Federal Court of Australia

Australian Energy Regulator v AGL Sales Pty Limited [2020] FCA 1623

ORDERS

DATE OF ORDER: |

THE COURT DECLARES BY CONSENT THAT:

AGL Sales

1. The First Respondent (AGL Sales) failed to submit, in respect of its performance in ACT, NSW, QLD and SA, information and data by the relevant due dates for:

(a) the Quarter 1 reporting period, 1 July 2017 to 30 September 2017 (Quarter 1 Reporting Period), which was to be submitted by 31 October 2017 and which was not finally submitted until 19 September 2018;

(b) the Quarter 2 reporting period, 1 October 2017 to 31 December 2017 (Quarter 2 Reporting Period), which was to be submitted by 31 January 2018 and which was not finally submitted until 19 September 2018;

(c) the Quarter 3 reporting period, 1 January 2018 to 31 March 2018 (Quarter 3 Reporting Period), which was to be submitted by 30 April 2018 and which was not finally submitted until 19 September 2018;

(d) the Quarter 4 reporting period, 1 April 2018 to 30 June 2018 (Quarter 4 Reporting Period), which was to be submitted by 31 August 2018 and which was not finally submitted until 19 September 2018,

and therefore failed to submit to the Applicant (AER) information and data in the manner and form (including by the dates) required by the AER Performance Reporting Procedures and Guidelines (Guidelines) and contravened s 282(1) of each of the National Energy Retail Law (ACT) (ACT Retail Law), the National Energy Retail Law (NSW) (NSW Retail Law), the National Energy Retail Law (QLD) (QLD Retail Law) and the National Energy Retail Law (SA) (SA Retail Law) between 31 October 2017 and 19 September 2018.

AGL South Australia

2. The Second Respondent (AGL SA) failed to submit, in respect of its performance in NSW and SA, information and data by the relevant due dates for:

(a) the Quarter 1 Reporting Period, which was to be submitted by 31 October 2017 and which was not finally submitted until 19 September 2018;

(b) the Quarter 2 Reporting Period, which was to be submitted by 31 January 2018 and which was not finally submitted until 19 September 2018;

(c) the Quarter 3 Reporting Period, which was to be submitted by 30 April 2018 and which was not finally submitted until 19 September 2018;

(d) the Quarter 4 Reporting Period, which was to be submitted by 31 August 2018 and which was not finally submitted until 19 September 2018;

and therefore failed to submit to the AER information and data in the manner and form (including by the dates) required by the Guidelines and contravened s 282(1) of each of the NSW Retail Law and the SA Retail Law between 31 October 2017 and 19 September 2018.

AGL Retail

3. The Third Respondent (AGL Retail) failed to submit, in respect of its performance in NSW, QLD and SA, information and data by the relevant due dates for:

(a) the Quarter 1 Reporting Period, which was to be submitted by 31 October 2017 and which was not finally submitted until 19 September 2018;

(b) the Quarter 2 Reporting Period, which was to be submitted by 31 January 2018 and which was not finally submitted until 19 September 2018;

(c) the Quarter 3 Reporting Period, which was to be submitted by 30 April 2018 and which was not finally submitted until 19 September 2018;

(d) the Quarter 4 Reporting Period, which was to be submitted by 31 August 2018 and which was not finally submitted until 19 September 2018;

and therefore failed to submit to the AER information and data in the manner and form (including by the dates) required by the Guidelines and contravened s 282(1) of each of the NSW Retail Law, the QLD Retail Law and the SA Retail Law between 31 October 2017 and 19 September 2018.

Powerdirect

4. The Fourth Respondent (Powerdirect) failed to submit, in respect of its performance in ACT, NSW, QLD and SA, information and data by the relevant due dates for:

(a) the Quarter 1 Reporting Period, which was to be submitted by 31 October 2017 and which was not finally submitted until 19 September 2018;

(b) the Quarter 2 Reporting Period, which was to be submitted by 31 January 2018 and which was not finally submitted until 19 September 2018;

(c) the Quarter 3 Reporting Period, which was to be submitted by 30 April 2018 and which was not finally submitted until 19 September 2018;

(d) the Quarter 4 Reporting Period, which was to be submitted by 31 August 2018 and which was not finally submitted until 19 September 2018;

and therefore failed to submit to the AER information and data in the manner and form (including by the dates) required by the Guidelines and contravened s 282(1) of each of the ACT Retail Law, the NSW Retail Law, the QLD Retail Law and the SA Retail Law between 31 October 2017 and 19 September 2018.

THE COURT ORDERS BY CONSENT THAT:

5. AGL Sales pay to the Commonwealth of Australia pecuniary penalties totalling $325,000 in respect of the breaches referred to in order 1 above, within 30 days.

6. AGL SA pay to the Commonwealth of Australia pecuniary penalties totalling $325,000 in respect of the breaches referred to in order 2 above, within 30 days.

7. AGL Retail pay to the Commonwealth of Australia pecuniary penalties totalling $325,000 in respect of the breaches referred to in order 3 above, within 30 days.

8. Powerdirect pay to the Commonwealth of Australia pecuniary penalties totalling $325,000 in respect of the breaches referred to in order 4 above, within 30 days.

9. AGL Sales, AGL SA, AGL Retail and Powerdirect pay a total contribution towards the AER’s costs in the amount of $100,000, within 30 days.

10. AGL Sales, AGL SA, AGL Retail and Powerdirect will be jointly and severally liable for the payment of the costs referred to in order 9.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ANDERSON J:

Introduction

1 The Applicant (AER) is established by s 44AE of the Competition and Consumer Act 2010 (Cth) (CCA). The AER is responsible for reporting on information and data submitted by energy retailers, including the Respondents, about their performance and activities in the retail energy market. The AER uses that information and data to influence stakeholders about the effectiveness of the operation of the retail energy market.

2 The Respondents are four companies, namely AGL Sales Pty Limited (AGL Sales), AGL South Australia Pty Limited (AGL SA), AGL Retail Energy Pty Limited (AGL Retail) and Powerdirect Pty Ltd (Powerdirect).

3 Certain of the AER’s functions are designated in various pieces of state legislation. The “National Energy Retail Law” (Retail Law) is contained in the Schedule to the National Energy Retail Law (South Australia) Act 2011 (SA) (SA Retail Law), and applied relevantly:

(1) in South Australia, pursuant to s 4(3) of the SA Retail Law;

(2) in New South Wales, pursuant to s 4 of the National Energy Retail Law (Adoption) Act 2012 (NSW) (NSW Retail Law);

(3) in Queensland, pursuant to s 4 of the National Energy Retail Law (Queensland) Act 2014 (Qld) (QLD Retail Law); and

(4) in the Australian Capital Territory, pursuant to s 6 of the National Energy Retail Law (ACT) Act 2012 (ACT) (ACT Retail Law).

4 The AER’s functions include monitoring compliance of regulated entities with the requirements of the Retail Law and associated regulations and rules: s 272 of the Retail Law. The rules are the “National Energy Retail Rules” which have force under s 15 of the Retail Law.

5 In the 2017/2018 year, the Respondents were required under s 282(1) of the Retail Law to submit to the AER information and data about the performance and activities in the manner and form required by the AER Performance Reporting Procedures and Guidelines (Guidelines). The Guidelines are made under s 286 of the Retail Law.

6 AER, by its Concise Statement dated 11 November 2019, alleged that the Respondents submitted information and data to the AER that was inaccurate and late, and prepared without due care and skill. The AER alleged that this conduct contravened s 282(1) of the Retail Law.

7 Each Respondent supplies gas and/or electricity and is a “retailer” and “regulated entity” within the meaning of s 2(1) of the Retail Law. The Respondents are wholly-owned subsidiaries of AGL Energy Limited (AGL). AGL had over 3.5 million consumer customer accounts in 2017/2018 and is one of the largest participants in the retail energy market.

8 For the purpose of this proceeding only, the Respondents have made the admissions in a Statement of Agreed Facts and Admissions (SOAFA) pursuant to s 191 of the Evidence Act 1995 (Cth). The SOAFA is included as Annexure A to these Reasons for Judgment.

9 The AER and the Respondents have agreed to resolve the proceeding and, in accordance with that agreed position, have agreed upon the SOAFA, the joint submissions and the proposed consent orders set out in Annexure B to these Reasons for Judgment (Proposed Orders).

10 The parties submit that the Proposed Orders are appropriate and that a penalty of $325,000 for each of the Respondents (totalling $1.3 million) is appropriate to:

(1) evidence the Court’s disapproval of the Respondents’ conduct;

(2) deter the Respondents from repeating the conduct;

(3) operate as a strong deterrent to others from contravening the Retail Law; and

(4) reflect the totality of the contravening conduct.

11 For the following reasons, a total penalty of $1.3 million is appropriate in the circumstances of this case. I have made the Proposed Orders sought by the parties. These are my reasons for doing so.

The Relevant Statutory Provisions

12 I have set out above how the Retail Law applies in each relevant jurisdiction and the statutory provision which created the AER. AER administers the Retail Law.

13 Section 282(1) of the Retail Law provides:

A regulated entity must submit to the AER, in the manner and form (including by the date or dates) required by the AER Performance Reporting Procedures and Guidelines, information and data relating to –

(a) the performance of the entity against the hardship program indicators and distributor service standards; and

(b) the activities of the entity in relation to any other matters that are required by the Rules to be included in a retail market performance report.

14 Section 282(1) is a civil penalty provision pursuant to s 4 of the Retail Law.

15 The reference in s 282(1)(b) of the Retail Law to the “Rules” is a reference to the National Energy Retail Rules (Rules), made pursuant to Part 10 of the Retail Law.

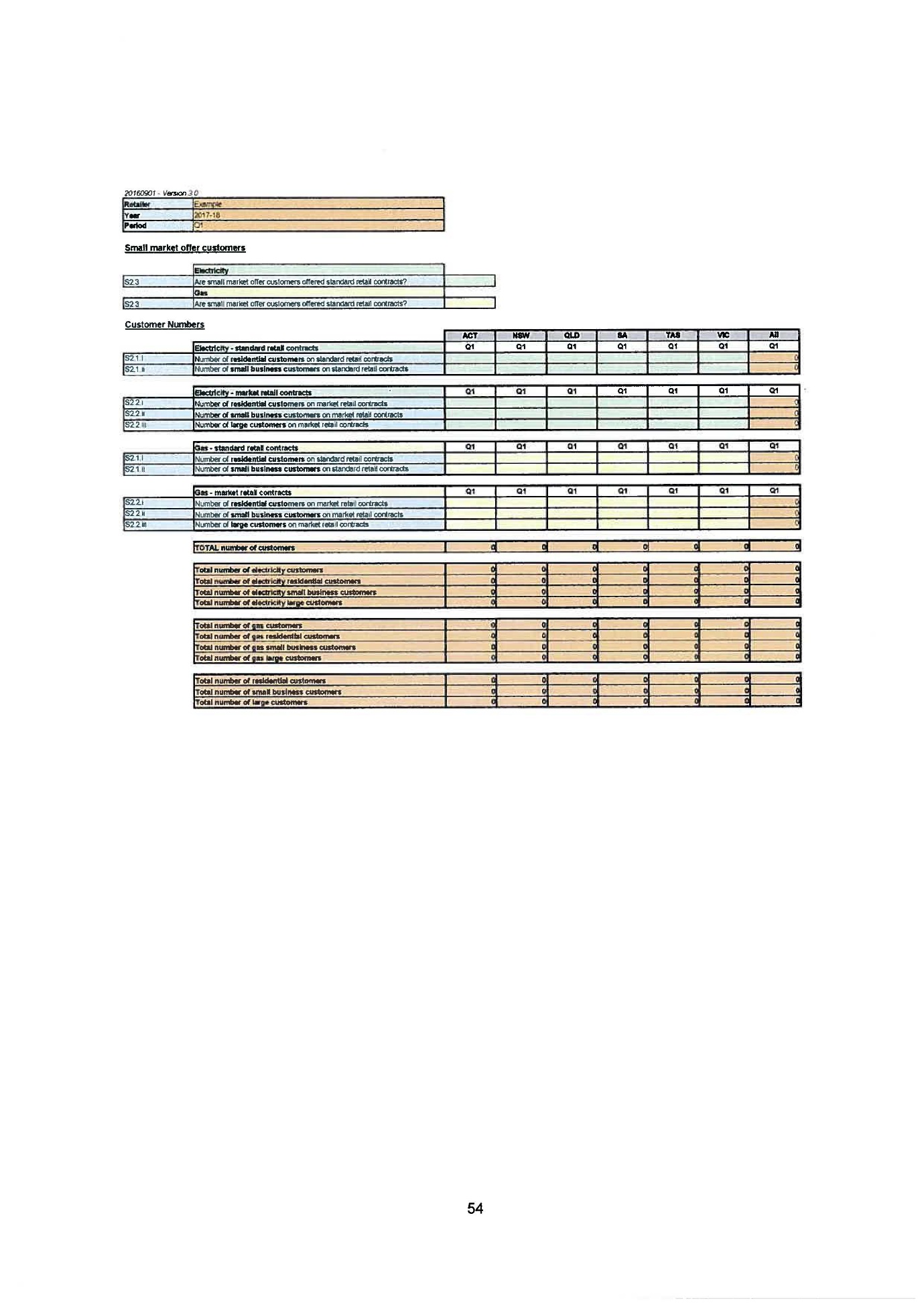

16 Pursuant to r 166(1) of the Rules (as applicable at the relevant time):

A retail market overview in a retail market performance report must include:

(a) …

(b) an indication of the number of customers of each retailer; and

(c) an indication of the total number of customers with standard retail contracts and market retail contracts, respectively, and the numbers by reference to each retailer …

17 Pursuant to r 167(1) of the Rules (as applicable at the relevant time):

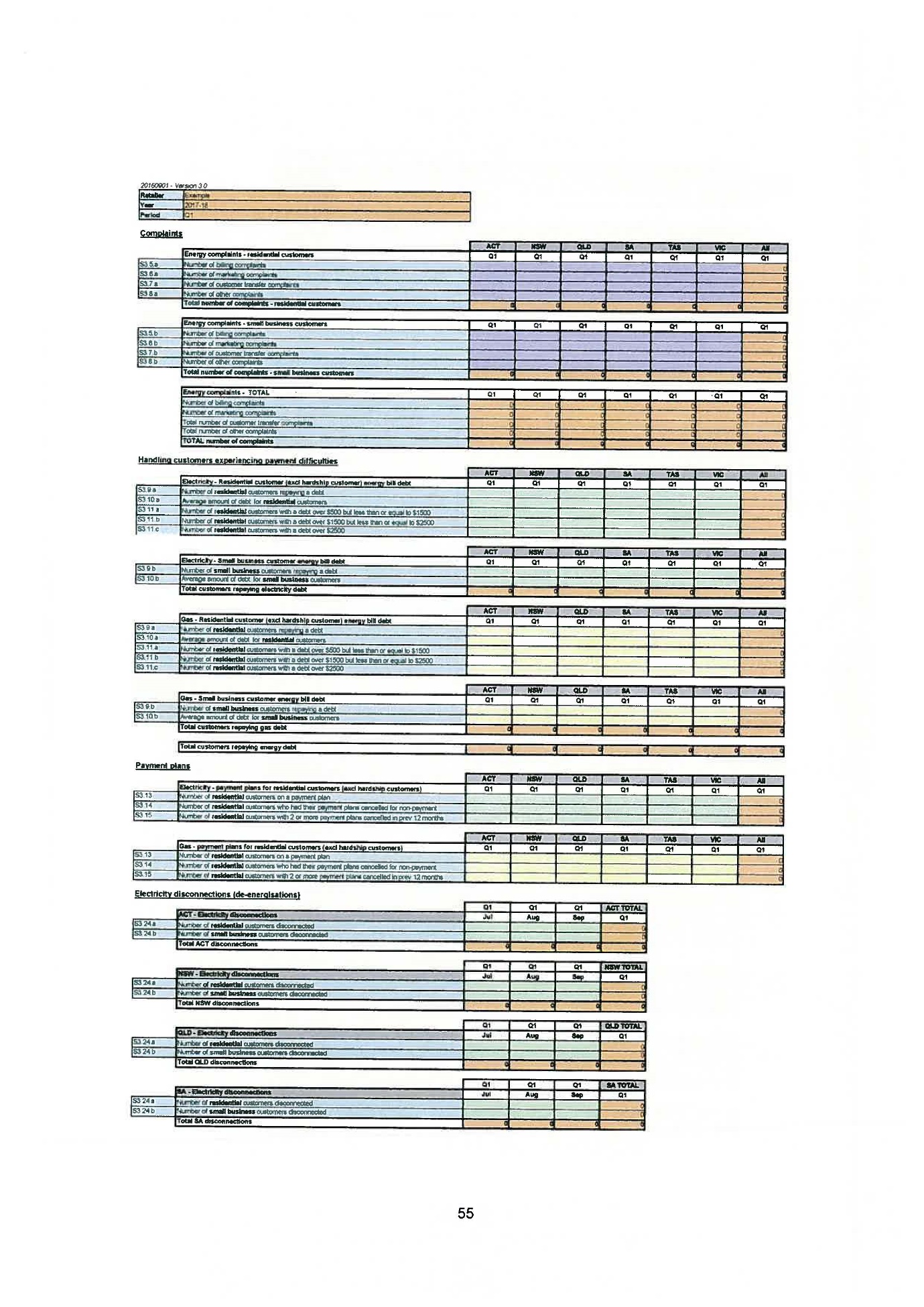

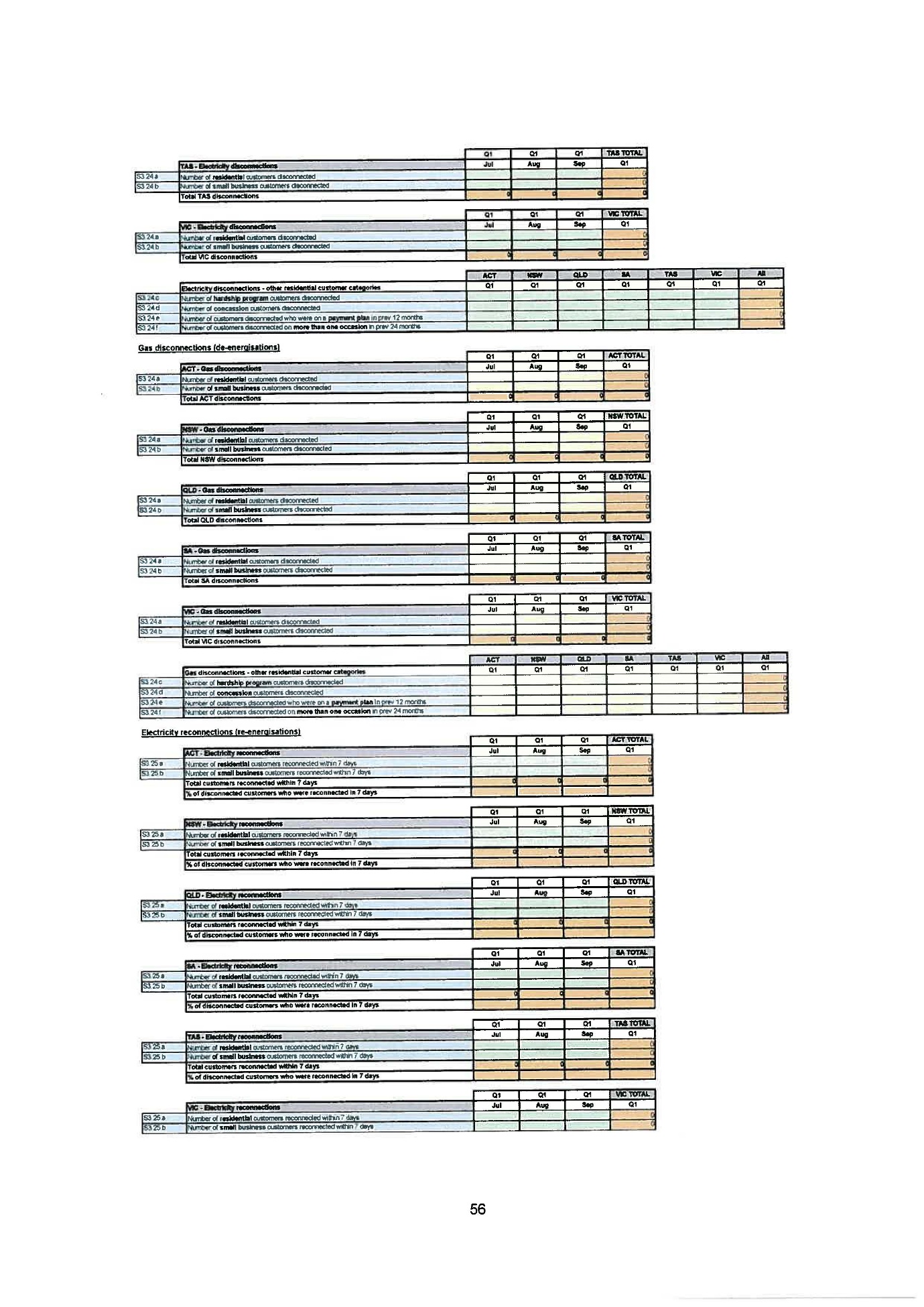

A retail market activities report in a retail market performance report must include:

