Federal Court of Australia

Crowley v Worley Limited [2020] FCA 1522

ORDERS

Applicant | ||

AND: | WORLEY LIMITED (ACN 096 090 158) Respondent | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The issues common as between the applicant and the group members and to be determined at the initial trial, identified by order made on 22 March 2019 be amended in the terms set out at [678] and following of the accompanying reasons for judgment, to correspond with terms used in the accompanying reasons for judgment.

2. The originating application and the fourth further amended statement of claim be dismissed.

3. Provided that the respondent does not file an application for a different costs order or orders, and subject to any costs order previously made, the applicant pay the respondent’s costs of the proceeding.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

REASONS FOR JUDGMENT

CONTENTS:

GLEESON J:

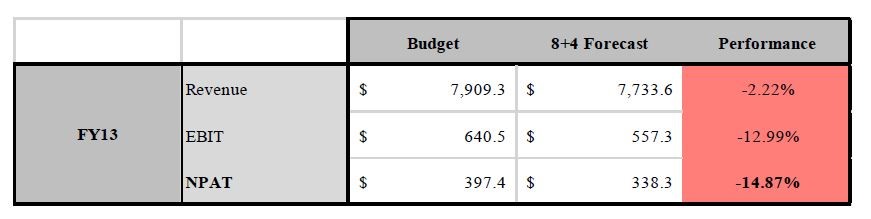

1 In late November 2013, the price of ordinary shares in the respondent (WOR shares) fell approximately 26% on the company’s announcement of revised earnings guidance. That guidance was markedly different from the company’s 14 August 2013 announcement to the effect that WOR had a solid foundation for expecting earnings growth on the figure of $322 million, being WOR’s net profit after tax (NPAT) for the year ended 30 June 2013 (FY13).

2 WOR’s August 2013 earnings guidance statement, published on 14 August 2013 was as follows:

While recognizing the uncertainties in world markets, we expect our geographic and sector diversification to provide a solid foundation to deliver increased earnings in FY2014.

3 On 9 October 2013, WOR made a further relevant announcement to the market, to the effect that its first-half result would be lower than in the prior year, but that it affirmed the August 2013 earnings guidance statement (9 October 2013 announcement).

4 The August 2013 earnings guidance statement was repeated on 10 and 15 October 2013.

5 WOR’s November 2013 revised earnings guidance, published on 20 November 2013, was in the following terms:

On current indications the company now expects to report underlying NPAT for FY2014 in the range of $260 million to $300 million with first half underlying NPAT in the range of $90 million to $100 million.

6 Looking back, the basis for the August 2013 earnings guidance statement is plainly open to question. What could have changed between 14 August 2013 and 20 November 2013 (just over three months) to cause WOR to revise its forecast so significantly? In early December 2013, WOR’s Chief Financial Officer (CFO), Simon Holt’s description of WOR’s budgeting/forecasting performance as “poor”, would reasonably strengthen a suspicion that the August 2013 earnings guidance statement might not have been well-founded.

7 The applicant (Mr Crowley) contended that the August 2013 earnings guidance statement forecast an earnings result that was unreasonably high, having regard to the information available to WOR at the time. Alternatively, Mr Crowley argued, even if the August 2013 earnings guidance statement could be justified when first made, by 21 September 2013, WOR was on notice that the year ending 30 June 2014 (FY14) was tracking far worse than expected and, accordingly, on that day (or in the days following) it should have issued revised guidance to the effect of the November 2013 revised earnings guidance.

8 WOR’s earnings guidance was based upon its internal FY14 budget, initially approved by WOR’s board of directors (Board) in August 2013. The FY14 budget forecast FY14 NPAT of $352 million. WOR contended that the FY14 budget was the result of a comprehensive, robust and detailed process.

9 Mr Crowley submitted that the FY14 budget did not provide a reasonable basis for the August 2013 earnings guidance statement because, in outline:

… although the early part of the budget process – in May 2013 – can be regarded as a “bottom up build”, from the end of May 2013 the inputs from senior management went beyond “challenge” and pushed the Locations to forecast revenues and cost savings that in combination went beyond aggressive, to become plainly unreasonable and improbable of achievement. The budget also lacked a risk analysis that would have identified this serious overreach.

…

The initial bottom-up build from the Locations and Regions became distorted by a series of “challenges” from management, to which the Locations and Regions acquiesced because … the lower-level managers recognised that the targets were being set by senior management and they had to be reflected in the “forecasts”, one way or another. That was the practical reality of the demands expressed as “challenges”.

10 The expression bottom-up indicates the role of the individual locations and cost centres in the early construction of the draft budget.

11 Mr Crowley argued that “clinching support” for his case was to be found in the events leading to the November 2013 revised earnings guidance. Specifically, Mr Crowley referred to “two senior executives, working overnight on 18-19 November 2013 and bluntly stripping $97 million in projected earnings from the then-current FY2014 forecast”.

12 Mr Crowley’s case that was, by this activity, WOR removed so-called management adjustments (defined at [34] below) that had been made to the draft FY14 budget in late May and June 2013. In final submissions, Mr Crowley characterised the management adjustments as a series of top-down adjustments (that is adjustments by or at the behest of senior management) that aimed to increase operational EBIT (operational earnings before interest and tax) by $88.6 million. Mr Crowley also contended that “the essential effect was that the revenue line … was held too high, having regard to the expected market conditions and to the reductions being demanded for the costs line”.

13 Although hindsight plainly suggests that the FY14 budget may have been overly optimistic, for the reasons that follow, I am not persuaded by the available evidence that WOR’s FY14 budget lacked reasonable grounds when it was approved by the Board on 14 August 2013. It follows that I am not satisfied that WOR’s August 2013 earnings guidance statement lacked reasonable grounds. As explained below, these factual conclusions lead to the result that Mr Crowley’s primary “budget” case must fail.

14 Nor am I am satisfied that the position changed so that, by 21 September 2013, 9 October 2013, 10 October 2013 or 15 October 2013 (being the dates alleged by Mr Crowley), WOR lacked a reasonable basis for maintaining or failing to correct the August 2013 earnings guidance statement. Again, as explained below, the consequence is that Mr Crowley’s alternative “performance” case must fail.

15 Mr Crowley’s third case, the “consensus” case, was predicated on the existence of a consensus expectation of professional analysts covering the Australian Stock Exchange (ASX) and WOR shares, held between 14 August 2013 and immediately prior to the November 2013 revised earnings guidance, that WOR would deliver between $354 and $368 million in NPAT for FY14. Assuming in Mr Crowley’s favour the existence of that consensus expectation, his “consensus” case also fails because it required Mr Crowley to demonstrate that, while the so-called consensus expectation existed, WOR knew or ought to have known that its FY14 earnings would fall materially short of a range between $354 and $368 million. I am not satisfied that any relevant officer or officers of WOR, whose state of mind is to be attributed to WOR, had or ought to have had that knowledge or belief at any relevant time.

Mr Crowley and the group members

16 Mr Crowley is a self-funded retiree and former accountant who manages his own share portfolio. Mr Crowley purchased 423 WOR shares on 4 October 2013 for a total consideration (including brokerage) of $10,046.59. On 30 May 2015, Mr Crowley sold all of his WOR shares for $2,755.70.

17 Mr Crowley brought the proceeding on his own behalf and on behalf of other persons (with the exception of those who opted out) who purchased WOR shares in the period between 14 August 2013 and 20 November 2013 (relevant period), and who allegedly suffered loss by reason of WOR’s conduct as pleaded in the fourth further amended statement of claim (4FASOC) filed on 28 August 2019, that is, the first day of the trial.

18 Analysed by reference to the alleged facts, Mr Crowley’s case involved the following three aspects:

(1) the budget case;

(2) the performance case; and

(3) the consensus case.

19 Analysed by the pleaded laws, Mr Crowley’s case alleged contraventions of:

(1) WOR’s “continuous disclosure obligations” which arose under s 674 of the Corporations Act 2001 (Cth) (Corporations Act) and r 3.1 of the ASX Listing Rules.

(2) Proscriptions on misleading or deceptive conduct in s 1041H of the Corporations Act, s 12DA of the Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act) and or s 18 of the Australian Consumer Law (being Schedule 2 of the Competition and Consumer Act 2010 (Cth)).

20 Mr Crowley’s budget case is first predicated on allegations that, by no later than 14 August 2013:

(a) WOR did not have a reasonable basis for making the August 2013 earnings guidance statement (defined in the 4FASOC as Material Information); and

(b) WOR’s FY14 earnings were likely to fall materially short of the consensus expectation of professional analysts covering the ASX and WOR securities that WOR would deliver between approximately $354 and $368 million in NPAT for FY14 (defined in the 4FASOC as Earnings Expectation Material Information).

21 Mr Crowley alleged that, in circumstances pleaded in the 4FASOC, by no later than 14 August 2013, WOR became obliged pursuant to Listing Rule 3.1 to tell the ASX the Material Information and or the Earnings Expectation Material Information.

