Federal Court of Australia

GetSwift Limited, in the matter of GetSwift Limited (No 2) [2020] FCA 1733

ORDERS

IN THE MATTER OF GETSWIFT LIMITED ACN 604 611 556

| ||

GETSWIFT LIMITED ACN 604 611 556 Plaintiff | ||

AUSTRALIAN SECURITIES & INVESTMENTS COMMISSION Intervener | ||

RAFFAELE WEBB Interested Person | ||

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The application for orders under s 411(4)(b) of the Corporations Act be stood over to 10.15 am on Monday, 7 December 2020.

2. GetSwift must advise the Court within one business day after it becomes aware of a decision made by the Treasurer with respect to FIRB approval with a view to fixing a date for the further hearing of the application for orders under s 411(4)(b) of the Corporations Act.

3. There be liberty to apply on 24 hours’ notice.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

FARRELL J:

1 The second court hearing in relation to a proposed scheme of arrangement between GetSwift Limited and its members has been conducted over a number of days since 12 November 2020. These are reasons for making orders to adjourn the further hearing of the application for orders under s 411(4)(b) of the Corporations Act 2001 (Cth) until 7 December 2020 rather than refusing approval of the scheme.

Background

2 GetSwift was incorporated as an Australian public company in the state of Victoria in March 2015.

3 GetSwift and its subsidiaries (GetSwift Group) provide technology and services to clients in over 70 countries around the world. Its software products and services focus on business and logistics automation, data management and analysis, communications, information security and infrastructure optimisation.

4 GetSwift’s registered office is in Sydney, but it is headquartered in New York City and has technology centres in Denver, Colorado in the United States of America (USA) and in Belgrade, Serbia. In the year to 30 June 2020, 54.1% of all new customers acquired by GetSwift were in North America.

5 Ordinary shares in GetSwift (GetSwift Shares) were first listed on the Australian Stock Exchange (ASX) under the code “GSW” on 7 December 2016 following an initial public offering of GetSwift Shares at 20 cents each pursuant to a prospectus lodged with the Australian Securities and Investments Commission (ASIC) on 26 October 2016. GetSwift Shares are also traded on the Open Market segment “Quotation Board” operated by the Frankfurt Stock Exchange and in the United States of America (USA) on the OTC Pink Open Market operated by OTC Markets Group, in each case without the consent of GetSwift.

6 GetSwift raised capital over the course of 2017 in circumstances which have proved to be controversial. GetSwift raised an aggregate of $24 million at 80 cents per GetSwift Share in two tranches, on 4 July 2017 and 15 August 2017 (first capital raising). GetSwift conducted a further placement, in which it raised an additional $75 million at $4.00 per share on 22 December 2017 (second capital raising). At the time that a trading halt was imposed on GetSwift on 22 January 2018, the price of a GetSwift Share had fallen to $2.92. The price fell further to $1.31 when the trading halt ceased on 19 February 2018 following corrective disclosures made by GetSwift to the ASX. At the close of trading on 5 November 2020, the share price of GetSwift was 35 cents.

7 A number of representative actions were commenced under Part IVA of the Federal Court of Australia Act 1976 (Cth) against GetSwift and Joel Macdonald (a director of GetSwift) between 20 February 2018 and 13 April 2018. On 23 May 2018, the Federal Court of Australia ordered that only the action commenced by Mr Webb on 13 April 2018 (NSD 580 of 2018) could continue (the Webb proceeding). That order was upheld upon appeal to the Full Court and special leave to appeal the Full Court’s decision was refused by the High Court.

8 The Webb proceeding was filed on behalf of persons who acquired GetSwift Shares during the period from 24 February 2017 until 19 January 2018 and who claim to have suffered loss as the result of contraventions of s 674(2) of the Corporations Act and ss 1041E and 1041H of the Corporations Act and equivalent provisions of the Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act) and the Australian Consumer Law. The claims in those proceedings are that GetSwift and Mr Macdonald engaged in misleading and deceptive conduct and made false and misleading statements in the manner in which they made announcements to the market on the ASX, including in relation to 16 client contracts; that GetSwift failed to meet its continuous disclosure obligations in relation to information about certain client contracts and client contracts generally; and that Mr Macdonald was involved in the contraventions. The relief sought includes declarations of contravention against GetSwift and Mr Macdonald as well as compensation for loss suffered.

9 On 22 February 2019, ASIC commenced proceedings (VID 146 of 2019) against GetSwift and two of its directors, Mr Macdonald and Bane Hunter. Those proceedings were later amended to include Brett Eagle who was a director and corporate counsel at the relevant time (the ASIC proceeding). ASIC’s claims relate to a series of announcements that GetSwift submitted to the ASX between February and December 2017 concerning agreements it had entered into with clients for the use of GetSwift’s software-as-a-service platform in the periods leading up to the first capital raising and the second capital raising. ASIC claims that there were 20 contraventions of s 674(2) the Corporations Act and breaches of s 1041H of the Corporations Act and s 12DA of the ASIC Act and the maximum penalty for each of those alleged contraventions is $1 million. ASIC seeks:

(a) Declarations of contraventions against GetSwift and each of Messrs Macdonald, Hunter and Eagle;

(b) Pecuniary penalties payable to the Commonwealth against GetSwift in relation to the alleged continuous disclosure contraventions and against Messrs Hunter and Macdonald in relation to the alleged continuous disclosure contraventions and breach of directors’ duties “in such amount as the Court considers appropriate in respect of each of the declared contraventions”;

(c) Orders disqualifying each of Messrs Macdonald, Hunter and Eagle from managing corporations for a period of time to be determined; and

(d) Its costs.

10 Issues of liability in the ASIC proceeding were heard between 15 June 2020 and 30 September 2020 and judgment has been reserved.

11 The Judge who is currently listed to preside at the trial in the Webb proceeding is the same Judge who presided in the trial in the ASIC proceeding. The respondents to the Webb proceeding filed an application seeking that that matter be reallocated to a different Judge. That application was dismissed on 9 September 2020 and the parties were given leave to appeal the judgment: Webb v GetSwift Limited (No 6) [2020] FCA 1292. The respondents lodged an appeal on 23 September 2020 and are currently waiting for the Court to advise a hearing date for the appeal. Trial dates for hearing the substantive application in the Webb proceeding have been vacated. It is not expected that the trial Judge in the ASIC proceeding will deliver judgment on liability in the ASIC proceeding until after the appeal in the Webb proceeding has been heard and judgment delivered and not before February 2021. If ASIC is successful on the issue of liability in the ASIC proceeding, it will then be necessary for a further hearing to determine appropriate penalties.

Proposed scheme and first court hearing

12 On 4 September 2020, GetSwift entered into a Scheme Implementation Deed (SID) with GetSwift Technologies Limited (Holdco) in relation to a proposed scheme of arrangement between GetSwift and its shareholders, the intended purpose of which is to re-domicile GetSwift to Canada. Holdco was incorporated in British Columbia, Canada, on 19 May 2020 for the purpose of implementing the scheme and it has not otherwise conducted business.

13 On the same day, GetSwift announced its intention to establish an off-market unmarketable parcel share buy-back facility. An unmarketable parcel would comprise up to 946 GetSwift Shares. The maximum number of GetSwift Shares in an unmarketable parcel was calculated on the basis that each GetSwift Share had a buy-back price of $0.52815 as at 7 pm (Sydney time) on 3 September 2020 such that the aggregate value of the parcel was $500. A holder of an unmarketable parcel could sell its shares to GetSwift without incurring brokerage or handling costs until 5 pm on 21 October 2020.

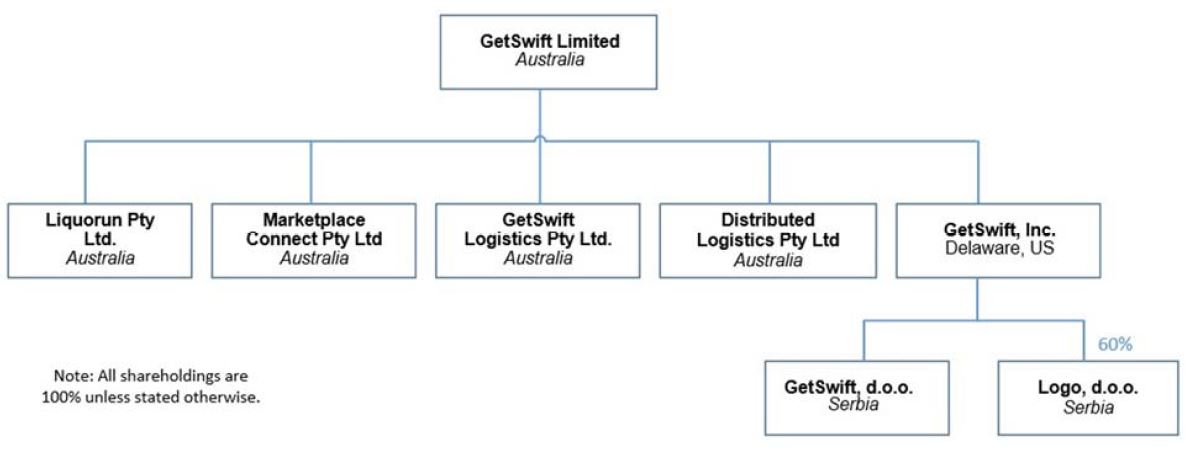

14 GetSwift’s current group structure is as follows:

15 A scheme of the kind proposed is sometimes called a “top hat” scheme. If the scheme is implemented, all of the issued GetSwift Shares will be transferred to Holdco and GetSwift shareholders (other than ineligible foreign shareholders) would be issued one Holdco share for every seven GetSwift shares. GetSwift would be delisted from the ASX and Holdco shares would be listed on the NEO Exchange Inc in Canada (NEO). Holdco shares which would otherwise have been issued to ineligible foreign shareholders as scheme consideration will be sold on NEO and the net proceeds distributed to those former shareholders in proportion to their holding. A shareholder on the record date of the scheme will be an “ineligible foreign shareholder” if their registered address is in a jurisdiction other than Australia (including its external territories), Canada, New Zealand, the USA and any other jurisdiction that Holdco determines that it is lawful and not unduly onerous or impracticable to issue Holdco shares to a GetSwift Shareholder with a registered address in that jurisdiction. The evidence before the Court indicates that approximately 0.15% of GetSwift Shares were held by ineligible foreign shareholders.

16 By an application lodged with the Court on 21 September 2020, GetSwift sought orders under ss 411(1) and 1319 of the Corporations Act in relation to convening a meeting of GetSwift shareholders (scheme meeting) for the purpose of considering a resolution to approve the proposed scheme (with or without modifications). It also sought orders under ss 411(4)(b), 411(12) and (if necessary) 411(6) of the Corporations Act. The first court hearing was held on 8 and 9 October 2020.

17 Exhibit B in the proceedings is a scheme booklet which discloses the following information about the proposed scheme, GetSwift and Holdco.

18 As at 9 October 2020, GetSwift’s capital structure comprised 215,629,796 GetSwift Shares and 15,142,167 unlisted options over GetSwift Shares (Options): section 5.8 of the scheme booklet. GetSwift has entered into binding agreements with all holders of GetSwift options to amend the terms of their issue to effectively place all holders of Options in the same position with respect to rights to shares in Holdco as were previously enjoyed in respect of shares in GetSwift. GetSwift obtained a waiver of ASX Listing Rule 6.23.4 to permit this treatment of the options without obtaining shareholder approval: section 10.6 of the scheme booklet.

19 GetSwift and Holdco have the same board: sections 5.4 and 6.2 of the scheme booklet. The directors’ interests in GetSwift Shares and Options were as follows as at 9 October 2020:

Name | Role | Relevant interests in GetSwift Shares | Options |

Stanley Pierre-Louis | Independent Chairman and non-executive director | 687,500 | |

Bane Hunter | Chief Executive Officer and executive director | 21,531,627 | 5,500,000 |

Joel Macdonald | President, Managing Director and executive director | 51,567,357 | 1,000,000 |

Marc Naidoo | Independent non-executive director | 300,000 | |

Carl Mogridge | Independent non-executive director | 150,000 | 200,000 |

20 As at 1 October 2020, Mr Macdonald was a substantial holder in respect of 23.91% of the issued capital and Mr Hunter was a substantial holder in respect of 9.99% of the issued capital: section 5.9 of the scheme booklet.

21 The directors recommended that GetSwift shareholders vote in favour of the proposed scheme, as they intended to do in the absence of a superior proposal. In their view, the reasons to vote in favour of the proposed scheme outweighed the reasons to vote against it: Chairman’s letter and sections 3.1 and 3.2 of the scheme booklet.

22 The independent expert (Shinewing Australia Corporate Finance Pty Ltd) found that, on balance, implementation of the scheme was in the best interests of GetSwift shareholders in the absence of a superior proposal: Annexure B to the scheme booklet. The independent expert took these matters into account (among others set out in Annexure B):

(a) GetSwift is an “early stage technology company” and it may need to raise additional capital to fund research and development activities and its global expansion plans.

(b) The Canadian and neighbouring US technology industries are among the largest in the world.

(c) GetSwift’s operations have been predominantly US-centric in the last few years, with corporate and operational headquarters located in New York City, New York, and GetSwift’s main technology centre located in Denver, Colorado in addition to a technology centre in Belgrade, Serbia.

(d) Approximately 54.1% of GetSwift’s new customer acquisitions in the financial year ending 30 June 2020 relate to the North American market.

(e) GetSwift’s most recent capital raising (in which GetSwift entered into a put option agreement (LDA Agreement) with LDA Capital Limited (LDA) and LDA Capital, LLC (LDA LLC)) was with a US-based alternative investment group.

(f) Following implementation of the scheme, key business stakeholders who are more familiar with local US and Canadian laws may be more at ease dealing with a Canadian-based head company. However, GetSwift’s US business is already primarily being undertaken through its US subsidiary, therefore any additional benefit may be limited.

(g) There may be operational efficiencies in the longer term from North American based directors, management and employees having access to lawyers, accountants and taxation advisers in the same time zone as its primary business operations.

23 The Chairman’s letter and section 3.2 of the scheme booklet discloses that the directors identified the possible reasons to vote against the scheme as being, in summary:

(a) A GetSwift shareholder might wish to maintain an interest in an ASX listed company with GetSwift’s specific characteristics so as to maintain the existing investment profile.

(b) A GetSwift shareholder might believe that a superior proposal will emerge in the future.

(c) Holdco shares will confer different rights and protections to those available with respect to GetSwift shares and some of those differences may be considered disadvantageous.

(d) There are one-off transaction costs associated with the proposed scheme.

(e) GetSwift shareholders may prefer liquidity on the ASX as no active market may develop for Holdco shares.

24 Section 8 of the scheme booklet disclosed general risks, risks relating to the transaction and risks related to GetSwift’s business. In the course of the first court hearing, section 8.3(e) was amended to include the following disclosure:

… If the ASIC Proceedings result in adverse findings or orders or settlement outcomes against either Mr Hunter or Mr Macdonald, it is possible that the consequential effects could similarly have a material adverse impact on Mr Hunter’s or Mr Macdonald’s (as the case may be) ability to continue to serve GetSwift and Holdco in their current capacities.

NEO has indicated that, if the disqualification orders sought by ASIC against Mr Hunter and Mr Macdonald in the ASIC litigation are secured, that may present a concern for NEO regarding their suitability to continue as directors or officers of Holdco. However, NEO has advised the Company that at present, it is satisfied that the ASIC litigation is adequately disclosed in Holdco’s draft preliminary prospectus (provided to NEO in connection with Holdco’s listing application) and does not in and of itself present a suitability concern. NEO has further advised that Mr Hunter and Mr Macdonald will be accepted as directors and officers of Holdco, subject to clearing any customary international background checks, but not subject to any other condition or other requirement.

The BCSC will be the principal regulatory body responsible for Holdco's status as a reporting issuer in Canada. It is expected that the BCSC will consider the results of the ASIC Proceedings when the outcome is known. Under the Securities Act (British Columbia), the BCSC has broad powers to make orders in the public interest. If there is an adverse finding in the ASIC Proceedings, the BCSC has the power to require a hearing under s 161 of the Securities Act (British Columbia) and the power to make orders including requiring Mr Hunter and Mr Macdonald to cease being directors or officers or otherwise involved in the management of Holdco.

Mr Hunter and Mr Macdonald each possess substantial skills and experience in relation to GetSwift’s business, which may be difficult to replace quickly and in such circumstances could have a material adverse effect on GetSwift’s business plan and strategy. Holdco will undertake to inform the BCSC of any material changes or updates with respect to the civil proceedings that occur from time to time following the receipt for a prospectus of Holdco from the BCSC. In addition, Mr Hunter and Mr Macdonald have each proposed to undertake to complete a course offered by Simon Fraser University and supported by the BCSC with respect to the financing, governance, and compliance responsibilities of public companies within six months of the receipt for a prospectus of Holdco. Mr Hunter and Mr Macdonald completed such course entitled Public Companies Financing, Governance and Compliance on 25 September 2020. Holdco will ensure that the prospectus of Holdco will include, in the risk factors and in the legal proceedings section, disclosure of Holdco’s proposed undertaking to keep the BCSC apprised of updates in the civil proceedings and the proposed undertaking by Mr Hunter and Mr Macdonald to complete the governance course referred to above. Refer to Section 10.7 for further information on material disputes and litigation to which the GetSwift Group, Mr Hunter and Mr Macdonald are currently a party.

25 The Court notes that by an affidavit sworn on 9 October 2020, Mark Bernard Joseph Crean, a partner at Jones Day, solicitors to GetSwift in these proceedings, advised the Court at [12] that Messrs Hunter and Macdonald had informed him that if ASIC secures disqualification orders against them in the ASIC proceeding and the British Columbia Securities Commission (that is, the BCSC) also made orders disqualifying them from being involved in the management of Holdco, to the extent that their continued involvement would lead NEO to de-list Holdco, both Mr Hunter and Mr Macdonald would agree to comply with any such orders in respect of Holdco so as to maintain the NEO listing.

26 Section 4.4 of the scheme booklet disclosed that the proposed scheme is subject to the following conditions (among others) which are also conditions of the SID which are disclosed at section 10.4:

(a) Obtaining shareholder approval to the scheme by the requisite majorities at the scheme meeting;

(b) Obtaining Court approval under s 411(4)(b) of the Corporations Act;

(c) Obtaining necessary regulatory approvals, including from ASIC, the ASX and pursuant to the Foreign Acquisitions and Takeovers Act 1975 (Cth) (FIRB Act) (the last of which will be referred to as FIRB approval);

(d) NEO approving the listing of Holdco shares on NEO, subject only to the scheme becoming effective and the satisfaction of customary listing conditions that are typical to a listing application on NEO;

(e) No restraining order, injunction or other order being made that would prevent or delay the scheme made by a court of competent jurisdiction or regulatory authority being in effect as at 8 am on the day of the second court hearing; and

(f) The condition with respect to FIRB approval reflects the condition in cl 3.1(a)(i) of the SID that before 8 am on the day the Court makes an order approving the scheme:

FIRB approval: either:

(A) the Treasurer (or the Treasurer's delegate) has provided no objection notification to the Scheme either without conditions or with conditions accepted by Holdco (acting reasonably); or

(B) following notice of the proposed Scheme having been given under the FIRB Act, the Treasurer has ceased to be empowered to make any order under Part 3 of the FIRB Act because the applicable time limit on making orders and decisions under the FIRB Act has expired;

27 Section 5.6 of the scheme booklet discloses GetSwift’s historical financial information for the financial years ending on 30 June 2018, 2019 and 2020. It discloses (among other things) the following:

Historical consolidated statement of profit and loss | Year ended 30 June 2020 $’000 | Year ended 30 June 2019 $’000 | Year ended 30 June 2018 $’000 |

Revenue and other income | 26,589 | 3,820 | 1,477 |

Other gains | 1,790 | 5,184 | 5,360 |

Operating loss/ loss before income tax | (31,166) | (19,494) | (12,123) |

Total comprehensive loss for the period | (31,241) | (20,350) | (12,386) |

Historical consolidated statement of financial position | Year ended 30 June 2020 $’000 | Year ended 30 June 2019 $’000 | Year ended 30 June 2018 $’000 |

Total current assets | 54,914 | 70,428 | 97,721 |

Property, plant and equipment | 1,917 | 176 | 61 |

Intangible assets | 18,887 | 7,923 | 22 |

Deferred tax assets | 47 | - | - |

Other assets | 190 | 114 | - |

Total non-current assets | 21,041 | 8,213 | 83 |

Total assets | 75,955 | 78,641 | 97,804 |

Total current liabilities | 22,713 | 4,599 | 4,965 |

Total non-current liabilities | 2,850 | 11 | 9 |

Total liabilities | 25,563 | 4,610 | 4974 |

Net assets | 50,392 | 74,031 | 92,830 |

EQUITY | |||

Share capital | 103,840 | 103,242 | 103,242 |

Other reserves | 6,241 | 5,054 | 4,359 |

Accumulated losses | (65,892) | (34,265) | (14,771) |

Non-controlling interests | 6,204 | - | - |

Total equity | 50,392 | 74,031 | 92,830 |

Historical consolidated statement of cash flow | Year ended 30 June 2020 $’000 | Year ended 30 June 2019 $’000 | Year ended 30 June 2018 $’000 |

Net cash outflow from operating activities | (26,790) | (26,812) | (9,166) |

Net cash outflow from investing activities | (8,720) | 59,428 | (55,827) |

Net cash inflow (outflow) from financing activities | (1,536) | - | - |

Net (decrease) increase in cash and cash equivalents | (37,047) | 32,616 | 17,722 |

Cash and cash equivalents at end of period | 33,949 | 68,809 | 35,845 |

28 Section 5.7 of the scheme booklet discloses that:

To the knowledge of the GetSwift Directors at the last practicable date before this Scheme Booklet, other than as disclosed in this Scheme Booklet or as otherwise disclosed to ASX by GetSwift, the financial position of GetSwift has not materially changed since 30 June 2020.

29 Section 6.3 of the scheme booklet discloses the proposed governance structure of Holdco.

30 Section 6.5 of the scheme booklet discloses Holdco’s intentions for GetSwift if the scheme is implemented including with respect to removal of GetSwift from the ASX and its conversion to a proprietary company, Holdco’s listing on other exchanges, board composition as set out above, location of the head office in New York, retention of current employees and maintenance of the current dividend policy (that is, the intention to retain future earnings and other cash resources for development and growth of the business). Further:

(a) Section 6.5(f) says the following about Holdco’s intentions with respect to the business, operation and assets of GetSwift Group:

Holdco currently intends that the business of the GetSwift Group will be conducted in the same manner as at the date of this Scheme Booklet. Holdco does not intend to make any material changes to the business of the GetSwift Group as a result of or immediately following implementation of the Transaction.

Holdco intends to continue to operate the business of GetSwift under its current name.

Holdco may undertake a review of GetSwift and its business, operations and assets following implementation of the Transaction to determine how to best operate and further develop and grow the business and operations of the company. Decisions regarding future business operations will be made following completion of that review and in light of circumstances at the relevant time. Additionally, future economic, market and business conditions may cause Holdco to make changes it considers necessary and in the interests of its shareholders.

(b) Section 6.5(j), discloses that:

Other than set out in this Section 6.5, it is Holdco’s intention to the extent possible:

• to continue the business of GetSwift;

• not to make any major changes to the business of GetSwift nor to redeploy or transfer any of GetSwift’s assets, other than the movement of cash amongst subsidiaries in the ordinary course of business for purposes such as working capital and projects; and

• to continue the employment of GetSwift’s present employees.

31 Section 6.6 of the scheme booklet makes disclosures about the LDA Agreement. Pursuant to the LDA Agreement, GetSwift could, at any time during a commitment period of 36 months commencing on 11 March 2020 require LDA to subscribe for GetSwift Shares having a total issue price not exceeding US$45 million, subject to GetSwift satisfying certain conditions in the LDA Agreement. The LDA Agreement therefore provides GetSwift with access to committed equity capital in the event GetSwift requires capital for use in its business (including for working capital purposes). Pursuant to the LDA Agreement, the scheme is a transaction that would require GetSwift, LDA, and LDA LLC to novate the LDA Agreement to add Holdco as a party in place of GetSwift and to update the conditions applicable to drawdowns to reflect the re-domiciliation of GetSwift to Canada and the listing of the Holdco shares on NEO. As of the date of the scheme booklet, the parties had not entered into the amended LDA Agreement. GetSwift advised shareholders of its intention to novate the LDA Agreement.

32 The scheme booklet also makes disclosures with respect to the following issues:

(a) The rights and liabilities attaching to Holdco shares: section 7.3;

(b) A comparison of the key aspects of Australian and Canadian shareholder rights and corporate laws: section 7.4 and Annexure A;

(c) Taxation implications of the implementation of the scheme: section 9;

(d) Disputes and litigation, including in relation to the Webb proceeding and the ASIC proceeding: section 10.7; and

(e) ASIC has granted relief relating to disclosure under paragraph 8302(d) of Part 3 of Sch 8 to the Corporations Regulations 2001 (Cth) and ASIC waived compliance with Listing Rule 6.23.4 to permit the treatment of the Options as set out in section 10.6 of the scheme booklet: section 10.8.

33 Based on the evidence before the Court at the first court hearing:

(a) The scheme booklet appeared to have been verified in the usual way; and

(b) The scheme of arrangement in Annexure C of the scheme booklet and the deed poll in Annexure D of the scheme booklet provided for the usual protections against execution risk upon implementation of the scheme. On 1 October 2020, GetSwift and Holdco entered into a deed poll in common form in schemes of arrangement in Australia designed to protect GetSwift shareholders against risk in relation to receipt of scheme consideration in exchange for their GetSwift Shares. By a letter dated 6 October 2020, Dentons Canada LLP, Canadian counsel to HoldCo, expressed the opinion that Holdco is a corporation in good standing in British Columbia, it has the necessary power and authority to enter and perform its obligations under the deed poll, that according to the laws of British Columbia and Canada, the deed poll was duly authorised, executed and delivered and constitutes a legal, valid and binding obligation of Holdco, no consents or approvals of any governmental body or authority was required for its execution and delivery and that does not violate its articles or the notice of articles of Holdco.

34 Senior counsel for ASIC, Mr Halley SC, and counsel for Mr Webb, Mr Davies, appeared at the first court hearing on 8 and 9 October 2020. Mr Davies advised that Mr Webb did not seek to oppose orders being made convening a scheme meeting but that as a shareholder and contingent creditor of GetSwift arising out of the Webb proceeding, he would reserve his position on whether orders should be made under s 411(4)(b) of the Corporations Act. Mr Halley initially sought an adjournment of the first court hearing to allow ASIC further time to consider the scheme, but ultimately did not oppose orders being made convening the scheme meeting having regard to additional disclosures made in the scheme booklet.

35 Having regard to:

(a) The evidence before the Court at the first court hearing;

(b) The principles I discussed in Capilano Honey Limited, in the matter of Capilano Honey Limited [2018] FCA 1568; (2018) 131 ACSR 9 at [32]-[34] in relation to matters it is appropriate to take into account at the first court hearing; and

(c) The fact that similar re-domiciliation schemes have previously been approved by this Court in cases including News Corporation Ltd [2004] FCA 1480; (2004) 51 ACSR 394; Peplin Limited [2007] FCA 1387; [2007] FCA 1558; Heartware Limited, in the matter of Heartware Limited [2008] FCA 1997; Re Sylvania Resources Ltd [2009] FCA 955; (2009) 179 FCR 306; Unilife Medical Solutions Limited, in the matter of Unilife Medical Solutions Limited (No 2) [2010] FCA 12; Marengo Mining Ltd, in the matter of Marengo Mining Ltd [2012] FCA 1220; Atlassian Corporation Pty Limited, in the matter of Atlassian Corporation Pty Limited [2013] FCA 1451; [2014] FCA 60; and Sundance Energy Australia Limited, in the matter of Sundance Energy Australia Limited [2019] FCA 1944,

on 9 October 2020, the Court made orders convening the scheme meeting and addressing other related matters.

36 The orders made on 9 October 2020 included the following:

(a) That a scheme meeting to consider a scheme substantially in the form set out in Annexure C to the scheme booklet be convened at 10 am on 9 November 2020 (AEDT) to be held as a wholly virtual meeting by means of audio visual technology, with no physical assembly and otherwise in accordance with orders made on 24 September 2020. In relation to the orders made by Yates J on 24 September 2020, see GetSwift Limited, in the matter of GetSwift Limited [2020] FCA 1382;

(b) Authorising despatch of the scheme booklet and related materials in the approved form on or before 9 October 2020 by electronic means or by post (to shareholders with registered addresses in Australia) and by airmail or international courier service (to shareholders with registered addresses outside Australia);

(c) Requiring despatch of the scheme booklet and related materials on or before 14 October 2020 in relation to shareholders in respect of which the delivery system log indicates that email delivery was unsuccessful;

(d) Requiring provision of the scheme booklet and related materials to new GetSwift members who appear on the register after 9 October 2020 on either of 19 or 30 October 2020;

(e) Appointing Stanley Pierre-Louis or failing him Marc David Naidoo as chair of the scheme meeting;

(f) Requiring voting on the resolution to approve the scheme be conducted by poll; and

(g) Requiring publication in The Australian newspaper on or before 4 November 2020 of a notice of the second court hearing to be held on Thursday, 12 November 2020 at 10.15 am.

Events between the first and second court hearings

37 On 21 October 2020, the Court made orders under s 1319 of the Corporations Act authorising communications with GetSwift Shareholders in accordance with a script marked as Exhibit D in the proceedings.

38 On 30 October 2020, GetSwift advised the ASX that it had acquired a total of 275,377 GetSwift Shares under the unmarketable parcel share buy-back facility and that it had 1,642 shareholders. Accordingly, GetSwift’s issued capital at the time of the scheme meeting was 215,354,419 GetSwift Shares.

39 GetSwift also filed an Appendix 4C with the ASX on 30 October 2020. In it, GetSwift reported that its cash and cash equivalents at the end of the quarter ending 30 September 2020 had reduced to $16.2 million compared with a figure of $34.0 million at 30 June 2020. GetSwift also reported (at 8.6.1 of Appendix 4C) that:

… the company does not expect the current level of net operating cash outflows to continue. This higher level of spend is not expected to continue. In addition, the customer receipts related to the spend during the current quarter are expected to be received in the first quarter of 2021. As noted in the Scheme Booklet dated 9 October 2020 the company believes that it is reasonably foreseeable that the GetSwift group will continue as a going concern having regard to a number of factors including current working capital, receivables and access to the LDA Facility referred to in item 7 above. The company anticipates that its ability to continue as a going concern will likely be dependent on its ability to obtain additional equity, debt or other financing as and when required until it is able to achieve profitable operations. The company’s directors currently have a reasonable expectation that the company will be able to obtain sufficient funds from existing shareholders or external parties in order to continue as a going concern.

40 The scheme meeting was held on 9 November 2020. The votes cast in relation to the resolution to approve the scheme were as follows:

For | Against | Abstain | Total votes | |

Votes | 163,989,097 | 697,281 | 1,000 | 164,686,378 |

Holders | 82 | 42 | 1 | 124 |

Percentage of votes | 99.58% | 0.42% | n/a | 100% |

Percentage of holders | 66.13% | 33.87% | n/a | 100% |

41 Mr Webb filed an interlocutory application on 11 November 2020 seeking leave to appear at the second court hearing under r 2.13 of the Federal Court (Corporation) Rules 2000 (Cth) and on the basis there be no order as to costs. Mr Webb also filed written submissions and an affidavit affirmed by Timothy Michael Luke Finney on 10 November 2020. Mr Finney is a director of Phi Finney McDonald (PFM), Mr Webb’s lawyers in the Webb proceeding.

42 ASIC filed a notice of intervention on 11 November 2020, written submissions and the affidavit of Anthony Vardy (a lawyer employed by ASIC) affirmed on 6 November 2020.

Second Court hearing

43 The Court was satisfied, based on the evidence before the Court on the first day of the second court hearing on 12 November 2020, that:

(a) The scheme booklet and the orders made on 9 October 2020 were lodged with ASIC on 9 October 2020 and the scheme booklet was registered on that day.

(b) The orders made on 9 October 2020 with respect to despatch of the scheme booklet and proxy forms, the conduct of the scheme meeting on 9 November 2020 and publication of a notice of the second court hearing in The Australian have been complied with in all material respects.

(c) Save as set out under the heading “Conditions which were not satisfied or waived as at 12 November 2020”, all necessary regulatory approvals had been obtained.

(d) GetSwift’s shareholders approved the scheme by the majorities required under s 411(a)(ii) of the Corporations Act.

(e) The procedural and other requirements in the Corporations Act, Corporations Regulations 2001 (Cth) and the Federal Court (Corporations) Rules 2000 (Cth) have been complied with.

(f) The fairness and reasonableness of the scheme in the interests of shareholders is supported by the report of the independent expert. The Court is satisfied that an intelligent and honest shareholder, properly informed and acting alone, could approve of the scheme. That view is supported by the majorities by which the scheme was approved: see Amcor Limited, in the matter of Amcor Limited (No 2) [2019] FCA 842 (Re Amcor Limited (No 2)) at [10] (Beach J). There is no suggestion of oppression of any minority shareholders.

(g) ASIC did not provide the “usual letter” pursuant to s 411(17)(b) of the Corporations Act indicating that it had no objection to the scheme of arrangement. In such a circumstance, under s 411(17)(a), the Court must not approve a scheme unless it is satisfied that the scheme has not been proposed for the purpose of enabling any person to avoid the operation of any of the provisions of Chapter 6. The Court is satisfied that the scheme was not proposed for that purpose.

