FEDERAL COURT OF AUSTRALIA

St. George Life Limited, in the matter of St. George Life Limited (No 2) [2018] FCA 1396

ORDERS

ST. GEORGE LIFE LIMITED ABN 88 076 763 936 First Plaintiff WESTPAC LIFE INSURANCE SERVICES LIMITED ABN 31 003 149 157 Second Plaintiff | ||

DATE OF ORDER: | ||

THE COURT ORDERS THAT:

1. Pursuant to s 194 of the Life Insurance Act 1995 (Cth), the scheme for the transfer of all of the life insurance business of St. George Life Limited to Westpac Life Insurance Services Limited (Scheme) in the form of Annexure A to these orders, be confirmed without modification.

2. The Scheme takes effect on and from 12.01 am (AEST) on 1 September 2018.

3. The plaintiffs pay the costs of the proceeding of the Australian Prudential Regulation Authority as agreed or assessed.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

MARKOVIC J:

1 St. George Life Limited (SGLL) and Westpac Life Insurance Services Limited (WLISL), the first and second plaintiff respectively, applied under s 193 of the Life Insurance Act 1995 (Cth) (Act) for an order under s 194 of the Act confirming a scheme for the transfer of the life insurance business of SGLL to WLISL (Scheme). On 29 August 2018, after considering the evidence and the plaintiffs’ written submissions and hearing oral submissions made by senior counsel on behalf of the plaintiffs, I made an order confirming the Scheme. These are my reasons for making that order.

2 On 13 July 2018 I made orders pursuant to s 191(5) of the Act dispensing with the requirement for distribution of the approved summary of the Scheme (Scheme Summary) to every affected policy owner pursuant to s 191(2)(c) provided that the plaintiffs carried out certain steps concerning the publication and dissemination of the Scheme Summary (July Orders): St. George Life Limited, in the matter of St. George Life Limited [2018] FCA 1206 (St. George Life Limited (No 1)).

3 The background to and overview of the Scheme is set out at [4]-[22] of St. George Life Limited (No 1). I also note the following additional matters by way of background.

4 The Scheme is based on an actuarial report dated 4 July 2018 prepared by Andrew Katon, the appointed actuary of both SGLL and WLISL (Appointed Actuary Report). Mr Katon addresses the nature of the Scheme and the impact of the transfer on relevant policy owners. The plaintiffs also engaged Briallen Cummings of KPMG to prepare an independent actuarial report and provide an opinion on the implications of the Scheme and transfer on relevant policy owners. Ms Cummings prepared a report dated 5 July 2018 (Independent Actuary Report).

5 Since preparing their respective reports more recent financial information became available. Mr Katon and Ms Cummings considered the impact of that further information on the conclusions reached in their respective reports. They have each affirmed an affidavit providing an update to their reports based on the more recent financial information and have confirmed the conclusions and opinions in their respective reports.

evidence

Conditions precedent to the Scheme

6 Clause 1(b) of the Scheme provides that the Scheme gives effect to the transfer deed dated on or about 5 July 2018 between SGLL and WLISL under which SGLL agreed to transfer its life business to WLISL, subject to confirmation by the Court and satisfaction of certain conditions. Those conditions, which are set out in cl 2.1 of the transfer deed, are:

(1) confirmation of the Scheme by the Court;

(2) receipt of advice from or on behalf of the treasurer under the Insurance Acquisitions and Takeovers Act 1991 (Cth) (IATA Act) that the Commonwealth Government has no objection to the proposed transfer;

(3) certification by the appointed actuary of SGLL and WLISL as to certain solvency and capital requirements; and

(4) each plaintiff has approved the filing of this proceeding for approval of the Scheme.

7 The evidence relied on by the plaintiffs established that each of the conditions precedent referred to at (2), (3) and (4) above had been satisfied. In particular:

on 7 August 2018 WLISL received a copy of a notice of go-ahead decision under s 41(1) of the IATA Act dated 6 August 2018;

by letters dated 16 August 2018 Mr Katon certified to the boards of SGLL and WLISL that: as at 30 September 2017 each of the statutory funds of SGLL and WLISL complied with the Australian Prudential and Regulatory Authority’s (APRA) solvency and capital adequacy standards; as at 1 August 2018 there had been no material adverse changes to the solvency and capital positions of SGLL and WLISL; and each of SGLL and WLISL statutory funds continue to be of a sound financial position; and

on 3 July 2018 a delegate of the board of each of SGLL and WLISL approved the filing of the originating process commencing this proceeding.

Actuarial evidence

8 Central to the exercise of the Court’s discretion under s 194 of the Act was the actuarial evidence relied upon by the plaintiffs. It is thus of assistance to address that evidence at the outset.

9 Mr Katon and Ms Cummings each considered the financial strength and adequacy of SGLL and WLISL based principally on financial reports prepared as at 30 September 2017, the financial year end for both companies. As set out at [5] above Mr Katon and Ms Cummings updated their reports by reference to more recent financial information, namely the 30 June 2018 unaudited quarterly returns submitted to APRA on 27 July 2018 for each of SGLL and WLISL. Based on that material Mr Katon and Ms Cummings considered whether there had been any changes to the insurance liability and asset positions of SGLL and WLISL as well as any other material changes to the financial position of each of SGLL and WLISL as at 30 June 2018.

10 In the Appointed Actuary Report and the Independent Actuary Report, Mr Katon and Ms Cummings each expressed an opinion to the effect that no SGLL or WLISL policy owner will be adversely effected by the implementation of the scheme. I set out below their respective opinions and evidence in relation to three key issues: capital adequacy and reserve position before and after the proposed transfer as it impacts on the benefit security of policy owners; changes to the terms and conditions of SGLL policy owners; and the reasonable benefit expectation of policy owners.

Capital adequacy levels

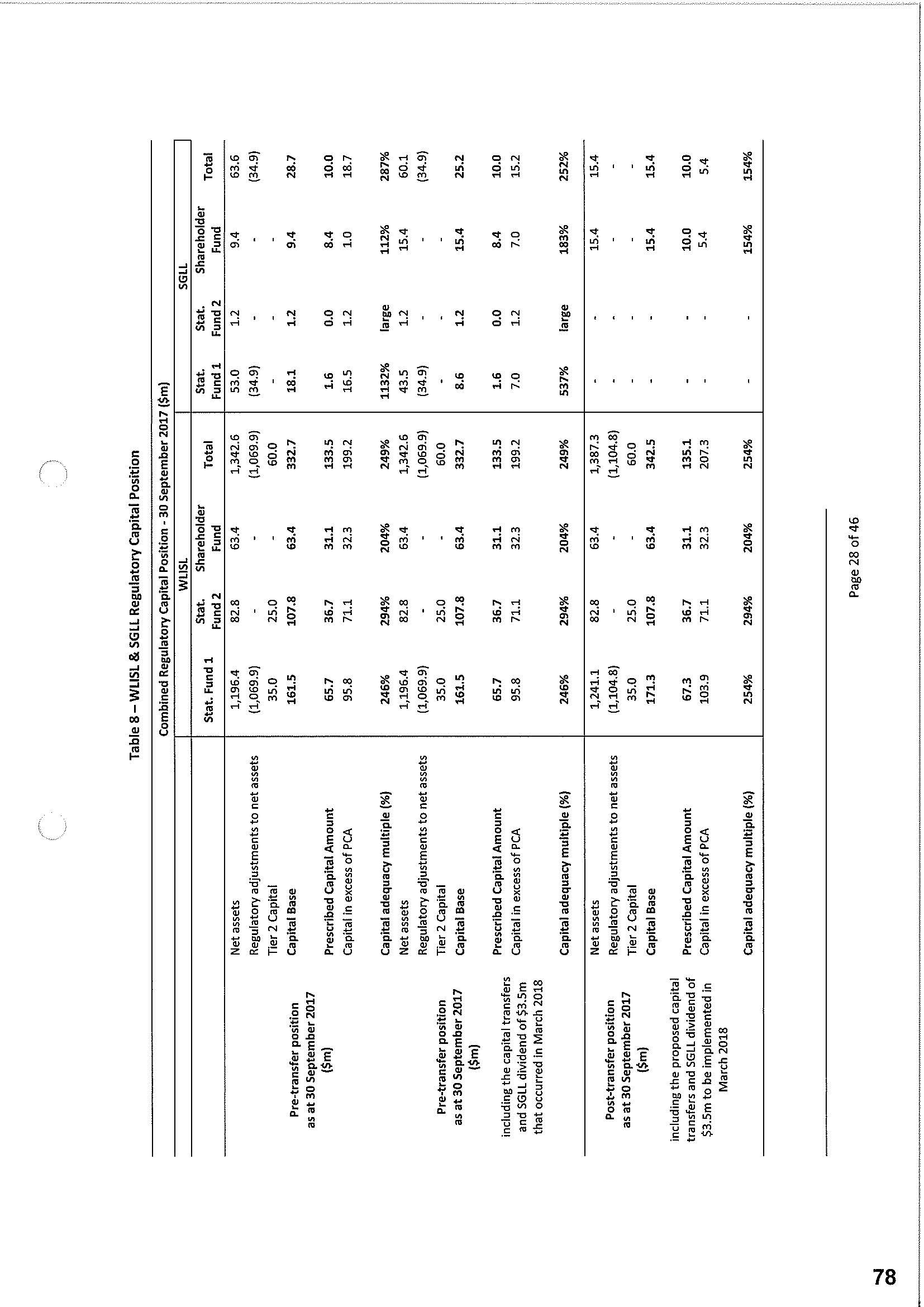

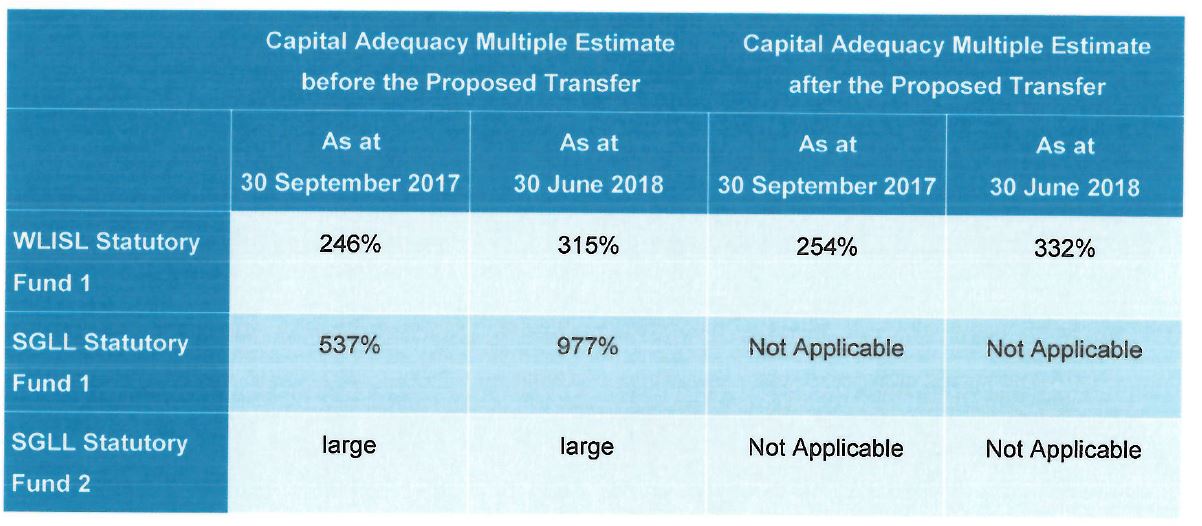

11 In assessing the benefit security of affected policy owners, both Mr Katon and Ms Cummings considered the financial position and capital adequacy reserves of SGLL and WLISL both before and after the proposed transfer.

12 Mr Katon considered the capital adequacy position for both SGLL and WLISL as at 30 June 2018 before and after the Scheme in his updated Table 8 (Updated Table 8) which is reproduced at Annexure 1 to these reasons. Among other things, Table 8 shows the capital adequacy multiple (CAM) calculated as at 30 June 2018 for SGLL before the proposed transfer and for WLISL both before and after the proposed transfer. The plaintiffs explained in their submissions that the CAM is a percentage ratio of the capital base over the prescribed capital amount (PCA) which measures the proportion of the capital of a statutory fund in excess of its minimum regulatory requirements.

13 Ms Cummings prepared a short form table showing the position before and after the proposed transfer on the basis of 30 September 2017 results and 30 June 2018 results based on Updated Table 8. Ms Cummings’ summary is reproduced below:

14 Mr Katon gave the following evidence in relation to the capital adequacy levels demonstrated by Updated Table 8:

15. As at 30 June 2018, the capital adequacy level of SGLL Statutory Fund 1 and 2 remains in excess of 500%. The updated table 8 shows that the post-transfer capital adequacy multiple for WLISL Statutory Fund 1 is 332% (as compared to 254% as at 30 September 2017), which is sufficiently high but lower than the pre-transfer capital adequacy multiple of 977% for SGLL Statutory Fund 1 due to the relative size of the PCA to SGLL's minimum internal capital requirements. The growth of the capital adequacy multiples in both SGLL Statutory Fund 1 and WLISL Statutory Fund 1 are the result of profits earned over the period to 30 June 2018 by these statutory funds.

16. In my opinion the lower multiples of capital in WLISL Statutory Fund 1 as compared to SGLL Statutory Fund 1 and SGLL as a whole do not negatively impact the benefit security of the transferring SGLL policy owners. This is because (as I noted in section 6.4.2.1 of the Appointed Actuary Report) these policy owners will be included as part of a larger pool of capital, and capital will continue to be held commensurate with the risk of the post-transfer WLISL Statutory Fund 1. The updated Table 8 shows that post-transfer WLISL Statutory Fund 1 has capital in excess of PCA of $148.1m and WLISL as a whole has capital in excess of $235m. These figures demonstrate more than adequate levels of capital reserves in excess of the minimum requirements of APRA in a larger and more diversified post-transfer entity. Further, SGLL policy owners could not reasonably expect to have maintained and are not guaranteed such high capital adequacy multiples as it would ordinarily be open to their insurer (subject to APRA approval) to reduce capital to the level prescribed by APRA (plus any target management surplus).

Mr Katon concluded that for those reasons WLISL Statutory Fund No 1 is in a stronger capital position as at 30 June 2018 than it was as at 30 September 2017 and that, as a result, his opinions on policy owners’ benefit security set out in the Appointed Actuary Report were unchanged. In that regard, in the Appointed Actuary Report at section 5.6, Mr Katon concluded that subject to Court approval of the Scheme:

• Following the transfer, each WLISL statutory fund and WLISL as a whole will remain in a sound financial position and the policy owners benefit security will remain adequate after the Proposed Transfer.

• Immediately after the Proposed Transfer all Statutory Funds of WLISL and WLISL as a whole will continue to satisfy the requirements of regulatory capital standards.

• Immediately after the Proposed Transfer, the Shareholders Fund of SGLL and SGLL as a whole will also continue to satisfy the requirements of regulatory capital standards.

• WLISL is projected to be profitable on an ongoing basis with relatively stable capital coverage.

• The risk profile considerations and expected profitability of the WLISL Funds and WLISL as a whole will contribute towards my overall conclusion on policy owners benefit security.

15 Ms Cumming’s considered that the new information, that is the financial position of each of SGLL and WLISL as at 30 June 2018, did not change the observations she made in relevant parts of the Independent Actuary Report and her conclusions in sections 6.7 and 7.2 of that report. In particular at section 6.7 Ms Cummings concluded that:

After the Transfer SGLL Policyholders' benefits will be supported by an insurer with a strong credit rating and capital and risk management practices that satisfy APRA requirements. Based upon this analysis, upon amalgamation of the SGLL Policies with the WLISL business:

• WLISL is expected to continue to have assets in excess of APRA's Prudential Capital Requirements as at the Transfer Date (as per the tables in Section 6.6.2); and

• The security of SGLL Policyholder benefits as at that date is expected to be adequate.

16 Two other matters relevant to the security of SGLL policy owner benefits have been considered by Mr Katon and Ms Cummings.

17 First, Westpac Banking Corporation (Westpac) and WLISL are respondents in a representative proceeding filed in this Court in relation to premiums charged for policies taken out with WLISL on recommendations given by Westpac financial advisors (Representative Proceeding). In Mr Katon’s opinion, WLISL currently holds sufficient capital to cover all potential risks facing it within the adopted sufficiency levels, including the risks associated with the Representative Proceeding. He also noted that he had “been advised that the claims in the class action are pleaded in such a way that if WLISL is found to have any liability to the Applicants or to the Group Members then [Westpac] will also necessarily be found to be jointly liable. As such [Westpac] will accept and pay any amounts owing under the judgment”. Mr Katon also noted that he had been advised that if that occurs Westpac will not seek contribution from WLISL. Mr Katon has assessed Westpac’s capital position and concluded that it has capital well in excess of any potential costs related to the Representative Proceeding. He thus concluded that there will be no material adverse impacts on the SGLL policy owners arising from the proceeding.

18 Ms Cummings similarly concluded that “there is no indication that this representative action will have any material adverse impact on the capital position of WLISL”. In coming to her conclusion Ms Cummings relied on information provided to her by WLISL management that they had assessed Westpac’s capital position and concluded that it has capital well in excess of any potential costs related to the Representative Proceeding.

19 Secondly, Mr Katon noted that subject to board approval, WLISL is proposing to make a dividend payment of $45 million in September 2018 from its shareholder fund to Westpac Financial Services Group Limited which is proposed to include $31 million to be transferred from the profits of WLISL’s Statutory Fund 1 in accordance with the provisions of Div 4 of Pt 6 of the Act. Mr Katon also noted that, if approved, the dividend will reduce the CAM for WLISL Statutory Fund 1 from 332% to 283%, before allowing for any profits earned over the quarter ending 30 September 2018. Notwithstanding that, Mr Katon concluded that as the CAM will remain above the position reported as at 30 September 2017 after any dividend is paid, his opinions on benefit security are unchanged.

Changes to policies

20 Under the Scheme there will be no change to the terms and conditions of SGLL policies other than to St. George Life Protection Choices policies issued prior to 1 December 2003 (SGL Protection Policies). For those policies, upon consolidation with WLISL, the value of the sum insured will be indexed by the greater of the consumer price index (CPI) and 3%. SGLL policy owners will be given advance notice of this change and, under the Scheme, will be given the option to remove indexation or alternatively, reduce the value of the sum insured at any time.

21 Mr Katon is of the opinion that the changes to benefit indexation in relation to the SGL Protection Policies are advantageous to most policy owners as they will provide additional cover without medical underwriting.

22 Ms Cummings observed that modern products typically index benefits to the greater of the CPI or a fixed percentage such as 3%. She considered the change to be favourable as it will improve the benefit indexation options available to SGLL policy owners and they have the ability to reject the indexation or request a lower indexation level at each policy anniversary.

23 There will be no changes to the terms and conditions of WLISL policies as a result of the Scheme.

Policy owners’ reasonable benefit expectations

24 In the Appointed Actuary Report, Mr Katon explained that the fundamental expectation of policy owners is that they will receive their contractual benefit entitlements when due. He noted that there are some areas that in the past involved the exercise of some discretion by SGLL and which will involve the exercise of some discretion by WLISL in the future which may impact policy owners’ reasonable benefit expectations. The discretion involves premium rate changes, claims handling philosophy and policy administration capabilities, each of which have been considered by Mr Katon and Ms Cummings.

Premium rate changes and claims handling philosophy

25 As SGLL and WLISL are both entities in the Westpac Group, the philosophies and practices with respect to premium re-rating and claims management are aligned. The same staff perform these activities for both entities. In particular, in relation to claims management, BT Financial Group (BTF Group), the Westpac Group’s wealth and insurance division, access and manage claims for both SGLL and WLISL. Accordingly, Ms Cummings was of the opinion that there is no prima facie basis to infer that there is likely to be any difference in philosophy or practice with respect to those matters as a result of the Scheme.

26 Mr Katon also concluded that SGLL policy owners’ reasonable benefit expectations are expected to be met in regards to both premium rate changes and claims handling philosophy.

Policy administration

27 SGLL policies will be transitioned from its administration system, Fintechnix, to WLISL’s administration system known as CLOAS. BTF Group has identified a number of migration issues that have the potential to affect the administration of certain aspects of some of SGLL’s policies following their transfer across to CLOAS but has put in place measures to ensure that those issues are addressed and that SGLL policy owners will not be disadvantaged as a result.

28 In the Appointed Actuary Report, Mr Katon noted that:

(1) in general CLOAS is a more contemporary policy administration system which is more regularly maintained;

(2) the Scheme will result in SGLL decommissioning Fintechnix as a policy administration system which aligns with APRA’s focus on life insurers reducing their reliance on legacy systems;

(3) WLISL has prepared an integration plan with the intent that the transition between the two systems causes no disruption to either WLISL or SGLL policy owners; and

(4) SGLL policies will continue to be administered on Fintechnix until the minor alterations needed to be made in CLOAS to accommodate them have been completed and tested after the proposed transfer.

29 In summary the changes to the administrative processes which are a function of the harmonisation of SGLL with WLISL policies include:

timing of when a policy lapses following a dishonoured premium payment;

service differences including premium grace period, renewal notice timing and cancellations;

offering some policy owners, as policies expire at age 65, the option to extend their cover to age 70; and

discounts for a number of policy owners to ensure they are not adversely impacted due to the new administration having a different structure.

30 Ms Cummings noted that in most circumstances premium rates are not guaranteed and/or policy conditions are not explicit with respect to the application of guarantees and/or the calculation of discounts, such that there is no obligation to ensure that policy owners are not disadvantaged by a change in the administration system. However, as an act of good will associated with the transfer, WLISL has provided a range of discounts and waivers.

Compliance with the July Orders and procedural requirements

31 The plaintiffs relied on the following evidence to establish compliance with the July Orders and other regulatory requirements:

affidavit of Robert McCabe, consultant program manager at BTF Group, sworn on 22 August 2018;

affidavits of Alfred Wong, financial services executive, sworn on 9 July 2018 and 21 August 2018; and

affidavit of Philip Hopley, solicitor in the employ of the plaintiffs’ solicitors, sworn on 22 August 2018.

Legislative framework and legal principles

32 Part 9 of the Act sets out the regime for transfers and amalgamations of life insurance businesses. Formal and procedural requirements are also provided for in the Life Insurance Regulations 1995 (Cth) (Regulations).

33 Section 190 of the Act relevantly provides that no part of the life insurance business of a life company may be transferred to another life company or amalgamated with the business of another life company except under a scheme confirmed by the Court. Section 190(3) of the Act requires a scheme to set out:

(1) the terms of the agreement or deed under which the proposed transfer or amalgamation is to be carried out; and

(2) particulars of any other arrangements necessary to give effect to the scheme.

34 Section 191(2) of the Act provides:

(2) An application for confirmation of a scheme may not be made unless:

(a) a copy of the scheme and any actuarial report on which the scheme is based have been given to APRA in accordance with the regulations; and

(b) notice of intention to make the application has been published by the applicant in accordance with the regulations; and

(c) an approved summary of the scheme has been given to every affected policy owner.

35 Section 191(5) of the Act empowers the Court to dispense with the need for compliance with s 191(2)(c) in relation to a particular scheme if it is satisfied that, because of the nature of the scheme or the circumstances attending its preparation, it is not necessary that there be compliance with the subsection.

36 As noted above, formal requirements are also included in the Regulations as follows:

(1) regulation 9.01 sets out the requirements in relation to documents to be lodged with APRA pursuant to s 191(2)(a) of the Act. That is, a copy of the scheme and each actuarial report on which the scheme is based must be given to APRA before a notice of intention to apply to the Court for confirmation is published in accordance with reg 9.02;

(2) regulation 9.02:

(a) sets out formal requirements in relation to a notice of intention required by s 191(2)(b). It provides that a notice of intention to make the application for confirmation must:

(i) be published in a form approved by APRA in the Gazette and in at least one newspaper, approved by APRA, circulating in each state and territory in which an affected policy owner is registered;

(ii) state the place, time and period in which an affected policy owner may obtain a copy of the scheme; and

(iii) be published before the scheme is released for public inspection under reg 9.02(4); and

(b) requires that a copy of the scheme be open for public inspection from 9.00 am until 5.00 pm everyday (except weekends and public holidays) for at least 15 days in an office of the applicant, or another location approved by APRA, in each state and territory in which there is a register of life policies that includes the relevant policy of an affected policy owner.

37 Section 192 of the Act provides that where a copy of the scheme has been given to APRA for the purposes of s 191(2)(a) of the Act, APRA may arrange for an independent actuary to make a written report on the scheme. In this case APRA has elected not to exercise that right.

38 Section 193 of the Act provides:

(1) Any of the companies affected by a scheme may apply to the Court for confirmation of the scheme.

(2) An application for confirmation must be made in accordance with the regulations.

(3) APRA is entitled to be heard on an application.

39 Regulation 9.03 provides that an application to the Court for confirmation of a scheme may be made no earlier than whichever is the later of:

(1) the day after the day on which the period referred to in reg 9.02(4) relating to public inspection of scheme documents ends; or

(2) 15 days after the approved summary of the scheme has been given to every affected policy owner (unless the Court dispenses with the need for compliance with s 191(2)(c) of the Act).

40 Section 194 of the Act provides:

(1) The Court may:

(a) confirm a scheme without modification; or

(b) confirm the scheme subject to such modifications as it thinks appropriate; or

(c) refuse to confirm the scheme.

(2) In deciding whether to confirm a scheme (with or without modifications), the Court must have regard to:

(a) the interests of the policy owners of a company affected by the scheme; and

(b) if a report relevant to all or part of the scheme has been filed with the Court under section 175—that report; and

(c) any other matter the Court considers relevant.

41 Finally, s 195 of the Act provides for the effect of confirmation by the Court. When the scheme is confirmed it becomes binding on all persons and it has effect despite anything in the constitution of any company affected by the scheme.

42 In In the Application of Commonwealth Insurance Holdings Ltd and The Colonial Mutual Life Assurance Society Ltd [2007] FCA 1012 at [12]-[14] Edmonds J said the following about the discretion conferred by s 194 of the Act:

12 Whilst the Court’s discretion is broad, it is not unfettered, and must be exercised on the evidence and having regard to the objects of the Act, principally, the protection of the interests of policyholders and prospective policyholders (s 3(1) of the Act). See Colonial Portfolio Services Ltd v Australian Prudential Regulation Authority (2000) 11 ANZ Ins Cas 90-103; [1999] FCA 1779 at [4] and [29].

13 There are two aspects to the protection of the interests of policyholders:

1. First, there are the procedural aspects in which the Court is concerned to see that the process undertaken has been properly executed in accordance with the requirements of the Act and the Life Insurance Regulations 1995 (Cth) (‘the Regulations’); and

2. Second, there is a substantive aspect in which the Court is concerned to see that the Scheme will not be prejudicial to the interests of policyholders and that policyholders are properly safeguarded, i.e., there is not likely to be any material detriment to policyholders affected by the Scheme (see NuLife Insurance Ltd v Norwich Union Life Australia Ltd [2005] FCA 1635 at [24] per Emmett J; MLC Lifetime Company Ltd & Anor (No. 2) [2006] FCA 1367 at [5] per Bennett J; Colonial Portfolio at [25] per Mathews J)

14 The question of whether policyholders would be adversely affected by the Scheme is largely actuarial and involves a comparison of their security and reasonable expectations without the Scheme with what they would be if the Scheme were implemented.

See too National Mutual Life Association of Australasia Limited, the application of National Mutual Life Association of Australasia Limited and AMP Life Limited (No 2) [2016] FCA 1591 at [29]-[32] (per Gleeson J).

Consideration

Compliance with the July Orders and procedural requirements

July Orders

43 The July Orders dispensed with the requirement for the plaintiffs to provide the Scheme Summary to policy owners of SGLL’s Statutory Funds 1 and 2 and WLISL’s Statutory Fund 1 provided they complied with the steps in Order 2 of those Orders. The evidence relied on by the plaintiffs established that there had been compliance or, in one case, substantial compliance with Order 2 of the July Orders.

Order 2(a) of the July Orders – publication of notice of intention

44 Order 2(a) required publication of the notice of intention to make the application to the Court for confirmation of the Scheme (Notice of Intention) to be published in the Commonwealth Government Notices Gazette (Gazette) and the company announcements section of the newspapers approved by APRA which were listed in Annexure C to the originating process (Newspapers).

45 Mr McCabe gave evidence that on 18 July 2018 a copy of the Notice of Intention was published in the Gazette and the Newspapers.

Order 2(b), (c) and (d) of the July Orders – webpages and email

46 Order 2(b) required that from or shortly after 19 July 2018, but not before the Notice of Intention had been published in the Gazette and the Newspapers, up to and including the effective date, copies of the Notice of Intention, scheme document, Scheme Summary, the Appointed Actuary Report and the Independent Actuary Report be made available on the webpages specified in Order 2(c). Order 2(c) required that from or shortly after 19 July 2018 and up to and including the effective date, links to four specified webpages be included on the websites for “Westpac”, “St George”, “BankSA” and “Bank of Melbourne”. Order 2(d) required that from 19 July 2018 until the date of the confirmation hearing a dedicated email address be established to receive inquiries about the Scheme.

47 Mr McCabe gave evidence that on 18 July 2018 he arranged for copies of the documents required by Order 2(b) to be published on the webpages listed in Order 2(c) of the July Orders. However, Mr McCabe noted that during the period from 19 to 20 July 2018 an incorrect version of the scheme document was published on each of the four websites. The document that was published for those two days differed from the version which should have been published in the following ways:

(1) at cl 1(b) the execution date of the transfer deed was recorded as 2 July 2018 when the correct date was 5 July 2018;

(2) there was a cross-referencing error at cl 2.3 in that the reference to cls 3 to 6 stated “clauses 3 to 0”; and

(3) clause 8 incorrectly referred to the defined term “Effective Date” instead of “Effective Time”.

48 For the two day period before the correct version of the scheme document was published on the websites, the four webpages were viewed a total of five times.

49 I was satisfied that the differences in the incorrect scheme document were not material and not of a kind which were likely to confuse or mislead policy owners who viewed it. In those circumstances, there had been substantial compliance with Orders 2(b) and (c).

50 Mr McCabe also gave evidence verifying that the dedicated email address specified in the Scheme Summary became operational and was able to receive emails from 18 July 2018.

Orders 2(e) and (f) of the July Orders - mail out

51 Orders 2(e) and (f) required that between 18 and 20 July 2018 or shortly after, the plaintiffs send by regular prepaid post the Scheme Summary to all SGLL policy owners and insured beneficiaries of the BankSA Flexi Cover Loan and Lifestyle Insurance group life policy (BankSA Group Policy) except for those policy owners or BankSA Group Policy insured beneficiaries for whom SGLL had no record of a current mailing address and that, in the event that any of the material posted was returned undelivered up to and including 25 days prior to the date of the confirmation hearing, then to the extent reasonably practicable, the returned mail procedure be followed.

52 Mr McCabe gave evidence that he arranged for a third party administrator to carry out the mail out to owners of SGLL policies administered by SGLL as well as those administered by Insurance Australia Limited and Advanced Asset Management Limited. On 19 July 2018 89,680 letters were posted to SGLL policy owners and insured beneficiaries of the BankSA Group Policy for whom SGLL had a current mailing address. The mail out to owners of SGLL policies administered by Aegon Insights Australia Pty Ltd (Aegon) was carried out by it and on 19 July 2018 the third party administrator appointed by Aegon lodged 21,339 letters for posting addressed to the policy owners of SGLL for which Aegon had a record of a current mailing address.

53 Mr McCabe’s evidence was that as at 19 August 2018, 814 letters had been returned undelivered. Under Mr McCabe’s supervision address checks were conducted for the returned mail in accordance with the specified procedure but no updated addresses were identified.

Order 2(g) – public inspection

54 Order 2(g) required that from 19 July 2018 to 10 August 2018 inclusive (Inspection Period) a copy of the scheme documents be made available for public inspection from 9.00 am to 5.00 pm (local time) on weekdays at each location specified in the Notice of Intention.

55 Mr Hopley was responsible for arranging for the carrying out of the public inspection process as required by Order 2(g) of the July Orders. Mr Hopley arranged for electronic copies of the scheme documents and instructions for the inspection process to be provided to the nominated representatives for each of the offices of the firms of solicitors referred to in the Notice of Intention prior to commencement of the Inspection Period. The Inspection Period commenced on 19 July 2018 and ended on 10 August 2018. Mr Hopley received confirmation that the scheme documents were made available for public inspection at each relevant location during that period.

Order 2(h) and (i) of the July orders – call centre

56 Orders 2(h) and (i) required that from or shortly after 18 July 2018 up to and including the date of the confirmation hearing, a call centre be established to handle calls about the Scheme made to a dedicated toll free phone number specified in the Notice of Intention and that call centre staff be trained to handle the calls.

57 In July 2018 Mr McCabe made arrangements for the establishment of the toll free telephone number to handle calls about the Scheme and on 18 July 2018 the dedicated toll free telephone number referred to in the scheme documents came into operation. According to Mr McCabe, telephone calls made to SGLL’s general customer telephone number about the Scheme were transferred through to the dedicated telephone number. He said that staff in the SGLL call centre who answered calls about the scheme received training on, among other things, SGLL product information, the background to the Scheme, and a walk through of a document prepared by the project management team that contained answers to a series of frequently asked questions.

Order 2(j) of the July Orders – other notification

58 Order 2(j) required that from or shortly after 18 July until the date of the confirmation hearing, on request and as soon as reasonably practicable, a copy of the scheme documents be provided to SGLL policy owners and WLISL policy owners free of charge. Mr McCabe gave evidence that from 18 July 2018 to 10 August 2018 SGLL received seven requests by telephone for copies of the scheme documents which were then either posted or emailed to the caller.

Procedural requirements under the Act and the Regulations

59 The evidence relied on by the plaintiffs in relation to compliance with the necessary procedural requirements established the following matters:

(1) a copy of the Scheme and the actuarial reports upon which the scheme is based, among other things, were sent to APRA on 6 July 2018 prior to the publication of the Notice of Intention as required by reg 9.01 of the Regulations and in compliance with s 191(2)(a) of the Act;

(2) the Notice of Intention was published in the Gazette on 18 July 2018 and in the Newspapers approved by APRA as required by reg 9.02(1)(a) and (b) of the Regulations and pursuant to s 191(2)(b) of the Act;

(3) the Notice of Intention, which had been approved by APRA, was in conformity with the requirements of reg 9.02(2) of the Regulations and was published before the Scheme was released for public inspection as required by reg 9.02(4);

(4) for a period of 15 days after publication of the Notice of Intention the Scheme was open to inspection in accordance with the requirements of reg 9.02(4) of the Regulations;

(5) noting that the public inspection period ended on 10 August 2018, the application to the Court for confirmation of the scheme was made in accordance with reg 9.03 of the Regulations; and

(6) the July Orders dispensed with the need to provide the Scheme Summary to every affected policy owner as required by s 191(2)(c) of the Act provided that the steps set out in Order 2 of those July Orders were carried out, which was the case: see [48]-[58] above.

Substantive matters – Scheme will not be prejudicial to policy holders

60 I was satisfied, on the basis of the actuarial evidence summarised above, that the Scheme will not be prejudicial to the interests of any of SGLL or WLISL policy owners. In summary that evidence disclosed that:

(1) the benefit security of SGLL policy owners will not be adversely affected in a material way by the implementation of the Scheme notwithstanding that solvency coverage of the fund to which their policies will be referrable, WLISL Statutory Fund 1, will diminish;

(2) notwithstanding (1) above, after the proposed transfer WLISL will retain adequate excess capital over regulatory requirements both for its Statutory Fund 1 and as a whole;

(3) except for one class of policy, the Scheme does not involve any change in policy terms and conditions issued by SGLL. Insofar as that one class of policy is concerned the evidence establishes that the effect of the change will be advantageous to most policy owners, and to the extent that policy owners do not wish to accept policy cover, they will be given the option to remove indexation or reduce the sum insured;

(4) WLISL will provide a range of discounts and waivers which are designed to ensure that the transferring policy owners’ reasonable expectations are met with respect to the migration from the SGLL to the WLISL administration system.

61 The diminution in the solvency coverage for SGLL policy owners was not an impediment to making the order for confirmation of the Scheme given the evidence clearly established that those policy owners will be adequately protected: see PMI Indemnity Limited (No 2) [2005] FCA 1842 at [71]-[74] (per Lindgren J). Further, as Mr Katon noted “SGLL policy owners could not reasonably expect to have maintained and are not guaranteed such high capital adequacy multiples as it would ordinarily be open to their insurer (subject to APRA approval) to reduce capital to the level prescribed by APRA”.

View of affected policy holders

62 Despite the extensive notification procedures undertaken by the plaintiffs, they did not receive any objection to the Scheme or any communication of an intention to object to the Scheme from policy owners or from anyone else. Further, no person appeared on 29 August 2018 when the confirmation hearing was listed for hearing.

63 The notification procedure undertaken pursuant to the July Orders elicited the following inquiries:

there were a total of 12 page views across the four webpages established pursuant to Order 2(c) of the July Orders;

as at 15 August 2018 the dedicated email address established pursuant to the July Orders had not received any emails from policy owners. However, a small number of emails had been received from administrator partners, such as Aegon, to pass on requests they received from customers requesting call backs from the call centre or for copies of scheme documents to be posted;

during the Inspection Period, no one attended any of the public inspection locations to inspect the scheme documents; and

as at 10 August 2018 a total of 233 calls were received in relation to the Scheme at the dedicated call centre. The purpose of each call was captured by call centre staff. According to Mr McCabe, no caller raised an objection to the Scheme. The subject matter of the calls was generally confined to queries relating to the caller’s understanding of the Scheme, requests for the scheme documents to be mailed out, requests to update personal details and, in some cases, to cancel policies. A number of calls raised complaints or concerns about SGLL’s ownership by Westpac arising from its merger with St. George Bank Limited in 2008.

The position of APRA

64 As is evident from the provisions of the Act and the Regulations, APRA is a significant participant in the process of confirmation of scheme transfers: see Re Royal & Sun Alliance Life Assurance Ltd (2000) 104 FCR 37 at [24] (per Katz J).

65 Here, the evidence demonstrated that APRA played an active role in the preparation of the Scheme. It approved the Notice of Intention, the Scheme Summary, the Newspapers and the locations where the scheme documents were made available for public inspection. It also monitored the scheme documents and actuarial reports relied on by the plaintiffs.

66 Mr Claxton appeared on behalf of APRA at the confirmation hearing. He informed the Court that APRA had no objection to the proposed orders. He submitted that APRA had reviewed the various iterations of the documents; believed that the issues raised by its actuarial experts had been addressed; was satisfied that there was no detriment to affected policy holders; was satisfied that the benefit expectations and benefit security of affected policy owners is well protected; and was satisfied that after the transfer, WLISL will be significantly in excess of APRA’s capital requirements.

67 Mr Claxton also informed the Court that APRA had raised the issue of WLISL’s potential exposure in the Representative Proceeding and, having been provided with a written assurance from Westpac that it would honour its undertaking to meet WLISL’s liabilities under any judgment, was satisfied that WLISL’s exposure would be limited.

Conclusion

68 For those reasons I was satisfied that the Scheme should be confirmed without modification and I made the orders sought by the plaintiffs.

I certify that the preceding sixty-eight (68) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justice Markovic. |

Annexure 1