FEDERAL COURT OF AUSTRALIA

Australian Securities and Investments Commission v Mitchell (No 2) [2020] FCA 1098

ORDERS

AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff | ||

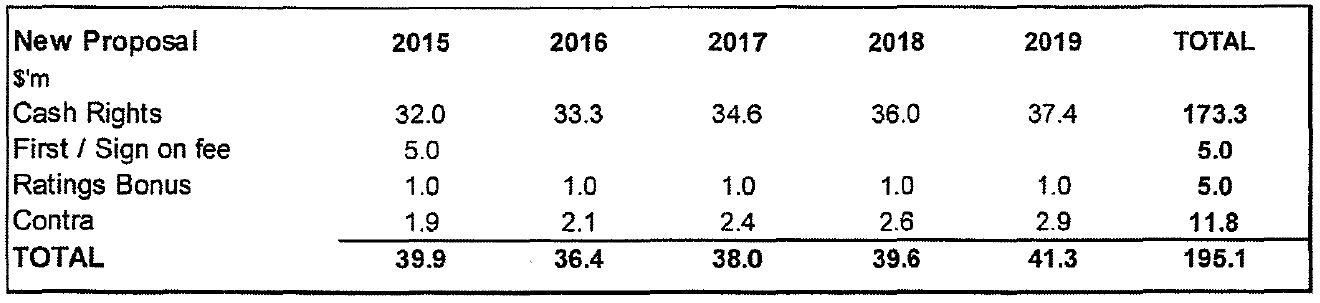

AND: | First Defendant STEPHEN JAMES HEALY Second Defendant | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The proceeding as against the second defendant be dismissed.

2. ASIC pay the second defendant’s costs of and incidental to the proceeding including all reserved costs, to be taxed in default of agreement.

3. Within 14 days of the date hereof, ASIC file and serve proposed minutes of orders to give effect to these reasons and short written submissions (limited to five pages) dealing with the making of declarations against the first defendant, the further conduct of the penalty phase and as to costs.

4. Within 14 days of receipt of ASIC’s proposed minutes of orders and submissions, the first defendant file and serve responding proposed minutes of orders and submissions (limited to five pages).

5. Liberty to apply.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

BEACH J:

1 ASIC has sued two former directors of Tennis Australia Ltd (TA), Mr Harold Mitchell and Mr Stephen Healy. It says that Mr Mitchell contravened ss 180(1), 182(1) and 183(1) of the Corporations Act 2001 (Cth) and that Mr Healy contravened s 180(1). ASIC seeks declarations under s 1317E, civil penalties under s 1317G and disqualification orders under ss 206C and 206E.

2 TA is the peak body for the sport of tennis in Australia. Its members are each of the State and Territory tennis associations. It is a company limited by guarantee. Mr Healy was the president of TA. He is a solicitor and former professional tennis player. Mr Mitchell was a vice president of TA. He is through various corporate vehicles the owner of a media buying business.

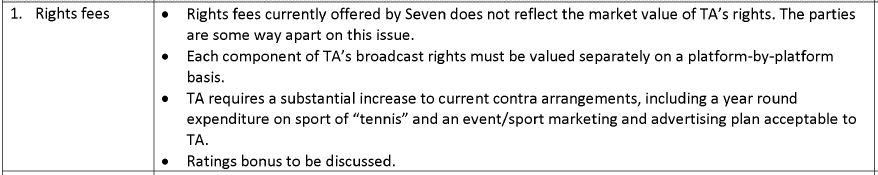

3 TA stages a number of tennis tournaments in Australia, notably the Australian Open (AO) at Melbourne Park in the searing heat and brilliant sunshine of January each year. One of TA’s major sources of revenue is the fees that it earns from the licensing of rights to broadcast its tournaments both domestically and internationally. In 2012 the rights to broadcast within Australia, which I will refer to as the domestic broadcast rights, had been held for 40 years by Seven Network (Operations) Ltd or its predecessor entity (Seven), the operator of the Channel Seven television network. The then most recent agreement was due to expire in July 2014 (the Seven agreement). Pursuant to the Seven agreement the broadcast fees payable by Seven were $100.75 million over the five years of that agreement, being 2010 to 2014, including $20 million for 2013 and $21 million for 2014. Under the Seven agreement, Seven did not have a right of last refusal in respect of any renewal of the rights, but it did have an exclusive negotiating period with TA from 1 April 2013 to 30 September 2013 (the ENP).

4 The genesis of ASIC’s proceedings arises out of the unanimous decision of TA’s board of directors on 20 May 2013 to accept the recommendation of TA’s then CEO, Mr Steven Wood, to approve a $195.1 million domestic broadcast rights deal with Seven. This was to achieve the renewal of the domestic broadcast rights for a further five years. The domestic rights fee negotiated with Seven was a very substantial increase over the Seven agreement.

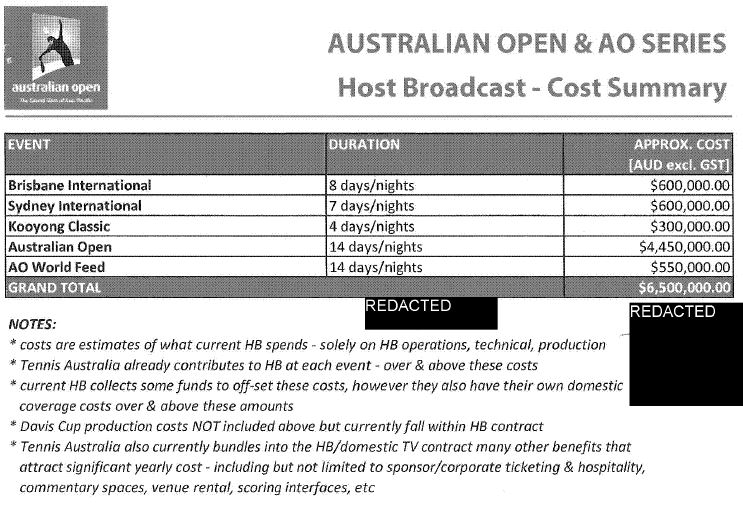

5 TA achieved most of its commercial aims in its domestic broadcast rights negotiations with Seven, including importantly the assumption of the host broadcast role, increased exploitation of digital and streaming coverage, and control over archive footage. Further, by TA becoming the host broadcaster it enabled it to tailor the coverage of the AO into individual international markets, thereby unlocking increased revenues in the form of international rights fees and higher sponsorships.

6 On 29 May 2013 TA executed a new long form five year agreement with Seven to broadcast in Australia the AO and other Australian tennis tournaments staged by TA.

7 Now ASIC alleges that in the internal deliberations by TA in respect of that agreement, and in its negotiations with Seven for the agreement, the defendants failed to exercise the degree of care and diligence that a reasonable person in their position would exercise. Further, it is said that Mr Mitchell improperly misused his position as a director of TA and improperly misused information gained from that position to gain an advantage for Seven during the course of its negotiations with TA.

8 In summary, I would reject all of ASIC’s case against Mr Healy. But I would accept some parts of its case against Mr Mitchell. Let me make these general points at the outset.

9 First, much of ASIC’s construction of its evidence displayed confirmatory bias.

10 Second, the various cover up and conspiracy theories that it floated turned out to lack substance.

11 Third, when one analyses the evidence, the Seven deal with TA procured largely through the efforts of Mr Wood and his executive management team was anticipated to be and was very advantageous for TA. The directors of TA were entitled to take that deal, as against the risks of rejecting it and going out to competitive tender after the ENP had elapsed. Further, in my view they had the information necessary to make such an informed choice.

12 Fourth, although I am applying a retrospective lens, one modification to the focus that can be made to diminish the effect of hindsight is to endeavour to perceive the events as they were unfolding in real time appreciating the speed and concurrent conflicting themes and actors at work with different roles, skills, motivations and objectives. And when one does this, personality differences of board members, dissension and diverse styles can all be seen in a more positive light as part of the robust dynamics necessary to achieve the best outcome. But an observer without that perspective may only observe board dysfunction and then seek to identify and condemn the culprit. I say all of this because once one adopts the appropriate perspective, the board processes of TA that I have had to scrutinise can be seen in a much more favourable light than ASIC would have it.

13 Fifth, in my view once the evidence was in, the case against Mr Healy was not sustainable in terms of the pleaded allegations, whatever view one took about the evidence of Dr Janet Young and Ms Kerryn Pratt concerning the events of 2014 and 2015, which I note were well after the dates of the pleaded contraventions; Dr Young and Ms Pratt were former directors of TA.

14 Sixth, the case against Mr Mitchell presented an interesting problem. True it is that he was keen to do a deal with Seven. True it is that he thought that this should have been done and dusted as soon as realistically possible; after all, he was all for momentum. And true it is that he was a host broadcast sceptic. Moreover, he was not a details man. He did not think much of legal niceties and long form agreements; as he would perceive it, mere matters of detail that had the tendency to produce unnecessary delay. But ASIC’s case that Mr Mitchell deliberately sought to prefer Seven’s interests over TA’s interests fails. I am satisfied that although some of his conduct could be criticised, nevertheless he acted in what he perceived to be TA’s interests. Further, ASIC did not allege let alone prove that Mr Mitchell was acting in a conflict of interest. So much for Dr Young’s views expressed after the event, and so much for the distracting events of 2014 and 2015 upon which I admitted, regrettably, large slabs of evidence lathered with distortion and self-justification.

15 What then was Mr Mitchell doing in his private communications with Mr Bruce McWilliam of Seven, who seemed quite a colourful character? In the context of TA’s negotiations with Seven, was Mr Mitchell acting as a good cop to Mr Wood’s bad cop approach? If so, that strategy was uncommunicated and therefore uncoordinated as between them, although this is not necessarily fatal to such a characterisation. Was Mr Mitchell really trying to present himself to Mr McWilliam as the leader of the negotiations and the go to person at TA, rather than Mr Wood, so that he could control the course of events? This is more likely, but such behaviour had the capacity to undermine what Mr Wood was doing. After all, it was Mr Wood as the CEO who had the authority of the board to lead TA’s negotiations with Seven, not Mr Mitchell.

16 I gained the impression from the picture painted of Mr Mitchell, who did not personally give evidence, that he was one of those characters who often liked to and did get his own way. But I am satisfied that in the present context his mindset was bona fide in the sense that he sought to act in the interests of TA. But his subjective motivations for acting as he did on the one hand, and the objective characterisation and effect of his conduct on the other hand, are two quite different things. And his bona fides are not a sufficient answer to the contraventions alleged by ASIC.

17 In my view, Mr Mitchell stepped over the line in his dealings with Mr McWilliam. And his overall conduct had the tendency to undermine the stance and approach of Mr Wood. There were some things that he communicated to Mr McWilliam that he ought not to have done, particularly in the latter part of 2012. Now none of this ultimately caused damage to TA. And none of this was motivated by anything other than Mr Mitchell’s perception that he thought that it was in the interests of TA that a deal with Seven should be stitched up sooner rather than later. But to so conclude does not entail that Mr Mitchell has not contravened some of his director’s duties. In my view, he did so contravene s 180(1) on three occasions; see my findings at [1713] to [1741]. But his contraventions are far narrower in scope than ASIC would have it. Moreover, and in order to be helpful to both ASIC and Mr Mitchell, I would indicate now that any necessary general deterrence, specific deterrence and protective objectives may well be served by making declarations and imposing a moderate pecuniary penalty without any disqualification order being imposed. But I will hear further from ASIC and Mr Mitchell on these questions.

18 Let me now set out my detailed reasons.

19 For convenience, I have structured my analysis as follows:

(a) ASIC’s narrative – [21] to [136]

(b) The factual background – [137] to [681]

(c) The key themes relevant to negotiations – [682] to [899]

(d) The post-contravention conduct – [900] to [1121]

(e) The case against Mr Healy – [1122] to [1512]

(f) The case against Mr Mitchell – [1513] to [2023]

(g) Conclusion – [2024] to [2025]

20 Unusually, I will begin with a detailed summary of ASIC’s factual narrative. Only with that appreciation can the forensic detail which follows be assimilated and then contrasted. And in that respect, let me explain how what follows in later sections of my reasons has been built up. First, I have set out a largely neutral factual background of the relevant events in 2012 and the first half of 2013 concerning TA’s negotiations with Seven, information flow within TA and the decision making processes within TA including, of course, the board’s involvement. Second, I have then sought to distil some of the key themes relevant to the negotiations, including the potential for competition. Only with an appreciation of such themes can one put oneself in the position and mind-set of TA, its directors and particularly Mr Healy and Mr Mitchell at the relevant time. Third, I have then sought to address the evidence concerning the post-contravention conduct, that is, the events of 2014 and 2015. Now much of this is peripheral. But I have considered it to the extent that it throws probative light on the events of 2012 and the first half of 2013 or constitutes admissions made by the defendants. Moreover, it goes without saying that before drawing conclusions and to the extent that any part of ASIC’s case is circumstantial, I have considered the totality of the evidence, whether the evidentiary facts have afforded proof or an indication that was prospectant, concomitant or retrospectant. And the linear sequence of these written reasons should not distract from that reality, which is that I have considered all of the evidence and considered the probative force of its combined weight; if you like, simplistic “strands in a cable” or “links in a chain” type metaphors can be invoked to explain such a conception. Fourth, I have then addressed ASIC’s specific case against Mr Healy. Finally, I have then turned to ASIC’s specific case against Mr Mitchell. Now it may be thought that I should have reversed the order of these last two sections. But information flow to TA’s board is an over-lapping theme of ASIC’s case against both Mr Healy and Mr Mitchell. And as Mr Healy and Mr Wood were more responsible for the relevant information flow to the board than Mr Mitchell, it is more suitable to address that over-lapping theme first in the context of ASIC’s case against Mr Healy.

ASIC’s NARRATIVE

21 In this section I will set out ASIC’s narrative concerning the relevant events and a summary of the allegations that it has made against Mr Mitchell and Mr Healy.

22 But first it is necessary to identify the key characters and entities relevant to its narrative and the broader evidence:

Mr Peter Armstrong: Director of TA, 2014 to 2016

Mr Stephen Ayles: Commercial director of TA, 2008 to 2013

Mr Jeffrey Browne: Managing director of Nine, 2010 to 2013

Mr Tim Browne: In-house lawyer of TA

Mr Ashley Cooper: Director of TA, during, inter-alia, 2012 to 2013

Mr James Davies: Director of TA, 2011 to 2013

Mr John Fitzgerald: Director of TA, 2010 to 2013

Mr Chris Freeman: Director of TA, 2007 to 2017

Gemba Pty Ltd: Sports consultancy and media rights valuer

Mr Greg George: Head of broadcasting of TA

Mr Chris Guinness: Asia Pacific head of IMG from 2011 to the present

Mr David Gyngell: CEO of Nine, 2007 to 2015

Mr Steven Healy: Director, 2008 to 2017, and president of TA, 2010 to 2017

Mr Graeme Holloway: Director of TA, during, inter-alia, 2012 to 2013

Mr Russell Howcroft: Executive general manager of Network Ten, during, inter-alia, 2013

IMG Media Ltd: a US based sports and media business and the licensee of TA’s international media rights

Mr Ken Laffey: Director of TA, 2014 to 2016

Mr Jonathan Marquard: Chief operating officer of Network Ten, 2012 to 2013

Mr Lewis Martin: Managing director (Melbourne) of Seven

Mr Hamish McLennan: CEO of Network Ten, during, inter-alia, 2013

Mr Bruce McWilliam: Group chief legal and commercial director of Seven during, inter-alia, 2012 to 2014

Mr Harold Mitchell: Director, 2008 to 2016, and vice-president of TA, 2010 to 2016

Nine Entertainment Holdings Co Ltd: Operator of the Channel Nine television network

Mr Darren Pearce: Chief communications officer at TA, 2012 to 2014, and also prior to that time director of marketing

Mr Roger Perrins: Director, Legal and Melbourne Park redevelopment at TA, 2010 to 2013

Ms Kerryn Pratt: Director of TA, 2013 to 2016

Mr David Roberts: Chief operating officer, chief financial officer and company secretary of TA, during, inter-alia, 2012 to 2018

Seven Network (Operations) Ltd: Operator of Channel Seven television network

Mr Kerry Stokes: Chairman of Seven

Mr Scott Tanner: Director of TA, 2007 to 2015

Ten Network Holdings Ltd: Operator of Channel Ten television network

Mr Craig Tiley: Director of tennis, 2005 to 2013, then CEO of TA, 2013 to present

Mr James Warburton: CEO of Network Ten, during, inter-alia, 2012 to 2013

Mr Steven Wood: CEO of TA, 2005 to 2013

Mr Tim Worner: CEO of Seven, 2013 to 2019 and head of television, inter-alia, 2012

Dr Janet Young: Director of TA, 2008 to 2016

(a) A questionable chronicle

23 Let me now set out ASIC’s narrative.

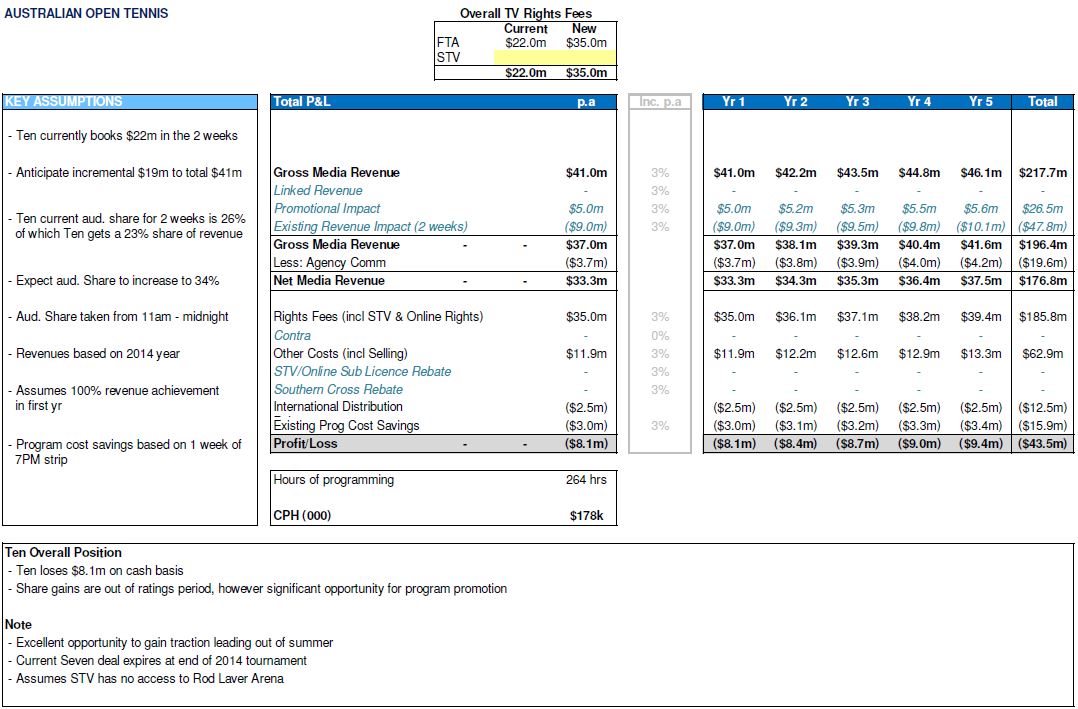

24 In late 2011, negotiations for a renewal of the Seven agreement started between TA and Seven. On ASIC’s case, Seven’s competitors were also interested in the rights. According to ASIC, in January 2012 Mr Jonathan Marquard, chief operating officer of Ten Network Holdings Ltd (Network Ten), approached Mr Wood, chief executive officer of TA, and Mr Stephen Ayles, commercial director of TA, and told them that Network Ten would be very interested in acquiring the domestic rights.

25 According to ASIC, Mr Marquard repeated Network Ten’s interest to Mr Ayles several more times until about May 2012, when he told Mr Ayles that “Ten would be willing to pay in excess of 40 million annually for those rights”. According to ASIC, this message, repeated to Mr Ayles several more times, was reported to Mr Wood, who reported it to Mr Mitchell and Mr Healy. But according to ASIC, neither Mr Mitchell nor Mr Healy ever reported it to the board of TA.

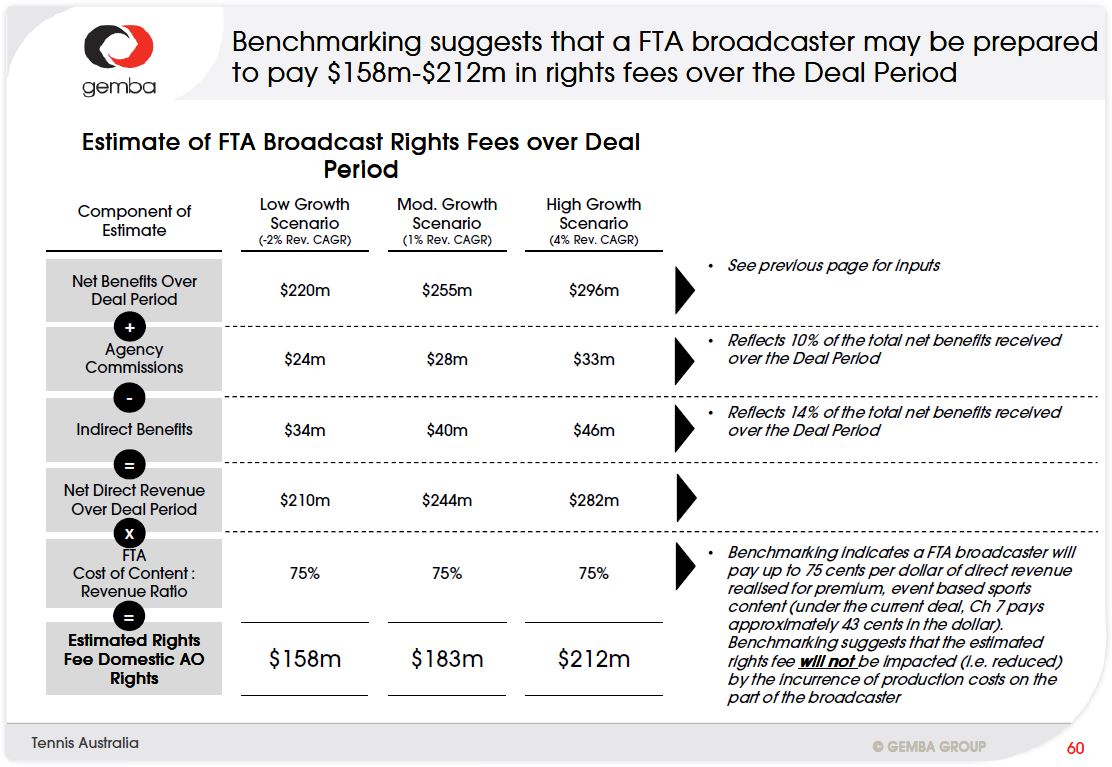

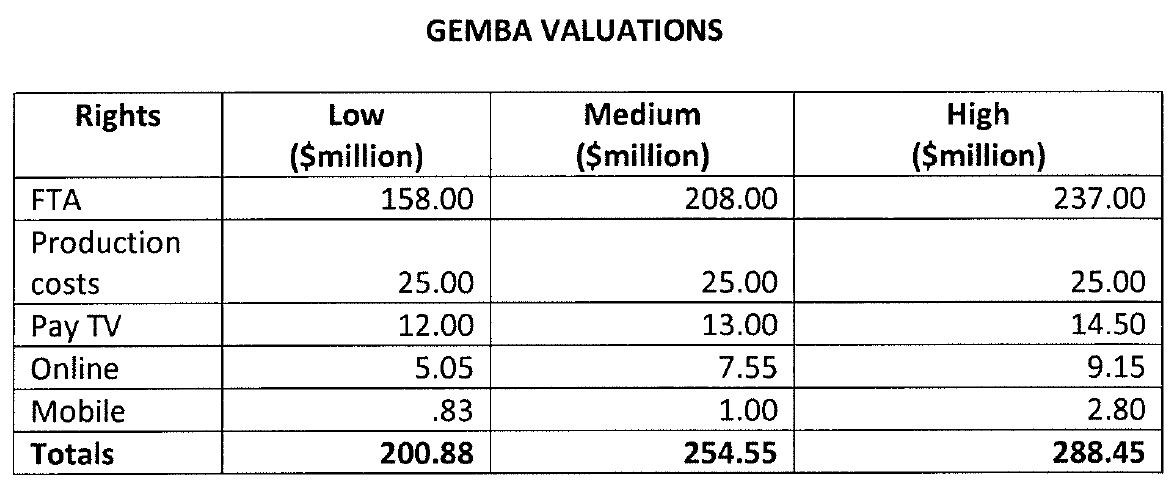

26 Meanwhile, TA’s management obtained a report in May 2012 from Gemba Pty Ltd (Gemba), a valuer of sports broadcast rights (the Gemba report). Gemba said that the rights were undervalued under the Seven agreement, and according to ASIC recommended that they be broken down into free to air TV (FTA) rights, subscription TV (STV) rights, online rights and mobile rights. According to ASIC, Gemba valued the FTA rights at between $158 and $212 million over a five year term, the STV rights at $12 to $14.5 million, online rights at $5.05 to $9.15 million and the mobile rights at $831,000 to $2.8 million. According to ASIC, the aggregate rights were thus valued over five years at between $175.88 million and $238.4 million or between $35 and $48 million per annum. Now according to ASIC, Mr Wood told Mr Healy about the Gemba report and sent him a copy, but Mr Healy never put the Gemba report before the TA board.

27 ASIC’s narrative continued. In anticipation of the Gemba report going to the TA board, Mr Ayles asked Gemba to produce a summary version of its report for putting to the board (Gemba summary). In June 2012, Gemba did so. Mr Wood emailed a copy of the Gemba summary to Mr Healy and handed a hard copy to Mr Mitchell. According to ASIC, Mr Mitchell looked quickly at it and told Mr Wood, “Get Ayles fired. This is garbage. This is crap. Don’t bother getting reports like this again”. ASIC also complains that the Gemba summary was never presented to the TA board.

28 ASIC says that Gemba’s valuation coincided with the level of interest that had already been expressed by Network Ten and was later confirmed by an expression of interest by Nine Entertainment Holdings Co Ltd (Nine). It is said that this occurred in late 2012, first in a meeting between Mr David Gyngell, the CEO of Nine, and Mr Wood and Mr Ayles, and second in a phone call shortly afterwards from Mr Jeffrey Browne, managing director of Nine, to Mr Wood. According to ASIC, in that phone call Mr Browne assured Mr Wood that despite Nine’s commitment to the cricket, “[W]e can do the tennis … and I will pay you what it’s worth… A number with a 4 in front of it is not out of the question”. ASIC says that Mr Wood reported this to Mr Healy, but Mr Healy never reported this to the board.

29 Further, ASIC says that in late 2012 interest in the domestic broadcast rights was also expressed to TA by IMG Media Ltd (IMG). IMG is a US based company and one of the biggest sports marketing companies in the world, but it is not a broadcaster. It on-sells broadcast rights to broadcasters for a commission or share of the revenue paid by the broadcaster. In other words, it is little more than an agent.

30 In 2012 IMG held the rights to license TA’s international broadcast rights. By a letter dated 16 November 2012 IMG offered TA a guaranteed minimum of $30 million a year for the domestic rights for seven years, plus a split of between 85% and 100% of anything above $30 million in revenue from the broadcaster (the first IMG offer). So, for example, if the broadcaster paid $40 million for the domestic rights, TA would receive $38.5 million. But the offer was conditional on approval by the board of IMG and acceptance by TA of a concurrent offer for its international broadcast rights, which were due to expire in 2014. According to ASIC, Mr Wood, to whom the first IMG offer had been sent, gave copies to Mr Healy and Mr Mitchell on 22 and 23 November 2012 respectively.

31 On 30 November 2012, Mr Chris Guinness, Asia Pacific Head of IMG, told Mr Wood that the first IMG offer had been approved by the board of IMG. According to ASIC, Mr Wood reported this both to Mr Healy and to Mr Mitchell. Yet, so ASIC complains, neither Mr Healy nor Mr Mitchell ever put the first IMG offer before the board of TA. Instead, TA’s board was told about the offer at its meeting on 3 December 2012 by Mr Wood, who said that it was for hundreds of millions of dollars, but subject to conditions. But on ASIC’s case, before he could say more, Mr Mitchell interjected to dismiss the first IMG offer and to say that TA should be dealing with Seven. Nothing more was said at the board meeting as to the first IMG offer.

32 On 1 March 2013, at Mr Wood’s request, IMG restated its offer reducing it from seven to five years and uncoupling it from an offer for the international rights (the second IMG offer). The level of fees remained the same. Further, between the first and second IMG offers, IMG had had a number of discussions with Network Ten and had, according to ASIC, secured a non-binding commitment from Network Ten to bid for the domestic rights in the event that they were awarded to IMG. According to ASIC, Mr Wood, to whom the second IMG offer had been sent, told Mr Healy about the further offer, but Mr Healy never told the board at any time; I should say that ASIC during the running of its case abandoned its criticism of Mr Healy on this aspect to some extent.

33 Around late March 2013, Mr Hamish McLennan, the recently appointed new CEO of Network Ten, separately approached Mr Wood and said, according to ASIC, that it could pay about $50 million a year for the domestic broadcast rights. ASIC says that Mr Wood reported this to Mr Healy, who did not report it to the board. ASIC says that Network Ten were engaging in serious internal deliberations in respect of sports rights and were very keen to acquire the rights to one of the major sports.

