted distributions in respect of each of the Income Trust and the Growth Trust;

(c) SFAL or another Sterling entity had not established a Reserve Fund for the purpose of holding 1.5 times the amount required to pay the targeted distributions in respect of each of the Income Trust and the Growth Trust;

(d) no Reserve Fund provided a guarantee that could be drawn upon in the event that the Sterling Group failed to meet its obligations; and

(e) the SIT did not have the benefit of a General Security Agreement between the SIT and SFAL or another Sterling entity in respect of any Reserve Fund.