(a) customer service and customer complaints;

(b) the handling of customers experiencing payment difficulties (distinguishing hardship customers and other residential customers experiencing payment difficulties);

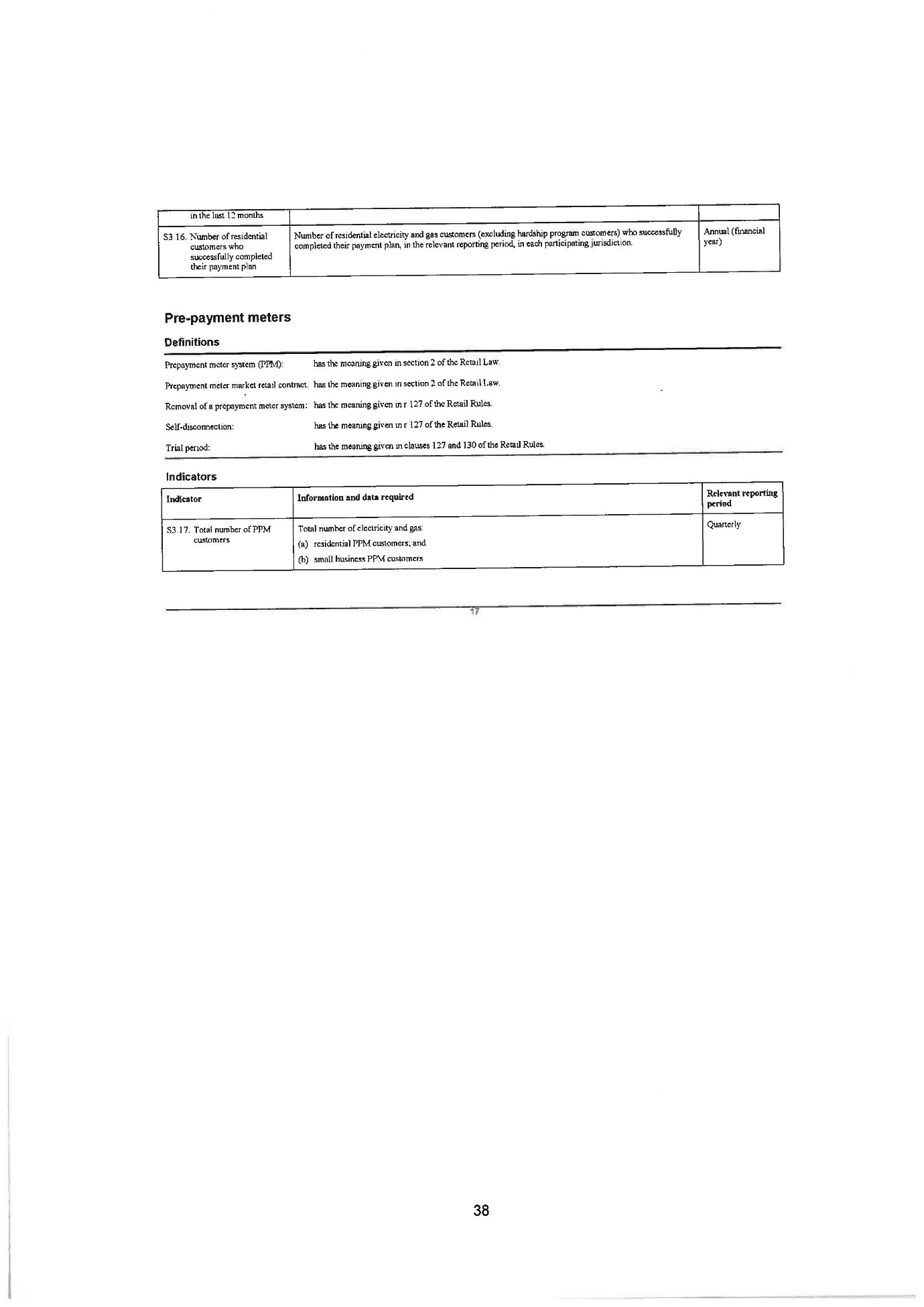

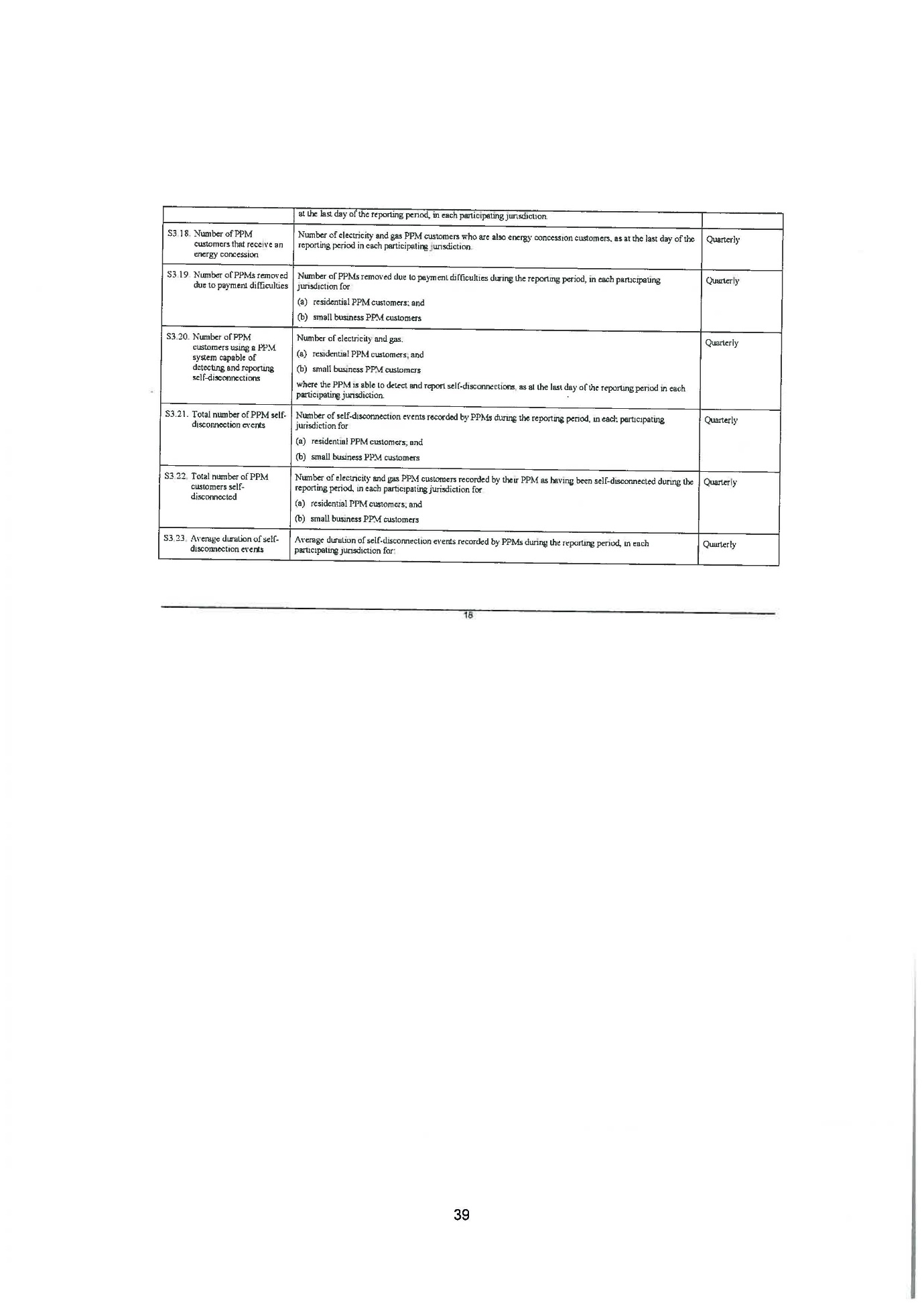

(c) the provision of prepayment meter systems to customers, including (but not limited to) the total number of customers using prepayment meters, self-disconnections and numbers of prepayment meters removed due to customer payment difficulties;

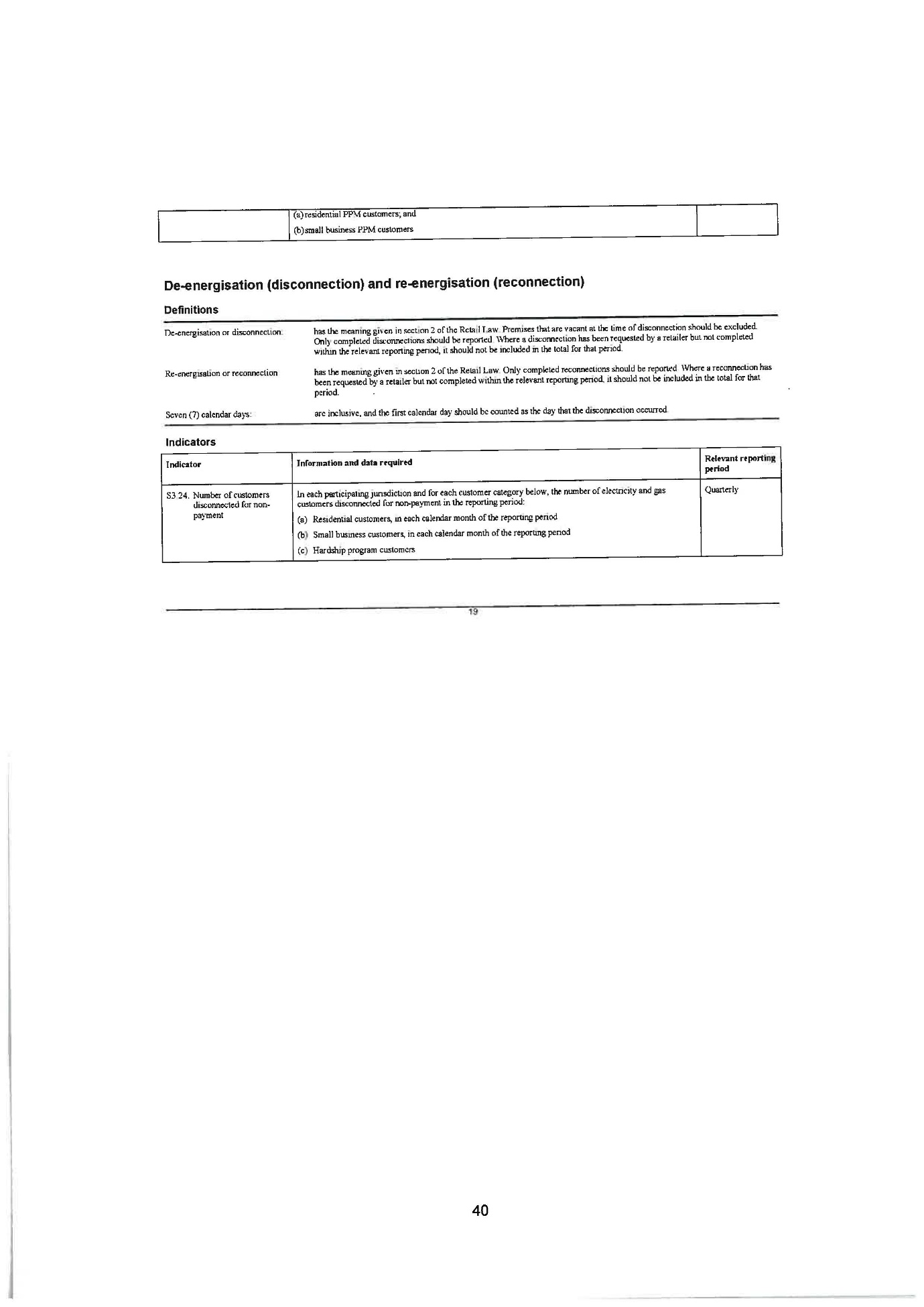

(d) de-energisation of premises for reasons of non-payment (distinguishing hardship customers and other residential customers on payment plans);

(e) re-energisation of premises referred to in paragraph (d);

(f) concessions for customers where retailers administer the delivery of concessions to customers;

(g) the number and aggregate value of security deposits held by each retailer as at 30 June each year.

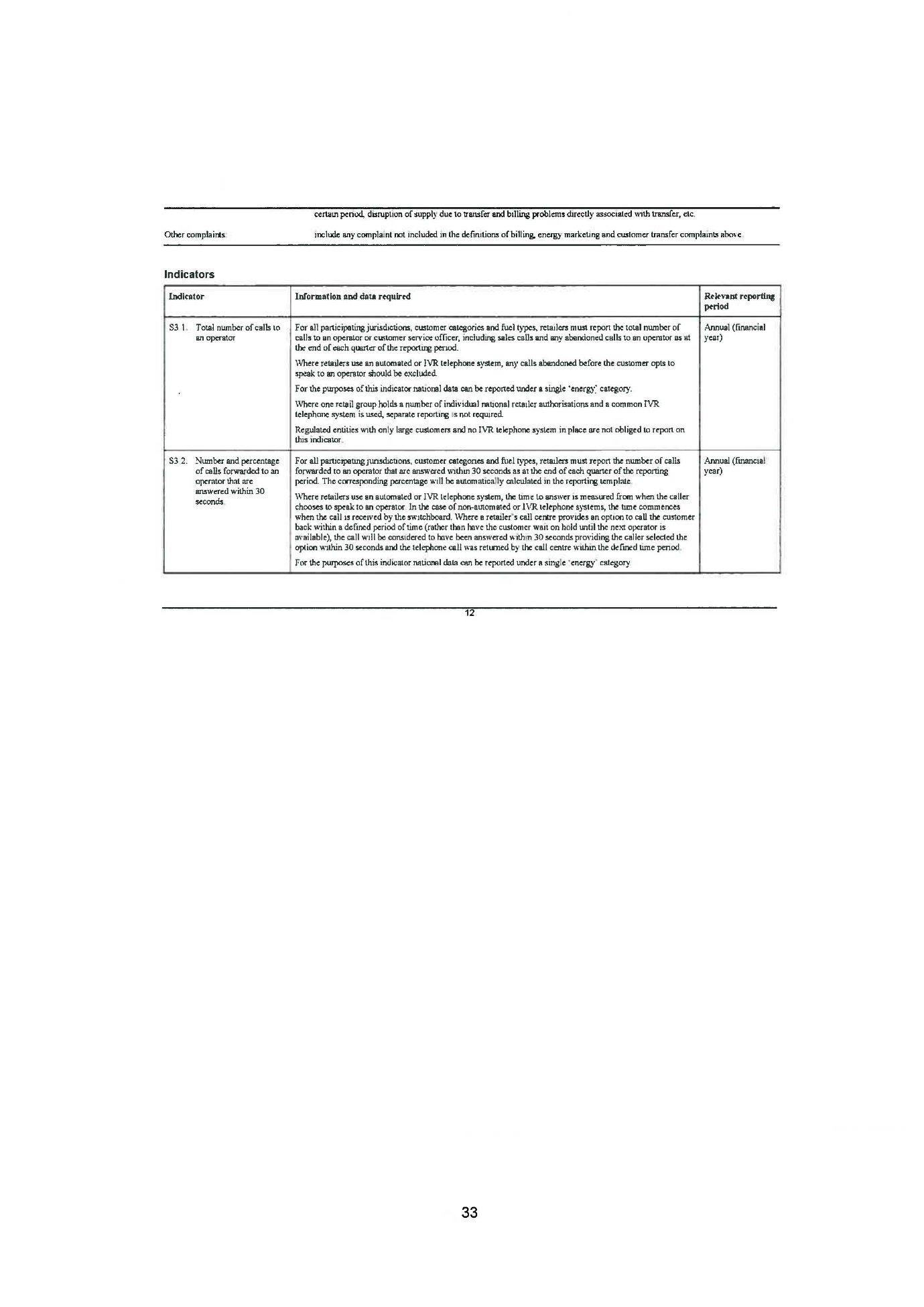

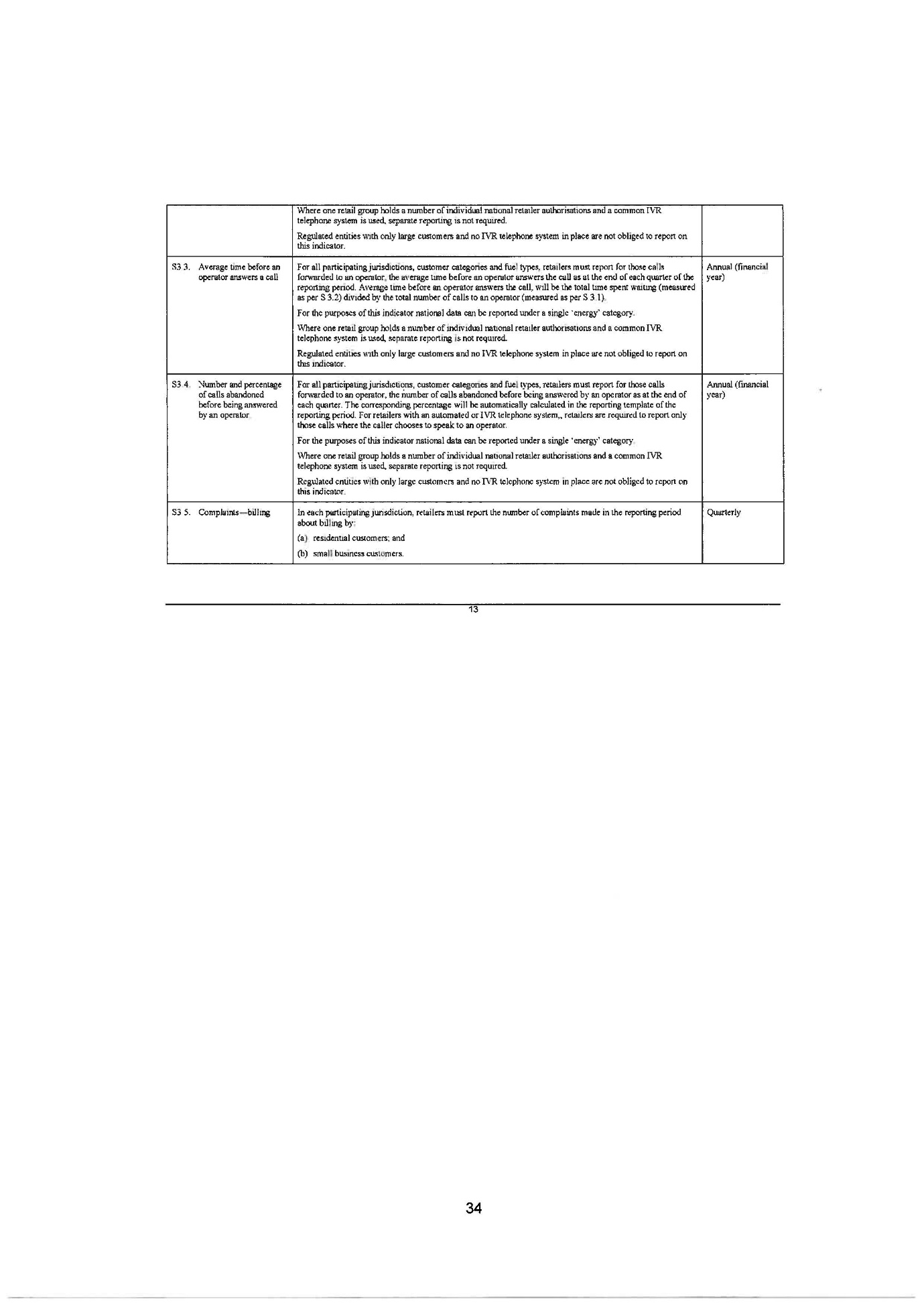

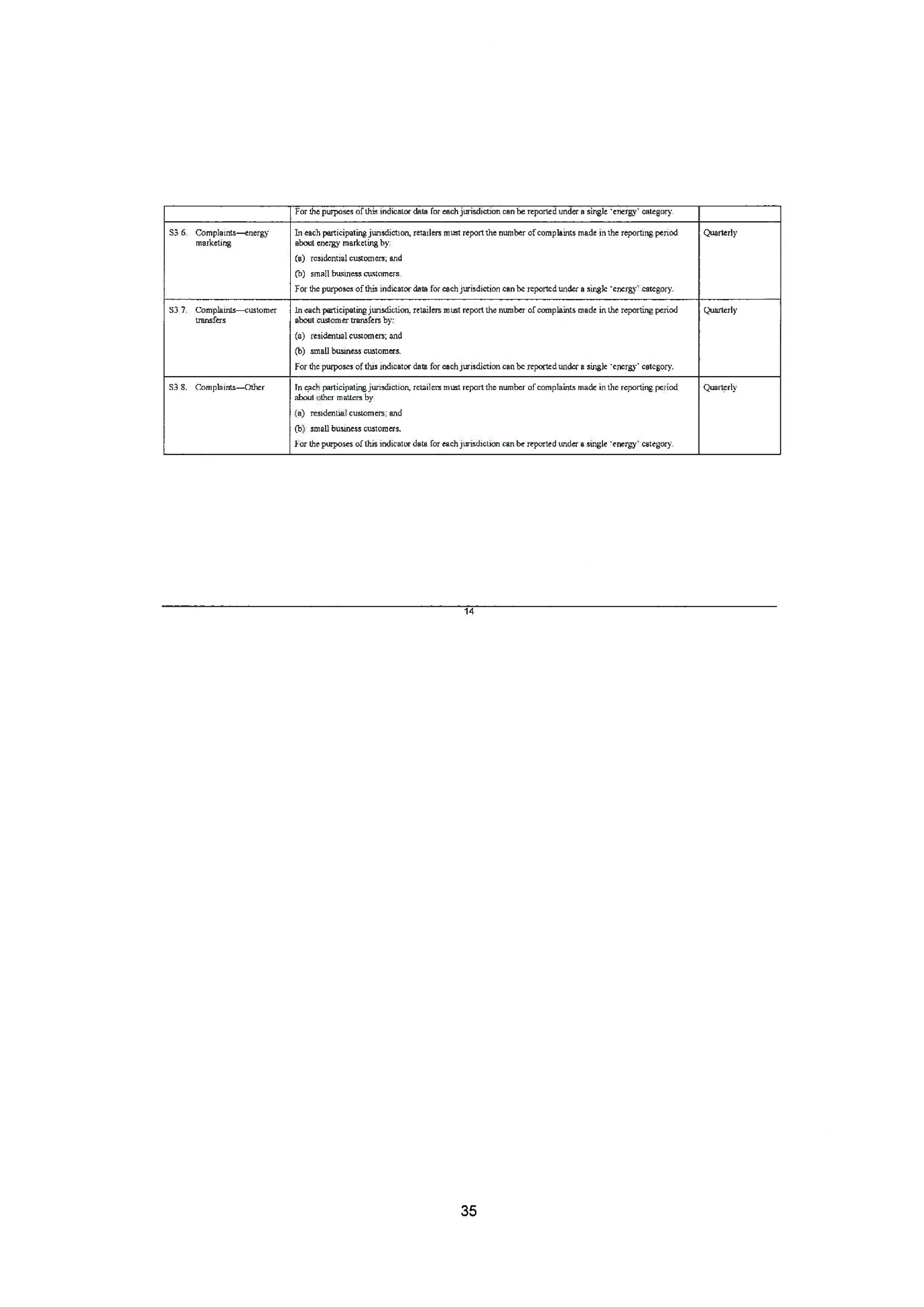

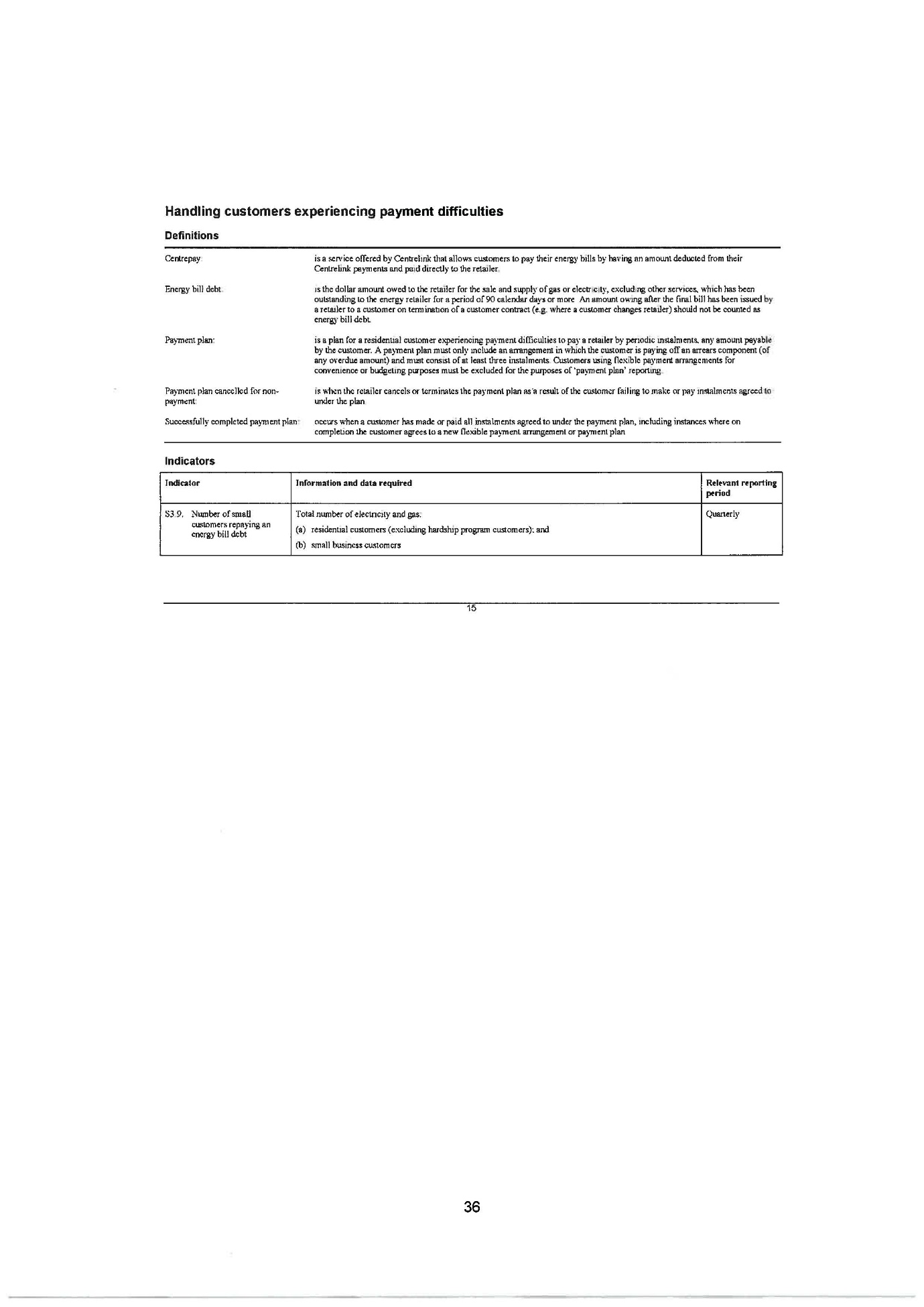

The Guidelines

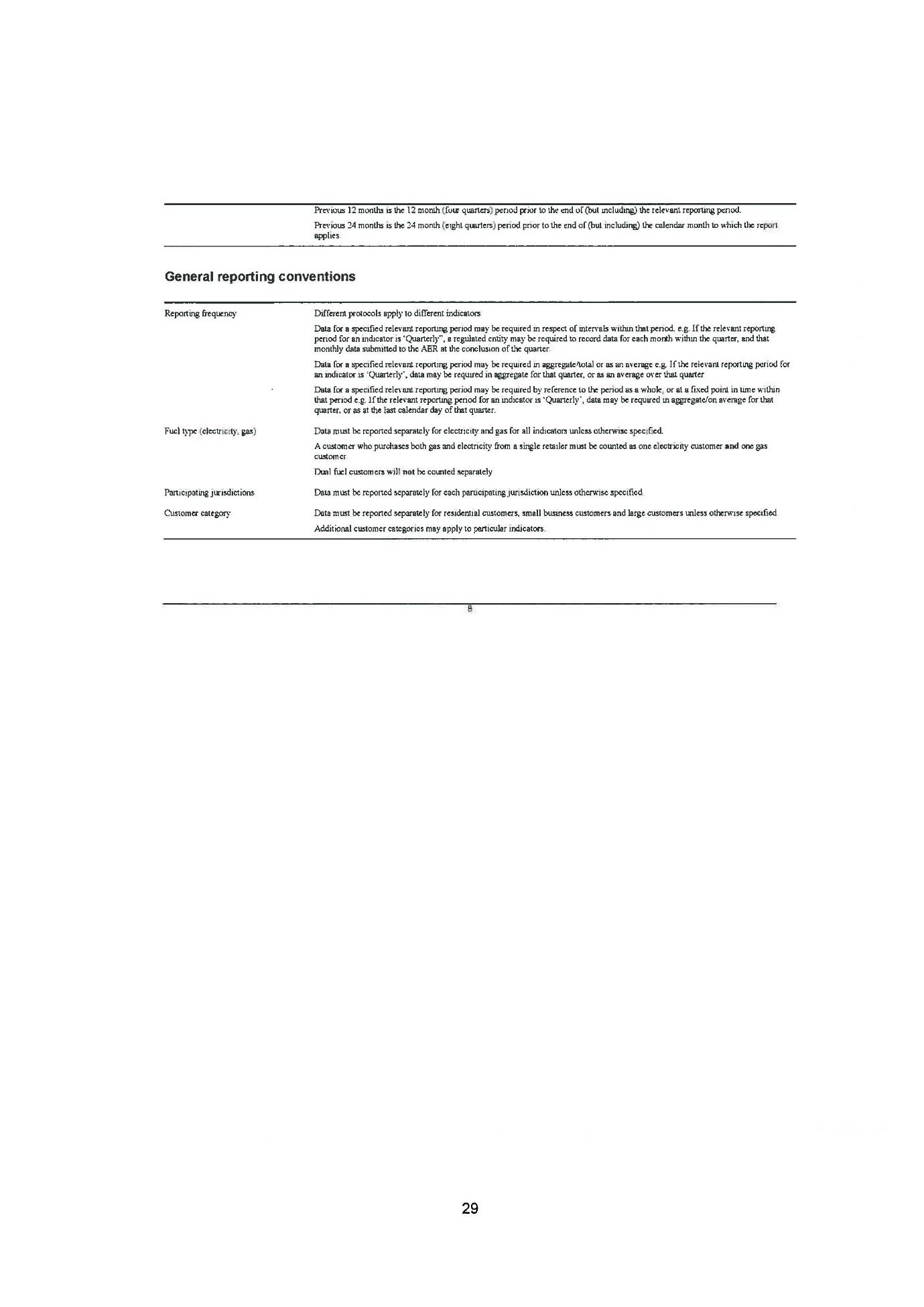

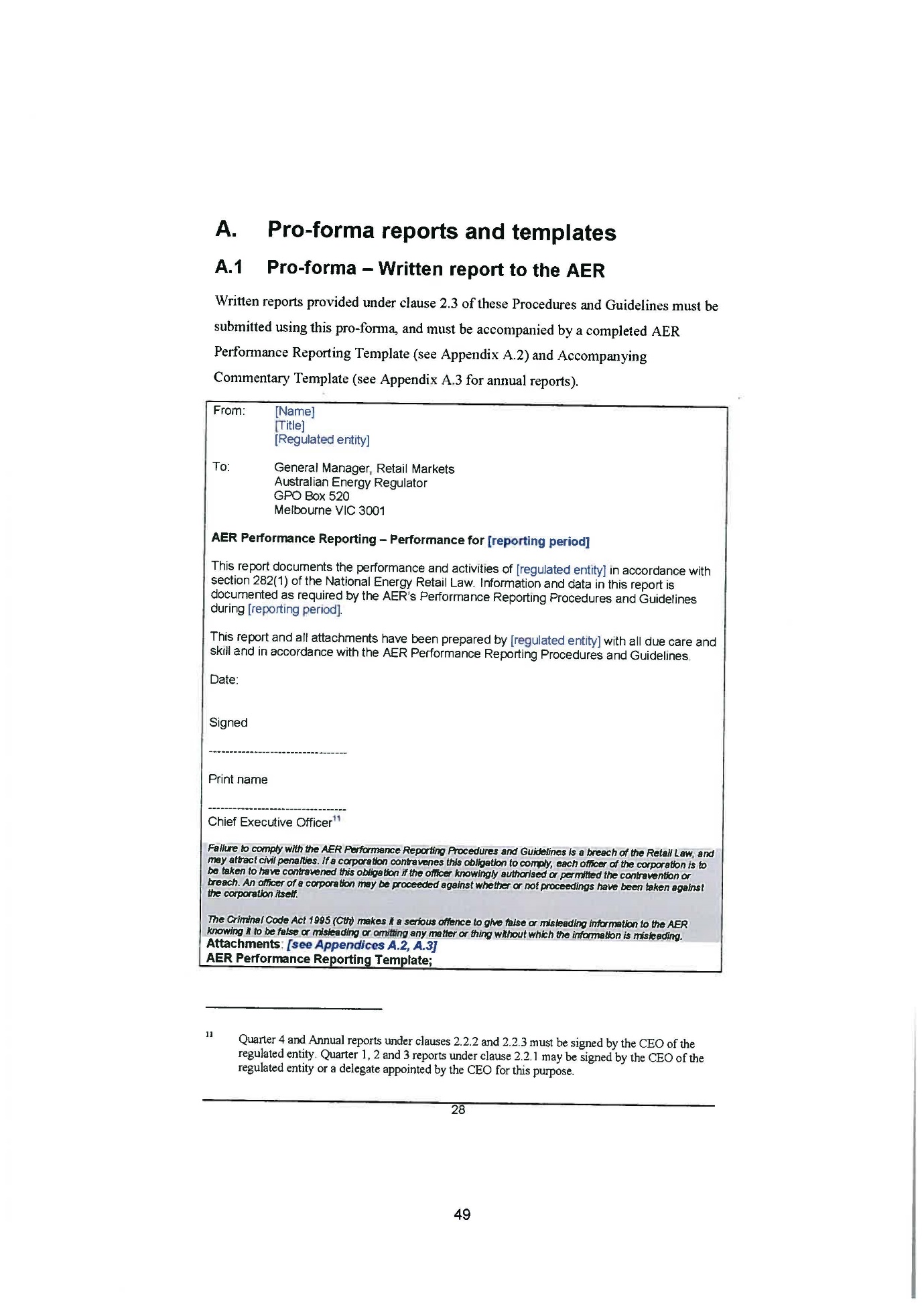

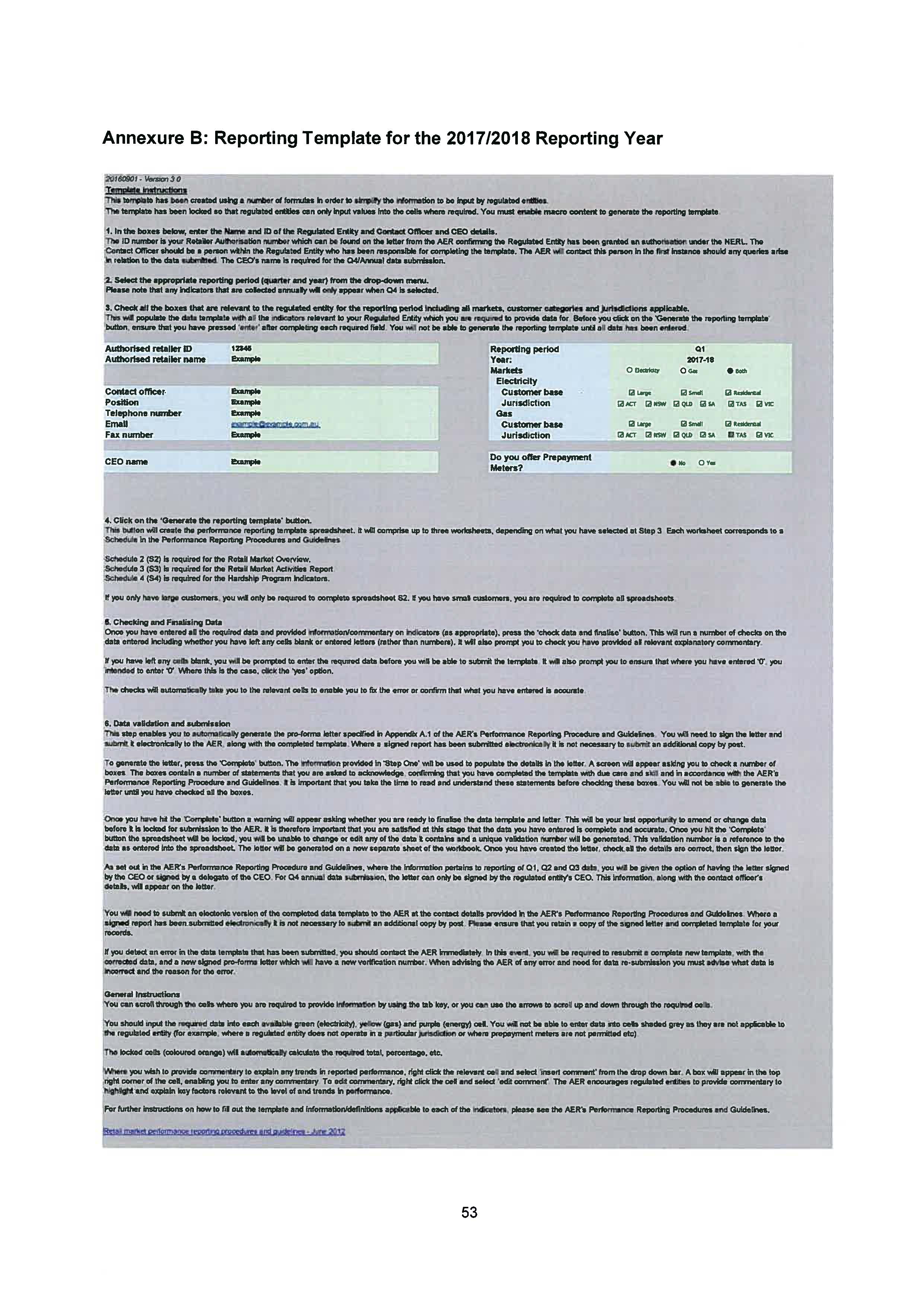

18 The Guidelines are contained in a document made by the AER under s 286 of the Retail Law. During the period 1 July 2017 to 30 June 2018 (the 2017/2018 Reporting Year), the relevant version of the Guidelines was titled “AER (Retail Law) Performance Reporting Procedures and Guidelines, June 2012, Version 2”.

19 The stated purpose of those Guidelines was to:

… set out the manner and form in which regulated entities must submit information and data to the AER relating to their performance under the [Retail Law] and [Rules], including the dates by which it must be submitted.

(Cl 1.1.1 of the Guidelines.)

20 The Guidelines relevantly provide that:

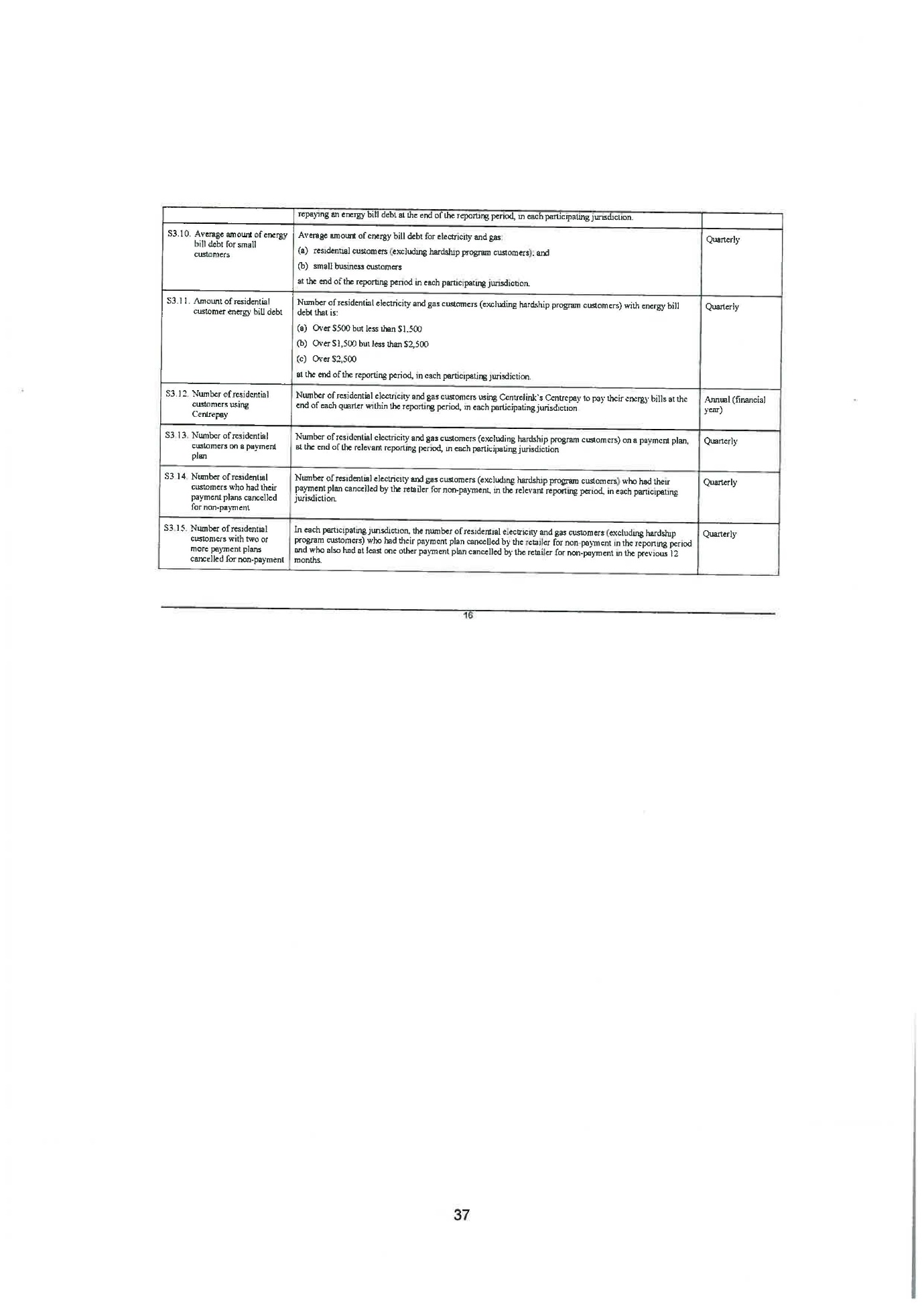

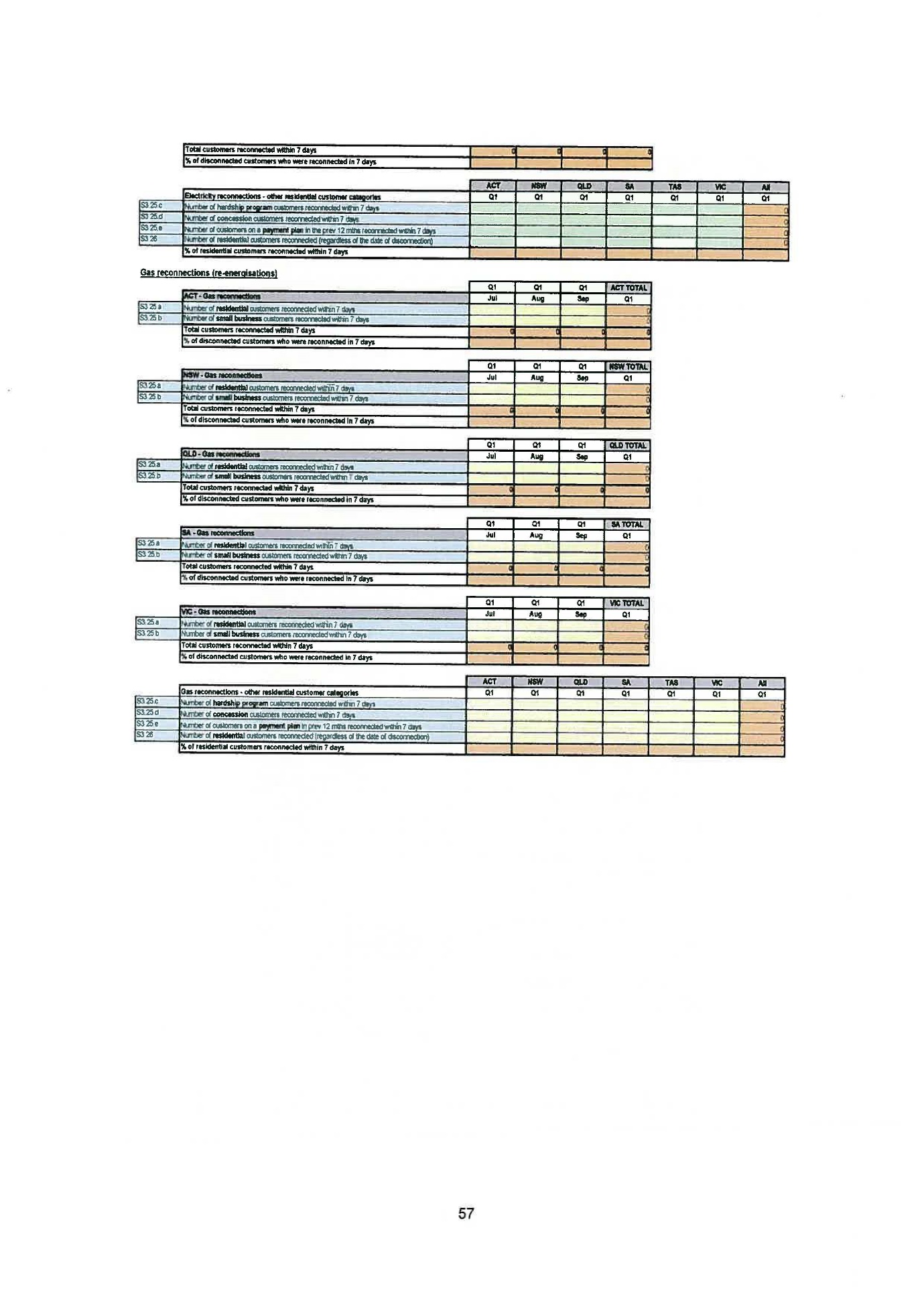

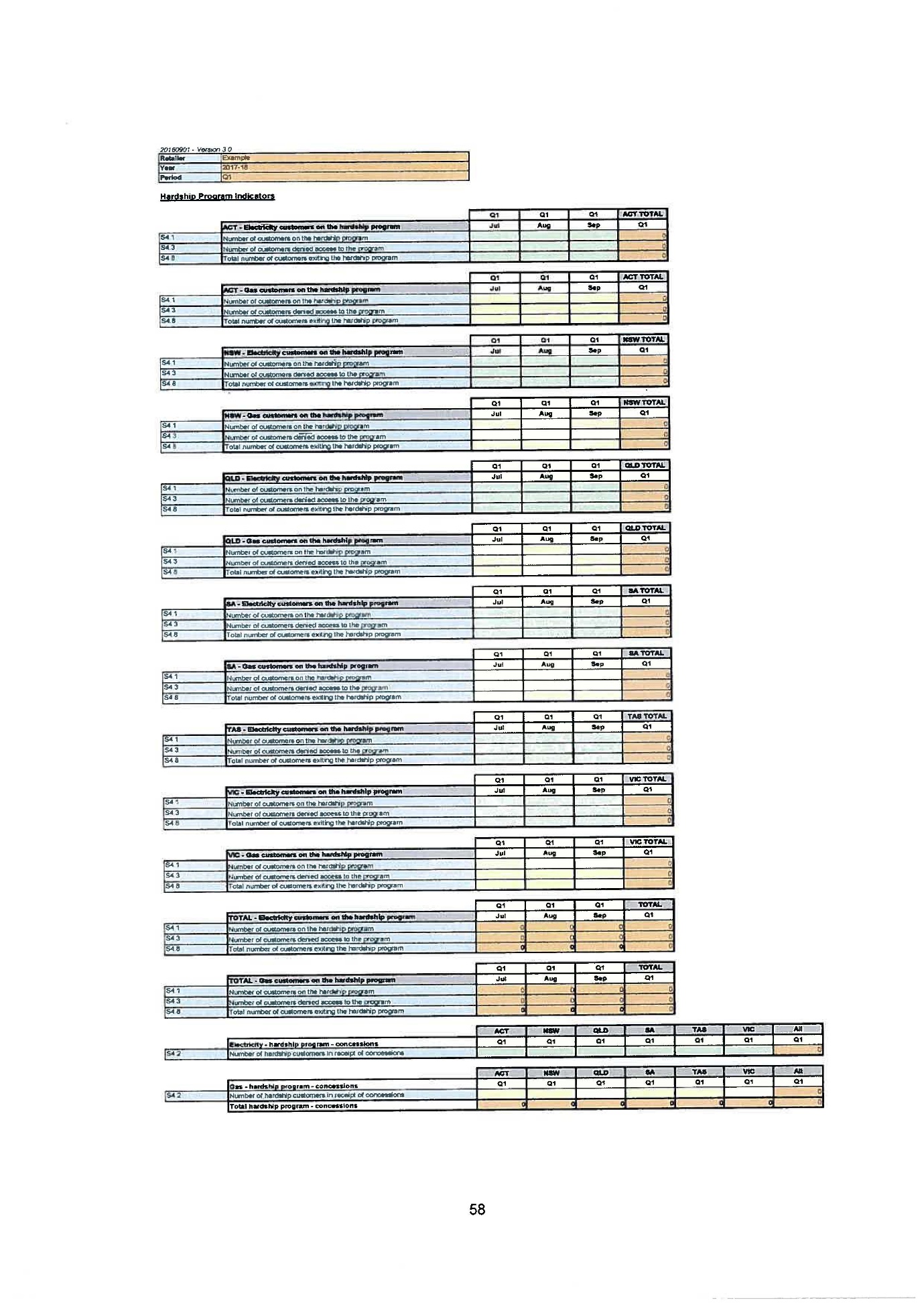

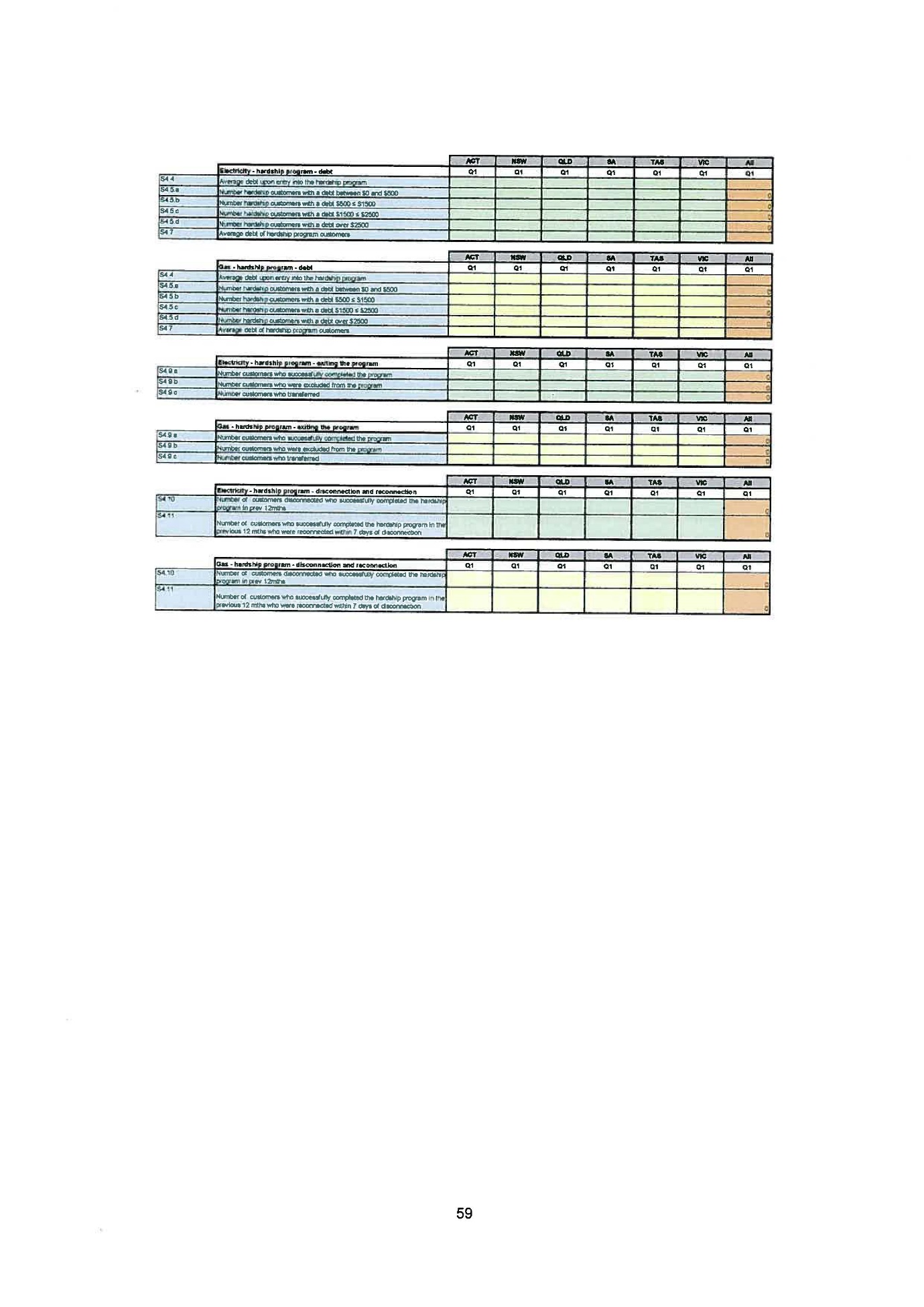

(1) the information and data that is required to be submitted to the AER is set out in the schedules to the Guidelines: Guidelines, cl 2.1.5;

(2) the report for the 1 July to 30 September quarter is to be submitted by 31 October, the report for the 1 October to 31 December quarter is to be submitted by 31 January, and the report for the 1 January to 31 March quarter is to be submitted by 30 April: Guidelines, cl 2.2.1;

(3) the report for 1 April to 30 June and the annual report are to be submitted by 31 August: Guidelines, cl 2.2.2;

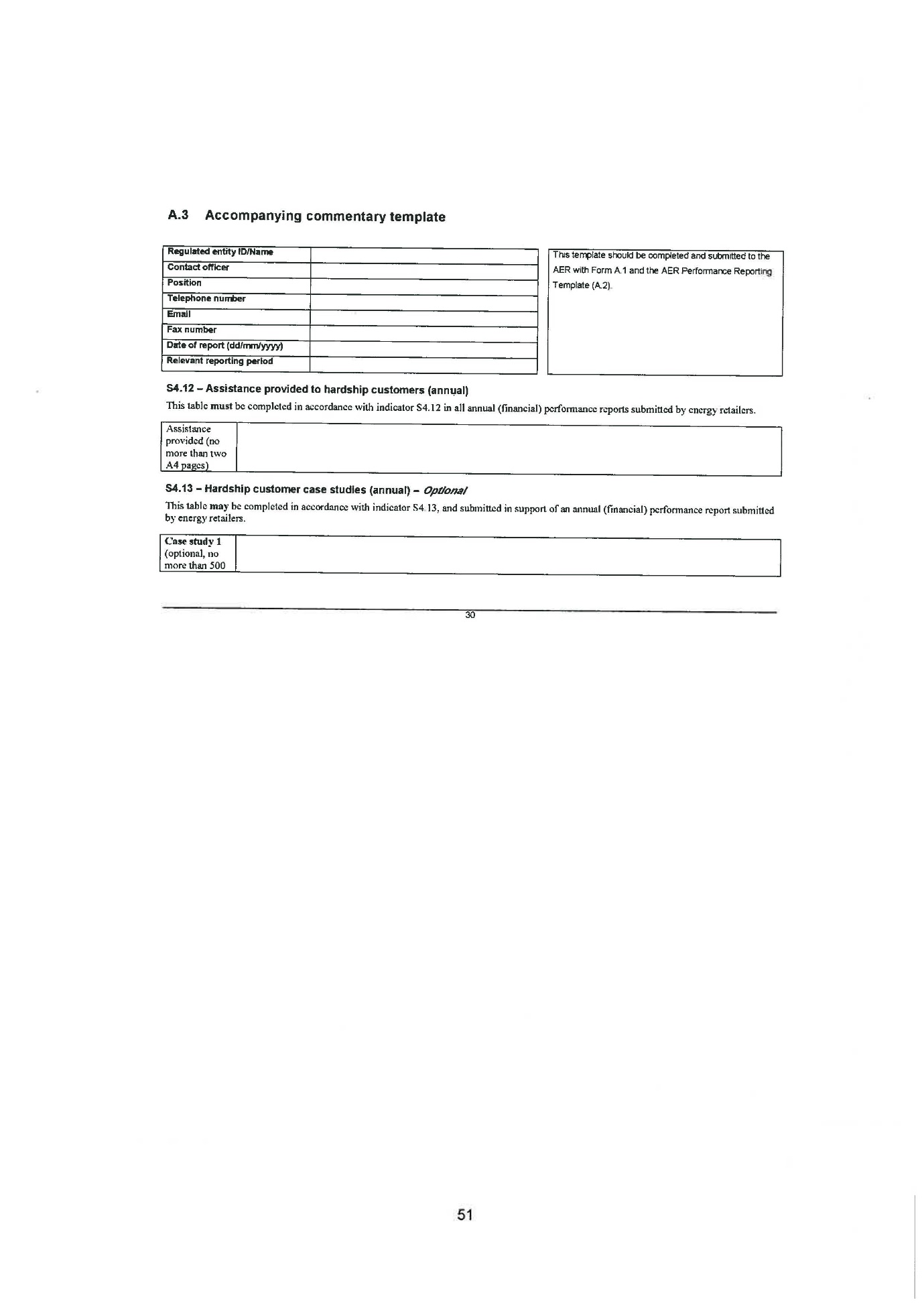

(4) reports must be prepared using the pro-forma in Appendix A.1, must be accompanied by a completed AER Performance Reporting Template (Appendix A.2) and must be submitted electronically: Guidelines, cl 2.3.1.

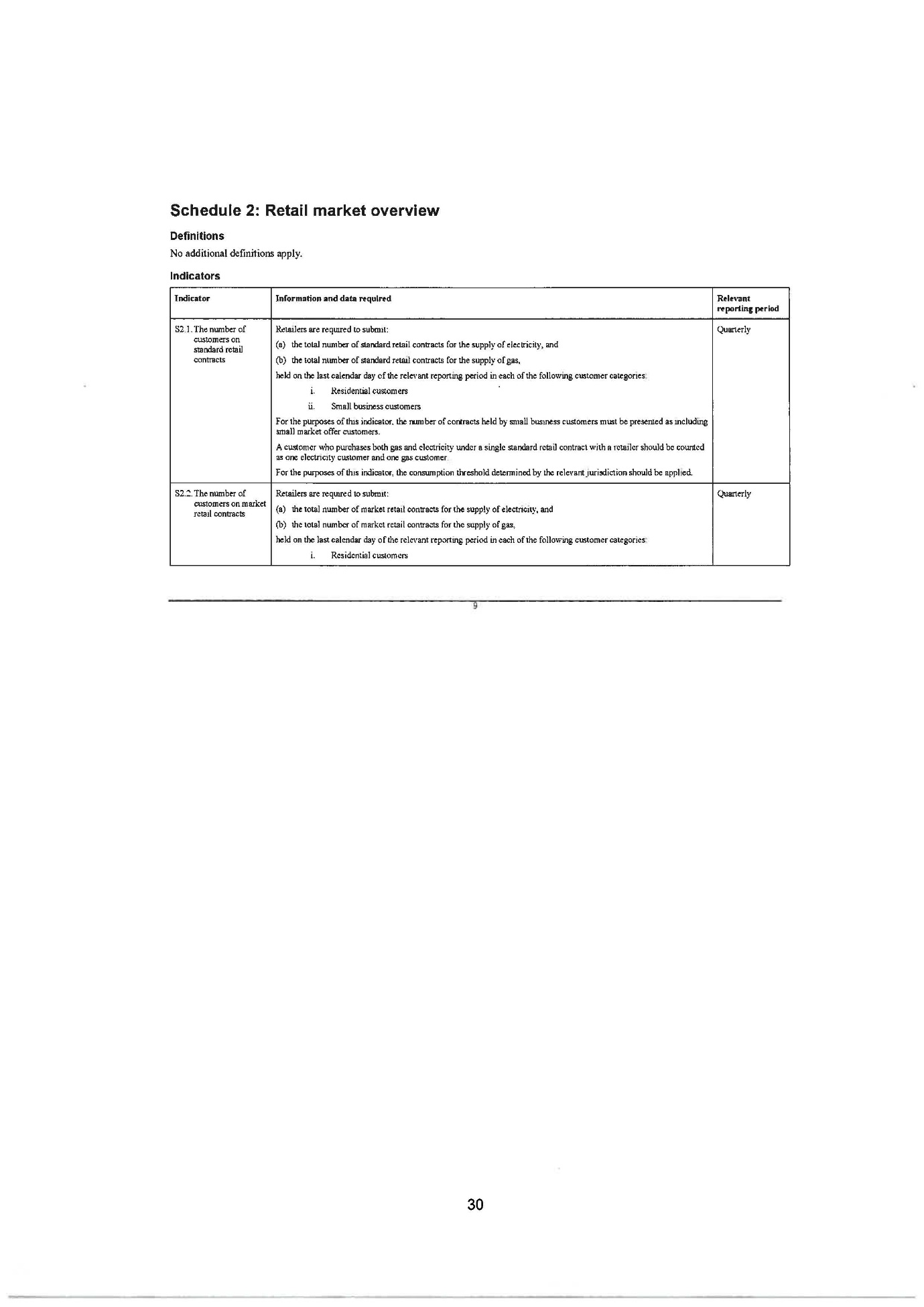

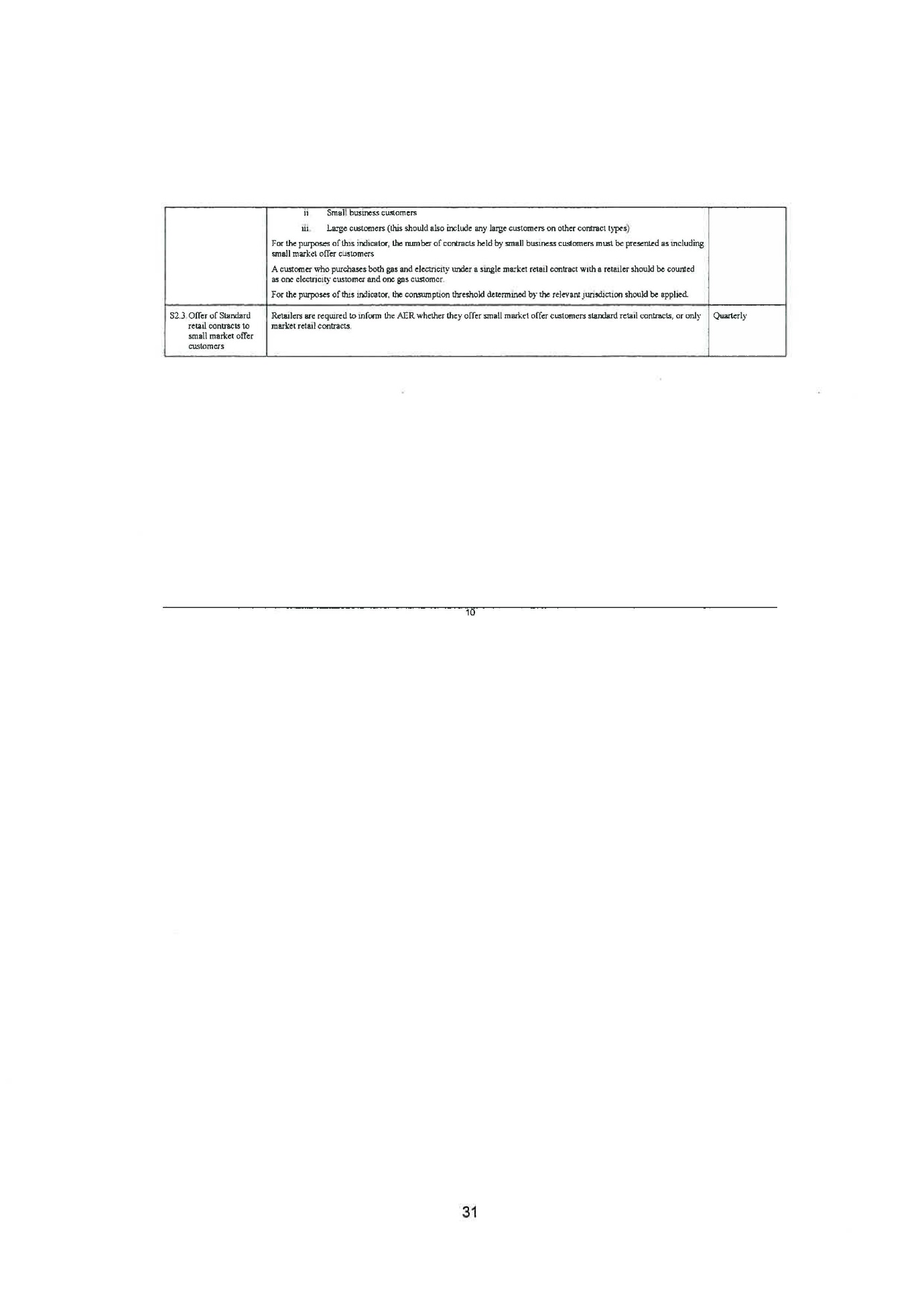

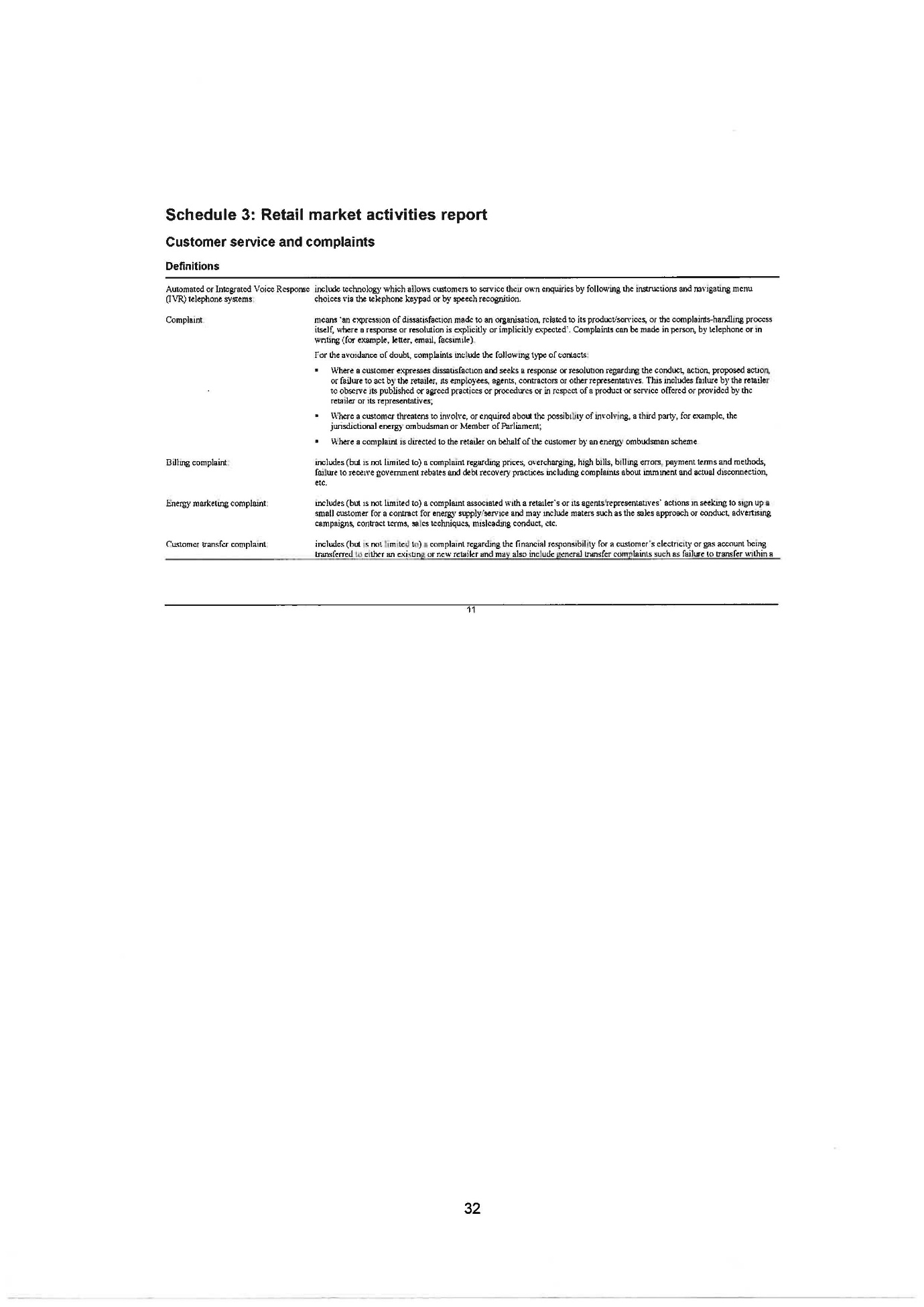

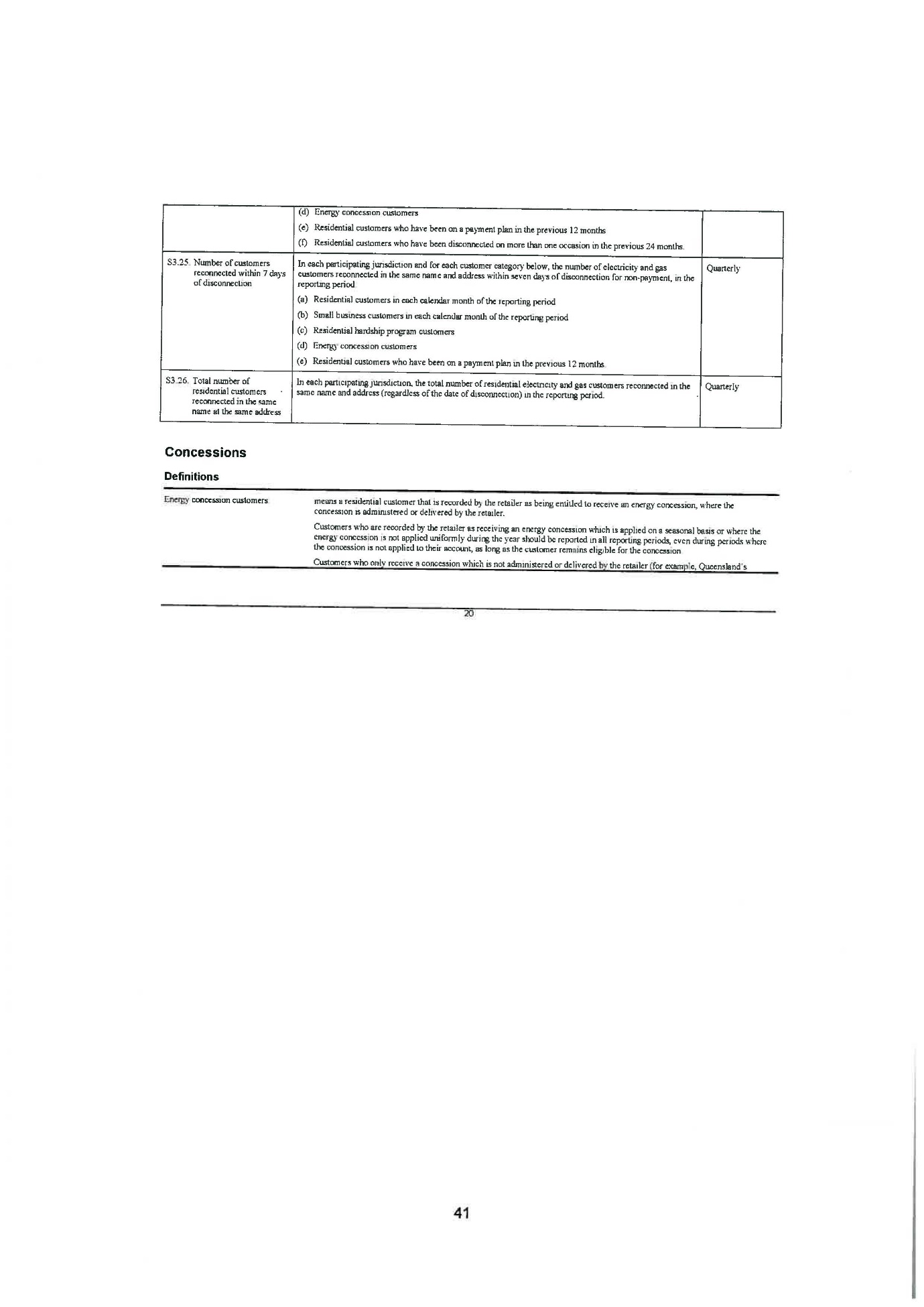

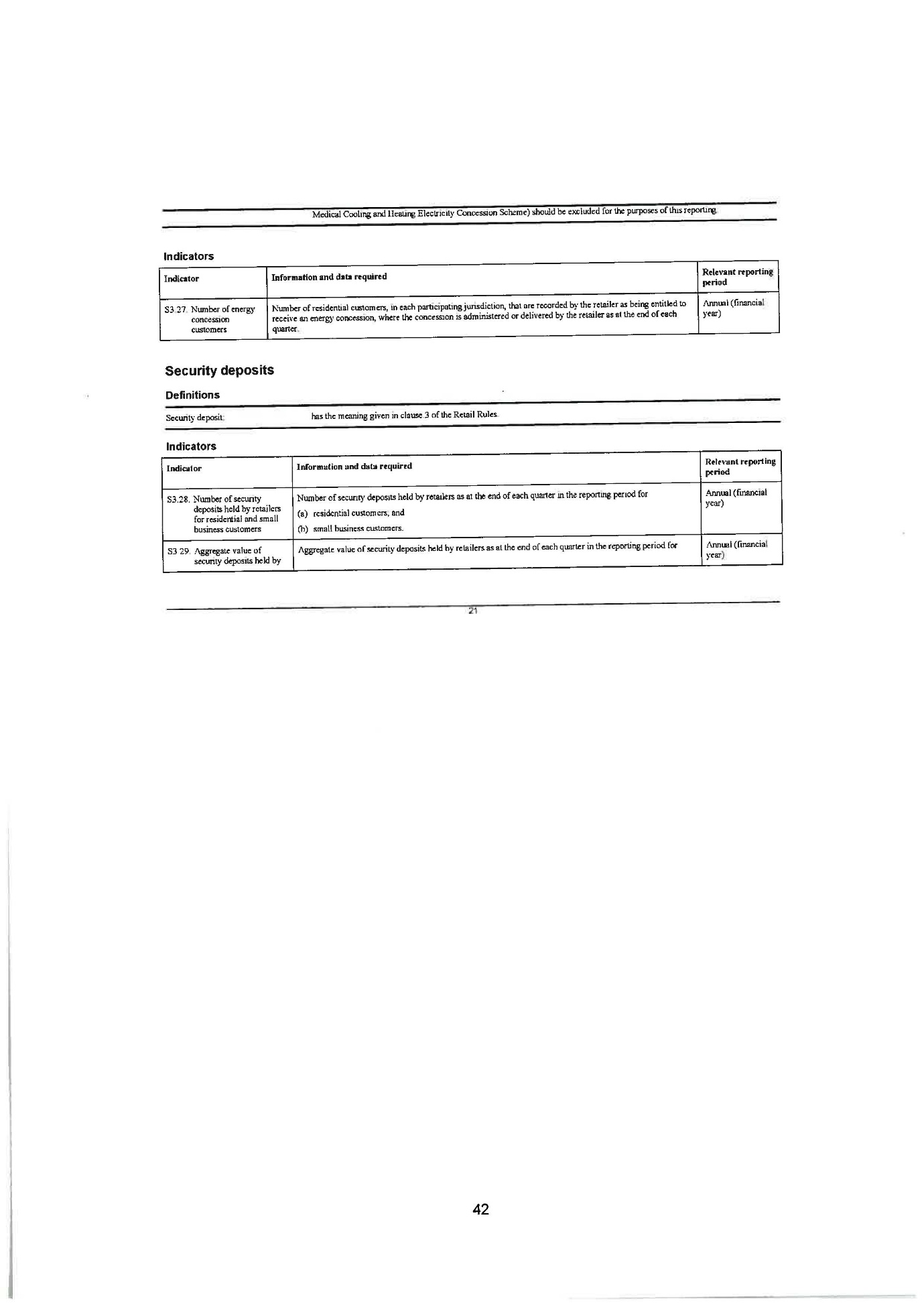

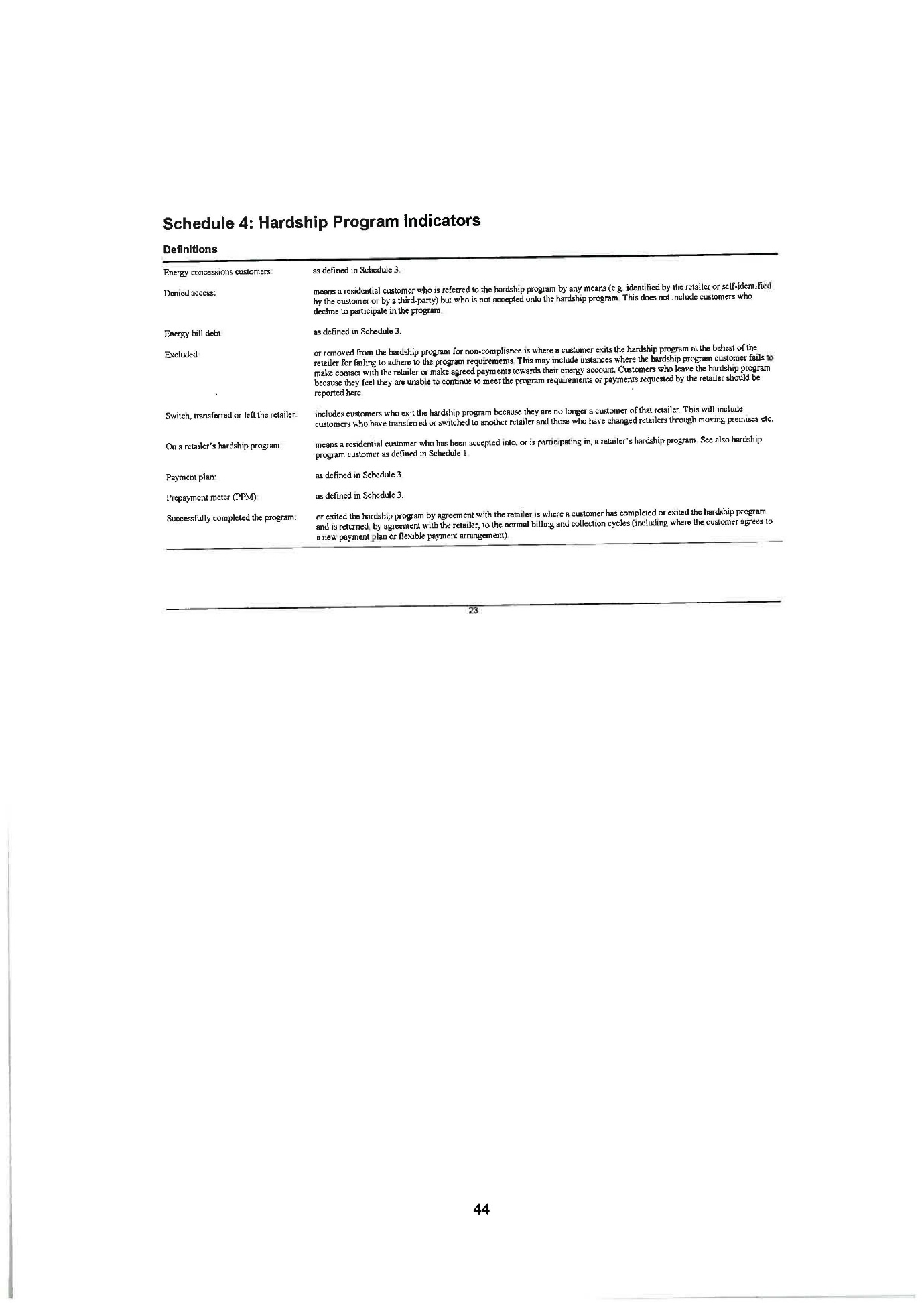

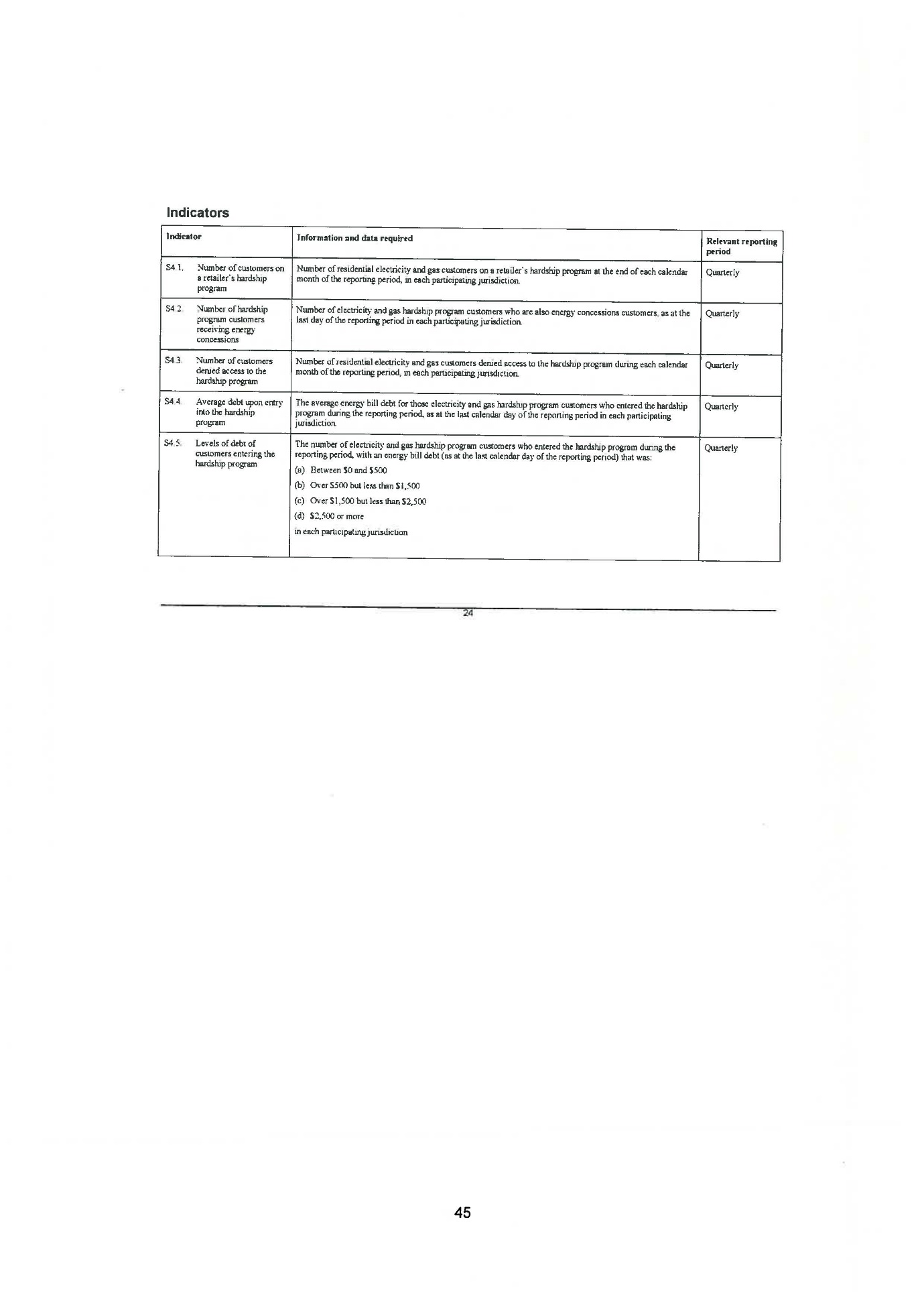

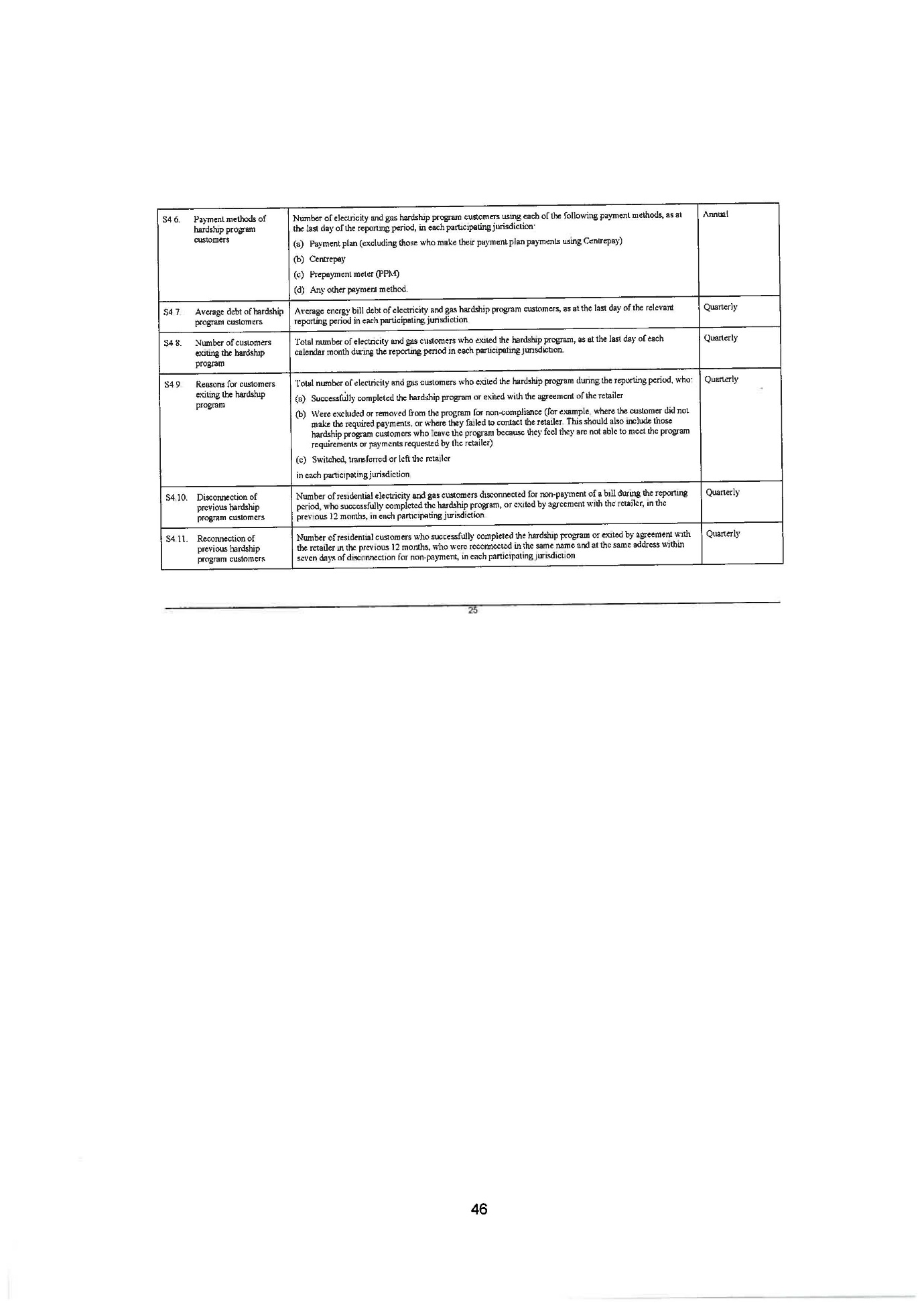

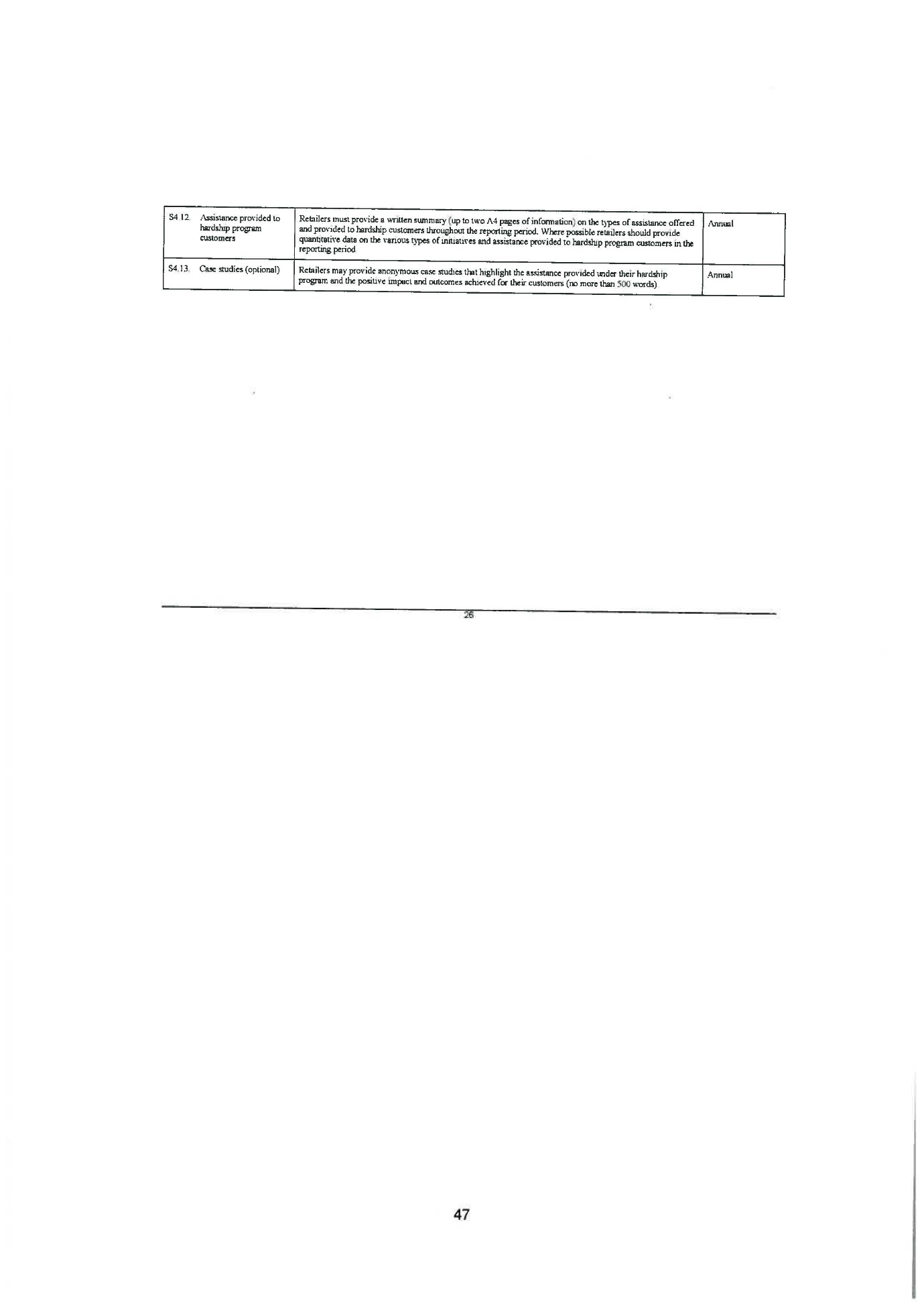

21 Schedule 2 of the Guidelines relates to a “Retail market overview”, Schedule 3 of the Guidelines relates to a “Retail market activities report” and Schedule 4 of the Guidelines relates to “Hardship program indicators”. Each Schedule contains a table setting out a series of indicators, the information and data required for each indicator and the relevant reporting period.

The Conduct

22 The parties jointly submit that, by reason of the matters set out in the SOAFA (Annexure A to the Reasons for Judgment), the Court should be satisfied that the Respondents have contravened s 282(1) of the Retail Law by the late submission of information and data referred to in the SOAFA. A summary of the relevant conduct is as follows.

AGL Sales

23 AGL Sales admits that it failed to submit, in respect of its performance in ACT, NSW, QLD and SA, information and data by the relevant due dates for:

(1) the Quarter 1 reporting period, 1 July 2017 to 30 September 2017 (Q1 Reporting Period), which was to be submitted by 31 October 2017 and which was not finally submitted until 19 September 2018;

(2) the Quarter 2 reporting period, 1 October 2017 to 31 December 2017 (Q2 Reporting Period), which was to be submitted by 31 January 2018 and which was not finally submitted until 19 September 2018;

(3) the Quarter 3 reporting period, 1 January 2018 to 31 March 2018 (Q3 Reporting Period), which was to be submitted by 30 April 2018 and which was not finally submitted until 19 September 2018;

(4) the Quarter 4 reporting period, 1 April 2018 to 30 June 2018 (Q4 Reporting Period), which was to be submitted by 31 August 2018 and which was not finally submitted until 19 September 2018.

24 AGL Sales admits that it therefore failed to submit to the AER information and data in the manner and form (including by the relevant due dates) required by the Guidelines and contravened s 282(1) of each of the ACT Retail Law, the NSW Retail Law, the QLD Retail Law and the SA Retail Law between 31 October 2017 and 19 September 2018.

AGL South Australia

25 AGL SA admits that it failed to submit, in respect of its performance in NSW and SA, information and data by the relevant due dates for:

(1) the Q1 Reporting Period, which was to be submitted by 31 October 2017 and which was not finally submitted until 19 September 2018;

(2) the Q2 Reporting Period, which was to be submitted by 31 January 2018 and which was not finally submitted until 19 September 2018;

(3) the Q3 Reporting Period, which was to be submitted by 30 April 2018 and which was not finally submitted until 19 September 2018;

(4) the Q4 Reporting Period, which was to be submitted by 31 August 2018 and which was not finally submitted until 19 September 2018.

26 AGL SA admits that it therefore failed to submit to the AER information and data in the manner and form (including by the relevant due dates) required by the Guidelines and contravened s 282(1) of each of the NSW Retail Law and the SA Retail Law between 31 October 2017 and 19 September 2018.

AGL Retail

27 AGL Retail admits that it failed to submit, in respect of its performance in NSW, QLD and SA, information and data by the relevant due dates for:

(1) the Q1 Reporting Period, which was to be submitted by 31 October 2017 and which was not finally submitted until 19 September 2018;

(2) the Q2 Reporting Period, which was to be submitted by 31 January 2018 and which was not finally submitted until 19 September 2018;

(3) the Q3 Reporting Period, which was to be submitted by 30 April 2018 and which was not finally submitted until 19 September 2018;

(4) the Q4 Reporting Period, which was to be submitted by 31 August 2018 and which was not finally submitted until 19 September 2018.

28 AGL Retail admits that it therefore failed to submit to the AER information and data in the manner and form (including by the relevant due dates) required by the Guidelines and contravened s 282(1) of each of the NSW Retail Law, the QLD Retail Law and the SA Retail Law between 31 October 2017 and 19 September 2018.

Powerdirect

29 Powerdirect admits that it failed to submit, in respect of its performance in ACT, NSW, QLD and SA, information and data by the relevant due dates for:

(1) the Q1 Reporting Period, which was to be submitted by 31 October 2017 and which was not finally submitted until 19 September 2018;

(2) the Q2 Reporting Period, which was to be submitted by 31 January 2018 and which was not finally submitted until 19 September 2018;

(3) the Q3 Reporting Period, which was to be submitted by 30 April 2018 and which was not finally submitted until 19 September 2018;

(4) the Q4 Reporting Period, which was to be submitted by 31 August 2018 and which was not finally submitted until 19 September 2018.

30 Powerdirect admits that it therefore failed to submit to the AER information and data in the manner and form (including by the relevant due dates) required by the Guidelines and contravened s 282(1) of each of the ACT Retail Law, the NSW Retail Law, the QLD Retail Law and the SA Retail Law between 31 October 2017 and 19 September 2018.

Declaratory Relief

31 By the Proposed Orders, the parties seek declarations from the Court that each of the Respondents engaged in specified contraventions of the Retail Law. It is those contraventions which form the basis of the Court’s jurisdiction to make the pecuniary penalty orders and the order for contribution as to costs.

32 This Court has the power to make declarations under s 21 of the Federal Court of Australia Act 1976 (Cth) (FCA Act). The Court also has the power under s 44AAG(1)(b) of the CCA to make an order, on application by the AER, declaring that a person is in breach of a State/Territory energy law (as defined in s 4(1) of the CCA), which includes the Retail Law.

33 The discretion to exercise this power is wide: Forster v Jododex Australia Pty Ltd (1972) 127 CLR 421 at 437-438 (Foster v Jododex Australia); Australian Energy Regulator v Snowy Hydro Limited (No 2) [2015] FCA 58 (AER v Snowy Hydro) at [164].

34 Nevertheless, the power to issue a declaration is not unfettered and is “confined by the considerations which mark out the boundaries of judicial power”: Ainsworth v Criminal Justice Commission (1992) 175 CLR 564 at 582.

35 In Australian Building and Construction Commissioner v Construction, Forestry, Mining and Energy Union [2017] FCAFC 113; 254 FCR 68 (ABCC v CFMEU), the Full Court of the Federal Court (Dowsett, Greenwood and Wigney JJ) held at [90]:

The fact that the parties have agreed that a declaration of contravention should be made does not relieve the Court of the obligation to satisfy itself that the making of the declaration is appropriate … It is not the role of the Court to merely rubber stamp orders that are agreed as between a regulator and a person who has admitted contravening a public statute …

(Citations omitted.)

36 The Full Court continued (at [93]):

Declarations relating to contraventions of legislative provisions are likely to be appropriate where they serve to record the Court’s disapproval of the contravening conduct, vindicate the regulator’s claim that the respondent contravened the provisions, assist the regulator to carry out its duties, and deter other persons from contravening the provisions …

(Citations omitted.)

37 It is sufficient for the facts necessary to support a declaration to be established by agreed facts under s 191 of the Evidence Act 1995 (Cth) and admissions: Minister for Environment, Heritage and the Arts v PGP Developments Pty Ltd [2010] FCA 58; 183 FCR 10 at [30]-[38]; ABCC v CFMEU at [91].

38 In Forster v Jododex Australia at 437-438, Gibbs J held that before making declarations three requirements should be satisfied:

(1) the question must be a real and not a hypothetical or theoretical one;

(2) the applicant must have a real interest in raising it; and

(3) there must be a proper contradictor.

39 The parties jointly submit that each of these requirements is satisfied in this case. In particular, it is jointly submitted that:

(1) the proposed declarations identify with precision the conduct that contravened the Retail Law and are directed to the determination of an extant legal controversy rather than any abstract or hypothetical question;

(2) the AER is a public regulator and has a genuine interest in seeking the declaration and for the declaration to be made; and

(3) the Respondents are each a proper contradictor because they are the subject of the declarations and had an interest in opposing them.

40 The parties submit that the facts and admissions set out in the SOAFA are sufficient for declarations to be made in the form proposed in the Proposed Orders and that it is appropriate for the Court to make them.

Pecuniary penaltIES

41 By the Proposed Orders, the parties jointly seek a pecuniary penalty order in the amount of $325,000 for each Respondent.

42 The parties submit that the Court has the power to order the Respondents to pay a pecuniary penalty under s 44AAG(2)(a) of the CCA, if it has made an order declaring that a person is in breach of a State/Territory energy law under s 44AAG(1): Australian Competition and Consumer Commission v EnergyAustralia Pty Ltd [2015] FCA 274 (ACCC v EnergyAustralia) at [73].

43 Where civil penalty orders are sought by consent, a Court is permitted to receive and act upon joint submissions, but it remains a matter for the Court to determine whether the proposed civil penalty is appropriate: Commonwealth of Australia v Director, Fair Work Building Industry Inspectorate [2015] HCA 46; 258 CLR 482 at [1], [64], [68] and [79] (Commonwealth v FWBII).

44 Provided the Court is sufficiently persuaded as to the accuracy of the SOAFA and that the penalty proposed is an appropriate remedy in the circumstances, substantial weight should be given to the parties’ agreement as to the appropriate penalty: Commonwealth v FWBII at [58]. Where the parties are legally represented and understand the desirability of the proposed penalties, judicial restraint is particularly important: Australian Competition and Consumer Commission v Woolworths (South Australia) Pty Ltd (t/a Mac’s Liquor) [2003] FCA 530; 198 ALR 417 at [21]. In Australian Competition and Consumer Commission v Australia and New Zealand Banking Group Limited [2016] FCA 1516; 118 ACSR 124 (ACCC v ANZ), Wigney J said at [104]:

The Court should also recognise that the agreed penalty is most likely the result of compromise and pragmatism on the part of the Commission, and to reflect, amongst other things, the Commission’s considered estimation of the risks and expense of the litigation had it not been settled.

45 It was jointly submitted that, in NW Frozen Foods Pty Ltd v Australian Competition and Consumer Commission (1996) 71 FCR 285 (NW Frozen Foods v ACCC), Burchett and Kiefel JJ (with Carr J agreeing) held at 291 and 299 that the relevant question for the Court to consider in relation to a proposed agreed penalty is whether the amount is “within the permissible range in all the circumstances”: see also Minister for Industry, Tourism and Resources v Mobil Oil Pty Ltd [2004] FCAFC 72 at [82] (Mobil Oil); Chief Executive Officer of Australian Transaction Reports and Analysis Centre v TAB Limited (No 3) [2017] FCA 1296 at [7] (CEO of AUSTRAC v TAB).

46 The term “permissible range” refers to the range that would be permitted by the Court, which is neither manifestly inadequate nor manifestly excessive: Ponzio v B & P Caelli Constructions Pty Ltd [2007] FCAFC 65; 158 FCR 543 at [129]; Australian Competition and Consumer Commission v Pepe’s Ducks Ltd [2013] FCA 570 at [25].

47 The Court should also recognise that there is no single appropriate penalty and that an agreed penalty may be appropriate if it falls within an appropriate range, having regard to all relevant circumstances: ACCC v ANZ at [144]–[145].

Sections 2, 294, 296, 297 of the Retail Law

48 Pursuant to s 2 of the Retail Law, “civil penalty” means:

(a) …

(b) in the case of a breach of a civil penalty provision by a body corporate—

(i) an amount not exceeding $100,000; and

(ii) an amount not exceeding $10,000 for every day during which the breach continues.

49 Section 296 of the Retail Law provides:

For the purpose of determining the civil penalty for a breach of a civil penalty provision, if the breach consists of a failure to do something that is required to be done, the breach is to be regarded as continuing until the act is done despite the fact that any period within which, or time before which, the act is required to be done has expired or passed.

50 Section 297 of the Retail Law provides:

(1) If the conduct of a person constitutes a breach of 2 or more civil penalty provisions, proceedings may be instituted under this Law against the person in relation to the breach of any one or more of those provisions.

(2) However, the person is not liable to more than one civil penalty under this Law in respect of the same conduct.

51 Section 294 of the Retail Law sets out the matters to take into account in determining a civil penalty. Specifically, civil penalties must be determined:

… having regard to all relevant matters, including:

(a) the nature and extent of the breach; and

(b) the nature and extent of any loss or damage suffered as a result of the breach;

(c) the circumstances in which the breach took place; and

(d) whether the person has engaged in any similar conduct and been found to be in breach of a provision of this Law, the National Regulations or the Rules in respect of that conduct; and

(e) in the case of a regulated entity – whether the person has established, and has complied with, policies, systems and procedures under s 273.

52 It was jointly submitted that the factors enumerated in s 294 are similar to those set out in s 224(2) of the Australian Consumer Law (ACL), for the assessment of civil penalties for contraventions of that law. In ACCC v EnergyAustralia, Gordon J accepted that “the principles relevant to determination of penalties under s 76 of the TPA [now the CCA] and s 224 of the ACL are also relevant to the assessment of civil penalties under the [Retail Law]”: ACCC v EnergyAustralia at [109] (emphasis in the original). It follows that the matters generally taken into account by courts in assessing civil penalties under the CCA and ACL are relevant to the assessment of penalties under the Retail Law.

“Course of conduct” principle

53 The parties jointly submitted that the “course of conduct” principle operates to ensure that the Respondents are not “doubly punished in respect of the relevant acts or omissions that make up the multiple contraventions”: ABCC v CFMEU at [148]. In Construction, Forestry, Mining & Energy Union v Cahill [2010] FCAFC 39 (CFMEU v Cahill), Middleton and Gordon JJ described this principle in the following way at [41]:

… where there is an interrelationship between the legal and factual elements of two or more offences for which an offender has been charged, the Court must ensure that the offender is not punished twice for the same conduct. In other words, where two offences arise as a result of the same or related conduct that is not a disentitling factor to the application of the single course of conduct principle but a reason why a Court may have regard to that principle, as one of the applicable sentencing principles, to guide it in the exercise of the sentencing discretion …

(Citations omitted.)

54 The course of conduct principle has been applied in the context of determining pecuniary penalties under s 44AAG(2) of the CCA: ACCC v EnergyAustralia at [120]. As the Full Court has recognised, “the application of the course of conduct principle requires an evaluative judgment in respect of the relevant circumstances”: Australian Competition and Consumer Commission v Cement Australia Pty Ltd [2017] FCAFC 159; 258 FCR 312 at [425].

“Totality” principle

55 The parties jointly submit that, related to the course of conduct principle, is the “totality principle”. Both principles are tools of analysis rather than rules to be applied in determining the appropriate penalty: Australian Competition and Consumer Commission v Yazaki Corporation [2018] FCAFC 73; 262 FCR 243 at [226] and [237].

56 The totality principle operates as a “final check” to ensure that the penalties, as a whole, are just and appropriate: Australian Competition and Consumer Commission v ACM Group Ltd (No 3) [2018] FCA 2059 (ACM) at [37]; Australian Competition and Consumer Commission v Australian Safeway Stores Pty Ltd [1997] FCA 450 (Safeway).

“Parity” principle

57 Finally, it was jointly submitted that the Court should apply the “parity principle” to ensure that, other things being equal, persons committing the same contravention receive the same punishment. The parity principle only applies where the contraveners’ circumstances are comparable: Australian Competition and Consumer Commission v ABB Transmission and Distribution Limited (No. 2) [2002] FCA 559; 190 ALR 169 at [40] (ABB). As to the parity principle, see Postiglione v The Queen (1997) 189 CLR 295 at 335 (Kirby J); see also Australian Competition and Consumer Commission v Cement Australia Pty Ltd [2016] FCA 453; 242 FCR 389 at [91] (Cement).

Other relevant matters

58 It was submitted by the parties that s 294 of the Retail Law requires the Court to have regard to “all relevant matters” in assessing the appropriate civil penalty.

59 In the context of determining civil penalties under the ACL, some of the recognised factors to which the Court may have regard in an appropriate case have become known as the “French factors”. This is because they were initially identified by French J in Trade Practices Commission v CSR Limited [1990] FCA 521; (1991) ATPR 41-076 at 52, 152–153. Those factors have been endorsed by this Court on numerous occasions (see eg NW Frozen Foods v ACCC), and were more recently identified by Perram J in Australian Competition and Consumer Commission v Singtel Optus Pty Ltd (No 4) [2011] FCA 761; 282 ALR 246 at [11] (ACCC v Singtel Optus (No 4)).

60 In ACCC v Singtel Optus Pty Ltd (No 4), 28 Perram J at [11] outlined the “French factors” as follows:

(1) the size of the contravening company;

(2) the deliberateness of the contravention and the period over which it extended;

(3) whether the contravention arose out of the conduct of senior management or at a lower level;

(4) whether the company has a corporate culture conducive to compliance with the Act as evidenced by educational programs and disciplinary or other corrective measures in response to an acknowledged contravention;

(5) whether the company has shown a disposition to cooperate with the authorities responsible for the enforcement of the Act in relation to the contravention;

(6) whether the contravener has engaged in similar conduct in the past;

(7) the financial position of the contravener; and

(8) whether the contravening conduct was systematic, deliberate or covert.

61 The “French factors” have been referred to as “relevant non-mandatory factors”: ACCC v Singtel Optus (No 4) at [11]. Whether or not individual factors constitute “relevant matters” within the meaning of s 294 of the Retail Law will depend upon the circumstances: CEO of AUSTRAC v TAB at [9]. The “French factors” are not “a rigid catalogue or checklist of matters to be applied in each case”: ABCC v CFMEU at [101]. The “overriding principle is that the Court should weigh all relevant circumstances”: ibid. Such factors are “not, and plainly were not intended to be, exhaustive”: ibid.

62 It was jointly submitted that the fixing of a pecuniary penalty involves the identification and balancing of all the factors and circumstances relevant to the contravention and the contravener and making a value judgment as to what is the appropriate penalty. This process involves an “intuitive” or “instinctive synthesis” of the relevant factors: Australian Competition and Consumer Commission v Coles Supermarkets Australia Pty Limited [2015] FCA 330; 327 ALR 540 (ACCC v Coles) at [6] (Allsop CJ).

The proposed penalty

63 The parties jointly submit that the Court should impose, upon each Respondent, a pecuniary penalty of $325,000 in relation to their respective contraventions of the Retail Law.

64 Taking into account the period over which the contraventions occurred, the parties jointly submit that the Court should impose pecuniary penalties for each Respondent as follows:

(1) Q1 Report contravention: $150,000;

(2) Q2 Report contravention: $100,000;

(3) Q3 Report contravention: $50,000; and

(4) Q4 Report contravention: $25,000.

CONSIDERATION

65 Having regard to the principles set out above regarding the approach to fixing a pecuniary penalty, and on the basis of the facts and admissions set out in the SOAFA, I turn to consider whether pecuniary penalties totalling $325,000 for each Respondent (cumulatively, $1.3 million) are appropriate in the circumstances of this case.

66 It is accepted that the Respondents vary in size and that the extent of their respective conduct in breach of s 282(1) of the Retail Law is different. However, in circumstances where each of the Respondents is a wholly owned subsidiary of AGL and shares data and reporting resources, and the contraventions by each of them were similar and occurred in respect of the same periods, it is submitted that it is appropriate to impose an equivalent penalty on each of the Respondents. This, it is jointly submitted, is consistent with the parity principle.

Nature and extent of the breach – s 294(a)

67 The Respondents have each admitted to contravening s 282(1) by failing to submit information and data by the dates required between 31 October 2017 and 19 September 2018 (Relevant Period).

68 The information and data submitted in reports by energy retailers under s 282(1) of the Retail Law is important. The information and data to be provided for each of the indicators relates to a variety of performance measures, including areas such as customer numbers, disconnections, debt and hardship assistance. The information and data is in turn published by the AER to inform stakeholders, including policymakers, so they can identify emerging trends and provide better outcomes for consumers.

69 The Respondents accept that their breaches of the Retail Law were serious. The submission of information and data by the dates required by the Guidelines is critical to the AER’s economic and market monitoring function. It helps ensure market transparency and promotes confidence in the retail energy market. It also helps ensure stakeholders are informed which leads to effective policy making.

70 As set out in the SOAFA, the Respondents finally submitted information and data in respect of the Q1, Q2, Q3 and Q4 Reporting Periods, in three tranches on 5 September 2018 (in respect of Schedule 2 to the Guidelines), 12 September 2018 (in respect of Schedule 3 to the Guidelines) and 19 September 2018 (in respect of Schedule 4 to the Guidelines). Accordingly, each of the Respondents contravened s 282(1) for the following periods:

(1) Q1 Reporting Period: 323 days (the Q1 Report was due on 31 October 2017);

(2) Q2 Reporting Period: 231 days (the Q2 Report was due on 31 January 2018);

(3) Q3 Reporting Period: 142 days (the Q3 Report was due on 30 April 2018); and

(4) Q4 Reporting Period: 19 days (the Q4 Report was due on 31 August 2018).

71 The parties jointly submit that the contraventions of s 282(1) were not the result of a deliberate intention to breach the Retail Law. Rather, the failure to provide information and data on time was due to human error and processes and systems for reporting that proved to be flawed. The Respondents were not aware of any serious issues with their reporting system until early 2018, and subsequently rebuilt their reporting system such that the Respondents could finalise their reports by 19 September 2018 for the Q1 to Q4 Reporting Periods.

72 Each failure by the Respondents to submit their Q1, Q2, Q3 and Q4 Reports by the relevant due dates gives rise to a separate contravention of s 282(1). It will be recalled that s 2 of the Retail Law relevantly defines “civil penalty” as follows:

civil penalty means—

…

(b) in the case of a breach of a civil penalty provision by a body corporate—

(i) an amount not exceeding $100 000; and

(ii) an amount not exceeding $10 000 for every day during which the breach continues;

73 As a consequence, The theoretical maximum penalties for each Respondent’s contraventions of s 282(1), including the amount in respect of each day during which those contraventions continued, are set out below:

Quarter | Days late | Maximum penalty |

Q1 | 323 | $3,330,000 |

Q2 | 231 | $2,410,000 |

Q3 | 142 | $1,520,000 |

Q4 | 19 | $290,000 |

74 The parties submit that each Respondent’s contravention of s 282(1), which concerned separate quarterly reports, are factually and temporally distinct: Australian Competition and Consumer Commission v Jetstar Airways Pty Limited (No 2) [2017] FCA 205 at [21]-[23]. The duration of each contravention also varies. In the case of the Q1 Report contravention, the contravention continued for 323 days. By contrast, in the case of the Q4 Report contravention, the contravention continued for 19 days. Accordingly, the parties submit, and I accept, that this is not a matter which attracts the application of the course of conduct principle.

Nature and extent of any loss or damage suffered – s 294(b)

75 The parties jointly submit that no consumer harm has been identified as a result of the contravening conduct.

76 The Respondents’ breaches of s 282(1) of the Retail Law likely resulted in loss and damage to stakeholders. This was due either to stakeholders:

(1) likely relying on information and data, and the analysis of that information and data in quarterly reports for the Q1 – Q3 Reporting Periods, which were published on the AER website during the 2017/2018 Reporting Year on the basis of the Respondents’ purported submissions rather than the information and data as finally submitted (given such information was submitted late). On around 11 September 2018, the AER took the unprecedented step of removing all retail performance data for the 2017/2018 Reporting Year from the AER website due to the material inaccuracies contained in the Respondents’ purported submissions; or

(2) not being able to access the information and data regarding the 2017/2018 Reporting Year until 13 December 2018 (when the AER published its annual retail market performance report), or 25 January 2019 (when the AER published corrected information and data for the Q1 – Q3 Reporting Periods of the 2017/2018 Reporting Year).

77 However, there is no agreed fact or submission which quantified the extent of any such loss and damage (assuming any such quantification is possible).

78 The late Q1 – Q3 Reports were preceded by submissions which contained material inaccuracies. The information and data in the reports finally submitted by the Respondents in September 2018 differed substantially from the information and data previously submitted.

79 Examples of this are:

(1) in AGL Sales’ Final Q1 Report, 191 data points (relating to 23 out of 25 indicators) differed from those in the report initially submitted. An example of an amendment made by AGL Sales concerns the number of small business electricity customers in NSW repaying an energy bill debt, being data submitted in respect of item “S3.9.b” of the Guidelines. In its Q1 Report dated 31 October 2017, AGL Sales stated that it had 3,169 such customers in NSW. By contrast, in AGL Sales’ Final Q1 Report, AGL Sales stated (on a final basis) that it had 2,379 such customers;

(2) in AGL Sales’ Final Q2 Report, 178 data points relating to 22 out of 25 indicators differed from those in the report initially submitted. An example of an amendment made by AGL Sales concerns the number of residential electricity customers in NSW repaying an energy bill debt, being data submitted in respect of item “S3.9.a” of the Guidelines. In its Q2 Report dated 31 January 2018, AGL Sales stated that it had 23,442 such customers. By contrast, in AGL Sales’ Final Q2 Report, AGL Sales stated (on a final basis) that it had 17,855 such customers;

(3) in AGL Sales’ Final Q3 Report, 199 data points (relating to 24 out of 25 indicators) differed from those in the report initially submitted. An example of an amendment made by AGL Sales concerns the total number of electricity customers in NSW who exited a hardship program in January 2018, being data submitted in respect of item “S4.8” of the Guidelines. In its Q3 Report dated 30 April 2018, AGL Sales stated that it had 483 such customers. By contrast, in AGL Sales’ Final Q3 Report, AGL Sales stated (on a final basis) that it had 692 such customers;

(4) in AGL SA’s Final Q1 Report, 111 data points (relating to 23 out of 25 indicators) differed from those in the report initially submitted. An example of an amendment made by AGL SA concerns the number of residential electricity customers in SA with an energy bill debt over $500 but less than or equal to $1500, being data submitted in respect of item “S3.11.a” of the Guidelines. In its Q1 Report dated 31 October 2017, AGL SA stated that it had 3,646 such customers. By contrast, in AGL SA's Final Q1 Report, AGL SA stated (on a final basis) that it had 1,679 such customers;

(5) in AGL Retail’s Final Q1 Report, 62 data points (relating to 22 out of 25 indicators) differed from those in the report initially submitted. An example of an amendment made by AGL Retail concerns the number of small business gas customers in NSW on market retail contracts, being data submitted in respect of item “S2.2.b.ii” of the Guidelines. In its Q1 Report dated 31 October 2017, AGL Retail stated that it had 10,432 such customers. By contrast, in AGL Retail's Final Q1 Report, AGL Retail stated (on a final basis) that it had 13,298 such customers;

(6) in Powerdirect’s Final Q2 Report, 140 data points (relating to 23 out of 25 indicators) differed from those in the report initially submitted. An example of an amendment made by Powerdirect concerns the number of small business electricity customers in NSW on market retail contracts, being data submitted in respect of item “S2.2.a.ii” of the Guidelines. In its Q2 Report dated 31 January 2018, Powerdirect stated that it had 2,945 such customers. By contrast, in Powerdirect’s Final Q2 Report, Powerdirect stated (on a final basis) that it had 6,808 such customers.

80 These are not the only examples. There are other instances of material differences between the relevant final submission and the relevant initial submission.

Circumstances in which the breaches took place – s 294(c)

The Respondents’ size and financial position

81 The Respondents accept that it is appropriate that the Court have regard to a company’s size and profitability in determining the pecuniary penalty. This is relevant to the consideration of the extent to which the penalty achieves deterrence and the need to ensure that it is sufficient to achieve specific and general deterrence: ACCC v Coles at [92]. The penalty should be set at a level that would be meaningful: Australian Competition and Consumer Commission v Apple Pty Limited [2012] FCA 646 at [39].

82 In ACCC v ANZ, Wigney J stated at [89] the following:

The size of the contravening corporation does not of itself justify a higher penalty than might otherwise be imposed: Australian Competition and Consumer Commission v Coles Supermarkets Australia Pty Ltd [2015] FCA 330; (2015) 327 ALR 540 at 559-561 [89]-[92]. The size of the corporation may, however, be particularly relevant in determining the size of the pecuniary penalty that would operate as an effective deterrent. The sum required to achieve that object will generally be larger where the company has vast resources: Australian Competition and Consumer Commission v Leahy Petroleum Pty Ltd (No 3) [2005] FCA 265; (2005) 215 ALR 301 at 309 [39]; Australian Competition and Consumer Commission v Apple Pty Limited [2012] FCA 646 at [38].

83 As to the Respondents’ size, the Respondents are each wholly-owned subsidiaries of AGL, a leading integrated energy business which is listed on the ASX. AGL operates Australia’s largest private electricity generation portfolio, and is an active participant in gas and electricity wholesale markets, with residential, small and large business and wholesale customers.

84 Through its various subsidiaries, AGL had approximately 3.6 million customer accounts in the 2017/2018 Reporting Year, including residential, small and large business and wholesale customers. Of those customer accounts, 2,411,143 (or approximately 67%) were held by the Respondents.

85 In the 2017/2018 Reporting Year, AGL had total revenue of $12,816 million and profit after tax of $1,582 million.

86 It was jointly submitted that the size of AGL is a matter that is relevant to the assessment of appropriate penalties in respect of the Respondents: ABB at [40]; Schneider Electric (Australia) Pty Ltd v Australian Competition and Consumer Commission [2003] FCAFC 2; 127 FCR 170 at [49]; Global One Mobile Entertainment Pty Ltd v Australian Competition and Consumer Commission [2012] FCAFC 134 at [128].

Involvement of senior management

87 Representatives of the Respondents’ senior management were involved in the relevant approval processes. They were involved in the approval process for all of the purported submissions for the Q1 – Q3 Reporting Period and the late submissions for the Q1 – Q4 Reporting Period, which were submitted on a final basis.

Processes and systems

88 The processes and systems used by AGL to prepare the Respondents’ purported submissions (i.e. the submissions which preceded the reports submitted on a final basis) (Processes and Systems) were initially built or put in place across 2010 and 2011. The Processes and Systems had the following characteristics:

(1) they relied to an extent on “manually” accessing, collating and checking the information and data used to prepare these performance reports, with the consequence that the performance reports were vulnerable to human error;

(2) despite updates, they had become subject to underlying “source code” and “system logic” issues as AGL’s products, reporting obligations and relevant databases evolved over time, which affected the accuracy of the information and data used to prepare the Respondents’ performance reports and increased the importance of manual review and quality control; and

(3) they maintained information and data regarding customer accounts on a dynamic basis such that information and data was updated at the time it was received to reflect the effective date of the change. This aspect of AGL’s Processes and Systems did not cause the relevant material inaccuracies.

89 The Respondents submit that they have since taken steps to improve their Processes and Systems.

90 This is yet another recent occasion where this Court has before it a large business that has contravened statutory obligations (at least in part) by reason of (what might be described as) information technology system issues. For other instances, see, for example:

(1) Australian Competition and Consumer Commission v Medibank Private Limited [2020] FCA 1030 at [21]-[24] (ACCC v Medibank);

(2) Australian Securities and Investments Commission v National Australia Bank Limited [2020] FCA 1494 at [51] (“[d]uring the Relevant Period there was no single point of accountability for the programme across NAB. Investment in the systems and processes had not kept up with the growth of the programme, in that the last significant investment in the Introducer system had been made over 10 years prior to the discovery of [certain] conduct, notwithstanding the significant growth in the programme over that time. There were shortcomings in the controls used to ensure that NAB’s policies were followed and to detect conflicts of interest or fraud; there were database and information systems limitations …”);

(3) Australian Securities and Investments Commission v Australia and New Zealand Banking Group Limited (No 3) [2020] FCA 1421 (“[t]he reality was that the Bank’s systems were not robust enough to prevent wrongdoing, and, for whatever reason, those who appreciated that there was a risk did not take steps to ensure the Bank came to a view that it was required to come to about the appropriateness of charging the fees”).

91 As I indicated in ACCC v Medibank at [78]-[84], large businesses in particular should formulate and maintain governance processes and arrangements that are adequate to ensure compliance with statutory obligations. It is evident that the Respondents here did not have such arrangements in respect of the Respondents’ relevant submissions to the AER.

Absence of past similar conduct – s 294(d)

92 The parties submit there are no findings of any similar conduct by the Respondents in breach of a provision of the Retail Law, the Retail Regulations or the Retail Rules. Nor have there been any infringement notices issued to any of the Respondents in respect of their reporting obligations under s 282(1) of the Retail Law. This is not a case where the contravening party has shown a tendency to be “recidivist”, such that higher penalties are required to achieve the purpose of specific deterrence: ABCC v CFMEU at [159].

Policies, systems and procedures under s 273 – s 294(e)

93 Under s 294(e) of the Retail Law, a mandatory factor for the Court to consider, in the case of a regulated entity, is whether the contravener has established, and has complied with, policies, systems and procedures under s 273. Section 273(1) provides:

A regulated entity must establish policies, systems and procedures to enable it to efficiently and effectively monitor its compliance with the requirements of [the Retail Law], the National Regulations and the Rules.

94 The Respondents accept that their policies, systems and procedures in place prior to September 2018 did not prevent the contraventions the subject of the present proceeding.

Other relevant matters

95 Section 294 requires the Court to have regard to “all relevant matters” (including the matters in ss 294(a)-(e), referred to above) in determining the appropriate penalties to be imposed in this proceeding. As to the “other matters” the parties consider to be relevant for the purposes of s 294, the parties jointly submit as follows.

Impact on the AER

96 The Respondents’ conduct resulted in additional AER resources being dedicated to processing the Respondents’ late submissions. This included managing and analysing the information and data included in the purported submissions for the Q1 – Q3 Reporting Period (which contained material inaccuracies), and the information and data included in the late submissions for the Q1 – Q4 Reporting Period.

97 In addition, as a consequence of the Respondents’ late submissions, the AER was unable to publish its annual retail market performance report for the 2017/2018 Reporting Year by 30 November 2018. The AER is, pursuant to s 284 of the Retail Law, required to publish such a report “as soon as practicable after 30 June (but on or before 30 November)”. The AER ultimately published that report on 13 December 2018 and, after removing its quarterly reports from its website, published revised information and data for Q1 – Q3 on its website on 25 January 2019.

Compliance culture

98 The Respondents were not aware of any serious issues with their Processes and Systems until early 2018, although it may have been possible to identify these issues sooner. Following a query from the AER in late February 2018, which identified potential issues with Powerdirect’s Q2 Report (which was purportedly submitted on 31 January 2018), the Respondents were prompted to review the accuracy of the information and data submitted by them in their Q1 and Q2 Reports.

99 Between late February 2018 and late May 2018, the Respondents identified the majority of further issues with respect to the accuracy of the Respondents’ Q1 and Q2 Reports. The AER identified some further issues with respect to the accuracy of the Respondents’ Q1 and Q2 Reports. The Respondents purported to resubmit their Q1 and Q2 Reports on a number of occasions between 7 March 2018 and 22 May 2018 (after the relevant due dates), as set out in s 3 of the SOAFA. The Respondents also purported to submit their Q3 reports on 30 April 2018 (the relevant due date), as set out in s 3 of the SOAFA.

100 By June 2018, it became apparent to the Respondents that they would not be able to finalise their Q1 – Q3 Reports, or their Q4 Reports (due by 31 August 2018), until a full system rebuild of AGL’s reporting systems had been completed. AGL completed this full system rebuild by September 2018.

101 The Respondents’ approach to compliance may have initially been described as “reactive”: see Australian Competition and Consumer Commission v Jetstar Airways Pty Limited (No 2) [2017] FCA 205 at [49]. However, having being prompted by the AER to consider issues with their reporting, when it became apparent that there were underlying issues with their Processes and Systems, AGL proactively took steps to undertake a complete system rebuild of its reporting systems.

Corrective measures and enhancements

102 By June 2018, AGL had established a dedicated team to undertake a complete review of its information and data reporting systems. As a result of this review, AGL invested considerable staffing and financial resources to rebuild its reporting systems in a short period of time which was completed by September 2018.

Respondents’ co-operation with the AER and contrition

103 The Respondents cooperated with the AER throughout the AER’s investigation and after proceedings were issued. They have sought to resolve the proceeding at an early stage, without the need for a contested hearing on liability or penalty.

Profit or benefit

104 The contravening conduct has not resulted in a financial gain or benefit to any of the Respondents.

Comparability with other decisions

105 There have only been two civil penalty proceedings by the AER to date: AER v Snowy Hydro Ltd and ACCC v EnergyAustralia. Neither relates to a breach of s 282(1) of the Retail Law. When compared to this case, the facts of those cases are sufficiently different so as to make any comparison inutile.

Costs

106 On the question of costs, the Respondents have agreed to make a contribution to the AER’s costs fixed in the total amount of $100,000. Each of the Respondents will be jointly and severally liable for the payment of those costs.

CONCLUSION

107 By way of summary, in my opinion, the agreed facts and admissions made in the SOAFA satisfy the three requirements identified by Gibbs J in Forster v Jododex Australia at 437-438 for making the declarations sought. First, the proposed declarations identify with precision the conduct that contravened the Retail Law and are directed to the determination of an extant legal controversy rather than any abstract or hypothetical question. Second, the AER is a public regulator and has a genuine interest in seeking the declarations and for the declarations to be made. Third, the Respondents are each a proper contradictor because they are the subject of the declarations and had an interest in opposing them.

108 I am satisfied that the pecuniary penalty provided for in the Proposed Orders in the amount of $325,000 for each Respondent is a penalty that is “within the permissible range in all the circumstances”: NW Frozen Foods v ACCC at 291 and 299; Mobil Oil at [82] and CEO of AUSTRAC v TAB at [7].

109 Having considered the relevant matters in the SOAFA and the parties’ joint submissions, and the circumstances to be taken into account in determining the civil penalty in s 294 of the Retail Law (set out above), I am satisfied that the proposed penalty is, in the circumstances, appropriate, having regard to the admitted conduct and in particular:

(1) the nature and extent of the breaches;

(2) the nature and extent of any loss or damage suffered as a result of the breaches;

(3) the circumstances in which the breaches took place;

(4) whether the Respondents have engaged in any similar conduct previously and have been found to be in breach of a provision of the Retail Law, the national regulations or the Rules in respect of the conduct; and

(5) it appears the Respondents have now established, and complied with, policies, systems and procedures under s 273 of the Retail Law.

110 I am also satisfied that the proposed penalty does not fall foul of the “course of conduct” principle so that it does not result in the Respondents being “punished twice for the same conduct” in respect of relevant acts or omissions that make up multiple contraventions: CFMEU v Cahill at [41].

111 The proposed penalty is also appropriate having regard to the “totality principle” which requires that the total penalty for related offences does not exceed what is appropriate for the entire contravening conduct in question: Australian Competition and Consumer Commission v Yazaki Corporation [2018] FCAFC 73; 262 FCR 243 at [226] and [237]; ACM at [37]; see also Safeway. The totality principle operates as a final check to ensure that the penalties, as a whole, are just and appropriate. Having conducted that final check, I am satisfied that the penalties proposed are, as a whole, just and appropriate in the circumstances of this case.

112 For the reasons given, I am satisfied that the proposed penalties are just and appropriate having regard to the admitted facts in respect of the contravening conduct.

113 I am also satisfied that the proposed penalty, such that each of the Respondents is ordered to pay a pecuniary amount in the sum of $325,000, is consistent with the parity principle which is directed to ensuring persons committing the same contraventions receive the same punishment: ABB at [40] and Cement at [91].

114 I am required by s 294 of the Retail Law to have regard to “all relevant matters” in assessing the appropriate civil penalty. In this regard, I have considered the “French factors” in considering whether the proposed civil penalty is appropriate. I accept, as was jointly submitted, that the “French factors” are non-mandatory: ACCC v Singtel Optus (No. 4) at [11]. A consideration of the “French factors” involves an intuitive or instinctive synthesis of the relevant factors.

115 In this respect, I have taken into account the SOAFA and the parties’ joint submissions and I note in particular the following:

(1) I have taken into account the size of the Respondents and the fact that they are part of the AGL group.

(2) I have considered the deliberateness of the contraventions having regard to the SOAFA, and the period of time over which the contraventions occurred. I accept that the contraventions were not the result of a deliberate intention to breach the Retail Law but rather were a failure to provide information and data on time which was due to human error and deficiencies in the processes and systems of the Respondents. I accept that the Respondents did not become aware of any serious issues of their reporting systems until early 2018. I also accept that the Respondents have now rebuilt their reporting systems such that they can comply with their reporting obligations to the AER.

(3) I accept that there is no evidence of any consumer harm as a result of the contravening conduct.

(4) I accept that the contraventions arose out of the conduct of representatives of the Respondents’ senior management who were involved in the approval process for the late and final provision of the relevant information and submissions to AER.

(5) I am satisfied that there is no past similar conduct in respect of breaches of provisions of the Retail Law, the Retail Regulations or the Rules by any of the Respondents.

(6) I accept, as was submitted by the Respondents, that their policies, systems and procedures in place prior to September 2018 were not adequate so as to prevent the contraventions which are the subject of the admitted contravening conduct.

116 Insofar as I am required by s 294 to consider “all relevant matters” in determining the appropriate penalties to be imposed on the Respondents, I note in particular that I have considered the following:

(1) The impact on the AER as a consequence of the Respondents’ contravening conduct which resulted in additional AER resources being dedicated to processing the Respondents’ late submissions and analysing the relevant data during the reporting periods. I have taken into account the fact that, as a consequence of the Respondents’ late submissions, the AER was unable to publish its annual retail market performance report for the 2017/2018 Reporting Year by 30 November 2018. The AER is, pursuant to s 284 of the Retail Law, required to publish such a report “as soon as practicable after 30 June (but on or before 30 November)”.

(2) The admitted facts and the submissions of the parties do not suggest that there is a serious issue with compliance culture within the Respondents. I am satisfied that the Respondents, upon being alerted to the reporting problems by the AER in early 2018, took steps to modify and improve their reporting systems.

(3) I am satisfied that the Respondents have taken corrective measures to review their information and data reporting systems and that the Respondents have invested resources to ensure that they can now readily comply with their reporting obligations to the AER.

(4) I accept that the Respondents have cooperated with the AER and have sought to resolve this proceeding at an early stage without the need for a contested hearing on liability or penalty.

(5) I am satisfied that the contravening conduct has not resulted in a financial gain or benefit to any of the Respondents.

117 Having considered each of the abovementioned “other relevant matters” for the purposes of s 294, I am satisfied that the proposed penalty of $325,000 for each Respondent is appropriate.

118 I am also satisfied that I ought make an order that the Respondents pay AER’s costs fixed in the amount of $100,000. Each of the Respondents will be jointly and severally liable for the payment of those costs.

Disposition

119 For the reasons given, I will make the proposed declarations and orders.

I certify that the preceding one hundred and nineteen (119) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Anderson. |

Associate:

ANNEXURE A

ANNEXURE B

Proposed Orders

No. VID1219 of 2019

Federal Court of Australia

District Registry: Victoria

Division: General

Commercial and Corporations National Practice Area (Regulator and Consumer Protection)

AUSTRALIAN ENERGY REGULATOR

Applicant

AGL SALES PTY LIMITED (ACN 090 538 337) and others named in the Schedule

Respondents

THE COURT DECLARES BY CONSENT THAT:

AGL Sales

1 The First Respondent (AGL Sales) failed to submit, in respect of its performance in ACT, NSW, QLD and SA, information and data by the relevant due dates for:

(a) the Quarter 1 reporting period, 1 July 2017 to 30 September 2017 (Quarter 1 Reporting Period), which was to be submitted by 31 October 2017 and which was not finally submitted until 19 September 2018;

(b) the Quarter 2 reporting period, 1 October 2017 to 31 December 2017 (Quarter 2 Reporting Period), which was to be submitted by 31 January 2018 and which was not finally submitted until 19 September 2018;

(c) the Quarter 3 reporting period, 1 January 2018 to 31 March 2018 (Quarter 3 Reporting Period), which was to be submitted by 30 April 2018 and which was not finally submitted until 19 September 2018;

(d) the Quarter 4 reporting period, 1 April 2018 to 30 June 2018 (Quarter 4 Reporting Period), which was to be submitted by 31 August 2018 and which was not finally submitted until 19 September 2018,

and therefore failed to submit to the Applicant (AER) information and data in the manner and form (including by the dates) required by the AER Performance Reporting Procedures and Guidelines (Guidelines) and contravened s 282(1) of each of the National Energy Retail Law (ACT) (ACT Retail Law), the National Energy Retail Law (NSW) (NSW Retail Law), the National Energy Retail Law (QLD) (QLD Retail Law) and the National Energy Retail Law (SA) (SA Retail Law) between 31 October 2017 and 19 September 2018.

AGL South Australia

2 The Second Respondent (AGL SA) failed to submit, in respect of its performance in NSW and SA, information and data by the relevant due dates for:

(a) the Quarter 1 Reporting Period, which was to be submitted by 31 October 2017 and which was not finally submitted until 19 September 2018;

(b) the Quarter 2 Reporting Period, which was to be submitted by 31 January 2018 and which was not finally submitted until 19 September 2018;

(c) the Quarter 3 Reporting Period, which was to be submitted by 30 April 2018 and which was not finally submitted until 19 September 2018;

(d) the Quarter 4 Reporting Period, which was to be submitted by 31 August 2018 and which was not finally submitted until 19 September 2018,

and therefore failed to submit to the AER information and data in the manner and form (including by the dates) required by the Guidelines and contravened s 282(1) of each of the NSW Retail Law and the SA Retail Law between 31 October 2017 and 19 September 2018.

AGL Retail

3 The Third Respondent (AGL Retail) failed to submit, in respect of its performance in NSW, QLD and SA, information and data by the relevant due dates for:

(a) the Quarter 1 Reporting Period, which was to be submitted by 31 October 2017 and which was not finally submitted until 19 September 2018;

(b) the Quarter 2 Reporting Period, which was to be submitted by 31 January 2018 and which was not finally submitted until 19 September 2018;

(c) the Quarter 3 Reporting Period, which was to be submitted by 30 April 2018 and which was not finally submitted until 19 September 2018;

(d) the Quarter 4 Reporting Period, which was to be submitted by 31 August 2018 and which was not finally submitted until 19 September 2018,

and therefore failed to submit to the AER information and data in the manner and form (including by the dates) required by the Guidelines and contravened s 282(1) of each of the NSW Retail Law, the QLD Retail Law and the SA Retail Law between 31 October 2017 and 19 September 2018.

Powerdirect

4 The Fourth Respondent (Powerdirect) failed to submit, in respect of its performance in ACT, NSW, QLD and SA, information and data by the relevant due dates for:

(a) the Quarter 1 Reporting Period, which was to be submitted by 31 October 2017 and which was not finally submitted until 19 September 2018;

(b) the Quarter 2 Reporting Period, which was to be submitted by 31 January 2018 and which was not finally submitted until 19 September 2018;

(c) the Quarter 3 Reporting Period, which was to be submitted by 30 April 2018 and which was not finally submitted until 19 September 2018;

(d) the Quarter 4 Reporting Period, which was to be submitted by 31 August 2018 and which was not finally submitted until 19 September 2018,

and therefore failed to submit to the AER information and data in the manner and form (including by the dates) required by the Guidelines and contravened s 282(1) of each of the ACT Retail Law, the NSW Retail Law, the QLD Retail Law and the SA Retail Law between 31 October 2017 and 19 September 2018.

THE COURT ORDERS BY CONSENT THAT:

5 AGL Sales pay to the Commonwealth of Australia pecuniary penalties totalling $325,000 in respect of the breaches referred to in order 1 above, within 30 days.

6 AGL SA pay to the Commonwealth of Australia pecuniary penalties totalling $325,000 in respect of the breaches referred to in order 2 above, within 30 days.

7 AGL Retail pay to the Commonwealth of Australia pecuniary penalties totalling $325,000 in respect of the breaches referred to in order 3 above, within 30 days.

8 Powerdirect pay to the Commonwealth of Australia pecuniary penalties totalling $325,000 in respect of the breaches referred to in order 4 above, within 30 days.

9 AGL Sales, AGL SA, AGL Retail and Powerdirect pay a total contribution towards the AER’s costs in the amount of $100,000, within 30 days.

10 AGL Sales, AGL SA, AGL Retail and Powerdirect will be jointly and severally liable for the payment of the costs referred to in order 9.

VID 1219 of 2019 | |

Powerdirect Pty Ltd |