FEDERAL COURT OF AUSTRALIA

Endeavour River Pty Ltd v MG Responsible Entity Limited (No 2) [2020] FCA 968

ORDERS

VID 1010 of 2018 | ||

| ||

BETWEEN: | ENDEAVOUR RIVER PTY LTD Applicant | |

AND: | MG RESPONSIBLE ENTITY LIMITED First Respondent MURRAY GOULBURN CO-OPERATIVE CO. LIMITED Second Respondent | |

JUDGE: | MURPHY J |

DATE OF ORDER: | 9 JULY 2020 |

THE COURT ORDERS THAT:

1. Order 1 of the orders made on 20 December 2019 be varied so that:

(a) the affidavit of Clive Norman Bowman (#1) sworn on 2 December 2019 and each of its exhibits be treated as confidential, not be published or made available and not be disclosed to any person or entity except to the docket Judge, his or her personal staff, any officer of the Court authorised by the docket Judge, the Contradictor, the Applicants (who have received a redacted version of this affidavit), and their legal representatives (who have a received redacted version of this affidavit), and such disclosures to be upon terms that none of those parties or persons disclose that material or any part thereof to any person or entity; and

(b) except to the extent that the Court considers it appropriate to provide reasons for judgment, those paragraphs and annexures of the affidavit of Clive Norman Bowman (#2) sworn on 2 December 2019 identified in the Schedule to this order be treated as confidential, not be published or made available and not be disclosed to any person or entity except to the docket Judge, his or her personal staff, any officer of the Court authorised by the docket Judge, the Contradictor, the Applicants (who have received a redacted version of this affidavit), and their legal representatives (who have received a redacted version of this affidavit), and such disclosures to be upon terms that none of those parties or persons disclose that material or any part thereof to any person or entity.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

Schedule: Confidentiality of the Affidavit of Clive Norman Bowman #2

| No | Confidential Paragraphs/Annexures |

| 1. | Paragraphs 33(a) to (f) (inclusive) and Tab 1 of CNB-3 |

| 2. | Paragraphs 39(a) to (i) (inclusive) |

| 3. | Paragraph 43 |

| 4. | Paragraphs 47 to 89 (inclusive) and Tabs 3 to 30 of CNB-3 (inclusive) |

| 5. | Paragraphs 90 to 103 (inclusive) and Tabs 31 to 40 of CNB-3 (inclusive) |

| 6. | Paragraphs 104 to 117 (inclusive) and Tabs 41 to 51 of CNB-3 (inclusive) |

| 7. | Paragraphs 118 to 119 (inclusive) and Tabs 52 to 53 of CNB-3 (inclusive) |

| 8. | Paragraphs 126 to 128 (inclusive) and Tab 58 of CNB-3 |

| 9. | Paragraphs 129 to 142 (inclusive) |

| 10. | Paragraphs 143 to 145 (inclusive) |

| 11. | Paragraph 148 |

| 12. | Paragraphs 152 to 153 (inclusive) and Tab 61 of CNB-3 |

| 13. | Paragraphs 157 to 161 (inclusive) and Tab 64 of CNB-3 |

| 14. | Tab 65 of CNB-3 |

| 15. | Second sentence of paragraph 173 |

| 16. | Tab 66 of CNB-3 |

| 17. | Tabs 67 and 68 of CNB-3 |

| 18. | Second sentence of paragraph 181 |

ORDERS

Applicant | ||

AND: | First Respondent MURRAY GOULBURN CO-OPERATIVE CO. LIMITED Second Respondent | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

Settlement Approval Orders

Confidentiality

1. Except to the extent that the Court considers it appropriate to provide reasons for judgment, and subject to further order, pursuant to ss 37AF and 37AG(1)(a) of the Federal Court of Australia Act 1976 (Cth) (the Act) until further order of the Court, in order to prevent prejudice to the proper administration of justice, the confidential affidavit of Andrew Paull affirmed on 28 November 2019 and its annexures and the two confidential affidavits of Clive Norman Bowman sworn on 2 December 2019 and their exhibits be treated as confidential, not be published or made available and not be disclosed to any person or entity except to the docket Judge, his or her personal staff, any officer of the Court authorised by the docket Judge, the Applicants (who have received redacted versions of these affidavits), and their legal representatives (who have received redacted versions of these affidavits), and such disclosures to be upon terms that none of those parties or persons disclose that material or any part thereof to any person or entity.

Approval of Settlement

2. Pursuant to sections 33V(1) of the Act, settlement of the proceeding upon the terms set out in the settlement agreement executed by the Applicant, the Respondents, Slater and Gordon and IMF dated 24 June 2019 and annexed as EPC-1 to the affidavit of Emma Pelka-Caven affirmed on 28 June 2019 (Settlement Agreement) be approved.

3. Pursuant to section 33ZF of the Act or otherwise, the Court authorises the Applicant nunc pro tunc for and on behalf of the Group Members (being those persons who meet the definition of “Group Member” in the Amended Statement of Claim and who did not file an opt out notice) to enter into and give effect to the Settlement Agreement on behalf of Group Members.

4. Pursuant to section 33ZB and section 33ZF of the Act, the persons affected and bound by the settlement of the proceedings be the Applicant, the Respondents and Group Members.

5. Pursuant to section 33ZF of the Act:

(a) the Settlement Distribution Scheme (and any annexures thereto) in the form annexed to these orders at Annexure A be approved; and

(b) Mr Benedict Tobin Hardwick be appointed Administrator of the Settlement Distribution Scheme and is to act in accordance with the rules of the Settlement Distribution Scheme.

6. Pursuant to section 33ZF and section 33V(2) of the Act, the following distributions from monies paid under the settlement be approved:

(a) $10,700,865 being 25% of the Settlement Sum plus GST to IMF as Funding Commission as referred to in clause 4.1(f) of the Settlement Distribution Scheme;

(b) $130,000 for the costs and disbursements of the administration of the Settlement Distribution Scheme from the date of the approval of the Settlement Documents to the date of completion of distribution of the Settlement Sum (as contemplated in 4.1(d) of the Settlement Distribution Scheme);

(c) $2,562,393.10 for the Applicant’s legal costs and disbursements on a solicitor and own client basis incurred in connection with the proceeding on its own behalf and on behalf of all Group Members in the proceeding (as contemplated in 4.1(a) and (b) of the Settlement Distribution Scheme);

(d) $19,310.10 for the costs of the special reference to Ms Elizabeth Harris (as contemplated by 4.1(e) of the Settlement Distribution Scheme);

(e) $5,717.94 for disbursement invoices paid directly by IMF Bentham as ‘Project Costs’ pursuant to the terms of the Funding Agreement; and

(f) $12,500 for the Applicant’s reasonable claim for compensation for time spent and/or expenses incurred in the interests of prosecuting the proceeding on behalf of Group Members as a whole.

Other

7. The Applicant has liberty to apply to re-list the proceeding as soon as practicable after completion of the distribution of the Settlement Sum (and must in any event do so no later than thirty days after such completion) so that final orders can be made, including orders that:

(a) the proceeding be dismissed on the basis that the dismissal is a defence and absolute bar to any claim (either directly or indirectly) or proceeding by the Applicant or any Group Member in respect of, or relating to, the subject matter of the proceeding, without prejudice to:

(i) the right of any party to the Settlement Agreement to make an application to enforce the Settlement Agreement in a new proceeding; or

(ii) the right of any Registered Group Member to make application to the Court in accordance with the terms of the Settlement Distribution Scheme; or

(iii) the right of the Administrator of the Settlement Distribution Scheme to refer any issues relating to the Settlement Distribution Scheme to the Court for direction or determination in accordance with the terms of the Settlement Distribution Scheme.

(b) there be no order as to costs as between the Applicant and the Respondents.

8. As soon as practicable after completion of the distribution of the Settlement Sum, the Applicant file an affidavit regarding the steps undertaken and outcomes of the settlement distribution process.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

Annexure A

MURPHY J:

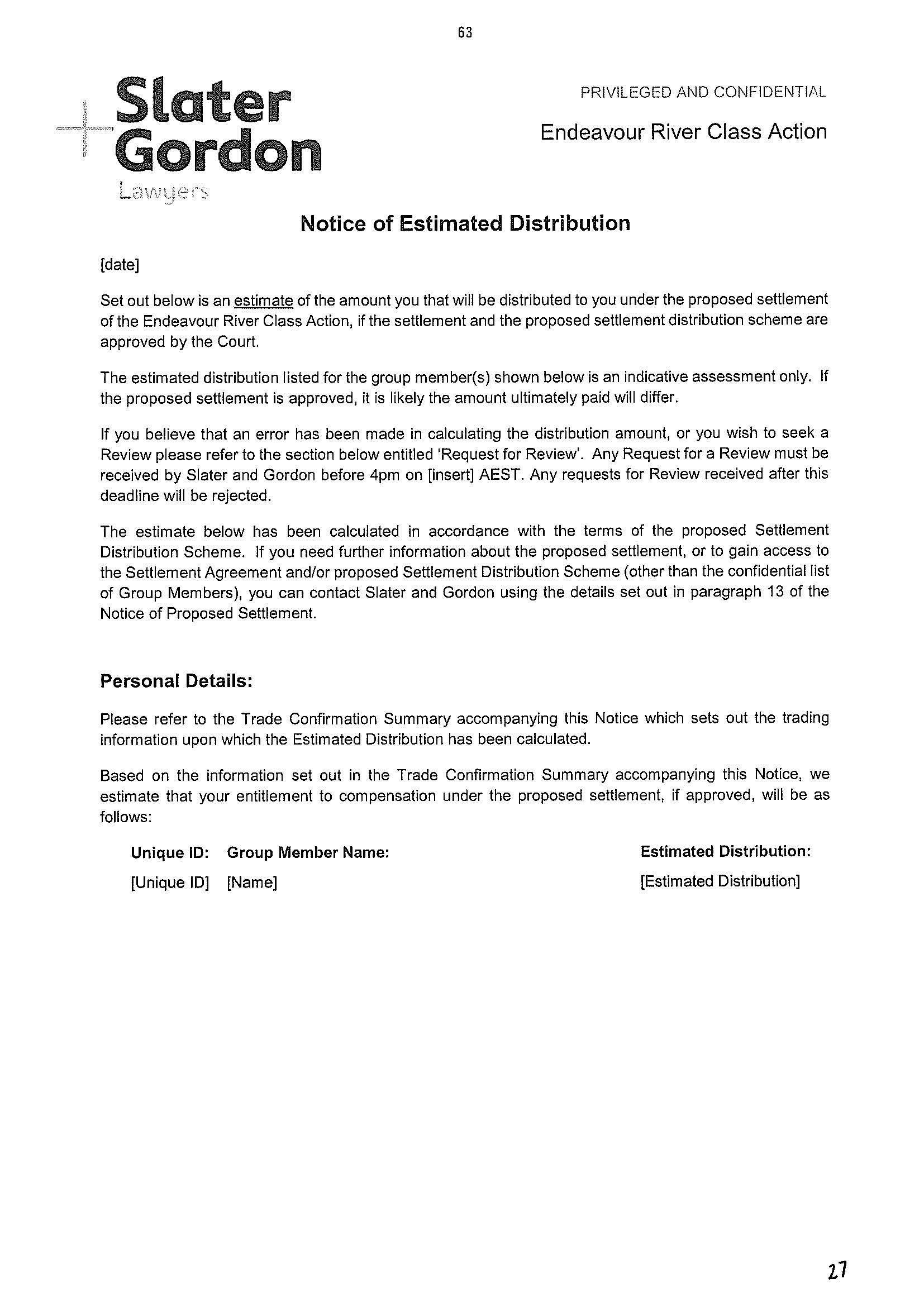

1 This is an application for Court approval of the settlement of a ‘closed’ investor class action pursuant to s 33V of the Federal Court of Australia Act 1976 (Cth) (the Act). The applicant, Endeavour River Pty Ltd (Endeavour River) brought the class action against the respondents MG Responsible Entity Limited and Murray Goulburn Co-operative Co (together, MG), alleging misleading or deceptive conduct and contravention of their continuous disclosure obligations, on its own behalf and on behalf of all persons who acquired an interest in fully paid units in the Murray Goulburn Unit Trust during the period between 29 May 2015 to 26 April 2016 (the relevant period), who are alleged to have suffered loss or damage by reason of the pleaded conduct and who have entered into a litigation funding agreement with IMF Bentham Limited (IMF). The parties reached an in-principle settlement of the proceeding, subject to Court approval pursuant to which MG was required to pay the applicant and class members a sum of $42 million, inclusive of legal costs and interest (settlement sum), in full and final settlement of their claims.

The settlement approval hearing

2 I heard the settlement approval application on 16 October 2019 and expressed my views regarding the proposed settlement in the course of the hearing. I delivered written reasons on 18 October 2019: Endeavour River Pty Ltd v MG Responsible Entity Limited [2019] FCA 1719 (Endeavour River No 1). In those reasons I explained that I considered:

(a) the settlement sum and the terms of settlement to be fair and reasonable in the interests of class members to be bound to the settlement;

(b) the settlement distribution scheme also to be fair and reasonable; and

(c) the deductions proposed to be made from the settlement sum prior to distribution to class members to be fair and reasonable, being deductions for reasonable legal costs, reimbursement to IMF of its Project Costs, a reimbursement payment to Endeavour River, settlement administration costs and an amount for the Cost Referee’s charges for conducting an independent assessment of the applicant’s legal costs.

3 I was not however satisfied that the amount proposed to be deducted for litigation funding charges was fair and reasonable. Pursuant to the funding agreements that each class member had entered into with IMF, the class members were obligated to pay a funding commission at the rate of 30% or 35% of the gross settlement, depending upon the number of units the class member acquired during the relevant period. Endeavour River sought approval for the deduction of litigation funding charges which equated to approximately 32.1% of the gross settlement, being $13,472,805. For the reasons I set out in Endeavour River No 1 (at [30]-[31]) I expressed a preliminary view that having regard to the circumstances of the case, and subject to any further submissions and evidence in relation to the reasonableness of the proposed funding commission, the proposed funding commission was excessive, but a funding rate of 25% may be reasonable.

4 Having regard to my preliminary view that the proposed funding rate was excessive but the other aspects of the proposed settlement were fair and reasonable, one option was to approve the settlement but vary the funding rate to one that was reasonable. However, as I in noted Endeavour River No 1 (at [33]) different views had been expressed by single judges of the Court as to whether, in a settlement approval application under s 33V, the Court has power to vary the funding commission class members are required to pay pursuant to funding agreements they have entered into: see Earglow Pty Ltd v Newcrest Mining Limited [2016] FCA 1433 at [133]-[158] (Murphy J); Blairgowrie Trading Ltd v Allco Finance Group Ltd (Recs & Mgrs Apptd) (In Liq) (No 3) [2017] FCA 330; (2017) 343 ALR 476 at [101] (Beach J); and Mitic v OZ Minerals Limited (No 2) [2017] FCA 409 at [27]-[29] (Middleton J); Liverpool City Council v McGraw-Hill Financial, Inc (now known as S&P Global Inc) [2018] FCA 1289 (Liverpool) at [47] (Lee J).

5 If I took the step of approving the settlement but varying the funding commission rate, there was a prospect that questions would arise in respect to the Court’s power to do so, and thus a prospect that the settlement approval process might descend into protracted arguments and appeals relating to power.

6 Another option was to refuse to approve the proposed settlement on the basis that the funding commission was excessive, but that had its own difficulties. In any event, at that point my view was only preliminary, and it would be unfair to refuse to approve the proposed settlement without first giving IMF the opportunity to put on evidence and submissions as to the reasonableness of the funding commission it sought. Accordingly, I expressed my preliminary view and the reasons for it and adjourned the application to allow the applicant and IMF to decide whether to press the application for approval of a funding commission at a rate of 32.1% of the gross settlement. I indicated that if the application was to be pressed: (a) the applicant and IMF would be given leave to put on further evidence and submissions; (b) a suitably qualified contradictor would be appointed to represent class members’ interests in relation to the reasonableness of the proposes funding commission; and (c) the settlement approval application would be relisted to be heard the following month.

IMF’s contention that the Court lacks power to require that litigation funding be reasonable

7 On 19 October 2019, the day after the reasons for judgment were delivered, IMF’s solicitors, Arnold Bloch Leibler (ABL), sent a letter to chambers stating IMF’s position as follows:

…our client does not accept that the Court has power to alter the contractual promises of group members to pay commission, except where, because of individual circumstances, there is an established legal or equitable basis to interfere with those contractual rights, none of which exist here.

Our client maintains that a commission rate of 32% is a fair and reasonable rate of commission having regard to all of the circumstances of this matter some of which the Court has not had the benefit of considering. Nevertheless, in the event the Court determines that the Court does have power to vary the commission payable to our client, and subject to any appeals our client may bring on the question of the Court’s power, our client would not seek to challenge his Honour’s preliminary view that 25% would be an appropriate rate of commission in this matter.

IMF submitted that, having regard to the importance of the issue and the divergent views expressed by single judges of the Court, the question as to whether the Court has power to vary the funding commission payable to IMF was appropriate to be determined by a Full Court.

8 If the question of power was to be heard by a Full Court the question or questions to be answered required specificity. On 1 November 2019 I proposed the following questions for consideration by the parties:

1. Is a funding commission of $13,472,805, representing a funding rate of 32.1%, fair and reasonable in the interests of class members in the circumstances of the case?

2. If the funding commission is found to be excessive, that is, not fair and reasonable:

(a) is it a proper exercise of discretion to refuse to approve the proposed settlement and/or the distribution of the proposed funding commission from the settlement on the basis that the funding commission is excessive, in circumstances where the proposed settlement is otherwise fair and reasonable and IMF’s entitlement to the proposed funding commission arises under pre-existing contractual agreements with class members?;

(b) does the Court have power, and/or is it a proper exercise of discretion, to approve the settlement but refuse to approve the proposed funding commission and/or its distribution from the settlement on the basis that the funding commission is excessive, in circumstances where IMF’s entitlement to the proposed funding commission arises under pre-existing contractual agreements with class members?; and

(c) does the Court have power, and/or is it a proper exercise of discretion, to reduce the proposed funding commission under the proposed settlement and/or reduce the distribution of the funding commission from the settlement on the basis that the funding commission is excessive, in circumstances where IMF’s entitlement to the proposed funding commission arises under pre-existing contractual agreements with class members?

The appointment of the Contradictor and the dispute regarding the scope of the Contradictor’s role

9 In the meantime steps were taken to engage counsel to appear as a contradictor to represent class members’ interests in the application. Subject to orders to formally appoint them to the role, Mr Peter Jopling AM QC and Ms Jennifer Collins of counsel agreed to act as the contradictor (the Contradictor).

10 At the case management hearing on 1 November 2019, all parties, including IMF as an intervener, were represented by counsel, and Mr Jopling QC and Ms Collins appeared as the Contradictor. It was uncontentious that it was appropriate to appoint a contradictor, but IMF contended that the role of the contradictor should be restricted so that it was not empowered to seek documents from the applicant or IMF or otherwise interrogate the applicant or IMF, and that the Contradictor should not be permitted to adduce evidence. IMF contended that to permit the Contradictor to take such steps had the potential to lead to substantial costs which were not proportionate to the issues in dispute. Endeavour River gave some light support to that contention.

11 I declined to limit the scope of the Contradictor’s role as IMF sought, and indicated that some limited and targeted discovery was appropriate in relation to the reasonableness of the proposed funding commission. In my view it was also appropriate for IMF to file and serve any evidence upon which it sought to rely, including material as to the rate of return IMF will achieve in this case in the event that the proposed funding commission is approved and as to IMF’s rate of return across all the class actions it funds in Australia. Upon receipt of discovery and IMF's evidence the Contradictor could decide whether it wished to file its own evidence.

IMF withdraws the contention as to the lack of power

12 On 13 November 2019 ABL informed my chambers that IMF no longer intended to contest that the Court had power to vary the funding commission rate, nor that it was not a proper exercise of discretion for the Court to refuse to approve the proposed settlement when IMF’s entitlement to the proposed funding commission arose under pre-existing contractual agreements with class members. IMF only sought to argue that the funding rates it had agreed with class members were in the range of what is fair and reasonable in the circumstances of the case.

13 I was concerned not to embark upon a hearing to decide what funding commission was fair and reasonable if the question of power might later reappear. That was addressed by IMF providing an undertaking to the Court, as follows:

IMF Bentham Limited (IMF) undertakes to the Court that if the Court finds that the answer to question 1(a) or (b) in the Schedule to these orders is “No”:

(a) subject to any exercise of IMF’s rights of appeal, IMF will accept a distribution from the global settlement sum applying the funding commission rates that accord with the Court’s finding in relation to question 2 in the Schedule; and

(b) upon receipt of such distribution, IMF will be satisfied as to the whole of its rights under its funding agreements with the applicant and group members and will not take any step to enforce those funding agreements to the extent the funding agreements might otherwise entitle IMF to a funding rate greater than the rate determined by the Court.

For the avoidance of doubt, IMF’s undertaking means that it will not argue any of questions 2(a), (b) and (c) of the questions identified by the Court on 1 November 2019 as to the Court’s power and as to the proper exercise of discretion, and instead will argue that the funding commission as agreed between itself and each of the group members is in the range of what is fair and reasonable in the circumstances of the case.

14 The Schedule referred to in the undertaking set out the questions agreed between the parties for determination by the Court (the Funding Commission Issues) as follows:

1. Is a funding rate of:

(a) 35% for group members holding less than 500,000 Relevant Securities; and

(b) 30% for group members holding greater than or equal to 500,000 Relevant Securities;

which will result in an aggregate funding commission of approximately $13,472,805, fair and reasonable or in the range of what is fair and reasonable in all of the circumstances of the case?

2. If either or both of the funding commission rates referred to in question 1 above are found not to be fair and reasonable or not in the range of what is fair and reasonable, what is a fair and reasonable funding commission in all of the circumstances of the case?

15 Upon receipt of the undertaking by IMF, I made orders on 15 November 2019:

(a) to give IMF leave to intervene in the settlement approval application, to file evidence and to make submissions in respect of the Funding Commission Issues;

(b) to appoint Mr Jopling and Ms Collins as Contradictor in relation the Funding Commission Issues and allow the Contradictor to seek information and documents in respect of the Funding Commission Issues, adduce evidence and make submissions;

(c) for Endeavour River and IMF to provide specified categories of documents to each other and the Contradictor;

(d) for IMF to file and serve a confidential affidavit disclosing various matters with respect to every Australian funded investor or shareholder class action submitted to IMF’s investment committee for approval for funding in the period from 27 April 2016 to 26 October 2018 in which IMF offered or provided litigation funding, including: the commission rate and other charges payable to IMF; IMF’s and/or the solicitor’s estimate of the size or value of the claim; the estimated legal costs of the claim; the terms on which the lawyers were retained to act; the terms relating to securing the costs; and the terms relating to any adverse costs orders;

(e) for Slater & Gordon, the solicitors for Endeavour River, to file and serve a confidential affidavit disclosing effectively the same matters with respect to every Australian funded investor or shareholder class action proposal filed in the period from 27 April 2016 to 26 October 2018 in which Slater & Gordon acted as solicitor for the applicant;

(f) for the Contradictor’s reasonable costs to be paid, in the first instance, by IMF, within 30 days of presentation of an invoice;

(g) for IMF to file and serve any evidence on which it intends to rely in respect of the Funding Commission Issues; and

(h) listing the matter for a further case management hearing on 6 December 2019.

The case management hearing on 6 December 2019

16 By the case management hearing on 6 December 2019, IMF and the applicant had provided discovery and had filed affidavits in relation to the Funding Commission Issues being:

(a) an affidavit of Andrew Paull, a practice group leader in the class actions practice of Slater & Gordon, the solicitors for Endeavour River, made 28 November 2019; and

(b) two affidavits of Clive Bowman, Global Chief Investment Officer of IMF, both made 2 December 2019 (the first and second Bowman affidavits).

17 Four issues arose for consideration at the case management hearing: (a) a dispute regarding the Contradictor’s proposal to engage an expert witness; (b) an open offer made by IMF to reduce the funding rate it sought to 28%; (c) an application by the applicant for an interim partial distribution to class members; (d) an application by IMF for an interim part-payment of the funding commission.

The dispute regarding expert evidence

18 The Contradictor proposed to engage an expert to provide an opinion and to give evidence on the Funding Commission Issues, which proposal IMF strenuously opposed. While I doubted that I would be assisted by expert evidence regarding the appropriate pricing of “litigation risk”, which is the main risk taken on by a litigation funder, I considered that it was possible the Court would be assisted by evidence from an expert in the capital market or finance regarding the rates of return available for other types of investment, including those that are comparable with litigation funding in terms of risk, security, liquidity and other relevant matters, to assist in assessing whether the proposed rate of return by IMF is fair and reasonable. However, in circumstances where if the Contradictor adduced expert evidence then IMF might also wish to do so, I was concerned to ensure that the costs of allowing expert evidence to be adduced were reasonable and proportionate to the amount in dispute. In light of those concerns I directed the Contradictor to file and serve proposed questions for the expert, and obtain a quote from the proposed expert for the provision of an opinion in respect to those questions.

19 On 14 December 2019 the Contradictor provided to the Court the proposed brief to the expert and a relatively modest quote for the cost of the report. The Contradictor subsequently identified the expert witness as a Professor Emeritus at the University of Melbourne and chairman of a publicly listed financial advisory and investment company.

20 On 16 December 2019 IMF strenuously objected to the proposed questions. One of the proposed questions was as follows:

If you were advising a litigation funder in the position of IMF in March 2018 in connection with a proposed investment in funding the Proceeding, how would you model the expected returns from their investment, and how would you determine what expected rate of return was sufficient to justify the investment?

IMF contended that the Court could not be assisted by the views of an expert witness on that question, as the issue for the Court in a settlement approval application is whether the proposed commission rate is fair and reasonable or in the range of what is fair and reasonable in all the circumstances. It argued that the proper question is not whether IMF’s return on investment is “sufficient” to justify the investment, and further that the “sufficiency” of the return on investment is not one of the factors listed in Money Max Int Pty Ltd v QBE Insurance Group Ltd [2016] FCAFC 148; (2016) 245 FCR 191 (Money Max) at [80] (Murphy, Beach and Gleeson JJ) as being relevant to the Courts’ determination of whether a funding commission is fair and reasonable.

21 Against that, the Contradictor submitted that Money Max is not an exhaustive statement of the matters that the Court may have regard to in determining a fair and reasonable funding commission. It also argued that the question of IMF’s return on capital may arise under the factors enunciated in Money Max as those factors include issues as to the size of the settlement and the amount of legal costs and security for costs expended, which invites attention to the funder’s return on capital. There was force in the Contradictor’s submissions, particularly as IMF advanced evidence going to its rates of return on capital, both across its entire portfolio and in relation to the 20 shareholder class actions it had funded in the period from 2001 to 2019. A confidential table annexed to the second Bowman affidavit at tab 64 of exhibit “CNB-3” (tab 64) disclosed the rate of return achieved by IMF in each of the 20 shareholder or investor class actions in Australia which IMF had funded in the period post August 2001 until November 2019, as well as the average rate of return over that period. IMF adduced that evidence in support of its contention that a funding rate of 32.1% was fair and reasonable, and I considered the Contradictor should be permitted to advance evidence to contest that proposition.

IMF’s offer to reduce its funding commission to 28% of the gross settlement

22 IMF informed the Court that it was prepared to consent to an order approving a funding commission fixed at 28% of the gross settlement, and suggested that the dispute regarding the funding commission could be resolved by consent with the Contradictor. The Contradictor, however, said that it was not its role to enter into a commercial negotiation; nor could it decide whether a 28% funding rate was fair and reasonable without having the benefit of the expert opinion it sought.

The request for an interim distribution

23 Having regard to: (a) the issue of the Court’s power no longer being in dispute; (b) there being no suggestion of any impropriety by IMF or Slater & Gordon; and (c) the only remaining issue being the reasonableness of the proposed funding commission; Endeavour River sought orders for an interim distribution to be made to class members so that the distribution of the compensation to class members was not further delayed. It proposed to only hold back an amount to cover the funding commission sought and the costs associated with the dispute in that regard. I accepted that submission.

24 IMF advanced a similar contention in respect of the funding commission. It submitted that if interim distribution was to be made, it was also appropriate to make an interim payment of the funding commission to which it was entitled, at a funding rate of 15% of the gross settlement. It submitted that it could not reasonably be suggested that IMF would not, at least, be entitled to a funding commission at that rate. I accepted that submission too.

The email to the parties on 17 December 2019

25 On 17 December 2019 I informed the parties that:

(a) having read the affidavits of Mr Paull and Mr Bowman as well as the Contradictor’s proposed brief to the expert, subject to submissions to be made, I continued to hold the preliminary view that a funding rate of 25% was fair and reasonable in the circumstances of the case; and

(b) my preliminary view was that if IMF continued to seek a funding rate of 28% of the gross settlement, subject to any further submissions IMF wished to make it was likely to be appropriate to allow the Contradictor to obtain the expert report it proposed.

IMF’s change of position

26 On 19 December 2019 ABL sent an email to chambers and the parties stating that “in the interests of saving costs and bringing this matter to a close, IMF is prepared to accept a funding commission rate of 25%”.

The resumed settlement approval application

27 The hearing of the settlement approval application resumed on 20 December 2019. As I said in Endeavour River No 1, other than the proposed litigation funding commission I considered all aspects of the proposed settlement to be fair and reasonable. The only issue for determination was whether a funding commission at the rate of 25% of the gross settlement, being $10.5 million, was fair and reasonable.

Confidentiality

28 The first Bowman affidavit provided the following information, required pursuant to order 8 of the orders made on 15 September 2019, in respect of each Australian funded investor class or shareholder class action considered by IMF’s investment committee in the period between 27 April 2016 and 26 October 2018:

(a) the identity of the funder, being IMF;

(b) the commission rate;

(c) any other fees paid or payable to IMF;

(d) IMF and/or the solicitors estimate of the size or value of the claim at the time at which:

(i) the decision to grant conditional funding for the claim was made;

(ii) the decision to grant unconditional funding for the claim was made; and

(iii) the proceedings were concluded (save in respect of any action that was not yet completed);

(e) IMF’s and/or the solicitors’ estimated costs of the claim at the time at which;

(i) the decision to grant conditional funding for the claim was made;

(ii) the decision to grant unconditional funding for the claim was made; and

(iii) the proceedings were concluded (save in respect of an action is not yet completed);

(f) the terms on which the lawyers were retained to act with respect to payment of their fees;

(g) the terms if any relating to security for costs; and

(h) the terms if any relating to adverse costs orders.

IMF’s investment committee considered 13 funded shareholder or investor class actions in the specified period and the specified information was provided in relation to each of them.

29 IMF made a confidentiality claim in respect of the entirety of the first Bowman affidavit. Mr Bowman deposed that the information is privileged, confidential or commercially sensitive to IMF. Insofar as the information is commercially sensitive he deposed that if it is disclosed it could damage IMF’s commercial interests or the commercial interest of those with whom it transacts. I accept this submission and have treated this affidavit as confidential.

30 Mr Paull’s affidavit provided the same information in relation to the eight funded investor or shareholder class action proceedings which will proposal filed in the period between 27 April 2016 and 26 October 2018, and in which Slater & Gordon acted or proposed to act as solicitors for the applicant. Mr Paull made a confidentiality claim in respect to the entirety of the affidavit. He deposed that the information is subject to legal professional privilege and confidentiality obligations that Slater and Gordon has in respect of its clients and to litigation funders in other proceedings, some of which are presently ongoing. He said that its disclosure would prejudice the interests of the applicants and class members in those proceedings by conferring a strategic advantage on the respondents, and that certain of the information was commercial in confidence. I accept this submission and have treated this affidavit as confidential.

31 The second Bowman affidavit is voluminous, running to 181 paragraphs and attaching six lever arch binders of exhibits. It contains information about IMF’s business, its services, its investment track record as published in IMF’s 2019 Annual Report (the FY19 Annual Report), and its case selection process; some of the matters relevant to IMF’s decision to provide funding, and some of the specific risks of the case against MG; Mr Bowman’s view regarding some of the matters referred to in Endeavour River No 1 at [31]; Mr Bowman’s view regarding the difficulties of comparing commission rates between cases funded by IMF and cases funded by other funders; some amendments to the funding agreement requested by institutional investors (none of which went to the funding rate); and the fact that no class members objected to the proposed funding rate. Except for a few identified paragraphs, IMF does not claim confidentiality over these parts of the affidavit. I am satisfied it is appropriate to treat those few identified paragraphs as confidential.

32 Mr Bowman also deposed as to: the history of IMF’s involvement in the development of the case theory in the proposed class action against MG; the consideration of the proposed class action by IMF’s investment committee; the events leading to the unconditional approval of funding of the case by the investment committee; the last investment committee meeting; some principles IMF applies in assessing the suitability of cases for funding; the specific risks of the case against MG; Mr Bowman’s response to a number of the matters referred to in Endeavour River No 1 at [31]; and the returns achieved by IMF in funded shareholder or investor class actions from 2001 until November 2019. As I have said, Tab 64 of the exhibit to this affidavit is a table setting out 20 shareholder or investor class actions funded by IMF over the period post-August 2001 to November 2019. It details the time period between provision of unconditional funding and resolution of each case; IMF’s total expenditure in each case; the total amount received by IMF in each case; IMF’s profit in each case; IMF’s return on invested capital in each case; and IMF’s average return on invested capital across all of the cases.

33 IMF made a confidentiality claim in relation to these parts of the second Bowman affidavit. It submitted that the information regarding the 20 funded shareholder or investor class actions is not publicly available information, and that while IMF publishes its overall rate of return on all of its investments in funded matters, it does not publish the specific rates of return achieved for individual matters or for specific subsets of matters such as class actions. IMF contended that the information in relation to which it claimed confidentiality was commercially sensitive and it had the potential to provide an advantage to IMF’s competitors if it was disclosed.

34 On 16 December 2019 IMF provided an updated version of tab 64, incorporating the estimated returns to IMF in the present case assuming different funding rates of 32.1%, 28% and 25%. In relation to the information in the updated version of tab 64, IMF did not claim confidentiality over the information relating to its estimated returns in the present case under the three different funding rates, but it did claim confidentiality over the balance of the information in the table.

35 Section 37AF of the Act provides that the Court may make a suppression or non-publication order only “on grounds permitted by this Part”. Section 37AG(1)(a) relevantly provides that such an order may be made where it “is necessary to prevent prejudice to the proper administration of justice”. Necessary is a strong word: Hogan v Australian Crime Commission [2010] HCA 21; (2010) 240 CLR 651 at [30]. When considering making confidentiality or non-publication orders it must also be kept in mind that a primary objective of the administration of justice is to safeguard the public interest in open justice: s 37AE. It is also relevant that the settlement of class action proceedings is not just a private bargain between the parties. It has a public dimension and the community has a significant interest in access to relevant information: Liverpool at [107]; Santa Trade Concerns Pty Limited v Robinson (No 2) [2018] FCA 1491 at [26] (Lee J). In my view the public interest extends to the rates of return achieved by litigation funders in class action proceedings.

36 Notwithstanding this public interest, I accept the primary thrust of IMF’s submissions in relation to confidentiality. Some of the material over which confidentiality is claimed, particularly the internal memos and correspondence between IMF and Slater & Gordon in relation to the risks of the case on liability and quantum, is plainly either privileged or confidential. In relation to the information about IMF’s rates of return across the 20 shareholder or investor class actions it funded in Australia over the period from post-August 2001 to November 2019, I accept IMF’s submission that the information is not publicly available and that IMF may be prejudiced by the disclosure of such information to its competitors in the litigation funding market. I also consider that releasing the information may prejudice the proper administration of justice by inhibiting the full disclosure of information by litigation funders to courts assessing the reasonableness of litigation funding charges. But while I accept that there may be some prejudice to IMF by the disclosure of the detailed information in tab 64 regarding expenditure and profit per case, rates of return per case and the average rate of return, I do not consider that it will suffer any prejudice nor will there be any prejudice to the proper administration of justice through disclosure of the broad conclusions that may be drawn from the information in tab 64, which conclusions form part of my reasons.

Is a 25% funding rate on the gross settlement fair and reasonable in the present case?

37 Litigation is inherently risky, as is the funding of it. Even more so when the funded case is a large, complex, commercial class action in which it is difficult to accurately assess the liability and quantum risks at the stage when the funding commitment is made. One way a well-run litigation funder will address the inherent uncertainties in such a business is by having a portfolio of cases so as to spread the risk. IMF’s 2019 Annual Report shows that it funds many different types of cases, in a variety of jurisdictions both in Australia and overseas, and using different funding models. The cases that it funds carry different levels of risk for IMF and deliver different rates of return. Even in a particular category of cases, such as shareholder class actions in Australia, tab 64 shows that there is a great deal of variability in the rates of return it achieved in different shareholder or investor class actions, with some high returns, some modest returns, and some low returns, although no losses. A competent commercial litigation funder operating in a competitive market will price the risk it takes on in a particular case having regard to the knowledge that returns are variable between cases, with good, intermediate and bad results, including outright losses, to be expected over time.

38 In a settlement approval application the Court must focus on whether the funding commission in that case is fair and reasonable, so as to avoid the funder making excessive or disproportionate profits at the expense of class members. Thus the Court may consider the funder’s rate of return in that case. But while it is the interests of class members in that case which are relevant, at least in relation to commercial litigation funders, the Court may also take into account the funder’s rate of return over time as that may assist in understanding the range of fair and reasonable funding rates. Having regard to its confidentiality I will not disclose the average rate of return which IMF has achieved in shareholder and investor class actions over time, but it is not in my view manifestly excessive or unreasonable.

39 IMF’s FY19 Annual Report shows that:

(a) in the period between IMF’s public listing in 2001 and 30 June 2019, IMF has commenced and completed the funding of 192 cases;

(b) of those cases, 171 were won or settled, and 21 resulted in unsuccessful court verdicts;

(c) the successful cases generated total recoveries of $2.39 billion;

(d) of the $2.39 billion recovered, $1.49 billion was remitted to the funded party or parties (being 62.34% of the total amount recovered), with the balance of $897 million going to IMF;

(e) the average duration of completed cases was 2.6 years;

(f) IMF had an 89% success rate in relation to completed cases; and

(g) IMF’s average return on invested capital is 1.3 times.

40 I doubt that anybody would argue that a rate of return of 1.3 times or 130% is excessive in a risky, illiquid and essentially unsecured investment class like litigation funding. But the 1.3 times return is IMF’s general rate of return on its entire portfolio of cases both in and outside of Australia. Tab 64 shows that, while the rates of return achieved by IMF in funded shareholder class actions in Australia are quite variable, it has achieved a significantly better average rate of return in such cases compared with its average rate of return across its entire portfolio.

41 IMF does not assert confidentiality in relation to its estimated returns in the present case. The updated version of tab 64 shows the return that will be achieved in the present case calculated by reference to different funding rates, as follows:

(a) 32.1% (as initially sought) means that IMF's return would be 6.32 times, or 632%;

(b) 28% (as IMF later offered) means that IMF’s return would be 5.62 times, or 562%; and

(c) 25% (which is now the rate for consideration) means that IMF’s return would be 5.02 times or 502%.

The return of 5.02 times achieved on 25% funding rate is almost four times more than IMF’s average return on investment across its entire portfolio in and outside of Australia, and is also in excess of IMF’s average rate of return on funded shareholder or investor class actions in Australia.

42 In Endeavour River No 1 at [25]-[31] I set out the reasons for my preliminary view that a funding rate of 32.1% of the gross settlement was excessive and that 25% of the gross settlement may be fair and reasonable in the particular circumstances of the case. I said the following (at [31):

The circumstances in the present case include that:

(a) IMF agreed to fund the proceeding only after being provided with the detailed funding proposal which disclosed a high level of case preparation (for that early stage), a well-grounded case theory, and high levels of interest from unit holders. Each of those matters is relevant to the level of risk that IMF took on by agreeing to fund the case;

(b) IMF agreed to fund the proceeding relatively late in the day. Prior to commencement of the proceeding:

(i) the Webster proceeding raising the same or similar allegations was already on foot against MG from May 2016;

(ii) on 15 December 2017 MG was ordered to pay a penalty of $650,000 in an ASIC prosecution for a contravention of the continuous disclosure regime. The Court made a declaration in the following terms:

The defendant contravened section 674(2) of the Corporations Act 2001 (Cth) (“the Act”) on and from 22 March 2016 continuing until 8:48 am on 27 April 2016 by failing to notify the Australian Securities Exchange (“the ASX”) that circumstances had arisen a consequence of which was that Murray Goulburn Co-operate Co. Limited was unlikely to achieve the forecast Available Weighted Average Southern Region Farmgate Milk Price for the financial year ending 30 June 2016 (“FY16”) of $5.60 per kilogram of milk solids and full-year net profit after tax for FY16 of appropriately $63 million as stated by MG and MGRE in their ASX announcements dated 29 February 2016 titled “Murray Goulburn – Half Year Financial Results News Release” and “Murray Goulburn – Half Year Financial Results Presentation”.

: see Australian Securities & Investments Commission, in the matter of MG Responsible Entity Limited v MG Responsible Entity Limited [2017] FCA 1531; and

(iii) MG publicly stated that it was putting aside $195 million to deal with potential costs from class action litigation.

(c) I have had the benefit of reading the funding proposal and Counsel’s Opinion in relation to the risks associated with the litigation. It is important to avoid hindsight bias, but they allow some insight into the liability and quantum risks associated with the litigation at the time IMF agreed to provide funding, including any risk that IMF may be required to meet an adverse costs order;

(d) the legal costs and disbursements that IMF incurred in the proceeding are relatively low for litigation of this type and size. To the date of the approval application IMF paid $1.86 million in costs and disbursements (and except for an outstanding invoice, the balance is conditional on a successful outcome). The proposed funding commission is more than seven times that amount;

(e) nor was IMF out of pocket for a lengthy period for the monies it paid for costs. The proceeding was filed on 16 August 2018 and settled in-principle at a mediation on 30 May 2019. I estimate that IMF outlaid the costs over a period of approximately 12-14 months, and upon settlement approval it would be reimbursed those monies;

(f) the quantum of any exposure to adverse costs liability which IMF took on was reduced because the case was to be heard together with the Webster proceeding. If the case was unsuccessful at trial it is unlikely that IMF would have borne the burden of adverse costs by itself. Most likely it would only be liable for approximately half of any adverse costs order made because the other half would be paid by the unsuccessful applicant or funder of the Webster proceeding;

(g) IMF was not required to advance security for costs in cash, as it did so by way of a deed poll;

(h) this is a matter that requires further evidence, and it is appropriate to be cautious in comparing headline funding rates, but it appears that funding rates lower than 30% and 35% were available in 2018. In Re Banksia Securities Ltd (Rec & Mgr Apptd) (in liq) (No 2) [2018] VSC 47 at [90] Croft J reviewed the gross and net funding rates approved in six class actions in 2016 and 2017, which ranged from 17% to 27% of the gross settlement and 26% to 45% of the net settlement (excluding one idiosyncratic case which can be excluded for the purposes of comparison: see Blairgowrie at [156]). Perera v GetSwift Limited [2018] FCA 732; (2018) 263 FCR 1 at [68]-[73], handed down on 23 May 2018, records that three competing litigation funders offered to fund the proceeding at: (a) the lesser of 25% of net proceeds or 22.5% of gross proceeds; (b) 10% of gross proceeds before an early date, 20% of gross proceeds until 42 days prior to the initial trial and 30% thereafter; and (c) the lesser of 2.2 the costs of the proceeding (or 2.8 times depending upon when a successful resolution of the case occurs) and 20% of net proceeds.

43 The second Bowman affidavit responded to each of these matters, and I have taken those responses into account. It is unnecessary to detail Mr Bowman’s responses, and in any event some of them are confidential. Overall, I consider the material provides no support for the funding rate of 32.1% that IMF initially claimed. That funding rate would have provided a return on investment of 632%, in a case in which the risks did not justify such a return, derived over an investment period of less than eighteen months.

44 A funding rate of 25% which provides a return of 502% may also be argued to be too high. The evidence however shows that the case faced risks on liability, and a risk that the quantum of any settlement or judgment would not be sufficient to justify the expense and risk of the proceeding and yet provide class members with a reasonable level of recovery. IMF took on the case with liability and quantum risks at a time when it was uncertain that the case would be successful, and if successful uncertain as to the quantum of any settlement or judgment, with budgeted legal costs of $6.26 million and an exposure to substantial adverse costs.

45 Ultimately the case settled very much in the upper end of the range, and with substantially lower expenditure on legal costs than IMF anticipated would be necessary. That drove the rate of return which, at a 25% funding rate, is above IMF’s average rate of return for such cases. But hindsight bias must be avoided, and IMF took on the risks when the outcome on liability and quantum was uncertain. Further, over the period from post August 2001 to November 2019 while IMF achieved high rates of return in some shareholder class actions and lesser or poor rates of return in others, over time it achieved an average rate of return which I would not describe as excessive or unreasonable. That is, the good results for IMF were balanced by some poor results.

46 To reiterate what I said in Endeavour River No 1 at [29], in Money Max the Full Court said (at [82]) that it expected that the courts:

…will approve funding commission rates that avoid excessive or disproportionate charges to class members but which recognise the important role of litigation funding in providing access to justice, are commercially realistic and properly reflect the costs and risks taken by the funder, and which avoid hindsight bias.

The approval of funding commission rates should not become a “race to the bottom” and funding rates should provide an appropriate reward for the risk undertaken by a litigation funder: Kuterba v Sirtex Medical Limited (No 3) [2019] FCA 1374 at [12] (Beach J).

47 Having regard to the matters above, the relevant considerations set out in Money Max at [80]; the various matters I set out in Endeavour River No 1 at [31] and Mr Bowman’s responses to those matters; the variability in IMF’s rate of return in shareholder class actions; and its average rate of return in shareholder class actions over time, I consider a 25% funding rate is within the range of what is a fair and reasonable funding commission.. It provides IMF a funding commission of $10.5 million, which constitutes a reduction of almost $3 million on the funding commission it sought, and to which class members had agreed.

Settlement approval orders

48 As the issue regarding the reasonableness of the funding commission was the only matter holding up approval of the proposed settlement, I made orders on 20 December 2019 to approve the settlement, including the settlement distribution scheme and the various proposed deductions from the settlement sum prior to any distribution to class members, as follows:

(a) $2,562,393.10 for the applicant’s legal costs and disbursements on a solicitor and own client basis incurred in connection with the proceeding on its own behalf and on behalf of class members;

(b) $130,000 for settlement administration costs;

(c) $19,310.10 for the charges of the Costs Referee;

(d) $5,717.94 for disbursements invoices paid directly by IMF as ‘Project Costs’; and

(e) $12,500 as a reimbursement payment to the applicant.

49 At the hearing on 20 December 2019 Mr Paull filed a further affidavit in support of an application for a further $152,420.22 in costs incurred between the initial settlement approval hearing on 16 October 2019 and 20 December 2019. I took the view that it was not appropriate for class members to be visited with the costs of the dispute regarding the reasonableness of the proposed funding commission, which costs should be met by IMF. Mr Paull informed the Court that $30,000 of those costs did not directly relate to the reasonableness of the funding commission, and I approved that amount of the further costs. I left the balance of the further costs as a matter to be resolved between IMF and Slater & Gordon.

The role of the Contradictor

50 There was no suggestion in this case of any impropriety in relation to legal costs and litigation funding charges by Slater & Gordon or IMF. I appointed the Contradictor to represent the interests of class members in relation to the Funding Commission Issues, as then identified, so as to allow the Court to more effectively discharge its judicial function under s 33V: see Bolitho v Banksia Securities Ltd (No 6) [2019] VSC 653 at [123] (Dixon J). Initially, those issues included:

(a) whether a funding commission of $13,472,805, representing a funding rate of 32.1%, was fair and reasonable in the interests of class members;

and if the 32.1% funding rate is found to be excessive;

(b) whether it is a proper exercise of discretion to refuse to approve the proposed settlement when the settlement is otherwise fair and reasonable and IMF’s entitlement to the proposed funding commission arises under pre-existing contractual agreements with class members;

(c) whether the Court has power, and/or is it a proper exercise of discretion, to approve the settlement but refuse to approve the proposed funding commission in circumstances where IMF’s entitlement to the proposed funding commission arises under pre-existing contractual agreements with class members; and

(d) whether the Court has power, and/or is it a proper exercise of discretion, to reduce the proposed funding commission under the proposed settlement in circumstances where IMF’s entitlement to the proposed funding commission arises under pre-existing contractual agreements with class members.

51 In the finish the only question for determination was whether a funding commission of $10.5 million, representing a 25% funding rate, was fair and reasonable. I consider the Contradictor played a valuable role in narrowing the issues in dispute, and I have no doubt that its involvement in the proceeding was a factor in IMF’s changes of position. The orders provide for IMF to meet the Contradictor’s costs, which are in addition to its own costs of the application.

I certify that the preceding fifty-one (51) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justice Murphy. |

Associate: