FEDERAL COURT OF AUSTRALIA

Palladium Group Holdings Pty Ltd, in the matter of Palladium Group Holdings Pty Ltd [2020] FCA 1123

ORDERS

IN THE MATTER OF PALLADIUM GROUP HOLDINGS PTY LTD ACN 140 654 075 | ||

PALLADIUM GROUP HOLDINGS PTY LTD ACN 140 654 075 Plaintiff | ||

DATE OF ORDER: | 29 July 2020 |

THE COURT ORDERS THAT:

1. Pursuant to ss 411(1) and 1319 of the Corporations Act 2001 (Cth) (Act):

(a) the plaintiff convene a meeting (scheme meeting) of the holders of ordinary shares in the plaintiff (scheme participants), for the purpose of considering and if thought fit, agreeing (with or without modification) to the proposed scheme of arrangement (scheme) between the plaintiff and the scheme participants, the terms of which scheme of arrangement are set out in Annexure C of the document which has been tendered and marked Exhibit 1 (Scheme Booklet);

(b) the scheme meeting be held on 24 August 2020 at Level 7, 307 Queen Street, Brisbane, Queensland 4000 at 10:00 am (AEST);

(c) the chairperson of the scheme meeting be Ann Caroline Sherry, or failing her, John Anthony Eales;

(d) the chairperson appointed to the scheme meeting has the power to adjourn or postpone the scheme meeting in his or her absolute discretion for such time and to such date as the chairperson considers appropriate;

(e) at the scheme meeting, the resolution to approve the scheme be decided by way of a poll;

(f) the explanatory statement substantially in the form, or to the effect, of the Scheme Booklet be approved for distribution to scheme participants, together with a proxy form for the scheme meeting (substantially in the form of the pro forma copy which is set out at Annexure A (page 451) to the Affidavit of David Peter Anthony Campbell sworn 28 July 2020 (Proxy Form)).

2. Pursuant to s 1319 of the Act, the plaintiff is to cause to be issued a copy of the Scheme Booklet, Proxy Form to each scheme participant who has nominated an electronic address for the purpose of receiving notices of meeting and proxy forms from the plaintiff, at such address, an email substantially in the form of the document which is Annexure I (page 478) to the Affidavit of David Peter Anthony Campbell sworn 28 July 2020.

3. If an email notification of a failure to deliver an email to a scheme participant's nominated electronic address pursuant to order 2 above of these orders is received, there be issued by hand at, or by ordinary pre-paid post or courier to, the address of each such scheme participant as set out in the register of members of the plaintiff, a copy of the Scheme Booklet, Proxy Form and a reply envelope addressed to C/- Thomson Geer, Level 14, 60 Martin Place, Sydney NSW 2000.

4. Rule 2.15 of the Federal Court (Corporations) Rules 2000 (Cth) shall not apply to the scheme meeting.

5. Notice of the hearing of the application for orders approving the proposed scheme be published once in "The Australian" newspaper, by advertisement substantially in the form of Annexure "A" to these Orders, such advertisement to be published on or before 26 August 2020.

6. The proceeding be stood over to 10.15 am on Wednesday, 2 September 2020 before Justice Farrell for the hearing of any application to approve the scheme.

7. There be liberty to apply.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ANNEXURE "A"

1. PALLADIUM GROUP HOLDINGS PTY LTD ACN 140 654 075

2. NOTICE OF HEARING TO APPROVE COMPROMISE OR ARRANGEMENT

TO all the creditors and members of PALLADIUM GROUP HOLDINGS PTY LTD ACN 140 654 075 (Palladium)

TAKE NOTICE that at 10:15 am on 2 September 2020, the Federal Court of Australia at Law Courts Building, Queens Square, Sydney, New South Wales will hear an application by Palladium seeking the approval of an arrangement between Palladium and its members (Palladium Scheme Participants) as proposed by a resolution passed by the meeting of the Palladium Scheme Participants held on 24 August 2020.

If you wish to oppose the approval of the arrangement, you must file and serve on Palladium a notice of appearance, in the prescribed form, together with any affidavit on which you wish to rely at the hearing. The notice of appearance and affidavit must be served on Palladium at its address for service at least one day before the date fixed for the hearing of the application.

The address for service of the plaintiff is C/- Thomson Geer, Level 14, 60 Martin Place, Sydney NSW 2000 (Attention: Sylvia Fernandez).

Sylvia Fernandez, Thomson Geer

Solicitor for Palladium Group Holdings Pty Ltd

FARRELL J:

Introduction

1 These are reasons for orders made pursuant to ss 411(1) and 1319 of the Corporations Act 2001 (Cth) in relation to convening and the conduct of a meeting of the members of Palladium Group Holdings Pty Limited (Palladium) (scheme meeting) to consider and vote on a proposed scheme of arrangement (scheme) between Palladium and its members and approving the despatch of a scheme booklet (in the form of Exhibit 1) and related documents.

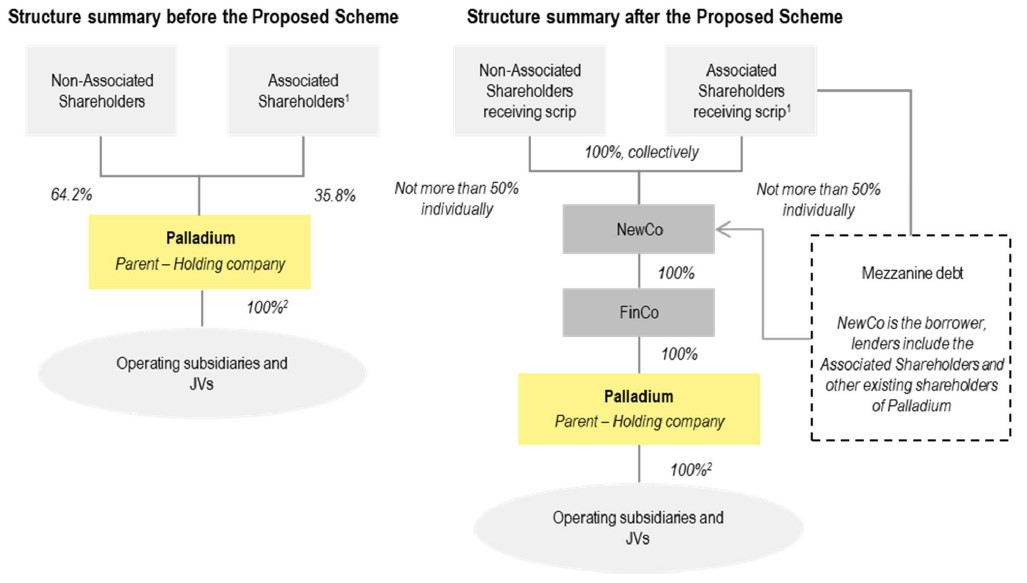

2 The purpose of the scheme is to facilitate the recapitalisation and restructure of the shareholding of Palladium by the transfer of all of the shares in Palladium to Palladium Group Management Pty Ltd (FinCo). FinCo is, in turn, a wholly owned subsidiary of Palladium Holdings Pty Ltd (NewCo). FinCo and NewCo are newly established companies for the purpose of the transaction.

3 Palladium’s current shareholders may be broken down into the following categories:

Category | Number of shareholders | Total number of Palladium shares | % of shareholders |

Employee | 94 | 4,073,448 | 36.45% |

Former Employee | 38 | 893,992 | 8.00% |

External | 26 | 6,206,683 | 55.55% |

Total | 158 | 11,174,123 | 100.00% |

Background

4 Palladium’s core business is said to be as a managing contractor responsible for implementing projects in the international development (Official Development Assistance) market, mainly on behalf of donor governments and institutions. Its core competency is advisory services and program management in emerging markets with particular industry expertise in economic development and trade; public policy and governance; supply chain management; crisis planning and administration; workforce development and education; health systems; agriculture and food security; environment and natural resource protection; and emergency response and logistics.

5 The corporate group before and after implementation of the scheme is represented in the independent expert’s report as follows:

6 Under the scheme, scheme participants (other than ineligible foreign shareholders) will be entitled to make an election in respect of any proportion or all of their Palladium shares as to whether they wish to receive cash consideration of $17.50 per Palladium share or scrip consideration of one NewCo share for each Palladium share, or a combination of cash and shares. If no election is made by the Election Time (as defined in the scheme booklet) or a scheme participant makes an invalid election, the participant will be deemed to have elected to receive cash consideration. Ineligible foreign shareholders will receive cash consideration.

7 The maximum aggregate number of NewCo shares which may be issued as share consideration is 5,140,097 NewCo shares (maximum scrip consideration). If scheme participants elect to receive more than that number of NewCo shares in aggregate, those elections will be subject to being scaled back on a pro rata basis so that that limit is not exceeded and they will receive cash consideration for any shares scaled back (section 4.3 of the scheme booklet).

8 The scheme is subject to a condition precedent that scheme participants, in aggregate, elect to receive scrip consideration in relation to at least 41% of all Palladium shares (minimum scrip consideration condition). Another condition precedent of the scheme is that, upon implementation, no scheme participant (together with that participant’s relevant interests) would acquire more than 50% of NewCo shares.

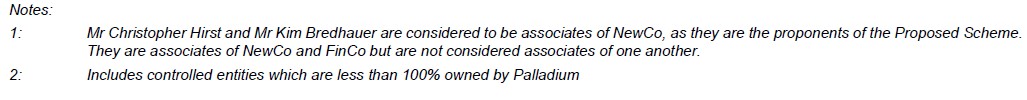

9 The number of Palladium shares in which Palladium’s directors have a relevant interest as disclosed at section 5.6.2 of the scheme booklet is as follows:

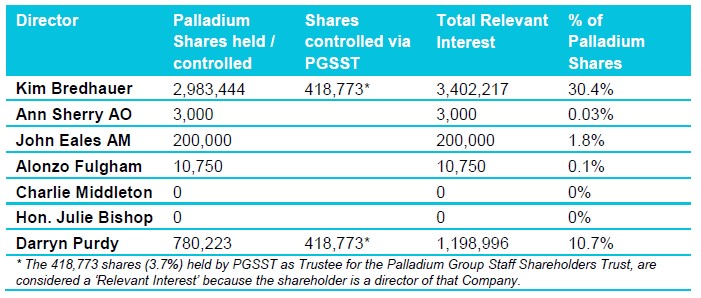

10 The number of Palladium shares in which Palladium’s chief executive officer, Christopher Hirst, has a relevant interest as disclosed at section 5.6.3 of the scheme booklet is as follows:

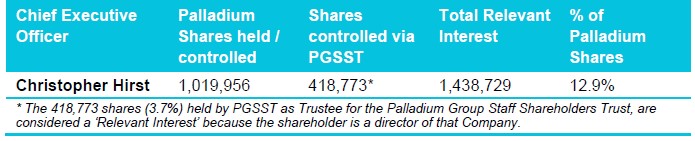

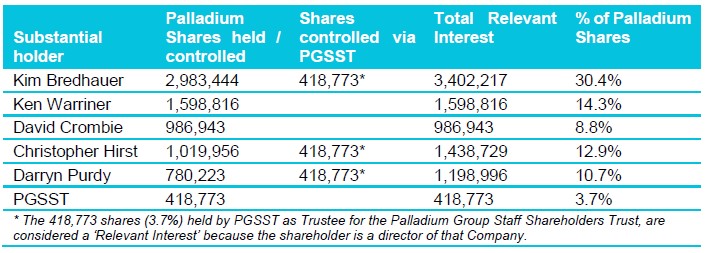

11 The substantial shareholdings disclosed at section 5.7.2 of the scheme booklet are as follows:

12 If the scheme is approved, funding for the cash consideration will be raised through a combination of bank debt, mezzanine debt and Palladium’s funds. The terms of the new debt is set out in section 9 of the scheme booklet. FinCo will raise new bank debt from Palladium’s existing banking consortium and it will have a term of three years. Mezzanine debt will be raised by NewCo from substantial shareholders of Palladium as set out at [14] below. It will rank after the new bank debt, have a higher interest rate than the new bank debt and it will have a term of five years. In addition, if the scheme is approved and implemented, FinCo proposes to raise new working capital and other facilities from Palladium’s existing banking consortium. If the scheme does not proceed, Palladium’s current facilities would be due for refinancing in September 2020.

13 Section 9.1.3 of the scheme booklet discloses that the “flex” in the cash required to fund the cash consideration will be made up from mezzanine debt. To the extent that Palladium’s cash is applied to assist in funding the cash consideration, the amount of bank debt will be reduced. If elections to receive scrip consideration in respect of only 41% of Palladium shares are received (as required to meet the minimum scrip consideration condition), then $115.4 million will be required to fund the cash consideration, comprising $72 million bank debt and $43.5 million mezzanine debt. If the maximum scrip consideration is to be issued (that is in respect of 46% of Palladium shares), then the cash required to fund the cash consideration will be $105.6 million of which $72 million will be bank debt and $33.6 million will be mezzanine debt.

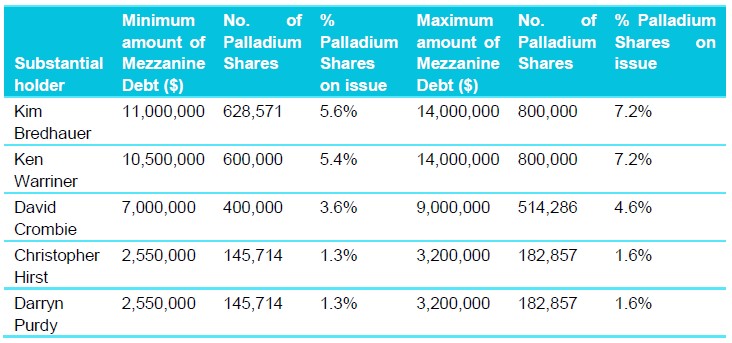

14 Pursuant to cl 5.3(f) of the proposed scheme of arrangement, some substantial shareholders will convert some of their entitlement to receive cash consideration to mezzanine debt. Other than in respect of mezzanine debt, the substantial shareholders have not yet made a decision as to the election they will make with respect to their remaining Palladium shares. The maximum and minimum amount of mezzanine debt to be provided by those substantial shareholders is set out at section 9.2.2 of the scheme booklet as follows:

15 Kim Bredhauer is the executive chairman of Palladium. Darryn Purdy is an executive director of Palladium. The other five directors are non-executive directors and the scheme booklet indicates that:

(1) The other five directors are considered independent.

