FEDERAL COURT OF AUSTRALIA

Jahani, in the matter of The Ralan Group Pty Ltd (administrators appointed) [2019] FCA 1446

ORDERS

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The originating process dated 20 August 2019 (originating process) be made returnable instanter.

2. Pursuant to s 439A(6) of the Corporations Act 2001 (Cth) (Act), the convening period, as defined by s 439A(5) of the Act, with respect to each of the other 57 companies listed in the schedule (the Ralan Group or companies) be extended up to and including 4 December 2019.

3. Pursuant to s 447A(1) of the Act, Pt 5.3A of the Act is to operate in relation to the companies as if the meeting of creditors of the companies, required by s 439A of that Act, may be convened and held at any time during the period as extended under order 2 above, and the period of five (5) business days thereafter, notwithstanding the provisions of s 439A(2) of the Act.

4. Liberty to apply be granted to any person, including any creditor of the companies or the Australian Securities and Investments Commission (ASIC), who can demonstrate sufficient interest to vary the orders sought on the giving of reasonable notice to the plaintiffs, and to the Court.

5. The plaintiffs, within seven (7) business days of making these orders, are to take all reasonable steps to give notice of these orders to the companies’ creditors (including the persons claiming to be creditors), by means of a circular:

(a) to be sent by email transmission to creditors for whom the plaintiffs have a current email address; or

(b) to be sent by ordinary post to creditors for whom the plaintiffs have only a postal address.

6. Pursuant to s 447A(1) of the Act, Pt 5.3A of the Act is to operate in relation to the companies such that any notice (including those pursuant to r 75-225(1) of the Insolvency Practice Rules (Corporations) 2016 (Cth) (IPRC) and r 75-15(1) of the IPRC) (other than the notices referred to in order 5 above), reports and communication that the plaintiffs must or may give or send to creditors of the companies (notices) will be validly given to creditors of the companies by:

(a) causing the notices to be published on the ASIC published notices website at https://insolvencynotices.asic.gov.au/;

(b) publishing the notices on the website maintained by the plaintiffs at https://www.grantthornton.com.au/creditors-information/creditors-information-n-t/the-ralan-group-pty-ltd/;

(c) sending a hyperlink to the notices published on the company website by email to the email address of each creditor at such email address as is recorded in the books and records of the company; and

(d) where an email address is not recorded in the books and records of the company but a postal address is recorded, sending by post the Notices to the postal address of each creditor at such postal address as is recorded in the books and records of the company.

7. The costs and expenses of and incidental to this originating process be costs and expenses in the administration of the companies.

8. These orders be entered forthwith.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

(Revised from the transcript)

GLEESON J:

1 This is an ex parte application made by the plaintiffs (administrators) of The Ralan Group Pty Ltd (Administrators Appointed) and 57 other companies listed in a schedule to this judgment (Ralan Group or companies). The application is made under s 439A and s 447A of the Corporations Act 2001 (Cth) (Act) to extend the convening period for the second meeting of the creditors of the companies to 4 December 2019 (that is, a period of approximately 3.5 months), and consequential orders. The convening period is due to expire on 27 August 2019.

2 The application was supported by an affidavit of the first plaintiff, Said Jahani, affirmed 20 August 2019 (and accompanying exhibit “SJ-1”), an affidavit of Eirene Psomas affirmed 21 August 2019 and by written and oral submissions made by Mr Rose, counsel for the administrators.

3 Three of the four creditors who have registered a security interest over property of the companies confirmed to Mr Jahani that they did not oppose the application. At the first meeting of creditors, Mr Jahani informed those present that the administrators intended to seek an extension of the convening period for a period of approximately three months. No creditor expressed any objection to the proposal at that meeting. Further, on 19 August 2019, Mr Jahani caused a circular to creditors to be sent by email to creditors whose email address was recorded in the books and records of the companies, notifying them of the intended application. The circular was also uploaded to the Grant Thornton webpage for the Ralan Group. Mr Jahani did not receive any objection to the application from any creditor.

4 I am satisfied that the Court has the power to make the orders sought and that it is appropriate to make those orders for the following reasons.

Background facts

5 The administrators were appointed to the companies on 30 July 2019, pursuant to s 436A of the Act.

6 Since then, on 1 and 5 August 2019, receivers have been appointed over various assets owned by various of the companies.

7 Based on Mr Jahani’s investigations to date, the Ralan Group specialises in the development, marketing and management of residential and commercial property in New South Wales and Queensland. It also operates a hotel in Surfers Paradise, Queensland, which has approximately 300 rooms.

8 It appears that 44 of the 58 companies are non-trading entities. However, their affairs are intertwined with those of the trading entities. In his affidavit, Mr Jahani has identified the activities and operations of the other 14 entities.

9 The primary assets of the companies, identified by the administrators to date, are listed in Mr Jahani’s affidavit.

10 The administrators have identified 2,635 creditors who together claim to be owed approximately $515 million. These comprise:

(1) four creditors who have registered a security interest over the property of the companies, together claiming a total of $222,505,374, and who comprise primarily financial institutions or non-bank lenders who have provided loans to entities within the Ralan Group;

(2) 331 priority creditors (including employees); and

(3) approximately 2,300 unsecured creditors claiming a total amount of $292,000,000, comprising primarily purchasers of property in the various ‘completed’, ‘in-progress’ and ‘future’ projects of the Ralan Group and suppliers to the Ralan Group.

11 As a result of deficiencies in the books and records of the companies, the administrators are yet to confirm the interests of the persons claiming to be secured creditors. The administrators are continuing to confirm the entitlements of employee creditors. Mr Jahani also anticipates that further proofs of debt will be lodged.

12 The first creditors’ meeting was held on 9 August 2019. As at that date, the administrators presented their preliminary findings on the total shortfall in cash from various projects of the Ralan Group. This included an apparent total shortfall of $275,635,568 in respect of amounts initially paid as deposits by purchasers of units in those projects, which appear to have been subsequently released to the Ralan Group by agreement with the relevant purchasers.

13 Mr Jahani’s opinion is that it is in the best interests of the companies’ creditors to extend the convening period to 4 December 2019 for the following reasons:

(1) The administrators consider that the extension would provide the best opportunity to investigate maximising returns to all creditors and do not consider that there would be any specific prejudice if the convening period were to be extended.

(2) The administrators have yet to ascertain the entitlements of all employee creditors.

(3) The administrators require more time to investigate the companies’ affairs, including reconciling inter-company loans and establishing the financial position of each of the companies.

(4) The administrators are seeking to investigate possible recovery actions and other claims which may be available to the companies or their external administrators. In particular, they are investigating the circumstances surrounding the treatment and release of deposits paid by purchasers of various properties sold by different entities in the Ralan Group and will probably require further information from third parties and legal advice in respect of any potential recovery actions or claims.

(5) The sale or recapitalisation of the assets under the administrators’ control, including the business associated with the property management services to property owners, maintenance business and Ralan Arncliffe, which are held by various entities in the Ralan Group, will take a number of months, and may require the administrators to undertake various marketing activities, set up a data room, allow for due diligence, engage in contract negotiation and post-contractual steps such as an assignment/novation of assets and consents from various third parties.

(6) In order to facilitate the sale of any of the entities within the Ralan Group under the administrators’ control or the associated assets, or, alternatively, a recapitalisation (including by way of Deed Of Company Arrangement (DOCA)), in his experience and based on his preliminary discussions with interested parties, it is his view that not only is a longer expressions of interest campaign necessary, but the sale of assets whilst the companies are in administration could avoid any destruction to the value of those assets should the companies be placed into liquidation prematurely.

(7) The extension will provide the administrators with sufficient time to issue a detailed and thorough report to creditors, including an assessment of the expressions of interest received, a recommendation as to whether the companies should enter into a DOCA (should one be proposed), the companies should be placed into liquidation or the administration should end, and an estimate of the likely return to creditors in such scenarios.

Legal framework

14 Section 439A of the Act relevantly provides:

(1) The administrator of a company under administration must convene a meeting of the company’s creditors within the convening period as fixed by subsection (5) or extended under subsection (6).

(2) The meeting must be held within 5 business days before, or within 5 business days after, the end of the convening period.

(5) The convening period is:

(a) if the day after the administration begins is in December, or is less than 25 business days before Good Friday—the period of 25 business days beginning on:

(i) that day; or

(ii) if that day is not a business day—the next business day; or

(b) otherwise—the period of 20 business days beginning on:

(i) the day after the administration begins; or

(ii) if that day is not a business day—the next business day.

(6) The Court may extend the convening period on an application made during or after the period referred to in paragraph (5)(a) or (b), as the case requires…

15 Requirements for giving notice of a meeting pursuant to s 439A are set out in r 75-15 and r 75-225 of the Insolvency Practice Rules (Corporations) 2016 (Cth) (Insolvency Rules).

16 Pursuant to s 447A(1), the Court may make such order as it thinks appropriate about how Pt 5.3A is to operate in relation to a particular company.

447A General power to make orders

(1) The Court may make such order as it thinks appropriate about how this Part is to operate in relation to a particular company.

(2) For example, if the Court is satisfied that the administration of a company should end:

(a) because the company is solvent; or

(b) because provisions of this Part are being abused; or

(c) for some other reason;

the Court may order under subsection (1) that the administration is to end.

(3) An order may be made subject to conditions.

(4) An order may be made on the application of:

(a) the company; or

(b) a creditor of the company; or

(c) in the case of a company under administration—the administrator of the company; or

(d) in the case of a company that has executed a deed of company arrangement—the deed’s administrator; or

(e) ASIC; or

(f) any other interested person.

17 The relevant statutory framework was summarised by Markovic J in Crawford, in the matter of North Queensland Heavy Haulage Services Pty Ltd (Administrators Appointed) [2017] FCA 635 at [18]-[20] as follows:

[18] In exercising the jurisdiction to extend time under s 439A(6) the Court must have regard to the objects of Pt 5.3A of the Act as set out in s 435A. Those objects are to maximise the chances of the company or as much as possible of its business continuing in existence or, if that is not possible, to result in a better return for the companies' creditors and members than would result from an immediate winding-up of the company.

[19] The approach taken by the Court in applications of this type is well settled. The power to extend the time for convening the second meeting is one that should not be exercised as of course. Rather, the Court must strike an appropriate balance between the expectation that administration will be a relatively speedy matter and the requirement that undue speed should not be allowed to prejudice sensible and constructive actions directed towards maximising the return for creditors and any return for shareholders (see In the matter of Harrisons Pharmacy Pty Limited (Administrators Appointed) (Receivers and Managers Appointed) [2013] FCA 458 (Harrisons Pharmacy) (per Farrell J) at [11] and the authorities referred to therein).

[20] Other relevant factors, particularly in the circumstances of this case, are:

(1) whether the prospects of a better outcome for creditors through a longer period of administration may outweigh the general expectation of a prompt resolution of the administration: see Fincorp Group Holdings Pty Ltd (2007) 62 ACSR 192; [2007] NSWSC 363 (Fincorp) at [18];

(2) the fact that while the voluntary administration continues there is an embargo or moratorium on the enforcement of remedies by secured creditors, lessors and others, a factor which may militate against the too ready grant of an extension: see Fincorp at [4]; and

(3) whether an extension is necessary to enable the administrators to prepare and provide the report and statements, and to arrive at the opinion required by s 439A(4), in order to inform creditors adequately so that they, in turn, will be in a position to decide whether to terminate the administration, execute a DOCA or place the company in liquidation: see Re Pan Pharmaceuticals Ltd (admins apptd) (ACN 091 032 914) (McGrath and Honey as joint liquidators) (2003) 46 ACSR 77; [2003] FCA 598 at [41]).

18 See also Silvia, in the matter of Austcorp Group Limited (Administrators Appointed) [2009] FCA 636 at [18].

Consideration

19 I am satisfied that the Court had power to make the orders sought and that those orders were appropriate. In particular, I am satisfied that the proposed extension until 4 December 2019 was reasonable having regard to the following matters:

(1) The evidently complex nature of the combined administrations and Mr Jahani’s resultant opinion, which I accept, that the administrators are not yet able to report properly to the companies’ creditors or form the opinions required for compliance with their obligations under r 75-225 of the Insolvency Rules.

(2) Mr Jahani’s opinion that the extension is in the best interests of the companies’ creditors.

(3) The administrators have taken steps to attempt to sell the companies’ assets to the extent that they are not under the control of receivers, but require additional time to facilitate that sale process or to allow a recapitalisation to occur without any unnecessary destruction of value in the assets.

(4) To the extent that they have been notified, creditors have not opposed the extension.

(5) The orders proposed make provision for any person who can demonstrate sufficient interest to apply to the Court for modification of those orders.

(6) There is no winding up application on foot in respect of any of the companies.

Electronic notification of creditors

20 Mr Jahani’s evidence was that the companies have a significant number (some 2,635) of creditors. Mr Jahani estimates that the notification of creditors would cost approximately $50,000. As the companies have email addresses for some 2,550 of those creditors, however, Mr Jahani proposes that the administrators provide notices as required under the Act to those creditors by email.

21 In In the matter of BBY Limited [2015] NSWSC 974 at [7], Brereton J said:

Courts have become increasingly willing to make orders such as those sought in this case in respect of the manner in which notices may be given of meetings of creditors of companies under external administration, both to save costs and to save time, and thus to conserve the limited available assets for the benefit of creditors. As Black J has pointed out, most recently in In the matter of Creative Memories Australia Pty Limited (administrators appointed) [2013] NSWSC 732 (at [8]), this no doubt reflects, amongst other things, the fact that electronic means of communication are now widely accepted in the investing and commercial communities. There are now many decisions in which the Courts have made orders in respect of meetings of creditors permitting notice to be given by electronic means to those for whom e-mail addresses are available and otherwise by notice, for example, on an administrator's website, or by newspaper advertisement: [see ABC Learning Centres Ltd (Administrators Appointed) (Receivers & Managers Appointed) ACN 079 736 664 v Honey [2010] FCA 353; Silvia, in the matter of FEA Plantations Ltd (Administrators Appointed) [2010] FCA 468; Carson, in the matter of Hastie Group Limited [2012] FCA 626; Carson, in the matter of Hastie Group Limited (No 2) [2012] FCA 717; In the matter of Mothercare Australia Limited (administrators appointed) [2013] NSWSC 263, [8] (Black J); In the matter of Creative Memories Australia Pty Limited (administrators appointed) [2013] NSWSC 732].

22 See also Quinlan, in the matter of Halifax Investment Services Pty Ltd (Administrators Appointed) [2018] FCA 1891 at [12]-[14].

23 I accept Mr Rose’s submission that the proposed order for notification of the orders now made is appropriate, and fulfils the objective of notifying as many creditors of the companies as quickly and cheaply as possible, conserving the limited assets of the companies for the benefit of creditors.

CONCLUSION

24 Accordingly, I make orders 1, 2, 3, 4, 5, 6, 7 and 8 in the originating process.

I certify that the preceding twenty-four (24) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justice Gleeson. |

Associate:

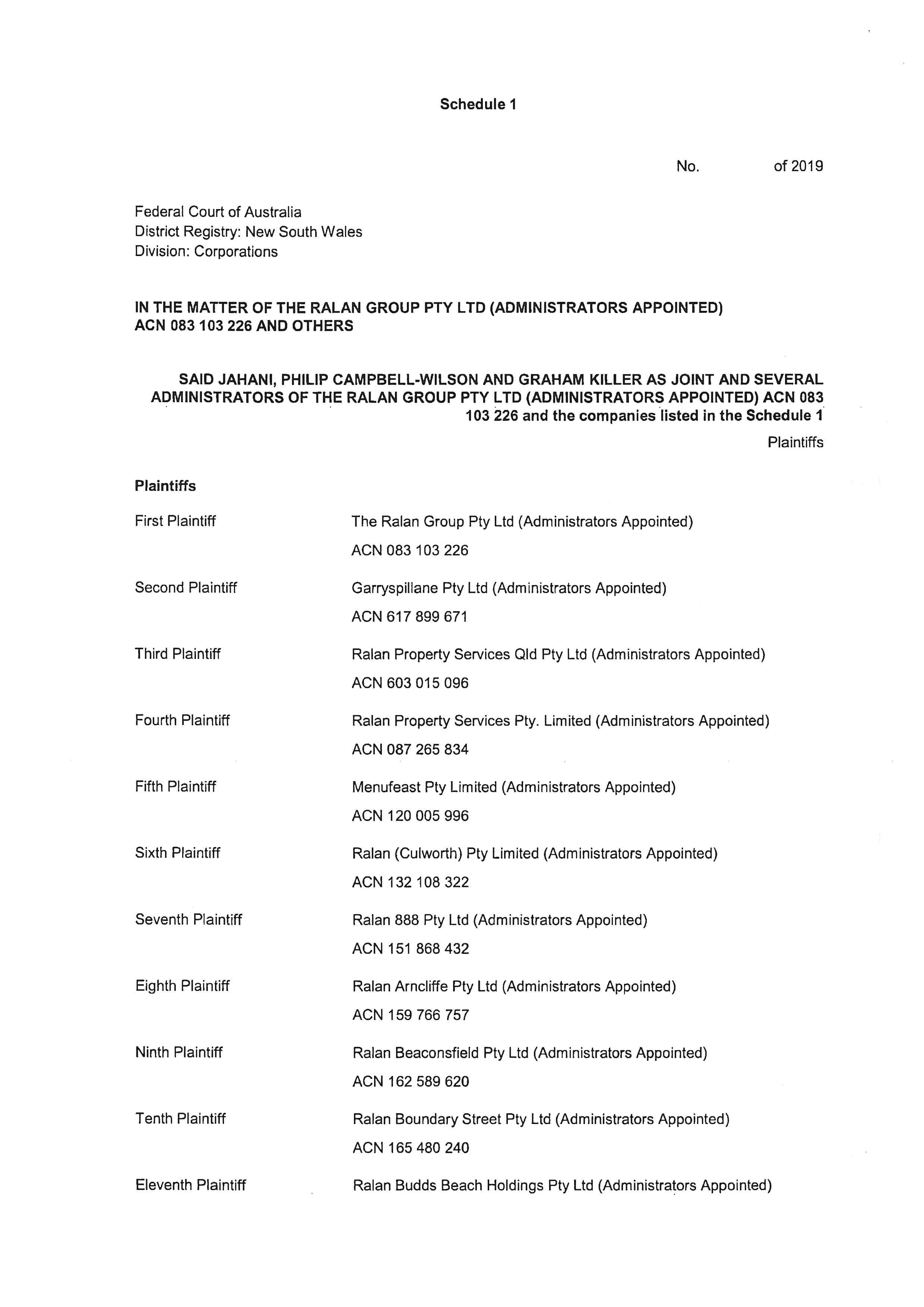

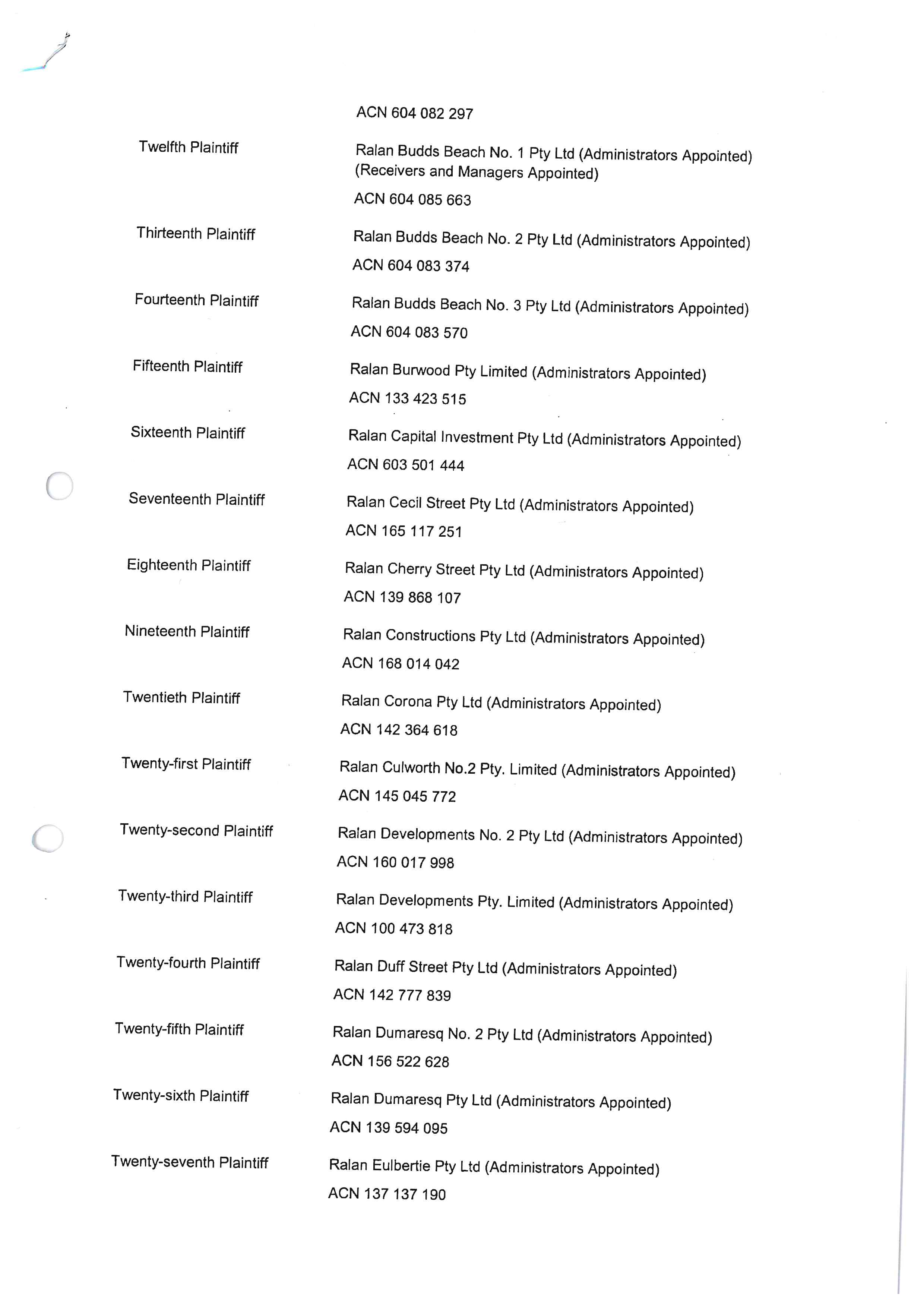

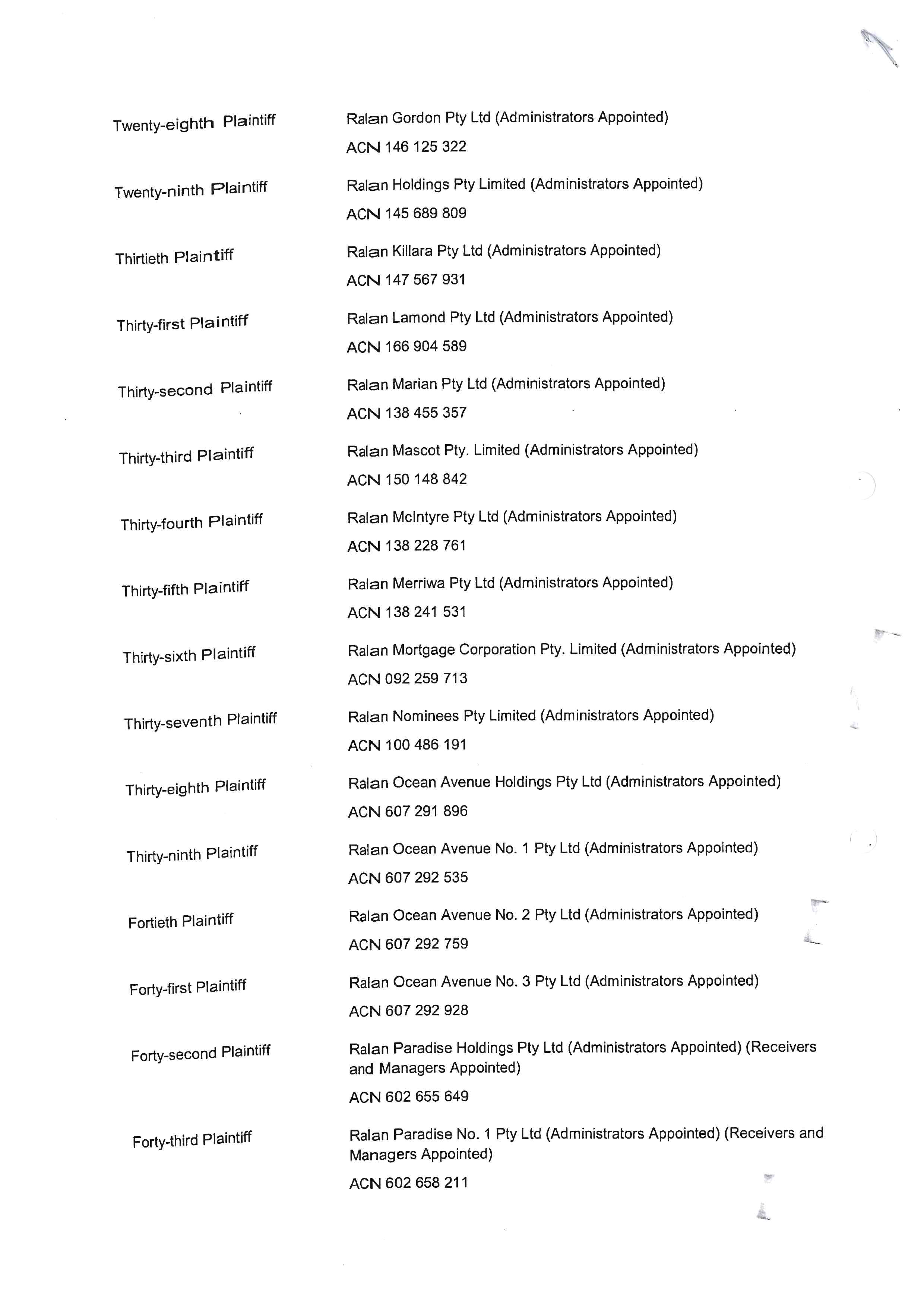

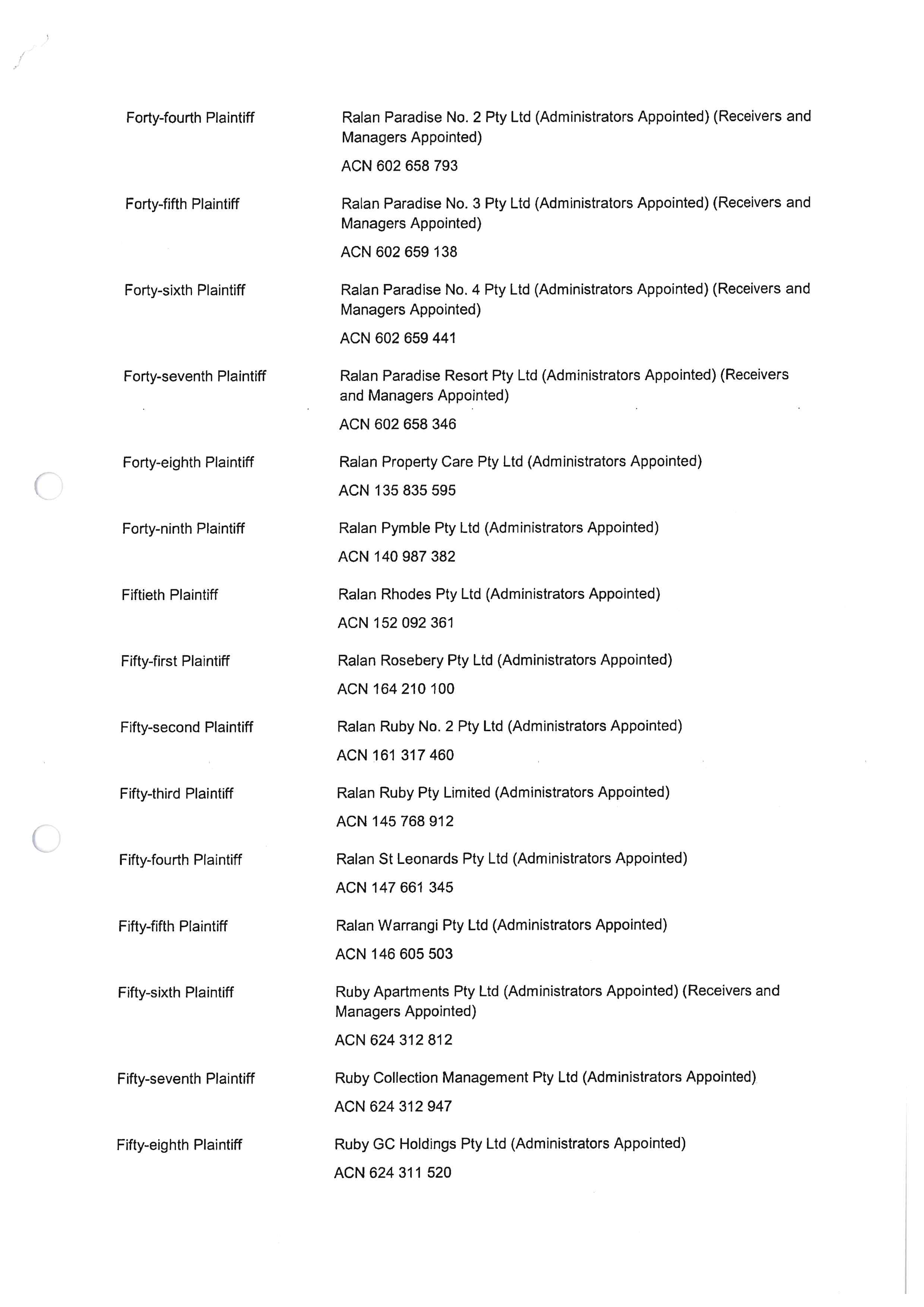

Schedule

No: NSD1333/2019

Federal Court of Australia

District Registry: New South Wales

Division: General