34 Meanwhile, negotiations between TA and Seven for a renewal of the Seven agreement continued throughout 2012 and into early 2013. Seven made a number of written offers from 3 September 2012 to 26 March 2013, each of which included fees of no more than $24 million a year. Notwithstanding the low level of these offers, according to ASIC Mr Mitchell repeatedly pressed Mr Wood to do a deal with Seven.

35 Further, according to ASIC, not only was Mr Mitchell pressuring Mr Wood to finalise a deal with Seven, but he was also reporting to Seven on TA’s internal deliberations.

36 Now a meeting was scheduled between TA and Seven in mid-2012. On ASIC’s case, shortly beforehand Mr Tim Worner, the CEO of Seven, emailed others at Seven saying that “our understanding is that Harold will support our very strong stance”. ASIC says that after the scheduled meeting Mr Mitchell called Mr McWilliam and said, “We should try to wrap it up this week”. Later, in an email in August 2012 Mr Worner urged others at Seven to wrap up the tennis rights: “Time is our enemy as the price will only go up. Not down”.

37 On 10 October 2012, Mr Mitchell sent an email to Mr Wood saying that “We better fix Channel 7…We are ready to do it all”. Mr Mitchell then forwarded this email to Mr McWilliam and Mr Lewis Martin, managing director of Seven in Melbourne, and added, “Let’s wrap this up next week. Leave it with me”.

38 In late November and early December 2012, according to ASIC, Mr Mitchell said to Mr Wood a number of times, “Tell me again you’re going to get the deal done with Seven by the new year”.

39 Now it is not in doubt that the negotiations between TA and Seven in the early stages did not go into the level of fees but focused on other substantive questions such as the archive rights, the quality of the broadcast, the separation of FTA, STV, online and mobile rights and who would be host broadcaster. As I have indicated, the host broadcaster was responsible for producing the broadcast feed. Up to this point Seven had always performed this role, but TA was keen to become host broadcaster to give it more control over the broadcast and to enable it better to exploit its international rights.

40 And it is also not in doubt that another negotiation issue between TA and Seven was over a long form agreement. By 2012 the contractual documents constituting the Seven agreement comprised a series of letters and other short form documents amending the original long form agreement from 2007. Seven were keen to get TA to commit early to a renewal and to do so by an exchange of letters.

41 In early November, Seven sent one of its offer letters to TA. TA returned a marked-up version of the letter to Seven. According to ASIC, this produced a blunt response from Mr McWilliam, who accused Mr Wood of “completely bad faith”, said it was “amateur hour” and derided TA’s response to the offer as a “piece of rubbish” and a “piece of crap.” Mr McWilliam insisted that an agreement had been reached at a prior meeting and alleged, “you sat there and agreed things with us and Harold”.

42 According to ASIC, shortly after this correspondence Mr Mitchell and Mr McWilliam spoke by telephone and Mr Mitchell re-assured Mr McWilliam, “It will be OK. We will sign your document”.

43 Now because of Seven’s repeated insistence that a deal had already been concluded, it was not in doubt that Mr Wood wanted a clause to be included in any Seven offer that it was not binding until the conclusion of a long form agreement. He proposed a form of clause to Seven and also sent a copy to Mr Mitchell. But Mr Mitchell told Mr Wood that it was “a lawyer’s way of saying ‘I don’t trust you’ Bad sign! Won’t fly with them… Or me!!!” On ASIC’s case, Mr Mitchell then reported to Mr McWilliam that he had “stamped on” Mr Wood’s proposal for a non-binding clause and had also “jumped on” Mr Wood appointing IMG to sell the rights. This led to Mr McWilliam telling other Seven directors: “We have to hope Harold can carry the board”.

44 On 3 December 2012, the TA board met. According to ASIC, on the morning of the meeting Mr Mitchell and Mr McWilliam spoke for 13 and a half minutes on the telephone. At the meeting, Mr Wood reported to the board on the negotiations for the broadcast rights and of the offers received from Seven and IMG. According to ASIC, Mr Mitchell dismissed the first IMG offer, which was not tabled at the meeting, and told the board that Seven’s offer was reasonable and that Mr Wood and he would “wrap this up” with Seven and bring it back to the board. Immediately after that meeting, Mr Mitchell told Mr Wood: “Just get the deal done with Seven, we’re not doing IMG”.

45 After the 3 December 2012 board meeting TA management, according to ASIC, were concerned that the board was not being fully informed about the broadcast rights. It sought advice from a law firm about this, which advice was received around 10 December 2012; TA has claimed legal professional privilege over the advice and its terms are not in evidence.

46 In mid-December 2012 Mr McWilliam requested a Sunday meeting with Mr Mitchell in Melbourne to discuss the broadcast rights. Mr Mitchell proposed that Mr Wood also be invited. But when Mr McWilliam proposed that he send Mr Wood some points in advance of the meeting, Mr Mitchell replied, “Think we should hold it until Sunday! He talks to the people on his staff [a]nd gets pushed into a corner! To[o] much thinking time!” The meeting proceeded, but not with Mr Wood present.

47 Mr McWilliam reported on the meeting to Mr Worner and Mr Don Voelte (also of Seven) in the following terms: “Steve [w]ood wasn’t at the meeting, just Harold, who insists it is all going to plan”.

48 Around 18 December 2012, Mr Ayles and Mr Greg George, head of broadcasting for TA, prepared a paper at Mr Wood’s request comparing Seven’s offer and the first IMG offer in the light of, first, the interest expressed by other potential buyers, second, of the Gemba report and third, of sales of broadcast rights for other sports (the Ayles paper). According to ASIC Mr Wood made some amendments to the Ayles paper. According to ASIC, Mr Wood sent his amended paper to Mr Healy. Then, so ASIC says, Mr Healy gave some comments on it. Mr Wood also reported, according to ASIC, the recommendations of the paper to Mr Mitchell, adding that they needed to get more information on the domestic broadcast rights to the board. According to ASIC, Mr Mitchell responded:

You’re not going to do that. You’re going to do it this way with Seven. This will cost you your job. When will you learn to be a good CEO? Let me handle that.

49 On ASIC’s case, after that exchange Mr Wood told Mr Healy that he thought Mr Mitchell was hijacking the negotiations. Mr Healy assured Mr Wood that he would speak to Mr Mitchell and ask him to stop interfering. Further, according to ASIC, Mr Wood told Mr Healy that he thought the board should see the Ayles paper and that TA should take the rights to market.

50 On ASIC’s case, around late February 2013 Mr Wood again recommended to Mr Healy that the board should see the Ayles paper as an inclusion in the board pack for the board meeting on 4 March 2013. But Mr Healy said that it would be sufficient to discuss the paper. The paper was neither included in the board pack nor discussed at that meeting.

51 On ASIC’s case, on 23 February 2013 Mr Kerry Stokes, the chairman of Seven, told Mr McWilliam of the meeting to be held by the board of TA on 4 March 2013, “We need to make sure we are there at this board meeting.” Mr McWilliam replied, “Agree … I will call Harold again about this … Harold swears we [are] safe”.

52 At the TA board meeting on 4 March 2013 there was little detailed discussion of the TV rights. Mr Mitchell proposed that a subcommittee be formed, consisting of himself as chair and of Mr Healy, Mr Wood, and Mr Chris Freeman, “to meet to discuss TA’s strategy on the domestic broadcast renewal and then report back to the Board”. The recommendation was accepted. According to ASIC, Mr Scott Tanner, a director of TA, said that he opposed Mr Mitchell’s participation in the board subcommittee because of potential conflicts of interest; this was not minuted. According to ASIC there was also a sharp exchange between Mr Mitchell and Dr Young at that meeting when Mr Mitchell accused her of leaking information concerning the broadcast rights to the press. Dr Young denied the allegation and Mr Mitchell apologised to her.

53 ASIC’s narrative continued. After that meeting, Mr Wood instructed Mr Ayles to prepare a paper setting out a process for how the board subcommittee should operate. Mr Ayles did so in the form of a paper that envisaged three stages of negotiations (the board subcommittee paper). The third stage envisaged that “[d]epending on Seven’s reaction/approach during the [exclusive negotiating] period TA may be required to test the market via a formal bidding process”. Mr Ayles emailed the board subcommittee paper to Mr Wood on 8 March 2013, who then emailed the paper to Mr Mitchell the same day. About two hours later, Mr Mitchell replied:

Steve, I’ve [had a] quick look at this 7 pages of the paper. I’m not happy.

As Chairman of any subcommittee, any framework documentation that we might commence would only be in a manner that I suggest.

I therefore have put your paper on hold until we can speak. …

54 According to ASIC, they spoke shortly after, when Mr Mitchell said the following to Mr Wood:

You should get on and do the deal with Seven.

I have never heard of Gemba.

The reports from Gemba were a waste of time.

Ayles should be fired after commissioning Gemba.

The long-standing arrangement in place for media rights in Australia that has existed for many years is that Nine has the cricket, Seven has the tennis and football and Ten gets the dregs.

TA should not seek to disturb this long-standing arrangement.

You should keep off the grass.

55 On 23 March 2013, Mr Wood emailed a copy of the board subcommittee paper to Mr Healy. The board subcommittee never met and never transacted any business.

56 According to ASIC, throughout March 2013 Mr Mitchell was in regular contact with Mr McWilliam. Phone records disclose a 10 minute call on 4 March 2013, a two minute call on 5 March 2013, a nine minute call on 14 March 2013, and seven text messages on 18 March 2013.

57 On 26 March 2013, Mr Wood and Mr Mitchell met with Mr Worner and Mr McWilliam in Mr Mitchell’s office in South Melbourne. Mr Worner and Mr McWilliam handed over a letter containing a new offer from Seven. The rights fees remained at $24 million per annum. Mr Wood said at the meeting that TA wanted to take over the host broadcast of the AO. But according to ASIC, this was rejected not only by Mr Worner and Mr McWilliam but also by Mr Mitchell, who told Mr Wood after the meeting: “TA is not going to do the host broadcast. You don’t know what you’re doing”.

58 On 1 April 2013 the ENP with Seven began.

59 On 5 April 2013 Mr Worner sent an email to others at Seven expressing concern that the longer it took to negotiate a deal with TA, the more likely Seven’s competitors would focus on the tennis “as cricket situation develops”; negotiations were then also in train for a new broadcasting deal for the cricket. Seven was concerned that the loser in that bid, which would be either Nine or Network Ten, would bid aggressively for the tennis. Mr Worner then emailed Mr Wood and Mr Mitchell and said, “it would be good to get the main terms nailed down and then lock everyone up to conclude the long form”. That email was sent at 10.20 am on 5 April 2013. According to ASIC, phone records disclose that Mr McWilliam rang Mr Mitchell at 10.22 am and they spoke for nine minutes. ASIC invited me to infer that in this conversation Mr McWilliam passed on to Mr Mitchell Seven’s concerns about delay and the outcome of the cricket negotiations.

60 A meeting between TA and Seven was planned for 9 May 2013, but Mr Wood and Mr Martin of Seven met informally beforehand over breakfast on 7 May 2013. In his report to others at Seven of the meeting with Mr Wood, Mr Martin wrote in respect of the possibility that Network Ten would partner with Foxtel in a bid: “If I was Ten I would leap at it – coming from nothing I’ll take something – I could enter a premium sport, take it off Seven and at a manageable price supported by News [l]td press!”.

61 Now at the meeting between TA and Seven on 9 May 2013 there was no resolution of the key issues concerning the fees, host broadcast and digital rights. In his report of the meeting, Mr McWilliam again expressed Seven’s concern about the impact of the cricket rights when he said:

But given gyngell’s telling tim (down the other end of the room) cricket’s a $100 mill A year proposition (he’s considering matching) we have to take this off the table.

62 According to ASIC, the next day Mr McWilliam called Mr Mitchell and spoke to him for five minutes. The day after that there was a newspaper article which said that Network Ten had bid $500 million for the cricket. In the wake of this publicity, Gemba sent TA a further report saying that the cricket negotiations presented TA with the opportunity to win a significant increase in the broadcast rights fees. Apparently this further report was unsolicited.

63 On 16 May 2013, Mr Wood travelled to Sydney and met with Mr Worner alone. He told Mr Worner: “We need at least $40 million per annum”. Mr Worner replied that Seven could not do that. Mr Worner showed Mr Wood some advertising figures then said, “Seven is prepared to offer $195 million over five years”. Mr Wood said again that TA wanted the host broadcast. Mr Worner replied: “We can work something out on that”.

64 Later that day Mr McWilliam called Mr Mitchell and they spoke for five minutes. ASIC invited me to infer that Mr McWilliam told Mr Mitchell about Mr Worner’s offer to Mr Wood. Mr McWilliam then emailed others at Seven:

Also spoke to Harold (in shanghai) who thought we had been more generous than we expected and he said they were now more nervous of what production responsibilities they were taking on. Harold said they had a board meeting of TA on Monday.

65 On 17 May 2013, Seven put an offer of $195.1 million over five years in writing. The offer left open for further negotiation the question of host broadcast production.

66 Seven’s final offer was reported to the board of TA on 20 May 2013. According to ASIC, Mr Mitchell told the board that the board subcommittee, which had never met, recommended that the board accept the final offer; ASIC’s case on this was muddled and I will return to this later. He also said that Nine was not interested in the tennis as it was committed to the cricket and that Network Ten was not in a sound financial position and so should not be considered. He also said that he did not understand why TA would want to do the host broadcast. The board resolved to accept Seven’s final offer.

67 ASIC’s narrative continued. Mr Mitchell also asked at the meeting whether a long form of the agreement could be concluded within a week. According to ASIC, the CFO/COO and company secretary of TA, Mr David Roberts, concerned that this would weaken TA’s negotiating position, replied that he did not think it was a good idea. Mr Mitchell then said to Mr Roberts “That’s how CFOs lose their job”.

68 ASIC says that there was no imperative for TA to conclude the long form agreement expeditiously and that there were good reasons for TA to take time over it. The ENP still had four and a half months to run. ASIC invited me to infer that in pressuring TA management to conclude a long form agreement expeditiously, Mr Mitchell was motivated by Seven’s concerns about delay and the potential impact of the cricket rights negotiations.

69 In the event, between 27 and 29 May 2013 the long form agreement was negotiated to a conclusion. In the course of those negotiations, from which Mr Mitchell was absent, Seven agreed for TA to be the host broadcaster. On 29 May 2013, the long form agreement was signed.

70 Now according to ASIC, before the long form agreement was signed between TA and Seven, Network Ten again approached TA to express its interest in the broadcast rights. And in the midst of the negotiations for the long form agreement, Mr Worner reported to the Seven board that he hoped the agreement would be concluded soon. He said:

The cricket rights negotiations could reach an end point by this weekend and we would not welcome the prospect of a cricket-less Nine or Ten arriving on the scene.

71 In June 2013, the cricket rights were awarded for $500 million. This was divided between Nine, being $400 million for test cricket and one day internationals, and Network Ten, being $100 million for domestic T20. This was as a result of a competitive tender.

72 According to ASIC, the concluded long form agreement between TA and Seven had a number of serious and adverse repercussions, both immediate and longer term. There was immediate and unfavourable press reaction to the deal, which included criticism by both Nine and Network Ten for the failure to put the rights out to tender as cricket had done. ASIC says that TA went into damage control over the deal with Seven and Mr Wood prepared a detailed defence of the deal for directors.

73 Let me now turn to ASIC’s narrative concerning later events, which I have dealt with in a later section of my reasons concerning post-contravention conduct.

74 ASIC says that on 15 July 2013, Dr Young met Mr Healy and told him that she was concerned that Mr Mitchell had had a conflict of interest in the renewal of the agreement with Seven. According to ASIC, Mr Healy responded:

I had my own concerns about Harold’s conflicts of interest. In fact, I was concerned and went to see him and asked him to step aside from the negotiations, but he refused to do so.

75 In August 2013, Mr Wood resigned as CEO and was replaced by Mr Craig Tiley. According to ASIC, his resignation followed criticism of his performance by Mr Mitchell over the level of TA’s accumulated reserves. According to ASIC, Mr Wood’s removal was likely to be payback by Mr Mitchell for Mr Wood’s refusal to follow Mr Mitchell’s repeated instructions to do an unfavourable deal with Seven. I am tempted to pause at this point, but I will let ASIC’s narrative continue.

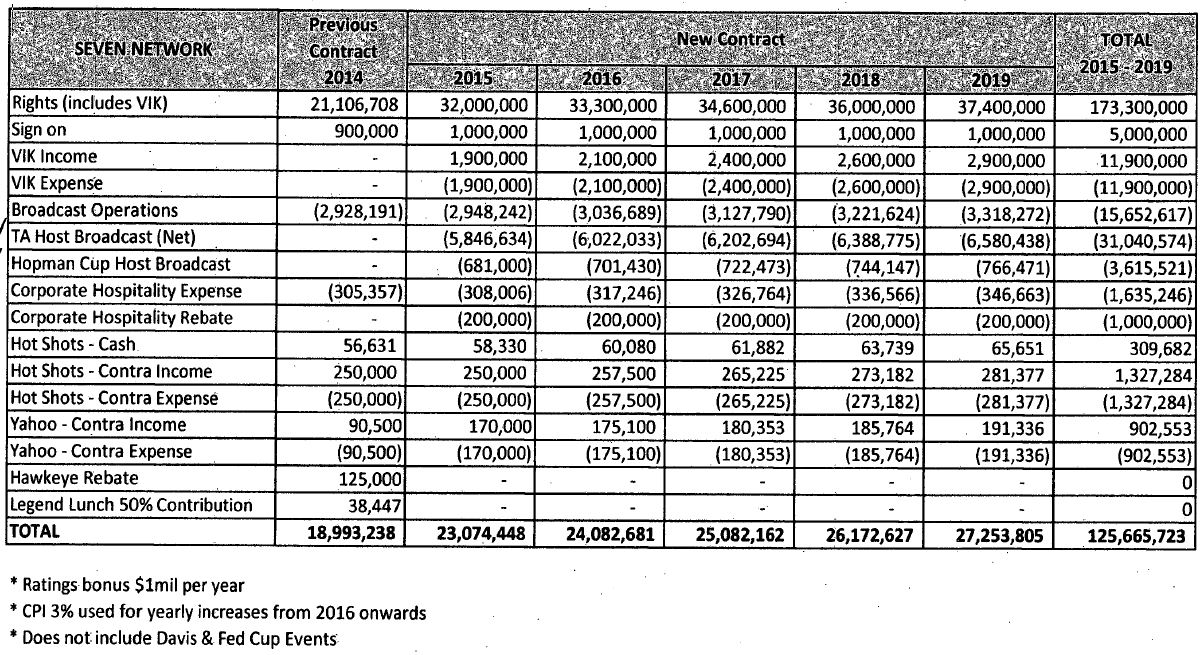

76 In late 2013, Mr Tiley and Mr Roberts caused a TA finance analyst to prepare a summary of the net financial benefits of the broadcast rights agreement with Seven. According to ASIC, the summary showed that after taking account of the cost of host broadcasting, what were described as “contra” items and other non-cash items, the net cash benefits of the Seven deal to TA were $125,665,723.

77 In October 2013, Ms Pratt was appointed to the TA board. She was also appointed to the audit and risk committee.

78 On 12 May 2014, at a meeting of the audit and risk committee, Ms Pratt saw budgeted figures for the cost of the host broadcast. According to ASIC, she expressed concern that the cost could blow out to $9 million to $10 million. But Mr Roberts replied that it would be only $5.8 million, of which $4 million was being paid by Seven. According to ASIC, Ms Pratt asked why TA had accepted only $4 million more from Seven, when the host broadcast would cost more. According to ASIC, Mr Roberts said that TA should have gone to market for the deal. He said that Mr Mitchell had done an about turn on TA’s assumption of the host broadcast, having been against it until Seven conceded it.

79 On 19 May 2014, the TA board was scheduled to meet in Sydney. ASIC says that on the evening before the meeting and at a dinner in Sydney, Mr Tiley told Dr Young that Mr Healy knew more about the broadcast deal than the board, that there was a one page summary of the deal which she would be shocked to see and that the contract had been too rushed. ASIC says that Mr Tiley also told Ms Pratt about the one page summary but asked her not to raise the numbers as nothing could be done, that the organisation’s processes had broken down over the broadcast deal, that Mr Healy was implicated in this and that it would never happen again.

80 According to ASIC, the next morning before the board meeting, Mr Roberts told Dr Young that IMG had offered $40 million per annum for the broadcast rights, that management had expected to get $50 million per annum, that information was withheld from the board and that Mr Mitchell had employed aggressive and bullying tactics.

81 Further, ASIC says that Mr Healy told Ms Pratt before the board meeting that he was uncomfortable with the process by which the contract with Seven had been negotiated. According to ASIC, he told Ms Pratt:

Please do not raise the issues about the media broadcast contract with the Seven Network at the meeting. It will create disharmony and issues for me and others. …

Roberts and I were bullied into the deal by Mitchell. Mitchell rushed the executive team to conclude the negotiation … When Roberts questioned it, Mitchell said to Roberts, ‘That’s how CFOs lose their jobs’.

82 ASIC says that after the board meeting, Ms Pratt told Mr Healy: “I am very concerned about Harold’s conflict of interest in the deal, with his mate Bruce McWilliam, and how the integrity of the board was compromised”. According to ASIC, Mr Healy replied:

Yes. This is terrible. It will never happen again. I should have stood up to Harold and got independent advice.

83 In May 2014, Ms Pratt asked for a copy of the contract with Seven. ASIC sought to weave a cover up theme on some of the events around this time which I will return to later.

84 ASIC says that around mid-December 2014, Mr Healy again told Dr Young that he had asked Mr Mitchell to stand aside from the negotiations and that procedures would be changed next time around.

85 Let me go further forward in ASIC’s narrative into 2015.

86 The TA board met on 5 October 2015. At that meeting, Mr Healy proposed that Mr Mitchell, who was nearing the end of his term, be nominated for re-appointment to the board for three years. Ms Pratt, Dr Young and another director Mr Peter Armstrong opposed the proposal. According to ASIC only two directors eligible to vote, namely, Mr Freeman and Mr Ken Laffey, supported Mr Mitchell. According to ASIC, as a compromise the board resolved to nominate Mr Mitchell for one year but on the understanding that he would retire in February 2016 after the next AO, with Mr Healy to communicate that to Mr Mitchell.

87 Further, according to ASIC, on 16 October 2015, Mr Healy and Dr Young had a heated meeting in which Dr Young asked Mr Healy why he supported Mr Mitchell for a further three year term. According to ASIC, Mr Healy called Dr Young a liar and accused her of putting her personal interest of wanting to be vice-president above all else. But according to ASIC, he also told Dr Young that Mr Mitchell had withheld information and given misleading information to the board about the broadcast rights deal, that the board believed that there was only one prospective television network and that there had been a total disregard of the committee process. According to ASIC he also told her that Mr Mitchell had bullied directors and management, that Mr Mitchell tried to get TA to accept Seven’s offer of $22 million per annum, that the value of the Seven deal was really $125 million not $195 million, and that he, Mr Healy, had tried to get Mr Mitchell to withdraw.

88 Let me press on with ASIC’s narrative. A TA general meeting of its members was scheduled for 23 October 2015. At that general meeting resolutions were to be proposed for the appointment and re-appointment of directors. The agenda foreshadowed that Mr Mitchell would be re-appointed for a further one year. But according to ASIC, Ms Pratt was concerned that this did not reflect the resolution at the last directors’ meeting and so called a further directors’ meeting immediately before the general meeting on 23 October 2015. According to ASIC, at that directors’ meeting Mr Mitchell attacked Ms Pratt and Dr Young for not being “team players”, and then resigned.

89 But ASIC says that Mr Mitchell was not done. In November 2015, according to ASIC there was an apparent ground-swell of support for him among the member associations of TA. And in apparent response to that ground-swell, Mr Healy notified the board that he intended to nominate Mr Mitchell for the vacant board position. According to ASIC, he also notified a resolution to amend TA’s constitution to give the president a casting vote on board nominations. An extraordinary general meeting of TA was then held by telephone conference at 7.00 pm on Sunday 6 December 2015, which passed a resolution amending the constitution. This paved the way for the board to reappoint Mr Mitchell, which it did the next day.

90 ASIC says that at this time and in an apparent concession to the dissenting directors, the board resolved to constitute an independent inquiry into whether Mr Mitchell had any conflict of interest in relation to the broadcast rights contract with Seven. But according to ASIC, Mr Tanner could see what was coming and he resigned from the board on 11 December 2015. He told Dr Young the same day, “I can see where the report is going”.

91 ASIC says that the so-called inquiry was a whitewash. According to ASIC, although the inquiry was supposed to be into whether Mr Mitchell had a conflict of interest in respect of TA’s dealings with Seven, the inquiry did not interview Mr Mitchell or anyone from Seven. According to ASIC, those conducting the inquiry appear to have received a written confirmation from Mr Mitchell’s adviser that Mr Mitchell’s media buying business had business relationships with Seven which were not materially different from relationships with other media outlets. But it says that the inquiry did not appear to have investigated Mr Mitchell’s dealings with Seven any further.

92 Further, according to ASIC, the inquiry reported only that nothing had been brought to its attention during the course of the review which would suggest that Mr Mitchell had a material personal interest in connection with the broadcast rights deal with Seven. ASIC says that this unsurprising and meaningless conclusion did not answer the question of whether Mr Mitchell had a conflict of interest. Further, it says that it was made in ignorance of the vast body of evidence unearthed by ASIC of “direct collusion” between Mr Mitchell and Seven in the course of the negotiation of the broadcast rights deal.

93 Further, according to ASIC, in the course of the inquiry Dr Young had notified two former directors who had been in office at the relevant time, the late Mr Graeme Holloway and Mr James Davies, of the inquiry in case they wanted to participate. ASIC said that this was something that she was entitled to do. Dr Young notified Ms Karen Wood, one the two persons conducting the inquiry, of her contact with the two former directors. Ms Wood then told Mr Healy. Ms Wood then told Dr Young that Mr Healy was “comfortable for us to speak to both” former directors and would set up a time to speak to them. But according to ASIC, within an hour of that communication Mr Healy wrote to all board members that there had been “a fundamental and serious breach of directors’ duties” by a director who had involved former directors in the review without his permission.

94 ASIC says that Mr Healy’s allegation of breach of directors’ duties by Dr Young not only contradicted what Ms Wood had said in her email to Dr Young, but was also wrong. According to ASIC Mr Healy claimed that the allegation was based on advice from the solicitors conducting the inquiry, but ASIC says that there is no evidence of any such advice nor any support for it in the inquiry report. The report instead contained a section headed “Additional observations”, which ASIC says included what looked to be a heavily negotiated passage urging “great care” in any discussions with non-board members, though it recognised that any external party consulted over the inquiry also owed strict duties of confidentiality.

95 Nevertheless, according to ASIC, Mr Healy’s baseless allegation of breach of directors’ duties by Dr Young was the pretext for demanding not only her resignation but that of the other remaining dissenters, Ms Pratt and Mr Armstrong. ASIC says that Mr Armstrong was caught up in this purge for doing no more than expressing support for Dr Young and Ms Pratt in raising concerns over Mr Mitchell’s role in the broadcast deal. On 18 December 2015 he had written to Mr Healy:

I do support Janet [Young] and my other colleagues, however, in expressing their concerns on the matter. As I see it, in doing so, they are doing no more than exercising their fiduciary duties as directors of Tennis Australia in what they consider to be the best interests of the organisation.

96 On 6 January 2016 the board passed motions of no confidence in Dr Young, Ms Pratt and Mr Armstrong and each of them resigned before a special general meeting which had been called to remove them on 15 January 2016.

97 Thus, so ASIC says, in a shameful coda to the sorry saga of the Seven broadcast rights deal of 2013, the directors who had sought faithfully and conscientiously to discharge their duties to TA were all removed from the board and those who flagrantly breached their duties were confirmed in their positions.

98 I will come back and deal with ASIC’s penny dreadful narrative concerning these post 2013 events later.

99 Finally, ASIC says that in a revealing postscript to the 2013 broadcast rights deal, in March 2018 TA put the broadcast rights out to competitive tender which was won by Nine at a price of $60 million per annum.

(b) Contraventions alleged against Mr Mitchell

100 ASIC alleges in its further amended statement of claim (FASOC) that Mr Mitchell breached ss 180(1), 182(1) and 183(1) by engaging in the following conduct which it was said was engaged in by Mr Mitchell exercising his powers or discharging his duties as a director of TA.

101 But let me stress at the outset that ASIC’s allegations of contravention only concern events up to the end of May 2013. There are no allegations of contravention concerning any event in 2014 or 2015.

102 ASIC says that by dismissing the first IMG offer out of hand, Mr Mitchell contravened s 180(1) because a reasonable person occupying such an office with the same responsibilities as him would not have dismissed the first IMG offer but would have given it serious consideration. Further, by that conduct he contravened s 182(1) by using his position as a director of TA improperly to gain an advantage for Seven.

103 Further, ASIC says that by informing Mr McWilliam of the first IMG offer on 30 November 2012, Mr Mitchell contravened s 180(1) because a reasonable person occupying such an office with the same responsibilities as him would not have disclosed to Seven the details of a rival’s offer for the domestic broadcast rights. Further, he contravened s 183(1) by improperly using information, namely the details of the first IMG offer, he obtained because of his position as a director of TA because it was confidential to TA and IMG and was disclosed without the consent of IMG to gain an advantage for Seven.