(2) Mr Bredhauer is not considered to be an independent director due to his association with NewCo and because he is a lender of mezzanine debt. Mr Purdy is not considered to be an independent director because he is a lender of mezzanine debt. They consider that it is not appropriate that they make recommendations to Palladium shareholders in relation to the scheme.

(3) A committee (referred to as the Independent Board Committee) comprising independent directors Ann Sherry AO, Alonzo Fulgham, the Honourable Julie Bishop, John Eales AM and Charlie Middleton and non-director, Marita Corbett (Chair of Palladium’s Audit and Risk Committee) was formed to consider the proposed scheme.

(4) The Independent Board Committee unanimously recommends that Palladium shareholders vote in favour of the scheme in the absence of a superior proposal, and subject to the independent expert concluding that the scheme is fair and reasonable and therefore is in the best interests of Palladium shareholders.

(5) The independent directors intend to vote all Palladium shares held or controlled by them in favour of the scheme subject to the same qualifications as those in their recommendation. Mr Bredhauer and Mr Purdy intend to vote their Palladium shares in the same way.

(6) The Independent Board Committee makes no specific recommendation in relation to the scrip consideration due to the speculative nature of the NewCo shares and the fact that their appropriateness will depend significantly on the characteristics and risk profile of individual Palladium shareholders. However, the Independent Board Committee encourages current employee shareholders to consider electing to take the scrip consideration and former employees are encouraged to consider electing to take the cash consideration.

16 The Independent Board Committee appointed Ernst & Young Strategy and Transactions Limited as the independent expert commissioned to provide a report concerning whether the proposed scheme is in the best interests of Palladium shareholders.

17 The independent expert’s report is Annexure A to the scheme booklet. In summary:

(1) In assessing “fairness” of the proposed scheme, the independent expert assessed the value of a Palladium share on a non-controlling basis as being between $12.63 and $15.50 per share. The cash consideration is $17.50 per share and the independent expert assessed the value of the scrip consideration as being between $16.91 and $21.32 per Palladium share. As both the cash consideration and the fair value of the scrip consideration are above or within the range of values assessed for Palladium shares, the independent expert concluded that the proposed scheme was fair.

(2) In assessing “reasonableness” of the proposed scheme, the Independent Expert has considered the advantages, disadvantages and other factors that shareholders should consider in forming their view as to whether or not to vote in favour of the resolution required to effect the Scheme.

(a) The advantages are said to be: the proposed scheme provides immediate liquidity for Palladium shareholders receiving cash consideration; the cash consideration is at a premium to historical share prices; greater alignment between shareholders and the ongoing business by providing an opportunity for shareholders who are not current employees (comprising 38.8% of all shareholders) to exit their investment; and, shareholders receiving scrip consideration will continue to share in any future growth in value.

(b) The disadvantages are said to be: shareholders who receive cash consideration will not share in any potential future value growth of Palladium and they will forgo any potential opportunity to participate in a control transaction. The independent expert noted that it had valued Palladium shares on the basis that this was not a control transaction but the cash consideration of $17.50 implies a premium above the assessed range of values of a Palladium share before the proposed scheme of 13% to 39% and the scrip consideration is 34% to 38% above the range of values before the proposed scheme. Accordingly, even if the scheme were to be assessed as a control transaction and a control premium were relevant, cash consideration and the scrip consideration would still likely be higher than most of the range of fair values of Palladium shares on a controlling interest basis.

(c) Other disadvantages were said to be: the potential for lower dividends, at least in the near term, noting that the obligation to service bank debt and mezzanine debt would reduce the amounts which would otherwise be available for distribution, all else being equal; the changed capital structure and increase gearing levels may involve risk that individual Palladium shareholders do not desire; and costs associated with the implementation of the scheme (estimated to be $1.1 million of which $0.7 million will be incurred regardless).

(3) The independent expert concluded that the potential advantages of the scheme outweigh the potential disadvantages to Palladium shareholders as a whole and that the scheme is therefore reasonable.

(4) The independent expert concluded that the scheme is therefore in the best interests of Palladium shareholders.

18 It is notable that the independent expert also had regard to some other factors as follows:

(1) The Independent Board Committee considered alternatives to the proposed transaction but ultimately its members unanimously recommended that Palladium shareholders should approve the proposed scheme.

(2) If too many shareholders elect to receive cash consideration, the scheme will not proceed. Shareholders must elect to receive scrip consideration for at least 41% of the Palladium shares, meaning they may not elect to receive cash consideration in respect of more than 59% of the Palladium shares.

(3) The difference between the board of NewCo and the existing board of Palladium. The independent expert noted that the Palladium board includes seven directors (comprised of an executive chairman, five non-executive directors and one director). Mr Hirst and Mr Bredhauer are the only directors of NewCo. If the proposed scheme is approved and implemented, it is intended that additional directors, including at least one independent director will be appointed to the NewCo board. The proposed NewCo constitution states that there must be between two and eight directors. The appointment of all directors for an initial term will be confirmed at a general meeting of the NewCo shareholders within a short period after implementation of the scheme as set out in section 8.1.3 of the scheme booklet. Until another director is appointed, Mr Bredhauer and Mr Hirst will be able to exercise the powers of the NewCo board and Palladium shareholders will need to consider whether this short-term concentration of power is considered to be a risk.

(4) If it is approved, an outcome of the scheme will be that shareholders of NewCo will be subject to a different constitution, with key changes noted at section 1.7 of the report and section 1.3.5 of the scheme booklet. While the changes could have been made to Palladium’s constitution, the expert notes that NewCo’s constitution will have less restrictive rules regarding share transfers and will adopt the shareholding creep provisions of the Corporations Act. Accordingly, even though no shareholder may hold more than 50% of the issued shares in NewCo when the scheme is implemented, a shareholder could increase their holding more quickly than under Palladium’s constitution and no shareholder approval would be required for a shareholder to exceed 50% with the result that NewCo shareholders may not receive a premium for control.

(5) Some shareholders may receive less scrip consideration than they elect having regard to the proposed scaleback mechanism described in section 4.3.1 of the scheme booklet.

(6) If the scheme is not approved, shareholders would be reliant on a future liquidity event occurring, which is not certain, or an internal share sale in order to sell their shares and Palladium will incur approximately $0.7 million of one-off transaction related costs. Further, Palladium will be required to refinance its existing debt facilities in September 2020, however given the current net cash balance of $1.3 million and the fact that the business is generating cash, that is not expected to be an onerous requirement.

(7) Warranties typically required in transactions for sale of shares involving third parties are not required in this transaction and no duty or brokerage will be incurred.

(8) The exact nature of tax consequences for individual shareholders will need to be weighed in determining the merit of the scheme for those shareholders.

(9) The position of holders of small parcels of Palladium shares (being less than 1% of shares on issue) will change and that should be considered in the context of the scheme. There are currently over 120 such shareholders representing about 15% of the issued Palladium shares and about 43 of those shareholders are not employees or directors, representing about 6% of issued Palladium shares. Under the Palladium constitution, Palladium may buy back small parcels at the latest price set by its board if the holder is not and has not been for 12 months an employee or director of Palladium. Under NewCo’s proposed constitution, its board may require the holder of a small parcel of NewCo shares to sell those shares within six months if the holder ceases to be an employee or director of NewCo. If the shares are not sold within that time, NewCo may buy back the shares or its board may require them to be transferred to the trustee of any trust created for the purposes of administering a Palladium employee share scheme. That would be undertaken at the prevailing share price set by the board.

(10) Ineligible foreign shareholders will not be entitled to elect to receive scrip consideration. There are about 23 shareholders holding approximately 10.9% of Palladium shares who fall into this category. Excluding an interest held by Mr Bredhauer through a foreign domiciled entity, there are about 22 ineligible foreign shareholders who hold approximately 1.4% of Palladium shares on issue. Senior counsel for Palladium submitted that the cash consideration related to the shares held by Mr Bredhauer’s foreign domiciled entity will be applied to mezzanine debt so that there are a minimal number of shareholders who will not be entitled to elect to receive scrip consideration.

(11) The independent expert’s opinion is based on prevailing economic, market and other conditions as at the date of its report. In making its assessment, the independent expert considered the current financial and economic uncertainty which has arisen as a result of the coronavirus (“COVID-19”) pandemic. The management of Palladium has represented to the expert that there have been no significant impacts related to COVID-19 as at the date of the report that would materially impact the forecast for the year ending 30 June 2020 or the future performance of the business

19 Annexure B to the scheme booklet is a copy of a Scheme Implementation Agreement which Palladium, FinCo and NewCo executed on 27 July 2020 (SIA) pursuant to which they agreed to implement the scheme subject to the terms and conditions of the SIA before the End Date (being 31 October 2020 unless extended by agreement).

20 Conditions precedent to the scheme are set out in cll 3.1 and 3.2 of the SIA. Those conditions include:

(1) Those typical in most schemes of arrangement including regulatory, shareholder and Court approval to the scheme, no adverse regulatory action, no prescribed occurrences, and no material adverse change being discovered by Palladium, FinCo and NewCo;

(2) Any approval required pursuant to the Foreign Acquisitions and Takeovers Act 1975 (Cth) being obtained. This condition cannot be waived;

(3) FinCo and NewCo obtaining approval for sufficient finance to pay the cash consideration;

(4) Palladium shareholders passing a resolution pursuant to s 260B(1) of the Corporations Act approving the provision of financial assistance in connection with the scheme as described in section 11.1 of the scheme booklet (financial assistance resolution);

(5) Palladium shareholders passing a resolution for the purpose of cl 9.10 of Palladium’s constitution as described in section 12.1 of the scheme booklet (constitution resolution);

(6) The minimum scrip condition being satisfied; and

(7) The outcome of the implementation of the scheme being that no Palladium shareholder would (together with that shareholder’s other relevant interests) acquire 50% or more of NewCo. This condition cannot be waived.

21 The SIA contains no exclusivity or break free arrangements.

22 Annexure C to the scheme booklet is a copy of the scheme of arrangement. The Court notes that under cl 4.6(b) of the scheme, title to Palladium shares will only pass to FinCo when the scheme consideration has been paid to Palladium shareholders. Clause 4.4 of the scheme of arrangement includes “deemed warranties” in the usual form which are disclosed in section 4.6.6 of the scheme booklet and in the frequently asked questions section of the scheme booklet.

23 Annexure D to the scheme booklet is a copy of the deed poll executed by FinCo and NewCo on 27 July 2020 for the benefit of Palladium shareholders pursuant to which they have each undertaken to procure that each Palladium shareholder is provided with the scheme consideration to which they are entitled under the scheme, subject to the scheme becoming effective. The deed poll is in usual form.

24 Annexure E to the scheme booklet is the notice of the scheme meeting. The resolution to approve the scheme is conditional on both the financial assistance resolution and the constitution resolution being passed.

25 Annexure F to the scheme booklet sets out the notice of the general meeting to consider the financial assistance resolution and the constitution resolution. That meeting will be held immediately following the scheme meeting.

26 Annexure H is the Election Form pursuant to which a shareholder will notify its election between cash and scrip consideration. This form states that the form must be received by no later than the Election Time, which is 5 pm (AEST) on 13 August 2020. Under cl 5.2 of the scheme, the election may be revoked or varied by a replacement Election Form, provided it is received on or before the Election Time.

27 Annexure I to the scheme booklet is a copy of NewCo’s constitution.

28 Annexure J to the scheme booklet is a Roll-Over Election Form in relation to scrip-for-scrip roll-over relief in relation to capital gains tax on the disposal of Palladium shares pursuant to the scheme.

Principles to be applied at first Court hearing

29 The principles to be applied at the first court hearing in an application under s 411(1) of the Corporations Act are well known. I set them out in Capilano Honey Limited; in the matter of Capilano Honey Limited [2018] FCA 1568; (2018) 131 ACSR 9 (Re Capilano Honey Limited) at [32]-[34].

30 The application for leave to summon a scheme meeting is in the nature of an interlocutory proceeding and is preliminary to the final determination which is to be made when the matter comes back to the Court for approval after the holding of the meeting which has been directed: Australian Securities Commission v Marlborough Gold Mines Limited [1993] HCA 15; (1993) 177 CLR 485 at 504-05. By granting leave, the Court does not give its imprimatur to the proposed scheme. At the stage of ordering a scheme meeting, the Court does not ordinarily go very far into the question of whether the arrangement is one that warrants the approval of the Court; that question is to be answered when the scheme returns to the Court for final approval.

31 At the first court hearing, the Court is concerned with whether the proposed scheme is one which is adequately explained to those who have a financial interest in it and whether there is any obvious flaw in the scheme, such that it would be inappropriate even for it to be submitted for consideration: see Abacus Funds Management [2005] NSWSC 1309; (2006) 24 ACLC 211 at [23] (Campbell J). The Court is not required to be satisfied that no better scheme could have been proposed. The question is whether it is reasonable to suppose that sensible business people might consider the arrangement proposed to be of benefit to members: see Centrebet International Limited, in the matter of Centrebet International Limited [2011] FCA 870 at [29] (Emmett J).

Particular issues

32 Palladium filed submissions prepared by senior counsel who also drew a number of matters to the Court’s attention in oral submissions. The Court notes the following issues.

Constitution of classes at the scheme meeting

33 Palladium does not propose that the shareholders should be divided into different classes for voting purposes. It submits that the fact that some shareholders are content for their cash consideration to be “captured” and retained as mezzanine debt under cl 5.3(f) of the scheme of arrangement does not result in their interests being so dissimilar to the interests of other shareholders as to make it impossible for them to consult together with a view to their common interest.

34 The Court is satisfied that that is the appropriate test for determining whether shareholders’ interests fall into different classes: see Nine Entertainment Group Limited, in the matter of Nine Entertainment Group Limited (No 1) [2012] FCA 1464; (2012) 211 FCR 439 at [53] (Jacobson J). Senior counsel told the Court that the Palladium shares held by shareholders who will convert their share consideration to mezzanine debt will be tagged for voting purposes. The Court was prepared to make orders convening the meeting and approving the scheme booklet on that basis. The Court notes that any view reached at the first court hearing as to the proper constitution of classes is necessarily provisional and will not prevent full debate, should it arise, at the second court hearing where the question of whether orders will be made under s 411(4)(b) will be determined: see The MAC Services Group Limited [2010] NSWSC 1316; (2010) 80 ACSR 390 at [20] (Barrett J).

Physical meeting of shareholders in COVID-19 context

35 The notice of the scheme meeting contemplates that it will be a physical meeting of shareholders with no provision being made for shareholders to participate remotely by way of an electronic platform having regard to the COVID-19 pandemic. The Court did not consider that this was a reason to refuse to make orders under s 411(1). Shareholders can appoint proxies and corporate representatives. The scheme meeting will be convened in Brisbane. Senior counsel advised that this is the place at which annual general meetings are usually held. It is not anticipated that any limits on the persons who may gather in public (designed to suppress transmission of COVID 19) will be exceeded at the meeting. At the time the orders were made, most members of the public in Queensland were free to leave their homes and it appeared that community transmission of COVID-19 was rare. Whether or not holding a physical meeting affects voter turn-out at the scheme meeting in any pejorative way will be a consideration at the second court hearing.

General meeting to consider financial assistance resolution and constitution resolution

36 A general meeting of Palladium shareholders will be convened immediately after the scheme meeting for the purpose of considering the financial assistance resolution and the constitution resolution. The need for the financial assistance resolution arises because Palladium will provide security to banks who will make loans to FinCo to assist in the purchase of Palladium shares and Palladium may lend its own funds to assist in the purchase of its shares. Palladium’s constitution also requires shareholder approval to the acquisition of the Palladium shares pursuant to the scheme. Information relevant to these resolutions is set out at sections 11 and 12 of the scheme booklet. It is a condition of the resolution to approve the scheme that the financial assistance resolution and the constitution resolution are passed. The general meeting will be held immediately after the scheme meeting.

Application of s 113 of the Corporations Act

37 Section 113 of the Corporations Act provides that a proprietary company must have no more than 50 non-employee shareholders. Senior counsel noted that s 113(2)(b)(ii) defines an “employee shareholder” to include “a shareholder who was an employee of the company” and s 113(2)(b)(i) defines an “employee shareholder” to include “an employee … of a subsidiary of the company”. Senior counsel submitted that, as Palladium will be a subsidiary of FinCo and of NewCo upon implementation of the scheme, the requirements of s 113 will be satisfied.

38 It is useful to note the full terms of s 113 as they are relevant to this issue as follows (emphasis added):

113 Proprietary companies

(1) A company must have no more than 50 non-employee shareholders if it is to:

(a) be registered as a proprietary company; or

(b) change to a proprietary company; or

(c) remain registered as a proprietary company.

(2) In applying subsection (1):

(a) count joint holders of a particular parcel of shares as 1 person; and

(b) an employee shareholder is:

(i) a shareholder who is an employee of the company or of a subsidiary of the company; or

(ii) a shareholder who was an employee of the company, or of a subsidiary of the company, when they became a shareholder; and

…

39 Palladium’s current shareholders may be broken down into the categories set out at [3] above.

40 A person who is a former employee of Palladium at the time the scheme is implemented will not be a person who was an employee of NewCo or an employee of its subsidiary when they become a shareholder of NewCo, albeit that Palladium will become a subsidiary of NewCo by virtue of the issue of shares in NewCo upon implementation of the scheme.

41 Accordingly, it appears to the Court that, should less than 14 former Palladium employees and external shareholders in aggregate elect or (being ineligible foreign shareholders) be required to take cash consideration, it may be that s 113(1) and (2)(b)(ii) will not be satisfied if the scheme is implemented. Should that occur, this issue and its consequence for the making of orders under s 411(4)(b) may arise for argument at the second court hearing.

42 The Court did not consider this issue was an impediment to making orders under s 411(1) convening the scheme meeting because:

(1) The Independent Board Committee has encouraged former employees of Palladium to elect to receive cash consideration.

(2) There are 23 ineligible foreign shareholders and they must receive only the cash consideration. It is not clear to the Court what number of these shareholders are former employees.

(3) By its “usual letter” dated 28 July 2020, the Australian Securities and Investments Commission (ASIC) has indicated that it did not intend to appear to make submissions or intervene to oppose the scheme at the first court hearing.

(4) While ASIC has no power to vary or modify the operation of s 113, it does have a power to require a proprietary company to change status to a public company within two months if it is satisfied that the company has contravened s 113. If the company fails to do so, ASIC may change its registration to a public company under s 165 of the Corporations Act. While a change to a public company would affect the costs of administering NewCo, it would not diminish the rights of shareholders of NewCo and it may enhance them.

Intention to rely on s 3(a)(10) of the Securities Act of 1933 (US)

43 The Court has been advised that, if the Court makes orders approving the scheme at the second court hearing, it is intended that reliance will be placed on the Court’s approval for the purposes of the exemption under s 3(a)(10) of the Securities Act of 1933 (US) in relation to the issue of NewCo shares to US shareholders.

COVID-19 disclosure

44 The Court notes that the scheme booklet at section 5.13 contains a disclosure concerning the effects of the COVID-19 pandemic on Palladium as follows:

Palladium has not seen or expected to see any material adverse changes as a result of COVID-19 global pandemic. While some existing projects have been impacted, there have also been a number of new opportunities that the company is currently tendering for and some small contracts have already been won. This includes the company's emergency response and logistics offering that has seen an increase in revenue in these areas.

Despite this Palladium understands the need for risk mitigation and has implemented various strategies to ensure the business is able to withstand any negative changes. This includes a freeze on all non-essential recruitment, frequent review of planned staff utilisation, and close monitoring of any potential impact to milestone achievement.

The company expects some delays in the award and procurement of some contracts currently in the pipeline.

Evidence

45 Palladium relied on the following affidavits:

(1) Two affidavits sworn by David Peter Anthony Campbell on 28 July 2020. Mr Campbell is Palladium’s company secretary and general counsel. Mr Campbell gives evidence in relation to Palladium’s business, its constitution, a search of ASIC’s register with respect to Palladium, Palladium’s issued shares and the breakup of holdings as between current employees, former employees and external shareholders, the execution of the SIA and its terms, the scheme booklet, the execution of the deed poll, scheme consideration, the scheme meeting and the general meeting, the verification process undertaken with respect to the scheme booklet, resolutions passed by the Independent Board Committee, the proposal to dispatch the scheme booklet by electronic means and the fact that all shareholders have elected to receive electronic notifications.

(2) An affidavit sworn by Ann Caroline Sherry on 28 July 2020 in which Ms Sherry deposes to: her role as a non-executive director of Palladium since 1 December 2015; her relevant interests in 3,000 Palladium shares; the establishment of the Independent Board Committee on 6 May 2020; the adoption of a protocol designed to manage conflicts of interest; the adoption of a protocol designed to quarantine confidential information in relation to the proposed scheme; confirmation that Ms Sherry has no interest in the outcome of the scheme otherwise than as disclosed in her affidavit or the scheme booklet; and Ms Sherry’s consent to act as chairman of the scheme meeting.

(3) An affidavit sworn by John Anthony Eales sworn on 27 July 2020 in which Mr Eales deposes to: his relevant interest in 200,000 Palladium shares; his confirmation that he has no interest in the outcome of the scheme except as disclosed in his affidavit or the scheme booklet; and his consent to act as chairman of the scheme meeting if Ms Sherry is unable to do so.

(4) Affidavits sworn by James Robert Stewart on 27 and 28 July 2020. By the affidavit sworn on 27 July 2020, Mr Stewart deposes to the following matters: that he is a partner of Ernst & Young and a director and representative of Ernst & Young Strategy and Transactions Ltd; his curriculum vitae; that he holds the opinions expressed in the independent expert’s report; that he has been informed by and believes that Julie Wolstenholme, a co-signatory of the report, holds those opinions; and that he is not aware of any matter that would affect independence for the purpose of the preparation of the independent expert’s report. By the affidavit sworn on 28 July 2020, Mr Stewart corrected some material in the report so that it is in the same form as Annexure A to the scheme booklet.

(5) An affidavit sworn by Christopher Leslie Hirst on 27 July 2020. Mr Hirst deposes to the following matters: he is a director of NewCo and FinCo and he is the Chief Executive officer of Palladium; the constitutions of NewCo and FinCo; searches of ASIC’s register with respect to NewCo and FinCo; and verification of statements in the scheme booklet relating to NewCo and FinCo.

(6) Affidavits sworn by Roberta Pamela Bozzoli sworn on 28 and 29 July 2020. Ms Bozzoli is a partner at Thomson Geer, solicitors for Palladium in these proceedings. Ms Bozzoli deposes to her communications with ASIC. The Court notes that ASIC’s usual letter is Annexure A to Ms Bozzoli’s second affidavit. In it, ASIC confirms that drafts of the explanatory statement (contained in the scheme booklet) were provided to ASIC on 17 June 2020 and on 21, 27 and 28 July 2020 and that it has had a reasonable opportunity to consider that material, such that s 411(2)(a) and (b) have been satisfied. As noted above, ASIC also advised that it did not intend to appear at the first court hearing to make submissions or intervene to oppose the scheme.

Conclusion

46 The Court made orders pursuant to ss 411(1) and 1319 convening the scheme meeting and concerning its conduct because, on the basis of the foregoing, it was satisfied as follows:

(1) Palladium is a Pt 5.1 body;

(2) The proposed scheme is a compromise or (relevantly) an “arrangement” within the meaning of s 411;

(3) The scheme booklet will provide proper disclosure to Palladium shareholders;

(4) The scheme is bona fide and properly proposed;

(5) ASIC has had a reasonable opportunity to examine the terms of the scheme and the scheme booklet and make submissions and it has had at least 14 days' notice of the proposed hearing date;

(6) Applicable procedural requirements have been met; and

(7) The scheme is of such a nature and cast in such terms that, if it receives a statutory majority at the meeting, the Court would be likely to approve it on the hearing of a petition which is unopposed.

I certify that the preceding forty-six (46) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justice Farrell. |

Associate:

Dated: 4 August 2020