Federal Court of Australia

Loo, in the matter of Halifax Investment Services Pty Ltd (in liquidation) v Quinlan (Liquidator) [2021] FCAFC 186

Table of Corrections | |

On the orders page amendment of description of Respondents |

ORDERS

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The application for an extension of time to seek leave to appeal be granted.

2. The applicant have leave to appeal from paragraph 14 of the orders of the primary judge dated 19 May 2021.

3. Within seven days, the applicant file and serve a notice of appeal substantially in the form of the draft notice of appeal which is annexure “DAF-3” to the affidavit of Danielle Funston dated 15 June 2021.

4. The appeal be treated as having been heard.

5. The appeal be dismissed.

6. In relation to costs:

(a) Within seven days, each party file and serve a written submission (of no more than two pages) on costs.

(b) Within a further seven days, each party file and serve any responding written submission (of no more than two pages) on costs.

(c) Subject to further order, the issue of costs be determined on the papers.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

THE COURT:

Introduction

1 The issue raised by this application for an extension of time to seek leave to appeal, and by the proposed grounds of appeal, concerns the date for valuation of the proportionate entitlements of clients (or investors) in respect of a single deficient mixed fund. The primary judge held that the appropriate date was the date of administration of the relevant companies. The applicant, Choo Boon Loo, on behalf of a certain category of investors, contends that the primary judge erred and that her Honour should have adopted a date as close as possible to the date for final distribution. The fourth respondent, Elysium Business Systems Pty Ltd (Elysium), on behalf of another category of investors, supports the primary judge’s conclusion.

2 The issue relates to the insolvency of two companies, Halifax Investment Services Pty Ltd (in liquidation) (Halifax AU) and Halifax New Zealand Limited (in liquidation) (Halifax NZ). Since 2013, Halifax AU has held 70% of the shares in Halifax NZ.

3 In the period from February 2003 to January 2019, Halifax AU held an Australian Financial Services Licence (AFSL) that authorised it to provide financial product advice on a range of financial products, deal in financial products and make a market for foreign exchange contracts and derivatives. Halifax AU was not a licensed broker, but facilitated the acquisition of shares by clients through an online broker and made a range of financial products available to clients. Halifax AU conducted its business by way of a number of trading platforms.

4 Halifax NZ held a Financial Service Provider’s Licence granted by the Financial Markets Authority (New Zealand), which authorised it to sell derivatives, including contracts for difference, options, futures, margin foreign exchange contracts and non-derivative products including warrants and margin foreign exchanges, equities and exchange-traded funds. Halifax NZ also acted as a broker for its clients in respect of various exchange-traded products including shares and warrants. Halifax NZ conducted its business by providing access for its clients and clients of Halifax AU to certain trading platforms.

5 On 23 November 2018, Halifax AU went into voluntary administration. Halifax NZ went into voluntary administration several days later, on 27 November 2018. The joint and several voluntary administrators of both companies were Morgan John Kelly, Philip Alexander Quinlan and Stewart McCallum (the Administrators).

6 In March 2019, both companies went into liquidation. Messrs Kelly, Quinlan and McCallum were appointed as liquidators of both companies. In May 2019, Mr McCallum resigned his appointment as a liquidator of the companies. We will refer to the remaining liquidators, Messrs Kelly and Quinlan, as the Liquidators in these reasons.

7 In the period prior to November 2018, in breach of applicable statutory requirements, there was commingling between Halifax AU accounts, between Halifax NZ accounts, and between accounts of Halifax AU and Halifax NZ.

8 As at 23 November 2018, there was a deficiency in the funds held by Halifax AU and Halifax NZ to meet client entitlements. In particular:

(a) the total balance of individual client accounts (Total Client Equity Positions) was AUD211.6 million;

(b) the total amount held in accounts in the name of Halifax AU which held client moneys and were designated as s 981B trust accounts (Named s 981B Accounts) (referring to s 981B of the Corporations Act 2001 (Cth)), accounts in the name of Halifax AU or Halifax NZ which held client moneys but were not specifically named as s 981B trust accounts (Investor Fund Accounts) and accounts in the name of Halifax AU or Halifax NZ but which were held by third parties (Third Party Accounts) was approximately AUD192.6 million; and

(c) the difference between the Total Client Equity Positions and the total money held in the Named s 981B Accounts, the Investor Fund Accounts and the Third Party Accounts was approximately AUD19 million.

The amount of AUD19 million was partially offset by an amount of approximately AUD3.668 million, which was held by Halifax AU and Halifax NZ in company accounts and security deposits.

9 The moneys paid to Halifax AU and Halifax NZ by clients were held on trust for the clients’ benefit. As at the date of administration of the companies there was, relevantly, a single deficient mixed fund.

10 By interlocutory process dated 2 July 2019, the Liquidators applied to the Federal Court of Australia for directions and judicial advice regarding a number of questions relating to the distribution of funds held on trust by Halifax AU for its investor clients. A similar application was made in the High Court of New Zealand. With the consent of the parties, the two proceedings were heard together by Markovic J in the Federal Court of Australia and by Venning J in the High Court of New Zealand. The parties consented to the judges conferring with each other. Their Honours delivered separate judgments on the same day: Kelly (Liquidator), in the matter of Halifax Investment Services Pty Ltd (in liquidation) v Loo [2021] FCA 531; and Halifax New Zealand Limited (in liquidation) v Loo [2021] NZHC 1113. As the application before this Court relates to the judgment of the Federal Court, we will refer to Markovic J as the primary judge and to her Honour’s reasons for judgment as the Reasons.

11 In the proceeding before the primary judge, representative orders were made with the effect that persons were appointed to represent the interests of certain categories of investors. Relevantly for present purposes:

(a) Mr Loo was appointed to represent “category 1 investors”, being all clients/investors of Halifax AU and Halifax NZ whose proportionate entitlement to, or share of funds from, the “deficient mixed fund” (as that expression was defined in paragraph 189 of the affidavit of Mr Kelly sworn on 26 June 2019) will be higher after the realisation of all extant investments than it was on the date administrators were appointed to Halifax AU and Halifax NZ.

(b) Elysium was appointed to represent “category 2 investors”, being all clients/investors of Halifax AU and Halifax NZ whose proportionate entitlement to, or share of funds from, the “deficient mixed fund” (as so defined) will be lower after the realisation of all extant investments than it was on the date administrators were appointed to Halifax AU and Halifax NZ.

12 One of the issues before the primary judge, referred to in the Reasons as the “date of valuation issue”, was whether the date for valuation of clients’ proportionate entitlements to the deficient mixed fund should be the date of administration or a date as close as possible to the date for final distribution. Mr Loo, on behalf of the category 1 investors, contended that it should be as close as possible to the date for final distribution. Elysium, on behalf of the category 2 investors, contended that it should be the date of administration.

13 The date of valuation issue arose in circumstances where the Administrators/Liquidators had taken the unusual step of permitting investors to maintain open positions after their appointment. Some investors had maintained open positions and the value of some of those positions had increased.

14 The primary judge determined that the date of valuation of client entitlements to the deficient mixed fund should be the date of administration. For practical reasons, her Honour adopted 27 November 2018, the date of administration of Halifax NZ, rather than 23 November 2018, the date of administration of Halifax AU, as the relevant date. By paragraph 14 of orders made by the primary judge on 19 May 2021, her Honour ordered that, subject to certain other orders, the Liquidators “are justified in adopting 27 November 2018 as the date at which the proportionate entitlements of clients are to be calculated”.

15 No issue is raised concerning the primary judge’s selection of 27 rather than 23 November 2018. Accordingly, for present purposes, it is unnecessary to distinguish between those two dates.

16 On 15 June 2021, Mr Loo filed an application for an extension of time to seek leave to appeal from paragraph 14 of the primary judge’s orders. The application was heard together with the appeal (should the extension of time and leave be granted). In advance of the hearing, orders were made appointing Mr Loo as representative of the category 1 investors and Elysium as representative of the category 2 investors (in each case, adopting the definitions of those categories that applied at first instance) for the purposes of the application and any appeal.

17 Mr Loo also filed a notice of appeal in respect of the comparable order made by Venning J in the New Zealand proceeding. With the consent of the parties, the application in this Court and the appeal in the Court of Appeal of New Zealand (Kós P, Cooper and Goddard JJ) were heard concurrently. The parties were represented by the same counsel (with one additional member of counsel appearing in the New Zealand appeal) and relied on the same written and oral submissions in both proceedings. The parties consented to the members of this Court conferring with the members of the Court of Appeal of New Zealand and we have done so. It is appropriate to confirm that this judgment is our own judgment.

18 In respect of the Australian proceeding, Mr Loo, on behalf of the category 1 investors, contends that the primary judge erred in relation to the date of valuation issue and her Honour should have chosen a date as close as possible to the date for final distribution. Elysium, on behalf of the category 2 investors, supports the primary judge’s determination. The Liquidators have adopted a neutral position, but have made submissions to assist the Court.

19 For the reasons that follow, we have concluded that the application for an extension of time and the application for leave to appeal should both be granted, but that the appeal should be dismissed. In summary, we consider that no error is shown in the primary judge’s determination that the date for valuation of clients’ proportionate entitlements to the deficient mixed fund should be the date of administration.

Background facts

20 The background facts are set out in detail in section 3 of the Reasons. No issue is taken with her Honour’s statement of the background facts. Given the confined nature of the present application and any appeal, it is unnecessary to set out all of those facts in detail. We will focus on the facts and matters that are, or may be, of particular relevance to the present application.

21 On 12 March 2019, the Administrators provided a report to creditors of Halifax AU. The purpose of the report was to table the findings of the Administrators’ investigations of Halifax AU’s business, property, affairs and financial circumstances, as well as their opinion on the options available to creditors in deciding the future of the company at the second meeting of creditors. In section 5.4 of the report (Calculation of entitlements), the Administrators stated:

The recent decision in BBY suggests that it is preferable to use consistent data for ascertaining Client entitlements, and that the starting point is that the date of the appointment of administrators is the appropriate date at which to calculate entitlements. There is thus a strong argument in support of the position that all Clients’ entitlements should be valued as at the time the Administrators were appointed to the Company.

Such a position is somewhat complicated where Client positions remained open on the appointment date. In such circumstances, it may be appropriate to determine the value of the positions by reference to the value of those positions when closed out.

The calculation of such entitlements is not straightforward and the approach to be taken in relation to such open positions will depend on a number of factors, including:

— Whether it is reasonably practicable to carry out a calculation of the value, as at the appointment date, of positions which were open on the appointment date but which were closed out subsequently; and

— Whether it is the position that the value of all of the open positions on the date when they are closed out will be viewed to be the best available, and the most reasonable, value to be given to those positions as at the appointment date.

It appears that it is reasonably practicable to carry out a calculation of the value, as at the appointment date, of positions which were open on the appointment date but which were closed out subsequently. Accordingly, it appears that the appointment date of 23 November 2018 is likely to be accepted by the Court as the appropriate date for crystallising the value of all investments.

(Emphasis added.)

22 As stated in section 8.2 of the report, as a result of the appointment of the Administrators and in accordance with the terms of the AFSL, all investor accounts were “frozen” as at the date of appointment. Investors were able to close out positions, but no new trades could be entered into.

23 In section 13.1 of the report (Return to Investors and creditors), it was stated:

As outlined in Section 5.3 (sic), the recent decision in BBY Limited suggests that the date of the appointment of administrators is the appropriate date at which to calculate entitlements.

However, such a position is somewhat complicated where Client positions remained open on the appointment date. In such circumstances, it may be appropriate to determine the value of the positions at the time they were closed out, unless it is reasonably practicable to carry out a calculation of the value, as at the appointment date, of positions which were open on the appointment date but which were closed out subsequently.

It appears that, with Halifax, it is reasonably practicable to carry out such a calculation of positions which were open on the appointment date but which were closed out subsequently.

Accordingly, it appears that the appointment date of 23 November 2018 is likely to be accepted by the Court as the appropriate date for crystallising the value of all investments, even in respect of Client positions that remained open on the appointment date.

However, this will ultimately be determined by the Court.

(Emphasis added.)

24 On 20 March 2019, the second meeting of Halifax AU’s creditors took place. In item 12 of the minutes (headed “Pooling”) the following matters are recorded:

The Chairperson advised that examples of issues where a liquidator, if appointed, would likely seek a determination by the Court include:

…

— How positions which remain open should be dealt with; and

…

The Chairperson advised that if the Administrators are appointed as liquidators, they intend to propose that representative defendants be appointed to represent the respective interests of the different classes of clients. This would ensure that arguments are presented for and against each position.

25 In item 15 of the minutes it was stated that the investigations undertaken by the Administrators to that date indicated a deficiency in client funds of approximately $19.7 million.

26 The materials before the Court include a transcript of the second meeting of creditors. The following exchange is recorded at pages 13-15:

Barry Brading: | It’s number 75, my name’s [Barry Brading]. My question is around the calculation date for the loss, whether it’s nine per cent or five per cent. Is it the calculation date 23 November or would it be the calculation date later and therefore the variation in asset values subsequent to 23 November would be 100 per cent owned by the client whether it be a profit or whether it a be a loss? As well as that question I’d like to know what will happen to the platform when liquidation takes place. Will that mean that we will have to close out all our positions and turn them into cash, or can we continue to hold positions? Given that most of us are probably long term investors and we would like to keep invested rather than having money sitting there where it’s not earning any interest at all or any other values and - yeah, I think that’s probably the two questions. |

Morgan Kelly: | Those are both very, very good questions and very key issues. In relation to the first question the date of valuing investor claims and the date of valuing trust assets is obviously really important. The total investor equity position has moved significantly since the date of our original appointment. There has been recent case law which is the BBY matter where the courts have held that the appropriate date for valuing investor claims is the date of actual appointment, so in our case that would be 23 November 2018. If the assets have appreciated in value (which they have at this stage) then it may be the case that there is a larger pool of assets to be distributed amongst investor creditors than there was at 23 November 2018 (being the date on which investor claims are valued). Now I’ll move to your next question. Which date is determined or which date is used will be determined by the courts? If it is the date of 23 November then all the net gains afterwards will be available to investors in the event that pooling is undertaken (subject to us obtaining directions from the Court in this regard). Now with respect to your question about closing out, again if you’re distributing - if we choose a date, say 23 November, and that’s the date that investor positions are being valued at, that’s a static position, but the open positions of investors are fluid and they change regularly. You can’t distribute equally amongst a static position with a fluid moveable asset on this side. So at some point in time some hard stop may be required. That may require all positions to be closed out and funds converted to cash and distributed. Now that’s obviously got some considerations around that, for example just simple issues like paying brokerage. For those investors that have open positions the situation remains that we won’t close them, unless the court determines we are required to do so. |

Barry Brading: | Just so that I understand for the movements in the value of assets subsequent to 23 November I think I understood you to say that that will not be 100 per cent to my account. You’re saying if I’ve made $100,000 in increased value from 23 November that value is going to be available to other people as well as part of the pooling arrangement and not 100 per cent to my account. Is that what you’re saying?’ |

Morgan Kelly: | That’s a possible outcome, but that is not necessarily going to be the outcome. But if a pooling Order is obtained and the date for valuing claims is 23 November 2018 then yes, that is what will happen. |

Barry Brading: | So why would an investor agree to pooling if people have held their accounts open and most accounts if they’ve held their equities have increased substantially in value since 23 November? |

Morgan Kelly: | Sir, that’s precisely why we don’t want to make a pooling application without giving investors such as yourself the opportunity to be represented in court to argue to not pool and to not make those funds available to other investors. |

Barry Brading: | Yeah, okay. |

27 The following exchange, which includes Mr Jason Opperman of K&L Gates, the solicitors acting for the Liquidators, is recorded at pages 16-17 of the transcript:

Jody Elliss: | Hi, I’m Jody Elliss from Investor Centre, card 212. Is it possible that we can argue for another date other than the 23rd? We - just to clarify that, I recommended to all Investor Centre clients not to liquidate positions at the bottom of the market and 23 November we were very low for Australian equities, which is our primary interest. We were anticipating a subsequent rise in January for the marketplace, so our advice to clients was don’t liquidate as at that date. So they’ve held equities, or I assume – I’ve held my equities and they’ve held theirs. Can we argue for another date other than 23 November? |

Morgan Kelly: | Absolutely. That’s not to say that 23 November 2018 is definitely going to be the date to value investor claims moving forward, that’ll be up to the court. The facts of the BBY case are very different to Halifax and there are different circumstances that present there. But I’d take it a step further and say it’s not even necessarily the date that would apply for all the investor classes and it may well be appropriate to deal with different investor classes at different dates. |

Morgan Kelly: | Jason, is there anything to add to that in terms of the BBY example? |

Jason Opperman: | No, I mean Morgan is correct, the BBY example was remarkably different to this particular situation and there were quite distinct product lines in BBY, in particularly their ETO, exchange traded options, and equities that were traded and cleared through the ASX. Those positions are quite different to the co-mingling that has happened here. So it really is going to be a matter for the court to review these specific circumstances and decide on the appropriate date. The other complexity here is the relationship and the co-mingling with the New Zealand investors as well. We’ve got some jurisdictional issues with the fact that there is an, if you like, parallel administration happening in New Zealand at the moment and investors there that are also making claims and seeking to pursue their entitlements. So that adds a layer of complexity to the commingling issue as well here that’s different to BBY. |

28 Further relevant exchanges are recorded at pages 19-20 and 22-23 of the transcript. However, it is not necessary to set these out. Halifax AU was placed into liquidation at the second meeting of creditors.

29 On 17 April 2019, the Liquidators sent a circular to creditors. Under the heading “Operations” on page 1, it was stated that the Liquidators were continuing to maintain the trading platforms, IT infrastructure, and office operations on a limited basis to (among other things) “[a]llow investors to close out any remaining open positions”. It was stated that “[a]ll investor accounts have been switched to ‘Close Only’ mode – i.e. it is not possible to enter into new positions, nor is it possible to withdraw money from investor accounts, however it is possible to close out current positions”. The circular included, under the heading “Estimated outcome for creditors and investors”:

As advised in our Administrators’ Report, we estimate that a dividend of approximately 85 to 95 cents in the dollar will be payable to investors in their capacity as beneficiaries with an entitlement to claim trust monies.

This estimate is preliminary only and may be subject to revision. In particular, it may be impacted by any market movement in the value of open positions and the Court’s determination on any appropriate pooling and the date to value investor claims.

(Emphasis in original.)

30 On 14 June 2019, the Liquidators provided a statutory report. In the executive summary it was noted that all investor accounts remained in ‘close only’ mode and the Liquidators did not expect this position to change in the short to medium term. In section 8.1 (Return to Investors and creditors) it was stated:

As foreshadowed in section 13.1 of the Voluntary Administrators’ Report, the decisions of the NSW Supreme Court in the BBY Limited matter suggest that the date of the appointment of the Administrators is the appropriate date at which to calculate entitlements.

On this basis 23 November 2018 is likely to be the date on which investor claims are crystallised. However, this will ultimately be determined by the Court.

As per the Voluntary Administrators’ Report, the variance between possible scenarios as to the appropriate date for calculation of entitlements is significant as the market values of open investor positions have moved materially since the appointment of the Administrators (and will continue to move).

(Emphasis added.)

31 On 3 July 2019, the Liquidators filed an interlocutory process in the Federal Court seeking directions and judicial advice. The Liquidators sought the following relief in paragraph 9 of the interlocutory process:

A direction, and judicial advice, as to whether the Liquidators and Halifax Australia are entitled to calculate, or would be justified in calculating, the value of the investments by each client, for the purposes of distributions pursuant to paragraph 5 above:

(a) on 23 November 2018, being the date on which the Administrators were appointed to Halifax Australia;

(b) on 27 November 2018, being the date on which the Administrators were appointed to Halifax NZ;

(c) on the date of sale, closing out or realisation of each individual investment; or

(d) if not (a), (b) or (c), on what date.

32 On 5 July 2019, the Liquidators provided an update to investors, including an update on the Court application. A further update was provided on 31 July 2019.

33 On 14 November 2019, Gleeson J, then a Judge of this Court, made orders in the proceeding at first instance, including an order pursuant to s 90-15 of the Insolvency Practice Schedule (Corporations), being Schedule 2 to the Corporations Act, that the Liquidators provide a communication to investors in the form attached to the orders. The attached investor notice included a questionnaire regarding the closing out of investor positions (the questionnaire was Annexure C to the investor notice).

34 On 24 December 2019, the Liquidators provided an update to investors.

35 In an affidavit dated 25 March 2020, filed in the proceeding at first instance, Mr Kelly stated:

51. Since the Appointment Dates, the Liquidators have continued to permit each Investor to close out open positions, or to sell or realise investments in financial products, on the trading platforms at the Investor’s own discretion, but have not entered into any new transactions or trades on behalf of Investors. In effect, the Liquidators have allowed Clients to convert their investments to cash (for non-derivative products) or to crystallise the liability between Halifax AU and the Client (for derivative products), although the date for valuing claims has not yet been determined. The Investors have been notified on a number of occasions of their ability to close extant investments, including (without limitation) by Reports to Creditors, FAQs posted to the Halifax AU and Halifax NZ websites, and Investor Notices.

52. However, notwithstanding these Investor notices, since the Appointment Dates, a total of only 18,235 positions have been closed by Investors, still leaving 22,645 open positions.

36 Mr Kelly referred to the questionnaire that was Annexure C to the investor notice and stated:

59. A total of 68 responses were received in relation to Annexure C. The responses were overwhelmingly in support of refraining from closing out. The 68 Investors who responded to this issue included:

(a) 49 Investors who advised that they did not want Investor positions to be closed out;

(b) 8 Investors who advised that they wanted Investor positions to be closed out; and

(c) 11 Investors who responded on the issue, but did not put forward any clear position.

37 Mr Kelly then summarised the key points advanced by investors who did not want the open positions to be closed out, and the key points raised by investors who said that all open positions should be closed out. Mr Kelly stated, at paragraph 64 of his affidavit, that one of the issues that was raised in response to the investor notice was that realising extant investments may expose investors to potentially adverse taxation consequences.

38 Mr Kelly stated at paragraphs 67-68 of his affidavit that: at the time the investor notice was issued, he considered that there may be utility in seeking a direction or judicial advice in respect of the closing out of extant investments in advance of the other issues raised by the interlocutory process; since the time of the investor notice he had considered the issue further, particularly in light of the further information he had gained and the further views that had been conveyed to him; there were competing considerations in favour of and against closing out extant investments; based on the material available to him, he had decided that, subject to receiving directions and judicial advice from the Court, the appropriate course was to refrain from realising all extant investments until the determination by the Court, following final hearing, of the substantive issues raised in the interlocutory applications. (By this stage, the Liquidators had filed an originating application in the High Court of New Zealand in addition to the interlocutory process in the Federal Court of Australia.) Mr Kelly set out his reasons for coming to this view at paragraphs 71-80 of his affidavit. These included:

71. First, if all extant investments were realised in advance of all other issues in the Interlocutory Application being determined, this would preclude the Plaintiffs and Halifax AU from making an in specie distribution of any investments and this would have a number of consequences that many Investors may regard as adverse.

72. The possibility of making an in specie distribution to Investors was raised by a number of Investors who responded to the Investor Notice. Some of those Investors put forward a proposal whereby, even if a particular investment was not traceable, Investors could receive an in specie distribution of particular investments on the basis that, in effect, they would pay cash to fund any excess in the value of the assets transferred by in specie distribution when compared with the entitlement of that Investor as determined by the Courts.

73. If Investors received an in specie distribution, this may also mean that Investors do not incur a capital gains tax liability, at least in the short term, in respect of the assets so transferred. On the other hand, if extant investments are realised now, this may well crystallise a capital gains tax liability on the part of many Investors.

74. Further, if an in specie distribution occurred in respect of some or all investments, this would reduce the percentage of the portfolio of investments held by Halifax AU that would need to be realised. This could significantly reduce the time and cost involved in realising the portfolio and therefore maximise the value of the portfolio.

75. Secondly, a related argument against closing out all extant investments now is that some Investors contend that they hold an investment that is traceable and that they should therefore not share in the deficiency resulting from the use by Halifax AU of Investor funds for operating expenses (see my First Australian Affidavit at [24]) and resulting from the application of Investor funds for the costs and expenses of the liquidation and the litigation. If all extant investments were realised now before the Court had made a determination in respect of whether those investments were traceable, that would preclude those Investors from obtaining an in specie distribution of those investments which were traceable.

39 On 23 April 2020, Gleeson J delivered an interlocutory judgment in the proceeding at first instance: Kelly, in the matter of Halifax Investment Services Pty Ltd (in liquidation) (No 8) [2020] FCA 533 (Kelly (No 8)). Her Honour made a direction, pursuant to s 90-15 of the Insolvency Practice Schedule (Corporations), that the Liquidators were justified in refraining from realising any and all extant investments until determination of all substantive issues in the proceeding. Her Honour’s core reasoning for making this direction was set out at [70]-[80] of the judgment. In particular, her Honour stated at [80]:

… I am satisfied that this an appropriate case for a direction of the kind sought by the liquidator having regard to the matters set out at [69] to [76] above. In particular, on the available evidence the following matters justify the making of such a direction:

(1) The liquidators are not able to make a decision about when to close out extant investments that will meet the wishes of all investors and they cannot confidently predict that any particular approach to closing out positions will be in the interests of all investors.

(2) The orderly and efficient determination of the issues in the proceeding requires the determination of potential entitlements to in specie distribution of investments prior to closing out of all extant positions.

(3) The liquidators’ proposal to refrain from closing out is consistent with the apparent wishes of a substantial number of investors, who currently hold over 22,000 open positions.

(4) Although the liquidators’ proposal is contrary to the wishes of some investors, they are very much in the minority. Moreover, the evidence does not reveal any clear benefit to an early closure of positions held by or on behalf of an investor who does not seek to close out. Even accepting that the additional costs of maintaining the investment platforms are significant, it is not possible to say that those costs will not be recouped or exceeded by increases in the value of the extant investments. Thus, it is [not] obvious that any investor will ultimately be disadvantaged if the liquidators act in accordance with their proposal.

40 On 31 August 2020, the Liquidators provided a report to investors and creditors. Section 9 of the report provided an estimate, by way of an Estimated Outcome Statement (EOS), of the distribution to be received by investors subsequent to the receipt of judicial advice and directions. Section 9.4 was headed “Date of valuation of investor claims” and noted that representative defendants had been joined to the Court proceedings to represent the category 1 and category 2 investors. The report stated:

The Courts will determine the date on which Investor claims should be valued. That date will have a material impact on the likely outcome for individual Investors. As noted above, the date selected by the Courts will not necessarily be the date for which either the representative of Category 1 or the representative of Category 2 contends.

To assist Investors in forming a view as to the potential return, we have presented this EOS showing the following scenarios:

– Total investor entitlements (account balances) are calculated after the realisation of all extant investments. For illustrative purposes only we have used 31 July 2020 (noting that this date cannot be the date contended for by the representative of Category 1 because the realisation of all extant investments has not occurred). In this scenario, the Category 1 argument prevails; and

– Total Investor entitlements (account balances) are calculated as at 23 November 2018 (the date that voluntary administrators were appointed). In this scenario, the Category 2 argument prevails.

The variance between these scenarios is significant given the value of investor account balances has increased from $211.7 million as at 23 November 2018 to $264.8 million as at 31 July 2020. Please note that the reference to “investor account balances” throughout this document refers to the recorded value of investor accounts on the various trading platforms and is not representative of the assets available for distribution to Investors.

(Emphasis in original.)

41 As is apparent from the above extract, the total value of investor account balances had increased substantially between the date of administration and 31 July 2020 – from approximately AUD211.7 million to approximately AUD264.8 million. This increase was wholly or largely due to increases in the account balances of investors who had maintained open positions (but noting that some account balances with open positions had decreased).

42 In section 9.6.2 of the report, two worked examples of potential returns to investors were set out. As explained in the above extract, the date 31 July 2020 was used for illustrative purposes only. The examples were as follows:

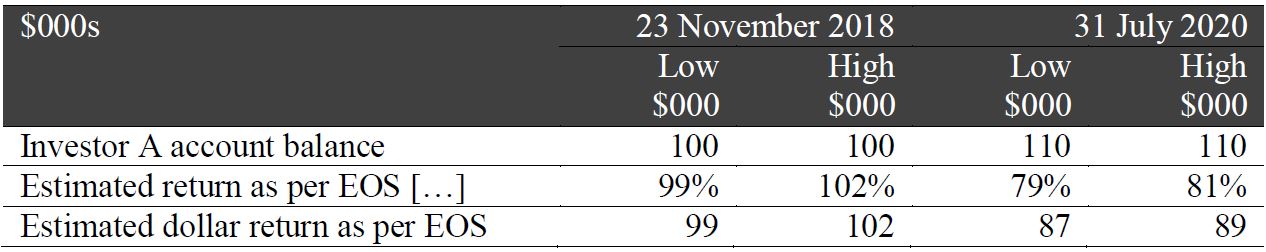

Worked example 1: Investor A

Investor has an account balance of $100,000 as at 23 November 2018 and $110,000 as at 31 July 2020. It is assumed that Investor A falls within Category 2 above. The following table provides a summary of the estimated returns based on the EOS outlined above and subject to the various assumptions and disclaimers set out in this document.

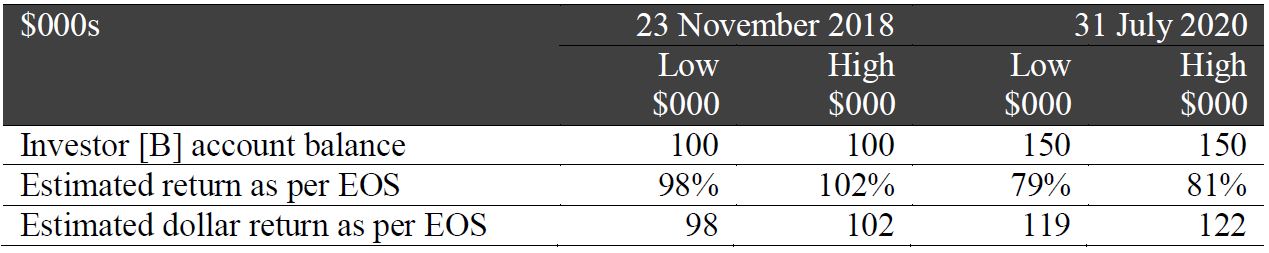

Worked example 2: Investor B

Investor B has an account balance of $100,000 as at 23 November 2018 and $150,000 as at 31 July 2020. It is assumed that Investor [B] falls within Category 1 above. The following table provides a summary of the estimated returns based on the EOS outlined above and subject to the various assumptions and disclaimers set out in this document.

43 The worked examples are useful in illustrating the competing positions of the parties on the date of valuation issue. Mr Loo contends that the date of valuation of investor entitlements should be as close as possible to the date for final distribution (notionally 31 July 2020 in the above examples). The effect of this approach would be that investors (such as Investor B) who maintained open positions and whose account balances have increased in value, would stand to benefit from those increases, while investors (such as Investor A) who closed their positions, would not stand to benefit from those increases. On the other hand, Elysium contends that the date of valuation of investor entitlements should be the date of administration (23 November 2018). The effect of this approach would be that all investors share in the increase in total account balances to the extent of their proportionate entitlements as at the date of administration.

44 The parties prepared an agreed statement of facts dated 3 November 2020. This included the following agreed facts:

50. On 31 July 2020 there were 1,028 investors in Category 1 and 10,910 investors in Category 2.

51. At as 23 November 2018, the total value of the 1,028 investor account balances that were notionally in Category 1 as at 31 July 2020, was A$81,908,935.41.

52. As at 23 November 2018, the total value of the 10,910 investor account balances that were notionally in Category 2 as at 31 July 2020, was A$129,692,896.28.

53. As at 31 July 2020, the total value of the 1,028 investor account balances that were notionally in Category 1 as at 31 July 2020, was A$138,036,324.77.

54. As at 31 July 2020, the total value of the 10,910 investor account balances that were notionally in Category 2 as at 31 July 2020, was A$126,761,344.07.

…

61. Since 23 November 2018, the Administrators, and subsequently the Liquidators, have permitted investors to close out open positions, or to sell or realise investments in financial products, but have not entered into any new transactions or trades on behalf of investors.

62. Investors have been advised on various occasions since 23 November 2018 that they are permitted to close out open positions, but cannot enter into new positions.

(Footnote omitted.)

45 As set out in the Reasons at [97], the Liquidators expressed the opinion that, save for funds deposited shortly prior to or after the appointment of the Administrators that were not allocated to any client account:

(a) as a result of the significant commingling between the funds that were held in the bank accounts held by Halifax AU and Halifax NZ as at 23 November 2018 (Bank Accounts) and between the MT4, MT5, IB AU and IB NZ platforms (as defined in the Reasons) and across clients that have signed a client service agreement (CSA) with Halifax AU or with Halifax NZ, it is not practically feasible to identify money in any particular Bank Accounts or statutory trust accounts held by Halifax AU or Halifax NZ, or held by IB, Gain and Invast (as defined in the Reasons), as belonging to any individual client of Halifax AU or Halifax NZ;

(b) the exercise of attempting to identify and trace funds deposited by each client into each statutory trust account would be extremely time consuming and expensive and the likely costs of undertaking such an exercise would be disproportionate to the likely deficiency and the potential benefits clients would gain from such an exercise;

(c) it is not feasible to determine how much of the deficiency should be regarded as standing to the credit of any particular statutory trust account, let alone to the credit of any particular clients of Halifax AU or Halifax NZ;

(d) a large part of the funds that make up the Client Moneys (as defined at [79] of the Reasons) which, following the sale, closing out or realisation of investments on the IB platform, will be held by Halifax AU and Halifax NZ on trust for clients arise from, in effect, a single “deficient mixed fund” containing moneys held on trust both by Halifax AU for those clients who invested through it and by Halifax NZ for those clients who invested through it. Tracing of any entitlement on the part of individual clients is, in an extremely high percentage of cases, not practically feasible; and

(e) funds that Halifax AU received from and held for its clients became so commingled with the funds that Halifax NZ received from and held for its clients that the Liquidators are unable to distribute the trust funds in a manner which they can be satisfied accords with strict legal requirements.

The Reasons

46 The primary judge identified the defendants (including the representatives of various categories of investors) in section 1 of the Reasons, and discussed the nature of the proceeding in section 2 of the Reasons.

47 The primary judge set out the background facts in section 3 and the statutory framework and legal principles in section 4 of the Reasons. Among other provisions, her Honour referred to ss 981A, 981B, 981F and 981H of the Corporations Act and reg 7.8.03 of the Corporations Regulations 2001 (Cth).

48 In section 5 of the Reasons, headed “Client moneys are held on trust”, the primary judge noted at [134] that there was no dispute that the moneys paid by clients to Halifax AU and Halifax NZ were held on trust for the clients’ benefit. Her Honour stated at [135] that, insofar as Halifax AU was concerned, moneys paid to it by clients were moneys to which Subdiv A of Div 2 of Pt 7.8 of the Corporations Act applied; accordingly, pursuant to s 981H, those moneys were taken to be held on trust by Halifax AU for the benefit of those clients. The reasons for reaching that conclusion were set out at [136]-[145] of the Reasons, which are not the subject of challenge.

49 In section 6 of the Reasons, the primary judge considered whether there was a single deficient mixed fund. The primary judge set out at [149]-[158] a summary of the evidence as to the flow of funds: first, between accounts held by Halifax AU; secondly, between accounts held by Halifax NZ; and thirdly, between, on the one hand, accounts held by Halifax AU and, on the other, accounts held by Halifax NZ. The primary judge held at [159] that there was commingling between Halifax AU accounts, between Halifax NZ accounts, and between accounts of Halifax AU and Halifax NZ in various ways. This included, relevantly for present purposes, commingling described by the primary judge in the following way:

despite the time it took for the funds deposited by Halifax AU and Halifax NZ clients to clear, they were credited immediately with funds which they could use to trade. This meant that clients were in fact using the commingled pool of funds deposited by other clients to trade …

50 The primary judge held at [161]-[162] that as at 23 November 2018 there was a deficient mixed fund. At [163], the primary judge set out a passage from the judgment of Gordon J in Georges (in his capacity as joint and several liquidator of Sonray Capital Markets Pty Ltd (in liq)) v Seaborn International (as trustee for the Seaborn Family Trust) (2012) 288 ALR 240 (Sonray) at [82]-[86] in which her Honour discussed the principles applicable to a deficient mixed fund. At [164], the primary judge stated that, with the exception of the Whitehead interests (the sixth and seventh defendants in the proceeding at first instance, who have not appeared on the present application), there was no dispute between the parties about the existence of a single deficient mixed fund and the applicability of the principles identified in Sonray. The primary judge also stated that “given that the Liquidators have established that it is not possible to work out with any precision who is entitled to what moneys in the accounts held by Halifax AU and Halifax NZ, the moneys so held should be pooled”. That was the “inevitable outcome” of the evidence, the primary judge stated. No issue is raised in the present application about these findings and conclusions.

51 In section 7 of the Reasons, the primary judge considered whether any clients should be excluded from the pooling order. This involved a consideration of the positions of the Whitehead interests and categories of investors referred to as the category 3 investors and category 5 investors. The present application does not involve any challenge to this part of the Reasons.

52 Section 8 of the Reasons, headed “How should the pooled funds be distributed?”, is the section of principal relevance for present purposes. In this section of the Reasons, the primary judge considered two issues. The first, referred to as the “distribution issue”, was whether there should be an in specie distribution of each client’s portfolio. The second issue, referred to as the “date of valuation issue”, was whether the Liquidators should value the client positions as at the date of administration, or as at a date as close as possible to the date for final distribution. While it is the second of these issues that is directly relevant for present purposes, we outline the primary judge’s consideration of the first issue to provide context for her Honour’s consideration of the second issue.

53 The primary judge summarised the evidence relied on by Mr Loo at [288]-[297]. This included a proposed method of distribution dealt with in the evidence of Barry Taylor, a chartered accountant, registered liquidator and trustee in bankruptcy. This was referred to as “Methodology 3” in the Reasons.

54 The primary judge dealt with the distribution issue at [298]-[324]. As recorded at [298], Mr Loo, on behalf of category 1 investors, proposed an in specie distribution in accordance with Methodology 3. Mr Loo submitted that he had made investment decisions since the date of the appointment of the Administrators, for example by electing to keep positions open, by selecting the time at which to close positions and by electing to exercise call options. He submitted that there had been a significant change in his position since the administration date and that this was the result of the positive investment strategy he had pursued.

55 The primary judge concluded that an in specie distribution was not appropriate: at [312]-[324]. The primary judge stated at [313]:

Of central importance to the resolution of the issues that arise in this case are the following propositions. First, once a contribution was made to the mixed fund, it ceased to be identifiable. All clients’ rights became proportionate rights to the fund as it exists from time to time. Secondly, once the assets of Halifax AU and Halifax NZ became part of a deficient mixed fund, any beneficial interest held by clients in particular assets acquired through their trading ceased to exist. As the Liquidators submit, the respective interests of clients in particular assets transmogrified into an equitable charge over all of the assets within the deficient mixed fund securing the value of the contribution made by each client in respect of those assets: see Sonray at [83].

56 The primary judge considered that a distribution in specie in accordance with Methodology 3 “would be of such complexity and would take so much time that the Liquidators would be justified to distribute on a pari passu basis”: at [315]. The primary judge’s reasons for rejecting an in specie distribution also included as follows:

316 The Liquidators’ evidence establishes that it is not possible to identify, by way of tracing, on behalf of which clients particular assets are held. Mr Sutherland’s evidence is that undertaking an exercise to trace all deposits since 2016 would cost between approximately AUD26.4 million and AUD37.5 million as well as the cost of additional employees and leasing.

317 Putting that to one side, the Liquidators have attempted, by way of worked examples, to find a way to achieve an in specie distribution which would be fair and equitable to clients as a whole but which would avoid the risks resulting from the constant fluctuation in the value of assets where open positions are still held. However, they have been unable to identify a way in which to distribute the assets that would operate fairly and equitably in relation to the body of clients as a whole.

318 Methodology 3 does not result in each client ending up with their proportionate entitlement of the available fund. That is because under Methodology 3 the total value of assets to be allocated to category 1 investors includes the increase in value in their investments between the date of administration and the date of distribution. This means that the value of entitlements of those receiving an in specie distribution under Methodology 3 would not be confined to the value of their proportionate entitlements calculated as at the date of administration. In contrast, the balance of clients, who would not receive an in specie distribution, would receive an entitlement confined to a value calculated as at the date of administration alone.

319 Methodology 3 results in most, if not all, post administration gains going only to some creditors, i.e. those with open positions, and thus discriminates between creditors. It is a divergence from the intent of reg 7.8.03(6) of the Corporations Regulations which, it has been observed, mandates a pari passu distribution: see MF Global at [102].

57 Having considered, and rejected, the contention that there should be an in specie distribution, the primary judge considered the date of valuation issue at [325]-[339]. Mr Loo contended on behalf of the category 1 investors that if the Court determined that an in specie distribution was not practically feasible, then there should be a closing out of all extant investments with the date of calculation of respective entitlements being as close as practicable to the date on which distributions were to be made to clients of Halifax AU and Halifax NZ. Elysium contended on behalf of the category 2 investors that the Liquidators ought to value all client positions as at the date of appointment of the administrators to Halifax AU, namely 23 November 2018.

58 There was no dispute between Mr Loo and Elysium that a single date should be appointed for the valuation of client positions: Reasons, [329]. In this regard, the primary judge referred to the judgment of Black J in Re MF Global Australia Ltd (in liq) (2012) 267 FLR 27 (MF Global) at [110], the judgment of Gordon J in Sonray at [112] and the judgment of Brereton J in Re BBY Limited (Receivers and Managers appointed) (in liquidation) (No 3) [2018] NSWSC 1718 at [4].

59 The primary judge’s core reasoning on the date of valuation issue was as follows:

333 Mr Loo submits that in Sonray and BBY (No 3) no party spoke against the proposition that the appropriate date for valuation of a client’s proportional entitlement should be the administration date but the position is different here. In other words, Mr Loo says that in the absence of any contradictor in relation to the date of valuation the Court in those cases was not required to consider an alternative date. That may be so but in MF Global there was no consensus about the date. After setting out the differing positions put by the parties, at [114] Black J said:

I have referred to the structure of the relevant provisions above. Regulation 7.8.03(4) imposes a trust in favour of a person entitled to be paid money from an account maintained for s 981B at the point that, relevantly, an administrator is appointed to a financial services licensee under ss 436A to 436C of the Corporations Act. Regulation 7.8.03(6) specifies how money in the account is to be paid. In my view, the adoption of the Appointment Date as the date for the quantification of entitlements finds strong support in the approach adopted in trust law generally and in insolvency.

334 At [117] his Honour continued:

In the present case, the trust under reg 7.8.03(4) is imposed on the Appointment Date and that supports a quantification of entitlements under that trust for the purposes of distribution under reg 7.8.03(6) as at that date. The arguments for calculation as at the date of payment, which Underdog helpfully identified, are weakened by the fact that it will always be necessary to determine entitlements prior to the date of payment so as to allow the amounts to be paid to be calculated. In that case, a determination at the Appointment Date has a principled basis which an arbitrary later date closer to the date of payment would lack. The difference between a determination of entitlements at the Appointment Date and at the later date of payment under reg 7.8.03(6) may be reduced, at least where clients’ positions are closed on a licensee’s insolvency, if the concept of “entitlement” includes (as I hold in [135]-[145] below) at least contingent entitlements which will be realised on closing clients’ open positions.

(Emphasis added.)

335 Regardless of which date is chosen to value clients’ proportionate entitlements, prejudice will be suffered by one category or other of clients.

336 On the one hand, Mr Loo’s evidence focusses on suffering prejudice and subsidising clients who have lost value since the date of appointment of the administrators or who closed out their positions and have forgone any potential upside in exchange for eliminating their exposure. However, as Elysium submits category 2 investors stand to suffer an actual decrease in entitlement from their account value on the date of appointment of the administrators to Halifax AU should a later date be chosen by comparison to category 1 investors. As to the latter, their prejudice is not receiving the full benefit of the profits accrued to their account after the administration date. That that is so is illustrated by the investor update provided by the Liquidators dated 31 August 2020 by which they provide an estimate, by way of an Estimated Outcome Statement, of the distribution to be received by clients subsequent to the determination of this proceeding and the proceeding in the NZ High Court. In particular using 31 July 2020 as an alternative valuation date:

(1) a category 2 investor with a balance of AUD100,000 as at 23 November 2018 and a balance of AUD110,000 as at 31 July 2020 will receive a return of only AUD87,000 or AUD89,000 (depending on recoveries). That client would thus incur an actual loss of AUD11,000 or AUD13,000 on their November 2018 balance;

(2) by comparison, a category 1 investor with a balance of AUD100,000 as at 23 November 2018 and a balance of AUD150,000 as at 31 July 2020 will receive a windfall of AUD19,000 to AUD22,000 (depending on recoveries) on their 23 November 2018 balance; and

(3) if entitlements are valued as at 23 November 2018 both groups will see a return with a decrease, or increase, of AUD1,000 to AUD2,000 on their 23 November 2018 balances.

337 Having regard to the authorities referred to above, and in particular the comments of Black J in MF Global at [117], the more principled date for the date of valuation of clients’ entitlement is the date of appointment of the administrators.

338 One further issue arises. That is whether the date should be the date of the appointment of administrators to Halifax AU, 23 November 2018, or the date of the appointment of administrators to Halifax NZ, 27 November 2018. In that regard, it is more appropriate to adopt the latter, being the date of the appointment of administrators to Halifax NZ, because there may have been investment activity by clients of Halifax NZ between 23 and 27 November 2018.

339 Accordingly, the appropriate date for valuation of clients’ proportionate entitlements is 27 November 2018.

60 In sections 9 and 10 of the Reasons, the primary judge dealt with other issues that are not relevant for present purposes.

61 The primary judge’s conclusion in respect of the date of valuation issue was reflected in paragraph 14 of the orders dated 19 May 2021. By that paragraph, it was ordered that, subject to certain other orders, the Liquidators “are justified in adopting 27 November 2018 as the date at which the proportionate entitlements of clients are to be calculated”.

The application for an extension of time and leave to appeal

62 By application filed on 15 June 2021, Mr Loo seeks an extension of time to seek leave to appeal, and seeks leave to appeal, in respect of paragraph 14 of the primary judge’s orders dated 19 May 2021. The grounds of the application are set out in the affidavit of Danielle Funston sworn 15 June 2021. In brief, it is explained that the delay in filing the application was caused in part by meeting with various litigation funders and allowing them time to consider the merits of bringing an appeal.

63 In our view, a satisfactory explanation has been provided as to why the application for leave was filed out of time and the leave application has merit. It is not suggested that there is any prejudice in an extension of time being granted and the period of delay is relatively short. It is therefore appropriate to grant the application for an extension of time. As for the application for leave to appeal, the proposed appeal raises an issue of some importance and the proposed grounds of appeal have merit. Accordingly, we consider it appropriate to grant Mr Loo leave to appeal from paragraph 14 of the primary judge’s orders dated 19 May 2021.

The appeal

64 Mr Loo’s grounds of appeal are set out in his draft notice of appeal (which is annexure “DAF3” to Ms Funston’s affidavit of 15 June 2021). The grounds are as follows:

1. The Primary Judge erred in concluding that the Liquidators of Halifax Investment Services Pty Ltd (in liquidation) (Halifax AU) were, subject to certain other orders, justified in adopting 27 November 2018 (the Administration Date) as the date at which the proportionate entitlements of the clients of Halifax AU were to be determined by:

(a) failing to assign any, or sufficient, weight to the fact that the Liquidators had elected to allow investors to maintain open positions and make investment decisions post-administration;

(b) failing to give effect to, and account for, the variations in the investment position of Category 1 Investors following the Administration Date;

(c) failing to assign any, or sufficient, weight to the fact that investors who maintained open positions post-administration were, in practice and in principle, in a different position to that of investors who closed out their positions on or shortly after the Administration Date by reason of their election to bear the risk associated with ongoing trading post-administration;

(d) failing to recognise that the matters identified in sub-paragraphs (a) to (c) above distinguished the circumstances of Category 1 Investors from those of clients in Georges (in his capacity as joint and several liquidators of Sonray Capital Markets Pty Ltd (in liq)) v Seaborn International (as trustee for the Seaborn Family Trust) (2012) 288 ALR 240 at [112], where the date of administration was appropriate and logical “because active trading by Sonray clients ceased as at that date”;

(e) failing to assign any, or sufficient, weight to the fact that valuation of clients’ proportionate entitlements as at the Administration Date in substance operated to reduce Category 1 Investors’ proportionate entitlement in the total value of the available fund (Judgment at [336]);

(f) failing to recognise that, in light of the matters identified at sub-paragraphs (a) to (e) above, there existed a basis upon which the Category 1 Investors’ positions and intentions could be differentiated from other investors which justified adoption of a valuation date which accounted for the different position and intentions of Category 1 Investors; and

(g) assigning significant weight to the judgment of Black J in In re MF Global Australia Ltd (in liq) [2012] NSWSC 994 (MF Global) at [117] to support the conclusion that the “more principled date” for valuation of clients’ entitlements to be the Administration Date (Judgment at [334], [337]) without recognising and accounting for the fact that:

(i) in MF Global, no client had a choice to continue trading or not have its position realised by the administrators or not to become a “cash client” given that all positions were to be closed by the administrators within a relatively short time following the appointment of the administrators (MF Global at [145]);

(ii) the adoption of the date of appointment of the administrators in MF Global was justified by the fact that the material difference in clients’ entitlements as between the date of administration and a later date closer to the date of distribution was reduced by valuing clients’ entitlements by reference to clients’ contingent entitlements which would be realised on closing clients’ open positions (MF Global at [117]); and

(iii) accordingly, the circumstances of investors in this case were materially distinguishable from those in MF Global, rendering reliance upon MF Global in support of valuing clients’ entitlements as at the Administration Date unsafe; and

(h) in substance, adopting a distribution methodology which, in the circumstances of this case, gives investors who closed out their accounts on the Administration Date a disproportionate share of the deficient mixed fund and which is therefore not fair and equitable in relation to the body of investors as a whole.

2. The Primary Judge ought to have concluded that the Liquidators of Halifax AU were to have calculated the proportionate entitlements of the clients of Halifax AU as close as possible to the distribution date and, in any event, only after the Liquidators have realised all extant investments.

Consideration

65 Mr Loo, on behalf of the category 1 investors, accepts that the primary judge’s decision with respect to the date of valuation issue was discretionary and that appellate intervention requires satisfaction of the well-established grounds of appeal identified in House v The King (1936) 55 CLR 499.

66 Something should be said about the nature of the decision under appeal and the question of appellate review. Although both Mr Loo and Elysium characterised the decision as a discretionary decision to which the principles in House v The King apply, it may be that the decision in question (namely as to the date of valuation) is better characterised as an evaluative judgment. Assuming that to be the case, while it is necessary for Mr Loo to establish error, this is not a case where it can be said that the primary judge enjoyed any particular advantage compared with the appeal court: see Branir Pty Ltd v Owston Nominees (No 2) Pty Ltd (2001) 117 FCR 424 at [24]-[30], in particular [28]-[29], per Allsop J (as his Honour then was) (Drummond and Mansfield JJ agreeing); Optical 88 Ltd v Optical 88 Pty Ltd (2011) 197 FCR 67 at [33]-[34] per Cowdroy, Middleton and Jagot JJ. We approach the task of appellate review with those considerations in mind.

67 Mr Loo’s written submissions focus on two bases upon which it is said that the primary judge’s conclusions with respect to the date of valuation issue were erroneous, namely:

(a) that the primary judge failed to consider the fact that the Liquidators permitted clients to maintain open positions following their original appointment as administrators of Halifax AU and Halifax NZ; and

(b) that the primary judge erred in law by misapplying the dicta of Black J in MF Global to justify the adoption of the date of administration as the “more principled” date for valuation.

68 Mr Loo’s submissions in relation to the first of these bases can be summarised as follows:

(a) The primary judge acknowledged the fact that some clients had left their positions open following the date of administration, and that indeed those positions remained open as at the date of determining the applications before the Court. The primary judge similarly addressed the differential positions of category 1 investors (who opted to keep their positions open) and category 2 investors (who also made that election but experienced a depreciation in the value of their positions) and the prejudice that may be occasioned by the selection of one valuation date rather than another.

(b) However, the primary judge’s appreciation of that fact went no higher. Critically, the primary judge did not address the fact that the changes in clients’ positions were due to a choice that each of the investors was permitted to make on and following the date of administration, which choice carried with it vastly different risk and value propositions and the outcome of which may have involved either increases or decreases in the value of each investor’s position.

(c) That factual component of this case was a significant and a material consideration that ought to have carried some weight in the primary judge’s exercise of discretion. It supplied a basis to distinguish the mixed fund the subject of directions in this case from the circumstances previously addressed by the courts, where the relevant fund was wholly realised on the date of administration (or shortly thereafter as positions were uniformly closed as soon as possible following the appointment of the administrator).

(d) In such conventional cases, fluctuations in the value of the fund and the value of a client’s particular entitlements after the administration date are not attributable to any activity conducted by use of the fund itself. Rather, it is the consequence of structural or temporal factors which prevent the immediate realisation of the clients’ positions. In such circumstances, there is a logical coherence in valuing the clients’ entitlements as at the date of administration, given that it was upon that date that the relevant trading activity for which the fund was deployed ceased and all extant positions were closed out. To the extent that positions remained open after that date and experienced losses, it would be capricious and inconsistent with the principles of fairness which justify the adoption of a single valuation date (see Re BBY Limited (Receivers and Managers appointed) (in liquidation) (No 2) (2018) 363 ALR 492 at [42]; Sonray at [85]) to visit those losses upon particular clients in circumstances where the delay in closing out their positions was both outside their control and the consequence of their misfortune in not being dealt with earlier in the liquidators’ administrative processes.

(e) In contrast, the mixed fund the subject of this case continued, to an extent, to be consciously and intentionally deployed for the purpose for which it was originally constituted. In that regard, fluctuations in clients’ positions were only to be expected, as expressly acknowledged by Mr Kelly and accepted by Gleeson J in granting directions that it was appropriate not to close out extant positions in Kelly (No 8). It was the intention of the Liquidators and particular clients alike to permit those fluctuations to affect the value of those clients’ accounts.

(f) In such circumstances, where the fund effectively continues to operate to facilitate clients’ trading activities, at each client’s election, adoption of a later valuation date could not be said (to use the language of Black J in MF Global at [117]) to be arbitrary by comparison to the date of administration. Rather, it would be consistent with the contemplated operation of the fund in the period before the Liquidators were in a position to distribute the fund to clients.

69 Mr Loo’s submissions in relation to the second basis referred to above, namely that there was an error of law in adopting the date of administration as the “more principled” date, can be summarised as follows:

(a) It can readily be accepted that MF Global is one of few cases which has elucidated, in some detail, the principles which underpin the courts’ typical preference for the administration date when valuing investors’ entitlements out of a deficient mixed fund. In his Honour’s decision, Black J explained that adoption of the administration date found “strong support” in the approach adopted in trust law generally and in insolvency, namely by reference to the apparently well-entrenched proposition that “the date when a fund is first constituted should be adopted for the purposes of a pari passu distribution”: MF Global at [114]-[115].

(b) However, in simply adopting Black J’s conclusion, without having regard to the reasoning by which his Honour expressed that conclusion, the primary judge failed to appreciate that the principles underpinning the date of administration were not equally – or even sufficiently – applicable in the circumstances of this case.

(c) Justice Black explained that the appointment date supplied the principled date for valuation as that was the date on which a company is divested of its property, at which point valuation is necessary in order to facilitate, as soon as possible, the appropriate and prompt distribution of property to the company’s creditors: MF Global at [115]-[116]. In so reasoning, Black J relied primarily upon Re European Assurance Society Arbitration (1872) 17 SJ 69 at 70 per Lord Westbury and Re Lehman Brothers International (Europe) (in administration) [2009] EWHC 3228 (Ch) (Re Lehman Brothers) at [291]-[294] per Briggs J.

(d) Such reasoning is not only inapt in the context of this case, but is of questionable application within the Australian statutory context. On a factual level, the administration date did not operate to vest control in Halifax AU’s and Halifax NZ’s assets – including the fund which the companies held on trust for the benefit of clients – in the hands of the Administrators and, later, the Liquidators. The fact that the category 1 investors and the category 2 investors were permitted to maintain open positions for a considerable period after their appointment demonstrates that the transfer of control, which is what colours the date of administration with its principled appropriateness for valuation purposes, is absent in this case.

(e) Moreover, as a matter of law, the principled reasoning advanced by Black J does not appear to account for the effect of s 981H, which creates one or more mixed trust funds with special characteristics which cannot be used to satisfy the creditors of the licensee: see Sonray at [77]. In that regard, ascertaining the value of the fund has no relevance to identifying the general body of assets available to satisfy creditors’ claims and is only relevant for the purpose of distribution of the fund to clients.

(f) Similarly, it cannot be said here (as Black J did in MF Global) that a date closer to the date of payment would be “arbitrary”. There is a logical basis for selecting a date close to the date of payment, when the value of the assets reflects the risks voluntarily undertaken by those investors who kept open positions.

(g) Further, Black J opined at [117] that the trust that was created under reg 7.8.03(4) upon entry into external administration was imposed on the appointment date, thereby supporting the quantification of entitlements under that trust as at that date. While that proposition might be a sensible one in circumstances where clients’ entitlements are likely to be fixed as at that same date – for instance, by reason of positions being closed on or shortly after that date (as was the case in MF Global) – the same cannot be said of a case where client entitlements might change post-appointment and will not be finally known and capable of adjudication until those positions are finally closed out.

(h) Indeed, when a client’s rateable entitlement out of the fund is to be ascertained by reference to their contribution to the fund (Sonray at [82]-[86]) ignoring contributions made after the date of administration (such as by gains achieved by the deployment of those funds in an open position) is inconsistent with the very principle upon which each client’s beneficial interests are to be ascertained. That is particularly so given that the trust imposed under reg 7.8.03(5) extends to the investments made using funds deposited into an account that was maintained for the purposes of s 981B, and realisation of that investment will see the cash derived from the investment included within the fund the subject of the statutory trust.

70 Before directly addressing Mr Loo’s submissions regarding the date of valuation issue, the following matters should be noted.

71 First, while there is no dispute that the relevant assets were held on trust by Halifax AU and Halifax NZ for the benefit of their clients, some analysis is required as to the relevant legislative provisions that apply to the trust (at least insofar as Halifax AU is concerned). The relevant provisions are set out in detail in the Reasons at [118]-[130]. It is sufficient for present purposes to set out ss 981F and 981H of the Corporations Act and reg 7.8.03 of the Corporations Regulations. Sections 981F and 981H provide:

981F Regulations may deal with how money to be dealt with if licensee ceases to be licensed etc.

The regulations may include provisions dealing with how money in an account maintained for the purposes of section 981B, or an investment of such money, is to be dealt with if:

(a) the licensee ceases to be a financial services licensee; or

(b) the licensee becomes insolvent, within the meaning of the regulations; or

(c) the licensee merges with another financial services licensee; or

(d) the licensee ceases to carry on some or all of the activities authorised by their licence.

…

981H Money to which Subdivision applies taken to be held in trust

(1) Subject to subsection (3), money to which this Subdivision applies that is paid to the licensee:

(a) by the client; or

(b) by a person acting on behalf of the client; or

(c) in the licensee’s capacity as a person acting on behalf of the client;

is taken to be held in trust by the licensee for the benefit of the client.

(3) The regulations may:

(a) provide that subsection (1) does not apply in relation to money in specified circumstances; and

(b) provide for matters relating to the taking of money to be held in trust (including, for example, terms on which the money is taken to be held in trust and circumstances in which it is no longer taken to be held in trust).

72 Regulation 7.8.03 provides:

7.8.03 How money to be dealt with if licensee ceases to be licensed etc

(1) For paragraph 981F(a) of the Act, this regulation applies if a financial services licensee ceases to be licensed (including a cessation because the financial services licensee’s licence has been suspended or cancelled).

(2) For paragraph 981F(b) of the Act, this regulation applies if a financial services licensee:

(a) becomes insolvent under an administration; or

(b) is the subject of any of the following arrangements:

(i) the appointment of an administrator under section 436A, 436B or 436C of the Act;

(ii) the commencement of winding up;

(iii) the appointment of a receiver of property of the financial services licensee, whether by a court or otherwise;

(iv) the appointment of a receiver and manager of property of the financial services licensee, whether by a court or otherwise;

(v) entry into a compromise or arrangement with creditors of the financial services licensee, or a class of creditors;

(vi) if the financial services licensee is deceased—administration of the estate of the financial services licensee under Part XI of the Bankruptcy Act 1966;

(vii) if the financial services licensee is deceased—administration of the estate of the financial services licensee under the law of an external Territory that provides for the administration of the insolvent estate of a deceased person;

(viii) an arrangement under the law of a foreign country that provides for a matter mentioned in subparagraphs (i) to (vii).

(3) For paragraph 981F(d) of the Act, this regulation applies if:

(a) a financial services licensee ceases to carry on a particular activity authorised by the financial services licence; and

(b) money is paid in connection with that activity.

(4) For each person who is entitled to be paid money from an account of the financial services licensee maintained for section 981B of the Act, the account is taken to be subject to a trust in favour of the person.

(5) If money in an account of the financial services licensee maintained for section 981B of the Act has been invested, for each person who is entitled to be paid money from the account, the investment is taken to be subject to a trust in favour of the person.