FEDERAL COURT OF AUSTRALIA

Australian Securities & Investments Commission v Thorn Australia Pty Ltd [2018] FCA 704

ORDERS

AUSTRALIAN SECURITIES & INVESTMENTS COMMISSION Applicant | ||

AND: | THORN AUSTRALIA PTY LTD (ACN 008 454 439) Respondent | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. Pursuant to ss 166(2) and (3) of the National Consumer Credit Protection Act 2009 (Cth) (the National Credit Act) the Court declares that:

(a) in the period between 23 January 2012 and 1 May 2015 (the Relevant Period), the Respondent contravened s 153(1)(b) of the National Credit Act in respect of 275,060 consumer leases, being those assigned to consumers numbered 3,624 to 278,683 in Schedule 1 to the Statement of Agreed Facts that is annexure PB1 to the Affidavit of Penelope Beck dated 22 January 2018 (the Relevant Consumer Leases), in that it failed to make reasonable inquiries about each consumer's financial situation, specifically it failed to make an inquiry as to each consumer's actual housing costs, before making an assessment as to the unsuitability of each lease;

(b) in the Relevant Period, the Respondent contravened s 153(1)(c) of the National Credit Act in respect of each of the Relevant Consumer Leases in that it failed to take reasonable steps to verify each consumer's financial situation, specifically it failed to verify each consumer's actual expenses, before making an assessment as to the unsuitability of each lease;

(c) in the Relevant Period, the Respondent contravened s 151 of the National Credit Act in respect of each of the Relevant Consumer Leases in that it entered into each lease in circumstances where it had not:

(i) made reasonable enquiries about each consumer's financial situation, specifically, each consumer's actual housing costs; and

(ii) taken reasonable steps to verify each consumer's financial situation, specifically, each consumer's actual expenses;

(d) in the Relevant Period, the Respondent contravened s 151 of the National Credit Act in respect of each of the Relevant Consumer Leases in that it entered into each lease in circumstances where by reason of its failure to make an inquiry as to each consumer's actual housing costs and its failure to verify each consumer's actual expenses it had not made an assessment that properly assessed whether the lease would be unsuitable for the consumer if the lease was entered into as required by s 152 of the National Credit Act.

2. Pursuant to s 167(2) of the National Credit Act the Court orders that the Respondent pay to the Commonwealth a pecuniary penalty of $2 million in respect of the declared contraventions in paragraph 1.

3. The Court orders that the Respondent pay the Applicant's costs of and incidental to the proceedings, fixed in the amount of $200,000.

4. Exhibit 4 be returned to the applicant.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

JAGOT J:

1 I accept the joint submissions of the parties that I should impose a pecuniary penalty of $2 million on the respondent in relation to its admitted contraventions of ss 151, 153(1)(b) and 153(1)(c) of the National Consumer Credit Protection Act 2009 (Cth).

2 The parties filed a statement of agreed facts and joint submissions. These documents, as well as the enforceable undertaking referred to in the statement of agreed facts, are annexed to and are taken to form part of these reasons for judgment.

3 The admitted contraventions relate to 275,060 consumer leases entered into by the respondent, trading as Radio Rentals, RR and Rentlo Reinvented, between 23 January 2012 and 1 May 2015.

4 In the statement of agreed facts and the joint submissions, the Relevant Period is defined to be the period between 1 January 2012 and 1 May 2015. The reason for the difference between that period and the period to which I have referred (and which is reflected in the orders I will make today) is that, when the proceedings were commenced, the limitation period had expired for the period between 1 and 21 January 2012. Accordingly, no pecuniary penalty can be imposed for that period. This means that there are some differences between the relevant number of leases referred to in the statement of agreed facts and the joint submissions and the number of admitted contraventions for the purpose of imposing pecuniary penalties.

5 In respect of each contravening lease, the respondent admitted that it:

(a) failed to make reasonable inquiries about each consumer’s financial situation, by failing to make an inquiry as to each consumer’s actual housing costs, before making any assessment as to unsuitability, in contravention of s 153(1)(b) of the Act;

(b) failed to take reasonable steps to verify each consumer’s financial situation, by failing to verify each consumer’s actual expenses, before making any assessment as to unsuitability, in contravention of s 153(1)(c) of the Act;

(c) by reason of each of the contraventions of ss 153(1)(b) and (c) of the Act outlined above, entered into each of the Relevant Consumer Leases without:

(i) making an assessment of unsuitability in accordance with s 152 contrary to s 151(c) of the Act; and

(ii) undertaking the required inquiries and verifications contrary to s 151(d) of the Act.

6 The critical facts are these:

(1) In respect of the 275,060 leases entered into over the three year period, the respondent did not make any inquiry as to consumer’s actual housing costs or take any steps to verify each consumer’s expenses.

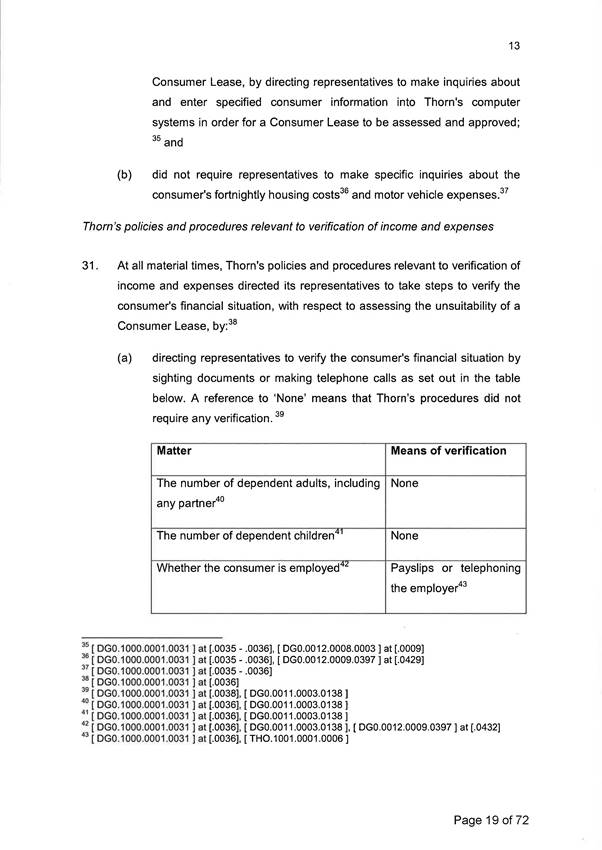

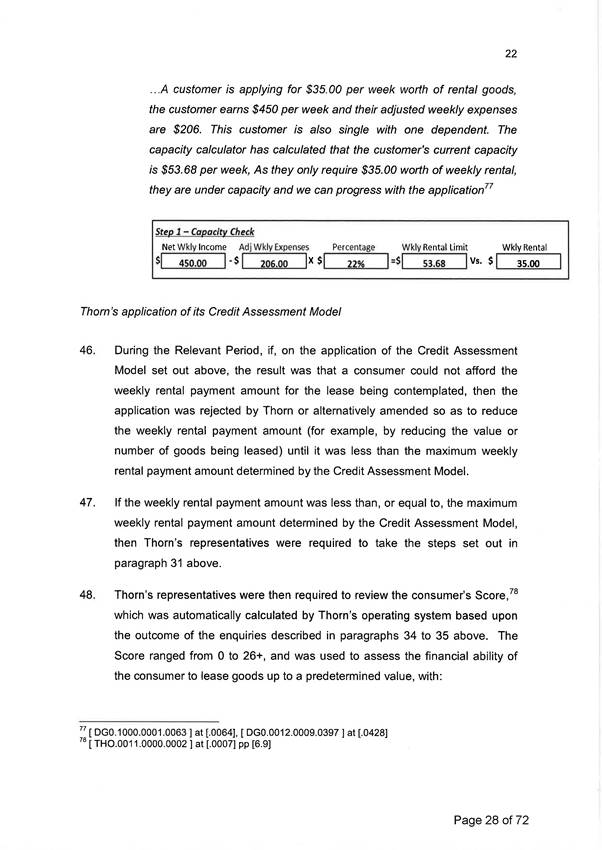

(2) It is not, however, that the respondent ignored its statutory obligations or did nothing to comply with them. Rather, instead of doing what was actually required, the respondent applied its Credit Assessment Model to determine a consumer’s capacity to make repayments.

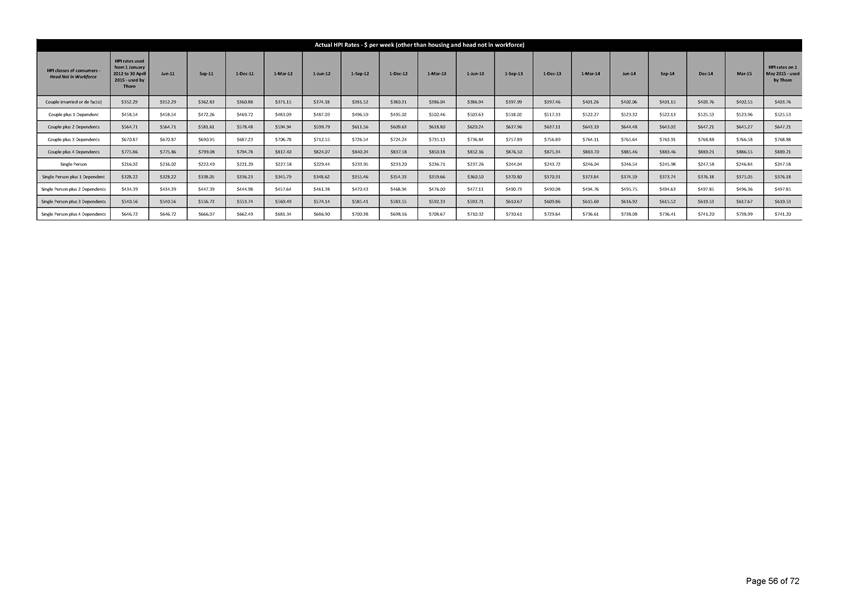

(3) The parties agree that:

It is accepted that Thorn believed that the inclusion in the Credit Assessment Model of a Capacity Percentage would address housing costs and provide a buffer for housing costs that would enable Thorn to be in a position to assess the unsuitability of a consumer lease for each consumer who entered into a Relevant Consumer Lease.

However, ASIC submits and Thorn now accepts that it ought to have known that the Credit Assessment Model did not enable it to assess whether a consumer lease was unsuitable for each consumer with whom it entered into a Relevant Consumer Lease. ASIC submits and Thorn now accepts that it also ought to have known that the Credit Assessment Model did not comply with the Responsible Lending Obligations under the Act.

By applying the Capacity Percentage and not inquiring about each consumer’s actual housing costs before making its assessment of unsuitability, ASIC submits and Thorn now accepts that it did not satisfy its obligation to make reasonable inquiries about each consumer’s financial situation in contravention of s 153(1)(b) of the Act.

7 The critical considerations are as follows.

8 The maximum penalty: By s 167(3) of the Act, the pecuniary penalty must not be more than five times the maximum number of penalty units referred to in the civil penalty provisions (2,000 units for each contravention in the present case). Whatever view is taken of the number of contraventions per lease, the fact that the statutory requirements were contravened for each of the 275,060 leases means that the maximum penalty is so large as to be meaningless in the context of the respondent’s overall conduct.

9 Deterrence: Despite the maximum penalty being so large as to be meaningless, the central requirement of deterrence, both specific and general, demands a material pecuniary penalty. In particular, the parties agree this:

Although Thorn believed that the Credit Assessment Model was sufficient to enable it to comply with its obligations under the Act and minimise the risk of causing serious potential financial harm to consumers, ASIC submits and Thorn now accepts that Thorn ought to have known that its failure to comply with the obligations under the Act could cause serious potential financial harm to its consumers including its consumer base who were recipients of Centrelink payments and were making payments under the Relevant Consumer Leases using Centrepay.

Thorn’s contraventions in respect of its failures to inquire about consumers’ actual housing costs and to verify consumer’s expenses were serious breaches of important aspects of the legislative scheme designed to protect the interests of all consumers, including the vulnerable consumers that constituted the majority of Thorn’s consumer base, although they were not deliberate.

10 To this must be added the fact that the respondent:

… had between an approximately 25 to 33% share of the market for consumer leases in Australia. That market share resulted in Thorn deriving substantial revenue and profit from its consumer leasing business. Thorn’s Consumer Leasing Business was the primary contributor to Thorn Group Limited’s financial results.

11 In addition, the parties agreed that:

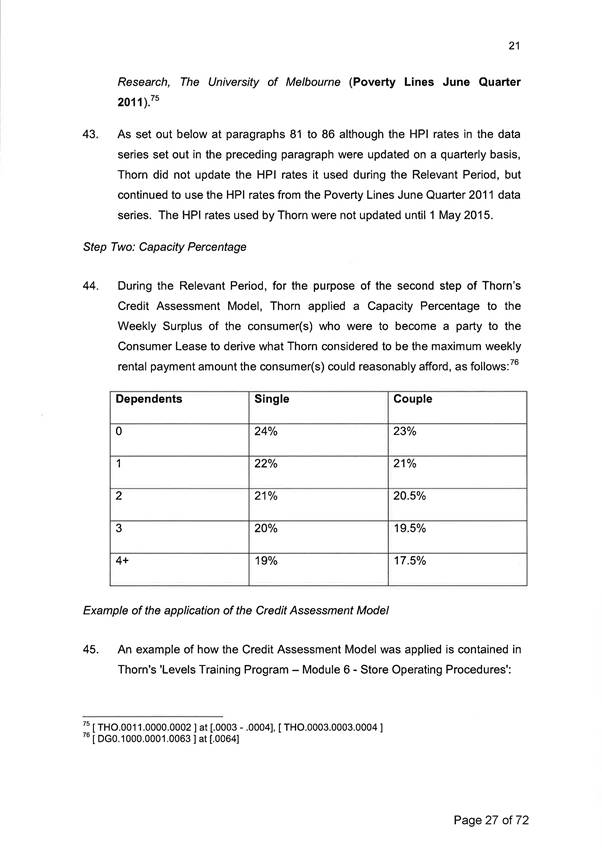

…there was a substantial profit from Thorn’s Consumer Leasing Business is relevant not only to ensuring that the quantum of the penalty is appropriate, it is also relevant that by such profit Thorn had substantial resources at its disposal to enable it to implement policies and procedures to secure strict compliance with the Responsible Lending Obligations. In the face of substantial profits, Thorn ought to have complied with the obligations applicable to the line of business which was making the substantial contribution to those profits.

12 Further, the following matters are agreed, which must be taken into account in the context of the need for specific deterrence:

For the financial year ended 31 March 2017, Thorn Group Limited’s net assets were $210,238,000, including cash and cash equivalents of $14,681,000. During the Relevant Period, the Consumer Leasing Business was the largest contributor to the Thorn Group Limited’s and Thorn’s earnings during that period. Thorn’s Consumer Leasing Business generated earnings before interest, tax, depreciation and amortisation (EBITDA), which increased each year during the Relevant Period.

Revenue, EBIT and net profit after tax after adjustment for interest and corporate costs (NPAT) for Thorn’s Consumer Leasing Business during the Relevant Period were as follows:

(a) for the financial year ended 31 March 2012, $157,817,000 revenue and $45,071,000 EBIT and $25,354,100 NPAT;

(b) for the financial year ended 31 March 2013, $170,020,000 revenue, $46,786,000 EBIT and $25,605,328 NPAT;

(c) for the financial year ended 31 March 2014,: $196,800,000 revenue, $48,078,000 EBIT and $26,931,995 NPAT;

(d) for the financial year ended 31 March 2015, $246,169,000 revenue, $54,874,000 EBIT and $30,855,965 NPAT;

(e) for the financial year ended 31 March 2016, $245,701,000 revenue, $49,724,000 EBIT and $25,132,816 NPAT; and

(f) for the financial year ended 31 March 2017, $251,175,000 revenue, $36,342,000 EBIT and $16,210,643 NPAT.

13 The respondent also charged numerous consumers additional fees for late payments, dishonoured payments and early termination under the leases. It has also agreed, however, to make repayments as described in paragraph 139 of the joint submissions of the parties.

14 The role of the Australian Securities and Investment Commission (ASIC): Given its statutory mandate and its obligations, it may be expected that ASIC has agreed a position with the respondent which reflects an informed and appropriate view as to the pecuniary penalty which, in all of the circumstances, as identified in the joint submissions, properly should be imposed.

15 To my mind, the joint submissions demonstrate a detailed consideration of the relevant facts, the applicable law, and a reasonable synthesis of all matters to which regard should be had for the imposition of penalty. Given this, the joint submissions should be accepted and I accept them.

16 For these reasons I make the declarations and the orders the parties have proposed.

I certify that the preceding sixteen (16) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justice Jagot. |

Associate:

ANNEXURE A

ANNEXURE B

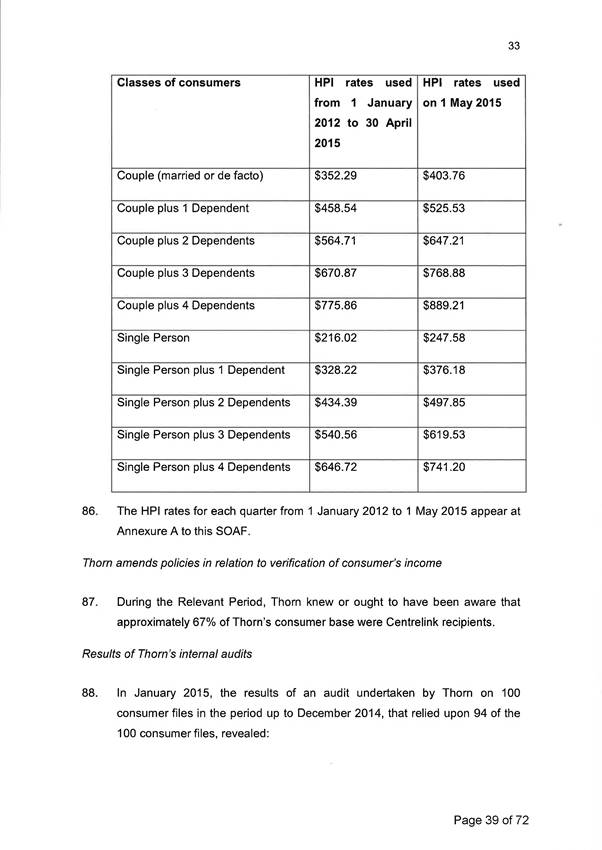

ANNEXURE C