Federal Court of Australia

Habrok (Dalgaranga) Pty Ltd v Gascoyne Resources Ltd [2020] FCA 1395

ORDERS

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The proceeding be dismissed.

2. The plaintiff pay the defendants’ costs of and incidental to the proceeding including any reserved costs.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

BEACH J:

1 The plaintiff (Habrok) commenced the present proceeding on 4 August 2020 seeking orders under ss 445D and 447A of the Corporations Act 2001 (Cth) terminating the deed of company arrangement (DOCA) executed on 26 June 2020 by the first to seventh defendants (the GCY Group) and the eighth defendant (the administrators) that had been propounded by the administrators. Habrok also seeks the appointment of liquidators.

2 The administrators were appointed as such to the GCY Group on 2 June 2019. The administrators then undertook a dual track process that investigated the possibility of either:

(a) a recapitalisation of the GCY Group; or

(b) a sale of the GCY Group’s assets, including the Dalgaranga gold mine in the Murchison region of Western Australia (the Mine).

3 Ultimately, the administrators recommended to the creditors of the GCY Group that a DOCA should be entered into involving a recapitalisation. Prior to this time the administrators had received two offers to purchase the assets of the GCY Group which were insufficient. Contrastingly, the DOCA proposed by the administrators involving a recapitalisation provided for a projected return of up to 100 cents in the dollar to all unsecured creditors through a combination of cash and shares.

4 At the second meetings of creditors of the GCY Group held on 25 June 2020 (the second creditors’ meetings), the creditors voted on whether to adjourn the meetings to consider two other DOCA proposals, including one from Habrok Mining Pty Ltd (Habrok Mining), which was at the time the holding company of Habrok. In the case of Habrok Mining’s DOCA proposal, it was received on the day before the meetings. The creditors voted not to adjourn the meetings and voted to execute the DOCA put forward by the administrators, which was then executed.

5 Now at the time, Habrok was not a creditor of any entity in the GCY Group. Accordingly, it was ineligible to vote at the second creditors’ meetings. In addition, no representatives of Habrok attended the second creditors’ meetings, which were held virtually given the COVID-19 restrictions in place.

6 Following the execution of the DOCA, steps have now been undertaken to implement it, including:

(a) quantifying the debts due to the creditors;

(b) paying entitlements to former employees of the GCY Group; and

(c) putting in place steps for the capital raising contemplated by the DOCA, including the holding of an extraordinary general meeting (EGM) of shareholders of the first defendant (GCY) on 5 August 2020 to approve the proposed share issues, entering into an underwriting agreement with Cannacord Genuity (Australia) Ltd (Cannacord) and issuing the prospectus for the capital raising.

7 Habrok’s grounds for seeking termination of the DOCA under s 445D focus on:

(a) the pre-appointment involvement of FTI Consulting (FTI), a firm associated with the administrators, and Herbert Smith Freehills (HSF) with GCY;

(b) the inadequacy of the administrators’ investigations;

(c) the inadequacy of the sale process conducted by the administrators and the treatment and assessment of competing proposals to the DOCA; and

(d) the risk of future insolvency of the GCY Group notwithstanding the proposed capital raising.

8 Habrok’s principal complaint against the administrators is that having assisted GCY to formulate a turnaround plan in late 2018 when FTI were consultants to GCY, the administrators pursued their plan for the DOCA with single-minded determination during the administration, and in the process:

(a) disregarded material conflicts of interest;

(b) failed to carry out adequate and independent investigations as required by s 438A and Pt 5.3A of the Corporations Act;

(c) squandered the opportunity to pursue a sale proposal from Adaman Resources Pty Ltd (Adaman);

(d) precluded creditors from considering rival DOCAs; and

(e) preferenced the interests of NRW Holdings Limited (NRW), the principal mining contractor at the Mine.

9 Let me elaborate on some of these themes for a moment.

10 First, Habrok says that there has been preferential treatment of the second-ranking secured creditor, NRW, in relation to:

(a) the terms on which NRW became a second-ranking secured creditor;

(b) the inadequacy of investigations into whether the NRW security was void;

(c) the commerciality of NRW’s rates under the NRW mining contract;

(d) the renegotiation of the amount that NRW was to receive under the DOCA, which coincided with a stated intention by NRW to support the DOCA and vote against an adjournment of the second creditors’ meetings to consider rival DOCAs; and

(e) the fact that NRW stands to derive a profit from the administration despite being a member of the committee of inspection (COI).

11 Second, Habrok says that there has been a lack of genuine engagement with alternatives to the DOCA, including the consideration of rival DOCAs and also the consideration of a sale of assets as opposed to recapitalisation. I will discuss this later concerning what has been described as the dual track process.

12 Third, Habrok says that there has been an inadequate investigation of claims that could potentially be pursued in a liquidation in relation to:

(a) potential claims by shareholders in relation to the two capital raisings undertaken by GCY in August 2018 and May 2019;

(b) whether the NRW security should be set aside on the basis that it was given and registered within six months of the appointment of the administrators and/or was registered more than 20 business days after it was created;

(c) whether NRW has received preferential payments from the GCY Group; and

(d) insolvent trading in circumstances where the GCY Group experienced a lack of liquidity including being insolvent in March and April 2019.

13 Fourth, Habrok says that there has been inadequate disclosure in the administrators’ report to creditors issued on 18 June 2020 (the administrators’ report) regarding the proposed capital raising and in particular whether, even if successful, it will return the GCY Group to solvency; in particular, it is said that there was no forecast cash flow analysis or restructured balance-sheet and financial position.

14 Fifth, Habrok says that there has been inadequate disclosure in the administrators’ report regarding the creditors’ trust and other matters dealing with some of the above issues.

15 Sixth, Habrok says that there has been an inappropriate extinguishment of shareholders’ claims.

16 Now the defendants oppose Habrok’s application.

17 First, they say that Habrok does not have standing as an assignee creditor to seek the relief claimed. Moreover, they say that Habrok is not “any other interested person” for the purposes of s 445D as it has no material rights or economic interests that would be affected by the operation of the DOCA. Habrok had no involvement in the administration of the GCY Group. Its only connection was that on the day before the second creditors’ meetings its holding company submitted a proposed DOCA. But this did not give Habrok material rights or an economic interest that could be affected by the DOCA process. And as to Habrok’s standing under s 447A, whilst s 447A captures a broad class of applicants, the defendants say that this does not extend to Habrok.

18 Second, the defendants say that Habrok, having sought to buy into the DOCA by acquiring the debt of Orlando Drilling Pty Ltd (Orlando) after the DOCA was entered into, cannot now seek to challenge the DOCA. It is said that Habrok cannot purchase its standing to set aside the DOCA on the basis of an assignment of a debt after the DOCA has been made.

19 Third, the defendants say that none of the grounds enlivening the exercise of power under ss 445D and 447A have been made out.

20 Fourth, I have a discretion in deciding whether to set aside a DOCA. And such a discretion should be exercised by reference to the interests of the creditors and the public interest. But the defendants say that even if the conditions for the exercise of power under ss 445D and 447A have been enlivened, in the exercise of my discretion I should not terminate the DOCA.

21 More generally, the defendants say that it is not beneficial for the creditors to have the GCY Group wound up. The return to unsecured creditors is projected to be greater under the DOCA than on a winding up. The unsecured creditors stand to potentially receive 100 cents in the dollar. Moreover, under the DOCA the operations of the GCY Group will continue, with a corresponding benefit in the continued employment of its employees.

22 For the reasons that follow, in my view Habrok has not justified the orders that it seeks. Indeed, to terminate the DOCA would not be conducive to achieving the objective reflected in s 435A(a).

23 Before proceeding further, let me say something about the conduct of this case. This matter had to be heard and disposed of quickly given the capital raising of $85 million for the GCY Group that is part way through completion, with 30 September 2020 being the deadline. This required an expedited time-table with special procedures to deal with and digitally churn through 35 volumes of material, and to conduct a pre-trial voir dire and a five day hearing using video technology for large teams of lawyers and witnesses in Victoria, New South Wales and Western Australia.

24 Further, given the significance of this matter, including the consequences of this litigation for the GCY Group, the Mine and the large workforce, and the necessity for the matter to be disposed of by 30 September 2020, the Chief Justice gave this matter priority status so that the Stage 4 COVID-19 restrictions in Victoria could properly be tailored to facilitate the expeditious exercise of federal judicial power.

25 I should also record here that during the video conference hearing, counsel for the parties presented their cases with notable efficiency. Moreover, it was a pleasant surprise that the technology exceeded expectations. And except by the use of such technology, how else could one transcend the current border restrictions between the States to satisfactorily deal with such litigation?

26 Let me now turn to some facts.

SOME FACTUAL BACKGROUND

27 Let me begin by saying something about the relevant entities.

28 Habrok, an Australian company, is a special purpose vehicle established for the acquisition of the assets, whether by asset sale or share purchase, of the GCY Group. Habrok was established in May 2020 and was until recently a subsidiary of Habrok Mining, a privately owned investment company established in 2019 which has interests in both gold and iron ore projects in Western Australia. Habrok Mining is a holding entity for a range of investments made by Remagen Capital Pty Ltd, a privately owned investment firm that specialises in distressed and expansion debt and equity capital investments in the mining sector.

29 Habrok is a creditor of the second defendant (GNT Resources), one of the GCY Group companies, pursuant to a deed of assignment. Habrok acquired the debt owed by GNT Resources from Orlando, a creditor that sought to adjourn the second creditors’ meetings to enable time for consideration of alternative DOCA proposals to that propounded by the administrators.

30 Adaman is a privately-owned resource investment company established in 2017. A fund managed by Remagen Capital holds a 20% interest in Adaman. On 2 September 2020, Habrok Mining sold its shares in Habrok to Adaman.

31 In addition to its investments in Habrok and Adaman, Remagen Capital also has a range of other mining investments in original equipment manufacturers and equipment rental and mining contractor investments, in debt, convertibles and equity.

32 In late 2019, Adaman sought to participate in the sale track of the dual track process that was conducted in parallel with the recapitalisation track. According to Habrok, Adaman’s ability to formulate and submit a timely and compelling proposal was hampered by a lack of engagement by the administrators.

33 Habrok Mining subsequently submitted a DOCA in respect of the GCY Group on 24 June 2020 (Habrok Mining DOCA proposal). The Habrok Mining DOCA proposal was not put to a resolution at the second creditors’ meetings because a resolution to adjourn the meetings in order to give creditors sufficient time to consider the Habrok Mining DOCA proposal (and another DOCA proposal) was not passed. The meetings proceeded and resolutions were carried in respect of the DOCA propounded by the administrators.

34 The GCY Group comprises the following companies:

(a) GCY;

(b) GNT Resources;

(c) the third defendant, Gascoyne Resources (WA) Pty Ltd;

(d) the fourth defendant, Dalgaranga Operations Pty Ltd;

(e) the fifth defendant, Dalgaranga Exploration Pty Ltd;

(f) the sixth defendant, Gascoyne (Ops Management) Pty Ltd; and

(g) the seventh defendant, Egerton Exploration Pty Ltd.

35 The GCY Group carries out gold mining and exploration activities and holds mining assets and exploration tenements in the Gascoyne and Murchison regions of Western Australia, with its main project being the Mine.

36 GCY is an Australian publicly listed company. Its shares were and still are suspended from trading on the ASX following the appointment of the administrators in June 2019.

37 The second to seventh defendants are subsidiaries of GCY.

38 Mr Ian Francis, Mr Michael Ryan and Ms Kathryn Warwick of FTI, in their capacity now as joint and several deed administrators of the first to seventh defendants, are the eighth defendant.

39 The GCY Group has had various dealings with NRW and NRW Pty Ltd, the trustee for the NRW Unit Trust, before and during the administration of the GCY Group, involving a mining services contract, working capital facility and a general security agreement. NRW is an Australian publicly listed mining services company.

40 In December 2017, GNT Resources executed a contract with NRW for the provision of open pit mining services in respect of the Mine (NRW mining contract).

41 As at the date of the administrators’ report, the amount due under the NRW mining contract was $21,067,000, which is in addition to NRW’s $12 million loan amount and a contingent claim that NRW has for $15,347,681 in respect of early termination charges arising from termination of the NRW mining contract.

42 On 16 August 2018, GCY announced a placement to raise up to $15 million by the issue of up to 50 million ordinary shares at $0.30 per share, with the ability to accept oversubscriptions of up to an additional $4 million (the August 2018 capital raising). In its equity raising presentation, GCY stated that the proceeds of this capital raising would be used as follows:

(a) $6.5 million as payment for the remaining Dalgaranga construction capital and critical spares;

(b) $1.5 million as a final payment to Dalgaranga vendor;

(c) up to $5 million for exploration at the Mine and at the Glenburgh gold mine, a pre-development project in the Southern Gascoyne region of Western Australia; and

(d) the remainder for corporate costs and general working capital.

43 On 20 August 2018, GCY announced that it had completed the August 2018 capital raising and had raised $19 million. GCY also offered its existing shareholders an opportunity to subscribe for up to a maximum of $15,000 worth of shares at the placement issue price of $0.30 per share to raise an additional $5 million in capital.

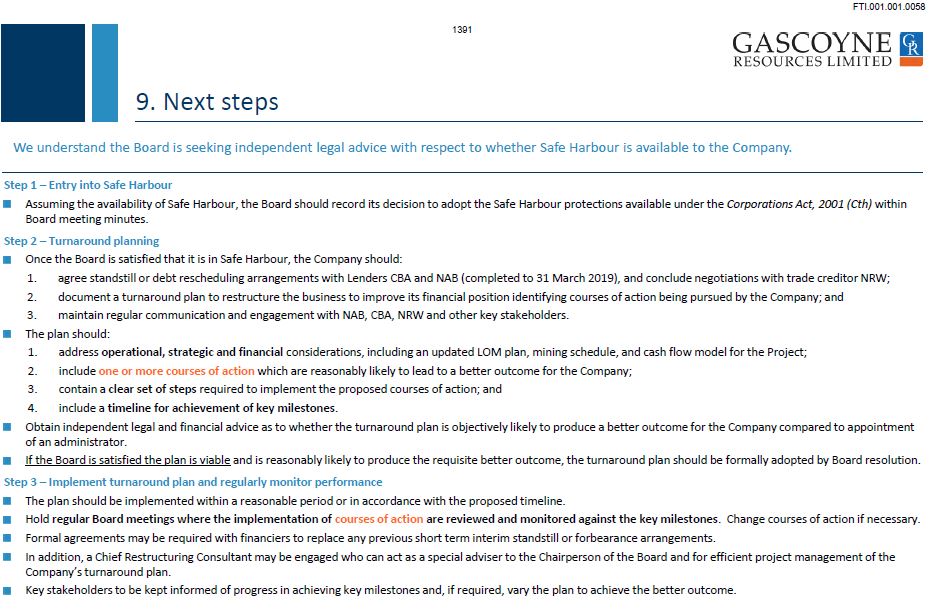

44 On 6 November 2018, FTI were engaged by the GCY Group to provide assistance in assessing the GCY Group’s financial position. The engagement included a review of the GCY Group’s current financial position and turnaround plan developed by management, a review of the GCY Group’s economic modelling / cash flow forecasting systems and tools and a rebuild of the GCY Group’s financial model to reflect the transitioning in the GCY Group’s operations from mine exploration / development only to include the mining operations at the Mine.

45 Its work for the GCY Group involved constructing a rebuild of the GCY Group’s financial model between the period from 8 November 2018 to 19 January 2019. On 19 December 2018, FTI delivered its findings in a report that I have described as the 19 December 2018 FTI report, which provided an overview of the GCY Group’s financial position and a review of a turnaround plan developed by the GCY Group’s management.

46 The 19 December 2018 FTI report came to be provided in January 2019 to HSF, in its capacity as the GCY Group’s legal advisor. Further, at this time the board of the GCY Group sought legal advice from HSF in relation to whether safe harbour protection from insolvent trading claims was available to the board.

47 On 24 December 2018, GCY announced to the ASX that NRW had agreed to provide a $12 million loan facility to GNT Resources (NRW loan agreement). Security for the repayment of the NRW loan was a general security agreement between NRW Pty Ltd and GCY over all of the assets of GNT Resources dated 21 December 2018 (the NRW security or the NRW GSA). To elaborate:

(a) NRW Pty Ltd agreed to provide a short term second-ranking secured loan for $12 million repayable in six monthly instalments, commencing 31 July 2019;

(b) no physical payment was made to GNT Resources under the NRW loan agreement, as GNT Resources had agreed to pay the full amount of the loan to NRW on account of outstanding invoices ($10 million), loan facility fees ($800,000), and prepaid interest ($1.2 million); and

(c) in addition to taking security for repayment of the loan amount, a term of the NRW loan agreement also allowed NRW Pty Ltd to take security for all future amounts payable under the NRW mining contract.

48 The amount of NRW’s secured debt was $32.7 million as at the date of the appointment of the administrators.

49 An organisation grantor extract for GNT Resources obtained from the Personal Property and Securities Register (PPSR) on 1 August 2020 shows that on 7 January 2019, NRW Pty Ltd in its capacity as trustee for the NRW Trust registered an “all present and after acquired property” security interest on the PPSR.

50 The NRW security was registered within six months of the appointment of the administrators on 2 June 2019. Further, if the NRW security was created on 21 October 2018 (as indicated in the DOCA proposed by the administrators) it was also registered outside the 20 business day period for registration required by s 588FL of the Corporations Act.

51 Mr Ryan and Mr Matthew Chivers of FTI held meetings with Mr Mike Ball, the former Chief Financial Officer of the GCY Group, on 11 January 2019 and 15 January 2019 to discuss FTI’s financial model. On 19 February 2019, Mr Chivers met with Mr Ball for a general update discussion regarding the GCY Group.

52 On 23 February 2019, Mr Ryan met with Ms Sally-Anne Layman, the then chairwoman of the GCY board, to discuss closing out the FTI engagement.

53 On 18 March 2019, FTI provided the GCY Group with a document titled “Overview of the VA Process Paper” that provided, inter-alia:

(a) how a voluntary administration may be utilised to effect a restructure in the GCY Group’s circumstances; and

(b) implications for creditors and shareholders in a voluntary administration scenario.

54 In an operational and corporate update to shareholders dated 27 March 2019, GCY stated that external mineral resource specialists had recommended that it consider developing an alternative to the ordinary kriging estimate technique, the orebody reconciliation model that it used at the time.

55 The external mineral resource specialists recommended an alternative model using a non-linear estimate method such as localised uniform conditioning (LUC) or localised inverse kriging. The announcement stated that GCY had engaged Cube Consulting to prepare the alternative model.

56 As a part of its operational update to shareholders, GCY stated that an equity raise was being progressed to provide additional working capital as production from the Mine increased.

57 On 28 March 2019, in an equity presentation to investors GCY announced another capital raising (May 2019 capital raising) generally in the following terms:

(a) a placement to raise $3.86 million before costs by the issue of up to 77.3 million new fully paid ordinary shares at an issue price of $0.05;

(b) a 4:5 pro-rata non-renounceable entitlement offer at $0.05 per share to raise $20.6 million, subject to entry into underwriting agreements; and

(c) a “top-up placement” whereby GCY would separately make an offer at the issue price of $0.05 upon conclusion of the placement and entitlement offers to raise an additional $3 million.

58 In its presentation to investors, GCY stated that the proceeds of the May 2019 capital raising would be applied towards strengthening its balance sheet and meeting working capital requirements with the uses being:

(a) $24.1 million to be used as working capital;

(b) $2.6 million to be applied towards the payment of expenses relating to the entitlement offer and placement; and

(c) $7.2 million to be paid to NRW in settlement of an invoice due as at the date of the presentation.

59 The May 2019 capital raising was announced to the ASX on 1 April 2019. On the same day, NRW announced to the ASX that it had agreed to sub-underwrite up to $5.3 million of the entitlement offer and that its participation in the capital raising would be applied to the trade receivable owing to it and to return the balance to contractual terms.

60 The prospectus sent to eligible shareholders in advance of the May 2019 capital raising stated that NRW would be paid $7.2 million from the $24.5 million proceeds of the capital raising.

61 On 8 May 2019, GCY announced that it had issued 412,252,289 new shares under the entitlement offer and raised approximately $20.6 million and that it had determined not to proceed with the top-up placement.

62 On 10 May 2019, NRW filed a notice of initial substantial holder with GCY and the ASX. This document shows that NRW was issued 86,238,410 fully paid ordinary shares to be applied against the $4,311,920.50 trade receivable owed to NRW.

63 The balance of the May 2019 capital raising, being about $18 million, was subsequently applied as follows:

(a) $10.56 million was used to pay further amounts said to be owing to NRW; and

(b) $7.8 million was used as working capital.

64 Although the information provided by GCY to its shareholders in advance of the May 2019 capital raising indicated that NRW would be paid $7.2 million, the administrators’ report revealed that NRW received $14.86 million in equity and cash from the May 2019 capital raising.

65 On 29 May 2019, about three weeks after the placement of the shares issued pursuant to the May 2019 capital raising, Mr Ryan and Mr Chivers held a meeting with Mr Richard Hay, the recently appointed Chief Executive Officer of the GCY Group, and Mr Ball to discuss:

(a) GCY Group’s recent operating performance, cash flow and financial position;

(b) various forms of insolvency appointments and potential options available to the GCY Group having regard to the GCY Group’s financial position; and

(c) the process following an insolvency appointment.

66 On 30 May 2019, GCY’s securities were placed on a trading halt at its request pending an announcement to the market.

67 On 2 June 2019, the directors of the GCY Group resolved to appoint Mr Ryan, Ms Warwick and Mr Francis as administrators under Pt 5.3A.

68 At the time:

(a) GCY had experienced issues with reconciling production from ore reserves with the data outputs of the mineral resources models it used;

(b) on 28 May 2019, a preliminary LUC resource model had been recommended by consultants to GCY’s board as the preferred model from several that had been developed;

(c) after urgently preparing pit mining schedules based on the new model, GCY discovered that it would incur a material cash flow shortfall;

(d) GCY had investigated options to address the cash flow shortfall including obtaining financial accommodation from creditors and shareholders but it had become apparent that those options would not successfully address the cash flow shortfall; and

(e) consequently, the directors of GCY determined to appoint administrators.

69 On 5 June 2019, the administrators provided the creditors of the GCY Group with a document titled “Initial Information for Creditors and Suppliers.” The first creditors’ meetings were held on 13 June 2019.

70 On 27 June 2019, on application of the administrators, the Supreme Court of Western Australia extended the period for convening the second creditors’ meetings pursuant to s 439A(6) of the Corporations Act to 4 November 2019.

71 In a circular to creditors dated 2 July 2019, the administrators informed creditors that an extension to the convening period had been sought to enable the administrators to pursue a dual track process to realise the value from the assets of the GCY Group.

72 On 31 October 2019, on application of the administrators, the Supreme Court of Western Australia further extended the period for convening the second creditors’ meetings pursuant to s 439A(6) to 6 March 2020.

73 In a circular to creditors dated 4 November 2019, the administrators informed creditors a further extension to the convening period to 6 March 2020 had been obtained to allow the dual track process to continue.

74 The dual track process, initially announced by the administrators in the circular to creditors dated 2 July 2019, involved an investigation of the possibility of a recapitalisation of GCY and/or GNT Resources through a further capital raising or merger and the sale of the Mine and other assets of the GCY Group.

75 In summary, the dual track process involved the following steps:

(a) the administrators appointed Investec Australia Ltd (Investec) as a corporate and financial advisor to assist in facilitating the dual track process;

(b) an expression of interest campaign for the sale or recapitalisation of GCY was initiated;

(c) on 18 October 2019, 11 first round non-binding indicative offers were received for the GCY Group’s assets;

(d) on 22 November 2019, two “final” offers were received for the assets; and

(e) later steps were taken.

76 Apparently, according to the administrators the offers made for the GCY Group’s assets were not considered to satisfactorily reflect the value of the GCY Group having regard to the updated Life of Mine Plan (LoMP) developed in late 2019 and early 2020.

77 I will elaborate further in a separate section of my reasons concerning the sale process.

78 On 20 February 2020, on application of the administrators, the Supreme Court of Western Australia further extended the period for convening the second creditors’ meetings pursuant to s 439A(6) to 30 June 2020.

79 The premise of the application to the Supreme Court of Western Australia on 20 February 2020 was to obtain a further extension of the convening period in order to investigate the possible recapitalisation of GCY and to allow Investec to continue discussions with interested parties as part of the sale process.

80 The following steps were taken in relation to the recapitalisation of GCY.

81 In March 2020, the administrators established a due diligence committee for the purpose of advancing a capital raising and completed due diligence of two potential non-executive directors to form the newly constituted board of GCY post-recapitalisation.

