Federal Court of Australia

Australian Securities and Investments Commission v Helou (No 2) [2020] FCA 1650

ORDERS

AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff | ||

AND: | First Defendant BRADLEY HINGLE Second Defendant | |

DATE OF ORDER: |

THE COURT DECLARES THAT:

1. The first defendant, in his position of director, contravened ss 674(2A) and 675(2A) of the Corporations Act 2001 (Cth) (the Act) on various occasions on and from 8 March 2016 until 27 April 2016 by reason of his being knowingly concerned in the contravention of ss 674(2) and 675(2) of the Act by MG Responsible Entity Limited (MGRE) and Murray Goulbourn Cooperative Co. Limited (MG), whereby MGRE and MG failed to disclose that there was likely to be a material decrease in MG’s earnings guidance for FY16 published on 29 February 2016 and that the earnings guidance was unlikely to be achieved from 8 March 2016 until 8.48 am on 27 April 2016.

THE COURT ORDERS THAT:

2. Pursuant to s 206E of the Act, the first defendant be disqualified from managing corporations for the period of 3 years from the date of these orders.

3. The first defendant’s application under s 206G of the Act be heard and determined instanter consequent upon order 2.

4. Pursuant to s 206G of the Act the first defendant have leave to manage the following five corporations:

(a) Vanmatt Pty Ltd (ACN 606 327 851);

(b) Vanmatt Enterprise Pty Ltd (ACN 168 958 469);

(c) 8 Pulses Food Company Pty Ltd (ACN 615 115 976);

(d) Proplant Foods Pty Ltd (ACN 638 856 667); and

(e) Bee Way Pty Ltd (ACN 168 961 573),

provided that during the period of the first defendant’s disqualification:

(i) Vanmatt Pty Ltd (ACN 606 327 851) continues to act solely as trustee of the Garzanne Super Fund;

(ii) Vanmatt Enterprise Pty Ltd (ACN 168 958 469) continues to act solely as trustee of the Helou Family Trust; and

(iii) none of the companies listed in (a) to (e) above take any steps to become a “disclosing entity” as defined in s 111AC of the Act.

5. The first defendant pay the plaintiff’s costs of this proceeding in the sum of $30,000 within 28 days of the date of these orders.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

VID 682 of 2019 | ||

| ||

BETWEEN: | AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff | |

AND: | GARY HELOU First Defendant BRADLEY HINGLE Second Defendant | |

order made by: | BEACH J |

DATE OF ORDER: | 13 NOVEMBER 2020 |

THE COURT DECLARES THAT:

1. The second defendant, in his position of chief financial officer, contravened ss 674(2A) and 675(2A) of the Corporations Act 2001 (Cth) (the Act) on various occasions on and from 8 March 2016 until 27 April 2016 by reason of his being knowingly concerned in the contravention of ss 674(2) and 675(2) of the Act by MG Responsible Entity Limited (MGRE) and Murray Goulbourn Cooperative Co. Limited (MG), whereby MGRE and MG failed to disclose that there was likely to be a material decrease in MG’s earnings guidance for FY16 published on 29 February 2016 and that the earnings guidance was unlikely to be achieved from 8 March 2016 until 8.48 am on 27 April 2016.

THE COURT ORDERS THAT:

2. Pursuant to s 206E of the Act, the second defendant be disqualified from managing corporations for the period of 2 years from the date of these orders.

3. The second defendant’s application under s 206G of the Act be heard and determined instanter consequent upon order 2.

4. Pursuant to s 206G of the Act, the second defendant have leave to manage Tank Stream Design Pty Ltd (ACN 095 139 521).

5. The second defendant pay the plaintiff’s costs of this proceeding in the sum of $25,000 within 21 days of the date of these orders.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

REASONS FOR JUDGMENT

BEACH J:

1 The present proceeding concerns events relating to Murray Goulburn Co-operative Co Limited (MG), MG Responsible Entity Limited (MGRE) and its directors and officers concerning the non-disclosure of material information relating to securities to the ASX as concerns MGRE (a listed disclosing entity), ASIC as concerns MG (an unlisted disclosing entity), and the market generally.

2 The present proceeding is the last of five proceedings that have been brought in this Court concerning these events, four of which have been in my docket. There have been three regulatory enforcement proceedings, two of which have been brought by ASIC and one which has been brought by the ACCC. The first ASIC proceeding was brought against MGRE seeking declarations and a pecuniary penalty only. It was resolved by another judge of this Court. The present proceeding has been brought against MG’s and MGRE’s former managing director Mr Gary Helou and the former chief financial officer Mr Bradley Hingle seeking declarations and disqualification orders. Previously there had also been an ACCC proceeding which had been brought against MG, Mr Helou and Mr Hingle seeking declarations, pecuniary penalties and disqualification orders, which I disposed of. In addition to the three regulatory proceedings, there have been two class actions. These were both set down for a joint trial before me but have now settled.

3 The present proceeding concerns Mr Helou’s and Mr Hingle’s knowing involvement, now admitted, in breaches of the continuous disclosure regime embodied in Chapter 6CA of the Corporations Act 2001 (Cth) (the Act).

4 As to the statutory purposes for that regime, it was explained in Grant-Taylor v Babcock & Brown Ltd (in liq) (2016) 245 FCR 402 at [92] per Allsop CJ, Gilmour and Beach JJ that:

The statutory purposes for the continuous disclosure regime were foreshadowed in the 1991 Australian Companies and Securities Advisory Committee Report and in a second reading speech to the 1992 Corporate Law Reform Bill (although the 1992 Bill was superseded by the 1993 Bill). The main purpose is to achieve a well-informed market leading to greater investor confidence. The object is to enhance the integrity and efficiency of capital markets by requiring timely disclosure of price or market sensitive information (see James Hardie Industries NV v Australian Securities and Investments Commission (2010 274 ALR 85 ; 81 ACSR 1 ; [2010] NSWCA 332 at [353]–[355] (James Hardie); Re Chemeq Ltd (ACN 009 135 264); Australian Securities and Investments Commission v Chemeq Ltd (2006) 234 ALR 511 ; 58 ACSR 169 ; [2006] FCA 936 at [42]–[46] per French J (as he then was)). Further, one of the justifications for introducing the continuous disclosure regime, as referred to by that Committee, was to “minimize the opportunities for perpetrating insider trading” thereby providing an explicit link between the purposes of the continuous disclosure regime and the insider trading regime.

5 Now in the present proceeding each of Mr Helou and Mr Hingle previously made an application to permanently stay or dismiss the proceeding as an abuse of process. They each sought to invoke the usual conditions said to justify a permanent stay being that the present proceeding was unjustifiably oppressive or vexatious and that it brought the administration of justice into disrepute. I dismissed both applications (see Australian Securities and Investments Commission v Helou (2019) 139 ACSR 489; [2019] FCA 1634).

6 Principally, ASIC now presses for disqualification orders; no pecuniary penalties are sought. The parties have put to me a joint position that under s 206E, Mr Helou should be disqualified from managing corporations for three years and Mr Hingle should be so disqualified for two years.

7 Section 206E relevantly provides:

(1) On application by ASIC, the Court may disqualify a person from managing corporations for the period that the Court considers appropriate if:

(a) the person:

(i) has at least twice been an officer of a body corporate that has contravened this Act or the Corporations (Aboriginal and Torres Strait Islander) Act 2006 while they were an officer of the body corporate and each time the person has failed to take reasonable steps to prevent the contravention; or

(ii) has at least twice contravened this Act or the Corporations (Aboriginal and Torres Strait Islander) Act 2006 while they were an officer of a body corporate; or

(iii) has been an officer of a body corporate and has done something that would have contravened subsection 180(1) or section 181 if the body corporate had been a corporation; and

(b) the Court is satisfied that the disqualification is justified.

…

(2) In determining whether the disqualification is justified, the Court may have regard to:

(a) the person’s conduct in relation to the management, business or property of any corporation; and

(b) any other matters that the Court considers appropriate.

…

8 It is not in doubt that my power has been enlivened under s 206E(1)(a)(ii), given the admissions that have been made by the defendants. Further, I have been provided with a statement of agreed facts for the purposes of this proceeding only, in accordance with s 191(3)(a) of the Evidence Act 1995 (Cth). Accordingly, there is before me the necessary factual foundation to make relevant orders.

9 Mr Helou admits that he was knowingly concerned in the contravention by MG of s 675(2) on and from 8 March 2016 until 8.48 am on 27 April 2016, by failing to notify ASIC of the early March material information, which I will define later, and thereby himself contravened s 675(2A). Further, he admits that he was knowingly concerned in the contravention by MGRE of s 674(2) on and from 8 March 2016 until 8.48 am on 27 April 2016, by failing to notify the ASX of the early March material information and thereby himself contravened s 674(2A).

10 He makes similar admissions concerning the period on and from 22 March 2016 until 8.48 am on 27 April 2016 concerning the late March material information, which I will define later, and also concerning the period on and from 13 April 2016 until 8.48 am on 27 April 2016, concerning the April material information, which I will define later.

11 Mr Hingle admits that he was knowingly concerned in the contravention by MG of s 675(2) on and from 8 March 2016 until 8.48 am on 27 April 2016, by failing to notify ASIC of the early March material information and thereby himself contravened s 675(2A). Further, he admits that he was knowingly concerned in the contravention by MGRE of s 674(2) on and from 8 March 2016 until 8.48 am on 27 April 2016, by failing to notify the ASX of the early March material information and thereby himself contravened s 674(2A).

12 He makes similar admissions concerning the period on and from 22 March 2016 until 8.48 am on 27 April 2016 concerning the late March material information, and also concerning the period on and from 13 April 2016 until 8.48 am on 27 April 2016 dealing with the April material information.

13 Now I will make the disqualification orders sought. But to explain my reasons it is necessary first to say something about the prior proceedings and then to describe the necessary factual background.

Prior proceedings

14 In mid May 2016, a class action was commenced by Mr John Webster on behalf of unit holders of the Murray Goulburn Unit Trust (MG Unit Trust), which investment structure I will discuss later, against MG and MGRE and their directors including Mr Helou, although not Mr Hingle, seeking compensation for alleged contraventions of the Act (the Webster class action). The contraventions were alleged to arise by reason of the issue of a defective product disclosure statement and market announcements made by MGRE and the failure to correct misleading statements contained in them. The Webster class action had originally been instituted in the Supreme Court of Victoria but was later transferred to this Court.

15 On 25 August 2016, ASIC commenced an investigation under s 13 of the Australian Securities and Investments Commission Act 2001 (Cth) into the conduct of MG, MGRE and their directors and officers in relation to the circumstances disclosed in MG’s and MGRE’s ASX announcement on 27 April 2016, which relevantly for the present proceeding I have described as the April announcement.

16 On 27 April 2017, the ACCC commenced a proceeding in this Court against MG, Mr Helou and Mr Hingle. The ACCC proceeding sought declarations that Mr Helou and Mr Hingle were knowingly concerned in or parties to alleged contraventions by MG of ss 18, 21 and 29 of the Australian Consumer Law between 24 June 2015 and 27 April 2016, an order under s 248 of the ACL that Mr Helou and Mr Hingle be disqualified from managing corporations for seven years, and a pecuniary penalty under s 224 of the ACL. The ACCC proceeding relied on a common substratum of facts to the present proceeding.

17 On 9 May 2017, the Webster class action was cross-vested to this Court.

18 On 15 September 2017, I listed the ACCC proceeding for trial before me on 17 September 2018 on an estimate of 10 days.

19 On 16 November 2017, ASIC entered into a Settlement Deed with MG and MGRE. The Settlement Deed reserved ASIC’s right to later issue proceedings against Mr Helou and Mr Hingle as distinct from other MG related entities. On the same day, as I have already mentioned, ASIC commenced the earlier ASIC proceeding against MGRE to give effect to the settlement between ASIC, MG and MGRE, and seeking an order that MGRE pay a $650,000 pecuniary penalty for its alleged contravention of s 674(2) in the period 22 March 2016 to 27 April 2016. No pleadings were filed. The disposition of the matter proceeded on an agreed statement of facts. The agreed statement of facts covered events between 1 May 2015 and 27 April 2016. ASIC did not commence any proceeding against Mr Helou and Mr Hingle at this time.

20 On 6 December 2017, the earlier ASIC proceeding was heard as an agreed penalty hearing, and on 15 December 2017 that proceeding was disposed of by the Court declaring that MGRE had committed the contraventions alleged by ASIC and an order that it pay a penalty of $650,000, together with ASIC’s costs.

21 On 10 August 2018, the ACCC proceeding against Mr Hingle was dismissed by consent based upon a settlement that had been reached. The settlement with the ACCC was that Mr Hingle agreed to give an undertaking to the Court not to be directly or indirectly involved in the management of a corporation which carried on business in the dairy industry for a period of three years and agreed to pay $50,000 towards the ACCC’s costs. In exchange, the ACCC consented to an order dismissing the proceeding against Mr Hingle. There was no express finding of contravention against Mr Hingle. The settlement was reflected in my order of 10 August 2018, which noted the undertaking given by Mr Hingle.

22 On 16 August 2018, a second class action was commenced against MG and MGRE (the Endeavour River class action). This class action, unlike the Webster class action, did not sue any of the directors.

23 On 9 November 2018, MG, Mr Helou and the ACCC reached an in-principle settlement of the ACCC proceeding. MG, Mr Helou and the ACCC filed a statement of agreed facts, in which Mr Helou made various admissions.

24 On 6 December 2018, I heard and disposed of the ACCC proceeding declaring that MG had contravened ss 18 and 29(1)(i) of the ACL in the period between 29 February 2016 and 27 April 2016 and that Mr Helou was knowingly concerned in that contravention (see Australian Competition and Consumer Commission v Murray Goulburn Co-Operative Co Limited [2018] FCA 1964). Mr Helou was ordered to pay a pecuniary penalty of $200,000 in respect of his involvement in MG’s contraventions and $50,000 towards the ACCC’s costs. Mr Helou also gave an undertaking not to be involved in the management of a corporation carrying on business manufacturing or supplying animal-based dairy products or services for a period of three years.

25 Subsequently, the Webster class action and the Endeavour River class action were settled as I have indicated.

26 On 20 June 2019, the present proceeding was commenced by ASIC against Mr Helou and Mr Hingle.

27 I have set out the above as it provides important context for my consideration as to the appropriate disqualification orders to be made given the penalties, undertakings and involvement that the defendants have been subjected to in these other proceedings.

28 Let me now turn to addressing the relevant factual substratum upon which the present disqualification orders are now sought. I have set out more than is usual from the parties’ agreed statement given the nature of the investors that have been harmed by the relevant conduct and the fact that this is the last of the proceedings. They are entitled to have some picture at least as to what occurred; I have made some excisions and simplifications.

Factual substratum for the contraventions

29 MG was an unlisted disclosing entity within the meaning of s 111AL(2). And pursuant to s 111AP, it was subject to the continuous disclosure requirements of s 675.

30 On 1 May 2015, the MG Unit Trust was established. The MG Unit Trust was a managed investment scheme registered under s 601EB.

31 MGRE was the trustee of the MG Unit Trust and was its responsible entity for the purposes of Pt 5C.2 of the Act. It was a listed disclosing entity within the meaning of s 111AL(1). And pursuant to s 111AP, it was subject to the continuous disclosure requirements of s 674 and was bound to comply with the ASX Listing Rules.

32 Between 3 July 2015 and 27 April 2016, MGRE was a wholly owned subsidiary of MG and had the same directors as MG. It also had the same managing director and the same chief financial officer as MG.

33 Mr Helou was employed by MG as its managing director from October 2011 until he was stood down on 26 April 2016. He was also a director of MGRE from 24 April 2015 to 28 April 2016. Further, the board of directors of MG and MGRE had delegated to him as managing director over the relevant period responsibility for the day-to-day management of MG’s and MGRE’s affairs and the implementation of corporate objectives, strategy and policy initiatives. Further, he was until 26 April 2016 a member of the MG executive leadership team (ELT). Moreover, he was from 1 October 2015 to 26 April 2016 a member of what was described as the Disclosure Committee for both entities, although this did not meet during 1 January 2016 to 27 April 2016.

34 Mr Hingle as chief financial officer of both MG and MGRE reported to Mr Helou. He was a member of the ELT, but he was not a director of either MG or MGRE. Further, he was from 1 October 2015 to 26 April 2016 a member of the Disclosure Committee.

35 On 29 May 2015, MGRE issued a product disclosure statement (PDS) by which it offered fully paid units (the units) in the MG Unit Trust. The units were intended to give unitholders an economic exposure to MG and its business.

36 On and from 3 July 2015:

(a) the MG Unit Trust became admitted to the official list of the ASX;

(b) the MG Unit Trust issued units to investors pursuant to the offer in the PDS;

(c) MG issued notes and convertible preference shares to a sub-trust of the MG Unit Trust; and

(d) MGRE paid any distributions on notes and dividends on convertible preference shares that it received from the sub-trust to unitholders.

37 Pursuant to a Profit Sharing Mechanism Deed dated 26 May 2015 between MG and MGRE, it was agreed that:

(a) the board of MG would determine the net profit after tax (NPAT) in each financial year in accordance with a “Profit Sharing Mechanism” set out in the Deed;

(b) the Profit Sharing Mechanism required the board to adjust the NPAT depending on a variable defined in the Deed as the “Actual Weighted Average Southern Milk Region Farmgate Milk Price”; and

(c) following determination of the NPAT under the Deed, the board of MG would determine any dividend on MG shares, distribution on notes and dividend on convertible preference shares.

38 In MGRE’s PDS, MGRE referred to its continuous disclosure policy and said:

[MGRE] …places a high priority on communication with Unitholders and is aware of the obligations it will have, once listed, under the Act and the ASX Listing Rules, to keep the market fully informed of any information …[MGRE] becomes aware of concerning the MG Unit Trust which is not generally available and which a reasonable person would expect to have a material effect on the price or value of Unit.

…

[MGRE] …has entered into the Relationship Deed with… [MG] in recognition that most of the information that will have a material effect on the price of the Units will relate to the performance and operations of …[MG].

39 By a Relationship Deed dated 18 May 2015, MG and MGRE agreed that:

(a) MG and MGRE would coordinate their continuous disclosure functions and ensure that a representative of MG was a member of the MGRE continuous disclosure committee and that a representative of MGRE was a member of the MG continuous disclosure committee;

(b) the purpose of such an arrangement was to ensure that each of MG and MGRE were aware of matters that may cause the other to need to make a continuous disclosure announcement in accordance with the Act or the ASX Listing Rules;

(c) MG would notify MGRE immediately upon becoming aware of any information concerning MG that a reasonable person would expect to have a material effect on the price or value of the units; and

(d) MGRE would notify MG immediately upon becoming aware of any information concerning MGRE that a reasonable person would expect to have a material effect on the price or value of the MG shares.

40 By a Continuous Disclosure Deed Poll dated 26 May 2015, MG undertook:

(a) that once it was or became aware of any information concerning it or the MG Unit Trust that was not generally available or was information that a reasonable person would expect, if it were generally available, to have a material effect on the price or value of the shares in MG or the units in the MG Unit Trust, MG would immediately notify its shareholders and MGRE; and

(b) to ensure that whilst MGRE was a subsidiary of MG, MGRE complied with its continuous disclosure obligations under s 674.

41 Between 1 January and 27 April 2016, MG had an ELT which was responsible for implementing MG’s strategy and objectives, and for carrying out the day-to-day management and control of MG’s affairs. It usually met on a monthly basis. It was comprised of Mr Helou, Mr Hingle, Mr Albert Moncau (executive general manager of the Dairy Foods division), Ms Fiona Smith (executive general manager corporate development, company secretary and chair of the due diligence committee), Mr David Mallinson (executive general manager business operations), Ms Betsy Harrington (executive general manager business transformation) and Mr Robert Poole (executive general manager supplier relations). During that period, all members of the ELT reported directly to Mr Helou.

42 Let me now turn to some broader matters.

43 At the relevant time, MG was Australia’s largest dairy producer. Between 1 July 2015 and 27 April 2016, MG’s business was broadly divided into three segments or divisions. Let me deal with two of them. The Ingredients & Nutritionals division sold bulk and customised dairy ingredients to markets in Australia, Asia, Sri Lanka and the USA. This division was heavily exposed to fluctuating dairy commodity prices which during the financial year ended 30 June 2015 had faced a rapidly deteriorating trading environment. The Dairy Foods division comprised two further divisions: the Dairy Foods Domestic/Australia division and the Dairy Foods International division. The Dairy Foods division sold ready-to-consume dairy foods products including fresh milk, long-life UHT milk, cheese, cream, butter and instant milk powder.

44 Between 1 January and 27 April 2016, MG produced and sold 1 kg bags of adult milk powder through the Dairy Foods division, which was referred to by MG interchangeably as “sachets”, “sachet powder”, “adult milk powder”, “instant milk powder” and “consumer milk powder”; I will use “sachets” to embrace any and all of these products. Sachets were sold only through the Dairy Foods division, and not the Ingredients & Nutritionals Division. The majority of sachets sold by the Dairy Foods International division were sold to distributors who on-sold to customers in China.

45 Sachet volumes in the first half of FY16 had been approximately triple the sachet volume in the second half of FY15, and in excess of the sachet volume for the whole of FY15.

46 In January 2016, demand for sachets exceeded what MG could supply, with MG unable to fulfil an order for 420,000 sachets.

47 Let me say something about market disclosures.

48 In MGRE’s PDS dated 29 May 2015 published to the ASX, ASIC and more widely to potential investors, MGRE gave pro forma forecasts for MG for the financial year ending 30 June 2016 (FY16) including:

(a) the NPAT attributable to shareholders and unitholders of $86 million; and

(b) the available Southern Milk Region Farmgate Milk Price (FMP) of $6.05 per kilogram of milk solids (kgms).

49 The available Southern Milk Region FMP in a given year was the headline price notified to milk suppliers by MG at the end of each financial year. It was calculated as the actual weighted average Southern Milk Region FMP plus the add-back of quality adjustments accrued from the supply of non-premium milk. It was the average price available to the average milk supplier in the Southern Milk Region if they supplied premium quality milk for the duration of the entire financial year.

50 On 31 August 2015, MG and MGRE released MG’s financial results for the full year ended 30 June 2015 to the ASX (the August announcement) and published those results on MG’s website.

51 The August announcement stated:

Since issuing the PDS in May 2015, dairy commodity prices have continued to decline. This has been in contrast to MG and market commentators’ expectations that they would begin to increase in the 1HFY16, before recovering significantly in the 2HFY16. Despite this, in recent months, MG has benefited from a more favourable exchange rate than forecast in the PDS and this, combined with initiatives we are taking to mitigate the impact of lower commodity prices, supports our view that the FY16 Available Southern Milk Region FMP of $6.05 per kgms and NPAT attributable to shareholders and unitholders of $86 million can be achieved, provided dairy commodity prices strengthen during the balance of FY16.

…

Meeting the FY16 forecast remains subject to certain assumptions including a material strengthening of commodity prices during the balance of FY16, foreign exchange and other risk factors as outlined in the PDS. If these factors do not materialise, MG’s FY16 Available Southern Milk Region FMP is more likely to be in the range of $5.60 - $5.90 per kgms and NPAT attributable to shareholders and unitholders between $66 million to $79 million.

…

MG will continue to monitor the situation closely and will update the market as soon as circumstances materially change. In the meantime, MG remains focused on executing its growth and value creation strategy to shift its product mix away from the volatility of commodity products to ready-to-consumer dairy foods.

52 On 1 October 2015, MG and MGRE released MG’s Annual Report for 2015 and published it on MG’s website.

53 The 2015 Annual Report included MG’s Corporate Governance Statement, which included the following statements:

Murray Goulburn is committed to making timely and balanced disclosure of all material matters and effective communication with its key stakeholders so as to give them ready access to clear and relevant information to assist them in making informed decisions.

…

As an unlisted public company and disclosing entity, Murray Goulburn Cooperative Co Limited has significant continuous disclosure obligations under the Corporations Act 2001.

…

Following the listing of the MG Unit Trust on the ASX on 3 July 2015, MG Responsible Entity Limited (a wholly owned subsidiary of Murray Goulburn Cooperative Co Limited and responsible entity of the MG Unit Trust) also has significant continuous disclosure obligations under the Corporations Act 2001 and the ASX Listing Rules.

…

It is expected that most of the information that will have a material effect on the price of units in the MG Unit Trust will relate to the performance and operation of Murray Goulburn.

…

Therefore, Murray Goulburn has entered into a Continuous Disclosure Deed Poll undertaking:

(i) that once it becomes aware of any information concerning it that a reasonable person would expect to have a material effect on the price or value of units in the MG Unit Trust, Murray Goulburn will immediately notify its shareholders and MG Responsible Entity Limited;

(ii) to ensure that, while MG Responsible Entity Limited is a subsidiary of Murray Goulburn, MG Responsible Entity Limited complies with its continuous disclosure obligations.

54 On 26 October 2015, MG and MGRE released the managing director’s AGM address to the ASX (the October announcement) and published it on MG’s website.

55 In the October announcement, Mr Helou stated that:

Turning now to outlook. MG continues to believe in the solid long-term growth prospects and fundamentals of the dairy industry. We are confident that a global supply response is emerging as a result of the low dairy commodity price environment and starting to have an impact on prices. We believe dairy commodity prices have bottomed and will trend higher over the financial year. Since August prices have risen by around 60 percent.

Based on this we believe the FY16 PDS forecast of a $6.05 per kgms Available Southern Milk Region FMP can be achieved, provided dairy commodity prices continue to materially strengthen during the balance of FY16. Meeting the FY16 forecast is subject to foreign exchange and other risk factors as outlined in the PDS.

If MG’s expectations do not materialise, it is likely that:

• the Available Southern Milk Region FY16 FMP would be in the range of $5.60 to $5.90 per kgms;

• the FY16 NPAT attributable to shareholders and unitholders would be in the range of $66 million to $79 million; and

• subject to Board declaration, this would result in dividends and distributions to shareholders and unitholders in relation to FY16 of between 11.9 to 14.4 cents per share / unit, applying the proposed 100 percent payout ratio.

56 On 29 February 2016, MG and MGRE released:

(a) MG’s interim financial report for the half year ended 31 December 2015;

(b) MG’s half year financial results presentation; and

(c) MG’s half year financial results news release,

(together the February announcement) and published it on MG’s website.

57 MG’s half year financial results presentation and MG’s half year financial results news release, which formed part of the February announcement, included the following statements:

Since issuing the PDS for the IPO of the MG Unit Trust in May 2015, and again since MG’s Annual General Meeting in October 2015, dairy commodity prices have continued to decline. Whilst MG and market commentators expect a recovery in dairy commodity prices, this is taking longer than expected due to the ongoing oversupply in global dairy commodity markets.

The weakness in dairy commodity prices is now expected to result in the Ingredients and Nutritionals segment materially underperforming against the PDS forecasts in FY16. This underperformance is expected to be partially offset by the growth in the Dairy Foods segment resulting from the acceleration of production mix shift and the expected strong performance of domestic and international ready-to-consume dairy foods product sales.

MG expects to maintain its opening Available Weighted Average Southern Milk Region FMP of $5.60 per kgms in FY16 with Southern Milk Region milk intake of approximately 230 million kgms or higher. However, this is subject to there being no further material deterioration in dairy commodity prices or unfavourable changes to the current AUD:USD exchange rate. This is at the bottom end of the previous guidance provided and reflects the lack of improvement in global dairy commodity prices and the continued weak outlook for those prices.

Under the Profit Sharing Mechanism, a $5.60 per kgms milk price would be expected to generate for the full year FY16 NPAT attributable to shareholders and unitholders of approximately $63 million. In line with the Profit Sharing Mechanism and applying the proposed 100 percent payout ratio, the dividend/distribution to be determined for the full year is expected to be approximately 11.3 cents per share/unit.

…

Dairy Foods delivered another very strong performance in 1H16 with revenues of $695 million, up 27 percent on 1H15, driven by outstanding sales and marketing execution in the domestic market and continued strong growth across international markets. This is the second consecutive comparable period where Dairy Foods revenue growth has exceeded 20 percent. This growth drove a 357 percent increase in segment contribution to $66 million for the half, from $14 million in 1H15.

…

For Dairy Foods International, revenue was also up strongly by 21.4 percent to $83 million compared to 1H15. All markets delivered revenue growth, particularly Vietnam, Singapore and China. In China, MG’s largest dairy foods export market, sales of consumer milk powders and cheese were up strongly compared to 1H15, supported by expanded grocery and online listings, cross border sales and a broadened distribution network that extends MG’s reach to tier two and tier three cities across China.

In response to growing demand for MG’s Devondale products, a series of investments have been completed to increase production capacity for Devondale consumer milk powders, cheese and dairy beverages.

…

International Dairy Foods revenue continues to experience significant growth

• Revenue up 21.4% on 1H15 to $83 million

– Growth across most products and categories including Consumer Milk Powder sales

– All markets improving including Middle East, SE Asia and China

• In addition, management believes significant portion of Consumer Milk Powder recognised in Dairy Foods Australia includes outbound sales (OBS) that are ultimately consumed offshore

– Management estimate outbound sales captured in Dairy Foods Australia of ~$60m for 1H16

– Implies ~110% half-on-half growth for international Consumer Milk Powder

• Joint business plans developed during the half-year with major online sales channels including JD.com and Tmall.com, adding to MG’s access to this growing demand

– Milestones for MG’s developing international supply chain strategy

…

Internationally, Dairy Foods sales growth of 21.4 percent was supported by a broadened distribution network and very strong demand for Devondale branded consumer milk powders. In particular, we are pleased to have advanced our Asian distribution strategy in this period by securing valuable supply agreements with major retailers and entering into joint business plans with global eCommerce platforms including JD.com and Tmall.com.

58 By the February announcement, MG and MGRE forecasted that MG would generate NPAT of $63 million and FMP of $5.60 for FY16 (the February earnings guidance).

59 On 22 April 2016, MGRE requested a trading halt.

60 On 27 April 2016, MG and MGRE released an announcement titled “Trading Update and Revised Outlook” which stated that MG expected its FY16 Distributable Milk Pool (DMP) to be approximately $170 million to $220 million lower than previously forecast, resulting in an FY16 FMP of between $4.75 to $5.00 per kgms, and that applying the Profit Sharing Mechanism to the revised FY16 FMP, MG expected to achieve NPAT attributable to shareholders and unitholders of between $39 million to $42 million (the April announcement). The April announcement was published on MG’s website.

61 I should at this point say something about the forecasting process.

62 Throughout the period 1 July 2015 to 30 April 2016, MG prepared monthly “revised income forecasts” (RIFs) which were internal management documents which provided a monthly update of the company’s forecast FMP and NPAT for FY16. Each RIF aggregated the actualised results for the preceding months together with an updated forecast for the remaining months of the financial year based on the assumptions set out in each RIF. Preparation of the monthly RIF was complex and typically included the following steps:

(a) early in the month, each business unit provided to the finance team a submission containing their actualised results for the preceding months together with an updated forecast for the remaining months of the financial year;

(b) the finance team checked to ensure submissions had been received from all business units and then consolidated the submissions to produce a consolidated draft RIF including MG’s NPAT and FMP forecast for that financial year;

(c) if necessary, the finance team sought explanations as to any major variances from the last RIF from the relevant business unit concerned;

(d) the finance team and Mr Hingle then met to discuss the business unit submissions and the consolidated draft RIF; from time to time, if necessary, Mr Hingle required business units to review and resubmit their submissions;

(e) the consolidated draft RIF was then revised as required and a further draft sent to Mr Hingle;

(f) once finalised the draft RIF was provided to the ELT for review;

(g) the ELT met to discuss and debate the RIF, including the scenarios in the RIF and the assumptions behind those scenarios; each of the heads of business units provided feedback on the figures in the RIF from, or derived from, their respective business units; after any changes to the RIF had been agreed, the heads of the business units approved the figures in the RIF from, or derived from, their respective business units; and any input from ELT members was taken into account and a final draft of the RIF was prepared; and

(h) once approved by the ELT, the RIF was presented at the next board meeting.

63 If the RIF was not presented to the board, as was the position in January 2016 when there was no board meeting held and in March 2016 when the RIF was not presented at that month’s board meeting, the RIF was not finalised in the way that I have described and remained a draft internal working document.

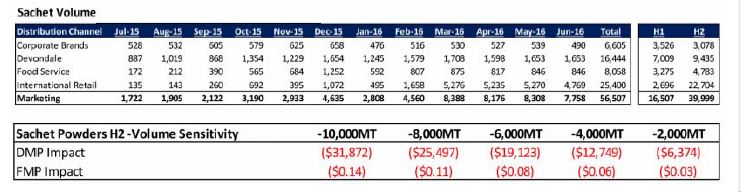

64 The February RIF was provided to the board on 26 February 2016. It forecast a mid case FY16 FMP of $5.62 and a mid case FY16 NPAT of $63.7 million. The February RIF was based on a number of assumptions, including that MG would sell 56,507 tonnes of sachets in FY16, 37,192 tonnes of which were forecast to be sold by inter-alia Dairy Foods Australia and Dairy Foods International from February to June 2016 at an average unit price of $8.37 per unit. The sale of 56,507 tonnes of sachets was forecast to deliver a gross profit of $162.2 million for FY16. The February RIF contained the following tables with respect to the sachet forecast:

65 The “Sachet Volume” table contained actual sales figures for the months of July 2015 to January 2016 and forecast figures for the months of February 2016 to June 2016. The “Sachet Powders H2 – Volume Sensitivity” table showed the potential impact on the DMP and the FMP of a decrease in sachet sales volume as against the February RIF forecast in 2,000 metric tonne increments, to the exclusion of all other risks and opportunities.

66 The February RIF stated that:

(a) in the 7 months from July 2015 to January 2016, Dairy Foods International had sold 3,192 tonnes of sachets;

(b) in the remaining 5 months, being February 2016 to June 2016, MG forecast that the Dairy Foods International division would sell 22,209 tonnes of sachets, which was reflective of increased sachet packing capacity being available;

(c) forecast gross profit from the sale of sachets in the period February to June 2016 was $118.5 million;

(d) demand for sachet sales had softened in February due to the Chinese New Year;

(e) to achieve the forecast sachet sales for the full fiscal year (FY16) required the market to bounce back from late February through the remainder of the fiscal year;

(f) given the sensitivities, full year guidance was expected to be around $5.60/kgms to $5.70/kgms; and

(g) there were a number of key initiatives driving the full year estimate and that the greatest focus to mitigate downside risk was delivery of sachet volumes.

67 At the time the February RIF was prepared, MG management expected demand for sachet sales to rebound in March 2016 and the following months, after the softening in demand in February due to the Chinese New Year.

68 The February RIF also identified a number of potential risks and opportunities to the FMP, including in relation to sachet sales. It showed, by way of illustration in relation to sachets, that, to the exclusion of all other risks and opportunities, if sales of sachets in the period February to June 2016 were 7 kt less than the forecast 37 kt, this would have an impact to gross profit of minus $23.6 million and an FMP impact of minus 10 cents; and it also showed that if opportunities were realised in relation to sachet sales so that 60 kt of sachet sales were achieved in FY16, this would increase gross profits by $9.6 million with an FMP impact of plus 4 cents.

69 At the board meeting on 26 February 2016 the February RIF was presented to the board by Mr Hingle in the presence of Mr Helou and Mr Moncau and the board noted the key assumptions relied on in relation to NPAT. Further, a draft of the February announcement was tabled at the board meeting in the presence of Mr Helou and Mr Hingle and the directors provided their initial feedback. Further, noting that a final review of the February announcement was to be undertaken, the board agreed to delegate authority to a sub-committee comprising the chairman, Mr Helou, the Finance, Risk and Audit Committee chairman and the Compliance Committee chairman to approve the February announcement.

70 On 29 February 2016, the sub-committee, which did not include Mr Hingle, approved the February announcement for immediate release to the market.

71 Now by 26 February 2016, the following circumstances existed which had the potential to affect MG’s and MGRE’s ability to achieve the forecast NPAT and FMP contained in the February RIF (the February circumstances).

72 First, actual sachet sales for February 2016 were below forecast in that:

(a) 90% of the month had passed;

(b) total actual sachet sales in Dairy Foods were 1,646 tonnes, which was materially below the 4,483 tonnes forecast for February in the February RIF and below the monthly figures that had been achieved in the previous 5 months;

(c) total actual sachet sales in Dairy Foods International were 464 tonnes, which was materially below the 1,658 tonnes forecast for February; and

(d) total actual sachet sales in Dairy Foods Domestic/Australia were 782 tonnes, which was materially below the forecast of 2,018 tonnes for February.

73 Second, as to the 37,192 tonnes sachet sales forecast for February to June 2016:

(a) MG did not have in place contracts or firm commitments from customers for the entirety of the 37,192 tonnes forecast sachet sales;

(b) approximately half had not been allocated for sales to existing customers;

(c) the unallocated amounts were forecast to be taken up by new distributors in the period from March to June 2016, who had not previously purchased from MG and had no distribution agreements in place with MG;

(d) there were no significant forward orders for sales allocated to existing customers for March or April to June 2016; and

(e) the sachet sales forecast was based on production capacity, not sales capacity.

74 Third, MG did not have physical distribution channels in China to enable MG to achieve the forecast sales in the February RIF. In this regard:

(a) up to February 2016, MG had sold its sachets predominantly through e-commerce (online) distributors and achieving the February earnings guidance required MG to develop MG’s physical (offline) distribution channels into stores in China;

(b) MG’s only offline distributor for China, Foodgears, had historically purchased sachets volumes of less than 100 tonnes per month representing less than 1.5% of the forecast sachet volume in the February RIF;

(c) no distribution agreements had been signed with offline distributors in China during FY16 save for Foodgears; and

(d) Foodgears had advised that there was an oversupply of sachets in the market.

75 Fourth, MG did not have enough supply arrangements in place with major retailers in Asia for all the forecast sachet sales that had to be produced in the remainder of FY16.

76 Fifth, Foodgears had told MG that the market for milk powder had slowed down as there was an oversupply of milk powder and competitive prices from other channels and origins.

77 Sixth, as for customers of MG in the domestic market, Costco was not taking all of its allocated sachet volumes, Woolworths had indicated that some stores were overstocked with sachets, and senior staff reported that there were high stocks of sachets held by the biggest distributors.

78 In early March 2016, MG received interest for sachet sales from existing and potential new online distributors and progressed discussions with five regional offline distributors in China who were keen to establish “bricks and mortar” distribution in Beijing, Shanghai and Zhejiang respectively. At that time Mr Peter Scott, general manager sales – consumer brands, was in China meeting with potential offline distributors.

79 On 2 March 2016, Mr Moncau sent an email to Mr Helou stating:

Just a short note to confirm that we have locked JD.com for 500t per month from now to June (at AUD$7.85 CIF), and also 10 containers of UHT milk per month as part of the deal.

80 On 7 March 2016, Mr Moncau spoke with Mr Helou on the telephone. The following day, Mr Helou emailed Mr Moncau stating:

I haven’t received your Sachet volume note. I thought long and hard about your call last night, I’m more convinced now that our task is to get new physical retail distribution in new geographies. Cities. Accounts. Etc. This is what we MUST do. Do we have the right people to activate this button? Not just rotating Coles Ww and JD.

81 On 8 March 2016, Mr Moncau emailed Mr Helou stating:

I’m working on the note Gary, I will send you a Low, Mid and High scenario for discussion.

Concerning your below question we’re set for the online business but not for the retail offline capillar distribution. The transition from Foodgears to other players is being difficult and we don’t have a wide sales organisation in China. One of my goals next week is to get deep into this subject and see if we can find a player there to immediately help us. As a heads up, Monday 21st I’m meeting Master Kong top [sic] see how far we can go with them.

Master Kong is one of the largest food and beverage company with annual turnover around US$10B in China.

Master Kong product portfolio includes instant noodle, RTD tea drink, mineral water, Pepsi beverage, Starbucks RTD coffee and snacks. Usually this is achieved through [sic].

82 On 8 March 2016, Mr Moncau sent an email to Mr Helou, which was copied to Mr Hingle, attaching a document entitled “Sachet Risk Profile” (the March sachet risk profile) and stating:

Hi Gary, as discussed yesterday find here attached a detailed analysis of the risk profile of our latest Instant Milk Powder forecast.

You’ll find attached a Low, Mid and High scenario view based on today’s performance. We have looked at every single known opportunity and also have added some aspirational additional volumes to get to those Low and Mid scenarios, and will continue looking at opportunities of additional volume at different price points, particularly with the June 18 event in mind.

Next Friday we’re meeting TMall here in Melbourne, and next week I’ll be in China to continue chasing opportunities, particularly the Master Kong one mentioned in a previous email.

We would need to align on what to include in our next forecast. I would suggest the Mid Scenario is the more realistic, but if we want to maintain the volume our estimated price for higher volumes would be in line with domestic pricing, that is AUD 6.70 per kg.

Sorry for the news but I think it is important to highlight the risks now we better know the market appetite and we still have some time to react. Happy to discuss at your convenience.

83 The “Mid Scenario” set out a forecast of sales of 47,800 tonnes of sachets in FY16, stated to be a gap of 8,700 tonnes from the “Previous Forecast” (February RIF) of 56,500 tonnes, and set out a corresponding gross profit of $81.1 million in FY16, stated to be a gap of $29.3 million from the “Previous Forecast” of $110.4 million.

84 The March sachet risk profile stated in part:

• Initial estimates after 2 weeks of sales activity show a significant potential risk vs our previous forecast…

• We will continue chasing volume, particularly in the Offline Chinese market in order to achieve our latest forecast number, that is 56,500 tons.

• Worth to consider though alternative opportunities for our milk availability to be able to offset the potential down-call on Instant Milk Powder vs. forecast.

• Would recommend to either reduce the forecasted volume for Instant or reduce the price assumption. If we push for volume for June 18 event prices will need to be lower than forecasted. Our estimated price for higher volumes would be in line with domestic pricing, that is AUD 6.70.

• The fact that our product is a hot item and also there’s no stock shortage has brought retail price from 100 RMB 6 months ago to prices around 50 or 60 RMP [sic] today.

• Consumption level has not decreased but has not increased either.

• Big players have used Chinese New Year to reduce stocks and now are more reluctant to be aggressive due to the price war. They don’t see the opportunity to make as much money as they made before.

• We have gained direct customers, but this has brought a reduction of the sales from Costco and others given those customers were buying to Costco before. We’re gaining $1.5 per bag on average for 2,000 tons (500 tons per month), but the volume is not additional.

• We’re well distributed Online but we’re not well distributed offline. A big push is taking place during March to activate new Offline customers and promote our product in local stores, supermarkets and hypermarkets before June 18 big day.

85 Under the heading “Next Steps”, the March sachet risk profile stated: “Get Offline Distribution in China” and “Get International opportunities materialized” and “Look for further opportunities to offset the potential loss: Maximise Infant Formula, Cost savings (Overheads), Potential utilisation of capacity of other products (i.e. Nutritionals)”.

86 On 8 March 2016, Mr Helou responded to Mr Moncau’s email attaching the March sachet risk profile stating:

I understand the situation, but our task remains to activate direct distribution to off line retail outlets.

We were always going to struggle to place all that additional volume via existing online and cross border trade.

The challenge was and still is “new” direct customers in “new” geographies, “new” cities and “new” outlets.

We need to sign “new” distribution agreements.

To date we haven’t done that.

I expect us to do so.

I will be doing so.

We can’t walk away from 60kt.

87 By 8 March 2016, the following circumstances existed which had the potential to affect MG’s and MGRE’s ability to achieve the February earnings guidance (the early March circumstances). First, the February circumstances had not been mitigated. Second, actual sales for February 2016 were materially below forecast, in that 1,645 tonnes of sachets had been sold as against a forecast of 4,560 tonnes in the February RIF. Third, the March sachet risk profile also forecast that:

(a) if the volume in the February RIF was to be maintained for the period 1 February to 30 June 2016, the estimated price for the higher volumes would need to be in line with domestic pricing, namely $6.70 per kg;

(b) 47,800 tonnes of sachets would be sold during FY16 instead of the 56,500 tonnes which had been forecast in the February RIF for sachets for FY16; and

(c) gross profit from sachet sales would be $81.1 million instead of $110.4 million, the latter of which had been forecasted for sachet sales in the February RIF, representing a gross profit downgrade of minus $29.3 million.

88 Now both Mr Helou and Mr Hingle knew of the early March circumstances by 8 March 2016. Correspondingly, as at 8 March 2016, MG and MGRE were aware of the early March circumstances.

89 As at 8 March 2016, by reason of the early March circumstances there was likely to be a material decrease in the February earnings guidance which was unlikely to be achieved (the early March material information).

90 And as at 8 March 2016 MG and MGRE were aware of the early March material information, which was not generally available. Further, the early March material information comprised information that a reasonable person would have expected to have had a material effect on the price or value of MG’s shares, within the meaning of ss 675(2) and 677, and the price or value of the units, within the meaning of ss 674(2)(c)(ii) and 677, and comprised information that was required to be notified to ASIC by MG under s 675(2) and required to be notified to the ASX by MGRE under ASX Listing Rule 3.1 and s 674(2)(b).

91 By failing to disclose the early March material information, on and from 8 March 2016 MG contravened s 675(2) and MGRE contravened s 674(2).

92 As at 8 March 2016, each of Mr Helou and Mr Hingle knew:

(a) the early March material information;

(b) by reason of their knowledge of the early March material information, MG and MGRE were aware of the early March material information;

(c) the early March material information was not generally available;

(d) the early March material information comprised information that a reasonable person would have expected, if it had been generally available, to have had a material effect on the price or value of MG’s shares and the price or value of the units; and

(e) ASX Listing Rule 3.1 required that once an entity is or becomes aware of any information concerning it that a reasonable person would expect to have a material effect on the price or value of the entity’s securities, the entity must immediately tell ASX that information.

93 Between 8 March and 27 April 2016, MG did not notify ASIC of the early March material information, and MGRE did not notify the ASX of the early March material information. At 8.48 am on 27 April 2016 prior to the commencement of trading, MGRE released the April announcement, which disclosed the substance of the early March material information along with other information.

94 Let me turn to some events in late March 2016.

95 On 10 March 2016, Mr Moncau sent an email to Mr Helou referencing a meeting on 10 March 2016 with Chaopi, a potential distributor of sachets in China, who had “confirmed to start the business asap”.

96 In the week commencing 14 March 2016, Mr Moncau travelled to China, returning to Australia on or about 22 March 2016. The principal purpose of his trip was to sign additional offline distributors in China to purchase sachets including in the period prior to the end of FY16 so as to achieve the targeted sachet sales of 60 kt in FY16. In the period 15 March to 21 March 2016, Mr Moncau visited a number of Chinese distributors including thirteen distributors located variously in Hong Kong, Chengdu, Wuhan, Beijing, Guangzhou, Fuzhou and Shanghai.

97 On 18 March 2016, Mr Hingle sent an email to Mr Moncau stating:

I know you are in numerous meetings, but when you have an opportunity, please can you send through an update of what volume and orders you expect to generate out of your trip.

Would like to get a more up to date understanding of the balance of year outlook.

98 On 19 March 2016, Mr Moncau sent an email to Mr Helou stating:

March looks much better than February and January but unfortunately the traction we’re getting is not good enough to achieve our expected results. As you can see below we’re aiming to get 3,000 tons this month, which means 1,500 tons short. We have still some opportunities we’re discussing but it’s a bit late to be able to get them shipped in March. The reference to 3,000 tonnes was a reference to the forecast for the month of March for the Dairy Foods International division of 2,840 tonnes (being the forecast contained in the Low Case and Mid-Case in the March Sachet Risk Profile).

…

Bad news, and I’m very frustrated for that, but the market is a bit of a chaos these days due to pricing. Different reasons are causing this result:

• JD has moved to 49.90 RMB (10 AUD) pricing on daily offers and this is making our product less attractive for the grey market

• There was enough stock in our customers’ warehouse to continue supplying the demand without placing new orders

• By finding new direct customers Costco and others have lost customers and we have just shifted volume

• Our distribution is limited to cross-border, we have very limited offline distribution

On this last point the discussions we started 4 to 5 months ago with potential new distributors seem to get to a conclusion. From this trip we have got confirmation of 2 distributors for the West provinces (Sichuan and Chongqing), another 2 for the centre provinces (Hubei, Henan and ), and one for Beijing. Tomorrow we’re in Guangzhou and Sunday in Fuzhou, so hopefully new customers will be added to our distribution network. We should see results of that expansion in April, and the team is working to size the opportunity. On top of that we keep using our existing Infant Formula distributors to sell sachets. We have mobilized 200 tons this month and we’re planning to mobilize another 400 next month. And we also met some traders that need to give us an answer next week on how much they would be ready to buy.

…

We also met JD today. A lot of good news and good support for our Infant Formula. We’re the biggest Food brand in sales in JD, which makes me think our sales of powder are pretty impressive yet. We can still grow, and we talked about June 18 big sales day. Tony calculated what would it mean to be one of the 20 promoted brands in JD that day, and the extra sales if we agree on the terms would be 240 tons. We will go for it, but at the same time it made me think and somehow confirms that the volumes we’re targeting must be achieved outside the online channel.

…

Next week we have a meeting set with Walmart where we expect to get listed, so results are coming but don’t know if fast enough to recover the volumes lost in the first quarter of 2016. The team is 100% focused on Powder and DD Infant Formula, we have put a special reward structure based on sales of those products, and we will not rest till we explore every single opportunity in this and other markets.

99 Later on 19 March 2016, and in response to Mr Hingle’s email of 18 March 2016, Mr Moncau forwarded his email sent to Mr Helou to Mr Hingle and stated in his covering email that:

We’re getting some order here and there from existing Distributors, and we’re also getting alignment with big distributors in the different regions we’re visiting (crossed fingers today we got a major one in Guangzhou!), so expectations are good for the months to come.

The balance of the year looks far from reaching the 57k tons. We’re anyway still looking for trading opportunities, but there the price will be lower than what we want so the contribution impact would be worse if at the end this volume replaces the volume we’re targeting at 7.5 AUD average price.

I will still fight for the 57k, but I think it would be wise to use the mid case scenario for our next forecast. We will lose 1,500 tons or more for March, and getting to a 8,000 level per month will be tough but I don't want to lower more our forecast, we need to keep believing in what we put and for that it has to be achievable. Maintaining 57k will mean including a lot of risk in our numbers if we take into account (1) last 2 month results, (2) the feedback from the market, (3) the lack of regional distributors today, and (4) the fact that our competitors (Nestle) are also reacting and defending its field.

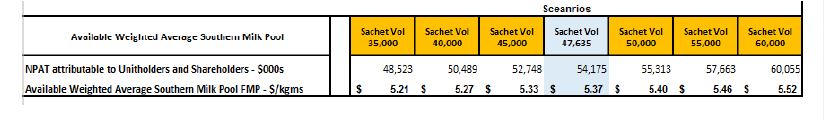

100 On 21 March 2016, Mr Hingle received an email from a senior member of the finance team which attached a document titled “NPAT Scenarios”. The NPAT Scenarios document included a forecast of the FMP and NPAT for FY16 on the basis of 7 different assumed sachet sales volumes as follows:

101 On 21 March 2016, Mr Hingle received a draft RIF analysis from a member of the finance team which estimated a “ball park” FMP of $5.32 on the basis of the forecast information contained in the analysis, some of which was still under investigation, including sachet sales in accordance with the “Mid Scenario” of the March sachet risk profile. Later that day, Mr Hingle received a further draft of that document which was still estimating a “ball park” FMP of $5.32. Even later, Mr Hingle received a draft from a member of the finance team, which on the basis of the assumptions set out in the draft RIF including the sachet sales in accordance with the “Mid Scenario” of the March sachet risk profile, forecast an FY16 FMP of $5.38 and FY16 NPAT of $54.6 million. The draft indicated that other parts of MG’s business apart from sachets were underperforming and were contributing to the lower forecast FY16 FMP and FY16 NPAT.

102 On 22 March 2016, Mr Moncau returned from China. Notwithstanding his meetings with various Chinese distributors over the period between 15 March and 21 March 2016, Mr Moncau was unable to conclude new distribution arrangements under which sufficient sachets would be sold and shipped to China before the end of FY16 to meet forecast sales for FY16.

103 Further on the same day, Mr Hingle, Mr Helou, Mr Mallinson, Mr Moncau and others received the daily sachet sales report for 21 March 2016 which showed that:

(a) the month to date sales volume for sachets was 1,138.8 tonnes, against the forecast for the month of 8,366.4 tonnes;

(b) the month to date gross sales revenue for sachets was $8.27 million, against the forecast for the month of $67.97 million; and

(c) the projected month end results were 1,752 tonnes, against the forecast for the month of 8,366.4 tonnes, and $12.72 million, against the forecast for the month of $67.97 million.

104 On 22 March 2016, Mr Hingle received a further draft of the RIF (the draft March RIF) from a member of the finance team, which on the basis of the assumptions set out in the draft including the sachet sales in accordance with the “Mid Scenario” of the March sachet risk profile, forecast an FY16 FMP of $5.32 and an FY16 NPAT of $52.4 million.

105 By 22 March 2016, the following circumstances existed which had the potential to affect MG’s and MGRE’s ability to achieve the February earnings guidance (the late March circumstances):

(a) the February circumstances and early March circumstances continued and had not been mitigated;

(b) the draft March RIF forecast that:

(i) the FY16 NPAT was likely to be $52.4 million;

(ii) the FY16 FMP was likely to be $5.32; and

(iii) MG would sell 26,675 tonnes of sachets from March to June 2016;

(c) actual sachet sales for March 2016 were materially below forecast, in that:

(i) 65% of the month had passed;

(ii) the month to date sales volume for sachets was 1,138.8 tonnes, which was materially below the 8,366.4 tonnes forecast for March; and

(iii) the month to date gross sales revenue for sachets was $8.268 million, which was materially below the $67.974 million forecast for March;

(d) Mr Moncau had advised Mr Helou and Mr Hingle that March sachet sales were looking better than January and February but were not good enough to achieve the forecast for the month of March set out in the March sachet risk profile, customers had surplus stock and did not need to place new orders with MG to meet their existing demand, and MG had very limited offline distribution; and

(e) Mr Daniel Egan, head of group finance, had prepared an analysis which showed a number of scenarios and a range of data, including that even if the maximum number of sachets that were able to be produced by MG for FY16 were sold by 30 June 2016 (ie 60,000 tonnes), the resulting NPAT and FMP would fall below the February earnings guidance, namely to $60.1 million and $5.52 respectively, and if a total of 35,000 tonnes of sachets for FY16 were sold by 30 June 2016, the resulting NPAT and FMP were likely to be $48.5 million and $5.21 respectively.

106 By 22 March 2016, Mr Helou knew of the late March circumstances save for the matters identified in sub-paragraphs (b) and (e) above. Further, by 22 March 2016, Mr Hingle knew of the late March circumstances. Correspondingly, as at 22 March 2016, MG and MGRE were aware of the late March circumstances.

107 As at 22 March 2016, by reason of the late March circumstances there was likely to be a material decrease in the February earnings guidance which was unlikely to be achieved (the late March material information).

108 And as at 22 March 2016 MG and MGRE were aware of the late March material information, which was not generally available. Further, the late March material information comprised information that a reasonable person would have expected to have had a material effect on the price or value of MG’s shares, within the meaning of ss 675(2) and 677, and the price or value of the units, within the meaning of ss 674(2)(c)(ii) and 677, and comprised information that was required to be notified to ASIC by MG under s 675(2) and required to be notified to the ASX by MGRE under ASX Listing Rule 3.1 and s 674(2)(b).

109 By failing to disclose the late March material information, on and from 22 March 2016 MG contravened s 675(2) and MGRE contravened s 674(2).

110 As at 22 March 2016, both Mr Helou and Mr Hingle knew:

(a) the late March material information;

(b) by reason of their knowledge of the late March material information, each of MG and MGRE was aware of the late March material information;

(c) the late March material information was not generally available; and

(d) the late March material information comprised information that a reasonable person would have expected, if it had been generally available, to have had a material effect on the price or value of MG’s shares and the price or value of the units.

111 Between 22 March and 27 April 2016, MG did not notify ASIC of the late March material information and MGRE did not notify the ASX of the late March material information. At 8.48 am on 27 April 2016 prior to the commencement of trading, MGRE released the April announcement, which disclosed the substance of the late March material information along with other information.

112 Let me turn to some events after 22 March 2016.

113 On 29 March 2016, MG met with Asipac Corporation Pty Ltd and commenced discussions for the acquisition of potentially large quantities of sachets and long-life UHT milk, being as I have mentioned another of the product lines sold by the Dairy Foods division, with possible exclusive rights to distribution in China. These discussions continued into April 2016.

114 On 31 March 2016, Mr Helou, Mr Hingle, and others received a daily sachet report which showed that the month to date sales volume for sachets was 2,005.6 tonnes, below the forecast for the month of 8,366.4 tonnes, and the month-to-date gross sales revenue for sachets was $15.078 million, below the forecast for the month of $67.97 million.

115 As at 31 March 2016, MG had sold 4,256 tonnes of sachets since 1 February 2016, below the 12,948 tonnes that had been forecast for February and March 2016 according to the February RIF.

116 On 8 to 9 April 2016, MG and Asipac conducted advanced negotiations for Asipac to buy 23,000 tonnes of sachets at a price of $7.60 per kg and $60 million of long-life UHT milk in the remainder of FY16.

117 On 12 April 2016, Mr Hingle received a draft April RIF which forecast a resulting FMP of $5.33 and a resulting NPAT of $52.4 million. The draft April RIF included sachet sales contemplated by the Asipac deal that was being negotiated.

118 On 12 April 2016, Ms Smith sent an email to the directors of MG and MGRE attaching an update on the progress of sachet sales, and advising the directors that a further update would be provided at the April board meeting. The update stated:

March month sales volume lower than forecast by 5.7kt, mainly as a result of slower than anticipated distribution arrangements in place. As a result of lower volume and sales prices Gross Profit adverse to forecast by $20m. Positive development in week 1 April with new distribution arrangement into China being finalised for 23kt Sachet volume for Q4 FY16 ... , In process of finalising arrangements and will update the Board at the April Board meeting.

119 On 13 April 2016, Mr Hingle forwarded the draft April RIF to Mr Helou.

120 By 13 April 2016, the following circumstances existed which had the potential to affect MG’s and MGRE’s ability to achieve the February earnings guidance (the April circumstances):

(a) the February circumstances, early March circumstances, late March circumstances had not been mitigated;

(b) the draft April RIF forecast that:

(i) the FY16 NPAT was likely to be $52.4 million;

(ii) the FY16 FMP was likely to be $5.33;

(iii) MG would sell 27,900 tonnes of sachets from April to June 2016;

(c) actual sachet sales for April 2016 were materially below forecast, in that:

(i) 45% of the month had passed;

(ii) the month to date sales volume for sachets was 738.8 tonnes, which was materially below the 8,176 tonnes forecast for April; and

(iii) the month to date gross sales revenue for sachets was $5.468 million, which was materially below the $66.939 million forecast for April;

(d) MG’s finance team had reported that recent and forecast performance suggested that an FMP of $5.60 for FY16 was untenable;

(e) Mr Chris Carbone, head of commercial finance, sent an email to Mr Moncau, Mr Mallinson, Mr Helou, Mr Hingle and various others that indicated that an allocation of 47,000 mt of sachet sales had only ever been achieved in December 2015 when significant stock was sold for Chinese New Year; further, he indicated that supply was exceeding demand, sales orders from the major Australian customers like Costco, Woolworths and Coles had decreased and MG had reduced prices to international customers.

121 By 13 April 2016, Mr Helou knew of the April circumstances save for the matter in sub-paragraph (d) above. Further, by 13 April 2016, Mr Hingle knew of the April circumstances. Correspondingly, as at 13 April 2016 MG and MGRE were aware of the April circumstances.

122 On 19 April 2016, Mr Hingle presented an April RIF to the board. The 19 April RIF stated in relation to sachet sales that:

• Previously forecast 57kt sachets. Slower offtake in Feb and March has impacted full year projection.

• In process of finalising China distribution for Apr to June with 23kt of the 27kt forecast for balance of year supply to China;

• Management require further analysis over the next 2 weeks to better understand:

• Performance of April month, in particular final sachet shipments;

• Agreement of terms and contracts for Sachet sales for May/June with agreed pricing.

• Infant formula sales into both Domestic and Chinese markets.

• Promotional activities for domestic consumer markets for May/June to increase consumer sales over the remaining year.

• Propose to revert to Board on 6 May, following performance of April, with a definitive range for FY16 outlook.

123 The 19 April RIF did not include a forecast FY16 NPAT or FY16 FMP as had been contained in the draft April RIF. Further, it stated that further analysis was required over the next two weeks in relation to sachet performance and sale terms for the balance of the year.

124 At the board meeting on 19 April 2016, the board requested management to undertake urgent further analysis to better understand final sachet shipments in April, expected contract sales for May and June, infant formula sales into both domestic and Chinese markets and the impact of an increase in promotional activities for domestic consumer markets for May and June, in order to assess the impact, if any, on the current forecast.

125 On 22 April 2016, MGRE requested a trading halt and the units were placed into a trading halt until the commencement of trading on 27 April 2016.

126 Between 19 April and 24 April 2016, MGRE undertook a detailed further analysis, including in relation to sachet sales, as requested by the board on 19 April 2016.

127 At the next board meeting on 24 April 2016 a revised April RIF was provided to the board. The 24 April RIF stated that “Sachet full year sales forecast of 28kt to 44kt” and the estimated FMP for FY16 was in the range $4.75 to $5.05. The board noted:

the expected full year forecast for sachet powder, together with management’s explanation for the variance compared to the forecast advised in February (with a total negative impact of $72.7 million based on the ‘likely case’), including:

• a slower than expected build up of the distribution network in China;

• lower demand over the Chinese new year period;

• confusion arising from the recent announcement of regulatory changes in China;

…

detailed breakdown of sachet forecast by customers in China for the remainder of the year with a likely and low scenario case.

…

flow on impact of lower sachet sales impacting the NRV with a negative variance of $54 million.

128 On 27 April 2016, MG released to the ASX and published on its website the April announcement which included an announcement of an expected FY16 FMP and NPAT and an announcement that:

…Managing Director, Mr Gary Helou, will step down from his role, but remain with the company for a short period to assist with the transition to an interim Chief Executive Officer…

…Chief Financial Officer, Mr Brad Hingle has resigned from his position following Mr Helou’s decision to step down as managing director but will remain in the business to assist with the finalisation of the FY16 annual results.

129 As at 13 April 2016, by reason of the April circumstances there was likely to be a material decrease in the February earnings guidance which was unlikely to be achieved (the April material information).

130 And as at 13 April 2016 MG and MGRE were aware of the April material information, which was not generally available. Further, the April material information comprised information that a reasonable person would have expected to have had a material effect on the price or value of MG’s shares, within the meaning of ss 675(2) and 677, and the price or value of the units, within the meaning of ss 674(2)(c)(ii)and 677, and comprised information that was required to be notified to ASIC by MG under s 675(2) and required to be notified to the ASX by MGRE under ASX Listing Rule 3.1 and s 674(2)(b).

131 By failing to disclose the April material information, on and from 13 April 2016 MG contravened s 675(2) and MGRE contravened s 674(2).

132 As at 13 April 2016, each of Mr Helou and Mr Hingle knew:

(a) the April material information;

(b) by reason of their knowledge of the April material information, each of MG and MGRE was aware of the April material information;

(c) the April material information was not generally available; and

(d) the April material information comprised information that a reasonable person would have expected, if it had been generally available, to have had a material effect on the price or value of MG’s shares and the price or value of the units.

133 Between 13 April and 27 April 2016, MG did not notify ASIC of the April material information and MGRE did not notify the ASX of the April material information.

134 At 8.48 am on 27 April 2016 prior to the commencement of trading, MGRE released the April announcement, which disclosed the substance of the April material information, including the following:

Adult Milk Powder volumes for the 6 months to 31 December 2015 were approximately triple those in the prior corresponding period, and had exceeded the total volume for the full 2015 financial year. Importantly, Adult Milk Powder sales in-country (i.e. not cross-border) had grown from a negligible base in 1H15 to a little under 20 percent of total Adult Milk Powder sales in 1H16. As a result of this increased demand, management significantly increased its forecasts for the sale of Adult Milk Powder in 2H16 and increased production to match the forecast sales. In addition, actions were taken to develop the MG’s in-country distribution in China. These actions gave management confidence that the forecast sales for 2H16 would be achievable.

…

In 2H16, initial falls in Adult Milk Powder demand from Chinese consumers were forecast by MG due to Chinese New Year celebrations in February. While volume recovered in March, early results for April showed a slowing in sales growth against forecast sales. As a result of this slowing growth rate and the resulting impact on revenue, a revised sales forecast has been undertaken for 4Q16 which has significantly reduced expectations for the remainder of the financial year.