FEDERAL COURT OF AUSTRALIA

Australian Competition and Consumer Commission v Cascade Coal Pty Ltd (No 3) [2018] FCA 1019

(Revised on 15 August 2018)

ORDERS

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The Application be dismissed.

2. The applicant pay the first, second and fourth to eleventh respondents’ costs of and incidental to the Application.

JUDGE: | FOSTER J |

DATE OF ORDER: | 15 august 2018 |

THE COURT ORDERS THAT:

1. Pursuant to r 39.04 of the Federal Court Rules 2011 (FCR) or, alternatively, pursuant to r 39.05(e) and (h) FCR, the Orders made by Foster J on 6 July 2018 be varied by deleting from Order 2 made on that day the word “second” so that Order 2 now reads:

2. The applicant pay the first and fourth to eleventh respondents’ costs of and incidental to the Application.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

LOYAL COAL | [23] |

A BRIEF OVERVIEW OF THE RELEVANT FACTS | [26] |

THE ACCC’S CASE AND THE RESPONDENTS’ DEFENCES | [48] |

THE RELEVANT FACTS | [83] |

The Witnesses | [83] |

The Primary Facts | [87] |

Introduction | [87] |

The Obeids’ Interest in Coal Ventures in the Bylong Valley – June and July 2008 | [90] |

Brook and his Introduction to the Obeids | [99] |

Arrangements between Brook, Monaro and the Obeids | [105] |

Obeid Interests and Associates Acquire Coggan Creek and Donola | [154] |

The EOI Process for Mt Penny Commences | [166] |

MMNL’s EOI for Mt Penny and Glendon Brook | [178] |

The DPI Reopens the EOI Process | [190] |

Negotiations between Cascade and the Obeids, Related Matters and Subsequent Events (20 May 2009 to May 2012) | [242] |

The 31 May 2009 Meeting | [252] |

The Meeting of 3 June 2009 | [294] |

The Meeting of 5 June 2009 | [312] |

The Yarrawa Deal Involving Coalworks | [389] |

The 23 May 2009 Meeting | [395] |

Additional Findings of Fact | [417] |

THE RELEVANT STATUTORY PROVISIONS | [434] |

CONSIDERATION | [455] |

Attribution of the Main Actors’ Conduct | [455] |

The Alleged Contract, Arrangement or Understanding | [464] |

The Competition Issue | [492] |

The Purpose Issue | [516] |

The “Giving Effect” Issue | [527] |

The Accessorial Liability of John McGuigan, James McGuigan, Poole, Moses Obeid and Paul Obeid | [529] |

The Credit of Individual Witnesses | [531] |

The Joint Venture Defences | [539] |

Evidentiary Rulings | [568] |

CONCLUSIONS | [569] |

REASONS FOR JUDGMENT

FOSTER J:

1 In the period from the late 1980s until about 2011, Edward Moses Obeid (Eddie Obeid) was a prominent politician in NSW. He was a member of the Legislative Council throughout the period from 1991 to 2011. He was a power broker in the Australian Labor Party who exercised significant influence in that Party at all times during those years.

2 Eddie Obeid has nine children—five sons and four daughters. Four of Eddie Obeid’s sons feature in the events which are the subject of this proceeding. Two of those sons, Moses Edward Obeid and Paul Edward Obeid, played a significant part in those events. Two other sons, Damien Edward Obeid and Gerard Edward Obeid, were also involved.

3 Members of the Obeid family conducted numerous business transactions together. Frequently, they deployed the following structure:

(a) A company would be used as the entity that would enter into the particular transaction. The directors and shareholders of that company would be associates of the Obeid family such as a family friend, an accountant, a lawyer or business adviser;

(b) The shareholders of the transacting company would hold the shares in that company on trust for one or more members of the Obeid family or their relatives, or on trust for other companies or trusts, the ultimate controllers and beneficiaries of which were one or more members of the Obeid family, their spouses or their relatives; and

(c) The directors of the transacting company would act on the instructions of one or more members of the Obeid family and for their benefit.

4 Business structures with the features which I have described at [3] above were used by the Obeid family in and in connection with the transactions which are under scrutiny in the present case.

5 An important object sought to be achieved by the Obeid family by the use of such structures was to conceal the involvement of the Obeid family in those transactions from all except those who necessarily needed to know of that involvement.

6 The conduct of Moses Obeid and Paul Obeid in 2008 and 2009 is at the heart of the present case.

7 In this proceeding, the applicant, the Australian Competition and Consumer Commission (ACCC), claims relief against eleven respondents. The first six named respondents are corporate entities and the remaining five respondents are individuals. The ACCC claims declarations against all respondents, civil penalties against all respondents, disqualification orders against the individual respondents and costs in respect of alleged contraventions of ss 45(2)(a)(i), 45(2)(b)(i) and 44ZZRK (in respect of cartel provisions where the purpose conditions in s 44ZZRD(3)(a)(iii) and in s 44ZZRD(3)(c) are satisfied) of the Competition and Consumer Act 2010 (Cth) (CCA) by the corporate respondents. The individual respondents are all alleged to be liable as accessories to the alleged contraventions by the corporate contraveners.

8 The alleged contravening conduct took place in early June 2009. For this reason, the Court must apply s 4D and s 45 of the CCA in the form in which those sections then stood. Since 2009, s 45 has been substantially amended and s 4D has been repealed (as to which, see Act No 114 of 2017). In addition, the Court must apply s 44ZZRD and s 44ZZRK in the form in which those sections stood in 2009. Those sections have been renumbered by Act No 114 of 2017. Finally, I note that the joint venture defence provided for in relation to certain contraventions of the CCA has been reformulated by Act No 114 of 2017. The applicable sections in 2009 were ss 4J, 76C and 44ZZRP.

9 The references to sections of the CCA in these Reasons for Judgment are to the applicable sections in the form in which they stood in June 2009.

10 These Reasons for Judgment address questions of liability only. That is, by these Reasons for Judgment, I determine whether any declaratory relief should be granted to the ACCC and, if so, the form of that relief. In the event that it is necessary to address the ACCC’s claims for civil penalties and disqualification orders, those claims will be dealt with at a later date.

11 The corporate respondents are:

1. Cascade Coal Pty Ltd (ACN 119 180 620) (Cascade);

2. Mincorp Investments Pty Limited (ACN 132 441 868) formerly called Voope Pty Limited (Voope);

3. Loyal Coal Pty Ltd (ACN 132 497 913) (Loyal Coal) formerly called Monaro Coal Pty Ltd (ACN 132 497 913) (Monaro Coal);

4. Locaway Pty. Limited (ACN 066 616 484) (Locaway);

5. Coal & Minerals Group Pty Ltd (ACN 144 641 092) (CMG); and

6. Southeast Investment Group Pty Limited (ACN 143 535 620) (Southeast).

The individual respondents are:

7. Moses Edward Obeid;

8. Paul Edward Obeid;

9. Richard Jonathan Poole;

10. John Vern McGuigan; and

11. James William McGuigan.

12 Relevantly, the alleged contraventions of s 45 of the CCA are based upon the proposition that certain provisions contained in two letter agreements signed on 5 June 2009 (one of which was varied on 6 June 2009) were exclusionary provisions (as to which, see ss 4D, 45(2)(a)(i) and 45(2)(b)(i) of the CCA). The s 44ZZRK contraventions are founded upon the proposition that the same two letter agreements contain cartel provisions (as to which see ss 44ZZRD(1)(a)(ii), 44ZZRD(3)(a)(iii) and 44ZZRD(3)(c)). In particular, the ACCC relies upon s 44ZZRD(3)(a)(iii) which relevantly provided that a provision of a contract, arrangement or understanding is a cartel provision if the provision has the purpose of directly or indirectly preventing, restricting or limiting the supply, or likely supply, of goods or services to persons or classes of persons by any or all of the parties to the contract, arrangement or understanding and if at least two of the parties to the contract, arrangement or understanding are or are likely to be, or, but for any contract, arrangement or understanding, would be or would be likely to be, in competition with each other in relation to the supply of those goods or services. The ACCC also relies upon s 44ZZRD(3)(c) which relevantly provided that the purpose condition in s 44ZZRD(1)(a)(ii) would be satisfied if the alleged cartel provision had the purpose of directly or indirectly ensuring that one of the statutorily stipulated outcomes in the nature of bid rigging was achieved in relation to requests for bids for the supply or acquisition of services. The ACCC alleges that certain of the corporate respondents were parties to the contract, arrangement or understanding which contained the alleged exclusionary provisions and cartel provisions and that all of the corporate respondents gave effect to those provisions. The ACCC alleges that the corporate respondents contravened s 44ZZRK of the CCA by giving effect to the cartel provisions contained in the arrangements made on 5 and 6 June 2009.

13 One letter agreement (the Buffalo Agreement) concerned the establishment of a coal mining venture in the Mt Penny coal exploration area in NSW. The entities expressly identified in that agreement as parties to the arrangements reflected therein were Cascade and Buffalo Resources Pty Limited (ACN 137 486 385) (Buffalo). The obligations of Buffalo under the arrangement recorded in the letter were expressed, at least in part, as obligations of Buffalo and “… its associates and related parties including Gardner Brook and Loyal Coal Pty Ltd”.

14 The other letter agreement (the Landowners Agreement) concerned the acquisition by Cascade of three rural properties located more or less above the likely mine site near Mt Penny (Cherrydale Park (Cherrydale), Donola and Coggan Creek). The entities expressly identified in that agreement as parties to the arrangements reflected therein were Cascade, United Pastoral Group Pty Limited (ACN 127 743 453) (UPG), Geble Pty Ltd (ACN 132 441 877) (Geble) and Justin Kennedy Lewis Pty Ltd (ACN 133 940 388) (JKL). As at 5 June 2009, Geble was already the registered proprietor of Donola and JKL was the purchaser under a Contract for the Sale of Coggan Creek which had not yet been completed. As at that date, Locaway, in its capacity as the trustee of the Moona Plains Family Trust, was still the registered proprietor of Cherrydale although steps were under way to replace it on the title to that property with UPG who was, by June 2009, the trustee of that Trust. UPG had changed its name to Rothshire Group Pty Limited on 27 September 2007 but that fact appears to have gone unnoticed by the Obeids when they began to involve UPG in the present matters in 2008.

15 The two letter agreements were interdependent.

16 The Buffalo Agreement was amended by a further letter agreement between Cascade and Buffalo on 6 June 2009 (the Buffalo Agreement Variation).

17 The respondents conveniently fall into four groups. At the commencement of the hearing before me, each of those groups was separately represented. The groups were:

Cascade, John McGuigan and James McGuigan (the Cascade respondents);

Locaway, Southeast, Moses Obeid and Paul Obeid (the Obeid respondents);

Loyal Coal; and

CMG and Poole (the CMG respondents).

18 James McGuigan is the son of John McGuigan. At all relevant times, John McGuigan was a director of Cascade.

19 At all material times, Poole was a director of Cascade and of CMG.

20 When the hearing commenced, Voope (the second respondent) was unrepresented. It had not filed an Address for Service nor had it ever been represented at any pre-trial directions hearing or case management hearing. It has never filed a Defence. For these reasons, on Day 2 of the hearing, Senior Counsel for the ACCC applied for an order pursuant to r 30.21(1)(b)(i) of the Federal Court Rules 2011 (FCR) that the hearing proceed generally against Voope notwithstanding its absence when this proceeding was called on for trial. I made that order on 5 April 2016. Thereafter, the ACCC’s case against Voope proceeded notwithstanding its absence.

21 On 29 March 2017, well after the trial had concluded, Deutsch Partners filed a Notice of Acting – Change of Lawyer in respect of Voope and the other Obeid respondents.

22 In these Reasons, I will generally refer to particular individuals by their surname alone. I mean no disrespect by taking that approach. The exceptions to this general approach are the Obeids and the McGuigans. For obvious reasons, it is necessary to refer to those persons by their Christian name as well as their surname.

23 At the commencement of Day 2 of the hearing, Counsel for Loyal Coal informed the Court that, upon the basis of an agreed statement of facts and admissions, Loyal Coal would consent to a declaration that it contravened s 45(2)(a)(i) of the CCA (read with s 4D) by arriving at what is described at pars 108 and 180 of the Further Amended Statement of Claim filed on 24 March 2016 (FASOC) as “the EOI Withdrawal Understanding”. Counsel also said that the ACCC and Loyal Coal intended to make a joint submission to the Court as to penalty and costs. Until the Court was informed of these matters, Loyal Coal had actively defended the proceeding. It had filed its Second Further Amended Defence as recently as 31 March 2016.

24 Loyal Coal requested to be excused from further attendance at the hearing and also requested that I defer further consideration of the ACCC’s claims against Loyal Coal until after judgment has been delivered in the ACCC’s cases against the other respondents. I acceded to both of these requests and Loyal Coal took no further part in the hearing.

25 At some future date, it will be necessary to conduct a hearing in order to determine whether the Court should approve and give effect to the settlement reached between the ACCC and Loyal Coal.

A Brief Overview of the Relevant Facts

26 In November 2007, Locaway, a company controlled by the Obeid family, completed the purchase of Cherrydale which is located at Bylong. Subsequently, over the next two years, the Obeid family, through companies and trusts controlled by the family, and, on occasion, in conjunction with associates of the family, also purchased two additional rural properties in the same area, Donola and Coggan Creek. These additional properties adjoined Cherrydale. The total sum outlaid on the three acquisitions was $7.75 million.

27 In early July 2008, Moses Obeid, who is the eldest son of Eddie Obeid, met with Paul Gardner Brook (Brook), who was, at that time, Senior Vice President, Asia Special Situations Group, of Lehman Brothers (Lehman) in Sydney, in order to gauge Lehman’s interest in being involved in a coal mining venture in the Mt Penny coal exploration area. Bylong is a few kilometres from Mt Penny. Cherrydale, Donola and Coggan Creek are centrally located in the Mt Penny coal exploration area which was one of the areas released by the NSW Government in September 2008 for the purposes of allowing exploration for coal to be undertaken there.

28 When he met with Brook in early July 2008, Moses Obeid provided to Brook a list of those small to medium mining companies which he (Obeid) believed would be invited to lodge an Expression of Interest (EOI) for an Exploration Licence (EL). ELs are granted under the Mining Act 1992 (NSW) (Mining Act). One company on that list was Monaro Mining NL (MMNL), a company which, up to that time, had not been involved in mining coal. It had focussed on mining uranium.

29 In August 2008, the NSW Department of Primary Industries (DPI), which was responsible for allocating and regulating ELs under the Mining Act, prepared an EOI Information Package (initial EOI information package) in respect of the NSW Government’s plan to release eleven areas of the State for the purpose of allowing exploration for coal in those areas and ultimately allowing mining for coal in those areas. After that package was prepared, the DPI sought and obtained the approval of the relevant Minister (at the time, Mr Ian Macdonald) to send the initial EOI information package to a number of specific mining companies together with an invitation to the recipients of that package to lodge EOIs in respect of ELs for one or more of the eleven coal release areas. This was the first external step taken in the process which, in substance, was a closed tender process.

30 On 19 September 2008, an invitation to lodge an EOI in respect of all eleven coal release areas was sent to MMNL. At the same time, invitations were also sent to other companies. An initial EOI information package was sent with each EOI invitation. Cascade did not receive an initial invitation to lodge an EOI for any of those coal release areas.

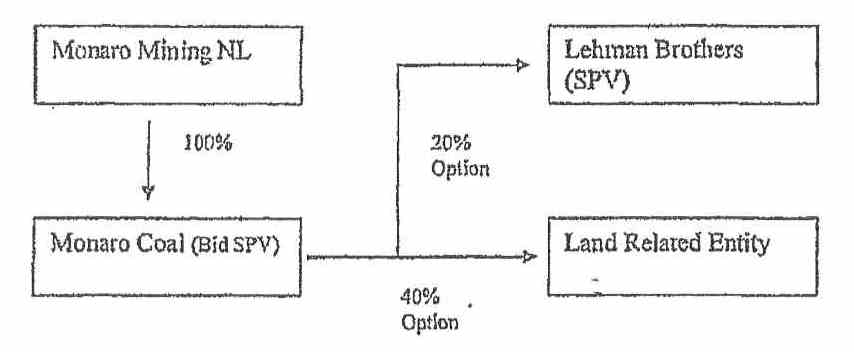

31 Soon after Brook’s first meeting with Moses Obeid, Brook contacted Mr Warwick Grigor, who was then the Chairman of MMNL. Over the next few weeks, Brook negotiated an arrangement between Voope, a company beneficially owned and controlled by the Obeid family, and MMNL, whereby MMNL granted to Voope or its nominee an option to acquire 80% of the issued capital of a special purpose vehicle (SPV) which was initially to be a wholly-owned subsidiary of MMNL, Monaro Coal Pty Ltd. Ultimately, Monaro Coal was registered with the intention of being that SPV. The option granted to Voope by MMNL was designed to place Voope in control of any EOIs lodged by MMNL pursuant to the DPI invitations of 19 September 2008. This arrangement was ultimately recorded in an Option Deed over Shares dated 20 August 2008 between MMNL and Voope (Voope Option Deed). Monaro Coal Pty Ltd later changed its name to Loyal Coal Pty Ltd.

32 On 15 September 2008, Lehman collapsed. As a result, Brook began to act on his own and for himself in connection with his ongoing dealings with the Obeid family and MMNL. At the same time, his nominee company, Oregon Standard Pty Limited (Oregon), signed a consultancy agreement with MMNL. Subsequently, Brook also intruded himself into the dealings between the Obeid family and Cascade and its directors.

33 On 21 November 2008, MMNL lodged EOIs for nine of the eleven coal release areas referred to in the initial EOI information package. Included within those nine areas were the Mt Penny and Glendon Brook coal release areas.

34 In January 2009, the DPI re-opened the EOI process. As a result, additional companies were invited by the DPI to lodge EOIs. A revised EOI Information Package (revised EOI information package) was prepared and sent to all invitees. Cascade was included within the group of invitees to whom revised EOI information packages were sent in January 2009.

35 On 16 February 2009, Cascade lodged an EOI for the Mt Penny coal exploration area. On the same day, it also lodged an EOI for the Glendon Brook coal exploration area. Glendon Brook is located in the Hunter Valley, approximately 12 km east of Singleton and approximately 170 km east of Mt Penny.

36 In its EOI for Mt Penny, MMNL had promised to pay not only the requisite financial contributions spelt out in the initial EOI information package (a total of $1,071,000) but had also offered an additional voluntary financial contribution of $25 million. In similar vein, it also offered an additional voluntary financial contribution of $5 million in its EOI for Glendon Brook.

37 In the period between August 2008 and May 2009, Brook claims to have tried to find an investor or financial partner for MMNL in order to enable it to meet the financial commitments which it had made in its EOIs but had been unsuccessful in finding such a partner. In May 2009, Brook told the directors of MMNL that he did not expect to be able to secure the necessary investment funds to support the promises made by MMNL in its EOIs.

38 In light of Brook’s communications at this time, and for reasons associated with its own financial position and business goals, on 22 May 2009, MMNL decided to withdraw all of its EOIs, subject to certain conditions being met. But, as a result of Brook’s entreaties, it did not do so immediately after 22 May 2009.

39 On 23 May 2009, Brook, Moses Obeid, John McGuigan and James McGuigan met in order to discuss a potential deal with Cascade.

40 Between 23 May 2009 and 31 May 2009, Brook and Moses Obeid took steps by which they intended that Voope would gain complete ownership and control of Monaro Coal and control of the EOIs lodged by MMNL in respect of a number of coal exploration areas, including the Mt Penny and Glendon Brook coal exploration areas.

41 On 31 May 2009, a second meeting took place. Those in attendance were Brook, Moses Obeid, Paul Obeid, John McGuigan and James McGuigan. An in-principle agreement was struck at this meeting. The substance of that agreement was: For a consideration equivalent to four times the value of Cherrydale, Donola and Coggan Creek, the owners of those properties would transfer those properties to Cascade or its nominee. In addition, Cascade and a nominee entity of the Obeids would enter into a coal mining venture in order to exploit the coal reserves in the Mt Penny coal exploration area. The Obeid entity would have 25% equity in that venture subject to certain detailed terms. The Obeids and Brook would ensure that the EOIs lodged by MMNL for Mt Penny and Glendon Brook would be withdrawn.

42 Further negotiations took place between representatives of Cascade, Brook and the Obeids in the period between 1 June 2009 and 5 June 2009.

43 The two letter agreements documenting the final arrangements were signed on 5 June 2009.

44 On 9 June 2009, Loyal Coal sent letters to the DPI by which it purported to withdraw the EOIs lodged by MMNL in respect of the Mt Penny, Glendon Brook and Spur Hill coal exploration areas. Those letters were signed by Brook.

45 On 19 June 2009, the DPI informed Cascade that it had been selected as the successful EOI applicant in respect of both the Mt Penny and Glendon Brook coal exploration areas.

46 On or about 27 October 2009, the DPI granted ELs over both the Mt Penny and Glendon Brook coal exploration areas to Cascade.

47 In late 2010, CMG agreed to buy out the Obeid interests from the coal mining venture. By then, Cherrydale, Donola and Coggan Creek had come under the control of Mt Penny Properties Pty Limited (Mt Penny Properties), a wholly-owned subsidiary of Cascade.

The ACCC’s Case and the Respondents’ Defences

48 The ACCC’s claims for relief are set out in detail in the Amended Originating Application filed by it on 24 March 2016 (Amended OA). Its pleaded case is found in the FASOC.

49 I shall now endeavour to explain the ACCC’s case as pleaded in the FASOC.

50 At pars 1 to 61, the ACCC describes the respondents as well as a number of other corporate entities and individuals who featured in the events which are the subject of the present proceeding. These paragraphs of the FASOC collect in one place a useful dramatis personae for this case. With one or two exceptions, which I shall identify, the Obeid respondents and Loyal Coal admitted the matters pleaded in pars 1 to 61 of the FASOC. The Cascade respondents and the CMG respondents did not admit most of those matters but, at the trial, did not seriously dispute most of them. Subject to the matters in dispute which I shall shortly identify, I will proceed in these Reasons upon the basis that the facts and matters pleaded at pars 1 to 61 of the FASOC are true. I make findings to that effect.

51 Paragraphs 1 to 61 of the FASOC are in the following terms:

Parties

Applicant

1. The applicant is a body corporate established pursuant to section 6A of the Competition and Consumer Act 2010 (Cth), formerly the Trade Practices Act 1974 (Cth) (the CCA), and is entitled to sue in its corporate name.

Corporate Respondents

Cascade

2. The first respondent, Cascade Coal Pty Ltd (Cascade) is and at all material times was a corporation duly incorporated according to law and a trading corporation within the meaning of s 4 of the CCA.

3. At all material times from 21 August 2009, Cascade held 100% of the issued share capital in Mt Penny Coal Pty Ltd (Mt Penny Coal).

4. At all material times from 4 September 2009, Cascade held 100% of the issued share capital in Mt Penny Properties Pty Ltd (Mt Penny Properties).

Voope

5. The second respondent, Mincorp Investments Pty Limited, previously known as Voope Pty Ltd (Voope), is and at all material times was a corporation duly incorporated according to law and a trading corporation within the meaning of s 4 of the CCA.

6. At all material times from on or about 28 July 2008 to 10 December 2009, Gregory Allen Skehan (Greg Skehan) held 100% of the issued share capital in Voope on bare trust for the Obeid Family Trust No. 2, or alternatively, for members of the Obeid Family (as defined below) including, at least, the sixth respondent, Moses Edward Obeid (Moses Obeid), and the seventh respondent, Paul Edward Obeid (Paul Obeid).

7. At all material times from 2 June 2009, Voope owned 100% of the issued share capital in the third respondent Loyal Coal Pty Ltd, formerly Monaro Coal Pty Ltd (Loyal), and was a related body corporate of Loyal for purposes of s 4A(5) of the CCA.

Loyal

8. The third respondent, Loyal, is and at all material times was a corporation duly incorporated according to law and a trading corporation within the meaning of s 4 of the CCA.

9. At all material times prior to 2 June 2009, Loyal was a wholly owned subsidiary of Monaro Mining NL (Monaro Mining).

10. At all material times from 2 June 2009, Loyal was a wholly owned subsidiary of Voope and a related body corporate of Voope for purposes of s 4A(5) of the CCA.

Locaway

11. The fourth respondent, Locaway Pty. Limited (Locaway), is and at all material times was a corporation duly incorporated according to law and a trading corporation within the meaning of s 4 of the CCA.

12. At all material times, the directors of Locaway included Moses Obeid and Paul Obeid.

13. At all material times, Locaway was trustee for the Moona Plains Family Trust.

14. At all material times, the beneficiaries of the Moona Plains Family Trust included Moses Obeid and Paul Obeid.

15. At all material times, Locaway held the property known as “Cherrydale Park” Bylong (being Lot 1 in Deposited Plan 421103 and Lot 31 in Deposited Plan 598162), on trust for the beneficiaries of the Moona Plains Family Trust.

Coal & Minerals

16. The fifth respondent, Coal & Minerals Group Pty Ltd (Coal & Minerals):

16.1. is and at all material times from on or about 16 June 2010 was a corporation duly incorporated according to law and a trading corporation within the meaning of s 4 of the CCA; and

16.2. at all material times until 27 September 2010 had the ninth respondent, Richard Jonathan Poole (Richard Poole) as its sole director and shareholder;

16.3. at all material times after 27 September 2010 had Arthur Phillip Pty Ltd (Arthur Phillip) as its sole shareholder and Richard Poole as its sole director.

Southeast Investments

17. The sixth respondent, Southeast Investment Group Pty Limited (Southeast Investments):

17.1. is and at all material times was a corporation duly incorporated according to law and a trading corporation within the meaning of s 4 of the CCA; and

17.2. at all material times had Sevag Chalabian as its sole director and shareholder.

Individual Respondents

Moses Obeid

18. The seventh respondent, Moses Obeid, was at all material times:

18.1. a director of Locaway;

18.2. a director of Obeid Corporation Pty Ltd (Obeid Corporation);

18.3. a beneficiary of the Obeid Family Trust No. 1;

18.4. a beneficiary of the Obeid Family Trust No. 2; and

18.5. a beneficiary of the Moona Plains Family Trust.

Paul Obeid

19. The eighth respondent, Paul Obeid, was at all material times:

19.1. a director and secretary of Locaway;

19.2. a director of Obeid Corporation;

19.3. a beneficiary of the Obeid Family Trust No. 1;

19.4. a beneficiary of the Obeid Family Trust No. 2; and

19.5. a beneficiary of the Moona Plains Family Trust.

Obeid Family

20. Moses Obeid and Paul Obeid are brothers, together with Gerard Edward Obeid, Damian Edward Obeid and Edward Joseph Obeid (the Obeid Family).

21. Members of the Obeid Family conducted numerous business transactions together. In conducting their business transactions, members of the Obeid Family often utilised the following structure:

21.1. a company would be used to enter into the transaction, the directors and shareholders of which would be associates of the Obeid Family such as a family friend or an accounting, business or legal adviser;

21.2. the shareholder or shareholders of the company would hold the shares on trust for one or more members of the Obeid Family or their relatives, or on trust for further companies or trusts the ultimate beneficiaries of which were one or more members of the Obeid Family, their spouses or their relatives; and

21.3. the director or directors of the company would act on the instructions of one or more members of the Obeid Family and for their benefit.

22. Each of Voope, Loyal (from 2 June 2009), Southeast Investments, Calvin Holdings Pty Ltd (Calvin Holdings), Equitexx Pty Limited (Equitexx), Buffalo Resources Pty Limited (Buffalo) and Rothshire Group Pty Limited, previously known as United Pastoral Group Pty Limited, (UPG) were entities that adopted, or operated in accordance with, the structure referred to in the previous paragraph.

23. By reason of the matters pleaded in paragraphs 20 to 22:

23.1. members of the Obeid Family, including Moses Obeid and Paul Obeid, had authority to negotiate transactions on behalf of each of Voope, Loyal (from 2 June 2009), Southeast Investments, Calvin Holdings, Equitexx, Buffalo and UPG; and

23.2. Moses Obeid and Paul Obeid were agents for each of Voope, Loyal (from 2 June 2009), Southeast Investments, Calvin Holdings, Equitexx, Buffalo and UPG, and their conduct was conduct within their actual or apparent authority, for the purposes of section 84 of the CCA.

23A. Further or in the alternative, the conduct of Moses Obeid and Paul Obeid alleged herein with respect to each of Voope, Loyal, Southeast Investments, Calvin Holdings, Equitexx, Buffalo and UPG was conduct engaged in with the express or implied consent or agreement of the directors of each of those companies for the purposes of s 84(2)(b) of the CCA, in circumstances where the giving of such consent or agreement was within the actual or apparent authority of those directors in each case.

24. Further or in the alternative to the allegation in paragraph 23.2 above:

24.1. Moses Obeid and Paul Obeid were at all material times directors of Voope and (from 2 June 2009) Loyal within the meaning of the CCA, and their conduct was conduct within their actual or apparent authority as directors of Voope and/or Loyal, for the purposes of section 84 of the CCA;

24.2. Moses Obeid, Paul Obeid and Paul Gardner Brook (Gardner Brook) were at all material times officers of Voope and (from 2 June 2009) Loyal;

24.3. Moses Obeid and Paul Obeid were (either together or individually) the directing mind and will of each of Voope and (from 2 June 2009) Loyal; and, or alternatively,

24.4. Moses Obeid, Paul Obeid and Gardner Brook were each persons able to make contracts or arrangements with third parties, or to reach understandings with third parties, on behalf of Voope and (from 2 June 2009) Loyal.

Richard Poole

25. The ninth respondent, Richard Poole:

25.1. was a director of Cascade at all material times since its incorporation on or about 7 April 2006;

25.2. was a director of Mt Penny Coal since its incorporation on or about 21 August 2009;

25.3. was a director of Mt Penny Properties since its incorporation on or about 4 September 2009;

25.4. was a director of Coal & Minerals since its incorporation on or about 16 June 2010; and

25.5. held 100% of the issued share capital in Coal & Minerals from on or about 16 June 2010 to on or about 27 September 2010.

26. Richard Poole had actual or apparent authority for the purposes of section 84 of the CCA to act on behalf of Cascade in relation to the conduct pleaded in paragraphs 77 to 148 below.

27. Richard Poole had actual or apparent authority for the purposes of section 84 of the CCA to act on behalf of Coal & Minerals in relation to the conduct pleaded in paragraphs 142 to 163 below.

John McGuigan

28. The tenth respondent, John Vern McGuigan (John McGuigan) was:

28.1. a director of Cascade from on or about 19 February 2009;

28.2. a director of Mt Penny Coal since its incorporation on or about 21 August 2009; and

28.3. a director of Mt Penny Properties since its incorporation on or about 4 September 2009.

29. John McGuigan had actual or apparent authority for the purposes of section 84 of the CCA to act on behalf of Cascade in relation to the conduct pleaded at paragraphs 77 to 148 below.

James McGuigan

30. The eleventh respondent, James William McGuigan (James McGuigan) was at all material times an employee of Arthur Phillip.

31. James McGuigan:

31.1. had actual or apparent authority for the purposes of section 84 of the CCA to act on behalf of Cascade in relation to the conduct pleaded in in [sic] paragraphs 77 to 128 below; or, alternatively,

31.2. engaged in such conduct at the direction of, or with the express or implied consent or agreement of, one or more directors of Cascade for the purposes of s 84(2)(b) of the CCA, and in circumstances where the giving of such direction, consent or agreement was within the actual or apparent authority of those directors.

Other Relevant Corporations

Arthur Philip [sic]

32. Arthur Phillip is and at all material times was a corporation duly incorporated according to law.

33. At all material times Arthur Phillip:

33.1. employed Richard Poole and James McGuigan; and

33.2. provided advisory and investment banking services to Cascade.

Buffalo

34. Buffalo was a corporation duly incorporated according to law at all material times from about 3 June 2009 until its deregistration on or about 9 September 2010.

Calvin Holdings

35. Calvin Holdings is and at all material times from 28 April 2011 was a corporation duly incorporated according to law.

36. At all material times from about 29 April 2011, Calvin Holdings was trustee for the Obeid Family Trust No. 2.

Equitexx

37. Equitexx is and at all material times was a corporation duly incorporated according to law.

38. At all material times until about 28 April 2011, Equitexx was trustee for the Obeid Family Trust No. 2.

39. At all material times from 3 June 2009 to 9 September 2010, Equitexx held 88% of the issued share capital in Buffalo.

Geble

40. Geble Pty Ltd (Geble) is and at all material times was a corporation duly incorporated according to law.

41. At all material times, Geble held the property known as “Donola” at Bylong (as in 77/DP755419, 78/DP755419, 90/DP755419, 177/DP755419, 178/DP755419, 192/DP755419, 210/DP755419, 211/DP755419 and 212/DP755419), on trust for the beneficiaries of the Elbeg Unit Trust.

42. At all material times:

42.1. 50% of the units in the Elbeg Unit Trust were held by UPG on trust for the beneficiaries of the Moona Plains Family Trust; and

42.2. 50% of the units in the Elbeg Unit Trust were held by Challenge Property Investments Group Pty Limited as trustee for the Triulco Family Trust.

JKL

43. Justin Kennedy Lewis Pty Ltd, formerly Coopers World Pty Ltd, (JKL) is and at all material times was a corporation duly incorporated according to law.

44. At all material times, Justin Kennedy Lewis (Justin Lewis) held 100% of the issued share capital in JKL.

45. At all material times, JKL held the property known as “Coggan Creek” at Bylong (as in 203/DP755419), on trust for the beneficiaries of the Justin Kennedy Lewis Family Trust.

Monaro Mining

46. Monaro Mining is and was at all material times a corporation duly incorporated according to law.

47. At all material times prior to 2 June 2009, Monaro Mining owned 100% of the issued share capital in Loyal.

Mt Penny Coal

48. Mt Penny Coal is and at all material times from on or about 21 August 2009 was:

48.1. a corporation duly incorporated according to law; and

48.2. a wholly owned subsidiary of Cascade.

Mt Penny Properties

49. Mt Penny Properties is and at all material times from on or about 4 September 2009 was:

49.1. a corporation duly incorporated according to law; and

49.2. a wholly owned subsidiary of Cascade.

Warbie

50. Warbie Pty Limited (Warbie) is and at all material times was a corporation duly incorporated according to law.

51. At all material times, 100% of the issued share capital in Warbie was held by Gardner Brook.

52. At all material times from 3 June 2009 to 9 September 2010, Warbie held 12% of the issued share capital in Buffalo.

UPG

53. UPG is and at all material times was a corporation duly incorporated according to law.

54. At all material times, Andrew Ausama Kaidbay (Andrew Kaidbay) was the sole director and shareholder of UPG.

Other relevant individuals

Gardner Brook

55. Gardner Brook:

55.1. was a director of Buffalo from on or about 3 June 2009 to on or about 9 September 2010;

55.2. was a director of Warbie from on or about 3 June 2009 to on or about 18 December 2011;

55.3. held 100% of the capital issued shares in Warbie at all material times from on or about 3 June 2009;

55.4. was a director of Loyal from on or about 16 September 2009 to on or about 16 August 2011;

55.5. at all material times, in relation to the matters pleaded in this statement of claim, was acting as an adviser to the Obeid Family, or alternatively, to Moses Obeid and/or Paul Obeid, and entered into transactions on their behalf, or alternatively primarily on their behalf; and

55.6. at all material times, engaged in the conduct pleaded in this statement of claim, at the direction of, or with the express or implied consent or agreement of, Moses Obeid and/or Paul Obeid for the purposes of s 84(2)(b) of the CCA, and in circumstances where the giving of such direction, consent or agreement was within the actual or apparent authority of Moses Obeid and Paul Obeid as directors or agents of Voope; and, or alternatively,

55.7. at all material times from 2 June 2009, engaged in the conduct pleaded in this statement of claim, with the express or implied consent or agreement of Andrew Kaidbay for the purposes of s 84(2)(b) of the CCA, and in circumstances where the giving of such direction or consent was within the actual or apparent authority of Andrew Kaidbay as a director of Loyal; and, or alternatively,

55.8 at all material times from 2 June 2009, engaged in the conduct pleaded in this statement of claim, at the direction of, or with the express or implied consent or agreement of, Moses Obeid and/or Paul Obeid for the purposes of s 84(2)(b) of the CCA, and in circumstances where the giving of such direction, consent or agreement was within the actual or apparent authority of Moses Obeid and Paul Obeid as directors or agents of Loyal.

Sevag Chalabian

56. At all material times from at least 9 November 2009 to at least 31 December 2010, Sevag Chalabian was a director of Lands Legal Pty Limited (Lands Legal).

57. At all material times from at least 7 May 2010 to at least 31 December 2010, Sevag Chalabian was sole director, secretary and shareholder of Southeast Investments.

58. At all material times from at least 9 November 2009, Sevag Chalabian acted as a solicitor for Locaway, Geble and JKL in connection with the transactions and agreements pleaded at paragraphs 128 to 132 below.

Andrew Kaidbay

59. Andrew Kaidbay was:

59.1. a director of Loyal from on or about 4 June 2009 to on or about 15 September 2009;

59.2. the sole director and secretary of UPG from on or about 15 February 2008; and

59.3. a director of Buffalo between 3 June 2009 and 9 September 2010.

60. At all material times, in respect of the matters pleaded in this statement of claim, Andrew Kaidbay acted on the instructions, and for the benefit, of members of the Obeid Family, or alternatively, on the instructions, and for the benefit, of Moses Obeid and/or Paul Obeid.

Greg Skehan

61. Greg Skehan:

61.1. was at all material times a partner in the firm Colin Biggers & Paisley (now known as CBP Lawyers);

61.2. was a director of Voope in the period 28 July 2008 to 10 December 2009, and as pleaded in paragraph 6 above, held 100% of the issued share capital in Voope on bare trust for the Obeid Family Trust No. 2, or alternatively, for members of the Obeid Family including, at least, Moses Obeid and Paul Obeid, at all material times from on or about 28 July 2008 to 10 December 2009;

61.3. was a Dubai resident during the period August 2008 to October 2009, and had no day-to-day involvement in the affairs of Voope during that period;

61.4. acted on, and followed, the requests, instructions and directions of members of the Obeid Family (including at least Moses Obeid and Paul Obeid) in conducting the affairs of Voope;

61.5. executed documents on behalf of Voope at the request, instruction or direction of members of the Obeid Family (including Moses at least [sic] Obeid and Paul Obeid);

61.6. was acting within the scope of his actual or apparent authority for the purposes of s 84 of the CCA when executing documents on behalf of Voope; and

61.7. resigned as a director of Voope on or about 10 December 2009 at the request, instruction or direction of members of the Obeid Family (including at least Moses Obeid and Paul Obeid).

52 The matters in pars 1 to 61 which were in dispute were whether:

(a) Poole ceased to be the sole shareholder of CMG on 21 September 2010 or on 27 September 2010 (par 16.2 and par 16.3);

(b) Each of Voope, Loyal Coal (from 2 June 2009) and Buffalo were entities that adopted, or operated in accordance with, the structure referred to in par 21 of the FASOC. The Obeid respondents admitted that Calvin Holdings, Equitexx Pty Limited (Equitexx) and UPG did so operate (par 21 and par 22);

(c) Paul Obeid had the pleaded authority in respect of Voope, Loyal Coal and Buffalo or was relevantly an agent of any of those companies. The pleaded authority and agency were both admitted insofar as Moses Obeid was concerned and also admitted in respect of Southeast, Calvin Holdings, Equitexx and UPG insofar as Paul Obeid was concerned (pars 23 and 23A);

(d) Paul Obeid was ever a director of Voope or Loyal Coal; Paul Obeid was ever an officer of Voope or Loyal Coal; Paul Obeid was, either individually or together with Moses Obeid, the directing mind and will of Voope or Loyal Coal; and Paul Obeid was ever a person who could make contracts or arrive at arrangements or understandings on behalf of Voope or Loyal Coal (par 24). These matters are all denied by the Obeid respondents. Paragraph 24 is admitted in respect of Moses Obeid and separately asserted by those respondents as also being correct in respect of Brook;

(e) Poole had actual or apparent authority for the purposes of s 84 of the CCA to act on behalf of Cascade in relation to the conduct pleaded at pars 77 to 148 of the FASOC or on behalf of CMG in relation to the conduct pleaded at pars 142 to 163 of the FASOC (par 26 and par 27);

(f) John McGuigan had actual or apparent authority for the purposes of s 84 of the CCA to act on behalf of Cascade in relation to the conduct pleaded at pars 77 to 148 of the FASOC (par 29);

(g) James McGuigan had actual or apparent authority for the purposes of s 84 of the CCA to act on behalf of Cascade in relation to the conduct pleaded in pars 77 to 128 of the FASOC or engaged in conduct at the direction of, or with the express or implied consent or agreement of, one or more of the directors of Cascade for the purposes of s 84(2)(b) of the CCA, acting within their authority (par 31);

(h) Brook acted as an adviser to the Obeid family or, alternatively, Moses Obeid and/or Paul Obeid (par 55.5);

(i) Brook acted at the direction of Moses Obeid and/or Paul Obeid in their capacity as directors of Voope (par 55.6);

(j) Brook acted at the direction of Andrew Kaidbay and/or Moses Obeid and/or Paul Obeid in their capacity as directors of Loyal Coal (par 55.7); and

(k) Brook, acting in his own interests, also gave directions to Skehan in relation to the affairs of Voope.

53 At pars 62 to 93 of the FASOC, the ACCC pleads a number of contextual facts and matters concerning Voope’s dealings with MMNL, the EOI process and MMNL’s involvement in that process. Most of the matters pleaded in this section of the FASOC were either admitted or not seriously disputed. However, some matters were in contest. These were:

(a) Whether, from on or around 28 July 2008, Moses Obeid and Paul Obeid engaged Brook to act for Voope in negotiating a possible transaction with MMNL (par 62). The Obeid respondents deny that allegation;

(b) Whether Brook also gave instructions to Christopher Rumore, a solicitor and partner in the law firm, Colin Biggers & Paisley (CBP), who was, in 2008 and 2009, acting for members of the Obeid family, in relation to negotiations with MMNL and whether he did so acting on his own behalf or, for a time, acting on behalf of Lehman;

(c) Whether, in the period from around 15 May 2009 until 1 June 2009, Brook was acting at the direction of Moses Obeid and on behalf of Voope when he negotiated with the directors of MMNL for the acquisition by Voope of all of the shares in Monaro Coal and the nomination of Monaro Coal as the entity to take up any ELs offered by the DPI (par 82). The Obeid respondents deny that Brook was acting at the direction of Moses Obeid in the respects alleged, deny that Brook was acting on behalf of Voope in the negotiations with MMNL and contend that he was acting on his own behalf and using his own authority as a director of Voope; and

(d) Whether MMNL’s decision to withdraw the EOIs which it had lodged with the DPI in respect of the Mt Penny and Glendon Brook coal exploration areas reflected in the resolution of the Board of Directors of MMNL passed on 22 May 2009 was contingent upon Voope agreeing new terms with MMNL which would include an outline of a satisfactory mechanism for transferring from MMNL to Voope or its nominee any ELs that may be initially awarded to MMNL, a promise to hold MMNL harmless in all respects and an agreement to reimburse MMNL all of the expenses incurred by it in relation to its EOI in respect of Mt Penny (par 83).

54 At pars 94 to 97 of the FASOC, the following is pleaded:

Competition

94. At all material times, it was in the interests of Voope that Loyal was successful in obtaining Exploration Licences in respect of the Mount Penny and Glendon Brook Coal Release Areas.

95. The effect of the request by Monaro Mining pleaded in paragraph 88.1 above was that:

95.1. on and from 1 June 2009, or alternatively, 2 June 2009, Loyal was deemed to be the applicant for any Exploration Licence issued pursuant to the Monaro Mining EOI; and

95.2. the DPI was required to grant any Exploration Licence issued pursuant to the Monaro Mining EOI to Loyal.

Particulars:

Mining Act 1992 (NSW), s 133

96. Further, and in the alternative, at all material times, it was the practice of the DPI to:

96.1. assign an Exploration Licence or an application for an Exploration Licence to a company nominated by the successful applicant for an Exploration Licence, upon the request of that applicant; or

96.2. permit the holder of an Exploration Licence to transfer or assign the Exploration Licence to another corporation;

96.3. permit a party participating in an expressions of interest process to nominate another entity to be the person to whom ministerial consent to apply for an Exploration Licence is given in the event that the party’s expression of interest was successful; or

96.4. issue an Exploration Licence to another entity nominated by an applicant for an Exploration Licence, where the applicant was the successful participant in an expressions of interest process and/or had received consent to apply for an Exploration Licence;

provided in each case that the person to whom the Exploration Licence or application was to be issued, transferred or assigned complied with the formal requirements to hold an Exploration Licence, including under s 129 of the Mining Act 1992 (NSW) and provided that the decision maker was not satisfied that the application ought to be refused pursuant to s 22 of that Act.

97. By reason of the matters pleaded in paragraphs 64 to 89 and 94 to 96, at all material times from at least 1 June 2009, or alternatively, 2 June 2009:

97.1. Loyal was competitive with, or likely to be competitive with, Cascade within the meaning of s 4D and in competition with, or likely to be in competition with Cascade within the meaning of s 44ZZRD(4) of the CCA in relation to:

97.1.1. the acquisition of services from the Crown; and/or

97.1.2. the supply of services to the Crown; and

97.2. further or in the alternative, by reason of its ownership and control of Loyal, Voope was competitive with, or likely to be competitive with, Cascade within the meaning of s 4D and in competition with, or likely to be in competition with Cascade within the meaning of s 44ZZRD(4) of the CCA in relation to:

97.2.1. the acquisition of services from the Crown; and/or

97.2.2. the supply of services to the Crown.

Particulars

The September 2008 EOI process contemplated both the acquisition of services from the Crown and/or the supply of services to the Crown by the successful bidder

The services which Cascade and Loyal, and/or Cascade and Voope, competed to acquire or were likely to compete to acquire, included:

i. the right to participate in the EOI process;

ii. the opportunity to apply for, or obtain, an Exploration Licence for coal in respect of mining activities in the Mount Penny and Glendon Brook Coal Release Areas;

iii. the right to apply for, or obtain, the necessary approvals for mining activities in the Mount Penny and Glendon Brook Coal Release Areas;

iv. the contractual right to the grant of an Exploration Licence; and

v. the rights conferred by the grant of an Exploration Licence, including but not limited to the right to apply for a Mining Lease under s 51(4)(a) of the Mining Act 1992 and thereafter conduct mining activities pursuant to any Exploration Licence granted by the Minister.

The services which Cascade and Loyal, and/or Cascade and Voope, competed to supply or were likely to compete to supply included:

vi. giving the Crown the valuable opportunity to grant an Exploration Licence in respect of the Mount Penny and Glendon Brook Coal Release Areas under the Mining Act 1992 (NSW), with conditions, undertakings and requirements to be performed by the licensee;

vii. the performance of the conditions, undertakings and requirements attached to an Exploration Licence in respect of the Mount Penny and Glendon Brook Coal Release Areas, including paying or negotiating for the payment of additional financial contributions referred to at p 10 of the document titled Expression of Interest Information for the Mount Penny and Glendon Brook Coal Release Areas published by the Crown, dated January 2009;

viii. the exploration of each of the Mount Penny and Glendon Brook Coal Release Areas;

ix. the development and operation of a mine and related infrastructure in each of the Mount Penny and Glendon Brook Coal Release Areas; and

x. the payment of royalties to the Crown.

55 Thus, the parties alleged to be in competition from at least 1 June 2009 or, alternatively, 2 June 2009, were Loyal Coal and Cascade (par 97.1) and Voope and Cascade (par 97.2). The services which those companies competed to acquire or were likely to compete to acquire were the various rights set out at subpars i., iii., iv. and v. of the Particulars provided in par 97 and the opportunity described in subpar ii. of those Particulars. The services which those companies competed to supply or were likely to compete to supply were those described at subpars vi. to x. of those Particulars.

56 A critical element in the ACCC’s case is the proposition pleaded at par 88.1 of the FASOC that, in accordance with the Deed of Release dated 2 June 2009 between MMNL and Voope, MMNL wrote to the DPI on 1 June 2009 and again on 2 June 2009 requesting that any EL issued pursuant to any EOI submitted by MMNL be issued to Loyal Coal. This request is said to have the consequences that Loyal Coal was deemed to be the EOI applicant in respect of such bids from that point on and that the DPI was obliged to grant any ELs that flowed from such bids to Loyal Coal (par 95). The fact that letters were sent to the DPI as alleged in par 88 was admitted by all parties. The alleged consequences were not admitted.

57 The allegations made at pars 94 to 97 of the FASOC are all either denied or not admitted.

58 At par 98 of the FASOC, the ACCC alleges that, between about 23 May 2009 and 5 June 2009, Brook, Moses Obeid and Paul Obeid negotiated with representatives of Cascade and sought to reach agreement on, the terms of a contract, arrangement or understanding in respect of the Mt Penny and Glendon Brook coal exploration areas. Those allegations are essentially admitted by the respondents although the Cascade respondents and the CMG respondents quibble about the capacity in which Poole and James McGuigan participated in the discussions referred to in that paragraph.

59 At par 99 of the FASOC, the ACCC makes the following allegations:

99. In the course of the negotiations referred to in the previous paragraph:

99.1. one or more of Gardner Brook, Moses Obeid and Paul Obeid indicated they had an ability to gain control of the Monaro Mining bid for the Mount Penny and Glendon Brook Coal Release Areas and could pursue that bid if necessary;

99.2. one or more of Gardner Brook, Moses Obeid and Paul Obeid indicated that members of the Obeid Family had formed an alliance of owners of land the subject of the Mount Penny Coal Release Area, being Cherrydale Park, Donola and Coggan Creek, and were in a position to negotiate for the sale of that land to Cascade;

99.3. there were negotiations for the withdrawal of the Monaro Mining bid for the Mount Penny and Glendon Brook Coal Release Areas;

99.4. there were negotiations as to the grant by Cascade to members of the Obeid Family or to Gardner Brook (or their nominees) of an interest in any resulting mining venture, and negotiations as to the size of that interest (ultimately agreed at 25%) and its terms; and

99.5. there were negotiations as to the purchase by Cascade of Cherrydale Park, Donola and Coggan Creek, including the purchase price (ultimately agreed at four times land value).

60 The respondents admit the matters pleaded at pars 99.2 to 99.5 but some of them dispute the matters pleaded at par 99.1. In particular, the Cascade respondents contend that one or more of Brook, Moses Obeid and Paul Obeid indicated during the relevant negotiations that MMNL had formally resolved to withdraw its bids for the Mt Penny and Glendon Brook coal exploration areas because MMNL was unable to meet the financial obligations assumed by it in its EOI and because there was a determination by MMNL to focus on uranium exploration following a Board dispute. The CMG respondents do not admit the matters alleged at par 99.

61 At pars 100 to 107 of the FASOC, the ACCC alleges that, at a meeting held on or about 5 June 2009 attended by Moses Obeid, Brook, Poole, John McGuigan and James McGuigan, the Buffalo Agreement and the Landowners Agreement were signed.

62 At par 102 of the FASOC, the ACCC alleges that the Buffalo Agreement was executed in circumstances where Moses Obeid, Paul Obeid and Brook had effective control over Loyal Coal and had actual or apparent authority to act on behalf of Loyal Coal as they saw fit and with the knowledge, consent and agreement of Voope, Loyal Coal, Moses Obeid, Paul Obeid and Brook. The Obeid respondents admitted these matters. The remaining respondents did not contest these matters at the trial.

63 At par 105 of the FASOC, the ACCC alleges that the Landowners Agreement was negotiated and finalised by Moses Obeid and Paul Obeid, who were directors of Locaway, and who had authority to enter into an agreement on behalf of Locaway for the sale of Cherrydale. Accordingly, as alleged at par 106 of the FASOC, the ACCC alleges that Locaway was a party to the Landowners Agreement. The Obeid respondents also admitted these matters. The other respondents did not contest these matters at the trial.

64 It is then alleged that the Landowners Agreement was executed in circumstances where Moses Obeid, Paul Obeid and Brook had effective control over Loyal Coal and had actual or apparent authority to act on behalf of Loyal Coal as they saw fit and with the knowledge, consent and agreement of Voope, Loyal Coal, Moses Obeid, Paul Obeid, Brook and Locaway. The Obeid respondents admitted these matters in respect of Moses Obeid and Brook but denied them in respect of Paul Obeid. The other respondents did not contest these matters at the trial.

65 At pars 108 to 111 of the FASOC, the ACCC pleads the following:

The EOI Withdrawal Understanding

108. By reason of the matters pleaded in paragraphs 98 to 102 above, on or about 5 June 2009, Cascade made a contract or arrangement or arrived at an understanding (the EOI Withdrawal Understanding), with:

108.1. Loyal;

108.2. Gardner Brook;

108.3. Buffalo; and

108.4. further or alternatively, Voope

containing a provision that Loyal, Gardner Brook and any other “associates or related parties” of Buffalo including any companies controlled by the Obeid Family or by Gardner Brook (including Voope) would:

108.5. withdraw any existing application for an Exploration Licence in relation to the Mount Penny and Glendon Brook Coal Release Areas (including the Monaro Mining EOI); and/or

108.6. not pursue the grant of any mining rights, including the grant of an Exploration Licence, in the Mount Penny Coal Release Area or any contiguous area or the Glendon Brook Coal Release Area

and in consideration of these matters, Cascade would:

108.7. vest its interest in an Exploration Licence for the Mount Penny Coal Release Area in a separate company or unincorporated venture; and

108.8. grant Buffalo a 25% interest in the separate company or unincorporated venture (together the 25% Interest).

Particulars

In addition to the matters pleaded in paragraphs 98 to 102 above, the existence of the EOI Withdrawal Understanding is to be inferred from:

i. Loyal’s conduct in withdrawing the Monaro Mining EOI as pleaded at paragraphs 118 and 119, below;

ii. the email from Gardner Brook to James McGuigan pleaded at paragraph 119 below; and

iii. the conduct of Cascade, Coal & Minerals and Southeast Investments in relation to the finalisation of the 25% Interest pleaded at paragraphs 142 to 163 below.

108A In circumstances where Loyal was a party to a contract, arrangement or understanding as alleged in paragraphs 108, Voope is taken to be a party to that contract, arrangement or understanding pursuant to s 44ZZRC of the CCA.

109. The provision pleaded in paragraph 108 above constituted:

109.1. an exclusionary provision within the meaning of s 4D of the CCA; and, or alternatively,

109.2. a cartel provision for the purposes of s 44ZZRD(3)(c) of the CCA, as that section applied from 24 July 2009; and

109.3. a cartel provision for the purposes of s 44ZZRD(3)(a)(iii) of the CCA, as that section applied from 24 July 2009, in that it had a substantial purpose of preventing, restricting or limiting the supply, or likely supply, of services to the Crown by Loyal, Gardner Brook and any other “associates or related parties” of Buffalo, including Voope.

Particulars

The applicant refers to and repeats the particulars to paragraph 97.2

110. Alternatively, by reason of the matters pleaded in paragraphs 98 to 107 above, on or about 5 June 2009, Cascade made a contract or arrangement or arrived at an understanding (the EOI Withdrawal and Land Sale Understanding), with at least:

110.1. Loyal;

110.2. [Not used];

110.3. Gardner Brook;

110.4. Locaway;

110.5. Buffalo; and

110.6 further or alternatively, Voope

containing a provision that Loyal, Gardner Brook and any other “associates or related parties” of Buffalo including any companies controlled by the Obeid Family or by Gardner Brook (including Voope) would:

110.7 withdraw any existing application for an Exploration Licence in relation to the Mount Penny and Glendon Brook Coal Release Areas (including the Monaro Mining EOI); and/or

110.8 pursue the grant of any mining rights, including the grant of an Exploration Licence, in the Mount Penny Coal Release Area or any contiguous area or the Glendon Brook Coal Release Area

and in consideration of these matters, Cascade would:

110.9 grant Buffalo the 25% Interest;

110.10. purchase the properties known as Cherrydale Park, Coggan Creek and Donola at a multiple of four times the unencumbered value of those properties; and

110.11. refinance the mortgages over those properties with a facility at a zero per cent (0%) coupon rate or alternatively pay all interest attached to the existing mortgages.

Particulars

In addition to the matters pleaded at paragraphs 98 to 107 above, the existence of the EOI Withdrawal and Land Sale Understanding is to be inferred from:

i. Loyal’s conduct in withdrawing the Monaro Mining EOI as pleaded at paragraphs 118 and 119, below;

ii. the email from Gardner Brook to James McGuigan pleaded at paragraph 119 below;

iii. the conduct of Cascade, Locaway, Geble and JKL pleaded at paragraphs 128 to 131 below; and

iv. the conduct of Cascade, Coal & Minerals and Southeast Investments in relation to the 25% Interest pleaded at paragraphs 142 to 163 below.

110A. In circumstances where Loyal was a party to a contract, arrangement or understanding as alleged in paragraphs 110, Voope is taken to be a party to that contract, arrangement or understanding pursuant to s 44ZZRC of the CCA.

111. The provision pleaded in paragraph 110 above constituted:

111.1. an exclusionary provision within the meaning of s 4D of the CCA; and, or alternatively

111.2. a cartel provision for the purposes of s 44ZZRD(3)(c) of the CCA, as that section applied from 24 July 2009; and

111.3. a cartel provision for the purposes of s 44ZZRD(3)(a)(iii) of the CCA, as that section applied from 24 July 2009, in that it had a substantial purpose of preventing, restricting or limiting the supply, or likely supply, of services to the Crown by Loyal, Gardner Brook and any other “associates or related parties” of Buffalo, including Voope.

Particulars

The applicant refers to and repeats the particulars to paragraph 97.2

66 The matters pleaded in these paragraphs are essentially disputed by all respondents.

67 In light of the above matters, the two cases sought to be put against the primary contraveners may be summarised as follows:

(a) On or about 5 June 2009, Cascade, Loyal Coal, Brook, Buffalo and Voope, made a contract or arrangement or arrived at an understanding (called the “EOI Withdrawal Understanding” in the FASOC) which understanding was not necessarily confined to the Buffalo Agreement and which understanding contained a provision whereby Loyal Coal, Brook and all associates or related parties of Buffalo (including any companies controlled by the Obeid family or by Brook including Voope), agreed to withdraw any existing EOIs in relation to the Mt Penny and Glendon Brook coal exploration areas lodged by them with the DPI or over which they had control (including the EOIs lodged in respect of those two areas by MMNL) and not pursue any exploration or mining rights over those areas in return for which Cascade would vest its interest in any EL granted to it in respect of the Mt Penny coal exploration area in a separate company or unincorporated joint venture and grant to Buffalo or its nominee a 25% equity interest in that separate company or unincorporated venture (pars 98 to 102, 108 and 108A of the FASOC);

(b) Alternatively, on or about 5 June 2009, Cascade, Loyal Coal, Brook, Buffalo, Locaway and Voope made a contract or arrangement or arrived at an understanding (called the “EOI Withdrawal and Land Sale Understanding” in the FASOC) which understanding was not necessarily confined to the contents of the Buffalo Agreement and the Landowners Agreement and which understanding contained a provision whereby Loyal Coal, Brook and all associates or related parties of Buffalo (including any companies controlled by the Obeid family or by Brook including Voope) agreed to withdraw any existing EOIs in relation to the Mt Penny and Glendon Brook coal exploration areas lodged by them with the DPI or over which they had control (including the EOIs lodged in respect of those two areas by MMNL) and not pursue any exploration or mining rights over those areas in return for which Cascade would vest its interest in any EL granted to it in respect of the Mt Penny coal exploration area in a separate company or unincorporated joint venture, grant to Buffalo or its nominee a 25% equity interest in that separate company or unincorporated venture, purchase the properties known as Cherrydale, Donola and Coggan Creek at a multiple of four times the unencumbered value of those properties and refinance the mortgages over those properties with a facility at a zero percent (0%) coupon rate or alternatively pay all interest attached to the existing mortgages (pars 98 to 107, 110 and 110A of the FASOC);

(c) Loyal Coal was competitive with, or likely to be competitive with, Cascade within the meaning of s 4D and in competition with, or likely to be in competition with, Cascade within the meaning of s 44ZZRD(4) of the CCA as alleged at par 97.1 of the FASOC;

(d) By reason of its ownership and control of Loyal Coal, Voope was competitive with, or likely to be competitive with, Cascade within the meaning of s 4D and in competition with, or likely to be in competition with, Cascade within the meaning of s 44ZZRD(4) of the CCA as alleged in par 97.2 of the FASOC;

(e) The impugned provisions contained in the EOI Withdrawal Understanding and in the EOI Withdrawal and Land Sale Understanding were made for purposes, or substantial purposes, which were proscribed purposes within the meaning of s 4D and s 44ZZRD(3)(a)(iii) and s 44ZZRD(3)(c) of the CCA;

(f) The impugned provisions contained in the said Understandings constituted exclusionary provisions within the meaning of ss 4D, 45(2)(a)(i) and 45(2)(b)(i) of the CCA and cartel provisions within the meaning of s 44ZZRD(1) of the CCA; and

(g) By making or arriving at the said Understandings containing such provisions, the parties to those Understandings contravened s 45(2)(a)(i) of the CCA and, by giving effect to those provisions, most of the parties to the said Understandings together with CMG and Southeast contravened s 45(2)(b)(i) and s 44ZZRK(1)(b) of the CCA. The case against Voope is confined to alleged contraventions of s 45(2)(a)(i) constituted by its conduct in making or arriving at the two Understandings in question and the case against Loyal Coal is confined to contraventions of s 45 by making or arriving at the two Understandings in question and also by giving effect to the impugned provisions contained in those Understandings. The case against Southeast and CMG is confined to their conduct in giving effect to the impugned provisions.

68 At pars 178 to 183 of the FASOC, the ACCC specifies the particular contraventions alleged against each of the primary contraveners (Cascade, Voope, Loyal Coal, Locaway, CMG and Southeast). Those paragraphs are in the following terms:

Contraventions

Cascade

178. The first respondent, Cascade:

178.1. contravened s 45(2)(a)(i) of the CCA by making or arriving at that the EOI Withdrawal Understanding as pleaded at paragraph 108 above;

178.2. alternatively, contravened s 45(2)(a)(i) of the CCA by making or arriving at the EOI Withdrawal and Land Sale Understanding as pleaded at paragraph 110 above;

178.3. contravened s 45(2)(b)(i) and s 44ZZRK of the CCA by giving effect to the provision of the EOI Withdrawal and Land Sale Understanding pleaded at paragraph 110 above by causing Mt Penny Properties to enter into the Deed of Put and Call Option with Locaway, Geble and JKL;

178.4. contravened s 45(2)(b)(i) and s 44ZZRK of the CCA by giving effect to the provision of the EOI Withdrawal and Land Sale Understanding pleaded at paragraph 110 above by causing Mt Penny Coal to enter into the Access Agreements with Locaway, Geble and JKL as pleaded at paragraphs 128 to 132 above;

178.5. contravened s 45(2)(b)(i) and s 44ZZRK of the CCA by giving effect to the provision of the EOI Withdrawal and Land Sale Understanding pleaded at paragraph 110 above by causing and funding Mt Penny Coal to make the payments to Locaway, Geble and JKL pleaded at paragraph 133 above; and

178.6. contravened s 45(2)(b)(i) and s 44ZZRK of the CCA by giving effect to the provision of the EOI Withdrawal Understanding pleaded at paragraph 108 above or alternatively the provision of the EOI Withdrawal and Land Sale Understanding pleaded at paragraph 110 above by its conduct in relation to the finalisation of the 25% Interest pleaded at paragraphs 144.2, 147 to 150 above.

Voope

179. The second respondent, Voope:

179.1. contravened s 45(2)(a)(i) of the CCA by making or arriving at the EOI Withdrawal Understanding as pleaded at paragraph 108 above;

179.2. alternatively, contravened s 45(2)(a)(i) of the CCA by making or arriving at the EOI Withdrawal and Land Sale Understanding as pleaded at paragraph 110 above.

Loyal

180. The third respondent, Loyal:

180.1. contravened s 45(2)(a)(i) of the CCA by making or arriving at that the EOI Withdrawal Understanding as pleaded at paragraph 108 above;

180.2. alternatively, contravened s 45(2)(a)(i) of the CCA by making or arriving at the EOI Withdrawal and Land Sale Understanding as pleaded at paragraph 110 above; and

180.3. contravened s 45(2)(b)(i) of the CCA by giving effect to the provision of the EOI Withdrawal Understanding pleaded at paragraph 108 above or alternatively the provision of the EOI Withdrawal and Land Sale Understanding pleaded at paragraph 110 above by withdrawing or purporting to withdraw the Monaro Mining EOI as pleaded at paragraph 118 above.

Locaway

181. The fourth respondent, Locaway:

181.1. contravened s 45(2)(a)(i) of the CCA by making or arriving at the EOI Withdrawal and Land Sale Understanding as pleaded at paragraph 110 above;

181.2. contravened s 45(2)(b)(i) and s 44ZZRK of the CCA by giving effect to the provision of the EOI Withdrawal and Land Sale Understanding pleaded at paragraph 110 above by entering into the Deed of Put and Call Option with Mt Penny Properties;

181.3. contravened s 45(2)(b)(i) and s 44ZZRK of the CCA by giving effect to the provision of the EOI Withdrawal and Land Sale Understanding pleaded at paragraph 110 above by entering into the Locaway Access Agreement with Mt Penny Coal as pleaded at paragraphs 128 to 131 above; and

181.4. contravened s 45(2)(b)(i) and s 44ZZRK of the CCA by giving effect to the provision of the EOI Withdrawal and Land Sale Understanding pleaded at paragraph 110 above by requiring Mt Penny Coal to make the payments pleaded at paragraph 133 above.

Coal & Minerals

182. The fifth respondent, Coal & Minerals contravened s 45(2)(b)(i) and s 44ZZRK of the CCA by giving effect to the provision of EOI Withdrawal Understanding pleaded at paragraph 108 above or alternatively the provision of the EOI Withdrawal and Land Sale Understanding pleaded at paragraph 110 above by its conduct in relation to the finalisation of the 25% Interest pleaded at paragraphs 142 to 163 above.

Southeast Investments

183. The sixth respondent, Southeast Investments contravened s 45(2)(b)(i) and s 44ZZRK of the CCA by giving effect to the provision of EOI Withdrawal Understanding pleaded at paragraph 108 above or alternatively the provision of the EOI Withdrawal and Land Sale Understanding pleaded at paragraph 110 above by its conduct in relation to the finalisation of the 25% Interest pleaded at paragraphs 142 to 162 above.

69 At pars 113 to 116 of the FASOC, the ACCC refers to the 6 June 2009 Agreement which is alleged to have operated as a variation of the Buffalo Agreement.

70 At par 117 of the FASOC, the ACCC pleads the following:

117. In the balance of this pleading:

117.1. a reference to the EOI Withdrawal Understanding includes a reference to the varied EOI Withdrawal Understanding;

117.2. a reference to the EOI Withdrawal and Land Sale Understanding includes a reference to the varied EOI Withdrawal and Land Sale Understanding; and

117.3. a reference to the 25% Interest includes a reference to that interest modified as pleaded in paragraph 115.2 above.

71 At pars 118 to 122 of the FASOC, the ACCC pleads that, on or about 9 June 2009, Loyal Coal withdrew, or purported to withdraw, the EOI lodged by MMNL in respect of the Mt Penny coal exploration area, in accordance with the arrangements made between Loyal Coal and Cascade. These matters were not disputed by any of the respondents.

72 At pars 128 to 135 of the FASOC, the ACCC pleads the facts concerning the Deed of Put and Call Option entered into between the owners of Cherrydale, Donola and Coggan Creek and Cascade dated 24 November 2009 pursuant to which Cascade agreed to purchase those properties at four times their unencumbered value and to refinance the mortgages over those properties or, alternatively, pay the interest due on those mortgages. At around the same time, Cascade entered into access agreements with the owners of those properties pursuant to which Cascade was given access to those properties upon payment of certain access fees. These matters were also not disputed.

73 At pars 136 to 171 of the FASOC, the ACCC recounts the facts and matters concerning the replacement of Buffalo by Southeast and then ultimately the buyout of the Obeid family’s interests in the proposed mining venture. The facts and matters pleaded in these paragraphs were not seriously in dispute.

74 At par 150 of the FASOC, the ACCC alleges that, between 20 October 2010 and 3 May 2012, CMG made five payments totalling $30 million to Southeast. At par 153, the ACCC alleges that, between 21 October 2010 and 4 May 2012, Southeast distributed $29,461,665 out of the $30 million received by it from CMG to entities owned and controlled by the Obeid family. Those allegations are admitted by the Obeid respondents and were not disputed by the other respondents.

75 At pars 172 to 178 of the FASOC, the ACCC pleads the facts, matters and circumstances which it contends demonstrate that each of CMG, Moses Obeid, Paul Obeid, Poole, John McGuigan and James McGuigan had knowledge which justifies each of those parties being made liable as accessories to the contraventions by Cascade, Voope, Loyal Coal, Locaway, CMG and Southeast.

76 At pars 184 to 205 of the FASOC, the ACCC pleads the particular contraventions relied upon against each of the individual respondents. I will discuss these allegations more fully later in these Reasons.

77 The respondents also rely upon several positive defences.

78 First, in answer to the contraventions of s 45(2)(a)(i) pleaded against Voope, Loyal Coal, Locaway and Southeast, the Obeid respondents plead that the EOI Withdrawal Understanding and the EOI Withdrawal and Land Sale Understanding were for the purposes of a joint venture within the meaning of s 4J of the CCA and did not have the purpose of substantially lessening competition, and did not have, and were not likely to have the effect of, substantially lessening competition and that, for those reasons, they have a defence to the ACCC’s claims based upon s 45(2)(a)(i) by reason of the provisions of s 76C of the CCA.

79 Second, for similar reasons, those respondents argue that s 44ZZRK of the CCA did not apply to any conduct giving effect to the impugned contracts or arrangements made or understandings arrived at in the present case because the alleged cartel provisions were for the purposes of a joint venture and the other exculpatory conditions specified in s 44ZZRP were satisfied.

80 Third, the Obeid respondents also contend that the ACCC cannot rely upon s 44ZZRC of the CCA because that provision did not come into force until 24 July 2009 and does not apply to conduct engaged in prior to that date.

81 The Cascade respondents and the CMG respondents also rely upon joint venture defences.

82 In its Amended Replies filed on 23 March 2016, the ACCC joined issue with the respondents’ Defences and pleaded that the respondents’ joint venture defences were not maintainable because they had not been adequately pleaded. However, the ACCC did not make any application to strike out those defences.

The Witnesses