FEDERAL COURT OF AUSTRALIA

Jamsek v ZG Operations Australia Pty Ltd [2020] FCAFC 119

ORDERS

NSD 495 of 2019 | ||

| ||

BETWEEN: | MARTIN JAMSEK First Applicant DANIEL CIVTANOVIC AS TRUSTEE FOR THE BANKRUPT ESTATE OF ROBERT WILLIAM WHITBY Second Applicant STEPHEN HUNDY AS TRUSTEE FOR THE BANKRUPT ESTATE OF ROBERT WILLIAM WHITBY Third Applicant | |

AND: | ZG OPERATIONS AUSTRALIA PTY LIMITED ACN 060 142 501 First Respondent ZG LIGHTING AUSTRALIA PTY LIMITED ACN 002 281 601 Second Respondent | |

JUDGES: | PERRAM, WIGNEY AND ANDERSON JJ |

DATE OF ORDER: | 16 JULY 2020 |

THE COURT ORDERS THAT:

1. The orders made by the primary judge on 4 November 2018 in relation to the first applicant and Robert William Whitby are set aside.

2. The first applicant and Robert William Whitby were between about 25 August 1993 and about 1 October 2015 employees of the first respondent:

(a) within the meaning of s 335 and item 1 in the table at s 342(1) of the Fair Work Act 2009 (Cth); and

(b) for the purposes of s 12(1) of the Superannuation Guarantee (Administration) Act 1992 (Cth).

3. The first applicant and Robert William Whitby were between about 25 August 1993 and about 1 October 2015 employees of second respondent:

(a) within the meaning of s 335 and item 1 in the table at s 342(1) of the Fair Work Act 2009 (Cth); and

(b) for the purposes of s 12(1) of the Superannuation Guarantee (Administration) Act 1992 (Cth).

4. The first applicant and Robert William Whitby were between about 1 January 1977 and 20 January 2017 workers in the service of the second respondent for the purpose of s 3 of the Long Service Leave Act 1955 (NSW).

5. The matter be remitted to the primary judge to:

(a) determine what, if any, contraventions of the Fair Work Act 2009 (Cth) and Long Service Leave Act 1955 (NSW) have been effected by the respondents;

(b) determine what quantum of compensation of entitlements the respondents are liable to pay the applicants under the Fair Work Act 2009 (Cth);

(c) determine what long service leave entitlements the respondents are liable to pay the applicants under the Long Service Leave Act 1955 (NSW); and

(d) conduct a hearing on penalties.

6. The respondents pay the first applicant’s costs of and incidental to the application for an extension of time to appeal (and subsequent appeal) to the Full Court.

7. The parties otherwise bear their own costs of the proceeding.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

PERRAM J:

1 I have had the advantage of reading in draft the reasons of Anderson J. I agree with his Honour that both Mr Jamsek and the Trustees should be granted leave to appeal out of time. The explanations proffered for the delay were reasonable in the circumstances and the proposed appeal is of substance. It would be unjust in the circumstances if the appeal was not to be heard by reason of a concatenation of events for which the Appellants are largely blameless.

2 As to the appeal itself, I agree with Anderson J that if this Court were to come to a different view on the question of employment to that of the trial judge, that would be sufficient to conclude that the trial judge had erred and to engage this Court’s jurisdiction to review. The question of whether one person is an employee of another involves the application of a legal standard to a given set of facts. In this case, the legal standard is s 13 of the Fair Work Act 2009 (Cth) which defines a ‘national system employee’ (which the Appellants alleged themselves to be). An individual will be a national system employee ‘so far as he or she is employed, or usually employed’ by a national system employer. By s 11 ‘employee’ in that provision is taken to have its ordinary meaning, from which I would take that ‘employ’ also has its ordinary meaning.

3 The ordinary meaning of employment has been the subject of exposition by the High Court on a number of occasions including in Stevens v Brodribb Sawmilling Co Pty Ltd [1986] HCA 1; 160 CLR 16 (‘Stevens’) and Hollis v Vabu Pty Ltd [2001] HCA 44; 207 CLR 21 (‘Hollis’). It is the principles stated in those cases which are to be applied to the facts in this appeal. No different principles are to be applied to the Appellants’ claims about either their superannuation under the Superannuation Guarantee (Administration) Act 1992 (Cth) (which uses the word ‘employee’ in its ordinary sense in s 12(1)) or their claims about long service leave under the Long Service Leave Act 1955 (NSW) (which in s 3(1) uses the word ‘worker’). The standard in each case is the same.

4 The question of whether a given set of facts could satisfy a particular legal standard is a question of law (Vetter v Lake Macquarie City Council [2001] HCA 12; 202 CLR 439 at 450 [24]). On the other hand, the question of whether the same facts do satisfy that legal standard is generally a question of fact. For their appeal to succeed the Appellants need to establish that on the facts as found below the Court should have found that they were employees. Consequently, their appeal is an appeal on a question of fact.

5 But the fact in question (whether the Appellants were employed) is an inference drawn from other facts found. This Court stands in the same position as the trial judge in the drawing of that inference and whilst it will give respect and weight to his Honour’s conclusion it will not shrink from giving effect to its own conclusion: Warren v Coombes [1979] HCA 9; 142 CLR 531 at 551. Furthermore, the particular standard to be applied – employment – has a correct answer. One either is employed or one is not. There is no indeterminate middle state. Consequently, if this Court draws a different inference to that drawn by the trial judge this will entail that the trial judge erred and this Court will be bound to substitute its own conclusion.

6 The question then is what inference this Court should draw about the issue. The Court is required to consider the totality of the relationship between the parties: Stevens at 29 per Mason J; applied in Hollis at 24 at [44] per Gleeson CJ, Gaurdron, Gummow, Kirby and Hayne JJ. As Mummery J observed in Hall (Inspector of Taxes) v Lorimer [1992] 1 WLR 939 at 944 the object of this exercise is to paint a picture from the accumulation of detail and thereby to obtain an informed consideration of the qualitative nature of the whole. Having done so, it is often said that the difference between an employee and an independent contractor is ‘rooted fundamentally in the difference between a person who serves his employer in his, the employer’s, business, and a person who carries on a trade or business of his own’: Marshall v Whittaker’s Building Supply Co [1963] HCA 26; 109 CLR 210 (‘Marshall’) at 217 per Windeyer J. This might be thought to suggest that there is a natural dichotomy between, on the one hand, being employed and, on the other, conducting one’s own business. On this view, an affirmative answer to the latter inquiry would imply a negative answer to the former. The logic of this would suggest that one could substitute the question of whether a person was an employee with the question of whether the person was conducting their own business.

7 There are, it turns out, two difficulties with this thinking. First, it pays insufficient attention to the word ‘serves’ in Marshall. The dichotomy Windeyer J identified was not between those who work in someone else’s business and those who conduct their own business; it was between those who serve in the employ of another and those who conduct their own business. Secondly, as has been pointed out, working in the business of another is not necessarily inconsistent with working in a business of one’s own: ACE Insurance Limited v Trifunovski [2013] FCAFC 3; 209 FCR 146 (‘ACE Insurance’) at 182 [128] per Buchanan J. The facts of Dental Corporation Pty Ltd v Moffet [2020] FCAFC 118 (‘Dental Corporation’), delivered contemporaneously with the decision in this appeal, illustrate that. Thus an affirmative answer to the question of whether one is working in one’s own business does not necessarily entail that one is not working in another’s business or that one cannot be an employee. It all depends on the facts. ACE Insurance was a case where insurance sales agents were working in their own businesses and in the business of ACE Insurance and were employees. Dental Corporation is a case where Dr Moffet was working in his own business and in Dental Corporation’s business and was not an employee.

8 For that reason, alighting upon the question of whether someone is working in their own business may have a tendency to cause confusion in an area which is already replete with traps for the unwary. This Court has, therefore, affirmed that the question which is to be asked and answered is whether the person is an employee and not whether the person is conducting their own business: Tattsbet Limited v Morrow [2015] FCAFC 62; 233 FCR 46 at 61 [61] per Jessup J (Allsop CJ and White J agreeing). No doubt understanding whose business is being conducted is a valuable aid to comprehension but it is not the central inquiry and an answer to it, one way or the other, is not necessarily decisive.

9 Anderson J has explained the facts of this case and the application of those principles to the appeal in terms from which I respectfully would not dissent. But I would add this: to my mind the most important element in the present appeal is the question of goodwill. The trial judge thought that the Appellants could have sold their businesses and any such sale could have included a sale of goodwill. I would accept this is technically a correct statement in that there was no legal prohibition on the Appellants preventing them from including in an agreement for the sale of their businesses a component for goodwill.

10 But I do not think that conclusion was the correct question for the purposes of an industrial analysis. No doubt, the expression ‘goodwill’ is sometimes used in the context of a contract for sale of a business to denote the difference between the assigned value of the assets of a business and the sale price. But for legal purposes goodwill is a species of property and consists of the right or privilege to conduct a business in substantially the same manner and by substantially the same means that have attracted custom to it: Commissioner of Taxation v Murry [1998] HCA 42; 193 CLR 605 at 615 [23]. Viewed from that perspective, I do not think it can be correct to say that the Appellants had any capacity to generate goodwill in their own businesses. Although they had an entitlement to work for third parties the fact is that after 1986 they did not. The practical exigencies of the relationship explain why this was so: for most of the relevant period they were required to work from 6 am to 3 pm Monday to Friday and had no time to work for anyone else. There was therefore no realistic possibility of the liberty being taken up. This reality was part of the totality of the relationship.

11 The trial judge focussed on the submission of the Appellants that their work had not involved or resulted in the development of any goodwill. But his Honour was unimpressed by this fact concluding that ‘there are many businesses which do not generate goodwill and which cannot be effectively sold’. That may well be so but in this area the absence of goodwill in an employee’s business is a potential indicator that the goodwill is possessed by the employer and hence that the business being conducted is the employer’s business. This is not to deny that the Appellants were conducting their own businesses but it is a matter which can throw real light on whether they were being employed. It does not determine the matter but it is a helpful and important aspect of it. In my view, these men were much closer to the situation of the insurance sales agents in ACE Insurance who had their own cars, issued invoices for GST and ran their own businesses.

12 Consequently, in my view, the trial judge erred in three related ways. First, he erred in concluding that the Appellants had goodwill in their businesses which could be disposed of by sale for this involved the incorrect notion of goodwill. In practical terms, they had no goodwill and no possibility of acquiring it. Secondly, he erred in thinking that the absence of goodwill was, in any event, a factor of ‘little weight’. It was in fact an important matter. Thirdly, his Honour erred in drawing the inference that there was no relationship of employment. The correct inference was that there was.

13 The appeal must therefore be allowed. I agree with the orders proposed by Anderson J.

I certify that the preceding thirteen (13) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justice Perram. |

Associate:

REASONS FOR JUDGMENT

WIGNEY J:

14 I agree with the orders proposed by Anderson J. Subject to what follows, largely by way of elaboration, I also agree with the reasons to be published by both Anderson J and Perram J. Like their Honours, I have concluded that the primary judge erred in inferring from the whole of the evidence that the relationship between Mr Jamsek and Mr Whitby and the business conducted by the respondent companies was not a relationship of employer and employee.

15 The relevant facts are comprehensively described in the reasons of Anderson J. The facts show that the reality of the relationship was that, for over 30 years, Mr Jamsek and Mr Whitby were continuously employed driving delivery trucks exclusively for the respondents’ business for effectively nine hours a day, five days a week, on conditions and at pay rates set by the business.

16 It is true that, in 1986, faced with the choice between redundancy and accepting a change to the nature of the relationship dictated by the business, the two men chose the latter course. That involved them buying the trucks previously owned by the business at values determined by the business and signing a contract which described them as “contractors”. Yet the reality was that, aside from the fact that the men took over the risk and expense of owning and operating the delivery trucks, little else changed. The men certainly had no real independence. While they continued to have some flexibility in the way they carried out their work, they had no real or effective control in respect of the key aspects of the work relationship. The business effectively continued to dictate the hours during which the men were to be available for work, what they were to do, the remuneration that they were to receive, the annual leave that they could take, the paperwork they had to complete and other key rights and obligations.

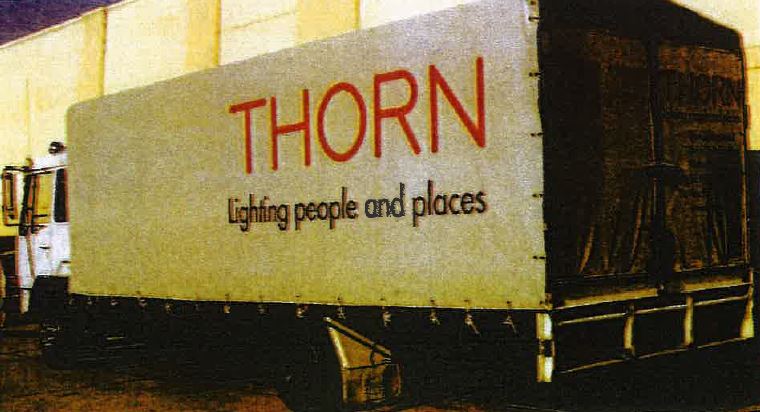

17 It may have been strictly correct to say, as the primary judge did, that after 1986 the men “in principle” could have used their trucks to “serve others”. Yet that was no more than a chimera. There was no real scope for them to do so given that they were required to be at the disposal of the business for nine hours a day, five days a week, and their trucks were, for the most part, adorned with the business’s livery. When and for whom and in what circumstances could they realistically have done deliveries for others? Of course, the evidence showed that they never could and they never did.

18 The notion that the men could have sold their “businesses” if they wanted to and that such sales “may have included goodwill” was equally illusory and fanciful. There was in reality no scope for them to generate their own goodwill. They had no customers of their own and had always driven their trucks in circumstances which required them, for all intents and purposes, to appear to be representatives of the business. Their trucks and shirts bore the names and logo of the business, not some other business name or logo.

19 To my mind, the primary judge concluded as he did by giving primacy and excessive weight to contractual labels and theoretical possibilities and insufficient weight to the reality and totality of the working relationship between the parties, as demonstrated by the way they actually conducted themselves over many years. The evidence of the totality of the relationship compelled the conclusion that Mr Jamsek and Mr Whitby were employees of the business at all relevant times. The primary judge erred in concluding otherwise.

20 The appeals accordingly must be allowed. As indicated earlier, I agree with the orders proposed by Anderson J.

I certify that the preceding seven (7) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justice Wigney. |

Associate:

Dated: 16 July 2020

REASONS FOR JUDGMENT

ANDERSON J:

21 For nearly 40 years, Martin Jamsek and Robert Whitby were delivery truck drivers for essentially the same business. After leaving high school at an early age, they commenced with the company that owned the business in 1977 and, from 1980 until 2017, worked full-time as truck drivers. That work was their sole source of income during that period. They did not drive, or deliver goods, for any other business or entity.

22 Since 1986, however, Mr Jamsek and Mr Whitby (applicants) were not formally considered employees of the respective companies that owned the business from time to time (for simplicity, referred to below in the singular as the company). The relationship between the applicants and the company was, for the large part, subject to contracts, entered into at various intervals, between, on one hand, partnerships in which the applicants were members with their spouses and, on the other hand, the company. These contracts were each entitled a “Contract Carriers Arrangement”. The partnerships were described therein as “Contractors”.

23 After termination of their working relationship with the company in 2017, the applicants commenced proceedings in this Court seeking declarations and orders in respect of certain statutory entitlements. The central issue concerns the nature of the relationship between the applicants and the company. The key questions include whether the applicants were, at the relevant times, “employees” within the meaning of the Fair Work Act 2009 (Cth) (FW Act) or the Superannuation Guarantee (Administration) Act 1992 (Cth) (SGA Act), or “workers” within the meaning of the Long Service Leave Act 1955 (NSW) (LSL Act). The primary judge held that the applicants did not meet these statutory definitions.

24 For the reasons explained below, my view, contrary to the primary judge, is that, upon an assessment of the totality of the relationship between the applicants and the company, the applicants were employees of the company during the relevant period. Notwithstanding the form of the contractual framework agreed between the parties, the relationship of the applicants and the company was, in substance, that of employee and employer.

25 Accordingly, the application for an extension of time, and the substantive appeal, by Mr Jamsek and the trustees for the bankrupt estate of Mr Whitby are allowed. On this basis, the matter will be remitted to the primary judge to determine the statutory entitlements of the applicants.

26 It is necessary to outline some defined terms before setting out the relevant background. Firstly, as Mr Whitby had been declared bankrupt by the time of the appeal, it was the trustees of his bankrupt estate that were the applicants for an extension of time to appeal, not Mr Whitby himself. Regardless, for consistency with the reasons of the primary judge, these reasons refer collectively to Mr Jamsek and Mr Whitby personally as the applicants.

27 Secondly, as detailed below, the business for which the applicants carried out their delivery activities (business), was transferred to a new corporate entity on three occasions during the relevant period. To summarise, adopting broad dates, the sequence of owners of the business were as follows:

(a) from 1977 (upon commencement by the applicants) until 1986, Associated Lighting Industries Pty Limited (ALI);

(b) from 1986 to 1993, Thorn EMI Pty Limited (which changed its name to Thorn Australia Pty Limited on 19 August 1996) (Thorn EMI);

(c) from 1993 to 2015, Thorn Lighting Pty Ltd (which changed its name to ZG Operations Australia Pty Ltd on 28 September 2015) (Thorn Lighting or ZG Operations, as relevant). This entity is the first respondent; and

(d) from 2015 until 2016 (upon termination of the applicants), ZG Lighting Australia Pty Ltd (ZG Lighting) (which had previously been named Zumtobel Lighting Pty Limited (Zumtobel Lighting)). This entity is the second respondent.

28 Finally, as noted above at [22], the owner of the business from time to time is referred to in these reasons as the “company”.

29 The relevant background, which was largely not in dispute on appeal, was set out in the primary judge’s reasons: Whitby v ZG Operations Australia Pty Ltd [2018] FCA 1934 (Primary Judgment) at [13]–[120]. Borrowing from those reasons, a summary of the background facts is set out below.

30 Mr Jamsek and Mr Whitby left high school when they were 14 years old and 15 years old respectively. Neither has any formal education or qualifications. Both have only ever worked in jobs requiring manual labour.

Commencement of working relationship

31 Mr Jamsek started working as an employee of ALI on 7 September 1977. He was then about 22 years old. He was a driver for the company at the latest by 1980.

32 Mr Whitby began working for ALI in October 1977, initially in the company’s paint shop. He was then about 17 years old. He became a delivery driver in 1980.

33 For most of the relevant period during which the applicants were drivers, warehouse staff “picked and packed” the orders for delivery and moved them to a despatch area of the relevant warehouse. They were sorted in that area before being loaded into the trucks. While the products were being “picked and packed”, the drivers would wait in a canteen and have a cup of tea or something to eat. The applicants would then move the products around on the back of their trucks using a pallet jack to ensure their safe transit.

34 There was no dispute that, at least up until the events next described (in late 1985 and early 1986), the applicants were employees of the company.

35 Mr Jamsek, on the advice of his accountant, set up a partnership, MJ & PT Jamsek (Jamsek Partnership), with his wife in late 1985 or early 1986. His income was received and declared as partnership income until his working arrangement with the company ceased in 2017.

36 Around the same time, Mr Whitby, on the advice of his accountant, also set up a partnership, R&D Whitby (Whitby Partnership), in which he and his wife were partners. (It was an agreed fact at trial that the partnership existed from 1 January 1986, and that Mr Whitby was a member.) Mr Whitby was advised that one of the advantages of setting up a partnership was the tax advantages of splitting the income of the partnership between himself and his wife. The income generated from Mr Whitby’s activities was received and declared as business income of the partnership up until 30 June 2012. From 1 July 2012, his income was declared as business income personally derived from a transport operation or courier service business.

37 The Jamsek Partnership and the Whitby Partnership are collectively referred to below as the “Partnerships”.

38 In late 1985, the company was looking to move the NSW branch of its business to Silverwater, a suburb in Western Sydney. Mr Jamsek and another driver, Mr Robinson, asked the company’s manager, Mr Vittens, for a pay rise to compensate them for the extra travel time. The request was rejected. Mr Jamsek and Mr Robinson (who were members of the Transport Workers’ Union) reported this rejection to the remaining drivers, including Mr Whitby. At the time there were five drivers working for the business.

39 After a couple of weeks, and immediately before Christmas 1985, Mr Vittens confirmed that the company would not offer a pay rise but would offer the opportunity for the drivers to “become contractors”. The drivers, including the applicants, were informed to the following effect: “If you don’t agree to become contractors, we can’t guarantee you a job going forward”. The proposal was for the drivers to buy the trucks they were using and be paid “carton rates” with a minimum of $120 per day. The drivers would cover all expenses of operating and maintaining the trucks.

40 Each of the five drivers took up the offer to become contractors. Mr Whitby and Mr Jamsek, on behalf of their respective Partnerships, executed a written contract with ALI to give effect to the new arrangements. The primary judge inferred that this probably occurred around 1 January 1986 (1986 Contract). A copy of the 1986 Contract could not be located and was not in evidence. However, the applicants recalled that it was in similar terms to contracts subsequently entered into (as described below), with the exception that the pay was on a “per carton” rate.

41 Before entering into the 1986 Contract, Mr Whitby was earning approximately $410 a week. The 1986 Contract provided a minimum of $600 per week ($120 per working day). The amount in fact earned each week built up over time. Mr Whitby gave oral evidence that he understood that a significant portion of the increase in earnings over $410 turned on the fact that he was, after entering in to the 1986 Contract, providing to the company a truck in addition to his labour.

42 At the time of entering into the 1986 Contract, Mr Whitby was paid out his accrued annual leave balance. He understood that this was paid out because his employment with the company had come to an end.

43 Consistent with the prelude to, and execution of, the 1986 Contract, Mr Whitby and Mr Jamsek purchased delivery trucks from the company. The primary judge inferred that these trucks, like the trucks acquired subsequently, were purchased on behalf of their respective Partnerships.

44 Mr Whitby purchased a 4 tonne truck from ALI for $21,000. He borrowed money in order to fund the purchase. Mr Whitby gave oral evidence at trial that he would not have committed to buying the truck and taking out a loan if he did not know that there would be sufficient work and income to repay the loan and cover the expenses associated with the truck.

45 Mr Jamsek purchased an Isuzu Pantech 4 tonne truck from the company for $15,000. He and his wife approached a bank to obtain finance before agreeing to purchase the truck. He only agreed to the purchase once he had secured sufficient funding.

46 The applicants were responsible for the registration, maintenance and other costs associated with the upkeep of the trucks which they had purchased. The Partnerships paid all expenses associated with the trucks that they purchased, including interest on the funds borrowed to finance the purchase of the trucks.

Change in ownership from ALI to Thorn EMI

47 The primary judge inferred that, at some point in early 1986, after the 1986 Contract was executed and before 31 May 1986 when ALI was deregistered, ALI transferred the business to Thorn EMI.

48 The applicants did not enter into a new written agreement with Thorn EMI. There was no material change in the conduct of the delivery activities of Mr Jamsek or Mr Whitby at this time.

49 From 1988, after the company installed two-way radios in the trucks, the applicants communicated from time to time with warehouse staff using the radios, and later by mobile phone, in relation to urgent pick-ups, or to accommodate a priority delivery or pick-up.

Purchase of new trucks in 1989 and 1990

50 The Whitby Partnership acquired a 6 tonne truck in 1989 for $70,000. The partnership obtained finance in order to do so. The truck was registered in the name of the partnership. The partnership did not negotiate with the company as to the type or model of truck purchased.

51 In 1990, Mr Jamsek acquired an Isuzu Flat Top 10 tonne truck for an amount between $70,000 and $80,000. It was financed, and paid back over 10 years. At this time, he was asked to, and did, install a tarpaulin on it bearing a “Thorn” logo. He also arranged to have the truck painted.

52 At some time between 1990 and 1993, the Partnerships began invoicing the company on an hourly rate, rather than on a “per carton” basis.

53 Thorn Lighting was incorporated on 17 May 1993.

54 In 1993, Mr Whitby and other drivers approached the company and negotiated or discussed a new arrangement with a minimum 9 hour day, but on the understanding that the number of hours could be more or less than that. Mr Jamsek agreed that Mr Whitby was to negotiate or discuss on his behalf.

55 Around 1 July 1993, four “contractors”, including the applicants through their respective Partnerships, executed a written agreement entitled “Contract Carriers Arrangement” with “Thorn Lighting”, described as a division of Thorn EMI (1993 Contract).

56 The agreed rate under the 1993 Contract included an allowance for annual leave, public holidays and sick days. It guaranteed 9 hours of pay each day, even though it was anticipated that the drivers might not necessarily have to work 9 hours per day.

57 The 1993 Contract included the following terms:

1. The Contractors so named are:

a) Separate legal entities both from each other and THORN LIGHTING.

b) Able to work for other parties, providing that such work is not detrimental to either THORN LIGHTING or THORN LIGHTING customers.

c) To present an invoice for work carried out in the preceding week.

2. THORN LIGHTING and the Contractors have agreed:

1. The Contractors will:

a) Undertake carriage of goods as reasonably directed

b) Comply with all Acts, Ordinances, Regulations and By-laws relating to the registration, third party insurance and general operation of the vehicle within New South Wales.

c) Pay all legal costs, such as tax and duty, payable in respect of the vehicle and keep the vehicle in a mechanically sound, road worthy and clean condition.

d) Be responsible for the vehicle equipment and gear, the safe loading of the vehicle and the securing and weather protection of the load.

e) Exercise all reasonable care and diligence in the carriage and safe keeping of the goods in their charge. Account for all goods by use of run sheets and return of signed delivery dockets or similar documents.

f) Hold at all times and on request produce for inspection, a current driver's licence issued in respect of a vehicle of the class of the vehicle in use and immediately notify THORN LIGHTING if the licence is suspended or cancelled.

g) Not engage or use the services of a driver for the vehicle without prior and continuing approval by THORN LIGHTING. Such driver is to be correctly licensed, suitably dressed, and in all other respects entirely to the satisfaction of THORN LIGHTING.

h) Obtain and maintain a public liability insurance policy for an amount of $2,000,000 or greater in respect of any liability incurred by the Contractor in performance of work for THORN LIGHTING.

i) Obtain and maintain a comprehensive motor insurance policy over the vehicle including cover for amount of $5,000,000 or greater for third party property damage in respect of one accident.

j) Immediately report any accident to the person in charge of the N.S.W. Branch Warehouse and to attend to any legal requirements at the scene or subsequent to the accident.

k) Not offer his vehicle for sale with any guarantee of either continuity of work for THORN LIGHTING, or implied acceptance by THORN LIGHTING of the purchaser.

…

3. ANNUAL LEAVE:

a) Each Contractor is entitled to four weeks annual leave without pay.

It is normally expected that each Contractor will take at least two weeks over the January factory reduced output period. The leave dates to be determined on a roster basis which ensures that no more than two trucks are off at the same time. The roster details to be arranged between the Contractors and the person in charge of the NSW Branch Warehouse.

More than two weeks annual leave at that time must be agreed between the Contractor and THORN LIGHTING.

If THORN LIGHTING should decide to extend the reduced output period to more than two weeks or the NSW Branch close for a longer period, and as a consequence the Contractors have no work during that period, they will be paid on the following formula:

i) Notice of the change given before October 31st, no payment will be made.

ii) Notice given between November 1st and December 18th: the Contractors affected will be paid an amount of $18.92 per hour for a 9 hour day. During that period, the Contractors will be available on call.

iii) No notice given before December 19th, then the Contractors will be paid at their usual weekly rate and must attend either THORN LIGHTING Wetherill Park or Smithfield sites and work as directed.

…

7. PAY RATES:

a) The pay package has been based on trucks over one year old with a carrying capacity of not less than 5 tonnes but less than 8 tonnes. As at 5th July, 1993, the current running rate is $34.33 per hour and standing rate is $18.92 per hour.

Contractors will not be paid for any annual leave, public holidays, and sick days as an allowance has been made within the above rates.

However, if industrial action by THORN LIGHTING employees creates a situation where the Contractors have no work, then the standing rate of $18,92 per hour will be paid,

b) The Contractors and THORN LIGHTING have agreed to a standard nine hour working day with a usual starting time of 6 a.m., both parties accepting that the actual hours may vary due to work load fluctuations.

c) On the basis of (a) and (b), the full weekly pay rate for Contractors doing metropolitan work is $1544.85 per week.

d) The full weekly pay rate for country work, including two trips to Canberra, two trips to Central Coast/Newcastle, and one trip to South Coast is $2250.

As the country work is done on a set day in each area basis, it is possible that the timing of a public holiday may cause no consignments being available for country delivery on the next working day. In this situation, the country run Contractor will be available for metropolitan work and for that day be paid at the metropolitan rate.

e) If the metropolitan work load requires an earlier start than 6 a.m., an hourly rate of $34.33 will apply.

f) THORN LIGHTING agree to review these rates with the Contractors annually, in June of each year, any changes to apply from the 1st of July. If during the period prior to the review an unexpected increase in vehicle costs should arise, then THORN LIGHTING agree to an earlier review date.

g) The Contractors will present invoices for work carried out during the preceding week on the following Monday. THORN LIGHTING will pay by direct bank method on the following Thursday.

…

9. OPERATIONAL POINTS:

a) THORN LIGHTING will where ever possible, offer any extra work to the Contractors at a mutually agreed rate for each job.

b) if the need arises where THORN LIGHTING request a Contractor to return to base to pick up an extra job, the Contractor will assess the effect on deliveries already on board and advise, if in his opinion, the extra work cannot be performed without causing late deliveries to those already onboard points. THORN LIGHTING will then decide the priorities and accept responsibility for any customer inconvenience.

c) The Contractors will arrange amongst themselves, whereby one truck will automatically come to Smithfield each morning to pick up transfer to Wetherill Park. If on arrival at Smithfield, there is more volume than one truck can handle, the Contractor will contact Wetherill Park to arrange assistance. However, if a truck cannot be spared for the transfer, Smithfield Warehouse should be advised to arranged alternative transport.

d) THORN LIGHTING recommend that as each Contractor, is responsible for their own sickness and accident liabilities, they carry appropriate insurance including General Carriers Liability, in addition to any other insurances set out previously in this document.

58 At or around the time of the 1993 Contract, Mr Jamsek was supplied with “Thorn” uniforms, to replace the “ALI” uniforms that he had previously worn. The primary judge accepted that the drivers were provided with various items of clothing which bore a “Thorn” logo.

59 In about 1993, a company manager stated to Mr Jamsek that “you can’t include any additional hours worked unless it is a special delivery which we have agreed”.

1993 transfer of business to Thorn Lighting

60 On 25 August 1993, the business name “Thorn Lighting” was registered by Thorn Lighting. The primary judge inferred that, around this time, the business was transferred from Thorn EMI to Thorn Lighting. No new written contract was entered into between the Partnerships and the new owner of Thorn Lighting until 1998.

61 In 1993, the Whitby Partnership traded in the truck acquired in 1989 (see above at [50]) and leased a 6 tonne tabletop Mitsubishi. The leased Mitsubishi was treated as an asset of the partnership and deductions were claimed on the costs of the lease, running costs and for depreciation. Mr Whitby did not negotiate with the company as to the type or model of truck acquired. A company manager told Mr Whitby “we want you to fix a new tarp on the truck”. Mr Whitby purchased a tarpaulin that the company installed and to which it affixed company logos.

62 In 1998, Mr Whitby approached Mr Paul Higgins, the New South Wales State Manager of the company, on behalf of all the drivers and proposed an increase in the rate provided in the 1993 Contract. The catalyst for this proposal, at least on the part of Mr Whitby, was a concern about increased costs, including fuel costs, registration and insurance costs.

63 Mr Jamsek and Mr Whitby, on behalf of their respective Partnerships, executed a further “Contract Carriers Arrangement”, dated 1 October 1998, with Thorn Lighting (1998 Contract). The “contractors” were named as the Jamsek Partnership, the Whitby Partnership and Mr Robinson. The 1998 Contract provided for an increased rate, which had been approved by Mr Higgins’ manager. For the purposes of this appeal, there were, other than the rate increases, no material changes between the 1993 Contract and 1998 Contract.

64 In around 1998, Mr Higgins told Mr Jamsek: “You will need to install a new tarp on your truck, but you need to paint the truck first”. Mr Jamsek complied.

65 In 2001, Mr Jamsek and Mr Whitby, on behalf of the respective Partnerships, executed a further “Contract Carriers Arrangement”, dated 1 January 2001, with Thorn Lighting (2001 Contract). Mr Whitby had again approached Mr Higgins and proposed on behalf of the drivers that they be given an increase in their rate of pay. Mr Whitby gave evidence at trial, as recounted at [52] of the Primary Judgment, that the purpose of increasing the rates was to secure or improve the profitability of the business of the Partnerships. Mr Jamsek gave oral evidence at trial that he had discussed what rate of pay he would require with Mr Whitby. The increase was approved by Mr Higgins’ managing director.

66 For the purposes of this appeal, there were, other than the rate increases, no material changes between the 1993 Contract, 1998 Contract and the 2001 Contract.

67 The goods and services tax (GST) system commenced on 1 July 2000. At the time of signing the 2001 Contract, the Partnerships were invoicing for the services provided and charging GST to the company.

68 By 2001, Mr Whitby lived in Bungonia, about 160 kilometres from Wetherill Park, a suburb in Western Sydney, where the business’ warehouse was then located. Mr Whitby would, relatively frequently drive home after making his last delivery rather than return to the warehouse. Mr Whitby structured his deliveries such that he made the deliveries closest to the warehouse first and ended with the deliveries furthest away from the warehouse.

69 From at least 2001, Mr Whitby primarily delivered products in the eastern Sydney metropolitan area, but would occasionally deliver to Canberra or Wollongong. The drivers agreed amongst themselves their respective delivery areas.

70 Mr Jamsek delivered primarily into the north west of the Sydney metropolitan area. He occasionally delivered to Newcastle and Wollongong.

71 The drivers were given delivery dockets which were to be signed by customers. This had been the case since the applicants first commenced being delivery drivers from at least 1980. Despite the reference to “run sheets” in cl 2(1)(e) of the 1993 Contract (see above at [57]), 1998 Contract and 2001 Contract, the evidence at trial was that these were first introduced after 2001. In any event, at some time after 2001, the applicants were asked to complete a “manifest run sheet” every day. This practice (although what precisely was involved altered from time to time), continued up until the termination of the applicants’ relationship with the company. One of the purposes of the run sheet was to outline the deliveries to be completed that day, and allow the warehouse manager or other company managers to identify where the drivers would be at certain times.

72 The drivers would complete run sheets in the morning before leaving the warehouse. The run sheets were also generally signed by each customer at delivery, along with a delivery docket. The run sheets generally recorded the driver’s arrival at the warehouse in the morning, and the time that the driver had completed the deliveries for the day. The run sheets were returned to the warehouse either at the end of the day or the next morning depending on whether the driver went straight home after their last delivery for the day. Other than the run sheets, the applicants were not required to fill out any other document akin to a timesheet.

73 Around 2002, the company supplied and installed a new tarpaulin on the truck used by Mr Whitby. The Whitby Partnership paid for half of the cost of the new tarpaulin. The company paid for the other half of the cost of the tarpaulin and for the cost of “Thorn” logos which were added after the tarpaulin had been installed.

74 Around 2006, a manager had told Mr Whitby that he needed “to start sorting out which runs are going on the trucks”. This had previously been the job of people in the warehouse. After six months, Mr Whitby was told by employees in the warehouse that he was not to sort runs inside the warehouse and should sort his own run outside. From that time, as had been the practice beforehand, warehouse employees brought deliveries on pallets to Mr Whitby’s truck. If Mr Whitby needed to sort any of the runs he would do so outside under an awning attached to the warehouse. The warehouse manager advised Mr Whitby how the trucks should be loaded.

75 Mr Whitby gave the following evidence about the manner in which deliveries were readied at the warehouse around this time:

COUNSEL: And warehouse staff picked and packed the orders for delivery and moved them by forklift or pallet jack to the dispatch area at the warehouse?

MR WHITBY: Yes. That’s correct.

COUNSEL: And they were then loaded onto your truck by warehouse staff?

MR WHITBY: Loaded up to the back of the truck, yes …

COUNSEL: Yes. And once the goods were on your truck it was then a matter for you to sort them in a way that reflected the way you wanted to make the delivery?

MR WHITBY: Once – no, we sorted them outside on the ground before they came to the truck and then the warehouse staff would bring them up to the truck in the order we sorted them.

COUNSEL: You used a pallet jack on the truck, didn’t you, to move – shift the …

MR WHITBY: That’s correct. Yes.

COUNSEL: … the goods around?

MR WHITBY: Yes.

COUNSEL: And you were shifting them around – is this right – to ensure the safe transit of the goods. Was it a safety reason that you might need to shift them?

MR WHITBY: That’s correct. Yes. Whichever way we packed them on the truck was for safety reasons, yes.

COUNSEL: I see. Because as a driver you had obligations in relation to …

MR WHITBY: That’s correct. Yes.

COUNSEL: … safe transit. Now, while the loads were being picked and packed in – and placed in dispatch you would normally go to the canteen?

MR WHITBY: We were instructed to go to the canteen, yes.

76 Around 2007, Thorn Lighting and ZG Lighting merged their warehousing and manufacturing divisions, maintaining separate sales divisions. Thorn Lighting undertook all distribution, transport and delivery of products for both sales divisions, with the costs of ZG Lighting’s distributions invoiced back to them by Thorn Lighting.

77 In 2008, Mr Whitby made another request for an increase to the drivers’ rate of pay. This request was made to Mr Graham Hayward. The request was supported by a letter Mr Whitby wrote on behalf of the Whitby Partnership, the Jamsek Partnership and Mr Robinson. It expressed the following (emphasis in original):

CONTRACT CARRIERS AGREEMENT RATE REVIEW

23rd May 2008

RE.

MJ & PT Jamsek of [address]; (31 years service)

R & D Whitby of [address]; (31 years service)

R Robinson of [address]; (32 years service)

Mr. Graham Hayward

Graham as it has been over 2 years since our last rate adjustment, we feel we are justified in approaching Thorn for an increase in our rates; we appreciate that it is quite [sic] at the moment and that is why we have not approached Thorn earlier ‘however we can no longer absorb the ever increasing fuel cost (from $1.38 at last review to $1.80, a 30% increase and with no immediate end to the increases) because of that and the following reasons we must increase our rates by 7.2%, (an increase of $2.97 per hr). From the [date] the new rate will take affect [sic] ...

Please note …

1. We together have served Thorn Lighting for a combined 94 years.

2. Outside transport carriers have had numerous increases upward of 4.5% + over that 2 year period and add a fuel levy to their rates.

3. We have never had a dispute or [withdrawn] our service [to] Thorn as Contractors.

4. Fuel up a huge... 30% ($1.38 to $1.80). And still increasing.

5. More use of tolls and increases in toll costs fixed to the CPI.

6. Due to increase in fuel our maintenance cost are up; oil, tyres, greases etc.

7. Increases in registration and insurances .e.g. green slip 07/08 $1078 to 05/06 $1145 (NRMA)

8. Parking fines and fines in general have [increased] and are enforced more severely.

9. Increase use of mobile phones to customers and job sites.

10. We still have been helping in the warehouse in the mornings as to ensure the deliveries are pulled.

11. Advertising on trucks.

12. General cost of living up over this period.

Over the years we have served Thorn Lighting we have always giving [sic] the best service we could or were allowed to give. We have outstanding relations with Thorns valued customers and are a source of feedback for Thorn on what the customer are thinking and of any problems they are having of which we do not hesitate to inform Thorn. We feel this increase is justified and fair.

78 An increase was agreed. Mr Jamsek gave evidence that this document was one example of the three or four occasions during the period from 1985 that he approached a representative of the company for a rates increase.

79 Around 2008 or 2009, the company supplied and installed a black tarpaulin bearing both “Thorn” and “Zumtobel” logos on Mr Whitby’s truck.

80 In 2009, the drivers approached Mr Chris Dixon (who was employed by the company as a Supply Chain Manager since 31 March 2018) and submitted a proposal to quote for non-metropolitan deliveries. Mr Dixon agreed to “give it a go” if it was cheaper or the same amount as what the company was paying others to make those deliveries. The primary judge inferred that, from time to time after 2009, Mr Dixon would approach the drivers to see if they were interested in a non-metropolitan delivery and, if the driver was interested, they would quote for that job and complete it, if approved.

81 In 2010, Mr Whitby purchased a one tonne “Rodeo” tray back utility vehicle (ute), initially for private use, but which was later used for making deliveries. This enabled Mr Whitby to do smaller deliveries in locations like the CBD where it was difficult to drive a larger vehicle. He notified the company in a letter to Mr Dixon dated 13 May 2010 that he had purchased the ute and intended to use it for some deliveries. The letter relevantly stated the following:

Chris, as discussed my area mostly covers the central city area and a lot of cost is wasted on couriers to service this area I have now purchased a [1 tonne] rodeo trayback Ute to service and cut the cost to this area. I will also be available for small, height restricted deliveries in other areas. It also has been pointed out to me the [outrageous] cost of ‘must ride deliveries to country areas and [I] will [be] available to help in this area also.

My 6 tonne truck will also be stripped down to tray top as discussed for long extrusion deliveries when needed.

82 Mr Whitby was able to use the ute to perform deliveries that the company had otherwise been engaging external couriers to perform. He had the ute for approximately 4 years before purchasing another one. The second ute was also used for deliveries. Neither vehicle bore a “Thorn” logo.

83 In 2010, Mr Whitby disassembled the gates and tarpaulin on his truck so that it would become a “flatbed”. From that point onwards it did not bear a company logo.

84 After 2010, Mr Whitby used his ute, rather than the truck most of the time. Generally, it was left to Mr Whitby to decide which vehicle to use. Mr Whitby decided which vehicle he would use based on the nature or size of the products to be delivered. It was more profitable for Mr Whitby’s business to use the ute rather than the truck. However, there were some items that could not be delivered with the ute.

85 The manifest run sheets, at least from around 2012, included the time of arrival at the customer’s place of delivery and the time of departure. Mr Whitby gave evidence that, around 2011 or 2012, the warehouse coordinator at the time, Ms Shelly Newton, told him the following:

We want you to start photocopying the run manifest. Leave the original in the warehouse. When you come back in the afternoon, put the delivery documents with the run manifest in the correct order, scan the delivery documents and pick up the slip documentation and give it to the warehouse staff.

86 Mr Whitby stated that this task took approximately 15 minutes a day. He performed this task daily until the termination of his relationship with the company.

87 Mr Jamsek likewise gave evidence that he was told in August 2012 by the warehouse foreman that he had to start scanning the delivery dockets”. Mr Jamsek stated that he told the warehouse foreman that it was not part of his job, but Mr Jamsek was told that he had to do the clerical work. Mr Jamsek duly complied.

88 The Whitby Partnership was dissolved with effect from 30 June 2012.

(a) Thorn Lighting changed its name to ZG Operations; and

(b) Zumtobel Lighting changed its name to ZG Lighting.

90 On the same date, ZG Operations and ZG Lighting executed a “Restructure Deed”. The deed restructured these companies by separating the sales and operations functions such that ZG Lighting (which had previously been called Zumtobel Lighting Pty Limited) would be solely responsible for sales and ZG Operations (which had previously been called “Thorn Lighting Pty Ltd”) would be responsible for the balance of the business functions.

91 As a result of the restructure, the staff of certain divisions of ZG Operations were transferred to ZG Lighting on 1 October 2015.

92 Around this time, the applicants received a document entitled “Organisational Announcement – Business Name Changes” and dated 22 September 2015. The document explained the imminent changes to the names of the entities (as referred to above at [89]). The memo also stated that there would be no impact on employment entitlements.

93 At the same time, letters were sent by ZG Lighting and ZG Operations to suppliers advising them of the restructure. The primary judge expressed that it was not clear whether or not copies of these letters were provided to the drivers, although it was submitted on the applicants’ behalf that they were: Primary Judgment at [88].

94 In October 2015, the drivers were instructed that their invoices would need to be made out to ZG Lighting. The Jamsek Partnership and Mr Whitby did so on and from 10 October 2015.

Termination of working relationship

95 Both Mr Whitby and Mr Jamsek’s services were terminated by ZG Lighting on 20 January 2017. They each received a letter on 14 November 2016 which stated that the impending termination of the 2001 Contract was the product of financial conditions and the need for the company to reduce costs. By this time, the applicants were earning $1995.95 a week for nine hours a day, for five days.

Particular aspects of the relationship

96 The primary judge also summarised various evidence in relation to particular aspects of the working relationship between the applicants and the company. Borrowing from the Primary Judgment, those matters are summarised below.

97 In 2000, Mr Jamsek took six or seven weeks of leave. During this period, a friend of Mr Jamsek drove his truck and the Jamsek Partnership paid him for his work. The Jamsek Partnership received payment for the provision of the partnership’s truck and the services of Mr Jamsek’s friend in accordance with the 1998 Contract.

98 Mr Jamsek took two weeks annual leave over Christmas each year. He took five or six weeks off in 2010 and handed his run to other drivers at the company. If they could not do it, external couriers delivered the goods.

99 Mr Jamsek took two weeks leave in 2012, 10 days of leave in 2014, and he took leave from October 2016 to 7 November 2016.

100 In the period from 2012 to 2016, Mr Jamsek was not starting work regularly at 6 am, although he would start early if there were urgent deliveries. In and after 2012, he would typically drive straight home after the last customer delivery. In the years leading to the termination of the working relationship, his deliveries would finish fairly regularly before 3 pm.

101 In 2015 and 2016, Mr Jamsek arrived at work between 7 am to 7.30 am. There were occasions in 2014 to 2016 when there was no delivery work to be done.

102 Up until around 2009, Mr Whitby regularly arrived at the warehouse at 6 am. From about 2014, Mr Whitby would typically arrive no earlier than 7 am and leave to perform his deliveries after 9 am. Until that time, he would sit in the canteen.

103 The finishing time for Mr Whitby varied. There were occasions, but not many, on which there was no delivery work. Frequently, deliveries would be finished before 3 pm. However, Mr Whitby’s evidence was that, except towards the end of his relationship with the company, he was regularly working nine hour days.

104 Mr Jamsek said that twice a year, when the company completed a stocktake, he would be told to clean outside the back of the warehouse. Occasionally he would not do this if there was an urgent delivery. However, Mr Dixon gave evidence that a stocktake did not occur each year over his tenure. Furthermore, Mr Dixon denied that Mr Jamsek had cleaned up outside the warehouse while the stocktake was occurring.

105 Mr Whitby also said that on a few occasions from 1993 to 2001, he was told to complete the stocktake. However, on each of these occasions, a warehouse employee would tell Mr Whitby that “the union does not want you to do the stocktake”. He stated that a manager told him to “just go and clean up the yard” on these occasions. He stated that he would clean up the yard after he finished his deliveries (if he had any) until 4pm. Mr Whitby also gave evidence that “[a]t one stage in about 2013 Chris Dixon said to me “There are no deliveries due because of stocktake. Clean up the rear of the warehouse”.” However, Mr Dixon denied making that statement.

106 As a result of this evidence, the primary judge concluded at [94] of the Primary Judgment that there were at least some occasions on which Mr Jamsek and Mr Whitby, at the request of employees of the company, assisted in cleaning up whilst a stocktake was being undertaken. However, neither assisted in the actual stocktake. The primary judge did not draw any conclusion about the credibility of any witness arising from the differing recollections of these events: Primary Judgment at [95].

107 Both Mr Jamsek and Mr Whitby used their trucks on occasions to help move the location of the factory or warehouse. They were paid their usual rate for helping with the relocations. Also, from time to time until 2016, the applicants picked up and returned empty pallets to the warehouse. They charged the company and were paid for this assistance.

108 While working for ALI until 1986, Mr Jamsek and Mr Whitby wore a uniform with an “ALI” logo that was supplied by the company. From time to time thereafter, the company provided, or made available, items of clothing bearing branding of the business or company. Mr Jamsek usually wore a high visibility shirt bearing the relevant company branding and shorts (without branding). In 2014 or 2015, he was provided with a high visibility vest which he was told to wear in the warehouse. Ms Newton’s recollection, in contrast, was that Mr Jamsek and Mr Whitby wore company clothing from time to time, but primarily wore their own clothes without a company logo.

109 The primary judge concluded at [99] of the Primary Judgment that the drivers wore a mix of clothing provided by the company (bearing branding or logos) and their own clothing. Again, according to the primary judge’s finding, the applicants were, at least from 2014, required to, and did, wear high visibility vests in the warehouse.

Accounting arrangements – Mr Jamsek

110 There were no tax returns or financial statements of the Jamsek Partnership in evidence for the 1987 to 1996 and 2000 to 2006 financial years. However, the available tax returns and financial statements of the Jamsek Partnership establish that, from 1997, the income derived by the partnership was split, generally evenly, between Mr Jamsek and his wife. The primary judge inferred that this occurred on and from 1 January 1986.

111 The 1997 financial statements recorded expenses of almost $34,000 and income of almost $75,000. Motor vehicle expenses were over $25,000. There was an expense of $1,200 for “casual labour”. Depreciation was claimed on a commercial motor vehicle (being the truck). Depreciation was also claimed on a typewriter, a truckport, a truck canopy and a desk.

112 The 1998 financial statements and partnership and individual income tax returns contained the same kind and levels of deductions and claims for depreciation. The expense for “casual labour” was $1,000.

113 The 1999 financial statements and partnership and individual income tax returns also recorded similar levels of deductions and claims for depreciation as in the 1997 year. The expense for “casual labour” was $200. Depreciation was also claimed in respect of a “capital improvement – driveway” which appears to have occurred on 9 March 1999 at a cost of $2,180.

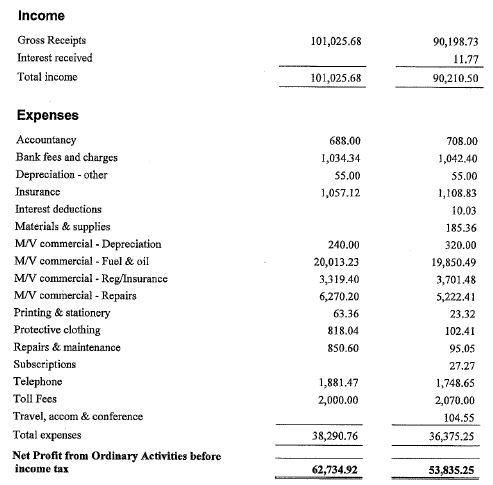

114 The 2007 financial statements recorded income and expenses as follows:

115 At this time, depreciation was being claimed on the typewriter, truckport, truck canopy, desk, truck, truck radio and the “improvement to driveway”.

116 The 2008 to 2017 financial statements and partnership and individual income tax returns recorded similar kinds and levels of expenses and depreciation as indicated above in relation to the 2007 year.

117 The Jamsek Partnership insured Mr Jamsek’s vehicles, met all the running costs and maintained public liability insurance and comprehensive motor vehicle insurance after entry into the 2001 Contract. The primary judge inferred (at [119] of the Primary Judgment) such insurances were maintained at all relevant times.

118 According to this evidence, the Jamsek Partnership charged GST in relation to the services it supplied, which it invoiced as “Labour and Equipment”, and claimed input tax credits on partnership purchases.

Accounting Arrangements – Mr Whitby

119 In all financial years from 1 July 1986 until 30 June 2012, the income from the work performed by Mr Whitby under the various contracts was declared as income of the Whitby Partnership. Deductions were claimed in respect of the partnership expenses. At all times up until 30 June 2012, the Whitby Partnership’s income was split between his wife and himself as partners.

120 The Whitby Partnership also claimed deductions, in certain years, in respect of a rental property in Smithfield, which was used to save the partnership running costs due to Mr Whitby travelling between the warehouse and his home.

121 Tax returns of the Whitby Partnership for the 1987 to 2010 years were not in evidence. The 2011 partnership tax return claimed deductions for rent ($6,930), depreciation ($2,409), motor vehicle expenses ($14,758) and other expenses ($14,758). The 2012 partnership tax return claimed deductions for rent ($6,900), depreciation ($1,688), motor vehicle expenses ($23,267) and other expenses ($10,772).

122 After the introduction of GST, the Whitby Partnership provided the company with tax invoices and charged GST for the supplies made.

123 As noted above, the Whitby Partnership was dissolved from 30 June 2012 and the partnership ceased to be registered for GST. Mr Whitby, continuing his work as previously, commenced invoicing for his services using his own Australian Business Number.

124 In his 2013, 2015, 2016 and 2017 tax returns, Mr Whitby declared income from, and claimed deductions in respect of, carrying on either a “transport operation” or a “courier service”. He declared that he was carrying on a business. The information in those returns included that:

(a) in the year ended 30 June 2013, Mr Whitby claimed deductions of $10,800 for rent expenses. In that year, motor vehicle expenses were $18,040. He also claimed depreciation (in relation to a ute) of $1,181 and other expenses totalling $4,826;

(b) in the year ended 30 June 2015, Mr Whitby claimed deductions of $7,698 for rent, motor vehicle expenses of $17,647, depreciation of $1,659 and other expenses totalling $4,325;

(c) in the year ended 30 June 2016, Mr Whitby claimed deductions of $5,188 for rent, motor vehicle expenses of $14,361, depreciation (in relation to a ute) of $2,730 and other expenses totalling $4,209; and

(d) in the year ended 30 June 2017, Mr Whitby claimed motor vehicle expenses of $8,046, depreciation of $945, repairs and maintenance of $2,416 and other expenses totalling $7,665 (which included home office expenses of $4,259). He claimed a loss on sale of a ute of $1,370.

Application to this Court

125 The applicants, alongside Mr Robinson, initiated proceedings in this Court on 15 November 2017. An amended originating application, which removed Mr Robinson as an applicant, was filed on 7 August 2018. By the time of the primary judge’s decision, the three respondents were ZG Operations, ZG Lighting and Mr Dixon.

126 According to the Primary Judgment at [7], the parties accepted that the following contentions comprised the applicants’ claims:

(1) pursuant to s 87(1) of the FW Act and cl 29.1 of the Road Transport and Distribution Award 2010 (Award), the applicants were each entitled to four weeks of paid annual leave for each year of their (alleged) employment, and they were not given any such paid leave by ZG Operations and/or ZG Lighting;

(2) pursuant to cl 29.2 of the Award, ZG Operations and/or ZG Lighting were required to pay the applicants a loading of 17.5% of the minimum rate specified in cl 15 of the Award;

(3) ZG Operations and/or ZG Lighting breached s 90(2) of the FW Act by failing to pay the applicants upon termination of their (alleged) employment amounts owing for leave accrued and not taken in the period 1 January 1986 (or alternatively 25 August 1993) to 20 January 2017;

(4) pursuant to s 96 of the FW Act and cl 30 of the Award, the applicants were each entitled to 10 days of personal leave per year for each year of service. ZG Operations and/or ZG Lighting failed to pay them in respect of their outstanding personal leave entitlements in breach of s 99 of the FW Act and cl 30 of the Award;

(5) in breach of s 116 of the FW Act and cl 32 of the Award, ZG Operations and/or ZG Lighting failed to pay the applicants for certain designated public holidays each year on which they absented themselves from work, specifically two days in 2011, nine days in each of the years 2012 to 2014, eight days in 2015, nine days in 2016 and one day in 2017;

(6) pursuant to cl 27.1 of the Award, the applicants were entitled to be paid overtime for all hours worked outside of ordinary working hours, being 7 hours 36 minutes each day over five days, Monday to Friday. ZG Operations and/or ZG Lighting contravened s 45 of the FW Act and cl 27.1 of the Award by failing to pay the applicants overtime, calculated at a rate of $66.88 per hour for the first two hours of time worked outside of ordinary hours, and $88.88 per hour for overtime in excess of two hours;

(7) ZG Operations and/or ZG Lighting contravened cl 13.3 of the Award by failing to give the applicants a total of 10 days of paid time off work to search for another job during their 10-week notice period;

(8) ZG Operations and/or ZG Lighting failed to pay the applicants 12 weeks of redundancy compensation, calculated at their weekly contract rate, in breach of s 118 of the FW Act and cl 14.1 of the Award;

(9) pursuant to cl 21.2 of the Award, ZG Operations and/or ZG Lighting were obliged to make such superannuation contributions for the applicants’ benefit to avoid being required to pay the superannuation guarantee charge. ZG Operations and/or ZG Lighting failed to make such superannuation contributions in breach of cl 21.2 of the Award;

(10) in contravention of s 357 of the FW Act, ZG Operations and/or ZG Lighting put a contract to the applicants in or about December 2000 (which was subsequently entered into by the applicants’ respective Partnerships in 2001), which identified the applicants as independent contractors, not employees;

(11) ZG Operations and/or ZG Lighting did not permit the applicants to take long service leave in accordance with the LSL Act during the period they were “workers”, and on termination of their (alleged) employment, ZG Operations and/or ZG Lighting were obliged to pay to the applicants an amount equal to the value of their long service leave accrued over 33.8 weeks and calculated at the weekly contract rate prevailing upon termination; and

(12) to the extent they were not principal contraveners of the FW Act or the Award, ZG Operations and ZG Lighting, as well as Mr Dixon (for the period 21 November 2011 to 30 April 2015), were each knowingly concerned in or party to the contraventions of the FW Act or the Award for the purposes of s 550(2)(c) of the FW Act. Accordingly, they were taken to have personally contravened the FW Act.

127 The applicants also alleged that Mr Dixon was personally liable because he was, for the purposes of s 550(2)(c) of the FW Act, “knowingly concerned” in contraventions by the respondents of ss 44, 45 and 357 of the FW Act.

128 The respondents’ case, in summary, was that the applicants were independent contractors and not employees of ZG Operations or ZG Lighting. Nor were they “workers” within the meaning of the LSL Act.

Primary judge’s substantive judgment

129 On 30 November 2018, the primary judge dismissed the applicants’ proceedings: Whitby v ZG Operations Australia Pty Ltd [2018] FCA 1934 (i.e. the Primary Judgment). The primary judge, assessing the totality of the relationship between the applicants and the company, held that the applicants were not employees for the purposes of the FW Act: ibid at [212].

130 The primary judge recognised that whether or not a person is an employee requires an objective assessment of the nature of the relationship between that person and the other party: ibid Reasons at [122]. The key factors that led to the primary judge’s conclusion were as follows.

131 The first key factor was the motivations of the contracting parties in entering into the 1986 Contract. The primary judge held at [133] that the circumstances prior to the entry into that contract, and the terms of the contract, indicated “a mutual intention that significant aspects of the existing relationship would come to an end, and that arrangements would change”.

132 Second, the primary judge found that the choice of the applicants to enter into the Partnerships in or around 1985 to 1986, and to contract with the company through the Partnerships, pointed against an employment relationship: ibid at [134]–[152]. Having regard to, amongst other things, the taxation implications of operating throughout the partnership, the primary judge concluded at [147] that “[t]he profitability of the partnerships turned in large measure on the costs associated with operating the vehicles purchased by the partnerships, including the costs associated with the substantial purchase price of the vehicles”.

133 Third, the primary judge held that the provision of vehicles by the applicants (or their respective Partnerships) was a significant matter in considering the “totality” of their relationships with the company: ibid at [153]–[168]. In particular, the primary judge expressed at [167] that “the manner in which [the trucks] were operated and maintained indicate that the company did not have the control over the activities of the drivers which might be expected if the drivers were employees”.

134 Fourth, after considering the relevant written contracts, the primary judge observed that the terms of the contracts were clear in identifying each Partnership as a party, and that the parties in fact conducted their activities on the basis that the Partnerships were supplying equipment and services: ibid at [173]. The primary judge rejected the applicants’ submission that the contracts should be construed as contracts with the individuals rather than the Partnerships.

135 The primary judge also observed at [179]–[180] that no written contract governed the work of the applicants during certain periods during the relationship. However, his Honour inferred from the parties’ conduct that there was an agreement between them during these periods in the same terms as the written contracts. The primary judge did not regard the absence of written contracts as tending to suggest that the applicants were employees: ibid at [182].

136 Fifth, and finally, the primary judge considered various factors such as working hours, length of service, control and activities at the warehouse: ibid at [183]–[211]. The primary judge recognised at [183] that the applicants earned their income from a single source for nearly 40 years. However, his Honour expressed at [185] that “[w]hilst the applicants did not serve other customers … there was no reason why the applicants could not have served others in the hours available to them outside of the hours in which they had contracted to provide services to the companies”.

137 In relation to the applicants’ contention that the company exercised control of their activities, the primary judge noted in opposition that:

(a) the number of hours in fact worked by the applicants, and the flexibility around returning home once all deliveries were completed indicated a relationship of less control than might be expected of a typical employment relationship ([187]);

(b) the applicants were not instructed by the company to wear a uniform ([188]);

(c) the company had no real control over the way in which Mr Jamsek and Mr Whitby managed and operated their trucks, and the company did not purport to exercise control over the applicants’ purchase or maintenance of the trucks ([189]);

(d) with limited exceptions, the applicants were not directed how to conduct their deliveries ([192] and [195]). The primary judge accepted that it was overwhelmingly a matter for Mr Whitby and Mr Jamsek as to how they secured their deliveries and then carried them out ([195]);

(e) the applicants notified the company when they wanted to take leave ([210]); and

(f) the fact that Mr Jamsek paid for someone to carry out his delivery activities when he took leave in 2000 weighs against the conclusion he was an employee ([211]).

138 The collective consideration of these factors led the primary judge to conclude at [212] that the applicants were not employees for the purposes of the FW Act. Neither were they employees within the meaning of the SGA Act ([218]) or workers within the meaning of the LSL Act ([224]). As a result, the applicants failed to obtain the relief sought.

Primary judge’s costs judgment

139 On 22 February 2019, the primary judge ordered that the applicants pay the costs of Mr Dixon, but that the respondents’ application for costs be otherwise dismissed: Whitby v ZG Operations Australia Pty Ltd (No 2) [2019] FCA 201.

140 The basis for the award of costs against the applicants in respect of Mr Dixon was summarised by the primary judge as follows at [36] of the costs judgment:

I am satisfied that the respondents have established that the proceedings were instituted against Mr Dixon “without reasonable cause”. There was no real prospect of establishing that Mr Dixon knew the applicants were, in truth, employees on any of the bases identified by the appellants after the proceedings were instituted.

141 The time period specified by r 36.03 of the Federal Court Rules 2011 (Cth) for the applicants to file a notice of appeal against a decision of the primary judge is 28 days. No notice of appeal was filed within 28 days of the substantive judgment by the primary judge.

142 On 2 April 2019, Mr Jamsek filed an application for an extension of time to file a notice of appeal. Mr Jamsek initially sought to appeal against both the primary judge’s substantive judgment and costs judgment. He also appealed against each of ZG Operations, ZG Lighting and Mr Dixon. However, a subsequent amended application for an extension of time, and a revised draft notice of appeal, discontinued his appeal against the costs judgment, and also removed Mr Dixon as a respondent. Mr Jamsek’s application for an extension of time in respect of the substantive judgment was 103 days out of time.

143 On 15 July 2019, a Registrar of the Court ordered that the hearing of the application for the extension of time and the proposed appeal be heard concurrently.

144 Mr Whitby was declared bankrupt on 5 February 2019, being a date after the delivery of the substantive judgment but before the delivery of the costs judgment. The Official Trustee in Bankruptcy was the initial trustee of Mr Whitby’s bankrupt estate, however a creditor in the estate subsequently nominated registered trustees to take over the administration.

145 On 2 August 2019, Daniel Civtanovic and Stephen Hundy (Trustees) were appointed as the new trustees of the bankrupt estate of Mr Whitby. The Trustees shortly thereafter sought advice in relation to the application initiated by Mr Jamsek in the Full Court.

146 On 8 August 2019, the Trustees applied to be joined as applicants to this appeal proceeding. Perram J granted the joinder on 14 August 2019: Jamsek v ZG Operations Australia Pty Ltd (Joinder Application) [2019] FCA 1332.

147 The appeal was heard on 26 August 2019. The applicants were represented by Ms Francois, Mr Crossland and Ms Hooper of counsel. The respondents were represented by Mr Kenzie QC and Mr Meehan of counsel.

148 The three grounds of appeal advanced by the applicants in their further amended draft notice of appeal, subject to being granted the requisite extension of time, were as follows:

1. The primary judge erred in failing to find:

(a) that in the period 25 August 1993 to about 1 October 2015 the First Appellant (Mr Jamsek) and Mr Whitby were “employees” of the First Respondent (ZG Operations) within the meaning of the [FW Act] and/or the [SGA Act]; and/or that they were “workers” in the service of ZG Operations under the [LSL Act];

(b) that in the period from about 1 October 2015 to about 20 January 2017 Mr Jamsek and Mr Whitby were “employees” of the fourth [sic: second] respondent (ZG Lighting) within the meaning of that word in the FW Act and/or the SGA Act; and/or they were “workers” in the service of ZG Lighting within the meaning of the LSL Act;

…

2. The primary judge erred in finding that ‘in principle there was no reason why Mr Jamsek and Mr Whitby could not have served others in the hours available to them outside of the hours in which they had contracted to provide services’ to ZG Operations and ZG Lighting … in that:

(a) this proposition was not put to Mr Jamsek or Mr Whitby;

(b) it was contrary the substance of the conduct of all parties since 1993 and Mr Jamsek’s and Mr Whitby’s role in the Business since 1977 (being that they worked regular weekly hours of 40-45 hours per week in the Business only and not in other businesses) …;

(c) it would be unreasonable to expert Mr Jamsek or Mr Whitby to drive trucks or be involved in truck-driving on a more than full-time basis or more than 40-45 hours per week;

(d) the finding appears to have assumed that Mr Jamsek or Mr Whitby should have subleased their trucks or engaged an employee to drive it at night or on the weekends, but without any evidence of the cost-benefits or of the viability of doing so;

(e) in the circumstances of (b) to (d) above it was a finding without evidence or was an irrelevant speculation.

3. The learned primary judge erred in finding that Mr Jamsek and Mr Whitby could have sold businesses and they included goodwill … because there was no evidence to support the finding of “goodwill” and selling would involve no more than selling the vehicles and other such assets.