Federal Court of Australia

Argo Managing Agency Ltd for and on behalf of the underwriting members of Lloyd’s Syndicate 1200 v Quintis Ltd (subject to deed of company arrangement) [2022] FCAFC 86

Counsel for the Respondents in NSD390 of 2021 and NSD391 of 2021: | Mr W A D Edwards with Mr A H Edwards |

Solicitor for the Respondents in NSD390 of 2021 and NSD391 of 2021: | Piper Alderman |

ORDERS

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. Within fourteen (14) days the parties file an agreed form of orders, or in default of agreement, any submissions as to the form of the appropriate orders reflecting the reasons of the Court.

2. Subject to any further directions, the final orders of the Court will be made on the papers.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ORDERS

NSD 391 of 2021 | ||

BETWEEN: | VIBE SYNDICATE MANAGEMENT LIMITED AS MANAGING AGENT FOR AND ON BEHALF OF THE UNDERWRITING MEMBERS OF LLOYD’S LONDON SYNDICATE 5678 (AS SUBSCRIBING UNDERWRITERS TO POLICY NUMBER B0507N16FA15370) Appellant | |

AND: | QUINTIS LTD (SUBJECT TO DEED OF COMPANY ARRANGEMENT) (ACN 092 200 854) First Respondent EXCEL TEXEL PTY LTD (ACN 082 642 742) (AS TRUSTEE FOR THE MANDEX FAMILY TRUST) Second Respondent GEOFFREY PETER DAVIS (and others named in the Schedule) Third Respondent | |

order made by: | ALLSOP CJ, MIDDLETON AND YATES JJ |

DATE OF ORDER: | 19 May 2022 |

THE COURT ORDERS THAT:

1. Within fourteen (14) days the parties file an agreed form of orders, or in default of agreement, any submissions as to the form of the appropriate orders reflecting the reasons of the Court.

2. Subject to any further directions, the final orders of the Court will be made on the papers.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

THE COURT:

INTRODUCTION

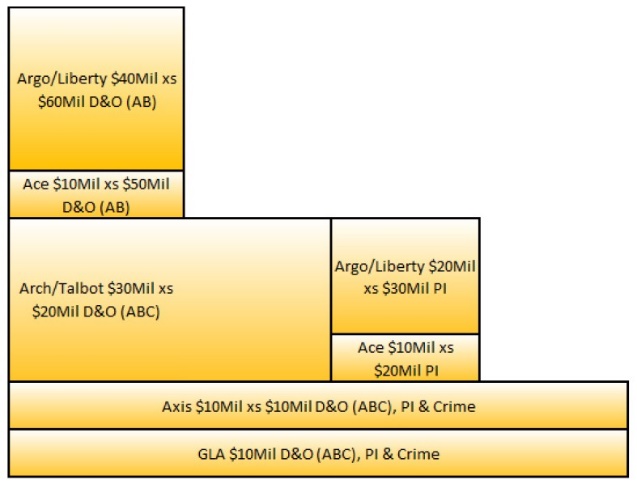

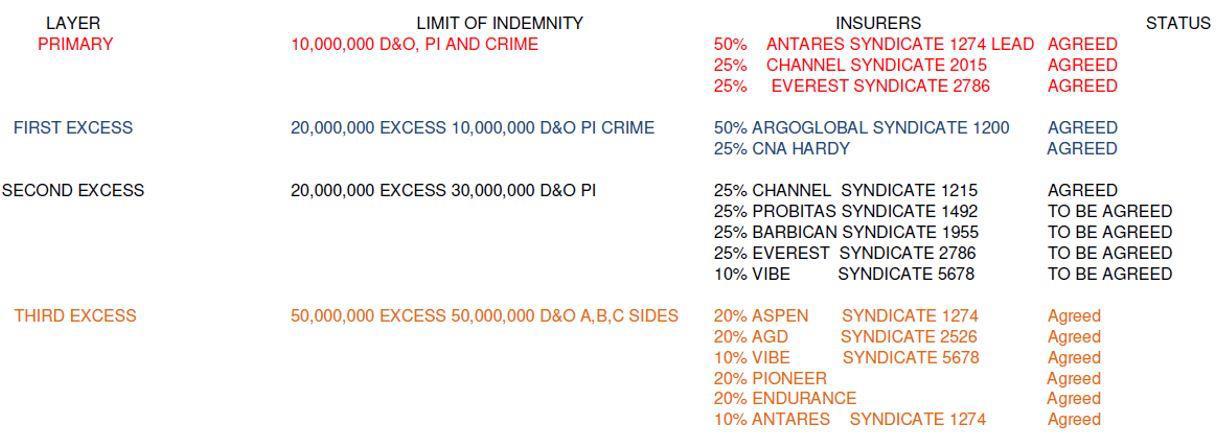

1 These two appeals concern the extent of coverage available under insurance policies in favour of the first respondent, Quintis Limited (‘Quintis’), a sandalwood plantation investment company subject to a deed of company arrangement. The claims arise in relation to two shareholder class actions where it has been alleged that Quintis and others engaged in conduct in contravention of various statutory norms causing loss and damage for which the class action applicants and group members seek compensation. A settlement in principle in respect of those proceedings has been reached but the application for settlement approval has been adjourned so as to determine the correct value of any responsive insurance policies, being the only asset of value held by Quintis.

2 In the period 30 September 2016 to 31 March 2018, Quintis carried insurance policies with various Lloyd’s of London (‘Lloyd’s’) underwriting syndicates providing up to $100 million in coverage for directors and officers (‘D&O’) liability. The policies that are relevant to these appeals are those that Quintis entered into in 2016, when it sought to renew its expiring insurance coverage on the Lloyd’s market. Quintis relevantly entered into the following policies (collectively, ‘2016-17 Policies’):

(a) a policy schedule identified as policy number B0507N16FA15350 and Munich Re Financial & Professional Risks Policy 09/14 policy wording (‘2016-17 Primary’);

(b) a first excess layer policy identified as policy number B0507N16FA15360 (‘2016-17 1XS’); and

(c) a second excess layer policy identified as policy number B0507N16FA15370 (‘2016-17 2XS’).

3 There was also a third excess layer policy identified as policy number B0507N16FA15380 (‘2016-17 3XS’) which is not the subject of any dispute.

4 It is common ground that, when entering into the 2016-17 Policies in 2016, Quintis intended the coverage layers to include $50 million in entity securities liability (‘Side C’) cover and instructed its Australian producing broker (‘PSC’) to this effect. Before the primary judge, Quintis claimed the 2016-17 Policies included $50 million in Side C cover. Yet after construing the 2016-17 Policies, the primary judge found that Side C cover was in fact only available under the policies up to a ‘sub-limit’ of $10 million: Quintis Ltd (Subject to Deed of Company Arrangement) v Certain Underwriters at Lloyd’s London Subscribing to Policy Number B057N16FA15350 [2021] FCA 19 (28 January 2021) (‘J’ or ‘January judgment’) at [53], [55]-[60].

5 However, the primary judge found that this construction of the 2016-17 Policies did not reflect the intentions held by certain parties: [303], [348], [383], [392] J. The primary judge thus determined to rectify the 2016-17 1XS and 2016-17 2XS (‘Excess Policies’) to reflect what he considered to be the common commercial intention of:

(a) Quintis;

(b) Quintis’ Lloyd’s placing broker (‘Price Forbes’);

(c) one insurer subscribing to the first excess layer 2016-17 1XS, Argo Managing Agency Ltd (‘Argo’);

(d) and another insurer subscribing to the second excess layer 2016-17 2XS, Vibe Syndicate Management Limited (‘Vibe’),

that the 2016-17 Policies would collectively provide for Side C cover of up to $50 million: see [392] J; Quintis Ltd (Subject to Deed of Company Arrangement) v Certain Underwriters at Lloyd’s London Subscribing to Policy Number B0507N16FA15350 (No 2) [2021] FCA 327 (6 April 2021) (‘J2’ or ‘April judgment’).

6 It is these findings as to the intention held by Price Forbes, Argo and Vibe, as well as the related decision to rectify the Excess Policies, which are the subject of the present appeals.

7 The appeals are brought by Argo and Vibe on behalf of participating syndicates in the 2016-17 1XS and 2016-17 2XS, respectively. The syndicate represented by Argo was a 50% participant in (and lead insurer for) the 2016-17 1XS, and the syndicate represented by Vibe was a 6.25% participant in the 2016-17 2XS. Argo and Vibe represent two of the four syndicates that were the respondents to proceedings in the court below (the other two syndicates being subscribed to the 2016-17 Primary and the 2016-17 3XS which were not subject to rectification orders).

8 There are, broadly, three common issues in the appeal brought by Argo (‘Argo Appeal’) and the appeal brought by Vibe (‘Vibe Appeal’):

(1) whether the primary judge erred in finding that Price Forbes held the Side C Coverage Intention — being the intention that Side C cover under the 2016-17 Policies was not subject to a sub-limit of $10 million but was in fact equal to the limit of liability for “Section 1B cover” under each of the 2016-17 Policies such that they collectively provided Side C cover of up to $50 million — at all relevant times up to the point that Argo and Vibe subscribed to the 2016-17 1XS and 2016-17 2XS;

(2) whether the primary judge erred in finding that Argo and Vibe held the Side C Coverage Intention;

(3) whether the primary judge erred in granting relief that is said not to reflect the subjective intentions of the parties and create a contractual structure whereby different parties to the 2016-17 1XS and 2016-17 2XS are bound by unreconciled yet interacting obligations as between the rectified and unrectified contracts, and which departs from the relief sought by Quintis in its amended originating application.

9 There was no issue before us as to the principles applicable to the grant of the equitable remedy of rectification adopted by the primary judge.

10 A convenient summary was set out in Simic v New South Wales Land and Housing Corporation (2016) 260 CLR 85 by Gageler, Nettle and Gordon JJ at [103]–[104]:

[103] Rectification is an equitable remedy, the purpose of which is to make a written instrument “conform to the true agreement of the parties where the writing by common mistake fails to express that agreement accurately”. For relief by rectification, it must be demonstrated that, at the time of the execution of the written instrument sought to be rectified, there was an “agreement” between the parties in the sense that the parties had a “common intention”, and that the written instrument was to conform to that agreement. Critically, it must also be demonstrated that the written instrument does not reflect the “agreement” because of a common mistake. Unless those elements are established, the “hypothesis arising from execution of the written instrument, namely, that it is the true agreement of the parties” cannot be displaced.

[104] The issue may be approached by asking – what was the actual or true common intention of the parties? There is no requirement for communication of that common intention by express statement, but it must at least be the parties’ actual intentions, viewed objectively from their words or actions, and must be correspondingly held by each party.

(Citations omitted)

11 As to the form of relief (which is the third common issue in the appeals), the observations in Franklins Pty Ltd v Metcash Trading Ltd (2009) 76 NSWLR 603 of Campbell JA (agreed with by Allsop P and Giles JA) are apposite and worth repeating here:

[431] A striking feature of the order for rectification made in the court below is that it amends the written terms of the Supply Agreement in a way for which neither party contended at the hearing below, and which neither party supports on the appeal. For a remedy that is supposed to give effect to the common intention of the parties to be said by both parties to be erroneous is not a sufficient reason to overturn the order, but is sufficient to make one consider carefully the reasoning that led to the order.

…

[444] In considering whether to grant rectification of a written contract, equity does not use any of its own principles to decide what the terms of the contract are, or how they are construed — those matters are decided solely by the common law. Rather, equity focuses on what it is unconscientious for a party to assert about the contract. The rationale is that it is unconscientious for a party to a contract to seek to apply the contract inconsistently with what he or she knows to be the common intention of the parties at the time that the written contract was entered. In other words, when a plaintiff succeeds in a claim for rectification, the plaintiff is found to have been justified in effect saying to the defendant “you and I both knew, when we entered this contract, what our intention was concerning it, and you cannot in conscience now try to enforce the contract in accordance with its terms in a way that is inconsistent with our common intention.”

…

[446] The remedy that is granted is, as with all equity’s remedies, one that will seek to undo, so far as is in practice possible, the departure, that the litigation has shown to exist, from equity’s standards of conscientious behaviour. The way this is achieved, when a remedy of rectification is granted, is by rewriting the contract so that it […] no longer departs from the common intention of the parties. The rewriting is done in a quite literal sense — the proper form of order identifies the precise words of the contract that are to be struck out, the precise words that are to be inserted, and where those words are to be inserted: H W Seton, Forms of Judgments and Orders in the High Court of Justice and Court of Appeal 7th ed, vol 2 (1912) London, Stevens and Sons Ltd at 1638–1643 (“Judgments and Orders”). As well the order usually (but not always — for example, Wilson v Registrar-General (NSW) [2004] NSWSC 1220; (2004) 12 BPR 22,667 at [13]–[14]) involves calling in the original document and actually endorsing the order on the instrument that is to be rectified: Seton, Judgments and Orders (at 1644–1645); Re Jay-O-Bees Pty Ltd (In Liq) [2004] NSWSC 818; (2004) 50 ACSR 565 at [74]; Stock v Vining (1858) 25 Beav 235 at 235; 53 ER 626 at 627; Malmesbury v Malmesbury (sub nom Phillipson v Turner) (1862) 31 Beav 407 at 419; 54 ER 1196 at 1201; Johnson v Bragge [1901] 1 Ch 28 at 37. In that way the executed contractual document is no longer able to be a potential source of error and confusion, by appearing to state legal relations that in truth are not as the document says.

[447] That this is the type of remedy that is granted has an effect on the sort of “common intention” that is relevant for rectification. The common intention of the parties has to relate to what the mutual rights and obligations of the parties will be, and has to be sufficiently well-defined and clear to be able to be stated in words that can be incorporated in a contract.

[448] The rewriting should not do anything more than rewrite the contract to the minimum extent that is necessary for it to no longer fail to express the common subjective intention the parties had when the contract was entered. Thus, to the extent that the words of the contract cover some situation concerning which the parties had no common subjective intention, the words of the contract continue to govern that situation.

…

[450] Crafting a remedy in rectification involves close attention to the words of the document. However, in the prior step of making a finding about a common intention, for the purpose of a rectification order, it is important that the court not confine itself to a narrow focus on particular words of the document. It is the document as a whole that is rectified, and the point of the exercise is that, once rectified, the document will not be contrary to the common intention of the parties to the document. Thus if a particular change to some words will result in some other words of the document operating in a different way, rectification will be justified only if that different operation of those other words is shown to be in accordance with the common intention of the parties.

12 In addition, in Liberty Mutual Insurance Company Australian Branch trading as Liberty Specialty Markets v Icon Co (NSW) Pty Ltd [2021] FCAFC 126; (2021) 396 ALR 193 (‘Liberty Mutual’) at [284] the Full Court stated that:

… As the primary judge made clear, this was not a rectification case in which the parties were mistaken as to the words used. If it were, there would need to be a clear common intention as to what words were intended. But it is not. It is a rectification case in which the parties were said to have a common intention as to the effect of the policy: that it could be utilised to provide contracts commencing cover up to and including the defects liability period. For Mr O’Reilly and Mr Burgess, this common intention was founded in a mistaken (on the hypothesis necessary for examining the rectification case) belief that condition 15 if invoked brought about that result. In these circumstances there was no requirement for there to be a common intention as to the words necessary to give effect to the common intention as to the effect of the policy. The Court must, however, determine with textual clarity the variation to the wording to give effect to the common intention: GPI Leisure Corp Limited v Herdsman Investments Pty Ltd (No 4) (1990) 9 BPR 17,461 at 17,465-6 (Young J); Muriti v Prendergast [2005] NSWSC 281 at [137] (White J); Crane v Hegeman-Harris Co Inc [1939] 1 All ER 662 at 669 (Simonds J); and Bush v National Australia Bank (1992) 35 NSWLR 390 at 407 (Hodgson J).

13 We should indicate that it is not necessary to show exactly and precisely the form to which the contract to be rectified should be brought: see eg Thomas Bates & Son Ltd v Wyndham’s (Lingerie) Ltd [1981] 1 WLR 505.

14 The aim of any relief that is granted is to formulate the precise terms by which the contract is to be made so as to conform to the relevant common intention, provided the principles of granting the equitable remedy of rectification are otherwise satisfied.

15 There was also no dispute in these appeals as to the exactitude of proof needed as to the existence of the relevant common intention. In Liberty Mutual, the Full Court (Allsop CJ, Besanko and Middleton JJ) at [269] and [270] recognised that “clear and convincing proof” must be present.

16 It is then worth saying something briefly about the way in which the matter proceeded before the primary judge. The matter was heard over the course of two days (on 11 August 2020 and 18 September 2020) and all of the evidence was documentary. None of the parties called any witnesses, and the only affidavit filed in the proceeding related to the verification of a list of documents. The primary judge in his detailed and careful judgment set out the relevant documentation and the inferences he drew from the primary evidence before him. We are mindful of the somewhat advantaged position of a primary judge presiding over the presentation of a mosaic of evidence (see Federal Commissioner of Taxation v Glencore Investment Pty Ltd (2020) 281 FCR 219 at [150]), to which the appeal court should give appropriate respect. In these appeals we are not in a dissimilar position to the primary judge, and perhaps in a somewhat better position having regard to the analysis so well undertaken and explained by the primary judge. Nevertheless, it is necessary that the appellate court recognise that its role is the correction of error. Such may appear from a difference of view, notwithstanding the respect given to any advantage in the primary judge in presiding over the presentation of evidence in the mosaic, or from some identified error of approach. In either the aim of the appeal is the correction of error: see the discussion in Aldi Foods Pty Ltd v Moroccanoil Israel Ltd (2018) 261 FCR 301 (at [2]-[10] per Allsop CJ, at [47]-[53] per Perram J and at [169] per Markovic J; see, especially for factual questions, as here, involving no impressionistic evaluation, [47]-[49] agreed in at [2] and [169]. In this case we have come to the view that important assumptions made by the primary judge lacked sufficient evidentiary foundation, and other probabilities so outweighed inferences made by the primary judge that it can be concluded his Honour’s conclusion was wrong.

17 We make another preliminary observation. There is no appeal from the construction conclusion reached by the primary judge that the Side C coverage was subject to a sub-limit of $10 million. Nevertheless, it must be accepted that there may be differing views as to the proper construction of the relevant policies. Perhaps more significantly, personnel in a busy insurance market who are considering various aspects of coverage, not necessarily by the same mode of communication across the commercial world, and without the aid of ongoing legal advice, may have different understandings of the coverage being provided or sought. A general misunderstanding of the coverage being sought on the part of some participants leading up to and at the time the relevant insurance policies were entered into does not lead to a conclusion that there was a consensus amongst them as to the coverage. In fact, it would tend to the opposite conclusion. More specifically, the fact that two participants (Quintis and PSC) intended that the coverage layers included a total of $50 million Side C cover does not necessarily lead to the conclusion that other participants (Price Forbes, Argo and Vibe) held a similar or common intention. In other words, a mutual mistake or misunderstanding as to what each party intends is not sufficient to establish a common intention which could lead to the grant of the equitable remedy of rectification. In our view, this was the position that existed based upon the evidence before the primary judge, where there was no common intention sufficient to displace the written agreements and their integrity as the written instruments governing the contractual relationship between the parties. On this basis, both appeals should be allowed.

THE PRIMARY JUDGE’S CONSTRUCTION OF THE 2016-17 POLICIES

18 It is helpful to begin by setting out the primary judge’s construction of the 2016-17 Policies as they stood prior to rectification, as well as some background to the insurance programme. As we have already noted, the primary judge’s construction of the 2016-17 Policies is not in dispute. The following detail is informed by the background at [10]-[16], [40]-[43] J and the analysis at [44]-[60] J.

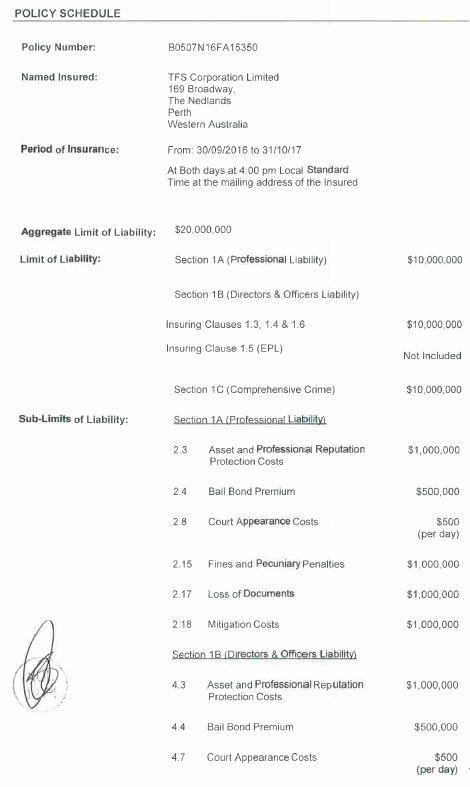

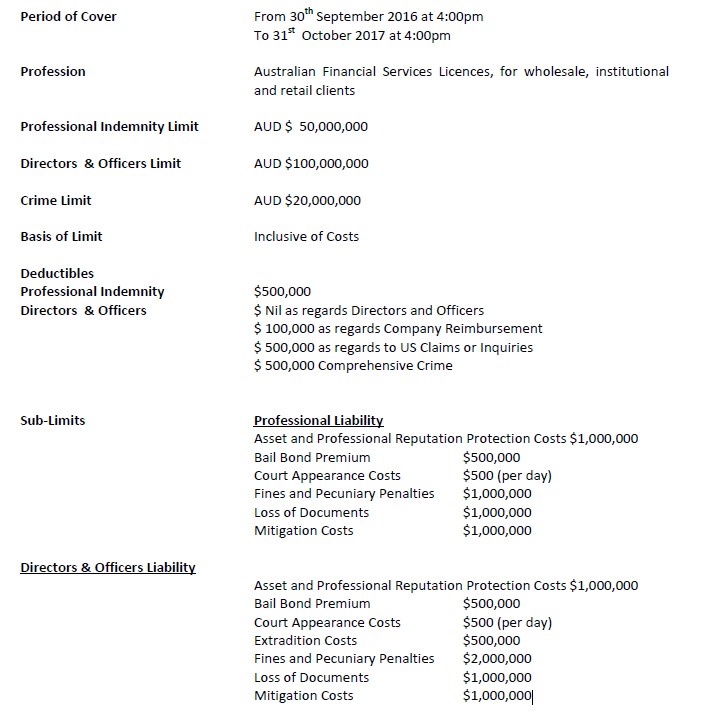

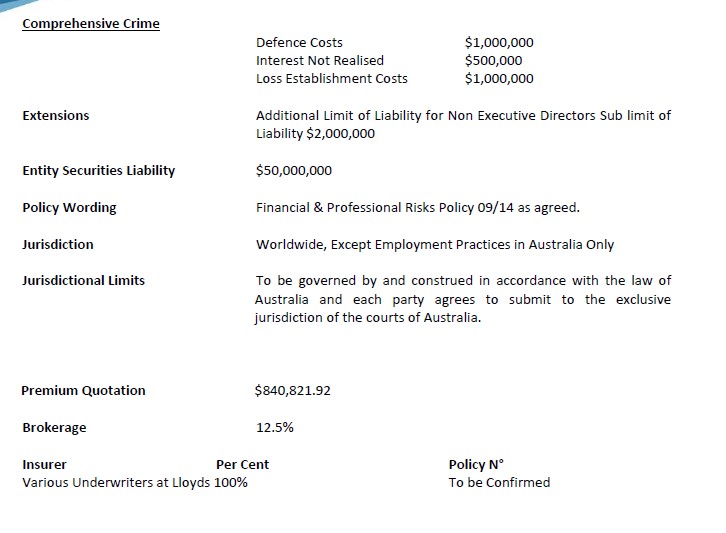

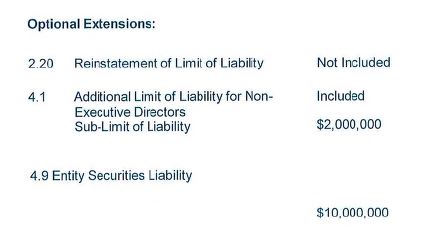

19 The 2016-17 Primary included the following schedule:

20 The 2016-17 Primary also included the following relevant provisions:

SECTION 4: EXTENSIONS TO SECTION 1B (DIRECTORS & OFFICERS LIABILITY)

Subject to all the terms, conditions and exclusions, including all definitions of the Policy, the Insurer further agrees to extend cover provided under Section 1B of the Policy as follows:

4.1 Additional Limit of Liability for Insured Persons

Notwithstanding subclauses 8.14(a) and (b) of this Policy, the Insurer will pay for any Insured Person under Insuring Clause 1.3, the Sub-Limit of Liability stated in the Schedule, in addition to the Limit of Liability applicable to Section 1B (Directors & Officers Liability), provided that each of:

(a) the Limit of Liability applicable to Section 1B (Directors & Officers Liability);

(b) any other directors and officers liability policy which covers the Insured Person; and

(c) all other indemnification available to the Insured Person

has been exhausted.

This extension is not automatic and will only apply if it is specifically included in the Schedule.

This extension does not provide any cover to the Insured Organisation.

[…]

4.9 Entity Securities Liability

The Insurer will pay on behalf of the Insured Organisation the liability and associated Defence Costs which the Insured Organisation is legally liable to pay as a result of a Securities Claim alleging a Wrongful Act first made the Insured Organisation, and notified to the Insurer, during the Period of Insurance.

This extension is not automatic and will only apply if it is specifically included in the Schedule.

The maximum amount payable by the Insurer under this extension is the applicable Sub-Limit of Liability specified in the Schedule. This sub-limit is part of and not in addition to the Limit of Liability.

[…]

SECTION 8: CONDITIONS APPLICABLE TO ALL COVER SECTIONS

[…]

8.14 Limit of Liability

(a) The maximum amount payable by the Insurer under each of Sections 1A, 1B and 1C of the Policy (and their associated extensions) is the applicable Limit of Liability.

(b) The Limit of Liability is inclusive of any Defence Costs, Sub-Limits of Liability and any other amounts insured under each part of the Policy but does not include costs incurred by the Insurer in determining whether the relevant part of the Policy provides insurance to the Insured.

(c) Aggregate Limit of Liability

The total aggregate limit of the Insurers’ liability under all of Sections 1A, 1B and 1C of the Policy (and their associated extensions) is the Aggregate Limit of Liability. The Aggregate Limit of Liability is inclusive of any Defence Costs, Sub-Limits of Liability and any other amounts insured under the Policy.

(d) If any amounts insured under the Policy are covered under one or more parts of the Policy, then the maximum amount payable by the Insurer will be the highest of the applicable Limits of Liability or Sub-Limits of Liability and the Excess will be the applicable Excess for the Insuring Clause or Extension to which that Limit of Liability or Sub-Limit of Liability applies.

(Emphasis in original to signify defined terms).

21 It is cl 4.9 of the 2016-17 Primary (‘Entity Securities Liability’) that provides for the Side C cover.

22 The wording at the conclusion of cl 4.9 (“the maximum amount payable by the Insurer under this extension is the applicable Sub-Limit of Liability specified in the Schedule” and “[t]his sub-limit is part of and not in addition to the Limit of Liability” (‘sub-limit wording’)) is used on 15 separate occasions in the 2016-17 Primary: cll 2.3, 2.4, 2.8, 2.16, 2.17, 4.3, 4.4, 4.7, 4.9, 4.12, 4.14, 4.15, 6.3, 6.5 and 6.6.

23 In the “Definitions” section of the 2016-17 Primary:

(a) “Limit of Liability” is defined as “the limit of liability stated in the Schedule and referred to in clause 8.14 of the Policy” (emphasis in original); and

(b) “Sub-Limit of Liability” is defined as “any sub-limit of liability stated in the Schedule and referred to in clause 8.14 of the Policy” (emphasis in original).

24 The Excess Policies, the 2016-17 1XS and the 2016-17 2XS, then include the following provisions which are relevantly identical:

EXCESS LIABILITY INSURANCE

In consideration of the payment of premium and subject to the terms of this Policy, Insurers agree with the Insured that:

Section 1 - Insuring Section

1. Insurers shall provide the Insured with insurance coverage for claims first made against the Insured during the Policy Period in excess of the Primary Insurance and in excess of any Underlying Insurance. Insurance coverage hereunder will apply in conformance with the terms, conditions, endorsements, limitations and warranties of the Primary Insurance and any Underlying Insurance except as otherwise stated in this Policy.

[…]

Section 4 - Depletion of Primary Insurance and Underlying Insurance

[…]

4.4 In the event that the Primary Insurance or any Underlying Insurance specifically provides for a sub-limit of liability it is agreed that:

(a) where such sub-limit of liability is totally exhausted solely as a result of payment of losses under the Primary Insurance or any Underlying Insurance, then this Policy shall not provide any coverage in respect of such sub-limit of liability; or

(b) where such sub-limit of liability is partially exhausted solely as a result of payment of losses under the Primary Insurance or any Underlying Insurance, then this Policy shall continue for subsequent losses that would be subject to such sub-limit of liability provided that the amount payable hereunder shall not exceed the balance of the amount remaining under such sub-limit of liability and shall otherwise be part of and not in addition to the Limit of Liability.

(Emphasis in original to signify defined terms).

25 At cl 2.5 of the Excess Policies, “Primary Insurance” is defined as the “policy identified as such in Item 4 of the Schedule”. There is no schedule attached to these policies but there is a document entitled “Risk Details” at the front of each of the policies. The “Risk Details” document is not itemised and so there is no “Item 4”. However, next to the sub-heading “Conditions” it is stated “Full Follow Form As attached Primary Policy Number B0507N16FA15350”. And next to the sub-heading “Interest” it is stated “As more fully defined in the PRIMARY wording and clauses attached hereon being Munich Re Financial and Professional Risks Policy 09/14 as expiry [sic] and as agreed”. The reference to “Primary Insurance” in the excess policies is therefore to be understood as a reference to the 2016-17 Primary: see [52] J.

26 Similarly, at cl 2.3, “Limit of Liability” is defined as the “amount stated in Item 3 of the Schedule”, which is to be understood as the “Limit of Liability” stated on the first page of the “Risk Details” document: see [53] J.

27 It is worth noting that “Underlying Insurance” is also defined at cl 2.6 of the Excess Policies as “the policy or policies identified as such in Item 5 of the Schedule”. There does not appear to be any reference to any underlying insurance policy in the “Risk Details” document, as one might expect to find a reference to the 2016-17 1XS within the 2016-17 2XS. However, in the April judgment the primary judge accepted that the reference to “Underlying Insurance” in the 2016-17 1XS is a reference to the 2016-17 Primary, and in the 2016-17 2XS it is a reference to the 2016-17 1XS: see [77] J2.

28 The primary judge made the following findings in respect of the 2016-17 Primary:

(1) the extensions set out in cl 4 of the 2016-17 Primary, including cl 4.9, are provided “under Section 1B of the Policy” as recognised in the chapeau to cl 4: at [50] J;

(2) cl 4.9 falls within Section 1B: at [50] J;

(3) the sub-limit wording in cl 4.9 means that the figure alongside “Entity Securities Liability” in the schedule to the 2016-17 Primary is a nomination of a sub-limit to be a part of, and not in addition to, the limit of liability that is also specified in the schedule: at [50] J;

(4) this construction is supported by the fact that the schedule provides the “Limit of Liability” for Section 1B claims is $10 million “in the aggregate” (ie it does not contemplate aggregate Section 1B claims under the policy exceeding $10 million): at [51] J; and

(5) it is further supported by the terms of cl 8.14 which state that the “Limit of Liability “ is “inclusive of any…Sub-Limits of Liability and any other amounts insured under each part of the Policy”: at [51] J.

29 The primary judge did not accept Quintis’ contention that the heading “Optional Extensions” had been erroneously indented under the heading “Sub-Limits of Liability” instead of being its own sub-heading such that the reference to “4.9 Entity Securities Liability AUD $10,000,000” was to be understood as a restatement of the Limit of Liability for Section 1B cover: see [44], [51] J. Rather, the primary judge found that the words “4.9 Entity Securities Liability AUD $10,000,000” were a specification of the applicable sub-limit for Side C cover under the 2016-17 Primary.

30 Turning to the Excess Policies, the primary judge found that the effect of cl 1 in both of the 2016-17 1XS and 2016-17 2XS was to incorporate the relevant terms of the 2016-17 Primary: [51]-[52] J. This included cover in respect of entity securities liability (or Side C cover) up to a $10 million sub-limit: [53] J. The primary judge found that cl 4.4 served to clarify the incorporation of the 2016-17 Primary by limiting the cover extended to the unexhausted portion of the sub-limit and only on the basis that the sub-limit is part of, and not in addition to, the limits of liability provided for under 2016-17 1XS and 2016-17 2XS: at [53] J.

31 The primary judge pointed out that cl 4.4 proceeds on the basis of the existence of a sub-limit in the 2016-17 Primary, such that if the primary Section 1B cover is exhausted as a result of payments not made under cl 4.9, then the unexhausted portion of the sub-limit in respect of Side C cover will continue into the excess policies: at [59] J. It is helpful to illustrate this by way of example:

if there were claims of $11 million comprised of:

(a) $6 million in other Section 1B liability (cl 4.3 asset and professional reputation protection costs, cl 4.4 bail bond premium, cl 4.13 fines and pecuniary penalties etc); and

(b) a later claim of $5 million in cl 4.9 Side C;

then the limit of liability for Section 1B cover under the 2016-17 Primary would be totally exhausted;

the sub-limit of liability for Side C cover under the 2016-17 Primary would be partially exhausted ($4 million); and

the remaining Side C claim ($1 million) would ‘float up’ to the first excess layer pursuant to cl 4.4(b) of the 2016-17 1XS to be covered under that policy so long as the amount does not exceed the sub-limit under the 2016-17 Primary ($10 million) or the limit of liability for Section 1B cover under the 2016-17 1XS ($20 million in the aggregate).

32 In construing the 2016-17 Policies in this way, the primary judge rejected Quintis’ submissions that there was any ambiguity in the 2016-17 Primary such as to require him to look at any extrinsic material or construe the policy contra proferentem: see [61], [64] J.

33 As we have already mentioned, there was also a third excess layer, the 2016-17 3XS. As the primary judge noted, in May 2017, the underwriters to the 2016-17 3XS executed a retrospective endorsement excluding any liability for Side C cover: see [11], [224] J. The endorsement provided:

Full follow form as attached Primary Policy Number, N16FA15350 except that Section 4: Extensions to Section 18 (Directors and Officers liability) 4.9 Entity Securities Liability is NOT COVERED HEREON.

By reason of this endorsement, a Side C claim would not ‘float up’ to the third excess layer. It follows that the 2016-17 3XS was of minimal relevance to the dispute about the extent of Side C cover.

SUMMARY OF PRIMARY JUDGE’S APPROACH TO RECTIFICATION

34 It is worth saying something briefly about the primary judge’s approach to rectification, even though it will be addressed in more detail below.

35 The primary judge’s analysis commenced by identifying the purported Side C Coverage Intention (at [80] J). As it was not in dispute that Quintis (and PSC) held the Side C Coverage Intention ([4] J), the primary judge proceeded to consider the evidence available in relation to the intentions of each insurer of the 2016-17 Policies and Price Forbes in order to assess whether any of the insurers’ held the Side C Coverage Intention.

36 On that question, the primary judge found as follows:

(a) Price Forbes held the Side C Coverage intention at the time of execution of the 2016-17 Policies: [303] J;

(b) it had not been established that any of the insurers of the 2016-17 Primary held the Side C Coverage Intention: [319], [327], [336] J;

(c) Argo held the Side C Coverage Intention in respect of the 2016-17 1XS: at [348] J;

(d) it had not been established that the other insurers of the 2016-17 1XS held the Side C Coverage Intention: [354], [355] J;

(e) Vibe held the Side C Coverage Intention in respect of the 2016-17 2XS: at [383] J; and

(f) it had not been established that the other insurers of the 2016-17 2XS held the Side C Coverage Intention: [365], [370], [387] J.

37 The primary judge thus concluded that the Side C Coverage Intention was commonly held as between Quintis, Price Forbes, Argo and Vibe: at [392] J. In this regard, it is worth noting that the content of the Side C Coverage Intention was not modified to account for the finding that it was held by only two of the insurers. It is convenient to restate that intention (as defined by the primary judge at [80] J):

…the parties intended to execute the 2016-17 Policies on the basis that Side C cover was not subject to a sub-limit of $10 million, but was in fact equal to the Limit of Liability for Section 1B cover provided for by each of the 2016-17 Primary, the 2016-17 1XS and the 2016-17 2XS, meaning that the 2016-17 Policies collectively provided Side C cover of up to $50 million.

(Emphasis added.)

The point to note is that the intention goes to the overall effect of the 2016-17 Policies. It is on this basis that the primary judge then proceeded to consider a form of rectification orders reflecting the parties’ (that is, Quintis, Price Forbes, Argo and Vibe’s) true intention.

38 In the first judgment, the primary judge identified two issues in respect of the form of relief sought by Quintis.

39 First, the primary judge noted (at [395] J) that the form of relief sought by Quintis in its amended originating application was premised upon all parties being found to have the Side C Coverage Intention: at [396] J. However, the primary judge also observed (at [396] J) that the parties had accepted that the 2016-17 Policies represented a bundle of separate contracts with each insurer and that it was possible for the rectification claim to succeed against some insurers and not others. This appeared to satisfy the primary judge that he could grant relief against Argo (as between Quintis and Argo) and Vibe (as between Quintis and Vibe) in respect of the 2016-17 1XS and the 2016-17 2XS respectively, and not the other insurers subscribed to the 2016-17 1XS or 2016-17 2XS or any of the insurers subscribed to the 2016-17 Primary.

40 Second, the primary judge found that the form of relief sought by Quintis could not be reconciled with the primary judge’s construction of the 2016-17 Policies: see [397] J. Quintis had proposed replacing the reference to $10 million for Side C cover in the schedule of the 2016-17 Primary with a reference to $50 million. However, as the primary judge recognised, on his construction of the policies this would mean that the sub-limit for Side C cover would exceed both the aggregate limit of liability for Section 1B cover and the 2016-17 Primary, and would not result in any additional cover under 2016-17 1XS and 2016-17 2XS, which only covered the unexhausted portion of the sub-limit as part of the aggregate limit of liability for the policies.

41 The primary judge considered whether that meant Quintis was to be denied relief, but after referring to applicable principles as to the importance of substance over form in granting rectification (at [399]-[401] J), the primary judge concluded (at [402]-[403] J):

[402] It would be at odds with equity’s flexibility to relieve against unconscientious departure from an accord to conclude a bargain existed that is not reflected in a written instrument, but deny an equitable remedy on the basis that the precise form of relief reflecting the conclusions reached in this judgment was not articulated in the Amended Application.

[403] The appropriate course is for each party to provide submissions on the specific question of relief in the light of these reasons and, except in circumstances where the parties wish to be heard orally, that such a question be determined on the papers. Further, given the mixed result, the parties should also provide submissions on the issue of costs.

42 The parties filed further submissions on the question of relief in which Quintis proposed amendments to the 2016-17 1XS “to the extent it records a contract with Argo” and the 2016-17 2XS “to the extent it records a contract with Vibe” such that there would be cumulative sub-limits in the 2016-17 Policies of $10 million, $20 million and $20 million, and the insurers submitted that relief was not available at all: at [6], [18] J2.

43 The primary judge (at [20] J2) identified three overarching submissions by the insurers as to why relief ought not to be awarded, which were dealt with in turn.

44 First, the insurers submitted that the relief now sought by Quintis went beyond the amended originating application. The insurers pointed out that Quintis had never sought rectification of the 2016-17 1XS and 2016-17 2XS independently of the 2016-17 Primary and, in particular, had never sought rectification of cl 4.4 of those policies. However, the primary judge did not accept that the insurers had no notice of the case put against them and, in the absence of sworn evidence, did not accept the insurers would have run their case differently even if they had been made aware of the specific relief now sought from the outset: at [26], [33]-[34] J2. The primary judge also emphasised the importance of substance over form (at [28]-[31] J2) and observed that the “the exact form of words in which the common intention is to be framed is immaterial as long as in substance and in detail the parties’ intention is to be ascertained”: at [28] J2 citing Crane v Hegeman-Harris Co Inc [1939] 1 All ER 662 (at 669 per Simonds J) approved on appeal in Crane v Hegeman-Harris Co Inc [1939] 4 All ER 68 (at 72 per Wilfrid Greene MR, with whom Clauson and Goddard LJJ agreed).

45 Second, the primary judge addressed Vibe’s argument that as it was not the slip leader of the 2016-17 2XS and had only intended to support the terms agreed by the slip leader (‘Channel’), it could not be said that Vibe intended to accept more onerous terms than Channel: [35] J2. Vibe submitted that there was a tension between the Court finding that Vibe held the Side C Coverage Intention and also finding that it intended to support the terms of the slip leader who did not have the Side C Coverage Intention: [35] J2. The primary judge did not consider this submission to be relevant to the question of relief (at [36] J2) but rejected it in any event, including because there was no logical inconsistency in having found (at [327] J) that it had “not been satisfactorily established that Channel held the Side C Coverage Intention” (as distinct from finding that Channel did not have the Side C Coverage Intention): see [37] J2. The primary judge also considered the relevant intention was with each of the subscribing underwriters and as such the subjective intention of Channel or Vibe’s offer of support was irrelevant to determining the intention of Vibe: at [38] J2.

46 Third, the primary judge turned to the submission of Argo and Vibe that to rectify the contracts as between Quintis and those parties was to transform the bargain into one that was not intended by the parties: at [40] J2. The primary judge considered the scope of equity’s powers of intervention and observed that “it is no place of equity to relieve a mistake in a document where this would amount to writing a new agreement for the parties”: at [42] J2. However, the primary judge determined that rectification was consistent with the intention of the parties in respect of the relevant individual contracts and the bilateral rights and obligations created thereunder. His Honour reached this conclusion by finding as follows:

[48] It is necessary to recall four important findings made in the principal judgment:

(1) the Side C Coverage Intention is defined at J[80] in the following terms:

… the parties intended to execute the 2016-17 Policies on the basis that Side C cover was not subject to a sub-limit of $10 million, but was in fact equal to the Limit of Liability for Section 1B cover provided for by each of the 2016-17 Primary, the 2016-17 1XS and the 2016-17 2XS, meaning that the 2016-17 Policies collectively provided Side C cover of up to $50 million.

(2) all parties accepted, consistent with what is revealed in the authorities, that the slip method of placing insurance, by signing the MRC and stating the proportion of the risk that the underwriter is prepared to subscribe, results in the conclusion of separate contracts between the insured and each subscriber of the slip (J[29(5)]);

(3) hence, while there may only be one primary policy and three excess polices, there are in fact nineteen separate contracts reflected by the 2016-17 Policies (J[29(7)]); and

(4) in light of these findings, it was necessary to assess the intention of each individual insurer: cf Towry Law plc v Chubb Insurance Co of Europe SA [2008] NSWSC 1352 (at [66] and [138] per McDougall J).

[49] These findings are integral to the question of relief. That is because the common intention as defined must be understood in the context of how it applies to the specific contract between Quintis and each Relevant Insurer and the rights and obligations created by that contract. As was made clear in General Reinsurance Corporation v Forsakringsaktiebolaget Fennia Patria [1983] QB 856 (at 864 per Kerr LJ, with whom Slade and Oliver LLJ agreed), each subscribing insurer becomes bound to the extent of its proportion of the risk when it accepts its individual contract. Hence, while I have found that Argo and Vibe were operating with the intention that the layers to which they were subscribing provided Side C cover up to the Limit of Liability for Section 1B cover, and that Quintis’ overall insurance programme provided for $50 million in Side C Cover, the manifestation of that intention as it applied to their contract with Quintis was to provide a set proportion of cover at a specific layer.

[50] While no party referred at length to these provisions, what I have said is consistent with what appears under in the MRC under the Security Details heading:

[…]

[51] Indeed, I do not think that it is a precondition to the award of relief, as the second respondent suggests, to find that Argo and Vibe intended to provide Side C cover irrespective of the position of the other insurance contracts (although there is no direct evidence bearing on this question one way or another). To refuse relief on the basis that it has not been found that the other insurers to the 2016-17 Policies held the Side C Coverage Intention is to confuse the 2016-17 Policies, which record the bundle of contracts, with the individual contracts themselves, and the bilateral rights and obligations created under these contracts.

[…]

[57] In these circumstances, I am not of the view that to order rectification in the circumstances would, on the evidence, be fashioning a bargain that the parties did not strike or giving effect to an agreement that goes beyond that which the parties intended: see Muriti (at [137] per White J). Nor is there a danger, to adopt the words of Campbell JA in Franklins (at [459]), of “imposing on a party a contract which he did not make”. All that rectification is doing in these circumstances is bringing the policy, as the document recording the contracts of insurance, into line with the common intention of the parties. Indeed, this is not a situation where there was in fact no common intention between the parties, a common misunderstanding, or an oversight of a particular matter: see, eg, Club Cape Schanck Resort Co Ltd v Cape Country Club Pty Ltd [2001] VSCA 2; (2001) 3 VR 526 (at [12] per Tadgell JA). Nor is this a case in which the Court would be supporting a doctrine of rectification pro tanto: cf KPMG v Network Rail Infrastructure Ltd [2007] EWCA Civ 363; [2008] P&CR 11 (at 199 [31]–[33] per Carnwath LJ). It is a situation in which parties entered into bilateral contracts with a common intention to provide a specific proportion of cover at a specific layer.

47 The primary judge thus determined (at [58] J2) that it would be against conscience to allow the 2016-17 Policies to stand in their current form. After rejecting various submissions by the insurers objecting to the form of relief proposed by Quintis (at [71]-[87] J2) the primary judge awarded relief in substantially the same form as that proposed by Quintis. That is, cumulative sub-limits of $10 million for the 2016-17 Primary, and $20 million for each of the 2016-17 1XS and the 2016-17 2XS.

48 It is important to appreciate two things about the operation of the policies as against Argo and Vibe, as construed and rectified by the primary judge. First, Argo and Vibe did not become liable for the entirety of the sub-limits, but rather the proportions of the sub-limits that they had subscribed to under the policies (50% of the 2016-17 1XS and 6.25% of the 2016-17 2XS, respectively). Second, cl 4.4(b) of the excess policies continued to limit liability such that the amount payable under the sub-limit could go no further than the unexhausted portion of the sub-limit of the underlying policy that had ‘floated up’.

49 The primary judge illustrated this operation of the rectified 2016-17 Policies by way of annexures to the April judgment. For example, by reference to a hypothetical scenario in which there was a Side C claim of $35 million and Side C cover under the 2016-17 Primary had already been partially exhausted, Annexure D to J2 provided as follows:

$5 million of the claim would be covered by the unexhausted portion of the $10 million sub limit under the 2016-17 Primary;

$10 million of the claim would be covered by Argo contributing 50% of the $20 million sub-limit under the rectified 2016-17 1XS;

the other insurers to the 2016-17 1XS would contribute nothing as the $10 million sub-limit under the unrectified 2016-17 1XS was already exhausted;

$0.625 million of the claim would then be covered by Vibe contributing 6.25% of the unexhausted portion of the rectified 2016-17 1XS ($10 million) that has ‘floated up’ to Vibe only; and

the other insurers to the 2016-17 2XS would contribute nothing as the $10 million sub-limit under the unrectified 2016-17 1XS was already exhausted and so nothing has ‘floated up’ to them.

ISSUE 1: WHETHER PRICE FORBES HELD THE SIDE C COVERAGE INTENTION

50 The first issue is whether the primary judge erred in finding that Price Forbes held the Side C Coverage Intention at all relevant times up to the point that Argo and Vibe subscribed to the 2016-17 1XS and 2016-17 2XS. This relates to ground 3 of the Argo Appeal, and grounds 1 to 10 of the Vibe Appeal.

Grounds of appeal

51 In ground 3 of its notice of appeal, Argo contends:

The primary judge erred in reasoning to and finding that Price Forbes held the Side C Coverage at relevant times up to the point that Argo subscribed to the first excess policy.

52 In grounds 1 to 10 of its notice of appeal, Vibe contends:

1. The trial judge having found that:

(a) Price Forbes & Partners Ltd’s (Price Forbes) intention, as the placing broker for the First Respondent’s (Quintis) insurances at Lloyd’s, was the relevant intention attributed to Quintis’ for the purposes of the claim for rectification [Primary Judgment (PJ) 29(3)], [PJ95], [PJ97], [PJ98];

(b) Price Forbes saw the 2015-16 Primary Wording and there was no evidence to suggest that Price Forbes saw the 2015-16 first or second excess wordings [PJ275];

(c) there was no reason that Price Forbes would not have interpreted Side C cover to be subject to a sub-limit, and therefore implicitly that Price Forbes would have interpreted the Side C cover in the 2015-16 policy to be subject to a sub-limit [PJ275];

(d) the 2015-16 fourth excess policy (which Price Forbes placed) included a term identical to that of cl 4.4 of the 2016-17 excess policies, meaning that Price Forbes had familiarity with the sub-limit wording, and that this wording was acceptable to Quintis [PJ275];

(e) Price Forbes was told that Quintis was looking for continuity [PJ278], [PJ280];

(f) Price Forbes was supplied with a draft 2016-17 Primary form by PSC Insurance brokers (PSC) [PJ296], which was a form that included the Side C sub-limit of $10m [PJ53];

(g) Price Forbes was responsible for drawing, presenting and negotiating the terms of the policies for subscription [PJ95];

(h) Price Forbes was responsible for adopting the expiring wording [PJ95];

(i) the 2016-17 Primary Wording was identical in all relevant respects to the 2015-16 Primary Wording (including the term ‘Entities Securities Liability$10,000,000) [J275], being a sub-limit of $10m [PJ53];

(j) Price Forbes received, without objection, a draft quote signed by Argo, with a form of ‘Short Excess Wording’ attached by Argo, which included a slice of the sub-limits clause similar to what appeared in the 2016-17 Excess Policies [PJ153], [PJ294];

(k) on the proper construction of each of the primary, first excess and second excess policies, all of them provided Side C cover, however that cover was the subject of a sub-limit of $10m, which [sic] [PJ53], [PJ66]; and

(l) Price Forbes provided a copy of the 2016-17 Primary form to PSC that had been negotiated with Antares and PSC gave no indication that there was a need to alter the way in which Side C cover was presented [PJ298],

and in the absence of Quintis calling any of the individuals then employed by Price Forbes to draw, present and negotiate the primary, first excess and second excess policies, the trial judge:

(m) erred in finding [PJ303] to the necessary proof (as described at [PJ74]-[PJ76]) that Price Forbes held the Side C Coverage Intention (as described at [PJ80]) at relevant times up to the point that Vibe subscribed to the second excess policy; and

(n) should have found either that:

(i) Price Forbes did not hold the Side C Coverage intention; or alternatively,

(ii) the evidence was not sufficient to satisfy the necessary proof (as described at [PJ74]-[PJ76]) that Price Forbes held the Side C Coverage intention.

2. The trial judge erred in his recording of the submissions of the Responding Insurers to the effect that ‘there was technically $50 million available in Side C cover, but given the sub-limit, only $10 million could actually be paid’ [PJ285], when the submissions of the Responding Insurers were those made on construction, being that each of the primary, first excess and second excess policies provided Side C coverage, but subject to the sub-limit of $10m.

3. The trial judge erred in attributing his own interpretation of an email from Ms Purdy (of PSC) to Mr Butler (of Price Forbes) [PJ133], [PJ286] (Structure Diagram) as a basis for finding that Price Forbes was told that the commercial intent of Quintis was to maintain its current amount of cover, which included up to $50 million in Side C cover [PJ287] when:

(a) the email was sent in response to a request for information as to the current structure programme [PJ284];

(b) the email on its face identifies the nature of cover at various layers of the programme;

(c) the email does not purport to record the terms of the identified cover, including any applicable sub-limits thereto.

4. The trial judge erred in attributing to the relevant employees of Price Forbes a state of mind by reference to the Structure Diagram that they would not have apprehended Side C cover was sub-limited to $10m [PJ287] and that the expiring programme provided Side C of up to $50m [PJ290], without regard, or proper regard, to his other findings recorded at paragraphs 1(b)-(e) above.

5. The trial judge erred in inferring that PSC communicated in discussions with Price Forbes an intention that Side C cover was intended to be for an amount up to $50m [PJ287], when there was no evidence from any participant in any such conversation that such words were spoken.

6. The trial judge erred in finding that when Price Forbes advised PSC of its intention to use the current wording that it had actually given any consideration to the policy wording [PJ289], when there is no evidence from any employee from Price Forbes as to what it had considered prior to the sending of that communication.

7. In considering Price Forbes’ intention, the trial judge erred in giving no weight to the form of the wording that had been negotiated between Antares (as primary slip leader) and Price Forbes and the absence of objection to that wording by PSC when sent to it by Price Forbes (describing it as relatively neutral) [PJ294].

8. In considering Price Forbes’ intention, the trial judge erred in placing weight on the form of the reweighting spreadsheet [PJ301] when:

(a) the spreadsheet on its face identifies the nature of cover at various layers of the programme;

(b) the spreadsheet does not purport to record the terms of the identified cover, including any applicable sub-limits thereto,

and where he separately found that the level of satisfaction necessary for the rectification claim was not reached where the reweighting spreadsheet was the only evidence supporting the Side C coverage intention [PJ378].

9. In considering Price Forbes’ intention, the trial judge erred in placing weight on the retrospective endorsement issued on 26 May 2017 [305] when that endorsement expressly referred to clause 4.6 of the primary policy, which the trial judge held provided Side C cover subject to a sub-limit of $10m [PJ53], [PJ66].

10. In considering Price Forbes’ intention, the trial judge erred in placing weight on the spreadsheet circulated between Price Forbes and PSC following the September 2017 meetings [306] when:

(a) the spreadsheet on its face identifies the nature of cover at various layers of the programme;

(b) the spreadsheet does not purport to record the terms of the identified cover, including any applicable sub-limits thereto,

and where he separately found that the level of satisfaction necessary for the rectification claim was not reached where the reweighting spreadsheet was the only evidence supporting the Side C coverage intention [PJ378].

The evidence

53 The evidence going to Price Forbes’ intention can be summarised as follows:

(a) notes in relation to a Quintis presentation delivered in London to various London underwriters in May 2016 (‘May 2016 Insurer Update Presentation’) which was attended by Price Forbes and certain insurers;

(b) correspondence between PSC, Price Forbes and certain insurers (Argo, Vibe and others) in August 2016 at the commencement of the negotiation process referring to the terms and structure of the proposed 2016-17 insurance programme and providing quotes; and

(c) correspondence between PSC, Price Forbes and certain insurers between September and October 2016 finalising the terms of the 2016-17 Policies.

54 The focus in both appeals (in respect of Price Forbes’ intention as well as that of Argo and Vibe) is the primary judge’s approach to the August 2016 correspondence, and in particular a structure diagram sent by email from Ms Purdy (PSC) to Mr Butler (Price Forbes) on 16 August 2016 relating to Quintis’ 2015-16 insurance programme. (The structure diagram is sometimes referred to as ‘the visual’). We will come to this email in due course (at [66]) as we deal with all of the key evidence in chronological order, all of which should be understood in the context of the 2015-16 insurance programme.

The 2015-16 insurance programme

55 The evidence going to Price Forbes’ intention in respect of brokering the 2016-17 Policies must be understood in the context of the outgoing 2015-16 insurance programme. Quintis’ insurance programme in 2015-16 was comprised of the following policies (collectively, ‘2015-16 Policies’):

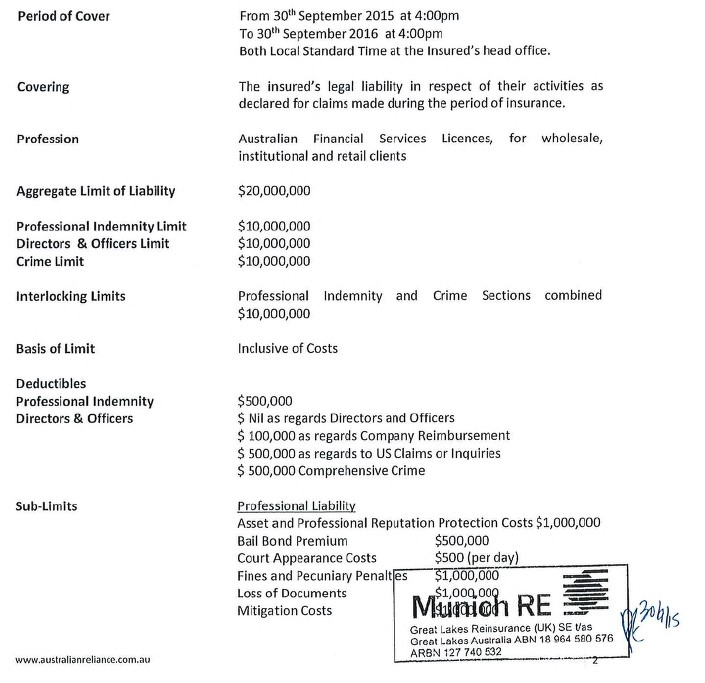

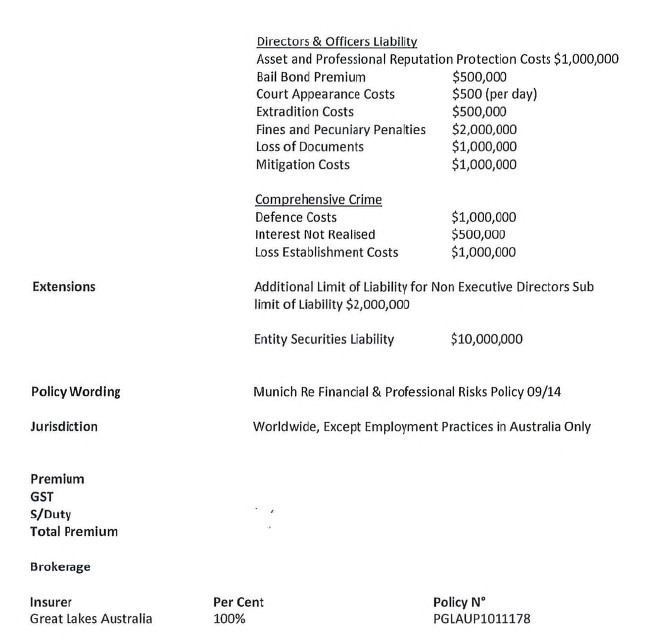

(1) a Policy Schedule identified as policy number PGLAUP1011178 and Munich Re Financial & Professional Risks Policy 09/14 policy wording (‘2015-16 Primary’);

(2) a first excess layer policy identified as policy number FLD-368431 (‘2015-16 1XS’);

(3) two second excess layer policies identified as policy number CFD212004A15 and policy number 50000/27/2015/0009 (‘2015-16 2XS’);

(4) a third excess layer policy identified as policy number 05CH010390 (‘2015-16 3XS’); and

(5) a fourth excess layer policy identified as policy number B0507N15T2300 (‘2015-16 4XS’).

56 Four of the insurers to the 2016-17 Policies (including Argo) provided insurance under the 2015-16 Policies, specifically the 2015-16 4XS, but none of those insurers provided Side C cover: see [63], [122] J. Price Forbes was the London-based broker for the 2015-16 4XS: [275] J. The 2015-16 4XS did not provide Side C cover but it did include a term identical to that of the 2016-17 Excess Policies, which meant (as the primary judge found at [275] J) that Price Forbes had some familiarity with the sub-limit wording. As the 2015-16 4XS included the term “per primary wording attached” (and as the primary judge also found at [275] J), Price Forbes was also familiar with the wording of the 2015-16 Primary.

57 The primary judge did not make any specific finding as to the operation of the 2015-16 Policies, although (at [111]-[121] J) he set out details of the correspondence in relation to the 2015-16 renewal and pointed out a few notable differences in wording between the two sets of policies. We note that Quintis had claimed, in relation to the construction question before the primary judge, that ambiguity in the 2016-17 Policies ought be resolved by reference to the fact that Quintis had the commercial object of seeking to preserve its expiring amount of cover and the wording of the 2015-16 Primary was understood to provide for up to $50 million in Side C cover: see [63] J. However, as the primary judge did not find any ambiguity in the 2016-17 Policies, his Honour considered that he was not required to determine the proper construction of the 2015-16 Policies: at [121] J.

58 The primary judge made the following findings in respect of the 2015-16 Policies:

[122] The involvement of the Lloyd’s syndicates (Argo, ANV, Barbican, Antares and Channel) in the 2015-16 D&O tower should be noted. These insurers covered Sides A and B (not Side C) at the fourth excess level in the amount of $40 million (excess $60 million). Of relevance, the slip leader of the 2015-16 4XS, Argo, together with the subscribing insurers, Antares and Channel, all became slip leaders for the 2016-17 Policies in the London takeover of Quintis’ insurance programme: Antares became the 2016-17 Primary slip leader; Argo became the 2016-17 1XS slip leader; and Channel became the 2016-17 2XS slip leader. Price Forbes also acted as the London broker for the 2015-16 4XS.

[…]

[274] Price Forbes arranged the 2015-16 4XS, and Argo, ANV, Barbican, Antares and Channel all provided cover under such a policy. That policy did not, however, provide Side C cover. Nevertheless, Quintis placed emphasis on the fact that since the layers formed part of a larger structure and were interdependent upon each other, Price Forbes and these insurers would have been aware of that overall structure. I accept that proposition, but would caveat such awareness with the qualifier “generally”. That is because Side C cover was not a risk that these insurers quoted on, nor a risk that affected the way in which the policies applied to their layer of cover. It was similarly not a risk that Price Forbes would have had to contemplate in the arrangement of this policy. It is therefore unlikely that Price Forbes and these insurers would have had the same level of knowledge in relation to how Side C cover operated as they would in relation to those risks that they were actually insuring.

[275] A number of reasons support this conclusion. First, the 2015-16 4XS (being $40 million excess $60 million for D&O cover Sides A and B) did not even sit beside the layers that provided Side C cover (there being an intermediate third excess policy (see [12])). Secondly, while I accept that Price Forbes and these insurers would have seen the 2015-16 Primary (given that the 2015-16 4XS included the term “per primary wording attached”), there is no evidence to suggest that Price Forbes and these insurers saw the terms of the 2015-16 1XS or 2015-16 2XS in order to demonstrate an appreciation of how those policies interacted with the 2015-16 Primary. Thirdly, and following on from the previous point, the 2015-16 Primary was identical in all relevant respects to the 2016-17 Primary (including the term “Entity Securities Liability $10,000,000”), meaning that even if Price Forbes and these insurers did concern themselves with Side C cover, there is no reason why they would not have interpreted Side C cover to be subject to a sub-limit. Fourthly, the 2015-16 4XS actually included a term identical to that of cl 4.4 of the 2016-17 Excess Policies, meaning, if anything, Price Forbes and these insurers had familiarity with the sub-limit wording, and that this wording was acceptable to Quintis. I am therefore inclined to treat the involvement of Price Forbes, Argo, ANV, Barbican, Antares and Channel in Quintis’ 2015-16 insurance programme as no more than a neutral consideration.

[276] I should also note here Quintis’ submission that if the 2015-16 Primary wording was simply adopted in 2016-17, then the insurers must have had the same understanding of Side C cover as they did the previous year. That submission may have some force if it involved an insurer providing Side C cover in the expiring programme, but Argo, ANV, Barbican, Antares and Channel did not. To assert that these underwriters had the intention to provide Side C cover of up to $50 million because the underwriters providing Side C cover in the previous programme intended as much, is purely a matter of speculation.

(Emphasis added.)

May 2016 Insurer Update Presentation

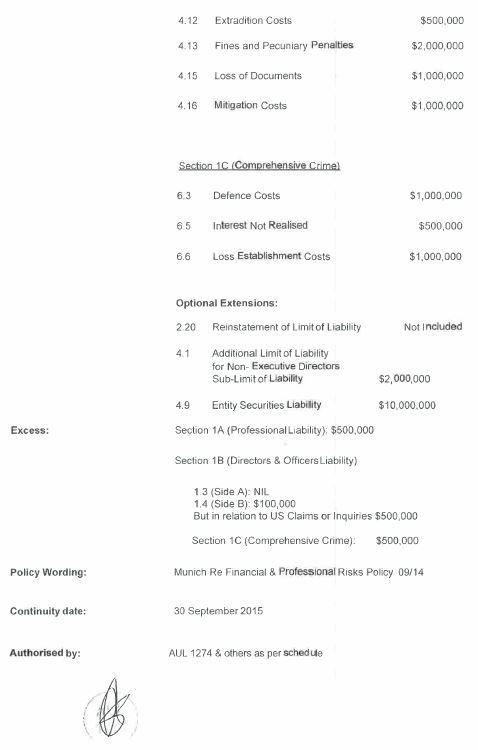

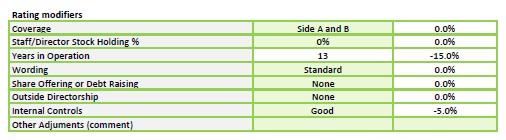

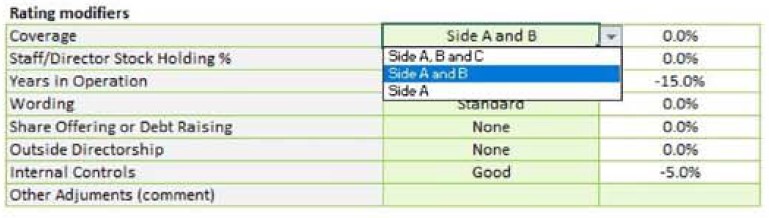

59 In advance of the expiry of the 2015-16 Policies, PSC (on behalf of Quintis) commenced approaching existing insurers for renewal quotes for the 2016-17 insurance programme: [124] J. As part of this process, the May 2016 Update Presentation was delivered to various underwriters in London: see [124]-[130] J. One of the slides in the presentation titled “IMI Program Structure” includes the following information:

• The structure of the current IMI program was put in place at renewal last year in Sept.

• The limits placed are not likely to be increased this year.

• Participants in the program last year will be asked if they are still able to participate in the 2016-17 renewal.

• Axis Australia will not be able to participate in the program this year, and this ‘gap’ is being promoted to fill, currently $10M excess of primary $10M across full program D&O, PI and Crime.

60 There is evidence of handwritten notes of representatives of insurers (including Vibe but not Argo) who were in attendance at the meeting (see [126] J). This included signed notes taken by Vibe personnel including “Unchanged programme on the IMI … Looking for continuity!” and that there was a “[$]100 limit on D&O”: see [126], [278] J.

61 Vibe points to these notes and says (consistently with the primary judge’s findings at [278], [280] J) that Price Forbes understood that Quintis was looking to maintain its current amount of cover and that this is relevant to the terms that Price Forbes understood Quintis was prepared to accept. That is, in order to place the 2016-17 programme, Price Forbes would be required to understand the entire 2015-16 programme (beyond the 2015-16 4XS which it had familiarity with from the previous year).

62 The primary judge made the following findings in respect of the evidence surrounding the May 2016 Insurer Update Presentation:

[277] I turn now to the May 2016 Insurer Update Presentation. As I noted above (at [126]), I find representatives of Price Forbes, Antares, Channel, Vibe, ANV and Barbican attended. However, for the reasons that follow, I do not think I should place a great deal of reliance on the evidence surrounding the Insurer Update Presentation in making an overall assessment of whether Price Forbes and the Relevant [Insurers] held the Side C Coverage Intention.

[278] First, the Insurer Update Presentation occurred three months prior to when Price Forbes approached the London market for quotations. Secondly, while the Insurer Update Presentation slide deck notes that “the limits placed are not likely to be increased this year” (see [125]), this statement is not definitive as to whether Quintis was going to maintain its current amount of cover, nor what that cover was. Indeed, there is no evidence to suggest that Side C cover was discussed. At the most, given the handwritten notes of Vibe outlining “Unchanged programme on the IMI … looking for continuity” and that there is a “$100m limit on the D&O”, it seems it was proposed Quintis was anticipating maintaining its current amount of cover and that the level of cover was explained at a high level of generality. However, even then, a reference in Vibe’s notes to “D&O policy up to $100m” is immediately followed by the text “does not know until June/July time & will see what pricing looks like then”, indicating an element of fluidity in the content of the 2016-17 renewal at this stage. Thirdly, this presentation was not actually part of the formal renewal process and the “Underwriting Update” formed only part of a broader presentation given by Quintis in relation to the company’s performance, business strategy and risk appetite.

[…]

[280] I am unable to conclude that the participants at the Insurer Update Presentation would have been told that Quintis was seeking to secure up to $50 million of Side C cover in the 2016-17 period. I do infer, however, that the representatives of Price Forbes and the Relevant Insurers would have understood that: (a) Quintis was looking for continuity; (b) the expiring programme included up to $100 million in D&O cover; and (c) the limits of cover were not likely to change. The Relevant Insurers submitted that even if I were to accept that such information was conveyed, for that evidence to have weight, it would need to carry with it an understanding that the underlying layers were not written on a sub-limited basis. I do not think that is correct. Of course, at risk of stating the obvious, the less specific the finding can be made on the evidence, the less probative it is to Quintis’ Rectification Claim, but that does not mean it does not form part of the overall mosaic.

(Emphasis added.)

63 We interpolate that in relation to the comment at [277] J, the primary judge did not actually say at [126] J that Price Forbes attended the May 2016 Insurer Update Presentation. There is no finding that Price Forbes did so attend. The primary judge did in his overall assessment put some weight on the matters emphasised above in his reasons as forming part of the overall mosaic. However, the primary judge also said he was not putting a great deal of reliance on the May 2016 Insurer Update Presentation. We think the primary judge was correct in this assessment, although we consider that as far as Price Forbes’ intention is concerned, the events surrounding the May 2016 Insurer Update Presentation should not be treated as “part of the overall mosaic”.

Email correspondence between Ms Purdy (PSC) and Mr Butler (Price Forbes) on 16 and 17 August 2016

64 We then move on in the chronology to August 2016. In August 2016, Price Forbes took steps to progress the renewal of the insurance programme. It was agreed that Price Forbes would approach the whole of the market for the 2016-17 insurance programme, and to that end Mr Butler of Price Forbes sought further detail in relation to the 2015-16 insurance programme.

65 Ms Purdy (PSC) sent the following email to Mr Butler (Price Forbes) dated 16 August 2016 (see [132] J):

Hi Shaun,

It was good to touch base with you last Thursday on this client and discuss how we wish to proceed with renewal this year. As discussed in the telephone conversation we already have a timeline which we need to adhere to, to ensure all board papers and presentations are kept on schedule.

As agreed the timetable should go as follows;

9th August – renewal information out to markets

12th August – client to return renewal questionnaire which has some queries on it from the current primary lead (Munich Re), but no proposal form is being completed this year.

24th August – any underwriters queries to be group complied and forwarded to client for responses.

8th Sept – all terms and program structures to be received by PSC Perth

15th Sept – PSC Perth to provide board papers to TFS for circulation

29th Sept – Board resolution and instructions

Attached to this email are the following documents which can be distributed amongst the market for quotations;

§ Current IMI program Structure and participants

§ Unaudited 9mth Financials to March 2016

§ Update on ASX announcements from May – Jun 2016

§ Annexure A – Updated Organisational Structure

§ Annexure F - ASX announcement 21 July 16 New Senior Note Secure

* Presentation from May 2016 as delivered to the London Markets – removed already with you.

The client has suggested that full and final financials may be available at the end of Aug, obviously we’ll all know once released. Additional information requested from the client and we hope to be in receipt of this soon;

§ Details of new investor clients in the 15 16 period

§ Commentary on ongoing dispute with former employee & investor (grower) Teague Czislowski

With respect to the ASIC s912 Notice in March 2016, issued to TFS Properties Ltd TFS remark that their responses were provided and no further correspondence has been received from ASIC since.

As discussed on the phone Shaun, we would be happy for you to approach the market for the whole of the program, at present we are looking to deliver premium savings to the client, with as broad a coverage as possible.

I hope this all makes sense to you, let me know if you need anything else.

Kind Regards

Sarah Purdy

66 In response, Mr Butler requested Ms Purdy to “send … over the current structure program” (see [133] J). Ms Purdy responded on the same day with the structure diagram as follows:

Please see below, this shows it as a visual, but the Liberty would part [sic] would need to be replaced with the other lines that filed in and are shown in the premium table I have sent over.

If you have any queries please let me know essentially we have separate towers on $100M D&O (AB) including $50M side C, PI at $50M and Crime at $20M.

67 It is not in dispute that this structure diagram or visual is a depiction of the 2015-16 programme, ie the “outgoing structure” ([285] J). It is convenient to address the submissions of Vibe and Argo as to the meaning (and significance) of this structure diagram. The respondents effectively supported the reasoning of the primary judge and his approach to the visual.

68 The most important point to note is the inclusion of “ABC” in the first three layers of the diagram. At the hearing, senior counsel for Vibe said that the references to “ABC” in the first three layers were not to the sections of the policies (ie “Section 1B”, “Section 1C”) but rather to the type of cover including “C” for entity securities liability or Side C cover:

[…] A would be a payment directly to the director, B would be company reimbursement, and C is an entity cover.

[…]

A would be the direct indemnity of the insured person. B is the company reimbursement cover, and C is the entity cover.

69 Vibe says that what this document really shows is that there is D&O Side C cover in the first three layers (as indicated by “D&O (ABC)”), being layers that accommodate insurance up to $50 million, and then there is no D&O Side C cover in the layers above it.

70 Both Vibe and Argo submit that the visual is a generalised pictorial seeking to illustrate the existing programme structure at a high level of generality for someone with little prior knowledge of the programme. Vibe also points out that the visual does not attempt to describe all commercial terms and, in particular, sub-limits attributable to different coverage benefits. The visual therefore assists in a “rough understanding of splits” but does not attempt to record the terms such as sub-limits.

71 Vibe also submits that the important point is that the person receiving this document (in this instance, Price Forbes) also has access to a wording that contains the contractual terms dealing with the bottom layer (ie the 2015-16 Primary) which include Side C cover described as an extension subject to a sub-limit. That is, as we have already mentioned, Price Forbes had available to it the expiring wording for the 2015-16 Primary because of its role in placing the 2015-16 4XS (as the primary judge found at [275] J) and so would have been able to refer to that document for the particular contractual details rather than relying on the structure diagram. As Price Forbes already had access to the expiring wording for the 2015-16 Primary, Vibe submits that it was unnecessary for Ms Purdy to send through that wording again.

72 In respect of the terms of the email, the important thing to note is the phrase “including $50M side C”, which the primary judge placed emphasis on in his reasons (at [285]-[287] J, which are set out below).

73 There was a further exchange of emails between PSC and Price Forbes. On 17 August 2016, Ms Purdy responded to a request from Mr Butler as to “what the primary and first excess layer was paying last year”. In her email, Ms Purdy stated (as recorded by the primary judge at [146] J):

Base premiums last year; Primary $390, 175, Axis $10M ex $10M $215,000

[…]

If you have a primary under consideration in London could you send over the wording?

[…]

74 Mr Butler then responded the same day (as recorded by the primary judge at [146] J):

Our initial thoughts is [sic] to use the current wording but tweak it update, add on take-off etc […]

75 Vibe submits that “current wording” ought to be interpreted as a reference to the 2015-16 Primary, given the primary judge’s finding (at [275] J) that there was no evidence to suggest that Price Forbes or the other insurers saw the terms of the 2015-16 1XS or the 2015-16 2XS.

76 On 25 August 2016, after obtaining quotes from various syndicates in the London market for the entire 2016-17 insurance programme, Mr Fox (Price Forbes) attached each of the quotes to Ms Purdy (PSC) in the following email (see [179] J):

Sarah, I refer to my earlier email today and have pleasure in attaching hereto the preliminary terms we’ve received from our marketing efforts in London.

We have quoted for the full DO 100,000,000/EO 50,000,000 and Crime 20,000,000 in 4 layers.

We have support for the primary – 75%/1st XS 100%/2nd XS 100% and 3rd XS a lead line (we’ve not pushed this yet).

The deal all hangs together as one – i.e. ARGO will be supporting an Antares lead. If the primary lead changes – say the incumbent stands up then we will need to review with ARGO and the markets on the other 2 layers.

These terms represent the best we’ve been able to achieve to date and are based on the EXPIRING FORM. We felt it easier to follow this as the client knows the wording.

We ill [sic] be placing this 100% in Lloyd’s [sic] We are continuing to market the risk and are awaiting fro [sic] several insurers to come back to us. WE [sic] do not foresee any problems in being able to fill the capacity 100% in Lloyd’s.

We can chat through these preliminary numbers tomorrow.

Best Regards

Adrian Fox

77 The primary judge found (at [285]-[287], [289], [295] J):

[285] The question that arises is what does this structure diagram represent? Quintis argued that the diagram and accompanying blurb given by Ms Purdy made plain that the outgoing structure included up to $50 million in Side C cover and showcased the layer that provided this cover. The Relevant Insurers, on the other hand, attempted to downplay the diagram because Ms Purdy identified it as a “visual”, and because it only depicts at a general level the layers and underwriters of the expiring programme. In particular, as a visual, the structure diagram does not record any terms applicable to each layer, nor indicate any terms of limitation such as sublimits. For example, the Relevant Insurers submitted that the GLA layer (the 2015-16 Primary) included 16 sub-limits, none of which are denoted in the diagram. It was said that what should instead be extrapolated from the “inelegant” reference to “$50M Side C” and the use of the notation “(ABC)” in the diagram is the layers of the tower offering Side C cover (which together add up to $50 million), not the terms upon which it is offered. Indeed, the Relevant Insurers maintained throughout the course of the hearing that there was technically $50 million available in Side C cover, but given the sub-limit, only $10 million could actually be paid.