44 The Court notes that, although votes were cast at the scheme meeting in respect of over 76% of all GetSwift Shares on issue at the time of the scheme meeting, only 7.7% of shareholders voted. If GetSwift Shares in which Messrs Macdonald and Hunter have a relevant interest are disregarded, there would be no material effect on the achievement of the margins by which statutory majorities were achieved. While the turn-out at the scheme meeting by number of shareholders was low, the Court is satisfied that all necessary measures were taken to draw the scheme booklet and notice of the scheme meeting to the attention of GetSwift shareholders and there is nothing in the evidence that suggests that there was any error in the printing or despatch of the scheme booklet which might have caused voter turnout to be low. There is no reason to infer that there was a protest vote and such apathy should not be presumed to be antagonism: see Re Matine Limited (1998) 28 ACSR 268 at 295 (Santow J).

45 As at 12 November 2020, there were two outstanding issues.

Conditions which were not satisfied or waived as at 12 November 2020

46 First, not all conditions precedent to the scheme were satisfied or waived by 8 am on 12 November 2020. By an email sent to the Court at 9.39 am on that day, GetSwift proposed orders approving the scheme subject to conditions that:

(a) on or before 2 December 2020 (AEDT):

(i) the Treasurer (or the Treasurer’s delegate) has provided no objection notification to the Scheme either without conditions or with conditions accepted by GetSwift Technologies Limited (Holdco) (acting reasonably); or

(ii) following notice of the proposed Scheme having been given under the Foreign Acquisitions and Takeovers Act 1975 (Cth) (FIRB Act), the Treasurer has ceased to be empowered to make any order under Part 3 of the FIRB Act because the applicable time limit on making orders and decisions under the FIRB Act has expired; and

(b) issuance by the British Columbia Securities Commission of a receipt for a final non-offering prospectus of Holdco on or before 8 December 2020 (AEDT).

47 By his affidavit sworn on 11 November 2020, Mr Crean gave evidence as follows:

(a) The reason why GetSwift proposes that the condition must be satisfied by 2 December 2020 is so that all of the events which need to occur by 31 December 2020 to enable Holdco shares to be listed on NEO can occur. If they do not, NEO’s conditional approval to listing will cease to have effect.

(b) He had a conversation with officers of the Treasury in relation to FIRB approval. The Treasury officer indicated that there was no assurance that the Treasurer would make a decision by 11 December 2020. He confirmed that a relevant issue was the position of contingent creditors and that it would assist the Treasurer if the Court made its position on that issue clear.

48 The Court notes that the issues relevant to the Court’s decision whether or not to approve a scheme do not turn on the same national interest considerations which are relevant to the Treasurer’s decision whether or not to grant FIRB approval.

49 At the time of the second court hearing, the Court would usually know whether FIRB approval has been given and whether the approval is subject to conditions which the bidder considers acceptable but which have not previously been advised to shareholders of the scheme company. In those cases, the Court is in a position to consider whether the conditions accepted by the bidder are of a kind which would make it inappropriate to approve the scheme unless shareholders are given the opportunity to vote in relation to the scheme being effected subject to those conditions. That is particularly so where, as here, the target company shareholders will be shareholders of the bidder upon implementation of the scheme. Accordingly, unless the Court was not minded to approve the scheme for other reasons, it would be appropriate to adjourn the hearing pending determination of the terms of any FIRB approval. The Court indicated that it would be prepared to disclose whether it would be minded to grant approval under s 411(4)(b) (to which the issue concerning the position of contingent creditors was relevant) subject to FIRB approval being given and no other issue arising which might affect that position before any final order was made.

Contingent creditors

50 Third, senior counsel for Mr Webb and ASIC appeared to oppose the scheme on the basis that the re-domiciliation of GetSwift to Canada would materially prejudice their interests as contingent creditors. No other creditors or contingent creditors gave notice of their intention to attend the second court hearing to oppose the scheme and none did.

51 GetSwift did not oppose Mr Webb’s interlocutory application for leave to appear and leave was granted. Mr Finney’s affidavit was read. ASIC appeared on behalf of the Commonwealth and on its own behalf as contingent creditors in respect of fines and ASIC’s costs respectively which GetSwift may be required to pay in the ASIC proceeding and investigation costs which ASIC may be entitled to recover if it is successful in the ASIC proceeding. ASIC also appeared to make submissions concerning matters that go to the public interest regarding regulatory oversight of Australian listed public companies. Mr Vardy’s affidavit was read.

Would prejudice to the interests of contingent creditors be a reason to refuse to make orders under s 411(4)?

52 The essence of ASIC’s concerns about the implementation of the scheme as explained in its written and oral submissions at the second court hearing on 12 November 2020 were also recorded in a letter sent by ASIC’s solicitors, Johnson Winter and Slattery (JWS) to Jones Day dated 19 October 2020 as follows:

ASIC's concerns primarily relate to the proposed delisting of GetSwift and its conversion into a proprietary company limited by shares and the risk that GetSwift's assets (including cash) may be or already have been moved outside of Australia, and that, as a result of the Scheme, GetSwift may be unable or otherwise have little incentive as a proprietary company, rather than a listed entity, to take all necessary steps to ensure that it is able to and does in fact meet any liability to pay, inter alia:

1 any pecuniary penalties imposed against it by the Court in the ASIC Proceeding;

2 ASIC's legal and investigation costs, if ASIC is successful in the ASIC Proceeding; and

3 any judgment, cost order or settlement sum in the Webb Proceeding.

Bearing in mind that the claims made in the ASIC Proceeding and the Webb Proceeding principally arise out of contraventions of the continuous disclosure obligations by GetSwift as a listed entity in the periods leading up to significant capital raisings, ASIC is of the view that the Scheme, does not adequately protect the interests of GetSwift's contingent creditors, as there is no indication that GetSwift as a proprietary company, or Holdco as the new listed entity for the GetSwift Group will make available, or otherwise retain within Australia, sufficient assets to meet any potential liabilities arising in connection with the ASIC Proceeding and Webb Proceeding. These concerns are highlighted by the statements made in section 6.5(j) of the explanatory statement in relation to the Scheme, published on 12 October 2020, which provides that:

Other than set out in this Section 6.5, it is Holdco's intention to the extent possible:

…

- not to make any major changes to the business of GetSwift nor to redeploy or transfer any of GetSwift's assets, other than the movement of cash amongst subsidiaries in the ordinary course of business for the purposes such as working capital and projects: and

[our emphasis]

This appears to suggest that the directors of Holdco may transfer any assets at any time in the ordinary course of business.

ASIC is also concerned that the novation of the LDA Agreement from GetSwift to Holdco may have serious ramifications with regard to the solvency of GetSwift. In its most recent annual report, one of the four factors which the directors of GetSwift relied on in determining that the group will continue as a going concern was that “the group has access to the LDA Facility (as per note 5(d)) providing funds up to $45 million, subject to the terms of the agreement”. If GetSwift no longer has access to the funds under the LDA Agreement, it is not clear whether GetSwift would remain as a going concern and have access to sufficient funds to meet any potential liabilities arising in connection with the ASIC Proceeding and Webb Proceeding.

53 Jones Day wrote to ASIC on 29 October 2020 stating that GetSwift understood that contingent creditors were seeking comfort that they would not be worse off as a result of the scheme, but equally GetSwift should not be in a worse position vis-a-vis its contingent creditors or its ability to operate and fund its businesses in the ordinary course. To that end, Jones Day indicated that Holdco was prepared to give an undertaking to the effect of the first Holdco undertaking set out at [58] below.

54 On Mr Webb’s behalf, PFM wrote to Jones Day on 3 November 2020 and cited well-recognised authorities (on which ASIC and Mr Webb relied in their written and oral submissions) as follows:

As was made clear in Re Centro Properties Limited [2011] NSWSC 1465; 6 BFRA 543; 86 ACSR 584; (at [32]), in deciding whether to grant approval to a scheme, the Court “will properly take into account not only the direct effects of the schemes upon the persons who will be bound by them but also consequential effects upon other persons having an interest in the broader context in which the schemes will operate”. This includes the interests of contingent creditors with claims against the company: Re CSR Ltd [2010] FCAFC 34; 183 FCR 358; 265 ALR 703. In exercising its discretion, the Court should be satisfied that there is no evidence that any third parties will be disproportionately adversely affected by the operation of the Scheme: Amcor Limited, in the matter of Amcor Limited (No 2) [2019] FCA 842 at [8].

55 PFM went on to express the same concerns as ASIC has in its submissions to the Court:

On analysis, the Scheme raises concerns for contingent creditors of GetSwift, such as the Applicant and group members in the Webb Proceeding. In particular, the Applicant has concerns about GetSwift’s solvency post-implementation of the Scheme and its capacity to meet any judgment debt in favour of the Applicant and group members. The concerns are principally based on the following 3 matters that flow from approval of the Scheme (addressed in further detail below):

a) The novation of the LDA Facility, replacing GetSwift with Holdco as the beneficiary of the facility (Scheme Booklet, section 6.6), in circumstances where the LDA Facility was identified in the annual statement for FYE2020 as one of four factors underpinning the director’s view that GetSwift would continue as a going concern (notwithstanding that GetSwift reported an operating loss of just over $31 million for the 2020 financial year).

b) Any new capital raisings post implementation of the Scheme would accrue to the benefit of Holdco rather than GetSwift, in circumstances where GetSwift has approximately $16 million remaining in cash, a cash burn rate of approximately $5 million per month and Holdco has refused to indemnify GetSwift in respect of any adverse judgment debt arising from the Webb Proceedings.

c) The review of the operations of GetSwift post implementation of the Scheme foreshadowed in the Scheme Booklet is opaque, and framed by reference to a consideration of “the interests of shareholders” (Scheme Booklet, section 6.5(f)), which will likely stand in direct opposition to the interests of the Applicant and group members (as creditors) if successful in the Webb Proceeding.

56 Consistently with Mr Webb’s written submissions to the Court, PFM went on to say:

Holdco has declined to provide any indemnity to GetSwift in respect of any adverse judgment against GetSwift in the Webb Proceedings, and refuses to submit to the jurisdiction of the Federal Court of Australia (as stated in your correspondence of 8 September 2020).

…

[Mr Webb] is concerned, particularly in light of Holdco’s refusal to indemnify GetSwift for any liability arising out of the Webb Proceeding, that the practical effect of the Scheme being approved will be to accrue the benefit of future investments and revenues from the GetSwift Group to Holdco, while ringfencing liabilities within GetSwift, an entity of increasingly questionable solvency.

57 By a letter dated 4 November 2020 from Jones Day to Mr Finney at PFM, GetSwift made the same offer to Mr Webb as that made to ASIC. The letter noted that the passage quoted above incorrectly referred to correspondence with Jones Day rather than with Quinn Emanuel, GetSwift’s lawyers in the Webb proceeding, which is also in evidence in these proceedings. In Quinn Emanuel’s letter of 8 September 2020, Quinn Emanuel said to PFM:

GetSwift Limited will remain the owner of the shares in all of its operating companies (as is the present case). As such, there is no basis for Holdco to provide any indemnity to GetSwift Limited in respect of any potential adverse judgment against GetSwift Limited, nor is there any basis for Holdco to submit to the jurisdiction of the Federal Court of Australia.

58 By the email sent to the Court at 9.39 am on 12 November 2020, GetSwift provided a draft undertaking to be provided to the Court by Holdco (first Holdco undertaking) as follows:

GetSwift Technologies Limited (Holdco) undertakes to the Court that:

Until such time that both the Webb proceeding (FCA proceeding no. NSD 580 of 2018) and the ASIC proceeding (FCA proceeding no. VID 146 of 2019) are resolved on a final basis (by way of judgment, settlement or discontinuance), including the final resolution of any relevant appeal proceedings resulting therefrom, any capital raised by Holdco by way of debt or the issue of equity will be used only for the purpose of funding the business activities of GetSwift Limited (GetSwift) and GetSwift’s subsidiaries in the ordinary course in a manner consistent with how GetSwift would otherwise conduct its business activities, absent the scheme of arrangement the subject of this proceeding, and subject to:

1. Holdco retaining sufficient funds from any such fundraising to meet its ongoing overhead and operating costs; and

2. any applicable legal obligations.

For the avoidance of doubt, Holdco submits to the jurisdiction of the Federal Court of Australia for the purposes of any action to enforce this undertaking.

59 Neither ASIC nor Mr Webb was satisfied that the first HoldCo undertaking addressed their concerns.

Second Holdco undertaking

60 In the afternoon of 12 November 2020, GetSwift tendered a different undertaking. There have been some slight amendments to that document since then and it is convenient to set out the undertaking taking into account those amendments (second Holdco undertaking):

GetSwift Technologies Limited (Holdco) undertakes to the Court that, until such time as any adverse judgment, including, but not limited to, any award of damages, compensation and/or penalties, in each of the Webb proceeding (FCA proceeding no. NSD 580 of 2018) and the ASIC proceeding (FCA proceeding no. VID 146 of 2019), and any order under s 91 of the Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act) in respect of the ASIC proceedings, has been satisfied, including a final determination of damages in respect of all group member claims in the Webb proceeding, or each of the proceedings are otherwise resolved on a final basis (by way of settlement or discontinuance), including the final resolution of any relevant appeal proceedings resulting therefrom, Holdco will indemnify GetSwift Limited (GetSwift) in respect of any liability in respect of pecuniary penalties or other monetary liabilities that may be ordered against GetSwift in any adverse judgment in the Webb proceeding and in the ASIC proceeding, inclusive of any pre or post-judgment interest and costs orders, and in addition any order against GetSwift under s 91 of the ASIC Act in respect of the ASIC proceeding.

This undertaking will take effect immediately upon commencement of the Implementation Date (as that term is defined in the proposed scheme of arrangement between GetSwift and its members under section 411 of the Corporations Act 2001 (Cth)).

For the avoidance of doubt, Holdco submits to the jurisdiction of the Federal Court of Australia for the purposes of any action to enforce this undertaking.

61 The second court hearing was stood over to the next day to allow consideration of the second Holdco undertaking.

62 On 13 November 2020, senior counsel for Mr Webb, Ms Collins SC, indicated that Mr Webb was satisfied with the second Holdco undertaking and that on that basis he withdrew his opposition to the Court making orders under s 411(4)(b).

63 Mr Halley advised that ASIC did not accept that an undertaking such as the second Holdco undertaking would address its concerns as a contingent creditor because:

(a) Although he could not point to any provision of Canadian law which would prevent a judgment obtained in this Court based on the second Holdco undertaking from being enforced in Canada, Mr Halley submitted that there is a prospect that it may not be effective to indemnify ASIC because Holdco would have its own liabilities, its own assets, its own commitments and any ability of Holdco to meet any obligations of GetSwift in Australia would have to be subject to those considerations. The indemnity provided by the second Holdco undertaking would not be secured or rank ahead of other creditors or other arrangements that Holdco had entered into. Holdco can operate in quite a different manner to how the GetSwift Group operates today. In effect, GetSwift can be allowed to “wither on the vine”, without any re-charging of capital through fundraising.

(b) If, however, GetSwift remains the listed holding company (that is, the “economic entity”), all economic activity will be conducted under its umbrella. Enforcement issues remain the same as those that ASIC expected to face when it commenced the ASIC proceeding. While GetSwift is listed in Australia and is the primary economic entity, GetSwift’s directors have duties and its two principal shareholders (Messrs Macdonald and Bane) have an incentive to bring assets on-shore and conduct its operations so that GetSwift avoids winding up and maintains its value. ASIC does not have assurance that, if the scheme is implemented, the directors of GetSwift as a proprietary company subsidiary of Holdco would have the same incentive to bring assets on-shore or at least make them available to creditors here for the purposes of satisfying debts.

(c) Where some $100 million has been raised by an Australian listed company and a trial has been held in relation to ASIC’s claims that there were contraventions of the continuous disclosure provisions and the misleading and deceptive conduct provisions of the Corporations Act at relevant times, ASIC is concerned that “if this all goes offshore, that is, the economic entity”, then effectively the ability to recover any pecuniary penalties or costs orders is compromised and will not be able to be met satisfactorily under the second Holdco undertaking.

(d) It might make a difference if Holdco provided an indemnity directly to ASIC, but that was a matter on which Mr Halley would require instructions.

64 Senior counsel for GetSwift, Mr Sheahan QC, made the following submissions orally and in written submissions.

65 First, although ASIC has an interest in opposing approval of the scheme on the basis that it is a contingent creditor, it has provided no evidence as to the value of its contingent claims. ASIC must be able to prove some material prejudice to it consequent on the operation of the proposed scheme.

66 Second, the fact that the shareholders might agree to exchange their GetSwift Shares for Holdco shares and future capital raisings might be conducted through Holdco and not GetSwift is something on which creditors of GetSwift have no say, since GetSwift Shares are not the property of GetSwift.

67 Third, contingent creditors have no “right” to the proceeds of any future capital raising. That is a threshold issue. The willingness of shareholders to dilute their interest in return for capital is not something in which creditors have a legitimate interest. In any event, the position of contingent creditors is likely to be improved by the scheme. As explained in the scheme booklet, one of the objectives of the scheme is to enable Holdco (and the GetSwift Group generally) to access greater capital in the North American market that is “more familiar with and more likely to invest in earlier to mid-stage technology companies, which may lead to a re-rating of the GetSwift Group and a stronger market capitalization and valuation over time”. The greater ability of Holdco to raise capital or debt, the greater the prospect that the GetSwift Group, including GetSwift, will remain a going concern. In turn, the ability of the GetSwift Group to continue to operate as a going concern provides a greater prospect that GetSwift will be in a position to satisfy any judgment that may in the future be awarded to ASIC or Mr Webb.

68 Fourth, statements in section 6.5 of the scheme booklet indicate that, should the scheme be approved, Holdco currently intends to continue to operate the business of GetSwift and does not intend to make any material changes to the business of GetSwift. Holdco has expressed its current intention not to redeploy or transfer any of GetSwift’s assets, other than the movement of cash among subsidiaries in the ordinary course of business for purposes such as working capital and projects.

69 Fifth, in response to a question put by the Court concerning why the impact of the loss of GetSwift’s capacity to raise capital directly was not relevant to whether contingent creditors would be materially prejudiced, having regard to the fact that GetSwift is an early to mid-stage technology company with a significant cash burn and it has never reported a profit in the five years of its existence so that its business model requires continued access to capital, Mr Sheahan made the following submissions:

(a) All creditors deal with companies on the basis of the balance sheet as it exists; future prospects are not something ever assured to a creditor, much less a contingent creditor.

(b) The only considerations of “public policy” or “commercial morality” which are relevant for the purpose of s 411(4) of the Corporations Act are those which find a basis in the text and purpose of that Act: see CSR Limited, in the matter of CSR Limited [2010] FCAFC 34; (2010) 183 FCR 358 (Re CSR Limited) at [51] (Keane CJ and Jacobson J). In Re CSR Limited, the relevant policy of the Corporations Act was to be found in s 256B, dealing with capital reductions. Relevantly, the policy reflected in s 256B was that a reduction in capital may occur notwithstanding that it may involve an increase in the abstract risk to those with claims against the company: Re CSR Limited at [48] and [66]. The proposition that any increase in the level of risk of non-payment is unacceptable was specifically rejected in Re CSR Limited at [48]. GetSwift’s proposed scheme does not involve a capital reduction and there is nothing in the Corporations Act which might inform the exercise of the discretion under s 411(4) in a case such as this. The authorities cited by ASIC for the proposition that a Court should not approve a scheme unless it is clearly satisfied that contingent creditors are not worse off by reason of the implementation of the scheme (being the same as those referred to at [54] above and In the matter of Stork ICM Australia Pty Ltd [2006] FCA 1849; (2007) 25 ACLC 208) are all cases which involved reductions of capital.

(c) The only capacity of GetSwift affected by the scheme is the capacity to raise capital. That issue is addressed by the second Holdco undertaking. The prospect that ASIC would not be paid if GetSwift was not able to do so has not been shown to be a realistic one. There would be no benefit to Holdco, as the new parent company, in allowing GetSwift to fail to meet any judgment debt. To do so would likely lead to GetSwift entering into a form of insolvent administration; which would undoubtedly lead to the end of the operation of the GetSwift Group as a going concern and an insolvency practitioner taking control of GetSwift’s assets, including GetSwift’s shares in the GetSwift Group’s operating subsidiaries.

(d) There is a lack of commercial reality in what appears to be the basis of ASIC’s submissions: that is, that Holdco would allow GetSwift to be wound up rather than ensure that it is able to pay a penalty of indeterminate amount and costs which may amount to a few hundred thousand dollars. GetSwift Group and its assets will continue to be owned by GetSwift and they continue to have value. The LDA Agreement, which will be vested in Holdco if the scheme goes ahead, will provide a source of equity capital which will enable Holdco to ensure that its only currently existing asset of any value, namely GetSwift, does not go into liquidation.

(e) It would also be uncommercial for Holdco to allow GetSwift to become insolvent having regard to the terms of the novated LDA Agreement which GetSwift, Holdco, LDA and LDA LLC entered into on 4 November 2020. There has been no drawdown under the US$45 million (said to be A$63 million) facility to date. The commitment period ends on 7 March 2023. These features of the LDA Agreement are relevant:

(i) LDA’s obligations to subscribe for Holdco shares is subject to the “Capital Call Conditions” set out in cl 3.3 which include that representations and warranties made in the LDA Agreement remain true at any time a capital call is made. One of the ongoing warranties is set out in cl 6.5(c) and that is to the effect that neither Holdco nor any of its subsidiaries “is insolvent, has committed an act of bankruptcy, proposed a compromise or arrangement … taken any proceedings to have itself declared or, to its knowledge, had any proceeding taken to declare it bankrupt or wound-up … [or] to have a receiver appointed of any part of its assets”.

(ii) It is an event of default if any of the warranties is found to have been false and misleading in any material respect when made or becomes false or misleading or if any of the events mentioned in cl 6.5(c) occur: cl 14.2.

(iii) Clause 10.4 of the LDA Agreement requires Holdco to use reasonable endeavours to ensure that no business decision is taken that will or is likely to cause a material adverse effect on Holdco. A material adverse effect means any effect on the business, operations, financial condition or (in so far as they may reasonably be foreseen) prospects of Holdco and its subsidiaries that is material and adverse to Holdco and its subsidiaries taken as a whole.

So unless Holdco wishes to give up entirely the value of this enormously attractive source of at call capital worth US$45 million, it has to put GetSwift in funds to enable it to satisfy a judgment debt in Australia, if it can. And the obvious source of its ability to do so is to call on the LDA Agreement to create the funds to permit such a judgment debt to be satisfied.

(f) ASIC’s desire that GetSwift should remain an Australian listed company, rather than be a subsidiary of a Canadian listed company, is “almost incoherent” in the absence of some suggestion that there is material difficulty in enforcing a judgment against Holdco in Canada and in the absence of any basis for concluding that GetSwift would not be able to satisfy any order that was made against it in the ASIC proceeding.

70 Sixth, Mr Sheahan responded to the Court’s question of whether it is consistent with the due administration of justice for an Australian listed company which is the subject of significant regulatory litigation to seek to re-domicile out of Australia during a hearing on liability and before any penalty has been decided.

71 Mr Sheahan submitted that questions related to the due administration of justice come down to whether implementation of the scheme will stand in the way of enforcement of ASIC’s rights and full recovery of whatever its rights might be. The way concerns about the administration of justice are vindicated is by seeking an asset preservation order against defendants to constrain them from dealing with their assets if that is thought to be necessary. As matters stand, ASIC has no basis in evidence in these proceedings for suggesting to the Court that there is any plan for making the assets of the GetSwift Group not amenable to satisfy any order that is made in the ASIC proceeding. There is no asset preservation order being sought nor has ASIC suggested a basis for thinking there might be a ground for one.

72 In response, Mr Halley submitted that:

(a) The existence of the LDA Agreement does not remove concerns as to whether GetSwift would be allowed to become insolvent in the face of the award of substantial penalties or judgments in the ASIC and Webb proceedings. While GetSwift’s insolvency might mean that Holdco would lose the benefit of the LDA Agreement, it would commercially still be available to Holdco to develop businesses outside the GetSwift Group and raise capital from sources other than LDA.

(b) ASIC’s concern and interest in this case is not simply limited to its legal costs incurred with respect to the civil penalty case; ASIC would not be intervening to save legal costs. This case raises a fundamental question of how it is that companies listed on the ASX can be held accountable for serious contraventions of continuous disclosure laws if, at the “pointy end”, they can move offshore and then leave the creditors, contingent creditors, the Commonwealth, ASIC and others to have to rely on indemnities provided by offshore corporations in circumstances where, upon implementation of the scheme, that offshore corporation has no assets and no liabilities other than GetSwift Shares.

(c) While Mr Sheahan sought to minimise the amount that might be recovered in the ASIC proceeding, there are 20 claimed contraventions for each of which the maximum penalty is $1 million. Further, ASIC’s costs are not in the order of a couple of hundred thousand dollars; Mr Finney has estimated that costs incurred in the Webb proceeding on a party/party basis is $4 million to 30 September 2020 (being slightly less than 70% of total legal professional fees and disbursements incurred by Mr Webb).

(d) GetSwift is subject to ongoing significant cash burn and the LDA Agreement is one of the bases on which the directors are satisfied it may continue as a going concern (as disclosed in Appendix 4C filed with the ASX on 30 October 2020) but the LDA Agreement is being novated for the benefit of Holdco if the scheme is implemented.

(e) The Court should not accept that the resolution of the Webb proceeding and the ASIC proceeding will happen quickly, given that the Judge who presided in the liability phase of the ASIC proceeding will only deliver judgment after the appeal on the question of whether that Judge should preside in the Webb proceeding has been determined. The Webb proceeding will have to be heard, the penalty phase of the ASIC proceeding will have to be heard if ASIC is successful on the question of liability and judgment in the Webb proceeding and the penalty phase of the ASIC proceeding will need to be delivered. Accordingly, it is likely that Holdco will be conducting its operations for at least a year or more before those proceedings are resolved.

(f) As a matter of commercial reality, there is the prospect of a substantial amount of time for change in the structure and operations of Holdco and the statements in section 6.5 of the scheme booklet are statements of current intention only.

73 The proceedings were stood over to Monday, 16 November 2020. At that time the Court indicated that it would publish reasons subsequently but it was not minded to refuse to make orders under s 411(4)(b) of the Corporations Act on the basis that having regard to Holdco’s willingness to provide the second Holdco undertaking, it had not been demonstrated that there is a real or practical risk, as opposed to a theoretical risk, that as a result of implementation of the scheme, the contingent creditors will be materially prejudiced in relation to the receipt of any amount to which they may become entitled pursuant to the Webb proceeding or the ASIC proceeding or in relation to ASIC’s investigation costs.

74 Mr Halley then raised, for the first time, ASIC’s concern that a Canadian court might not give effect to a judgment of the Federal Court of Australia enforcing an undertaking in the form of the second Holdco undertaking on the basis that it is direct or indirect enforcement of a penalty imposed in a foreign jurisdiction. The second court hearing was stood over to 26 November 2020 to allow ASIC and GetSwift to obtain expert evidence and provide written submissions on that issue.

Treasurer’s letter

75 On 24 November 2020, GetSwift released to the ASX a copy of a letter dated 20 November 2020 which it said it received late on 23 November 2020. The letter was issued by Federal Treasurer, the Hon Josh Frydenberg MP, indicating that his preliminary view was that he should issue an order prohibiting Holdco from making the proposed acquisition of GetSwift under s 67 of the FIRB Act on the basis that the re-domiciliation of GetSwift while the “Australian legal proceedings currently on foot” are yet to be resolved would be against the national interest on the basis that the re-domiciliation may have a “negative impact on the interests of possible contingent creditors associated with those proceedings”. GetSwift was provided with a period in which it may respond to the Treasurer’s concerns.

GetSwift undertaking

76 When the Court reconvened on 26 November 2020, GetSwift advised the Court that GetSwift would be prepared to provide an undertaking to the Court. While amendments were made to the form of the GetSwift undertaking, its ultimate form was as follows:

GetSwift Limited (GetSwift) undertakes to the Court, Mr Raffaele Webb and the Australian Securities and Investments Commission that, in the event GetSwift Technologies Limited (Holdco) fails to meet any of its obligations under the Deed Poll appearing in the Annexure to this undertaking (Deed Poll), GetSwift will promptly take all reasonable and practicable steps to enforce GetSwift’s rights under the Deed Poll against Holdco.

GetSwift undertakes to the Court that, except as provided in clause 3.2 of the Deed Poll, it will not agree to vary or terminate the Deed Poll except with leave of the Court.

This undertaking will take effect immediately upon Holdco’s execution of the Deed Poll and will terminate automatically upon the termination of the Deed Poll pursuant to clause 3.2 of its terms.

Deed polls

77 GetSwift also advised that it was willing to enter into a deed poll with Holdco in either one of two forms. In each case, Holdco provided an Australian address and submitted to the non-exclusive jurisdiction of the Federal Court of Australia and Supreme Court of New South Wales and courts hearing appeals from those Courts.

78 In scenario 1, the deed poll would relevantly provide as follows:

1.3 Nature of Deed Poll

Holdco acknowledges that this Deed Poll may be relied on and enforced by GetSwift in accordance with its terms even though GetSwift is not a party to it.

2. Holdco obligations

2.1 Holdco undertakings

(a) Holdco undertakes to provide GetSwift with sufficient funds to permit it to discharge its liabilities to the extent that GetSwift is unable to discharge them as and when they fall due, until such time as any adverse judgment, including, but not limited to, any award of damages, compensation and/or penalties, in the Webb Proceedings, the ASIC Proceedings and any order under s 91 of the ASIC Act in respect of the ASIC Proceedings, has been satisfied, including a final determination of any award of damages in respect of all group member claims in the Webb Proceedings, or the proceedings are otherwise resolved on a final basis (by way of settlement or discontinuance), including the final resolution of any relevant appeal proceedings resulting therefrom, to the extent of Holdco’s assets, as at the date any claim on this undertaking is made.

(b) Holdco undertakes to not oppose the enforcement in British Columbia of any judgment against it of any superior court in Australia under, or in relation to, this Deed Poll.

(c) Holdco undertakes not to allege, submit or seek to characterise in any proceedings that any of its obligations under this Deed Poll involve direct or indirect enforcement of a penalty.

3. Conditions to obligations

3.1 Conditions

The obligations of Holdco under this Deed Poll are subject to the Scheme becoming Effective.

3.2 Termination

The obligations of Holdco under this Deed Poll will automatically terminate upon the satisfaction by GetSwift or Holdco of any adverse judgment, including, but not limited to, any award of damages, compensation and/or penalties, in the Webb Proceeding, the ASIC Proceeding and any order under s 91 of the ASIC Act in respect of the ASIC Proceedings, or the proceedings are otherwise resolved on a final basis (by way of settlement or discontinuance), including the final resolution of any relevant appeal proceedings resulting therefrom.

79 The deed poll for scenario 2 is the same as the deed poll for scenario 1 save that cl 2.1(a) provides as follows:

Holdco undertakes to provide GetSwift with sufficient funds to permit it to discharge its liabilities, to the extent that GetSwift is unable to discharge them, arising from any adverse judgment, including, but not limited to, any award of damages, compensation and/or penalties, in the Webb Proceeding (including a final determination of any award of damages in respect of all group member claims), the ASIC Proceeding and any order under s 91 of the ASIC Act in respect of the ASIC Proceeding, to the extent of Hold co-op’s assets, as at the date any claim on this undertaking is made.

Mr Webb’s position

80 Ms Collins advised the Court that, as a contingent creditor of GetSwift, Mr Webb has no objection to the Court making orders under s 411(4)(b) of the Corporations Act if the Court accepts the second Holdco undertaking, the GetSwift undertaking and a deed poll in the form of that for scenario 1 was executed by Holdco. Ms Collins advised that Mr Webb drew more comfort from the scenario 1 deed poll than the scenario 2 deed poll because in scenario 1 Holdco is undertaking to ensure that GetSwift will remain solvent until judgment is obtained whereas in scenario 2, GetSwift may become insolvent during the course of the Webb proceeding or the ASIC proceeding which would give rise to a number of issues including (if the hearing in the Webb proceeding had not yet occurred) the need to obtain leave to proceed with that hearing.

ASIC’s position

81 Mr Halley advised the Court that ASIC maintains its objection to the Court making orders under s 411(4)(b) of the Corporations Act approving the scheme.

82 ASIC relied on an expert opinion which it obtained from James Sullivan QC, a specialist in corporate law in British Columbia and a partner at Blake, Cassels & Graydon LLP. Mr Sullivan has been a member of the bar in British Columbia since 1988 and has been an author or co-author of a number of books and papers primarily relating to class actions. The Court accepts that Mr Sullivan was qualified to give an opinion concerning the matters on which that opinion was sought.

83 On 18 November 2020, Mr Sullivan was asked to respond to the following questions, albeit that he responded to them as if the references to “Canada” below were references to “British Columbia”:

1. Is any judgment obtained by ASIC in the Federal Court of Australia requiring HoldCo to comply with the Undertaking enforceable, in whole or in part, in Canada, insofar as it relates to:

(a) an order in the nature of specific performance requiring Holdco to do an act or thing to give effect to the Undertaking; or

(b) the payment of the sum due under an adverse judgment against GetSwift.

2. Is any judgment obtained by ASIC in the Federal Court of Australia requiring HoldCo to comply with the Undertaking enforceable, in whole or in part, in Canada, insofar as it relates to the payment of pecuniary penalties to the Commonwealth of Australia?

3. If any judgment obtained by ASIC in the Federal Court of Australia requiring HoldCo to comply with the Undertaking is enforceable, in whole or in part, in Canada, what steps would ASIC need to take to enforce this judgment against HoldCo in Canada?

4. If any judgment requiring HoldCo to comply with the Undertaking is obtained by ASIC in Canada, what remedies are available to ASIC under Canadian law?

5. If HoldCo fails to comply with any judgment obtained by ASIC in Canada, what remedies are available to ASIC under Canadian law?

84 On 23 November 2020, Mr Sullivan was asked to respond to the further question: