Federal Court of Australia

Masters v Lombe (liquidator), in the matter of Babcock & Brown Limited (in liq) [2021] FCAFC 161

Masters v Lombe (Liquidator); In the Matter of Babcock & Brown Limited (In Liq) [2019] FCA 1720 | |

File number(s): | NSD 1915 of 2019 NSD 1929 of 2019 NSD 1930 of 2019 |

Judgment of: | MIDDLETON, BEACH AND COLVIN JJ |

Date of judgment: | |

Catchwords: | CORPORATIONS – continuous disclosure obligations under s 674 of Corporations Act 2001 (Cth) – application of ASX listing rules 3.1 and 3.1A – non-disclosure of material information – shareholders’ claims for damages under s 1317HA of Corporations Act – debts or claims provable in winding up – rejection of proofs of debt – appeals to the primary judge from rejection of proofs of debt – whether trial judge erred in making findings of non-contravention of s 674 – whether contraventions, if made, would have caused share price inflation – applicability of market based causation – no proof of contraventions – no proof of loss – appeals dismissed |

Legislation: | |

Cases cited: | Grant-Taylor v Babcock & Brown Ltd (in liq) (2016) 245 FCR 402 TPT Patrol Pty Ltd as trustee for Amies Superannuation Fund v Myer Holdings Ltd (2019) 140 ACSR 38 |

Division: | General Division |

New South Wales | |

National Practice Area: | Commercial and Corporations |

Sub-area: | Commercial Contracts, Banking, Finance and Insurance |

Number of paragraphs: | |

Solicitor for the Appellants: | Thomas Booler & Co |

Counsel for the Respondents: | Mr J Lockhart SC with Mr J Hutton |

Solicitor for the Respondents: | Johnson Winter & Slattery |

ORDERS

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The appeal be dismissed.

2. The appellants pay the respondent’s costs of and incidental to the appeal.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ORDERS

NSD 1929 of 2019 | ||

IN THE MATTER OF BABCOCK & BROWN LIMITED (ACN 108 614 955) (IN LIQUIDATION) | ||

BETWEEN: | BRUCE BROOME and others Appellants | |

AND: | DAVID LOMBE IN HIS CAPACITY AS LIQUIDATOR OF BABOCK & BROWN LIMITED (ACN 108 614 955) (IN LIQUIDATION) Respondent | |

order made by: | MIDDLETON, BEACH AND COLVIN JJ |

DATE OF ORDER: | 3 September 2021 |

THE COURT ORDERS THAT:

1. The appeal be dismissed.

2. The appellants pay the respondent’s costs of and incidental to the appeal.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011]

ORDERS

NSD 1930 of 2019 | ||

IN THE MATTER OF BABCOCK & BROWN LIMITED (ACN 108 614 955) (IN LIQUIDATION) | ||

BETWEEN: | SARAH WILHELM and others Appellants | |

AND: | DAVID LOMBE IN HIS CAPACITY AS LIQUIDATOR OF BABOCK & BROWN LIMITED (ACN 108 614 955) (IN LIQUIDATION) Respondent | |

order made by: | MIDDLETON, BEACH AND COLVIN JJ |

DATE OF ORDER: | 3 September 2021 |

THE COURT ORDERS THAT:

2. The appellants pay the respondent’s costs of and incidental to the appeal.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011]

THE COURT:

1 The three proceedings below involved claims made by acquirers of ordinary shares in Babcock & Brown Limited (in liquidation) (BBL) between 12 August 2008 and 12 March 2009 (inclusive) concerning the alleged breach by BBL of its continuous disclosure obligations. In form, before the primary judge were appeals against the rejection by the liquidator of BBL of proofs of debt in which compensation was sought by such shareholders against BBL on the basis of alleged failures by BBL to disclose material information to the market as required by s 674 of the Corporations Act 2001 (Cth); such appeals were brought under s 1321.

2 The primary judge rejected such claims and dismissed those appeals. The appellants now appeal from those dismissals. We should note that there are three separate appeals before us to reflect the three proceedings below, which together cover all remaining shareholders’ claims. For present purposes it is not necessary to distinguish between the three appeals.

3 Before proceeding further, we should dispose of a preliminary point. In the proceedings below, 874 of the then 1,221 plaintiffs abandoned their claims. But all such 1,221 plaintiffs have been identified as appellants before us. This is erroneous. Now although BBL’s notices of contention have raised this issue, the primary judge disposed of the point below by confirming that there were only 347 active plaintiffs before him. In summary then, only these corresponding 347 appellants can maintain their present appeals. We need say nothing further on that aspect.

4 In summary, the appellants asserted below that BBL failed to disclose forecasts made by BBL of its 2008 group net profit after tax (NPAT), which was material information that the appellants asserted that BBL had withheld from the market. The appellants alleged that BBL had failed to disclose material information about its expected NPAT in the financial year ending 31 December 2008 on five separate occasions between 11 August 2008 and 8 December 2008.

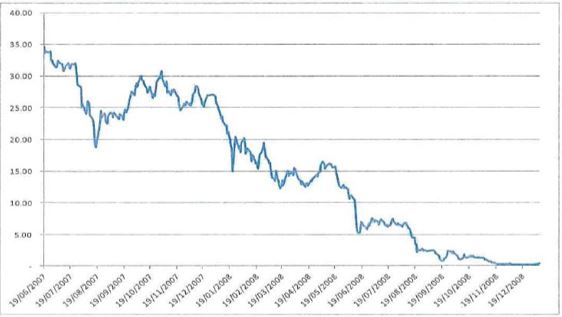

5 By way of background, BBL was a global financial services and asset management business. But in the second half of 2008 the peak of the global financial crisis occurred. And as the graph set out in his Honour’s reasons illustrates, by 11 August 2008 BBL’s share price had collapsed from a high of $34.63 in June 2007 to $6.80 and then continued to decline:

BBL closing share price (19 June 2007 to 7 January 2009)

6 His Honour rejected the appellants’ case and found that no contravention of s 674 had occurred on any of the five occasions alleged. Further, he held that no causation or loss had been established. And in doing so he made various observations concerning what has been described as market-based causation.

7 For the reasons that follow, we would dismiss the appeals. In summary, we agree with the primary judge that there was no contravention of s 674 concerning the first, second and third non-disclosure cases. But in our view there was a contravention of s 674 concerning the fourth and fifth non-disclosure cases. But concerning all non-disclosure cases, no causation or loss was established. On that basis the appeals must be dismissed.

8 Before proceeding further we should say something about the relevant statutory provisions and the applicable principles.

RELEVANT STATUTORY PROVISIONS

9 Sections 674 and 677 at the relevant time provided:

674 Continuous disclosure—listed disclosing entity bound by a disclosure requirement in market listing rules

(1) Subsection (2) applies to a listed disclosing entity if provisions of the listing rules of a listing market in relation to that entity require the entity to notify the market operator of information about specified events or matters as they arise for the purpose of the operator making that information available to participants in the market.

(2) If:

(a) this subsection applies to a listed disclosing entity; and

(b) the entity has information that those provisions require the entity to notify to the market operator; and

(c) that information:

(i) is not generally available; and

(ii) is information that a reasonable person would expect, if it were generally available, to have a material effect on the price or value of ED securities of the entity;

the entity must notify the market operator of that information in accordance with those provisions.

…

677 Sections 674 and 675—material effect on price or value

For the purposes of sections 674 and 675, a reasonable person would be taken to expect information to have a material effect on the price or value of ED securities of a disclosing entity if the information would, or would be likely to, influence persons who commonly invest in securities in deciding whether to acquire or dispose of the ED securities.

10 Listing rule 3.1 of the ASX listing rules at the relevant time provided:

Once an entity is or becomes aware of any information concerning it that a reasonable person would expect to have a material effect on the price or value of the entity’s securities, the entity must immediately tell ASX that information.

11 Listing rule 3.1A provided at the relevant time:

Listing rule 3.1 does not apply to particular information while all of the following are satisfied.

3.1A.1 A reasonable person would not expect the information to be disclosed.

3.1A.2 The information is confidential and ASX has not formed the view that the information has ceased to be confidential.

3.1A.3 One or more of the following applies.

• It would be a breach of a law to disclose the information.

• The information concerns an incomplete proposal or negotiation.

• The information comprises matters of supposition or is insufficiently definite to warrant disclosure.

• The information is generated for the internal management purposes of the entity.

• The information is a trade secret.

12 For present purposes, it is convenient to set out some relevant observations from the analysis of Allsop CJ, Gilmour and Beach JJ in Grant-Taylor v Babcock & Brown Ltd (in liq) (2016) 245 FCR 402.

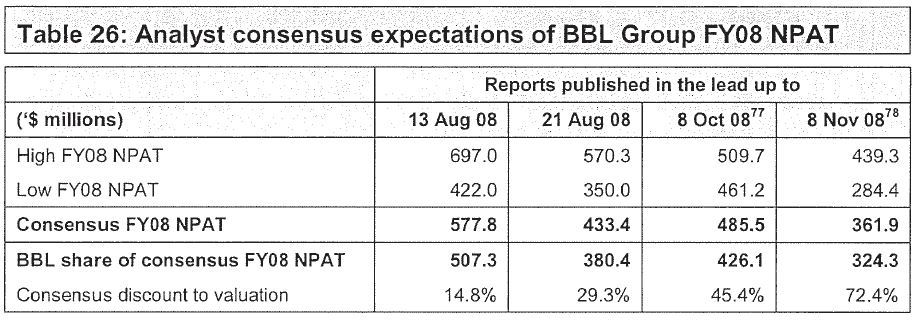

13 At [49] to [51] it was observed:

BBL was a “listed disclosing entity” within the meaning of s 674(1) (see also s 674(2)(a)).

Part 1.2A of the Act deals with what is meant by a “disclosing entity” (s 111AA(a)). Section 111AC(1) provides that if any “securities” of a body are “ED securities” then the company is a disclosing entity. Section 92(3) defines “securities” to include shares in a company. It is to be noted that the s 92(3) definition is expressed to specifically apply to Ch 6CA. Securities of a company are ED securities if, inter alia, they are ED securities under s 111AE. Section 111AE(1) provides that if the company is included in the official list of a “prescribed financial market” and that market’s listing rules apply to the securities, then the securities are “ED securities”. The ASX is a “prescribed financial market” (reg 1.0.02A of the Corporations Regulations 2001 (Cth)) and ASX Ltd is a prescribed market operator (the then reg 7.1.01(a)). Section 111AL(1) provides that a disclosing entity is a “listed disclosing entity” if the ED securities are quoted ED securities. In summary, and by this modern drafting technique, a company which is on the official list of the ASX and whose shares are quoted is a “listed disclosing entity”…

There is a further requirement for s 674(2), namely, that provisions of the Listing Rules require the entity to notify the market operator of relevant information (s 674(1)). An ASX listed company satisfies such a requirement because of the disclosure obligations of Chapter 3 of the Listing Rules, particularly Listing Rule 3.1.

14 At [52] to [54] it was observed:

The objective and hypothetical (in one sense) requirement of s 674(2)(c)(ii) is identical to the equivalent part of Listing Rule 3.1; but Listing Rule 3.1 requires disclosure of information even if it has come into the public domain (is generally available) in contradistinction to the limitation of not being generally available in s 674(2)(c)(i).

ASX Listing Rule 3.1 at all relevant times provided that:

Once an entity is or becomes aware of any information concerning it that a reasonable person would expect to have a material effect on the price or value of the entity’s securities, the entity must immediately tell ASX that information.

The word “aware” was defined in ASX Listing Rule 19.12 at the relevant time in the following terms:

an entity becomes aware of information if a director or executive officer (in the case of a trust, a director or executive officer of the responsible entity) has, or ought reasonably to have, come into possession of the information in the course of the performance of their duties as a director or executive officer of that entity.

…We note that the current form of “aware” is now defined differently, having been amended on 1 May 2013. We also note that the exception contained in Listing Rule 3.1A was also modified by a re-ordering, but the changes are not relevant for present purposes. Finally, a definition of “information” was added to Listing Rule 19.12 on 1 May 2013; no definition of “information” was contained in the Listing Rules at the relevant time involving these proceedings.

15 At [92] and [93] it was observed:

The statutory purposes for the continuous disclosure regime were foreshadowed in the 1991 Australian Companies and Securities Advisory Committee Report and in a Second Reading Speech to the Corporate Law Reform Bill 1992 (Cth) (although the 1992 Bill was superseded by the 1993 Bill). The main purpose is to achieve a well-informed market leading to greater investor confidence. The object is to enhance the integrity and efficiency of capital markets by requiring timely disclosure of price or market sensitive information. Further, one of the justifications for introducing the continuous disclosure regime, as referred to by that Committee, was to “minimize the opportunities for perpetrating insider trading” thereby providing an explicit link between the purposes of the continuous disclosure regime and the insider trading regime.

It is also to be noted that ss 674 to 677 are remedial or protective legislation. They should be construed beneficially to the investing public and in a manner which gives the “fullest relief” which the fair meaning of their language allows.

(Citations omitted.)

16 In relation to the question of information it was said (at [94]):

Section 674(2) requires it to be established that the company has “information” which the Listing Rules require the company to notify to the market operator. “Information” is not defined for the purposes of s 674. But “information” is defined, for the purposes of the insider trading provisions, to include matters of supposition and matters relating to intentions; see s 1042A…But there is no similar statutory definition for the purposes of s 674. In that context, “information” may be given a more restrictive interpretation in the specific context of s 674 given the reference to “information about specified events or matters”. This is consistent with the philosophy underpinning Australian securities law, particularly in the takeovers context, that disclosure of speculation is not required and is to be avoided. But s 674(1) is a generic provision concerned to identify relevant provisions of the Listing Rules as to whether they exist. Further, “specified” is not a direct qualifier of “information”. Also, it is to be noted that one element of the exception in Listing Rule 3.1A refers to excluding information which “comprises matters of supposition or is insufficiently definite to warrant disclosure”. That might suggest that the Listing Rule 3.1 general context does prima facie use “information” as embracing speculation or insufficiently definite information, but leaves the work to the carve-out to operate to exclude supposition or indefinite information; or, it may simply be a way of emphasising the considerations referred to in Rossington. The current form of Listing Rule 19.12 now defines “information” as including “matters of supposition and other matters that are insufficiently definite”…

(Citations omitted.)

17 In terms of expectation of material effect it was said (at [95] and [96]):

Listing Rule 3.1 prima facie only requires disclosure if “a reasonable person would expect [it] to have a material effect on the price or value” of the shares. This looked at the question through an ex ante lens. The Listing Rule does not elaborate further on this concept. In contrast, the Act does. Section 674(2)(c)(ii) provides that it be shown (in order for the statutory disclosure obligation to apply) that the information is such that “a reasonable person would expect, if it were generally available, to have a material effect on the price or value”. This mirrors the Listing Rule requirement in terms of a positive element required to be satisfied in order for disclosure to be required. Section 677 elaborates on this concept. Section 677 provides that “a reasonable person would be taken to expect information to have a material effect … if the information would, or would be likely to, influence persons who commonly invest in securities in deciding whether to acquire or dispose of” the shares. The question arises as to the relationship between the Listing Rule and s 677. It seems to us that s 677 does not narrow the ordinary meaning of the concept in the Listing Rule. It is not expressed as “if and only if”. Moreover, it does not appear to change the ordinary meaning of the concept. Moreover, reading the Listing Rule 3.1 concept to implicitly embrace the elaboration in s 677 avoids difficulties of discordance between the two. The Listing Rule 3.1 concept should be taken to implicitly embrace the s 677 concept…

What is meant by “material effect” in s 674(2)(c)(ii)? As stated earlier, s 677 illuminates this concept and also identifies the genus of the class of “persons who commonly invest in securities”. It refers to the concept of whether “the information would, or would be likely to, influence [such] persons … in deciding whether to acquire or dispose of” the relevant shares. The concept of “materiality” in terms of its capacity to influence a person whether to acquire or dispose of shares must refer to information which is non-trivial at least. It is insufficient that the information “may” or “might” influence a decision: it is “would” or “would be likely” that is required to be shown. Materiality may also then depend upon a balancing of both the indicated probability that the event will occur and the anticipated magnitude of the event on the company’s affairs. Finally, the accounting treatment of “materiality” may not be irrelevant if the information is of a financial nature that ought to be disclosed in the company’s accounts. But accounting materiality does have a different, albeit not completely unrelated, focus. It is appropriate to address s 677 in more detail on one aspect relevant to the grounds of appeal.

(Citations omitted.)

18 Further, in terms of the expression “persons who commonly invest in securities” in s 677, we note the Full Court’s observations (at [97]) to [116]), although we do not need to set these out. Likewise, we note their observations (at [117] to [124]) concerning the expression “generally available” in s 674(2)(c)(i). These questions were not in issue before us.

WERE THERE BREACHES OF SECTION 674?

19 It is convenient to now address the question as to whether BBL contravened s 674 on the five separate occasions alleged. His Honour answered that question in the negative for each occasion. But as we have indicated, although we agree with his Honour concerning the alleged first, second and third non-disclosure cases, we disagree with his Honour concerning the alleged fourth and fifth non-disclosure cases. It is convenient to address each non-disclosure case in turn.

The first alleged non-disclosure – 13 August 2008

20 We should first set out aspects of the primary judge’s reasons which identify the alleged first non-disclosure and his Honour’s conclusions.

21 His Honour (at [316] to [320]) made the following findings:

The first alleged non-disclosure is said to be of information which, by 13 August 2008, BBL was aware to the effect that its earnings for the full Financial Year 2008 were expected to be in the range between $400–$600 million and that its earnings were therefore expected to be materially lower than the earnings guidance previously provided on 30 May 2008 and on 11 August 2008. This information is extracted from the memorandum from Michael Larkin, the CFO of BBL at the time, to the BBL Board dated 13 August 2008. In that memorandum, Mr Larkin said that, on adjustment for a probability weighted outcome and applying a +/- factor of $100 million, 2008 Group NPAT was estimated to be between $400 million and $600 million. The memorandum also contained observations to the effect that the 2008 earnings were dependent upon the timing and outcome of the 2008 asset sale program, whether there was a requirement for further provisions against impairment and progress in relation to restructuring and costs reduction. Mr Larkin expressly recommended that BBL retain its most recent earnings guidance (no greater than $643 million) because of lack of clarity regarding any more definite guidance. The BBL Board considered Mr Larkin’s memorandum at its meeting of 14 August 2008, Mr Larkin spoke to it and the Board agreed that no change was warranted to the current forecast earnings guidance based upon Mr Larkin’s memorandum.

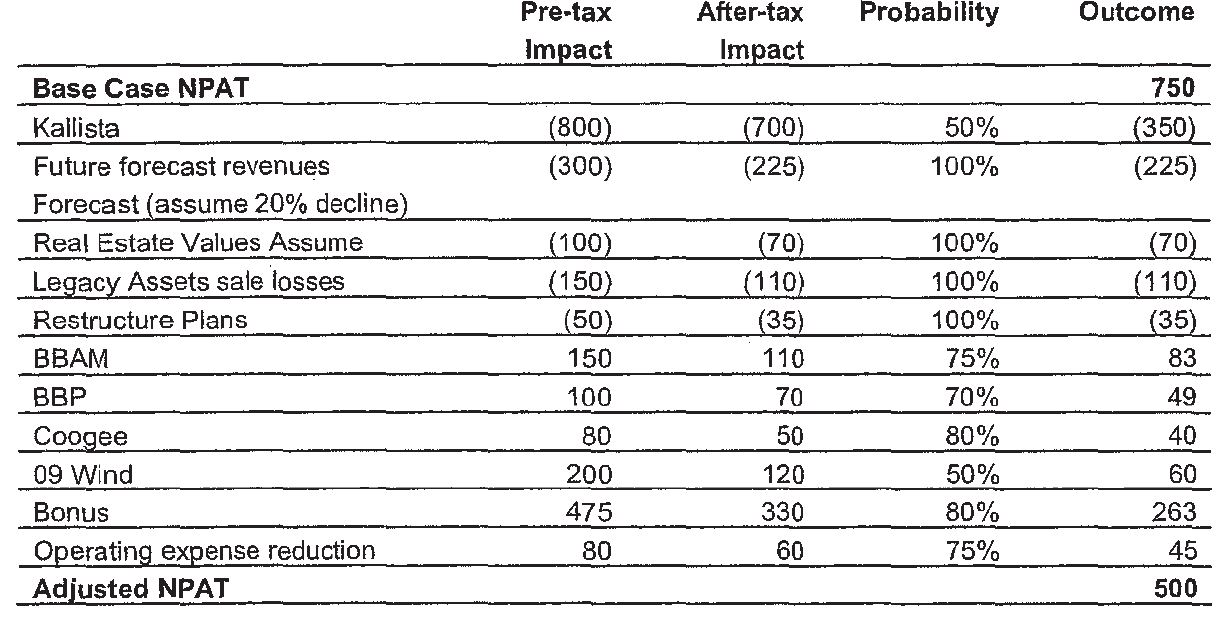

In his memorandum, Mr Larkin provided two Group NPAT estimates:

(a) A Base Case NPAT of $750 million which assumed that “Kallista completes in full”; and

(b) A second NPAT estimate of between $400 million and $600 million after adjustment for a probability weighted outcome and applying a +/- factor of $100 million to the $500 million adjusted NPAT estimate.

The liquidator submitted that the Larkin memorandum was clearly a management document within the exception specified in Listing Rule 3.1A.3 and that the information which the plaintiffs allege should have been disclosed was insufficiently definite to warrant disclosure.

As far as this first alleged non-disclosure is concerned, the plaintiffs selected one item of information which appeared in that memorandum without paying due regard to the context in which that item of information appeared. That context included the fact that Mr Larkin himself was of the opinion (expressed to the Board in the memorandum) that no further earnings guidance was warranted as at 13 August 2008.

Whether one takes the view that information which the plaintiffs allege should have been disclosed on 13 August 2008 was not information which was material in the relevant sense or whether one takes the view that it properly falls within the exceptions to the requirements to disclose provided for in Listing Rule 3.1A.3, I am of the opinion that BBL was not obliged to disclose to the ASX the information which the plaintiffs allege should have been disclosed on 13 August 2008.

22 His Honour also said (at [313]):

In 2008, the ASX had issued a version of Guidance Note 8. The plaintiffs placed reliance upon that Note. I do not think that it adds anything of substance to s 674 and Listing Rule 3.1 and, of course, in any event, is not binding.

23 Now by their appeal grounds 1, 3 and 4, the appellants challenge various findings.

24 First, it is said that the primary judge erred by failing to take into account ASX Guidance Note 8 when interpreting and applying ss 674 and 677 and listing rules 3.1 and 3.1A (ground 1). We would say now that this ground has no substance. His Honour quite rightly construed the operative provisions, and in a manner free from error save as to aspects of listing rules 3.1A.1 and 3.1A.2. We deal with those aspects separately below. Further, the contents of the Guidance Note are not binding as to the content of the law and, for reasons expressed below, in the respects relied upon by the appellants do not assist them in the resolution of the issues raised by the case advanced on appeal.

25 Second, it is said that the primary judge erred by finding that the Larkin memorandum, which we will identify in a moment, was not material within the meaning of ss 674(2)(c)(ii) and 677 (ground 3). We will refer to the content of the Larkin memorandum in a moment but indicate at this point that, in our view, there was no error made by the primary judge on this aspect.

26 Third, it is said that the primary judge erred by failing to find non-satisfaction of listing rules 3.1A.1 and 3.1A.2, in addition to listing rule 3.1A.3, in relation to the Larkin memorandum and further erred by concluding that listing rule 3.1A.3 was itself satisfied (ground 4). We agree that his Honour erred by not properly considering listing rules 3.1A.1 and 3.1A.2, but the point goes nowhere. Either the information was not material or these conditions justifying the application of the exception were made out in any event. Further, his Honour did not err in considering listing rule 3.1A.3.

Appellants’ arguments

27 Now it is not contested that on 17 April 2008 BBL published its 2007 annual report and stated its expectation that 2008 NPAT would be at least $750 million. It is also not contested that on 30 May 2008 at its annual general meeting BBL reaffirmed its position that its expected 2008 group NPAT was $750 million.

28 Further, on 11 August 2008, BBL announced to the market that its “2008 earnings are now not expected to exceed 2007 Group Net Profit of $643 million”.

29 The appellants say that on 13 August 2008 BBL had and was aware of information to the effect that its expected NPAT for the 2008 financial year was around $500 million or in the range of $400 to $600 million. The information is said to be that which is contained in the Larkin memorandum.

30 The appellants’ case is that on 13 August 2008, the then chief financial officer of BBL, Mr Michael Larkin, wrote a memorandum to the board of directors in relation to profit guidance for 2008.

31 Mr Larkin noted a previous “base case” forecast of $750 million. This forecast was premised, inter-alia, on “Kallista completes in full”. “Kallista” was a reference to the Kallista project, being BBL’s sale of its European wind assets.

32 On 14 August 2008, a meeting of the board was held, at which Mr Larkin spoke to his memorandum. After discussion, it was agreed, as the minutes record, “that no change was warranted to current market guidance at this point”.

33 The appellants say that the figure for 2008 NPAT of $500 million referred to in the Larkin memorandum should have been disclosed to the market. Their contention depends upon characterising the $500 million amount as a revised forecast of earnings.

34 Further, it was submitted that Mr Larkin’s alleged revised forecast was said to be subject not only to the Kallista project completing, but also to certain other initiatives and market conditions. As to the initiatives, the appellants say that without these the alleged forecast would have been even lower. As to the market conditions, the appellants say that any alleged forecast had a degree of contingency built into it.

35 Now the primary judge rejected the appellants’ case on the non-disclosure of the Larkin memorandum or the so-called forecast contained therein. He held that the information was either not material in the relevant sense or that it fell within the exceptions to the requirements to disclose provided for in listing rule 3.1A. But the appellants say that on both aspects his Honour’s determination was flawed.

36 It is convenient to first summarise the appellants’ arguments on the question of materiality.

37 As to materiality, the appellants correctly pointed out that information will be material pursuant to s 674(2)(c)(ii) where it “is information that a reasonable person would expect, if it were generally available, to have a material effect on the price or value of [the shares]”. Further, s 677 provides that for the purposes of s 674, “a reasonable person would be taken to expect information to have a material effect on the price or value of [the shares] if the information would, or would be likely to, influence persons who commonly invest in securities in deciding whether to acquire or dispose of [the shares]”. The appellants say that materiality is to be assessed ex ante by reference to a reasonable expectation that the disclosure will affect the price of the share or have an influence on decisions to buy and sell the share.

38 The appellants submitted that earnings information is ordinarily material to a company’s share price. Further, the appellants said that the experts called at trial agreed that the market’s expectations of earnings is the starting point for any valuation of BBL’s shares.

39 The appellants relied upon what was said in TPT Patrol Pty Ltd as trustee for Amies Superannuation Fund v Myer Holdings Ltd (2019) 140 ACSR 38; [2019] FCA 1747, where various tenets of finance theory were discussed by Beach J being, first, that the price of an efficiently-traded security reflects the present discounted value of the future cash flows expected to be generated by the underlying asset (at [668]), second, that in an efficient market, share prices should adjust in response to changes in the market’s expectations of cash flows (at [1094] to [1095]) and third, that a forecast is a reference point for the market’s assessment of the level and associated risk of future earnings (at [1035]). Accordingly it was also pointed out in Myer (at [1107]):

Market participants use guidance as to firms’ future profits to form expectations of future cash flows.

40 The appellants pointed out that Mr Michael Potter, BBL’s expert, gave evidence at trial that:

All things being equal, it could be expected that earnings guidance will have a material effect on the traded share price if the guidance differed materially to the market's pre-existing expectations.

41 Further, they also pointed out that the primary judge said (at [387]):

It is not a self-evident proposition that, in all circumstances and in respect of all listed companies, the downgrading of earnings forecasts, even to a substantial degree, necessarily leads to a reduction in the price of the shares in the entity. Whether that is the result of such a downgrade will depend upon all of the circumstances of the case. This is so notwithstanding the fact that financial professionals generally agree that such a consequence can generally be accepted.

42 Further, the appellants noted what was said in Myer (at [670]) that:

But not all new information about a company will necessarily be expected to have a material effect on the price of its shares. Some information is not “price sensitive”. Information that is inconsequential to a company’s future earning potential cannot be expected to change investors’ collective valuation of the company, and so its share price. Alternatively, sometimes information that can be expected to cause investors to alter their valuation of a company, for example, movements in the market price of a particular product or service supplied by the company, may be inferred from publicly available data, and so will often be reflected in the price of a security ahead of any formal disclosure of those effects, say, in the form of a profit announcement.

43 Further, the appellants pointed out that Guidance Note 8 at the relevant time stated:

Listing rule 3.1 provides examples of information that, if material, would require disclosure. One of those examples is a change in the entity’s previously released financial forecast or expectation. As a general policy, a variation in excess of 10% to 15% may be considered material, and should be announced by the entity as soon as the entity becomes aware of the variation. If the entity has not made a forecast, a similar variation from the previous corresponding period will need to be disclosed. In certain circumstances a smaller variation will be disclosable.

44 The appellants say that the primary judge was wrong to say that Guidance Note 8 did not add anything of substance to the appellants’ claim. We would say now that we agree with his Honour. General guidance is one thing. But the primary judge had to consider the facts and circumstances before him as to what was material and what was needed to be disclosed. In any event the point goes nowhere, including by reason of the operation of listing rule 3.1A.

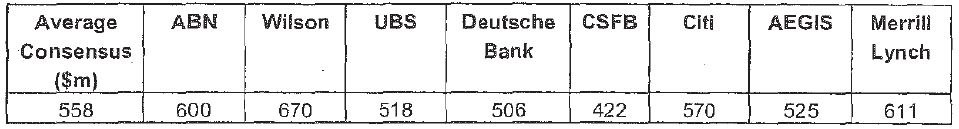

45 The appellants also say that it was common ground between the parties below that one would ordinarily expect that an assessment of market expectations would be done by reference to the earnings forecasts of security analysts reported by the Bloomberg service. We note that the average of such estimates is informally referred to as the Bloomberg consensus.

46 The appellants say that the evidence of Mr Potter was to the effect that there is a correlation between the movement in share price of an entity, such as BBL, and the announcement of earnings guidance that differs from the Bloomberg consensus. He further said that whether an announcement was treated as “good news” or “bad news” by the market depended on whether it was of a forecast greater or less than “the most recent analyst-consensus forecasts”. It was also said that Mr Potter also confirmed that analysts’ expectations were “important” in assessing the effect of any disclosure on share price.

47 The appellants say that if it was the case that a forecast of $500 million was below the market’s expectations of earnings in any significant way, then it follows that this information was material in the relevant sense.

48 The appellants say that in his memorandum, Mr Larkin said that eight analysts had a view of BBL’s expected 2008 group NPAT updated by reference to recent announcements. The consensus used by him was $558 million. The appellants say that in his report, Mr Potter identified a higher consensus at this date of $577.8 million. Accordingly, the appellants say that what they characterise as an earnings forecast of $500 million by Mr Larkin was material information.

49 Now the appellants pointed out that at trial, Mr Potter expressed the view that all of the analysts following BBL were, in fact, wrong, and that the market’s expectation of BBL’s earnings was to be ascertained using his Residual Income Model (RIM). But it was pointed out that the primary judge rejected this RIM approach. As a result, so the appellants say, this approach did not undermine the use of Bloomberg consensus. But we would note here that it does not follow from the fact that the primary judge rejected the RIM approach, that Mr Potter was incorrect concerning his analysis of the analysts’ observations.

50 The appellants say that as at 13 August 2008 and at subsequent dates, it was reasonable to have such an expectation concerning Mr Larkin’s forecast in light of the Bloomberg consensus figure, regardless of whether the Bloomberg consensus was an accurate proxy for the market’s expectations. It is said that this is because “the forecast of future earnings for any given financial year provided by security analysts would usually be an appropriate source for assessing the market’s expectation of future earnings” (at [236]).

51 Further, the appellants say that even if a forecast figure is no different from the Bloomberg consensus, this may mean that the non-disclosure has caused no loss. But it does not mean that the information is not material. They say that even simply confirming the consensus views may give new and important information to the market that is material (Myer at [1209] and [1211]).

52 Further, the appellants say that Mr Larkin’s figure was much less than the figure for earnings of $643 million that had been used in the announcement of 11 August 2008.

53 Now the appellants accept that it is true that the 11 August 2008 forecast was expressed as a ceiling, without a “floor” being identified. But they say that BBL did not intend to convey by this statement that it did not expect any profit or that it expected a loss. It was signalling to the market that a forecast of $643 million would not be unreasonable. They say that this is why Mr Larkin in his memorandum spoke of what BBL needed to do to achieve guidance. The appellants say that this would make no sense if the only guidance was that NPAT could be anything at all, provided it was not higher than $643 million.

54 The appellants say that the radically lower forecast of $500 million, as compared with $643 million, was material information that should have been disclosed.

55 Now the appellants point out that the primary judge appears to have found that from the middle of 2008 no one in the market had any belief that BBL would make any profit in 2008 at all. But the appellants say that this does not answer the materiality question.

56 But in any event the appellants say that this finding is wrong. First, as at 13 August 2008 the market had a positive earnings expectation. Second, the conclusion is inconsistent with the fact that the eight analysts covering BBL at 13 August 2008 considered that its 2008 NPAT would be between $422 million and $670 million. Third, the primary judge’s conclusion is inconsistent with his later conclusion (at [340]) that:

… by mid-September 2008, such investors would not have been influenced at all by being provided with earnings guidance at the times and in the terms of those which the plaintiffs allege should have been announced to the market.

57 We would say now that in our view his Honour was wrong on this aspect. But this does not assist the appellants. For reasons we will come to, the information the subject of the first, second and third non-disclosure cases was not required to be disclosed. And in terms of the information concerning the fourth and fifth non-disclosure cases, which information was required to be disclosed, there was a market expectation of no profit to say the least.

58 Further, the appellants point out that the primary judge considered it relevant that Mr Larkin and/or the board were of the opinion that no further earnings guidance was warranted as at 13 August 2008. But the appellants say that this is conclusory. And they say that the fact that an entity does not consider that disclosure is required does not resolve whether, as a matter of law, it is required. We agree with the appellants at least on this.

59 The appellants also made more general points concerning their case dealing with the alleged first non-disclosure and the other alleged non-disclosures that we will come to later.

60 First, the appellants say that uncertainties and contingencies are inherent in the process of making forward-looking statements and arriving at forecasts. The appellants say that the question is not whether such uncertainties or contingencies in the process exist, but whether they mean that the information will, as a consequence, be considered trivial by the market or irrelevant or immaterial to it. If so, it does not need to be disclosed. We agree with that proposition in the generality with which it has been expressed.

61 Second, the appellants say that where there is an uncertainty or contingency, there is nothing preventing that uncertainty or contingency being disclosed together with the forecast or guidance to which it is relevant, so that the market has the complete picture. They say that the mere existence of an uncertainty or contingency does not mean that information does not need to be disclosed. Rather it conditions the nature of the information that must be disclosed. Again, we agree with such a proposition in the generality with which it has been expressed.

62 Third, it may be accepted as the appellants submitted that, generally speaking, information concerning a company’s future cash flows, earnings and NPAT or relevant forecasts on such matters may be said to be material to the extent that it involves a change over prior forecasts, where that change is 10% or more; indeed in some contexts it may be lower, as in Myer. Such information may well be relevant as to investors’ perceptions as to the net present value of the company’s future cash flows. Moreover, and generally speaking, share prices would normally adjust in response to changes in the market’s expectations of cash flows. Further, share price reaction to a change in expectations as to future cash flows may vary depending on factors such as the risk that the market ascribes to those earnings, their timing of receipt, and general market sentiment which affects risk perception generally.

63 But, as we will see, the difficulty for the appellants is that in the particular circumstances of BBL, particularly in the latter part of 2008, these general propositions no longer held.

64 The other main part of the appellants’ arguments concerned the listing rule exception.

65 The appellants say that even if one assumes that the requirements of listing rule 3.1A.3 were made out, the exception in listing rule 3.1A will only be engaged where the requirements of listing rules 3.1A.1 and 3.lA.2 are also satisfied. But the appellants say that no findings were made in this regard.

66 In particular, as regards listing rule 3.1A.1, the appellants say that a reasonable person would expect that where BBL had, first, issued guidance to the market that its earnings would exceed $750 million, and, second, that they would be not more than $643 million, and where the Bloomberg consensus was $558 million, BBL would update the market if it held information that it expected that those earnings would be $500 million or thereabouts.

67 Further, the appellants say that primary judge did not identify which aspects of listing rule 3.1A.3 he considered were made out. In any event, the appellants say that any suggestion that the forecast was insufficiently definite to warrant disclosure was misplaced.

Analysts and their forecasts and valuations

68 Before turning to our analysis, it is convenient to note some aspects of Mr Potter’s evidence and more general evidence concerning analysts and their forecasts and valuations.

69 Mr Potter observed that analysts’ expectations of group NPAT deteriorated over time, with this decline occurring independently of specific earnings forecasts issued by BBL. Further, his consideration of the available analyst reports suggested consensus figures that expected NPAT for the year ended 31 December 2008 would be lower than BBL’s guidance.

70 On the basis of the material before him he drew the following conclusions.

71 First, consensus NPAT expectations for the year ended 31 December 2008 peaked at $736.3 million between 27 March 2008 and 23 May 2008. At this point in time, NPAT for the year ended 31 December 2008 was expected by analysts to be approximately 15% higher than the figure of $639.3 million reported for the year ended 31 December 2007.

72 Second, consensus expectations declined gradually, reaching $686 million by 16 July 2008. This decline in consensus expectations of NPAT was in the absence of earnings guidance being issued by BBL; the next earnings guidance was issued on 11 August 2008.

73 Third, consensus expectations declined dramatically on 11 August 2008, from $686 million to $564.5 million, which represented a decline of $121.5 million. Further, whilst the consensus forecast for NPAT for the year ended 31 December 2008 was $564.5 million, BBL had announced that it had expected to achieve NPAT for the year ended 31 December 2008 of no more than $643 million. This indicated that analysts were discounting BBL’s announced earnings guidance by approximately 12%, prior to further valuation discounts made by them.

74 Fourth, consensus expectations continued to decline over the course of 2008, reaching $417.8 million on 16 December 2008. By this date, however, the number of analysts covering BBL had declined to two analysts. The last data point included in Bloomberg’s data that Mr Potter had was a consensus forecast figure of $417.8 million on 16 December 2008. By this time, however, the two analysts that were continuing to cover BBL, namely, Citigroup and ABN Amro, were expecting NPAT for the year ended 31 December 2008 of $257.7 million, in the case of Citigroup, and $284.4 million, in the case of ABN Amro. The “consensus” of these two forecasts was $271.0 million, which was materially lower than the figure of $417.8 million suggested by the Bloomberg data.

75 In addition, whilst these two analysts continued to include positive NPAT for BBL for the year ended 31 December 2008, the same analysts were applying discounts of up to 75% to their assessed valuations of BBL in deriving a target price for the shares in BBL. This indicated that, rather than updating their forecasts as to BBL’s NPAT, analysts retained the same level of “headline” NPAT but applied a discount to reflect the risks associated with BBL achieving this level of NPAT. Furthermore, he considered that it was relevant to note that whilst these analysts retained a positive assessed NPAT, the analysts considered that BBL was a “Speculative Risk”, in the case of Citigroup, and there was a possibility of breaching debt covenants, in the case of ABN Amro.

76 In general, Mr Potter considered that there was a level of pessimism held by analysts that, whilst reflected in the analysts’ views towards BBL and its ongoing viability, may not have been reflected directly in the level of NPAT that analysts continued to forecast that BBL would achieve in the year ended 31 December 2008.

77 For all of these reasons, Mr Potter considered that analysts’ consensus forecasts of BBL’s NPAT for the year ended 31 December 2008 were not a reliable indicator of the market’s expectation of BBL’s NPAT for the year ended 31 December 2008, which was open to his Honour to find based upon the evidence of Mr Potter. The views expressed by Mr Potter concerning the analysts’ views were not impeached by the rejection of his RIM approach. They stood separately. Further, the matters just outlined were no more than a convenient summary of the evidence which the primary judge was entitled to accept as accurate.

78 His Honour appears to have also so concluded, and no error has been shown in such a conclusion.

79 Further, Mr Potter noted that the analysts’ target price for shares in BBL, which itself was assessed after the application of a discount, exceeded the market price of shares in BBL. This indicated that the market applied a further discount to analysts’ expectations for BBL.

80 Further, it was also apparent that analysts’ expectations of BBL’s NPAT for the year ended 31 December 2008 declined independently of specific earnings guidance being issued by BBL. In particular, the sharp decline in expected NPAT that commenced from 11 August 2008 was a decline against a backdrop where BBL did not alter its announced maximum group NPAT for the year ended 31 December 2008 of $643 million. Therefore, it was open to conclude on the basis of the analysts’ views that the market had formed pessimistic views as to the prospect of BBL achieving the maximum NPAT that had been provided by way of guidance and was not treating that figure as an indication of likely NPAT for the year ended 31 December 2008.

81 Further, Mr Potter compiled all analyst forecasts that were provided to him and grouped these by date. He grouped analyst reports for the periods leading up to each of the valuation dates with a view to ascertaining analysts’ expectations of BBL’s expected financial performance immediately prior to each valuation date based on published reports. As at each of the valuation dates, based on the analyst reports that he had been provided, he set out expectations of NPAT for the BBL group for the year ended 31 December 2008, along with BBL’s share of expected NPAT as follows:

82 The following conclusions were drawn.

83 First, as at 13 August 2008, group NPAT for the year ended 31 December 2008 was expected to be $577.8 million (with a high/low range of $422.0 million to $697.0 million), with BBL’s share of expected group NPAT of $507.3 million.

84 Second, without any further specific earnings guidance, analysts’ expectations of group NPAT for the year ended 31 December 2008 declined:

(a) as at 21 August 2008, to $433.4 million (with a high/low range of $570.3 million to $350.0 million), with BBL’s share of group NPAT expected to be $380.4 million;

(b) as at 8 October 2008, to $485.5 million (with a high/low range of $509.7 million to $461.2 million), with BBL’s share of group NPAT expected to be $426.1 million; and

(c) as at 8 November 2008, to $361.9 million (with a high/low range of $439.3 million to $284.4 million), with BBL’s share of group NPAT expected to be $324.3 million.

85 Third, consensus expectations of NPAT as at 8 October 2008 and 8 November 2008 reflected the expectations of only two analysts, whereas eight analysts covered BBL as at 13 August 2008.

86 Fourth, in addition to expectations of NPAT, at each of the valuation dates the discount applied by analysts to their valuations of BBL, being a discount to derive a target price, increased markedly, rising from 14.8% as at 13 August 2008 to 72.4% as at 8 November 2008.

87 Accordingly, notwithstanding that BBL on 11 August 2008 announced to the market that it expected to earn no more than $643 million for the year ended 31 December 2008 (on a group basis), analysts applied substantial discounts to this guidance. They expected NPAT to be lower than BBL’s announced guidance. And they further discounted their own valuations, being valuations that were based on NPAT assumptions lower than the guidance provided by BBL.

88 In our view, this was all evidence before his Honour that he was entitled to accept.

89 At this point we should say something more by way of illustration concerning the analysts’ valuations.

90 On 2 May 2008, Merrill Lynch said:

BNB trading at 28% discount to break-up valuation…

Despite delivering a strong FY07 result and FY08 guidance for at least 17% Group NPAT growth, BNB’s share price has fallen 41% CY08 YTD. This earnings valuation disconnect highlights the market’s unwillingness to ascribe value to future principal investment activity and advisory revenues tied to growth in its specialist funds platform. Accordingly, we provide a new valuation approach separately valuing BNB’s balance sheet at a realisable market value and its recurring funds management earnings at an appropriate multiple. This break-up type approach values BNB at $20.43/shr highlighting 28% potential upside to BNB’s current share price. While we regard this approach as overly conservative, it nevertheless highlights bearish views have been significantly overplayed in our view (BUY).

…

Buy rating retained, PO reduced to $24/shr...

In total, our more conservative sum-of-the-parts valuation amounts to $20.43/shr, implies 28% potential upside to the current share price. Our revised price objective of $24/shr is based on the average our sum-of-parts and DCF ($28/shr) valuations and combined with a 4% dividend yield implies a 12 month TSR of 55%.

91 So, the break up value was perceived to be higher than the market price.

92 On 12 June 2008, Wilson HTM expressed the following views:

Babcock and Brown Limited (BNB) is now in the hands of its bankers. If they decide to review BNB’s $2.8B senior debt facility, then BNB will need the lenders’ permission to pay dividends and interest on subordinated debt. This is the most crucial event which has occurred since our last report on the company. The main catalyst for the current situation is the company’s recently failed refinancing of Babcock & Brown Power’s debt facility. This reflected poorly on management’s competence and the market's confidence in them consequently nose-dived.

The company is in an unacceptable risk position from the viewpoint of generating value for shareholders. Accordingly, we have reduced our recommendation to SELL. The risk relates to the company's ability to reduce its gearing through an equity raising and asset sales and the profit achieved from those sales. These risks are further discussed later in the report.

The outcome of the current situation comes with great uncertainty and we view the stock as highly speculative. While we have changed our recommendation to sell, the company is still operating in a profitable manner. For example, today it announced the participation by its European Infrastructure Fund (BBEIF) in the £3.6B purchase of Angel trains. This will provide BNB with advisory fees and funds management fees. Below we list possible outcomes:

1. Banks will require BN 8 to reduce its gearing through a combination of asset sales and an equity issue. We have made this our most likely outcome for the purpose of the earnings forecast. The sell recommendation takes this case and applies our judgement on risk. Our forecast includes BNB’s gearing reducing from 81% at 31/12/07 to 57% at 31 /12/08 and results in a large fall in our EPS forecast. This provides a $5.40 DCF. It includes a $1.4B equity raising at $4 per share.

2. MQG acquiring BNB. MQG has a habit of not paying more than NTA for distressed assets. In the case of BNB, this is approximately $5 per share based on our assessment of current asset values.

3. BNB being privatised. BNB needs to find $1.1 B from investors (at $5 per share) to take the company private. It would need to look offshore for that investment.

4. No change. The lenders may decide that it should be allowed to maintain its capital structure, which we consider to be the least likely outcome. The market cap trigger at $2.5B was included in the loan conditions for the benefit of the lenders and we would expect that they would exercise this option. Lenders do use the falls in share prices as an indicator of the potential risk of loss. If there is no change in the capital structure there is substantial upside in the stock, the details of which are contained in our last report.

(Emphasis in original.)

93 On 30 June 2008, Deutsche Bank was doing its valuation on a net tangible asset basis. Their target price of $7 per share was on the basis of $7.19 per share calculated on a net tangible asset basis.

94 On 11 August 2008, Citigroup gave its valuation which was not referable to earnings.

95 So it said:

Valuation

Our target price has been reduced to $6.68 (from $9.50) and now reflects a 10% discount to our estimated CY08e Book Value.

Our NAV is $9.53 and reflects a blended 2009E PER of global investment banks, asset managers and wind energy developers, less a 20% discount for company-specific issues of late which have significantly reduced market confidence in the company.

Our spot DCF valuation is $11.18, having been derived by explicit forecasts through to CY11e, and then based on key value drivers to CY17e, assuming a risk-free rate of 6.5%, ERP of 5.5%, equity beta of 2.0 and terminal growth rate of 3%, yielding a discount rate of 11.8%.

96 This was not a valuation referable to earnings. Indeed, the price ($6.68) was at a 40% discount to the “spot DCF valuation” of $11.18 per share.

97 On that day, Deutsche Bank also gave its valuation, which was not a DCF calculation but a net tangible assets calculation.

98 Further, on 11 August 2008, Merrill Lynch said:

In total, we have made the following adjustments to our earnings forecasts and valuation as a result:

• EPS downgraded 18%. We have downgraded FY08 Group NPAT 18% to $611m, 5% below the $643m in FY07, and cut FY09 by a similar extent on lower fund raising forecasts and development profits

• Price objective reduced to $7.00/shr. After allowing for the impact of write downs on BNB’s NAV, our break-up valuation driven price objective reduces from $7.50/shr to $7.00/shr. This valuation values BNB’s balance sheet assets at a 20% discount to ML’s market value estimate and funds management at run-off.

While BNB is only trading at 4x revised prospective EPS, earnings risks remain skewed to the downside in this environment and with little investor support we believe BNB is unlikely to outperform. Neutral rating maintained.

99 Also on 11 August 2008, ABN Amro said:

Valuation and risks to our target price

We use a DDM valuation for BNB and apply a 30% discount to arrive at our target price. The discount reflects the difficult market environment and general aversion to financial companies at this time. Key downside risks to our price target include potentially sizeable write-downs or further delays in asset sales. Key upside risks are 20%-plus EPS growth in the medium term or the profitable sale of wind power assets.

100 This was a dividend discount model using future earnings.

101 Further, on the same day, UBS said:

• Gearing and asset value risk leaves material earnings uncertainty

We expect BNB to make organisational changes in the near term. We have low confidence in our earnings estimates given the implied ~8% (~$400m) pre-tax impairments in the BNB Investment Portfolio of $5.0bn. We need clarification on sustainable gearing and staff payout ratios to determine BNB’s earnings capacity. Deal timing/completion on wind farm portfolio sales is a key risk to 2H08E.

• Valuation: $6.80 Price Target (historic b/v plus equity raised)

Our PT and rating are unchanged pending IH08 disclosures next Thu 21st August.

102 They also said:

We have downgraded BNB’s earnings materially. We struggle to envisage earnings growth for the business as it restructures, repositions and de-levers. Given that BNB continues to generate earnings in excess of its cost of capital, arguably BNB appears cheap trading at 0.9x NTA. However we see material earnings risk driven by the uncertainty surrounding the value of balance sheet assets, particularly during a period of de-leveraging. There is a growing reliance on the realisation of development profits, primarily infrastructure, for ongoing earnings delivery. The timing and quantum of these development profits is likely to be volatile.

103 On 12 August 2008, Credit Suisse published a report which said:

• View: We have not credited BNB with achieving its FY08E guidance statement for some time. Nevertheless we see this as another confidence shattering event for BNB, underscoring key uncertainties regarding the value of assets held on balance sheet and BNB’s ongoing earnings power.

104 All of these analysts’ reports well demonstrate that the market did not take BBL’s forecasts seriously. Further, most used valuation methodologies that eschewed reliance on BBL’s NPAT forecasts in any event.

105 All of the evidence to which we have referred supported a conclusion that there was a disconnect between BBL’s forecast as to the maximum NPAT for the year ended 31 December 2008 and widely held views in the market as reflected in the share price concerning the NPAT that might be achieved. Further, those views became considerably more pessimistic over the period of alleged non-disclosure. Therefore, the usual premise that the share price reflected market expectations concerning NPAT forecasts and associated uncertainties and contingencies likely to affect the business of the company concerned did not hold. A different kind of analysis was required when considering the circumstances of BBL at the relevant time.

106 Having set out what in our view is important context, it is appropriate to then turn to the appellants’ specific arguments concerning non-disclosure.

Analysis

107 We would reject the appellants’ non-disclosure case concerning the Larkin memorandum. But before we proceed further, it is worth setting out some aspects of the Larkin memorandum.

108 At the outset it was stated:

This paper provides an analysis of issues effecting BNB Group FY08 guidance, sensitivity analysis around the range of potential outcomes, a recommendation for the guidance to be provided to the market and recommendations as to the specific actions to meet guidance.

109 Then there was a discussion of the most recent guidance that BBL had given to the market. Mr Larkin then said:

The issue with the most recent guidance provided to the market is that [it] does not provide a floor for FY08 earnings.

110 It was then said:

As noted to the Board sub-committee on 6 August 2008, FY08 guidance will be impacted by:

1. Kallista outcomes

2. Completing transactions in accordance with the forecast, particularly in Real Estate and Infrastructure

3. Any decline in real estate values and other provisions required in addition to forecast

4. Loss on exit of investments not in forecast, in particular in Corporate & Structured Finance or non-strategic assets

5. Restructure provision, including the impact of BDR’s

The analyst current view updated for our most recent announcement (excluding non-updated outliers) is:

111 It was then said:

On the specific matters noted in the presentation to the Sub-Committee on 6 August 2008:

Kallista

An overview provided by Toto Lo Bianco to the Board sub-committee on 7 August 2008, outlining the status of the Kallista sale process, is attached as Appendix A. B&B European Infrastructure will be focused on approaching those major bidders who either withdrew from the sale process or did not participate, with a view to having them reengage in the process, especially those key bidders who have completed due diligence i.e. [Suez] and Gas Natural and other major companies including, RWE, ENEL, EON.

Real Estate/Infrastructure

The real estate and infrastructure groups have recently reforecast revenue for 2008. A summary of transactions to achieve these forecasts are included as Appendix B. In current market conditions (notwithstanding the probability weighting/analysis of each group) there is a clear risk that forecast transactions will either not occur at forecast values or be deferred.

…

Sale of US 09 Wind

The US 09 wind assets are in late stages of development and could be sold prior to December 2008. A detailed note on the potential for a sale prior to 31 December 2008 from Mike Garland is attached in Appendix C.

112 Then it was said:

SENSITIVITY ANALYSIS FULL YEAR 2008 GUIDANCE

Base Case Profitability of $750m assumes:

i) Kallista completes in full

ii) Remuneration rate is 45%

iii) Current forecasts are met

iv) No restructure provision is required

v) No additional losses arise from Real Estate or legacy assets

In the context of the uncertainty in providing FY08 guidance around the existing issues we have undertaken a probability weighted assessment of our 2008 guidance:

If we adjust for the probability weighted outcome and apply +/. $100m factor, this allows earnings of between $400 – $600 NPAT for the year. The guidance is subject to (a) market conditions; and (b) outcomes from the sale of European wind assets, as well as achievement of each of the initiatives noted above.

113 Clearly this was a sensitivity analysis and not a forecast.

114 Mr Larkin then recommended:

Guidance Recommended

In light of the above we recommend that we retain our most recent guidance, in that we do not expect 2008 profit to be above the 2007 Group NPAT of $643 million. Our result will be dependent on a number of things including:

• the timing and outcome of our 2008 asset sale program

• whether there is a requirement for further provisions against impairment

• Progress in relation to restructuring and cost reduction program

Further guidance to the market would be provided when we have more clarity on some of these issues.

Clearly this does not address the issue of a “floor” on our FY08 earnings, however given that the market has been informed of our current position and given the uncertainty of the potential outcomes including what may be a reasonable view of a floor of our guidance. We are consulting with our advisers and this will provide the meeting with an update of their advice on this matter.

115 Further, in an appendix to the memorandum there was a detailed discussion of the Kallista project. A fair reading of the detail, which we do not need to set out in full, realistically portrays the scene that the sale of part or all of the assets could be completed before the end of the 2008 financial year.

116 It was said in section 2 “Current Status” of the appendix that:

Following the withdrawal of bidders discussed above, in any event, a total of 8 bids have been received for Spain, Portugal, France and Germany. The Greek bids in relation to the Arkadia projects are due Friday the 8th.

Negotiations are currently underway in relation to the possible finalisation of a transaction for Spain, the second largest of the Kallista businesses. If they are concluded on the anticipated terms it would provide a compelling benchmark and message to the market, and would provide momentum for the whole process. The objective is to conclude these discussions in the coming 7 days or immediately following the mid-August break. In relation to Greece, we will receive the bids shortly and look to engage on them accordingly.

In France we have received one offer, from Singapore-based industrial Keppel Holdings, and are awaiting another one from ENEL, who was a late entrant into the process and who will require additional time to complete their work and have indicated they could do so and provide a binding bid by the 15th of September. With both Gas Natural and Suez withdrawing from the process for external reasons days before final bid submission, Portugal has been hardest hit. Iberdrola submitted an offer, but- as with ENEL- they still have work to complete. Also, as expected, Iberdrola has tried to take advantage of the withdrawal of the other bidders. Two offers were received for Germany, one from a consortium of two local utilities and another from a Danish investor.

The French, Portuguese and German offers received thus far are not currently at levels we would accept or that we believe are representative of fair value, even in the current challenging market conditions.

117 Indeed, some of these assets were sold in that time-frame, for example, the Spain and Portugal assets. By 29 October 2008 the Spanish assets had been sold with regulatory approval for the sale obtained. The Portuguese assets were sold on or around 17 November 2008.

118 Further, it was said in section 3 “Next Steps” of the appendix that:

We spent a lot of time with a lot of bidders and everyone agrees we have great assets and unfortunate timing! In addition to the compelling asset quality, all of the documentation, all the sale materials and all the necessary corporate restructurings have been completed so that a revised approach to the process can move forward. In addition to working through the Greek and French offers, it is proposed that in late August, immediately after the holidays, we move forward as follows:

• Continue to look to re-engage Suez, and possibly Gas Natural (who have both completed full due diligence and are ready to bid). If we manage to bring them back, at the very least we can better leverage Iberdrola to push up their price and move towards close.

• Bring in select, qualified bidders who didn't participate originally, often due to conflicts. International Power, who have previously expressed their interest, is one such example. RWE and ENEL (in respect of other countries) are other examples. A number of these parties have been indirectly approaching us in the last 48 hours, including EON, Taqa, and some other cash-rich financial investors. With these parties a direct, less formal dialogue is likely to get a better result.

• Explore a range of potential options including full sale, partnership, the sale of stakes to passive investors and other financing alternatives.

• Present infrastructure investors the opportunity to acquire only the operating assets, and possibly also to enter into a framework agreement with us for the projects in development. This model could be applied in France and Germany to the existing bidders as well. Subject to related party concerns, BBEIF might also now participate in the process.

These options will run in parallel, and will require flexibility and creativity. We are particularly encouraged by the very recent, unsolicited approaches we have received from bidders wishing to engage. A sale of the Spanish assets would also add further positive momentum.

119 We would begin by making several points.

120 First, the Larkin memorandum and its analysis was not a forecast or a revised forecast. Rather, it was a sensitivity analysis or a “probability weighted assessment of our 2008 guidance”, as Mr Larkin described it.

121 Mr Larkin’s purpose was to identify the different sources of uncertainty and their impacts to assess whether BBL had sufficient certainty about 2008 NPAT to give further revised earnings guidance in circumstances where, as Mr Larkin put it, “[t]he issue with the most recent guidance provided to the market is that it does not provide a floor for FY08 earnings”.

122 Viewed as a whole the Larkin memorandum had the character of a briefing paper bringing to the attention of the reader both analysis and information available at the time that might be used to make an assessment as to likely earnings. It did so in circumstances where the likely earnings depended upon lumpy events, being asset sales, rather than the more usual context in which the pattern of sales in the ordinary course of trading might be assessed and presented, in effect, as themselves stating a likely forecast. The matters in the Larkin memorandum called for the reader to make a judgment as to likely NPAT and offered a provisional personal view. Viewed objectively, its content and form was not to state a conclusion or to express a forecast. Rather, it invited discussion and the formation of an opinion by others based on its content concerning likely NPAT.

123 Mr Larkin started with the figure of $750 million rather than building it up, and identified various positive or negative potential impacts. Moreover, many of the impacts were assumptions or identified in a provisional manner. So, for example, the major negative potential impact, apart from the Kallista project not completing in full, which was assigned a 50% probability, was a reduction in future revenues in respect of which Mr Larkin stated “assume 20% decline”.

124 Mr Larkin assigned probabilities between 50% and 100% to the various positive and negative impacts.

125 Mr Larkin’s sensitivity analysis showed that, assuming that the Kallista project realised only $350 million in 2008 rather than $700 million, 2008 NPAT could still vary substantially. Indeed, if all of the identified negative and positive impacts came about, 2008 NPAT would be $700 million, which was higher than the actual 2007 NPAT.

126 Mr Larkin also applied what he described as a “+/- $100m factor”. This was a notional figure, apparently adopted to emphasise that the sensitivity analysis was itself uncertain.

127 Mr Larkin concluded that BBL “retain our most recent guidance” even though it did not address “the issue of a ‘floor’ on our FY08 earnings” given that the market had been “informed of our current position” and the “uncertainty of the potential outcomes”.

128 In summary, the exercise was not a forecast or revised forecast for NPAT, let alone one adopted by the board. It is difficult to see how the memorandum or the analysis contained therein was material information in a relevant sense requiring disclosure.

129 Second, the revised earnings guidance that had been given on 11 August 2008, from an estimate of $750 million to a statement that earnings were not expected to exceed $643 million, did not result from a re-evaluation of whether the sale of European wind farm assets (the Kallista project) would complete in full in the 2008 financial year.

130 Now the Kallista project was announced in February 2008 and was expected to account for up to $800 million of estimated NPAT for the 2008 financial year. It was being undertaken by a global competitive bid process.

131 By early August offers had been received for some of the assets. Further, offers continued to be received and considered during October. Moreover, on 29 October 2008 it was announced that the Spanish assets had been sold for $1.42 billion, resulting in an estimated profit of $266 million.

132 Now at all relevant times there was material before the board indicating that there were real prospects of selling the relevant wind assets so that the revenue could be brought to account in 2008. But there was uncertainty as to prices.

133 Now the appellants say that if one looks at the table used to produce the guidance in the Larkin memorandum, it is apparent that the impact of real estate re-valuation ($70 million) is dwarfed by the impact of the Kallista project ($350 million). And they say that it is evident from his approach in the Larkin memorandum that Mr Larkin did not consider that he could base any forecast upon the assumption that the Kallista project would complete in full, as otherwise the forecast would have been $750 million in accordance with the previous guidance. Further, they say that even if one removes Mr Larkin’s adjustment for real estate re-valuation in the table in the Larkin memorandum ($70 million), the forecast would be $680 million, still well above the revised forecast of “not above $643 million”.

134 Further, as to the contention that Mr Larkin’s computation is not a forecast but a sensitivity analysis, the appellants say that this is an exercise in semantics. And they say that uncertainty is present in any forecast or guidance, and the guidance arrived at will no doubt always be the product of an assessment of the likelihood (or not) of particular events in the future occurring.

135 But in our view the appellants’ points go nowhere. Clearly the Larkin exercise was not a forecast, let alone a forecast adopted by the board. Both BBL and the primary judge have accurately characterised it for what it is.

136 Third, the appellants submitted that the Larkin memorandum contained a forecast of “$500 million and/or a range of between $400 - $600 million” which was below “the market’s expectations of earnings in a significant way” as reflected in the Bloomberg consensus. But that wrongly treats the provisional sensitivity analysis in the Larkin memorandum as a forecast and wrongly equates the Bloomberg consensus with the market’s expectation as to 2008 NPAT without engaging with the primary judge’s findings on this issue.

137 Fourth, the appellants refer to the average of analyst forecasts before 14 August 2008 used by Mr Potter, being $577 million. But as is apparent from Mr Potter’s evidence more generally, he did not put the $577 million average of analyst forecasts forward as something that could be equated with market-expected 2008 NPAT as at 13 August 2008. Further, every analyst report included in it set a value or target price materially above BBL’s closing market price on 11 August 2008, and even further above its closing market price on 13 or 14 August 2008. Further, the two analyst reports received on 12 August 2008, which were the closest analyst reports in date to the Larkin memorandum, contained 2008 NPAT forecasts of $524 million (Aegis) and $422 million (Credit Suisse), giving an average below the $500 million figure it is alleged was required to be announced.

138 Generally, there is no reason to think that BBL’s market price on 14 August 2008, when the Larkin memorandum was discussed with the board, reflected or instantiated an expectation of 2008 NPAT that was the same as the 2008 NPAT forecasts given by analysts on 11 August 2008, who valued BBL at substantially higher prices than the market did.

139 Fifth, the appellants take issue with the primary judge’s finding at [86], where his Honour found that the objective material which his Honour had summarised in [76] to [85] “made it unlikely that there were any expectations in the market from the middle of 2008 to the end of December 2008 of positive earnings being achieved by BBL for the full Financial Year ending 31 December 2008”. But his Honour’s finding concerned likely market expectations given the objective circumstances. The finding preceded a detailed consideration of the expert analysis of the same issue. It was not categorical.

140 Sixth, the appellants further submit that the sensitivity analysis in the Larkin memorandum was material because it was “radically lower” than the $643 million “ceiling” referred to in the 11 August 2008 announcement. Similarly, they refer to Myer and submit that a company which has given earnings guidance is generally required to announce to the market any “corrections thereto” (at [1304]). But the sensitivity analysis in the Larkin memorandum was not radically lower than the earnings guidance given on 11 August 2008. It was consistent with it, insofar as it supported the view that in the circumstances in which BBL found itself no better guidance could be offered than that already given.

141 In summary, we reject the appellants’ arguments concerning materiality.

142 We should now say something about the listing rule exceptions, upon which BBL bore the onus to establish.

143 His Honour’s reasons do not expressly discuss the operation of listing rules 3.1A.1 and 3.1A.2 in their application to the first non-disclosure case, or indeed the other non-disclosure cases.

144 But assessing the matter for ourselves, on the evidence there is little doubt that the confidentiality condition of listing rule 3.1A.2 was satisfied concerning the information said not to have been disclosed in each non-disclosure case. Indeed, the obviousness of that conclusion given the form, content and intended audience for the Larkin memorandum may explain the failure to address the matter expressly in the reasons.

145 As for the condition in listing rule 3.1A.1, this is more complicated. But again, assessing the matter for ourselves, we would say this was satisfied concerning the information said not to have been disclosed in the first, second and third non-disclosure cases.

146 Now the appellants say that the primary judge did not make any finding on the requirements of listing rule 3.1A.1. And the burden in this regard is on the party seeking to establish the exception. The appellants say that as a consequence of the absence of such a finding, there is no basis to conclude that the exceptions in listing rule 3.1A are made out at all. We agree with the first and second propositions, but not the third. We can and have assessed that for ourselves. As we have said, the requisite elements of listing rule 3.1A have been made out concerning the alleged first, second and third non-disclosure cases. Further, there is no substance to the appellants’ complaint concerning his Honour’s finding as regards listing rule 3.1A.3.

147 Finally, in our view, even if the information in the Larkin memorandum was required to be disclosed, that is no basis for overturning the primary judge’s findings on causation and loss.