104 Further, ASIC says that by instructing Mr Wood on 1 December 2012 to abandon his request to Seven for a non-binding clause pending the formalisation of a long form agreement, Mr Mitchell contravened s 180(1) because a reasonable person occupying the office of director of TA with the same responsibilities as him would not have given that instruction to Mr Wood. Further, by that conduct he contravened s 182(1) because he used his position improperly to gain an advantage for Seven.

105 Further, ASIC says that by forwarding his 1 December 2012 emails with Mr Wood to Seven, Mr Mitchell contravened s 180(1) because a reasonable person occupying the office of director of TA with the same responsibilities as him would not have so forwarded them. Further, he contravened s 183(1) because he improperly used information, namely, the emails he obtained because he was a director of TA to disclose TA’s internal deliberations to Seven to gain an advantage for Seven.

106 Further, ASIC says that by telling Mr McWilliam that he had “stamped on” Mr Wood’s proposal for a non-binding clause and that he had “jumped on [Mr Wood] appointing IMG to sell the rights” Mr Mitchell contravened s 180(1) because a reasonable person occupying the office of director of TA with the same responsibilities as him would not have told Mr McWilliam those things. Further, he contravened s 183(1) as he improperly used information he obtained, namely, his directions to Mr Wood not to seek a non-binding clause and not to appoint IMG to sell the domestic broadcast rights, because it disclosed to Seven TA’s internal deliberations to gain an advantage for Seven.

107 Further, ASIC says that by not disclosing the details of the first IMG offer to the TA board meeting on 3 December 2012 and telling the board that the first IMG offer had a number of shortcomings and should not be considered, Mr Mitchell contravened s 180(1) because a reasonable person occupying the office of director of TA with the same responsibilities as him would not have told the TA board that the first IMG offer should not be considered and would have disclosed its details to the board. Further, he contravened s 182(1) because he used his position improperly by concealing relevant information from the board on a subject of financial significance for TA, to gain an advantage for Seven.

108 Further, ASIC says that by telling the TA board on 3 December 2012 that he and Mr Wood would work on an agreement with Seven and wrap it up and come back to the board, Mr Mitchell contravened s 180(1) because a reasonable person occupying the office of director of TA with the same responsibilities as him would not have told the TA board that it should only consider making an agreement with Seven. Further, he contravened s 182(1) because he used his position improperly by seeking to prevent the TA board from considering a broadcast rights agreement with any person other than Seven to gain an advantage for Seven.

109 Further, ASIC says that by not disclosing to the TA board at its meeting on 3 December 2012 the level of interest of Network Ten in the domestic broadcast rights, Mr Mitchell contravened s 180(1). Further, he contravened s 182(1) because he used his position improperly as he concealed relevant information from the board on a subject of financial significance for TA to gain an advantage for Seven.

110 Further, ASIC says that by telling Mr McWilliam not to send materials to Mr Wood in advance of a proposed meeting on 13 December 2012, Mr Mitchell contravened s 180(1). Further, he contravened s 182(1) because he used his position improperly by withholding advance receipt of materials which could only disadvantage Mr Wood in his negotiations at the meeting, to gain an advantage for Seven.

111 Further, ASIC says that by meeting with Mr McWilliam and Mr Martin alone and without Mr Wood on 16 December 2012 and telling them that “it is all going to plan”, Mr Mitchell contravened s 180(1) because a reasonable person occupying the office of director of TA with the same responsibilities as him would not have met alone with Mr McWilliam and Mr Martin or told them that it was all going to plan. Further, he contravened s 183(1) because he improperly used information that he obtained because he was a director of TA, namely, that TA’s deliberations concerning the domestic broadcast rights were going to plan, as it disclosed to Seven TA’s internal deliberations to gain an advantage for Seven. I should note that in closing address, ASIC abandoned the “meeting alone” dimension of this allegation.

112 Further, ASIC says that by telling Mr Wood that TA would not follow the recommendations of the Ayles paper but would instead award the broadcast rights to Seven, Mr Mitchell contravened s 180(1). Further, he contravened s 182(1) because he used his position to restrict TA’s consideration of the broadcast rights to gain an advantage for Seven.

113 Further, ASIC says that by assuring Mr McWilliam in January and February 2013 that Seven “was safe” and that TA would renew the broadcast rights agreement with it, Mr Mitchell contravened s 180(1). Further, he contravened s 183(1) because he improperly used information he obtained because he was a director of TA, namely, TA’s internal deliberations concerning the domestic broadcast rights, as it disclosed to Seven TA’s internal deliberations to gain an advantage for Seven.

114 Further, ASIC says that by not disclosing to the TA board at its meeting on 4 March 2013 the level of interest of Network Ten in the domestic broadcast rights, Mr Mitchell contravened s 180(1). Further, he contravened s 182(1) because he used his position as director of TA improperly, as he concealed relevant information from the board on a subject of financial significance for TA to gain an advantage for Seven.

115 Further, ASIC says that by informing Mr McWilliam what happened concerning the domestic broadcast rights at the TA board meeting on 4 March 2013, Mr Mitchell contravened s 180(1) because a reasonable person occupying the office of director of TA with the same responsibilities as him would not have given Mr McWilliam that information. Further, he contravened s 183(1) because he improperly used information that he obtained because he was a director of TA, namely, the TA board’s deliberations concerning the domestic broadcast rights, as it disclosed to Seven TA’s internal deliberations to gain an advantage for Seven.

116 Further, ASIC says that by instructing Mr Wood on 8 March 2013 not to distribute the board subcommittee paper to other members of the board subcommittee and not to send out any other documents unless he approved them, Mr Mitchell contravened s 180(1) because a reasonable person occupying the office of director of TA with the same responsibilities as him would not have imposed such restrictions on senior managers. He is further alleged to have used his position as director of TA improperly, because he concealed relevant information from the members of the board subcommittee of financial significance for TA to gain an advantage for Seven, and thereby contravened s 182(1).

117 Further, ASIC says that by failing to convene any meetings of the board subcommittee to ensure that it fulfilled its functions, Mr Mitchell contravened s 180(1) because a reasonable person occupying the office of director of TA with the same responsibilities as him would have ensured that the board subcommittee fulfilled its functions. Further, he contravened s 182(1) because he used his position as director of TA improperly, as the failure of the board subcommittee to fulfil its functions meant that it could not give the TA board the advice it needed to assess the Seven offers to gain an advantage for Seven.

118 Further, ASIC says that by telling Mr Wood to do the deal with Seven and to “keep off the grass”, Mr Mitchell contravened s 180(1) because a reasonable person occupying the office of director of TA with the same responsibilities as him would not have told Mr Wood those things. Further, he contravened s 182(1) because he used his position as director of TA improperly as he sought to restrict TA’s consideration of the domestic broadcast rights to gain an advantage for Seven.

119 Further, ASIC says that by informing Mr McWilliam on 16 May 2013 that Seven’s final offer was generous, Mr Mitchell contravened s 180(1) because a reasonable person occupying the office of director of TA with the same responsibilities as him would not have told Mr McWilliam the offer was generous. Further, he contravened s 183(1) because he improperly used information that he obtained because he was a director of TA, namely, his assessment of the offer, as it disclosed to Seven TA’s internal deliberations to gain an advantage for Seven.

120 Further, ASIC says that by recommending to the TA board at its meeting on 20 May 2013 to accept Seven’s final offer, Mr Mitchell contravened s 180(1) because a reasonable person in his position would not have made that recommendation but would instead have recommended a competitive tender for the domestic broadcast rights. Further, he contravened s 182(1) because he used his position as director of TA improperly as he made a recommendation which if accepted would not be in TA’s best interests to gain an advantage for Seven.

121 Further, ASIC says that by telling the TA board at its meeting on 20 May 2013 that the board subcommittee recommended that TA accept Seven’s final offer, Mr Mitchell contravened s 180(1) because a reasonable person occupying the office of director of TA with the same responsibilities as him would have told the board that the board subcommittee made no recommendation as it had not considered Seven’s final offer. Further, he contravened s 182(1) as he used his position as director of TA improperly as he misled the TA board about the board subcommittee’s position to gain an advantage for Seven.

122 Further, ASIC says that by not disclosing to the TA board at its meeting on 20 May 2013 the level of interest of Network Ten in the domestic broadcast rights or the opinion of Gemba that TA had the opportunity to increase significantly the amount it received for the domestic broadcast rights, Mr Mitchell contravened s 180(1). Further, he contravened s 182(1) as he improperly used his position as director of TA by withholding relevant information from the board of financial significance for TA to gain an advantage for Seven.

123 Finally, ASIC says that by telling the TA board at its meeting on 20 May 2013 that Nine was not interested in the domestic broadcast rights and that Network Ten could not afford to pay for them, Mr Mitchell contravened s 180(1) because a reasonable person occupying the office of director of TA with the same responsibilities as him would not have said those things to the board. Further, he contravened s 182(1) because he used his position as director of TA improperly as the board was misled about the true market for the domestic broadcast rights to gain an advantage for Seven. I would say now that it would seem that ASIC’s allegation is wrongly directed to the 20 May 2013 board meeting; it would seem that analogous comments were made at the 4 March 2013 board meeting, but ASIC makes no such allegation referable to the 4 March 2013 meeting.

(c) Contraventions alleged against Mr Healy

124 ASIC alleges that Mr Healy contravened s 180(1) of the Act in various respects, but the allegations of contravention only concern events up to the end of May 2013.

125 ASIC says that by failing to ensure that important documents were included in the board pack for the board meeting on 3 December 2012, Mr Healy failed to exercise his powers or discharge his duties as director of TA, and a reasonable person occupying the office of chair of the board of directors of TA with the same responsibilities as him would have ensured those documents were included in the board pack.

126 Further, ASIC says that by not disclosing to the TA board at its meeting on 3 December 2012 the first IMG offer and Network Ten’s interest, Mr Healy failed to exercise his powers or discharge his duties as director of TA, and a reasonable person occupying the office of chair with the same responsibilities as him would have told the TA board of the first IMG offer and Network Ten’s interest.

127 Further, ASIC says that by failing to ensure that important documents were included in the board pack for the board meeting on 4 March 2013, Mr Healy failed to exercise his powers or discharge his duties as director of TA, and a reasonable person occupying the office of chair with the same responsibilities as him would have ensured those documents were included in the board pack.

128 Further, ASIC says that by not disclosing to the TA board at its meeting on 4 March 2013 the level of interest of Network Ten in the domestic broadcast rights, Mr Healy failed to exercise his powers or discharge his duties as director of TA, and a reasonable person occupying the office of chair with the same responsibilities as him would have told the TA board of the level of interest of Network Ten.

129 Further, ASIC says that by failing to ensure that important documents were included in the board pack for the board meeting on 20 May 2013, Mr Healy failed to exercise his powers or discharge his duties as director of TA, and a reasonable person occupying the office of chair with the same responsibilities as him would have ensured those documents were included in the board pack.

130 Finally, ASIC says that by not disclosing to the TA board at its meeting on 20 May 2013 the level of interest of Network Ten and Nine in the domestic broadcast rights or the opinion of Gemba that TA had the opportunity to increase significantly the amount it received for the domestic broadcast rights, Mr Healy failed to exercise his powers or discharge his duties as director of TA, and a reasonable person occupying the office of chair with the same responsibilities as him would have disclosed those matters to the board.

(d) Harm to TA

131 ASIC alleges that each of the contraventions of Mr Mitchell and Mr Healy caused harm to TA by depriving it of the opportunity of obtaining a higher fee for the domestic broadcast rights in 2013 that it could have obtained by competitive tender.

132 ASIC says that it does not have to establish that the contraventions caused a loss as for a common law claim for damages. It says that proof of any such loss and of causation at common law are unnecessary.

133 ASIC’s case as opened was that the price paid by Seven was at the bottom end of the expected valuation and also that there were competing parties willing at least to bid up the price for the rights. ASIC says that the failure by TA to get the benefit of such competition was harm in the relevant sense.

134 Further, ASIC says that although it is likely that the overall harm to TA alleged by ASIC resulted from a combination of the alleged contraventions, nevertheless each individual contravention contributed to that overall harm and can therefore be said to have caused TA harm.

135 I would say now that ASIC’s harm theory was problematic at the start of the trial and not maintainable by its end.

136 Let me now turn to my principal task which is to mine the facts from the coal-face of forensic inquiry. I will add some law later once the facts have been separated and processed.

FACTUAL BACKGROUND

137 It is appropriate at this point to set out my synthesis of various matters from the documentary and witness evidence including a chronological sequence of the key events up to June 2013. ASIC’s pleaded case concerns the acts and omissions of Mr Healy and Mr Mitchell up to that point in time. Later events are dealt with in a separate part of my reasons, although they may throw light on earlier events. Indeed, ASIC says that later events may constitute in some cases admissions. Whether and how that could be so is something that I will discuss later.

Tennis Australia

138 As I have said, TA is a company limited by guarantee and is the governing body for tennis in Australia. Its members are the State and Territory peak tennis associations.

139 As I have said, TA organises and conducts the AO, one of only four Grand Slam events. It owns and controls the right to broadcast feeds of the tennis tournaments that it organises, including the AO, the Sydney International, the Kooyong Classic, the Brisbane International and the Hopman Cup. TA also licenses the right to broadcast feeds of official matches of the Davis Cup and the Federation Cup. Generally, TA is responsible for marketing the broadcast rights for the AO and the other tournaments and the granting of licences for those rights.

140 TA’s operations and activities are primarily funded by revenues from its tennis events including marketing and the licensing of rights and by government grants. In the 2011/2012 financial year, TA’s annual revenue was $167,021,117. In that financial year, revenue from grants of television rights to broadcast tennis events was about $45 million. In the 2012/2013 financial year, TA’s annual revenue was $176,212,052. In that financial year, revenue from grants of television rights to broadcast tennis events was about $45 million. Further, TA received $5,399,995 in government grants, and ticket sales and sponsorship comprised the majority of the balance of TA’s revenue. In the 2013/2014 financial year, TA’s annual revenue was $196,720,823. In that financial year, revenue from the grant of television rights was about $51 million.

TA’s board and management

141 During the period from December 2012 to December 2013, the directors of TA were:

Mr Healy, president and chairman

Mr Freeman, vice president

Mr Mitchell, vice president

Dr Young

Mr Tanner

Mr Davies

Mr Ashley Cooper

Mr Holloway

Mr John Fitzgerald

Ms Pratt

142 I will say something about the background of Mr Healy and Mr Mitchell later. At this point let me say something about Mr Wood.

143 Mr Wood was employed by TA as its CEO between 1 July 2005 and 1 October 2013; he was not though a director. As CEO, he was responsible for all aspects of TA’s activities, which included the AO, the AO series lead-up tournaments, player development, all competitions, player pathways for education and all matters to do with the tennis business. He reported to the president and to the board. During his time as CEO, TA had two presidents. The first was Mr Geoff Pollard, who served until 2010 and the second was Mr Healy, who was president from 2010.

144 Mr Wood was also an ex officio member of the following TA board committees from at least 2009 until he left TA in October 2013:

the audit and risk committee

the investment advisory committee

the AO focus group.

145 In 2008, Mr Wood created an executive management team (EMT). The EMT consisted of himself, Mr Darren Pearce, director of marketing, Mr Roberts, COO/CFO and company secretary, Mr Tiley, director of tennis, and Mr Ayles, commercial director. The EMT had a group email address of executiveteam@tennis.com.au and Mr Wood received emails sent to this address.

146 Mr Wood was ASIC’s principal witness. Mr Wood for the most part was a reliable witness. Now admittedly he gave cautious evidence at times, but I did not detect any real obfuscation.

147 I should say that occasionally his evidence was vague, with little independent recollection beyond the documents referred to in his written evidence or that he was cross-examined on. This created a difficulty for me in assessing some of his written evidence, because it would seem that parts of his two affidavits had been drafted so as to represent his recollection as being more detailed than it in fact was. This impacted on the reliability of some of his evidence.

148 I also perceived that on a few, albeit seldom occasions, a little of his evidence was tinged so as to more support ASIC’s case thesis in a fashion that was not convincingly justified.

149 But on the whole I have accepted his evidence, which for the most part, particularly after being stress tested under cross-examination, more supported the case of Mr Healy in particular.

150 Let me make a more general observation which is apparent from all of the evidence. There is little doubt of Mr Wood’s considerable commercial experience and acumen. His commercial negotiating and strategic skills were well up to the task of negotiating with Seven what turned out to be a very good deal. And indeed in that context he was hardly overborne by Mr Mitchell, although no doubt he saw him as a source of irritation and interference in his negotiations with Seven. But judged in the result, albeit achieved with less flamboyance than some CEOs, Mr Wood was very effective at firmly achieving what he needed to do on behalf of TA, to the considerable benefit of that organisation.

151 The commercial business unit of TA was managed by Mr Ayles. Its responsibility was to generate revenue and conduct all of TA’s business dealings.

152 Mr Ayles commenced employment with TA in about 2008 and he departed in October 2013. When he commenced at TA, he was the head of major events and was responsible for all of the lead in events to the AO. In particular, he was the tournament director for the Brisbane International tournament, and he oversaw the Davis Cup and Federation Cup events that were hosted in Australia.

153 Within six months of commencing his employment at TA, Mr Ayles was offered the role of commercial director. As commercial director, he reported to Mr Wood. Mr Ayles oversaw all of the commercial revenue streams for TA, including for the AO and its lead in events. He was responsible for broadcasting, sponsorship, ticketing and hospitality for the AO, the Davis Cup, the Federation Cup, the Hopman Cup, the Brisbane International and the Sydney International. The tournament directors for each of these events reported to Mr Ayles. He was responsible for running the domestic and international broadcasts for the AO, the Davis Cup, the Federation Cup, the Hopman Cup, the Brisbane International and the Sydney International. He also oversaw TA’s internal production team and also worked closely with IMG and Seven in this capacity.

154 He led the commercial team of TA, which was responsible for generating revenue and conducting TA’s business. The commercial team was also responsible for transactions relating to the television broadcast rights, although as CEO, Mr Wood was also heavily involved in the grant of TA’s broadcast rights due to the size of those transactions. There was also a commercial management team, which was a subset of the commercial team, which consisted of Mr George, head of broadcasting, Mr Glenn Findlay, head of sponsorship, Mr Frances Travers, head of ticketing and hospitality and Ms Kay Godkhindi, head of major events.

155 As I have said, Mr Ayles was part of the EMT of TA. During the time Mr Ayles worked at TA, the EMT usually met on a weekly basis.

156 Mr Ayles was occasionally asked to attend TA board meetings. This generally occurred if a major strategic issue or a major commercial transaction was going to be discussed at the meeting. The commercial management team and Mr Ayles were involved in preparing some of the documents for TA’s board meetings. The usual process was that each commercial management team member prepared a report and provided it to him. He then reviewed the reports and wrote an executive summary. He provided the reports and the executive summary to Mr Wood for his consideration and feedback. Occasionally, Mr Wood responded with questions and Mr Ayles responded accordingly.

157 Mr Ayles was responsible for driving or overseeing the negotiation of commercial transactions between TA and third parties. His usual practice was to conclude transactions up to the value of around $5 million per annum, with the approval of the CEO. Larger commercial transactions went to the board for approval.

158 Mr Ayles was also called as a witness by ASIC. For the most part he gave reliable evidence, although at times he was slightly slick in his answers in cross-examination.

159 Mr Tanner was serious and smart. He had considerable commercial experience. I found his evidence to be highly reliable and of much assistance. The only qualification concerns his written evidence concerning what was said about the board subcommittee on 20 May 2013. He seemed to confirm Dr Young’s version. But it seems to me more likely that the corrected minutes reflect the true version of what was said, as reflected in Mr Healy’s evidence.

160 Let me at this point say something about some of the other witnesses.

161 Mr Tiley, called by ASIC, was a very reliable and good witness. He had been employed by TA since 4 July 2005.