FEDERAL COURT OF AUSTRALIA

Australian Competition and Consumer Commission v We Buy Houses Pty Ltd [2017] FCA 915

ORDERS

AUSTRALIAN COMPETITION AND CONSUMER COMMISSION First Applicant SCOTT GREGSON Second Applicant | ||

AND: | WE BUY HOUSES PTY LIMITED (ACN 094 068 023) First Respondent RICHARD KEITH OTTON Second Respondent | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. Leave to file the third further amended statement of claim dated 5 September 2016 is refused.

2. The applicants file and serve draft orders contended for to give effect to these reasons on or before 18 August 2017.

3. Proceedings be set down for the making of orders to give effect to these reasons on a date to be fixed in consultation with the Associate to Gleeson J.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

INDEX

GLEESON J:

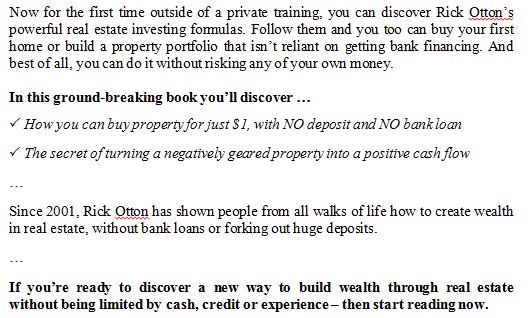

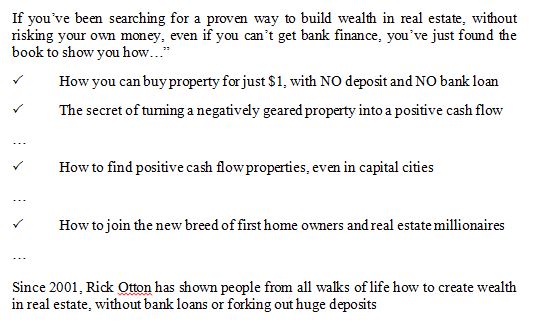

1 The applicants (“ACCC”) seek relief against the respondents for alleged contraventions of the Australian Consumer Law, being Schedule 2 to the Competition and Consumer Act 2010 (Cth) (“Act”), in connection with their promotion of a “wealth creation system” which purported to enable consumers to “buy a house for $1”.

2 The first respondent (“Mr Otton”) is the sole director and sole shareholder of the second respondent (“WBH”). He is the author of a book entitled “How to Buy a House for $1” (“book”), published and distributed in Australia by WBH from at least sometime in 2012. Mr Otton provided his services, his image and identity, and his knowledge and strategies in relation to property investment, to WBH. Mr Otton was involved in WBH by making or participating in the making of decisions that affected the whole, or a substantial part, of the business of WBH. As WBH’s sole director, Mr Otton had ultimate responsibility for WBH’s activities.

3 WBH carried on business in Australia conducting seminars, courses, boot camps, mentoring programs and supplying training materials to consumers (including the book). From at least 1 July 2009 to the present, each of WBH and Mr Otton promoted WBH’s business and sold goods and services to consumers and potential consumers, consisting of materials and information, seminars, boot camps and mentoring programs regarding the use of certain techniques regarding property investment.

4 WBH and Mr Otton established and operated websites with the URLs www.howtobuyahouseforadollar.com, www.rickotton.com and www.readysetboom.com.au (“websites”) from at least 1 January 2011. The activities of WBH were promoted on the websites.

5 The respondents denied that they promoted a wealth creation system. They said that their activities were to explain ideas whereby persons could invest in real estate. The respondents observed that there was no evidence before the Court of a single consumer complaint about their activities. They said that the statements relied upon by the ACCC invited the consumer to speculate on what might be possible, rather than promising a guaranteed outcome.

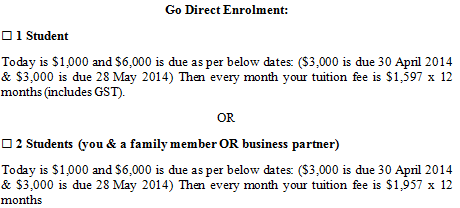

6 The ACCC sought to place a far more sinister complexion upon the respondents’ activities. It said that the respondents made false or misleading representations, particularly in the book, on the websites and at free seminars to promote boot camps from which WBH earned substantial income. Attendance at the boot camps cost approximately $6,000 for two tickets. The boot camps, the ACCC alleges, were used in turn to promote an “advanced training” and “mentoring” program. Varying evidence was given of the price for the program, but it included around $26,000 for one ticket and $30,000 for two tickets. The “mentoring” program was named “Go Direct” and is described below. The ACCC also submitted that, despite promoting WBH’s business by reference to Mr Otton’s own success as a “self made millionaire and property investor”, the respondents themselves did not deal in property; rather they were in the business of selling a business model that promised an easy to use system for property investment that included tips on who to target (both vendors and purchasers that fit a certain demographic), and that would produce immediate results.

7 The respondents conducted free seminars and boot camps throughout Australia between 1 January 2011 and 13 June 2014. During that period, approximately 3,400 consumers have attended free seminars and approximately 2,000 consumers paid to attend boot camps conducted by the respondents. Approximately 700 consumers participated in the Go Direct mentoring program. WBH generated a substantial income from conducting boot camps and the advanced training and mentoring programs, and from the sale of training materials. It admitted to a turnover of over $20 million during the period from 1 January 2011 to 17 June 2014.

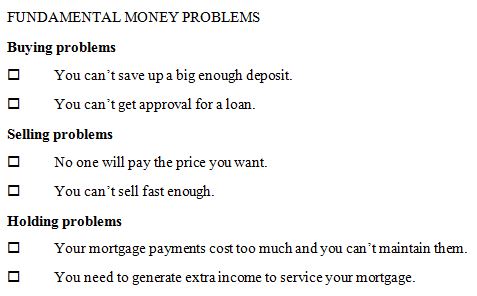

System and strategies representations

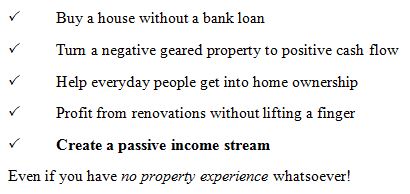

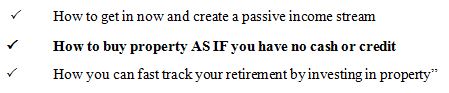

8 The ACCC allege that in the course of advertising and conducting the seminars and boot camps, and in the training materials and on various websites, the respondents made representations that, by following or implementing techniques promoted by the respondents (and described in detail below), consumers were able to:

(1) buy a house for $1;

(2) buy a house without needing a deposit, bank loan or real estate experience;

(3) buy a house using little or none of the consumer’s own money, including by buying at a discount;

(4) create passive income streams through property and/or quit their jobs, including by “[turning] negative gearing into positive cash flow”;

(5) build property portfolios without their own money invested and, without new bank loans or without real estate experience;

(6) start making profits immediately; and

(7) create or generate wealth.

9 In its second further amended statement of claim (“statement of claim”), the ACCC referred to these representations as the “System and Strategies Representations”.

10 The statement of claim pleads that the respondents did not have reasonable grounds for making the System and Strategies Representations and relies on s 4 of the Australian Consumer Law, by which a representation as to a future matter is taken to be misleading if the maker of the representation does not have reasonable grounds for making the representation. In his oral opening, senior counsel for the ACCC, Mr White SC, submitted that the parties were in agreement that the System and Strategies Representations are representations as to future matters. That submission was not disputed by counsel for the respondents, Mr Bell, in his oral opening. However, in his closing submissions, Mr Bell observed that the ACCC’s case was directed to both the past and the future – in that, as Mr Bell characterised the ACCC’s case, it was contending that the respondents’ strategies have not worked in the past and will not work in the future.

11 The ACCC also contended that the respondents engaged in misleading or deceptive conduct by failing to disclose to consumers and potential consumers, or warn consumers and potential consumers, that the techniques taught by the respondents were unlikely to achieve the outcomes conveyed in the System and Strategies Representations.

12 By their defence, the respondents deny making the System and Strategies Representations. That defence was maintained in the face of ample written evidence, set out below, that the respondents repeatedly and emphatically said the very things that the ACCC alleged to comprise the System and Strategies Representations. The respondents put a case that their statements were taken out of context but did not satisfactorily explain how their words bore a different meaning once context was taken into account.

13 By their defence, the respondents also say that if consumers followed “certain ideas” that include techniques promoted by the respondents, “they may be able to achieve certain goals including creating or generating income and wealth”. The respondents did not put a positive case that, if made, the System and Strategies Representations were true. However, the defence does assert that Mr Otton himself had been successful financially in following the ideas and using the strategies. The defence also contends that, if the System and Strategies Representations were made, then they were puffery “in that they were invitations to attend free seminars and buy the book where the ideas [including techniques promoted by the respondents] would be explained in detail” and that the respondents “did have reasonable grounds in the context”.

Representations about Mr Otton’s success in real estate

14 The ACCC alleged that, during boot camps, the respondents made claims about Mr Otton’s financial success in implementing the system and using the techniques. The statements upon which the ACCC relied are contained in a transcript of a boot camp held in April 2014 at the Canterbury Hurlstone Park RSL Club (“2014 Hurlstone Park boot camp”), and are set out in appendix 5 to this judgment (items 16, 17 and 18).

15 By their defence, the respondents “admit” that Mr Otton himself “had been successful financially in following the ideas and using the strategies”. The defence also states that Mr Otton was “successful financially in using the ideas pleaded in paras 8.1 to 8.5 of the Further Amended Statement of Claim” by reason of his being the director of WBH. In support of this statement, the defence provides particulars of gross income allegedly earned from property by WBH over the years ended 30 June 2003 to 30 June 2013.

16 Those gross income figures were not borne out by the evidence.

(1) the following statements on the webpage http://www.howtobuyahouseforadollar.com/register/, used by the respondents to promote free seminars in 2013 (“2013 free seminars webpage”):

(a) next to a picture of Mr Otton: “Rick Otton Director of We Buy Houses Pty Ltd Self-Made Millionaire & Property Investor”;

(b) “In the last 22 years I’ve purchased over 300 properties in Australia and the USA – using little or none of my own money”;

(c) “… I’ll share with you the same strategies I use to buy properties for $1 and create cash flow income – without ever stepping inside a bank or saving thousands for a deposit”;

(d) “Rick’s Story: How I became a real estate millionaire without money, finance or even a mobile phone to start with!”;

(e) “If you are open minded, then I’d love to show you the no-money-down strategies my students and I regularly use to buy property without a bank, a deposit or even paying stamp duty”;

(2) the following statements on the web page http://www.creativerealestate.com.au/readysetboom/, which was used by the respondents to promote free seminars in 2014 (“2014 free seminars webpage”):

(a) “About 20 years ago, I discovered a remarkable property investment system that allowed me to purchase 76 properties in 12 months without bank finance and in a FALLING MARKET... Since then my students and I have used this system to PROFIT throughout rising, falling and even BOOMING markets”; and

(3) the following statement on the webpage http://www.rickotton.com/about-us/:

(a) “Well I’m Rick Otton and I’ve bought a bunch of properties for $1 and I’d like to share with you why…”.

Testimonials supporting use of techniques

18 Testimonials are a significant feature of WBH’s various publications. The respondents sought to rely on the testimonials in their defence, noting that in the book there are six testimonials between pp 194-197 and 28 testimonials between pp 200-205. The respondents also noted that there are at least 22 testimonials on the www.howtobuyahouseforadollar.com website.

19 The ACCC alleged that the following publications contained representations purporting to be testimonials from consumers who had followed or implemented the techniques to achieve the outcome described by the System and Strategies Representations:

(1) advertisements about the free seminar, as set out in [336] below;

(2) the www.howtobuyahouseforadollar.com website; and

(3) the www.readysetboom.com.au website.

20 The testimonials relied upon by the ACCC and referred to above are identified at [330], [349], [350], [374] and [380] below. Each one contains a claim that the author bought a property for $1. There was no evidence from the persons who had purportedly given the testimonials to verify their claims.

21 The ACCC argued that a significant feature of the experiences of Mr Otton and the persons who purportedly gave the testimonials (as set out in the book, the various web pages set out above and the testimonials) was the ease with which the techniques could be used “(i) on any property, (ii) in any market and (iii) without the consumer having any real estate experience”.

22 The ACCC did not contend that the testimonials were fictitious. Its case was that the testimonials were false because it is not possible to buy a house for $1, and that the testimonials are deemed to be misleading under s 29(2) of the Australian Consumer Law (set out below) in the absence of evidence to the contrary.

23 The trial dealt with the ACCC’s case that the respondents had contravened the Australian Consumer Law, with questions of relief to be dealt with separately in the event that the Court found the alleged contraventions.

24 The principal findings for which ACCC contended are:

(1) WBH and Mr Otton made the System and Strategies Representations:

(a) in the book;

(b) at the free seminars (and in material promoting those events);

(c) at the boot camps (and in material promoting those events);

(d) in its training materials; and

(e) on the websites.

(2) Consumers using the system and strategies promoted and taught by WBH and Mr Otton could not achieve the outcomes represented, because the strategies require either:

(a) the purchase of a property using a consumer’s own money; a deposit and/or traditional bank finance; or

(b) the consumer to act as a “middleman” to facilitate property transactions between third party sellers and third party buyers.

(3) WBH and Mr Otton did not have reasonable grounds for making the System and Strategies Representations because:

(a) Mr Otton himself had not implemented the strategies in the manner that WBH and Mr Otton taught them; and

(b) WBH and Mr Otton called no evidence from anyone who had successfully implemented the strategies to achieve the outcomes represented.

(4) The System and Strategies Representations were false, misleading or deceptive or likely to mislead or deceive in that the strategies could not achieve the outcomes represented.

(5) WBH and Mr Otton failed to disclose to or warn consumers and potential consumers that the strategies were not easy to implement and work in limited circumstances only.

(6) The System and Strategies Representations were not puffery, having regard to the context which saw them repeated throughout the various forums and media in which they appeared.

(7) WBH and Mr Otton adduced no evidence that the testimonials were not false or misleading.

(8) Mr Otton had not been financially successful in implementing the strategies, and the representations to the effect that he was successful were false, misleading or deceptive or likely to mislead or deceive, because the vast majority of the properties he acquired were acquired using a deposit and mainstream bank finance.

25 The ACCC contended that, accordingly, the Court should conclude that the respondents contravened the Australian Consumer Law.

26 For the reasons that follow, I make, in substance, all of the principal findings for which the ACCC contended.

Leave sought to file third further amended statement of claim

27 The proceeding was commenced by an originating application dated 2 March 2015. On 8 August 2016, the ACCC filed a second further amended statement of claim. On the sixth day of the trial, Mr White SC handed up a third further amended statement of claim. The third further amended statement of claim seeks to include an allegation that the respondents made false representations about Mr Otton’s financial success in implementing the system and strategies promoted by the respondents on three webpages, set out at [17] above. Mr White SC noted that the second further amended statement of claim alleged that false representations were made about Mr Otton’s financial success at boot camps. Mr White SC submitted that there could not be any prejudice to the respondents arising from the proposed amendment.

28 The respondents opposed the filing of the amendment and noted that the representations relied upon extend beyond the representations pleaded in relation to boot camps and include representations concerning Mr Otton’s financial success in the Unites States of America.

29 There was no explanation given for why the ACCC had not pleaded the new allegations earlier. I am not satisfied that the respondents would not be prejudiced by the late introduction of the new allegations. Accordingly, I will not grant leave to file the third further amended statement of claim.

30 There was no dispute as to the applicable legal principles.

31 The originating application claims relief under the Australian Consumer Law or, in the alternative, the Australian Securities and Investments Commission Act 2001 (Cth) (“ASIC Act”).

32 The Australian Consumer Law regime applies to a supply, or possible supply, of “goods and services” and does not apply to “the supply, or possible supply, of services that are financial services, or of financial products”: s 131A(1) of the Act. The ASIC Act regime applies, relevantly, to “financial services”. The term “financial services” is defined in s 12BAB(1)(a) of the ASIC Act to mean, relevantly, “provide financial product advice”. A “credit facility” is a financial product for the purposes of the ASIC Act: s 12BAA(7)(k).

33 The ACCC submitted that the business of WBH, and Mr Otton’s involvement in it, related to the supply of services by the respondents, being the supply of “materials and information, seminars, boot camps and mentoring programs”. The ACCC submitted that the techniques, if implemented, might involve or contemplate the use of a credit facility and therefore a financial product within the meaning of the ASIC Act. However, the ACCC argued, the alleged representations do not relate to a credit facility, or any other financial product but, rather, to the outcomes the respondents said could be achieved by implementing the techniques.

34 Accordingly, the applicants submitted, the correct statutory regime against which to assess its case is the Australian Consumer Law.

35 The respondents did not argue against this analysis.

36 I accept the ACCC’s submission and have proceeded upon the basis that the relevant statutory regime is the Australian Consumer Law.

Relevant provisions of the Australian Consumer Law

37 The ACCC alleges that the pleaded representations variously contravened the following provisions of the Australian Consumer Law:

(1) section 18;

(2) sub-sections 29(1)(e), (f) and (g);

(3) section 34; and

(4) section 37.

38 Section 18(1) provides that a person must not, in trade or commerce, engage in conduct that is misleading or deceptive or is likely to mislead or deceive.

39 Section 29(1) provides, relevantly, that a person must not, in trade or commerce, in connection with the supply or possible supply of goods or services or in connection with the promotion by any means of the supply or use of goods or services:

(e) make a false or misleading representation that purports to be a testimonial by any person relating to goods or services; or

(f) make a false or misleading representation concerning:

(i) a testimonial by any person; or

(ii) a representation that purports to be such a testimonial;

relating to goods or services; or

(g) make a false or misleading representation that goods or services have sponsorship, approval, performance characteristics, accessories, uses or benefits; …

40 For s 29(1)(g), a performance characteristic, use or benefit in relation to services signifies something that the services can do or something that can be done with the services, or perhaps some consequence of having received the services: cf Australian Competition and Consumer Commission v Pest Free Australia [2004] FCA 527 at [15].

41 Section 29(2) provides:

For the purposes of applying subsection (1) in relation to a proceeding concerning a representation of a kind referred to in subsection (1)(e) or (f), the representation is taken to be misleading unless evidence is adduced to the contrary.

42 Section 34 provides that a person must not, in trade or commerce, engage in conduct that is liable to mislead the public as to the nature, the characteristics, the suitability for their purpose or the quantity of any services.

43 Section 37(1) provides that a person must not, in trade or commerce, make a representation that:

(a) is false or misleading in a material particular; and

(b) concerns the profitability, risk or any other material aspect of any business activity that the person has represented as one that can be, or can be to a considerable extent, carried on at or from a person's place of residence.

44 The allegations made against the respondents are serious and must be proved on the balance of probabilities, taking into account the nature of the cause of action, the nature of the subject matter of the proceeding and the gravity of the matters alleged: s 140 Evidence Act 1995 (Cth): cf. Australian Competition and Consumer Commission v Dateline Imports Pty Ltd [2014] FCA 791; (2014) 143 ALD 136 at [14]-[15] (“ACCC v Dateline Imports”); Australian Competition and Consumer Commission v Flight Centre Ltd (No 2) [2013] FCA 1313; (2013) 307 ALR 209 at [8] per Logan J; Australian Securities and Investments Commission v Australian Property Custodian Holdings Limited (Recs and Mgrs apptd) (in liq) (Controllers apptd) (No 3) [2013] FCA 1342 at [33]- [36] per Murphy J.

Representations as to future matters

45 Section 4 of the Australian Consumer Law facilitates proof in false, misleading or deceptive representation cases involving representations as to future matters. It has its origins in the former Trade Practices Act 1974 (Cth), s 51A.

46 Section 4 provides that in the case of a representation with respect to a future matter, unless evidence is adduced to the contrary, the person making the representation is taken not to have had reasonable grounds for making it, with the result that the representation will be taken to be misleading. Additionally, the person will not be taken to have reasonable grounds merely because such evidence is adduced. The fact that a person may believe in a particular state of affairs does not necessarily mean that there are reasonable grounds for that belief: Cummings v Lewis (1993) 41 FCR 559 at 565 per Sheppard and Neaves JJ.

47 Section 29(2) provides, for the purposes of applying s 29(1), in relation to a proceeding concerning a representation of a kind referred to in s 29(1)(e) or (f), the representation is taken to be misleading unless evidence is adduced to the contrary.

48 Section 29(3) provides:

(3) To avoid doubt, subsection (2) does not:

(a) have the effect that, merely because such evidence to the contrary is adduced, the representation is not misleading; or

(b) have the effect of placing on any person an onus of proving that the representation is not misleading.

49 The ACCC submitted that I should be guided in my review of the evidence by the comments of Lindgren J in Gillette Australia Pty Ltd v Energizer Australia Pty Ltd [2002] FCAFC 223; (2002) 193 ALR 629 at [47]:

I have carefully viewed the Modified Advertisement several times and tried to assess its likely effect on viewers. But, as I observed in the earlier Eveready case (at [38]), apart from the difference between a one-off viewing and repeated viewings, the circumstances in which a judge attends to a television commercial for the purposes of a case are not those in which members of the public do so. First, members of the public watch a commercial after and before viewing other things, rather than in isolation. Secondly, unlike the judge, they do not carefully view the commercial with a special interest in noting and memorising its features. Thirdly, they view the commercial, not in the calm of chambers, but against a background of distractions, such as domestic activity, or simply a preoccupation with other more interesting or pressing concerns. Fourthly, usually they do not know in advance that the commercial is about to commence.

50 A representation is a statement, made orally or in writing or by implication from words or conduct, relating to a matter of fact: Given v Pryor (1979) 24 ALR 442 at 446.

51 Whether representations are false, misleading or deceptive or likely to mislead or deceive requires the application of well-settled principles to the circumstances of the case: Specsavers Pty Ltd v Luxottica Retail Australia Pty Ltd [2013] FCA 648 at [49] (“Specsavers”).

52 The principles relevant, in the circumstances of these proceedings, can be summarised as follows.

53 There are two matters to be decided: firstly, whether the pleaded representation is conveyed by the particular events complained of, and if so, whether the representation conveyed is false, misleading or deceptive or likely to mislead or deceive: Australian Competition and Consumer Commission v Telstra Corporation Ltd [2007] FCA 1904; (2007) 244 ALR 470 (“ACCC v Telstra”) at [14]-[15]. In that case, Gordon J said at [14]-19]:

[14] The relevant legal principles have been well traversed by Australian courts. A two-step analysis is required. First, it is necessary to ask whether each or any of the pleaded representations is conveyed by the particular events complained of: Campomar Sociedad, Limitada v Nike International Ltd (2000) 202 CLR 45 at [105]; National Exchange Pty Ltd v Australian Securities and Investments Commission [2004] ATPR 42-000 at [18] per Dowsett J (with whom Jacobson and Bennett JJ agreed) and Astrazeneca Pty Ltd v GlaxoSmithKline Australia Pty Ltd [2006] ATPR 42-106 at [37]. That is, do the 12 Events singularly or collectively convey either of the Coverage Representations and do the 3 Events singularly or collectively convey the CDMA Comparison Representation.

[15] Second, it is necessary to ask whether the representations conveyed are false, misleading or deceptive or likely to mislead or deceive. This is a “quintessential question of fact”: Australian Competition and Consumer Commission v Telstra (2004) 208 ALR 459; [2004] FCA 987 at [49].

[16] Because the conduct complained of in the present matter was not directed at a specific individual both questions that have been identified must be considered by reference to the class or classes of consumers likely to be affected by the conduct: Parkdale Custom Built Furniture Pty Ltd v Puxu Pty Ltd (1982) 149 CLR 191 at 199 per Gibbs CJ; Nike at [102], [103], [105] and [106]; Butcher v Lachlan Elder Realty Pty Ltd (2004) 218 CLR 592 at [36] per Gleeson CJ, Hayne and Heydon JJ.

[17] In .au Domain Administration Ltd v Domain Names Australia Pty Ltd (2004) 207 ALR 521; 61 IPR 81; [2004] FCA 424 at [12]–[26] Finkelstein J provided a useful summary of the approach that might be taken where a court is required to assess conduct by reference to a specific class or classes of consumers, and did that by particular reference to Taco Co of Australia Inc v Taco Bell Pty Ltd (1982) 42 ALR 177 at 202–3 per Deane and Fitzgerald JJ and Nike at [100]–[103]. The approach may be summarised in six points, as follows:

(1) first, identify the relevant section or sections of the public by reference to which the issue is to be tested. The target section or sections of the public would, of course, vary according to the facts of each case: Parkdale at CLR 209; ALR 14–15; IPR 695–6 per Mason J; Finucane v New South Wales Egg Corp (1988) 80 ALR 486 at 516. The relevant section or sections of the public may be confined by factors such as the time period over which the alleged representations were made and the geographical circulation of the advertisements containing the alleged representations (for an example of geographical circulation defining the relevant test section, see Talmax Pty Ltd v Telstra Corp Ltd [1997] 2 Qd R 444 at 446; (1996) 36 IPR 46 at 47);

(2) second, having identified the relevant section or sections of the public, consider who comes within that section or those sections. This may include the astute and the gullible, the intelligent and the not so intelligent, the well educated and the poorly educated: see also Parkdale at CLR 199; ALR 6; IPR 688–9 per Gibbs CJ;

(3) third, it is permissible, but not essential, to have regard to evidence that some person has in fact been misled, though this evidence will not be conclusive;

(4) fourth, it is necessary to enquire whether any proven misconception has arisen because of the misleading or deceptive conduct;

(5) fifth, where the persons alleged to have been misled are members of a class, it is necessary to isolate a representative member of the class and enquire whether that hypothetical person is likely to be deceived; and

(6) sixth, when considering the likely effect of the misrepresentation on this hypothetical person, he or she should be judged as an “ordinary” or “reasonable” member of the class, excluding reactions to the representation that are “extreme” or “fanciful”.

….

[19] As noted, under the two-step analysis that has been described, the court cannot consider each event in isolation. Each event must be considered within the context of the advertising campaign of which it formed part: see Telstra Corporation Ltd v Optus Communications Pty Ltd (1996) 36 IPR 515 at 523–524; Trade Practices Commission v Optus Communications Pty Ltd (1996) 64 FCR 326 at 338; Astrazeneca at [24]; Johnson & Johnson Pacific Pty Ltd v Unilever Australia Ltd (No 2) [2007] ATPR 42-136 at [16]. In a national advertising campaign it would ordinarily be expected that there would be a dominant message and, in such a case, particular attention should be paid to that dominant message. In Telstra Corporation at 524, that principle was stated as follows:

In television and print advertising where a false dominant impression is conveyed, its message will not be ameliorated by the accuracy of the detailed message which is derived from a careful analysis of all the constituent parts of the advertisement.

54 Whether a representation is made must be considered in context: Hadgkiss v CFMEU [2008] FCAFC 22; (2008) 166 FCR 374 at [27]:

In determining whether a statement is false or misleading, it is necessary to consider the context within which the statement was made: Parkdale Custom Built Furniture Pty Ltd v Puxu Pty Ltd [1982] HCA 44; (1982) 149 CLR 191 at 199; Given v Pryor (1979) 24 ALR 442 at 446-447. In this case, as the appellant correctly recognised, the task of the primary judge was to make findings not only as to the particular words used by Mr Lane but also as to the implications to be drawn from those words.

55 In Specsavers, at [49], Griffith J said:

[W]hether or not conduct is misleading or deceptive is a question of fact to be determined objectively and upon the basis of the impugned conduct being viewed as a whole and in its full context (see Campbell v Backoffice Investments Pty Ltd [2009] HCA 25; (2009) 238 CLR 304 at [25] and [102] and Parkdale Custom Built Furniture Pty Ltd v Puxu Pty Ltd [1982] HCA 44; (1982) 149 CLR 191 at 199 per Gibbs CJ); …

56 A representation will be false, misleading or deceptive or likely to mislead or deceive if it if it has a tendency to lead into error, or if it induces or is capable of inducing error: Australian Competition and Consumer Commission v TPG Internet Pty Ltd [2013] HCA 54; (2013) 250 CLR 640 (“TPG”) at 651, [39]; Parkdale Custom Built Furniture Pty Ltd v Puxu Pty Ltd [1982] HCA 44; (1982) 149 CLR 191 at 198; Johnson Tiles Pty Ltd v Esso Australia Ltd [2000] FCA 1582; (2000) 104 FCR 564 at 589-590, [63].

57 Whether a representation is false, misleading or deceptive or likely to mislead or deceive is ‘quintessentially’ a question of fact, which should not be complicated or over-intellectualised: Australian Competition and Consumer Commission v Telstra Corporation Ltd [2004] FCA 987; (2004) 208 ALR 459 at [49] (Gyles J).

58 In ACCC v Dateline Imports at [30]-[32], Rangiah J said, concerning a proceeding for breach of s 52 of the Trade Practices Act:

[30] … The question is whether a not insignificant number of reasonable persons within the class have been misled or deceived or are likely to be misled or deceived by the conduct, whether in fact or by inference: Hansen Beverage Co v Bickfords (Aust) Pty Ltd [2008] FCAFC 181; (2008) 171 FCR 579 at [46] per Tamberlin J, at [66] per Siopis J; ConAgra Inc v McCain Foods (Aust) Pty Ltd [1992] FCA 159; (1992) 33 FCR 302 at 380-381; Bodum v DKSH Australia Pty Ltd [2011] FCAFC 98; (2011) 280 ALR 639 at [205].

[31] The question of what is the natural and ordinary meaning conveyed by a publication or conduct is to be ascertained by the Court applying an objective test of what ordinary or reasonable readers or consumers in the class would have understood as the meaning: Bodum v DKSH Australia Pty Ltd [2011] FCAFC 98; (2011) 280 ALR 639 at [203].

[32] It follows that where the alleged contravention of s 52 of the TPA involves the making of a representation to the public or a class of the public, it is necessary for the Court to consider what ordinary persons in the class to which the representation is made would understand by the representation, and whether a not insignificant number of such persons would have that understanding.

59 The ACCC submitted that the contextual approach requires consideration of any “hangover effect” caused by earlier representations: ACCC v Telstra (2007) 244 ALR 470 at [20].

Representations in advertising

60 Where representations are directed to members of the public at large, the representations must be judged by their effect on “ordinary” or “reasonable” members of the class: Australian Competition and Consumer Commission v Coles Supermarkets Australia Pty Ltd [2014] FCA 634; (2014) 317 ALR 73 (“Coles”) at [43], citing Campomar Sociedad Limitada v Nike International Ltd [2000] HCA 12; (2000) 202 CLR 45 at 86-87, [105]. The ordinary or reasonable person likely to be affected by advertising directed to the public at large or sections of the public may be intelligent or not, may be well educated or not, will not likely undertake “an intellectualised process of analysis … and will be likely affected by an intuitive sense of attraction rather than by any process of analytical or logical choice”: Coles at [43].

61 In assessing advertising material, the ‘dominant message’ of the material will be of crucial importance: Coles at [42], citing TPG at [45]. Where advertising material uses simple phrases and words evoking attractive notions, but without necessarily precise meaning, ambiguity or reasonably available different meanings may well arise. If one or more of the reasonably available different meanings is misleading, the conduct may well be misleading or deceptive, or false and misleading: Coles at [47].

62 As stated by Lee J in Australian Competition and Consumer Commission v Target Australia Pty Ltd [2001] FCA 1326; [2001] ATPR 41-840 at [15], “ ... it is often the case that the first impression will be the lasting impression”.

63 It is not necessary to prove the conduct in question has misled anyone. The question whether conduct is misleading or deceptive is to be assessed by reference to the reaction of the hypothetical representative member of the class to whom the representation is directed: .au Domain Administration Ltd v Domain Name Australia Pty Ltd (2004) 207 ALR 521 at [25] and [26].

64 Whether a representation constitutes puffery or marketing exaggeration and, consequently, is not actionable turns on the particular facts considered in light of the ordinary incidents and character of commercial behaviour: Specsavers at [49], citing General Newspapers Pty Ltd v Telstra Corporation [1993] FCA 473; (1993) 45 FCR 164 at 178 and Australian Competition and Consumer Commission v Henry Kaye and National Investment Institute Pty Ltd [2004] FCA 1363 (“Kaye”) at [122]. A claim will not be regarded as puffery if there is a definitive statement as to a characteristic or consequence of the claim: Specsavers at [49], citing Jainran Pty Ltd v Boyana [2008] NSWSC 468 (“Jainran”) at [117], Gillette Australia Pty Ltd v Energizer Australia Pty Ltd [2005] FCA 1647 at [25] and Procter & Gamble Australia Pty Ltd v Energizer Australia Pty Ltd [2011] FCA 1347 at [168]-[172].

65 By corollary, a characteristic often attributed to puffery is that it is “incapable of being proved to be correct or incorrect”: Pappas v Soulac Pty Ltd [1983] FCA 3; (1983) 50 ALR 231 at 238. In that case, a representation that a shopping centre was a good investment was found to be in the nature of puffery.

66 In Jainran at [117], Bryson AJ gave as examples of puffery statements such as “The greatest show on earth”, “the best car in its class on the market today”, “leading a new wave of talent” and “we’ve already been getting interest in this property”.

67 In Kaye, at [123], Kenny J held that representations to the effect that Mr Kaye could turn or make ordinary Australians into property millionaires by following his strategies; and that he would demonstrate this claim, were not puffery in the context in which they were made.

68 In Stuart Alexander and Co (Interstate) Pty Ltd v Blenders Pty Ltd (unreported, Lockhart J, 25 September 1981), Lockhart J said, in considering comparative television advertising for coffee:

I think a robust approach is called for when determining whether television commercials of this kind are false, misleading or deceptive. The public is accustomed to the puffing of products in advertising. Although the class of persons likely to see this commercial is wide, it is inappropriate to make distinctions that are too fine and precise.

69 Half-truths may be misleading by the insufficiency of information that permits a reasonably open but erroneous conclusion to be drawn: Coles at [46], citing Fraser v NRMA Holdings Ltd [1994] FCA 1397; (1994) 124 ALR 548 at 563 and Tobacco Institute of Australia Ltd v Australian Federation of Consumer Organisations Inc [1992] FCA 630; (1992) 38 FCR 1 at 50.

70 Even information that is literally true can be misleading or deceptive: National Exchange Pty Ltd v Australian Securities and Investments Commission [2004] FCAFC 90; (2004) 49 ACSR 369 at [49].

71 In Fraser v NRMA Holdings Ltd (1995) 55 FCR 452, at 467 the Full Federal Court stated:

Whilst s 52 does not by its terms impose an independent duty of disclosure which would require a corporation or its directors to give any particular information to members … where information for that purpose is promulgated, unless the information given constitutes a full and fair disclosure of all facts which are material to enable the members to make a properly informed decision, the combination of what is said and what is left unsaid may, depending on the full circumstances, be likely to mislead or deceive the membership.

72 In Australian Securities and Investments Commission v ActiveSuper Pty Ltd (in liq) [2015] FCA 342 at [388], White J stated:

The principles relevant to this part of ASIC's claim are settled. Many of the principles were discussed in Miller & Associates Insurance Broking Pty Ltd v BMW Australia Finance Ltd [2010] HCA 31; (2010) 241 CLR 357, in particular, at [16]-[21] (French CJ and Kiefel J). I take the applicable principles to be as follows:

(1) Conduct involving silence or omission may, in some circumstances, constitute misleading or deceptive conduct;

(2) In considering whether conduct is misleading or deceptive, silence is to be assessed as a circumstance like any other;

(3) Mere silence without more is unlikely to constitute misleading or deceptive conduct. However, remaining silent will be misleading or deceptive if the circumstances are such as to give rise to a reasonable expectation that if some relevant fact does exist, it will be disclosed;

(4) A reasonable expectation that a fact, if it exists, will be disclosed will arise when either the law or equity imposes a duty of disclosure, but is not limited to those circumstances. It is not possible to be definitive of all the circumstances in which a reasonable expectation of disclosure may arise but they may include circumstances in which a statement conveying a halftruth only is made, circumstances in which the representor has undertaken a duty to advise, circumstances in which a representation with continuing effect, although correct at the time it was made, has subsequently become incorrect, and circumstances in which the representor has made an implied representation;

…

Misleading conduct as to the nature of services

73 In relation to the expression “liable to mislead the public” in s 34, there will be a sufficient approach to the public if first, the approach is general and at random and secondly, the number of people who are approached is sufficiently large: cf Trade Practices Commission v J & R Enterprises Pty Ltd (1991) 99 ALR 325 at 347-348, cited in Shahid v Australasian College of Dermatologists [2008] FCAFC 72; (2007) 168 FCR 46 at [207].

74 By s 224(1)(e) of the Australian Consumer Law, the Court may order the payment of a pecuniary penalty, if the Court is satisfied that a person “has been in any way, directly or indirectly, knowingly concerned in, or party to, the contravention by a person of”, relevantly, a provision of Part 3-1 of the Australian Consumer Law. Sections 29(1)(f), 29(1)(g), 34 and s 37 are provisions of Part 3-1.

75 A person will be regarded as sufficiently involved in a contravention to invoke this provision if the person intentionally participated in the contravention. Intentional participation requires actual, rather than constructive, knowledge of the essential matters that make up the contravention, and a level of involvement: cf Yorke v Lucas [1985] HCA 65; (1985) 158 CLR 661 at 670 (Mason ACJ, Wilson, Deane and Dawson JJ), 676 (Brennan J); Giorgianni v The Queen [1985] HCA 29; (1985) 156 CLR 473 (“Giorgianni”) at 481-482 (Gibbs CJ), 494 (Mason J), 500 (Wilson, Deane and Dawson JJ); Gore v Australian Securities and Investments Commission [2017] FCAFC 13; (2017) 341 ALR 189 (“Gore”) at [6]-[16]. However, where there is a combination of suspicious circumstances and a failure to inquire, that may lead to an inference that the relevant person had actual knowledge of the essential matters that make up the contravention, which would be sufficient to attract s 224: cf. Giorgianni at 504-505 (Wilson, Deane and Dawson JJ), cited in Gore at [169].

76 In this case, Mr Otton was integrally involved in the activities of WBH, particularly as its main presenter at both free seminars and boot camps. Although at times Mr Otton sought to distance himself from some of the material published by WBH (and even some of the material in the book which he authored), there was no serious contest that he was responsible for all of the marketing material that was sent out by WBH. Mr Otton did not suggest that any particular person or persons employed or engaged by WBH acted outside the scope of his or her authority in publishing marketing material. Mr Otton suggested that he was not “in the boiler room”, but was “steering a ship”.

77 WBH’s marketing material included communications that purported to be from Mr Otton, such as a letter titled “Dear Friend” on the 2013 free seminars webpage, referred to below. In cross-examination, Mr Otton showed familiarity with WBH’s materials. For example, when questioned about a photograph of a home on the same webpage, under the words “Watch a Real Property Bought for $1 – Right Before Your Eyes”, Mr Otton did not hesitate to say that this was not a photograph of a property which had been bought for $1.

78 Mr Otton probably knew and approved the precise content of all of the materials published by WBH that are relied upon by the ACCC, and knew of and approved their publication. To the extent that he did not, Mr Otton knew and approved the substance of all of those materials. Mr Otton said that the proceeding had forced him to look more closely at the marketing material and, had he done so earlier, he would have said “Well, hang on. Let’s readdress that”. However, Mr Otton did not identify particular statements that he considered ought not to have been made and, in cross-examination, he defended the marketing materials about which he was questioned. In those circumstances, I am satisfied that he was both knowingly concerned in, and party to WBH’s publications relied upon by the ACCC.

79 The parties tendered a brief statement of agreed facts.

80 The ACCC relied on evidence of nine consumers who had attended the respondents’ free seminars and boot camps, and who gave evidence of their attempts to utilise the strategies taught by the respondents, as the witnesses understood them.

81 The consumer witnesses were:

(1) Igor Jovanovic, a business executive and former real estate agent, who visited the website webpage www.howtobuyahouseforadollar.com, purchased and read the book, attended a free seminar in October 2012, attended a boot camp held in Sydney in December 2012, and attempted to implement the techniques in Bass Hill, Quakers Hill, Homebush West, North Bondi, Eastlakes, Lake Haven, without success;

(2) Anh-Lan Nguyen, a tertiary-educated business consultant, who received a bundle of materials created by the respondents called the “Massive Passive Property Pack”, attended a free seminar, attended a boot camp held in Sydney in December 2012, and attempted to implement the techniques in various Sydney suburbs without success;

(3) Bevan Nel, a chartered accountant and businessman, who purchased and read the book, visited the website www.howtobuyahouseforadollar.com, attended a free seminar in March-June 2013, attended a boot camp held in Sydney in August 2013, and attempted to implement the techniques in Quakers Hill and Cessnock without success;

(4) Emmanuel Elturk, a personal trainer, who visited the website www.howtobuyahouseforadollar.com, and attended a free seminar in August 2013;

(5) Nadia Panizzutti, a change management specialist, who visited the website www.howtobuyahouseforadollar.com, purchased and read the book, attended a free seminar in Sydney on 27 October 2013, and attended a boot camp held in Sydney in December 2013;

(6) Linda Sereni, an executive assistant, who attended a free seminar in Sydney on 27 October 2013, and attended a boot camp held in Sydney in December 2013;

(7) Geoffrey Mackenzie, a Senior Constable in the NSW Police Force, who attended a free seminar in Sydney on 27 October 2013 where he received a copy of the book, which he read sometime in 2014;

(8) Adele Austin, an Australian Federal Police officer, attended a free seminar in Sydney on 27 October 2013; and

(9) Peter Ronhave, a tertiary-educated business consultant, who purchased and read the Book, visited the website www.howtobuyahouseforadollar.com, attended a free seminar in February 2014, attended a boot camp held in Sydney in April 2014.

82 In addition, the ACCC relied on evidence of two ACCC officers who investigated the respondents’ activities and officers of other regulators including three New South Wales Fair Trading officers and one Western Australian Department of Commerce officer.

83 In addition to evidence given by Mr Otton, the respondents adduced evidence from Peter Donkin, a chartered accountant who had been providing accountancy services to Mr Otton and WBH since March 2007, and a former student of the respondents, Karin Siekaup.

84 The respondents also tendered a bundle of documents, largely transcripts, recording claims made by former students at presentations made by the respondents. They were tendered as evidence that the respondents had received those “testimonials” from persons identified as James, Sheree, Mark, an unidentified person, Sirah, Simone Toohey, TC, Mark, Brett Mudie and Graham Wilson.

85 Mr Otton swore affidavits on 14 December 2015, 16 February 2016, 24 August 2016 and 25 August 2016.

86 The December 2015 affidavit contained a lengthy description of Mr Otton’s background and experience in the United States, engaging in property deals, including deals involving vendor finance. Mr Otton’s evidence was that he started buying properties in the western suburbs of Sydney in 2000. In August 2002, Mr Otton conducted his first “training boot camp” at the Hydro Majestic Hotel in the Blue Mountains outside Sydney.

87 In 2003, Mr Otton started the Vendor Finance Association in Australia. He was the founding president and remained president until 2009.

88 In the December 2015 affidavit Mr Otton gave the following sworn evidence:

[61] Through the years, I have poured most of my time and energy into going the extra mile for our sellers, buyers and our students because I care what happens to them. I think it is important to educate and empower them to know there are many ways to invest in property.

[62] It has always been important to me that I make a difference in people’s lives and that I conduct myself personally and professionally in a law abiding and ethical manner. It has never been my intent to mislead or deceive and do not believe I ever have.

89 The December 2015 affidavit also contains an explanation of the circumstances in which Mr Otton “decided to move on from the business and management of small property transactions and use that time to invest in the educational side of the business”.

90 The February 2016 affidavit contains evidence about two property transactions (“48 Ceres” and “9 Chardonnay”). In relation to the first, Mr Otton gives an explanation for why he incurred a capital loss. In relation to the second, Mr Otton describes some elements of an apparently loss making transaction and annexes a letter from Mr Donkin dated 16 October 2014 which lists the loss on that transaction as $62,421. Mr Otton asserts that the price for which the relevant property was sold “allowed the mortgage loan WBH had with National Australia Bank to be paid off.” The settlement adjustment sheet for the sale of the property shows that the whole of the amount due on settlement ($248,953.12) was paid to the bank, and an amount of $99.50 for a discharge of mortgage. The respondents did not suggest that either of these transactions provided a basis for any of the System and Strategies Representations.

91 The 24 August 2016 affidavit purports to give examples of the application by Mr Otton of various of the strategies. The limits of that evidence are explained later in these reasons. The 25 August 2016 affidavit corrects the evidence in the 24 August 2016 affidavit concerning a property at Railway Road, Quakers Hill.

92 The cross-examination of Mr Otton quickly demonstrated the paucity of the bases upon which Mr Otton was prepared to make extravagant claims to promote his business activities without any substantial basis. For example, Mr Otton was taken to the following claim on a webpage of www.howtobuyahouseforadollar.com:

BRAND NEW EVENT: If you’ve ever wanted to know how to build a passive income stream so you can retire early or quit work forever, this is the most important message you will ever read…

93 When asked how many people he knew had retired early or quit work forever, using Mr Otton’s strategies, Mr Otton said “Only the people who have informed me that they had done that.” It was a theme of Mr Otton’s evidence that he relied upon other people informing him of their claimed successes. That answer strongly suggested that Mr Otton did not verify the claims made by others before relying upon them to promote his own interest. There was no evidence that Mr Otton attempted to verify any claims upon which he relied.

94 Mr Otton was also taken to the following statement, on the same webpage:

All I ask is that you’re willing to “think outside the box” while I’ll share with you the same strategies I use to buy properties for $1 and create cash flow income – without ever stepping inside a bank or saving thousands for a deposit.

95 As appears below, there was no evidence that either of the respondents had bought a property since October 2006. Mr Otton disagreed with the proposition that people coming to his seminars would gain great comfort in knowing that the person who was tutoring them was himself presently engaged in the implementation of the strategies. In my view, that answer was discreditable. The obvious purpose of the statement was to give that comfort.

96 Mr Otton was shown the following statement in large font on the inside front cover of the book:

Discover how Rick bought a property for $1 in 3.5 minutes, turning it into $801 monthly positive cashflow.

97 Mr Otton said that he did not buy a property in 3.5 minutes and he did not know what the statement referred to. When asked to acknowledge that the statement was false, Mr Otton answered:

Sir, one of the forms that people sign is a Power of Attorney or a transfer deed. Once the person signs the transfer deed, although that transfer deed is not registered, the fact that they sign it and I sign means I have actually bought the property, sir.

98 Thus, Mr Otton was not prepared to acknowledge the falsity of the statement in his own book, preferring to give an answer that was frankly nonsense in the context of the question. When further questioned about the statement and asked whether it might just have been made up, Mr Otton answered:

My staff have written this and it would have been, I’m guessing, to something they saw me do. I can’t be – I can’t be specific. I can understand how it could be 345 dot minutes. And we will go through the forms on that; how it could be 3.5 minutes. Which property it is in that … I cannot give you any reference.

99 The respondents did not produce any evidence to support the statement. In the absence of such evidence, I conclude that the statement was false. It was to Mr Otton’s discredit that he sought to distance himself from the statement by saying that it was written by his staff, when he is the author of the book. It is also to his discredit that he suggested that the statement might have a factual basis when he had no reason to believe that.

100 When asked to identify a single property that he had purchased in Australia without a deposit or a bank loan, Mr Otton responded confidently by naming a property at Quaker’s Rd, Marayong and added: “That was where I didn’t put any money into that property whatsoever.”

101 He also referred to a property at Aloe Street, Quaker’s Hill, adding: “I put no money into that property whatsoever.”

102 When Mr White SC pointed out that the Marayong property was purchased using a loan facility from the National Australia Bank, Mr Otton feigned surprise that he had been asked to identify a purchase without a bank loan, and identified a property at Deception Bay. The Deception Bay transaction is discussed below.

103 A little later, when asked to identify a property that Mr Otton bought using little or none of his own money, Mr Otton again referred to the property at Quaker’s Rd, Marayong. Mr Otton accepted that the property was purchased with vendor finance of $50,000 at 6.5 per cent interest and volunteered that “it was $200,000 that the NAB put for that house.” Mr Otton maintained that this was an example of buying a house without using his own money, saying “if it’s bank money it’s not our money”. Mr Otton said that the point that he was making was that “you don’t need a lot of cash to get into property”.

104 When asked to agreed that he needed cash to service the loans, Mr Otton said:

No, because depending on what your exit strategy is for the property. If you’re going to buy this house for yourself you would probably need ongoing cash each month. But if you’re doing what I was doing with the properties then I didn’t.

105 However, as appears below, even on Mr Otton’s evidence, he was required to make monthly loan repayments in connection with the Quaker’s Rd, Marayong property for 59 months.

106 This evidence demonstrated that Mr Otton was either deliberately dissembling in his evidence to the court, or he was impervious to the fact that his claim that the Quaker’s Rd, Marayong property was purchased with little or none of his own money was not true.

107 Ultimately, Mr Otton accepted that, when he said that he purchased over 300 properties using little or none of his own money, he did not mean to suggest that he didn’t borrow money from a bank. He accepted that, in every case, he either borrowed money from a bank or from someone else.

108 Somewhat to his credit, Mr Otton conceded that there was a conflict between the book’s explanation of the meaning of the word “buy” as “own” (discussed below), and the marketing. However, he then maintained that he “used strategies to own houses where I’ve put no money in it”. Based on his concession that he borrowed money on every occasion, I understood Mr Otton to intend to say no more than that he paid no money towards the purchase of the properties up until the date of settlement of the purchase, and that the money he paid at settlement was all borrowed from a bank or someone else. Based on this understanding, the claim that Mr Otton used strategies to own houses where he put no money in it was not true.

109 I formed the view that Mr Otton was a very unreliable witness who was prepared to maintain or defend statements that were obviously untrue or misleading and who is habitually careless with the truth in making statements and claims designed to promote the respondents’ business interests. I do not accept his evidence except to the extent that it was against the respondents’ interest, or is corroborated by contemporaneous records.

Assessment of evidence of Mr Donkin and Ms Siekaup

110 As explained below, I formed a negative view of Ms Siekaup’s evidence.

111 Mr Donkin was a generally straightforward witness. I did not understand the ACCC to make any significant criticism of Mr Donkin’s credit. Equally, I did not understand the respondents to place significant reliance on this evidence in their defence.

Respondents’ submissions about boot camp evidence

112 In a written submission dated 5 September 2016, the respondents argued that it should be able to rely on evidence tendered by the ACCC about what was said at boot camps by the respondents’ former students as evidence of the use of the strategies taught by Mr Otton.

113 In support of this argument, the respondents noted that the relevant evidence was not admitted for a limited purpose. However, in Heydon JD, Cross on Evidence (10th ed, LexisNexis Butterworths, 2015) at [1655], Mr Heydon QC states that if evidence, admitted without objection, is legally admissible in proof of some issue in the case, its evidentiary use should be confined to that purpose. In this case, the relevant issue is what was said at boot camps and not the truthfulness or accuracy of what was said.

114 The decision of Walker v Walker (1937) 57 CLR 630, cited by the respondents and described by Mr Heydon QC as “enigmatic” at [1665], has no relevant application. As the respondents’ submissions recognise, Walker concerns the consequences of a party calling for a document and inspecting it. Similarly, Robert Bax & Associates v Cavenham Pty Ltd [2012] QCA 177; [2013] 1 Qd R 476 concerned a case where the relevant evidence was inadmissible but admitted without objection. That is not this case: the evidence was admissible as proof of what was said at boot camps.

115 The respondents referred to the principle that the tender of a statement may amount to a waiver by the tendering party of the application of the hearsay rule to that statement but noted the following qualification, stated by McLelland J in Ritz Hotel Ltd v Charles of the Ritz Ltd (1988) 15 NSWLR 158 at 170:

The tender of a statement may amount to a waiver by the tendering party of the application of the hearsay rule to that statement, and the absence of objection to the tender may amount to such a waiver by the party against whom the tender is made, but only in my view where such a waiver on each side can reasonably be inferred from the circumstances, and this will occur only where there is no other apparent explanation of the tender and the absence of objection.

116 Here, the explanation of the tender is the need to prove what was said at the boot camps.

117 Accordingly, in my view, the evidence of the boot camps may only be used to prove what was said at the boot camps, and may not be used as evidence of the truthfulness of what was said by Mr Otton’s former students.

118 The respondents also sought to tender a second bundle of emails purporting to be testimonials. That material is inadmissible hearsay to the extent that it is tendered as proof of the facts asserted. I will admit the bundle as evidence of communications received by the respondents from individuals claiming to have engaged in property transactions using various of the techniques.

The respondents’ techniques (or strategies)

119 The respondents taught techniques for dealing in real property to which they gave the names “rent to buy”, “sandwich lease option”, “deposit builder”, “handyman special” or “sweat equity”, “vendor finance” or “purchase by instalments”, and “some now, some later”. The following descriptions of the techniques were not in dispute:

(1) “rent to buy”:

(a) the seller enters into an option agreement with the buyer, granting the buyer the right to buy the house at a future date for an agreed price; and

(b) until completion, the buyer occupies the house pursuant to a residential tenancy agreement and pays rent and non-refundable ongoing option fees;

(2) “sandwich lease option”:

(a) a “middleman” enters into an assumptive (purchase) option and residential tenancy agreement with the owner;

(b) the middleman then enters into a sale option and sub-lease of the residential tenancy agreement with the buyer; and

(c) the middleman keeps the difference between (i) what is received from the buyer in upfront and ongoing option fees and rent and (ii) the fees and rent payable to the owner under the option and residential tenancy agreement;

(3) “deposit builder”: the buyer pays the deposit on a contract for sale by instalments and is permitted to occupy the property subject to payment of a licence fee;

(4) “handyman special” or “sweat equity”: the buyer is permitted to carry out non-structural renovations within a specified period in lieu of paying a deposit to purchase the property such that the buyer is credited with the agreed value of the renovations against the deposit;

(5) “vendor finance” or “purchase by instalments”: the buyer pays the purchase price of the property in instalments and the seller charges interest on those instalments; and

(6) “some now, some later”: the buyer funds part of the purchase price with a bank loan and the remainder of the purchase price is delayed and paid by the buyer in instalments.

120 Mr Otton’s evidence was that the “rent to buy” and “sandwich lease option” are effectively the same strategies, although there is a difference “in implementation”. The strategies are similar in that they require the seller to accept an option to purchase the property and to grant a lease over the property. In the case of “rent to buy”, the optionee is the tenant; in the case of the “sandwich lease option”, the optionee of the second option is the tenant.

121 As explained below, the evidence of the successful application of these techniques in relation particular properties was minimal.

122 For each technique, the ACCC referred to a model of the technique provided to one or more of the consumer witnesses, at a boot camp. The ACCC relied upon the models, described as “answer sheets”, to illustrate how consumers were misled about the viability of the techniques.

123 Chapter 18 of the book refers to this technique as “rent-to-own”. Page 172 describes the strategy as follows:

[W]hen a buyer purchases a property on a lease option, it’s for an agreed-upon price up-front. The buyer makes a monthly payment for a specified period of time and has the option, but not the obligation, to purchase the property – either during or at the end of the lease option period.

124 As described in this passage, if implemented to the point of exercise of the option, this technique enables a consumer to buy a house.

125 A sheet headed “Lease Option Answer Sheet”, which appears to have been provided to Ms Panizzutti at the boot camp she attended, models a transaction of which the “rent-to-buy” technique is a component, the other component being a property acquisition using a cash deposit and a bank finance loan. It explains how a boot camper who has purchased a property might sell it using the “rent-to-buy” technique.

126 The answer sheet commences with purchasing details for a hypothetical property at a “discounted purchase price” of $360,000 which include payment of a deposit of 20% of the discounted purchase price ($72,000) and a bank loan for 80% of the discounted purchase price ($288,000), with an interest rate of 6% and a term of 30 years. The monthly repayment for the mortgage is said to be $1,726.71. Thus, the total required to service the loan over the assumed option period of 24 months is $41,441.04.

127 The answer sheet then explains a transaction in which the boot camper might sell the property on a 24 month lease option, that is, to a third party buyer who would acquire the property using the “rent-to-buy” technique. The model assumes that the boot camper will be able to negotiate an option with a prospective purchaser who will agree on an option fee of $15,000, a price in the option of $440,000, and to lease the property for of $2,166.67 per month for the duration of the option. If the option is exercised, the prospective purchaser would pay a sum of $417,999.92, being the option price less the option fee and a “price credit” of $7,000.08. The price credit is an amount calculated by reference to a hypothetical deposit on the option price of $440,000.

128 Under the heading “We get paid three ways”, the answer sheet identifies payments that would be received by the boot camper from the buyer comprising “Upfront money” (the upfront option fee of $15,000), “Monthly Cash Flow” (the difference between the rent paid by the buyer and the mortgage payments made by the boot camper) and “Back End” (the amount owed by the buyer after 24 months less the amount borrowed by the boot camper from the bank).

129 The model assumes that the boot camper can obtain a “discounted purchase price”, can pay the $72,000 deposit for the property, and can obtain a bank loan of $288,000 to complete the purchase. It assumes that the boot camper has other accommodation, because the relevant property will be occupied by the buyer. It also assumes that there will be no delay between the boot camper’s purchase of the property for $360,000 and the entry into the option with the prospective buyer for the eventual sale of the property for $440,000 (that is, it assumes that there will be a simultaneous purchase and an entry into an option for sale for a substantially different price). It also assumes that the boot camper will invest $72,000 (the 20% deposit) and borrow $288,000 in order to achieve these benefits. In cross-examination, Mr Otton accepted that the model did not work. He appeared to say that the figures were chosen because they were simple to digest.

130 This is the technique that, according to the book, enables a consumer to “buy a house for a dollar”.

131 The technique is described on pages 183-184 of the book as follows:

[Y]ou become the ‘Transaction Engineer’ and buy a property as an investor on a lease option, then you onsell the property to an end buyer on another lease option at a slightly higher price. And you make sure that you’re receiving more money than you’re paying so the transaction generates cash flow each month.

The sale price is agreed at the start of the transaction, and you effectively sublet the property to the buyer at a higher price than you’re paying the seller. This way you get to profit from the sale of the property without ever officially owning it.

…

Many times when we babysit sellers’ loans we do it by using a rent-to-own paperwork system where the option to buy is simply the outstanding balance of the seller’s loan at the time we wish to exercise the option to buy.

For example, if I babysit a seller’s loan of $500,000 payable at a rate of 7% interest over 30 years, whatever the balance of the loan is when I decide to buy is the option price I pay.

132 Using this technique, Mr Otton claims that he could consider himself the “temporary owner” of the property:

[I]f I get the house on a lease option and I get my powers of attorney and I get my transfer signed, I believe – and I’m happy if [I’ve] totally read the Act wrong – that I’m now the owner of that property.

133 In cross-examination, it emerged that Mr Otton was relying on s 43A of the Real Property Act 1900 (NSW) to support his notion of “temporary ownership”. Section 43A provides:

43A Protection as to notice of person contracting or dealing in respect of land under this Act before registration

(1) For the purpose only of protection against notice, the estate or interest in land under the provisions of this Act, taken by a person under a dealing registrable, or which when appropriately signed by or on behalf of that person would be registrable under this Act shall, before registration of that dealing, be deemed to be a legal estate.

(2) No person contracting or dealing in respect of an estate or interest in land under the provisions of this Act shall be affected by notice of any instrument, fact, or thing merely by omission to search in a register not kept under this Act.

(3) Registration under Division 1 of Part 23 of the Conveyancing Act 1919 shall not of itself affect the rights of any person contracting or dealing in respect of estates or interests in land under the provisions of this Act.

(4) Nothing in subsection (2) or (3) operates to defeat any claim based on a subsisting interest, within the meaning of Part 4A, affecting land comprised in a qualified folio of the Register.

134 In cross-examination, Mr Otton accepted that there is a clear distinction between the buyer and the “transaction engineer” in the book’s description of this technique. Mr Otton said: “As a transaction engineer you don’t become the owner”.

Model of technique

135 An answer sheet, also apparently provided to Ms Panizzutti, provides an example in which the boot camper takes an option to purchase a property for $360,000 for a fee of $1. In addition, the boot camper incurs a monthly rental liability of $1,950 (although the vendor credits one-third of the rental against the outstanding purchase price). At the same time, the boot camper grants a buyer an option to buy the property from the boot camper for an upfront fee of $15,000 and a purchase price of $440,000, as well as entering into a lease with rent of $2,080 per month, of which 20% is credited to the purchase price eventually paid by the buyer.

136 Under the heading “We get paid three ways”, the answer sheet identifies payments that would be received by the boot camper from the buyer comprising “upfront money” (the option fee of $15,000), “monthly cashflow” (the difference between the rent paid by the buyer and the rent paid by the boot camper to the vendor) and “backend” (the amount owed by the buyer after 24 months less the amount owed by the boot camper to the vendor).

137 This model assumes simultaneous options to purchase the property: by the boot camper for $360,000 and by the buyer for $440,000. As for the previous model, it assumes that the boot camper has other accommodation, because the relevant property will be occupied by the buyer. Why the vendor and the buyer would deal with the “transaction engineer” rather than dealing directly with each other was unexplained.

138 In cross-examination, Mr Otton claimed that he had used “sandwich lease” options to purchase three or four properties in Australia. This claim was not borne out by the evidence. There was no evidence that the “sandwich lease option” technique has been implemented to the point of exercise of the options in respect of a single property.

139 By this technique, the buyer pays the deposit on a contract for sale by instalments and is permitted to occupy the property subject to payment of a licence fee until the deposit is paid in full.

140 The ACCC contended that this technique was described in Chapter 16 of the book, entitled “Deposit finance”. Although Mr Otton disagreed that the “deposit finance” and “deposit builder” strategies were synonymous, the respondents did not explain the difference. There may be a difference in timing of the completion of the sale.

141 Page 157 of the book describes the “deposit finance” technique as follows:

I suggest that the buyer gets a bank loan for as much as they can borrow. I’ll lend them whatever they can’t borrow and I’ll usually mirror the same terms that the lender offers.

142 Pages 158-159 say relevantly:

As a seller, I simply offer to finance the buyer’s deposit over a period of time, which can be payable monthly with interest or as a lump sum sometime further down the road. This enables potential purchasers to buy your property with no cash deposit, which allows you to sell your property very quickly for full retail price, with no discounting. … When I buy houses I find this is a good strategy, as it is one that agents can get their heads around. …

Recently, I met with a seller who needed to sell quickly in order to spend time with his sick father on the south coast. After prolonged discussion, which mainly involved me listening, I learnt that he was an electrician and would leave his employer, but was hoping to grab odd jobs down the coast.

I said to him that I could buy his house today, and that I had a ‘some now’ price and a ‘some now, some later’ price.

He asked me what my ‘some now’ price was, and I told him $320,000. He said he couldn’t make that work. Then he asked me about my ‘some now, some later” price, and I told him I could get him $320,000 now, and another $80,000 paid to him as an ongoing income stream to supplement his income while he was with his father. We agreed on $80,000 payable to him at the rate of $500 a month until paid in full, or a future date when the balance of the $80,000 would be paid out in one cheque. …

143 In cross-examination, Mr Otton identified the relevant transaction as the February 2003 purchase of a property in Colyton for $200,000. Mr Otton conceded that the transaction did not occur “[r]ecently” in relation to the publication of the book and the figure of $320,000 was incorrect. He maintained that the figure of $500 per month was correct. On Mr Otton’s version of events, the account of the transaction in the book was false.

Model of technique

144 The technique was explained in two answer sheets used at boot camps. One was entitled “Deposit Finance Answer Sheet”, and appears to have been provided to Ms Panizzutti. The model in this answer sheet assumes that the boot camper: (i) purchases a property for a “discounted purchase price” of $360,000; (ii) pays a deposit of $72,000; (iii) obtains bank finance for the balance of the purchase price of $288,000 with an interest rate of 6% for 30 years. That is, the boot camper does not use the “deposit builder” technique to buy the property. The buyer: (i) pays a purchase price of $420,000; (ii) agrees to pay 10% interest for 5 years on a loan of $84,000 from the boot camper; (iii) obtains bank finance for the balance of the purchase price of $336,000.

145 Under the heading “We get paid three ways”, the answer sheet identifies payments that would be received by the boot camper from the buyer comprising “upfront money” of $48,000, “monthly cashflow” of $700 (the interest on the loan of $84,000) and “backend” of $84,000 (the eventual repayment of the loan of $84,000).

146 The $48,000 “upfront money” was not satisfactorily explained. The answer sheet identifies it as the difference between the buyer’s bank finance of $360,000 and the consumer’s finance of $288,000. Mr Otton said that, when the boot camper’s finance was paid out by the buyer’s finance, there would be a cheque for $48,000 in favour of the boot camper. As for the “rent-to-buy” option, the analysis assumes that the boot camper has other accommodation and does not take into account the $72,000 that the boot camper was required to pay by way of deposit. If that were taken into account, the cheque for $48,000 would partially re-coup the deposit of $72,000 leaving $24,000 to be recovered by way of interest payments on the loan of $84,000 and the eventual repayment of the $84,000 loan.

147 The second answer sheet is entitled “Deposit Builder Answer Sheet”, which appears to have been provided to Mr Ronhave. In this model, the boot camper again purchases a property for a “discounted purchase price of $360,000, paying a 10% deposit of $36,000 and obtaining bank finance for the balance of the purchase price of $324,000 (with an interest rate of 6% for 30 years). The buyer: (i) pays a purchase price of $400,000; (ii) pays a deposit of $15,000; (iii) receives an interest free loan from the boot camper of $25,000 repayable over 4 years, which is said to be in respect of the remainder of a total deposit of $40,000; (iv) obtains finance for the balance of the purchase price of $360,000; (v) pays a monthly licence fee to occupy the property.