FEDERAL COURT OF AUSTRALIA

Australian Competition and Consumer Commission v CLA Trading Pty Ltd trading as Europcar [2019] FCA 1262

ORDERS

AUSTRALIAN COMPETITION AND CONSUMER COMMISSION Applicant | ||

AND: | CLA TRADING PTY LTD (ACN 082 220 339) (TRADING AS EUROPCAR) Respondent | |

DATE OF ORDER: | 14 August 2019 |

THE COURT DECLARES THAT:

1. The Respondent (“Europcar”) contravened s 55B(1) of the Competition and Consumer Act 2010 (Cth) (“CCA”) by imposing excessive surcharges for payments received by:

(a) use of the Visa credit system, the Visa debit system, the MasterCard credit systems, and the MasterCard debit systems in the period between 19 July 2017 and 31 August 2017; and

(b) use of the Visa debit system and MasterCard debit system in the period between 1 September 2017 and 5 November 2017.

THE COURT ORDERS THAT:

2. Within 30 days of the date of this order, Europcar pay to the Commonwealth of Australia:

(a) in respect of the contravention of s 55B(1) of the CCA referred to in subparagraph 1(a) above, a pecuniary penalty in the sum of $150,000; and

(b) in respect of the contravention of s 55B(1) of the CCA referred to in subparagraph 1(b) above, a pecuniary penalty in the sum of $200,000.

3. Europcar to pay a contribution to the Applicant’s costs in the sum of $25,000.

4. The proceeding otherwise be dismissed.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

DAVIES J:

1 The respondent, CLA Trading Pty Ltd, trades as Europcar (“Europcar”). Europcar is part of a global vehicle rental brand with operations in over 130 countries and territories.

2 The applicant (“the ACCC”) has alleged that Europcar contravened s 55B(1) of the Competition and Consumer Act 2010 (Cth) (“the Act”) by imposing excessive surcharges for payments received by:

(a) use of the Visa credit system, the Visa debit system, the MasterCard credit system and the MasterCard debit system in the period between 19 July 2017 and 31 August 2017; and

(b) use of the Visa debit system and MasterCard debit system in the period between 1 September 2017 and 5 November 2017.

3 Section 55B of the Act provides:

Payment surcharges must not be excessive

(1) A corporation must not, in trade or commerce, charge a payment surcharge that is excessive.

(2) A payment surcharge is excessive if:

(a) the surcharge is for a kind of payment covered by:

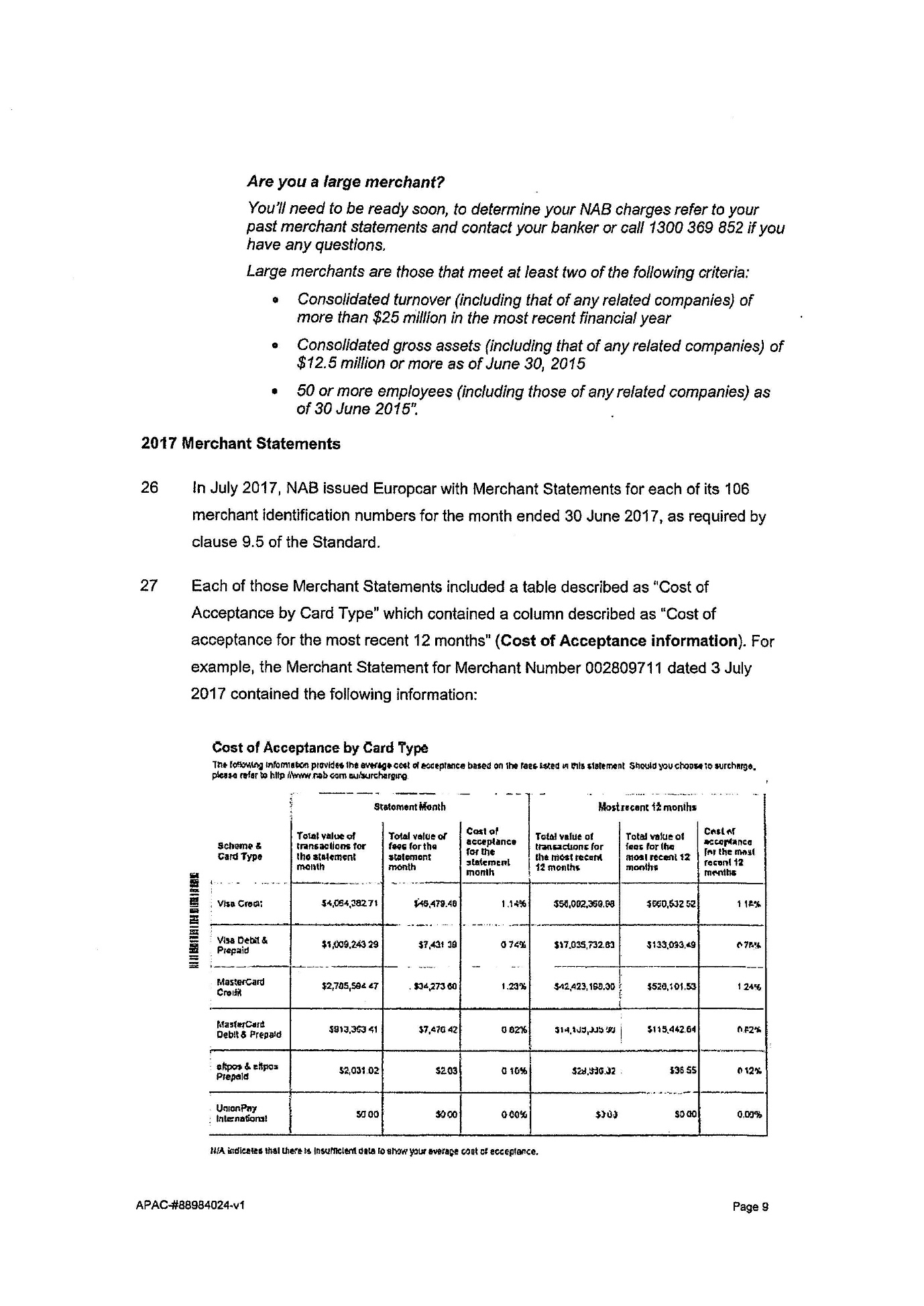

(i) a Reserve Bank standard; or

(ii) regulations made for the purposes of this subparagraph; and

(b) the amount of the surcharge exceeds the permitted surcharge referred to in the Reserve Bank standard or the regulations.

4 Europcar has admitted the contraventions and the parties jointly seek the declarations and orders set out in proposed orders signed by the parties on 5 March 2019, which include pecuniary penalties totalling $350,000. In support they have filed an Amended Statement of Agreed Facts and Admissions (“Amended Statement”) containing the facts on which they rely and joint submissions explaining why they contend that the proposed relief is appropriate and the Court ought to make the orders sought in the exercise of its discretion. The Amended Statement is annexed to these reasons (“Annexure A”) together with the joint proposed orders (“Annexure B”).

5 It is now well established that, in civil penalty proceedings, the Court can act upon parties’ agreed proposals as to an appropriate penalty and impose a proposed penalty, subject to the Court being sufficiently persuaded of the accuracy of the parties’ agreement as to facts and consequences and that the penalty proposed is an appropriate remedy: Commonwealth v Director, Fair Work Building Industry Inspectorate (2015) 258 CLR 482; [2015] HCA 46 at [46], [58], [79]. At [46], the plurality (French CJ, Kiefel, Bell, Nettle and Gordon JJ) emphasised the “important public policy involved in promoting predictability of outcome in civil penalty proceedings” which “assists in avoiding lengthy and complex litigation and thus tends to free the courts to deal with other matters and to free investigating officers to turn to other areas of investigation that await their attention”. The plurality further observed at [57] that “there is generally very considerable scope for the parties to agree on the facts and upon consequences. There is also very considerable scope for them to agree upon the appropriate remedy and for the court to be persuaded that it is an appropriate remedy” (original emphasis).

The contravening conduct

6 Europcar conducts a business in trade or commerce of renting vehicles to consumers in Australia. It is a “Large Merchant” within the definition of “Large Merchant” in cl 2.3 of the Reserve Bank of Australia Standard No. 3 of 2016 – Scheme Rules Relating to Merchant Pricing for Credit, Debit and Pre-Paid Card Transactions (“the Standard”).

7 Between 19 July 2017 and 5 November 2017 Europcar permitted consumers to pay for rental services by way of Visa credit cards, Visa debit cards, MasterCard credit cards and MasterCard debit cards (“payment methods”). Europcar incurred costs when it accepted payments from consumers using the payment methods, and charged amounts in addition to the price of services for the costs incurred in connection with accepting payment by way of the payment methods (“payment surcharge”). By force of s 55B(1) of the Act and the Standard, Europcar, from 1 September 2016, as a “Large Merchant”, was prohibited from charging a payment surcharge exceeding the permitted surcharge referred to in the Standard.

8 By cl 4.1 of the Standard, the permitted surcharge was an amount not exceeding the “Cost of Acceptance” (as defined in cl 5 of the Standard) for the applicable payment method. Clause 4.2 of the Standard provided that the “Cost of Acceptance” applicable at the time to the cards utilised in the payment methods was:

(a) subject to paragraph (b), the Cost of Acceptance for that payment method calculated for a 12 month period that ended not more than 13 months before that time; or

(b) if the Cost of Acceptance for that payment method for a 12 month period preceding that time was not reasonably ascertainable, an estimate of the average Cost of Acceptance for that payment method for a period of 12 months calculated by Europcar in good faith in the manner prescribed by paragraph 4.2(b) of the Standard.

9 Europcar has admitted that it contravened s 55B(1) of the Act by charging excessive payment surcharges for each payment received by use of the Visa credit system, Visa debit system, the MasterCard credit system and MasterCard debit system in the period between 19 July 2017 and 5 November 2017. The estimated financial benefits to Europcar as a result of it charging consumers excessive payment surcharges were:

(a) $46,921.59 in respect of contraventions in the period between 19 July 2017 and 31 August 2017; and

(b) $20,294 in respect of contraventions in the period between 1 September 2017 and 5 November 2017.

10 I note Europcar has since refunded the excessive payment surcharges to the relevant affected consumers but for an amount of $2,149 because the respective cards have been cancelled or expired or the customer’s bank has advised Europcar that a corresponding credit or debit card record could not be found. Europcar has sent emails to those affected customers, using the email addresses supplied at the time of renting the vehicle, seeking particulars of an account into which to pay the refund.

Grant of declaratory relief

11 I am satisfied that it is appropriate to make the declarations sought in this case. There is an important public interest in that declaratory relief, which serves to record the Court’s disapproval of the contravening conduct. The ACCC, as the statutory regulator, has an obvious and genuine interest in obtaining that declaratory relief and the proposed declarations sufficiently identify the nature of the conduct constituting the contraventions.

IMPOSITION OF PECUNIARY PENALTIES

12 The pecuniary penalties on which the parties have agreed are as follows:

(a) in respect of the contraventions in the period between 19 July 2017 to 31 August 2017, the sum of $150,000; and

(b) in respect of the contraventions in the period between 1 September 2017 and 5 November 2017, the sum of $200,000.

13 In addition Europcar has agreed to pay a contribution to the ACCC’s costs in the sum of $25,000. The Court has power to make such orders pursuant to s 76(1)(a)(ia) of the Act.

14 Whilst each of the excessive surcharges involved a separate contravention of s 55B of the Act, the parties submitted, and I agree, that it is appropriate to treat the contraventions with respect to the period between 19 July 2017 and 31 August 2017 as a single course of conduct, and the contraventions for the period between 1 September 2017 and 5 November 2017 as a separate single course of conduct. The reason for the differentiation in periods is that, in the earlier period, Europcar charged the amount that it had charged from 1 September 2016 until the end of the 12 month period ending 30 August 2017, despite in July 2017 receiving detailed information from National Australia Bank estimating a lower overall average of Europcar’s costs incurred in connection with accepting the payment methods. In the later period, Europcar charged customers paying by debit card a surcharge at rates set at the credit card level, which were higher than the Costs of Acceptance of debit cards, despite being aware from August 2017 that a blended rate for Visa credit and debit cards and MasterCard credit and debit cards was legally no longer acceptable and that National Australia Bank had calculated that the Cost of Acceptance was lower for debit cards. In my view, characterising the contraventions as courses of conduct by reference to the two different surcharging structures adopted and the circumstances in which they were applied is, in this case, an appropriate reflection of the actual, substantive wrongdoing.

15 The maximum penalty for a contravention of s 55B is 6,471 penalty units, that is $1,358,910: s 76(1A)(ba) of the Act and s 4AA of the Crimes Act 1914 (Cth).

16 Section 76(1) of the Act requires the Court to have regard to “all relevant matters” in determining the appropriate penalty. It also specifies a number of mandatory statutory factors to take into account: the nature and extent of the act or omission; any loss or damage suffered as a result of the act or omission; the circumstances in which the act or omission took place; and whether the person has previously been found by the Court in proceedings under Part VI or Part XIB to have engaged in any similar conduct.

17 The primary purpose of civil pecuniary penalties “is deterrence: specific deterrence of the contravener and, by his or her example, general deterrence of other would-be contraveners”: Australian Building and Construction Commissioner v Construction, Forestry, Mining and Energy Union (2018) 262 CLR 157 at 195; [2018] HCA 3 at [116] (Keane, Nettle and Gordon JJ).

18 The following factors are relevant to the penalty to be imposed.

19 First, the contraventions caused harm to 63,012 customers, comprising 44,560 customers in the period between 19 July 2017 and 31 August 2017 and 18,452 customers in the period between 1 September 2017 and 5 November 2017. Whilst the total loss suffered was estimated to be $67,215.59, the actual loss for each customer was a small amount per transaction as the surcharge in each case was a small percentage of the overall transaction amount.

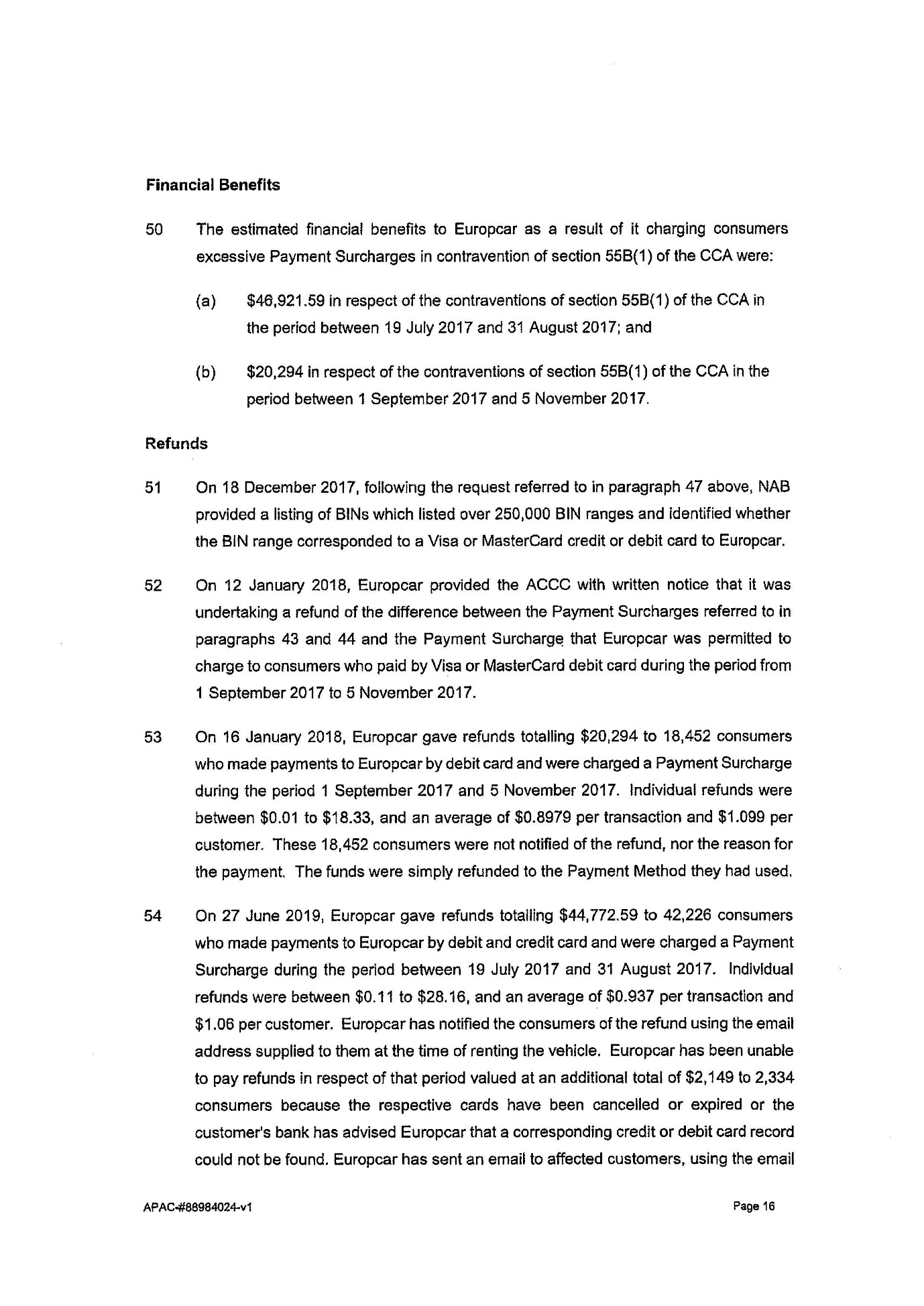

20 Secondly, Europcar has refunded the overpayments to the affected customers save for the amount of $2,149 where it has not yet been possible to pay the refunds. It has also taken corrective measures to adjust its surcharge to a permissible rate.

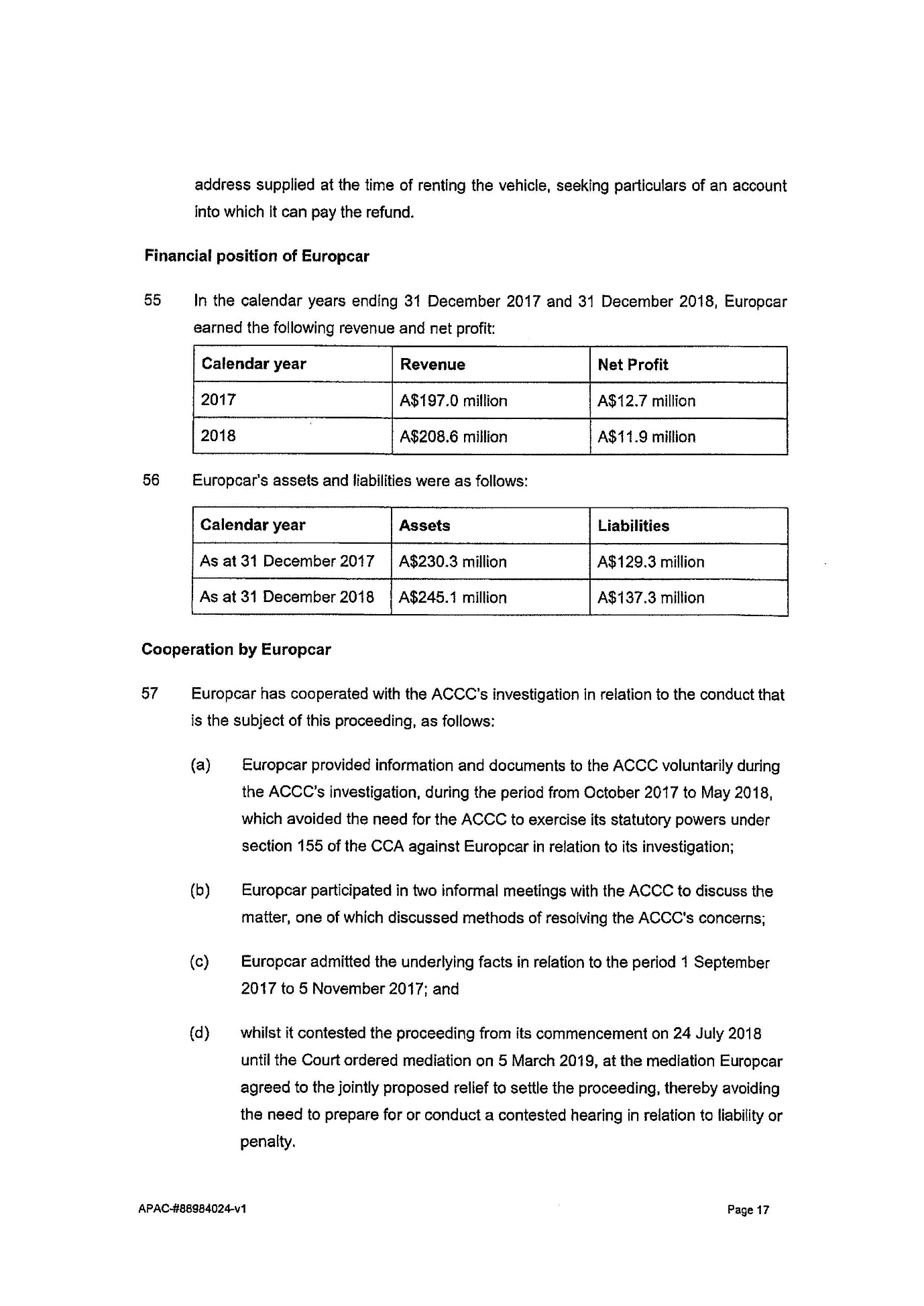

21 Thirdly, the proposed penalties substantially outweigh any gains which Europcar had secured before it refunded the amounts.

22 Fourthly, the proposed penalties reflect the seriousness of the contravening courses of conduct. Europcar imposed excessive surcharges on 73,112 payments received during the period from 5 July 2017 to 5 November 2017, overcharging 63,012 consumers.

23 Fifthly, there was a deliberateness to the contravening conduct. Europcar was aware from at least June 2016 that s 55B of the Act was coming into effect from 1 September 2016 but did not take adequate steps until August 2017 to prepare its systems to ensure compliance. Furthermore, senior management knew that Europcar was charging excessive surcharge rates for payment by debit cards in the period between 1 September 2017 and 5 November 2017. Europcar’s decision to engage in the contravening conduct from the period 1 September 2017 to 5 November 2017, notwithstanding the knowledge of senior management of the prohibition on excessive surcharging, is not consistent with a culture of compliance and reinforces the need for specific deterrence.

24 Sixthly, although Europcar has not previously been found to have contravened s 55B of the Act, in April 2016 it was ordered to pay a pecuniary penalty of $100,000 after this Court found it engaged in misleading or deceptive conduct and made false or misleading representations in relation to its car rental contracts in contravention of ss 12DA and 12DB of the Australian Securities and Investments Commission Act 2001 (Cth) (“the ASIC Act”). The Court also found that Europcar’s car rental contracts contained terms that were unfair within the meaning of s 12BG of the ASIC Act. Europcar’s past conduct reinforces the need for specific deterrence.

25 However, I do take into account that Europcar has cooperated with the ACCC’s investigation from its commencement. Whilst Europcar initially contested the proceeding, it then agreed to the making of all appropriate orders, agreed to penalty amounts and joined in the making of submissions which reflect the seriousness of its wrongdoing.

26 For these reasons, I consider that it is appropriate to make the orders in the terms agreed to by the parties.

I certify that the preceding twenty-six (26) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justice Davies. |

Associate:

ANNEXURE A

ANNEXURE B