22 There is no dispute that WOR did not tell the ASX either of these matters. Mr Crowley alleges that, by this failure, WOR contravened s 674 of the Corporations Act which, in summary, required disclosure to the market of information that was not generally available and that a reasonable person would expect, if it were generally available, to have a material effect on the price or value of WOR shares. In support of the alleged contraventions, Mr Crowley ultimately alleged that the Board of WOR and other “officers” of the company, within the meaning of the Corporations Act, ought reasonably to have recognised that the FY14 budget did not support the August 2013 earnings guidance statement.

23 Next, Mr Crowley made a case based on the allegation that, by making (and then maintaining) the August 2013 earnings guidance statement, WOR represented that:

(1) it expected to achieve NPAT in excess of $322 million in FY14; and

(2) it had reasonable grounds to expect that it would achieve NPAT in excess of $322 million in FY14,

(individually and together the FY14 guidance representation).

24 By its defence, WOR admitted that it made the FY14 guidance representation to the extent that WOR represented that it expected to achieve NPAT in excess of $322 million in FY14 in its August 2013 earnings guidance statement and repeated this statement on 9, 10 and 15 October 2013.

25 WOR also admitted that, by the August 2013 earnings guidance statement and the repetition of that statement, WOR represented that it had a basis for expecting that it would achieve NPAT in excess of $322 million in FY14.

26 In closing submissions, WOR acknowledged that, by conveying an opinion, WOR also conveyed that WOR had a basis that it considered reasonable for the opinion. However, WOR disagreed that it conveyed that it had reasonable grounds for expecting to achieve NPAT in excess of $322 million, relying on the following observation of the Full Court in Global Sportsman Pty Ltd v Mirror Newspapers Ltd [1984] FCA 180; (1984) 2 FCR 82 at 88:

An expression of opinion which is identifiable as such conveys no more than that the opinion expressed is held and perhaps that there is basis for the opinion.

27 In Forrest v Australian Securities Investments Commission [2012] HCA 39; (2012) 247 CLR 486 at [102], Heydon J stated:

… It is often said that to state an opinion one does not hold misleads the audience about one’s state of mind. That is understandable. It is also often said that to state an opinion which one does hold implies that one has reasonable grounds for holding it. In some circumstances that may be so, but why should it be so in all? Assume that two people are asked: “In your opinion, is that document a contract?”, one answers “Yes”, and the other answers “Yes, and I have reasonable grounds for that view.” The two answers are different. The first answer does not imply the second, unless there are special circumstances indicating that it should.

28 I accept Mr Crowley’s contention that the circumstances in which WOR made and repeated its August 2013 earnings guidance statement, including the fact that it was intended to convey information that would assist the market to understand WOR’s financial situation and that may have been material to an assessment of the value of WOR shares, were such that a reasonable person hearing or reading that statement was likely to understand WOR to convey that the company had reasonable grounds for the statement.

29 Accordingly, I accept that WOR made the FY14 guidance representation as pleaded, on the occasions pleaded.

30 At the core of Mr Crowley’s budget case is the proposition that the FY14 budget did not provide reasonable grounds for the August 2013 earnings guidance statement.

31 Mr Crowley alleged that the effect of the August 2013 earnings guidance statement (and the FY14 guidance representation conveyed by that statement) was that the trading price of WOR shares was higher than it otherwise would have been, and that the price was inflated from the time of the announcement until the corrective announcement on 20 November 2013.

32 The 4FASOC provides particulars in support of the allegation that the August 2013 earnings guidance statement lacked a reasonable basis. In summary, they concern:

(1) The development of the FY14 budget during which it is alleged that WOR senior management:

i. required Locations to reflect WOR’s FY14 “growth strategy” as determined by ExCo and CEOC without any or due regard to the market conditions referred to in (a) to (b) above [sic – there is no (a) to (b) above]

ii. added $88.6m of operational EBIT, via the Management Adjustments, to the “bottom up” build of Location budgets;

iii. included a $12m acquisition stretch to WOR’s EBIT figure without a proper basis;

iv. did not include in the budget any contingency against operational underperformance, except the FX contingency (described in par.22B [of the 4FASOC]) based on short term fluctuations in FX spot rates that were inherently volatile, with the result that the FX contingency was not appropriate or reliable as a contingency for operational risk; and

v. did not include any or adequate adjustments for projected restructuring costs arising from staff cuts made in order to implement the CEOC Commitments (as to reductions in overheads) or, after 15 October 2013, the termination of a further 1200 full time equivalent staff (FTE) as part of a redundancy program called ‘Project X’ and adopted by WOR to attempt to meet market earnings guidance…

(2) The absence of any or any adequate critical review of blue sky revenue figures in the FY14 budget prior to its approval, to ensure that those figures were not inflated.

(3) The claim that the FY14 budget included unreasonable amounts of blue sky revenue in WOR’s Australia New Zealand (ANZ) region and in the Southwest Ops (SWO) location of WOR’s USA and Caribbean (USAC) region.

(4) The conclusion, from (1) to (3), that WOR did not have reasonable grounds for including in the FY14 budget a NPAT forecast materially higher than approximately $284 million; or alternatively for a profit guidance to the market of “growth” on its FY13 result of $322 million.

33 In particular (1)(i) above, CEOC is a reference to the CEO’s Committee, which was a committee comprising members of WOR’s senior management that advised WOR’s Chief Executive Officer (CEO), Andrew Wood. CEOC is described in more detail at [100] below.

34 As to particular (1)(ii) above, the “Management Adjustments” are defined in the particulars to para 22B of the 4FASOC as follows:

… [T]he FY14 Budget as approved by the Board … set a budget NPAT approximately $100m higher than the NPAT indicated by Locations’ forecasts (being $252m …) of which $68m was attributable to the adjustments, acquisition stretch and CEOC commitments (together Management Adjustments) …

35 Paragraph 22B of the 4FASOC alleges, relevantly, that by 14 August 2013, it was a fact that the FY14 budget would be “challenging to achieve”. Paragraph 22B set out the following particulars about the management adjustments:

7) during the reviews in ‘6’, alternatively on or about 31 May 2013 at the time of compiling the Locations’ detailed budget submissions, Messrs Bradie and Daly instructed the Locations to include in their detailed budgets increased operational EBIT of $34.9m in total, resulting in the detailed budgets as compiled indicating a budgeted NPAT of $288.6m…;

8) further to the matters in ‘7’:

a) on or about 7 June 2013, Mr Allen added to the budget $12m EBIT as a provision for additional operational EBIT generated through acquisitions during FY14 (acquisitions stretch)…; and

b) on or about 12 June 2013, Messrs Bradie and Daly instructed a number of Locations to make further adjustments to their detailed budgets with the effect of increasing operational EBIT by $20.7m…;

with the result that budgeted NPAT increased to $295m;

9) then further to the matters in ‘8’:

a) on or about 17 June 2013, Mr Holt provided a draft budget to ExCo reflecting the outcome of the process particularised in ‘1’ to ‘8’ above and indicating an NPAT of $297m…;

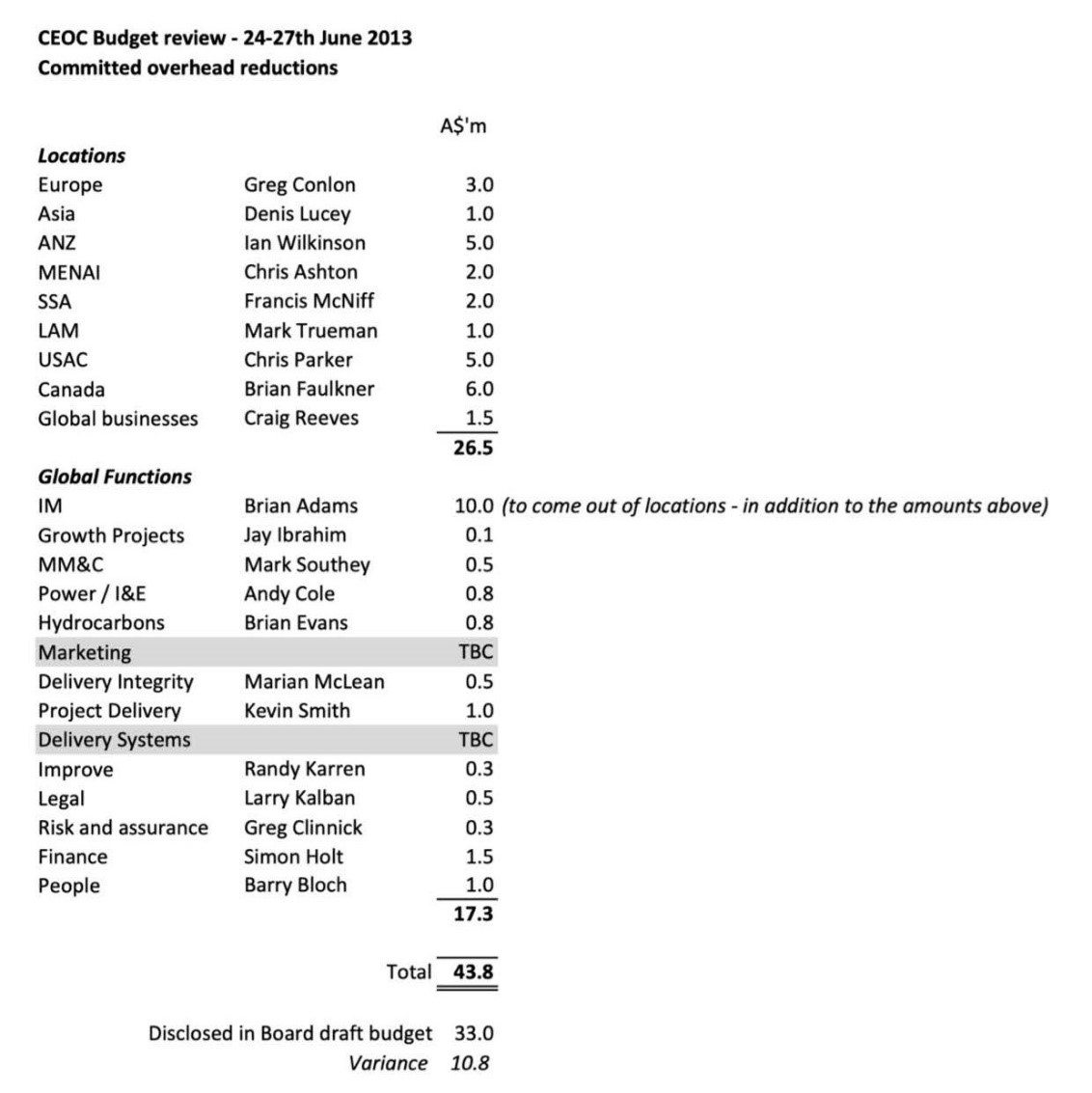

b) on or about 25 June 2013, a CEOC meeting resolved to include an additional $43.8m in overhead savings in the FY14 budget (CEOC commitments), of which $33m would be recorded in operational EBIT …;

c) on or about 26 June 2013, Messrs Allen, Daly and/or Holt incorporated the FX spot rate as at 14 June as the assumed FX rate for FY14, with the result that $32m was added to the budget NPAT figure…;

(Emphasis added)

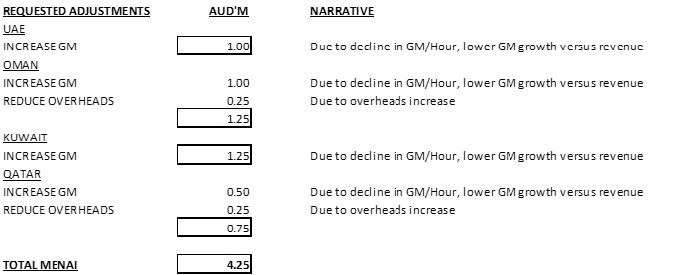

36 As to (7) immediately above, Stuart Bradie was WOR’s Group Managing Director (GMD) of Operations. Michael Daly’s title was Global Director – Operations and Communications Support. As to (8), John Allen’s title was Global Director – Corporate Finance.

37 The figure of $88.6 million in particular (1)(ii) is the sum of the following three items referred to in the particulars to para 22B of the 4FASOC:

(1) $34.9 million;

(2) $20.7 million; and

(3) $33 million.

38 The $68 million figure ([34] above) comprises the $88.6 million, less the $33 million for “CEOC commitments”, plus the $12 million acquisition stretch referred to in (8) of the particulars at [32] above.

39 In contrast with particular (1)(iii), particular (1)(ii) does not allege that the addition of $88.6 million to operational EBIT lacked a proper basis. This is consistent with para 22B of the 4FASOC, to which particular (1)(ii) refers, which only alleges that the FY14 budget would be “challenging to achieve”.

Contingency against operational underperformance

40 As to particular (1)(iv) ([32] above), the “FX contingency” was also identified in the particulars to para 22B of the 4FASOC, as follows:

[P]rior to the presentation of the final FY14 Budget to the Board on 13 August 2013, FX spot rate movements since June indicated a positive NPAT effect of up to $48m, which effect was booked to operational EBIT but (at the direction of Wood and Allen) was offset by a $16.1m “contingency” (FX contingency) resulting in no change to the $32m FX contribution to NPAT …

41 As explained in more detail below, blue sky is estimated revenue from projects not identified at the time of forecasting. As expressed in the 4FASOC, the first of the two allegations concerning blue sky revenue ([32](2) above) focuses on the absence of any or any adequate review of the estimates. It does not make a positive allegation that blue sky revenue forecasts were inflated by any particular amount.

42 Mr Crowley’s case as particularised was that the absence of a review could be inferred from the following two matters:

(1) Mr Daly’s 7 November 2013 observation that “some locations added blue sky to increase their figures to maintain budget but increased overhead in line with this proportionately”.

(2) Mr Daly’s “very critical” look at WOR’s operational EBIT forecast in November 2013, which led to his recommendation that the budget be changed in the following three respects:

(a) $97 million of operational EBIT relating to blue sky revenue should be removed;

(b) the $12 million acquisition stretch should be removed; and

(c) a $10 million provision for the Arkutun-Dagi project ought to be taken against EBIT.

43 The case that the blue sky revenue forecasts were inflated, as expressed in the second particular ([32](3) above) concerning blue sky revenue, is limited to WOR’s ANZ region and the SWO location of the USAC region.

44 The 4FASOC states that, in these premises:

(1) WOR did not have reasonable grounds for including in the FY14 budget an NPAT forecast materially higher than approximately $284 million; further or alternatively

(2) WOR did not have reasonable grounds for a profit guidance to the market of “growth” on its FY13 NPAT result of $322 million.

45 The figure of $284 million is said by Mr Crowley to be the approximate sum of the 27 May 2013 forecast NPAT of $252 million plus an allowance for foreign exchange effects accrued between that time and the final budget.

46 In the 4FASOC, Mr Crowley removed the following earlier allegations:

(1) WOR did not budget for the most reasonable and likely view of the outcome of the Imperial Oil Limited Aurora Tailings Management (IOL ATM) project in Canada.

(2) WOR did not incorporate an appropriate business risk or integration contingency in respect of “TWP” in the Sub-Saharan Africa (SSA) region.

(3) WOR did not budget for an appropriate provision of contingency in respect of an anticipated claim in relation to its Arkutun-Dagi project in the SWO location.

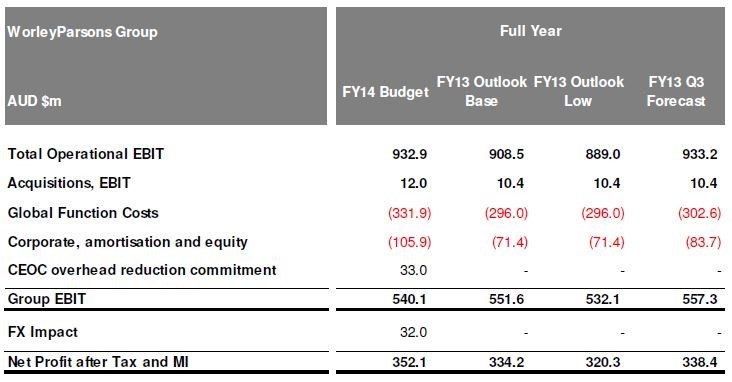

47 In opening, Mr Crowley contended that, over three rounds of management adjustments, approximately $100 million in operational EBIT was added to the bottom-up build of the FY14 budget. By the following process, WOR’s projected FY14 NPAT was increased from $252 million to $352.1 million:

(1) the 27 May 2013 draft budget produced a forecast NPAT of $252 million;

(2) Messrs Bradie and Daly then added $34.9 million in operational EBIT and Mr Allen added $12 million for acquisition stretch with the result that the budgeted FY14 NPAT was $288.6 million;

(3) Messrs Bradie and Daly then added $20.7 million in operational EBIT with the result that budgeted FY14 NPAT increased to $295 million;

(4) CEOC then resolved to include an additional $43.8 million in overhead savings in the FY14 budget, of which $33 million would be recorded in operational EBIT; and

(5) $32 million was added to the budget NPAT figure using the current foreign exchange spot rate (Mr Crowley makes no complaint about this adjustment).

48 As opened, the case was that the management adjustments were “imposed” by senior management.

49 In final submissions, Mr Crowley maintained the contentions that WOR did not have reasonable grounds on 14 August 2013:

(1) for calculating, in the FY14 budget, an NPAT forecast materially higher than approximately $284 million; and

(2) for giving guidance to the market to the effect of “growth” on its FY13 NPAT result of $322 million.

50 Further, Mr Crowley contended that a reasonable budget process would have forecast a FY14 result in the range $260 to $300 million, or in any event materially lower than the post-August 2013 analysts’ consensus promoted by WOR. This contention is similar to the following allegation that was deleted from the particulars to para 46(d) of the 4FASOC:

iii. WOR did not have reasonable grounds for a profit guidance to the market materially higher than:

…

B alternatively to A, NPAT of around $296.9m (Jaski Reply Report, 163);

…

D … NPAT of between $260m-$300m, inclusive of redundancy costs, being the amount in “B” less the further adjustment determined during the Board meeting on 20 November 2013 on the grounds that the ExCo recommendation of a forecast of $280-300m was insufficiently conservative.

51 The “Jaski Reply Report” was an expert report that was ultimately not relied on by Mr Crowley.

52 Mr Crowley identified eight core factual matters in support of his contention that the FY14 budget did not in fact provide reasonable grounds for the earnings guidance (and that the Board and other officers of WOR ought reasonably to have recognised as much). The eight core factual propositions are as follows:

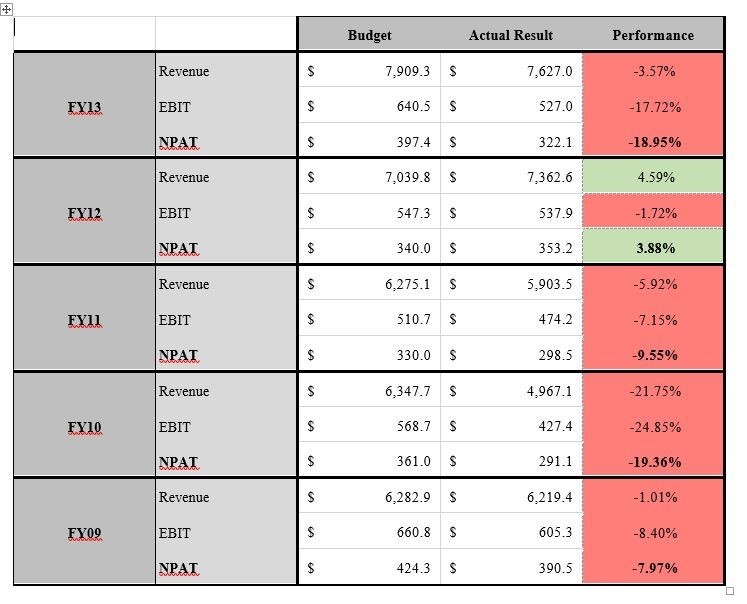

(1) WOR had a consistent record of underperforming against its internal budget since FY09, with the sole exception of FY12, and had not materially changed its FY14 budget-setting process from previous years.

(2) WOR had been required to downgrade its earnings guidance on two occasions in FY13 because of underperformance against its internal budget.

(3) In early 2013, as the FY14 budget-setting process began, WOR’s major markets were either not growing, or were deteriorating, and the expectation was for continued uncertainty in its markets during FY14.

(4) Between March and May 2013 the locations, together with the regional managing directors (RMDs) and managing directors of the customer service groups (CSGs), engaged in a thorough bottom-up budget process, with conscientious regard to “growth” and overhead reduction directives issued by senior management. The result was that the “detailed budget” compiled in very late May 2013 already incorporated stretch targets in respect of both revenue, and costs savings. Those targets were already optimistic, given market conditions.

(5) In June and July 2013, when it became apparent that the actual bottom-up budget would not support WOR’s Vision 2017 objective of year-on-year growth in every year from FY13 to FY17 (set out in full at [121] below), senior management, by the so-called management adjustments, demanded a series of top-down adjustments that aimed to increase operational EBIT by $88.6 million. The locations duly stretched again to reflect the majority of those adjustments in their local budgets (however improbable they were and proved to be).

(6) The FY14 budget included the $12 million acquisition stretch addition to EBIT that lacked a proper basis.

(7) The FY14 budget was not a true P50 budget (explained at [114] below), but rather included no adequate allowance for the risks associated with continued slow markets and operational underperformance.

(8) WOR’s budget process lacked a risk-adjusted review of its internal budget, particularly in relation to unsecured work, for the purpose of ensuring that any consequential guidance to the market properly reflected the risk associated with its stretch budget targets.

53 The performance case was put in the alternative to the budget case, against the possibility that the Court was not satisfied that the August 2013 earnings guidance statement lacked reasonable grounds. On this aspect of the case, Mr Crowley alleged that WOR’s actual performance in the early months of FY14 dissolved whatever hopes that had underpinned the FY14 budget. More specifically, Mr Crowley alleged that by late September 2013, WOR’s senior management was aware that the assumptions in the FY14 budget were failing but did not revisit those assumptions.

54 The performance case was that from 14 August 2013 and, specifically, on 9 October 2013, 10 October 2013 or 15 October 2013, WOR lacked a reasonable basis for maintaining the FY14 guidance representation and by failing to correct the August 2013 earning guidance statement (or the 9 October 2013 announcement), WOR engaged in conduct that was misleading or deceptive or likely to mislead or deceive.

55 The consensus case, as described in this judgment, comprises the claims premised upon a proposition that WOR was aware of a consensus expectation of market analysts that it would deliver between approximately $354 and $368 million in NPAT for FY14. Mr Crowley put a case that WOR had this state of knowledge from 14 August 2013 and that WOR ought to have known that its earnings were likely to fall materially short of the consensus expectation from 14 August 2013. In the alternatively, Mr Crowley contended that by specific dates, being 21 September 2013, 9 October 2013, 10 October 2013 or 15 October 2013, WOR was or ought reasonably to have been aware that its FY14 earnings were likely to fall materially short of $354 million. By failing to disclose that information, Mr Crowley alleges, WOR contravened s 674 of the Corporations Act.

56 Mr Crowley explained that the key difference between the performance case and the consensus case is that even if a reasonable forecast for FY14 was, for example, an NPAT of $323 million, so as to constitute minimal “growth” over the FY13 result and therefore be “notionally compliant” with the August 2013 earnings guidance statement, nonetheless that result was still sufficiently below the consensus expectation that it was material information that was required to be disclosed to the market.

57 By order made on 3 December 2018, the trial was a hearing of Mr Crowley’s claim and of issues common to the claims of group members as agreed by the parties or determined by the Court. On 22 March 2019, subject to further order, the Court made an order identifying the list of issues common as between Mr Crowley and the group members and to be determined at the initial trial. The common issues are addressed at the end of these reasons for judgment, amended to incorporate terms used in the judgment.

Legal principles concerning fact finding

58 Mr Crowley accepted that, in order to succeed, he must prove his case on the balance of probabilities in accordance with s 140 of the Evidence Act 1995 (Cth). By s 140(2), without limiting the matters that the Court may take into account in deciding whether it is satisfied that the case has been proved on the balance of probabilities, it is to take into account:

(a) the nature of the cause of action or defence; and

(b) the nature of the subject-matter of the proceeding; and

(c) the gravity of the matters alleged.

59 The allegation that a publicly listed company did not have reasonable grounds for its earnings guidance is a relatively serious one. In Briginshaw v Briginshaw [1938] HCA 34; (1938) 60 CLR 336, Dixon J (as his Honour then was) explained at 361-362:

Except upon criminal issues to be proved by the prosecution, it is enough that the affirmative of an allegation is made out to the reasonable satisfaction of the tribunal. But reasonable satisfaction is not a state of mind that is attained or established independently of the nature and consequence of the fact or facts to be proved. The seriousness of an allegation made, the inherent unlikelihood of an occurrence of a given description, or the gravity of the consequences flowing from a particular finding are considerations which must affect the answer to the question whether the issue has been proved to the reasonable satisfaction of the tribunal. In such matters “reasonable satisfaction” should not be produced by inexact proofs, indefinite testimony, or indirect inferences.

60 Mr Crowley observed that inferences, whether drawn from documents or from the absence of contradictory evidence, are part of the process by which the Court determines whether it has been persuaded of a fact in issue to the requisite standard. In Transport Industries Insurance Company Ltd v Longmuir [1997] 1 VR 125 at 141, where the issue was whether the respondent was responsible for causing a fire, Tadgell JA (Winneke P and Phillips JA agreeing) explained:

As will be seen, I respectfully differ from the learned [primary] judge upon several of the individual conclusions of fact which he drew from the evidence and which he considered to preclude a finding that the respondent was responsible for the fire. That aside, it should be said that, to assess the evidence in a case like this by reference to various individually-pleaded particulars, as though running through items on a check list, is apt to mislead. The evidence is to be evaluated as a whole in order fairly to consider whether the party bearing the onus of proof has established what is ultimately sought to be proved. The object of the exercise of evaluation is to discover whether the evidence paints a picture reflecting real life, rather than to place a tick or a cross against paragraph after paragraph of torpid pleading. A true picture is to be derived from an accumulation of detail. The overall effect of the detailed picture can sometimes be best appreciated by standing back and viewing it from a distance, making an informed, considered, qualitative appreciation of the whole. The overall effect of the detail is not necessarily the same as the sum total of the individual details …

(Citations excluded)

61 This analysis was adopted by Tracey J in Mathai v Nelson [2012] FCA 1448; (2012) 208 FCR 165 at [46] and following, in deciding the question whether Mr Mathai had used certain funds to purchase properties.

62 Whether an inference should be drawn is decided by reference to the particular circumstances of the case. In G v H [1994] HCA 48; (1994) 181 CLR 387 at 390, Brennan and McHugh JJ explained:

It is one thing to say that the Court may draw an inference; it is another to say what inference should be drawn. An inference is a tentative or final assent to the existence of a fact which the drawer of the inference bases on the existence of some other fact or facts. The drawing of an inference is an exercise of the ordinary powers of human reason in the light of human experience; it is not affected directly by any rule of law …

63 In that regard, the principle in Blatch v Archer (1774) 98 ER 969 at 970 may be relevant, namely, that “all evidence is to be weighed according to the proof which it was in the power of one side to have produced, and in the power of the other to have contradicted”.

