FEDERAL COURT OF AUSTRALIA

Australian Securities and Investments Commission v Bendigo and Adelaide Bank Limited [2020] FCA 716

ORDERS

IN THE MATTER OF BENDIGO AND ADELAIDE BANK LIMITED (ABN 11 068 049 178) | ||

AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff | ||

AND: | BENDIGO AND ADELAIDE BANK LIMITED (ABN 11 068 049 178) Defendant | |

THE COURT DECLARES THAT:

First Delphi Bank Contract

1. Pursuant to s 12GND of the Australian Securities and Investments Commission Act 2001 (Cth) (Act), each of clauses 10.1(c), 10.1(j), 10.1(k), 10.1(n), 11.1, 14, 17.6 and 22.1 of the Delphi Bank General Conditions dated July 2015 (Delphi Conditions) that comprises part of the small business contract between the defendant and the First Delphi Party (as identified in a confidential schedule provided to the defendant) dated 17 May 2018 (First Delphi Bank Contract) is an unfair term within the meaning of s 12BG of the Act.

2. Pursuant to s 21 of the Federal Court of Australia Act 1976 (Cth) (FCA Act) or alternatively ss 12GNB and 12GNC of the Act, each of clauses 10.1(c), 10.1(j), 10.1(k), 10.1(n), 11.1, 14, 17.6 and 22.1 of the First Delphi Bank Contract is void ab initio.

Second Delphi Bank Contract

3. Pursuant to s 12GND of the Act, each of clauses 10.1(c), 10.1(j), 10.1(k), 10.1(n), 11.1, 14, 17.6 and 22.1 of the Delphi Conditions that comprises part of the small business contract between the defendant and the Second Delphi Party (as identified in a confidential schedule provided to the defendant) dated 8 February 2018 (Second Delphi Bank Contract) is an unfair term within the meaning of s 12BG of the Act.

4. Pursuant to s 21 of the FCA Act or alternatively s 12GNB and s 12GNC of the Act, each of clauses 10.1(c), 10.1(j), 10.1(k), 10.1(n), 11.1, 14, 17.6 and 22.1 of the Second Delphi Bank Contract is void ab initio.

First Rural Bank Contract

5. Pursuant to s 12GND of the Act, each of clauses 2.3, 2.4, 4.2, 4.4, 8.1(c), 8.1(p), 8.1(q), 8.1(v), 12.1 and 13.1 of the Rural Bank Facility Terms dated November 2016 (Rural Conditions) that comprises part of the small business contract between the defendant and the First Rural Party (as identified in a confidential schedule provided to the defendant) dated 5 June 2017 (First Rural Bank Contract) is an unfair term within the meaning of s 12BG of the Act.

6. Pursuant to s 21 of the FCA Act or alternatively s 12GNB and s 12GNC of the Act, each of clauses 2.3, 2.4, 4.2, 4.4, 8.1(c), 8.1(p), 8.1(q), 8.1(v), 12.1 and 13.1 of the First Rural Bank Contract is void ab initio.

Second Rural Bank Contract

7. Pursuant to s 12GND of the Act, each of clauses 2.3, 2.4, 4.2, 4.4, 8.1(c), 8.1(p), 8.1(q), 8.1(v), 12.1 and 13.1 of the Rural Conditions that comprises part of the small business contract between the defendant and the Second Rural Party (as identified in a confidential schedule provided to the defendant) dated 13 December 2017 (Second Rural Bank Contract) is an unfair term within the meaning of s 12BG of the Act.

8. Pursuant to s 21 of the FCA Act or alternatively s 12GNB of the Act, each of clauses 2.3, 2.4, 4.2, 4.4, 8.1(c), 8.1(p), 8.1(q), 8.1(v), 12.1 and 13.1 of the Second Rural Bank Contract is void ab initio.

Third Rural Bank Contract

9. Pursuant to s 12GND of the Act, each of clauses 2.3, 2.4, 4.2, 4.4, 8.1(c), 8.1(p), 8.1(q), 8.1(v), 12.1 and 13.1 of the Rural Conditions that comprises part of the small business contract between the defendant and the Third Rural Party (as identified in a confidential schedule provided to the defendant) dated 5 July 2017 (Third Rural Bank Contract) is an unfair term within the meaning of s 12BG of the Act.

10. Pursuant to s 21 of the FCA Act or alternatively s 12GNB and s 12GNC of the Act, each of clauses 2.3, 2.4, 4.2, 4.4, 8.1(c), 8.1(p), 8.1(q), 8.1(v), 12.1 and 13.1 of the Third Rural Bank Contract is void ab initio.

Fourth Rural Bank Contract

11. Pursuant to s 12GND of the Act, each of clauses 2.3, 2.4, 4.2, 4.4, 8.1(c), 8.1(p), 8.1(q), 8.1(v), 12.1 and 13.1 of the Rural Conditions that comprises part of the small business contract between the defendant and the Fourth Rural Party (as identified in a confidential schedule provided to the defendant) dated 15 August 2017 (Fourth Rural Bank Contract) is an unfair term within the meaning of s 12BG of the Act.

12. Pursuant to s 21 of the FCA Act or alternatively s 12GNB and s 12GNC of the Act, each of clauses 2.3, 2.4, 4.2, 4.4, 8.1(c), 8.1(p), 8.1(q), 8.1(v), 12.1 and 13.1 of the Fourth Rural Bank Contract is void ab initio.

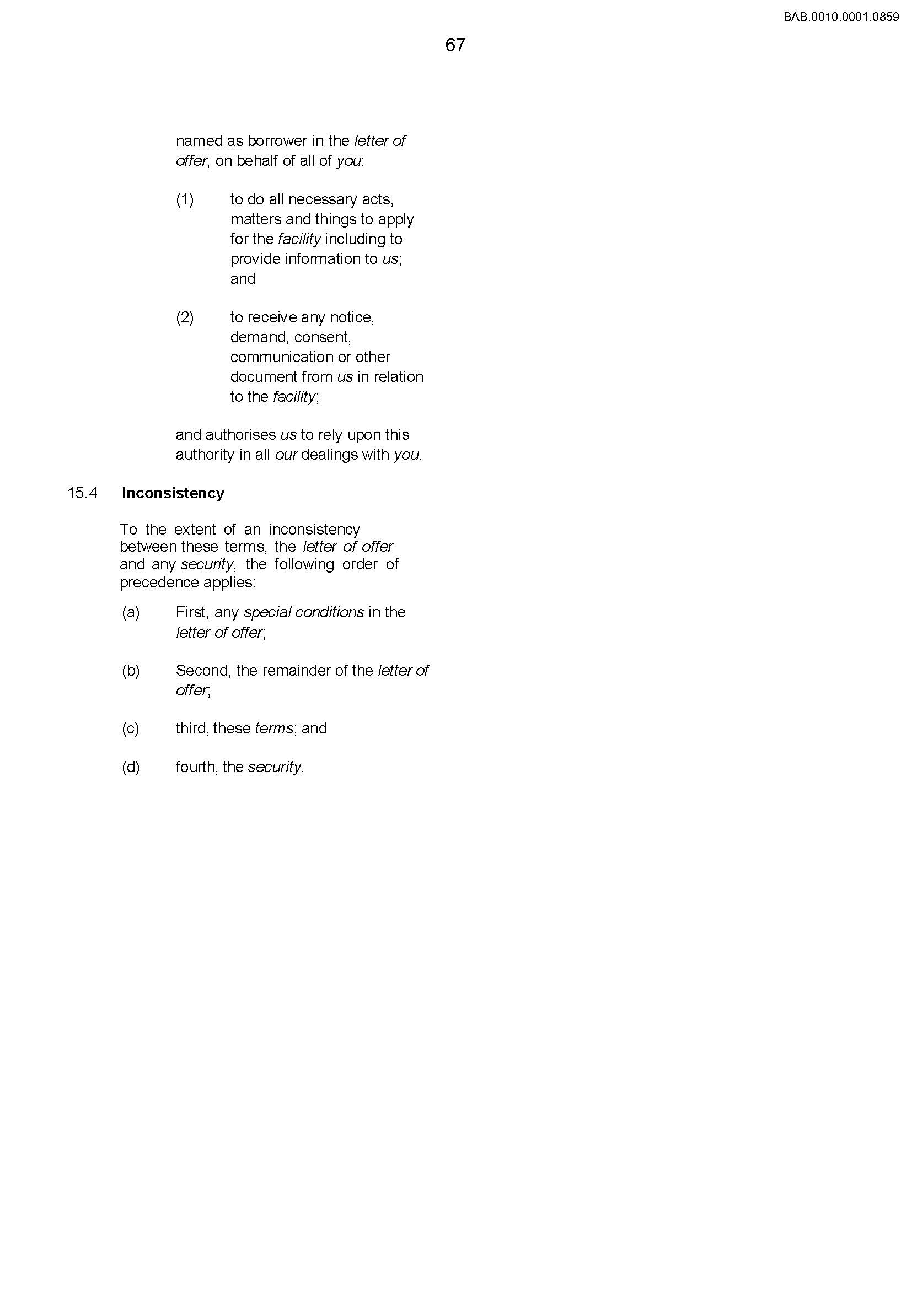

Delphi Conditions

13. Pursuant to s 12GND and s 12GNB of the Act, or alternatively s 21 of the FCA Act, any term in the same form as any of clauses 10.1(c), 10.1(j), 10.1(k), 10.1(n), 11.1, 14, 17.6 and 22.1 of the DelphiConditions in any small business contract entered into or amended or renewed on or after 12 November 2016 between the defendant and any of its customers, which incorporates the Delphi Conditions and meets the definition of a small business contract within the meaning of s 12BF(4) of the Act and which is a standard form contract within the meaning of s 12BK of the Act and is a contract for a financial product or a contract for the supply or possible supply of financial services within the meaning of the Act is an unfair term within the meaning of s 12BG of the Act and is void pursuant to s 12BF(1) of the Act and is void ab initio.

Rural Conditions

14. Pursuant to s 12GND and s 12GNB of the Act, or alternatively s 21 of the FCA Act, any term in the same form as any of clauses 2.3, 2.4, 4.2, 4.4, 8.1(c), 8.1(p), 8.1(q), 8.1(v), 12.1 and 13.1 of the Rural Conditions, in any small business contract entered into or amended or renewed on or after 12 November 2016 between the defendant and any of its customers, which incorporates the Rural Conditions and meets the definition of a small business contract within the meaning of s 12BF(4) of the Act and which is a standard form contract within the meaning of s 12BK of the Act and is a contract for a financial product or a contract for the supply or possible supply of financial services within the meaning of the Act is an unfair term within the meaning of s 12BG of the Act and is void pursuant to s 12BF(1) of the Act and is void ab initio.

THE COURT ORDERS THAT:

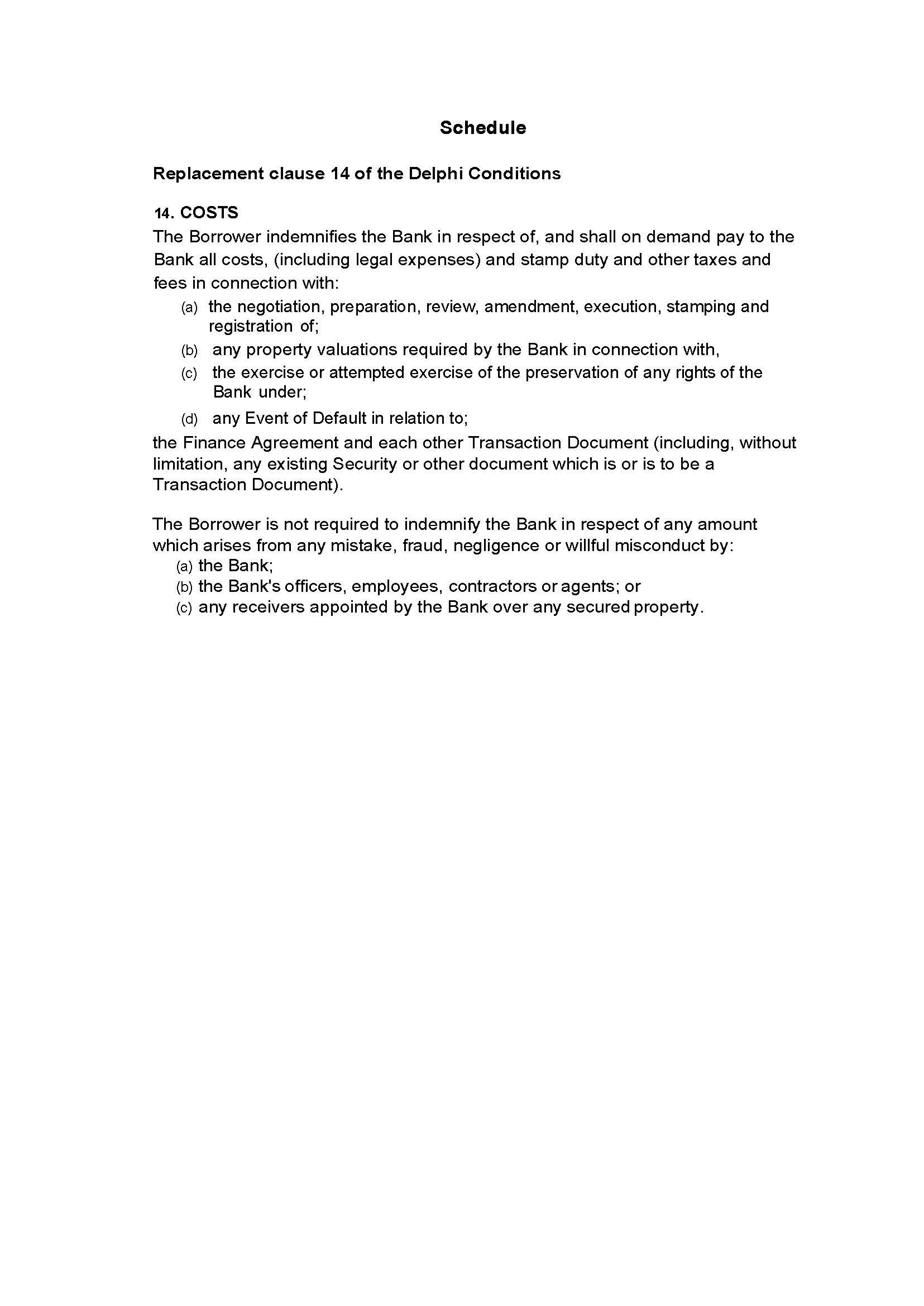

15. Pursuant to s 12GNB of the Act, the First Delphi Bank Contract be varied with effect from the date of the contract by replacing clause 14 with the clause relevantly specified in annexure “A” to these orders.

16. Pursuant to s 12GNB of the Act, the Second Delphi Bank Contract be varied with effect from the date of the contract by replacing clause 14 with the clause relevantly specified in annexure “A” to these orders.

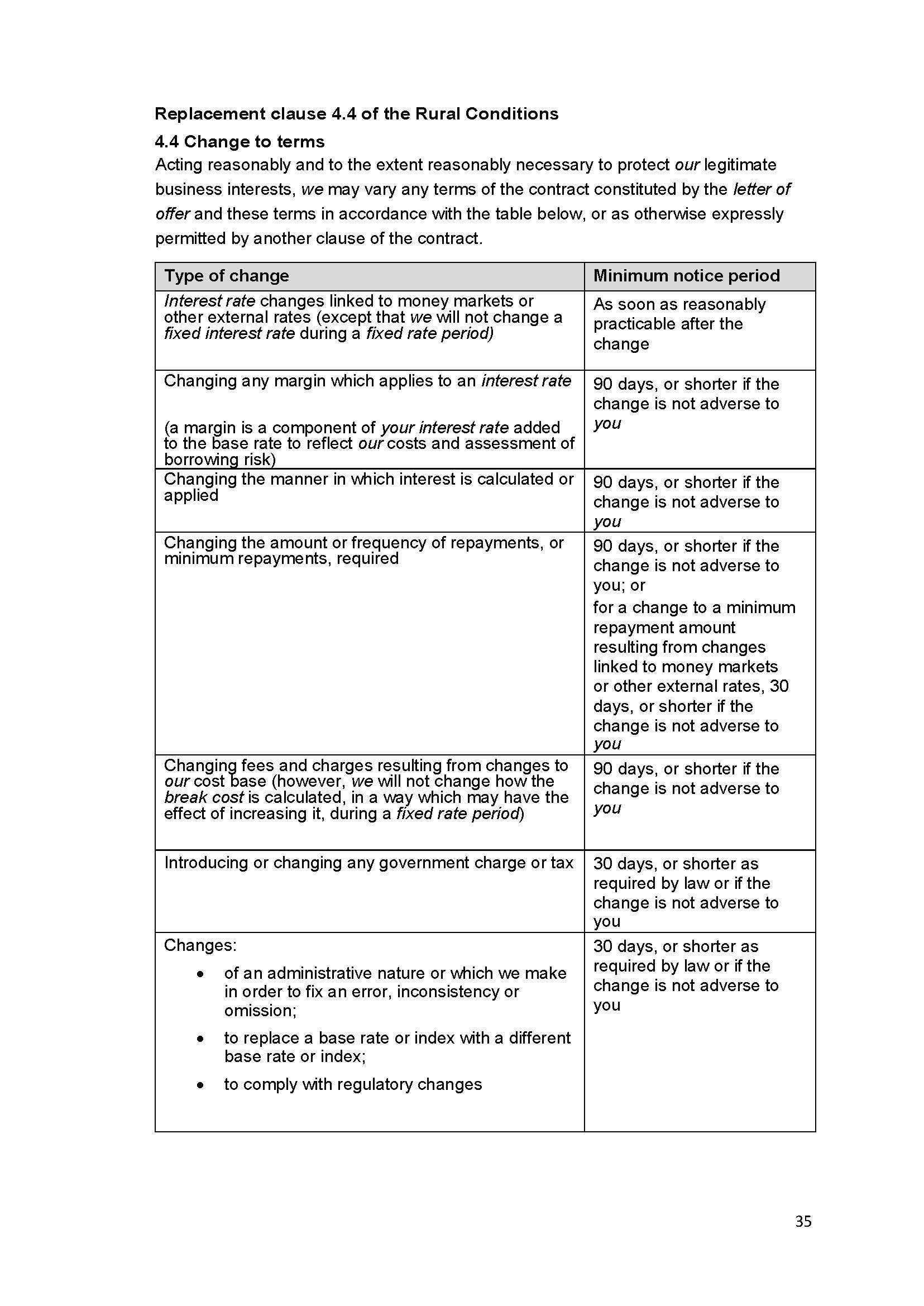

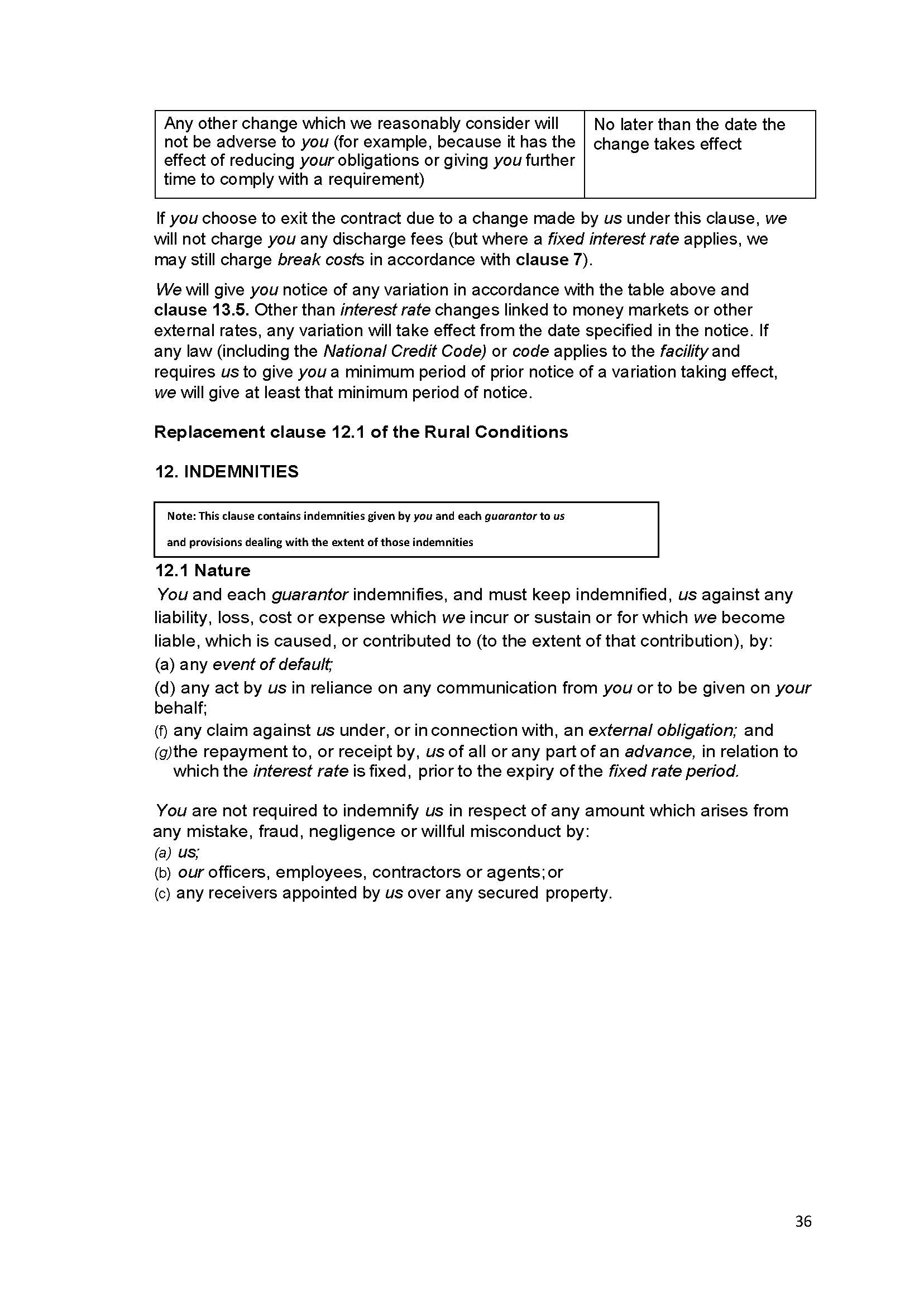

17. Pursuant to s 12GNB of the Act, the First Rural Bank Contract be varied with effect from the date of the contract by replacing clauses 4.4 and 12.1 with the clauses relevantly specified in annexure “A” to these orders.

18. Pursuant to s 12GNB of the Act, the Second Rural Bank Contract be varied with effect from the date of the contract by replacing clauses 4.4 and 12.1 with the clauses relevantly specified in annexure “A” to these orders.

19. Pursuant to s 12GNB of the Act, the Third Rural Bank Contract be varied with effect from the date of the contract by replacing clauses 4.4 and 12.1 with the clauses relevantly specified in annexure “A” to these orders.

20. Pursuant to s 12GNB of the Act, the Fourth Rural Bank Contract be varied with effect from the date of the contract by replacing clauses 4.4 and 12.1 with the clauses relevantly specified in annexure “A” to these orders.

21. The defendant file and serve its undertaking to the Court not to use or rely upon certain contract terms, referred to in para 3 of the joint submissions filed on 7 May 2020, within seven days of the date of this order.

22. The defendant pay the plaintiff’s costs of the proceeding.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ANNEXURE “A”

GLEESON J:

1 The plaintiff (ASIC) seeks declarations and other orders in connection with certain contracts used by the defendant (Bank) through two divisions, called Delphi Bank and Rural Bank. ASIC alleges and the Bank accepts that the contracts contain terms that are unfair within the meaning of s 12BG(1) of the Australian Securities and Investments Commission Act 2001 (Cth) (Act) and are therefore void pursuant to s 12BF(1) of the Act.

2 The impugned terms are contained in:

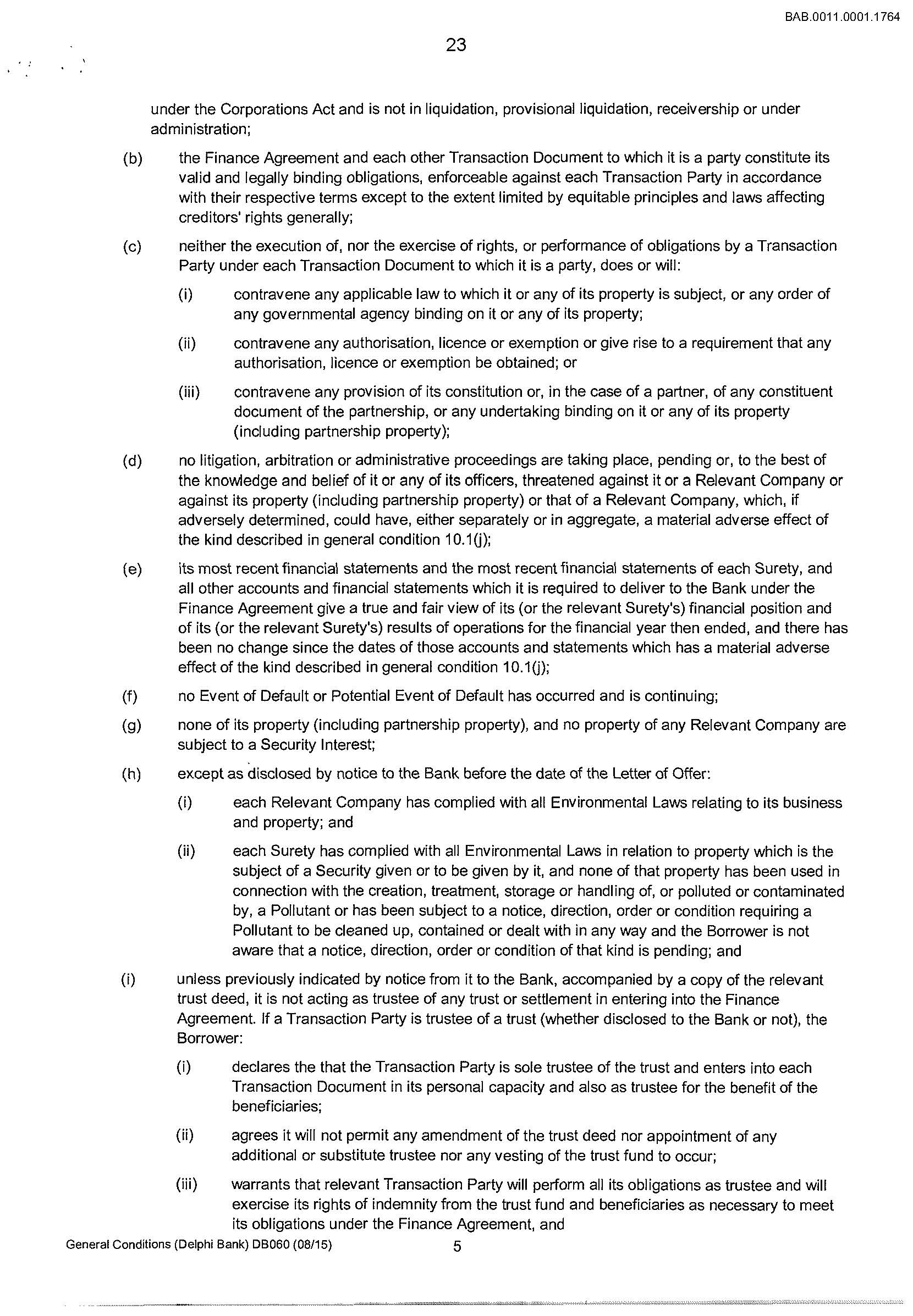

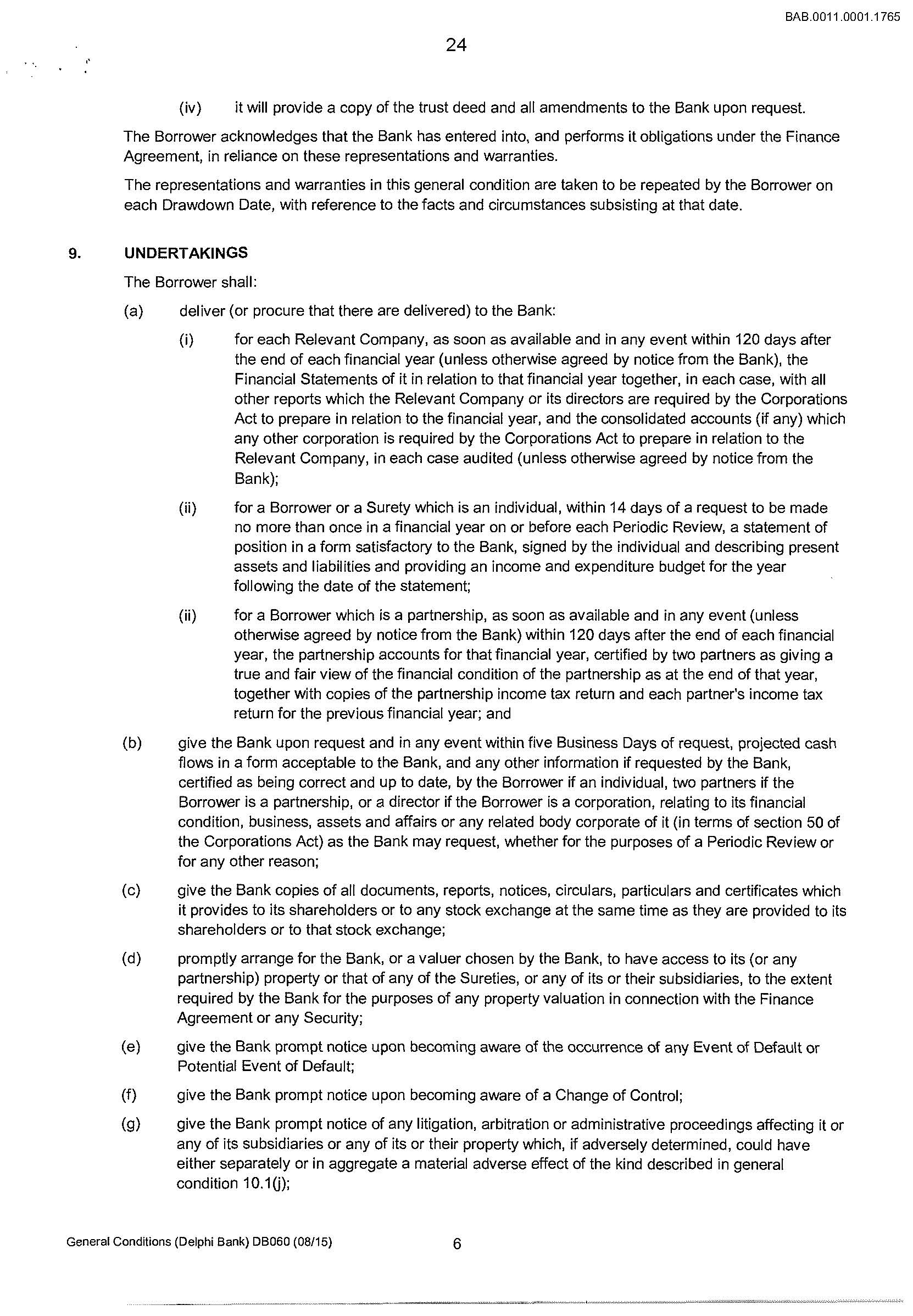

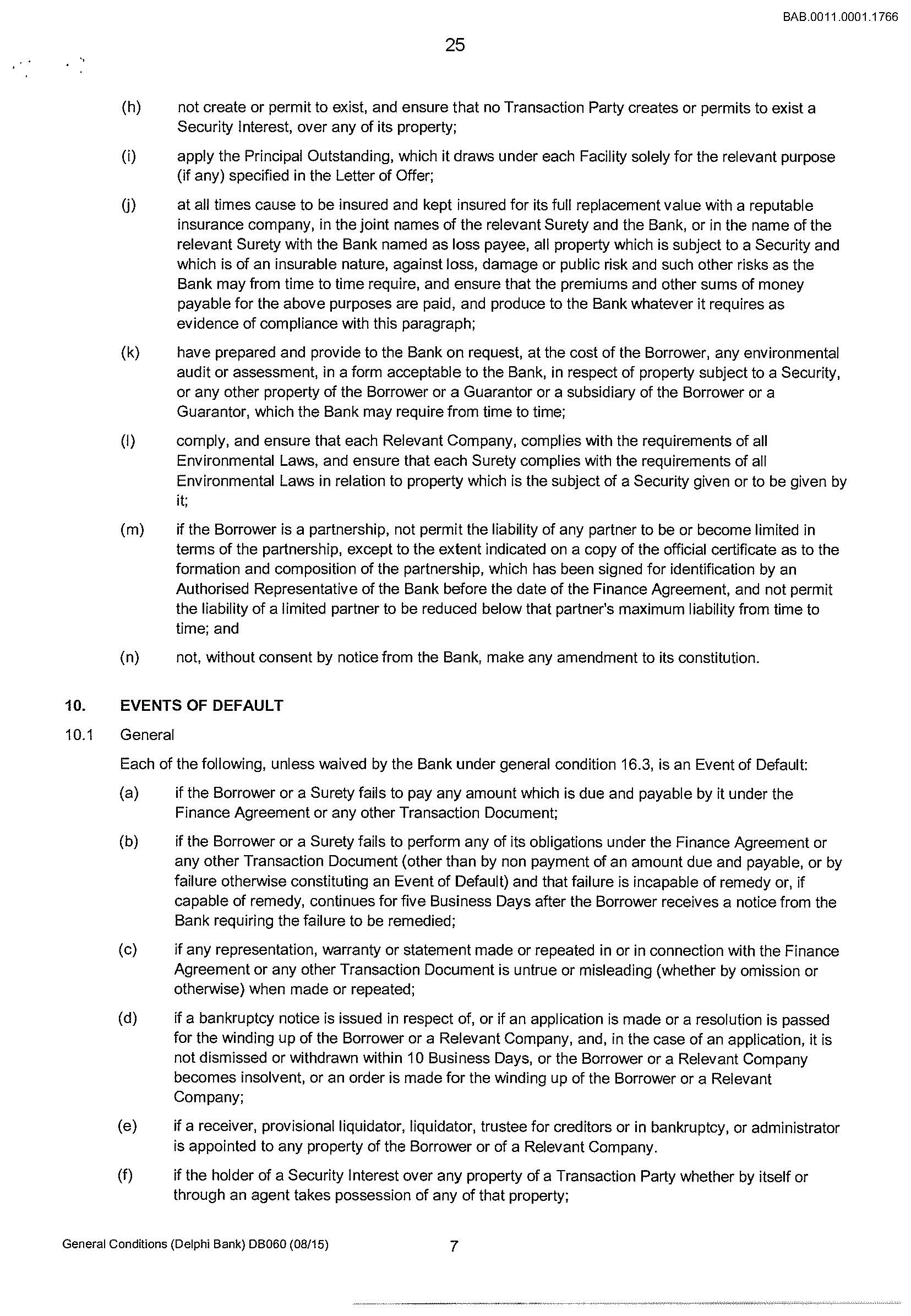

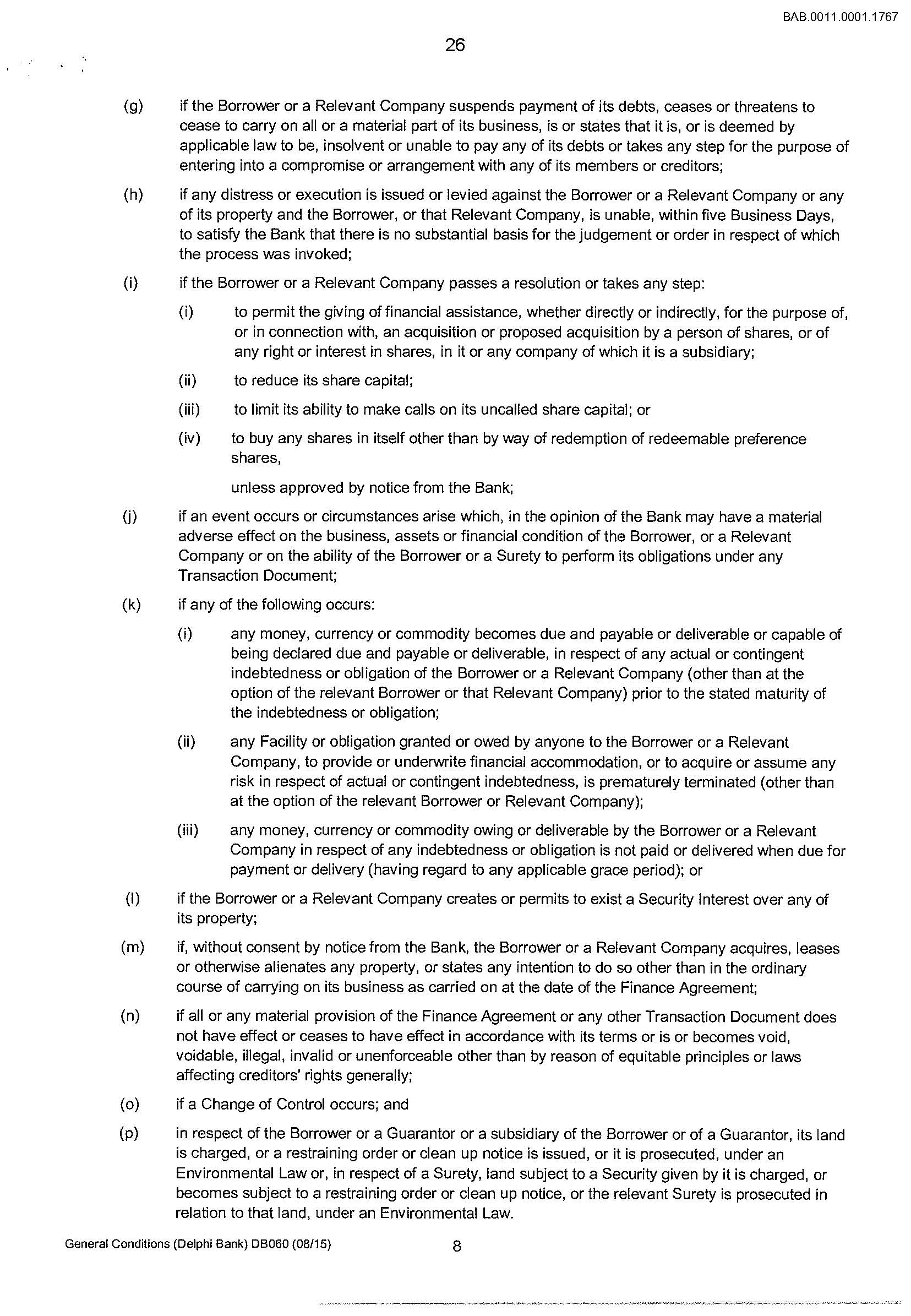

(1) the Delphi Bank General Conditions dated July 2015 (Delphi Conditions); and

(2) the Rural Bank Facility Terms (2016 Version 1) dated November 2016 (Rural Conditions).

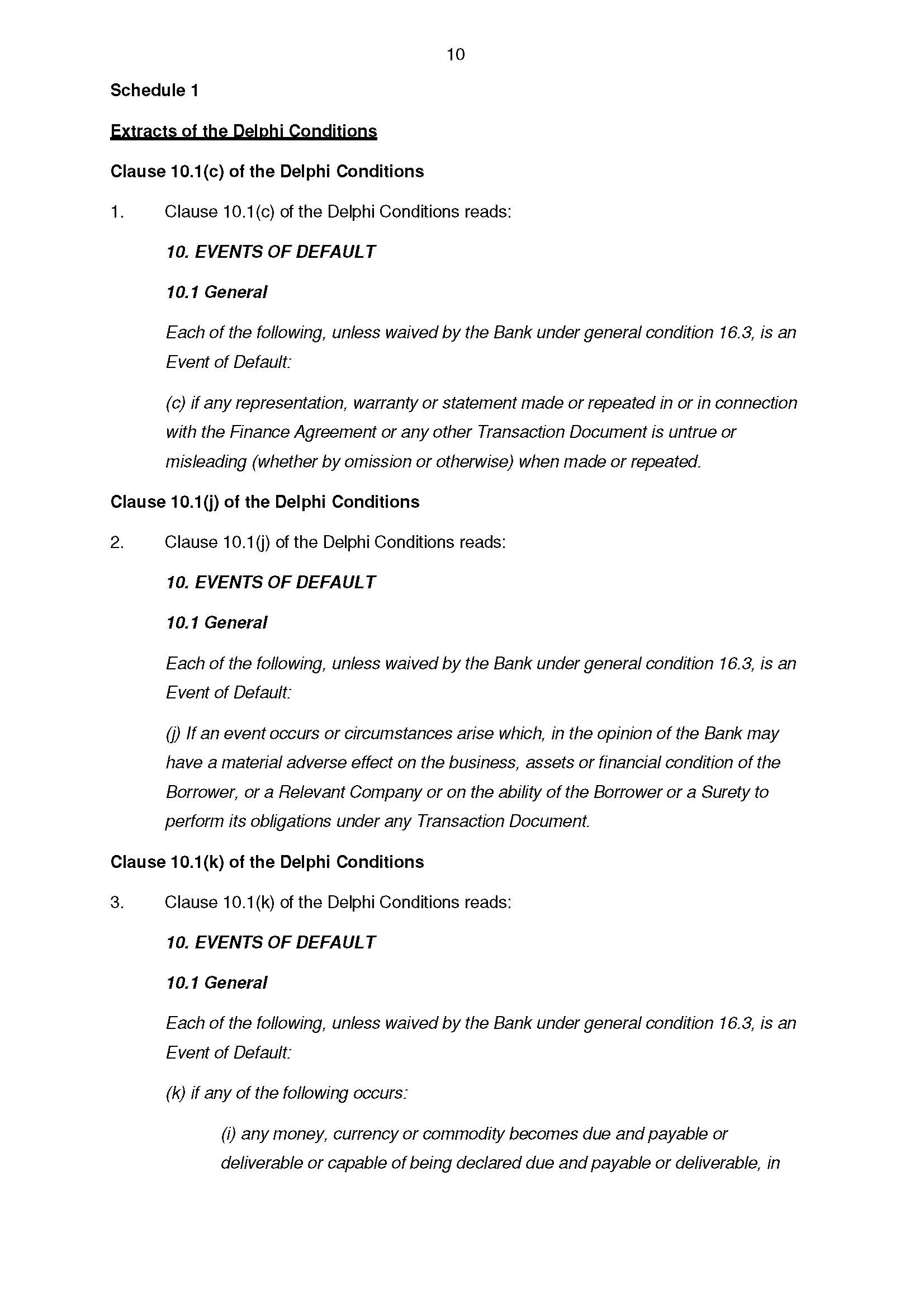

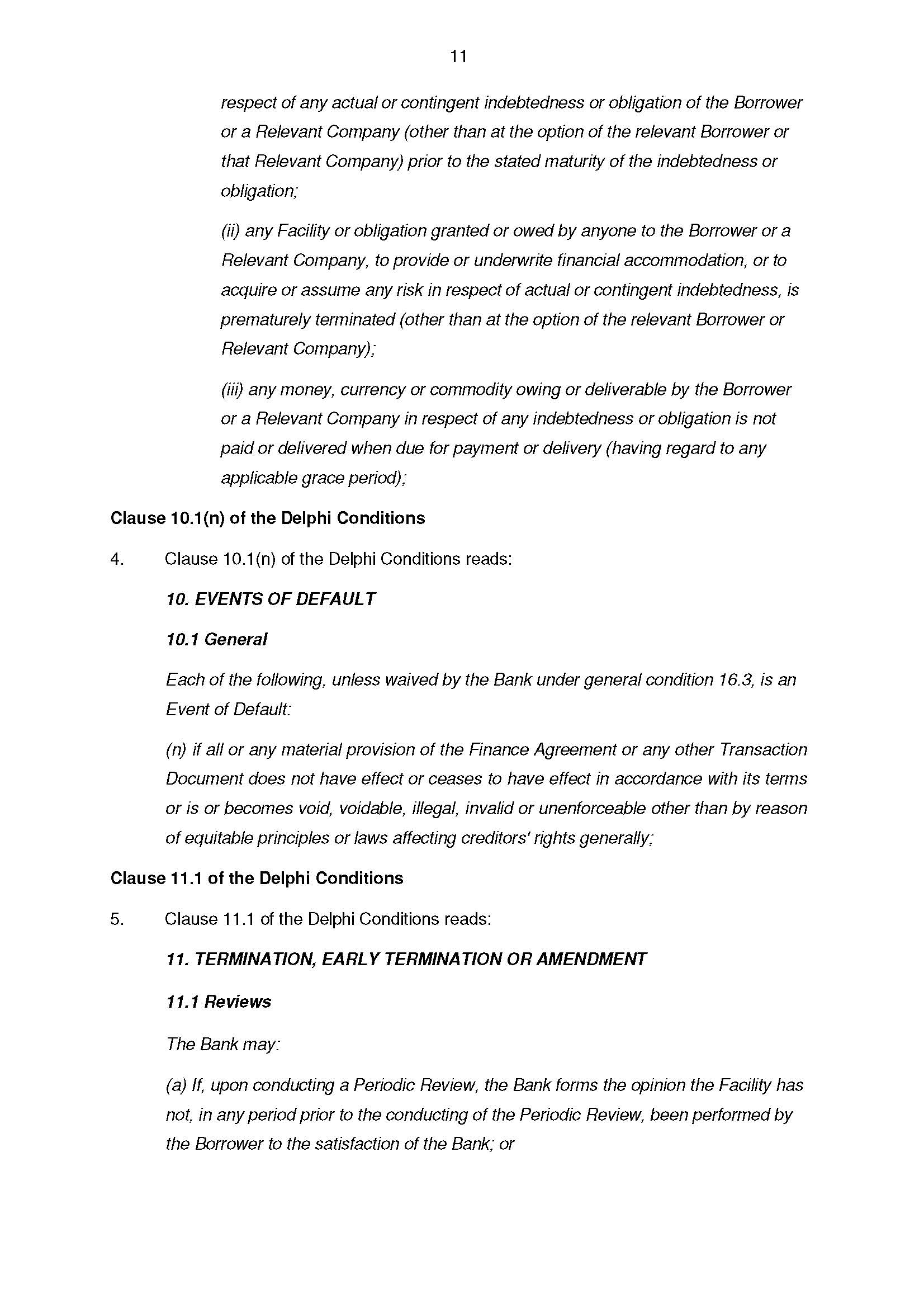

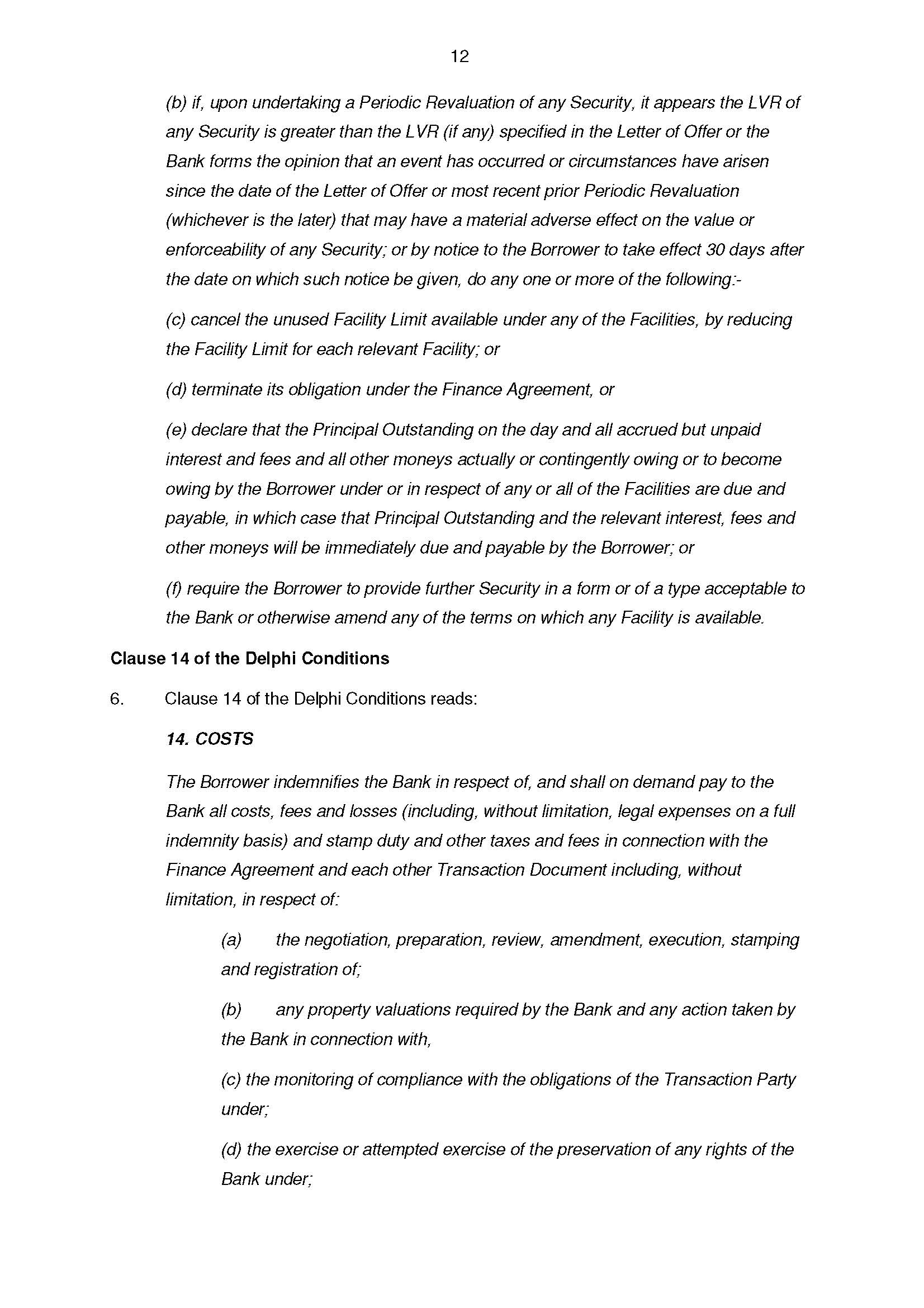

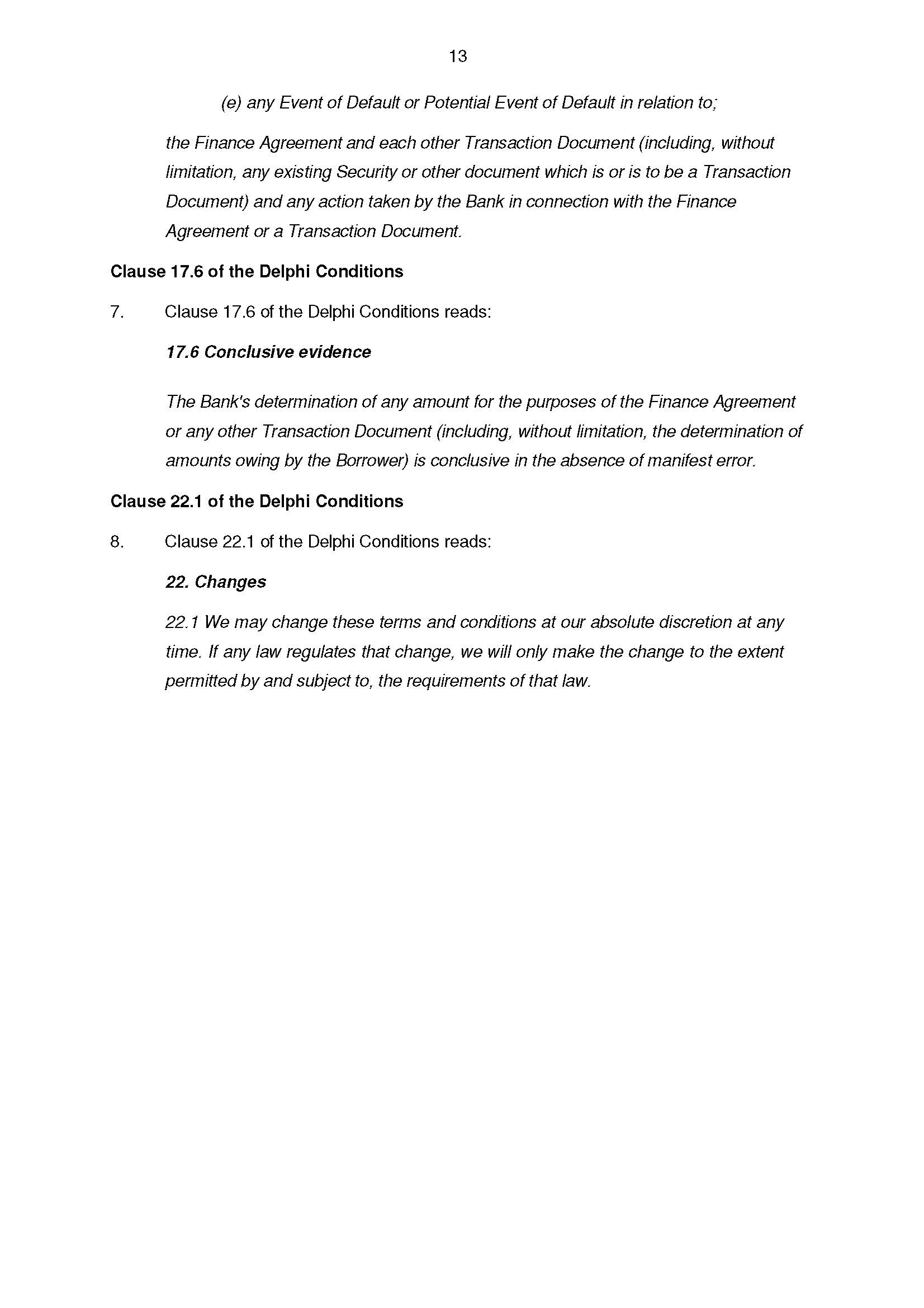

3 The impugned terms are set out at Schedules 1 and 2 to these reasons. A complete version of the Delphi Conditions is contained in Schedule 3 to these reasons. A complete version of the Rural Conditions is contained in Schedule 4 to these reasons.

4 The parties filed joint submissions in relation to the relief sought by ASIC, including proposed orders to be sought from the Court to resolve the proceeding.

5 ASIC does not allege that the Bank has relied upon any of the impugned terms in a manner that is unfair, or that has caused any customers to suffer loss or damage. The Bank has given an undertaking to ASIC and will give an undertaking to the Court, not to use or rely upon any of the impugned terms. Consequently, ASIC has withdrawn its claim for injunctive relief against the Bank.

6 For the reasons set out below, I am satisfied that the Court has power to make the proposed orders and that it is appropriate to make orders substantially in the terms sought.

Consumer protection in relation to unfair contract terms

7 Part 2 of the Act is headed “Australian Securities and Investments Commission and consumer protection in relation to financial services”. Division 2 of Pt 2 is headed “Unconscionable conduct and consumer protection in relation to financial services” and deals with unfair contract terms, unconscionable conduct, consumer protection and conditions and warranties in consumer transactions.

8 This matter is concerned with ss 12BF, 12BG, 12BH and 12BK, in Subdiv BA of Div 2 which is headed ‘Unfair contract terms’.

9 Section 12BF provides, relevantly:

(1) A term of a … small business contract is void if:

(a) the term is unfair; and

(b) the contract is a standard form contract; and

(c) the contract is:

(i) a financial product; or

(ii) a contract for the supply, or possible supply, of services that are financial services.

(2) The contract continues to bind the parties if it is capable of operating without the unfair term.

...

(4) A contract is a small business contract if:

(a) at the time the contract is entered into, at least one party to the contract is a business that employs fewer than 20 persons; and

(b) either of the following applies:

(i) the upfront price payable under the contract does not exceed $300,000;

(ii) the contract has a duration of more than 12 months and the upfront price payable under the contract does not exceed $1,000,000.

(5) In counting the persons employed by a business for the purposes of paragraph (4)(a), a casual employee is not to be counted unless he or she is employed by the business on a regular and systematic basis.

(6) For the purposes of subsection (4) and despite subsection 12BI(3), in working out the upfront price payable under a contract under which credit is or is to be provided, disregard any interest payable under the contract.

10 Section 12BK(1) provides that if a party to a proceeding alleges that a contract is a standard form contract, it is presumed to be a standard form contract unless another party to the proceeding proves otherwise.

11 Relevantly, s 12BAA(7)(k) provides that, subject to subs (8), a “credit facility (within the meaning of the regulations)” is a financial product for the purposes of Div 2.

12 Regulation 2B(1) of the Australian Securities and Investments Commission Regulations 2001 (Cth) (Regulations) provides that the provision of credit for any period is a “credit facility” for the purposes of s 12BAA(7)(k). By reg 2B(3)(a), “credit” means a contract, arrangement or understanding under which payment of a debt owed by one person (a debtor) to another person (a credit provider) is deferred or a debtor incurs a deferred debt to a credit provider. By reg 2B(3)(b)(i) and (ix), “credit” includes any form of financial accommodation and a financial benefit arising from or as a result of a loan.

13 Section 12BG deals with when a term will be ‘unfair’ and provides that:

(1) A term of a contract referred to in subsection 12BF(1) is unfair if:

(a) it would cause a significant imbalance in the parties’ rights and obligations arising under the contract; and

(b) it is not reasonably necessary in order to protect the legitimate interests of the party who would be advantaged by the term; and

(c) it would cause detriment (whether financial or otherwise) to a party if it were to be applied or relied on.

(2) In determining whether a term of a contract is unfair under subsection (1), a court may take into account such matters as it thinks relevant, but must take into account the following:

(b) the extent to which the term is transparent;

(c) the contract as a whole.

(3) A term is transparent if the term is:

(a) expressed in reasonably plain language; and

(b) legible; and

(c) presented clearly; and

(d) readily available to any party affected by the term.

(4) For the purposes of paragraph (1)(b), a term of a contract is presumed not to be reasonably necessary in order to protect the legitimate interests of the party who would be advantaged by the term, unless that party proves otherwise.

14 Section 12BH provides some examples of the kind of terms that may be unfair including, relevantly:

(a) a term that permits, or has the effect of permitting, one party (but not another party) to avoid or limit performance of the contract;

(b) a term that permits, or has the effect of permitting, one party (but not another party) to terminate the contract;

(c) a term that penalises, or has the effect of penalising, one party (but not another party) for a breach or termination of the contract;

(d) a term that permits, or has the effect of permitting, one party (but not another party) to vary the terms of the contract;

…

(g) a term that permits, or has the effect of permitting, one party unilaterally to vary financial services to be supplied under the contract;

(h) a term that permits, or has the effect of permitting, one party unilaterally to determine whether the contract has been breached or to interpret its meaning;

(i) a term that limits, or has the effect of limiting, one party’s vicarious liability for its agents;

…

(k) a term that limits, or has the effect of limiting, one party’s right to sue another party;

…

(m) a term that imposes, or has the effect of imposing, the evidential burden on one party in proceedings relating to the contract.

Unfairness: case law

15 The parties accepted that the case law dealing with the corresponding legislative regime in Chapter 2 of the Australian Consumer Law, Schedule 2 to the Competition and Consumer Act 2010 (Cth) (ACL) is relevant to the interpretation of the provisions applicable in this case.

16 Section 24 of the ACL is in identical terms to s 12BG of the Act.

17 The underlying policy of unfair contract terms legislation respects true freedom of contract and seeks to prevent the abuse of standard form consumer contracts which, by definition, will not have been individually negotiated: Australian Competition and Consumer Commission v CLA Trading Pty Ltd [2016] FCA 377; (2016) ATPR 42-517 (CLA Trading) at [54(a)], Jetstar Airways Pty Ltd v Free [2008] VSC 539 (Jetstar) at [112].

18 There is no presumption that terms of the kind listed in s 12BH are unfair. However, a contextual approach to statutory interpretation cannot ignore the matters at s 12BH which are specifically provided for the purpose of giving examples of potentially unfair terms: Australian Competition and Consumer Commission v Chrisco Hampers Australia Limited [2015] FCA 1204; (2015) 239 FCR 33; [2015] ATPR 42-513 (Chrisco) at [44].

19 Unfairness can be created by a number of terms operating in conjunction to create an overall effect: Australian Competition and Consumer Commission v Ashley & Martin Pty Ltd [2019] FCA 1436 (Ashley & Martin) at [160].

20 The assessment of “unfairness” is to be carried out with a close attendance to the statutory provisions and is of a lower moral or ethical standard than unconscionability: Paciocco v Australia and New Zealand Banking Group Ltd [2015] FCAFC 50; (2015) 236 FCR 199 at [363]-[364].

Significant imbalance in parties rights and obligations: 12GB(1)(a)

21 Relevant principles outlined in CLA Trading at [54] include:

(b) the requirement of a “significant imbalance” directs attention to the substantive unfairness of the contract: Director-General of Fair Trading v First National Bank plc [2001] UKHL 52; [2002] 1 AC 481 at [37];

…

(d) the “significant imbalance” requirement is met if a term is so weighted in favour of the supplier as to tilt the parties’ rights and obligations under the contract significantly in its favour – this may be by the granting to the supplier of a beneficial option or discretion or power, or by the imposing on the consumer of a disadvantageous burden or risk or duty: Director-General of Fair Trading v First National Bank at 494 [17] per Lord Bingham, applied in ACCC v ACN 117 372 915 Pty Ltd (in liq) (formerly Advanced Medical Institute Pty Ltd) [2015] FCA 368 at [950];

(e) significant in this context means “significant in magnitude”, or “sufficiently large to be important”, “being a meaning not too distant from substantial”: Jetstar … at [104]-[105] per Cavanough J: Cf. Director of Consumer Affairs Victoria v AAPT Ltd [2006] VCAT 1493 at [32]- [33];…

22 The lack of individual negotiation of contracts between an entity and its customers is not relevant to whether a term causes a significant imbalance in the rights and obligations arising under the contract. The assessment of that question requires consideration of the relevant term together with the parties’ other rights and obligations arising under the contract: Chrisco at [50]-[51].

23 It is suggested in CLA Trading at [54(c)] that it is useful to assess the impact of an impugned term on the parties’ rights and obligations by comparing the effect of the contract with the term and the effect it would have without it. This exercise is less appropriate where the alleged unfairness is not created by a single term but by a number of terms operating in conjunction: Ashley & Martin at [160].

24 Factors that have been identified as relevant include whether:

(1) The customer can “opt-out” of an unfair term: Chrisco at [52].

(2) The contract gives one party a right without imposing on that party a corresponding duty or without giving any substantial corresponding right to the counterparty: Chrisco at [53]. A relevant example for the purposes of this matter is at Australian Competition and Consumer Commission v JJ Richards & Sons Pty Ltd [2017] FCA 1224; [2017] ATPR 42-558 (JJ Richards) at [56(b)]. In that case, the price variation clause allowed the supplier to unilaterally increase the price of services for any reason. That clause created a significant imbalance in the absence of any corresponding right of the customer to terminate the contract or obtain a change to the scope or scale of services provided under the contract in response to a price increase.

(3) The party advantaged by the term is better placed to manage or mitigate the risk imposed by the term than the customer: JJ Richards at [56(c), (g)]. An example relevant to this matter is found at JJ Richards at [56(g)]. There, an indemnity clause created an unlimited indemnity in favour of the supplier, even where the loss incurred by the supplier was not the customer’s fault and the supplier could have avoided or mitigated the risk.

Not reasonably necessary to protect legitimate interests: 12GB(1)(b)

25 It is for the party advantaged by an impugned term to rebut the presumption at s 12BG(4) and prove that the impugned term is reasonably necessary to protect its legitimate interests: Chrisco at [43]. ASIC relies on the presumption to support its case that none of the impugned terms was at any relevant time reasonably necessary to protect the Bank’s legitimate interests.

26 The parties noted the following relevant principles for completeness:

(1) What is a “legitimate interest” and what is “reasonably necessary” will depend on the particular business of the supplier, including the particular circumstances of the business and the context of the contract as a whole: Ashley & Martin at [48], [51].

(2) “Legitimate interests” may be of a business or a financial nature and are not necessarily monetary. A party may have interests in contractual performance that are intangible and unquantifiable: Paciocco v Australia and New Zealand Banking Group Ltd [2016] HCA 28; (2016) 258 CLR 525 at [29], [161] and [266].

(3) An analysis of what alternatives are available to the party protected by the impugned term and proportionality may be relevant to the question of what is “reasonably necessary” to protect a parties’ legitimate interests: Ashley & Martin at [54]-[59], [168]; JJ Richards at [58(h)].

Detriment

27 More than a mere possibility of detriment is required: Ashley & Martin at [60].

28 Relevant examples of detriment include:

(1) terms that would allow the supplier to charge the customer for damage because the customer has committed a breach of the contract that did not cause or contribute to the damage: CLA Trading at [80]; and

(2) fees imposed on termination of a contract for medical services, comprising a 15% administration fee, a pro-rata fee for the expired portion of the treatment, a pro-rata fee for the 30 day notice period and the cost of medication supplied or prepared for the patient, whether the reason for termination was a change of mind very soon after a phone consultation, a severe adverse side effect or where the relevant medication proved ineffective: Australian Competition and Consumer Commission v ACN 117 372 915 Pty Limited (in liq) (formerly Advanced Medical Institute Pty Limited) [2015] FCA 368; [2015] ATPR 42-498 (Advanced Medical Institute) at [951].

Transparency

29 As appears above, s 12BG(3) specifies characteristics of a transparent term, namely, that it is expressed in reasonably plain language; legible; presented clearly and readily available to any party affected by the term.

30 Transparency is to be considered in relation to the particular term that is said to be unfair and only in relation to the matters concerning that term at s 12BG(1)(a)-(c): Chrisco at [43].

31 If a term is not transparent it does not mean that it is unfair and if a term is transparent, it does not mean that it is not unfair: Chrisco at [43].

32 In JJ Richards, Moshinsky J found (at [60]) that terms were not transparent where they were drafted in legal language and not in plain English; they were presented in a very small font size, and not in a way that drew them to the customer’s attention, when they could have been presented in a manner that was clearer and more readily accessible to a small business customer.

33 In Chrisco at [81], Edelman J found that a term that did not clearly identify amounts that the customer will be charged or the means by which those amounts would be determined was not plain. In Advanced Medical Institute, North J found (at [953]) that a term lacked transparency “to a significant extent” where the basis of calculation of an administration fee imposed by the term was not disclosed; the method of calculation of the cost of medication was not disclosed; the term itself was disclosed in a recorded message and the patient was not provided with a written copy of the term until after the contract was entered into, except in the case of patients who attended clinics.

34 Another matter relevant to transparency is whether terms interact with each other but do not refer to each other: Chrisco at [91].

Contract as a whole: s 12BG(2)(c)

35 “In considering ‘the contract as a whole’, not each and every term of the contract is equally relevant, or necessarily relevant at all. The main requirement is to consider terms that might reasonably be seen as tending to counterbalance the term in question”: CLA Trading at [54(g)], citing Jetstar at [128].

36 It is appropriate to consider how impugned terms interact and how non-impugned terms might ameliorate the impact of impugned terms: JJ Richards at [61], [63].

Agreed Facts

37 The Bank is a publicly listed entity and the holder of an Australian Financial Services Licence. Delphi Bank and Rural Bank are divisions of the Bank.

38 The Bank is Australia’s fifth largest retail bank with around 1.7 million customers, more than $70 billion of assets under management and a market capitalisation of around $5.2 billion. It is a top 100 listed company on the Australian Stock Exchange.

Impugned contracts

39 The Bank has used the Delphi Conditions since at least November 2016 and the Rural Conditions since at least April 2017.

40 Between 12 November 2016 and 30 June 2019, the Bank entered into at least:

(1) 147 facilities which incorporated the Delphi Conditions for which the upfront price payable under the contract did not exceed $300,000;

(2) 457 facilities which incorporated the Delphi Conditions for which the contract had a duration of more than 12 months and the upfront price payable under the contract did not exceed $1 million;

(3) 1,766 facilities which incorporated the Rural Conditions for which the upfront price payable under the contract did not exceed $300,000; and

(4) 1,333 facilities which incorporated the Rural Conditions for which the contract had a duration of more than 12 months and the upfront price payable under the contract exceeded $300,000 but did not exceed $1 million,

(individually, relevant facility and collectively, relevant facilities).

41 As at 30 June 2019, the Bank had:

(1) 94 active facilities which incorporated the Delphi Conditions and had a contract value of less than $300,000;

(2) 202 active facilities which incorporated the Delphi Conditions and had a contract value of less than $1 million;

(3) 10,485 active facilities which incorporated the Rural Conditions and had a contract value of less than $300,000; and

(4) 5,044 active facilities which incorporated the Rural Conditions and had a contract value of less than $1 million.

Individual contracts

42 ASIC illustrated its case by reference to six particular relevant facilities. Of these, two contracts incorporate the Delphi Conditions and four contracts incorporate the Rural Conditions.

43 The parties noted the following matters concerning the individual contracts:

(1) The first Delphi Bank contract is a business loan incorporating the Delphi Conditions for $150,000 with a term of 10 years. At the time of entry into the contract, the other party to the contract, (First Delphi Bank Party) conducted a business that had between six and eight employees.

(2) The second Delphi Bank contract is a business loan incorporating the Delphi Conditions for $252,000 with a term of 25 years. At the time of entry into the contract, the other party to the contract (Second Delphi Bank Party) conducted a business that had no employees.

(3) The first Rural Bank contract is a facility incorporating the Rural Conditions for up to $425,000 for 60 months. At the time of entry into the contract, the other party to the contract (First Rural Bank Party) conducted a business that had no permanent employees or employees employed on a regular and systematic basis.

(4) The second Rural Bank contract is a facility incorporating the Rural Conditions for up to $385,000 for 60 months. At the time of entry into the contract, the other party to the contract (Second Rural Bank Party) conducted a business that had no permanent employees or employees employed on a regular and systematic basis.

(5) The third Rural Bank contract is a facility incorporating the Rural Conditions for up to $200,000, repayable on demand. At the time of entry into the contract, the other party to the contract (Third Rural Bank Party) conducted a business that had no permanent employees or employees employed on a regular and systematic basis.

(6) The fourth Rural Bank contract is a facility that incorporates the Rural Conditions for up to $150,000, repayable on demand. At the time of entry into the contract, the other party to the contract, (Fourth Rural Bank Party) conducted a business that had no permanent employees or employees employed on a regular and systematic basis.

Application of law to relevant facilities and individual contracts

44 The parties agreed that some, likely a significant number, of the relevant facilities are small business contracts within the meaning of s 12BF(4).

45 The parties also agreed that each of the individual contracts is a small business contract within the meaning of s 12BF(4).

46 The Bank accepted that each relevant facility (including each of the six individual contracts) is a standard form contract within the meaning of s 12BK.

47 The Bank also accepted that each relevant facility (including each of the six individual contracts) is:

(1) A credit facility within the meaning of s 12BAA(7)(k) of the Act and the Regulations; and

(2) A financial product or a contract for the supply, or possible supply of services that are financial services within the meaning of s 12BF(1)(c) of the Act.

Unfair Terms

48 The impugned terms fall into the following four categories:

(1) indemnification clauses (cl 14 of the Delphi Conditions and cl 12.1 of the Rural Conditions);

(2) event of default clauses (cll 8(1)(c), (p), (q) and (v) of the Delphi Conditions and cll 10.1(c), (j), (k) and (n) of the Rural Conditions);

(3) unilateral variation or termination clauses (cll 11.1 and 22.1 of the Delphi Conditions and cll 2.3, 2.4, 4.2 and 4.4 of the Rural Conditions); and

(4) conclusive evidence clauses.

Indemnification clauses

49 On their proper construction, cl 14 of the Delphi Conditions and cl 12.1 of the Rural Conditions can be relied on by the Bank to make the customer liable for liability, loss or costs suffered or incurred by the Bank that:

(1) the customer has not caused; and/or

(2) has been caused by the Bank’s mistake, error or negligence; and/or

(3) could have been avoided or mitigated by the Bank.

50 The indemnification extends to the Bank’s servants and agents (in respect of the Rural Conditions, this is so because of cl 12.3).

51 These terms create a significant imbalance in the parties’ rights and obligations in that:

(1) the customer has no corresponding rights;

(2) the circumstances in which the liability, loss or costs may be incurred are not within the customer’s control; and

(3) the Bank controls at least some of the circumstances in which the liability, loss or costs may be incurred and can avoid or mitigate that liability, loss or costs.

52 These terms create detriment to the customer if applied or relied upon in an unfair manner because, in the above circumstances, the customer may be required to pay monies to the Bank in which the liability, loss or costs incurred are not within the customer’s control, and may not have been caused by the customer, and may have been caused by the mistake, error or negligence of the Bank or its agents, and could have been avoided or mitigated by the Bank or its agents.

53 The terms fall within the list of examples of terms set out in s 12BH(1) that may be unfair: see ss 12BH(1)(i) and (k). When regard is had to the Delphi Conditions and the Rural Conditions as a whole, there is nothing otherwise within the terms of the Delphi Conditions and the Rural Conditions which mitigates the unfairness of these terms.

54 ASIC submits that the terms are not transparent within the meaning of s 12BG(3) because they are not expressed in reasonably plain language or presented clearly. ASIC further submitted that the terms are drafted in legal language and are not by their font or position in the contract drawn to the customer’s attention (as distinct from other terms). In addition, taking for example Rural Conditions cl 12.1, to read this term in its entirety, it is necessary to read 35 definitions, including definitions that refer to other definitions. The Bank disagrees. However, the parties jointly submit that whether or not the Court determines that the terms lack transparency, the terms are in any event unfair under s 12GB(1).

55 As to cl 14 of the Delphi Conditions, I accept that it is not transparent in that it does not express the breadth of the borrowers’ obligation in reasonably plain terms, instead setting out a multiplicity of examples “without limitation”. The reference to “legal expenses on a full indemnity basis” is also not reasonably plain.

56 I also accept that cl 12.1 of the Rural Conditions lacks transparency because it does not state in reasonably plain terms the scope of the borrowers’ obligation, and contains a multiplicity of cross-references.

57 The parties submitted that an indemnity clause may be appropriately restricted in its application so as not to fall within the ambit of the legislation. As explained below, the parties seek orders to vary the Delphi Conditions and the Rural Conditions to include amended forms of cl 14 of the Delphi Conditions and cl 12.1 of the Rural Conditions which are appropriately restricted.

Event of default clauses

58 The significant imbalance in the event of default impugned terms is created:

(1) by the disproportionately severe default consequences set out below;

(2) because none of the event of default clauses permit the customer to remedy a default which may be capable of remedy;

(3) because each of the clauses creates a default based on events that may not involve any credit risk to the Bank (for example, by providing misleading or untrue information such as a director’s date of birth); and

(4) in relation to the following clauses, because they create an event of default in the circumstances set out below:

(a) an untrue or misleading statement being made or repeated by the customer (or its guarantors) which can in the context of the contract be insignificant, for example, an error as to a director’s date of birth: Rural Conditions cl 8.1(c), Delphi Conditions cl 10.1(c);

(b) any part of a relevant document (including the Rural Conditions and the Delphi Conditions) being capable of becoming void or voidable, for example, due to this litigation which is entirely within the control of the Bank and not the customer: Rural Conditions cl 8.1(p); Delphi Conditions cl 10.1(n);

(c) the Bank unilaterally forms an opinion that something has happened where the Bank’s opinion may be wrong or it may also be reasonable to hold the opposite opinion and the customer has no entitlement to rectify any matter on which the Bank’s opinion is based: Rural Conditions cl 8.1(q); Delphi Conditions cl 10.1(j); and

(d) in vague and largely undefined circumstances: Rural Conditions cl 8.1(v).

59 Default consequences under the Rural Conditions include:

(1) the Bank is entitled to cancel all or part of any facility with the customer: cl 8.2(a);

(2) the Bank is entitled to make the outstanding sum due under any facility with the customer payable immediately or on demand: cl 8.2(b);

(3) the Bank is entitled to enforce its rights under any “relevant document” (which includes any facility, terms and conditions, treasury agreement, guarantee or security document): cl 8.2(c). (The Bank may be required to give notice or to allow the customer to remedy a default before exercising its rights under cl 8 but it is not clear in what circumstances that will be so or how much notice will be given.);

(4) the customer may be liable for an unspecified amount of break costs: cl 7.1 and cl 7.2. Given the discretion in cl 7.2(b), it is unclear how those costs will be calculated;

(5) the customer indemnifies the Bank and may be held liable for the Bank’s costs of attempting to enforce, restructure or amend the facility: cl 3.7(e) and cl 12.1(a). Those costs are of an unspecified amount and are incurred in circumstances where the customer has no control over how they are incurred;

(6) there is no right of set-off for the customer but there is for the Bank: cl 3.1 and cl 13.14; and

(7) with the exception of the right in cl 8.2, the customer does not have any right to prevent any of the above by demonstrating that it has remedied (or will remedy) any default that can be remedied or that there is no credit risk to the Bank.

60 Default consequences under the Delphi Conditions include:

(1) the customer has no entitlement to use the facility or draw down any funds: cl 2(f);

(2) the customer indemnifies the Bank and is liable for all costs incurred in relation to the event of default, including an unspecified amount of break costs: cll 11.3 and 14;

(3) there is no right of set-off for the customer but there is for the Bank: cl 6.3 and cl 17.1; and

(4) the customer does not have any right to prevent any of the above by demonstrating that it has remedied (or will remedy) any default that can be remedied or that there is no credit risk to the Bank.

61 Each of the impugned event of default clauses would cause detriment to the customer if relied upon within the meaning of s 12BG(1) because of the relevant default consequences.

62 The impugned event of default terms fall within the list of examples of terms set out in s 12BH(1) that may be unfair: see ss 12BH(b), (c) and (h). When regard is had to the Delphi Conditions and the Rural Conditions as a whole, there is nothing otherwise within the terms of the Delphi Conditions and the Rural Conditions which mitigates the unfairness of these terms.

63 ASIC submitted that the terms are not transparent within the meaning of s 12BG(3) for the following reasons:

(1) they are not expressed in reasonably plain language or presented clearly;

(2) the terms are drafted in legal language and are not by their font or position in the contract drawn to the customer’s attention (as distinct from other terms);

(3) each of the event of default terms interacts with other terms that it does not refer to: see for example, Rural Conditions cll 3.7(e), 7.1, 7.2, 8.2, 12.1, 13.14; and

(4) each of the terms interacts with other terms that have the effect of imposing costs in circumstances where it is unclear what those costs will be or how those costs will be calculated: see, for example, Rural Conditions cl 7.1 and cl 7.2.

64 The Bank disagrees. However, the parties jointly submitted that whether or not the Court determines that the terms lack transparency, the terms are in any event unfair under s 12GB(1).

65 I am not persuaded that the relevant Delphi Conditions (cll 10.1(c), 10.1(j), 10.1(k) and 10.1(n)) or the relevant Rural Conditions (cll 8.1(c), 8.1(p), 8.1(q) and 8.1(v) lack transparency.

Unilateral variation or termination clauses

66 Delphi Conditions cl 11.1 and cl 22.1 and Rural Conditions cll 2.3, 2.4, 4.2 and 4.4 are unilateral variation or termination clauses which permit the Bank to vary the upfront price of the contract, the financial services to be supplied under the contract and other terms of the contract.

67 These terms create a significant imbalance in the parties’ rights and obligations because:

(1) the terms allow the Bank to vary the financial services to permit the Bank to reduce the amount of funds that the customer would otherwise be able to utilise. The Bank’s entitlement to do so is limited by the requirement that it give notice (14 days under the Rural Conditions, 30 days under the Delphi Conditions) but that notice period may not be sufficient to provide the customer with an opportunity to refinance;

(2) the terms allow the Bank unilaterally to vary the contract to permit one party, but not the other, to vary the obligations at will;

(3) some of the terms permit the Bank to terminate if the customer does not accept the new terms: see Delphi Conditions cl 11.2; Rural Conditions cl 4.2; and

(4) the customer has no corresponding rights.

68 Terms which allow the Bank to cancel any part of the facility would cause the customer detriment if relied upon because they reduce the amount of funds available to the customer. If the customer wishes to terminate the facility as a result of the Bank relying on one of these terms, unspecified fees and break costs may be payable: see, for example, Rural Conditions cll 3.7, 7 and 12. That would have the effect of imposing a termination fee regardless of the reason for termination.

69 Terms which allow the Bank unilaterally to vary the terms of the contract, unless used to reduce fees and charges payable or (otherwise benefit the customer) will cause detriment if relied upon in an unfair manner because:

(1) if the customer accepts the change, it will incur higher fees and charges (or some other consequence which is detrimental to it); and

(2) if the customer fails to accept the revised terms or fails to provide the additional security requested the facility may terminate in which case the customer is required to pay the outstanding sum within 30 days of ‘our original request’. Unspecified fees and break costs may be payable (see, for example, Rural Conditions cll 3.7, 7 and 12). That would have the effect of imposing a termination fee regardless of the reason for termination.

70 These terms fall within the list of examples of terms set out in s 12BH(1) that may be unfair: see ss 12BH(1)(a), (b), (c), (d) and (g). When regard is had to the Delphi Conditions and the Rural Conditions as a whole, there is nothing otherwise within the terms of the Delphi Conditions and the Rural Conditions which mitigates the unfairness of these terms.

71 ASIC submitted that the terms are not transparent within the meaning of s 12BG(3) for the reasons described at [54] above. The Bank disagrees. However, the parties jointly submitted that whether or not the Court determines that the terms lack transparency, the terms are in any event unfair under s 12BG(1).

72 I accept that cl 11.1 lacks transparency, principally because it is predicated upon a “Periodic Review” or a “Periodic Revaluation”, each of which is a complex defined term with no apparent “periodic” aspect. Clause 11.1(b) is also notably complex and it is not clear whether there is any limitation on the Bank’s power to act “by notice to the Borrower …”.

73 In my view, cl 22 lacks transparency because its title “Changes” does not suggest the breadth of the terms. Similarly cl 2.3 and cl 2.4 of the Rural Conditions are not transparent because they are contained in a section entitled “Use of facility” which is not likely to suggest that it concerns cancellation of the facility. I also accept that cl 4.4 of the Rural Conditions is not transparent because its heading “Change to terms” does not suggest the comprehensive nature of the changes that are permitted by cl 4.4.

74 The parties submitted that a unilateral variation clause may be appropriately restricted in its application so as not to fall within the ambit of the legislation. The parties seek orders to vary the Rural Conditions to include an amended form of cl 4.4 which is appropriately restricted, as set out below.

Conclusive evidence clauses

75 Delphi Conditions cl 17.6 and Rural Conditions cl 13.1 are conclusive evidence clauses that have the effect of imposing the evidential burden on the customer in proceedings relating to the contract. These clauses also have the effect of allowing the Bank but not the customer to terminate the contract if the customer does not pay an amount stated in a certificate created by the Bank by a stated date, in circumstances where the certificate created by the Bank is conclusive evidence of the amount claimed unless the customer is able to demonstrate “manifest error” (in relation to cl 17.6 of the Delphi Conditions), or the customer is able to prove that the certificate is incorrect (in relation to cl 13.1 of the Rural Conditions).

76 These terms create a significant imbalance in the parties’ rights and obligations because:

(1) the term allows the Bank to impose, by the issuing of a certificate, an evidential burden on the customer about matters upon which the Bank is best placed to provide primary evidence;

(2) the Bank has no additional duty;

(3) the customer has no corresponding right; and

(4) in the case of the Delphi Conditions, the customer can only contest the amount stated in the certificate if the customer can demonstrate “manifest error”.

77 Each of the terms would cause detriment if relied upon because it requires the customer to disprove matters about which the Bank is best placed to provide primary evidence. Further, it would cause detriment if relied upon in circumstances where the certificate was wrong but the customer could not or did not seek to disprove it. This is particularly so in relation to the Delphi Conditions, where the customer cannot contest the amount stated unless the customer can prove that there has been “manifest error”.

78 These terms fall within the list of examples of terms set out in s 12BH(1) that may be unfair: see ss 12BH(1)(l) and (m). When regard is had to the Delphi Conditions and the Rural Conditions as a whole, there is nothing otherwise within the terms of the Delphi Conditions and the Rural Conditions which mitigates the unfairness of these terms.

79 ASIC submits that the terms are not transparent within the meaning of s 12BG(3) because they are not expressed in reasonably plain language or presented clearly. The terms are drafted in legal language and are not by their font or position in the contract drawn to the customer’s attention (as distinct from other terms).

80 The Bank disagrees. However, the parties jointly submitted that whether or not the Court determines that the terms lack transparency, the terms are in any event unfair under s 12BG(1).

81 I agree that the phrase “determination of any amount … is conclusive in the absence of manifest error” in cl 17.6 of the Delphi Conditions lacks transparency by reason of its legal language. In my view, cl 13.1 of the Rural Conditions is sufficiently clear to be transparent.

Conclusion

82 I am satisfied that each of the impugned terms is unfair for the reasons set out above.

Relief

83 Subdivision G of Div 2 “Enforcement and remedies” deals with the relief available in respect of contraventions of Pt 2 of the Act, including in respect of terms declared to be unfair.

Declarations

84 Section 12GND(2), read with s 12GND(3), empowers the Court to declare that a term of a small business contract, that is a standard form contract and a financial product, is an unfair term on application by ASIC.

85 Section 12GND(5) provides, relevantly, that s 12GND(2) does not limit any other power of the Court to make declarations. Thus, the Court’s wide discretionary power to make declarations pursuant to s 21 of the Federal Court of Australia Act 1976 (Cth) is not limited by s 12GND(2).

86 Before making a declaration, three requirements should be satisfied:

(1) the question must be a real and not a hypothetical or theoretical one;

(2) the applicant must have a real interest in raising it; and

(3) there must be a proper contradictor: Forster v Jododex Australia Pty Ltd [1972] HCA 61; (1972) 127 CLR 421 at 437 per Gibbs J quoting Russian Commercial and Industrial Bank v British Bank for Foreign Trade Ltd [1921] 2 AC 438 at 448 per Dunedin LJ.

87 Where declarations are sought by consent, the Court’s discretion is not supplanted; however, the Court will not usually refuse to give effect to terms of settlement by declining to make orders where they are within jurisdiction and are otherwise unobjectionable: Australian Competition and Consumer Commission v Acquire Learning & Careers Pty Ltd [2017] FCA 602; [2017] ATPR 42-543 at [96] per Murphy J referring to Australian Competition and Consumer Commission v Econovite Pty Ltd [2003] FCA 964 at [11] per French J (as his Honour then was).

88 In this case, the requirements of s 12GND(2) and the other requirements for making a declaration are satisfied in respect of each of the impugned terms:

(1) There is a significant legal controversy in this case which is being resolved. The proposed declarations relate to conduct that contravenes the Act and the matters in issue have been identified and particularised by the parties with precision.

(2) It is in the public interest for the ASIC to seek to have the proposed declarations made and for the proposed declarations to be made. ASIC, as the statutory authority responsible for enforcing the Act has a genuine interest in seeking the declaratory relief.

(3) The Bank is a proper contradictor because it is the respondent and is the subject of the proposed declarations. The Bank therefore has an interest in opposing the making of the proposed declarations.

89 I am satisfied that the factual basis for each of the proposed declarations is contained in the agreed facts, as recorded above.

90 Further, having regard to Nicholson J’s reasoning in Australian Competition and Consumer Commission v Construction, Forestry, Mining and Energy Union [2006] FCA 1730; (2007) ATPR 42-140 at [6], I accept that the declarations sought are appropriate because they serve to:

(1) record the Court’s disapproval of the contravening conduct;

(2) vindicate ASIC’s claims that the Bank contravened the Act;

(3) assist ASIC to carry out the duties conferred upon it by the Act; and

(4) deter other corporations from contravening the Act.

91 Finally, as explained below, it is necessary for the declarations to be made to enliven the Court’s power under s 12GNB to make other orders sought by ASIC.

Other orders

92 Section 12GNB(1) provides:

Without limiting the generality of section 12GD, if:

(a) a person:

…

(ii) is a party to a contract who is advantaged by a term (the declared term) of the contract in relation to which the Court has made a declaration under section 12GND; and

(b) the contravening conduct or declared term caused, or is likely to cause, a class of persons to suffer loss or damage; and

(c) the class includes persons who are non-party consumers in relation to the contravening conduct or declared term;

the Court may, on the application of ASIC, make such order or orders (other than an award of damages) as the Court thinks appropriate against a person referred to in subsection (2) of this section.

93 The Bank is a person referred to in s 12GNB(2)(b).

94 The Bank accepts that the impugned terms (which will be declared terms within the meaning of s 12GNB(1)(b)) are terms which are likely to cause a class of persons to suffer loss or damage.

95 Section 12GNB(3) provides relevantly:

(3) The Court must not make an order under subsection (1) unless the Court considers that the order will:

…

(b) prevent or reduce the loss or damage suffered, or likely to be suffered, by the non-party consumers in relation to the contravening conduct or declared term.

96 Section 12BA defined “non-party consumer” relevantly to mean:

(b) in relation to a term of a contract referred to in subparagraph 12GNB(1)(a)(ii)—a person who is not, or has not been, a party to an enforcement proceeding in relation to the term.

97 A term referred to in s 12GNB(1)(a)(ii) is a term of a contract in relation to which the Court has made a declaration under s 12GND.

98 By s 12GNB(8), in determining whether to make an order under s 12GNB(1), the Court is not required to make a finding about which persons are non-party consumers in relation to the declared term or about the nature of the loss or damage suffered, or likely to be suffered, by such persons.

99 The parties submitted that the term “suffer loss” in s 12GNB(1)(b) should not be read as importing a requirement that the Bank in relying on an impugned term has acted unfairly and improperly.

100 Section 12GNC sets out a non-exhaustive list of the orders that the Court can make under s 12GNB(1) against a person, including relevantly:

(a) an order declaring the whole or any part of a contract made between the respondent and a non-party consumer referred to in that subsection, or a collateral arrangement relating to such a contract:

(i) to be void; and

(ii) if the Court thinks fit--to have been void ab initio or void at all times on and after such date as is specified in the order (which may be a date that is before the date on which the order is made);

(b) an order:

(i) varying such a contract or arrangement in such manner as is specified in the order; and

(ii) if the Court thinks fit--declaring the contract or arrangement to have had effect as so varied on and after such date as is specified in the order (which may be a date that is before the date on which the order is made) …

101 In Australian Competition and Consumer Commission v Coles [2014] FCA 1405 at [70]-[73], Gordon J set out the following principles concerning making of orders by consent in civil penalty proceedings brought by the Australian Competition and Consumer Commission, which apply equally to cases of this kind:

[70] The applicable principles are well established. First, there is a well-recognised public interest in the settlement of cases under the Act: NW Frozen Foods Pty Ltd v Australian Competition & Consumer Commission [1996] FCA 1134; (1996) 71 FCR 285 at 291. Second, the orders proposed by agreement of the parties must be not contrary to the public interest and at least consistent with it: Australian Competition & Consumer Commission v Real Estate Institute of Western Australia Inc [1999] FCA 18; (1999) 161 ALR 79 at [18].

[71] Third, when deciding whether to make orders that are consented to by the parties, the Court must be satisfied that it has the power to make the orders proposed and that the orders are appropriate: Real Estate Institute at [17] and [20] and Australian Competition & Consumer Commission v Virgin Mobile Australia Pty Ltd (No 2) [2002] FCA 1548 at [1]. Parties cannot by consent confer power to make orders that the Court otherwise lacks the power to make: Thomson Australian Holdings Pty Ltd v Trade Practices Commission (1981) 148 CLR 150 at 163.

[72] Fourth, once the Court is satisfied that orders are within power and appropriate, it should exercise a degree of restraint when scrutinising the proposed settlement terms, particularly where both parties are legally represented and able to understand and evaluate the desirability of the settlement: Australian Competition & Consumer Commission v Woolworths (South Australia) Pty Ltd (Trading as Mac’s Liquor) [2003] FCA 530 at [21]; Australian Competition & Consumer Commission v Target Australia Pty Ltd [2001] FCA 1326 at [24]; Real Estate Institute at [20]-[21]; Australian Competition & Consumer Commission v Econovite Pty Ltd [2003] FCA 964 at [11] and [22] and Australian Competition & Consumer Commission v The Construction, Forestry, Mining and Energy Union [2007] FCA 1370 at [4].

[73] Finally, in deciding whether agreed orders conform with legal principle, the Court is entitled to treat the consent of Coles as an admission of all facts necessary or appropriate to the granting of the relief sought against it: Thomson Australian Holdings at 164.

102 Each counter-party to each relevant facility in relation to which a declaration will be made will be a non-party consumer for the purpose of s 12GNB(1)(c).

103 ASIC does not allege in this proceeding that the Bank has relied on any of the impugned clauses in a manner that is unfair or that has caused any customer to suffer loss or damage. The orders sought are preventative in nature.

104 As the parties acknowledged, the Court must not make an order unless satisfied that the order will prevent or reduce the loss or damage suffered, or likely to be suffered, by the non-party consumers in relation to the declared term.

105 The parties submitted, in relation to the Delphi Conditions, that the Court will be satisfied that the requirements of s 12GNB(2)(b) are met because:

(a) each of cls. 10.1(c), 10.1(j), 10.1(k), 10.1(n), 11.1, 14, 17.6 and 22.1 is unfair within the meaning of s 12BG;

(b) the parties agree that reliance by the Bank on any of cls. 10.1(c), 10.1(j), 10.1(k), 10.1(n), 11.1 or 14 would cause or be likely to cause the counter-party to suffer loss or damage;

(c) the parties agree that cls. 17.6 and 22.1 can be used in a manner that is unfair. If they are used that way, they would cause or be likely to cause the counter-party to suffer loss or damage;

(d) if a term is unfair, there is at least a risk that it will be used in a manner that is unfair;

(e) it is not necessary for the Court to make any findings as to the nature of the loss or damage likely to be suffered. It is submitted, however, that the loss or damage would likely be what is characterised as detriment in relation to each of the relevant unfair terms; and

(f) the orders are drafted to vary cl. 14 such that it cannot be used in a manner that is unfair.

106 In relation to the Rural Conditions, the parties submitted that the Court will be satisfied that the requirements of s 12GNB(2)(b) are met because:

(a) each of cls. 4.2, 4.4, 2.3, 2.4, 8.1(c), 8.1(p), 8.1(q), 8.1(v), 12.1,13.1 and 22.1 is unfair within the meaning of s 12BG;

(b) the parties agree that reliance by the Bank on any of cls. 2.3, 2.4, 8.1(c), 8.1(p), 8.1(q), 8.1(v) and 12.1 would cause or be likely to cause the counter-party to suffer loss or damage;

(c) the parties agree that cls. 4.2, 4.4 and 13.1 and 22.1 can be used in a manner that is unfair. If they are used that way, they would cause or be likely to cause the counter-party to suffer loss or damage;

(d) if a term is unfair, there is at least a risk that it will be used in a manner that is unfair;

(e) it is not necessary for the Court to make any findings as to the nature of the loss or damage likely to be suffered. It is submitted, however, that the loss or damage would likely be what is characterised as detriment in relation to each of the unfair terms; and

(f) the orders are drafted to vary cls, 4.4 and 12.1 such that they cannot be used in a manner that is unfair.

107 I accept those submissions and accordingly accept that it is appropriate to make the other orders sought. It is also appropriate to make an order that the Bank pay the costs of the proceeding.

I certify that the preceding one hundred and seven (107) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justice Gleeson. |

Associate:

SCHEDULE 1

SCHEDULE 2

SCHEDULE 3

SCHEDULE 4