FEDERAL COURT OF AUSTRALIA

AIA Australia Limited v Richards (No 4) [2017] FCA 1100

ORDERS

AIA AUSTRALIA LIMITED (ABN 79 004 837 861) Applicant | ||

AND: | Respondent | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. Judgment be entered in favour of the applicant including pre-judgment interest up to 20 September 2017 in the sum of $69,722.71.

THE COURT DECLARES THAT:

2. On 19 October 2016, the applicant validly refused to pay claims made by the respondent pursuant to s 56(1) of the Insurance Contracts Act 1984 (Cth).

3. The contract of insurance between the applicant and the respondent was validly cancelled by the applicant on 19 October 2016.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ALLSOP CJ:

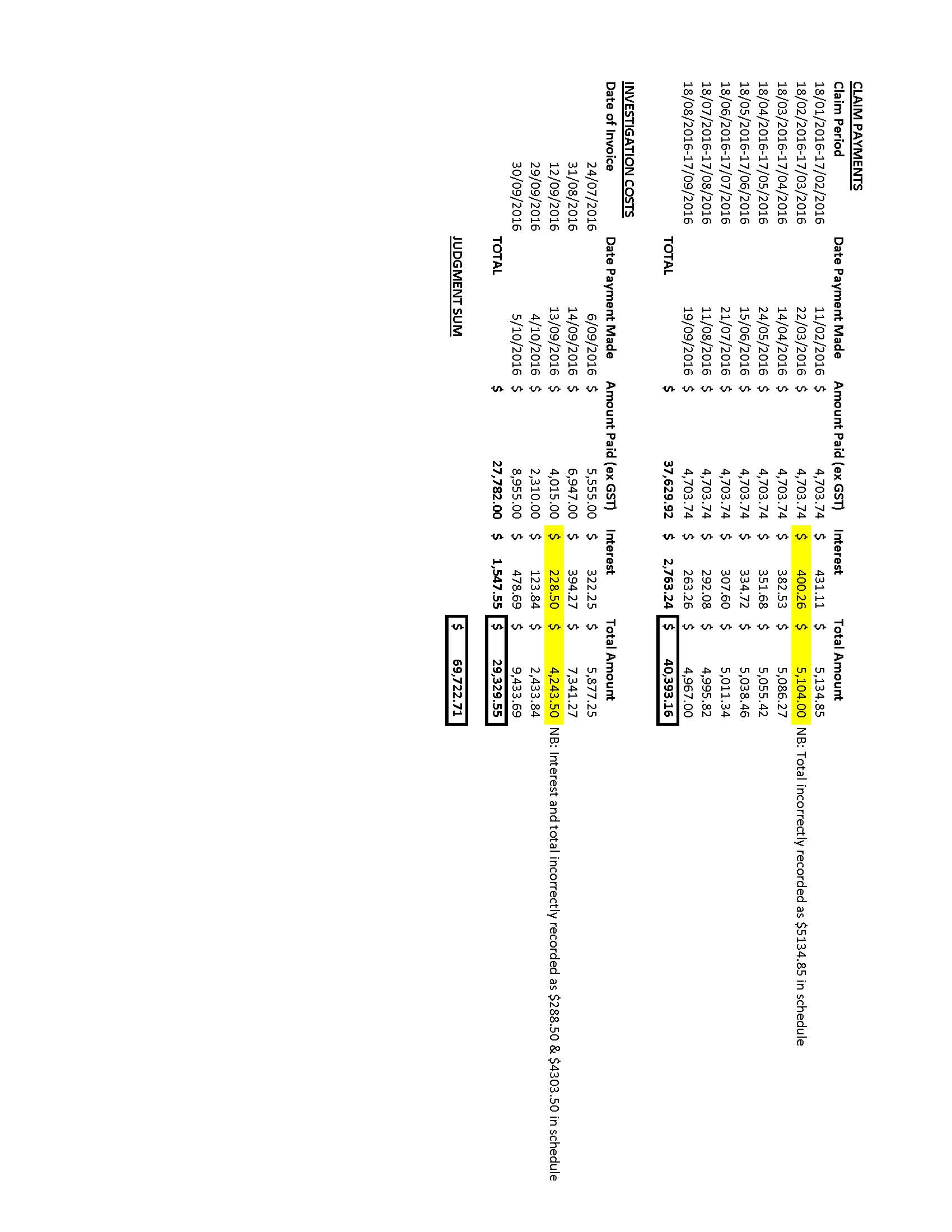

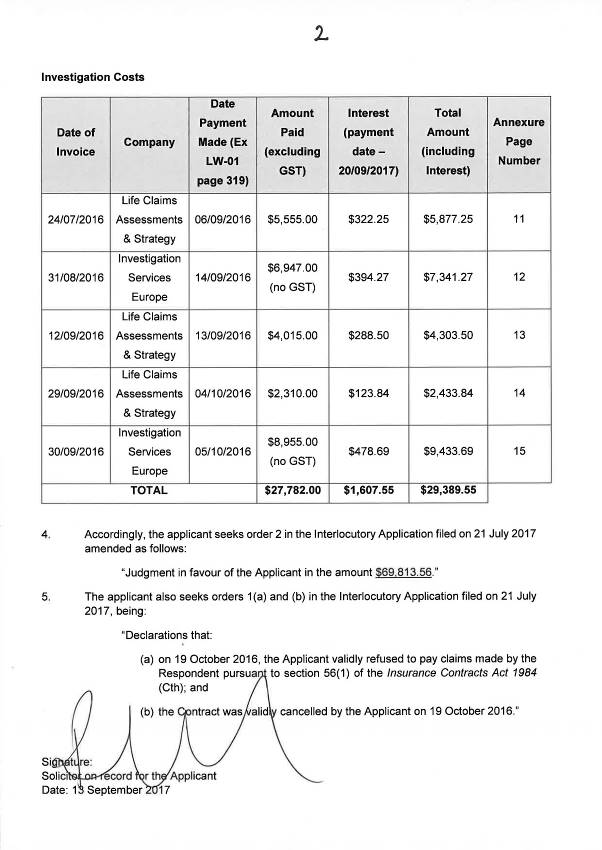

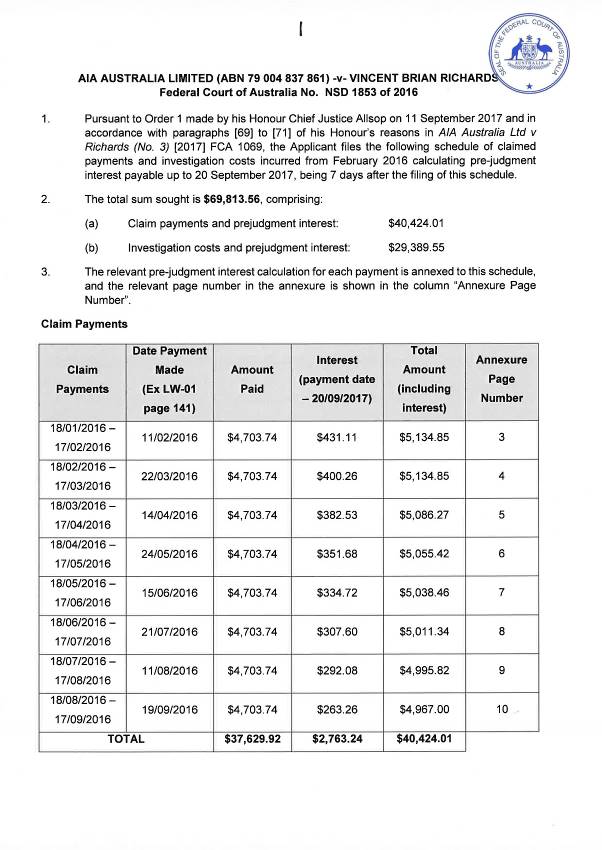

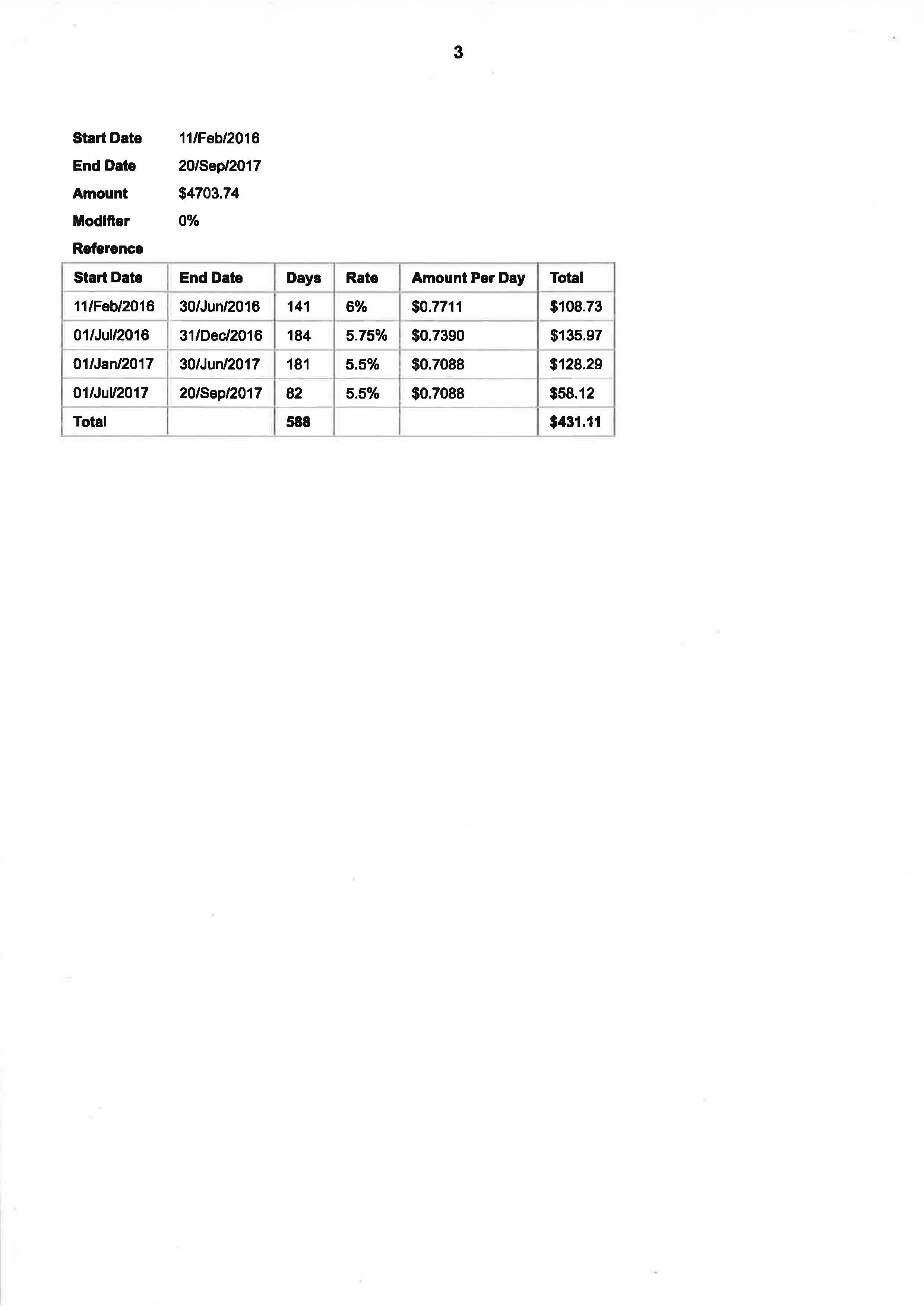

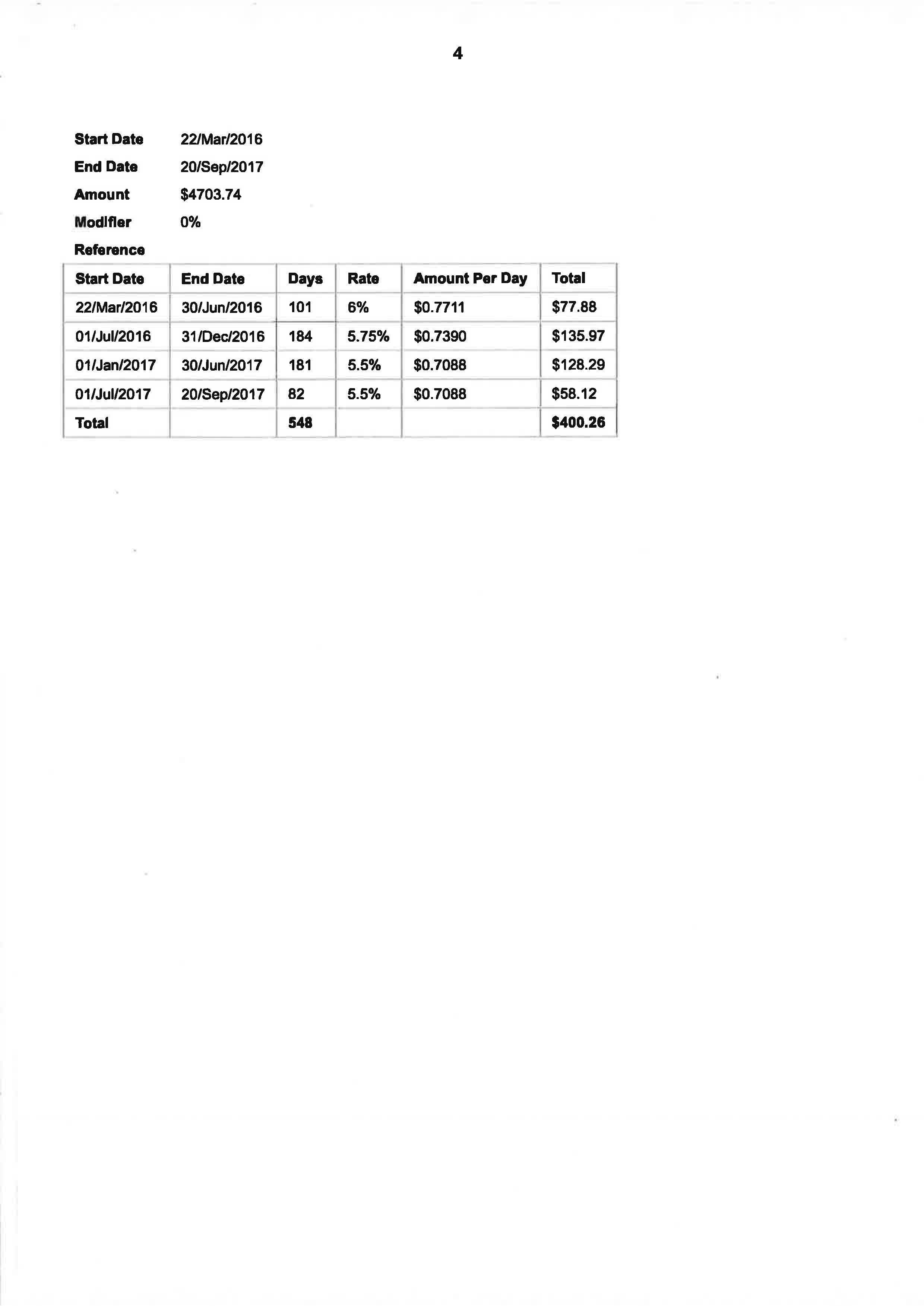

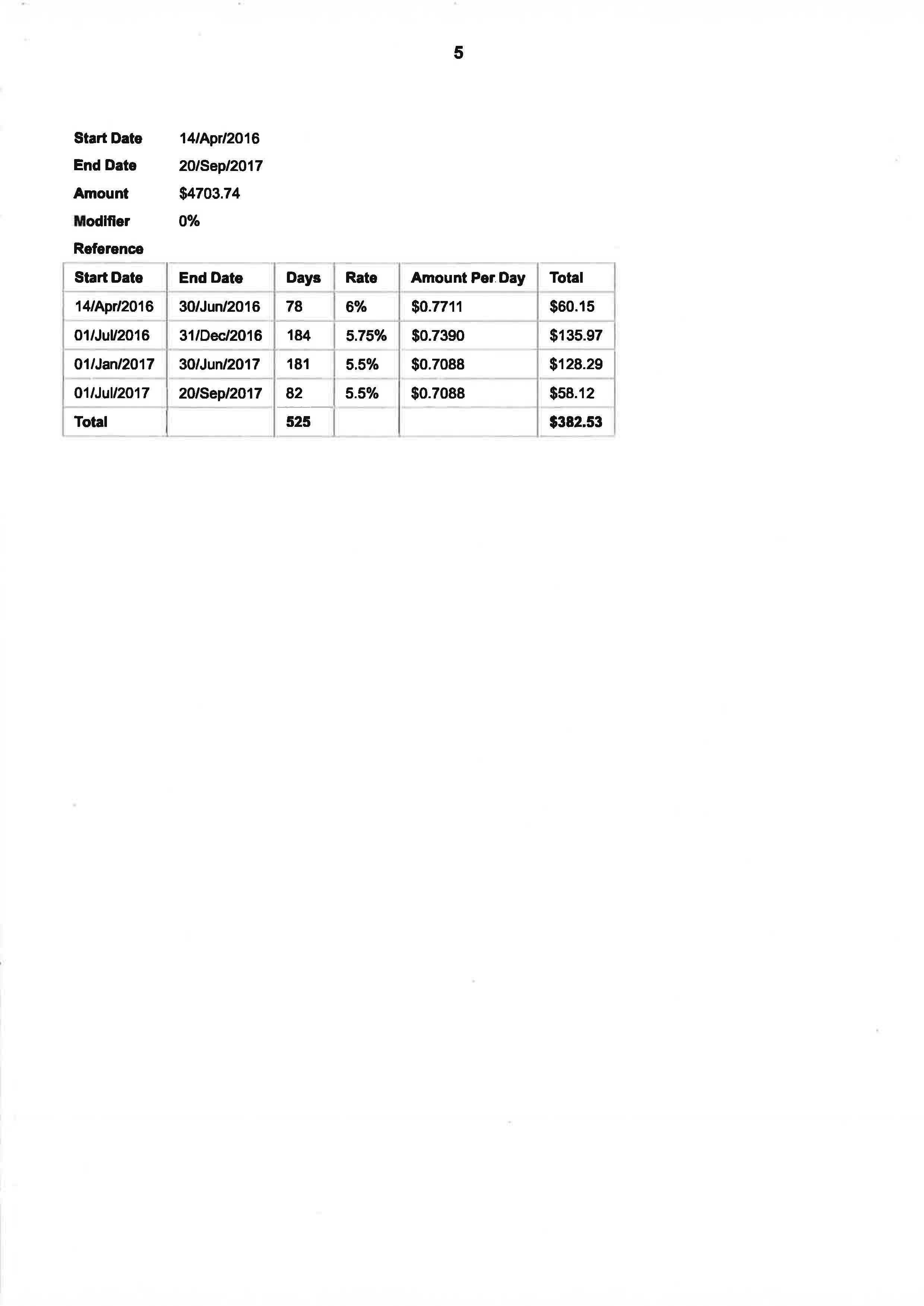

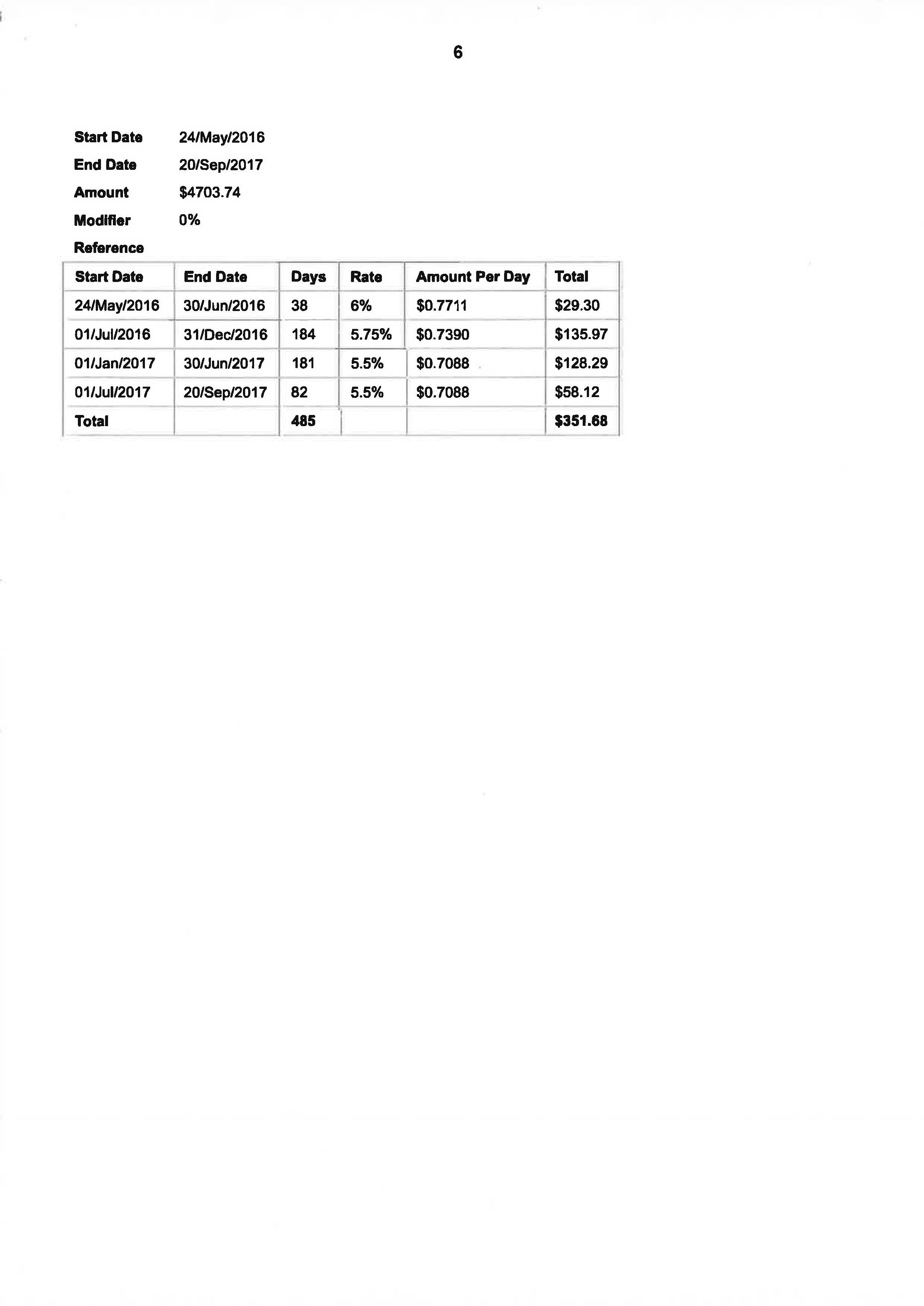

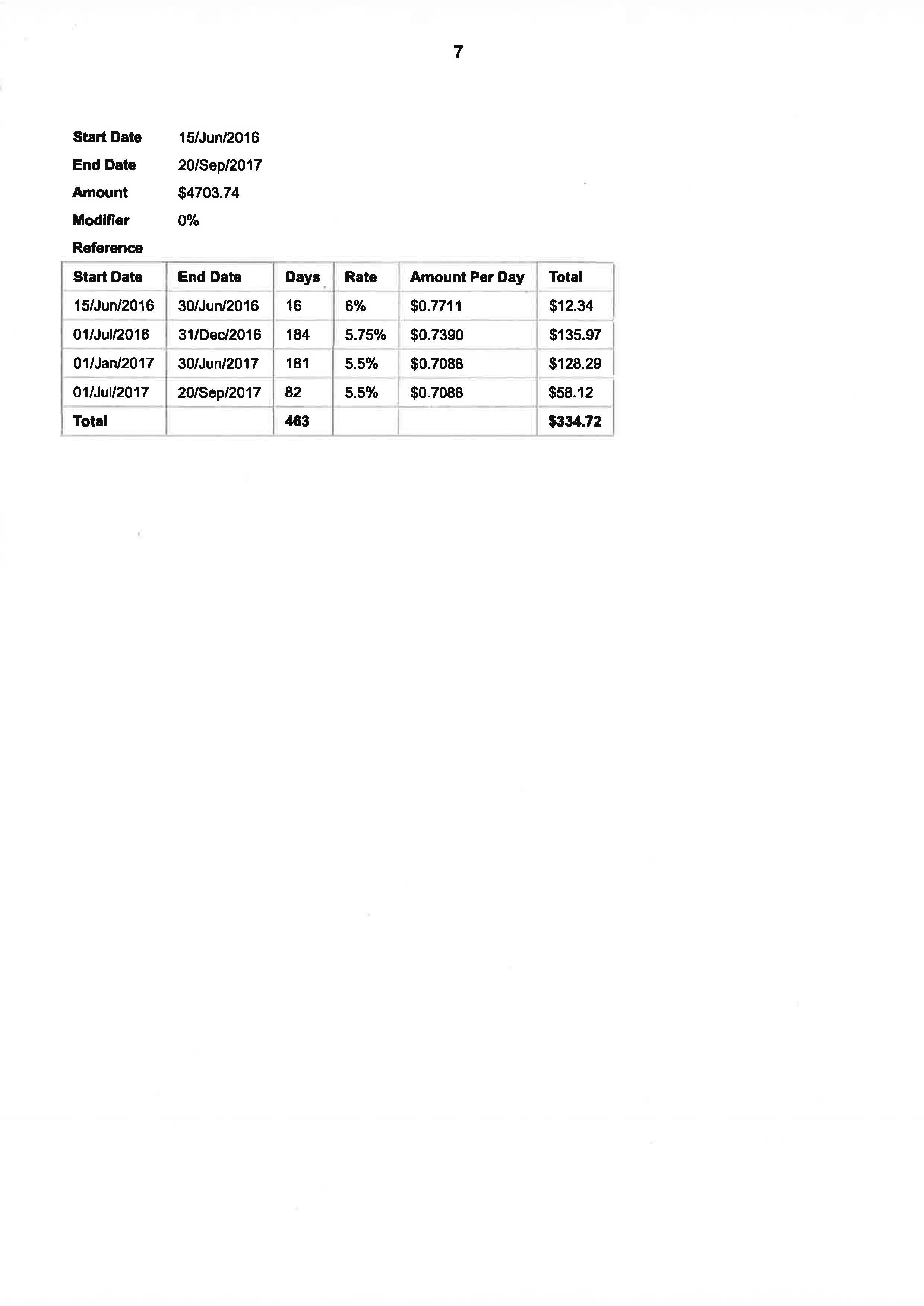

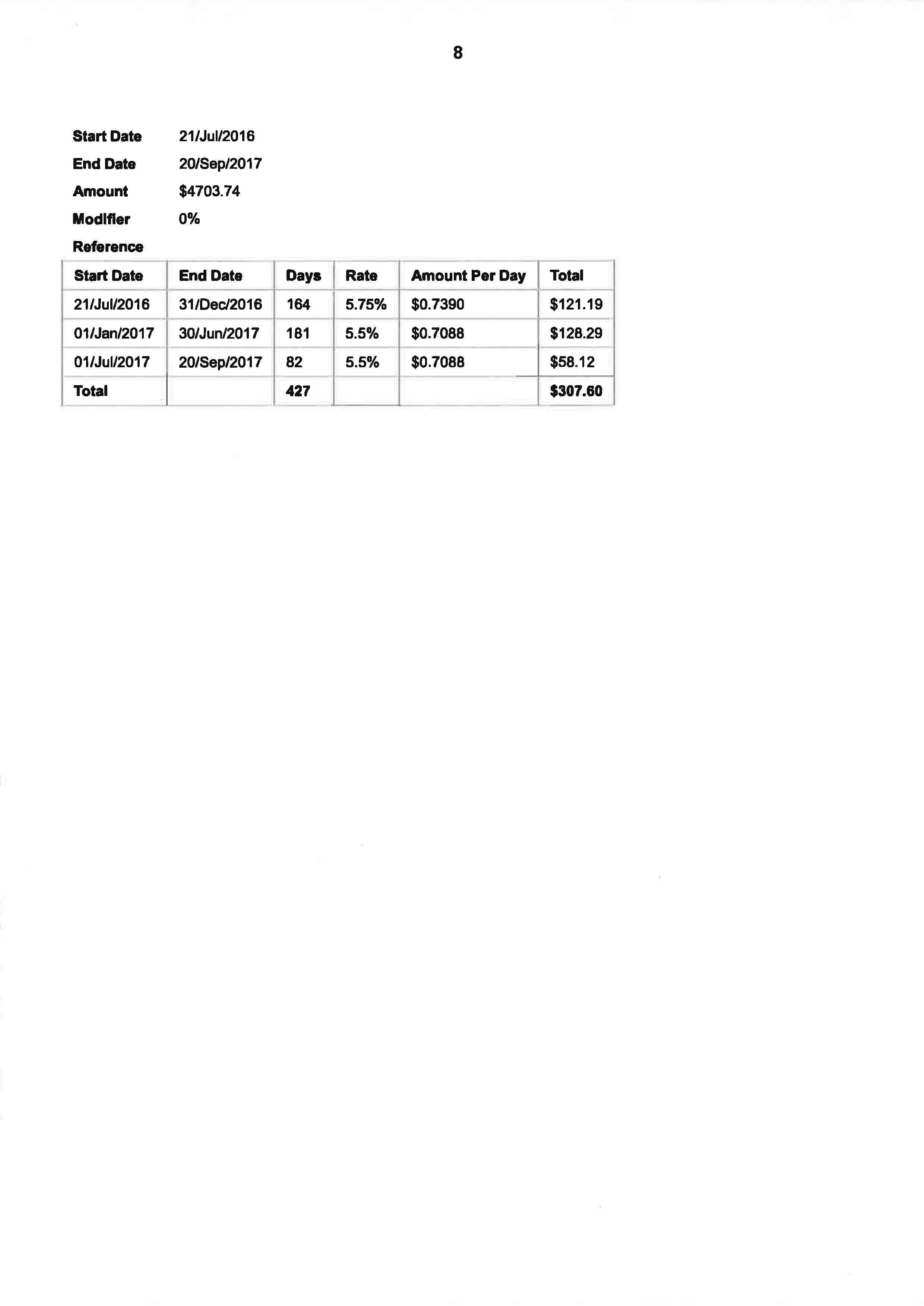

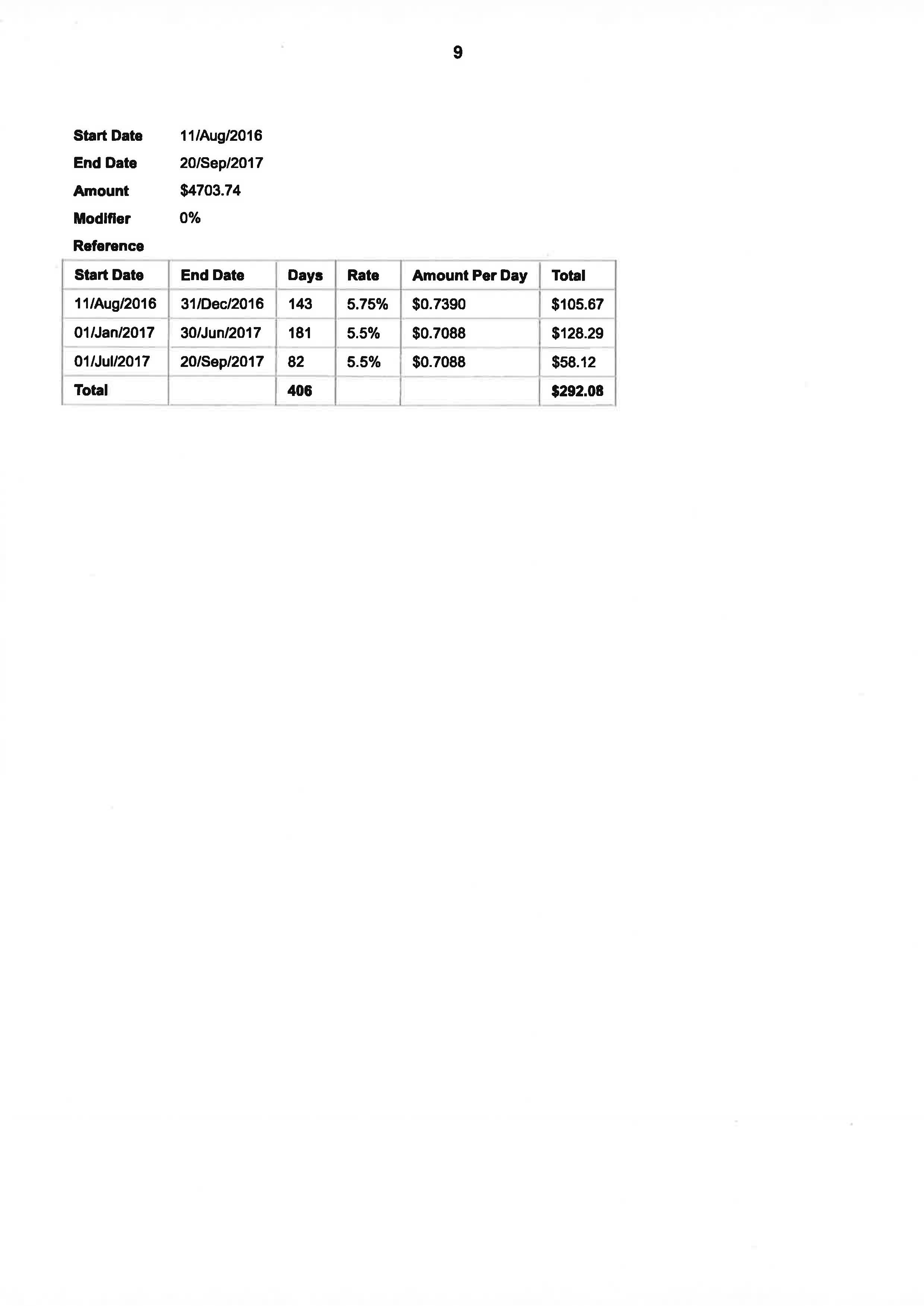

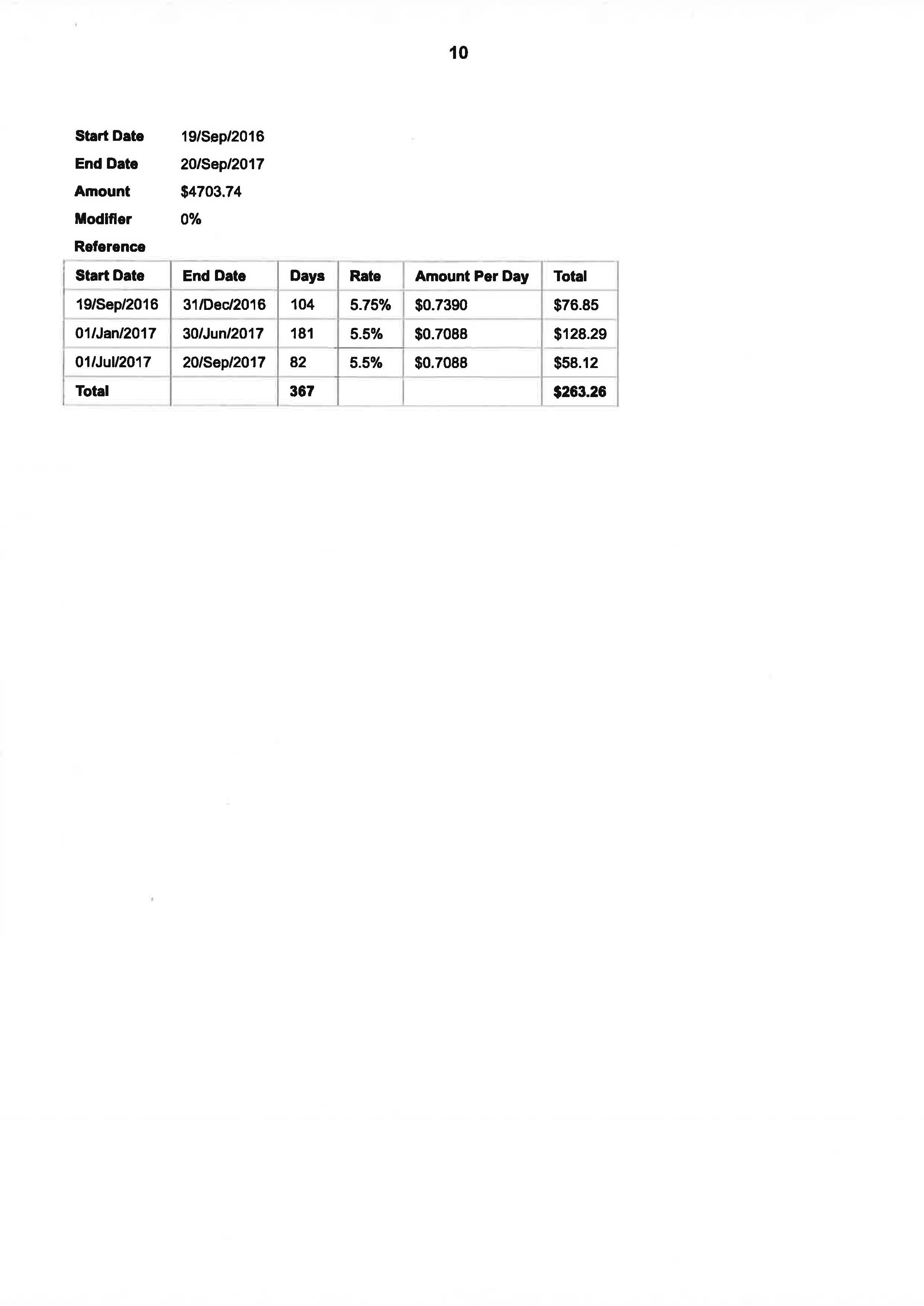

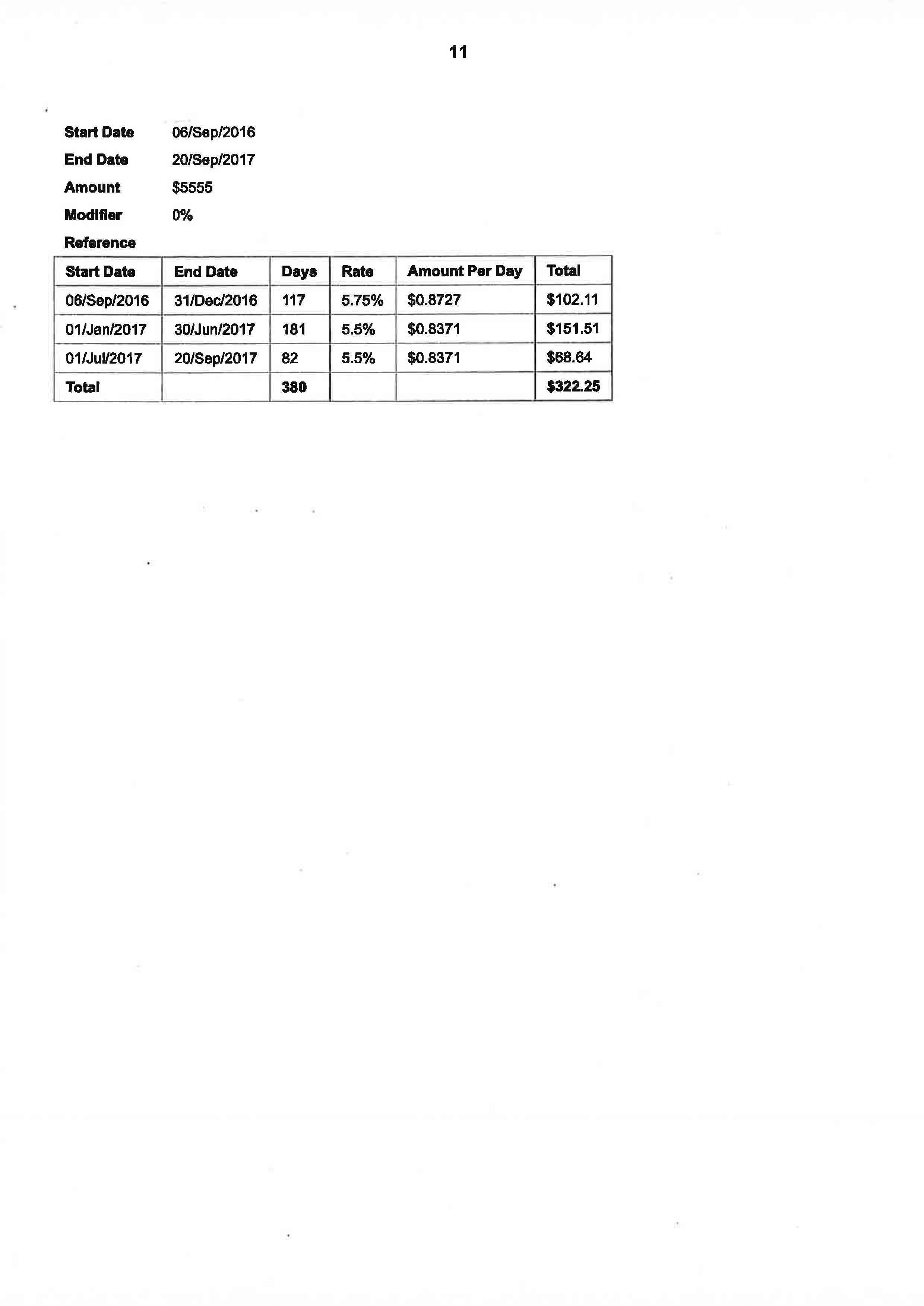

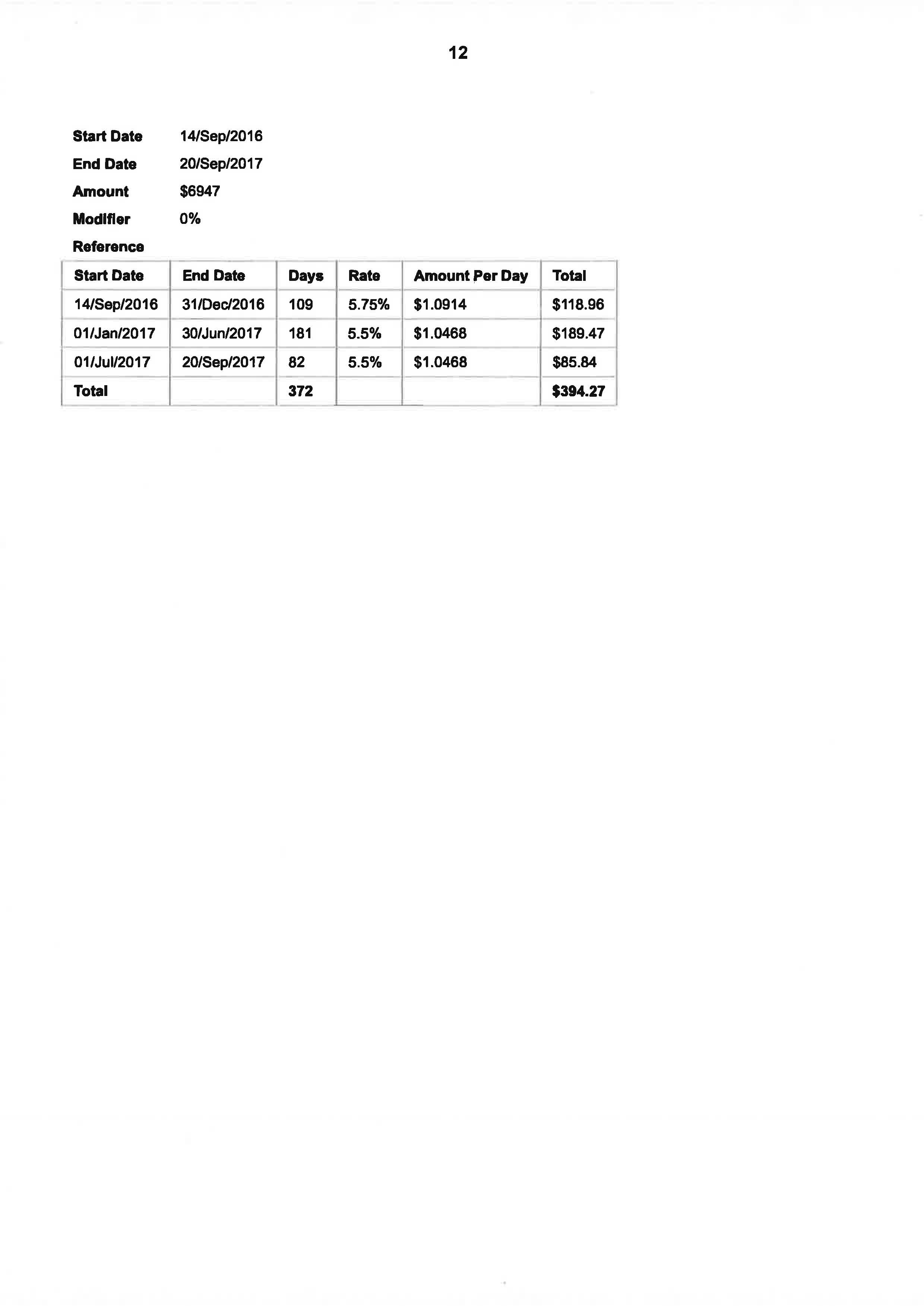

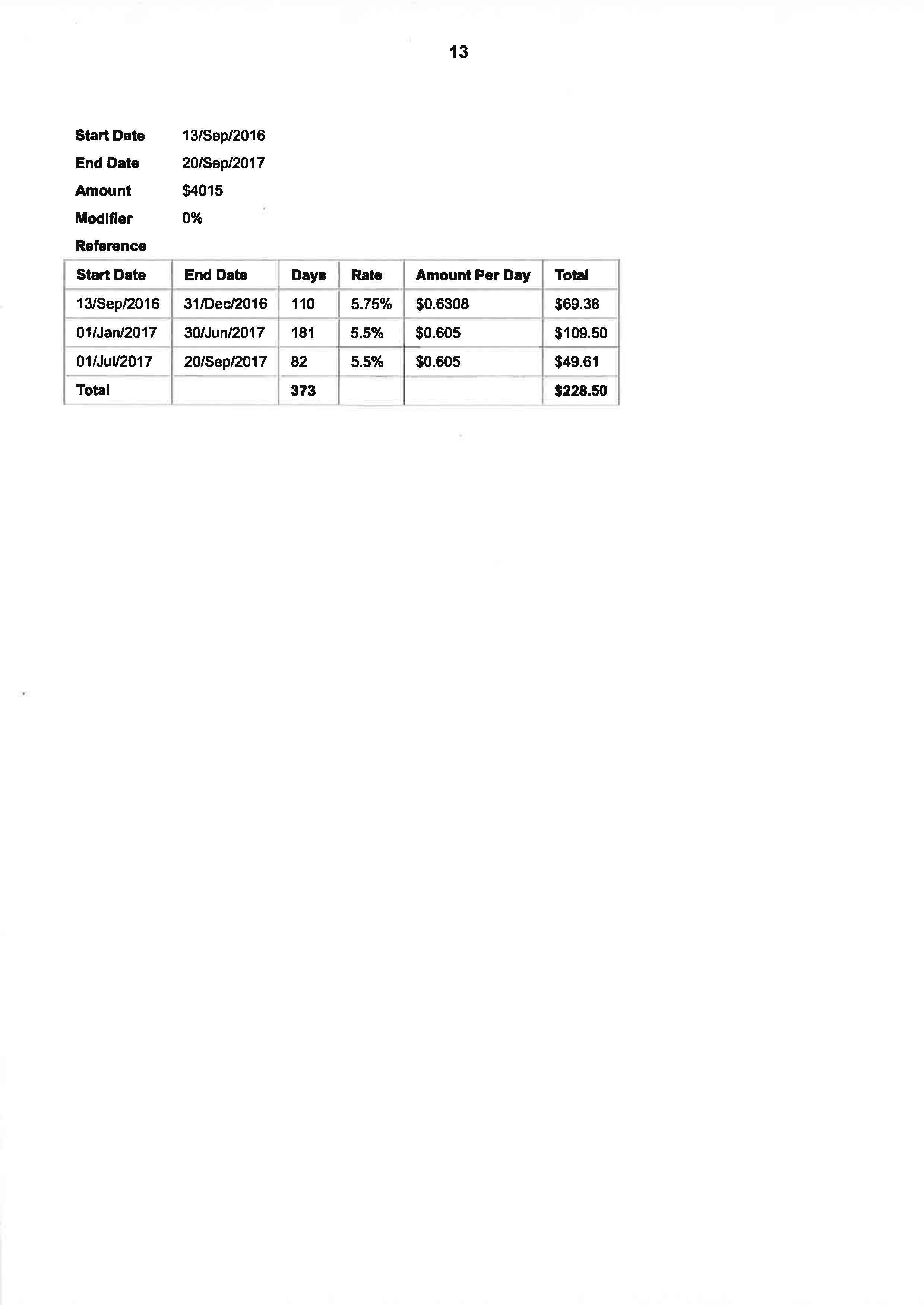

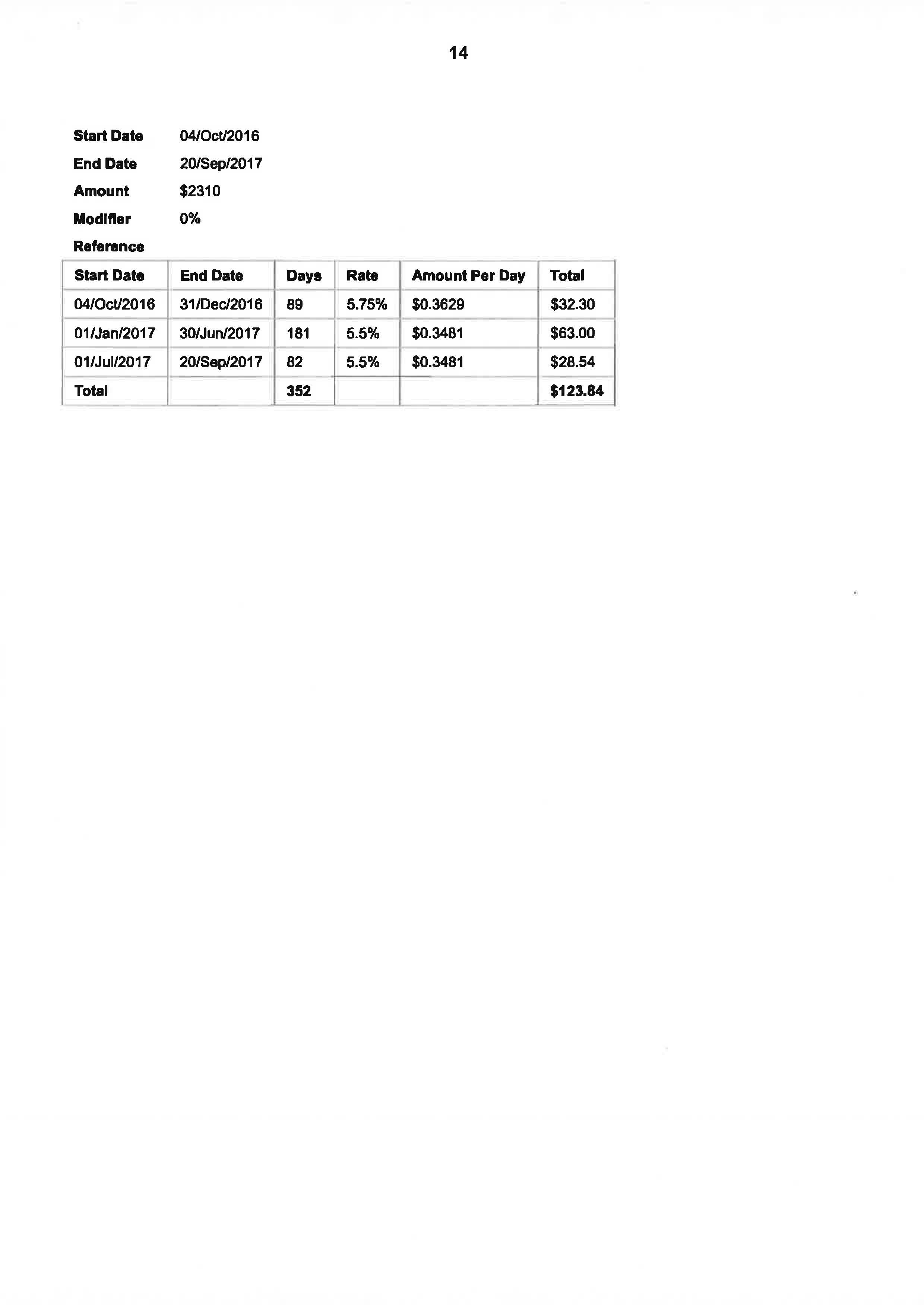

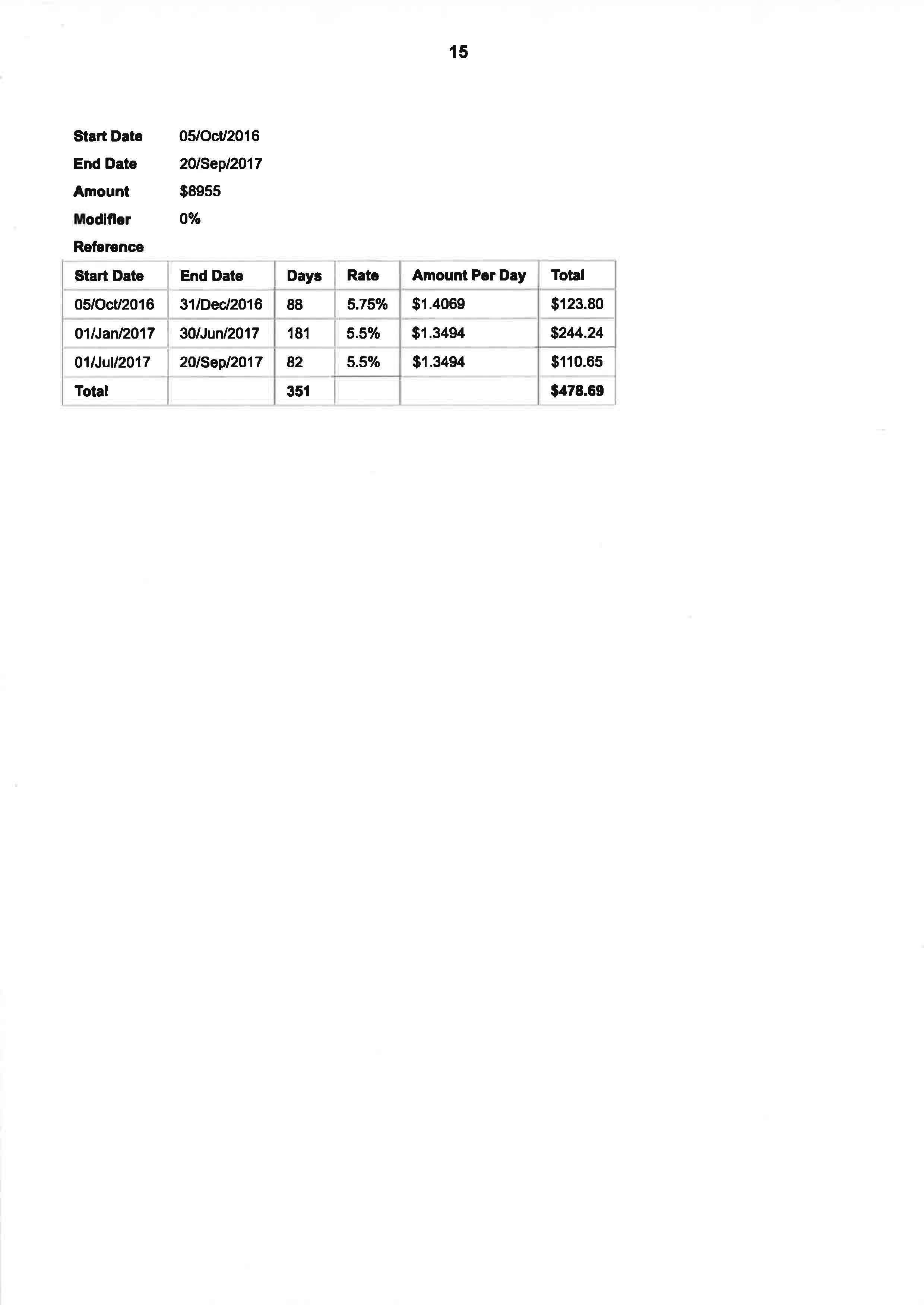

1 On 11 September 2017, I made orders in relation to this matter and published reasons: see AIA Australia Ltd v Richards (No 3) [2017] FCA 1069. I directed that the applicant file a schedule of sums paid after February 2016, together with pre-judgment interest thereof. I attach the schedule which was filed on 13 September 2017. I have checked that schedule and there is an inaccuracy. The judgment sum should be $90.85 less than the sum indicated of $69,813.56. Therefore, the orders that I make will include an order for judgment in the sum of $69,722.71.

2 In accordance with my reasons in Richards (No 3), the applicant is also entitled to the declarations sought in prayers 1(a) and (b) of the interlocutory application filed 21 July 2017.

3 I have already made an order for costs.

4 Therefore, the orders I would make, in addition to the orders made on 11 September 2017 are as follows:

1. Judgment be entered in favour of the applicant including pre-judgment interest up to 20 September 2017 in the sum of $69,722.71.

2. Declare that:

(a) on 19 October 2016, the applicant validly refused to pay claims made by the respondent pursuant to s 56(1) of the Insurance Contracts Act 1984 (Cth); and

(b) the contract of insurance between the applicant and the respondent was validly cancelled by the applicant on 19 October 2016.

I certify that the preceding four (4) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Chief Justice Allsop. |

Associate:

ANNEXURE A – SCHEDULE OF CLAIMED PAYMENTS AND INVESTIGATION COSTS

ANNEXURE B – CORRECTED SCHEDULE OF CLAIMED PAYMENTS AND INVESTIGATION COSTS