FEDERAL COURT OF AUSTRALIA

State Street Global Advisors Trust Company v Maurice Blackburn Pty Ltd [2019] FCA 1464

ORDERS

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The first applicant and its external legal representatives be released from their respective obligations to use for the purposes of this proceeding only the documents reproduced in confidential exhibit MJW-8 to the fifth affidavit of Michael John Williams sworn 5 August 2019 and confidential exhibit MJW-11 to the sixth affidavit of Michael John Williams sworn on 28 August 2019 but only in respect of category 1 documents as identified in the Court’s reasons for judgment delivered on 5 September 2019, with such release operating only to the extent that they may each use such category 1 documents for the purposes of proceeding State Street Global Advisors Trust Company v Visbal, case number 1:2019cv01719, in the US District Court for the Southern District of New York but for no other purpose.

2. The parties’ costs of the first applicant’s application concerning the partial release of the said obligations be their costs in the cause.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

BEACH J:

1 State Street Global Advisors Trust Company (SSGA), the first applicant in the proceeding before me, seeks an order that it be released from its implied Harman undertaking with respect to the use of 114 documents reproduced in confidential exhibit MJW-8 to the affidavit of Mr Michael Williams sworn 5 August 2019 and 116 documents reproduced in confidential exhibit MJW-11 to the affidavit of Mr Williams sworn 28 August 2019 (the Harman documents), such as to enable SSGA to use the Harman documents for the purposes of a US federal proceeding between SSGA and Ms Kristen Visbal (the artist) in the US District Court for the Southern District of New York (the US proceeding), but for no other purpose.

2 The first respondent, Maurice Blackburn Pty Ltd (MB), and the second respondent (Cbus) oppose the release of the Harman documents. The Harman documents contain material produced by MB and Cbus under the Court’s coercive processes including discovery as well as material produced under a subpoena directed to One Green Bean Pty Ltd (OGB).

3 SSGA seeks the orders based on the so-called special circumstances that:

(a) documents have been produced to SSGA by MB and Cbus in this proceeding including by way of discovery, and by OGB in response to a subpoena;

(b) SSGA is both a party to this proceeding and the US proceeding, although I would note that neither MB nor Cbus are parties to the US proceeding;

(c) pursuant to orders of the US Court, SSGA is required to complete its discovery in the US proceeding by 21 October 2019; and

(d) each of the Harman documents is relevant to an issue before the US Court.

4 Further, as to SSGA’s ability to compel production of the Harman documents in the US proceeding from the artist, who is the sole defendant to that proceeding, SSGA says that the artist has notified SSGA’s lawyers that her email account has been compromised by unknown third parties, and that this may affect her ability to produce documents by way of discovery. Further, SSGA says that some of the documents are unlikely, by their nature, to be documents that would be in the possession of the artist and capable of production by her in the US proceeding.

5 The principles to apply in dealing with a release or modification of the implied undertaking are not in doubt. In these reasons I will use the label of “implied undertaking” although it will be appreciated that “in truth it is an obligation of law arising from circumstances in which the material was generated and received” (Hearne v Street (2008) 235 CLR 125 at [102] per Hayne, Heydon and Crennan JJ).

6 Now the need to demonstrate “special circumstances” and what is meant by that phrase are not matters that require any elaborate disquisition. As stated in Liberty Funding Pty Ltd v Phoenix Capital Ltd (2005) 218 ALR 283 at [31], the notion of special circumstances “does not require that some extraordinary factors must bear on the question before the discretion will be exercised. The discretion is a broad one and all the circumstances of the case must be examined”.

7 Further, in Australian Trade Commission v McMahon (1997) 73 FCR 211 at 217, Lehane J said that “[w]here an application for release is decided in contested proceedings, it seems that ‘special circumstances’ will fairly readily be found where it is established that the use of documents discovered in a proceeding is reasonably required for the purpose of doing justice between the parties in other proceedings” (my emphasis). Of course in so assessing, a matter of significance in the exercise of the discretion is a commonality of issues between the proceeding in which the documents are produced and the proceeding in which the documents are sought to be used, a matter which I will discuss in more detail later. Another consideration is whether there is a unity of parties in the two proceedings or a difference; in the present matter there is no such unity.

8 Before proceeding further I would note that in Hearne at [107] it was accepted that in giving discovery “the law ensures that there is not placed upon litigants … any burden which is ‘harsher or more oppressive … than is strictly required for the purpose of securing that justice is done’”. Ms Claire Cunliffe, counsel for Cbus, put forcefully and attractively that such an expressed stricture should discipline any commercial latitude that I might otherwise be inclined to give to SSGA’s application. Fair point. But of course Hearne was not dealing with the context of any release or modification of the implied undertaking as such, albeit that their Honours went on to observe that although the undertaking can be released or modified, “that dispensing power is not freely exercised and will only be exercised where special circumstances appear”, but with nothing said as to the specific boundaries or content of “special circumstances”. For my part, on the question of such release or modification, I am bound to apply the Full Federal Court authority of Liberty.

9 The Harman documents fall within one or more of the following three categories.

10 The first category is any communication with the artist or her attorney (Ms Nancy Wolff) regarding the Australian Replica (I will define “Replica” later), including: (a) what was permitted or prohibited under the artist’s agreements with SSGA being the Master Agreement (I will define this later), the copyright licence and the trademark licence; (b) the artist’s or Ms Wolff’s knowledge, approval or encouragement of MB’s planned activities; and (c) the artist’s or Ms Wolff’s efforts to trump SSGA’s planned activities (category 1).

11 The second category is any communication between and among the artist’s buyers or their agents, recording what the artist told them about any permitted use of the Replica and their understanding of the same (category 2).

12 The third category is any document evidencing alleged infringing activities in Australia, including: (a) the sale of the Replica; (b) the Australian Launch Event (I will define this later); (c) social media posts; and (d) the lack of attribution to SSGA (category 3).

13 SSGA submits that there are special circumstances justifying the release of the Harman documents in each of categories 1, 2 and 3 for the purposes of the US proceeding. Both MB and Cbus oppose the release.

14 For the reasons set out below I have decided to permit the release of category 1 documents, but not category 2 or category 3 documents at this stage; I may revisit those categories at a later stage. Category 2 and category 3 documents may be relevant to the US proceeding or at least may be used for a legitimate forensic purpose in the US proceeding including as a launching pad for the questioning of the artist, either in a deposition or at trial. But I am not satisfied that sufficient need has been demonstrated to justify their release at this stage. Mr David Studdy SC for SSGA cleverly put me in the hypothetical past of how in the glory days I might have used these category 2 and category 3 documents if I had been so armed with them for the purposes of a firm but fair cross-examination. He did not need much to persuade me that all of them could have been used. Mr Colin Golvan QC for MB countered that I should not apply the lens of a hypothetical past Australian advocate, but rather the lens of a hypothetical future US trial attorney. I tend to agree. But having said that, I am not sure that the two lenses are so different when it comes to planning and performing a profitable cross-examination. In any event, as I say, SSGA has established a legitimate forensic purpose for obtaining the category 2 and category 3 documents not only to question the artist but also to tender some for a non-hearsay purpose or indeed as business records as a hearsay exception. But that is not sufficient to justify their release at this stage. I will revisit this during and after the trial before me in late November 2019.

15 Let me now begin with some background.

Background

16 SSGA by itself and through its affiliates operates an investment and asset management business; it is a trust company incorporated under the laws of Massachusetts. The second applicant (SSGA Australia) by itself and through its affiliates operates an investment and asset management business in Australia where it is incorporated.

17 MB is engaged in the business of providing legal services under the trading name “Maurice Blackburn Lawyers” and is an Australian company. Cbus, also an Australian company, is engaged in the business of providing financial services under the business name “Cbus”. There is a third respondent (HESTA) to these proceedings, but I have now dismissed the case against it.

18 SSGA is presently the second largest exchange-traded fund manager in the world and the third largest asset manager in the world with approximately $2.5 trillion in assets under management. Since around March 2017, and as part of its gender diversity and asset stewardship programs, SSGA has apparently publicly called on 3,500 companies in its investment portfolio in the US, UK and Australia to increase the number of women on their boards, published guidelines and engaged directly with companies on how to increase gender diversity within their organisations and signalled to companies that it would use its proxy voting power to effect change if companies did not commit to increasing gender diversity in their companies.

19 In 2016, SSGA says that as part of its gender diversity initiative, through its agent it designed and commissioned the creation by the artist of a bronze sculpture called “Fearless Girl” (the statue) featuring, as the following image depicts, a ponytailed girl standing defiantly with her hands on her hips.

20 In or around 7 March 2017, the statue was installed in Bowling Green, in New York City’s financial district opposite the much larger bronze sculpture of a charging bull, with a plaque referencing SSGA’s SHE NASDAQ ticker symbol. The plaque was replaced with a New York City Department of Transportation sanctioned sign near the statue. In December 2018, the statue was relocated to its current position on Wall Street across from the New York Stock Exchange, leaving a plaque at the original location at Bowling Green referring to SSGA.

21 According to SSGA, the statue has become world-famous and iconic, attracting members of the public, tourists, politicians and supporters of gender diversity from around the world to take photographs of, or with, the statue that are widely shared and distributed via social media including through the use of the #FearlessGirl hashtag.

22 Further and according to SSGA, the statue has also been extensively promoted by SSGA and its corporate affiliates worldwide, including in Australia, in order to promote gender diversity and asset stewardship initiatives.

23 It is SSGA’s case that SSGA, its group brand and its corporate affiliates are inextricably linked to the statue and its promotion as the “Fearless Girl”, such that a large number of consumers instantly associate the statue, the name “Fearless Girl” and the Fearless Girl trade mark with SSGA and SSGA’s gender diversity and asset stewardship initiatives.

24 Further, it is said that SSGA Australia carries on business in Australia as a member of the SSGA corporate group using the SSGA brands, including by reference to the group brand “State Street Global Advisors” and the brand “Fearless Girl”. Accordingly, SSGA says that SSGA’s gender diversity and asset stewardship initiatives, including those associated with the statue, the name “Fearless Girl” and the Fearless Girl trade mark, are associated in Australia with SSGA Australia, such that use of the brand “Fearless Girl” in Australia and its connection with the group brand “State Street Global Advisors” is and would be taken to be associated with SSGA Australia.

25 On 12 May 2017, SSGA entered into an agreement with the artist (the Master Agreement) regulating the rights of the parties in relation to the statue, the visual art that is embodied by the statue (the artwork), and the Fearless Girl trade mark.

26 According to SSGA, the Master Agreement:

(a) has preserved for SSGA the exclusive right to use the artwork in relation to promoting gender diversity in corporate governance and in the financial services sector;

(b) confirms that SSGA owns the Fearless Girl trade mark, and that SSGA has exclusive rights in relation to the artwork;

(c) acknowledges that use of the artwork by third party financial institutions, corporations or individuals may dilute, tarnish or otherwise damage SSGA and the SSGA brand; and

(d) places restrictions on the artist’s ability to deal with the rights in the artwork, particularly in connection with gender diversity issues in corporate governance or in the financial services sector, and on the permitted use of the Fearless Girl trade mark or any sublicensing of such use.

27 By reason of the above, it is said that SSGA and/or SSGA Australia has or have acquired a very substantial and valuable reputation and goodwill globally, including in Australia, in connection with the statue, the name “Fearless Girl” and the Fearless Girl trade mark, and with the promotion of gender diversity issues and asset stewardship particularly corporate gender diversity which the statue, the name “Fearless Girl” and the Fearless Girl trade mark represent.

28 According to SSGA, on 31 January 2019, without the knowledge or consent of SSGA, MB entered into an agreement with the artist or her agent(s) to purchase a replica of the statue and reproduction of the artwork. It is said that neither the artist nor MB sought or obtained the consent of SSGA before entering into that agreement.

29 On 6 February 2019, SSGA says that it became aware of media articles published in Australia that reported that MB would be bringing a three-dimensional bronze replica of the statue (the Replica) to Australia, for display in Federation Square in Melbourne ahead of International Women’s Day on 8 March 2019.

30 SSGA says that on 6 February 2019, MB posted a Tweet which included a 2D image of the statue, stating:

Artist Kristen Visbal has been commissioned to make a new Fearless Girl statue for Australia. We’re proud to bring this iconic symbol of gender equality, with partners @HESTAsuper @CbusSuperFund to @FedSquare for International Women’s Day. #fearlessgirl #IWD2019

31 Further, SSGA says that on 6 February 2019, MB published a LinkedIn post which included a 2D image of the statue, stating:

Fearless Girl is coming to Melbourne. The artist Kristen Visbal has been commissioned to make a new statue for Australia. We’re proud to be bringing this iconic symbol of gender equality to Fed Square Pty Ltd for International Women’s Day, along with our partners HESTA, Cbus Super Fund. #fearlessgirl #IWD2019

32 Further, SSGA says that on 7 February 2019 MB posted a photograph of the Replica on its “wefightforfair” page on Instagram, which included a 2D image of the statue, with the following comment and using the hashtags #fearlessgirl and #IWD2019 at https://www.instagram.com/p/BtkUyx6FMox/:

Fearless Girl is coming to Australia! We’re proud to be bringing this iconic symbol of gender equality to @federationsquare, in the lead up to International Women’s Day, along with our partners @hesta.super and Cbus Super. #fearlessgirl #IWD2019

33 Further, SSGA says that on 7 February 2019, in an article titled “‘Fearless Girl’ Statue is coming to Melbourne”, the CEO of MB was reported as saying:

“We are proud to be bringing Fearless Girl to Australia,” said CEO of Maurice Blackburn Jacob Varghese, the company responsible for bringing the sculpture to Australia alongside industry super funds HESTA and Cbus.

“Fearless Girl will be a reminder to Australian workplaces that we must keep up the fight for gender equality, including by tackling entrenched pay gaps, increasing the number of women in leadership positions, and providing flexible work environments,” he added.

34 Further, on or around 12 February 2019 SSGA says that MB circulated an invitation featuring the “HESTA”, “Cbus” and “Maurice Blackburn” trade marks, with the words “Australia’s own Fearless Girl is here!”

35 Further, SSGA says that on or around 25 February 2019, an electronic billboard was installed in Federation Square featuring an image of the statue with the text “FEARLESS AGAINST ALL ODDS!” alongside the “HESTA”, “Cbus” and “We Fight for Fair” trade marks.

36 Further, SSGA says that on 26 February 2019 a launch event was held at Federation Square in Melbourne, involving a breakfast which included speeches and a panel discussion, before the unveiling of the Replica (the Launch Event). During the Launch Event, the Deputy CEO of MB is alleged to have made statements relating to the importance of gender diversity in corporate governance. These included statements to the following effect:

The evidence shows that gender diversity promotes good decisions and profitability and productivity of companies, but too often it is not acted on. This is amazing and very difficult to understand given all of the proven benefits.

Women need to feel that there are opportunities for them to lead. We need to support their participation in senior roles. At Maurice Blackburn we do this.

At Maurice Blackburn we encourage women to take on senior positions. We have 50% representation of women on our board, and we promoted 97 women through our promotion process this year.

37 It is said that MB arranged for the artist to attend the Launch Event and to deliver two speeches. Apparently the two speeches delivered by the artist at the Launch Event included references to the importance of gender diversity in corporate governance.

38 SSGA says that on 2 March 2019, MB caused a wrap-around cover to be published in the Herald Sun newspaper (the Wrap-Around Cover), which included a 2D image of the statue and featured the “HESTA”, “Cbus”, “Maurice Blackburn” and “We Fight for Fair” trade marks, with the words “AUSTRALIA’S OWN “FEARLESS GIRL” HAS ARRIVED AT FEDERATION SQUARE!”.

39 Further, SSGA says that on 10 March 2019, MB caused a full-page advertisement to be published in the Stellar magazine which is distributed with the Herald Sun and Sunday Telegraph newspapers (the Stellar Advertisement), which included a 2D image of the statue and featured the “HESTA”, “Cbus”, “Maurice Blackburn” and “We Fight for Fair” trade marks, with the words “AUSTRALIA’S OWN “FEARLESS GIRL” HAS ARRIVED AT FEDERATION SQUARE!”.

40 As to where the Replica is now, it is still at Federation Square.

41 Let me turn to the alleged conduct of Cbus. SSGA says that on 8 February 2019, Cbus published a media release titled “Fearless Girl to take a stand for equality in Australia”. The press release quoted the CEO of Cbus stating:

While standing silent, and at just a little taller than a metre, Fearless Girl’s call for change has been heard right across the world. With all eyes on corporate Australia at the moment, it is the perfect time for her voice to be finding a permanent home in Australia

42 It is also said that around this time Cbus published a Tweet which included a 2D image of the statue, stating:

Fearless Girl inspired millions in New York. Cbus is proud to be joining with @HESTASuper and @WeFightForFair to bring Fearless Girl and her message of equality to @FedSquare

43 Further, it is said that Cbus published a LinkedIn post which included a 2D image of the statue stating:

The #FearlessGirl who faced off against the Charging Bull on Wall Street is coming to Melbourne

44 Further, it is said that the CEO of Cbus published a Tweet stating:

Fearless Girl’s call for equality has been heard across the world. Now is the perfect time for her voice to be finding a home in Australia.

45 Further, it is said that during the Launch Event, the CEO of Cbus made statements relating to the importance of gender diversity in corporate governance and in the financial services sector.

46 Further, it is said that Cbus approved of, and contributed financially to, the Launch Event, the Wrap-Around Cover and the Stellar Advertisement.

47 Generally, it is said that each of MB’s and Cbus’ acts were done in connection with gender diversity issues in corporate governance and in the financial services sector.

48 Accordingly, SSGA and SSGA Australia have brought proceedings against MB and Cbus making claims concerning contraventions of ss 18 and 29(1)(a), (g) and (h) of the Australian Consumer Law for false representations and misleading or deceptive conduct, trade mark infringement, passing off, the tort of interference with contractual relations and for copyright infringement.

49 Given the nature of SSGA’s application before me, it is appropriate to say something concerning the question of document production particularly as it relates to the Harman documents.

Production of documents

50 Documents have been produced by MB and Cbus in this proceeding pursuant to discovery and other orders made since February 2019.

51 On 14 February 2019, MB were ordered to produce certain categories of documents. On 19 February 2019, MB produced two tranches of documents pursuant that order. These documents were tendered at a hearing on 21 February 2019.

52 On 1 March 2019, MB was ordered to discover further documents in various categories and to complete production of the categories ordered on 14 February 2019. On 6 and 7 March 2019, MB produced documents in three tranches pursuant to the 1 March 2019 orders.

53 On 22 May 2019 further orders were made that provided for the exchange of further categories of discovery, the giving of discovery and the filing of any application in relation to disputed categories.

54 On 27 June 2019, agreement was reached between SSGA, MB and Cbus on the categories of documents that would be produced by MB and Cbus to SSGA.

55 On 18 July 2019, SSGA received production of numerous documents from MB and from Cbus by way of discovery. The solicitors for MB and Cbus notified SSGA that their discovery under the relevant categories was not complete and that further production of documents would occur.

56 Although no claim for confidentiality was made over the discovered documents when they were produced, MB has since made a general claim for confidentiality over the MB discovered documents. Recently Cbus made claims for confidentiality over the Cbus discovered documents.

57 I would note that in the proceeding before me, at trial SSGA intends to tender a large number of documents from within the MB discovered documents and the Cbus discovered documents, including documents that are the subject of the present application for SSGA to be released from its implied undertaking.

58 Further, since 5 August 2019 when SSGA filed the Harman application, further documents have been produced by MB and Cbus, and documents have been produced by OGB under subpoena. On 6 August 2019, I ordered the respondents to provide verified discovery by 20 August 2019. On 21 August 2019, Cbus provided verified discovery, including producing 1,518 documents not previously disclosed to SSGA. On 22 August 2019, MB provided verified discovery, including producing 4,508 documents not previously disclosed to SSGA.

59 The trial of these proceedings is set down for hearing before me to commence on 25 November 2019.

US proceeding

60 The US proceeding was instituted by SSGA against the artist on 14 February 2019 (State Street Global Advisors Trust v Kristen Visbal, 1:19-CV-01719-GHW, United States District Court, Southern District of New York).

61 The US proceeding came before the Honourable Judge Gregory H Woods on 25 February 2019 for the hearing of SSGA’s application for a temporary restraining order against the artist (the TRO hearing), on 5 March 2019 for the hearing of SSGA’s application for a preliminary injunction (the PI hearing) and on 18 March 2019 via a teleconference for a scheduling conference.

62 At the TRO hearing, Judge Woods partly granted SSGA’s request for expedited discovery concerning the artist’s undisclosed buyer in Germany, promotional plans concerning the replicas in Australia and Germany, and the identity of the artist’s buyers of replicas and their plans to promote and use their replicas. At the PI hearing, a preliminary injunction was granted against the artist.

63 On 18 April 2019, SSGA served a first request for production of documents on the artist.

64 On 24 April 2019 Judge Woods ordered a timetable in the US proceeding. Under that timetable, all fact discovery was required to be completed by 21 October 2019.

65 Apparently, the current timetable for the US proceeding as ordered by Judge Woods on 24 April 2019, but no doubt subject to any appropriate and justified modification, is as follows.

Event | Deadline |

Deadline to serve contention interrogatories pursuant to Local Rule 33.3(c) (actual deadline is Sat., Sept. 21, 2019) | 20 September 2019 |

Deadline to serve requests to admit | 21 September 2019 |

Completion of depositions (other than expert depositions) | 2 October 2019 |

Completion of all fact discovery | 21 October 2019 |

Deadline for party-proponent of a claim to make all expert disclosures required by Fed. R. Civ. P. 26(a)(2), including opening expert reports | 21 October 2019 |

Parties to confer to discuss settlement | 4 November 2019 |

Deadline for party-opponent of a claim to make all expert disclosures required by Fed. R. Civ. P. 26(a)(2), including opposition expert reports | 4 November 2019 |

Deadline to request leave to provide additional expert disclosures (e.g., rebuttal expert reports) | 14 November 2019 |

Completion of all expert discovery, including expert depositions | 9 December 2019 |

Parties to file a joint letter updating the Court on the status of the case | 12 December 2019 |

Deadline for a party seeking to move for summary judgment to request a pre-motion conference by letter setting forth the grounds for the proposed motion | 16 December 2019 |

Status conference before Judge Woods | 19 December 2019 at 4:30pm |

Deadline to file motions for summary judgment and motions to exclude expert testimony | 8 January 2020 |

Deadline to file responses to motions for summary judgment and motions to exclude expert testimony | TBD (estimated 22 January 2020) |

Deadline to file replies in support of motions for summary judgment and motions to exclude expert testimony | TBD (estimated 29 January 2020) |

Parties to file joint pretrial order, motions in limine, and pretrial memorandum of law | TBD – 21 days from the Court’s decision on any dispositive motion |

Trial | TBD (estimated length 4–6 days) |

66 It is appropriate to now detail the claims made in the US proceeding. SSGA has brought five sets of claims in the US proceeding based on alleged breaches by the artist of the Master Agreement including breaches of the copyright licence (Exhibit A to the Master Agreement) and the trademark licence (Exhibit D to the Master Agreement) (the Agreements).

67 The first set of SSGA claims involve allegations that the artist breached the following sections of the Master Agreement:

(a) Section 3(a), by speaking about gender diversity in corporate governance and in connection with the artwork (i.e., the work of visual art that is embodied by the original bronze statue known as “Fearless Girl”) at the Launch Event in Australia whilst promoting the Australian buyers;

(b) Section 7(c), by making unauthorised sales of replicas to unauthorised third-party buyers, namely: (i) MB, a proclaimed social justice activist, who the artist knew was acting in conjunction with two superannuation funds in the financial industry – HESTA and Cbus; (ii) a buyer in Germany, who the artist knew was purchasing the replica for his client, Accenture; and (iii) Mr Edwards Jones, a financial institution that used a mini replica to promote gender diversity in corporate governance and the financial sector;

(c) Section 1(d), by failing to provide attribution to SSGA on the replicas provided to an Oslo buyer, the Australian buyers, and Mr Edward Jones, all of which were used in a promotional or corporate event or ceremony;

(d) Section 6(a), by failing to use commercially reasonable efforts to ensure that the artwork was never exploited in a manner that could tarnish or dilute the SSGA brand or SSGA’s high-quality reputation;

(e) Section 6(f), by failing to request approval from SSGA to sell replicas to any buyers that were prohibited under Section 7(c) and for proceeding to use and make sales of unapproved replicas;

(f) Section 7(b), by failing to maintain the well-regarded reputation and integrity of Fearless Girl, the FEARLESS GIRL trade mark, and SSGA and by authorising expressly or impliedly her buyers to violate the “no branding” provision;

(g) Section 11(e), by using the domain “fearlessgirl.us” beyond the scope of use permitted by SSGA, that is, for direct sales of the artwork or replicas; and

(h) Section 14, by failing to negotiate with SSGA in good faith.

68 The second set of SSGA claims involve allegations that the artist breached the following sections of the trademark licence:

(a) Section 2(h), by failing to include on three-dimensional reproductions of the statue provided to any third party as part of any promotional or corporate event either attribution to SSGA required under Section 1(d) of the Master Agreement or the following trade mark notice: “The Fearless Girl trademark is owned by State Street Global Advisors”;

(b) Sections 3(a) and 3(d), by making unauthorised sales of replicas to third party buyers who then misused the SSGA’s FEARLESS GIRL trade mark and failing to maintain the well-regarded reputation and integrity of Fearless Girl, the FEARLESS GIRL trade mark, and SSGA; and

(c) Section 5, by failing to notify SSGA of the infringement or misuse of the FEARLESS GIRL trade mark, and instead defending improper use of the mark.

69 The third set of SSGA claims involve allegations that the artist has breached the following sections of the copyright licence:

(a) Section 1(a), by speaking about gender diversity in corporate governance and in connection with the artwork at the Launch Event in Australia whilst promoting the Australian buyer(s); and

(b) Section 1(b), by making unauthorised sales to third party buyers of replicas that were used in breach of the relevant Agreements and that infringed rights granted exclusively to SSGA and by explicitly or impliedly granting buyers those same rights.

70 The fourth set of SSGA claims involve allegations that the artist breached the covenant of good faith and fair dealing that was inherent in all of the Agreements by orchestrating sales of replicas in such a way that attempted to circumvent the plain terms of the Agreements, failing to conduct appropriate due diligence into her buyers and their intended uses of replicas to determine whether her sales complied with the terms of the Agreements, failing to negotiate in good faith with SSGA, encouraging her buyers to publicly unveil their replicas before SSGA, refusing to sell another replica to SSGA, and disclosing SSGA’s unveiling plans to her buyers.

71 The fifth set of SSGA claims involve allegations that the artist committed an anticipatory breach of the Agreements due to her intentions at the time to participate in the promotion of the Replica she sold to her Australian buyers, to complete a sale to the German buyer without SSGA’s permission and without attribution to SSGA, and by continuing to use an automated sales form to sell mini replicas.

72 Further, SSGA is currently seeking leave to add further claims against the artist of direct copyright infringement, inducement of copyright infringement, contributory copyright infringement and vicarious copyright infringement.

73 Let me now deal with the topic of how SSGA seeks to use the Harman documents in the US proceeding.

74 Mr O’Malley, the only representative of SSGA currently able to access the MB discovered documents and the Cbus discovered documents by reason of the claims for confidentiality by MB and Cbus, wishes to be able to use the said documents on behalf of SSGA in the US proceeding.

75 SSGA says that the Harman documents, which have been classified into category 1, category 2 and category 3 documents, which categories I have described earlier, are relevant to the pleaded issues in the US proceeding. Mr Williams, solicitor for SSGA before me, has reviewed the various sets of documents in his confidential exhibits MJW-8 (114 documents) and MJW-11 (116 documents) and categorised them in one or more of the said categories. Consequently, SSGA says that the documents are relevant to issues in the US proceeding and are documents that SSGA would wish to rely on in that proceeding.

76 Now a number of the Harman documents are documents that do not involve direct communications with the artist and it is not expected that such documents would be in the possession of the artist for the purposes of her giving discovery of them in connection with the US proceeding. These include communications between MB, Cbus and HESTA. Further, these documents would not otherwise be produced in discovery in the US proceeding, as neither MB nor Cbus are parties to that proceeding.

77 Further, as to the Harman documents comprising direct communications with the artist, being category 1 documents, during a teleconference between the US Court and the parties on 9 July 2019, counsel for the artist said that the artist was facing technical difficulties producing documents in her possession, including because her email account had been compromised by third parties. Accordingly, the artist may be unable to give complete discovery in the US proceeding, although the position on this is uncertain on the evidence before me. Now the artist did produce some documents on 31 July 2019. But regardless, SSGA is unable to presently determine if Harman documents in category 1 have been produced by the artist in the US proceeding without using information that would indirectly breach the implied undertaking.

Relevance

78 Let me deal further with the relevance of the Harman documents to the US proceeding.

79 There is evidence that documents evidencing draft marketing materials and planning documents are relevant to the US proceeding and would be relied on by SSGA to prove the scope of intended activity to be carried out by MB and Cbus as a consequence of the alleged breaches of the Master Agreement by the artist.

80 Further, there is evidence suggesting that the Harman documents in all categories are relevant to procedural steps that will be taken by SSGA in the US proceeding such as depositions and evidence preparation by SSGA.

81 Further, all categories of Harman documents are relevant to SSGA’s allegations against the artist in the US proceeding. Those claims include, inter alia, alleged breaches of the Master Agreement as a result of the artist’s unauthorised sale of the Replica to MB and the consequences of that sale, including MB’s and Cbus’ use of the Replica. Further, the fact that the claims against the artist in the US proceeding arise, at least in part, as a result of her dealings with MB in relation to the Replica, including the terms of the agreement between the artist and MB regarding the purchase of the Replica, inherently leads to a significant degree of commonality of factual issues between the proceedings.

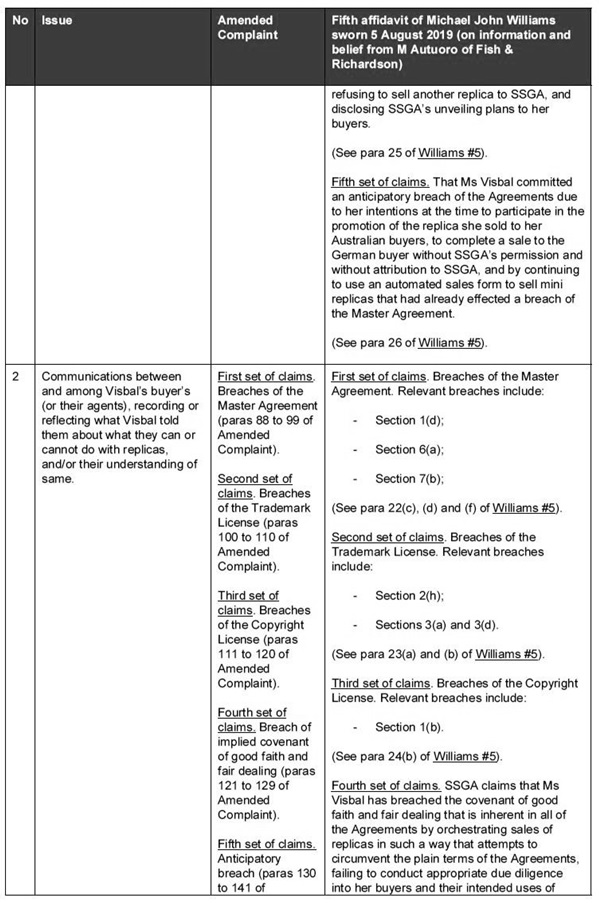

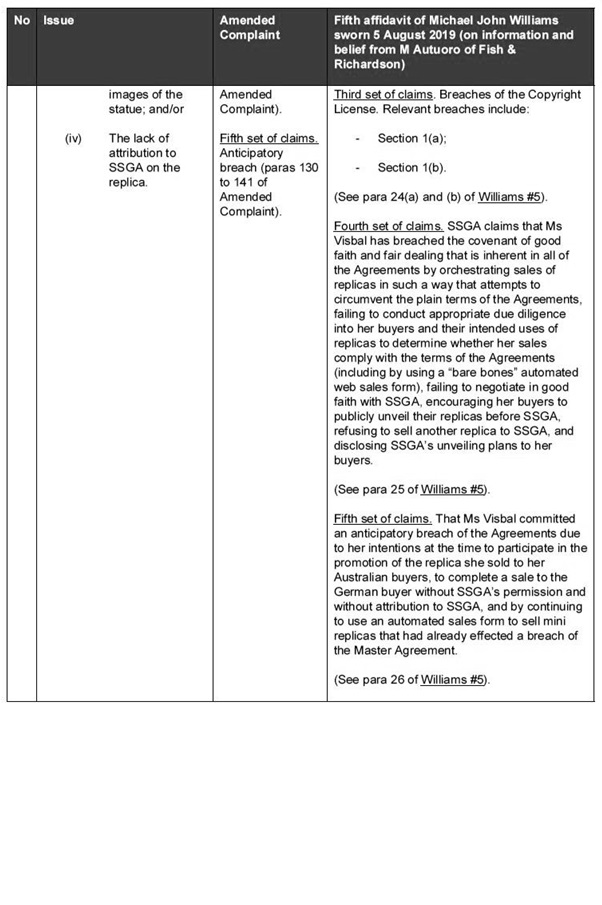

82 The relationship between categories 1, 2 and 3, the complaint in the US proceeding and the specific legal claims being pursued by SSGA in the US proceeding is set out as a schedule to my reasons, which I have taken from SSGA’s submissions.

83 Further, each of the Harman documents has been appropriately linked to one or more categories, as indicated in the schedules of documents comprising confidential exhibit MJW-7 and confidential exhibit MJW-10 to Mr Williams’ affidavits. I accept SSGA’s categorisation.

84 Now ultimately it will be a matter for the US Court as to whether the Harman documents are relevant and admissible in the US proceeding. But it is sufficient for my purposes to say that the documents may illuminate matters in the proceeding before the US Court. Further, it would be undesirable for me to conduct a mini trial about the relevance or admissibility of material that may be sought to be tendered in the US proceeding.

85 In summary, in my view categories 1, 2 and 3 are relevant to the US proceeding and in any event at the least could all be deployed for a legitimate forensic purpose in that proceeding. But it must be said that in considering the nature of the documents, the category 1 documents are much more compelling for release now than the category 2 or category 3 documents. They have higher relevance and probative value and are much more likely to be admissible in the US proceeding.

Timing

86 Let me turn to the question of timing. It has been submitted by MB that SSGA’s application be deferred until after the trial in the proceeding before me when, so it is said, “the documentary tender record [will be] clear”.

87 Further, in the case of documents recording communications between MB and the artist, MB has suggested that the relevant documents “are presumably the subject of the US discovery orders made by the US court” and that I should wait until discovery has been completed in the US proceeding before permitting any release. But as I have said, SSGA is unable to determine whether this is the case. Without access to the documents, it is not feasible to determine whether the documents have been produced by the artist in the US proceeding. The current Harman undertaking prevents SSGA from being able to disclose identifying details (date, title, sender, recipient etc.) to the US attorneys, particularly Mr Michael Autuoro, principal of US law firm Fish & Richardson and counsel for SSGA in the US proceeding.

88 Now SSGA submits that if the Harman application is deferred until trial in the proceeding before me in late November 2019, SSGA may be unable to rely on the documents at the trial of the US proceeding. Any production of the documents at that stage would be long after the closure of discovery in the US proceeding, which documents should be produced by way of discovery, and would be objected to by the artist. Further, SSGA says that it may suffer prejudice because other key procedural steps in the US proceeding will have taken place in the meantime, including depositions and evidence preparation, without the availability of the documents.

89 Without lingering too much on the timing question in terms of the truculent positions taken by each of the parties, I have reached the following conclusions.

90 First, the category 1 documents are of such significance and utility to the deposition process in the US proceeding that I am easily satisfied that they should be released now for that purpose.

91 Second, I think little of MB’s argument that even the release of category 1 documents should be postponed until after the trial of the proceeding before me and until after the artist completes discovery in the US proceeding. In the US proceeding, depositions (non-expert) are to be completed by 2 October 2019. The category 1 documents will be important to that process, but category 2 and category 3 documents much less so. Further, the artist’s discovery is not likely to be wholly satisfactory given her computer problems. Moreover, SSGA cannot tell whether it is complete without indirectly breaching the Harman undertaking in any event.

92 Third, as to the category 2 and category 3 documents, I am not satisfied that I should permit release of these before the trial before me. But on the current timetable for the US proceeding, if I was to determine to release these at trial, that should not substantially disrupt the US proceeding. Any motions for summary judgment and any trial in the US are for early 2020. Moreover, I would expect that Judge Woods might permit the use of late material from SSGA if it has been held up by my refusal to release the category 2 and category 3 documents at this stage.

93 It is all of course a question of balancing the interests of justice. But contrary to SSGA’s assertion, I should give primacy to the interests of justice in the proceeding before me and the parties before me, rather than to prefer and prioritise SSGA’s collateral purpose. Moreover, this is not a case where SSGA is an unwilling participant in the US proceeding. It wielded that sledgehammer. It can wear the consequences. If there is any prejudice to it on any timing question, it is the author of its own misfortune.

Confidentiality

94 Let me turn to the question of confidentiality.

95 MB has claimed confidentiality over all of the MB documents (82 with prefix “MBL” and 22 with prefix “SSGA.001.001”) the subject of the present application. Cbus has now claimed confidentiality over any of the Cbus documents that are the subject of the present application.

96 But a protective order can be put in place in the US proceeding that has the effect of protecting documents designated confidential from being disclosed outside the US proceeding, pending further order of the US Court.

97 Further, SSGA accepts that if I were to grant it leave to use the category 1 documents in the US proceeding, any documents claimed by MB or Cbus to be confidential would be designated by SSGA to be confidential and would be protected by the protective order.

98 In my view, any question of confidentiality is no bar to releasing the category 1 documents.

Status in Australia

99 Separately, MB submits that although SSGA has indicated that it intends to tender the Harman documents in the Australian proceeding, at this stage the use and admissibility or terms upon which admissibility may be ordered of the Harman documents is a matter of speculation. It says that the proposition that all such documents will be tendered by SSGA at trial does nothing to address the question of what may or may not be admitted into evidence, not least until the evidence has been adduced in fact rather than as presently speculated.

100 MB submits that until it has been determined how the documents are to be or have been treated in the Australian trial, it is not justifiable for that reason alone to have them made available for use by SSGA in the US proceeding.

101 In my view this argument is specious. Even if not one such document is tendered or admissible in the Australian trial, so what? That does not deny their relevance or admissibility in the US proceeding. And as to timing, the real issues are as I have discussed earlier.

Prejudice to respondents

102 The respondents have not identified any significant and relevant prejudice that they are likely to sustain as a consequence of the release of the Harman documents in category 1.

Other matters

103 Further, and to the extent not already addressed, as to the 7 considerations referred to by Wilcox J in Springfield Nominees Pty Ltd v Bridgelands Securities Ltd (1992) 38 FCR 217 at 225:

(a) there is nothing in the nature of the category 1 documents that inherently demonstrates why they should not be availed of in the US proceeding;

(b) the circumstances in which the category 1 documents came into existence arises out of the existing arrangements between SSGA and the artist, the rights and restrictions thereunder and the arrangements between the artist and MB;

(c) no evidence has been filed by the respondents demonstrating prejudice by my making the orders sought in relation to category 1 documents;

(d) the fact that the category 1 documents were largely created before litigation is only one matter for consideration;

(e) as to any question of confidentiality, confidentiality can be protected by any US protective order;

(f) the documents have come into the possession of SSGA through the compulsory processes of the Court in circumstances where the US proceeding has been on foot with an overlap of issues in the two sets or proceedings; and

(g) the evidence is that the documents are relevant to the issues in the US proceeding and may contribute to achieving justice in the US proceeding.

104 Finally, if it needs to be said, each case turns on its own facts. For example, the factors relied on by Besanko J in CSL Ltd v Novo Nordisk Pharmaceuticals Pty Ltd [2013] FCA 1307 at [44] to conclude that documents should not be released, do not apply here. First, the proceeding into which the applicant wanted to introduce the documents did not allow for discovery; this is to be compared to the US proceeding, which clearly does. Second, it was likely that the documents would be uploaded to the European Patent Office portal, and publicly accessible online, and it would be difficult to obtain a non-publication order; this is to be compared to the US proceeding, in which a protective order can be put in place. Third, as to the question of relevance, Besanko J held that the significance and relevance of the documents “must be heavily qualified by the substantial chance that the Technical Board would not allow the applicants to amend their case at this late stage” to introduce the documents into the proceeding. But in the US proceeding, there is more flexibility.

Conclusion

105 In summary, I will permit release of the category 1 documents, but not category 2 or category 3 documents. SSGA can renew its application concerning the category 2 and category 3 documents at trial. I am not satisfied that special circumstances have been shown to justify the release of those categories at this stage.

I certify that the preceding one hundred and five (105) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justice Beach. |

Associate:

SCHEDULE