FEDERAL COURT OF AUSTRALIA

Bradgate (Trustee) v Ashley Services Group Limited (No 2) [2019] FCA 1210

ORDERS

RICHARD JOHN FINDLAY BRADGATE AS TRUSTEE OF THE BRADGATE SUPERANNUATION FUND Plaintiff | ||

AND: | ASHLEY SERVICES GROUP LIMITED ACN 094 747 510 Defendant | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

Approval of settlement

1. Pursuant to sections 33V and 33ZF of the Act, settlement of the proceeding on the terms set out in the Deed of Settlement dated 24 April 2019 (Settlement Deed) and the Settlement Distribution Scheme (and any annexures therein) exhibited to the confidential affidavit of Blagoj Petrovski sworn 7 June 2019 (together, Settlement Documents) be approved.

2. Pursuant to section 33ZF of the Act, the Court authorises the Applicant nunc pro tunc for and on behalf of the Group Members (being those persons who meet the definition of “Group Member” in the Further Amended Statement of Claim and who did not file an opt out notice) to enter into and give effect to the Settlement Documents and the transactions contemplated for and on behalf of Group Members.

3. Pursuant to section 33ZB and section 33ZF of the Act, the persons affected and bound by the settlement of the proceedings and these orders (other than order 8 which applies generally to all persons) be the Applicant, the Respondent, the Cross Respondents and Group Members as defined in order 2 above.

4. Pursuant to section 33ZF of the Act, William Roberts Pty Ltd t/as William Roberts Lawyers be appointed Administrator of the Settlement Distribution Scheme and is to act in accordance with the rules of the Settlement Distribution Scheme.

Costs in the proceeding

5. All costs orders made to date in the proceeding be vacated.

6. There be no order as to costs of the proceeding as between:

(a) the Applicant and the Respondent;

(b) the Applicant and the Cross Respondents; or

(c) the Respondent and the Cross Respondents.

7. Pursuant to section 33ZF of the Act:

(a) the costs and disbursements incurred by the Applicant, in connection with the administration of the Settlement Distribution Scheme from the date of the approval of the Settlement Documents to the date of completion of distribution of the Settlement Sum, be approved up to the amount of $151,250;

(b) the Applicant’s legal costs and disbursements on a solicitor and own client basis, incurred in connection with the proceeding on its own behalf and on behalf of all Group Members in the proceeding, including the costs of this application, be approved up to the amount of $3,569,755;

(c) IMF Bentham Limited’s claim for its project costs be approved in the amount of $5,949.51;

(d) the Applicant’s reasonable claim for compensation for the time and/or expenses incurred in the interests of prosecuting the proceeding on behalf of Group Members as a whole, be approved in the amount of $21,900.

Other Matters

8. Pursuant to s 37AF(1)(b) and s 37AG(1)(a), on the ground that the order is necessary to prevent prejudice to the proper administration of justice and until further order:

(a) the affidavit of Ding Pan affirmed on 29 April 2019 including annexures;

(b) the affidavit of Blagoj (Bill) Petrovski sworn on 7 June 2019;

(c) Exhibit BP8 to the affidavit of Mr Petrovski sworn on 7 June 2019;

(d) paragraphs 8 and 9 of the affidavit of Blagoj (Bill) Petrovski sworn on 12 June 2019; and

(e) the affidavit of Joseph Anthony Mazzeo sworn on 6 June 2019 including annexures not be published or disclosed without prior leave of the Court to any person or entity other than the Court, the Applicant, IMF and their legal advisors

9. William Roberts have liberty to apply to the Court, including for directions, in relation to any matter referred to in cl10.1 of the Settlement Distribution Scheme. Without limitation, William Roberts may so apply in the manner set out in cl10.3 of the Scheme.

10. The proceeding be dismissed, 7 days after the Administrator of the Settlement Distribution Scheme notifies the Court and the parties in writing that the distribution under the Settlement Distribution Scheme is complete.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

MIDDLETON J:

1 On 13 June 2019, I made orders approving the settlement of this proceeding. These are the reasons for those orders.

2 The application before me calls on the Court to approve the proposed settlement of this representative proceeding pursuant to s 33V of the Federal Court of Australia Act 1976 (Cth) (the ‘FCA Act’). The application is relevantly supported by the following documents:

(1) an affidavit of Mr Joseph Mazzeo, a costs consultant engaged on behalf of the applicant in this proceeding, sworn 6 June 2019;

(2) a confidential affidavit of Mr Blagoj Petrovski, the solicitor on record for the applicant in this proceeding, sworn 7 June 2019;

(3) an ‘open’ affidavit of Mr Petrovski sworn 6 June 2019;

(4) the Deed of Settlement between the parties dated 24 April 2019 (being an annexure to Mr Petrovski’s confidential affidavit); and

(5) a joint opinion prepared by Mr Shereef Habib SC and Mr Thomas Bagley of Counsel dated 6 June 2019 (also annexed to Mr Petrovski’s confidential affidavit) (the ‘joint opinion’).

BACKGROUND

3 This proceeding concerned the respondent’s alleged breaches of certain provisions relating to prospectuses, continuous disclosure and misleading or deceptive conduct contained within the Corporations Act 2001 (Cth) (the ‘Corporations Act’). The applicant commenced the proceeding as a representative proceeding under Part IVA of the FCA Act on behalf of itself and its fellow group members, being persons who or which acquired shares in the respondent based on a prospectus for an initial public offering.

4 By way of background, the respondent issued the prospectus as part of the initial public offering to raise funds to acquire Integracom, a private education provider specialising in the delivery of telecommunications and electronic security training. Integracom’s primary source of revenue was Commonwealth and State Government Funding Schemes. Under one of these schemes, before it was replaced on 1 July 2014, new apprentices received what were called ‘Tools for Your Trade’ payments: tax-free payments to ease their financial burden (and therefore lower the barriers to entry faced when enrolling in courses of the kind offered by Integracom). At a high level, the applicant and group members’ claim against the respondent was that Integracom’s consolidated revenue, enrolment and EBITDA forecasts, which were contained in the respondent’s prospectus, were misleading because:

(1) the respondent could not be satisfied that the reporting systems within Integracom enabled reasonable or reliable forecasts to be prepared;

(2) the Integracom enrolment figures were unreliable and inappropriate; and

(3) the respondent could have, and should have, checked the Integracom forecasts against actual figures but chose not to.

5 By making allegedly misleading statements in the financial statements and forecasts contained within the prospectus, the applicant claimed that the respondent contravened s 728 of the Corporations Act. The applicant also alleged that the respondent had engaged in misleading or deceptive conduct in issuing the prospectus, contravening s 1041H of the Corporations Act, s 18 of the Australian Consumer Law (being Sch 2 to the Competition and Consumer Act 2010 (Cth)), and s 12DA of the Australian Securities and Investments Commission Act 2001 (Cth).

6 It was also alleged that the respondent breached ASX Listing Rule 3.1 and s 674 of the Corporations Act by failing to disclose the EBITDA figures and the effect of the replacement of the ‘Tools for Your Trade’ payment scheme on Integracom’s revenue, which was (on the applicant’s submission) information that a reasonable person would expect to have a material effect on the price or value of its securities, and which should have been communicated to the Australian Stock Exchange.

7 After prolonged settlement negotiations between the parties’ legal representatives, including four days of private mediation, an ‘in principle’ settlement agreement was struck on 13 December 2018. By 24 April 2019, a formal Deed of Settlement had been signed by each of the parties. A Settlement Distribution Scheme was also prepared as part of the proposed settlement.

8 If approved, the settlement will see the respondent (and various cross-respondents) pay a sum of $14.6 million (in specified contributions between them) in exchange for the applicant and group members providing releases and covenants not to sue in respect of claims against the respondent and cross-respondents. After the deduction of the funder’s commission and legal costs and disbursements, the settlement sum will be distributed amongst the applicant and its fellow group members in accordance with the terms of Settlement Distribution Scheme.

APPLICABLE PRINCIPLES

9 The principles applicable to court approval of settlements of representative proceedings are well-established. The fundamental task of the Court is to determine whether the settlement is fair and reasonable having regard to the interests of the group members who will be bound by it. Justice Lee recently summarised the applicable principles in McKenzie v Cash Converters International Ltd (No 3) [2019] FCA 10 at [24] as follows:

First, the Court assumes an onerous and protective role in relation to group members’ interests, in some ways similar to Court approval of settlements on behalf of persons with a legal disability; secondly, the Court must be astute to recognise that the interests of the parties before it and those of the group as a whole (or as between some members of the group and other members) may not wholly coincide; thirdly, and connected to the second point, the Court should be alive to the possibility that a settlement may reflect conflicts of interest or conflicts of duty and interest between participants in the common enterprise which has conducted the representative proceeding; fourthly, the Court should understand that at that point of settlement approval, the interests of the parties have merged in the settlement and both sides may not critique the settlement from the perspectives of the group members who may suffer a detriment or obtain lesser benefits through the settlement; fifthly, the Court must decide whether the proposed settlement is within the range of reasonable outcomes, not whether it is the best outcome which might have been won by better bargaining (in this way, the Court’s task is not to second-guess the applicant’s lawyers, and it should recognise that different applicants and different lawyers will have different appetites for risk).

(Citations omitted)

10 Further, when the Court performs its supervisory and protective role, and in particular when assessing whether the proposed settlement falls within the range of reasonable outcomes, the Court relies heavily on the applicant’s counsel who, as guided by [14.4] of the Class Actions Practice Note (GPN-CA), should address the following factors:

(1) the complexity and likely duration of the litigation;

(2) the reaction of the class to the settlement;

(3) the stage of the proceedings;

(4) the risks of establishing liability;

(5) the risks of establishing loss or damage;

(6) the risks of maintaining a class action;

(7) the ability of the respondent to withstand a greater judgment;

(8) the range of reasonableness of the settlement in light of the best recovery;

(9) the range of reasonableness of the settlement in light of all the attendant risks of litigation; and

(10) the terms of any advice received from counsel and/or from any independent expert in relation to the issues which arise in the proceeding.

CONSIDERATION

11 In light of the applicable principles referred to above, I am satisfied that the proposed settlement in this proceeding is fair and reasonable having regard to the interests of group members. In short summary:

(1) the settlement sum falls within the range of fair and reasonable outcomes, particularly having regard to the litigation risks identified in the joint opinion;

(2) the method by which the amounts payable to group members are to be calculated and assessed under the Settlement Distribution Scheme is fair and reasonable; and

(3) the funder fee, legal costs and disbursements are each reasonable, both in the context of the settlement sum and objectively (again having regard to the nature of the litigation as a whole as expressed in the joint opinion).

12 I will briefly address each of these points.

Settlement sum

13 The settlement sum of $14.6 million is not insubstantial in the context of the claims brought on behalf of the applicant and group members. On the one hand, each of the prospectus claim, the misleading or deceptive claims, and the continuous disclosure contraventions were all arguable. On the other hand, there were substantial risks inherent in the case pleaded which, as discussed in the confidential opinion of the applicant’s counsel, justified the settlement sum.

Funding equalisation mechanism

14 Turning to the method by which amounts payable to group members are to be calculated and assessed, the Settlement Distribution Scheme, which governs this process, proposes to use a funding equalisation mechanism to ensure that an amount equivalent to the funding commission (discussed further below) is distributed on a pro rata basis to all registered group members.

15 Funding equalisation mechanisms are regularly approved by courts: see, eg, Dorajay Pty Ltd v Aristocrat Leisure Limited [2009] FCA 19 at [14] and [17]; P Dawson Nominees Pty Ltd v Brookfield Multiplex Limited (No 4) [2010] FCA 1029 (‘Dawson Nominees’) at [28]; Modtech Engineering Pty Limited v GPT Management Holdings Limited [2013] FCA 626 (‘Modtech’) at [58]; Earglow Pty Ltd v Newcrest Mining Limited [2016] FCA 1433 (‘Earglow’) at [83]; HFPS Pty Limited (Trustee) v Tamaya Resources Limited (in liq) (No 3) [2017] FCA 650; Liverpool City Council v McGraw-Hill Financial, Inc (now known as S&P Global Inc) [2018] FCA 1289. They achieve equality of treatment between group members because unfunded group members (that is, group members who have not entered into a funding agreement with a litigation funder) would not receive any more ‘in hand’ than funded group members: Dawson Nominees at [28]. As has been espoused by the courts, there is no good reason why unfunded group members should be permitted to take the benefit of the proposed settlement without paying a proportionate share of the funding costs: Earglow at [83].

Funder’s fee, and legal costs and disbursements

16 I turn now to the reasonableness of the various costs to be borne by the applicant and the group members. In considering reasonableness, I also take into account whether the various costs are proportionate to the recoveries of the class members: see Petersen Superannuation Fund Pty Ltd v Bank of Queensland Ltd (No 3) [2018] FCA 1842 (‘Petersen’).

17 Regarding the funder’s fee (or funding commission), I am satisfied that in the context of s 33V settlement approval applications, the fee to be paid to the litigation funder in this proceeding is fair and reasonable.

18 The factors that a court may take into account when assessing the reasonableness of the fee to be paid to a litigation funder are well-settled and do not need to be repeated here. In the present circumstances, it suffices to refer to the Full Court’s comments in Money Max Int Pty Ltd (Trustee) v QBE Insurance Group Ltd [2016] FCAFC 148; (2016) 245 FCR 191 at 209 [80].

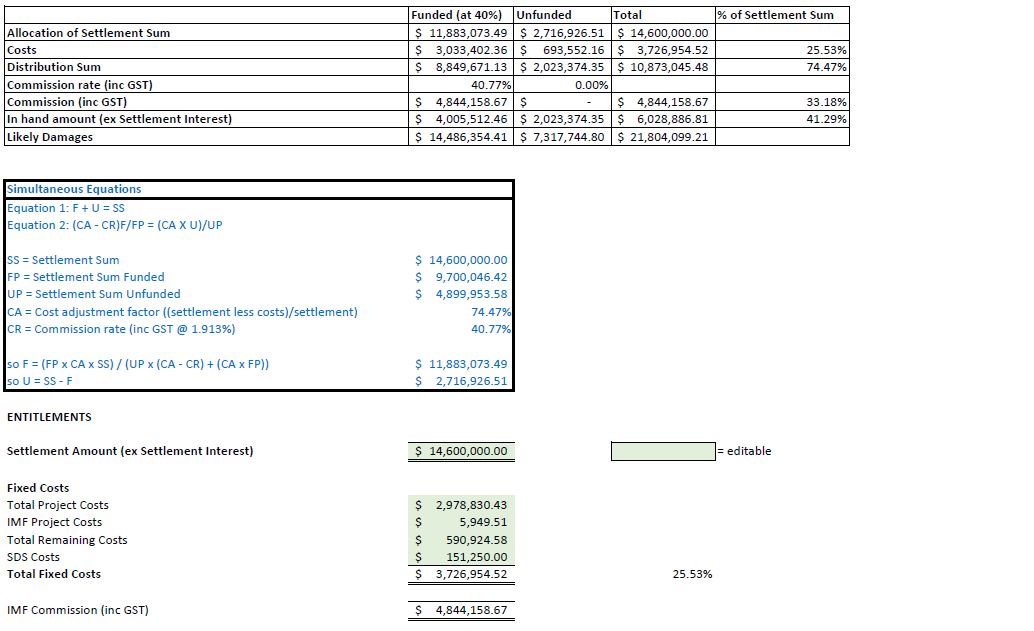

19 With those well-established factors in mind, and having regard to the spreadsheet attached as Annexure A to these reasons (which was included in an exhibit to Mr Petrovski’s confidential affidavit but which was agreed could be referred to in my reasons), I note the following:

(1) The average funding rate between funded group members and the funder was 40.77%. Relevantly, the funded group members include sophisticated institutional investors which, according to the confidential evidence of Mr Petrovski, represented the majority of the claim by value, and there is no reason to doubt that the rate agreed between the parties was the product of negotiation between well represented parties in equal bargaining positions.

(2) The funding fee rate of 33.18% (which is the average funding rate referred to at (1) above with the funding equalisation mechanism also referred to above, applied) is within the range of the usual funding fee rates that were available at the relevant time in the Australian market: see Earglow at [166]-[177] and Blairgowrie Trading Ltd v Allco Finance Group Ltd (in liq) (No 3) [2017] FCA 330; (2017) 343 ALR 476 at 509-514 [124]-[142]. Further, as stated by the Australian Law Reform Commission in its 28 May 2018 discussion paper entitled “Inquiry into Class Action Proceedings an Third Party Litigation Funders” at [5.34] when referring to fee rates charged by litigation funders operating in Australia, “commission rates are usually charged at about 30% of the settlement sum”. Collectively, these authorities demonstrate that the rate of 33.18% is broadly within the range of funding fee rates (although admittedly marginally higher) which have been held to be reasonable.

(3) The availability of funding (on the terms of the relevant funding agreement between the funder and funded group members) was, practically speaking, a precondition to the group members receiving any benefit under the proposed settlement. The evidence suggests that the applicant would not have brought the proceeding in the absence of litigation funding.

(4) The case was complex and at the time of its commencement the applicant faced the significant risks identified in the confidential opinion of its counsel. The significant risks in the present case, which I will not repeat here, are important factors in rendering the funder fee reasonable.

(5) The funder assumed at the commencement of the proceeding the risks of significant adverse costs orders and of providing security for the applicant’s costs.

(6) The funder fee to be received by the funder is proportionate to the amount sought and recovered in the proceeding and the settlement, and the costs and risks assumed by it.

20 Regarding the legal costs and disbursements of $3,569,755 that are sought to be approved, I am satisfied that these are reasonable and proportionate.

21 Again, the principles governing the Court’s determination of whether to approve the deduction of legal costs and disbursements from the settlement sum are well understood. At a high level, the Court must be satisfied that the costs and disbursements claimed are “reasonable in the circumstances”: see Modtech at [32] and [37] in which Gordon J set out a non-exhaustive list of factors to be considered.

22 Courts will, from time to time, rely on expert evidence from an independent costs consultant engaged by the applicant’s solicitors: see, eg, King v AG Australia Holdings Ltd (formerly GIO Australia Holdings Ltd) [2003] FCA 980 at [15]; Matthews v AusNet Electricity Services Pty Ltd [2014] VSC 663 at [356]-[386]. In this case, Mr Joseph Mazzeo, a costs consultant who has provided expert costs opinions in over thirty class actions, was engaged by the applicant to provide such expert evidence. He concluded that:

(1) the rates charged by William Roberts are ‘at the lower end of the range’ for comparable work by similar firms;

(2) all fees and disbursements were reasonable; and

(3) the (estimated) approval and administration costs are reasonable:

23 I accept this opinion and find the legal costs and disbursements claimed to be reasonable. In this case, the Court is able to reach this view without further assistance: see, eg, Petersen at [124]-[125].

Other considerations

24 Finally, I briefly mention two further points.

25 First, the additional compensation to be paid to the applicant for the time spent representing the interests of group members. As Lee J stated in Dillon v RBS Group (Australia) Pty Limited (No 2) [2018] FCA 395 at [72], this is a:

standard payment that has been made in a very large number of cases, to compensate an applicant for the time the applicant has spent representing interests other than his or her own.

It is appropriate for such an additional payment to the made to the named applicant, and the amount (and basis for the calculation) contained in Mr Petrovski’s confidential affidavit is reasonable.

26 Second, the amount of the administration costs of $151,250 is reasonable and is significantly lower than the administration costs approved in analogous applications by this Court: see Caason Investments v Cao (No 2) [2018] FCA 527 at [154].

CONCLUSION

27 For the reasons set out above, I am satisfied that the Court ought to order, pursuant to s 33V of the FCA Act, that the proposed settlement be approved on the terms set out in the Settlement Deed and the Settlement Distribution Scheme, and I will so order.

28 I will also make the other orders sought in the interlocutory application for the settlement approval.

I certify that the preceding twenty-eight (28) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justice Middleton. |

Annexure A

NSD 2074 of 2016 | |

First Cross-Claim | |

Ashley Services Group Limited (ACN 094 747 510) | |

First Cross-Respondent: | Holmes Management Group Pty Ltd (ACN 164 551 526) |

Second Cross-Respondent: | Carl Holmes |

Third Cross-Respondent: | Marie Holmes |

Second Cross-Claim | |

Cross-Claimant: | Ashley Services Group Limited (ACN 094 747 510) |

First Cross-Respondent: | Deloitte Touche Tohmatsu |

Second Cross-Respondent: | Deloitte Corporate Finance Pty Ltd (ACN 003 833 127) |

Third Cross-Claim | |

Cross-Claimant: | Ashley Services Group Limited (ACN 094 747 510) |

Cross-Respondent: | Grant Thornton Corporate Finance Pty Ltd (ACN 003 265 987) |

Fourth Cross-Claim | |

Cross-Claimant: | Grant Thornton Corporate Finance Pty Ltd (ACN 003 265 987) |

Cross-Respondent: | Ashley Services Group Limited (ACN 094 747 510) |