FEDERAL COURT OF AUSTRALIA

Campbell v van der Velde as trustee of the bankrupt estate of Marilyn Anne Rowan, in the matter of Rowan [2019] FCA 1871

ORDERS

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The parties are to bring in short minutes of orders to give effect to these reasons within 14 days.

2. Costs are reserved.

3. If the parties cannot agree the appropriate order as to costs, they must provide brief (that is, no longer than three pages) submissions as to the order as to costs for which they contend within 14 days.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

FARRELL J

1 The primary issues in these proceedings concern the nature and extent of interests in the land known as 19 Applecross Avenue, Castle Hill in New South Wales (often referred to as lot 1102 or No 19). The proceedings also concerned the nature and extent of interests in 25 Applecross Avenue (often referred to as lot 1105 or No 25) until concessions were made by the respondent trustee in closing submissions.

2 The respondent, Terry Grant van der Velde, is the trustee of the bankrupt estate of Marilyn Anne Rowan, appointed on 12 August 2015 along with Richard Moretti. On 1 June 2017, Mr Moretti resigned as trustee and his resignation was accepted by order of the Federal Circuit Court of Australia on 1 September 2017, leaving Mr van der Velde as the sole trustee.

3 The hearing of this matter was conducted in two tranches and the nature of the detail of the relief sought changed over the course of the hearings. At the commencement of the first tranche of hearings the Court was advised that the second applicant (Colin Campbell) was unwell and had dementia. The proceedings were conducted on his behalf by his son, the first applicant (Neil Campbell or Mr Campbell), under an enduring power of attorney, which is in evidence.

4 Colin Campbell died on 30 January 2018. Neil Campbell and his wife, Cheryl Anne Campbell (Cheryl Campbell) are the executors and principal beneficiaries of Colin Campbell’s estate. Neil Campbell was appointed to represent Colin Campbell’s estate in these proceedings by order made on 31 May 2018.

5 By consent, leave was granted to join Cheryl Campbell as an applicant after the first tranche of hearings.

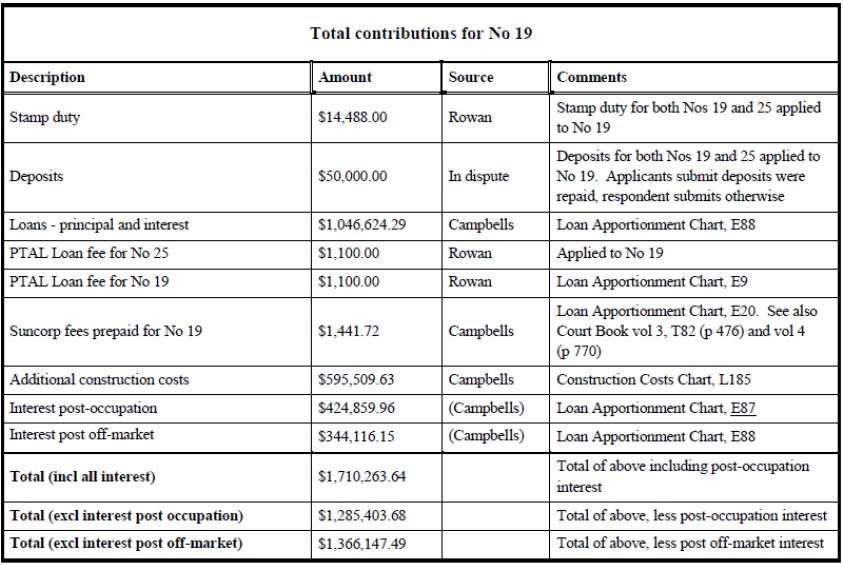

6 Before the second tranche of hearings the parties filed a Statement of Agreed Facts and Agreed Issues in Dispute, containing a list of 20 issues in dispute. They also prepared schedules of contributions to construction and financing of the purchase and development of lot 1102 which left some matters in dispute which were the subject of rulings made at the second tranche of hearings.

BACKGROUND

7 Neil Campbell and Christopher Rowan (Mr Rowan) came to be friends through the same church in the early 1980s. Neil and Cheryl Campbell and Mr Rowan and Marilyn Anne Rowan (Mrs Rowan) became friends after their respective marriages, around 1987. When Mr Campbell started a business in 1997, which he operated through Autus Australia Pty Ltd, Mr Rowan became a part-time employee of Autus Australia and he remained an employee of that company until around February 2006. In the early days, Mr Campbell sometimes asked Mrs Rowan for business advice and she gave him some helpful information. Mrs Rowan operated a “family history business” under the name Marbract Services, being a transcription agency service with the Registry of Births Deaths & Marriages in New South Wales.

8 Around 21 July 2001, Neil Campbell and Mrs Rowan agreed that she would advance $75,000 for the payment of deposits of $25,000 each on three lots of land, being lots 1101, 1102 and 1105 in Applecross Avenue, Castle Hill.

9 Around 26 July 2001, Mrs Rowan exchanged contracts for the purchase of lots 1102 and 1105 for a purchase price of $250,000 each. Mrs Rowan paid a deposit of $25,000 on each of them. No contract was exchanged or deposit paid in relation to lot 1101. The circumstances in which that occurred are disputed.

10 Mrs Rowan was named as purchaser in the contract for lot 1102 and Neil and Colin Campbell were named as purchasers of lot 1105.

11 At that time, Neil Campbell owned and lived with his family in 18 Megan Avenue, Bankstown and Colin Campbell owned and lived in 18A Megan Avenue, Bankstown.

12 In or about mid-2001, Neil Campbell and Mrs Rowan entered into an oral agreement, the terms of which are in dispute (joint venture agreement). The disagreement relates (among other things) to whether or not lot 1105 was to be part of the joint venture agreement. The trustee’s written closing submissions indicated that the trustee now accepts that lot 1105 was not part of any joint venture agreement between Mrs Rowan and Neil Campbell from 14 December 2001, when the purchase of lots 1102 and 1105 was completed.

13 On 14 December 2001, upon completion of the purchases:

(1) Mrs Rowan was registered as the proprietor of a 98/100 share in lot 1102 as tenant in common with Neil Campbell as to a 1/100 share and Colin Campbell as to a 1/100 share. That was still the position as at the date Mrs Rowan’s estate was sequestered on 12 August 2015.

(2) Neil and Colin Campbell were registered as the proprietors of lot 1105 as tenants in common in equal shares.

14 There are three signed transfer forms in evidence relating to lot 1102 (appearing at CB 132-134) as follows:

(1) At CB132 is a copy of an undated standard transfer form in relation to the transfer of lot 1102 for a stated consideration of $250,000 from PEK Holdings Pty Ltd to Mrs Rowan. It appears to be signed by Mrs Rowan and witnessed by Mr Rowan and stamped on 22 November 2001 under s 18(2) of the Duties Act 1997 (NSW) for duty paid of $2.00. This document does not appear to have been registered, since it has no dealing number.

(2) At CB133 is a copy of an undated standard transfer form in relation to the transfer of lot 1102 for a stated consideration of $5,000. The transferor is said to be Mrs Rowan and the transferees are said to be Mrs Rowan as to a 98/100 share, and Neil Campbell and Colin Campbell for a 1/100 share each. The signatures of Mrs Rowan as transferor and Mrs Rowan and Neil and Colin Campbell as transferees are witnessed by a person whose name appears to be Richard Broederlow, although the surname is difficult to read. It appears to have been stamped on 10 December 2001 with payment of $62.50 duty on a dutiable amount of $5,000. This document does not appear to have been registered as it bears no dealing number.

(3) At CB134 is a copy of what appears to be the same document as that at CB133, save that the date 14 December 2001 has been inserted and Marilyn Rowan’s name as transferor has been struck through and PEK Holdings name inserted instead. Next to the latter alteration is a stamp which appears to be a stamp of the Office of State Revenue NSW with the words “Alteration Noted”. That document appears to have been registered and bears dealing number 8214854V.

15 Except for the payment of the deposits and stamp duty in respect of lots 1102 and 1105 ($50,000 and $14,488 respectively) and loan application fees ($2,200) for an aggregate amount of $66,688, Mrs Rowan did not make payments towards to the purchase, development or construction of lots 1102 and 1105.

16 On 21 October 2002, Neil and Colin Campbell and Mrs Rowan entered into a building contract with Dennis Homes Pty Ltd to build a house on lot 1102.

17 During 2002 to late 2003, Mrs Rowan provided limited input on the dimensions, fittings and finishes for the house being built on lot 1102. In closing submissions, the trustee conceded that Neil Campbell was the person responsible for all discussions with Dennis Homes in relation to building works on both lots 1102 and 1105 and with all lenders so that, apart from being a party liable under facilities as described below, Mrs Rowan did not take an active role.

18 Mrs Rowan was a party to facilities provided by Permanent Trustee Australia Limited (PTAL) (as custodian for the Obelisk Mortgage Trust) (PTAL loan) on completion of the purchase of lots 1102 and 1105 on 14 December 2001. She was also a party to a facility with a limit of $1,658,500 provided by Suncorp-Metway Limited under a letter of offer dated 3 February 2003. Interest was capitalised on the loans from PTAL and Suncorp during the development period. The borrowers and mortgagors were as follows:

(1) The borrowers under the PTAL loan were Mrs Rowan and Neil and Colin Campbell. The PTAL loan was secured over lots 1102 and 1105 together with the property owned by Colin Campbell at 18A Megan Avenue.

(2) The borrowers under the Suncorp loan were Mrs Rowan and Neil and Colin Campbell. It was secured over lots 1102 and 1105 and over Neil Campbell’s 18 Megan Avenue property and Colin Campbell’s 18A Megan Avenue property.

19 By an email dated 4 February 2003, Neil Campbell sent Mrs Rowan a draft joint venture agreement. The 4 February 2003 email said:

Hi Marilyn,

Here is the joint venture agreement as discussed recently. I forwarded this agreement to Wayne Innis previously and he made some amendments resulting in the current form. As you will see, the agreement is straight forward and is meant to protect all parties. Whilst I am sure that such an agreement is probably considered unnecessary in practice, in principle it should be formalised (as we both agreed prior to the project commencing) as its intent is to protect all parties. It is important that this agreement is reviewed and signed in the next few days, prior to finalising the finance.

One matter that is not identified in the agreement that we have discussed is the matter about your being a signatory to the finance. If the finance structure of the land results in one loan for all of the construction, we need to identify that your involvement is limited to Lot 1102 only. Of course, a statutory agreement removing your involvement in the finance obligations will need to be completed and forwarded to the financier to have your details removed from the finance agreement. Whilst this is really a given, we should probably formalise it anyway for the same reason we have the written agreement i.e.: to protect the individual parties concerned.

Regards,

Neil.

20 The draft joint venture agreement was brief, comprising eight paragraphs, the last four of which are boilerplate. It relevantly provided as follows (as written):

THIS JOINT VENTURE AGREEMENT DATED February 2003

PARTIES

1. Neil Campbell of 18Megan Avenue Bankstown

2. Colin Campbell of 18A Megan Avenue Bankstown

3. Marilyn Rowan of [redacted] Menai

RECITALS

A. The Parties have agreed to enter into this Joint Venture Agreement (“the Agreement”) to combine certain resources with view to developing land at Lot 1102 Applecross Avenue Castle Hill.

B. The Parties wish to now seek to formalise a verbal agreement that they have previously entered into in respect of Lot 1102 (#19) Applecross Avenue Castle Hill.

OPERATIVE CLAUSES

In consideration of the mutual obligations of the parties they herewith agree as follows:

1. For the purposes of the joint venture only, and in accordance with a previous verbal agreement, Lot 1102 is to be identified as the “primary place of residence” of Marilyn Rowan. As Marilyn Rowan does not currently have a primary place of residence (i.e.: ownership of a property), Marilyn’s name has been placed on title with a disproportionate percentage compared to input, in order to reduce capital gain taxation obligations.

2. In order to meet initial financier requirements, each of the Parties was required to be identified on the Title of Lot 1102. Accordingly, the current Land Titles Office identifies Lot 1102 with a joint ownership comprised of Marilyn Rowan (98%), Neil Campbell (1%) and Colin Campbell (1%). The purpose of the proportions (%) identified on title is to maximise the return at the time of disposal only and in no way reflects the return for each party.

3. As a combined effort of each of the parties named above is being undertaken to acquire, construct and dispose of the residential dwelling (of Lot 1102), the ‘net return’, at the point of disposal, will be in accordance with the inputs (cash, security and expenses incurred) of each of the three parties, after the costs associated with the acquisition, construction and disposal of Lot 1102 have been taken into account. Further, a “Management Fee” of $20,000 (each) is to be allocated to Marilyn Rowan and Neil Campbell to reflect the inputs associated with the acquisition, construction and disposal of Lot 1102.

4. Each party agrees to fulfill their individual obligations associated with the acquisition, construction, identification of and disposal of Lot 1102 Applecross Avenue Castle Hill, NSW. Only the primary obligations for the parties are identified below. Other obligations/ requirements may arise during the course of acquisition, construction and disposal of Lot 1102:

Marilyn Rowan

Cash input used in relation to the acquisition, construction and disposal of Lot 1102

Meeting the ATO ‘primary place of residence’ requirements for Lot 1102 to minimise capital gain tax obligations.

Neil Campbell

Guarantor for finance purposes in relation to the acquisition and construction of Lot 1102.

Cash input used in relation to the acquisition, construction and disposal of Lot 1102

Colin Campbell

Guarantor for finance purposes in relation to the acquisition and construction of Lot 1102

Mrs Rowan did not respond to the email and did not sign the draft joint venture agreement, but it is notable that her tax returns for 2002/2003, 2003/2004 and 2008/2009 which are in evidence state that her address is 19 Applecross Avenue.

21 On or about 7 February 2003, by drawdown in the sum of $562,245.06 from Suncorp, the PTAL loan and mortgage was discharged.

22 Around 23 April 2003, Bank of Western Australia (Bankwest) approved two development finance facilities. One facility was with Neil and Cheryl Campbell and Mrs Rowan with a limit of $700,000 for the purpose of refinancing the Suncorp loan and funding the development of lot 1102. The other facility was with Neil and Cheryl Campbell with a limit of $800,000 for the purpose of refinancing the Suncorp loan and funding the development of lot 1105. Both facilities were to be secured by:

(1) A registered mortgage from Neil Campbell and Colin Campbell over lot 1105;

(2) A registered mortgage from Neil and Colin Campbell and Mrs Rowan over lot 1102;

(3) A fixed and floating charge over the assets and undertaking of Autus Australia; and

(4) Joint and several guarantees and indemnities from Autus Australia and Colin Campbell.

23 On or about 16 May 2003, the Suncorp facility, then in the sum of $951,185.21, was discharged from the two loans provided by BankWest, of which $569,965.14 was discharged using the BankWest loan for lot 1102.

24 In July 2003, Mrs Rowan expressed her disappointment to Neil Campbell about no longer being kept informed about what was going on with the houses. He told her that if she wants to know, she needed to call him. After that, Mrs Rowan ceased to ask for updates.

25 Some time between August and early October 2003, Neil Campbell signed an agency agreement for the purpose of advertising and selling 19 Applecross Avenue.

26 On 25 September 2003, Neil Campbell sent to Mrs Rowan a copy of the 4 February 2003 email attaching the draft joint venture agreement and saying “This is probably a good time to formalise this. Call me so we can discuss it”.

27 Neil Campbell says that, by about late 2003, his ongoing loan repayments for 19 and 25 Applecross Avenue and 18 Megan Avenue exceeded $13,000 per month and he considered that was untenable.

28 In October 2003, construction of a five bedroom house on lot 1102 was completed. 19 Applecross Avenue was placed on the market with an asking price of $1.35 million.

29 In late 2003, an offer was made to purchase lot 1102 for $1.22 million and Neil Campbell rejected that offer without discussing it with Mrs Rowan. Neil Campbell says he discussed it with the estate agent. Mrs Rowan says that when Neil Campbell told her of the offer, he said that he was advised to reject it by the estate agent and she accepted that.

30 In early 2004, another purchase offer was made, for $950,000 and it was rejected without reference to Mrs Rowan. Neil Campbell says that he rejected it because he thought it would produce a larger loss on lot 1102 than he was expecting at that time. The property remained on the market until August 2006 and no further offers were received until about August 2006.

31 In early 2004, construction of a seven bedroom house on lot 1105 was completed. The house included two bedrooms in a self-contained area of the building. At some time during 2004, the Campbells occupied the house.

32 On 23 June 2004, Neil and Colin Campbell exchanged contracts for the sale of 25 Applecross Road. On 7 October 2004, they completed the sale and shortly thereafter the BankWest loan for lot 1105 was discharged. BankWest discharged its mortgage over lot 1102 insofar as it encumbered lot 1105, but the registered mortgage over lot 1102 remained as an encumbrance on lot l102 and BankWest discharged its mortgage over lot 1105.

33 In October 2004, the Campbells occupied 19 Applecross Avenue and they have remained in occupation since that date. The Campbells paid all outgoings related to it.

34 Mrs Rowan was paid an aggregate amount of $50,000 in late October 2004. There is a dispute as to whether this was repayment of amounts advanced by her for the deposits on lots 1102 and 1105 or a loan in that amount from Autus Australia. Mrs Rowan says that her financial position did not improve between July 2001 and early 2004, that she had invested all of her cash into the properties and her business was only providing a basic income, which appears to be confirmed by her tax returns for that period which are in evidence. Accordingly, she was not in a position to contribute to interest expenses. She also had not been provided with information about expenditure on the basis of which she might assess any offers for 19 Applecross Avenue.

35 The trustee relies on a document which purports to be a loan agreement. It appears to be dated 15 November 2005 and bears the signatures of Neil Campbell (for Autus Australia) and Mrs Rowan and to have been witnessed by Autus Australia’s accountant, Robert H Simpson (Mr Simpson). Although it is now the evidence of both Neil Campbell and Mrs Rowan that the payment of $50,000 was in repayment of the deposits (although Mrs Rowan characterises it as an advance on repayment of her contribution pending the sale of lot 1102 and Neil Campbell characterises it as repayment of a loan for the deposits), the trustee presses its characterisation as a loan from Autus Australia to Mrs Rowan on the basis of the purported loan agreement, which Mrs Rowan agrees she signed, and a statutory declaration sworn by Mr Simpson on 11 October 2011. The trustee also relies on correspondence between Mr Campbell and his lawyers with Mrs Rowan’s lawyers from December 2008 to 2015.

36 The express terms of the purported loan agreement are (as written):

LOAN PURPOSE

Residential Construction in Applecross Avenue Castle Hill, NSW.

LOAN AMOUNT

Drawdown payments will be made as requested.

REPAYMENT REQUIREMENTS

The minimum loan fee (interest) will be calculated after the end of the financial year, or end of the loan, whichever comes first, payable by the end of the following financial year. Any interest not paid by this time, will be capitalised, (proportionally reducing the total loan amount availability) not exceeding the maximum loan amount.

TERM OF LOAN

5 Years – commencing from time of initial drawdown.

FEES (INTEREST RATE)

The fees for this loan are comprised of a rate of interest, calculated from the average of the Standard bank Variable Housing Loan interest rate published by the Reserve Bank, from the commencement of the loan to the end of the financial year and subsequently, from the commencement of the following financial year to the end of the financial year or loan whichever comes first. Any other direct fees incurred will also be included.

SECURITY

Prior to the commencement of the loan, Neil Campbell (Director of AUTUS Australia Pty Ltd) will need to be placed on the title of the property and will be removed once the loan is repaid in full.

37 In his statutory declaration made on 11 October 2011, Mr Simpson declared that he was Autus Australia’s accountant at the time the loan agreement was drawn up and completed. He went on to declare that (as written):

Loan Agreement Circumstances:

While in the process of completed the Financial Statements and tax returns for AUTUS Australia Pty Ltd and Mr Neil Campbell in 2004/05, I noted that a sum of money had been advanced to Marilyn Rowan from the company. In completing the accounts I advised Mr Campbell that a loan agreement should be drawn up to protect the company and to ensure that the withdrawals were not considered as a dividend by the Australian Taxation Office.

A loan agreement was subsequently prepared and I reviewed and confirmed the contents of it in March 2005.

38 It is Mrs Rowan’s evidence that when 25 Applecross Road was sold, she was under some financial pressure. Her business was providing only a basic income. Just after settlement she asked Neil Campbell “Can you pay me $25,000 out of the sale proceeds” and he said “I will see what I can do”. The next morning Neil Campbell telephoned and said that “Cheryl and I have had a chat, and we’ve decided to send you $50,000” and the amount was transferred following the discussion. Mrs Rowan assumed that it came from Neil Campbell, drawing on the sale proceeds, but later learned that it came from Autus Australia. Some months later, Neil Campbell said to her “I am being audited by the ATO. My accountant has said he needs to have you sign a document to complete my accounts paperwork.” Mrs Rowan says that she knew Mr Simpson by reputation as an honourable person (being a church member of some authority). She says that she signed the document at his office in Liverpool, not knowing what it was and that she was not provided with a copy, and that it may have been the loan agreement.

39 In cross-examination, Mrs Rowan insisted that the $50,000 paid on the deposits had been an investment and not a loan, that the payment made to her in October 2004 was not a loan, nor was it repayment of the $50,000 that she had put into the project, but rather, she understood the payment to be an advance on the proceeds of the project.

40 In his affidavit sworn on 18 August 2016, Mr Campbell said:

114. In about September 2004, Marilyn and I had a conversation as follows:

Marilyn said: “I know that 19 Applecross Avenue has not sold and that you are to repay me for the deposits when you sell it, but as you have sold number 25, can you repay me $25,000 from the proceeds of number 25? I have no one else I can go to. I need the money for the Registry”.

I said: “I’ll think about that and come back to you.”

115. …

116. In early October 2004, at about the time of settlement of the sale of 25 Applecross Avenue, I moved out of 25 Applecross Avenue with my family into 19 Applecross Avenue. We have lived in the house at 19 Applecross Avenue since early October 2004.

117. On settlement of the sale of 25 Applecross Avenue, I banked some of the proceeds of the sale of 25 Applecross Avenue and shortly after the settlement of that sale, I made two payments by EFT to Marilyn, each in the sum of $25,000. The first of these was on 18 October 2004 (page 49) and the second was on 21 October 2004 (page 48).

118. In about late October 2004 I had a conversation with Marilyn to the following effect:

I said: “I have paid you the $25,000 as requested, plus the remaining $25,000 owed. That will get the monkeys off your back.”

Marilyn said: “Thank you very much. I can’t thank you enough".

119. A dispute arose between Marilyn and myself soon after I made the payments to which I refer in the two preceding paragraphs. As the dispute developed, through her solicitors Elliot Tuthill and later MCW Lawyers, Marilyn consistently asserted that my payments in October 2004 were made in repayment of the deposits of $25,000 each (pages 55 - 57), although Marilyn also asserted that she had some other entitlement (page 57). I disagree with that assertion.

120. The dispute between Marilyn and I regarding her “interest” in 19 Applecross Avenue was ongoing over many years, and from time to time was agitated in our respective solicitor's correspondence without ever being resolved.

In his affidavit sworn on 20 June 2017, Mr Campbell sought to correct that evidence, saying:

29. … the conversations which actually occurred are in my affidavit in chief at paragraphs 114 and 118. I did not transfer the sum of $50,000 to Marilyn. I arranged two payments of $25,000 each, to which I deposed in paragraph 117 of my affidavit in chief.

30. In reply to paragraph 63, I had understood that Marilyn needed money urgently, based on the conversation between us at paragraph 114 of my affidavit in chief. The bank account in the names of Cheryl and myself at St George had insufficient funds in it at about the time of settlement of the sale of 25 Applecross Avenue to enable me to pay Marilyn $50,000. For that reason, I made two payments, each of $25,000 to Marilyn. The first payment was from a Commonwealth Bank account in the name of Autus Australia Pty Ltd, my company. A copy of the bank account statement referring to that transaction is at page 49 of exhibit “NCC 1”. The second payment was from the St George bank account in the names of Cheryl and myself. A copy of the bank account statement referring to that transaction is at page 48 of exhibit "NCC 1".

In his 20 June 2017 affidavit, Mr Campbell also said:

25. … although I was prepared to pay Marilyn in connection with the two $25,000 deposits, I thought about the problems which Marilyn had caused me, being the lost opportunity for me to purchase Lot 1101, additional borrowing costs due to Marilyn's delay in not completing a finance application until November 2001, and additional construction costs of about $100,000.00 and delays arising from the errors of the surveyor Marilyn recommended (Jared Hart). Due to those problems, I decided that I was not willing to sell 19 Applecross Avenue (being Lot 1102) without trying to obtain the best possible price for it. I was expecting to make a loss from the development of Lot 1102 from 2004 onwards.

…

33 … I say that:

(a) In the period from 2004 to about August 2006, I remained willing to sell 19 Applecross Avenue if I could achieve a good sale price, but the property had proved difficult to sell at an acceptable price;

(b) By late 2006, I regarded the payments I had made to Marilyn in October 2004 in the total amount of $50,000 as having fulfilled all of my obligations to her in relation to Lot 1102, taking into account the loss making nature of the development of that property. I wanted to have Marilyn's name removed as a registered proprietor from the title to that property;

(c) I did not take any legal action in 2006 to remove Marilyn's name as a registered proprietor because I understood there was a possibility that I would need to pay stamp duty to do so, and in 2006, I wanted to defer any such payment; and

(d) Part of the conversation in paragraph 73 [of Mrs Rowan’s affidavit] is inaccurate. In relation to a final accounting of building costs for Lot 1102 (being 19 Applecross Avenue), I did not say “I have it in my head’. I had compiled documents relating to construction costs for that property because I intended to demonstrate to Marilyn using information in those documents that the development of Lot 1102 had resulted in a loss, not a profit. On a number of occasions before the conversation in paragraph 73, I had said to Marilyn: “You are responsible for additional unnecessary costs in the project at Lot 1102.” She did not acknowledge that, and changed the subject on the various occasions when we discussed it.

41 Neil Campbell sent the following email dated 2 August 2005 to Mrs Rowan (2 August 2005 email) (emphasis added):

Last year, I was asked for a loan of $25,000 to go towards the registry fees. This amount was asked for because our home had just been sold. It was obvious that the financial shortfall went beyond the registry. I chose to provide an additional $25,000, as I stated at the time, "to get the monkeys off your back". My intention in providing an additional $25,000 on top the $25,000 asked for was to simply help. It was not meant to send the impression that I have an abundance of money. It has always been made clear that we do not. Previously, whenever money was asked for, it was paid back on the basis of interest, however it was only ever at the rate of interest from where the money was derived eg: home line of credit, and nothing more. I have also made a point of not asking to know the specifics of the financial circumstances of the Rowan household at any time.

There has developed over time a practice of not paying the novated lease payments on a regular basis. Rather than being told when the money is to be paid, I have had to ask when the payments were to be made. Initially there was no response to the emails then a response would be received. However, when the anticipated timeframes weren't met, no explanation was forthcoming and further requests needed to be made. This is not reasonable. Essentially, these have become unofficial interest free loans.

Truthfully, I would rather have a reduced interest payment on the joint housing loan. If there is to be a significant delay in payment, it is not unreasonable to anticipate being informed. The point was made, in our meeting late last year, that Chris’ willingness to accept $1000 without needing to respond to emails for 3 weeks at a time was justified because I had not been consistent in paying the money monthly during the housing construction period. Yet, the reason that the money was not paid consistently was perfectly understood and communicated and compounded by the fact that no assistance was able to be provided to meet the financial requirements of the repayments of the investment property. No, I have not forgotten the money used as deposits, nor have I forgotten the drawings against and the security of our house and my father’s home. I should quickly add, that approximately $65,000 was added to the cost of our house in Castle Hill during the difficulties arising from the refinancing to enable the construction to continue on the investment property as it was prioritised.

There also seems to be a view that I am fully responsible for the repayments for the investment property. This is certainly untrue. When our home in Castle Hill was sold, we moved into the investment property, as it was the only sensible thing to do. To continue to have the full repayment requirements of the investment property (approx $7500 per month - interest only!) as well as have an additional rent or mortgage repayment would be imprudent. We have not settled in, unless keeping the house in a state to enable inspections on short notice and keeping most personal items unpacked is considered, 'settled in'. The house is ready for an inspection with as little as 10 minutes notice and there have been numerous times when we have had to leave on short notice. Yes, inspections still occur. They are usually inconvenient. The most recent example occurred last Saturday when a last minute inspection necessitated taking Cheryl’s mother to the airport early.

Whenever I have been asked over the years to assist, I have. However, I am no longer in a position to do so. The loss of Lumley at the end of March, the primary source of income, has not been replaced. The termination fees applied to Lumley certainly assist, however it is easy to work out how long it will last after tax is removed, when the monthly house commitments are considered. Even so, the (approx $7500 per month) still needs to be paid as well as rates of $1,224.07 per annum.

Having a proportionate contribution towards the repayments would have been helpful previously and would be helpful now. This, I understand, is unlikely to happen. The seemingly bottomless pit of money actually has a limit. If the house does not sell in the next few months, the house will just have to be sold for whatever price it can get. The only advantage to this will be a limit to the loss. Accordingly, unless some significant contribution can be received towards the monthly interest payments, there simply isn't the money coming in to keep paying $1000 per month to Chris. Whilst undoubtedly unwelcome, this should not be a surprise. I have always done what I could. I can no longer do so.

I have spent a considerable amount of time trying to find a way to communicate this in the most constructive and positive light, particularly considering the amount of stress experienced by all concerned.

42 Although the evidence of Neil Campbell and Mrs Rowan varies slightly as to timing, the Court finds that in early September 2006, Mrs Rowan learned that, in August 2006, Neil Campbell had rejected an offer to purchase 19 Applecross Avenue for $1,150,000. Neil Campbell did not contest Mrs Rowan’s evidence that the property had, at that time, been on the market for about a year at a price of $1,195,000. Neil Campbell says that he rejected the offer because he expected that the price would produce a loss. He did not refer to Mrs Rowan in making that decision.

43 Mrs Rowan says, and the Court accepts, that she had a conversation with Neil and Cheryl Campbell and Mr Rowan on 8 September 2006 in which Neil Campbell confirmed that 19 Applecross Avenue had been taken off the market, confirmed that he had received on offer for $1,150,000, stated that the “house was a loss” and Mrs Rowan asked for “a proper accounting so that informed decisions can be made” which Neil Campbell agreed to provide by the end of September 2006. She sent emails pressing for an accounting on 3 October 2006 and 1 November 2006 and received responses that Neil Campbell had been unwell and was taking time to recover. She asked again on 20 November 2006 and 22 December 2006. On 9 February 2007, Neil Campbell responded, saying that “reconciling the accounts has not been forgotten about”.

44 Ultimately, on 5 September 2008, Neil Campbell sent Mrs Rowan a narrative document which will be referred to as the September 2008 summation. Most likely at the same time (although it may have been in December 2008) Neil Campbell provided a schedule of expenditure on lot 1102 which appears in the Court Book at pp 679-687 (the 2008 expenditure schedule).

45 In the September 2008 summation, Neil Campbell relevantly said (as written, emphasis in the original, footnote deleted):

Informal/Formal (Contract) – At first, Marilyn & I agreed to pay ourselves $20,000 each from the profit from the property development for our organisational and administrative involvement, followed by a proportionate division of the net return in accordance with the financial input, for the time/effort input into the development. It became clear early on, to both Marilyn & I, that Marilyn’s input was minimal and Marilyn acknowledged that as this was the case she would relinquish her $20,000 payment and just receive her apportioned payment from the net return.

Nevertheless, we had also agreed that a formal agreement was necessary to be agreed upon and signed. Accordingly, I sought legal advice on such and, having acquired an agreement, forwarded the agreement to Marilyn for perusal and subsequent signing. A copy of the ‘Joint Venture Agreement – Lot 1102’ was forwarded to Marilyn on Tuesday, 4th February 2003, the email stated:

…

No response was received to this email (with the attached agreement). The email was resent Thursday 25th September 2003. Again no response was received at all.

…

Offer on 19 Applecross Avenue – After two years of having to have our home in a constant state of preparedness for visitations, an impression was received on Saturday 25 August 2006, by both Cheryl & I (separately) to take the home off the market. We received a phone call for a visitation that evening which we declined and another phone call the next morning for a visitation, which we also declined. However, the estate agent was insistent and I allowed the person to visit. Long story short, an offer was made on the home a few days later (Wednesday, 30 August 2006).

As the home was not designed with our preferences in mind (like 25 Applecross Avenue), it financially made sense to sell the home and purchase a cheaper home with reduced mortgage or even build again. However, both Cheryl and I felt extremely uncomfortable doing so, which was unexpected since, whilst we like the home, we certainly hadn’t fallen in love with it as it came up short in a number of areas in regard to our preferences. Nevertheless, we decided to not sell the home in accordance with the impressions we both had, and have not had a moment of regret.

Marilyn’s Visit – Nevertheless, the decision to not accept the offer was made on Friday 1st September 2006. The next day, on Saturday 2nd September 2006, Marilyn dropped in for a chat to see how the housing market was doing. Marilyn specifically asked if we had had any offers on the home. I simply did not answer the question but rather answered that we had not had many visits (which was true) and the housing market was still slow (which was also true). I then, in changing the subject, asked Marilyn how her business was doing and Marilyn answered that her business had been growing and she had been very busy and in fact the previous Christmas (2005) has been their busiest ever and had continued to be busy.

Over the years I made a point of always saying to Marilyn that I did not want to know the specifics of their financial position … Nevertheless Marilyn had in the past asked for a loan of $10,000 which she promised to pay back within a few months, which she did … I only charged the interest I had paid on the money I loaned to her (as it was drawn down from my line of credit). …

When news that our home at 25 Applecross Avenue was sold, Marilyn approached me about a loan for $25,000 to pay the Registry of Birth’s, Deaths & Marriages which Marilyn stated she did not have. I was also aware of other debts Marilyn had, and whilst I was not aware of the specifics, I did not ask to know as I did not want to know. Consequently, I forwarded $50,000 to Marilyn with the instruction to “get the monkeys off your back”. Marilyn was both surprised and grateful. Marilyn had again expressed appreciation and assured me that I would again receive the money back over the following months.

At the point of Marilyn describing their fortunate financial circumstances (at the time of her visit Saturday 22nd Sept 2006), I reminded Marilyn of the $50,000 that I loaned her in 2004 and that she had promised to pay it back within the following months. Marilyn agreed that the money was owed and will be paid back. To this day, not one payment has been received, despite assurances each time I have reminded Marilyn.

I was both happy for her improve financial circumstances, yet also surprised that she would want to actually tell me how well financially they were doing as the previous June (2005), I had asked Marilyn if she was in a position to put any funds towards the interest payments (as at this point, the house was still on the market to sell). Marilyn felt the need to remind me that her involvement only pertained to the deposit on the land and that rest was up to me, whatever happened. (Marilyn also made no mention of the $50,000 owed by her). I was very clear of my responsibilities in making the repayments; however I was actually asking if she was in a position to put any money towards interest payments only. Marilyn’s patronising answer unfortunately reflected far more than the question sought.

There were several reasons why did not answer Marilyn’s question of whether we had received any offers on the home, in addition to the reasons mentioned in the preceding paragraphs. Most significantly, Cheryl & I actually couldn’t explain why we felt the need to take the home off the market. All we knew then and still now is that we were not to sell the home. We felt right about the decision then and continue to feel so now (I still cannot give a lucid reason to keep the home however I can certainly give good reasons why selling would make sense.)

Marilyn & Chris Rowan’s Visit – (Friday, 8 September 2006). After Marilyn visited me the previous Saturday, she dropped into the real estate agent on the way home to see what else could be done to sell the home. The same arrangement of the real estate agent contacting both Marilyn and I separately was also in place with this different estate agent (Louis Carr). The estate agent told Marilyn that an offer had been made and rejected. Marilyn had assumed that no office were received, when I hadn’t told her of the offer myself, even when she asked.

Marilyn & Chris dropped in unannounced the following Friday to accuse me of lying to them and demanded to have a summary of the housing costs provided. It is true that Marilyn asked me if we had received any offers on the home, however, it is equally true that I didn’t answer the question and changed the subject. I was somewhat taken aback by the outrageous accusation. If I had said that there hadn’t been any offers, then the accusation would be valid and justifiably stated. However it wasn’t true.

….

It is unfortunate that the enthusiasm for having this matter resolved has not been extended to repaying the outstanding $50,000 loan provided 4 years ago, despite assurances it would be. To state that he money borrowed will be paid on several occasions when there is no intention to do so is a more accurate description of dishonesty.

…

Financial Summary

The following is a summary of the total expenses and circumstances surrounding the final outcome of the ‘unprofitable’ venture in housing development.

$ 807,196.30 | Home Construction (including site works and landscaping) |

$ 255,620.78 | Finance Charges |

$1,062,817.08 | sub-total |

$ 40,000.00 | fee for Neil Campbell for direct involvement (as agreed between Marilyn & Neil) |

$1,102,817.08 | Total |

* As the market value is similar to the expenses identified, cause will need to be shown as to why the house should be sold. I am happy to have the net position apportioned, as agreed to, however when the direct costs attributable to Marilyn are applied, a significant input from Marilyn is required. I have communicated to Marilyn on several occasions that the financial return was negative nevertheless Marilyn has continued to hold the view that the development is financially positive. I can only surmise that Marilyn has not taken into account the return obtained from 25 Applecross Avenue that was used to reduce the outstanding mortgage on 19 Applecross Avenue resulting in a current mortgage lower than the identified amount above.

Please note the following about the above expenses;

* All expenses identified above were incurred up to September 2006 when the decision to not sell the home occurred.

Finance charges include:

• Council Rates charges (prior to moving in)

• AGL Charges (prior to moving in)

• Sydney Water charges (prior to moving in)

• Integral Energy charges (prior to moving in)

• Home & Contents Insurance (prior to moving in)

• Real Estate marketing charges ($4,000)

• Vendor Interest & Charges (delayed settlement $10,253.72 )

• Finance (14 Dec 2001 - 07 Feb 2003) - Obelisk (Private Funding) - fees & Charges $79,834.10

• Finance (07 Feb 2003 - 20 May 2003) - Suncorp Metway $49,512.07

• Finance (20 May 2003 - Sept 2006) - Bankwest Finance ($700,000 loan only) $79,956.18

• Finance (until - Sept 2006) - Police Credit Union $27/532.59

Construction Costs

A significant contributor to the cost over-run was the erroneous topographical survey measurements provided by Jared Hart and the subsequent costs on BOTH properties. The builder (Dennis Mirosevich) calculated that the additional combined cost for both properties would be in the order of $100,000+. The $500/property saving was somewhat outweighed by the costs associated with the rectification. . If a registered surveyor had caused the error, then the rectification costs would have simply been charged back to the surveyor. When Jared Hart was approached, he was initially helpful until he realised the implications of his error. His initial helpful tone was replaced by defensive statements ... His position is indefensible. The responsibility for Jared’s involvement was accepted by Marilyn at the time and the consequence is therefore directly born by Marilyn. At no point has Marilyn ever offered an apology for this or any of the adverse outcomes that Marilyn was directly responsible for.

Whatever way the figures are viewed, the end result is the same. What has been ignored by Marilyn was the reduction in the current mortgage from the proceeds received from the sale of 25 Applecross Avenue. The $50,000 provided to Marilyn also came from the sale proceeds. The proceeds from the sale of 25 Applecross Avenue is the primary reason why the current mortgage is not higher than it is.

The net position is, as previously stated on several occasions, a negative position. This cannot possibly be a surprise. In keeping with the original terms of the agreement between Marilyn Rowan & Neil Campbell, the negative position requires the input of both parties until a neutral position is achieved. The input is relative to the overall input, including any additional unplanned costs, which in the case of Marilyn is significant.

The financial (apportioned) return is to be calculated as follows:

1. The initial outlay by Marilyn,

2. less the costs of Jared Hart’s paid invoices (the full cost is borne by Marilyn as Marilyn did not seek this amount to be reimbursed as agreed),

3. less the direct costs associated with the cost overrun directly attributable to the Jared Hart supplied topographical survey's ($100,000+),

4. less the direct costs associated with the delayed settlement with the vendor,

5. less the $5,000 increase in the price of 19 Applecross Avenue (i.e: removal of discount),

6. less the direct costs associated with the delayed financials, requiring private funds to avoid forfeiting the deposits.

7. Of course, there is still the $50,000 already forwarded to Marilyn (loan on 2004), still unpaid.

The cost of Marilyn’s involvement is not limited to the aforementioned reasons. If Marilyn did not become involved, I would have acquired the additional two properties as intended. Within twelve months, property values had more than doubled. The consequence would have been a net return of $250,000 per property i.e.: a $500,000 net return, within twelve months, resulting in either no mortgage or a minimal mortgage.

Marilyn takes no responsibility for any of the negative outcomes of her direct involvement, nor have any measures been undertaken to pay what is owed despite assurances. Significantly, Marilyn has never apologised for any of the directly attributable adverse outcomes, and yet, Marilyn assumes that I am obliged to share the return on 25 Applecross Avenue, for which there was thankfully no involvement at all (except for adding significantly to the cost of and time for construction).

The net position is negative when the ‘contribution’ (positive & negative) is apportioned. Additionally, the $50,000 is still owed. Marilyn needs to provide a repayment schedule as well as extricating herself from the property title to allow her to pursue other financial investment measures, as previously expressed by Marilyn.

46 The construction costs and finance charges reflected in the 2008 expenditure schedule match the summary in the September 2008 summation.

47 The following correspondence ensued:

(1) On 1 December 2008, Bruce Ryrie of Elliot Tuthill Solicitors, wrote to Mr Campbell saying that Mrs Rowan wished to resolve the matter amicably and expeditiously, given the costs which would be incurred in litigation in the Supreme Court. Mr Ryrie said: Mrs Rowan required her liability under the mortgage over lot 1102 to be discharged. She was not satisfied with the detail supplied; she needed that detail to assess her situation properly. She contributed $50,000 “together with other payments” and “the sum of $50,000 has been repaid”. She is “entitled to a repayment of the balance of the moneys contributed by her, if she were to transfer her share in the property to you and discharge the mortgage”. Mrs Rowan denied owing anything to Mr Campbell.

(2) By letter dated 18 December 2008, Mr Campbell replied and made a number of comments which included:

Inventions have more place in the scientific realm, so I would recommend Marilyn rethink her view of the $50,000 and the creative conclusions she also referred to in the phone call. The correspondence on hand along with Marilyn’s responses to active questions clearly identifies the basis of the $50,000 loan. There was never any relationship between the $50,000 and the property. No point creating one now.

I was also intrigued that despite the agreement to proportionally share in the ‘proceeds’ of the venture, your statement that, “On our instructions, at the very least, she is entitled to a repayment of the balance of the moneys contributed by her, if she were to transfer her share in the property to you and discharge the mortgage”. Let’s see if I understand this correctly. If the house had sold and a profit was made (as we both thought would happen), Marilyn is entitled to her share of the profit, however in the case of a loss, Marilyn simply wants her money back, in full, and I bear all of the negative consequences, including those directly caused by Marilyn. And this is “On (your) instruction”? The spirit of the agreement was to share the ‘outcome’. … The advised approach is akin to investing in the stock market, losing on the ‘investment’ and then asking for your money back.

...

Nevertheless, as a demonstration of my willingness for an amicable resolution and as a sign of goodwill, I am happy to have Marilyn “released” from her name on title and the mortgage documents (see I didn’t use the word ‘liability’). …

Further, as a reciprocal goodwill response, Marilyn can repay the loan and I will also forgo the interest, provided it is repaid within 30 days.

(3) By letter dated 29 January 2009, Mr Ryrie responded to Mr Campbell and said:

1. Given your apparent misunderstanding of a mortgagor's liability, we strongly suggest that you obtain independent legal advice.

2. Our client denies that there was a loan from you to her and maintains a position that it was part repayment of the moneys advanced by her. Accordingly, it will not be repaid.

3. We are instructed that our client advanced the sums of -

• $50,000.00 by way of initial deposit

• $14,488.00 in payment of stamp duty

• $2,200.00 in loan fees

The sum of $50,000.00 has been repaid to her. The outstanding balance is therefore in the sum of $16,688.00.

We note your comments that the market value is similar to the expenses identified.

4. Our client has the capacity to approach the Supreme Court of New South Wales to obtain Orders for a sale and discharge, together with an Order for costs, but has instructed us that she is prepared to settle the matter on the basis outlined above, provided that the matter is settled expeditiously.

(4) Mr Campbell responded on 14 February 2009, saying that Mr Ryrie was under the mistaken assumption that he had not taken legal advice and asked for Mr Ryrie to identify the “basis in law” for his position because the “tenuous claims made, presumably by Marilyn Rowan, seem to have little reference to the events”.

(5) Mr Ryrie responded on 10 March 2009, saying that unless an “adequate response” to the letter dated 29 January 2009 was received, an application would be made to the Supreme Court of New South Wales “seeking a sale the property and the division of the proceeds and costs”.

(6) Neil Campbell responded by email dated 11 March 2009, noting his prior request for Mr Ryrie’s “basis in law” for his claims.

(7) Mr Ryrie responded by letter dated 17 March 2009 that Mrs Rowan is a joint owner of the property and requires sale and that is the “basis in law”. Mr Ryrie again recommended that Mr Campbell get legal advice.

(8) On 3 July 2009, Goldrick Farrell Mullan, solicitors, responded, saying that they acted for Mr Campbell who was willing to remove Mrs Rowan from the title to 19 Applecross Avenue. The letter asked Elliot Tuthill to provide copies of the certificate of title and mortgage documents and that Elliot Tuthill advise on what terms Mrs Rowan was prepared to transfer title.

(9) Mr Ryrie responded on 7 August 2009 saying:

Our instructions are consistent with our letter to your client dated 29 January 2009, a copy of which is enclosed. Our client is prepared to transfer the property on the basis of the payment to her of the sum of $16,888.00 and that all outstanding mortgages are discharged.

Further, she requires an indemnity from your client in relation to any advances by your client or his company to our client and in relation to rates or other outgoings in respect of the property.

Please advise us of your instructions.

(10) Mr Campbell wrote to Mr Ryrie on 14 April 2010. It appears that this letter follows commencement of legal action by Ms Rowan, although none of the pleadings related to that court action are in evidence. Among other things, Mr Campbell said (as written):

…

To be clear, the following matters are separate issues:

(a) Removal of Marilyn’s name from the property title,

(b) Marilyn Rowan’s still yet unpaid debt (loan + interest), and

(c) Marilyn Rowan’s share in the loss of the return of the investment property (+ interest).

…

As further evidence, one has only to consider Marilyn Rowan’s feigned expression of a desire to have her name removed from title. I have made it clear, from the beginning, that I am happy to have Marilyn Rowan’s name removed from title without conditions, yet instead of simply doing so, Marilyn has not accepted the offer. Her refusal to accept the offer to have her name removed from title, but rather making her name removal conditional upon unrelated matters has uncovered her real motive. They include, but not limited to:

1. Avoidance of her responsibility for a $50,000 loan (originally sought as a loan by Marilyn – it was only ever a loan and was never a request for a forwarding of the future ‘hopeful’ return of the proceeds of the profitable sale of the speculative investment, as is now claimed) – an attempt to make a relationship between two unrelated matters.

2. Avoidance of her liability towards the apportionment of the return of the speculative investment because it is negative. A very different approach would have been taken if the return was positive ie: profitable.

3. Contempt for the legal system with the attempt to use the legal system to leverage the defraud of my personal funds by sharing in the proceeds received from the selling of my personal home that were put into the mortgage to reduce the repayments that only I have contributed to. The real costs have been identified, but they are simply ignored, with efforts made to claim personal funds from the proceeds received from the sale of my personal home.

It is hard to decide which of the above is more repugnant.

Marilyn Rowan is (verifiably) directly responsible for:

1. The significant additional costs prior to construction.

2. The over-expenditure (verifiable $100k+ cots blowout) consequent to her negligence in organising the topographical surveys; and

3. Subsequent construction time delays (and associated costs) *** without these (Marilyn induced) time delays, the home would have been ready to sell some months prior to the end of the boom period, rather than being put on the market at the end of the boom.

(11) On 16 January 2012, Thompson Eslick Solicitors, wrote to Eliot Tuthill in the following terms on instructions from Mr Campbell. The loan agreement and statutory declaration set out above were attached to the letter:

1. Loan

In early 2004 our client, through his company, Autus Australia Pty Ltd, loaned to your client the sum of $50,000.00.

The agreement was oral. Your client agreed to repay the loan, together with interest at a commercial rate, as soon as she was in a position to do so.

The loan was subsequently confirmed by way of written agreement dated 15 November 2005.

We enclose a. copy of the written agreement. The written agreement introduced a loan term of five (5) years from initial drawdown. Therefore, the loan was required to be paid by early 2009.

We also enclose a copy of a statutory declaration of Mr Simpson, accountant for Autus Australia, confirming that the advance of funds to your client was a loan.

There has been no repayment of any sums and your client remains in breach of the loan agreement. In addition, your client has been unjustly enriched at our client’s expense.

Our client is entitled to repayment of the sum of $50,000.00 plus interest since early 2004. We calculate interest to be $35,595.99.

Our client requires payment of the amount of $85,595.99 in full within 14 days of the date of this letter.

2. Amounts Owing Due To Investment Losses

Our respective clients agreed to undertake a development of land at Lot 1102 Applecross Avenue, Castle Hill.

It was a term of the agreement that Mr Campbell and Ms Rowan would share on a pro rata basis any profit or loss on the venture.

Having regard to the substantial expenses incurred in connection with the development the investment will yield a loss.

Our client is obtaining a valuation of the property following which a final reckoning can be made.

We will provide details of the amount owing in the near future.

Please confirm within 14 days of the date of this letter that your client accepts that she is liable to contribute on a pro rata basis such loss as is established following a final reckoning.

3. Removal of Name From Title

It is necessary for your client’s name to be removed from the title of the Applecross Avenue property.

In the event, your client has made no contribution whatsoever towards repayments to the financier. We are instructed that the financier would support the removal of your client's name from the title.

Please confirm within 14 days of the date of this letter that your client agrees to the removal of her name from the title of 19 Applecross Avenue and that she will pay the costs associated with this process.

48 On 5 June 2012, Autus Australia commenced proceedings in the Local Court of New South Wales against Mrs Rowan seeking repayment of a loan of $50,000 plus interest, in aggregate $87,189.80. This was on the basis of an oral agreement said to have been made in June 2004 and memorialised in the loan agreement.

49 On 30 July 2012, MCW Lawyers, acting for Mrs Rowan, wrote to Thompson Eslick in relation to the debt claim. The letter said:

We assume that you are familiar with the lengthy background of the dispute between our client and your client’s director, Neil Campbell, and will therefore not recite its full history. However, suffice it to say that our client denies owing anything to Autus Australia Pty Ltd, and says that the $50,000 paid to her in or about 2004 was a payment out of the funds of the property development joint venture between her and Neil Campbell. She most definitely denies that there was any loan of $50,000, and indeed denies even requesting that sum of money; she says that she only asked for a release of $25,000 and that your client volunteered a release of $50,000.

50 The 30 July 2012 letter went on to point out a “number of weaknesses” in Autus Australia’s case, not least of which was that it was deregistered on 29 August 2010, so that the claim had no prospects of success. Noting that Mrs Rowan was “essentially assetless”, with no real property (aside from the joint venture), no accumulated wealth of any significance and a leased car, that she was “tired of her dispute with Mr Campbell” and offered to enter into an “appropriately worded Deed” under which:

1. Our client will transfer her share of 19 Applecross Road to Mr Campbell;

2. As a condition of the above, Mr Campbell is to arrange for the refinancing of the loan on the property, so as to remove our client as a liable party;

3. Our client and Mr Campbell are to mutually release each other from any claims that they may have against each other, and Mr Campbell is to indemnify our client against any future claim by Autus Australia (given that, as a deregistered company, it cannot even give an effective release).

51 Thompson Eslick responded on 23 August 2012. They noted that the action against Mrs Rowan had been discontinued and that re-registration of Autus Australia was a procedural matter that could be attended to promptly. The letter disagreed that the loan agreement was implausible, noting the 2 August 2005 email sent by Mr Campbell to Mrs Rowan and saying that if Mrs Rowan “denied the existence of the loan one would expect she would have stated as much”. The letter went on to say:

We agree, however, that if possible all parties are best served through a resolution of differences between the parties.

On our instructions, our client is entitled to:

1. Repayment of the loan of $50,000 plus interest (total to date of $36,560.81);

2. Transfer to Mr Campbell of 19 Applecross Avenue together with attendant costs;

3. Payment of your client’s pro rata share of losses on the development – yet to be quantified.

In the interest of early resolution, we are instructed to propose the following:

1. Payment within 28 days of $50,000;

2. Transfer to Mr Campbell of 19 Applecross Avenue and 50% of the attendant costs of doing so;

3. Mr Campbell will arrange refinancing so as to remove your client as a liable party;

4. The parties to provide mutual releases in respect of all claims including any claim by Autus Australia.

52 By letter dated 10 September 2012, MCW Lawyers responded, noting the fundamental disagreement between Mr Campbell and Mrs Rowan concerning whether there was a loan and the underlying joint venture, and saying that Mrs Rowan reiterated her position that she does not owe money to Autus Australia and that (on a proper accounting) she is owed money by Mr Campbell. The letter suggested that, given her current financial status, Mrs Rowan was “judgment proof”, so that irrespective of merit, there was nothing to be obtained by Mr Campbell that would be better than (or equal to) that which Mrs Rowan had already offered.

53 There then ensued correspondence from 28 March 2013 and 8 July 2013 in which the solicitors for Mr Campbell proffered draft statutory declarations to be signed by Mrs Rowan for the purpose of obtaining a stamp duty exemption under s 55(1)(b) of the Duties Act in relation to the transfer of Mrs Rowan’s interest in lot 1102 to him. It appears that Mrs Rowan’s advisors were not persuaded as to the efficacy of the statutory declaration and Mrs Rowan did not accept the content.

54 On 5 August 2013, MCW Lawyers wrote to Thompson Eslick. MCW Lawyers said that it remained their client’s position that the properties were purchased on the understanding that they would be mutually developed for profit. On this basis, Mrs Rowan paid a total of $66,688.00 comprising the deposits, stamp duty and loan application fees and saying:

Mrs Rowan believes that the $50,000 paid to her by Mr Campbell in 2004 was in repayment of the deposits.

The letter reiterated the offer made in the letter dated 30 July 2012 set out at [50] above and said that, for “clarification”, any costs of the transfer of the property or refinancing were to be borne by Mr Campbell alone.

55 On 26 August 2013, Thompson Eslick wrote to MCW Lawyers reiterating Mr Campbell’s view concerning the events leading up to the laying of the deposits and exchange of contracts for lots 1102 and 1105 and stating that those facts fell within the terms of s 55 of the Duties Act. It threatened that if Mrs Rowan remained unwilling to declare the statutory declaration, Mr Campbell would have “little alternative but to seek the reinstatement” of Autus Australia and recommence proceedings in the Local Court. The letter reiterated the offer in Thompson Eslick’s letter dated 23 August 2012 at [51] above.

56 On 4 September 2013, MCW Lawyers replied saying that, even if Mrs Rowan agreed with the contents of the statutory declaration proposed by Mr Campbell (which she disputed), it was necessary that it reflected the events which occurred, not his intentions. The letter reconfirmed the offer in the letter dated 5 August 2013.

57 On 3 October 2013, Thompson Eslick wrote to MCW Lawyers enquiring whether Mrs Rowan would be prepared to provide a letter stating that she no longer wishes to have further dealings with 19 Applecross Avenue and is happy to have her name removed from title to the property.

58 On 28 October 2013, MCW Lawyers replied that Mrs Rowan was only willing to provide the requested letter in exchange for: refinancing the loan on lot 1102 removing Mrs Rowan as a liable party, release from claims by Mr Campbell and indemnity against claims by Autus Australia and an undertaking that Mr Campbell be responsible for any costs incurred in refinancing and transfer.

59 Mrs Rowan presented a debtor’s petition and Messrs van der Velde and Moretti were appointed as trustees of her bankrupt estate on 12 August 2015.

60 On or about 18 August 2015, the BankWest loan for lot 1102 was discharged and BankWest discharged its mortgage over lot 1102.

SUMMARY OF PLEADINGS

Summary of relief sought in original summons

61 These proceedings were commenced in the Supreme Court of New South Wales and later transferred to this Court because its subject matter relates to a bankrupt estate. As originally pleaded, Neil and Colin Campbell sought the following relief against the trustees:

(1) Declarations that upon a true construction of a contract for the sale of land dated 25 July 2001 in respect of lot 1102, and in the events that have happened:

(a) Neil Campbell is the beneficial owner of all of that land.

(b) The interest of Mrs Rowan as registered proprietor of lot 1102 is held on constructive trust for Neil Campbell.

(2) An order that Mrs Rowan’s share of lot 1102 is charged in favour of Neil Campbell to the value of payments which he made to mortgagees, the builder (Dennis Homes) and competent authorities in relation to the costs of acquiring, developing and occupying that land and to the value of interest pursuant to s 100 of the Civil Procedure Act 2005 (NSW).

(3) An order that the trustee execute in registrable form and deliver to Neil Campbell a transfer in respect of lot 1102 in which the trustee is named as the transferor and Neil Campbell is named as the transferee, together with a bankruptcy application and withdrawal of caveat AJ785807 lodged by the trustees.

(4) Consequential orders.

Original points of claim

62 In the original points of claim filed in this Court, Neil and Colin Campbell pleaded that there were two agreements between Neil Campbell and Mrs Rowan. The first agreement was said to have been made in or around June 2001; it was particularised as being oral and express. That agreement was that, subject to them engaging a mutually acceptable builder and building consultant, Neil Campbell and Mrs Rowan agreed to share any saving in construction and consultancy costs proportionately between them in relation to the development of:

(1) Lots 1101, 1102 and 1105 in an unregistered plan of subdivision which Neil Campbell was intending to purchase for $250,000 each and develop; and

(2) Lots 12 and 13 in the same unregistered plan of subdivision, which Mrs Rowan was intending to purchase for $250,000 each and develop.

63 The second agreement was said to have been made on or about 21 July 2001; it was express to the extent of a telephone conversation on about 21 July 2001 and implied in all of the circumstances. The agreement was that, in consideration of Mrs Rowan agreeing to advance to Neil Campbell the sum of $75,000 for the payment of three deposits of $25,000 each on lots 1101, 1102 and 1105, Neil Campbell agreed to repay the sum on demand.

64 The applicants went on to plead that:

(1) Around 25 July 2001, Mrs Rowan advanced Neil Campbell $50,000 by making deposits to the agent for the vendors of lots 1102 and 1105 (for $25,000 each) but refused or neglected to advance the further sum of $25,000 intended as payment on the deposit of lot 1101.

(2) Mrs Rowan represented orally to the vendor’s agent that she would exchange, as purchaser, a contract for the sale of land in respect of lot 1102 and she had Neil Campbell’s authority to do so. She also represented that she would exchange a contract for the sale of land in respect of lot 1105 in the name of Neil Campbell as purchaser and she had Neil Campbell’s authority to do so. Contracts for lots 1102 and 1105 were exchanged accordingly but Mrs Rowan did not pay deposits in respect of lots 12 and 13 nor did she exchange contracts in respect of them.

(3) Between 26 and 28 July 2001, Mrs Rowan informed Neil Campbell that:

(a) She had exchanged contracts on lot 1102 in her name as purchaser as a means of obtaining security for repayment of the $50,000 advanced pursuant to the second agreement;

(b) She had not exchanged contracts on lot 1101 and had not advanced him the sum of $25,000 in respect of the deposit for it; and

(c) She had not exchanged contracts on lots 2 and 13.

(4) On and after 28 July 2001, Neil Campbell acquiesced in the events referred to at [64(3)] above and the second agreement was thereby varied or his conduct constituted a waiver of his rights under the second agreement with the effect that:

(a) Neil Campbell’s obligation under the second agreement was varied to require him to repay the sum of $50,000 to Mrs Rowan on demand; and

(b) The first agreement was terminated before it had been performed, having regard to her failure to exchange contracts on lots 12 and 13.

(5) In late 2001, Neil Campbell prepared two Transfers for registration by the Land Titles Office in respect of lot 1102: the first transfer was from the vendor of lot 1102 (PEK Holdings) as transferor to Mrs Rowan as transferee and the second transfer was from Mrs Rowan as transferor to herself as to a 98/100 share, to Neil Campbell as transferee of a 1/100 share and to Colin Campbell as transferee of a 1/100 share, in each case, as tenants in common. Mrs Rowan expressed agreement and signed each of the transfers as required. On or about 14 December 2001, contracts for the sale of land were completed and the first and second transfers in respect of lot 1102 were registered along with a mortgage in favour of PTAL.

(6) Pursuant to a loan agreement with the term of one year, PTAL advanced $550,000 to complete the purchase of lots 1102 and 1105. The advance was secured by first mortgage over lots 1102 and 1105. Interest was to be capitalised.

(7) By letter dated 3 February 2003 from the solicitors for Suncorp, Suncorp notified its approval of a development finance facility to Neil and Colin Campbell and Mrs Rowan with a limit of $1,658,500 for the purpose of refinancing the PTAL loan and funding the development of lots 1102 and 1105.

(8) Around 7 February 2003, the PTAL loan was refinanced by a drawdown of $562,245.06 of the facility from Suncorp and the PTAL mortgage was discharged and Suncorp was registered as the first mortgagee of lots 1102 and 1105. Neil Campbell made repayments to Suncorp between 7 February 2003 and 30 April 2003.

(9) Around 16 May 2003, the Suncorp loan and mortgage were discharged by drawdown of the sum of $951,185.21 from BankWest and on settlement of that loan, BankWest was registered as the first mortgagee of lots 1102 and 1105.

(10) On 7 October 2004, Neil and Colin Campbell completed a contract for the sale of lot 1105 and on completion of that contract, Neil Campbell directed that $803,957.40 be paid to BankWest in reduction of the debit balance of the loan with respect to the development of lot 1105. Neil Campbell made repayments to BankWest between 16 May 2003 and 7 August 2015, the effect of which, together with that payment of $803,957.40, was to pay out the BankWest loan and enable the discharge of its mortgage over lot 1105 on 7 October 2004 and its mortgage over lot 1102 on about 15 August 2015.

(11) Neil Campbell paid construction costs in respect of lots 1102 and 1105 which were not the subject of the construction finance facilities from Suncorp and BankWest. In respect of both lots 1102 and 1105, he also paid council rates and utilities, insurance premiums costs of landscaping and costs of maintenance of the completed dwellings.

(12) On or about 18 and 19 October 2004, Neil Campbell paid Mrs Rowan amounts of $25,000 ($50,000 in aggregate) in satisfaction and discharge of his obligations under the second agreement (as varied).

(13) In the premises, from 25 July 2001, Mrs Rowan held her interest in lot 1102 on constructive trust for Neil Campbell to the extent of the payments referred above plus interest, her interest in lot 1102 does not vest in the trustees pursuant to s 58(1) of the Bankruptcy Act and Neil Campbell is the beneficial owner of Mrs Rowan’s interest as registered proprietor in a 98/100 share as tenant in common in lot 1102.

Defence

65 For simplicity, at this point, only the following matters from the trustees’ defence will be set out:

(1) Any agreement that might have been entered into required writing by operation of s 54A of the Conveyancing Act 1919 (NSW) and there was none.

(2) The financing to acquire lots 1102 and 1105 was in the joint names of Neil and Colin Campbell and Mrs Rowan, with the borrowing being by Neil and Cheryl Campbell and Mrs Rowan and a guarantee provided by Colin Campbell.

(3) Equity is not available to the applicants because it is suggested by them that the ownership structure in respect of lot 1102 was entered into with the intention of defeating the revenue, namely, in respect of land tax, capital gains tax and GST on the basis that it was principally owned and occupied by Mrs Rowan.

(4) The trustees did not admit that Neil Campbell made the payments that he said he did.

(5) The trustees did admit that there was an agreement for Mrs Rowan to advance the sum of $75,000 in respect of the deposits on lots 1101, 1102 and 1105 and that she provided deposits in respect of contracts for the purchase of lots 1102 and 1105.

(6) In further answer to the points of claim:

(a) Pursuant to a joint venture agreement (or alternatively, a partnership agreement) entered into in March or April 2001, Mrs Rowan was to utilise the proceeds of sale of her property at Raine Place, Barden Ridge to pay deposits on up to five blocks of vacant land in Applecross Avenue, Castle Hill.

(b) By the time of settlement of the Barden Ridge property, there were only two blocks remaining available in Applecross Avenue.

(c) Mrs Rowan paid deposits of $25,000 each on those blocks, being lots 1102 and 1105. She also paid applicable stamp duty from her personal funds pursuant to the terms of the joint venture agreement or partnership agreement between Mrs Rowan and Neil and Colin Campbell.

(7) The particulars of the terms of the joint venture agreement or partnership agreement were that:

(a) One property would be in Neil Campbell’s name and one property would be in Mrs Rowan’s name.

(b) There was an intention to develop and sell both properties.

(c) The properties would be developed concurrently using the same builder and trades people.

(d) Neil Campbell would manage lot 1105 and Mrs Rowan would manage lot 1102 for which each would take a management fee of $20,000 from the proceeds of sale of the property which they respectively managed.

(e) The proceeds of sale would be applied towards meeting the costs of development and any amount owed to a mortgagee and then, following the payment of the management fee, the proceeds of sale would be divided equally between Neil Campbell and Mrs Rowan.

(8) In breach of the joint venture agreement or partnership agreement, around September 2001, Neil Campbell unilaterally determined that he would keep lot 1105 to be used as his family home.

(9) In August or September 2004, in further breach of the joint venture or partnership agreement, Neil Campbell sold lot 1105 and did not account to Mrs Rowan for the proceeds of that sale and moved into lot 1102.

(10) The respective rights of the parties in relation to lots 1102 and 1105 are to be dealt with pursuant to either the provisions of the Partnership Act 1892 (NSW) or, alternatively, in accordance with the provisions of the joint venture agreement entered into between them.

66 The trustees filed a cross-claim against Neil, Colin and Cheryl Campbell. As originally pleaded, the trustees claimed that:

(1) In June 2001, the common intention of Mrs Rowan and Neil and Colin Campbell was to:

(a) Construct a dwelling house on each lot and then sell them;

(b) To pay Mrs Rowan a management fee of $20,000 in relation to lot 1105;

(c) To pay Neil Campbell a management fee of $20,000 in relation to lot 1102; and

(d) Then to divide the net profits arising from the sale of both lots.

(2) In furtherance of the relationship in the nature of a joint venture or quasi-partnership, Mrs Rowan and Neil and Colin Campbell:

(a) Around 14 December 2001, applied for and obtained finance from Obelisk Mortgage Trust (represented by Perpetual Trustee Co Ltd) secured by mortgage over, among other things, lots 1102 and 1105.

(b) Around 21 October 2001, entered into a building contract with Dennis Homes in respect of the development of lot 1102;