82 In April 2020, the administrators engaged Canaccord as the lead manager and bookrunner for the proposed capital raising.

83 The administrators’ report was issued on 18 June 2020 pursuant to s 75-225 of the Insolvency Practice Rules (Corporations) 2016 (Cth) (Insolvency Practice Rules) and contained additional information in relation the GCY Group and the administrators’ DOCA proposal and intentions with respect to GCY Group’s future.

84 The administrators’ report stated that the sale process did not achieve a satisfactory value having regard to the two key factors of, apparently, improved mine performance and the significant movement in the gold price in the first half of the 2020 calendar year.

85 On 18 June 2020, the administrators also despatched notices of the second creditors’ meetings and a meeting of eligible employee creditors.

86 The key elements of the proposed DOCA by the administrators in their report were the following:

(a) The DOCA was propounded by the administrators in their then capacity as voluntary administrators.

(b) The deed administrators would cause GCY to undertake a capital raising in the order of $70 to $80 million, by way of entitlement offer and placement of shares.

(c) The secured creditors were not bound by the DOCA and repayment of the debts owed to secured creditors would be negotiated under separate agreements. As a condition precedent to the completion of the DOCA:

(i) after a partial repayment of the senior secured debt owed to the National Australia Bank and Commonwealth Bank of Australia (the senior secured creditors) from the proposed capital raising, there would be a refinance of part of the senior secured debt and subsequent release of their security; and

(ii) NRW would restructure its debt and release its security.

(d) A creditors’ trust would be established for the purpose of the DOCA and the deed administrators appointed as trustees. Upon completion of the DOCA, unsecured creditors would release their debts in consideration for the right to participate as beneficiaries of the creditors’ trust.

(e) All inter-group loans for the GCY Group would remain in place and would not be affected by the DOCA.

(f) Once the relevant conditions precedent were satisfied, including completion of the proposed capital raising, execution of the creditors’ trust deed, appointment of certain directors and the deed administrators securing various releases of security, the DOCA would terminate and control of the GCY Group would revert to the directors.

87 On 22 June 2020, Hanking Australia Investment Pty Ltd (Hanking), another interested party, submitted a DOCA proposal as an alternative to the DOCA proposed by the administrators (the Hanking DOCA proposal). I will discuss this in more detail later.

88 On 24 June 2020, at around 5.30 pm, Mr Simon Raftery, a director of Habrok and also Adaman, called Mr John Park, the managing partner of FTI’s insolvency division, to advise that Habrok Mining would be submitting a DOCA proposal and that Habrok Mining would request that the second creditors’ meetings be adjourned so that creditors could properly consider Habrok Mining’s DOCA proposal. Mr Park advised him to send through Habrok Mining’s DOCA proposal.

89 On 24 June 2020, Habrok Mining provided the administrators a term sheet for the Habrok Mining DOCA to be put forward at the second creditors’ meetings. Habrok Mining submitted its DOCA proposal as soon as Adaman SPV, a subsidiary of Adaman, had receipt of a funding term sheet from BlackRock (Singapore) Limited – APAC Fixed Income Portfolio Management Group.

90 Habrok Mining’s DOCA proposal proposed to establish a fund, to be funded by Habrok Mining and BlackRock in an amount of around $85 million, which would consist of inter-alia:

(a) an amount required to pay the senior secured creditors in full;

(b) an amount equal to the full entitlements of any non-continuing employee entitlements;

(c) an amount required to pay unsecured creditors:

(i) with debts less than $10,000 (small unsecured creditors), 100 cents in the dollar; and

(ii) with debts greater than $10,000 (large unsecured creditors), with respect to the first $10,000, 100 cents in the dollar; and

(d) $3 million to pay large unsecured creditors in addition to the first $10,000 as just described.

91 On 24 and 25 June 2020, Mr Raftery exchanged emails with the administrators requesting that the administrators adjourn the second creditors’ meetings to enable the creditors sufficient time to consider the Habrok Mining DOCA proposal as against the other DOCA proposals.

92 The second creditors’ meetings took place on 25 June 2020.

93 Shortly prior to the second creditors’ meetings, the administrators announced to the ASX that NRW would be voting against the adjournment of the second creditors’ meetings and in favour of the DOCA proposed by the administrators. The ASX announcement did not mention Habrok Mining’s DOCA proposal. The ASX announcement also mentioned that the upfront payment NRW was due to receive from the proceeds of the capital raising under the administrators’ DOCA would increase from 5% to 8.75%.

94 At the second creditors’ meetings, creditors were first asked to vote on resolution 1, being a resolution adjourning the meeting to 12 pm on Friday, 10 July 2020. The results of the poll in relation to the adjournment resolution were as follows:

GNT Resources Pty Ltd | ||

Option | Number | Creditor value |

In favour | 13 | $3,229,447 |

Against | 22 | $35,238,896 |

Abstain | 1 | $104,049,253 |

Gascoyne Resources Ltd | ||

Option | Number | Creditor value |

In favour | 1 | $11,803 |

Against | 15 | $154,329 |

Abstain | 1 | $11,520 |

95 The creditors were next asked to vote on resolution 2, being that the GCY Group enter into the DOCA proposed in the administrators’ report. The results of the poll in relation to the administrators’ DOCA resolution were as follows:

GNT Resources Pty Ltd | ||

Option | Number | Creditor value |

In favour | 34 | $35,738,430 |

Against | 10 | $2,571,591 |

Administration end | 1 | $5,315 |

Abstain | 1 | $104,049,253 |

Gascoyne Resources Ltd | ||

Option | Number | Creditor value |

In favour | 8 | $165,966 |

Against | 1 | $11,803 |

96 The attendance register records that NRW was admitted to vote in the amount of $34,780,390.83 and that it was secured for that amount. It may be inferred from the ASX announcement and the record of the votes in the minutes that NRW voted against the adjournment resolution and in favour of the administrators’ DOCA resolution. NRW’s vote, with a value of $34,780,390.83, resulted in the adjournment resolution failing and the administrators’ DOCA resolution being passed.

97 By the time of the second creditors’ meetings, the administrators had received two DOCA proposals: one from Hanking and the other from Habrok Mining.

98 Both Hanking and Habrok Mining requested that the administrators adjourn the second creditors’ meetings to enable creditors sufficient time to review and understand the competing DOCA proposals in accordance with the administrators’ powers to adjourn the meetings under s 75-140(1)(b) of the Insolvency Practice Rules.

99 At the meetings, the administrators declined to adjourn and instead put the adjournment requests to a vote in circumstances where NRW had previously indicated that it would vote against an adjournment and in favour of the DOCA proposed by the administrators.

100 Based upon the votes cast for the adjournment resolution in respect of GNT Resources and GCY, but for NRW’s vote, there would have been a deadlock between the number and value of votes cast on the adjournment resolution and the administrators’ DOCA resolution, which would have necessitated the administrators exercising their casting vote, a power that is subject to review under ss 75-42 and 75-43 of sch 2 to the Corporations Act (Insolvency Practice Schedule).

101 On 26 June 2020, the administrators executed the administrators’ DOCA and creditors’ trust deed.

102 On 6 July 2020, the deed administrators of GCY despatched the notice of EGM and accompanying explanatory statement to the shareholders of GCY.

103 The EGM was convened on 5 August 2020 in order to consider and vote on resolutions to facilitate the capital raising required by the DOCA.

104 In particular, the shareholders voted on the following resolutions, inter-alia:

(a) a resolution to approve the issue of shares under the entitlement offer;

(b) a resolution to approve the issue of 1,750,000,00 shares under the placement;

(c) a resolution to approve the issue of 600,000,000 shares to NRW in satisfaction of NRW debt in accordance with the debt-to-equity conversion proposed in the DOCA; and

(d) a resolution to approve the issue of shares to the trustees of the creditors’ trust for the benefit of the large unsecured creditors.

THE ADMINISTRATION – THE DETAIL

105 It is appropriate at this point to now say something more concerning the steps taken by the administrators.

106 At the time of the appointment of the administrators, the GCY Group operated the following three projects in Western Australia:

(a) the Glenburgh mine;

(b) the Egerton gold mine, which consists of two mining leases and two exploration licences covering approximately 180 km2 of the Lower Proterozoic Egerton inlier in the Gascoyne region of Western Australia; and

(c) the Mine.

107 The Mine is a currently operating mine with fully established infrastructure and processing facilities. All power at the Mine is generated by third party contractors. The Mine is owned by GNT Resources. All of the shares of GNT Resources are held by Dalgaranga Operations Pty Ltd, which in turn is wholly owned by GCY. The Mine has three deposits: Gilbey’s deposit, Golden Wings deposit and Sly Fox deposit.

108 The Mine employs 99 staff, 87 staff of whom are employed by GNT Resources and 12 of whom are employed by GCY, and three directors. There are a further approximately 300 persons employed by site contractors who provide mining and ancillary services at the Mine. All people who work on-site are on “fly-in fly-out” rosters and travel to site on charter air flights. GNT Resources engages with a number of other small and medium businesses in the nearby Geraldton and Mount Magnet areas, which rely on workflow from the Mine.

109 As at the date of the appointment of the administrators, the key stakeholders were:

(a) the senior secured creditors;

(b) critical suppliers to the business, including:

(i) NRW through its associated entity– mining contractor;

(ii) Zenith Pacific (DGA) Pty Ltd (Zenith) – power generation facilities;

(iii) Wesfarmers LNG Pty Ltd trading as EVOL LNG – LNG supplier to Zenith;

(iv) Nantay Pty Ltd trading as Maroomba Airlines – charter flight operators; and

(v) Northern Rise Village Services Pty Ltd – on-site catering and cleaning;

(c) the unsecured creditor group;

(d) employees; and

(e) shareholders.

110 The first creditors’ meetings were held on 13 June 2019. But as I have said, given the complexity of the business, the administrators sought and were granted three extensions of time in which to convene the second creditors’ meetings on 27 June 2019, 31 October 2019 and 20 December 2019.

111 A COI was formed at the first creditors’ meetings.

112 There were six meetings of the COI. The COI was comprised of representatives of large creditors and representatives of different creditor classes.

113 At the first creditors’ meetings, creditors voted in favour of resolutions that members of the COI of GNT Resources and GCY and related parties of such members were entitled to enter into arms-length transactions or dealings in the ordinary course with the administrators, GCY or GNT Resources or their creditors.

114 Now immediately following their appointment, the administrators took steps to commence stakeholder communication, including attending to their statutory duties regarding meetings with creditors and complying with the voluntary administration timelines and to commence their investigation into the causes for failure in order to prepare a report to creditors pursuant to s 75-225(3) of the Insolvency Practice Rules.

115 In addition, the administrators identified three key work streams that required immediate actions. They developed a systematic approach to the address these matters in these work streams.

116 First, they focused on operations and trading. This involved reviewing the existing operations to determine if there was a way to maintain the business as a going concern in the short term, including to stabilise operations and support for continued trading.

117 Second, they focused on technical aspects, including implementing an interim mine plan (IMP).

118 Third, they prepared for the dual track sale and recapitalisation process. They appointed a financial advisor, namely, Investec, to advise on and manage the dual track process. Investec was appointed following a formal selection process. Ten parties were approached, including Macquarie Capital Advisors, Investec, PCF Capital, Azure Capital, Treadstone Partners, Hartley’s Limited, Zephyr Capital, Origin Capital, Argonaut Corporate Finance and Discovery Capital. Five submitted compliant proposals and were interviewed. Investec was selected based on its technical expertise, experience in the resources space and distressed asset situations, global reach and strong relationships with potential investors.

119 The administrators were responsible for the management of different work streams, together with other staff under their direction. Broadly, as between Mr Francis, Ms Warwick and Mr Ryan:

(a) Mr Ryan was responsible for the overall approach to, and management of, the administration and had specific involvement with:

(i) operations and trading;

(ii) technical development, including engaging with mining consulting firms, together with his colleague at FTI, Mr Andrew Bantock, on the implementation of the IMP;

(iii) dealing with proposals for financial advisors and development of the dual track process;

(iv) stakeholder engagement including with NRW and Zenith; and

(v) finalising the administrators’ report;

(b) Ms Warwick was responsible for liaising with the senior secured creditors; and

(c) Mr Francis commenced investigations, managed the preparation of the administrators’ report, chaired the first three committee of inspection meetings and was responsible for the first two extension of time applications.

120 Following their initial assessment of the then state of operations at the Mine and the mineral resource modelling and mine planning, the administrators determined that in order to achieve the best value for creditors, it would be preferable, if possible, to continue to trade the Mine, rather than place it into care and maintenance.

121 It was considered that placing the Mine into care and maintenance would be destructive of value and would result in significant job losses. The administrators engaged an external mining consultant, Mr Gary Davison of Mining One, to assist with this review.

122 The administrators also maintained the engagement of geological and mine engineering consultants Cube Consulting to work on the LUC resource model.

123 It was anticipated that by continuing to trade the Mine the administrators would be able to demonstrate a reconciliation of mined ore delivery against the revised technical ore-body modelling and that such proven performance of the Mine, assuming it was achieved, would be value accretive and therefore would assist in negotiations with potential investors or purchasers of the Mine, with a view to increasing the return to creditors.

124 By focusing on and understanding the technical and commercial aspects of the business, the administrators were able to develop a greater understanding of the value of the operations.

125 In June 2019, in conjunction with Mining One and the management team, the administrators developed the IMP. The IMP was necessarily a short-term outlook and developed with a view to ensuring the operation could trade on a cash positive basis and could also be monitored closely and stopped if there were material negative deviations encountered.

126 On 24 June 2019, the administrators provided a report to the senior secured creditors on the IMP titled “Interim Mine Plan - High Level Overview (updated draft)” summarising preliminary work undertaken as at that date.

127 The administrators formed the view that the IMP had provided enough confidence to cause the Mine to operate on a longer term basis which would involve investing in certain longer term capital commitments and, accordingly, they prepared subsequent LoMPs.

128 On 19 September 2019, a revised LoMP titled “Gascoyne Valuation Model - September 2019 LOMP” (the September 2019 LoMP) was finalised.

129 On 10 December 2019, a further revised LoMP titled “Gascoyne Valuation Model - December 2019 LOMP” (the December 2019 LoMP) was being prepared based on the LUC resource model and an updated ore reserve. At the least, modelling had been updated by mid-December but work had not been completed.

130 In July 2020, the administrators finalised a further revised LoMP titled “Gascoyne Valuation Model - July 2020 LOMP” (the July 2020 LoMP).

131 On 31 July 2020, there was a release made to the ASX concerning an updated life of mine production target and ore reserve estimate which indicated that:

(a) over 400,000 ounces of gold were estimated to be mined and processed at the Mine over a seven year period;

(b) the average cost per ounce was estimated to be between $1,400 and $1,500;

(c) over the next three financial years, a further $115 million to $130 million was estimated to be spent on capital waste earth moving works to access the gold ore, as follows:

(i) FY2022, an estimated $40 - 45 million; and

(ii) FY2023, an estimated $5 - 10 million; and

(d) capitalised waste mining was planned to be funded from operational free cash flows generated in the normal course of operations.

132 Mr Ryan gave evidence that he had more recently reviewed the July 2020 LoMP. He identified that the amount shown in cell K892 in the sheet entitled “D1. Key Inputs” had been incorrectly inputted as $13.7 million instead of $20.7 million. He then caused an updated version of the July 2020 LoMP (the updated July 2020 LoMP) to be prepared.

133 The updated July 2020 LoMP corrected the amount shown in cell K892. It also updated cell G237 in the sheet entitled “F4. Debt Equity” to reflect the change to the timing of the upfront cash payment to NRW which was to be paid in August 2020, but is now proposed to be paid in September 2020. This change reflects the current recapitalisation timetable.

134 Based on the updated July 2020 LoMP and using a gold price assumption of $2,400 per ounce and the forecast cost of production, the administrators have calculated that over the seven years of operations, the Mine will generate:

(a) surplus cash of $307 million;

(b) project NPV (pre-tax) of $224 million;

(c) free cash flows to equity of $198 million; and

(d) equity NPV of $161 million.

135 Based on the updated July 2020 LoMP and using a gold price assumption of $2,900 per ounce and the forecast cost of production, it is calculated that over seven years of operations, the Mine will generate:

(a) surplus cash of $466 million;

(b) project NPV (pre-tax) of $352 million;

(c) free cash flows to equity of $358 million; and

(d) equity NPV of $287 million.

136 Now such estimates do not have regard to any additional ore recoveries. That is, these estimates are based on the reserves at the Mine and do not take into account resources, adopting the language used in the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, 2012 Edition.

137 According to the administrators, the Mine is therefore currently profitable. It has demonstrated continued high levels of steady state performance, which together with the current relatively high gold price, gives GCY a significant opportunity to raise new equity now from its existing shareholders and other investors.

138 For completeness, I would note at this point that Ms Tejal Magan, the Head of Finance of the GCY Group, gave uncontested evidence addressing various alleged discrepancies in the various LoMPs produced in 2020 that had been raised by Mr Raftery in his evidence. I accept her evidence. His criticisms went nowhere. Although Mr Raftery was frank, composed and commercial in his evidence, he lacked first-hand knowledge of the details.

(a) The dual track process: sale or recapitalisation

139 Shortly after the administrators’ appointment, they received a number of enquiries from parties who were interested in either an asset purchase or recapitalisation of the GCY Group.

140 Based on this level of interest, the administrators undertook a process to seek proposals from a number of financial advisors to assist them with this work stream.

141 As discussed, the administrators engaged Investec as their advisor in July 2019. In addition to the sale process, the administrators instructed Investec to consider a restructure of the GCY Group, via either a capital raising and/or debt refinancing, that is, a recapitalisation. They considered that they should pursue both of these tracks in order to maximise the potential for return to all creditors, not just the senior secured creditors.

142 The administrators therefore determined to pursue the dual track process. A dual track process is commonly used for listed companies where there is a possibility that the underlying business can be turned around with the injection of new capital. The dual track process embraced exploring the possibility of a sale of the GCY Group’s assets either as a whole or on a breakup basis or a recapitalisation of the GCY Group via a DOCA.

143 The administrators considered that there were advantages and disadvantages of both the asset sale and recapitalisation tracks.

144 According to the administrators, the reason for exploring a sale of the GCY Group’s assets was driven by a number of factors. The senior secured creditors had a preference for a sale so that they could recover money owed as quickly as possible. In the administrators’ experience, it is appropriate to determine whether a sale is a better way to proceed so as to maximise a return to creditors, even if there is a longer term possibility of ensuring that the relevant business of the company in administration continues. Sometimes, that possibility is not realistic because of the costs involved in proceeding to develop ways in which the business might continue. In this case, in contrast, given the administrators’ investigations including the fact that the Mine was continuing to produce gold, there was a way forward for the GCY Group’s business to continue and for all creditors and other stakeholders to obtain a return.

145 The reason to pursue a recapitalisation track was driven by the knowledge that GCY was listed on the ASX and therefore had the ability to raise further capital from the equity markets. Further, GCY had only recently established the Mine at significant cost. Therefore if the business could be turned around there was a likelihood that this cost could be recovered. There were also significant carry forward tax losses (exceeding $100 million as at 30 June 2019) in the GCY Group that would be available to offset tax liabilities in the future if it was able to be traded out of its financial difficulties.

146 A further reason for pursuing recapitalisation was that knowledge of that possibility usually encouraged interested parties to offer a higher price for the assets, knowing that a fire sale was not the only alternative that is available. In the present case, given the administrators’ investigations and the fact that the Mine was continuing to produce gold, a recapitalisation was a real possibility that could not be discounted. In the event, it appeared that a recapitalisation would be successful and would enable the GCY Group business to continue, with all creditors being paid in full.

147 The sale process ran from September 2019 into 2020. Investec was responsible for administering the sale process.

148 During the sale process, Ms Warwick kept the senior secured creditors informed. Mr Ryan’s role included monitoring the operational performance of the GCY Group. As part of this, he attended at the site and spoke with employees to ensure that they understood the administration process and were aware that their jobs were not necessarily at risk. He also spoke with GCY’s large shareholders to determine whether they would be willing to provide funding that he thought might have been necessary to keep the Mine operations going whilst the GCY Group’s position and a way forward were being investigated.

149 Given the trading performance of the Mine before the administrators’ appointment and then the improved trading performance and the improved gold price environment, the possibility of a recapitalisation increased over time in the latter part of 2019 and into 2020 as the value of the GCY Group’s assets increased.

150 Ultimately the outcome of the sale process was unsatisfactory. Investec was responsible for the sale process but decisions about whether to accept any proposal remained with the administrators. The administrators formed the view that none of the proposals were acceptable. Hanking made the highest offer. But Hanking’s offer was not sufficient even to repay the senior secured creditors in full. That would have left nothing for the other creditors and the other stakeholders.

151 Whilst the sale process was proceeding, the gold price had continued to rise, production had remained reasonable, a new resource and reserve estimate had been released, a new mine plan had been developed and a new life of mine model had been prepared. Also, as a consequence of the mining technical work that was undertaken, the administrators formed the view that the Mine was more valuable than the offers received through the sale process.

152 After discussion with the administrators, the senior secured creditors, NAB and CBA, were willing to permit a further investigation as to whether the Mine’s performance could be improved to obtain a higher return and were willing to have any further step in the sale process deferred whilst that occurred. NAB and CBA had the right to appoint a controller at any time if they thought that was the best way to recover money owing under their securities. NAB and CBA continued to monitor the operational performance of the Mine.

153 Whilst the administrators were further investigating the position and how best to proceed in the creditors and other stakeholders’ interests, they received enquiries from parties interested in the assets of the GCY Group, including from Hanking and Adaman. They also received enquiries from parties interested in the Glenburgh Mine and Egerton Mine. The administrators considered these enquiries but none of them were proposing to purchase the GCY Group’s assets at a price that would maximise returns to all stakeholders. In the administrators’ view, none of these parties were willing to pay for what appeared to be the improved value in the GCY Group.

154 Over the period between the beginning of 2020 and 25 June 2020, these expressions of interest remained “on the table” and improved somewhat. This gave the administrators confidence that the sale process remained available if needed albeit at a lower value outcome than they expected from the recapitalisation process. It showed that the competitive tension being applied by the dual track process achieved what the administrators had aimed for it to do.

155 It is convenient at this point to deal with Habrok’s misplaced criticisms of the sale process undertaken by the administrators.

156 Let me say at the outset that I do not accept that Adaman was dealt with inappropriately in the sale process. And before going through the chronology, let me say something about some of the witnesses.

157 The evidence of Mr Stefan Edelman, an executive director of Investec, reliably established that Adaman had access to whatever material it needed and requested to put in a bid. But the fact is that Adaman only bid at the level of $42 million, which was later increased to $65 million. But if it had wanted to go higher, assuming that it had the financial capacity to do so which was questionable, it could have done so. It chose not to.

158 Mr Edelman gave clear and accurate evidence. Contrary to Habrok’s cross-examination, it was reasonable for Mr Edelman not to have volunteered an updated LoMP to Adaman after submission of final offers in November 2019, given that Adaman was not the preferred bidder. Adaman was aware of the sale process and its timing. Throughout, Adaman had made proposals, incapable of immediate acceptance, with insufficient value. Moreover, it was reasonable to adopt a process under which only bidders with the best offers would be provided with further information after final offers had been provided.

159 Mr Mark Rowsthorn, the chairman of Adaman’s board, gave evidence. In his email of 6 April 2020, Mr Rowsthorn did not offer that Adaman would pay $140 million for the GCY Group’s assets; indeed, Mr Rowsthorn gave short evidence which did not seek to portray his email as such an offer. And Mr Edelman understood the email as a clear statement that Adaman could not offer sufficient value. The $140 million represented the total amount that Adaman might be able to borrow to repay its own liabilities and fund an acquisition of the GCY Group, which, after allowing for Adaman’s existing funding needs, would not be sufficient even to pay out the GCY Group’s secured debt. Based on that understanding, which was consistent with his previous discussions, Mr Edelman informed Mr Rowsthorn in a responsive email that it was unnecessary for Adaman to formalise any offer, but that lines of communication should be kept open. That was a reasonable position where Adaman had said it could not meet value expectations. I will discuss the significance of this 6 April 2020 email shortly.

160 Further, Mr Edelman’s evidence clearly establishes to my mind that there is no substance to Habrok’s assertion or the suggestion of its witnesses, Mr Rowsthorn and Mr Gary Ireson, Adaman’s Corporate Development Officer, that Adaman was denied relevant information.

161 Mr Rowsthorn asserted that Adaman lacked key information for its two $42 million offers, and was unable to submit better offers as a result. But Adaman’s second offer did not complain of any lack of information. Adaman also made overtures to Investec about increasing its offers to $65 million without receiving any further information. Further, apart from a few minor exceptions, whenever Adaman asked Investec for more information, that information was promptly given.

162 Now Mr Rowsthorn also insisted in his evidence that the administrators, or Investec, did not engage with Adaman and its bids throughout the sale process. But Investec had multiple meetings, site visits, email exchanges and phone-calls with Adaman’s representatives, kept them informed about the sale process, and was prompt in responding to their communications and in providing information where requested.

163 Mr Ireson gave evidence about the sale process. This included an asserted lack of information to support Adaman’s offers and a suggested lack of engagement by the administrators with the sale process. I do not accept the validity of his complaints. Although Mr Ireson said that when he reviewed the data room he noticed a number of important documents were missing, he did not ask Investec to supply that data with any promptness, despite making other requests. Mr Ireson also failed to articulate how Investec had failed to engage with Adaman about the sale process.

164 Ms Warwick also gave evidence. Contrary to Habrok’s submission that the administrators were only interested in pursuing a recapitalisation, Ms Warwick made it clear that in late November 2019 she was not prepared to put at risk the offer made by Hanking where, at that time, the recapitalisation track was uncertain. Further, around that time, in circumstances where the administrators were dealing with an offer from Hanking to purchase the assets of the GCY Group, it was not in the interests of the creditors to start a new sale process. Further, into 2020 the sale process was not going well and the recapitalisation track became more certain. But even then, Investec was instructed to keep discussions open with Hanking and Adaman.

165 Let me now say something more about the relevant chronology of events.

166 Adaman was sent a “teaser” document and confidentiality agreement on 12 September 2019 which it signed.

167 On 20 September 2019, Adaman was granted access to the phase 1 data room in which due diligence materials were provided including:

(a) the financial model prepared by FTI for the Mine based on the LoMP current at the time;

(b) an information memorandum relating to GCY’s assets prepared by Investec;

(c) updated reserve and resource reports;

(d) technical information on the geology, mining, processing and TSF/Infrastructure at the Mine including mine designs for the LoMP;

(e) GCY’s audited financial statements; and

(f) technical information on other exploration projects controlled by GCY.

168 On 24 and 26 September 2019, Adaman requested pit designs and historical as built pit data. Mr Edelman sought these documents from the administrators and made them available in the data room, and informed Adaman of this on 25 September and 1 October 2019.

169 On 15 October 2019, Mr Edelman emailed Mr Ireson requesting a phone call to obtain an update on how Adaman was progressing in respect of its offer. They arranged a call the following day.

170 On 18 October 2019, Adaman submitted a non-binding indicative offer for the whole of the GCY Group’s assets in the amount of $42 million.

171 On 24 October 2019, Mr Mischa Mutavdzic emailed Mr Ireson to confirm that Adaman had been selected to progress to “Round 2 of the Gascoyne sale process” and to inform Adaman that the due date for binding offers was 22 November 2019.

172 More detailed information was then uploaded to the data room for those third parties who had progressed through to phase 2, including Adaman. This included:

(a) updated technical information;

(b) monthly operating reports;

(c) tenement information;

(d) permitting information;

(e) detailed management accounts;

(f) details of tax losses;

(g) creditor breakdown by subsidiary; and

(h) key contracts and supplier invoices.

173 With respect to the information that Mr Rowsthorn in his evidence complained about not receiving, most of this information was provided with the exception of the debt facility documents and the NRW mining contract which was withheld due to a perceived conflict with Adaman’s associated contracting business, SMS Mining Services.

174 On 29 October 2019, Mr Anthony Hawke of Investec, Mr Mutavdzic and Mr Edelman met with Mr Ireson, Mr Craig Bradshaw and Mr John Fitzgerald of Adaman in Perth. They discussed the process and timeline for phase 2 along with the corporate history of Adaman; the basis for Adaman’s first round indicative offer; potential transaction structures; potential funding of an offer and intentions with respect to NRW’s ongoing operation. They also encouraged Adaman to look at opportunities to increase its first round offer as it was materially below other first round bids received.

175 On 30 October 2019, Mr Ireson emailed Mr Edelman referring to the meeting held the previous day, and setting out a detailed list of information requests. Mr Edelman responded to Mr Ireson’s email on 31 October 2019, and indicated where in the data room the documents had been uploaded.

176 On 1 November 2019, Mr Edelman enquired whether the Adaman team would be available to conduct a site visit, which was then arranged for 14 November 2019.

177 On 5 November 2019, Mr Ireson requested a copy of the end of month survey for October 2019. Mr Edelman arranged for that survey to be uploaded to the data room the following day once it had been completed.

178 The site visit referred to above occurred on 14 November 2019. Mr Richard Clayton from Investec attended along with the following representatives of Adaman: Mr Ireson, Mr Bradshaw, Mr Clay Gordon (Head Geologist), Mr Michael Di Trento (Process Manager) and Mr Simon Kelly (Mine Planning Engineer). At the site visit, Adaman was provided with detailed information on technical aspects of the Mine operation by Mr Hay and the site management team.

179 On 19 November 2019, Mr Hawke, Mr Mutavdzic and Mr Edelman met with Mr Bradshaw and Mr Ireson in Perth to discuss the final offer process. In the meeting they discussed feedback from the site visit and due diligence process, and expected transaction structures. They also reiterated to Adaman that it should significantly increase its first round offer. At that meeting, Mr Edelman received a question about mining costs. He provided a response to that question, and a follow-up question, the following day.

180 Final bids were due on 22 November 2019. Adaman could not meet this deadline and was granted an extension until 25 November 2019, at which time Adaman submitted a final non-binding offer to Investec in the amount of $42 million. Adaman chose not to increase its first round offer despite advice from Investec that its offer value was uncompetitive.

181 Mr Edelman responded to Mr Ireson’s email submitting Adaman’s final offer on the same day to say that Investec had received Adaman’s final offer and that they would discuss the offer with the administrators and get back to him.

182 Mr Edelman provided a further update to Mr Ireson on 29 November 2019 stating that Investec would not be in a position to provide feedback upon final offers until the following week.

183 After receiving Adaman’s offer, Mr Edelman informed Mr Ireson that Adaman’s offer was materially lower than another offer which had been received.

184 On 12 December 2019, Mr Edelman emailed Mr Ireson to confirm that the administrators were considering the offers received and would provide feedback in due course.

185 On 17 December 2019, Mr Edelman received an email from Mr Rowsthorn which stated that the “shareholders of Adaman are prepared to provide a significantly improved offer for the Gascoyne assets. We have advanced discussions with our funders. This will be a straightforward structure. If this is something you would consider can you let me know and we can set up a call”. He responded to Mr Rowsthorn’s email on 18 December 2019 and they thereafter arranged a call to discuss on 19 December 2019.

186 On the telephone call on 19 December 2019, Mr Edelman told Mr Rowsthorn that a $42 million offer was not going to be competitive and that they had relayed this previously to the Adaman management team. Mr Rowsthorn said to him words to the effect that Adaman’s bid for the GCY Group was opportunistic and that Adaman’s management team had not relayed Investec’s advice to improve the $42 million offer to Adaman’s board of directors. Mr Rowsthorn asked him whether Adaman should look to increase its offer, to which he agreed. Mr Rowsthorn told him that Adaman would send Investec an updated offer.

187 On 22 December 2019, Mr Rowsthorn informed Mr Edelman that Adaman’s shareholders had made a decision, which had been endorsed by the Adaman board, to increase its offer to $65 million, on terms identical to its previous proposal dated 25 November 2019.

188 On 24 December 2019, Mr Edelman emailed Mr Rowsthorn to say that he had spoken to one of the administrators but as the other two administrators were away until early January 2020, he would not have any meaningful feedback until then. Mr Rowsthorn responded to say that he understood.

189 On 7 January 2020, Mr Edelman informed Adaman, after consultation with FTI, that its offer of $65 million was insufficient and that the administrators were not proceeding with its offer but that Investec was willing to continue to engage with Adaman should it want to present a revised offer.

190 On 6 February 2020, Mr Byron Gordon of Investec and Mr Edelman attended a meeting in Perth with Mr Ireson, Mr Fitzgerald and Mr Bradshaw, during which they provided a general update on the Mine and dual track process.

191 On 11 March 2020, Mr Edelman attended a lunch at Cecconi’s restaurant in Melbourne with Mr Hawke, Mr Rowsthorn and Mr Anderson. In this meeting Mr Rowsthorn discussed other possibilities for Adaman to make its offer more attractive. To be attractive, they suggested a transaction would need to enable secured creditors to be paid out in full with some returns for unsecured creditors and shareholders. Mr Rowsthorn gave evidence that “Mr Brown of Investec told us that Investec and the Administrators were not interested in a sale proposal unless the sale price was in the order of approximately AU$150 million”. Mr Rowsthorn’s reference to Mr Brown is a reference to Mr Hawke. Mr Edelman did not recall a number of $150 million being mentioned.

192 One such suggestion at the 11 March 2020 meeting was to merge Adaman and GCY and refinance both group’s outstanding liabilities, which they agreed to look into. Investec reviewed cash flow information provided by Adaman to assess the debt carrying capacity of the combined projects.

193 On 26 March 2020, there was a conference call between representatives of Investec and Adaman. Mr Mutavdzic, Mr Hawke and Mr Edelman attended for Investec and Mr Rowsthorn and Mr Anderson attended for Adaman. On that phone call, the Investec team provided a high level operational update on the Mine and informed Adaman that the sale process was still being considered, but that improved offers were required. Mr Edelman does not recall telling Mr Rowsthorn or Mr Nicholas Anderson of Adaman that the administrators desired a price of around $150 million for the whole of the assets of the GCY Group. They also discussed the possible refinancing of the merged assets but concluded that this would be challenging and it was not clear that Adaman could provide the equity required.

194 As I have mentioned, on 6 April 2020, Mr Rowsthorn sent an email stating that “we will struggle to meet Fti expectations, on value etc, given lending constraints”. By such expectations, Mr Edelman understood Mr Rowsthorn to mean what they had discussed as set out above, namely, it was necessary to make an offer that would enable secured creditors to be paid out in full with some returns for unsecured creditors and shareholders. I will discuss this email further shortly, but it is appropriate to mention it again briefly now.

195 Mr Edelman does not recall Mr Rowsthorn at any point indicating to him that Adaman required further technical information in order to reassess its bid. As discussed below, Adaman did not have access to the data room between 27 November 2019, that is, after receipt of its “final” offer on 25 November 2019, and 30 April 2020.

196 Mr Raftery gave evidence that the administrators did not engage with Adaman between 1 January 2020 and 24 June 2020 other than a discussion with Investec on 26 March 2020. But this was inaccurate. Investec had been engaged by the administrators to handle the sale process and Investec had corresponded with representatives of Adaman on at least the following occasions:

(a) on 19 January 2020, a phone conversation with Mr Rowsthorn;

(b) on 6 February 2020, a meeting in Perth with Mr Ireson, Mr Fitzgerald and Mr Bradshaw;

(c) on 11 March 2020, a lunch at Cecconi’s restaurant with Mr Hawke, Mr Rowsthorn and Mr Anderson;

(d) on 26 March 2020, a conference call between representatives of Investec and Adaman; and

(e) emails with Mr Rowsthorn between 4 April 2020 and 14 April 2020, where Mr Rowsthorn stated that Adaman could not meet value expectations due to financing constraints.

197 Let me say something about Adaman’s access to the data room.

198 Access to the data room was only provided once a confidentiality agreement was signed by an interested third party.

199 Set out below is a list of individuals from Adaman that were given access to the data room, and a summary of their data room activity. Mr Ireson was the third most active person who accessed the data room.

Name | Number of logins | Number of documents viewed |

Gary Ireson | 49 | 235 |

John Fitzgerald | 6 | 13 |

Craig Bradshaw | 14 | 112 |

Linton Putland | 1 | 1 |

Nicholas Anderson | 5 | 112 |

Russell Hall (also a director of Habrok Mining) | 4 | 10 |

200 Adaman personnel accessed the data room:

(a) 13 times in September 2019;

(b) 16 times in October 2019;

(c) 20 times in total prior to submitting its indicative offer on 18 October 2019;

(d) 26 times in November 2019;

(e) 55 times in total prior to submitting its final offer on 25 November 2019 and revised offer on 22 December 2019;

(f) 18 times in May 2020; and

(g) 6 times in June 2020.

201 The data room was not accessed by Adaman representatives from 22 November 2019 to 30 April 2020 (inclusive).

202 Once Investec received binding phase 2 offers, the data room was closed to all bidders while it awaited instructions regarding the next steps from FTI and the senior secured creditors.

203 Adaman did not request from Investec additional information at any point after Adaman was advised in January 2020 and before 1 May 2020 that the administrators were not proceeding with its “final” offer of $65 million. As such, there was no need to reinstate Adaman’s access to the data room until Adaman’s contact on 1 May 2020.

204 On 1 May 2020, at Adaman’s request, Mr Edelman arranged for Mr Ireson, Mr Bradshaw, Mr Fitzgerald and Mr Anderson to be reinstated with access to the data room. On 14 May 2020, Mr Edelman arranged for Mr Russell Hall and Mr Linton Putland to have their access reinstated at Adaman’s request.

205 On 21 May 2020, Mr Edelman received a request from Mr Fitzgerald for a copy of the April operations report. He responded on 25 May 2020 to advise that the report had been added to the data room and to tell Mr Fitzgerald where it could be located in the data room.

206 On 22 May 2020, Mr Edelman received a request from Mr Fitzgerald for a copy of the GCY Group’s current organisational chart, which request was complied with.

207 On 25 May 2020, Mr Edelman received an email from Mr Fitzgerald requesting access to “(1.) The last 4 months actual cashflow (2.) The current mine plan - (3.) The latest face positions i.e. where are they in the pit”. To the best of Mr Edelman’s recollection, Mr Fitzgerald was not provided with the cash flows but the December 2019 LoMP was in the data room and the latest face positions, being the April 2020 survey data, was provided on 9 June 2020.

208 On 26 May 2020, Mr Edelman had a teleconference with Mr Ireson and Mr Fitzgerald during which he provided an update on the Mine and the progress of the recapitalisation process.

209 Mr Rowsthorn gave evidence that, “Despite Adaman’s requests between September 2019 and March 2020 for more information including an updated LoMP, details of the NRW mining contract, details of the GCY Group’s debt and security arrangements, Investec never provided the information sought and Adaman was hampered in its ability to formulate and submit a competitive and appropriate proposal to acquire the GCY Group’s business and assets through the Sale Process”.

210 Mr Edelman was not aware of any information having been requested by Adaman that was not provided or available to Adaman in the data room, with the exception of the NRW mining contract and the cash flows referred to above.

211 Mr Raftery stated that Adaman and Habrok did not have the benefit of information pertaining to the value of the GCY Group’s assets, particularly the December 2019 LoMP, and could not properly formulate and revise Adaman’s or Habrok’s bids at the time. Habrok and Habrok Mining did not submit any proposal at any time to acquire the GCY Group’s assets nor did they sign the required confidentiality agreement.

212 Mr Raftery says that the administrators did not revert to Adaman with information regarding an updated LoMP after December 2019. But the position appears to be as follows.

213 At the time of submitting its “final” offer on 25 November 2019, Adaman had access to all of the information in the data room, including the September 2019 LoMP. At that time, the December 2019 LoMP was in progress but was not completed.

214 Subject to what has been said above, whenever Adaman requested additional information, that information was provided to it.

215 Neither Habrok nor Habrok Mining requested information from Investec pertaining to the value of the GCY Group’s assets, including the December 2019 LoMP, for the purpose of formulating a bid or proposal, whether via access to the data room or in any other form.

216 Neither Habrok nor Habrok Mining had access to the data room because they did not execute a confidentiality agreement.

217 The December 2019 LoMP and associated explanatory memorandum were uploaded into the data room on 10 December 2019 and as it continued to evolve, and were therefore available to those with access to the data room from that date.

218 Further, below is a table summarising which representatives of Adaman viewed the December 2019 LoMP and the explanatory memorandum which has been extracted from the individual activity logs generated by FTI from the data room.

Name | December 2019 LoMP | Explanatory memorandum |

Gary Ireson | Once on 1 May 2020 | Once on 1 May 2020 |

John Fitzgerald | Once on 22 May 2020 | Once on 22 May 2020 |

Nicholas Anderson | Once on 1 May 2020 | Three times on 1 May 2020 Once on 4 May 2020 Twice on 5 May 2020 Once on 7 May 2020 |

Russell Hall | Did not view. | Once on 15 May 2020 Once on 18 May 2020 |