FEDERAL COURT OF AUSTRALIA

Davaria Pty Limited v 7-Eleven Stores Pty Ltd [2018] FCA 984

ORDERS

Applicant | ||

AND: | First Respondent 7-ELEVEN INC Second Respondent ANZ BANKING GROUP LIMITED Third Respondent | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The applicant file its Amended Statement of Claim and Amended Originating Application by 4:00pm on 18 May 2018.

2. The respondents file and serve a defence by 4:00pm on 27 July 2018.

3. The applicant file and serve any reply by 4:00pm on 24 August 2018.

Discovery

4. The parties confer with a view to agreeing a protocol for electronic discovery by 22 June 2018.

5. By 4:00pm on 13 June 2018 the applicant delivers to the respondents its proposals in respect of the scope and timing of discovery.

6. By 4:00pm on 4 July 2018 the respondents deliver their response to the proposals referred to in Order 5.

7. Any applications in respect of discovery be filed and served together with any affidavits in support, and submissions not exceeding 5 pages, by 17 August 2018.

8. Any submissions in response to an application filed pursuant to Order 7 be filed and served by 24 August 2018.

7-Eleven communications protocol

9. The applicant’s amended interlocutory application filed 2 May 2018 be dismissed with costs.

Security for costs – 7-Eleven

10. The applicant provides security for 7-Eleven’s costs of the proceeding from 1 June 2018 until 30 August 2018 in the sum of $540,000 (7-Eleven Security).

11. By 4:00 pm on 1 June 2018, the 7-Eleven Security be provided by the applicant by:

(a) delivery to 7-Eleven of a Deed of Indemnity in a form agreed between the parties and duly executed by AmTrust Europe Limited, and securing an amount not less than AUD $540,000; alternatively

(b) if the applicant does not provide Security in accordance with (a) - depositing cash in the amount of $540,000 with the Court in an interest-bearing account on or before 4:00 pm on 1 June 2018.

12. If the 7-Eleven Security is provided by Deed in accordance with Order 11(a), the applicant shall lodge at the same time with the Court an unconditional bank guarantee from an Australian Bank other than the ANZ Banking Group Limited in the sum of $40,000 in such form as is acceptable to the Registrar as security for the first respondent’s costs of enforcing the Deed.

13. In default of delivery of security in accordance with these Orders, the proceeding shall be stayed until such time as the security is provided, or further order of the Court.

Security for costs – ANZ

14. The applicant provides security for ANZ’s costs of the proceeding from 1 June 2018 until 30 August 2018 in the sum of $396,000 (ANZ Security).

15. By 4:00 pm on 1 June 2018, the ANZ Security be provided by the applicant by:

(a) delivery to ANZ of a Deed of Indemnity in a form agreed between the parties and duly executed by AmTrust Europe Limited, and securing an amount not less than AUD $396,000; alternatively

(b) if the applicant does not provide Security in accordance with (a) - depositing cash in the amount of $396,000 with the Court in an interest-bearing account on or before 4:00 pm on 1 June 2018.

16. If the ANZ Security is provided by Deed in accordance with Order 15(a), the applicant shall lodge at the same time with the Court an unconditional bank guarantee from an Australian Bank other than the ANZ Banking Group Limited in the sum of $40,000 in such form as is acceptable to the Registrar as security for the third respondent’s costs of enforcing the Deed.

17. In default of delivery of security in accordance with these Orders, the proceeding shall be stayed until such time as the security is provided, or further order of the Court.

Other

18. Compliance with the notices to produce served on 7-Eleven on 8 May 2018 and ANZ on 7 May 2018 be dispensed with.

19. Save as to the first respondent’s Interlocutory Application filed 2 May 2018, each of the Interlocutory Applications filed on 2 May 2018 and 7 May 2018 be otherwise dismissed.

General

20. Further case management hearings be listed at:

(a) 9:30am on 3 August 2018; and

(b) 9:30am on 14 September 2018.

21. Proceeding numbers VID180/2018 and VID182/2018 be heard together and that the evidence in one case be evidence in the other.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ORDERS

VID 180 of 2018 | ||

BETWEEN: | DAVARIA PTY LIMITED Applicant | |

AND: | 7-ELEVEN STORES PTY LTD First Respondent 7-ELEVEN INC Second Respondent ANZ BANKING GROUP LIMITED Third Respondent | |

JUDGE: | middleton j |

DATE OF ORDER: | 22 may 2018 |

THE COURT ORDERS THAT:

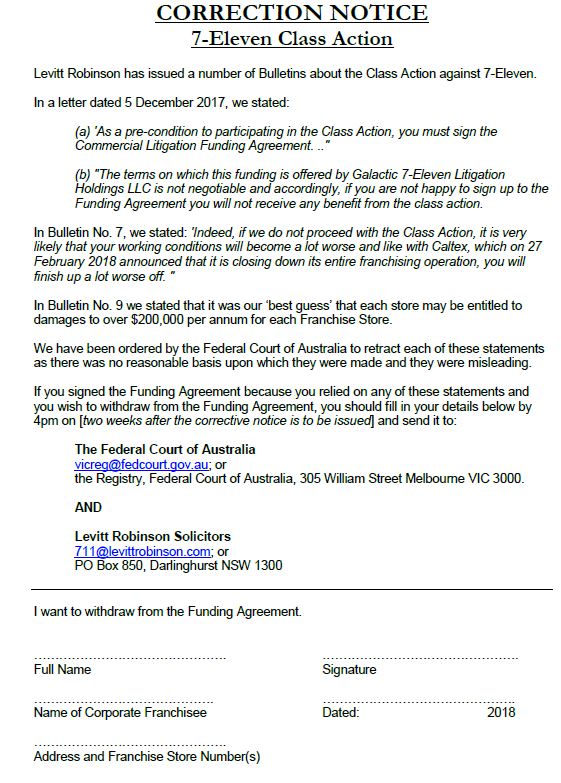

1. Pursuant to section 33Z(1)(g) and 33ZF of the Federal Court of Australia Act 1976 (Cth), the Applicant by its legal representatives, shall within 3 business days of this order:

(a) issue to each person and entity to which the letter dated 5 December 2017 from Levitt Robinson to “All 7-Eleven Franchisees”, Bulletins 7 and 9 were issued, a notice in the form attached at ‘A’ to this application (the “Correction Notice”); and

(b) publish the Correction Notice on the following page: http://levittrobinson.com/class-actions/7-eleven-class-action/ on the following website http://levittrobinson.com/.

2. The Applicant bear the costs of issuing the Correction Notice.

3. The Applicant to pay the First Respondent’s costs of and incidental to this application.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ORDERS

VID 182 of 2018 | ||

BETWEEN: | PARESHKUMAR DAVARIA First Applicant KHUSHBU DAVARIA Second Applicant | |

AND: | 7-ELEVEN STORES PTY LTD First Respondent ANZ BANKING GROUP (ABN 11 005 357 522 Second Respondent | |

JUDGE: | MIDDLETON J |

DATE OF ORDER: | 14 may 2018 |

THE COURT ORDERS THAT:

Pleadings

1. The applicants file their Amended Originating Application and their Statement of Claim by 4:00pm on 18 May 2018.

2. The respondents file and serve a defence by 4:00pm on 27 July 2018.

3. The applicants file and serve any reply by 4:00pm on 24 August 2018.

Discovery

4. The parties confer with a view to agreeing a protocol for electronic discovery by 22 June 2018.

5. By 4:00pm on 13 June 2018 the applicants deliver to the respondents their proposals in respect of the scope and timing of discovery.

6. By 4:00pm on 4 July 2018 the respondents deliver their response to the proposals referred to in Order 5.

7. Any applications in respect of discovery be filed and served together with any affidavits in support, and submissions not exceeding 5 pages, by 17 August 2018.

8. Any submissions in response to an application filed pursuant to Order 7 be filed and served by 24 August 2018.

7-Eleven communications protocol

9. The applicants’ amended interlocutory application filed 2 May 2018 be dismissed with costs.

Security for costs – 7-Eleven

10. The applicants provide security for 7-Eleven’s costs of the proceeding from 1 June 2018 until 30 August 2018 in the sum of $60,000 (7-Eleven Security).

11. By 4:00 pm on 1 June 2018, the 7-Eleven Security be provided by the applicants by:

(a) delivery to 7-Eleven of a Deed of Indemnity in a form agreed between the parties and duly executed by AmTrust Europe Limited, and securing an amount not less than AUD $60,000; alternatively

(b) if the applicants do not provide Security in accordance with (a) - depositing cash in the amount of $60,000 with the Court in an interest-bearing account on or before 4:00 pm on 1 June 2018.

12. If the 7-Eleven Security is provided by Deed in accordance with Order 11(a), the applicants shall lodge at the same time with the Court an unconditional bank guarantee from an Australian Bank other than the ANZ Banking Group Limited in the sum of $40,000 in such form as is acceptable to the Registrar as security for the first respondent’s costs of enforcing the Deed.

13. In default of delivery of security in accordance with these Orders, the proceeding shall be stayed until such time as the security is provided, or further order of the Court.

Security for costs – ANZ

14. The applicants provide security for ANZ’s costs of the proceeding from 1 June 2018 until 30 August 2018 in the sum of $44,000 (ANZ Security).

15. By 4:00 pm on 1 June 2018, the ANZ Security be provided by the applicants by:

(a) delivery to ANZ of a Deed of Indemnity in a form agreed between the parties and duly executed by AmTrust Europe Limited, and securing an amount not less than AUD $44,000; alternatively

(b) if the applicants do not provide Security in accordance with (a) - depositing cash in the amount of $44,000 with the Court in an interest-bearing account on or before 4:00 pm on 1 June 2018.

16. If the ANZ Security is provided by Deed in accordance with Order 15(a), the applicants shall lodge at the same time with the Court an unconditional bank guarantee from an Australian Bank other than the ANZ Banking Group Limited in the sum of $40,000 in such form as is acceptable to the Registrar as security for the second respondent’s costs of enforcing the Deed.

17. In default of delivery of security in accordance with these Orders, the proceeding shall be stayed until such time as the security is provided, or further order of the Court.

Other

18. Compliance with the notices to produce served on 7-Eleven on 8 May 2018 and ANZ on 7 May 2018 be dispensed with.

19. Save as to the first respondent’s Interlocutory Application filed 2 May 2018, each of the Interlocutory Applications filed on 2 May 2018 and 7 May 2018 be otherwise dismissed.

General

20. Further case management hearings be listed at:

(a) 9:30am on 3 August 2018; and

(b) 9:30am on 14 September 2018.

21. Proceeding numbers VID180/2018 and VID182/2018 be heard together and that the evidence in one case be evidence in the other.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ORDERS

VID 182 of 2018 | ||

BETWEEN: | PARESHKUMAR DAVARIA First Applicant KHUSHBU DAVARIA Second Applicant | |

AND: | 7-ELEVEN STORES PTY LTD First Respondent ANZ BANKING GROUP (ABN 11 005 357 522 Second Respondent | |

JUDGE: | MIDDLETON J |

DATE OF ORDER: | 22 may 2018 |

THE COURT ORDERS THAT:

1. Pursuant to section 33Z(1)(g) and 33ZF of the Federal Court of Australia Act 1976 (Cth), the Applicants by their legal representatives, shall within 3 business days of this order:

(a) issue to each person and entity to which the letter dated 5 December 2017 from Levitt Robinson to “All 7-Eleven Franchisees”, Bulletins 7 and 9 were issued, a notice in the form attached at ‘A’ to this application (the “Correction Notice”); and

(b) publish the Correction Notice on the following page: http://levittrobinson.com/class-actions/7-eleven-class-action/ on the following website http://levittrobinson.com/.

2. The Applicants bear the costs of issuing the Correction Notice.

3. The Applicants to pay the First Respondent’s costs of and incidental to this application.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

MIDDLETON J:

BACKGROUND

1 On 14 May 2018, the Court made orders in each proceeding that the interlocutory applications by the Applicant or Applicants in respect of the imposition of a communications protocol be dismissed with costs.

2 On 22 May 2018, the Court made further orders in each proceeding that pursuant to ss 33Z(1)(g) and 33ZF of the Federal Court of Australia Act 1976 (Cth) (‘FCAA’) the Applicant or Applicants by their legal representatives issue a Correction Notice in the form of Attachment “A” to these reasons.

3 These are the reasons for the making of these orders.

COMMUNICATIONS PROTOCOL

Introduction

4 I shall refer in these reasons to the Applicant and Applicants (as named in each proceeding) as the Applicants.

5 The Applicants sought orders pursuant to ss 33Z(1)(g) and 33ZF of the FCAA, imposing a communications protocol on the First Respondent (‘7-Eleven’) in relation to its communications with group members in the proceedings, being (in broad terms) its current or former franchisees (‘Franchisees’).

The principles applicable

6 Section 33Z(1)(g) of the FCAA empowers the Court to make such orders as it “thinks just”. Section 33ZF of the FCAA allows the Court, of its own motion or on application of a party or group member, to “make any order the Court thinks appropriate or necessary to ensure that justice is done in the proceeding.”

7 In acting pursuant to s 33ZF, it is not necessary for the Court to be satisfied that unless the order is made the administration of justice will collapse or that justice in the proceeding will not be “ensured” in the sense of being certain: see Money Max Int Pty Ltd (Trustee) v QBE Insurance Group Limited [2016] FCAFC 148 (‘Money Max’); (2016) 338 ALR 188 at [165]. Rather, the expression “necessary to ensure that justice is done” requires that “the proposed order be reasonably adapted to the purpose of seeking or obtaining justice in the proceeding”: see Money Max at [165]. In the alternative, an order may be made where “appropriate … to ensure that justice is done”.

8 The s 33ZF power has been used by the Court to require corrective notices to be sent to group members or to establish communication protocols where the Court has determined that such orders are necessary to ensure that communications with group members are accurate and not misleading in any material respect: see eg King v GIO Australia Holdings Ltd [2002] FCA 872; (2002) 121 FCR 480; Courtney v Medtel Pty Ltd [2002] FCA 957, (2002) 122 FCR 168 (‘Courtney’); Williams v FAI Home Security Pty Limited (No 3) [2000] FCA 1438 at [24] (‘Williams’).

9 The Court in Courtney considered the limits to this power to control communications between a respondent and unrepresented group members. As Sackville J observed at [52], it may be accepted that the Court should not restrain communications which are not misleading or otherwise unfair and which do not infringe any other law or ethical constraint.

10 In Courtney at [33] to [46], as an important and relevant consideration to these proceedings, it was articulated that even if each of the group members to whom an offer was made accepted that offer, it would not resolve the class action or even a part of the class action. In this way, on the facts before him, Sackville J was able to conclude that s 33V(1) of the FCAA would not render any individual settlement so reached invalid even though not approved by the Court.

11 With respect to s 33ZF of the FCAA, it is important to note what Sackville J stated in Courtney at [52]:

While s 33ZF(l) of the Federal Court Act should be given a broad construction, that does not mean it can or should become a vehicle for rewriting the legislation. For example, in my view s 33ZF(l) cannot be read as prohibiting the respondent to a representative proceeding from communicating with a group member unless the Court has given prior approval. The provision itself merely confers power on the Court to make any order it thinks appropriate or necessary to ensure that justice is done in the proceeding; it does not prohibit conduct which is otherwise lawful. Accordingly, neither s 33ZF(l) nor any other provision in Part IVA prevents a respondent communicating with a group member in a manner which is not misleading or otherwise unfair and which does not infringe any other law or ethical constraint (such as a professional conduct rule which requires solicitors to communicate with a represented group member through the latter’s own legal representatives). The principle also applies, in my opinion, to an offer made by a respondent to settle the claims of individual group members. This reflects the general policy of the law to encourage out of court settlement of disputes and to promote the individual’s right to enter negotiations for settlement without inhibition.

12 In my view, the entirety of this passage is an accurate statement of the law.

Parties position

The Applicants

13 The Applicants relied on the affidavits of:

(1) Mr Stewart Levitt sworn 13 March 2018; and

(2) Mr Ben Brady sworn 19 April 2018; and

(3) Mr Jem Punthakey sworn 2 May 2018.

14 The Applicants submitted the following:

7-Eleven’s communications to Franchisees, regarding proposed settlements and extensive releases, dealt inadequately with the long and complex history of the various claims which were the subject, directly or indirectly, of the proceedings.

7-Eleven knew that many of its Franchisees have English as a second language, and its correspondence imposed arbitrarily short deadlines for responses. Further, there was the consideration that the relative anonymity that Franchisees enjoy as group members in the “open” class actions was significantly undermined by 7-Eleven sending individual settlement offers and knowing, as a result, which group members have not settled with it.

In these circumstances, there were substantial grounds for concern that 7-Eleven’s communications could combine both confusing and potentially misleading language, with real commercial pressure upon the Franchisees to accept the proposed offers for fear of other retaliation against their businesses.

The recent history of 7-Eleven’s communications with Franchisees in respect of matters germane to this proceeding demonstrated a need for Court supervision of future communications. The proposal was that only written notice of any communication regarding the claims in the proceedings be given to the Applicants seven (7) days before they were proposed to be sent to the group members, providing the Applicants with the chance to approach the Court if there was any unresolved concern about the proposed communication.

7-Eleven

15 7-Eleven opposed the imposition of any communication protocol and relied upon:

(1) the affidavit of Mr Nigel David Jones affirmed on 15 March 2018; and

(2) the affidavit of Mr Nigel David Jones affirmed on 2 May 2018; and

(3) the affidavit of Mr Braeden Stephen Lord affirmed on 9 May 2018.

16 7-Eleven submitted the following:

The Applicants sought an ongoing right to see all communications between 7-Eleven and any group member regarding the claims in the proceedings, including by getting to know the identity of any group member with whom 7-Eleven wished to communicate. The Court cannot and ought not be satisfied that such an imposition was necessary for the purpose of seeking or attaining justice in the proceedings or was otherwise appropriate.

Relevantly, the Applicants complained about two distinct types of communications:

(1) First, communications by 7-Eleven with a limited number of Franchisees stemming from claims made by former employees that there had been underpaid wages by the Franchisees and the means of resolving those claims. These communications had not been with the entire class of group members or even an identifiable sub-class.

(2) Secondly, more general communications by 7-Eleven in response to inaccurate letters and Bulletins issued by Levitt Robinson (the solicitors for the Applicants) in an attempt to encourage Franchisees to sign funding agreements with the funder of the representative proceedings.

As to the first category of communications, 7-Eleven made the following submissions:

(1) First, contrary to the Applicants’ submission, the offers made by 7-Eleven to enter into mutual releases were only made to a limited number of Franchisees the subject of a Wage Claim Panel (‘WCP’) wage claim and not to all Franchisees. Even if each of the Franchisees to whom an offer was made to exchange mutual releases accepted that offer, it would not resolve the class actions or even a part of the class actions.

(2) Secondly, the ability of 7-Eleven to communicate with group members about the matters referred to above was an important feature of 7-Eleven’s and the group member’s individual right to enter into negotiations without inhibition. Absent the existence of the representative proceeding, 7-Eleven and Franchisees would undertake negotiations untrammelled by the attempts at interference by Levitt Robinson. 7-Eleven was seeking to resolve wage underpayment claims. These claims were not the subject of the representative proceedings. As a matter of individual negotiation, 7-Eleven was entitled to seek to compromise offsetting claims by procuring a release in respect of claims brought by those individual Franchisees (including releases in respect of the subject matter of the proceedings). Moreover, 7-Eleven was negotiating with group members who did not wish for the Applicants or their legal representatives to know the proposed commercial terms of the negotiations or the identity of the group members. There was no commercial or legal justification to intrude upon the wishes of those group members. Furthermore, commercial negotiations with Franchisees concerning the sale of franchise businesses necessarily extended to the provision of releases so as to cleanly and formally end the commercial relationship. The terms of those negotiations (including the price paid by 7-Eleven for the purchase of the franchise) were commercially sensitive.

(3) Thirdly, contrary to the submissions made by the Applicants:

(a) no existing agreement fettered or otherwise altered the right of 7-Eleven and employees to effect an assignment of the employees WCP claims as against relevant Franchisees;

(b) the evidence disclosed that WCP claims were not being processed where those claims related to an underpayment period over six years ago and, in any event, the application of a specific limitation period does not vitiate the existence of a right to bring a claim;

(c) the letters of offer were clear and sufficiently detailed so as to outline the key differences between the Wage Repayment Program (‘WRP’) and WCP and made apparent what was being offered by 7-Eleven in respect of WCP claims and the quid pro quo required of Franchisees.

(4) Fourthly, the evidence did not disclose that 7-Eleven had communicated or will be communicating with group members in a manner which was or would be misleading or otherwise unfair. The Applicants had not adduced any evidence from group members contending that they had been misled by 7-Eleven’s communications. 7-Eleven’s communications with group members was fair and compliant with the Court’s articulated standards for the making of offers of settlement – including making it apparent that independent legal advice ought to be sought. Specifically, it was put forward that the communications issued by 7-Eleven included clear and express statements such as:

7-Eleven will directly pay all verified claims lodged through the WCP and which relate solely to the period prior to 1 January 2016 and which have been lodged before 6 May 2018 even if they are not verified until after 6 May 2018. As a condition of receiving their payment, the claimants will be required to assign to 7- Eleven their right to claim. The assignments would entitle 7-Eleven to then recover directly from the responsible Franchisee the amount which 7-Eleven has paid.

…

7-Eleven is prepared to completely release any Franchisee from the assigned debt (or debts if there is more than one claimant) if the Franchisee is prepared to also release 7-Eleven (and relevant 3rd parties) from any claims that the Franchisee might have as at the date of the release (including those which are included in the class action which Levitt Robinson has filed against 7-Eleven). More information about how this proposal affects you and the steps you should take is set out below.

…

It is important to stress that these changes have been under consideration for some time and respond to concerns raised by Franchisees. It is also important to note that participation in this proposal and the entering into of a mutual release would preclude those Franchisees from participating in the class action.

How Does This Affect You?

…

Once an employee has accepted 7-Eleven’s payment of their claim and assigned that claim to 7-Eleven, 7-Eleven will be entitled to recover these payments from you. You are free to choose whether to accept 7-Eleven’s proposal releasing you from a claim for this amount in return for releasing 7-Eleven (and relevant 3rd parties) from litigation. Alternatively, you are free to take a different path.

In making your decision about this proposal, you should first carefully consider the proposal and seek your own independent legal advice.

If you already have legal representation, you should consult with your lawyers and also feel free to provide their details to us so that we can deal with them directly. If you have already signed the Funding Agreement and agreed to be a member of the Class Action then you are represented in that matter by Levitt Robinson and should refer this letter and the Deed of Release to them.

Otherwise, in relation to the issues involving the class action, you may nonetheless wish to consider seeking advice from Levitt Robinson. The relevant court documents can be found at:

https://www,7eleven.com.au/class-action.

(5) Fifthly, the logical manifestation of the Applicants’ proposal was that if the Applicants considered an offer to be misleading or unfair to others, it would seek to restrain the issuing of that offer to group members, even though the offer was in respect of matters that have nothing to do with the class actions.

(6) Sixthly, the imposition of a generalised a priori regime of the type proposed would be contrary to the over-arching purpose articulated in s 37M of the FCAA. In this respect, the prospect of involving the Court as an arbiter of communications was argued as not only inappropriate, but also, inefficient. Commercial negotiations often involve multiple communications and iterations of documents. Moreover, in circumstances where group members have historically entered into legal and commercial relationships with 7-Eleven, the Court ought to be slow to implement a regime which has the potential to create a situation in which a stylised or individualised offer to a particular Franchisee, cannot be seen, or is not capable of being considered by that Franchisee. The preferable course is to allow 7-Eleven and group members to exercise their conventional freedom as business people to negotiate confidentially.

17 The Applicants, in reply, contended that the communications protocol was consistent with the proper exercise of the Court’s power, because:

First, the terms of the proposed communication protocol limited it to communications “concerning the prospects of, progress of, or any proposal to compromise any claim in or arising out of the subject matter of this proceeding.” To the extent offers arise out of unrelated matters (such as unpaid wage claims), but include a release of a claim in or arising out of the subject matter of the class actions, that is a sufficient connection and relevance to the class actions to warrant Court intervention.

Secondly, it was submitted that the protocol did not envisage it would be the Applicants who determined whether communications would be misleading or unfair. That determination would be reserved for the Court. Contrary to 7-Eleven’s submissions, the Applicants submitted that the Court would not be endorsing settlement offers, but rather would only ensure settlement offers were not misleading or otherwise unfair. Those considerations do not prevent any “stylised or individualised offer to a particular franchisee” being made by 7-Eleven, so long as such an offer is communicated fairly.

Thirdly, it was argued it would not be inappropriate for the Court to have oversight of such communications in this way.

18 I should mention that during the course of argument in reply, the Applicants did not press the application in respect of seeking the identities of the unrepresented group members, or seeking communications that concerned “the prospects of” or “progress of” any compromise. The orders I made were on the basis of this position as adopted by the Applicants in reply.

Consideration

19 I cannot be satisfied that the proposed communication protocol is necessary for the purpose of seeking or attaining justice in the proceedings or appropriate or necessary to ensure that justice is done in the proceedings. That is so for the submissions put forward by 7-Eleven.

20 Neither ss 33Z(1)(g) or 33ZF of the FCAA would allow the Court in the proper exercise of its discretion to prohibit or limit communications between a respondent and an individual group member that are otherwise lawful and not subject to any ethical constraint, and where those communications are not misleading and do not involve any unfairness. The ability of a respondent to communicate with individual group members is an important feature of the individual rights of a respondent and a group member to enter into negotiations without inhibition. Unless there is a basis upon the evidence for the Court to intervene to prevent or cure the effects of improper conduct on the part of a respondent, the Court should not do so in the pretext of some guardianship role to protect individual unrepresented group members. Further, there is no provision in the FCAA which would invalidate a settlement reached between an individual group member and a respondent without the prior approval of the Court, unless ss 33V(1) or 33W are applicable. Of course, if an individual settlement is ultimately reached in circumstances where the Court comes to the view that there has been misleading or unfair conduct that settlement may be set aside.

21 The evidence adduced does not disclose that 7-Eleven communicated with or is likely to communicate with group members in a manner which is misleading or otherwise unfair. This is to be coupled with the fact that the Applicants have not adduced any evidence from group members contending that they have been misled by 7-Eleven’s communications to date. I agree with 7-Elevens’ submissions that the communications to date were fair and compliant with the Court’s articulated standards for the making of offers of settlement – importantly, they were in writing and invited the recipient to seek legal advice. I do not consider that the correspondence was oppressive in its demand for a response in the time allowed. Consistent with the observations of Sackville J in Courtney at [33] to [46], it is also material that the offers made by 7-Eleven to enter into mutual releases were only made to a limited number of Franchisees the subject of a WCP wage claim and not to all Franchisees. Even if each of the Franchisees to whom an offer was made to exchange mutual releases accepted that offer, it would not resolve the class actions or even a part of the class actions.

22 As a matter of individual negotiation, 7-Eleven was entitled to seek to compromise offsetting claims by procuring a release in respect of claims brought by individual group members (including releases in respect of the subject matter of these proceedings). Furthermore, I accept that some individual group members may not wish for the Applicants or their legal representatives to know the proposed commercial terms of the negotiations or the identity of the group members treating with 7-Eleven.

23 In my view, 7-Eleven and group members should be allowed to exercise their conventional freedom as business people to negotiate confidentially, and not involve the Court with respect to the imposition of a generalised communications protocol being a priori regime of the type proposed.

CORRECTIVE NOTICE

Introduction

24 7-Eleven sought orders pursuant to ss 33Z(1)(g) and 33ZF of the FCAA that the Applicant issue and publish a corrective notice to recipients of the following documents:

(1) the letter from Levitt Robinson dated 5 December 2017;

(2) the Levitt Robinson Bulletin No 7 dated 28 February 2018; and

(3) the Levitt Robinson Bulletin No 9 dated 8 March 2018.

25 There are three impugned representations said to be made by Levitt Robinson. The Applicants accepted that the first of those representations (‘opt in representation’) was misleading, and took steps to correct that representation. The dispute between the parties was whether the corrective disclosure was sufficient. The Applicants’ position was that the remaining two representations were not misleading. Each of these statements contained representations of opinion about future matters and Mr Stewart Levitt sought to explain that he had a reasonable basis for making those representations.

The principles applicable

26 Misleading communications can undermine the integrity of Part IVA proceedings by inducing a misunderstanding on the part of recipients as to the nature and operation of the representative proceeding, and the rights and liabilities of the recipients in respect of the proceeding: see eg Johnstone v HIH Ltd [2004] FCA 190 at [102] (‘Johnstone’).

27 As Tamberlin J stated in Johnstone, in this context of potential misleading communications the Court has an important and continuing role in managing representative proceedings in the public interest. Specifically at [105], as his Honour stated:

The Court has an important and continuing role in managing representative proceedings in the public interest to rectify any potential misleading communications to class members or potential class members, in order to ensure that there is no misunderstanding engendered by such communications, particularly when they emanate from legal advisers, as to rights and obligations and procedures to be followed by recipients of such communications.

28 The importance of accuracy in communications to group members was articulated by Goldberg J in Williams at [24]:

The nature of class actions brought pursuant to provisions of Pt IVA of the Act are such that it is imperative that any communications made to group members, in whatever form, be accurate especially in relation to the rights which they have in relation to class actions of which they are a group member and the rights which they have to opt out of such proceedings.

29 The power conferred on the Court by the FCAA extends to encompass all procedures necessary to bring the matter to a fair hearing on a just basis. Thus, an order may be made that a correcting notice be issued to remedy any misstatements that may be made during the course of a proceeding: see eg Jarra Creek Central Packing Shed Pty Ltd v Amcor Limited [2008] FCA 575; Pharm-a-Care Laboratories Pty Ltd v Commonwealth of Australia (No 4) [2010] FCA 749 at [24]. Similarly, if a funding agreement was executed in consequence of misleading, unfair or unlawful conduct, it is liable to be set aside on the basis that it is an appropriate course to ensure that justice is done in the proceeding: see Courtney at [53].

Parties Position

7-Eleven

30 7-Eleven relied upon the affidavits of Mr Nigel David Jones affirmed on 15 March 2018 and 2 May 2018.

31 7-Eleven submitted that the issuing and publication of a corrective notice was necessary so as to ensure that the integrity of the proceedings and the processes governing the proceedings under Part IVA of the FCAA are maintained. Specifically, having regard to the Commercial Litigation Funding Agreement (‘Funding Agreement’) entered into between Galactic Seven Eleven Litigation Holdings LLC (‘Funder’) and Levitt Robinson, as well as the commercial imperative of Levitt Robinson and the Funder to “sign up” 150 Franchisees by 31 March 2018, it was necessary and appropriate that:

(1) communications issued to Franchisees which were misleading and may have induced them to act are corrected; and

(2) Franchisees be given an unfettered and an unpressured opportunity to disclaim the Funding Agreement.

32 It was submitted that the communications were issued to engender an affirmative act on the part of the putative group members – which, if taken, would alter the rights and obligations of those group members. Specifically, the communications in question were directed towards requesting and encouraging group members to sign the Funding Agreement. The commercial imperative was made apparent by Bulletin Number 9 issued by Levitt Robinson on 8 March 2018 which stated, inter alia, that:

The reason why it is essential that you sign the Funding Agreement is that the Funder may not continue to fund the Class Action if by 31 March 2018, we do not have one-hundred and Fifty Franchisees signed up to the Funding Agreement.

The Applicants

33 As stated above, the Applicants accepted out of the three impugned representations, only the original ‘opt in’ representation was misleading (but had been subsequently corrected) and submitted the remaining two were not misleading.

34 The Applicants relied upon the affidavits of Mr Stewart Levitt sworn on 13 March 2018 and 9 May 2018.

Consideration

The “Opt in” Representation

35 On 5 December 2017, Levitt Robinson wrote to “All 7-Eleven Franchisees”. At the beginning of that letter, Levitt Robinson incorrectly stated that:

As a pre-condition to participating in the Class Action, you must sign the Commercial Litigation Funding Agreement (“the Funding Agreement”) (copy enclosed)…

The terms on which this funding is offered by Galactic 7-Eleven Litigation Holdings LLC is not negotiable and accordingly, if you are not happy to sign up to the Funding Agreement you will not receive any benefit from the class action.

36 As the proceedings are “opt-out” class actions and thus the very predicate (“as a pre-condition to participating”) upon which Levitt Robinson urged group members to sign the Funding Agreement was misleading. In my view this was compounded by the false statement that unless the Funding Agreement was executed “you will not receive any benefit”.

37 Bulletin No 11 was issued on 9 April 2018. Bulletin No 11 was distributed to the same persons whom had previously been sent the letter of 5 December 2017, and to any group member who had registered with Levitt Robinson subsequent to that date.

38 Bulletin No 11 did correct the references to signing the Funding Agreement and being part of the class action. Bulletin No 11, which among other things, stated that:

We wish to draw your attention once again to the fact that the Class Action is an Opt-Out Class Action, not an Opt-In Class Action. This means that you are automatically a group member in the Class Action, even if you do nothing. You do not have to sign the Funding Agreement to be a part of the class action.

39 However, in my view Bulletin No 11 did not adequately deal with consequences of the misleading nature of the earlier communications. Rather than providing group members with the unilateral right to void the Funding Agreement, Bulletin No 11 contained a statement which presaged that the only available outcome for misled group members was that the group member could contact Mr Stewart Levitt directly so as to “remain comfortable with the decision which you made.”

40 In my view, a correction notice is required. It is important that in relation to Bulletin No 11, as with Bulletin No 7 and No 9, (to which I come) if a group member signed the Funding Agreement because of the misleading statements, then that group member should be advised of the misleading statements and given the opportunity to withdraw from the Funding Agreement.

The Bulletin No 7

41 On 28 February 2018, Levitt Robinson published Bulletin No 7 on its website. This relevantly stated:

Whoever signs the Funding Agreement will gain the protection of our applying on their behalf to the Federal Court for an Order preventing 7-Eleven from terminating Franchisees without first getting the Court’s permission to do so. We will represent any Franchisee who has signed the Funding Agreement and wishes to fight a premature termination without further charge. This will apply from the date of the first Directions Hearing in the Federal Court in Melbourne, which is scheduled for 16 March 2018.

…

We are claiming a lot of money for you in the Class Action which you will not be able to access, if the Class Action does not proceed. We are also seeking better working conditions for you as a small business operator within the 7-Eleven network, which it is highly unlikely that you will be able to access if we do not keep up the Class Action. Indeed, if we do not proceed with the Class Action, it is very likely that your working conditions will become a lot worse and like with Caltex, which on 27 February 2018 announced that it is closing down its entire franchising operation, you will finish up a lot worse off.

42 Bulletin No 7 conveyed that if the class actions did not proceed it was very likely that Franchisees’ working conditions will become a lot worse, and if the class actions did not proceed, there was a reasonable prospect that 7-Eleven would close down its entire franchising operation.

43 These were dramatic statements and such statements of opinion, coming from a firm of solicitors, carried with them the implication that there was a reasonable basis for the asserted opinion.

44 I do not accept that there was a reasonable basis for these statements of opinion. The representations were to the effect that if the class actions did not proceed, conditions would deteriorate for Franchisees and the franchise network may be shut down, and that Mr Stewart Levitt had a reasonable basis for making these representations. Mr Stewart Levitt gave evidence as to his involvement with the Caltex franchisees in another context (see Mr Stewart Levitt’s affidavit sworn on 9 May 2018 at [20] to [22]). He believed that the failure by Caltex franchisees to protect their interests through a class action ultimately contributed to Caltex winding up the franchise network. He considered that his experience with the conduct of 7-Eleven led him to believe that the same conduct may occur here. For example, 7-Eleven’s regular attempts to pursue Franchisees for back pay claims is similar to the conduct he experienced in his representation of Caltex franchisees (see Mr Stewart Levitt’s affidavit sworn on 9 May 2018 at [22]). However, apart from the fact that Mr Stewart Levitt did not attest that this was the basis of his statements in issue, his experience with Caltex cannot on an objective or reasonable basis be a foundation for his opinion. The circumstances relating to the Caltex franchisees could not reasonably be translated to the circumstances of each Franchisee and the present proceedings.

The Bulletin No 9

45 The bulletin No 9 was issued on 8 March 2018. It stated:

It is presently difficult to estimate with any certainty, the extent of the damage that you have suffered….Our best guess is that the case is worth over two-hundred thousand dollars ($200,000.00) per annum for each Franchise Store.

46 Thus by Bulletin No 9, Levitt Robinson represented that although damages could not be estimated “with certainty” there was nonetheless a reasonable basis for assessing that the case was worth over $200,000 per annum for each Franchisee’s store. I accept that the opinion expressed was qualified and was a ‘best guess’.

47 I do not need to address the evidence of Mr Stewart Levitt where he sets out his basis of this representation at [23] to [29] in the 9 May 2018 affidavit as to the figure of $200,000, as this may or may not be a fair assessment overall.

48 However, if for no other reason, the representation as to $200,000 was misleading because the circumstances of each individual Franchisee will differ markedly. Accordingly, it could not reasonably be suggested that there was a typical financial outcome of over $200,000 per annum which could be applied to each Franchisee’s store.

49 For the above reasons, the Correction Notice was required in the terms it was issued so as to allow any recipient to withdraw from the Funding Agreement.

I certify that the preceding forty-nine (49) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justice Middleton. |

Attachment “A”