FEDERAL COURT OF AUSTRALIA

Kelly, in the matter of Halifax Investment Services Pty Ltd (in liquidation) (No 5) [2019] FCA 1341

ORDERS

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. Subject to order 2 below, pursuant to s 90-15 of the Insolvency Practice Schedule (Corporations), being Schedule 2 to the Corporations Act 2001 (Cth) and/or s 63 and s 81 of the Trustee Act 1925 (NSW), the first and second plaintiffs:

(a) were and will continue to be justified in using and applying the funds referred to in order 2 made by Gleeson J on 25 January 2019 to pay:

(i) the trading expenses of the third plaintiff (company) of the nature set out in the schedule of costs, which is attached to these orders and marked “Annexure A” to 30 August 2019, substantially in accordance with the amounts specified therein; and

(ii) the administration expenses of the third plaintiff in respect of meeting costs and Link Market Services of the nature set out in the schedule of costs, which is attached to these orders and marked “Annexure A” to 30 August 2019, substantially in accordance with the amounts specified therein,

(b) will be justified in using and applying the funds referred to in order 2 made by Gleeson J on 25 January 2019 and the funds held in the accounts set out in the schedule to these orders and marked “Annexure B” to pay:

(i) the trading and administration expenses of the third plaintiff of the nature set out in the weekly schedule of costs, which is attached to these orders and marked “Annexure C”, substantially in accordance with the amounts specified therein for each week during the period from 30 August 2019 and concluding two weeks after the application for judicial advice and directions sought in prayers 7 and 8 of the interlocutory process filed 3 July 2019 is determined; and

(ii) Any further reasonable and necessary trading expenses incurred by the third plaintiff.

2. Any person affected by order 1 above has liberty to apply on three business days’ notice, with such liberty to be exercised within 14 days of the plaintiffs’ complying with order 3 below.

3. Within seven business days of the making of these orders, the plaintiffs provide notice of orders 1 and 2 above to the third plaintiff’s creditors and clients by the following means:

(a) to be published on the website maintained by the first and second plaintiffs;

(b) to be published on the websites of the third plaintiff at www.halifax.com.au and www.halifaxonline.com.au (company websites);

(c) alerting clients of the company, who use the electronic trading platforms provided by the company, namely, “Halifax Plus”, “Halifax Pro” and “Trader Workstation”, to the publication of the circular on the company websites, via a message published on those electronic trading platforms;

(d) sending a hyperlink to the circular published on the company websites, by email to the email address of each client and creditor at such (if any) email address as is recorded in the books and records of the company or otherwise notified to the liquidators by any creditor; and

(e) where no email address is recorded in the books and records of the company, or otherwise notified to the liquidators by any client or creditor, but a postal address is recorded, sending a circular to the postal address of such clients and creditors at such postal address as is recorded in the books and records of the company.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

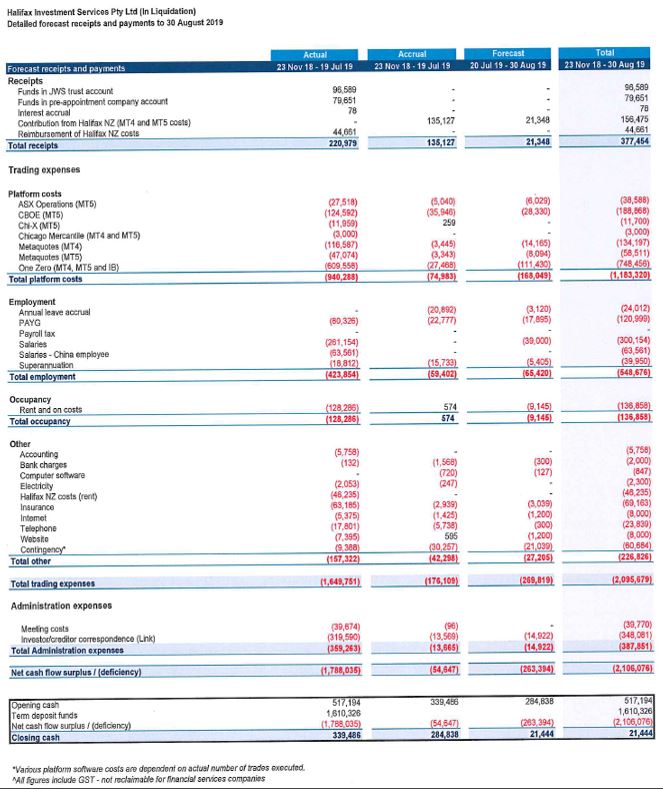

ANNEXURE A

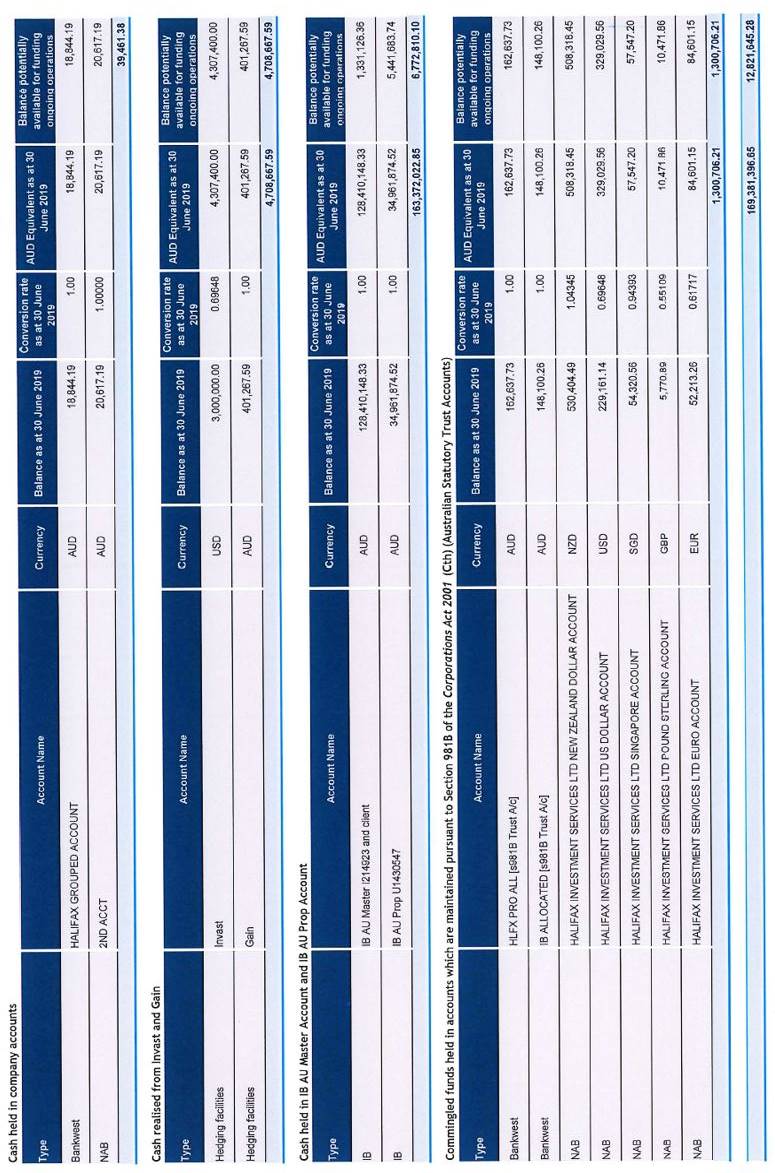

ANNEXURE B

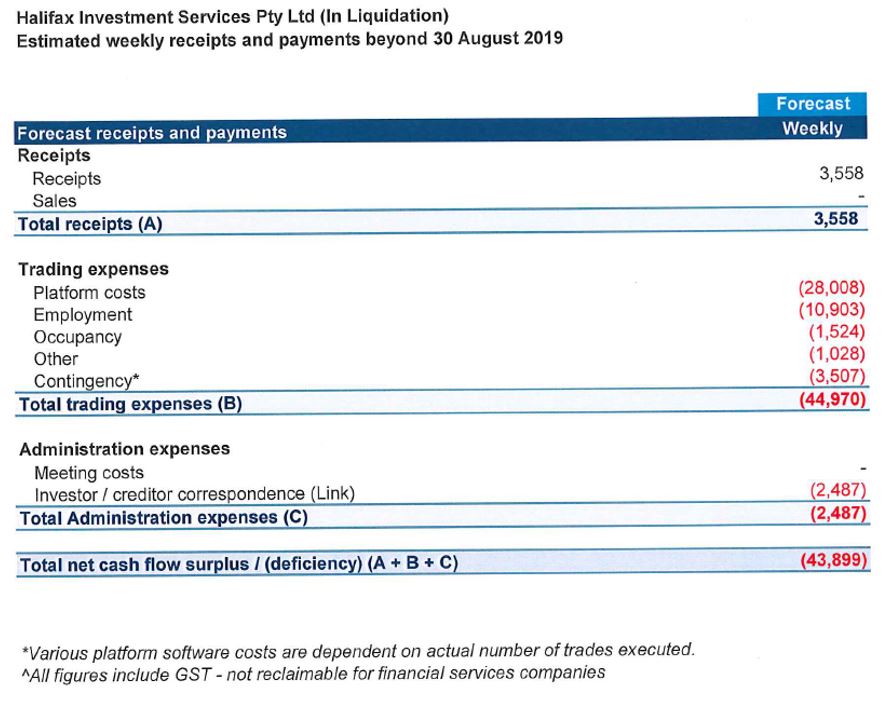

ANNEXURE C

GLEESON J:

1 This judgment concerns the plaintiffs’ ex parte application for several orders included in an interlocutory process filed 3 July 2019. After making various procedural orders on 29 and 30 July 2019, the details of which are set out below, I reserved judgment on the following aspects of the application:

(1) the plaintiffs’ application, pursuant to s 581(4) of the Corporations Act 2001 (Cth) (Act), for an order that the Court issue a letter of request to the High Court of New Zealand (NZHC), requesting that it act in aid of and be auxiliary to this Court in relation to certain matters concerning the liquidation; and

(2) the application of the first and second plaintiffs (liquidators) for judicial advice, pursuant to s 90-15(1) of the Insolvency Practice Schedule (Corporations), being Sch 2 to the Act (IPS) and ss 63 and 81 of the Trustee Act 1925 (NSW) (Trustee Act) in connection with the use of funds to pay ongoing trading and administration expenses of the company.

BACKGROUND

2 On 23 November 2018, administrators (comprising the present liquidators and Stewart McCallum) were appointed to the third plaintiff (Halifax AU) pursuant to a resolution of the board in accordance with s 436A of the Act.

3 On 27 November 2018, the liquidators and Mr McCallum were appointed to act as joint and several voluntary administrators of Halifax New Zealand Limited (Halifax NZ) pursuant to s 239(I) of the Companies Act 1993 (NZ) (NZ Companies Act).

4 Halifax AU owns 70% of the shares in Halifax NZ.

5 Halifax AU is or was the holder of an Australian Financial Services Licence and provided broking and investment services across “platforms” named Trader Workstation (IB Platform) (including Interactive Broker AU and Interactive Broker NZ, a dedicated New Zealand platform), MetaTrader4 (also known as Halifax Pro) and Metatrader5 (also known as Halifax Plus). Halifax NZ was licensed to be a derivatives issuer and was primarily an introducing broker to Halifax AU, earning commissions from client referrals to Halifax AU.

6 Based on the administrators’ report to creditors of Halifax NZ dated 14 March 2019, as at 23 November 2018, the split of investor accounts and client equity across Halifax AU and Halifax NZ was as follows:

Platform | No of investors | Equity $m |

IB | 2,101 | 110.0 |

IB NZ | 2,154 | 44.4 |

MT4 | 5,844 | 23.8 |

MT5 | 2,460 | 33.0 |

Total | 12,559 | 211.2 |

7 The comparable report to creditors of Halifax AU stated that total investors was 12,599, but showed the same number of investors for each platform and the same figures for equity.

8 Both administrators’ reports to creditors record that the administrations were independent but were run largely in conjunction due to the “significant cross-over of investors between the two entities”.

9 In December 2018, the Court granted an extension of time for the convening of a second meeting of creditors pursuant to s 439(6) of the Act until 29 March 2019: Quinlan, in the matter of Halifax Investment Services Pty Ltd (Administrators Appointed) (No 2) [2018] FCA 2115. A similar order was made by the NZHC in relation to the Halifax NZ administration, also in December 2018.

10 On 25 January 2019, the Court gave judicial advice to the administrators to the effect that the administrators were and would continue to be justified in using and applying specified funds to pay the trading and administration expenses of the company in respect of certain costs up to certain specified amounts, and “any further reasonable and necessary trading expenses incurred by” Halifax AU: Quinlan, in the matter of Halifax Investment Services Pty Ltd (Administrators Appointed) (No 3) [2019] FCA 124 (Halifax (No 3)).

11 On 20 March 2019, a meeting of creditors voted that the company be wound up pursuant to s 439C(c) of the Act. The liquidators and Mr McCallum were appointed as liquidators of the company.

12 On 22 March 2019, the liquidators and Mr McCallum were appointed as liquidators of Halifax NZ pursuant to s 241(2)(d) of the NZ Companies Act.

13 On 27 March 2019, the Court ordered that the operation of s 446A(2) of the Act be modified in relation to the company to facilitate the efficient and effective conduct of the liquidation: Quinlan, in the matter of Halifax Investment Services Pty Ltd (In liquidation) (No 4) [2019] FCA 604.

14 On 9 May 2019, Mr McCallum resigned from his appointment as liquidator of Halifax NZ. Mr McCallum resigned from his appointment as liquidator of Halifax AU on 13 May 2019.

15 The first plaintiff (Mr Kelly) gave evidence that in May 2019, at meetings of the creditors’ committee of Halifax NZ and the committee of inspection of Halifax AU respectively, he informed the committees about “this application”. I took this to include, in particular, the application for this Court to issue a letter of request to the NZHC, with a view to achieving a coordinated resolution of the application for the substantive relief described below, together with a similar application to be made in the NZHC.

16 The application for the relief which is the subject of this judgment, and for other procedural relief, was heard on 29 and 30 July 2019.

17 On 29 July 2019, among other orders, I made the following procedural orders:

(1) Pursuant to r 9.08 of the Federal Court Rules 2011 (Rules), Stewart McCallum be removed as a plaintiff.

(2) Pursuant to r 9.05 of the Rules, Halifax AU be joined as a plaintiff.

18 On 30 July 2019, I made the following further orders:

1. Pursuant to s 37AF of the Federal Court of Australia Act 1976 (Cth) (Act) and on the ground that it is necessary to prevent prejudice to the proper administration of justice for the purposes of s 37AG of the Act, the following material is not to be disclosed or made available for inspection by any person until further order other than the docket Judge, her Honour’s personal staff, any officer of the Court authorised by the docket Judge, the plaintiffs, their staff and their legal representatives:

(a) in the interlocutory process filed in these proceedings on 3 July 2019:

(i) the account numbers for those accounts with IB listed on page 17;

(ii) the account number for the account with IB listed on page 18; and

(iii) the account number for those accounts with IB listed on page 19;

(b) in the affidavit of Morgan John Kelly affirmed 26 June 2019:

(i) the account number in paragraph 65(a);

(ii) the account number in paragraph 67;

(iii) the account number in paragraph 71;

(iv) the account number in paragraph 72;

(v) the account numbers in the table at paragraph 121; and

(vi) the account numbers in the table at paragraph 125;

(c) the account numbers in the tables at pages 338, 339, 340 and 341 of the exhibit to the affidavit of Morgan John Kelly affirmed 26 June 2019 and marked “Exhibit MJK-1”; and

(d) the account numbers in the tables at pages 46, 47, 48 and 49 of the exhibit to the affidavit of Ian Phillip Sutherland sworn 26 June 2019 and marked “IPS-1”.

2. The plaintiffs are to file redacted copies of the documents referred to in order 1 by 2 August 2019 at 4.00 pm.

3. Within seven (7) business days of the making of these orders, the plaintiffs are to provide notice of the filing of the interlocutory process filed 3 July 2019 (Interlocutory Process) to the company’s clients by the following means:

(a) publishing copies of the following on a website maintained by the liquidators and on the websites of the company, at www.halifax.com.au and www.halifaxonline.com.au (Company Websites):

(i) a circular;

(ii) a redacted copy of the Interlocutory Process;

(iii) a redacted copy of the affidavit of Morgan John Kelly affirmed 26 June 2019;

(iv) a redacted copy of exhibit “MJK-1” to the affidavit of Morgan John Kelly affirmed 26 June 2019;

(v) a copy of the affidavit of Morgan John Kelly affirmed 26 July 2019;

(vi) a copy of the affidavit of Morgan John Kelly affirmed 29 July 2019;

(vii) a copy of the affidavit of Ian Phillip Sutherland sworn 26 June 2019;

(viii) a redacted copy of exhibit “IPS-1” to the affidavit of Ian Phillip Sutherland; and

(ix) a copy of the affidavit of Ian Phillip Sutherland sworn 26 July 2019;

(b) alerting clients of the company, who use the electronic trading platforms provided by the company, namely, “Halifax Plus”, “Halifax Pro” and “Trader Workstation”, to the publication of the circular on the Company Websites, via a message published on those electronic trading platforms;

(c) sending a hyperlink to the circular published on the Company Websites, by email to the email address of each client at such (if any) email address as is recorded in the books and records of the company or otherwise notified to the liquidators by any client; and

(d) where no email address is recorded in the books and records of the company, or otherwise notified to the liquidators by any client, but a postal address is recorded, sending a circular to the postal address of such clients at such postal address as is recorded in the books and records of the company.

4. These orders be entered forthwith.

Funds held by Halifax AU and Halifax NZ

19 The liquidators have identified 61 accounts held in the name of Halifax AU with a balance of AU$147,810,754.04 as at 23 November 2018.

20 They have identified 14 accounts held in the name of Halifax NZ with a balance of NZ$51,671,556.36 as at 27 November 2018.

21 Investigative work into the way in which Halifax AU and Halifax NZ dealt with funds paid by, and assets held for, the benefit of their respective clients for investing and trading has identified a total deficiency as at 23 November 2018 of approximately AU$19 million. The investigations have concluded that it is not practically feasible to identify the total proportion of the deficiency attributable to each particular client of Halifax AU and Halifax NZ or any particular statutory trust account in the Halifax Group (that is, Halifax AU and Halifax NZ).

22 In particular, Ian Sutherland, an employee of KPMG who works under the supervision of the liquidators, gave evidence that his investigations indicate 98% of funds held on trust by the Halifax Group are affected by commingling, with this commingling being across all platforms and between Halifax AU and Halifax NZ.

23 The liquidators have conducted investigations into the flow of funds between Halifax Group accounts including analysis to determine the extent of pooling and commingling of funds in these two accounts with funds in different accounts within the Halifax Group. They have also investigated the volume of transactions between accounts of Halifax AU and Halifax NZ.

24 On the basis of the liquidators investigations into the flow of funds, Mr Sutherland has formed the following conclusions:

(a) The only noticeable pattern of transfers between accounts is the crediting of a client account on the relevant trading platform shortly following a client deposit being allocated to an individual client. Otherwise, there is no pattern behind the transfer of funds between the various accounts in the Halifax Group. There is no pattern in frequency of transfers, where funds were directed to, or the purpose of the transfers;

(b) Funds appear to have been transferred on an “as needs” basis. When I refer to an “as needs basis”, I mean that funds were transferred between the various Halifax Group accounts in round sum figures and on an ad hoc basis with no noticeable pattern other than to ensure sufficient funds remained in each of the accounts to facilitate ongoing operational requirements, such as ensuring sufficient funds were available to meet client redemptions, credit the platforms with Interactive Brokers, or make necessary company payments;

(c) Halifax AU and Halifax NZ both made transfers to maintain a balance of funds in various client accounts (effectively running pooled accounts on an intermingled basis);

(d) Most transfers of funds do not appear to relate to individual client deposits or redemptions (with the exception of transfers between suspense accounts and allocated accounts); and

(e) Tracing of client deposits appears not to be practically feasible in most instances.

25 The two largest accounts are the “IB AU Master Account” (with a balance of AU$138,654,002 as at 23 November 2018) in the name of Halifax AU, and the “IB NZ Master Account” (with a balance of NZ$48,699,495 as at 27 November 2018) in the name of Halifax NZ. These accounts are held with Interactive Brokers LLC (IB) on behalf of Halifax AU and Halifax NZ respectively. The account balances comprise, predominantly, cash and stocks. Mr Sutherland observed that funds in other accounts were paid to the IB AU Master Account on an ad hoc basis, and funds were transferred to the IB NZ Master Account from various accounts within the Halifax Group as and when funds were required on the IB NZ platform. His analysis indicates, among other things, that net funds of $22.1 million have been transferred from various National Australia Bank (NAB) foreign currency accounts to the IB NZ Master Account. The NAB foreign currency accounts were accounts held in the name of Halifax AU.

26 If the liquidators’ analysis, based on their investigations to date, is correct, then there was substantial commingling of funds held on trust by Halifax AU and Halifax NZ with the result that Halifax AU or its clients may have claims in relation to funds held in the name of Halifax NZ and vice versa.

APPLICATION FOR LETTER OF REQUEST

27 The interlocutory process sets out a detailed explanation of the context in which the liquidators ask the Court to issue a letter of request. The explanation includes the following matters:

(1) The substantive relief sought concerns funds which, following the sale, closing out or realisation of the extant investments made by investor clients through Halifax AU, will be held by Halifax AU (or held or controlled by IB) or others on behalf of Halifax AU, following which those funds will be transferred to and held by Halifax AU pursuant to trusts (both under statute and at general law) for those clients. The relief sought also impacts on funds which, following the sale, closing out or realisation of the extant investments made by investor clients through Halifax NZ, will be held by Halifax NZ pursuant to trusts (both under statute and at general law) for its clients.

(2) It is the liquidators’ case that, prior to the administrators’ appointment in November 2018, the funds held by each of Halifax AU and Halifax NZ were part of what Brereton J, in In the matter of BBY Limited (Receivers and Managers appointed) (in liquidation) (No 3) [2018] NSWSC 1718 at [8], called a “deficient mixed fund”.

(3) The deficient mixed fund arose by reason of the following:

(a) First, in order to allow investors to invest immediately on the IB Platform, even before clearance had been obtained from banks in respect of the transfer of funds from the relevant Halifax AU account to the relevant IB account, and for other operational reasons (such as hedging activities), at all material times numerous inter-account transfers of funds occurred between many of the accounts held in the name of Halifax AU and Halifax NZ in respect of all investment platforms operated by both entities. Accordingly, there was at all material times an extensive commingling of funds in many of the accounts which Halifax AU and Halifax NZ held on trust for investor clients – as between clients, as between investor platforms and as between Halifax AU and Halifax NZ.

(b) Secondly, certainly from about January 2017, but very likely from an indeterminate time prior to that, these commingled funds became a “deficient mixed fund”, because Halifax AU withdrew from client segregated accounts funds that were held on trust for investor clients and utilised them for non-client purposes (that is, for corporate expenses and other non-client purposes).

(4) The commingling from an indeterminate time, coupled with the deficiency, has had the consequence that funds deposited by clients (or deposited as a result of the sale, closing out or realisation of investments by clients) into accounts held in the name of Halifax AU and Halifax NZ on behalf of investor clients have, in a very high percentage of cases, ceased to be feasibly traceable to any entitlement on the part of individual clients.

(5) On this basis, the liquidators consider that a very large part of the funds, which, following the sale, closing out or realisation of extant investments, will be held by Halifax AU and Halifax NZ on trust for investor clients, will constitute, in effect, a single “deficient mixed fund” containing moneys held on trust both by Halifax AU for those who invested through it and by Halifax NZ for those who invested through it, in respect of which tracing to any entitlement on the part of individual clients is not feasible.

(6) In addition, there are other accounts in the name of Halifax AU (such as accounts, in which, although in the name of Halifax AU, the funds are controlled by a Chinese merchant provider) where the liquidators have not been able to obtain sufficient information to form a conclusion as to whether funds are commingled. Those accounts have been included in the accounts the subject of the interlocutory process in the expectation that, by the time of the final hearing for substantive relief, further information will have been obtained which will cast light on whether those further accounts are or are not affected by commingling.

28 In summary, the substantive relief sought is in the nature of judicial advice to the liquidators, and judicial advice to Halifax AU as trustee, in respect of difficult questions which arise in respect of the distribution of the funds which will be held on trust, following realisation of the investments. A key question for the Court is whether there should be a “pooling” (or grouping) of the commingled funds to any, and if so, what, extent, with distributions (calculated in accordance with the directions or judicial advice of the Court) to the clients on behalf of whom those funds are held (see, for example, Georges v Seaborn International (Trustee); In the matter of Sonray Capital Markets Pty Ltd (in liq) [2012] FCA 75; (2012) 288 ALR 240 at [78]-[85]). The other questions concern the way in which funds held in foreign currency should be dealt with; the sale, closing out or realisation of extant investments; the date on which the value of each client’s investments should be calculated; the netting off of client balances in multiple accounts; disregarding of small balances; appointment of representative respondents; and remuneration, costs and expenses of the liquidators and the administrators (including on an interim basis).

29 The liquidators propose bringing a parallel application to the NZHC in their capacity as liquidators of Halifax NZ, and by Halifax NZ as trustee (proposed NZ application). The proposed NZ application will be in respect of funds which, following sale, closing out or realisation of extant investments, will be held by Halifax accounts in New Zealand on behalf of investor clients. The proposed NZ application will seek directions and judicial advice from the NZHC on questions mirroring those arising in this interlocutory process. The parallel applications will overlap at least to the extent that they will involve consideration of the correct approach by the liquidators, Halifax AU and Halifax NZ to a commingled fund in respect of which they will each have distinct obligations.

30 It appears to the liquidators that it is not feasible for this application and the proposed NZ application to be determined separately: each is to a significant extent an application for judicial advice or directions in respect of the same commingled pool of funds.

31 For that reason, the liquidators seek the issue by this Court (FCA) of a letter of request seeking that the NZHC act in aid of and auxiliary to the FCA in respect of the interlocutory process, so as to enable the application (and the proposed NZ application which heavily overlaps with this application) to be resolved in an effective way.

32 More specifically, the request, if issued, would be that the NZHC agree to hear and determine the proposed NZ application by sitting jointly with the FCA whilst the FCA hears and determines the application in this proceeding, with a view to each court hearing all of the evidence and all of the submissions in both proceedings together (including evidence adduced by, and submissions by, those who may be joined to either proceeding or who may be given leave in either proceeding to be heard). This could be done in a manner to be jointly determined by the courts, including by sitting together physically, which (to facilitate ease of access to each court by persons resident in each country who may wish to be heard) may be partly in Australia and partly in New Zealand. The letter of request, if issued by this Court as sought by the plaintiffs, would contemplate that the NZHC would deliberate together with the FCA so as to seek to achieve, so far as possible, an outcome in which inconsistency between the judicial advice or directions given by each Court in respect of the same commingled pool of funds is effectively eliminated. The manner in which such co-operation is achieved may, for example, be informed at least in part by the Guidelines developed by the Judicial Insolvency Network for Communication and Cooperation between Courts in Cross-Border Insolvency Matters, which Guidelines are currently under consideration by the Council of Chief Justices of Australia and New Zealand.

33 The plaintiffs observed that this Court is already obliged by s 581(2) of the Act to act in aid of, and to be auxiliary to, the NZHC in relation to the proposed NZ application because New Zealand is a “prescribed country” within the meaning of s 581 (see reg 5.6.74(e) of the Corporations Regulations 2001 (Cth)) and because the NZHC has jurisdiction in “external administration matters”. Section 581(2) therefore obviates the need for a letter of request from the NZHC to this Court in relation to this application if the NZHC were to accede to a letter of request, of the kind sought by the plaintiffs, from this Court.

34 In setting out these propositions, I note at the outset that the NZHC will be required to decide whether to accede to any request made and, if so, to what extent and in what fashion: cf. Re Ayres; Ex parte Evans (1981) 51 FLR 395 (Re Ayres) at 406.

Substantive relief sought by the liquidators

35 The principal relief sought in the interlocutory process is the application for a direction and judicial advice as to whether the liquidators and Halifax AU would, following the sale, closing out or realisation of extant investments, be justified in:

(a) grouping or pooling all or some of the funds (including interest thereon) in all (or some and, if so, which) of the Accounts [held in the name of Halifax Australia, including the IB AU Master Account] (or such other account(s) as may be established …) and/or the funds (including interest thereon) in all (or some and, if so, which) of the accounts … held by Halifax NZ (or such other account(s) as may be established …) (subject to advice to that effect in relation to these Halifax NZ accounts being given to Halifax NZ by the High Court of New Zealand).

(b) in lieu of applying Reg 7.8.03(6)(c) of the Corporations Regulations to the funds in the accounts (or such other account(s) as may be established …) within such group or pool, in lieu of applying equitable principles of tracing (or equivalent common law principles) and in lieu of paying each client the amount which represents what may have been their entitlement in accordance with legal and/or equitable principles, paying each client out of the pooled funds an amount equal to the proportion of the pooled funds which is the same proportion that that client’s entitlement would have been of the pooled funds had there not been a deficiency.

(c) distributing the funds held within the Accounts (or such other account(s) as may be established …) in some other way and if so in which way.

36 As I understand the plaintiffs’ case, part of the justification for pooling of the accounts held by both Halifax AU and Halifax NZ is that Halifax AU or its clients have claims in relation to the accounts held by Halifax NZ. Whether that is so is a matter for determination in the Halifax NZ liquidation and, accordingly, explains why the proposed direction as to pooling of funds is expressed as “subject to advice” being given to Halifax NZ by the NZHC.

37 Additionally, the liquidators seek the following direction and judicial advice concerning the conversion of funds into Australian dollars:

A direction, and judicial advice, as to whether the Liquidators and Halifax Australia would be justified in converting any funds:

(a) held in foreign currency into Australian dollars (subject to any particular exclusions, and if so, which) for the purpose of calculating the quantum of the funds to be distributed … and, if not, how and when the value of any funds held in foreign currency should be calculated for the purposes of distribution to clients of Halifax Australia;

(b) held in Australian dollars into New Zealand dollars (subject to any particular exclusions, and if so, which) for the purposes of making distributions to clients of Halifax NZ (subject to advice to that effect being given to Halifax NZ by the High Court of New Zealand).

38 Again, the proposed advice is expressed as being subject to Halifax NZ’s receipt of advice from the NZHC.

Form of the proposed letter of request

39 The substance of the request is contained in the following two paragraphs:

10. This request for aid is made to enable the Application in the Federal Court proceedings to be resolved in an effective way in circumstances in which it appears that neither the Federal Court of Australia Application nor the Proposed NZ Application can be effectively resolved separately from the other because most of the trust funds are so commingled that they form a (deficient) single pool of funds.

11. If the High Court were to accede to the aid request from it by the Federal Court in this letter, the aid would involve the High Court agreeing (pursuant to section 8(2) of the Insolvency (Cross-border) Act 2006 (NZ) or otherwise) to hear and determine the Proposed NZ Application jointly with the Federal Court of Australia whilst the Federal Court hears and determines the Application to the Federal Court, with a view to each Court hearing all of the evidence and the submissions from all of the parties in both proceedings (including those who may be joined to either proceeding) together. This could be done by sitting together physically, which may (to facilitate ease of access to each Court by persons resident in each country who may wish to be heard) be partly in Australia and partly in New Zealand; or by audiovisual link. The request envisages that, although the High Court of New Zealand and the Federal Court of Australia would deliver separate judgments determining the Application made in each proceeding, each court would, prior to delivery of judgment, deliberate together with a view to seeking to achieve, so far as possible, an outcome in which inconsistency between the judicial advice or directions given by each Court in respect of the same pool of funds is eliminated.

Parties

40 I have noted that the application was made ex parte. Mr Kelly’s evidence is that clients of Halifax AU and Halifax NZ have indicated that they wish to be heard in the proceedings, which I took to extend potentially to any relief sought in the interlocutory process that has not already been granted and in which the client has a relevant interest.

41 The interlocutory process seeks orders for the appointment of representative respondents. At this stage, the particular issues that might be agitated by individual clients or representative respondents are unknown. In particular, it is not known to what extent, if any, parties may dispute the matters set out by the liquidators in the interlocutory process, outlined at [27] above.

42 Similarly, it is not yet known what issues might be agitated by individual clients or representative respondents in response to the proposed NZ application.

Legal framework

43 Section 581(4) of the Act provides relevantly:

The Court may request a court of an external Territory, or of a country other than Australia, that has jurisdiction in external administration matters to act in aid of, and be auxiliary to, it in an external administration matter.

44 Section 580 defines “external administration matter” to mean a matter relating to, relevantly:

(a) winding up, under [Chapter 5 of the Act], a company …; or

(b) winding up, outside Australia, a body corporate …; or

(c) the insolvency of a body corporate. …

45 In Warner (Trustee), in the matter of Barnes and Barnes [2018] FCA 1784, Yates J identified the following three issues that arise on an application for the exercise of an analogous power in s 29 of the Bankruptcy Act 1966 (Cth) (Bankruptcy Act) at [19]-[21]:

(1) The Court must have power to issue the letter of request.

(2) The foreign court, as receiving court, must have power to act on the proposed letter of request.

(3) The power must be exercised with regard to considerations of utility and comity.

Power to issue letter of request

46 The power to issue a letter of request under s 581(4) of the Act relevantly arises where:

(1) There is a court of a country other than Australia that has jurisdiction in external administration matters.

(2) There is an external administration matter in relation to which a request may be made.

(3) The proposed request is to act in aid of, and be auxiliary to, the Court in an external administration matter.

47 The first two element are satisfied:

(1) The NZHC has jurisdiction in “external administration matters”: Senior Courts Act 2016 (NZ) s 12. It has already exercised this jurisdiction in connection with the administration of Halifax NZ.

(2) The liquidators’ claims for the substantive relief sought in the interlocutory process comprise “an external administration matter”, being a matter relating to the process that follows the making of a winding up order: Joye v Beach Petroleum NL & Cortaus Ltd (in liq) (1996) 67 FCR 275 (Joye) at 287.

48 The more difficult question is whether the third element is satisfied.

49 The liquidators contended that the language of acting “in aid of, and be auxiliary to” is broad language that extends to cooperation by the NZHC with this Court in coordinating so far as possible the conduct and hearing of the application to this Court and the proposed NZ application, given that the applications overlap in the sense described above.

50 In AFG Insurances [2002] NSWSC 735, Barrett J declined to order that a letter of request issue pursuant to s 581(4) in the terms sought by the administrators of the relevant company. At [16], his Honour stated that:

[I]n the administration context (much more, perhaps, than in the case of a winding up ordered by the court), a foreign court can be regarded as acting in aid of or as auxiliary to this court only where this court has become seised of a particular proceeding relevant to the administration and the full and effective exercise of this court’s jurisdiction will be assisted by some ancillary order of a foreign court.

51 At [17] and [19], Barrett J recorded the following examples of assistance by one court to another:

(1) The appointment of a receiver by the recipient court to collect property of the bankrupt in the recipient jurisdiction.

(2) The exercise of an examination power in respect of persons in the recipient jurisdiction able to give information relevant to the bankruptcy ordered by the requesting court.

(3) An order for the production of documents by persons within the recipient jurisdiction and in other specific ways to assist the Australian liquidator in his investigation of the affairs of the Australian company in liquidation.

52 In Re AFG [2002] NSWSC 844 (Re AFG), Barrett J acceded to a further application to issue a different form of letter of request. At [8] and [9], his Honour said:

[I]t was submitted that a future matter in which the jurisdiction of this court might be invoked in relation to an administration over which this court is clearly able to exercise jurisdiction is properly regarded as a matter within the purview of s.581(4); and that the section will support a request that the foreign court, as it were, act within its territory in ways in which this court could and would act here upon application made to it. This involves a somewhat broader view of “act in aid of, and be auxiliary to” than I was inclined to think available when the earlier application was before me. But having considered the further submission, I accept that broader view as warranted by the general approach in ss.580 and 581. The relevant concept of acting in aid of and being auxiliary to this court is not, I think, confined to recognizing or giving effect to an order of this court, although the concept certainly has that aspect. An additional aspect, I am persuaded, involves the making by the foreign court, within and for the purposes of its jurisdiction, of orders that this court could have made in relation to the relevant subject matter had this court’s jurisdiction, in the territorially limited sense, extended that far.

This court is invested with jurisdiction by the Corporations Act 2001 (Cth) in relation civil matters arising under the Corporations legislation of the Commonwealth. That jurisdiction is comprehensive and without territorial limit and, in referring to matter to which this court’s jurisdiction does not extend, I do not suggest that the jurisdiction with respect to matters presently relevant is in any way restricted. It is unrestricted from the perspective of our law. I merely intend to say that effective exercise of this jurisdiction in foreign places may be hampered by lack of recognition in those places. It is the resolution of that difficulty at which s. 581 is directed.

53 In Re Ayres at 405, Lockhart J observed that s 29 of the Bankruptcy Act does not create any new rights but only creates new remedies for enforcing existing rights.

54 The liquidators noted that, by reason of the fact that Halifax AU and Halifax NZ are separate corporate entities, albeit that Halifax NZ is Halifax AU’s subsidiary, it appears that the Cross-Border Insolvency Act 2008 (Cth), by which the Model Law on Cross-Border Insolvency of the United Nations Commission on International Trade Law (Model Law) is given force of law in Australia, has no relevant application. Thus, the liquidators’ contention is that s 581(4) extends further than the Model Law to permit the proposed letter of request to be issued.

55 At the outset, I accept that there is no reason to read down the breadth of the language in s 581(4), having regard to its evident facultative purpose to assist in the efficient resolution of external administration matters: cf. Owners of the Ship “Shin Kobe Maru” v Empire Shipping Co Inc [1994] HCA 54; (1994) 181 CLR 404 at 421.

56 Further, the language of s 581 should be taken to be “always speaking”: Aubrey v The Queen [2017] HCA 18; (2017) 260 CLR 305 at [39]; Brewster v BMW Australia [2019] NSWCA 35; (2019) 366 ALR 171 (Brewster) at [75]; Gageler SC (as his Honour then was), “Common Law Statutes and Judicial Legislation: Statutory Interpretation as a Common Law Process” (2011) 37(2) MonashULawR 1 at 1-2.

57 The liquidators pointed to the following authorities for the proposition that there is “nothing radical” about a joint hearing between two courts and that it is something to be encouraged:

(1) Article 27(e) of the Model Law contemplates “[c]oordination of concurrent proceedings regarding the same debtor” as an example of cooperation between courts of different jurisdictions which may be required by Art 25.

(2) Sections 81 and 85 of the Trans-Tasman Proceedings Act 2010 (Cth) explicitly contemplate this Court sitting in New Zealand and the NZHC sitting in Australia in the context of proceedings defined, respectively, as an “Australian market proceeding” and a “New Zealand market proceeding”.

(3) In February 2019, the New South Wales Court of Appeal and a Full Court of this Court sat together while hearing two separate cases together: Brewster and Westpac v Lenthall [2019] FCAFC 34; (2019) 366 ALR 136 (Westpac). In Brewster, the Court determined a separate question, removed from the primary judge to the Court of Appeal which asked whether the Court had power to make a “common fund” order. In Westpac, a Full Court heard an appeal from a decision of a single judge of this Court making a “common fund” order. At [2], the Full Court explained the basis upon which the cases were heard together:

Pursuant to agreement between the Chief Justice and the Chief Justice of New South Wales and the President of the Court of Appeal of New South Wales it was agreed to hear this matter and a matter before the Court of Appeal (BMW Australia Ltd v Owen Brewster 2018/00332812) at the same time in the same courtroom. The issues in the two matters overlapped considerably; and, given the importance of the questions, in particular of the Constitutional questions, it was thought convenient for the administration of justice that both Courts have the advantage of written and oral argument of counsel on the same occasion. Each Court would, of course, decide the matter before it according to the views of the judges constituting the Court.

58 If Halifax NZ had been a subsidiary company of Halifax AU registered as a company in Australia, it is reasonable to think that an application like the proposed NZ application would be heard together with the interlocutory process because they would involve common questions of fact and law and because the claims arise, at least to some extent (although the precise extent is not known) from the same series of transactions: see r 30.11 of the Rules.

59 I do not have any difficulty with the general proposition that this Court and the NZHC should endeavour to cooperate to the extent possible to promote the objectives of the liquidations of Halifax AU and Halifax NZ. Nor do I have any difficulty with the general idea that such cooperate could include a concurrent hearing of this court and the NZHC, if the NZHC were amenable to such a hearing.

60 Further, I accept that the proposed letter of request is a request “to act in aid of, and be auxiliary to” this Court in the matter of the claims for the substantive relief in the interlocutory process, at least to the extent that any pooling order of the kind sought will require recognition in New Zealand because it will affect bank accounts in New Zealand held in the name of Halifax NZ. Thus, this is a case where the effective exercise of this Court’s jurisdiction in New Zealand may be affected by a lack of recognition in New Zealand. Further, it can be readily appreciated that, if the liquidators’ applications are not coordinated, there is a real and obvious prospect of inconsistent findings, inconsistent directions or advice and consequent additional litigation, all potentially to the detriment of creditors of Halifax AU. One means by which the NZHC might act in aid of and be auxiliary to this Court in connection with the application for the pooling order might be to participate in a concurrent hearing of the proposed NZ application with the hearing of the interlocutory process.

61 More generally, the proposed coordination of the application for relief in this proceeding and the proposed NZ application, at least as it is expressed by the liquidators, goes beyond what was contemplated in Re AFG, although it is consistent with widely accepted approaches to dealing effectively with cross-border insolvency, at least in the case of a single insolvent entity. Section 581(4) does not permit a request to a foreign court for the purpose of facilitating the liquidations of both Halifax AU and Halifax NZ considered together. Rather, s 581(4) squarely focusses attention on the effective exercise of this Court’s jurisdiction.

Power to comply with request

62 I have accepted that this Court could request the NZHC to hear the application for a pooling order in the proposed NZ application concurrently with the application for a similar order in this proceeding.

63 I accept that the NZHC appears to have power to accede to such request. Section 8 of the Insolvency (Cross-border) Act 2006 (NZ) (NZ CBI Act) provides as follows:

(1) This section applies to a person referred to in article 1(1) of Schedule 1.

(2) If a court of a country other than New Zealand has jurisdiction in an insolvency proceeding and makes an order requesting the aid of the High Court in relation to the insolvency proceeding of a person to whom this section applies, the High Court may, if it thinks fit, act in aid of and be auxiliary to that court in relation to that insolvency proceeding.

(3) In acting in aid of and being auxiliary to a court in accordance with subsection (2), the High Court may exercise the powers that it could exercise in respect of the matter if it had arisen within its own jurisdiction.

64 Section 8 of the NZ CBI Act may apply independently of the Model Law on Cross-Border Insolvency. In Leeds v Richards [2016] NZHC 2314 at [31], Heath J referred to “the difference between the Model Law regime and the s 8 procedure” and said: “The issues under s 8 [are] whether a qualifying Request has been made and whether assistance should be given in respect of it.”

65 Prior to that, in Williams v Simpson [2011] 2 NZLR 380 (NZHC) at [7], [68] Heath J had said that s 8 provides “a general discretion to the Court to assist in cases where [the Model Law] is not engaged”. See also Keeper T, “Applications for Aid and Assistance in Respect of Foreign Insolvency Proceedings in New Zealand since the Enactment of the Insolvency (Cross-Border) Act 2006 (NZ)” (2019) 27 Insolv LJ 35.

66 Section 8(1) applies to “a person referred to in article 1(1)” of Schedule 1 (being the version of the Model Law adopted by the NZ CBI Act). The liquidators observed that the primary focus of Art 1(1) is not on persons, but rather on circumstances or actions, such as the seeking of assistance. Article 1(1) specifies four situations:

(a) assistance is sought in New Zealand by a foreign court or a foreign representative in connection with a foreign proceeding; or

(b) assistance is sought in a foreign State in connection with a New Zealand insolvency proceeding; or

(c) a foreign proceeding and a New Zealand insolvency proceeding in respect of the same debtor are taking place concurrently; or

(d) creditors or other interested persons in a foreign State have an interest in requesting the commencement of, or participation in, a New Zealand insolvency proceeding.

67 The phrase “a person” in s 8(1) must be understood in the light of the words in s 8(2). Section 8(2) applies where a court of a foreign country makes an order seeking the aid of the NZHC “in relation to the insolvency proceeding of a person to whom this section applies”.

68 The liquidators are “persons” referred to in Art 1(1)(a), each being a “foreign representative”. The term “foreign representative” is defined in Art 2(d) of the Model Law, as adopted by the NZ CBI Act, as a person who, relevantly, is “authorised in a foreign proceeding to administer the reorganisation or the liquidation of the debtor’s assets or affairs”. The liquidators are so authorised in these Australian winding up proceedings.

69 The liquidators of Halifax AU are therefore “persons” of the kind described in s 8(1) of the NZ CBI Act because they are persons “referred to in” Art 1(1)(a).

70 The requirement in s 8(2) is that “a court of a country other than New Zealand has jurisdiction in an insolvency proceeding and makes an order requesting the aid of the High Court in relation to the insolvency proceeding of a person to whom this section applies”.

71 An “insolvency proceeding” is defined in s 4 of the NZ CBI Act to mean (relevantly) a judicial “proceeding, including an interim proceeding, pursuant to a law relating to insolvency (whether personal or corporate) in which the assets and affairs of a debtor are subject to control or supervision by a judicial or other authority competent to control or supervise that proceeding, for the purpose of reorganisation or liquidation”.

72 All those requirements are satisfied:

(1) This Court is a court of a country other than New Zealand.

(2) This proceeding and the interlocutory process are each an “insolvency proceeding” in respect of which this Court has jurisdiction.

(3) If this Court were to make an order issuing the letter of request to the NZHC, that would be “in relation to” this “insolvency proceeding”. The statutory phrase “in relation to” is “obviously very broad”: Western Australia v Ward [2002] HCA 28; (2002) 213 CLR 1 at [577]. The proposed letter of request is evidently in relation to this proceeding.

(4) The liquidators are persons to whom s 8 applies.

(5) This proceeding and the interlocutory process are each an insolvency proceeding “of” Halifax AU and the liquidators, as they are the plaintiffs in each “insolvency proceeding”.

73 Accordingly, a request for aid by this Court would be a request of a kind which satisfies the requirements of s 8(2). It follows that s 8 of the NZ CBI Act would be engaged by the proposed letter of request.

74 In the light of the conclusion just reached, s 8(2) provides that, in the circumstances of the present case, if this Court were to make “an order requesting the aid of the High Court in relation to the insolvency proceeding of the person to whom this section applies, the High Court may, if it thinks fit, act in aid of and be auxiliary to that court in relation to that insolvency proceeding”. The relevant “insolvency proceeding” is the interlocutory process.

75 The nature or extent of the “aid” that may be requested of, and given by, the NZHC in respect of this application is not spelt out by s 8(2), but, just as in relation to s 581 of the Act, the language is broad and there is no reason to read it down. If “aid” of any kind is requested “in relation to” a foreign insolvency proceeding, and is in the interests of justice, there is no reason to think that it should not be given (although, obviously, that is a matter for the NZHC).

Discretionary considerations and conclusion

76 For the reasons set out above, I accept the liquidators’ submission that this case presents as a classic candidate for cross-border cooperation between courts to facilitate the fair and efficient administration of the winding up of Halifax AU (and Halifax NZ) that will protect the interests of all relevant persons, particularly the investor clients of Halifax AU and Halifax NZ who may have claims against the funds held by Halifax AU.

77 I also consider that the liquidators’ proposed letter of request does not raise concerns of international comity. In this context, I take “comity” to refer to mutual respect between courts of different countries for the territorial integrity of the other’s jurisdiction: Crédit Suisse Fides Trust SA v Cuoghi [1998] QB 818 at 827.

78 However, it is important that the application was made ex parte. As Jacobson J noted in Parbery; in the matter of Lehman Brothers Australia Limited (in liq) [2011] FCA 1449; (2011) 285 ALR 476 at [59], cooperation between courts will generally occur within a framework or protocol that has previously been approved by the court and is known to the parties in the particular proceeding. The liquidators seek the appointment of representative respondents and have given evidence that there are persons who may seek to appear in response to their application. No doubt the same will apply in relation to the proposed NZ application.

79 In my view, the parties who will respond to the liquidators’ application should be identified, the issues between them and the liquidators defined and their views sought as to the most efficient and effective way of proceeding in this case, before any formal request is made by this Court to the NZHC. One or more of those parties may oppose a concurrent hearing of the FCA and the NZHC. In addition, once the contradictors to the application are identified and their positions understood, it should be possible to identify with more precision about the respect or respects in which the NZHC will be asked to act in aid of and auxiliary to this Court and, quite probably, vice versa. More will also be known about the course of the proposed NZ application in the NZHC.

80 Accordingly, I consider the application for an order under s 581(4) to be premature. I will not make the order of the kind sought in prayer 3 of the interlocutory process, but note that the liquidators may make a further application for an order pursuant to s 581(4) in due course.

PAYMENT OF TRADING AND ADMINISTRATION EXPENSES

81 As noted above, in Halifax (No 3), the administrators obtained judicial advice concerning the use of specified funds to pay the trading and administration expenses of Halifax AU in respect of certain costs up to certain specified amounts, and “any further reasonable and necessary trading expenses incurred by” the company.

82 Those funds are expected to be exhausted by around the end of August 2019.

83 The liquidators and Halifax AU now seek directions and judicial advice in respect of operating and administrative expenses proposed to be incurred by Halifax AU in continuing to operate and utilise the company’s trading platforms and to employ employees in relation to the administration of those platforms.

84 This aspect of the application was supported by affidavits of the second plaintiff, Mr Quinlan, affirmed on 22 January 2019 and 26 July 2019.

Relevant facts

85 The directions and advice given in January 2019 were based on an estimate of funds required by the administrators up to the second creditors’ meeting. The administrators at that time anticipated that the meeting would take place by 1 March 2019 (and that a DOCA proposal would be put before the creditors): Halifax (No 3) at [24].

86 As it turned out, the administrators incurred substantially less trading and administration expenses to that point.

87 As at 19 July 2019, however, Halifax AU had exceeded the January estimate in respect of trading expenses to 1 March 2019, although it had not yet met that estimate in respect of administration expenses.

88 The liquidators are still incurring trading and administration expenses of the same nature as those the subject of Halifax (No 3), although these have been reduced to some extent in respect of employee costs and office lease costs.

89 Mr Quinlan maintains his view that it is necessary for the trading platforms to continue to operate until such time as investor creditor claims are adjudicated. The reasons for this include:

(1) to preserve investor positions on the trading platforms;

(2) to allow the liquidators to access the data and trading history on the trading platforms so that the liquidators can assess the trading positions of investor creditors to determine what amounts are owing to them;

(3) open positions held by some investors on the platforms; and

(4) to provide evidence for the resolution of issues arising on the interlocutory application.

90 The nature of the expenses in respect of which the liquidators seek judicial advice and directions is explained in Mr Quinlan’s 26 July 2019 affidavit. In summary, they are no different in nature from the trading and administration expenses set out in Annexure “A” to my 25 January 2019 orders.

91 The estimated future weekly expenses, from 30 August 2019, are:

Trading expenses | |

Platform costs | (28,008) |

Employment | (10,903) |

Occupancy | (1,524) |

Other | (1,028) |

Contingency* | (3,507) |

Total trading expenses (B) | (44,970) |

Administration expenses | |

Meeting costs | |

Investor / creditor correspondence (Link) | (2,487) |

Total Administration expenses (C) | (2,487) |

92 Mr Quinlan estimates a net cash flow deficiency of $43,899 per week, or $2,282,748 annually.

93 The funds to which the liquidators currently have ready access are either identifiable trust moneys (in that they are traceable to individual investors) or commingled trust funds. In those circumstances, I accept that the liquidators would be justified in using commingled trust funds to meet the ongoing trading expenses of Halifax AU.

94 Mr Quinlan identified 13 accounts from which the liquidators propose to access funds in order to cover expenses. The accounts may be categorised as follows:

Category of Account | Amount ($AUD) |

Cash held in company accounts | 39,461.38 |

Cash realised from Invast and Gain | 4,708,667.59 |

Cash held in IB AU Master and IB AU Prop Accounts | 6,772,810.10 |

Commingled funds held in accounts which are maintained pursuant to section 981B of the Act (Australian Statutory Trust Accounts) | 1,300,706.21 |

Total | $12,821,645.28 |

95 The 13 accounts are the only accounts that have significant cash balances and which do not contain traceable or partially traceable funds and are, therefore, practicable for the liquidators to access. The total funds in the accounts substantially exceed the estimated total expenses for one year and are in different currencies.

96 In the interlocutory process, the plaintiffs seek judicial advice and directions in respect of the closing out of open investments on the platforms. That advice and those directions will be sought at the earliest possible time. Presumably following the determination of those issues, all the extant investments can be sold, closed out or realised and the significant ongoing expense of maintaining the platforms can be eliminated. For this reason, the orders sought contemplate limiting the judicial advice and directions in respect of ongoing trading administration expenses in respect of the trading platforms up to the time which is two weeks following the date on which the closing out judicial advice and directions is determined. In that two week period, the liquidators can provide evidence of the time which it would take to sell, close out or realise extent investments and, consequently, for how long they estimate the platform trading and administration expenses would need to continue to be incurred.

97 As in Halifax No 3, I accept that the proposed expenditure will be incurred for the purpose of protecting investor funds. Although the likely benefit to investors is not estimated, based on the estimated dividend provided in January 2019, I am satisfied that the costs of maintaining the platforms continues to be proportional to the benefits that will accrue to investors. I also accept that it is appropriate to maintain the platforms until the plaintiffs are able to seek judicial advice and directions in respect of the closing out of open investments.

98 I have considered confining the directions to permit the liquidators to use only some of the nominated 13 accounts. However, there may be considerations affecting the use of particular accounts from time to time, such as movements in currency. In those circumstances, I will make the orders sought to permit the liquidators the maximum flexibility to act in the best interests of investor creditors.

I certify that the preceding ninety-eight (98) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justice Gleeson. |

Associate: