Bitech Engineering v Garth Living Pty Ltd [2013] FCA 881

| IN THE FEDERAL COURT OF AUSTRALIA | |

| Applicant | |

| AND: | GARTH LIVING PTY LTD (ACN 111 145 432) Respondent |

| DATE OF ORDER: | |

| WHERE MADE: |

THE COURT ORDERS THAT:

1. The respondent pay to the applicant the sum of $668,417 (comprising $433,969 by way of damages for infringement of Australian Patent No 621713 and $234,448 by way of interest).

2. Subject to the operation of all existing orders as to costs to the intent that all such orders shall remain undisturbed and of full force and effect, the respondent pay the applicant's costs of and incidental to these proceedings incurred after 23 July 2010 including reserved costs and, in particular, including the applicant's costs in respect of the issues heard by the Court in the period from 23 July 2012 to 27 July 2012:

(a) Up to and including 13 July 2012, on the party/party basis;

(b) With the exception of the costs described in subpar (c) below, thereafter on an indemnity basis; and

(c) Insofar as the costs of and incidental to the Supplementary Expert's Report dated 22 August 2013 prepared by Martin Paul Langridge are concerned, on the party/party basis.

3. At the expiration of twenty-one (21) days from the date of these orders, the exhibits and subpoenaed documents be returned to the person or entity (as the case may be) who tendered or produced the particular documents or things to the Court.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

| IN THE FEDERAL COURT OF AUSTRALIA | |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 43 of 2007 |

| BETWEEN: | BITECH ENGINEERING Applicant |

| AND: | BUNNINGS GROUP LIMITED (ACN 008 672 179) Respondent |

| JUDGE: | FOSTER J |

| DATE OF ORDER: | 30 AUGUST 2013 |

| WHERE MADE: | SYDNEY |

THE COURT ORDERS THAT:

1. The respondent pay to the applicant the sum of $668,417 (comprising $433,969 by way of damages for infringement of Australian Patent No 621713 and $234,448 by way of interest).

2. Subject to the operation of all existing orders as to costs to the intent that all such orders shall remain undisturbed and of full force and effect, the respondent pay the applicant's costs of and incidental to these proceedings incurred after 23 July 2010 including reserved costs and, in particular, including the applicant's costs in respect of the issues heard by the Court in the period from 23 July 2012 to 27 July 2012:

(a) Up to and including 13 July 2012, on the party/party basis;

(b) With the exception of the costs described in subpar (c) below, thereafter on an indemnity basis; and

(c) Insofar as the costs of and incidental to the Supplementary Expert's Report dated 22 August 2013 prepared by Martin Paul Langridge are concerned, on the party/party basis.

3. At the expiration of twenty-one (21) days from the date of these orders, the exhibits and subpoenaed documents be returned to the person or entity (as the case may be) who tendered or produced the particular documents or things to the Court.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 1681 of 2006 |

| BETWEEN: | BITECH ENGINEERING Applicant |

| AND: | GARTH LIVING PTY LTD (ACN 111 145 432) Respondent |

| IN THE FEDERAL COURT OF AUSTRALIA | |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 43 of 2007 |

| BETWEEN: | BITECH ENGINEERING Applicant |

| AND: | BUNNINGS GROUP LIMITED (ACN 008 672 179) Respondent |

| JUDGE: | FOSTER J |

| DATE: | 30 AUGUST 2013 |

| PLACE: | SYDNEY |

REASONS FOR JUDGMENT

1 On 14 August 2013, I delivered Reasons for Judgment in respect of the applicant's claims for damages against Garth Living Pty Ltd (Garth Living) and Bunnings Group Limited (Bunnings) (Bitech Engineering v Garth Living Pty Ltd [2013] FCA 822) (the Damages Reasons). As a result of the approach which I took to the applicant's damages claims in those Reasons for Judgment, I required further assistance in quantifying the amount of damages and pre-judgment interest which I proposed to award. For this reason, on 14 August 2013, I made the following orders:

1. By 23 August 2013, the applicant's expert accountant, Martin Paul Langridge, of Deloitte, file and serve a supplementary report verified by affidavit in which he sets out the calculations called for by the Court's approach to the assessment of damages explained at [75]–[80] of Reasons for Judgment of Foster J published this day (including interest calculated up to and including 30 August 2013).

2. By 26 August 2013, the respondents file and serve a Written Submission of no more than three (3) pages in length in which they identify and explain any errors in the calculations performed by Mr Langridge.

3. Thereafter, the form of final orders to be made be determined on the papers.

2 On 23 August 2013, the applicant filed and served an affidavit affirmed by Mr Langridge on 22 August 2013 to which Mr Langridge attached a further Expert's Report prepared by him as directed by me on 14 August 2013 (Mr Langridge's supplementary report). Garth Living and Bunnings lodged their responsive Submission on Damages on 26 August 2013, also as directed by me on 14 August 2013.

3 In light of the Reasons for Judgment delivered by me on 14 August 2013, on 19 August 2013, the applicant applied to the Court to have its costs incurred on and after 14 July 2012 assessed on an indemnity basis. On 23 August 2013, the applicant lodged a Written Submission dated that day in support of its application for indemnity costs. On 26 August 2013, Garth Living and Bunnings lodged a responsive Written Submission directed to the question of indemnity costs.

4 These Reasons for Judgment determine all outstanding questions in relation to damages and costs.

Damages

The Damages Reasons

5 At [31]–[39] of the Damages Reasons, I set out my reasons for concluding that the number of units of each model of heater specified at [40] of the Damages Reasons should be used as the starting point for the quantification of the number of units of each model to be deployed in the damages calculation to follow.

6 At [75]–[80] of the Damages Reasons, I said:

75. I think that the appropriate method for calculating the applicant's damages in the present case is as follows:

(a) As the maximum number of sales which the applicant could conceivably have lost by reason of the infringing conduct of Garth Living and Bunnings, the Court should determine the number of units of each infringing model actually sold by Bunnings. I prefer the sales figures over the importation figures for the reasons given at [41] above. The Court should ignore the sales made by Garth Living to Bunnings because to a large extent they are subsumed in the retail sales made by Bunnings to members of the public and, in any event, it is the number of retail sales made by Bunnings that most closely reflects the maximum number of sales likely to have been made by the applicant through its established channels had the infringing articles not been in the market. The Court should adopt the estimates which I have made in respect of the BH4 and BH12 models. For these reasons, the figures to be used are those set out under the second dot point in [40] above.

(b) The unit numbers of each model sold should then be broken down into the numbers of each model sold in each calendar year using the breakdown adopted by Mr Langridge in his Assumption A calculations set out in his first report.

(c) The relevant gross margins figure should then be multiplied by the number of units of each comparable BH model actually sold by Bunnings in each calendar year.

(d) The lost gross margins for each model for each calendar year should be added together in order to derive the total of the lost gross margins arrived at upon the assumptions specified above.

(e) Any appropriate discounts should then be factored into the calculations.

76. I intend to direct that Mr Langridge perform the necessary calculations in order to give effect to the approach which I have described in subpars (a) to (d) of [75] above.

77. I think that some discount to the figure arrived at in this way is warranted. My reasons are:

(a) Given the state of the market for electric flame effect heaters in Australia in 2006, 2007, 2008, 2009 and 2010, I am of the view that it is unrealistic to conclude that the applicant would have picked up all of the sales made by Bunnings had the infringing heaters not been in the market. A good percentage of those sales would have gone to trade branded products and some third party branded products. According to the GfK report, trade branded and non-infringing heaters held approximately 8.75% of the total market in 2006, approximately 19% of the total market in 2007, approximately 32% of the total market in 2008, approximately 32% of the total market in 2009 and approximately 46% of the total market in 2010. I think that the raw unit numbers set out under the second dot point in [40] above as broken down into calendar years using Mr Langridge's Assumption A figures should be discounted by 8.75% for sales made in 2006, by 19% for sales made in 2007, by 32% for sales made in 2008 and by 32% for sales made in 2009. In this way, account is taken for the likelihood that some of the infringing sales would have leaked to other non-infringing suppliers.

(b) I think that a further 10% discount should be applied to each of the discounted unit numbers arrived at after applying the discounts specified in subpar (a) above in order to take account of contingencies including consumer perceptions about price and value. The final unit numbers as discounted should then be deployed in the other calculations specified in subpars (a) to (d) of [75] above utilising the assumptions as to margin set out therein.

78. The applicant submitted that I should find both Garth Living and Bunnings jointly and severally liable for the entire damages award. I agree that this is the appropriate approach in the present case. My reasons are:

(a) At 102–103 [104]–[110] of my judgment on liability (Bitech Engineering v Garth Living Pty Ltd (2009) 84 IPR 78), I found that Garth Living had been directly involved in the importation, sale and distribution of all of the original heaters;

(b) At 104 [111] of the same judgment, I said that I would have found that Garth Living and Bunnings had been engaged in a common design directed to the sale of the infringing heaters, had it been necessary to do so. Garth Living admitted the alleged common design in its Defence, in any event;

(c) Similar findings are justified in respect of the additional models; and

(d) At [12] of their Closing Written Submissions, Garth Living and Bunnings conceded that both them should be found to be jointly and severally liable for the whole award of damages.

79. I therefore conclude that Garth Living and Bunnings should be made jointly and severally liable for the whole damages award which I will ultimately make.

80. Interest should be calculated using the methodology explained by Mr Langridge at pars 6.9 and 6.10 of his first report (viz the report annexed to his affidavit affirmed on 25 November 2011). In those paragraphs, Mr Langridge said:

6.9 As instructed (Refer paragraph 1.14), I have calculated interest applying annual interest rates as published in the Federal Court of Australia Harmonised interest rate table (Refer Exhibit L), for the calendar years 2006 to 2011. I have been instructed that only pre-judgement interest rates are to be used for all product models.

6.10 In calculating the applicable interest I have made the following assumptions:

(a) Interest is calculated on the basis that the lost gross margin claimed arose evenly across the year in which it arose

(b) Interest has been calculated on a simple interest basis

(c) The calculations have been performed to 31 October 2011.

7 Paragraphs 75 to 80 of the Damages Reasons were the main paragraphs to which Mr Langridge was required to direct his attention for the purpose of preparing his supplementary report.

Mr Langridge's Supplementary Expert's Report Dated 22 August 2013

8 At pars 2.2 to 2.6 of his supplementary report, under the heading "Lost number of units sold", Mr Langridge referred to [40] and [75(a)], [75(b)], [77(a)] and [77(b)] of the Damages Reasons. He said that he would apply the reasoning contained in those paragraphs when making his revised calculations.

9 Under the heading "Gross margin", at pars 2.7 to 2.9, Mr Langridge said:

2.7 At paragraph 75(c) of the Judgment, His Honour states that the relevant gross margins should then be applied to the number of units of each model sold for each calendar year. It is noted in paragraph 75(e) of the Judgment that the appropriate discounts should be factored into this calculation and I have taken this to mean that the gross margins should be applied to the net number of units after applying the discounts referred to in paragraphs 2.5 and 2.6 above.

2.8 At paragraph 70 of the Judgment, it is noted that the sales revenue, margins and manufacturing costs for each relevant model were established by evidence that was not challenged. These figures supported the gross margin figures used in My First Report and are therefore equally applicable for the calculations in this report.

2.9 As noted in paragraph 75(d) of the Judgment, the lost gross margins for each model for each calendar year, derived pursuant to the calculation described in paragraph 2.7 above, should then be added together to derive the total lost gross margin.

10 Mr Langridge has accurately interpreted my intentions insofar as the application of discounts is concerned. He has also accurately interpreted my intentions in respect of the calculation of the gross margin for each of the relevant models during each of the relevant calendar years.

11 Under the heading "Interest", Mr Langridge recorded his approach to the calculation of interest. That approach also accurately reflects my intentions in respect of interest as expressed in the Damages Reasons.

12 In section 3 of his supplementary report, Mr Langridge set out his analysis. At pars 3.1 to 3.17, Mr Langridge said:

3.1 I set out below details of my calculation in accordance with the approach set out in the Judgment as described in Section 2 above.

Lost number of units sold

3.2 I have been instructed to base my calculation on the number of infringing units actually sold by Bunnings to the public which have been determined by the Court to be the figures set out in the table in paragraph 2.3 above. [This table reproduced the findings which I set out at [40] of the Damages Reasons.]

3.3 Where possible I have allocated the lost number of units sold to calendar years based on a table of Bunnings sales which was included at Exhibit Q of My First Report (Table of Bunnings Sales).

3.4 BH4 and BH12 were not included in the Table of Bunnings Sales. His Honour explains at paragraph 41 of the Judgment that he has derived an estimate of BH4 and BHI2 sales, however, the Judgment does not specify how these units should be allocated to the years from 2006 to 2010. I note that in deriving this estimate His Honour has had regard to disclosed sales of these models from Garth to Bunnings. I have therefore allocated the volume of sales determined by the Court in proportion to the sales made each year by Garth to Bunnings.

3.5 For BH10 the Table of Bunnings Sales records 247 units sold while His Honour has determined that the calculation should include 537 units. I have therefore allocated the 537 units as determined by the Court to years in proportion to the sales of 247 units that were shown in the Table of Bunnings Sales.

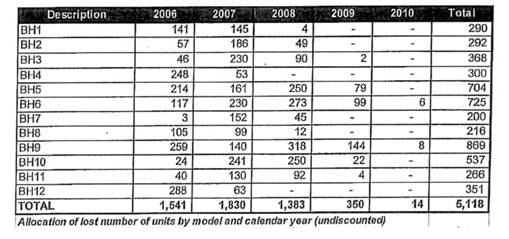

3.6 Following table summarises the results of my allocation of the number of units to years for each model (as required pursuant to paragraph 75(b) of the judgment), before applying any discounts.

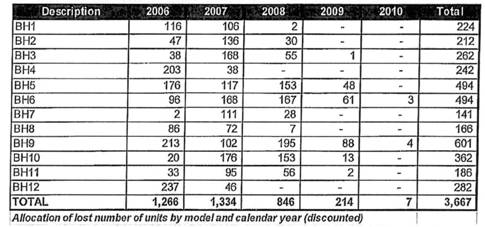

3.7 I have applied the discounts set out at paragraphs 77(a) and 77(b) of the Judgment (refer paragraphs 2.5 and 2.6 above) and set out the resultant unit numbers in the following table:

3.8 I have rounded the figures shown in the table in paragraph 3.7 for presentation purposes only. I have used unrounded figures in my calculation of the lost gross margin in paragraphs 3.9 to 3.12 below.

Gross margin

3.9 I have used the same assumptions for determining an appropriate gross margin as used in My First Report. I summarise the applicable assumptions that were set out in paragraphs 5.5 and 6.5 of My First Report:

a) The gross margin has been derived from sales information contained in Exhibit 1 to Mary Daly's Affidavit dated 15 March 2011.

b) Where total gross margin and units sold was available for a particular product for a particular year, the gross margin for that product was calculated as the total gross margin divided by the number of units.

c) Where total gross margin and units sold was not available for a particular product for a particular year, the gross margin for that product was taken as being the gross margin per unit for the most recent earlier year for which data was available.

d) For models BH4, BH7, BH9 and BH12, no gross margin information was contained in Mary Daly's Affidavit, dated 15 March 2011. I have therefore relied upon the gross margin information contained in Annexure NFD-1 to Mary Daly's Affidavit, dated 15 November 2011.

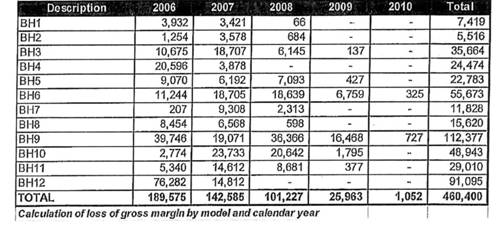

3.10 My calculation of the loss of gross margin is shown at Appendix C.

3.11 I summarise in the following table the loss of gross margin by model and calendar year.

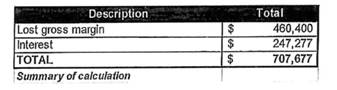

3.12 I have calculated the total loss of gross margin based on the methodology set out in the Judgment and the assumptions that I have made as set out in this report as $460,400.

Interest

3.13 As required in paragraph 80 of the Judgment, I have calculated interest using the same methodology applied in My First Report (paragraph 6.9 and 6.10 of My First Report).

3.14 Interest calculated up to and including 30 August 2013 totals $247,277.

3.15 I have provided my interest calculation at Appendix D which details the interest by model.

Summary

3.16 I was instructed by DLA Piper Australia to update my calculation in accordance with the orders of the Federal Court of Australia dated 14 August 2013.

3.17 My calculations result in lost gross margin and interest to 30 August 2013 as summarised in the following table:

Decision

13 Garth Living and Bunnings challenged only one aspect of the calculations carried out by Mr Langridge in his supplementary report. Subject to dealing with that one matter, I am content to adopt Mr Langridge's analysis and calculations as appropriately reflecting the Damages Reasons.

14 The challenge made by the respondents was not to Mr Langridge's work but rather to one of the findings which I made at [40] of the Damages Reasons which finding was then picked up and acted upon by Mr Langridge in his supplementary report. That finding concerned the number of units of the BH10 model of heater sold by Bunnings to the public in the relevant period. Garth Living and Bunnings submitted that the particular finding which I made in respect of that matter in the Damages Reasons was wrong. They also submitted that the error can now be corrected in these Reasons for Judgment. There is no doubt that, if my earlier finding was wrong, I can correct it now.

15 It was submitted that I made an error in the Damages Reasons when, at the end of [38], I said:

In the case of the BH10 model, Garth Living imported the same number of units as Bunnings onsold to the public (viz 537).

16 Garth Living and Bunnings went on to submit that the true position in respect of the BH10 model of heater demonstrated by the importation records and the sales records of each of Garth Living and Bunnings was as follows:

537 units of the BH10 model of heater were imported into Australia by Garth Living.

No BH10 models were imported directly by Bunnings.

Garth Living sold only 267 units of the BH10 model to Bunnings (as to which, see Exhibit S to Mr Langridge's report dated 25 November 2011, which Mr Langridge described as "… detailed sales invoice listings for each product model …" sold by Garth Living to Bunnings).

Bunnings sold 247 units of the BH10 model of heater to members of the public (as to which, see Exhibit Q to Mr Langridge's report of 25 November 2011, which Mr Langridge described as a "… summary of units sold (by Bunnings) by product model between 2005 and 2010"). I pause to note that, in their Closing Submissions at the damages hearing, the sole source for Bunnings' sales figures relied upon by the applicant to support the figures specified in the Table which I reproduced at [32] of the Damages Reasons was Exhibit Q to Mr Langridge's first report.

17 Garth Living and Bunnings submitted that Mr Langridge was correct when, at par 3.5 of his supplementary report, he said that Bunnings' sales records showed that Bunnings had sold only 247 units of the BH10 model of heater to members of the public. They went on to submit that the starting figure for the BH10 model should therefore have been 247 units, not 537 units.

18 The submissions made on behalf of Garth Living and Bunnings concerning the BH10 model of heater are correct and I accept them.

19 The table prepared by the applicant which I extracted at [32] of the Damages Reasons recorded that Bunnings had sold 537 units of the BH10 model of heater to members of the public when the true position was that it had sold only 247 units of that model to members of the public. In this respect, the applicant's table was inaccurate. In this respect, the findings which I made at [40] of the Damages Reasons were erroneous. I should have used 247 units for the BH10 model of heater, not 537 units.

20 On 27 August 2013, I sought further submissions from the applicant in relation to the point raised on behalf of the respondents. In its response, the applicant accepted that the correct starting figure for the number of units of the BH10 model of heater sold by Bunnings in the relevant period was 247 and also accepted the respondents' consequential adjustments to the damages calculations.

21 The respondents submitted that, when the correct number of units of the BH10 model of heater are factored into Mr Langridge's calculations, the amount of the loss suffered by the applicant by reason of the sale of that model of heater in Australia is reduced from $48,943 to $22,512 and the relevant amount of interest is reduced from $23,748 to $10,919. When these adjustments are made to Mr Langridge's calculations, the damages award to be made in favour of the applicant against the respondents is:

| Lost gross margin | $433,969 |

| Interest to 30-08-13 | $234,448 |

| Total damages (incl interest) | $668,417 |

22 Although orders will be made in each proceeding against each respondent requiring payment of the full amount of damages, interest and costs, consistent with earlier findings at the liability stage and with the Damages Reasons, liability for that amount is to be imposed upon Garth Living and Bunnings jointly and severally. That is to say, each of those organisations will be liable for the full amount of the damages, interest and costs but the applicant can recover no more than that amount in total.

23 In performing the above revised calculations, the respondents accepted and used Mr Langridge's methodology and calculations in respect of interest. There was no challenge by the respondents to that methodology or to the assumptions underpinning it.

Indemnity Costs

24 The precise order for costs sought by the applicant is:

The Court orders that, subject to the operation of existing orders as to costs, the respondents pay the applicant's costs of the proceedings after 23 July 2010, including without limitation reserved costs and the costs of the issues heard on 23–27 July 2012:

(a) Up to and including 13 July 2012, on the party-party basis; and

(b) After that date, on an indemnity basis.

25 The applicant contends in support of the indemnity costs component of the above order that the Court, in the exercise of its undoubted discretion as to costs, should award indemnity costs from 14 July 2012 because the respondents unreasonably and imprudently failed to respond to, or, alternatively, rejected, a reasonable compromise proposal propounded by the applicant by letter dated 29 June 2012 from its solicitors, DLA Piper, to the solicitors for the respondents, Eales & Mackenzie (the applicant's Calderbank letter). That letter was headed "Without prejudice save as to costs" and was sent in reliance upon the principles concerning costs expounded by the English Court of Appeal in Calderbank v Calderbank [1976] Fam 93; [1975] 3 All ER 333.

26 The letter from DLA Piper was in the following terms (omitting formal parts):

BITECH ENGINEERING V GARTH LIVING PTY LIMITED

FEDERAL COURT OF AUSTRALIA PROCEEDINGS NO. NSD 1681/2006

BITECH ENGINEERING V BUNNINGS GROUP LIMITED

FEDERAL COURT OF AUSTRALIA PROCEEDINGS NO. NSD 43/2007

(PROCEEDINGS)

1 We refer to the hearing of the Proceedings which is scheduled to commence on 23 July 2012 (Hearing).

2 Whilst our client is confident of damages being awarded on the basis of the evidence of Martin Langridge, our client is mindful of the considerable expense and time that will be involved in preparing the Proceedings for the Hearing and attending the Hearing itself.

3 For this reason, our client is willing to settle all outstanding issues in each of the Proceedings, being issues of damages, interest and costs incurred after the orders made on 23 July 2010 (Full Court Order) (which for the avoidance of doubt excludes those costs which are the subject of the current Federal Court taxation) on the following basis:

3.1 your clients (on a joint and several basis) pay our client the amount of $400,000 by way of damages, inclusive of interest, such amount to be payable within 21 days of acceptance of this offer;

3.2 subject to the operation of all existing costs orders in the Proceedings, your clients (on a joint and several basis) pay our client's party-party costs of the Proceedings, as agreed or taxed, since the date of the Full Court Order other than our client's costs of and incidental to the notices of motion filed by our client on 20 April 2011 in each of the Proceedings.

(Offer).

4 For the avoidance of doubt, the Proceedings referred to in the above Offer are the two proceedings against your clients, being NSD 1681 of 2006 and NSD 43 of 2007.

5 We note that the amount referred to in 3.1 above represents only about half the amount to which our clients would be entitled on Mr Langridge's evidence in respect of the heaters which have already been found to infringe our client's patent (being the BH1, BH2, BH4, BH5, BH6, BH7, BH9, BH10 and BH12 heaters), adopting Mr Langridge's Assumption A and allowing for interest to the date of this letter.

6 We also note that the proposed joint and several basis for your clients' liability reflects the findings already made by the Court to the effect that both of your clients have participated in the sale of all of those models of heaters: see Bitech Engineering v Garth Living Pty Ltd (2009) 84 IPR 78 at [6], [104]–[113].

7 This Offer is made pursuant to the principles of Calderbank v Calderbank [1975] All ER 33 and remains open for acceptance until 5 pm on 13 July 2012.

8 Our client will rely on this letter on the issue of costs, including by way of an application for indemnity costs in respect of the Hearing, if the Offer is not accepted.

9 We await your response.

27 The offer contained in the applicant's Calderbank letter was open for acceptance at any time up to 5.00 pm on 13 July 2012. That offer was not accepted by that time.

28 Instead, at 5.05 pm on 13 July 2012, five minutes after the passing of the acceptance deadline, Eales & Mackenzie despatched its own Calderbank letter by way of email to DLA Piper (the respondent's Calderbank letter). That letter was also headed "Without prejudice save as to costs".

29 That letter was in the following terms (omitting formal parts):

I refer to the hearing of these proceedings which are scheduled to commence on 23 July 2012.

My clients are confident that as your client will not be able to establish that the sale of a flame effect heater by my clients led to the loss of a sale of a flame effect heater by yours, that only nominal damages at best will be awarded. Despite that, my clients are mindful of the considerable expense and time that will be involved in preparing for the trial of the proceedings and attending the hearing itself. ·

For this reason, my clients are willing to settle all outstanding issues in each of the above mentioned proceedings, being issues of damages, interest and costs incurred after the orders made on 23 July 2010 (which for the avoidance of doubt excludes those costs which are the subject of the current Federal Court Taxation) on the following basis:-

1. My clients will (on a joint and several basis) pay your client the total amount of $150,000 by way of damages, inclusive of costs and interest;

2. Such amount to be paid within 30 days of acceptance of this offer.

For the avoidance of doubt, the proceedings referred to in the above offer are the two proceedings against my clients, being NSD 1681 of 2006 and NSD 43 of 2007.

This offer is made pursuant to the principles of Calderbank v Calderbank (1975) All ER 33 and remains open for acceptance unti1 5pm on 20 July 2012.

My clients will rely on this letter on the issue of costs, including by way of an application for indemnity costs in respect of the hearing, if the offer is not accepted.

Please acknowledge receipt of this email letter.

30 In Specsavers Pty Limited v Luxottica Retail Australia Pty Limited (No 2) [2013] FCA 807, Griffiths J helpfully summarised the relevant principles which inform the exercise of the Court's discretion when determining a claim for costs to be awarded on an indemnity basis in circumstances where that claim is based upon the unreasonable or imprudent rejection of a Calderbank offer. At [10], his Honour said:

The relevant principles may be summarised as follows:

• under s 43 of the Federal Court of Australia Act 1976 (Cth) (FCA Act), the Court has a power to award costs, which includes a power to award costs on an indemnity basis. The discretion to award costs must be exercised judicially;

• while various cases have identified various relevant factors, the presence or absence of which may be persuasive as to whether indemnity costs are appropriate, the exercise of the discretion in a particular case must depend on all relevant circumstances of that case (see MGICA (1992) Pty Ltd v Kenny & Good Pty Ltd (No 2) (1996) 70 FCR 236 at 238 per Lindgren J);

• the unreasonable or imprudent rejection of a Calderbank offer may result in indemnity costs being awarded. The mere rejection of a Calderbank offer followed by a result which is more favourable to the offeror and less favourable to the offeree than that represented by the offer does not automatically lead to the making of an order for payment of costs on an indemnity basis (MGICA at 239; Black v Lipovac (1998) 217 ALR 386 at 432);

• Part 25 of the Federal Court Rules 2011 establishes a regime which, if utilised, gives rise to a presumptive entitlement to indemnity costs (see MGICA at 240 and Specsavers Pty Ltd v The Optical Superstore Pty Ltd (2012) 208 FCR 78). But that regime was not employed here. It might also be noted that, under that regime, an offer to compromise has to be open to be accepted for a period of not less than 14 days after the offer is made (r 25.05);

• the offeror needs to show that the conduct of the offeree was unreasonable and that conduct is to be viewed in light of the circumstances which existed at the time the offer was rejected. The fact that the offeree ultimately fails to make good their case does not mean that they acted unreasonably in rejecting an offer (Alpine Hardwoods (Aust) Pty Ltd v Hardys Pty Ltd (No 2) (2002) 190 ALR 121 at [28] per Weinberg J); and

• a helpful but non-exhaustive list of circumstances which may be relevant in determining whether the rejection of a Calderbank offer is reasonable or not is set out in Hazeldene's Chicken Farm Pty Ltd v Victorian Workcover Authority (No 2) (2005) 13 VR 435 at [25] and includes:

(a) the stage of the proceeding at which the offer was received;

(b) the time allowed to the offeree to consider the offer;

(c) the extent of the compromise offered;

(d) the offeree's prospects of success, assessed as at the date of the offer;

(e) the clarity with which the terms of the offer were expressed; and

(f) whether the offer foreshadowed an application for an indemnity costs in the event of the offeree's rejection of it.

31 In support of its application for indemnity costs in respect of costs incurred from 14 July 2012, the applicant filed and served a Written Submission dated 23 August 2013. In that Written Submission, the applicant addressed a number of relevant considerations. On 26 August 2013, the respondents lodged and served an answering Submission.

32 I do not propose to recite the parties' respective submissions in relation to the outstanding question of costs. Those Submissions have been filed and will remain with the file.

33 I propose to accede to the applicant's application for indemnity costs. I do so for the following reasons.

34 First, the applicant's Calderbank letter was sent more than three weeks before the hearing fixed to commence on 23 July 2012. That hearing was intended to deal with all outstanding questions of infringement as well as the applicant's damages claims. By 29 June 2012, the parties had filed and served all of their evidence to be relied upon at that hearing. In particular, the applicant had filed and served all of its evidence, including two expert's reports by Mr Langridge. On 9 July 2012, the applicant filed a Written Opening which explained in detail the basis upon which it intended to claim damages. In addition, a good deal of the information relied upon by the applicant in its case had come from the books and records of the respondents. The respondents must be taken to have been well aware of the contents of their own books and records. Further, the respondents had had ample time to consult their own expert accountant on the question of damages prior to the dispatch of the applicant's Calderbank letter. In those circumstances, the period allowed by the applicant for acceptance of the offer contained in its Calderbank letter (14 days) was more than sufficient to allow the respondents to consider their position, to take advice and to respond. The respondents did, in fact, respond with a counter-proposal just five minutes after the passing of the applicant's deadline. As at 29 June 2012, the respondents were in a very good position to assess the applicant's offer and to compare the terms of that offer with their assessment of the likely result of the proceedings in the event that the proceedings were litigated to finality.

35 Second, the offer made by the applicant in its Calderbank letter represented a significant compromise of the claims then being made by it and represented, in the end, a substantial compromise when compared with the award of damages which I propose to make. The amount of the lost profits which I propose to award to the applicant by way of damages (excluding interest) exceeds the amount for which the applicant offered to settle in its Calderbank letter by $33,969. When interest is taken into account, the result achieved by the applicant is substantially more favourable to it than the offer which it made by means of its Calderbank letter. I note that the offer framed by the applicant in its Calderbank letter comprised a proposal to accept $400,000 on account of damages and interest and an offer to accept costs on the party/party basis allowing for all appropriate exceptions.

36 Third, by the time that the applicant despatched its Calderbank letter, the parties were well aware of the terms of the Full Court's decision on liability which, as previously noted, was in favour of the applicant. In addition, as at 29 June 2012, any reasonably objective assessment of the applicant's case at that time would have led to the conclusion that the applicant had very strong prospects of succeeding in having the additional models included within its claim for damages as infringing items. The respondents had conceded liability in respect of two of them and had a very weak case in respect of the third.

37 Fourth, the applicant's offer was clear and unambiguous and related sensibly and appropriately to its outstanding claims for relief. It specifically addressed damages, interest and costs.

38 Fifth, I think that the thought processes of the respondents as at 13 July 2012 are revealed by the terms of the respondents' Calderbank letter. The respondents obviously believed, for whatever reason, that the applicant was not going to recover substantial damages. This belief was not well-founded. In my judgment, an offer of $150,000 inclusive of damages, costs and interest on 13 July 2012, in answer to the applicant's claims, was a wholly inadequate and unreasonable response to the offer of compromise contained in the applicant's Calderbank letter. The respondents' counter-proposal did not engage in any sensible or meaningful way with the applicant's offer.

39 In their submissions directed to the question of indemnity costs, the respondents accepted that Griffiths J had helpfully, accurately and conveniently summarised the relevant principles in Specsavers Pty Limited v Luxottica Retail Australia Pty Limited (No 2). They also submitted that there was no presumption in the applicant's favour in respect of indemnity costs because the applicant had chosen to proceed by way of Calderbank letter rather than in accordance with Pt 25 of the Federal Court Rules 2011. This is true but of no significance in the present case. The respondents also submitted that the applicant's Calderbank letter was deficient because the offer set out therein did not offer to compromise orders for costs made in the applicant's favour in respect of the Court's determination of liability at earlier hearings. This submission is fallacious and I reject it. The applicant was not obliged to revisit previous costs orders and to compromise the financial consequences of those orders. Those orders were a "given" as at 29 June 2012. The respondents addressed other submissions in support of the general proposition that the quantum of damages was reasonably in issue between the applicant and the respondents as at late June and early July 2012. I do not think that these submissions have been made good. The quantum of damages was definitely in issue at that time but not to the extent believed by the respondents and not based upon a reasonable assessment of the parties' prospects. Finally, the respondents submitted that, even if the applicant is to be awarded indemnity costs from 14 July 2012, its costs of retaining Mr Langridge to prepare his supplementary report and its costs of and incidental to the preparation and filing of that report should be taxed on the party/party basis. I accept this last submission.

40 For the reasons explained at [25]–[39] above, I think that the respondents' failure to accept the offer made by the applicant in its Calderbank letter was both unreasonable and imprudent. I therefore propose to make an order for costs substantially in accordance with the order sought by the applicant, the terms of which I have extracted at [24] above.

41 I will carve out the costs associated with Mr Langridge's supplementary report from the indemnity costs order which I propose to make. Those costs will be taxed on the party/party basis.

42 The damages award will be as set out at [21] above.

| I certify that the preceding forty-two (42) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justice Foster. |

Associate: