FEDERAL COURT OF AUSTRALIA

Financial Synergy Holdings Pty Ltd v Commissioner of Taxation

[2016] FCAFC 31

ORDERS

FINANCIAL SYNERGY HOLDINGS PTY LTD Appellant | ||

AND: | Respondent | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

2. The respondent pay the appellant’s costs of the appeal and of the hearing below.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

MIDDLETON AND DAVIES JJ:

introduction

1 This appeal concerns the interaction between the capital gains tax provisions in Pts 3-1 and 3-3 of the Income Tax Assessment Act 1997 (“the 1997 Act”) and the consolidation provisions in Pt 3-90 of the 1997 Act. The appellant (“the taxpayer”) is the head company of the Financial Synergy consolidated group of which the Financial Synergy Unit Trust (“the unit trust”) is a subsidiary member. The unit trust became a subsidiary member of the consolidated group after the sole unitholder disposed of its units to the taxpayer in return for shares in the taxpayer. The issue raised by the appeal relates to the calculation of the cost base of the units for the purpose of determining the consolidated group’s “allocable cost amount” for the unit trust under s 705-60 of the 1997 Act. As the cost base of the units forms part of the calculation of the allocable cost amount (s 705-65(1)), the specific question concerns the time of acquisition of the units for the purposes of s 110-25(2) of the 1997 Act. Pursuant to s 110-25(2), the first element of the cost base of the units is the market value of the shares that the taxpayer issued in consideration for the acquisition of the units “worked out as at the time of the acquisition”. In this case, s 122-70(3) of the 1997 Act is also relevant because the entity that disposed of the units to the taxpayer chose to obtain roll-over relief under Subdiv 122-A of Pt 3-3 of the 1997 Act. As the units were pre-CGT assets, pursuant to s 122-70(3), the taxpayer was “taken to have acquired” the units before 20 September 1985. The specific question is whether the cost base of the units is the market value of the taxpayer’s shares issued in consideration for the units worked out as at 29 June 2007, when the taxpayer acquired the units (as contended by the taxpayer) or whether the cost base needs to be determined at a date before 20 September 1985 by virtue of s 122-70(3) (as the Commissioner contended and the primary judge found).

2 Before the primary judge, the taxpayer argued that the first element of the cost base of the units was the market value of the property that the taxpayer gave in consideration for the acquisition of the units, being the issue of the shares in it. It was not in dispute that the market value of the shares as at 29 June 2007 was $30 million. The Commissioner, on the other hand, argued that the first element of the cost base of the units was $1,560,649, being the market value, as at 1 July 1985, of the underlying business conducted by the unit trust that was effectively acquired by the taxpayer. The reason that the underlying business of the unit trust was the focus of the valuation was explained as follows by the primary judge at [4]:

The underlying value of the relevant units relates to an actuarial business which has been conducted from December 1978 by Financial Synergy Pty Ltd. On 21 December 1978 Financial Synergy Pty Ltd was appointed trustee of the Orford Family Trust and began to conduct the Financial Synergy business in its capacity as trustee of that trust. The Orford Family Trust was a discretionary trust whose beneficiaries included Mr David Orford. In June 1985 Mr Orford and his then business associate, Mr William Szuch, orally agreed that from 1 July 1985 Financial Synergy would henceforth conduct the Financial Synergy business as trustee for a unit trust “to be established” by them and that 80% of the units would be held by the Orford Family Trust and 20% of the units would be held by an entity to be nominated by Mr Szuch. The terms for the agreement between Financial Synergy, Mr Orford and Mr Szuch were set out in an undated memorandum from Mr Orford to Mr Szuch entitled “Financial Synergy Pty Ltd Financial Basis of Operation as from 1 July 1985” which contemplated the creation of a legal structure which, however, was not formally documented at the time, but which the parties to the agreement acted upon and which is not challenged by the Commissioner in these proceedings to be the source of the trust obligations subsequently formalised by the creation in 1989 of a unit trust.

3 The primary judge held that the “time of acquisition” of the units for the purposes of working out the first element of the cost base of the units in accordance with s 110-25(2) was deemed by s 122-70(3) to be “before” 20 September 1985. His Honour also held that s 122-70(3) should be construed as referring to a date “immediately” before 20 September 1985, that is, 19 September 1985.

4 For the reasons that follow, we have respectfully reached the different conclusion that the “time of acquisition” of the units for the purposes of working out the first element of the cost base of the units in accordance with s 110-25(2) was 29 June 2007.

part 3-90 of the 1997 Act

5 It is useful to start with a brief outline of the relevant statutory provisions in Pt 3-90 which make it necessary to ascertain the cost base of the units.

6 A consolidated group is treated as a single taxpayer for income tax purposes, with the head company as the taxpayer (“the single entity rule”): s 701-1 of the 1997 Act. The effect of the single entity rule is that the assets and liabilities of a subsidiary member of the consolidated group are treated as the assets and liabilities of the head company for the purposes of working out the head company’s tax liability on the group’s taxable income. The head company’s “tax cost” for each of the subsidiary’s assets is set under s 701-10 at the “tax cost setting amount” at the time that the subsidiary joins the consolidated group. The object is “to recognise the cost to the head company of [the subsidiary member’s] assets as an amount reflecting the group’s cost of acquiring the entity”: s 701-10(3), s 705-10(3).

7 An asset’s tax cost setting amount is worked out by allocating the group’s allocable cost amount for the joining entity to the joining entity’s assets. The allocable cost amount is calculated under s 705-60 and is a nine step process. Broadly, the allocable cost amount consists of the cost of the group’s membership interests in the joining entity, increased by the joining entity’s liabilities and undistributed profits accruing to the joined group before the joining time, less certain prior distributions of profits by the joining entity, and certain deductions and losses accruing to the joined group or inherited by the head company under the entry history rule. Section 705-10(3) relevantly provides that:

The reason for recognising the *head company's cost in this way is to align the costs of assets with the costs of *membership interests, and to allow for the preservation of this alignment until the entity ceases to be a *subsidiary member, in order to:

(a) prevent double taxation of gains and duplication of losses; and

(b) remove the need to adjust costs of membership interests in response to transactions that shift value between them, as the required adjustments occur automatically.

(italics added for emphasis)

8 The first step in working out the allocable cost amount is the cost base of the membership interest: s 705-60, s 705-65. If the market value of the membership interest is equal to or greater than its cost base, the relevant amount under step 1 is its cost base: s 705-65(1). In this case, the first step in working out the taxpayer’s “tax cost” of the assets brought into the Financial Synergy consolidated group by the unit trust was the cost base of the units. “Cost base” in the context of s 705-65(1) has the meaning given by Subdiv 110-A in Pt 3-1 of the 1997 Act (s 995(1) meaning of “cost base”).

9 Although the relevant roll-over in this case was under Div 122, in this context it is relevant at this stage also to mention s 716-855. Section 716-855 is relevant because the effect of the section is that where the membership interests are pre-CGT assets that have been the subject of a roll-over between wholly-owned companies under Subdiv 126-B of the 1997 Act or under the former s 160ZZO of the Income Tax Assessment Act 1936 (Cth), the cost base of the membership interests is worked out in the same way as if those interests were post-CGT assets, not pre-CGT assets. This means for the purposes of s 705-65 that the recipient company inherits the originating company’s cost base: see s 126-60(2).

10 Section 716-855 provides as follows:

716-855 Working out the cost base or reduced cost base of a pre-CGT asset after certain roll-overs

If:

(a) it is necessary for the purposes of this Part to work out the *cost base or *reduced cost base of a *pre-CGT asset owned at a particular time; and

(b) before that time:

(i) the owner was the recipient company involved in a roll-over under Subdivision 126-B in relation to a *CGT event that happened in relation to the CGT asset; or

(ii) the owner was the transferee in relation to a disposal of the CGT asset to which former section 160ZZO of the Income Tax Assessment Act 1936 applied;

the cost base or reduced cost base is worked out as if, in applying Subdivision 126-B or former section 160ZZO in relation to the CGT event or the disposal, the provisions of that Subdivision or section applying to CGT assets *acquired on or after 20 September 1985 replaced those that applied to CGT assets acquired on or before that date.

Note: The effect is that the owner's cost base or reduced cost base will be the same as that of the originating company or transferor, as is the case with post-CGT assets.

There is no cognate provision to s 716-855 in relation to Div 122 roll-overs.

part 3-1 of the 1997 Act

11 Part 3-1 contains the general CGT rules which apply to CGT assets. CGT assets include assets acquired before 20 September 1985 (“pre-CGT assets”).

12 Under the scheme of the CGT provisions, a taxpayer only makes a capital gain or loss if a CGT event happens: s 102-20. Section 104-5 sets out the list of CGT events and prescribes how to work out whether a gain or loss has been made. For example, relevantly CGT event A1 happens if a taxpayer disposes of a CGT asset. A capital gain is made on CGT event A1 if the capital proceeds from the disposal are more than the asset’s cost base and a capital loss is made if the capital proceeds are less than the asset’s reduced cost base: s 104-10(4). There is an exception in relation to pre-CGT assets. Section 104-10(5) provides that if a taxpayer disposes of a CGT asset that the taxpayer acquired before 20 September 1985, the capital gain or loss made by the taxpayer as a result of the disposal is disregarded. Essentially this means that capital gains on the disposal of pre-CGT assets are exempt from CGT.

13 Division 110 sets out how to work out the cost base and the five elements of the cost base of a CGT asset are contained in s 110-25. The first element is the total of the money paid or required to be paid in respect of “acquiring” the asset and the market value of any other property given, or required to be given, in respect of “acquiring it (worked out as at the time of acquisition)”: s 110-25(2) of the 1997 Act which provides as follows:

(2) The first element [of the cost base] is the total of:

(a) the money you paid, or are required to pay, in respect of *acquiring it; and

(b) the *market value of any other property you gave, or are required to give, in respect of acquiring it (worked out as at the time of the acquisition).

(italics added for emphasis)

14 The term “acquire” is defined in s 995-1 in relation to a CGT asset as follows:

you acquire a CGT asset (in its capacity as a CGT asset) in the circumstances and at the time worked out under Division 109 (including under a provision listed in Subdivision 109-B); and

Note: CGT asset acquired before 20 September 1985 may be treated as having been acquired on or after that day: see, for example, Division 149.

(italics added for emphasis)

15 Division 109 deals with the time of acquisition of CGT assets. Subdivision 109-A sets out the operative rules which include the “general acquisition rules” in s 109-5.

16 Section 109-5(1) provides that:

In general, you acquire a *CGT asset when you become its owner. In this case, the time when you *acquire the asset is when you become its owner.

17 Section 109-5(2) contains a table that sets out specific rules for the circumstances in which, and the time at which, a CGT asset is acquired as a result of a CGT event happening. In respect of CGT event A1 (case 1), the time of acquisition is “when the disposal contract is entered into or, if none, when the [disposing] entity stops being the asset’s owner”.

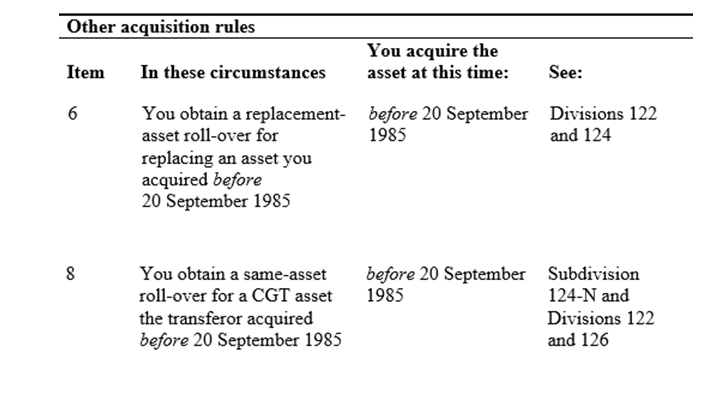

18 Subdivision 109-B contains provisions that are not operative but are expressed to be “sign posts” to other acquisition rules. They include s 109-55 which contains a table. Section 109-55 provides that the table:

… sets out other acquisition rules in [Part 3-1] and Part 3-3. Some of the rules have effect only for limited purposes.

19 Relevantly, Items 6 and 8 in the table under s 109-55 provide as follows:

20 It is also important to note s 109-50 which provides that Subdiv 109-B is a “Guide”. “Guide” has the meaning given by s 950-150 and consists of, relevantly, a subdivision that is identified as a Guide by a provision in the subdivision: s 950-150(1)(b). Section 950-150(2) provides that Guides form part of the 1997 Act “but they are kept separate from the operative provisions.” Section 950-150(2) also provides that:

…in interpreting an operative provision, a Guide may only be considered:

(a) in determining the purpose or object underlying the provision; or

(b) to confirm that the provision's meaning is the ordinary meaning conveyed by its text, taking into account its context in the Act and the purpose or object underlying the provision; or

(c) in determining the provision's meaning if the provision is ambiguous or obscure; or

(d) in determining the provision's meaning if the ordinary meaning conveyed by its text, taking into account its context in the Act and the purpose or object underlying the provision, leads to a result that is manifestly absurd or is unreasonable.

part 3-3 of the 1997 Act

21 Part 3-3 deals with special CGT rules that may apply in the calculation of capital gains and losses, including when a roll-over happens and the effect of a roll-over. Relevantly those rules include the rules in Subdiv 122-A for obtaining roll-over relief where a trustee transfers assets to a wholly-owned company in return for shares in the company. They also include the rules in Subdiv 126-B for obtaining roll-over relief where there is a transfer of a CGT asset between two companies in the same wholly-owned group.

22 Subdivision 122-A is relevant in the present case because CGT event A1 happened on the disposal of the units to the taxpayer and the entity disposing of the units to the taxpayer chose to obtain a roll-over under s 122-15. The roll-over was available if the only consideration that the entity received for the disposal was shares in the taxpayer and the market value of the shares was substantially the same as the market value of the units which the taxpayer acquired: s 122-20. The consequence of choosing to obtain a roll-over was that the capital gain (or capital loss) that the entity made from the disposition was disregarded (s 122-40(1)) and the point in time at which a capital gain or loss is made deferred until the subsequent disposal of the asset by the company (or some other CGT event occurring).

23 Section 122-70 sets out the consequences for the company where the trustee chooses roll-over relief, depending on whether the asset disposed is a post-CGT asset or a pre-CGT asset. If the asset is a post-CGT asset, the first element of the cost base of the asset in the hands of the company is the asset’s cost base when disposed of to the company: s 122-70(2). The effect of s 122-70(2) is that the company inherits the asset’s cost base in the hands of the disposing entity. If the asset is a pre-CGT asset, the company is “taken to have acquired” the asset before 20 September 1985: s 122-70(3).

24 Section 122-70 provides as follows:

122-70 Consequences for the company (disposal case)

(1) There are these consequences for the company in a disposal case if you choose to obtain a roll-over. They are relevant for each *CGT asset (except a *precluded asset) that you *disposed of to the company.

Note: A capital gain or loss from a precluded asset can be disregarded: see Subdivision 118-A.

Asset acquired on or after 20 September 1985

(2) If you *acquired the asset on or after 20 September 1985:

(a) the first element of the asset's *cost base (in the hands of the company) is the asset's cost base when you disposed of it; and

(b) the first element of the asset's *reduced cost base (in the hands of the company) is the asset's reduced cost base when you disposed of it.

Note 1: There are special indexation rules for roll-overs: see Division 114.

Note 2: The reduced cost base may be modified for a roll-over happening after a demerger: see section 125-170.

Asset acquired before 20 September 1985

(3) If you *acquired the asset before 20 September 1985, the company is taken to have acquired it before that day.

Note: A capital gain or loss from a CGT asset acquired before 20 September 1985 is generally disregarded: see Division 104. This exemption is removed in some situations: see Division 149.

The decision below

25 The primary judge held that the effect of s 122-70(3) was to deem the units to have been acquired by the taxpayer before 20 September 1985 with the effect that “the time of the acquisition” for working out the first element of the cost base of the units in accordance with s 110-25(2) was the deemed time of acquisition, not the actual time of acquisition. His Honour reasoned that the literal and grammatical construction of s 110-25(2)(b) links the expression “worked out as at the time of the acquisition” of the CGT asset to the actual time of the acquisition of the CGT asset that was acquired in exchange for consideration. However, his Honour reasoned, the link occurs for the purpose of determining the value of that which was given for the acquisition and does not govern how the time of acquisition was to be determined. His Honour stated that it is the time of acquisition which impacts upon, and directs the determination of, the market value of what has been given in exchange. His Honour stated that in this case the words “worked out as at the time of the acquisition” may be open to the two competing constructions advanced by the parties but the construction which accords with the intention expressed by the words used by the legislature was that advanced by the Commissioner. His Honour concluded that there was no compelling reason to construe the words “worked out as at the time of the acquisition” in s 110-25(2)(b) to exclude the impact upon them of the express deeming effect of s 122-70(3). His Honour stated at [16] that it was a false dichotomy in this case to draw a distinction between the date of acquisition of assets and their CGT asset status. His Honour concluded as follows:

…. It is clear from the effect of ss 122-70(3) that the relevant feature of the CGT status conferred upon assets by reliance upon the provision was that they were deemed to have been acquired before 20 September 1985. It is, in other words, the status of deemed acquisition before 20 September 1985 which attaches to the assets for the purposes of calculating capital gains and losses. The purpose of ss 122-70(3) may perhaps be limited but there is no reason to exclude the determination of the first element needed to calculate capital gains and losses from its (limited) application, namely, to exclude its operation to determining the cost base under ss 110-25(2)(b). It would, furthermore, be curious if the taxpayer in the position of Financial Synergy Holdings would be placed by the legislature in the position of being able to obtain a market value cost base for assets which have preserved their pre-CGT status yet also enjoy such benefits as are conferred by s 705-125 in working out the pre-CGT factor for assets of a joining entity. Section 705-125 is found in the consolidation regime and recognises the pre-CGT status of the membership interests of joining entities by allocating a pre-CGT factor to the assets of the joining entity. The Commissioner’s construction, in contrast to that urged for the taxpayer, is also consistent with the policy evinced by the introduction of s 716-855 with effect from 1 July 2002 dealing with the cost base or reduced cost base of a pre-CGT asset after a roll-over under subdivision 126-B.

26 His Honour went on to hold that the words “before that day” in s 122-70(3) are to be construed as referring to a date proximate to 20 September 1985, that is “about 19 September 1985”. His Honour held that the choice of the date immediately before 20 September 1985 as the date of acquisition serves the purposes for which the date of acquisition is relevant in the application of s 122-70(3) in the context of a consolidation, stating that:

In many cases in which Division 122 is relied upon it may not matter what date is deemed by s 122-70(3) as long as it is before 20 September 1985 because the pre-CGT status will be maintained as long as the deemed date is before 20 September 1985. The exact date deemed by ss 122-70(3) does matter, however, when, as in the context of consolidation, a value as at a date needs to be determined. The choice of the date immediately before 20 September 1985 as the date of acquisition recognises the full pre-CGT value of the assets brought into the group.

27 His Honour stated that in this case there was no evidence of the value of the units on or about 19 September 1985 but there was evidence of the value of the Financial Synergy business as at 1 July 1985. His Honour held that it may fairly be inferred that its value at 19 September 1985 would have been at least the same and that the cost base of the units as at 19 September 1985 was not less than $1,560,649.

decision

28 There are two principal grounds of appeal. The first principal ground is that the primary judge identified the wrong asset in applying s 110-25(2)(b) by valuing the units, not the shares given in consideration for the acquisition of the units. The second principal ground is that the primary judge erred in the construction of s 122-70(3) in finding that the effect of s 122-70(3) was that, for the purposes of s 110-25(2), the taxpayer was taken to have acquired the units before 20 September 1985.

Was the wrong asset identified?

29 This ground wrongly assumes that his Honour misdirected the inquiry required under s 110-25(2) to establish the cost base of the units by inquiring into the value of the units on or about 19 September 1985 when the inquiry directed by s 110-25(2) was into the value of the shares given in consideration for the units. It is clearly not the case that the wrong asset was identified. His Honour was plainly aware that cost base is worked out under s 110-25(2) by reference to the property given in consideration. The difference between the parties at trial concerned the time at which the cost base of the units was to be determined, not how the amount was to be determined. The case was conducted by the parties on the basis that the underlying value of the business at 1 July 1985 established the cost base of the units if the Commissioner’s argument on the time for working out the cost base was to be preferred, which the primary judge ultimately held. As his Honour noted, the units were only formally created in 1989, after the time at which the cost base was to be worked out. The only evidence led by the parties about value at the relevant time was the underlying value of the business at 1 July 1985 which the parties had agreed was $1,560,649 and which his Honour used as the proxy for the purposes of determining the cost base of the units. His Honour held that it may reasonably be inferred that the cost base of the units as at 19 September 1985 was not less than $1,560,649 based on the value of the business at 1 July 1985. There was no error in the approach taken by his Honour. One of the requirements for a Div 122 roll-over is that the market value of the shares given in consideration for the acquisition of the CGT asset must be substantially the same as the market value of that asset (s 122-20(3)(a)) and on the hypothesis that this requirement was met (which was not an issue in the proceeding) the cost base of the units at the deemed acquisition date could only be determined by reference to the underlying value of the business at 1 July 1985. It was necessary to take that approach on the particular facts of this case having regard to the way in which the case was conducted by both parties.

Does s 122-70(3) operate to deem the time of acquisition for the purposes of s 110-25(2) to be a date before 20 September 1985?

30 The substantive issue in the appeal concerns the application of s 122-70(3) in working out the cost base of the units in accordance with s 110-25(2).

31 Section 122-70(3) applies if the entity disposing of the asset to a wholly owned company acquired that asset before 20 September 1985. In that circumstance, the recipient company “is taken to have acquired [the asset] before that day”. The section operates to preserve the status of the asset as a pre-CGT asset in the hands of the recipient company, with the consequence that the subsequent disposition of that asset would not generally give rise to a capital gain or a capital loss for the recipient company: eg s 104-10(5) in relation to CGT event A1. The question is whether the section also has a deeming effect upon the time of acquisition for the purposes of s 110-25(2).

32 It is important to consider the function of s 122-70. Where a roll-over is obtained under Div 122, any capital gain or loss that the transferor makes on disposal of the asset to the wholly-owned company is disregarded (s 122-40) and instead, the point in time at which a capital gain or loss arises is deferred until the company disposes of the asset (or some other relevant CGT event happens). The function of s 122-70 is to preserve the CGT characteristics of the asset in the hands of the recipient company by providing, in the case of an asset acquired by the transferor on or after 20 September 1985, that the recipient company takes the same cost base of the asset as the transferor’s cost base at the time of disposal (s 122-70(2)) and, in the case of an asset acquired by the transferor before 20 September 1985, that the company is “taken to have acquired [the asset] before that day”: s 122-70(3). The effect therefore is that any CGT liability attaching to the disposal of that asset is transferred to the recipient company by, in the case of a post-CGT asset, treating the company as acquiring that asset for a consideration equal to the transferor’s cost base and, in the case of a pre-CGT asset, by treating the company as acquiring that asset before 20 September 1985. The acquisition rule in s 122-70(3) thus has the purpose of preserving the asset’s status as a pre-CGT asset.

33 There are a number of contextual reasons against extending the effect of the provision to govern the time of acquisition for the purpose of working out cost base under s 110-25(2).

34 First, considered in the context of s 122-70, the reference to a time “before 20 September 1985” in s 122-70(3) is intended to exclude assets that were acquired on or after 20 September 1985 which are dealt with under s 122-70(2). Where the legislative scheme is to exempt pre-CGT assets from the operation of the CGT provisions, the purpose served by s 122-70(3) is to preserve the pre-CGT status of an asset which has been rolled-over. The function of the deeming provision does not need to extend beyond that purpose in the context of Div 122: Commissioner of Taxation v Comber (1986) 10 FCR 88 at 96.

35 Secondly, the definition of “acquire” in s 995-1 does not extend the ambit of the deeming provision. The meaning of “acquire” in relation to a CGT asset is prescribed “in the circumstances and at the time worked out under Division 109 (including under a provision listed in Subdivision 109-B)”. Subdivision 109-B sets out s 122-70(3) as an acquisition rule (see s 109-55) but Subdiv 109-B is not an operative part of the 1997 Act: s 109-50, s 950-150. Subdivision 109-B does not of its own force have the effect that the time deemed by s 122-70(3) is to govern the time of acquisition for the purpose of s 110-25(2). The outcome that the pre-CGT assets are taken to have been acquired for the purposes of s 110-25 before September 1985 is not mandated by Div 109 or the definition of “acquire”.

36 Thirdly, it is relevant that the legislature specifically introduced s 716-855 to contain a special rule for consolidated groups in relation to Subdiv 126-B roll-overs. Subdivision 126-B roll-overs are available where a CGT asset is disposed of or created within a wholly-owned group where at least one of the companies is a foreign resident, and ss 126-60(2) and (3) are expressed in similar terms to ss 122-70(2) and (3). Section 716-855 has the effect that the owner’s cost base of a pre-CGT asset will be the same as that of the transferor, as in the case of post-CGT assets. A note is added to subs 126-60(3) to alert to the amended operation of the CGT roll-over provisions for the consolidated regime. A note is also added to subs 705-65(1) to refer to the operation of s 716-855. The notes form part of the 1997 Act: s 950-100(1). Importantly, there is no such cognate provision in respect of a Div 122 roll-over. The absence of a cognate provision in respect of a Div 122 roll-over is telling against the Commissioner’s construction.

37 The Commissioner submitted that it would be an anomalous result for the taxpayer to have a market value cost base for the pre-CGT assets in determining allocable cost amount. It was submitted that it was antithetical to the concept of a roll-over for the cost base of a pre-CGT asset to be “freshened up” on a roll-over to the amount in fact paid or given by a taxpayer because to achieve this “freshening up”, the disposition or the CGT event is not ignored but for cost base purposes is fully embraced and that the tax consequences of the event are not thereby delayed but assumed immediately. It was submitted that it was improbable that this was what Parliament intended. It was submitted that the consequences for the purposes of the consolidation provisions in Pt 3-90 would be that taxpayers would obtain the double benefit of a market value step-up in the cost base of the membership interests of an entity joining a consolidated group (so as to permit higher depreciation deductions for its underlying assets, amongst other things) as well as an exemption from capital gains tax on the ultimate disposal of those membership interests. It was submitted that there was no extrinsic material that supported the proposition that these outcomes were intended by Parliament.

38 The answer to these submissions is that the need to determine cost base for the purposes of the consolidation provisions arises in a separate and different context. The cost base is used to work out the allocable cost amount that is used in resetting the cost base for the assets of a joining entity. The object of the process is “to recognise the *head company’s cost of becoming the holder of the joining entity’s assets as an amount reflecting the group’s cost of acquiring the entity”: s 705-10(2). The taxpayer’s construction gives effect to and is consistent with that object. Section 716-855 provides an exception only in relation to pre-CGT assets acquired under Subdiv 126-B roll-overs.

39 Accordingly, the appeal should be allowed and the respondent should be ordered to pay the appellant’s costs of the appeal and of the hearing below.

I certify that the preceding thirty-nine (39) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justices Middleton and Davies. |

REASONS FOR JUDGMENT

LOGAN J:

40 I have had the advantage of reading in draft the reasons for judgement of Middleton and Davies JJ. I agree with those reasons and that the appeal should be allowed.

41 Out of respect for the learned primary judge and because we are differing from his Honour as to the disposal of the appellant’s tax appeal, I wish to add the following. For this purpose, I use the same abbreviations adopted by Middleton and Davies JJ in their judgement.

42 The controversy present in this case may perhaps be the result of an omission of express provision for the harmonious operation of two ameliorating Divisions within the 1997 Act; the provisions of Div 705 (tax cost setting amount for assets where entities become subsidiary members of consolidated groups) within the consolidated group provisions of Pt 3-90 on the one hand and, on the other, the capital gains tax (CGT) rollover relief provisions within Div 122 of Pt 3-3 within the CGT regime found in ch 3. Such is the intricacy of these two ameliorating Divisions that they were always fraught with the prospect that a statutory construction controversy might be generated by an omission of specific provision for a particular occurrence. The presence of ameliorating provisions is conducive to a particular ordering of business and personal affairs in order to have the advantage of them. Apart from challenging the limits of human comprehension, one of the difficulties of the contemporary preference for intricacy in the 1997 Act is the difficulty of predicting in advance and making related provision in advance for all of the ways in which this ordering of affairs might occur.

43 Flowing from the absence of this express provision, there is a certain attraction in the construction favoured by the learned primary judge, responsive to a submission by the Commissioner that it negated what would otherwise be a form of “double-dipping” by the appellant, i.e. the obtaining of a “market-value step up” under Subdiv 705-A while at the same time retaining pre-CGT status for the relevant asset.

44 In my view, characterisations of relevant provisions offered by the taxpayer in its submissions correctly reflect how they are to be construed and operate to negate the attraction just mentioned. The taxpayer submitted that, read in the context of the object of the Division in which each was located, s 110-25 was to be characterised as a quantitative valuation provision, whereas s 122-70(3) was to be characterised as a qualitative provision, each respectively linking, without conflict, to separate groups of provisions in the 1997 Act. I agree.

45 Section 110-25(2)(b) forms part of Div 110, the object of which is to work out the cost base and reduced cost base (each of which are defined terms for the purposes of the 1997 Act) of a CGT asset: s 110-1. It specifies a calculation by which an asset’s cost base is to be determined and hence is aptly characterised as a quantitative valuation provision. Materially, that specified calculation is the means by which one works out the amount of the cost base (used in its defined way) for the purpose of ascertaining the “step 1 amount” (s 705-65 refers) in the steps specified in s 705-60 for the working out of the “allocable cost amount”. Adopting this specified calculation serves the purpose specified in s 705-60 in respect of step 1, which is to “ensure that the allocable cost amount includes the cost of *acquiring the membership interests”. In turn, this serves the object specified in s 705-10:

(2) The object of this Subdivision is to recognise the *head company’s cost of becoming the holder of the joining entity’s assets as an amount reflecting the group’s cost of acquiring the entity. That amount consists of the cost of the group’s *membership interests in the joining entity, increased by the joining entity’s liabilities and adjusted to take account of the joining entity’s retained profits, distributions of profits, deductions and losses.

[Emphasis added]

46 In contrast, both language and context dictate that the better view to take to s 122-70(3) of the 1997 Act is that it does nothing more and nothing less than ascribe a status for a particular class of asset for rollover purposes, “[i]f you *acquired the asset before 20 September 1985, the company is taken to have acquired it before that day.” It is therefore aptly characterised as a qualitative provision. In so doing, s 122-70(3) links to a plethora of CGT provisions which provide for the disregarding of gains or losses on pre-CGT assets or which apply where the asset was acquired, “before 20 September 1985”.

47 The difficulty about assigning an additional, quantitative role to s 122-70(3) is that the provision says nothing as to precisely when before 20 September 1985 the asset concerned is taken to have been acquired. Such precision is unnecessary if one affords it only a qualitative role. This absence of precision may not, on the evidence, have been of particular moment in the present case but it by no means follows that this will always be so. The provision is perfectly capable of sensible operation without inserting the adverb, “immediately” prior to “before 20 September 1985”, so there is, in my respectful view, no warrant for the application of Cooper Brookes (Wollongong) Pty Ltd v Commissioner of Taxation (1981) 147 CLR 297 in order to prevent an absurdity.

48 Construing the two provisions in this way is in harmony with the express object of Subdiv 705-A, which is “to recognise the *head company’s cost of becoming the holder of the joining entity’s assets as an amount reflecting the group’s cost of acquiring the entity”: s 705-10(2) of the 1997 Act.

49 For these additional reasons, as well as those given by Middleton and Davies JJ, I agree that the appeal should be allowed.

I certify that the preceding ten (10) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justice Logan. |

Associate:

Dated: 10 March 2016