FEDERAL COURT OF AUSTRALIA

ABN AMRO Bank NV v Bathurst Regional Council [2014] FCAFC 65

| IN THE FEDERAL COURT OF AUSTRALIA | |

| JUDGES: | JACOBSON, GILMOUR AND GORDON JJ |

| DATE OF ORDER: | 6 june 2014 |

| WHERE MADE: | SYDNEY |

THE COURT ORDERS THAT:

1. The parties are directed to confer and bring in agreed orders to give effect to these reasons for judgment including the question of costs by 4:00pm on 13 June 2014. If the orders cannot be agreed, then the parties are to file a joint document which identifies the areas of agreement, the areas of disagreement and, for the areas of disagreement, the reason or reasons for that disagreement by 4:00pm on 13 June 2014.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011 (Cth).

| IN THE FEDERAL COURT OF AUSTRALIA | |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 502 of 2013 |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | MCGRAW-HILL INTERNATIONAL (UK) LIMITED Appellant |

| AND: | BATHURST REGIONAL COUNCIL First Respondent LOCAL GOVERNMENT FINANCIAL SERVICES PTY LIMITED (ACN 001 681 741) Second Respondent ABN AMRO BANK NV (ARBN 84 079 478 612) Third Respondent |

| JUDGES: | JACOBSON, GILMOUR AND GORDON JJ |

| DATE OF ORDER: | 6 june 2014 |

| WHERE MADE: | SYDNEY |

THE COURT ORDERS THAT:

1. The parties are directed to confer and bring in agreed orders to give effect to these reasons for judgment including the question of costs by 4:00pm on 13 June 2014. If the orders cannot be agreed, then the parties are to file a joint document which identifies the areas of agreement, the areas of disagreement and, for the areas of disagreement, the reason or reasons for that disagreement by 4:00pm on 13 June 2014.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011 (Cth).

| IN THE FEDERAL COURT OF AUSTRALIA | |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 503 of 2013 |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | ABN AMRO BANK NV (ARBN 84 079 478 612) Appellant |

| AND: | COOMA MONARO SHIRE COUNCIL (ABN 19 204 741 100) First Respondent COROWA SHIRE COUNCIL (ABN 43 874 223 315) Second Respondent DENILIQUIN COUNCIL (ABN 41 992 919 200) Third Respondent EUROBODALLA SHIRE COUNCIL (ABN 47 504 455 945) Fourth Respondent MOREE PLAINS SHIRE COUNCIL (ABN 46 566 790 582) Fifth Respondent MURRAY SHIRE COUNCIL (ABN 77 334 235 304) Sixth Respondent NARRANDERA SHIRE COUNCIL (ABN 96 547 765 569) Seventh Respondent NARROMINE SHIRE COUNCIL (ABN 99 352 328 504) Eighth Respondent OBERON COUNCIL (ABN 13 632 416 736) Ninth Respondent ORANGE CITY COUNCIL (ABN 85 985 402 386) Tenth Respondent PARKES SHIRE COUNCIL (ABN 96 299 629 630) Eleventh Respondent CITY OF RYDE (ABN 81 627 292 610) Twelfth Cross Appellant LOCAL GOVERNMENT FINANCIAL SERVICES PTY LIMITED (ACN 001 681 741) Thirteenth Respondent MCGRAW-HILL INTERNATIONAL (UK) LIMITED Fourteenth Respondent |

| JUDGES: | JACOBSON, GILMOUR AND GORDON JJ |

| DATE OF ORDER: | 6 june 2014 |

| WHERE MADE: | SYDNEY |

THE COURT ORDERS THAT:

1. The parties are directed to confer and bring in agreed orders to give effect to these reasons for judgment including the question of costs by 4:00pm on 13 June 2014. If the orders cannot be agreed, then the parties are to file a joint document which identifies the areas of agreement, the areas of disagreement and, for the areas of disagreement, the reason or reasons for that disagreement by 4:00pm on 13 June 2014.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011 (Cth)

| IN THE FEDERAL COURT OF AUSTRALIA | |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 504 of 2013 |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | MCGRAW-HILL INTERNATIONAL (UK) LIMITED Appellant |

| AND: | COOMA MONARO SHIRE COUNCIL (ABN 19 204 741 100) First Respondent COROWA SHIRE COUNCIL (ABN 43 874 223 315) Second Respondent DENILIQUIN COUNCIL (ABN 41 992 919 200) Third Respondent EUROBODALLA SHIRE COUNCIL (ABN 47 504 455 945) Fourth Respondent MOREE PLAINS SHIRE COUNCIL (ABN 46 566 790 582) Fifth Respondent MURRAY SHIRE COUNCIL (ABN 77 334 235 304) Sixth Respondent NARRANDERA SHIRE COUNCIL (ABN 96 547 765 569) Seventh Respondent NARROMINE SHIRE COUNCIL (ABN 99 352 328 504) Eighth Respondent OBERON COUNCIL (ABN 13 632 416 736) Ninth Respondent ORANGE CITY COUNCIL (ABN 85 985 402 386) Tenth Respondent PARKES SHIRE COUNCIL (ABN 96 299 629 630) Eleventh Respondent CITY OF RYDE (ABN 81 627 292 610) Twelfth Cross Appellant LOCAL GOVERNMENT FINANCIAL SERVICES PTY LIMITED (ACN 001 681 741) Thirteenth Respondent ABN AMRO BANK NV (ARBN 84 079 478 612) Fourteenth Respondent |

| JUDGES: | JACOBSON, GILMOUR AND GORDON JJ |

| DATE OF ORDER: | 6 june 2014 |

| WHERE MADE: | SYDNEY |

THE COURT ORDERS THAT:

1. The parties are directed to confer and bring in agreed orders to give effect to these reasons for judgment including the question of costs by 4:00pm on 13 June 2014. If the orders cannot be agreed, then the parties are to file a joint document which identifies the areas of agreement, the areas of disagreement and, for the areas of disagreement, the reason or reasons for that disagreement by 4:00pm on 13 June 2014.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011 (Cth).

| IN THE FEDERAL COURT OF AUSTRALIA | |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 505 of 2013 |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | LOCAL GOVERNMENT FINANCIAL SERVICES PTY LIMITED (ACN 001 681 741) Appellant |

| AND: | BATHURST REGIONAL COUNCIL First Respondent COOMA MONARO SHIRE COUNCIL (ABN 19 204 741 100) Second Respondent COROWA SHIRE COUNCIL (ABN 43 874 223 315) Third Respondent DENILIQUIN COUNCIL (ABN 41 992 919 200) Fourth Respondent EUROBODALLA SHIRE COUNCIL (ABN 47 504 455 945) Fifth Respondent MOREE PLAINS SHIRE COUNCIL (ABN 46 566 790 582) Sixth Respondent MURRAY SHIRE COUNCIL (ABN 77 334 235 304) Seventh Respondent NARRANDERA SHIRE COUNCIL (ABN 96 547 765 569) Eighth Respondent NARROMINE SHIRE COUNCIL (ABN 99 352 328 504) Ninth Respondent OBERON COUNCIL (ABN 13 632 416 736) Tenth Respondent ORANGE CITY COUNCIL (ABN 85 985 402 386) Eleventh Respondent PARKES SHIRE COUNCIL (ABN 96 299 629 630) Twelfth Respondent CITY OF RYDE (ABN 81 627 292 610) Thirteenth Respondent ABN AMRO BANK NV (ARBN 84 079 478 612) Fourteenth Respondent MCGRAW-HILL INTERNATIONAL (UK) LIMITED Fifteenth Respondent AMERICAN HOME ASSURANCE COMPANY (ABN 67 007 483 267) Sixteenth Respondent |

| JUDGES: | JACOBSON, GILMOUR AND GORDON JJ |

| DATE OF ORDER: | 6 june 2014 |

| WHERE MADE: | SYDNEY |

THE COURT ORDERS THAT:

1. The parties are directed to confer and bring in agreed orders to give effect to these reasons for judgment including the question of costs by 4:00pm on 13 June 2014. If the orders cannot be agreed, then the parties are to file a joint document which identifies the areas of agreement, the areas of disagreement and, for the areas of disagreement, the reason or reasons for that disagreement by 4:00pm on 13 June 2014.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011 (Cth).

| IN THE FEDERAL COURT OF AUSTRALIA | |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 507 of 2013 |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | ABN AMRO BANK NV (ARBN 84 079 478 612) Appellant |

| AND: | LOCAL GOVERNMENT FINANCIAL SERVICES PTY LIMITED (ACN 001 681 741) First Respondent MCGRAW-HILL INTERNATIONAL (UK) LIMITED Second Respondent |

| JUDGES: | JACOBSON, GILMOUR AND GORDON JJ |

| DATE OF ORDER: | 6 june 2014 |

| WHERE MADE: | SYDNEY |

THE COURT ORDERS THAT:

1. The parties are directed to confer and bring in agreed orders to give effect to these reasons for judgment including the question of costs by 4:00pm on 13 June 2014. If the orders cannot be agreed, then the parties are to file a joint document which identifies the areas of agreement, the areas of disagreement and, for the areas of disagreement, the reason or reasons for that disagreement by 4:00pm on 13 June 2014.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011 (Cth).

| IN THE FEDERAL COURT OF AUSTRALIA | |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 508 of 2013 |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | MCGRAW-HILL INTERNATIONAL (UK) LIMITED Appellant |

| AND: | LOCAL GOVERNMENT FINANCIAL SERVICES PTY LIMITED (ACN 001 681 741) First Respondent ABN AMRO BANK NV (ARBN 84 079 478 612) Second Respondent |

| JUDGES: | JACOBSON, GILMOUR AND GORDON JJ |

| DATE OF ORDER: | 6 JUNE 2014 |

| WHERE MADE: | SYDNEY |

THE COURT ORDERS THAT:

1. The parties are directed to confer and bring in agreed orders to give effect to these reasons for judgment including the question of costs by 4:00pm on 13 June 2014. If the orders cannot be agreed, then the parties are to file a joint document which identifies the areas of agreement, the areas of disagreement and, for the areas of disagreement, the reason or reasons for that disagreement by 4:00pm on 13 June 2014.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011 (Cth).

| IN THE FEDERAL COURT OF AUSTRALIA | |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 522 of 2013 |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | AMERICAN HOME ASSURANCE COMPANY (ABN 67 007 483 267) Appellant |

| AND: | BATHURST REGIONAL COUNCIL First Respondent LOCAL GOVERNMENT FINANCIAL SERVICES PTY LIMITED (ACN 001 681 741) Second Respondent ABN AMRO BANK NV (ARBN 84 079 478 612) Third Respondent MCGRAW-HILL INTERNATIONAL (UK) LIMITED Fourth Respondent |

| JUDGES: | JACOBSON, GILMOUR AND GORDON JJ |

| DATE OF ORDER: | 6 JUNE 2014 |

| WHERE MADE: | SYDNEY |

THE COURT ORDERS THAT:

1. The parties are directed to confer and bring in agreed orders to give effect to these reasons for judgment including the question of costs by 4:00pm on 13 June 2014. If the orders cannot be agreed, then the parties are to file a joint document which identifies the areas of agreement, the areas of disagreement and, for the areas of disagreement, the reason or reasons for that disagreement by 4:00pm on 13 June 2014.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011 (Cth).

| IN THE FEDERAL COURT OF AUSTRALIA | |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 523 of 2013 |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | AMERICAN HOME ASSURANCE COMPANY (ABN 67 007 483 267) Appellant |

| AND: | COOMA MONARO SHIRE COUNCIL (ABN 19 204 741 100) First Respondent COROWA SHIRE COUNCIL (ABN 43 874 223 315) Second Respondent DENILIQUIN COUNCIL (ABN 41 992 919 200) Third Respondent EUROBODALLA SHIRE COUNCIL (ABN 47 504 455 945) Fourth Respondent MOREE PLAINS SHIRE COUNCIL (ABN 46 566 790 582) Fifth Respondent MURRAY SHIRE COUNCIL (ABN 77 334 235 304) Sixth Respondent NARRANDERA SHIRE COUNCIL (ABN 96 547 765 569) Seventh Respondent NARROMINE SHIRE COUNCIL (ABN 99 352 328 504) Eighth Respondent OBERON COUNCIL (ABN 13 632 416 736) Ninth Respondent ORANGE CITY COUNCIL (ABN 85 985 402 386) Tenth Respondent PARKES SHIRE COUNCIL (ABN 96 299 629 630) Eleventh Respondent CITY OF RYDE (ABN 81 627 292 610) Twelfth Respondent LOCAL GOVERNMENT FINANCIAL SERVICES PTY LIMITED (ACN 001 681 741) Thirteenth Respondent ABN AMRO BANK NV (ARBN 84 079 478 612) Fourteenth Respondent MCGRAW-HILL INTERNATIONAL (UK) LIMITED Fifteenth Respondent |

| JUDGES: | JACOBSON, GILMOUR AND GORDON JJ |

| DATE OF ORDER: | 6 JUNE 2014 |

| WHERE MADE: | SYDNEY |

THE COURT ORDERS THAT:

1. The parties are directed to confer and bring in agreed orders to give effect to these reasons for judgment including the question of costs by 4:00pm on 13 June 2014. If the orders cannot be agreed, then the parties are to file a joint document which identifies the areas of agreement, the areas of disagreement and, for the areas of disagreement, the reason or reasons for that disagreement by 4:00pm on 13 June 2014.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011 (Cth).

| IN THE FEDERAL COURT OF AUSTRALIA | |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 524 of 2013 |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | AMERICAN HOME ASSURANCE COMPANY (ABN 67 007 483 267) Appellant |

| AND: | LOCAL GOVERNMENT FINANCIAL SERVICES PTY LIMITED (ACN 001 681 741) First Respondent ABN AMRO BANK NV (ARBN 84 079 478 612) Second Respondent MCGRAW-HILL INTERNATIONAL (UK) LIMITED Third Respondent |

| DATE OF ORDER: | |

| WHERE MADE: |

THE COURT ORDERS THAT:

1. The parties are directed to confer and bring in agreed orders to give effect to these reasons for judgment including the question of costs by 4:00pm on 13 June 2014. If the orders cannot be agreed, then the parties are to file a joint document which identifies the areas of agreement, the areas of disagreement and, for the areas of disagreement, the reason or reasons for that disagreement by 4:00pm on 13 June 2014.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011 (Cth).

INDEX

| [1] | |

| PART 2: THE FACTS | [17] |

| 1. THE COUNCILS | [18] |

| 1.1 Introduction | [18] |

| 1.2 Ministerial Order and s 625 of the Local Government Act | [19] |

| 1.3 Investment Guidelines | [21] |

| 1.4 NSW Local Government Investments Best Practice Guide | [25] |

| 2. LGFS | [26] |

| [32] | |

| 4. ABN AMRO | [37] |

| 5. S&P | [40] |

| 5.1 S&P's Ratings Business and General Practice | [40] |

| 5.2 Rembrandt 2006-2 and 2006-3 | [45] |

| 5.3 Rating of Rembrandt 2006-2 and 2006-3 | [46] |

| 6. SALE OF NOTES TO LGFS | [59] |

| 7. SALE OF NOTES TO THE COUNCILS | [98] |

| 8. DECLINE OF THE REMBRANDT NOTES | [142] |

| PART 3: S&P'S RATING AND ABN AMRO'S KNOWLEDGE THAT THE RATING LACKED REASONABLE GROUNDS AND WAS MISLEADING | [145] |

| 1. CHRONOLOGY OF EVENTS RELATING TO THE VOLATILITY ISSUE | [145] |

| 1.1 Introduction | [145] |

| 1.2 Background to the development of the CPDO | [157] |

| 1.3 The anti-DPN (or CPDO) is introduced to S&P | [179] |

| 1.4 ABN Amro communicates with S&P's rating committee | [196] |

| 1.5 ABN Amro provide S&P with more analysis | [204] |

| 1.6 S&P conducts further analysis | [207] |

| 1.7 The launch of the CPDO | [220] |

| 1.8 Some issues raised within ABN Amro about roll costs | [222] |

| 1.9 The CPDO in AUD | [227] |

| 1.10 Tightening spreads | [240] |

| 1.11 The ABN Amro Surf Presentation | [246] |

| 1.12 Further correspondence on tightening spreads | [248] |

| 1.13 Further emails about the rating | [251] |

| 1.14 S&P issues rating letter | [259] |

| 1.15 Mr Martorell's comparative table | [262] |

| 1.16 S&P realises 15% volatility not justifiable | [265] |

| 1.17 Mr Ding detects starting spread problem | [269] |

| 1.18 Further discussion of the parameters | [273] |

| 1.19 Rembrandt 2006-3 | [283] |

| 1.20 The stability analysis | [289] |

| 1.21 "A crisis in CPDO land" | [305] |

| 1.22 The ratings letter for Rembrandt 2006-3 | [318] |

| 1.23 More discussion about tightening spreads | [320] |

| 1.24 Some further problems emerge | [329] |

| 1.25 Further consideration of the rating | [334] |

| 1.26 Further development of S&P's model | [363] |

| 1.27 ABN Amro's "additional insertions" to the chronology | [371] |

| 2. CONSIDERATION OF THE VOLATILITY ISSUE | [374] |

| 2.1 The rebalancing issue | [374] |

| 2.1.1 Entitlement to raise rebalancing issue | [374] |

| 2.1.2 Reasons why ABN Amro is not entitled to raise rebalancing issue | [387] |

| 2.2 The 25% volatility argument | [425] |

| 2.2.1 The primary judge's findings on the volatility parameter | [432] |

| 2.2.2 The primary judge's three key findings on volatility | [464] |

| 2.2.3 The primary judge's rejection of Mr Ding's evidence | [466] |

| 2.2.4 The primary judge's rejection of Mr Chandler's evidence | [470] |

| 2.2.5 The primary judge's rejection of ABN Amro's "reasonable grounds" submission | [472] |

| 2.2.6 The primary judge's findings about the effect of tightening spreads and its relationship to volatility | [486] |

| 2.2.7 The primary judge's finding about the "new" volatility assumption | [492] |

| 2.2.8 ABN Amro's "unexplained error" influences the primary judge's finding | [501] |

| 2.2.9 Other reasons why ABN Amro did not have reasonable grounds | [504] |

| 3. CONSIDERATION OF THE PRIMARY JUDGE'S FINDINGS ON VOLATILITY | [508] |

| 4. CONCLUSION | [563] |

| PART 4: LGFS' PURCHASE OF REMBRANDT 2006-3 NOTES: S&P | [564] |

| 1. TORT CLAIMS | [566] |

| 1.1. Duty of care owed by S&P to LGFS? | [566] |

| 1.1.1 Facts | [569] |

| 1.1.2 Applicable legal principles | [573] |

| 1.1.3 Application of principles to facts | [579] |

| 1.1.4 No reasonable foreseeability / risk of harm insignificant? | [585] |

| 1.1.4.1 S&P's liability indeterminate and S&P not know identity of LGFS | [587] |

| 1.1.4.2 LGFS was not vulnerable and, even if it was, S&P did not know of its vulnerability | [596] |

| 1.1.4.2.1 Disclaimers | [602] |

| 1.1.4.2.2 Pre-Sale Report | [605] |

| 1.1.4.2.3 Ratings Letters | [611] |

| 1.1.4.3 S&P did not have direct dealings with or control LGFS | [614] |

| 1.1.4.4 LGFS contravened s 912A of the Corporations Act? | [617] |

| 1.1.4.4.1 Introduction | [617] |

| 1.1.4.4.2 Relevant Facts | [624] |

| 1.1.4.4.3 The statutory definition of a debenture | [642] |

| 1.1.4.4.4 The relevant provisions of the Corporations Act | [651] |

| 1.1.4.4.5 Discussion | [661] |

| 1.1.4.4.6 The legal consequences of LGFS selling and advising in relation to the Rembrandt notes in contravention of its AFSLs and s 912A of the Corporations Act | [701] |

| 1.2 Breach of duty | [721] |

| 2. STATUTORY CLAIMS - APPLICATION OF SS 1041H, 1041E OF THE CORPORATIONS ACT 1041E AND S 12DA OF THE ASIC ACT | [723] |

| 2.1 S&P's challenge to the primary judge's finding of liability under s 1041H of the Corporations Act | [724] |

| 2.2 Was the conduct "in this jurisdiction"? | [729] |

| 2.3 Section 1041E of the Corporations Act | [746] |

| 2.4 Section 12DA of the ASIC Act | [754] |

| 2.5 Was S&P's conduct misleading or deceptive? | [765] |

| 3. CAUSATION, RELIANCE AND REMOTENESS | [774] |

| 3.1 Introduction | [774] |

| 3.2 S&P's contentions on appeal | [785] |

| 3.2.1 Alternative Universe Contention | [786] |

| 3.2.2 Disclaimers Contention | [791] |

| 3.2.3 Real Cause of Loss Contention | [795] |

| 3.2.4 Indirect Causation Contention | [797] |

| 3.2.5 Remoteness Contention | [799] |

| PART 5: LGFS' PURCHASE OF 2006-3 NOTES: ABN AMRO | [801] |

| 1. TORT CLAIMS | [803] |

| 1.1 Introduction | [803] |

| 1.2 First duty - to exercise reasonable care and skill in providing to LGFS information and advice about the Rembrandt notes | [805] |

| 1.2.1 Introduction | [805] |

| 1.2.2 Applicable principles | [808] |

| 1.2.3 Evidentiary issues on appeal | [813] |

| 1.2.4 Findings and Appeal Grounds | [815] |

| 1.2.4.1 LGFS financially sophisticated and not vulnerable | [817] |

| 1.2.4.2 LGFS' precondition to acquisition of Rembrandt 2006-3 notes was that S&P (not ABN Amro) assign AAA rating | [834] |

| 1.2.4.3 Mandate Letter | [839] |

| 1.2.4.4 Disclaimers in Surf Presentation and Rembrandt 2006-3 term sheet | [852] |

| 1.3 Second Duty - to exercise reasonable care to arrange and cause to be issued to LGFS a financial product which had a degree of security commensurate with its AAA rating | [861] |

| 1.3.1 Mandate Letter | [864] |

| 1.3.2 Warranty? | [868] |

| 1.3.3 S&P should have detected lack of creditworthiness in the notes | [869] |

| 1.3.4 Vulnerability | [875] |

| 1.3.5 Unlawfulness | [876] |

| 1.4 Were these duties breached? | [877] |

| 1.4.1 First Duty - negligent misstatement | [878] |

| 1.4.1.1 Introduction | [878] |

| 1.4.1.2 Representations made? | [881] |

| 1.4.1.3 Representations misleading? | [906] |

| 1.4.2 Second Duty - duty as structurer | [907] |

| 2. STATUTORY CLAIMS | [911] |

| 2.1 Introduction | [911] |

| 2.2 Section 1041H of the Corporations Act and s 12DA of the ASIC Act | [912] |

| 2.3 Section 1041E of the Corporations Act | [915] |

| 3. CAUSATION | [916] |

| 3.1 Introduction | [916] |

| 3.2 Reliance Contention - First Duty and LGFS' misleading conduct case | [919] |

| 3.2.1 Finding LGFS proved reliance | [923] |

| 3.2.2 Finding that LGFS did not need to prove reliance on any of the ABN Representations | [930] |

| 3.3 Alternative Universe Contention | [934] |

| 4. CONTRACTUAL CLAIMS OF LGFS AGAINST ABN AMRO | [936] |

| 4.1 Introduction | [936] |

| 4.2 Legislation | [939] |

| 4.3 ABN Amro's contentions on appeal and analysis | [941] |

| 4.4 Breach of contractual obligations | [946] |

| 4.5 Loss and Damage | [948] |

| PART 6: LGFS AGAINST ABN AMRO AND S&P FOR LOSSES ON LGFS' RETAINED NOTES | [954] |

| 1. INTRODUCTION | [954] |

| 2. APPEAL GROUNDS | [955] |

| 3. POTTS v MILLER | [958] |

| 3.1 Introduction | [958] |

| 3.2 Analysis | [960] |

| 3.3 Extreme spread widening accompanying the GFC | [974] |

| 3.4 LGFS effectively "locked in"? | [978] |

| 3.5 Impugned conduct did not continue to operate | [980] |

| 3.6 LGFS able to sell to ABN Amro | [987] |

| 4. CREDIT FOR INTEREST OR COUPON PAYMENTS? | [989] |

| 5. NOTICES OF CONTENTION - LGFS AND COUNCILS | [990] |

| 6. LGFS CONTRIBUTORILY NEGLIGENT? | [992] |

| PART 7: LGFS' CLAIMS AGAINST ABN AMRO AND S&P IN RELATION TO SETTLEMENT WITH STATECOVER | [993] |

| 1. INTRODUCTION | [993] |

| 2. LIABILITY OF ABN AMRO TO LGFS | [997] |

| 2.1 Tort Claims | [997] |

| 2.2 Statutory Claims | [1000] |

| 2.3 Causation | [1001] |

| 3. LIABILITY OF S&P TO LGFS | [1003] |

| 3.1 Tort Claims | [1003] |

| 3.2 Statutory Claims | [1006] |

| 3.3 Causation | [1007] |

| 3.4 Loss and Damage | [1008] |

| 4. EQUITABLE CONTRIBUTION | [1009] |

| 5. LGFS CONTRIBUTORILY NEGLIGENT? | [1016] |

| PART 8: PA COUNCILS' PURCHASE OF 2006-3 NOTES: LGFS | [1017] |

| 1. INTRODUCTION | [1017] |

| 2. TORT AND EQUITABLE CLAIMS | [1018] |

| 2.1 Introduction | [1018] |

| 2.2 Factual Analysis | [1019] |

| 2.2.1 Nature of the relationship | [1021] |

| 2.2.2 Representations made by LGFS to PA Councils | [1025] |

| 2.2.3 The context in which the representations were made | [1027] |

| 2.2.4 Distinction between RB and NRB Councils? | [1033] |

| 2.2.5 LGFS' challenges to factual findings | [1035] |

| 2.2.5.1 Challenge 1: Whether the witnesses were the decision makers and the availability of other potential advisers | [1037] |

| 2.2.5.2 Challenge 2: Relevance of Right Balance Agreements | [1045] |

| 2.2.5.3 Challenge 3: Whether the Councils would have understood that LGFS would prefer its own interests over those of the Councils | [1048] |

| 2.2.5.4 Challenge 4: Whether the Councils were reliant on LGFS | [1050] |

| 2.2.5.5 Challenge 5: Findings concerning LGFS' beliefs in J[1371] | [1052] |

| 2.2.5.6 Challenge 6: Relevance of the speed of the Councils' decision to acquire the Rembrandt notes | [1056] |

| 2.2.5.7 Challenge 7: Price volatility and whether the Rembrandt notes were suitable for any Council at any time | [1060] |

| 2.2.6 Conclusion | [1062] |

| 2.3 Fiduciary duty claim | [1063] |

| 2.3.1 Introduction | [1063] |

| 2.3.2 Applicable legal principles - fiduciary relationship | [1066] |

| 2.3.3 LGFS' submission on appeal | [1067] |

| 2.3.4 Did a fiduciary relationship exist between LGFS and the NRB Councils? | [1068] |

| 2.3.5 Conflict of interest and therefore disclosures required by LGFS? | [1072] |

| 2.3.5.1 Failure to disclose potential risks and ramifications faced by LGFS in holding $40 million of notes | [1074] |

| 2.3.5.2 LGFS information | [1082] |

| 2.3.6 Factual causation | [1085] |

| 2.3.7. Contributory negligence / indemnity / apportionment in relation to fiduciary duty claim | [1099] |

| 2.4 Negligence and negligent misstatement | [1100] |

| 2.4.1 Introduction | [1100] |

| 2.4.2 Factual analysis | [1104] |

| 2.4.3 Duty of care | [1105] |

| 2.4.3.1 Conflict with LGFS' statutory duties as investment advisor? | [1108] |

| 2.4.3.2 LGFS undertook, or was to be taken to have undertaken, to perform those obligations to each of the NRB Councils? | [1119] |

| 2.4.4 Breach of duty | [1121] |

| 2.4.4.1 LGFS' commercial objectives | [1132] |

| 2.4.4.2 Suitability of Rembrandt for local councils | [1136] |

| 2.4.5 Other representations and non-disclosures | [1153] |

| 3. STATUTORY CLAIMS | [1154] |

| 3.1 Introduction | [1154] |

| 3.2 Section 1041H of the Corporations Act | [1155] |

| 3.2.1 'Conservatism' of Councils | [1162] |

| 3.2.2 LGFS' perception of the Councils' understanding of structured products | [1167] |

| 3.2.2.1 Previous investment in structured products and therefore necessary knowledge | [1169] |

| 3.2.2.2 Councils as institutions | [1174] |

| 3.2.2.3 Contents of documents provided by LGFS to PA Councils and their response | [1175] |

| 3.2.2.4 Eurobodalla | [1178] |

| 3.2.2.5 Oral Presentations to PA Councils | [1180] |

| 3.2.2.6 Nature of product | [1186] |

| 3.2.3 Specific representations | [1189] |

| 3.2.3.1 Role of LGFS | [1190] |

| 3.2.3.2 The highly volatile nature of the Rembrandt notes | [1197] |

| 3.2.3.3 The meaning of "market value" for purpose of sale back to LGFS | [1203] |

| 3.2.4. The modelling disclaimer | [1207] |

| 3.2.5 The March 2007 rating review by S&P | [1212] |

| 3.2.6 The cash out and cash in features of the Rembrandt notes | [1217] |

| 3.3 Section 1041E of the Corporations Act | [1222] |

| 3.4 Section 12DA of the ASIC Act | [1223] |

| 4. CONTRACT CLAIMS IN RELATION TO COOMA AND COROWA | [1224] |

| 5. CAUSATION | [1225] |

| 5.1 The 'But For' Test - the first step | [1226] |

| 5.1.1 Role of LGFS | [1228] |

| 5.1.2 NAV volatility and evolution of credit spreads | [1231] |

| 5.1.3 Calculation of market value | [1235] |

| 5.1.4 Modelling disclaimer | [1236] |

| 5.1.5 March 2007 S&P CPDO Evaluator | [1237] |

| 5.1.6 Likelihood of cash out | [1238] |

| 5.1.7 Prospects of cash in | [1239] |

| 5.2 The Scope of Liability - the second step | [1240] |

| 5.3 Contributory negligence of the Councils? | [1243] |

| 6. LOSS AND DAMAGE | [1244] |

| 7. SECTION 1041E CLAIMS APPORTIONABLE? | [1245] |

| 8. UNLICENSED TO DEAL CLAIM | [1246] |

| 9. RESCISSION CLAIM BY COUNCILS | [1247] |

| PART 9: PA COUNCILS' PURCHASE OF 2006-3 NOTES: S&P | [1248] |

| 1. INTRODUCTION | [1248] |

| 2. TORT CLAIMS | [1250] |

| 2.1 Negligence | [1250] |

| 2.2 Facts | [1253] |

| 2.3 Applicable legal principles | [1254] |

| 2.4 Application of principles to facts | [1255] |

| 2.5 S&P's Appeal Grounds | [1256] |

| 2.5.1 No reasonable foreseeability / risk of harm insignificant? | [1257] |

| 2.5.2 S&P's liability indeterminate and S&P did not know identity of the PA Councils | [1259] |

| 2.5.3 PA Councils not vulnerable | [1263] |

| 2.5.4 S&P did not control the PA Councils or have any direct dealings with them | [1270] |

| 2.5.5 Councils acted unlawfully: s 625 of the Local Government Act | [1272] |

| 2.5.6 Bathurst's concession | [1298] |

| 2.5.7 Conclusion | [1302] |

| 2.6 Breach of duty | [1303] |

| 3. STATUTORY CLAIMS | [1304] |

| 3.1 Introduction | [1304] |

| 3.2 Section 1041H of the Corporations Act | [1305] |

| 3.3 Section 1041E of the Corporations Act | [1306] |

| 3.4 Section 12DA of the ASIC Act | [1307] |

| 3.5 Conduct of S&P misleading or deceptive | [1308] |

| 3.6 Causation | [1309] |

| 4. CONTRIBUTORY NEGLIGENCE | [1310] |

| 5. LOSS AND DAMAGE | [1311] |

| PART 10: PA COUNCILS' PURCHASE OF 2006-3 NOTES: ABN AMRO | [1313] |

| 1. INTRODUCTION | [1313] |

| 2. FACTUAL FINDINGS | [1315] |

| 3. TORT CLAIMS | [1318] |

| 3.1 Introduction | [1318] |

| 3.2 Did a duty of care exist? | [1321] |

| 3.2.1 Introduction | [1321] |

| 3.2.2 Applicable principles | [1323] |

| 3.3.3 Findings | [1325] |

| 3.2.4 Appeal Grounds | [1326] |

| 3.2.4.1 ABN Amro did not know that LGFS intended to market the Rembrandt 2006-3 notes to the PA Councils or any specific matter which might have enabled it to assess the type of information which should be provided to the PA Councils | [1328] |

| 3.2.4.2 ABN Amro had no control over what (if any) information LGFS provided to the PA Councils | [1332] |

| 3.2.4.3 ABN Amro did not assume responsibility for the provision of information to the PA Councils | [1334] |

| 3.2.4.4 ABN Amro did not assume responsibility to LGFS "for modelling and structuring" the Rembrandt 2006-3 notes | [1337] |

| 3.2.4.5 The PA Councils were not vulnerable to a breach of the alleged duty by ABN Amro | [1338] |

| 3.2.4.6 The alleged duty was incompatible with the contractual relationship between ABN Amro and LGFS | [1341] |

| 3.2.4.7 The alleged duty would leave ABN Amro exposed to liability in an indeterminate amount to an indeterminate class | [1342] |

| 3.2.4.8 The alleged duty would require ABN Amro to review and assess the adequacy of S&P's rating of the Rembrandt 2006-3 notes in circumstances where it was inappropriate or impossible | [1343] |

| 3.3 ABN Amro breached the duty? | [1347] |

| 4. STATUTORY CLAIMS | [1349] |

| 4.1 Introduction | [1349] |

| 4.2 Section 1041H of the Corporations Act and s 12DA of the ASIC Act | [1350] |

| 4.2.1 ABN Amro's conduct | [1353] |

| 4.2.2 Was ABN Amro's conduct misleading? | [1361] |

| 4.3 Section 1041E of the Corporations Act | [1366] |

| 4.4 Accessorial liability claims | [1368] |

| 5. CAUSATION, RELIANCE AND REMOTENESS | [1370] |

| 5.1 Introduction | [1370] |

| 5.2 Indirect Causation Contention | [1374] |

| 5.3 Alternative Universe Contention | [1381] |

| 5.4 Unlawfulness Contention | [1382] |

| 6. LOSS AND DAMAGE | [1383] |

| 7. COUNCILS' FAILURE TO TAKE REASONABLE CARE AND CONTRIBUTORY NEGLIGENCE | [1386] |

| 8. NO DEDUCTION FOR COUPONS | [1387] |

| PART 11: BATHURST PURCHASE OF 2006-3 NOTES | [1388] |

| 1. ABN AMRO'S CLAIMS AGAINST BATHURST | [1388] |

| 1.1 Tort claims | [1388] |

| 1.2 Statutory claims | [1392] |

| 1.3 Loss and damage | [1395] |

| 1.4 Contributory negligence | [1396] |

| 2. S&P'S CLAIMS AGAINST BATHURST | [1397] |

| 2.1 Tort claims | [1397] |

| 2.2 Statutory claims | [1398] |

| 2.3 Causation | [1399] |

| 2.4 Loss and damage | [1400] |

| 2.5 Contributory negligence | [1401] |

| 3. LGFS' CLAIMS AGAINST BATHURST | [1402] |

| 4. RESCISSION CLAIMS - SECTION 925A OF THE CORPORATIONS ACT | [1403] |

| 4.1 The trial judgment | [1409] |

| 4.2 The appeal | [1419] |

| 4.3 Consideration | [1422] |

| PART 12: CROSS CLAIMS | [1446] |

| 1. ABN AMRO CLAIM AGAINST S&P | [1446] |

| 2. S&P CLAIM AGAINST ABN AMRO | [1453] |

| PART 13: CONTRIBUTORY NEGLIGENCE, APPORTIONMENT, PREJUDGMENT INTEREST AND COSTS | [1457] |

| 1. CONTRIBUTORY NEGLIGENCE | [1457] |

| 1.1 Introduction | [1457] |

| 1.2 Rembrandt 2006-3 - LGFS contributorily negligent? | [1458] |

| 1.2.1 Statutory framework | [1459] |

| 1.2.2 Appeal Grounds | [1467] |

| 1.2.2.1 Purchased notes for on-sale to councils | [1469] |

| 1.2.2.2 The notes were not suitable for on-selling | [1471] |

| 1.2.3 Conclusion | [1473] |

| 1.3 Rembrandt 2006-2 - LGFS contributorily negligent? | [1474] |

| 1.3.1 Appeal Grounds | [1474] |

| 1.3.2 Analysis | [1475] |

| 1.4 Councils contributorily negligent? | [1478] |

| 1.4.1 Introduction | [1478] |

| 1.4.2 Standard by which Councils' conduct to be assessed | [1482] |

| 1.4.3 Councils' reliance on LGFS | [1484] |

| 1.4.4 Councils' consideration of the Pre-Sale Report and the Post-Sale Report and other documents | [1489] |

| 1.4.5 Council Officers' understanding of the Rembrandt notes | [1494] |

| 1.4.6 Hindsight evidence as to what the Councils would have done | [1498] |

| 1.4.7 Councils breached the Local Government Act | [1502] |

| 1.4.8 LGFS' Appeal Grounds | [1503] |

| 1.4.9 Conclusion | [1505] |

| 2. APPORTIONMENT | [1506] |

| 2.1 Introduction | [1506] |

| 2.2 Apportionment of the losses | [1508] |

| 2.2.1 Applicable Principles | [1508] |

| 2.2.2 Councils' losses | [1512] |

| 2.2.3 LGFS' losses | [1513] |

| 2.3 AHAC's submissions | [1514] |

| 3. PROPORTIONATE LIABILITY UNDER THE CORPORATIONS ACT AND THE ASIC ACT | [1517] |

| 3.1 Introduction | [1517] |

| 3.2 Proportionate liability | [1528] |

| 3.3 Statutory framework | [1533] |

| 3.4 The proportionate liability provisions under Div 2A of the Corporations Act | [1544] |

| 3.5 The cross-appeal by LGFS, S&P and ABN Amro | [1553] |

| 3.6 Consideration | [1555] |

| 3.6.1 What facts established contraventions of s 1041E and s 1041H | [1591] |

| 3.6.2 Joint and several or apportioned damages awards | [1608] |

| 4. PRE-JUDGMENT INTEREST | [1612] |

| 5. COSTS | [1615] |

| PART 14: INSURANCE ISSUES - APPEALS BY AHAC AGAINST LGFS | [1618] |

| 1. INTRODUCTION | [1618] |

| 2. LGFS' NOTICE OF CONTENTION | [1627] |

| 2.1 Did LGFS owe the s 21 of the ICA duty of disclosure | [1627] |

| 2.2 Discussion | [1631] |

| 2.3 Were the Rembrandt notes a debenture | [1653] |

| 3. AHAC'S APPEALS | [1654] |

| 3.1 Did LGFS breach its s 21 duty of disclosure | [1654] |

| 3.2 LGFS' knowledge | [1677] |

| 3.3 Was the duty of disclosure waived? | [1699] |

| 3.4 Did any non-disclosure have a causative effect? | [1714] |

| 3.5 Exclusion in Endorsement 17 | [1739] |

| 3.5.1 Introduction | [1739] |

| 3.5.2 Was Endorsement 17 engaged? | [1742] |

| 3.5.3 Does the insuring clause apply only to conduct within LGFS' AFSL? | [1758] |

| 3.5.4 Conflict of interest | [1772] |

| 3.6 Exclusion in Endorsement 16 | [1776] |

| 3.7 Exclusion clause 3.3 | [1796] |

| 3.8 Was an excluded cause a proximate cause? | [1817] |

| 3.9 Whether the settlement of the StateCover proceedings was reasonable? | [1828] |

| PART 15: ORDERS | [1859] |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 501 of 2013 |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | ABN AMRO BANK NV (ARBN 84 079 478 612) and others named in the attached Schedule of Parties Appellant |

| AND: | BATHURST REGIONAL COUNCIL and others named in the attached Schedule of Parties First Respondent |

| IN THE FEDERAL COURT OF AUSTRALIA | |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 502 of 2013 |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | MCGRAW-HILL INTERNATIONAL (UK) LIMITED Appellant |

| AND: | BATHURST REGIONAL COUNCIL and others named in the attached Schedule of Parties First Respondent |

| IN THE FEDERAL COURT OF AUSTRALIA | |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 503 of 2013 |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | ABN AMRO BANK NV (ARBN 84 079 478 612) Appellant |

| AND: | COOMA MONARO SHIRE COUNCIL (ABN 19 204 741 100) First Respondent and others named in the attached Schedule of Parties |

| IN THE FEDERAL COURT OF AUSTRALIA | |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 504 of 2013 |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | MCGRAW-HILL INTERNATIONAL (UK) LIMITED Appellant |

| AND: | COOMA MONARO SHIRE COUNCIL (ABN 19 204 741 100) and others named in the attached Schedule of Parties First Respondent |

| IN THE FEDERAL COURT OF AUSTRALIA | |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 505 of 2013 |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | LOCAL GOVERNMENT FINANCIAL SERVICES PTY LIMITED (ACN 001 681 741) Appellant |

| AND: | BATHURST REGIONAL COUNCIL and others named in the attached Schedule of Parties First Respondent |

| IN THE FEDERAL COURT OF AUSTRALIA | |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 507 of 2013 |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | ABN AMRO BANK NV (ARBN 84 079 478 612) Appellant | |

| AND: | LOCAL GOVERNMENT FINANCIAL SERVICES PTY LIMITED (ACN 001 681 741) First Respondent MCGRAW-HILL INTERNATIONAL (UK) LIMITED Second Respondent | |

| IN THE FEDERAL COURT OF AUSTRALIA | ||

| NEW SOUTH WALES DISTRICT REGISTRY | ||

| GENERAL DIVISION | NSD 508 of 2013 | |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | MCGRAW-HILL INTERNATIONAL (UK) LIMITED Appellant |

| AND: | LOCAL GOVERNMENT FINANCIAL SERVICES PTY LIMITED (ACN 001 681 741) First Respondent ABN AMRO BANK NV (ARBN 84 079 478 612) Second Respondent |

| IN THE FEDERAL COURT OF AUSTRALIA | |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 522 of 2013 |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | AMERICAN HOME ASSURANCE COMPANY (ABN 67 007 483 267) Appellant |

| AND: | BATHURST REGIONAL COUNCIL and others named in the attached Schedule of Parties First Respondent |

| IN THE FEDERAL COURT OF AUSTRALIA | |

| NEW SOUTH WALES DISTRICT REGISTRY | |

| GENERAL DIVISION | NSD 523 of 2013 |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | AMERICAN HOME ASSURANCE COMPANY (ABN 67 007 483 267) Appellant | |

| AND: | COOMA MONARO SHIRE COUNCIL (ABN 19 204 741 100) and others named in the attached Schedule of Parties First Respondent | |

| IN THE FEDERAL COURT OF AUSTRALIA | ||

| NEW SOUTH WALES DISTRICT REGISTRY | ||

| GENERAL DIVISION | NSD 524 of 2013 | |

| ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

| BETWEEN: | AMERICAN HOME ASSURANCE COMPANY (ABN 67 007 483 267) Appellant |

| AND: | LOCAL GOVERNMENT FINANCIAL SERVICES PTY LIMITED (ACN 001 681 741) and others named in the attached Schedule of Parties First Respondent |

| JUDGES: | JACOBSON, GILMOUR AND GORDON JJ |

| DATE: | 6 JUNE 2014 |

| PLACE: | SYDNEY |

REASONS FOR JUDGMENT

PART 1: INTRODUCTION

1 ABN AMRO Bank NV (ABN Amro) is an investment bank. In 2006, it created a "CPDO" (a form of financial instrument or "structured financial product"), which it proposed to sell in AUD under the name "Rembrandt notes". Standard & Poors (S&P) was a division of McGraw-Hill Companies Inc. At the request of the issuer of a financial instrument, S&P would assign a rating to the instrument. The rating was intended to describe the likelihood that principal and interest due under the instrument would be paid in accordance with its terms. ABN Amro asked S&P to rate the Rembrandt notes. S&P rated them AAA (the highest rating assigned by S&P). S&P accepted on appeal that the rating was flawed.

2 ABN Amro marketed and sold the Rembrandt notes to Local Government Financial Services Pty Ltd (LGFS). The two Australian dollar issues were known as the Rembrandt 2006-2 and Rembrandt 2006-3 notes (collectively, the Rembrandt notes). As its name suggests, LGFS dealt with local government authorities. LGFS purchased $10 million of the Rembrandt 2006-2 notes ($6 million on behalf of StateCover Mutual Limited (StateCover) and $4 million which it purchased in its own name and subsequently transferred to StateCover). LGFS then purchased $45 million of the Rembrandt 2006-3 notes. LGFS sold a substantial portion of the Rembrandt 2006-3 notes to 13 municipal councils in New South Wales (the Councils). StateCover and the Councils lost much of the amounts they invested in the Rembrandt notes. StateCover and the Councils sued ABN Amro, S&P and LGFS for damages.

3 After a trial occupying 53 days, judgment was entered for the Councils against ABN Amro, S&P and LGFS and orders were made apportioning liability between them. LGFS also established an entitlement to equitable contribution from ABN Amro and S&P including on account of LGFS' payment to StateCover to discharge StateCover's claims against LGFS, S&P and ABN Amro (the StateCover settlement). The primary judge dealt also with other claims which are described in more detail below.

4 Ten separate proceedings were brought in the appellate jurisdiction of this Court and have been heard together. There are appeals and cross appeals. In their appeals, ABN Amro, S&P and LGFS advanced so many different appeal grounds that it was necessary to tabulate those grounds in tables comprising 306 entries set out over more than 120 pages. To assist the parties, and to the extent that it is feasible, we have endeavoured to note these tabulated appeal grounds in the course of our reasons. The grounds are identified in the following way "[Party Name] Appeal Grounds Matrix Row [##]". By their appeal grounds, ABN Amro, S&P and LGFS put in issue just about every finding of fact and conclusion of law made by the primary judge and for the most part pursued each allegation of error with undiscriminating vigour. As a result, these reasons for judgment must be, and are, very long and very complex. But, subject to some qualifications, the attacks made on the findings made, and conclusions reached, by the primary judge fail. The qualifications have only a limited effect on the primary judge's final orders. Defined terms are used throughout these reasons for judgment. For the assistance of the reader, a glossary of those terms is set out in Attachment A. Paragraphs of the trial judgment are identified by the prefix J[***]. On appeal, the parties also filed a statement of agreed facts. That statement was not comprehensive. Paragraphs of that statement are identified by the prefix [SAF***].

5 At trial, three proceedings were heard together ([SAF2]):

1. Proceedings commenced by Corowa Shire Council and 11 other New South Wales regional councils (the PA Councils) against LGFS, ABN Amro and S&P, in which cross claims were made between those parties and American Home Assurance Company (AHAC) (Corowa Proceedings);

2. Proceedings commenced by Bathurst Regional Council (Bathurst) against LGFS, ABN Amro and S&P, in which cross claims were made between those parties and AHAC (Bathurst Proceedings); and

3. Proceedings commenced by StateCover against LGFS, ABN Amro and S&P, in which cross claims were made between those parties and AHAC (StateCover Proceedings).

6 LGFS also sued both ABN Amro and S&P: (1) on account of LGFS' payment under the StateCover settlement; (2) LGFS' own losses incurred on the sale of the Rembrandt 2006-3 notes to its parent company, Local Government Superannuation Scheme (LGSS) and (3) any liability that LGFS might be found to have to the Councils in respect of their claims against LGFS. In addition, because LGFS' insurer, AHAC, denied LGFS cover for the StateCover settlement and the claims of the Councils, LGFS sued AHAC for indemnity under its insurance policy: [SAF1].

7 LGFS, ABN Amro, S&P and AHAC all denied liability and raised various defences and cross-claims to the claims against them. The cross-claims included not only those of LGFS against S&P and ABN Amro but also those of S&P and ABN Amro against each other and of AHAC against LGFS for the repayment of defence costs already paid. Issues of contributory negligence were raised against the Councils and LGFS by S&P and ABN Amro. Issues of proportionate liability were raised between LGFS, S&P and ABN Amro in respect of claims against and between them other than the claims of AHAC which were separate: [SAF1].

8 The PA Councils were commonly represented: [SAF4]. Bathurst was separately represented. Despite some differences in the formulation of the claims made by Bathurst and the PA Councils (including an unconscionable conduct claim by Bathurst against LGFS), the claims may be described together: [SAF1].

9 The Councils' and LGFS' claims may be described as follows:

1. The Councils against LGFS: (i) misleading and deceptive conduct; (ii) negligence; (iii) in respect of two of the councils, Cooma and Corowa, breach of contract; (iv) an unlicensed to deal claim and (v) breach of fiduciary duty. Bathurst also brought a claim for restitution based on an allegation that councils were not permitted to invest in the Rembrandt notes, a claim which the PA Councils made in the alternative only to their primary case that the Councils were permitted to invest in the Rembrandt notes. The remedies sought for the unlicensed to deal claim and the fiduciary duty claim included rescission of the Councils' agreements to purchase the Rembrandt notes with associated restitution and equitable compensation. The remedies sought for the other claims were damages: [SAF1]. On appeal, the PA Councils did not pursue their rescission claim.

2. The Councils against S&P: (i) misleading and deceptive conduct and (ii) negligence. The remedies sought were damages: [SAF1].

3. The Councils against ABN Amro: (i) misleading and deceptive conduct; (ii) knowing involvement in S&P's misleading and deceptive conduct and (iii) negligence. The remedies sought were damages: [SAF1].

4. LGFS against S&P: (i) misleading and deceptive conduct and (ii) negligence. The remedies sought were damages: [SAF1].

5. LGFS against ABN Amro: (i) misleading and deceptive conduct; (ii) negligence and (iii) a contract claim in respect of the Rembrandt 2006-3 notes. The remedies sought were damages: [SAF1].

10 S&P's claims against ABN Amro only arose if S&P was found liable to LGFS and / or the Councils. In that event, S&P brought proportionate liability claims against ABN Amro as a concurrent wrongdoer: [SAF1]. ABN Amro's claims against S&P only arose if ABN Amro was found liable to LGFS and/or the Councils. In that event, ABN Amro brought proportionate liability claims against S&P as a concurrent wrongdoer: [SAF1].

11 LGFS claimed that AHAC was liable to indemnify LGFS for any liability it had in respect of the claims of the Councils and in respect of the StateCover settlement and its defence costs in connection with each. AHAC denied that LGFS has any right to indemnity under the contract of insurance on various grounds and sought repayment from LGFS of the defence costs already paid: [SAF1].

12 The primary judge held, and we would uphold on appeal, that:

1. S&P's assignment of a AAA rating to the Rembrandt notes was misleading and deceptive and involved the publication of information or statements false in material particulars and otherwise involved negligent misrepresentations to the class of potential investors in Australia, which included LGFS and the Councils, because by the AAA rating there was conveyed a representation that in S&P's opinion the capacity of the notes to meet all financial obligations was "extremely strong" and a representation that S&P had reached this opinion based on reasonable grounds and as the result of an exercise of reasonable care and skill when neither was true and S&P also knew them not to be true when they were made;

2. ABN Amro was knowingly concerned in S&P's contraventions of the various statutory provisions proscribing such misleading and deceptive conduct, and also itself engaged in conduct that was misleading and deceptive and published information or statements false in material particulars and otherwise involved negligent misrepresentations to LGFS specifically and the class of potential investors with which ABN Amro knew LGFS intended to deal, being the Councils, by reason of ABN Amro's deployment of the AAA rating and its own representations as to the meaning and reliability of the AAA rating which also were not true and ABN Amro knew them not to be true when they were made;

3. ABN Amro breached its contract with LGFS under which ABN Amro was to model and structure the transaction by which LGFS would purchase the notes having a degree of security commensurate with a rating of AAA assigned by S&P; and

4. LGFS engaged in misleading and deceptive conduct and in one respect the publication of information or a statement false in material particulars and otherwise made negligent misrepresentations to the Councils about the Rembrandt 2006-3 notes and, in addition, breached its Australian Financial Services Licence (AFSL) in advising the Councils about and selling to them the notes because the notes were not a debenture and thus not a security but a derivative under the Corporations Act 2001 (Cth) (Corporations Act) in which LGFS was not licensed to deal.

13 The primary judge also held that LGFS was in a fiduciary relationship with each Council and, in its dealings with the Councils, LGFS breached its fiduciary obligations to avoid conflicts of interest in respect of the notes, or to disclose and obtain fully informed consent to such conflicts. The relationship between LGFS and each Council was of a fiduciary nature. LGFS breached its fiduciary obligations by failing to avoid conflicts of interest in respect of the notes although the conflict (and therefore the nature of the breach) we would describe differently.

14 In relation to the damages, contributory negligence and apportionment, the primary judge held:

1. The arguments made by:

1.1 LGFS, S&P and ABN Amro of contributory negligence or the equivalent by the Councils; and

1.2 S&P and ABN Amro of contributory negligence or the equivalent by LGFS in respect of, relevantly, the Rembrandt notes,

were rejected.

2. LGFS established its entitlement to damages against S&P and ABN Amro (which were held to be proportionally liable as to 50% each) for LGFS' loss incurred on the sale of the downgraded Rembrandt 2006-3 notes to its parent company LGSS ($15,970,184.72).

3. LGFS established its entitlement to damages or equitable contribution from S&P and ABN Amro (which were proportionally liable as to 331/3% each with LGFS liable for the other 331/3%) in respect of the settlement LGFS made of the StateCover proceedings against LGFS, S&P and ABN Amro ($3.175 million).

4. The Councils established their entitlement to damages from S&P, ABN Amro and LGFS (which were held to be proportionally liable as to 331/3% each) being the difference between the principal amount each paid and the payment they received on the cash out of the notes.

5. The Councils also established their entitlement to equitable compensation from LGFS for breach of fiduciary duty but the measure of equitable compensation was held to be the same as the damages otherwise payable by S&P, ABN Amro and LGFS as to 331/3% each.

6. LGFS established it was entitled to indemnity under the contract of insurance between FuturePlus Financial Services Pty Ltd (FuturePlus) and AHAC.

15 On appeal, we would uphold these findings in relation to damages, contributory negligence and apportionment except that we would hold that the damages assessed in relation to the claim under s 1041E of the Corporations Act are not apportionable.

16 The balance of the judgment is divided into Parts as follows:

1. The Facts: Part 2;

2. S&P's Rating and ABN Amro's knowledge that the rating lacked reasonable grounds and was misleading: Part 3;

3. LGFS' purchase of the Rembrandt 2006-3 notes:

3.1 As against S&P: Part 4;

3.2 As against ABN Amro: Part 5;

3.3 As against ABN Amro and S&P for losses on LGFS' Retained Notes: Part 6;

4. LGFS' claim against ABN Amro and S&P in relation to StateCover: Part 7;

5. The PA Councils' purchase of the Rembrandt 2006-3 notes:

5.1 As against LGFS: Part 8;

5.2 As against S&P: Part 9;

5.3 As against ABN Amro: Part 10;

6. Bathurst's purchase of the Rembrandt 2006-3 notes: Part 11;

7. The Cross-Claims: Part 12;

8. Contributory negligence, apportionment, pre-judgment interest and costs: Part 13;

9. Insurance Claim between LGFS and AHAC: Part 14;

10. The Orders: Part 15.

PART 2: THE FACTS

17 This part of the judgment is divided into the following sections:

1. The Councils;

2. LGFS;

3. CPDOs and Structured Finance Products;

4. ABN Amro;

5. S&P;

6. Sale of Rembrandt notes to LGFS;

7. Sale of Rembrandt notes to the Councils; and

8. Decline of the Rembrandt notes.

1. THE COUNCILS

1.1 Introduction

18 The Councils are bodies corporate constituted under the Local Government Act 1993 (NSW) (Local Government Act) and are the local government authorities for various shires in New South Wales: [SAF5].

1.2 Ministerial Order and s 625 of the Local Government Act

19 In making investments with council funds, the Councils were required to comply with s 625(1) of the Local Government Act which provides that a council "may invest money that is not, for the time being, required by the council for any other purpose": [SAF8]. Under s 625(2), "[m]oney may be invested only in a form of investment notified by order of the Minister published in the Gazette": [SAF8]. Ministerial orders were published in the Gazette in 2000 and 2005: [SAF8].

20 The Ministerial order of 15 July 2005 (Ministerial Order) permitted investments in nominated assets. The Ministerial Order relevantly stated that investment was permitted in (see [SAF8] and J[2214]):

(a) any public funds or Government stock or Government securities of the Commonwealth or any State of the Commonwealth;

(b) any debentures or securities guaranteed by the Government of New South Wales;

(c) any debentures or securities, issued by a public or local authority, or a statutory body representing the Crown, constituted by or under any law of the Commonwealth, of any State of the Commonwealth or of the Northern Territory or of the Australian Capital Territory and guaranteed by the Commonwealth, any State of the Commonwealth or a Territory;

(d) any debentures or securities issued by a Territory and guaranteed by the Commonwealth;

(e) any debentures or securities issued by a council (within the meaning of the Local Government Act 1993);

(f) mortgage of land in any State or Territory of the Commonwealth;

(g) purchase of land (including any lot within the meaning of the Strata Schemes Management Act 1996) in any State or Territory of the Commonwealth;

(h) interest bearing deposits in a bank authorised to carry on the business of banking under any law of the Commonwealth or of a State or Territory of the Commonwealth;

(i) interest bearing deposits with a building society or credit union.

(j) any bill of exchange which has a maturity date of not more than 200 days; and if purchased for value confers on the holder in due course a right of recourse against a bank, building society or credit union as the acceptor or endorser of the bill for an amount equal to the face value of the bill;

(k) any securities which are issued by a body or company (or controlled parent entity either immediate or ultimate) with a Moody's Investors Service, Inc. credit rating of "Aaa", "Aa1", "a2", "Aa3", "A1" or "A2" or a Standard & Poor's Investors Service, Inc credit rating of "AAA'', "AA+", "AA", "AA-"; "A+", or "A" or a Fitch Rating credit rating of "AAA", "AA+", "AA", "AA-", "A+" or "A";

(l) any securities which are given a Moody's Investors Service Inc credit rating of "Aaa", "Aa1", "Aa2", "Aa3", "A1"; "A2" or "Prime-1" or a Standard and Poor's Investors Service, Inc credit rating of "AAA", "AA+", "AA", "AA-", "A+"; "A"; "A1+" or "A1" or a Fitch Rating credit rating of "AAA", "AA+", "AA", "AA-", "A+" or "A";

(m) any debentures or securities issued by a bank, building society or credit union;

(n) a deposit with the Local Government Investment Service Pty Ltd;

(o) a deposit with the New South Wales Treasury Corporation or investments in an Hour-Glass investment facility of the New South Wales Treasury Corporation.

(Emphasis added.)

1.3 Investment Guidelines

21 On 29 November 2000, the Director-General of the Department of Local Government issued a circular (DLG 2000 Circular) to all councils attaching a copy of the relevant ministerial order as then in force: [SAF 11] and J[27]. The last two paragraphs of the circular stated:

In addition, Councils (sic) attention is drawn to Update 8 of the Code of Accounting Practice and Financial Reporting that contains a policy direction that states "councils must maintain an investment policy". That investment policy must comply with the legislation and investment guidelines.

In keeping with existing arrangements it is the responsibility of each individual council to determine that its investments are authorised in terms of the listed securities. Note that the Guidelines issued with the previous Order remain unchanged.

Those paragraphs of the DLG 2000 Circular provided that: (1) the councils must maintain an investment policy; (2) the investment policy must comply with the legislation and investment guidelines and (3) it is the responsibility of each individual council to determine that its investments are authorised in terms of the listed securities: [SAF 11] and J[27].

22 Under s 23A of the Local Government Act, the Director-General was authorised to issue guidelines to councils about the exercise of their functions: [SAF12] and J[28]. By s 23A(3), "a council must take any relevant guidelines issued under [s 23A] into consideration before exercising any of its functions". [SAF12] and J[28].

23 The investment guidelines referred to in the DLG 2000 Circular (Investment Guidelines) stated that ratings were an independent assessment of the capacity of an instrument to meet its obligations and, whilst ratings were in no way a guarantee against loss, "ratings provide the best independent information available": [SAF13], J[30] and J[2524].

24 On 27 November 2006, a date which is after Corowa, Eurobodalla, Parkes and Orange invested in Rembrandt 2006-3 but before the other Councils did so (although only by a few days in some cases), the Director-General of the Department of Local Government issued a further circular to all councils (DLG 2006 Circular): [SAF14] and J[31]. Part of the DLG 2006 Circular ([SAF14] and J[31]) stated:

Following a recent survey it is apparent that some councils are not adhering to the current Ministerial Investment Order regarding the investment of funds. As a consequence, this circular replaces Circular 00/71 and should be read in conjunction with Circular 05/53 to further remind councils of their responsibilities.

Councils must comply with the Ministerial Investment Order, section 625 of the Local Government Act 1993 and clause 212 of the Local Government (General) Regulation 2005.

...

Councils must consider the following when considering an investment:

• the purpose of the investment

• the desirability of investment diversification

• the nature and risks associated with the investments

• the likely income return and timing of any income return

• the length of the proposed investment

• the costs involved in making the investment

• other matters as appropriate

Councils need to be aware of their obligation to be transparent when reporting changes of value in investments. The onus for investments is to be on preservation of capital rather than the rate of return.

As part of its overall financial plan, each council should develop and maintain an investment strategy/policy. The strategy/policy should, as a minimum, consider the desirability of diversifying investments and the nature and risk associated with the investments.

...

1.4 NSW Local Government Investments Best Practice Guide

25 The NSW Local Government Investments Best Practice Guide, referred to in the DLG 2006 Circular, was a draft document prepared by two industry bodies, Local Government Financial Professionals and Local Government Managers' Association: [SAF15] and J[32]. A number of the Councils were aware of, and had regard to, this document in preparing their investment policies and otherwise when undertaking investments: [SAF15] and J[32]. The draft document, which was initially issued in 2000 and re-issued in April 2006, included the following statements ([SAF15] and J[32]):

2. The Requirement for a 'Prudent Person' Approach to Funds Management

Section 11.3.5 of the Local Government (Financial Management) Regulation requires council to ensure

'it or its representatives exercise care, diligence and skill that a prudent person would exercise in investing council funds.'

Based on the above a prudent person is one who exercises the key elements of care, diligence and skill.

Whilst not exhaustive the following is a list of the matters a prudent person would be expected to consider:

i) read and understand the legislative framework around which council is to exercise its powers of investment

ii) adopt an investment policy and strategy (see examples in Appendix (4) to this guide)

iii) confirm who has the authority to place investments on council's behalf

iv) identify any internal gaps in knowledge required to adequately manage council's investments

v) ensure a suitably skilled member of staff is given day to day responsibility for the management of councils (sic) investments

vi) ensure staff involved in managing council's investments receive adequate training to undertake their role(s)

vii) consider the use of advisers (appropriately licenced (sic) by ASIC) to fill any knowledge gaps and to provide expert advice on individual investments and portfolio design and construction. Refer to Appendix 7 for suggested evaluation criteria for selecting an adviser.

viii) invest only in accordance with the legislation, investment policy and strategy

ix) determine the purpose of the investment (e.g. future needs of funds invested)

x) do not invest in products you do not understand and take the time to learn/understand available products

xi) consider how any proposed investment compliments other investments in the portfolio as part of ensuring appropriate diversification of investment style, issuer/manager and maturity profile.

xii) review investment performance and portfolio mix at least monthly with reference to a set market benchmark and council objectives

xiii) request investment institutions/managers/advisers/brokers to provide immediate feedback when significant and/or adverse events occur that relate to your investments

xiv) ensure council maintains title to funds invested

xv) report to council monthly in accordance with the legislation

xvi) reconcile investments held to general ledger at least monthly

xvii) review investment strategy at least annually

xviii) seek independent research and advice before investing in sophisticated investment types (eg. managed funds, floating rate notes - FRN's or collateralised debt obligations - CDO's)

xix) refer to Appendix 6 of this guide - 'CDO Checklist' before placing CDO investments

xx) Refer to Appendix 8 of this guide - 'General Investments Checklist' before placing general investments (ie. cash funds, enhanced cash funds, fixed interest funds, bank bills/NCD's, floating rate notes, asset backed securities and bonds.

3. Development of an Investment Policy and Strategy

The Local Government Code of Accounting Practice & Financial Reporting requires council to maintain an investment policy and strategy and to review the strategy at least annually as part of its overall financial plan.

Example Investment Policy and Strategy documents are attached to this guide as Appendix (4).

In addition to the matters referred to in the example documents, in putting an Investment Policy and Strategy together you should consider the following:

i) are council's objectives and philosophy in relation to desired investment outcomes clear eg. is council seeking to maximise returns within regulatory investment boundaries, or to generate reasonable (nominated by council) returns with lowest risk exposure to achieve that return

ii) have you assessed your council's tolerance to risk (eg. to what levels is council willing to accept capital losses or significant fluctuations in returns)

iii) are council's objectives in relation to return and risk reconcilable

iv) have you assessed your council's expectations regards (sic) investment returns

v) does council have any environmental/ethical investment policies

vi) does council have any existing specific future uses for invested funds that would impact on the manner funds should be invested

vii) have you assessed the maximum and minimum terms over which investments should be placed

viii) does council have the systems in place to record and report on the investments it makes

ix) has council provided a commitment to staff training in relation to council's investing activities

x) does council have a formal process for determining what funds should be invested (eg. daily cash-flow analysis)

xi) what are the benchmarks against which you will measure the performance of council's portfolio.

2. LGFS

26 LGFS was established in 1979 as the financial services arm of the Local Government and Shires Associations, which operated as peak industry bodies for local government in New South Wales: [SAF40] and J[960]. In October 2004, LGFS was purchased by LGSS, a division of FuturePlus: [SAF40] and J[961].

27 Prior to its purchase by LGSS, all LGFS board members were councillors from New South Wales councils. After its purchase by LGSS, the LGFS board had six directors: three representatives of LGSS (who were also councillors) and three representatives of "various [l]ocal [g]overnment affiliated trade unions". The board later came to include a seventh member - a nominee of the Local Government Professionals Association: [SAF120] and J[1139].

28 Between 1986 and 1997, LGFS operated a deposit-taking institution for councils: [SAF121]. In 1997 or 1998, it launched its own funds management service, which involved accepting deposits from councils which were then deposited in a nominated LGFS facility (usually a short-term cash facility): [SAF123] and J[961]. LGFS would then aggregate the deposits for a particular facility and re-invest them with external fund managers: [SAF123] and J[961]. Mr Warwick Hilder was appointed as LGFS' Chief Executive Officer (CEO) in 1998: [SAF41] and J[1140]. One of his functions at the time of his appointment was to expand LGFS' operations to include a funds management service: [SAF41] and J[1140]. Subsequent initiatives included the development of a "Local Government Facility", which was a managed cash facility providing "socially responsible investment options for councils" and a "Committed Rolling Investment", which provided a floating rate of return and constituted "a series of term deposits joined together to provide an investment with a longer term": J[961]. By 2006, LGFS' "key business activity" was (as described by Mr Hilder) providing management services and facilities for local government entities in New South Wales: J[1140].

29 LGFS had a lengthy history of interactions with councils in New South Wales: [SAF42] and J[963]. LGFS presented its role to councils as helping councils to get the most out of financial markets: J[1141]. LGFS wanted the councils to "feel a strong relationship" with LGFS, acting as a sounding board by providing financial advice on an ongoing but informal (i.e., unpaid) basis: J[1141] and J[1147]. Both Mr Hilder and Mr Mark Tischler, a financial markets specialist with LGFS (who reported to Mr Hilder) agreed that LGFS wanted to be perceived by the councils as their confidant: J[1147] and J[1148]. The councils could only make investments in accordance with the relevant Ministerial Order, the relevant terms of which are set out at [20] above. Under the terms of the Ministerial Order in force at the relevant times, the councils could invest with LGFS regardless of whether LGFS carried a credit rating: J[962]. Nonetheless, LGFS sought and obtained a credit rating. At all material times, LGFS' rating was A/A1: [SAF122] and J[962].

30 During the relevant period, LGFS held two AFSLs: [SAF47] and J[2939]. The first was effective in the period from 5 November 2004 to 17 January 2007 (First AFSL). The second was effective in the period from 18 January 2007 until 30 June 2007 (Second AFSL): J[2939]. The First AFSL relevantly provided:

AUTHORISATION

This licence authorises the licensee to carry on a financial services business to:

(a) provide financial product advice for the following classes of financial products:

(i) deposit and payment products limited to:

A. basic deposit products;

B. deposit products other than basic deposit products;

(ii) debentures, stocks or bonds issued or proposed to be issued by a government;

…

(iv) securities; and

(b) deal in a financial product by:

(i) issuing, applying for, acquiring, varying or disposing of a financial product in respect of the following classes of financial products:

A. securities limited to:

1) debentures of a body corporate or unincorporated body only; and

(ii) applying for, acquiring, varying or disposing of a financial product on behalf of another person in respect of the following classes of products:

A. deposit and payment products limited to:

1) basic deposit products;

2) deposit products other than basic deposit products;

B. debentures, stocks or bonds issued or proposed to be issued by a government;

…

D. securities;

to wholesale clients.

(Emphasis added.)

31 In the Second AFSL, sub-paragraph (b) was altered to read as follows (emphasis added):

(b) deal in a financial product by:

(i) issuing, applying for, acquiring, varying or disposing of a financial product in respect of the following classes of financial products:

…

B. securities limited to:

1) debentures of a body corporate or unincorporated body only.

3. CPDOS AND STRUCTURED FINANCE PRODUCTS

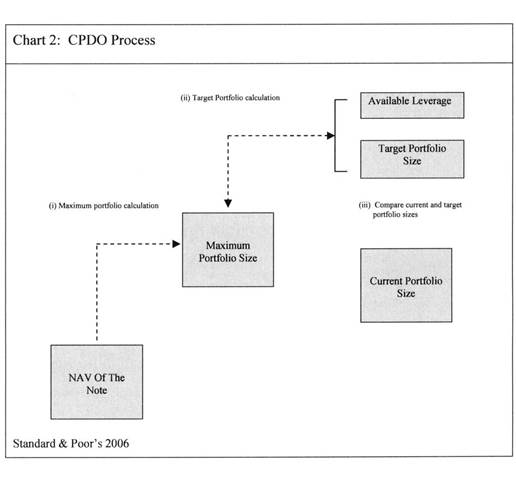

32 The CPDO is a form of structured finance product: [SAF82] and J[55]. Structured finance products use mechanisms and instruments to transfer and allocate cash flows and risks associated with a pool or portfolio of assets. A mechanism commonly used in structured finance products is leverage. An instrument commonly used in structured finance products is the credit default swap (CDS): [SAF82] and J[55].

33 A CDS is a contract relating to credit default risk: [SAF83] and J[56]. A typical CDS involves one party (the protection seller) selling to another party (the protection buyer) protection against the risk of a credit event. The credit event, for example, may be a default (such as failure to pay or bankruptcy) by a single entity or a pool of entities. The protection buyer pays the protection seller a fee for the protection against the risk of the credit event (the CDS premium fee). In return, the protection seller pays a sum to the protection buyer on the occurrence of the credit event (the CDS default payment). The CDS premium fee is usually fixed at the outset and paid quarterly. The method of calculating the CDS default payment is also fixed at the outset and is paid only after the occurrence of a credit event. In other words, the CDS premium fee is certain (or subject only to the risk of default by the protection buyer under the CDS) whereas the CDS default payment is contingent on an event which may or may not occur in the future (the credit event in respect of the referenced entity or entities): [SAF83] and J[56].

34 The mechanisms which apply to an actual CDS can also be applied to a notional or synthetic CDS: [SAF84] and J[58]. A notional or synthetic CDS still involves a contract but the contract need not involve any actual CDS: [SAF84] and J[58]. Instead the contractual provisions create an arrangement which mirrors the cash flows that would occur if an actual CDS had been executed: [SAF84] and J[58].

35 The pool or portfolio which a CDS can reference is also flexible. Instead of referring to a single entity (or obligor) a CDS can refer to a pool of entities (or obligors). The entities are obligors because they are subject to credit obligations. In or about late 2003 and early 2004, the CDX North America Investment Grade Index (the CDX) and the iTraxx Europe Index (iTraxx) were created. The CDX lists 125 US investment grade obligors and the iTraxx lists 125 European investment grade obligors. Investment grade means the obligor is rated BBB or above by S&P (or its equivalent by other ratings agencies). The obligors are included in the list by reference to a process which takes into account investment grade, liquidity and diversification across industry sectors. Both of these indices are rolled every six months in March and September of each year. On each roll, the identity of the obligors in the indices is reviewed. Obligors who have become sub-investment grade or illiquid (by reference to the index criteria) are removed from the index and replaced with investment grade obligors with the object of maintaining the index as one containing the most liquid 125 investment grade obligors across the diversified industry sectors: [SAF85] and J[59].

36 Together, if weighted 50% each, the CDX and iTraxx are referred to as the Globoxx Index (Globoxx): [SAF86] and J[60]. Globoxx consists of 250 obligors made up of the 125 US investment grade obligors on the CDX and the 125 European investment grade obligors on the iTraxx: [SAF86] and J[60]. The background to the development of the CDOs is described further in Part 3, Section 1.2 below.

4. ABN AMRO

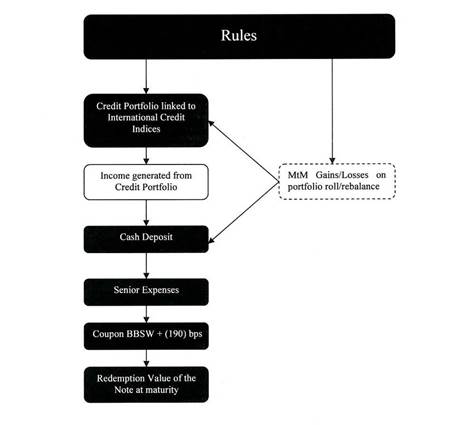

37 Purchased by the Royal Bank of Scotland in 2007, ABN Amro is an investment bank with its headquarters in London: [SAF52] and J[678]. It created the CPDO in early 2006: [SAF53] and J[1].

38 The first tranche of CPDOs were issued in Euros, US dollars and Yen: [SAF53] and J[390]. Later in 2006, ABN Amro decided to market the CPDOs in other currencies, including the Australian dollar: [SAF53] and J[1]. The two Australian dollar issues were known as the Rembrandt 2006-2 and Rembrandt 2006-3 notes: [SAF53] and J[1]. The Rembrandt notes aimed to pay high periodic coupons by taking leveraged exposure to a notional portfolio of credit indices: [SAF88] and J[41]. The notional CDS index contract referred to the CDX and iTraxx indices (which were known as the Globoxx index when weighted 50% each): [SAF87] and J[61]. Under the notional CDS contracts, the investors were the notional sellers of protection against default by entities listed on the indices and the counterparty was the notional buyer of such protection: J[5] and [SAF87]. Although the CPDO evolved out of other structured financial products which ABN Amro and other financial institutions had developed (such as collateral debt obligations (CDOs) and constant proportion principal insurance (CPPI) and variants thereof), ABN Amro's CPDO was a new structured financial product which the market had not previously seen and which no ratings agency had previously rated: [SAF87] and J[61].

39 In early May 2006, ABN Amro approached S&P for the purposes of obtaining a credit rating for the CPDO: [SAF104] and J[95]-J[99]. ABN Amro obtained the rating because many potential investors would not have the resources or expertise to assess the creditworthiness of the CPDO or to second-guess the rating of a structured financial product and many institutional investors could only invest in products with an investment grade rating: J[2759] and J[2816]. ABN Amro's role is further explained below.

5. S&P

5.1 S&P's Ratings Business and General Practice

40 S&P, at the relevant time a division of the McGraw-Hill Companies, Inc., carried on a business of providing credit ratings, including through McGraw Hill International (UK) Limited, at the request of the issuer of an instrument to be rated: [SAF63], J[23] and J[381]. S&P's business model for rating structured financial products depended on potential investors requiring banks and financial institutions to obtain ratings from internationally recognised credit rating agencies such as S&P: J[2524].

41 S&P was paid a substantial fee to assign a rating "knowing that the only purpose of its rating is to facilitate the marketing of the product": J[2787].

42 S&P described the meaning of its credit ratings in a document entitled "Issue Credit Ratings Definitions" which was available, amongst other places, on its public website: J[34], J[35] and J[1463(1)]. This publication does not suggest that the ratings scale can be understood only in the context of a report by S&P explaining the particular rating. It is a stand-alone document which assumes that the reader will correlate a rating to the definition. Relevantly, it described a AAA rating in the following way ([SAF103] and J[35]):