64 Mr Crowley noted that, relatedly, in Jones v Dunkel [1959] HCA 8; (1959) 101 CLR 298 at 321, Windeyer J stated that, when a party who is capable of testifying, fails to give evidence without explanation “it may lead rationally to an inference that his evidence would not help his case”.

65 The failure to call a witness may also permit the Court to draw with greater confidence any inference that is unfavourable to the party that failed to call the witness, if that inference is open on the evidence and the uncalled witness appears to be in a position to cast light on whether the inference should be drawn: Kuhl v Zurich Financial Services Australia Ltd [2011] HCA 11; (2011) 243 CLR 361, 384-385 at [63].

66 Mr Crowley observed that, by virtue of his position as a former shareholder of WOR, he has primarily sought to make his case at the initial trial from discovered documents while WOR is in possession of all available information concerning its FY14 budget and its performance against that budget. Mr Crowley did not make any complaint about the adequacy of discovery provided but observed that it was necessarily limited, including because of the passage of time, and because all information may not be recorded or recorded in documents that are now retrievable.

67 Mr Crowley acknowledged that neither Blatch v Archer nor Jones v Dunkel can be relied upon to “convert conjecture and suspicion into inference”: Fair Work Ombudsman v Hu [2019] FCAFC 133 at [56], but argued that, in the absence of clear evidence from WOR contradicting any inference available from the material relied upon by Mr Crowley for any particular fact in dispute, the Court may more readily draw the inference proposed by Mr Crowley.

68 Mr Crowley submitted that the documentary record in this case, taken as a whole, presents a picture which is not ambiguous but that WOR’s three lay witnesses had sought to “recharacterise” that record. Those witnesses were three senior executives: Mr Wood; Robert Ashton, the RMD of the Middle East, North Africa, India (MENAI) region from March 2013 to November 2016 and Denis Lucey, RMD of the Asia and China (ASCH) region from 2011 to 2014.

69 I do not accept either element of this submission, which is not supported by my detailed findings below. In summary, my impression was that the documentary record of the development of the FY14 budget is generally consistent with the evidence of WOR’s witnesses. The evidence that supports Mr Crowley’s case is mostly hindsight and is not supported by detail that might have contradicted the evidence of WOR’s witnesses in substantial respects.

70 Mr Crowley drew attention to WOR’s failure to call witnesses in the following three categories:

(1) Persons who were “key” to the 2013 budget process but who are no longer employed by WOR, particularly Mr Bradie, Mr Holt and Ian Wilkinson, RMD of the ANZ region at the relevant times.

(2) Persons whose current employment is not known, particularly Mr Daly.

(3) WOR employees and members of the Board, whose affidavits were served but who were not ultimately called. This included John Grill, the Board Chairman and Mr Allen.

71 Mr Crowley referred to In the matter of HIH Insurance Limited (In Liq) [2016] NSWSC 482; (2016) 335 ALR 320 at [33], in which Brereton J rejected a submission that the former CFO of HIH, Mr Fodera, was not in the defendants’ camp. His Honour inferred that Mr Fodera knew that the treatment of certain arrangements was incorrect according to proper accounting practice and standards and would create a misleading appearance of profitability. His Honour noted that, as a former officer, Mr Fodera was obliged to assist the liquidators and “he would much more naturally be called by the defendants to deny that he had guilty knowledge than by the plaintiffs to confess that he did”.

72 At a general level, I accept that WOR’s failure to call the witnesses identified by Mr Crowley may provide support for one or more adverse inferences. However, it is necessary to address the issue by reference to particular inferences and the available evidence for and against any proposed inference.

73 Mr Crowley identified as a significant proposed inference:

… that the descriptions of the budget-setting process recorded in the interview notes collated for the purposes of Mr Holt’s memorandum prepared for the Audit and Risk Committee of the Board (and comprising Board members) (A&RC) on 5 December 2013 (what became known at trial as the Holt Memorandum) were an accurate description of the process actually followed.

74 The interview notes (Holt Memo interview notes), which accompany the Holt Memorandum addressed by Mr Holt to the A&RC and dated 5 December 2013, are just that: 14 pages of bullet pointed observations, some of which are attributed to particular individuals but others of which are unattributed. There is no reason to doubt that they are an accurate record of the interviews that they record; or that they reflect opinions genuinely held (although Mr Lucey did not remember the discussion recorded in the notes and Mr Ashton had only a limited recollection). However, the meaning of the notes is very often unclear, as is the basis upon which interviewees expressed their opinions. For example, the notes include the following:

Strategy

• Location managers can only do so much

• Probably react by cutting costs

• If the market is declining there is not much to manage and there is not much that the location manager can do

• You need to Grow market share but that is a medium to long term strategy

• How do you grow by 10% in a flat market?

• Reality is that strategy change will only benefit in the new few years

• Where is the revenue going to come from

Financial Realities

• Over the last couple of years we have been bled down

• Underlying performance vs release of provisioning (headline performance)

• In the current cycle we are struggling to turn

Mal practice

• Little evidence of deliberate mal practice

75 By way of a further example, the following notes appear under the heading “Process”:

• Recognition of BlueSky

• Sum of the Locations does not equal Actual

• Multiple passes at forecast and reforecasts trying to get to a more palatable outcome

• Desire to get rid of the sandbagging

• Cultural pressure for Reforecasts to hold the line on budgets

• Culture of fear if they tell the truth with consequence of staff cuts

• Underlying performance vs Headline performance

• People put in number which look right rather than are right

• Exco will make the decision anyhow, and they WILL be asking for more

• There are too many people budgeting!!

• We budget too often

• Lack of transparency, if it is bad we have to know it is going bad!!!

• Push to Grow regardless of actual trading conditions and cycle

• Every budget has a perceived target which requires bluesky with great deal of uncertainty

• Higher and higher BlueSky with lower and lower probabilities leads to falling behind on actuals

• Nervous about the degree of BlueSky in the budget

• General recognition of P50 trending now to P25

• Some budgetary risk not provisions in final budget outcomes

• We do not have very good location controls and location level transparency to challenge and provide commercial oversight

76 And under the heading “How can we improve the process”

…

• With hindsight we would have attacked the overheads at the locations earlier

• Unrealistically high BlueSky number with little proper risk assessment

• What is the minimum we can spend globally since the cost base is too high

• The actual budget process is good we just need to risk assess it better

• We get a good first cut and then talk it up

• We are setting hurdles which are way too high

• …

• We have to stop kidding ourselves on revenue and take out costs quickly before the lag of 3, 4 or sometimes 6 months

…

77 These notes certainly indicate possible significant defects in the FY14 budget setting process and, ultimately, the FY14 budget. However, ultimately, it is necessary to look at all the available evidence concerning the process to determine whether WOR’s failure to call one or more witnesses supports an adverse inference based on documentary evidence (including the interview notes) or the oral evidence of Messrs Wood, Ashton and Lucey, each of whom was cross-examined by counsel for Mr Crowley.

78 As explained below, I concluded that Mr Crowley was a truthful witness.

79 I formed favourable views of the credibility of each of Messrs Wood, Ashton and Lucey. Each of these witnesses gave evidence that was forthright and generally responsive to the questions asked of them in cross-examination. Each appeared to be experienced and knowledgeable about WOR’s business and the budget setting process within their respective areas of responsibility. I was satisfied that they were truthful and candid witnesses and I generally accepted the evidence given by each of them.

Consensus expectation about WOR’s FY14 NPAT

80 Paragraph 22D of the 4FASOC alleges:

By 14 August 2013 WOR was aware, and it was the fact, that at all material times between 14 August 2013 and immediately before the 20 November 2013 Announcement and 20 November 2013 Presentation, the consensus expectation of professional analysts covering the ASX and WOR Securities was that WOR would deliver between approximately $354 and $368m in NPAT for FY14 (FY14 WOR Earnings Expectation).

81 As noted below, both WOR and professional analysts commenting on WOR made reference to “consensus” forecasts of WOR’s NPAT. The ASX also referred to “consensus estimate” in the following passage of its ASX Listing Rules Guidance Note 8:

ASX does not believe that a listed entity has any obligation, whether under the Listing Rules or otherwise, to correct the earnings forecast of any individual analyst or the consensus estimate of any individual information vendor to bring them into alignment with its own internal earnings forecast.

82 The evidence did not refer to any consensus expectation of NPAT expressed as a range. Rather, the evidence identified consensus NPAT figures as follows:

(1) “Average analyst consensus” of $374.6 million and “Bloomberg NPAT consensus at 17th June 2013” as $359.4 million in WOR’s FY14 Draft Group Budget pack dated 26 June 2013 (see [263], [264] and [306]);

(2) On 15 August 2013, Macquarie Equities Research stated, in relation to its forecast of WOR’s FY14 NPAT, “Consensus is similar at $368m” (see [320]);

(3) On about 24 September 2013, the FY14 August financial report ExCo pack stated “FY14 internal forecast NPAT of $352.1m is $12.5m or 3.5% below the average analyst estimate of $364.6m” (see [469]);

(4) On 19 October 2013, Mr Holt received the “Finance Report – ExCo September FY14” slide pack which recorded an average of analysts earnings estimates of $353.6 million and noted the Bloomberg consensus of $356.3 million (see [504]).

83 This evidence suggests that there was no single consensus expectation of professional analysts during the relevant period. However, WOR considered that there was a consensus expectation of professional analysts covering the ASX and WOR Securities throughout the relevant period, calculated by WOR to be $364.6 million on about 24 September 2013 and $353.6 million on about 19 October 2013.

Falling “materially short” of consensus expectation

84 Mr Crowley’s case included an allegation that, by no later than 14 August 2013 or (alternatively) 21 September 2013, 9 October 2013 or 15 October 2013, WOR’s FY14 earnings were likely to fall materially short of the FY14 WOR Earnings Expectation pleaded in para 22D of the 4FASOC, set out at [80] above.

85 In final submissions, Mr Crowley submitted that “materiality” is likely to connote a change between 5% and 10%. For the purpose of its case, WOR noted that throughout the relevant period, WOR’s internal forecasts were estimating its full year earnings to be within 5% of the pleaded “consensus estimates”.

86 In TPT Patrol Pty Ltd as trustee for Amies Superannuation Fund v Myer Holdings Ltd [2019] FCA 1747 (Myer) at [1166], Beach J found that information that the forecast NPAT in that case would be “materially lower” meant at least 5% lower, and rejected Myer’s contention that it was closer to 15% lower. His Honour referred to Guidance Note 8 which, during the relevant period stated relevantly:

ASX would therefore recommend that an entity consider updating its published earnings guidance for the current reporting period if and when it expects its earnings for the period to differ materially from that guidance. For these purposes, ASX would suggest that entities apply the guidance on materiality in Australian Accounting and International Financial Reporting Standards, that is:

• treat an expected variation in earnings compared to its published guidance equal to or greater than 10% as material and presume that its guidance needs updating; and

• treat an expected variation in earnings compared to its published guidance equal to or less than 5% as not being material and presume that its guidance therefore does not need updating,

unless, in either case, there is evidence or convincing argument to the contrary. Where the expected variation in earnings compared to its published earnings guidance is between 5% and 10%, the entity needs to form a judgment as to whether or not it is material. Smaller listed entities or those that have relatively variable earnings may consider that a materiality threshold of 10% or close to it is appropriate. Very large listed entities or those that normally have very stable or predictable earnings may consider that a materiality threshold that is closer to 5% than to 10% is appropriate.

This recommendation is purely a suggestion to assist listed entities in determining if and when they should be updating their published earnings guidance. The mere fact that an entity may expect its earnings to differ from its published guidance by more (or less) than a particular percentage will not necessarily mean that its guidance is (or is not) misleading.

(Footnotes omitted)

87 For the purposes of considering this aspect of Mr Crowley’s case, I have adopted Beach J’s approach in Myer. Accordingly, the relevant question is whether at the pleaded dates, WOR’s FY14 NPAT was likely to fall materially short of (more than 5% below) the following figures:

(1) by no later than 14 August 2013, $368 million (that is, below $349.6 million);

(2) by no later than 21 September 2013, $364.6 million (that is, below $346.37 million);

(3) by no later than 9 October 2013, $364.6 million (that is, below $346.37 million);

(4) by no later than 15 October 2013, $364.6 million (that is, below $346.37 million).

88 WOR is a professional services provider to customers in the resources, energy and infrastructure sectors. Its customers include multinational oil and gas, resources and chemicals companies, as well as more regionally and locally focussed companies, national oil companies and government owned utilities.

89 At all relevant times, WOR was listed on the ASX. As at 30 June 2013, it had 246.5 million ordinary shares on issue. WOR admitted that it was:

(1) a corporation included in the official list of the financial market operated by ASX and whose securities are enhanced disclosure (ED) securities for the purposes of s 111AE of the Corporations Act;

(2) subject to and bound by the ASX Listing Rules;

(3) a listed disclosing entity within the meaning of s 111AL(1) of the Corporations Act;

(4) a trading corporation within the meaning of the ASIC Act; and

(5) a corporation within the meaning of the Competition and Consumer Act 2010 (Cth).

90 During FY13, WOR operated out of 165 offices in 43 countries and employed approximately 39,800 people. During FY14, WOR operated out of 157 offices in 46 countries and employed approximately 35,600 people.

91 At the relevant times, WOR’s business was organised into the following eight regions, each headed by a RMD:

(1) ANZ (as previously noted Mr Wilkinson was RMD of ANZ);

(2) Canada (CAN);

(3) ASCH (as previously noted Mr Lucey was RMD of ASCH);

(4) USAC;

(5) Latin America (LAM);

(6) MENAI (as previously noted Mr Ashton was RMD of MENAI);

(7) Europe (EUR); and

(8) SSA.

92 Each region was divided into locations, of which there were 43 in total. For example, the ASCH region comprised eight locations, while MENAI comprised seven locations.

93 For FY14, WOR allocated customers to three CSGs:

(1) Hydrocarbons: being customers involved in extracting and processing oil and gas;

(2) “Minerals, Metals & Chemicals” (MM&C): customers involved in extracting and processing mineral resources and manufacturing chemicals; and

(3) Infrastructure: a consolidation of two sectors Infrastructure & Environment (customers involved in projects relating to water, the environment, transport, ports and site remediation and decommissioning) and Power (customers involved in power generation, transmission and distribution).

94 There was a CSG managing director for each of the CSGs.

95 According to WOR’s 2013 annual report, the Hydrocarbons sector contributed 70% of WOR’s aggregated FY13 revenue. Considered by region, ANZ, CAN and USAC together generated 67% of aggregated FY13 revenue. Mr Crowley described the Hydrocarbons sector and the ANZ, CAN and USAC regions as the “primary financial engines” of WOR. ANZ comprised four locations, CAN comprised six locations and USAC comprised five locations.

WOR’s senior management structure

96 From 23 October 2012 and throughout the relevant period, Mr Wood was CEO and WOR’s only executive director. The other members of the Board were Mr Grill (Chairman), Ron McNeilly (Deputy Chairman), Christopher Haynes OBE, Erich Fraunschiel, Catherine Livingstone AO, Xiao Bin Wang, JB McNeil, Larry Benke and John Green.

97 During the relevant period, the following executives reported directly to Mr Wood:

(1) CFO, Mr Holt;

(2) GMD Operations, Mr Bradie;

(3) GMD Development, Iain Ross;

(4) GMD New Ventures, David Steele;

(5) GMD Improve, Randy Karren; and

(6) GMD People, Barry Bloch.

98 The eight RMDs reported to Mr Bradie.

99 The CSG managing directors reported to Mr Ross. They were Brian Evans (Hydrocarbons), Andy Cole (Infrastructure) and Mark Southey (MM&C).

100 There were three management committees of relevance to this proceeding:

(1) The Board, which operated on a consensus basis and for which Mr Wood prepared a monthly CEO report or a CEO summary providing information on the prior month. There were two key sections of the CEO Report and CEO Summary: (i) a report of market conditions, which the CSG managing directors assisted in preparing; and (ii) a report on operational performance, which Mr Bradie had input into, assisted by the RMDs.

(2) The Executive Committee (ExCo), which comprised Mr Wood and his six direct reports from September 2013. Prior to that time, it comprised those individuals except Mr Holt. The ExCo met at least monthly.

(3) The CEOC, which comprised ExCo, the CFO (when not formally in ExCo), the eight RMDs and the three CSG managing directors. As Mr Wood explained it, the CEOC was an advisory group that provided him with advice and support. Many of the key business leaders at WOR were on the CEOC. The CEOC was not a decision-making body.

101 Mr Crowley referred to the following two other executives in particular:

(1) Mr Daly, who was “effectively the financial lead for Mr Bradie”. As previously noted, Mr Daly’s title was Global Director – Operations and Communications Support. Mr Daly reported to Mr Holt but Mr Wood had direct formal and informal discussions with him.

(2) Mr Allen, also reported to Mr Holt but, again, Mr Wood had direct formal and informal discussions with him. As previously noted, Mr Allen’s title was Global Director – Corporate Finance.

102 WOR monitored its financial performance through, among other things, monthly financial reports that detailed actual monthly financial performance and were typically finalised approximately two to three weeks after the end of each month. These monthly financial reports were provided both to the Board and ExCo.

WOR’s officers within the meaning of the continuous disclosure provisions

103 The definition of “officer” in s 9 of the Corporations Act (which applies to the ASX Listing Rules pursuant to r 19.3) is as follows:

“officer” of a corporation means:

(a) a director or secretary of the corporation; or

(b) a person:

(i) who makes, or participates in making, decisions that affect the whole, or a substantial part, of the business of the corporation; or

(ii) who has the capacity to affect significantly the corporation’s financial standing; or

(iii) in accordance with whose instructions or wishes the directors of the corporation are accustomed to act …

104 There is no dispute that each of the members of the Board, including Mr Wood, was an “officer” of WOR at the relevant times.

105 WOR also admitted that Mr Bradie was an officer of WOR, and that Mr Holt was an officer of WOR from September 2013, when he became a member of ExCo.

106 Mr Wood’s affidavit identified Mr Holt as CFO during the period 1 February to 19 November 2013. The Board minutes identify Mr Holt as CFO on 12 February 2013. On this evidence, and having regard to Mr Holt’s leading role in the development and finalisation of the FY14 budget, I find that Mr Holt was an officer of WOR from at least 1 February 2013.

107 Mr Crowley also contended that Messrs Allen and Daly were officers of WOR at the relevant times.

108 As Mr Crowley has failed in his case that WOR lacked a reasonable basis for its August 2013 earnings guidance statement to the market prior to the corrective disclosure on 20 November 2013, the issue (identified by Mr Crowley) of whether any WOR officer ought reasonably to have recognised the lack of such a basis does not arise.

109 Accordingly, it is unnecessary to decide whether either Mr Allen or Mr Daly was an officer of WOR within the meaning of the Corporations Act at any relevant time.

Overview of WOR’s budget process and market guidance

110 WOR admitted that, at all material times, it reported:

(1) on a consolidated basis for itself and its controlled entities;

(2) earnings as EBIT and profit as NPAT; and

(3) revenue as “aggregated revenue” which it defined as “statutory revenue and other income plus share of revenue from associates less procurement services revenue at nil margin, interest income and net gain on revaluation of investments previously accounted for as equity accounted associates”.

111 Mr Wood’s evidence was that WOR’s earnings guidance from time to time was based on its expected NPAT, calculated by reference to the company’s internal budgets and forecasts and business strategy for the financial year. The Board approved all earnings guidance given to the market. It was the practice of the Board, when forming its opinion regarding earnings guidance, that it also approved the internal budget on which the guidance was based. Mr Wood’s evidence was that “we work very hard in framing our guidance such that it gives a clear indication of our expectations of the business’s performance and where we sit in the market”. He agreed with Mr Holt’s December 2013 statement that “we have done a good job at year end of guiding the analysts to a consensus that is approaching our budgeted figure”.

112 As outlined in Mr Wood’s affidavit, WOR’s annual budget setting process broadly followed the following steps:

(1) In around March, a strategy session that involved identifying what was happening in the markets in which WOR operated, where the opportunities were and where the company should direct its efforts. The business presented a picture of expectations around sector or location market changes. The strategic plan was typically set in March and communicated to the Board in April. The strategic plan provided a framework for the budget process.

(2) A bottom-up build of the draft budget, involving each location considering and assessing anticipated revenues and costs or each project of contract. The bottom-up build was based on WOR’s portfolio of work in hand (referred to as “secured work”) and estimates for “unsecured work” which consisted of “proposals”, “prospects” and blue sky.

(3) Between March and June, the location draft budgets were reviewed by the RMDs, the Regional Finance Directors (RFDs), the CSG managing directors and ExCo. Thus, the bottom-up build was subject to top-down review and CSG “side-check”.

(4) In June, the draft budget was presented to the Board, with ExCo members, RMDs, CSG managing directors and other budget owners who stated their budget expectations for their own regions or sectors. The strategic plan was also presented to the Board for discussion.

(5) In August, the budget (typically closely aligned with the draft budget presented in June) was approved by the Board. The Board would also typically (and in August 2013 did) approve a separate directional guidance to be released to the ASX, indicating WOR’s expectation as to its earnings for the coming year.

113 This broad outline does not identify how WOR’s non-operational overheads are incorporated into the annual budget. WOR’s business structure included Global Functions, which were non-revenue generating cost centres. WOR’s Global Management Reporting FY14 Budget Global Instructions (FY14 budget instructions) indicate that Global Functions budgets were prepared separately from the location draft budgets. Global Functions costs totalled $437.4 million in the FY14 budget.

114 WOR professed to adopt the P50 parameter to produce its budgets. Mr Wood explained that P50 is the probabilistic Monte Carlo analysis of the statistical confidence level for an estimate. As Mr Wood put it, P50 means that 50% of estimates exceed the P50 estimate and, by definition, 50% of estimates are less than the P50 estimate. In other words, there is an equal chance of exceeding or going below the estimate.

115 In relation to “unsecured work”, WOR defined the different categories as follows.

116 “Proposal” related to tenders for which WOR had bid, or had received a request for tender information. Usually, there was a proposed start date for the project within the forthcoming year. An assessment of “Go” and “Get” likelihood was made for proposals in order to risk weight forecasted revenue and costs for work that may not materialise. “Go” was a percentage figure representing the likelihood that the project would be undertaken at all. “Get” was a percentage figure representing the likelihood that WOR would be engaged for the work in the event that the project went ahead.

117 “Prospect” related to tender processes for which WOR had not yet submitted a bid, or known projects where the tender process had not started. Budgeted revenue from “Prospects” was also discounted for “Go” and “Get” risks.

118 Blue sky was described by Mr Wood as expected projects based on discussions with customers and projects that are likely to materialise based on history and past experience, such as under a framework agreement. Mr Lucey described blue sky as an estimate of the value of projects which WOR expected to be engaged to undertake during the course of the financial year (other than secured work, proposals and prospects), based on a subjective assessment of the particular location’s historical performance and current market conditions and also taking into account WOR’s strategy for the coming year. Mr Ashton described blue sky as projects that were not known but were anticipated based on a combination of the operational history of the location, information obtained from customers or industry analysts and or anticipated market conditions.

119 Blue sky was estimated at a numerical value and accounted for that value in the budget without any discount.

120 The following financial terms were used in WOR’s budgeting documents:

(1) Revenue is WOR’s direct income from professional services.

(2) Costs of sales are deducted from the revenue figure to arrive at the gross margin (or GM).

(3) From the gross margin, each location deducted location-specific overheads to arrive at a “business earnings before interest and taxes” (BEBIT) figure.

(4) The total of BEBIT figures was operational EBIT. Operational EBIT is a metric that reflects the underlying performance of WOR’s business exclusive of head office expenses.

(5) WOR’s total group EBIT is calculated by deducting its global head office or Global Function costs from operational EBIT.

(6) NPAT is determined primarily by deducting corporate tax from group EBIT (at an effective tax rate of approximately 30%).

Context for FY14 budget setting process

121 In its 2012 annual report, released in August 2012, WOR recorded its Vision 2017 strategy as follows:

OUR VISION

It is 2017 ……..

• We consistently deliver high quality engineering, consulting, project and Improve services and as a result have become a world leader

• We have a recognized and valued position with our customers

• We are an admired employer

• We have a facilitating organizational structure

As a consequence of these attributes, we have enjoyed good growth, year-on-year for the last five years.

122 WOR’s Improve business provided asset maintenance services.

123 Also in the 2012 annual report, WOR reported an underlying NPAT excluding fair value gain on acquisitions for 2012 of $345.6 million, “an increase of 15.8% on the $298.5 million net profit reported in 2011”. The annual report made the following statements about growth:

(1) “we have enjoyed good growth, year-on-year for the last five years”;

(2) Under the heading “10 years of growth”:

Looking to the future, WorleyParsons will endeavour to continue to deliver to our shareholders through our vision of being the preferred global provider of technical, project and operational support services to our customers and using the distinctive WorleyParsons culture to create value for them and prosperity for our people and stakeholders.

(3) In the “Chairman’s Review”:

Our growth during the year was underpinned by strong capital spending by major global customers and strengthening of our global relationships with these customers. The ever growing demand for energy is driving the unconventional oil and gas sector, where we have seen strong growth in oil sands, shale gas and coal seam methane, in Canada, the USA and Australia.

Developing markets were also a significant driver of growth as large global clients continue to invest in projects in countries where the bulk of the world’s undeveloped resources lie.

124 On 29 August 2012, WOR made an announcement to the ASX which included the following statement:

Subject to the markets for our services remaining strong, we expect to achieve good growth in FY2013 compared to FY2012 underlying earnings.

We have a clear growth strategy in place focused on improving margins and developing our skill set and geographic footprint across our four customer sectors. This will be achieved through organic growth as well as by taking advantage of acquisition opportunities that provide value for shareholders.

We are confident that our medium and long term prospects remain positive based on our competitive position, our diversified operations and strong financial capacity.

125 On 13 February 2013, WOR made an announcement to the ASX which included the following statement:

Volatility in commodity prices impacted the market for our services and our growth in the first half. The markets for our services improved towards the end of the period and we continue to expect growth for FY2013 on FY2012 underlying earnings.

126 Mr Crowley described this statement as a qualitative downgrade from “good growth” to “growth”.

127 On 17 May 2013, WOR issued a trading update to the ASX, stating:

WorleyParsons Limited (“the Company”) provides a trading update and updated earnings guidance for the year to 30 June 2013.

At the Company’s half year results announcement on 13 February 2013 WorleyParsons provided guidance for FY2013 of growth compared to FY2012 underlying earnings. The company now expects to report a net profit after tax in the range of $320 million to $340 million compared to FY2012 underlying earnings of $345.6 million.

The West Australian business has been impacted by the softening of demand for resource infrastructure as clients defer major projects and implement cost management initiatives. This has particularly impacted the company’s Infrastructure & Environment and Minerals, Metals & Chemicals business.

In addition, the company’s fabrication and construction business in Canada, WorleyParsonsCord, has been impacted by a softening in construction activity in the Canadian oil sands market and will not achieve the growth previously expected.

Outperformance in a number of other markets will serve to largely offset the decline experienced in Western Australia. The company continues to achieve outperformance in the Chemicals sector, particularly in China and Brazil, and growth in the Hydrocarbons sector has continued, particularly in the Improve business in Canada.

Commenting, Chief Executive Officer, Andrew Wood, said: “Despite weaker than anticipated market conditions impacting the second half result we continue to have confidence in the medium and long term growth prospects of our business.

“The diversity of our business in terms of its geography, industry sector and service offering is a fundamental driver of this confidence. While Western Australia and WorleyParsonsCord have underperformed, a number of regions are performing strongly, particularly the United States, Canada and China. As existing assets age, new assets come online and regulatory requirements increase, we continue to see increased demand for our Improve services”.

128 On 14 August 2013, WOR announced NPAT of $322 million for FY13, down 7% on the previous year.

WOR’s markets in the second half of FY13

129 Mr Wood said that, coming out of the Global Financial Crisis (GFC), WOR experienced a period of growth in both the resources and hydrocarbons markets “on the back of very high resource prices and high levels of activity”. His evidence referred to an “incredibly turbulent period” in which it was very difficult to budget and forecast. I understood FY13 and FY14 to be part of the period of turbulence. Concerning FY13, Mr Wood said:

What we saw in FY13 was, even though – we saw a rapid falloff in key-resource prices and, basically, the minerals-and-metals market pretty much calling a halt to further development, and that impacted our business. But at the same time, we saw significant activity in the hydrocarbons market and that, with high oil prices, and an outlook, continued outlook from most of the major forecasters and our customers that they expected that to continue. So it’s a – was an incredibly turbulent period, and then we found what we then led into was the biggest crash in activity levels and prices for a couple of generations, in the following year. That’s the period we were trying to fore-cast in. It’s [an] exceptionally difficult time.

130 Concerning WOR’s various markets by early 2013, Mr Wood’s undisputed evidence was that:

(1) Hydrocarbons was broadly stable;

(2) the minerals and metals part of MM&C continued to struggle, and was particularly affected by delays and deferrals on major projects, especially in Australia;

(3) the chemicals part of MM&C was fine, especially in the USA and China;

(4) the infrastructure and environment sector was continuing to struggle in some places; and

(5) the power business was “okay”.

131 Mr Wood said that power, infrastructure, and minerals and metals were each overall small contributors to EBIT, while “Hydrocarbons was the big one”. This evidence is consistent with Mr Crowley’s view that the Hydrocarbons sector was one of the “primary financial engines” of WOR.

132 Mr Crowley submitted that, having regard to the state of WOR’s markets, “it is clear that estimates for blue sky revenue could not reasonably have been expected to match the estimates that had been adopted for the FY2013 year (and as we have seen, were not achieved). At the very least, blue sky projections that were of similar magnitude to prior years should have been seen as already ‘aggressive’ targets”.

133 This submission was not made out by the available evidence. In particular, the proposition that blue sky revenue targets for FY13 were not achieved was not the subject of supporting analysis on behalf of Mr Crowley. Further, it is far from clear that the FY14 blue sky revenue targets for the Hydrocarbons CSG (which contributed approximately 70% of revenue in 2013), could not reasonably have been expected to match FY13 estimates, where that business was “broadly stable”.

134 At this point, Mr Crowley also noted the general proposition that WOR’s capacity to win and complete blue sky work was affected by its spend on staff and overheads. Mr Crowley contended that “[i]f costs are cut then the ability to earn the blue sky is impaired”. No doubt, WOR could have cut costs in a way that would impair its ability to earn blue sky revenue. However, I do not accept that cost cutting impaired WOR’s ability to earn blue sky revenue without some analysis of the precise impact of cuts on WOR’s revenue earning capacity.

February to May 2013: High level budget process

135 In the light of Mr Crowley’s case, it is not necessary to make detailed findings about the high level budget (HLB) process. Mr Crowley noted that it was a new process at WOR.

136 Mr Wood characterised the HLB process as a “strategic process, where we would look at our markets and establish what, we believe, was happening in our markets”. The HLB process and the subsequent process of building a budget were “somewhat separate, and one informed the other”.

137 Mr Crowley referred to the following evidence about the HLB process up to 15 April 2013:

(1) It was hoped to provide senior management with a “heads up” or indication of the locations’ expectations for FY14, and to “allow the opportunity to review expectations with the locations and ensure that they are in line with the strategy prior to development of a full detailed budget”. Projections for FY13 based on the FY13 Q3 budget (that is, the FY13 budget with 9 months of actual results) were the proxy comparator for the FY14 HLB.

(2) The following email, sent on 27 March 2013 from the president of INTECSEA, a division of WOR involved in deep-water engineering, anticipated an expectation of an insistence on growth, asking:

… Before we spend time building budgets are there any expectations set by WorleyParsons for global EBIT improvement for FY14. Last year it was 20%; so if it is 20% again I would like to know since that will be the number demanded by the RMDs, regardless of what we develop.

(3) The instructions for the HLB exercise from Mr Daly to the RMDs and the operational finance team, sent on 16 April 2013, were to “overlay the following initial high level expectations with regard to the budget”. Those expectations included an “underlying assumption that there is year on year EBIT growth at each location”, with the level of growth to be reviewed based on location and relevant markets. The balance of the expectations indicated that various metrics (overheads as a percentage of professional services, revenue, overhead growth, EBIT percentage and chargeability percentage) were to be improved relative to the comparators from FY13.

(4) An early indicator that the HLB process involved rigorous consideration is an email sent by Mr Evans on 18 April 2013. In that email, Mr Evans referred to the need to achieve $27 million in overhead savings for Hydrocarbons, saying:

… Slash and burn. We need all to understand the implications of pushing us that deep – no incoming costs accepted from ANYONE. No people moves in (unless net net zero). Transfer out or make redundant people…we are asked to move folks to billable roles – where can we do that?

138 Mr Crowley did not seek a finding that Mr Daly’s instructions for the HLB exercise warranted criticism.

“Review calls” and “adjusted” HLB process (22 to 26 April 2013)

139 In the ASCH region, Mr Lucey reacted to Mr Daly’s 16 April 2013 instructions by sending emails to all of his eight locations (except Brunei) to the effect of this example, sent to Thailand on 1 May 2013:

I’ve now had a chance to collect my thoughts following an, at times, heated discussion with Stuart [Bradie] on the first pass high level budgets for FY14….What’s clear is the ASCH is seen globally as a growing region and as such, expectations are high!! Also, compliance with the guidelines below is pretty well mandatory (unless there’s a very good reason for not complying).

As such, as you prepare your detailed FY14 budget, please keep this in mind and ensure all of the metrics stack up. Also, see what you can do to get your BEBIT to AUD5M (using the FY14 budget forex rates). Note that I haven’t forgotten about your “special contribution” in March and advised Stuart accordingly. Whilst he genuinely appreciates this, he (and I) would still like you to see what you can do to reach the AUD5M target.

140 Mr Wood acknowledged that the aspiration to achieve results of the kind referred to in this email was “very strong”.

141 Although aware of the HLB process, Mr Wood was not closely involved in it and did not have an immediate recall of reports about the results of the HLB submissions. Mr Crowley noted an internal email sent on 30 April 2013 by Kirsty Wallace, WOR’s Group Financial Controller, to Roisin McIernon (who appears to have been assisting Ms Wallace), in the course of preparing the HLB. Ms Wallace anticipated that the figures would not be acceptable in the following terms:

Would like to get this to Simon [Holt] tomorrow … so that him and Andrew [Wood] can hit the roof about the proposed NPAT and then start some conversations around the actual budget.

142 There was evidently a process of conversations about the HLB in the last two weeks of April 2013, called the “HLB review calls”. Mr Crowley submitted that the effect of the April 2013 HLB review calls was “frankly surprising”, given that the locations had been on notice since the Ojai conference that senior management expected their budget submissions to show revenue growth and tight control on overheads. The submission did not explain the element of surprise, whether by reference to apparent lack of revenue growth or apparent lack of control on overheads or otherwise.

143 On 1 May 2013, a spreadsheet referred to as a “draft FY14 HLB vs FY13 NPAT Tracker” was sent to Messrs Holt and Allen for review. The spreadsheet records:

(1) the locations’ HLB “submissions” produced a total FY14 operational EBIT of $884.406 million and NPAT of $272.944 million; and

(2) a proposed “adjusted” HLB produced a total FY14 operational EBIT of $980.923 million and NPAT of $342.766 million.

144 The covering email noted, among other things, the following: