FEDERAL COURT OF AUSTRALIA

Fair Work Ombudsman v HSCC Pty Ltd [2020] FCA 655

ORDERS

Applicant | ||

AND: | HSCC PTY LTD (ACN 166 005 0720) First Respondent HSCK PTY LTD (ACN 163 351 148) Second Respondent HSPF PTY LTD (ACN 600 961 046) (and others named in the Schedule) Third Respondent | |

DATE OF ORDER: |

BY CONSENT, THE COURT DECLARES THAT:

1. The First Respondent contravened the following civil remedy provisions:

(a) during the Kotara First Period:

(i) section 45 of the Fair Work Act 2009 (Cth) (“FW Act”), by failing to pay the minimum rates to the Kotara Minimum Rate Employees as required by cll 17 and 18 of the Fast Food Industry Award 2010 (“Award”);

(ii) section 45 of the FW Act, by failing to pay casual loading to the Kotara Casual Employees as required by cl 13.2 of the Award;

(iii) section 45 of the FW Act, by failing to pay Saturday loading rates to the Kotara Saturday Loading Employees as required by cl 25.5(b) of the Award;

(iv) section 45 of the FW Act, by failing to pay Sunday loading rates to the Kotara Full-Time Employees as required by cl 25.5(c)(i) of the Award;

(v) section 45 of the FW Act, by failing to pay Sunday loading rates to the Kotara Casual Sunday Employees as required by cl 25.5(c)(ii) of the Award;

(vi) section 45 of the FW Act, by failing to pay public holiday penalty rates to the Kotara Public Holiday Rate Employees as required by cl 30.3 of the Award; and

(vii) section 45 of the FW Act, by failing to pay overtime to the Kotara Full-Time Employees as required by cl 26 of the Award.

(b) during the Kotara Second Period:

(i) section 45 of the FW Act, by failing to pay Hyemi Jang, Minseok Yun and Yuxin Chen the minimum rates required by cll 17 and 18 of the Award;

(ii) section 45 of the FW Act, by failing to pay casual loading to the Kotara Casual Employees as required by clause 13.2 of the Award;

(iii) section 45 of the FW Act, by failing to pay Saturday loading rates to Hyemi Jang, Minha Kim, Minjae Park and Minseok Yun as required by cl 25.5(b) of the Award;

(iv) section 45 of the FW Act, by failing to pay Sunday loading rates to Hyemi Jang and Kyoungho Kim as required by cl 25.5(c)(i) of the Award;

(v) section 45 of the FW Act, by failing to pay Sunday loading rates to the Kotara Casual Sunday Employees as required by cl 25.5(c)(ii) of the Award;

(vi) section 45 of the FW Act, by failing to pay public holiday penalty rates to the Kotara Public Holiday Rate Employees as required by cl 30.3 of the Award; and

(vii) section 45 of the FW Act, by failing to pay overtime to the Kotara Full-Time Employees as required by cl 26 of the Award;

(c) during the Kotara Assessment Period:

(i) section 45 of the FW Act, by failing to make superannuation contributions on behalf of the Kotara Employees as required by cl 21.2 of the Award;

(ii) section 45 of the FW Act, by failing to pay the special clothing allowance to the Kotara Employees as required by cl 19.2(b)(i) and (ii) of the Award;

(iii) section 44(1) of the FW Act, by failing to pay accrued but untaken annual leave to the Kotara Annual Leave Employees on termination of employment as required by s 90(2) of the FW Act; and

(iv) section 44(1) of the FW Act, by failing to pay the Kotara Public Holiday Absence Employees for their absence on a public holiday as required by s 116 of the FW Act;

(d) regulation 3.44(1) of the Fair Work Regulations 2009 (Cth) (FW Regulations), by making and keeping the Kotara First Set of Records in relation to the Kotara First Set of Records Employees, knowing that those records were false or misleading;

(e) regulation 3.44(1) of the FW Regulations, by making and keeping the Kotara Second Set of Records in relation to the Kotara Second Set of Records Employees, knowing that those records were false or misleading;

(f) regulation 3.44(1) of the FW Regulations, by making and keeping the Kotara Third Set of Records in relation to the Kotara Employees listed therein, knowing that those records were false or misleading;

(g) regulation 3.44(1) of the FW Regulations, by making and keeping the Kotara Fourth Set of Records in relation to the Kotara Employees listed therein, knowing that those records were false or misleading;

(h) regulation 3.44(1) of the FW Regulations, by making and keeping the Kotara Fifth Set of Records in relation to the Kotara Employees listed therein, knowing that those records were false or misleading;

(i) regulation 3.44(6) of the FW Regulations, by making use of entries in the Kotara First Set of Records in relation to the Kotara First Set of Records Employees by producing those records to the Applicant, knowing that those records were false or misleading;

(j) regulation 3.44(6) of the FW Regulations, by making use of entries in the Kotara Second Set of Records in relation to the Kotara Second Set of Records Employees by producing those records to the Applicant, knowing that those records were false or misleading;

(k) regulation 3.44(6) of the FW Regulations, by making use of entries in the Kotara Third Set of Records in relation to the Kotara Employees listed therein by producing those records to the Applicant, knowing that those records were false or misleading;

(l) regulation 3.44(6) of the FW Regulations, by making use of entries in the Kotara Fourth Set of Records in relation to the Kotara Employees listed therein by producing those records to the Applicant, knowing that those records were false or misleading;

(m) regulation 3.44(6) of the FW Regulations, by making use of entries in the Kotara Fifth Set of Records in relation to the Kotara Employees listed therein by producing those records to the Applicant, knowing that those records were false or misleading;

(n) section 535(1) of the FW Act, by failing to make and keep records that the First Respondent was required to make and keep under the FW Act and the FW Regulations for seven (7) years; and

(o) section 536(1) of the FW Act, by failing to give pay slips in the form prescribed by the FW Regulations in respect of the Kotara Employees within one working day of making payment.

2. The Second Respondent contravened the following civil remedy provisions:

(a) during the Canberra First Period:

(i) section 45 of the FW Act, by failing to pay the minimum rates to the Canberra Minimum Rate Employees as required by cll 17 and 18 of the Award;

(ii) section 45 of the FW Act, by failing to pay casual loading to the Canberra Casual Employees as required by cl 13.2 of the Award;

(iii) section 45 of the FW Act, by failing to pay Saturday loading rates to the Canberra Saturday Loading Employees as required by cl 25.5(b) of the Award;

(iv) section 45 of the FW Act, by failing to pay Sunday loading rates to the Canberra Full-Time Sunday Employees as required by cl 25.5(c)(i) of the Award;

(v) section 45 of the FW Act, by failing to pay Sunday loading rates to the Canberra Casual Sunday Employees as required by cl 25.5(c)(ii) of the Award;

(vi) section 45 of the FW Act, by failing to pay public holiday penalty rates to the Canberra Public Holiday Rate Employees as required by cl 30.3 of the Award; and

(vii) section 45 of the FW Act, by failing to pay overtime to the Canberra Full-Time Employees as required by cl 26 of the Award;

(b) during the Canberra Second Period:

(i) section 45 of the FW Act, by failing to pay casual loading to the Canberra Casual Employees as required by cl 13.2 of the Award;

(ii) section 45 of the FW Act, by failing to pay Saturday loading rates to Jeongmi Yun as required by cl 25.5(b) of the Award;

(iii) section 45 of the FW Act, by failing to pay Sunday penalty rates to Jeongmi Yun as required by cl 25.5(c)(i) of the Award;

(iv) section 45 of the FW Act, by failing to pay Sunday penalty rates to Hyejin Jang, Nina Yu and Yoo Jin Lee as required by cl 25.5(c)(ii) of the Award;

(v) section 45 of the FW Act, by failing to pay public holiday penalty rates to Ju Yeong Lee and Jeongmi Yun as required by cl 30.3 of the Award; and

(vi) section 45 of the FW Act, by failing to pay overtime to the Canberra Full-Time Employees as required by cl 26 of the Award;

(c) during the Canberra Assessment Period:

(i) section 45 of the FW Act, by failing to pay the special clothing allowance to the Canberra Employees as required by cl 19.2(b)(i) and (ii) of the Award;

(ii) section 45 of the FW Act, by failing to make superannuation contributions on behalf of the Canberra Employees as required by cl 21.2 of the Award;

(iii) section 44(1) of the FW Act, by failing to pay accrued but untaken annual leave to the Canberra Annual Leave Employees on termination of employment as required by s 90(2) of the FW Act; and

(iv) section 44(1) of the FW Act, by failing to pay the Canberra Public Holiday Absence Employees for their absence on a public holiday as required by s 116 of the FW Act;

(d) regulation 3.44(1) of the FW Regulations, by making and keeping the Canberra First Set of Records in relation to the Canberra First Set of Records Employees, knowing that those records were false or misleading;

(e) regulation 3.44(1) of the FW Regulations, by making and keeping the Canberra Second Set of Records in relation to the Canberra Employees listed therein, knowing that those records were false or misleading;

(f) regulation 3.44(1) of the FW Regulations, by making and keeping the Canberra Third Set of Records in relation to the Canberra Employees listed therein, knowing that those records were false or misleading;

(g) regulation 3.44(1) of the FW Regulations, by making and keeping the Canberra Fourth Set of Records in relation to the Canberra Employees listed therein, knowing that those records were false or misleading;

(h) regulation 3.44(6) of the FW Regulations, by making use of entries in the Canberra First Set of Records in relation to the Canberra Employees listed therein by producing those records to the Applicant, knowing that those records were false or misleading;

(i) regulation 3.44(6) of the FW Regulations, by making use of entries in the Canberra Second Set of Records in relation to the Canberra Employees listed therein by producing those records to the Applicant, knowing that those records were false or misleading;

(j) regulation 3.44(6) of the FW Regulations, by making use of entries in the Canberra Third Set of Records in relation to the Canberra Employees listed therein by producing those records to the Applicant, knowing that those records were false or misleading;

(k) regulation 3.44(6) of the FW Regulations, by making use of entries in the Canberra Fourth Set of Records in relation to the Canberra Employees listed therein by producing those records to the Applicant, knowing that those records were false or misleading;

(l) section 535(1) of the FW Act, by failing to keep records that the Second Respondent was required to keep under the FW Act and the FW Regulations for seven (7) years; and

(m) section 536(1) of the FW Act, by failing to give pay slips in the form prescribed by the FW Regulations in respect of the Canberra Employees within one working day of making payment.

3. The Third Respondent contravened the following civil remedy provisions during the Pacific Fair Assessment Period:

(a) section 45 of the FW Act, by failing to pay the minimum rates to the Pacific Fair Minimum Rate Employees as required by cll 17 and 18 of the Award;

(b) section 45 of the FW Act, by failing to pay casual loading to the Pacific Fair Casual Employees as required by cl 13.2 of the Award;

(c) section 45 of the FW Act, by failing to pay Saturday loading rates to the Pacific Fair Saturday Loading Employees as required by cl 25.5(b) of the Award;

(d) section 45 of the FW Act, by failing to pay Sunday loading rates to the Pacific Fair Full-Time Sunday Employees as required by cl 25.5(c)(i) of the Award;

(e) section 45 of the FW Act, by failing to pay Sunday loading rates to the Pacific Fair Casual Sunday Employees as required by cl 25.5(c)(ii) of the Award;

(f) section 45 of the FW Act, by failing to pay public holiday penalty rates to the Pacific Fair Public Holiday Rate Employees as required by cl 30.3 of the Award;

(g) section 45 of the FW Act, by failing to pay overtime to the Pacific Fair Full-Time Employees as required by cl 26 of the Award;

(h) section 45 of the FW Act, by failing to pay the special clothing allowance to the Pacific Fair Employees as required by cl 19.2(b)(i) and (ii) of the Award;

(i) section 45 of the FW Act, by failing to make superannuation contributions on behalf of the Pacific Fair Employees as required by cl 21.2 of the Award;

(j) section 44(1) of the FW Act, by failing to pay accrued but untaken annual leave to the Pacific Fair Annual Leave Employees on termination of employment as required by s 90(2) of the FW Act;

(k) section 44(1) of the FW Act, by failing to pay the Pacific Fair Public Holiday Absence Employees for their absence on a public holiday as required by s 116 of the FW Act;

(l) regulation 3.44(1) of the FW Regulations, by making and keeping the Pacific Fair First Set of Records in relation to the Pacific Fair Employees listed therein, knowing that those records were false or misleading;

(m) regulation 3.44(1) of the FW Regulations, by making and keeping the Second Set of Records in relation to the Pacific Fair Employees listed therein, knowing that those records were false or misleading;

(n) regulation 3.44(6) of the FW Regulations, by making use of entries in the Pacific Fair First Set of Records in relation to the Pacific Fair Employees listed therein by producing those records to the Applicant, knowing that those records were false or misleading;

(o) regulation 3.44(6) of the FW Regulations, by making use of entries in the Pacific Fair Second Set of Records in relation to the Pacific Fair Employees listed therein by producing those records to the Applicant, knowing that those records were false or misleading;

(p) section 535(1) of the FW Act, by failing to keep records that the Third Respondent was required to keep under the FW Act and the FW Regulations for seven (7) years; and

(q) section 536(1) of the FW Act, by failing to give pay slips in the form prescribed by the FW Regulations in respect of the Pacific Fair Employees within one working day of making payment.

4. That:

(a) the Fourth Respondent was involved, within the meaning of s 550(2) of the FW Act, in each of the contraventions by:

(i) the First Respondent declared in paras 1(a)(i), 1(b)(i), 1(a)(ii), 1(b)(ii), 1(a)(iii), 1(b)(iii), 1(a)(iv), 1(b)(iv), 1(a)(v), 1(b)(v), 1(a)(vi), 1(b)(vi), 1(a)(vii), 1(b)(vii), 1(c)(iii), 1(d), 1(e), 1(f), 1(g), 1(h), 1(i), 1(j), 1(k), 1(l), 1(m) and 1(o) above of ss 44, 45 and 536 of the FW Act and regs 3.44(1) and 3.44(6) of the FW Regulations;

(ii) the Second Respondent declared in paras 2(a)(i), 2(a)(ii), 2(b)(i), 2(a)(iii), 2(b)(ii), 2(a)(iv), 2(b)(iii), 2(a)(v), 2(b)(iv), 2(a)(vi), 2(b)(v), 2(a)(vii), 2(b)(vi), 2(c)(iii), 2(d), 2(e), 2(f), 2(g), 2(h), 2(i), 2(j), 2(k) and 2(m) above of ss 44, 45 and 536 of the FW Act and regs 3.44(1) and 3.44(6) of the FW Regulations; and

(iii) the Third Respondent declared in paras 3(a), 3(b), 3(c), 3(d), 3(e), 3(f), 3(g), 3(j), 3(l), 3(m), 3(n), 3(o) and 3(q) above of ss 44, 45 and 536 of the FW Act and regs 3.44(1) and 3.44(6) of the FW Regulations;

(b) the Fifth Respondent was involved, within the meaning of s 550(2) of the FW Act, in each of the contraventions by:

(i) the First Respondent declared in paras 1(a)(i), 1(b)(i), 1(a)(ii), 1(b)(ii), 1(a)(iii), 1(b)(iii), 1(a)(iv), 1(b)(iv), 1(a)(v), 1(b)(v), 1(a)(vi), 1(b)(vi), 1(a)(vii), 1(b)(vii), 1(c)(iii), 1(d), 1(e), 1(f), 1(g), 1(h), 1(i), 1(j), 1(k), 1(l) and 1(m) above of ss 44 and 45 of the FW Act and regs 3.44(1) and 3.44(6) of the FW Regulations;

(ii) the Second Respondent declared in paras 2(a)(i), 2(a)(ii), 2(b)(i), 2(a)(iii), 2(b)(ii), 2(a)(iv), 2(b)(iii), 2(a)(v), 2(b)(iv), 2(a)(vi), 2(b)(v), 2(a)(vii), 2(b)(vi), 2(c)(iii), 2(d), 2(e), 2(f), 2(g), 2(h), 2(i), 2(j) and 2(k) above of ss 44 and 45 of the FW Act and regs 3.44(1) and 3.44(6) of the FW Regulations; and

(iii) the Third Respondent declared in paras 3(a), 3(b), 3(c), 3(d), 3(e), 3(f), 3(g), 3(j), 3(l), 3(m), 3(n) and 3(o) above of ss 44 and 45 of the FW Act and regs 3.44(1) and 3.44(6) of the FW Regulations;

(c) the Sixth Respondent was involved, within the meaning of s 550(2) of the FW Act, in each of the contraventions by:

(i) the First Respondent pleaded in paras 1(a)(i), 1(b)(i), 1(a)(ii), 1(b)(ii), 1(a)(iii), 1(b)(iii), 1(a)(iv), 1(b)(iv), 1(a)(v), 1(b)(v), 1(a)(vi), 1(b)(vi), 1(a)(vii), 1(b)(vii), 1(c)(iii), 1(d), 1(e), 1(f), 1(g), 1(h), 1(i), 1(j), 1(k), 1(l), 1(m) and 1(o) above of ss 44, 45 and 536 of the FW Act;

(ii) the Second Respondent pleaded in paras 2(a)(i), 2(a)(ii), 2(b)(i), 2(a)(iii), 2(b)(ii), 2(a)(iv), 2(b)(iii), 2(a)(v), 2(b)(iv), 2(a)(vi), 2(b)(v), 2(a)(vii), 2(b)(vi), 2(c)(iii), 2(d), 2(e), 2(f), 2(g), 2(h), 2(i), 2(j), 2(k) and 2(m) above of ss 44, 45 and 536 of the FW Act and regs 3.44(1) and 3.44(6) of the FW Regulations; and

(iii) the Third Respondent pleaded in paras 3(a), 3(b), 3(c), 3(d), 3(e), 3(f), 3(g), 3(j), 3(l), 3(m), 3(n), 3(o) and 3(q) above of ss 44, 45 and 536 of the FW Act and regs 3.44(1) and 3.44(6) of the FW Regulations;

(d) the Seventh Respondent was involved, within the meaning of s 550(2) of the FW Act, in each of the contraventions by the First Respondent declared in paras 1(d), 1(e), 1(f), 1(g), 1(h), 1(i), 1(j), 1(k), 1(l) and 1(m) above of regs 3.44(1) and 3.44(6) of the FW Regulations; and

(e) the Eighth Respondent was involved, within the meaning of s 550(2) of the FW Act, in each of the contraventions by:

(i) the First Respondent declared in paras 1(a)(i), 1(b)(i), 1(a)(ii), 1(b)(ii), 1(a)(iii), 1(b)(iii), 1(a)(iv), 1(b)(iv), 1(a)(v), 1(b)(v), 1(a)(vi), 1(b)(vi), 1(a)(vii), 1(b)(vii), 1(c)(iii) and 1(o) above of ss 44, 45 and 536 of the FW Act;

(ii) the Second Respondent pleaded in paras 2(a)(i), 2(a)(ii), 2(b)(i), 2(a)(iii), 2(b)(ii), 2(a)(iv), 2(b)(iii), 2(a)(v), 2(b)(iv), 2(a)(vi), 2(b)(v), 2(a)(vii), 2(b)(vi), 2(c)(iii), 2(d), 2(e), 2(f), 2(g), 2(h), 2(i), 2(j), 2(k) and 2(m) above of ss 44, 45 and 536 of the FW Act and regs 3.44(1) and 3.44(6) of the FW Regulations; and

(iii) the Third Respondent pleaded in paras 3(a), 3(b), 3(c), 3(d), 3(e), 3(f), 3(g), 3(j), 3(l), 3(m), 3(n), 3(o) and 3(q) above of ss 44, 45 and 536 of the FW Act and regs 3.44(1) and 3.44(6) of the FW Regulations.

THE COURT ORDERS THAT:

Pecuniary Penalties

5. Pursuant to s 546(1) of the FW Act, that each of the respondents pay pecuniary penalties in relation to the contraventions set out in paras 1 to 4 above respectively as follows:

(a) First Respondent – $225,000

(b) Second Respondent – $225,000

(c) Third Respondent – $150,000

(d) Fourth Respondent – $85,000

(e) Fifth Respondent – $85,000

(f) Sixth Respondent – $75,000

(g) Seventh Respondent – $16,000

(h) Eighth Respondent – $30,000

6. Pursuant to s 546(3)(a) of the FW Act, requiring the First to Eighth Respondents to pay their respective penalty amounts to the Commonwealth within 12 months of the date of this order.

Workplace Notices

7. Pursuant to s 545(1) of the FW Act, that within 28 days of the date of this order:

(a) the First Respondent will display in the premises of the Kotara Store a notice in a prominent position that can be easily viewed by all employees (“Workplace Notice”);

(b) the Second Respondent will display in the premises of the Canberra Store a Workplace Notice; and

(c) the Third Respondent will display in the premises of the Pacific Fair Store a Workplace Notice;

(d) each Workplace Notice displayed by the First, Second and Third Respondents must:

(i) contain information on this proceeding and any orders made by the Court; information on entitlements contained in the Award; a link to the Applicant's webpage at http://www.fairwork.gov.au/how-we-will-help/how-we-help-you/record-my-hours-app where employees can obtain information about the Applicant’s ‘Record My Hours’ app; and information on how to contact the Applicant;

(ii) be in a form approved by the Applicant at least 7 days prior to the Workplace Notice being displayed in the relevant Store; and

(iii) be displayed for a period of one year; and

(e) the First, Second and Third Respondents will each provide proof of the display of the relevant Workplace Notice to the Applicant within 14 days of the Workplace Notice being approved by the Applicant.

Audit

8. Pursuant to s 545(1) of the FW Act, that each of the First, Second and Third Respondents will, at their own expense, engage a third party with qualifications in accounting and/or workplace relations approved by the Applicant and in accordance with a methodology approved by the Applicant to undertake an audit of compliance with the FW Act, the FW Regulations and the Award on the following terms:

(a) the audit period will be 6 months, and commence within 28 days of the date of order (“Audit Period”);

(b) the audit is to be completed within 60 days of the end of the Audit Period (“Audit Completion Date”);

(c) the audit will apply to all employees and persons otherwise engaged to perform work for the First, Second and Third Respondents;

(d) the audit will assess the First, Second and Third Respondents’ compliance with the following obligations according to each employee's classification of work, category of employment and hours worked during the Audit Period:

(i) wages and other work-related entitlements under the Award;

(ii) accrual and payment of entitlements under the NES in Part 2-2 of the FW Act; and

(iii) record keeping and pay slip obligations in Div 3 of Pt 3-6 of the FW Act and Pt 3-6 of the FW Regulations; and

(e) within 28 days of the Audit Completion Date, the First, Second and Third Respondents will provide to the Applicant:

(i) a copy of the audit report which will include a statement of the methodology used in the audit;

(ii) a copy of the source materials and records used to conduct the audit; and

(iii) written details of any contraventions identified in the audit, the steps the First Respondent, Second Respondent and Third Respondents will take to rectify any identified contravention(s) and by when that rectification will occur.

9. Pursuant to ss 545(1) and/or 545(2)(a) of the FW Act, that the Fourth and Fifth Respondents each comply with the requirements set out in para 8 above in respect of any other business owned and/or operated by a body corporate of which either the Fourth and Fifth Respondents are an officer.

10. The Applicant have liberty to apply on seven days’ notice in the event that any of the preceding orders are not complied with.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

FLICK J:

1 This is a case about greed and the exploitation of the vulnerable. Those in a position to ruthlessly take advantage of others pursued their goal of seeking to achieve greater profits at the expense of employees. In doing so, a great number of false documents were deliberately and repeatedly created with a view to concealing the fraud being perpetrated. Lies were told to cover up the wrongdoing. It was only when the “game was up” that those responsible admitted their misdeeds.

2 Once again it is a case arising in the fast food industry.

3 The underpayment of employees in the fast food industry has attracted the concern of both the Fair Work Ombudsman and the Courts.

4 In the present case, the Fair Work Ombudsman sought to rectify the wrong done to 94 employees who were underpaid by a total amount of $700,832.88. To the employers and those responsible, this money was more profit; to the employees, or at least some of them, the underpayment prejudicially affected their independence.

5 Now before the Court is the question as to the quantum of penalties to be imposed. Of paramount concern is the need to ensure that the quantum of penalties is such as to act as both a deterrence to those now before the Court and as a deterrence to others. The quantum of the penalties to be imposed has to be such that they are not seen as simply the “cost of doing business” in the fast food industry.

6 The total of the penalties to be imposed is $891,000. This, Senior Counsel for the Fair Work Ombudsman maintained, would be the highest quantum of penalties imposed upon an application instituted by that Office.

The present proceedings & the admissions made

7 It was in February 2019 that the Fair Work Ombudsman filed in this Court an Originating Application and a Statement of Claim. Contraventions of the Fair Work Act 2009 (Cth) (the “Fair Work Act”), the Fair Work Regulations 2009 (Cth) (the “Fair Work Regulations”) and the Fast Food Industry Award 2010 were alleged.

8 There were eight Respondents to the proceeding. There were three corporate Respondents, namely, HSCC Pty Ltd (ACN 166 005 072) (“HSCC”), HSCK Pty Ltd (ACN 163 351 148) (“HSCK”) and HSPF Pty Ltd (ACN 600 961 046) (“HSPF”). The corporate Respondents were part of a group of 17 companies operating Hero Sushi branded kiosk style outlets (the “Hero Sushi Group”). HSCC operated an outlet at Kotara in New South Wales; HSCK operated an outlet in Canberra in the Australian Capital Territory; and HSPF operated an outlet at Pacific Fair at Broadbeach in Queensland. In addition to these corporate Respondents, there were five individual Respondents, namely, Mr Deuk Hee Lee (aka “William Lee”); Mr Hokun Hwang (aka “Ho-Kun Hwang” and “Robert Hwang”); Mr Chang Seok Lee (aka “Tommy Lee”); Mr Ji Won Cho (aka “Brian Cho”); and Mr Junsung Kim (aka “Jimmy Kim”). Messrs William Lee and Robert Hwang are also both 50% shareholders in all of the companies that form part of the Hero Sushi Group.

9 An Amended Originating Application and an Amended Statement of Claim were filed in May 2019. The Amended Statement of Claim was a lengthy document totalling some 200 pages and some 484 paragraphs of pleadings. A Statement of Agreed Facts was also filed in May 2019 but a Defence was not filed by the Respondents. In the Statement of Agreed Facts, the Respondents admitted all of the contraventions alleged.

10 In very summary form, a number of contraventions were alleged (and admitted), as set out in the Amended Statement of Claim and the Statement of Agreed Facts, by one or other of the Respondents.

11 Section 45 of the Fair Work Act provides as follows:

A person must not contravene a term of a modern Award.

…

The provisions of the Fast Food Industry Award 2010 alleged to have been contravened were:

clauses 17 and 18 – being the provisions directed to payment of minimum ordinary hourly rates;

clause 13.2 – being the provision directed to casual loadings;

clause 25.5(b) – being the provision directed to Saturday loadings;

clause 25.5(c)(i) – being the provision directed to Sunday loadings for full-time employees;

clause 24.5(c)(ii) – being the provision directed to Sunday loadings for casual employees;

clause 30.3 – being the provision directed to public holiday rates;

clause 26 – being the provision directed to payment of overtime rates; and

clause 19.2(b) – being the provision directed to a special clothing allowance.

12 In addition to these contraventions, it was further alleged (and admitted) that one or other of the Respondents:

failed to pay annual leave owing on termination;

failed to make payments in respect to hours that would have been worked but for a day being a public holiday ;

failed to pay superannuation contributions; and

failed to keep records as required by reg 3.44(1) of the Fair Work Regulations.

13 This outline of the contraventions involved in the present case is not exhaustive. But it is sufficient to provide the background as to the extent of the non-compliant conduct of the Respondents.

14 The individual Respondents, it was alleged, assumed liability by reason of s 550 of the Fair Work Act. Each of the individual Respondents admitted to having been “involved” in the contraventions within the meaning of and for the purposes of that section.

15 The Fair Work Ombudsman and the Respondents filed submissions in respect to the relief to be granted including declaratory relief and the quantum of proposed penalties. The Outline of Submissions filed by the Fair Work Ombudsman was also lengthy – it comprised some 60 pages of submissions and some 22 pages of tables. Notwithstanding their length, the Outline of Submissions helpfully tracked through each of the contraventions, and ascribed to each contravention the agreement as to (inter alia) the range within which penalties were to be assessed, by reference to a stated maximum, the manner in which contraventions were to be “grouped” and the liability to penalty for each Respondent. The detail contained within the submissions and tables considerably reduced the length of what would otherwise have been a potentially lengthy and “messy” hearing.

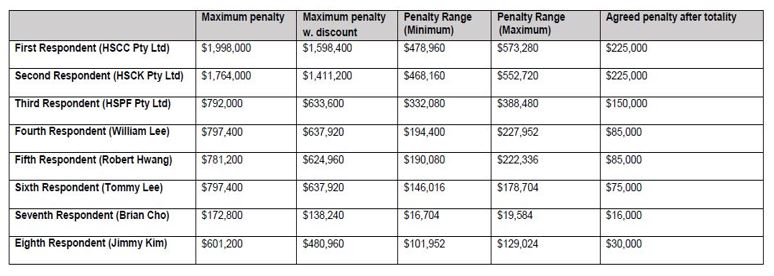

16 The maximum penalties, the range of penalties and the agreed penalties were quantified in the concluding table to the Annexure to the submissions of the Fair Work Ombudsman. As modified, only to the extent of including a “total” for each of the columns, that table provided as follows:

If aggregated, this represents a penalty of $600,000 for the three corporate Respondents and $291,000 for the five individual Respondents.

17 It was the final column, namely that directed to what was referred to as the “Agreed penalty after totality”, which attracted the greatest attention during the hearing.

The Annexure – a more detailed summary of the contraventions

18 The concluding table quantifying penalties was, not surprisingly, a summary of the many pages of tables forming an Annexure to the submissions of the Fair Work Ombudsman.

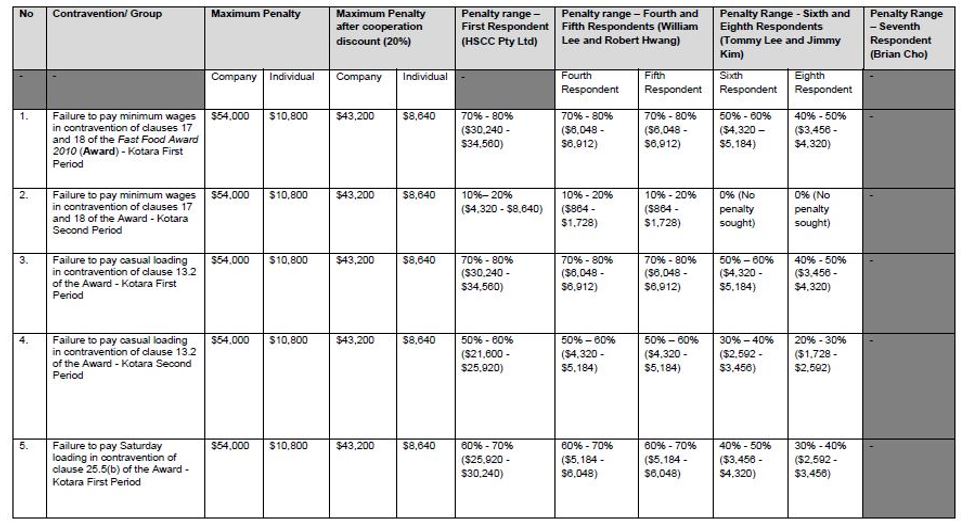

19 Thus, and by way of example, part of that Annexure provided as follows:

By reference to this part of the Annexure, it discloses:

the maximum penalty for the contraventions in question, in this case being $54,000 for a corporation and $10,800 for an individual;

the “discount” considered appropriate by the Fair Work Ombudsman with reference to the “co-operation” ultimately extended by the Respondents, that discount being 20% - 80% of $54,000 being (by way of example) $43,200; and

the “range” of the penalty to be imposed, that range being (in the case of the failure to pay minimum wages in contravention of cll 17 and 18 of the Fast Food Industry Award 2010 for the “first period”) between 70% to 80% for HSCC and the same range for Messrs William Lee and Robert Hwang, and 50% to 60% for Mr Tommy Lee.

The balance of the Annexure deals in like manner with the balance of the contraventions.

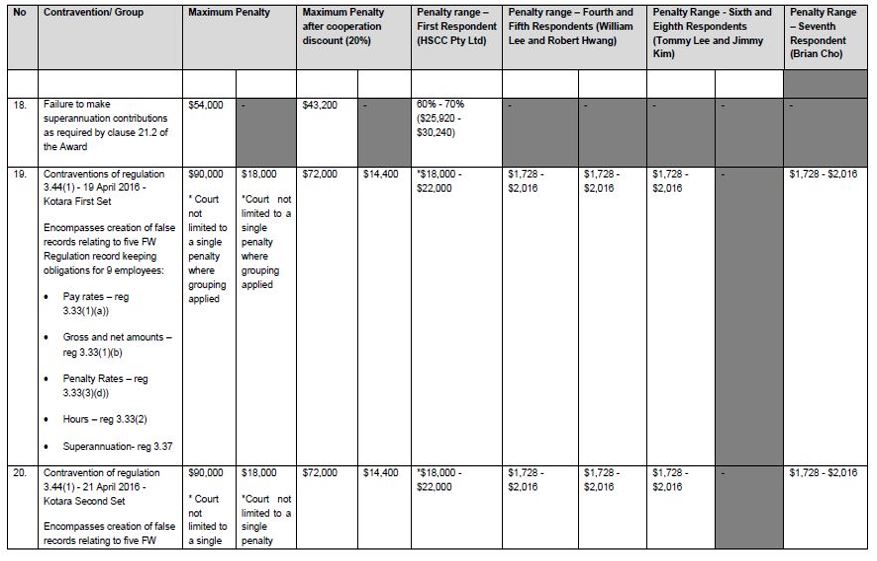

20 Other parts of the Annexure expose the manner in which the Fair Work Ombudsman proposes, and the Respondents agree, that individual contraventions should be “grouped” together. Thus, and again by way of example, part of the Annexure provides as follows:

This part of the Annexure exposes the proposal of the Fair Work Ombudsman, and as agreed by the Respondents, that:

what could otherwise be characterised as five contraventions of reg 3.44, and potentially five contraventions for each of the nine employees, has been “grouped” together as attracting a single penalty.

The Annexure then proceeds to set forth the proposed range of penalties and the exposure of the Respondents engaged in that contravention:

if the contraventions of reg 3.44 of the Fair Work Regulations could be characterised as five contraventions for each employee, the maximum penalty would be $18,000 x 5 (i.e., $90,000);

if the contraventions of reg 3.44(1) by HSCC could be characterised as five individual contraventions, one relating to pay rates, and others to gross and net amounts, penalty rates, hours and superannuation.

In its written submissions, the Fair Work Ombudsman then makes detailed submissions in respect to each of the contraventions set forth in this Annexure.

21 The particularised amounts set forth in the Annexure are then aggregated. The total of all of the “maximum penalties” for each of the Respondents then finds its way into the concluding table setting forth the manner in which the total of the penalties has been agreed. The total of each of the maximum penalties (for example) for HSCC thus totals $1,998,000. The total of the “maximum penalties” for HSCC after taking into account the 20% discount thus totals $1,598,400. And the same process of aggregating proceeds is undertaken in respect to the range for the agreed maximum and minimum penalties.

22 What does not follow in the same mathematical manner of aggregating those amounts previously set forth in the Annexure is the final column – namely the “Agreed penalty after totality”. The principles applied by the Fair Work Ombudsman in, for example, agreeing to that reduction, proved to be elusive. What remained elusive during the hearing was why it was appropriate to reduce, for example, the “Agreed penalty after totality” for HSCC to $225,000 from a penalty range of between $478,960 and $573,280.

23 Further submissions were filed subsequent to the hearing as to why such a reduction was appropriate.

24 But that reduction can presently be left to one side.

THE MANNER OF DETERMINING A PENALTY RANGE & PENALTIES

25 There was no dispute between the parties as to either:

the ability of this Court to give effect to an agreement between the parties as to the appropriate quantum of penalties to be imposed, provided the Court considered it otherwise appropriate to do so; or

the discretionary considerations to be taken into account when quantifying penalties.

Notwithstanding the absence of any dispute, each of these two matters should be briefly addressed.

The appropriateness of an agreement as to penalty

26 As to the former, this Court can give effect to an agreement between the parties as to the range within which penalties may be ordered if it is satisfied that it is “appropriate” to do so: Ministry for Industry, Tourism and Resources v Mobil Oil Australia Pty Ltd [2004] FCAFC 72 at [51] (“Mobil Oil”). Branson, Sackville and Gyles JJ were there considering an admitted contravention by Mobil of s 10 of the Petroleum Retail Marketing Sites Act 1980 (Cth). Their Honours referred to the earlier decision of the Full Court of this Court in NW Frozen Foods Pty Ltd v Australian Competition and Consumer Commission [1996] FCA 1134; (1996) 71 FCR 285 (“NW Frozen Foods”) and continued:

[51] The following propositions emerge from the reasoning in NW Frozen Foods:

(i) It is the responsibility of the Court to determine the appropriate penalty to be imposed under s 76 of the [Trade Practices] Act in respect of a contravention of the [Trade Practices] Act.

(ii) Determining the quantum of a penalty is not an exact science. Within a permissible range, the courts have acknowledged that a particular figure cannot necessarily be said to be more appropriate than another.

(iii) There is a public interest in promoting settlement of litigation, particularly where it is likely to be lengthy. Accordingly, when the regulator and contravenor have reached agreement, they may present to the Court a statement of facts and opinions as to the effect of those facts, together with joint submissions as to the appropriate penalty to be imposed.

(iv) The view of the regulator, as a specialist body, is a relevant, but not determinative consideration on the question of penalty. In particular, the views of the regulator on matters within its expertise (such as the ACCC’s views as to the deterrent effect of a proposed penalty in a given market) will usually be given greater weight than its views on more “subjective” matters.

(v) In determining whether the proposed penalty is appropriate, the Court examines all the circumstances of the case. Where the parties have put forward an agreed statement of facts, the Court may act on that statement if it is appropriate to do so.

(vi) Where the parties have jointly proposed a penalty, it will not be useful to investigate whether the Court would have arrived at that precise figure in the absence of agreement. The question is whether that figure is, in the Court’s view, appropriate in the circumstances of the case. In answering that question, the Court will not reject the agreed figure simply because it would have been disposed to select some other figure. It will be appropriate if within the permissible range.

But in giving effect to an agreed penalty or an agreed range of penalties the Court is required to “form its own view” and does not act as a “rubber stamp” to an agreement reached: Commonwealth of Australia v Director, Fair Work Building Industry Inspectorate [2015] HCA 46 at [30]-[31], (2015) 258 CLR 482 (“Commonwealth v Fair Work Building”) at 497-498 per French CJ, Kiefel, Bell, Nettle and Gordon JJ.

27 A Court should not depart from a figure otherwise agreed between the parties “merely because it might otherwise have been disposed to select some other figure, or except in a clear case”: NW Frozen Foods (1996) 71 FCR at 291. Burchett and Kiefel JJ (as her Honour then was) explained the approach to be pursued as follows at 291:

There is an important public policy involved. When corporations acknowledge contraventions, very lengthy and complex litigation is frequently avoided, freeing the courts to deal with other matters, and investigating officers of the Australian Competition and Consumer Commission to turn to other areas of the economy that await their attention. At the same time, a negotiated resolution in the instant case may be expected to include measures designed to promote, for the future, vigorous competition in the particular market concerned. These beneficial consequences would be jeopardised if corporations were to conclude that proper settlements were clouded by unpredictable risks. A proper figure is one within the permissible range in all the circumstances. The Court will not depart from an agreed figure merely because it might otherwise have been disposed to select some other figure, or except in a clear case.

These observations were endorsed by French CJ, Kiefel, Bell, Nettle and Gordon JJ in Commonwealth v Fair Work Building [2015] HCA at [28], (2015) 258 CLR at 496. Their Honours further observed in respect to the decision in NW Frozen Foods at 499:

…

(5) The decision in NW Frozen Foods allows for the following possibilities:

(a) if the court is not satisfied that the evidence or information offered in support of an agreed penalty submission is adequate, it may require the provision of additional evidence, information or verification and, if that is not forthcoming, may decline to accept the agreed penalty;

(b if the absence of a contradictor inhibits the court in the performance of its task of imposing an appropriate penalty, the court may seek the assistance of an amicus curiae or an individual or body prepared to act as an intervener;

(c) if the court is not prepared to impose the penalty proposed by the parties, it may be appropriate to allow the parties to withdraw their consent and for the matter to proceed on a contested basis.

In NW Frozen Foods (1996) 71 FCR 285, Burchett and Kiefel JJ later also observed (at 293):

… insistence upon the deterrent quality of a penalty should be balanced by insistence that it “not be so high as to be oppressive”. Plainly, if deterrence is the object, the penalty should not be greater than is necessary to achieve this object; severity beyond that would be oppression.

28 Although considerable misgivings were expressed during the course of the hearing in the present case as to the quantum of penalties agreed upon, it is not considered that the Court should depart from the agreements reached.

The maximum as a yardstick – instinctive synthesis

29 As to the latter, namely the discretionary considerations to be taken into account when quantifying penalties, the maximum penalty fixed by the Commonwealth Legislature remains a “yardstick” against which any process of assessment is to proceed (cf. Markarian v The Queen [2005] HCA 25 at [30] to [31], (2005) 228 CLR 357 at 372 per Gleeson CJ, Gummow, Hayne and Callinan JJ). Although the maximum penalty may remain a “yardstick”, the process of fixing upon an appropriate penalty in any individual case remains an “inexact science” and is essentially a process of “instinctive synthesis”: Australian Ophthalmic Supplies Pty Ltd v McAlary-Smith [2008] FCAFC 8 at [27] to [28], [55] and [78], (2008) 165 FCR 560 at 567 to 568 per Gray J, 572 and 577 per Graham J. In the criminal law context, what is meant to be conveyed by this phrase has been explained as follows by Gaudron, Gummow and Hayne JJ in Wong v The Queen [2001] HCA 64, (2001) 207 CLR 584 at 611:

[75] … Attributing a particular weight to some factors, while leaving the significance of all other factors substantially unaltered, may be quite wrong. We say “may be” quite wrong because the task of the sentencer is to take account of all of the relevant factors and to arrive at a single result which takes due account of them all. That is what is meant by saying that the task is to arrive at an “instinctive synthesis”. This expression is used, not as might be supposed, to cloak the task of the sentencer in some mystery, but to make plain that the sentencer is called on to reach a single sentence which, in the case of an offence like the one now under discussion, balances many different and conflicting features.

30 The process of assessing a penalty, accordingly, remains a process guided by a consideration of a number of well-accepted factors. In Kelly v Fitzpatrick [2007] FCA 1080 at [14], (2007) 166 IR 14 at 18 to 19 (“Kelly v Fitzpatrick), Tracey J was called upon to quantify penalties for admitted contraventions of the Transport Workers Award 1998 and in doing so adopted the following as a “non-exhaustive range of considerations” to be taken into account:

the nature and extent of the conduct which led to the breaches;

the circumstances in which that conduct took place;

the nature and extent of any loss or damage sustained as a result of the breaches;

whether there had been similar previous conduct by the respondent;

whether the breaches were properly distinct or arose out of the one course of conduct;

the size of the business enterprise involved;

whether or not the breaches were deliberate;

whether senior management was involved in the breaches;

whether the party committing the breach had exhibited contrition;

whether the party committing the breach had taken corrective action;

whether the party committing the breach had cooperated with the enforcement authorities;

the need to ensure compliance with minimum standards by provision of an effective means for investigation and enforcement of employee entitlements; and

the need for specific and general deterrence.

See also: Australian Ophthalmic Supplies Pty Ltd v McAlary-Smith [2008] FCAFC at [89], (2008) 165 FCR at 579-580 per Buchanan J; Plancor Pty Ltd v Liquor, Hospitality and Miscellaneous Union [2008] FCAFC 170 at [57]-[58], (2008) 171 FCR 357 at 374-376 per Branson and Lander JJ; Patrick Stevedores Holdings Pty Ltd v Construction, Forestry, Maritime, Mining and Energy Union [2019] FCA 1647 at [30] per Flick J. In addition to these considerations not being an exhaustive list of matters that may be taken into account when fixing a penalty, it should be further recognised that the facts and circumstances of relevance to one consideration may overlap with another. Contravening conduct which has been deliberately pursued may well occasion greater concern as to the need for specific deterrence.

31 Each of these considerations has been taken into account in ultimately concluding that the penalty as agreed is “appropriate”: cf. NW Frozen Foods Pty Ltd (1996) 71 FCR 285 at 290-291 per Burchett and Kiefel JJ; Mobil Oil [2004] FCAFC at [51]. A number of considerations, however, warrant greater attention than others.

Deterrence

32 Of the considerations outlined by Tracey J in Kelly v Fitzpatrick, the objective of deterrence remains of fundamental importance: cf. Commonwealth v Fair Work Building [2015] HCA at [55], (2015) 258 CLR at 506 per French CJ, Kiefel, Bell, Nettle and Gordon JJ; Australian Building and Construction Commissioner v Construction, Forestry, Mining and Energy Union [2017] FCAFC 113 at [98] to [99], (2017) 254 FCR 68 at 88 per Dowsett, Greenwood and Wigney JJ.

33 The quantification of an appropriate penalty focuses attention upon both the conduct of the contravener and the public interest in deterring the contravener and others from engaging in like conduct. A penalty, it has been said, “must be fixed at a level that is sufficiently high to deter repetition by a contravener and by others who might be tempted to follow suit”: Director of Fair Work Building Industry Inspectorate v Construction, Forestry, Mining and Energy Union [2015] FCA 1213 at [24] per Tracey J. In Singtel Optus Pty Ltd v Australian Competition and Consumer Commission [2012] FCAFC 20, (2012) 287 ALR 249 (“Singtel Optus v ACCC”) at 265, Keane CJ, Finn and Gilmour JJ stated:

[62] There may be room for debate as to the proper place of deterrence in the punishment of some kinds of offences, such as crimes of passion; but in relation to offences of calculation by a corporation where the only punishment is a fine, the punishment must be fixed with a view to ensuring that the penalty is not such as to be regarded by that offender or others as an acceptable cost of doing business. The primary judge was right to proceed on the basis that the claims of deterrence in this case were so strong as to warrant a penalty that would upset any calculations of profitability. …

[63] Generally speaking, those engaged in trade and commerce must be deterred from the cynical calculation involved in weighing up the risk of penalty against the profits to be made from contravention. ...

34 On the facts of the present case, there looms large the necessity to fix penalties that are sufficiently high to serve as a specific deterrence to the Respondents and as a general deterrent to others who may otherwise consider engaging in like conduct, in particular those in the fast-food industry.

35 The need for any penalty to act as a deterrent to the Respondents now before the Court arises because all the Respondents had committed to a course of deliberately underpaying employees and to a course of attempting to conceal their wrongdoing from the Fair Work Ombudsman. It was only when they realised, and in particular when Mr Tommy Lee and Mr Robert Hwang realised, that their fraud could no longer be concealed, that admissions were made to the Fair Work Ombudsman. No better evidence of the steps taken to conceal their fraud can be found than the responses provided to repeated requests to produce documents. Requests were made by the Office of the Fair Work Ombudsman for the production of documents and documents provided on:

8 March 2016;

19 April 2016;

21 April 2016;

3 May 2016;

6 May 2016

5 July 2016;

7 July 2016;

28 July 2016; and

5 August 2016.

The documents requested to be produced included those which were required to be kept pursuant to reg 3.44 of the Fair Work Regulations. The documents produced, it is admitted, were false and misleading. Indeed, it was during the course of a meeting at the Hero Sushi Head office in Chatswood on 23 August 2016 that Mr Tommy Lee ultimately admitted that he had “reverse engineered” the documents produced. As “reverse engineered”, documents were created not only where none had previously existed, but also created in a manner which falsely disclosed (for example) the payment of the correct minimum hourly rate. The time and effort consumed in creating such false documents must have been considerable. The documents produced were voluminous. On one occasion some 91 pages were provided to the Fair Work Ombudsman; on another occasions some 99 pages were provided. The production of false records over a lengthy period of time was only compounded by the continued persistence on the part of Mr Tommy Lee at the outset of the meeting on 23 August 2016 that there had been compliance in circumstances where he knew that not to be the case.

36 The deliberate conduct of concealment provides a firm basis upon which to conclude that the quantum of penalties imposed should be such that none of the Respondents henceforth regard non-compliance as an available option. The quantum of the penalties should be such as to act as a deterrent directed to each of the Respondents.

37 The need to also expressly consider the objective of general deterrence arises because a Report published by the Fair Work Ombudsman in October 2018 exposed the fact that of the 45 sushi business audited by that Office, 39 were shown to be non-compliant. That Report stated (in part) as follows:

Fair Work Inspectors found 87% non-compliance rate and recovered $797 063 for 406 employees. The activity identified the following items of concern:

• widespread use of false records

• non-issue of pay slips

• excessive unpaid or underpaid hours

• a reliance on vulnerable workers (young, migrant, non-English speaking background).

The activity resulted in the following compliance and enforcement outcomes:

• six legal proceedings (with 3 additional litigations likely)

• one Enforceable Undertaking

• six Compliance Notices

• nine Infringement Notices

• fifteen Formal Cautions.

The investigations that led to the publication of that report commenced in February 2016. The investigation into the business operations of the Respondents arose by reason of those more broadly based investigations.

38 Given these findings in the report, the need for penalties to be fixed at a level which will operate as a deterrent to others in the fast-food industry from continuing to engage in contravening conduct assumes particular importance. There is a need to ensure an “even playing field”: Fair Work Ombudsman v NSH North Pty Ltd [2017] FCA 1301, (2017) 275 IR 148 at 186-187 (“NSH North Pty Ltd”). Bromwich J there observed:

[113] The point made about an even playing field is an important one. It should be observed that a failure to ensure compliance by way of detection, investigation, litigation and sanction, may result in a de facto punishment for those who do the right thing and are required to compete in a market against those who do not. For this reason, amongst others, the FWO submitted that penalties needed to be imposed at a meaningful level for the Court to denounce the respondents’ conduct, to encourage compliance, and to create a financial incentive to change from non-compliance practices. The record keeping contraventions were said to be particularly serious because of the impact such conduct can have on the investigation of contraventions and the determination of unpaid entitlements.

39 Both the Respondents to the present proceeding, and others engaged in the fast food industry, need to know that contraventions of (inter alia) the Fair Work Act and the non-payment or underpayment of employees’ entitlements will attract substantial penalties. The quantum of those penalties needs to be such that the payment of penalties in lieu of compliance cannot be regarded as “an acceptable cost of doing business”: cf. Singtel Optus v ACCC [2012] FCAFC at [62], (2012) 287 ALR at 265 per Keane CJ, Finn and Gilmour JJ.

The nature and extent of the contraventions – the exploitation of the vulnerable

40 Those who most immediately suffered by reason of the contraventions of the Respondents are those employees who were not paid their entitlements.

41 The nature of the contraventions involved, on the facts of the present case, the exploitation of (in many cases) vulnerable employees.

42 Care must necessarily be taken not to over-generalise.

43 The Fair Work Ombudsman, however, did adduce evidence from three former employees who worked at the Kotara outlet, namely:

Ms Sori Kim, aged about 24 when she commenced work;

Mr Taewoo Kim, aged about 30 when he commenced work; and

Ms Isabel Soli Lauina, aged about 18 when she commenced work.

Each came from either non-English speaking and/or otherwise disadvantaged backgrounds. In addition to the evidence of the former employees, from which limited inferences may be drawn as to the background of the employees, evidence as to that background was also provided by:

an Inspector within the Office of the Fair Work Ombudsman, Ms Rebecca Cummings.

44 Ms Sori Kim, who regarded her communication skills in English to be intermediate, painted a picture of working 30 to 40 hours per week at the outset but thereafter working 50 to 60 hours per week. She became fatigued but was worried that she would lose her job if she did not work the hours allocated to her. She was paid a flat rate of $13.00 to $15.00 per hour, a rate below the ordinary minimum rate, and was never paid more when she worked on weekends or public holidays. She never received any pay slips. Whilst employed, she shared accommodation with four other employees and paid various amounts for the use of “utilities”, ranging from $10.00 to $30.00 per week. The outlet also had CCTV cameras which enabled those at the Chatswood Head Office to observe activities. When an Inspector from the Fair Work Ombudsman’s Office arrived, the Kotara outlet received a phone call from the Hero Head Office.

45 Mr Taewoo Kim gave evidence that new staff were paid a flat rate of $12.00 per hour if they were not experienced and $13.00 per hour if they had experience. He maintained that when the Kotara outlet first opened “there were many non-Korean workers at the store, for example, people who were English, Japanese or Indonesian and many of them were working holiday makers”. He had “some English skills”. His own shift was for a period of about 8 to 10 hours per day, he had one day off a week, but this varied, and he usually had to always work on Saturdays, Sundays and Thursdays. He received $1,000 per week even when he worked more than 55 hours per week. Like Ms Sori Kim, Mr Taewoo Kim shared accommodation with “up to ten people”. He likewise paid “amounts to cover the cost of utilities” but did not pay rent.

46 Ms Lauina was living “out of home … due to a family breakdown” and had to support herself. When interviewed for a job, the rate of pay was said to be $13.00 per hour. Although she “had a suspicion that [the rate of pay] wasn’t quite right”, she maintained that she “really needed the job and the money so [she] just accepted it”. She worked “around six days a week” and “worked around 35 hours to 47 hours per week”. She regularly worked on weekends. Her rate of pay increased to $15.00 per hour but she was “never paid more when [she] worked on the weekends or on public holidays”. Whilst working for the outlet Ms Lauina’s financial position was such that she “couldn’t go out to places or do things as [she] couldn’t afford basic things…”.

47 An inspector within the Office of the Fair Work Ombudsman, Ms Rebecca Cummings, maintained that “each of the employees spoken to at the Kotara Store [on 5 April 2016] were Chinese or Korean and present in Australian pursuant to a visa”.

48 Although some of the employees were of more mature age than others, it may safely be inferred that many were young persons in Australia on a visa granted under the Migration Act 1958 (Cth) and many were in need of money. A lack of familiarity with minimum rates of pay may also be inferred.

49 There was no question that employees were deliberately being paid less than the prescribed minimum rates of pay and not being paid for overtime or for entitlements for (for example) working on weekends and public holidays. The seriousness of these deliberate failures to pay employees was only compounded when it emerged that the rates of pay being offered to employees was being calculated by reference to a “target” of keeping wages “between 20 to 25 per cent” of “sales”. The entitlements of employees were deliberately being sacrificed by the Respondents in order to maximise their own financial returns. The existence of such a “target” was confirmed by Mr Robert Hwang during an interview conducted by Ms Cummins on 31 October 2016 and during the course of his cross-examination at the hearing before this Court. It was also confirmed during the cross-examination of Mr Tommy Lee.

The nature and extent of the contraventions – the failure to keep records

50 Express attention should also be directed to the deliberate conduct pursued by the Respondents in not keeping records and records correctly showing (inter alia) rates of pay and the payment of other entitlements.

51 The First to Third respondents, the Corporate Respondents, have admitted contraventions of:

regulation 3.44(1) of the Fair Work Regulations;

regulation 3.44(6) of the Fair Work Regulations;

section 535(1) of the Fair Work Act; and

section 536 of the Fair Work Act.

52 Regulations 3.44(1) and 3.44(6) of the Fair Work Regulations (as in force on 1 July 2017) provided as follows:

3.44 Records—accuracy

(1) An employer must ensure that a record that the employer is required to keep under the Act or these Regulations is not false or misleading to the employer’s knowledge.

…

(6) A person must not make use of an entry in an employee record made and kept by an employer for this Subdivision if the person does so knowing that the entry is false or misleading.

…

53 Section 535(1) of the Fair Work Act provides as follows:

An employer must make, and keep for 7 years, employee records of the kind prescribed by the regulations in relation to each of its employees.

…

54 Section 536 of the Fair Work Act provides as follows:

Employer obligations in relation to pay slips

(1) An employer must give a pay slip to each of its employees within one working day of paying an amount to the employee in relation to the performance of work.

…

(2) The pay slip must:

(a) if a form is prescribed by the regulations—be in that form; and

(b) include any information prescribed by the regulations.

…

(3) An employer must not give a pay slip for the purposes of this section that the employer knows is false or misleading.

…

(4) Subsection (3) does not apply if the pay slip is not false or misleading in a material particular.

55 The importance of compliance with the record-keeping requirements imposed by the Fair Work Act and the Fair Work Regulations cannot be underestimated. With reference to the importance of pay slips, White J in Fair Work Ombudsman v South Jin Pty Ltd (No 2) [2016] FCA 832 has observed:

[55] … Such slips allow employees to understand how their pay is calculated and to obtain independent advice concerning their entitlements. They allow genuine mistakes or misunderstandings to be identified quickly and rectified. In this way, the obligation of employers to issue pay slips is a significant adjunct to the enforcement of compliance with the requirements of industrial legislation and industrial Awards. The keeping of proper employment records serves a like purpose.

Likewise, Colvin J has also observed that “[r]ecord keeping obligations are an important part of the protections afforded by the Fair Work Act”: Ghimire v Karriview Management Pty Ltd (No 2) [2019] FCA 1627 at [11], (2019) 290 IR 331 at 337.

56 There can be no doubt on the facts of the present case that the failure to maintain records and the failure to provide pay slips to employees was part of a deliberate strategy pursued by the Respondents, and in particular the First to Sixth Respondents, to keep employees “in the dark”. The failure to provide pay-slips to employees provided them with no ability to check their hourly rates of pay. The provision of deliberately false records to the Fair Work Ombudsman was also part of the strategy to avoid scrutiny of the rates which had in fact been paid and to avoid scrutiny of the failure to pay loadings for (for example) week-ends and public holidays.

57 The conduct in the present case, the Fair Work Ombudsman submits, “is one of the most serious instances of false record keeping and production encountered by the Applicant, and the most significant to be placed before the courts”.

Contrition and remorse – the position of the individual Respondents

58 One of the other matters identified by Tracey J in Kelly v Fitzpatrick directs attention to whether a respondent has expressed contrition or remorse for their conduct.

59 It is within this context that particular attention has to be given to the individual circumstances of the Fourth to Eight Respondents.

60 The Fourth Respondent, Mr Deuk Lee (aka Mr William Lee), is one of two directors of the First to Third Respondents. He is also a 50% shareholder of those three Respondents. In presumably seeking to justify (at least in part) the rate of pay being offered to employees, he stated in his affidavit that he and Mr Robert Hwang “decided that we would offer our employees a minimum of $12 per hour in cash, so that we can be more competitive in the industry”. It is against that justification, and that his “judgment was incorrect”, that his conduct is to be viewed. Mr William Lee, however, does state that he is “sincerely remorseful of [his] actions and ha[s] been humbled by the experience”. The role of Mr William Lee as a director and shareholder and his participating in decision-making warrants the comparatively higher range of penalties proposed by the Fair Work Ombudsman. In total, the quantum of the penalties to be imposed upon Mr William Lee of $85,000 is considered to be appropriate.

61 The Fifth Respondent, Mr Hokun Hwang (aka Mr Robert Hwang), is the other director of the First to Third Respondents and the other 50% shareholder. He was born in South Korea but became a citizen of New Zealand in 1990. Together with Mr William Lee, Mr Robert Hwang “approved the mutually agreed rate of pay and conditions of employment for the employees at the Hero Sushi stores”. In his affidavit he accepts that he “made a very wrong decision at the time by directing Mr Chang Seok Lee … to make up the records which are required by the FWO in accordance with the relevant [Awards], even if it contradicted with the actual payroll records [they] had…”. He admits that his judgment “was clouded with financial and emotional distress with continuing pressure of increasing rents and other costs…”. But such statements stop well short of an apology for his conduct and well short of contrition. Like Mr William Lee, it is his role as director and shareholder and his involvement in the decision-making which warrants the higher range of penalties proposed by the Fair Work Ombudsman. In total, the quantum of the penalties to be imposed upon Mr Robert Hwang of $85,000 is considered to be appropriate.

62 The Sixth Respondent, Mr Chang Seok Lee (aka Mr Tommy Lee), was also born in South Korea. Between 2001 and 2003 he attended the University of New South Wales and undertook a Master of Commerce in Professional Accounting Course. Within the Hero Sushi Group, he occupied the position of Accounts Manager. He was responsible for the Group’s day to day operations. It was after discussions with Messrs William Lee and Robert Hwang that Mr Tommy Lee ordered the creation of false records. It is Mr Tommy Lee’s greater involvement in the creation of the false records than the involvement of either Mr Brian Cho or Mr Jimmy Kim, which warrants a higher penalty than for those other two respondents. Concurrence is expressed with the submission of the Fair Work Ombudsman that there should be no penalty imposed in respect to the failure to pay Saturday loadings for two periods of time by reason of the underpayments being for comparatively small amounts and for an isolated number of employees. In total, the quantum of the penalties to be imposed upon Mr Tommy Lee of $75,000 is considered to be appropriate.

63 The Seventh Respondent, Mr Ji Won Cho (aka Mr Brian Cho), worked for the Hero Sushi Group from 2014 to 2019 as the Account Supervisor. He was instructed by Mr Tommy Lee to prepare the false payslips in April 2016. In his affidavit Mr Cho accepted there was “no excuse for preparing and producing the false and misleading documents” but stated that in doing so he “was simply taking the directions from Tommy”. But, as noted by Bromberg J in NSH North Pty Ltd [2017] FCA, (2017) 275 IR at 204:

[173] … The public interest in ensuring compliance with workplace laws is not served by excusing a person’s ongoing participation in a contravention by reason only that they have raised the illegality of the conduct as an issue with their superiors and been rebuffed. That is especially so where the contravening conduct was far from momentary, and involved considerable time and effort to execute. ...

Mr Brian Cho goes on to state that he is “extremely embarrassed that [he] didn’t refuse the request, knowing that it was wrong”. It is his limited involvement in the contraventions and his expression of regret that, it has been concluded, warrants the comparatively lesser penalties for some of the contraventions proposed by the Fair Work Ombudsman. In total, the quantum of penalties imposed upon Mr Brian Cho is $16,000.

64 The Eighth Respondent, Mr Junsung Kim (aka Mr Jimmy Kim), started work for HSCT Pty Ltd in 2014. He worked under the direction of Mr Chang Seok Lee (aka Mr Tommy Lee). HSCT Pty Ltd is part of a group of companies including the First to Third Respondents. It was again in April 2016 when Mr Tommy Lee instructed him to prepare false documents so that they could be provided to the Fair Work Ombudsman. In his affidavit he states that he “passively followed the orders and directions from Tommy at the time” but further states that he is “terribly sorry and regret[s]” his involvement. Again, the total penalty agreed to in the sum of $30,000 is considered appropriate.

Co-operation

65 As noted by Tracey J in Kelly v Fitzpatrick, co-operation on the part of a contravener is of relevance when considering the quantum of any penalty to be imposed.

66 But, as further noted by Stone and Buchanan JJ in Mornington Inn Pty Ltd v Jordan [2008] FCAFC 70, (2008) 168 FCR 383 at 405:

[76] … a discount should not be available simply because a respondent has spared the community the cost of a contested trial. Rather, the benefit of such a discount should be reserved for cases where it can be fairly said that an admission of liability: (a) has indicated an acceptance of wrongdoing and a suitable and credible expression of regret; and/or (b) has indicated a willingness to facilitate the course of justice.

See also: Fair Work Ombudsman v Yogurberry World Square Pty Ltd [2016] FCA 1290 at [28] per Flick J.

67 The relevance of the co-operation of the Respondents in the present case must necessarily be tempered by the fact that:

initially, and for a considerable period of time, the Respondents deliberately sought to mislead the Fair Work Ombudsman; and

such co-operation as thereafter emerged only emerged because a view had been formed by the Respondents that they could conceal their fraud no longer.

There, nevertheless, remains the fact that the individual Respondents:

now admit their wrong-doing, albeit with a less than fulsome apology on the part of some of the Respondents;

participated in Records of Interview; and

have – by entering into a Statement of Agreed Facts and in concurrence with the approach of the Fair Work Ombudsman in respect to the assessment of penalties – saved the public (and this Court) considerable time in the resolution of otherwise lengthy and complicated litigation.

The administration of justice has been thereby facilitated by their co-operation.

68 The Fair Work Ombudsman has advanced a 20% discount as the appropriate discount to be applied for their co-operation. Although the Court may have applied a lesser percentage, it cannot be said that 20% is an inappropriate figure.

Corrective action

69 The steps taken by the Respondents to rectify their past conduct has again assumed some – but limited – relevance.

70 Those steps include:

attempts to pay those employees who have been underpaid – but those attempts have been frustrated by the absence of records. A majority of former employees have not been reimbursed; and

the retaining of an external accounting firm to conduct an audit to ensure compliance – but details as to the instructions, scope and methodology of the audit have not been disclosed and those conducting the audit have not been called by the respondents to give evidence in the present proceeding.

The weight to be given to these steps undertaken by the Respondents in reducing an otherwise appropriate penalty is thus not significant.

AGREED PENALTY AFTER TOTALITY

71 The manner in which the agreed minimum and maximum penalties for each contravention were reached in the present case occasions no reason to question the appropriateness as to the method by which penalties have been calculated in respect to each Respondent. That range has been reached in accordance with the application of well-established principles.

72 It was the manner in which the “Agreed penalty after totality” was determined which occasioned the greatest concern. Even though the parties to the present dispute have reached agreement, what may assume importance for future decision-making in other cases coming before this Court is the basis upon which a range of penalties, which may otherwise be considered appropriate, should be further reduced where there are multiple contravening employers.

73 The “totality principle” was addressed as follows by Goldberg J in Australian Competition and Consumer Commission v Australian Safeway Stores Pty Ltd (1997) 145 ALR 36 at 53:

The totality principle is designed to ensure that overall an appropriate sentence or penalty is appropriate and that the sum of the penalties imposed for several contraventions does not result in the total of the penalties exceeding what is proper having regard to the totality of the contravening conduct involved … But that does not mean that a court should commence by determining an overall penalty and then dividing it among the various contraventions. Rather the totality principle involves a final overall consideration of the sum of the penalties determined …

(citations omitted)

As Spender J pointed out in McDonald v R (1994) 120 ALR 629 at 631:

Implicit … is that the sentence for each offence should be “properly calculated in relation to the offence for which it is imposed”. …

It is explicit in this statement that a sentencer or penalty fixer must, as an initial step, impose a penalty appropriate for each contravention and then as a check, at the end of the process, consider whether the aggregate is appropriate for the total contravening conduct involved.

74 It may readily be accepted that the conduct that gave rise to the contraventions involved many common or “overlapping” considerations by reason of:

the common directorship and shareholding of the First to Third Respondents; and

a joint decision-making process whereby employees were engaged at the outlets operated by those Respondents.

And:

some contraventions had already been “grouped” together for the purposes of quantifying the appropriate penalty

The concern expressed during the hearing, however, arose out of the fact that:

the businesses conducted at the outlets of the First to Third Respondents were nevertheless separate business activities involving separate employees.

75 The concern was tested by assuming that a proceeding had been commenced solely as against the First Respondent. On that assumption, it may well have been appropriate to propose a “total” penalty as against that Respondent in the range of $478,960 to $573,280. Yet, on the approach jointly proposed by the parties, it was agreed that the “Agreed penalty after totality” for the first three Respondents, if considered individually, would be $225,000; $225,000 and $150,000 respectively – namely $600,000. It seemed questionable that the three corporate Respondents would be in much the same position irrespective of whether the proceeding had been commenced against one of them alone as opposed to all three.

76 Notwithstanding considerable misgivings, concurrence is nevertheless expressed with the agreement proposed. The principal reason for doing so is that it would be oppressive – and go beyond the objective of deterrence – to impose upon each of the First and Second Respondents individual penalties of about $500,000 and a further penalty of about $350,000 for the third Respondent. Such a penalty, in the aggregate sum of about $1,350,000 would be “oppressive”: NW Frozen Foods (1996) 71 FCR 285 at 293 per Burchett and Kiefel JJ.

CONCLUSIONS

77 The quantum of the penalties ultimately to be imposed upon each of the Respondents, and in particular the First to Sixth Respondents, has occasioned considerable concern. But for the endorsement on the part of the Fair Work Ombudsman as to the appropriateness of those penalties, the Court itself may well have imposed considerably higher penalties.

78 But those factors which have prevailed such that concurrence is expressed with the agreement reached between the parties as to the appropriateness of those penalties are:

the fact that the quantum of penalties was endorsed by the Fair Work Ombudsman, namely the Office with the accumulated expertise and experience in assessing what is an appropriate balance between securing compliance with the relevant legislative regime by means of agreement as opposed to litigation, and the expertise and experience in what the Office considers is adequate to deter the present Respondents and others from engaging in like conduct;

the fact that the Respondents, however belatedly, did co-operate with the Fair Work Ombudsman by admitting their wrongdoing and thereby avoiding a potentially lengthy hearing before this Court; and

the fact that the total amount of all underpayments to employees has either been made to those employees who have been identified or paid into the trust accounts of the Fair Work Ombudsman to be available for distribution to other employees who may be hereafter located.

The material before the Court, together with the fact that the Respondents were separately represented by Counsel, enables the Court to be satisfied that the penalties as agreed are appropriate: cf. Commonwealth of Australia v Director, Fair Work Building Industry Inspectorate [2015] HCA 46 at [32], (2015) 258 CLR 482 at 498-499 per French CJ, Kiefel, Bell, Nettle and Gordon JJ.

79 Appreciation is also expressed to the Office of the Fair Work Ombudsman and its legal representatives for the careful manner in which each of the contraventions – and the involvement of each of the Respondents in one or other of those contraventions – has been presented by way of written submissions. Although not all of those submissions have been expressly referred to, the attention to detail in those submissions provides considerable comfort in separately reaching the conclusion as to the appropriateness of each penalty sought to be imposed.

80 Declarations should also be made in the form proposed. It is further noted that the parties have reached agreement as to the publication of Workplace Notices pursuant to s 545(1) of the Fair Work Act.

BY CONSENT, THE COURT DECLARES THAT:

(1) The First Respondent contravened the following civil remedy provisions:

(a) during the Kotara First Period:

(i) section 45 of the Fair Work Act 2009 (Cth) (“FW Act”), by failing to pay the minimum rates to the Kotara Minimum Rate Employees as required by cll 17 and 18 of the Fast Food Industry Award 2010 (“Award”);

(ii) section 45 of the FW Act, by failing to pay casual loading to the Kotara Casual Employees as required by cl 13.2 of the Award;

(iii) section 45 of the FW Act, by failing to pay Saturday loading rates to the Kotara Saturday Loading Employees as required by cl 25.5(b) of the Award;

(iv) section 45 of the FW Act, by failing to pay Sunday loading rates to the Kotara Full-Time Employees as required by cl 25.5(c)(i) of the Award;

(v) section 45 of the FW Act, by failing to pay Sunday loading rates to the Kotara Casual Sunday Employees as required by cl 25.5(c)(ii) of the Award;

(vi) section 45 of the FW Act, by failing to pay public holiday penalty rates to the Kotara Public Holiday Rate Employees as required by cl 30.3 of the Award; and

(vii) section 45 of the FW Act, by failing to pay overtime to the Kotara Full-Time Employees as required by cl 26 of the Award.

(b) during the Kotara Second Period:

(i) section 45 of the FW Act, by failing to pay Hyemi Jang, Minseok Yun and Yuxin Chen the minimum rates required by cll 17 and 18 of the Award;

(ii) section 45 of the FW Act, by failing to pay casual loading to the Kotara Casual Employees as required by clause 13.2 of the Award;

(iii) section 45 of the FW Act, by failing to pay Saturday loading rates to Hyemi Jang, Minha Kim, Minjae Park and Minseok Yun as required by cl 25.5(b) of the Award;

(iv) section 45 of the FW Act, by failing to pay Sunday loading rates to Hyemi Jang and Kyoungho Kim as required by cl 25.5(c)(i) of the Award;

(v) section 45 of the FW Act, by failing to pay Sunday loading rates to the Kotara Casual Sunday Employees as required by cl 25.5(c)(ii) of the Award;

(vi) section 45 of the FW Act, by failing to pay public holiday penalty rates to the Kotara Public Holiday Rate Employees as required by cl 30.3 of the Award; and

(vii) section 45 of the FW Act, by failing to pay overtime to the Kotara Full-Time Employees as required by cl 26 of the Award;

(c) during the Kotara Assessment Period: