FEDERAL COURT OF AUSTRALIA

Lo Pilato, in the matter of CAL Consulting Pty Ltd (in liq) v CAL Consulting Pty Ltd (in liq) [2016] FCA 1170

File number(s): | ACD 48 of 2016 |

Judge(s): | JAGOT J |

Date of judgment: | |

Catchwords: | BANKRUPTCY AND INSOLVENCY – liquidator’s conflict of interest – utility and expense of independent liquidator – directions authorising admission of profits of debt |

Legislation: | Corporations Act 2001 (Cth) |

Registry: | Australian Capital Territory |

Division: | General Division |

National Practice Area: | Commercial and Corporations |

Sub-area: | Corporations and Corporate Insolvency |

Category: | Catchwords |

Number of paragraphs: | |

Solicitor for the Plaintiff: | Trinity Law Pty Ltd |

Counsel for the Defendant: | The defendant did not appear |

ORDERS

FRANK LO PILATO IN HIS CAPACITY AS LIQUIDATOR FOR CAL CONSULTING PTY LTD (IN LIQUIDATION) (ABN 76 100 941 400) Plaintiff | ||

AND: | CAL CONSULTING PTY LTD (IN LIQUIDATION) (ABN 76 100 941 400) Defendant | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The plaintiff is justified in not engaging an independent liquidator for ACN 114 250 529 Pty Limited (In Liquidation) (Ignetik) and Purple Consulting Pty Ltd (In Liquidation) (ACN 113 982 193) (Purple) for the purposes of assessing and admitting the formal proofs of debt lodged with the liquidator of CAL Consulting Pty Ltd (In Liquidation) (ABN 78 100 941 400) (CAL) on behalf of Ignetik and Purple.

2. The plaintiff is justified in admitting the formal proofs of debt for dividends for the creditors listed in Schedule A.

3. The plaintiff is justified to continue with the winding up of CAL.

4. The plaintiff’s costs of and incidental to this application are costs properly incurred in the liquidations of CAL or otherwise.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

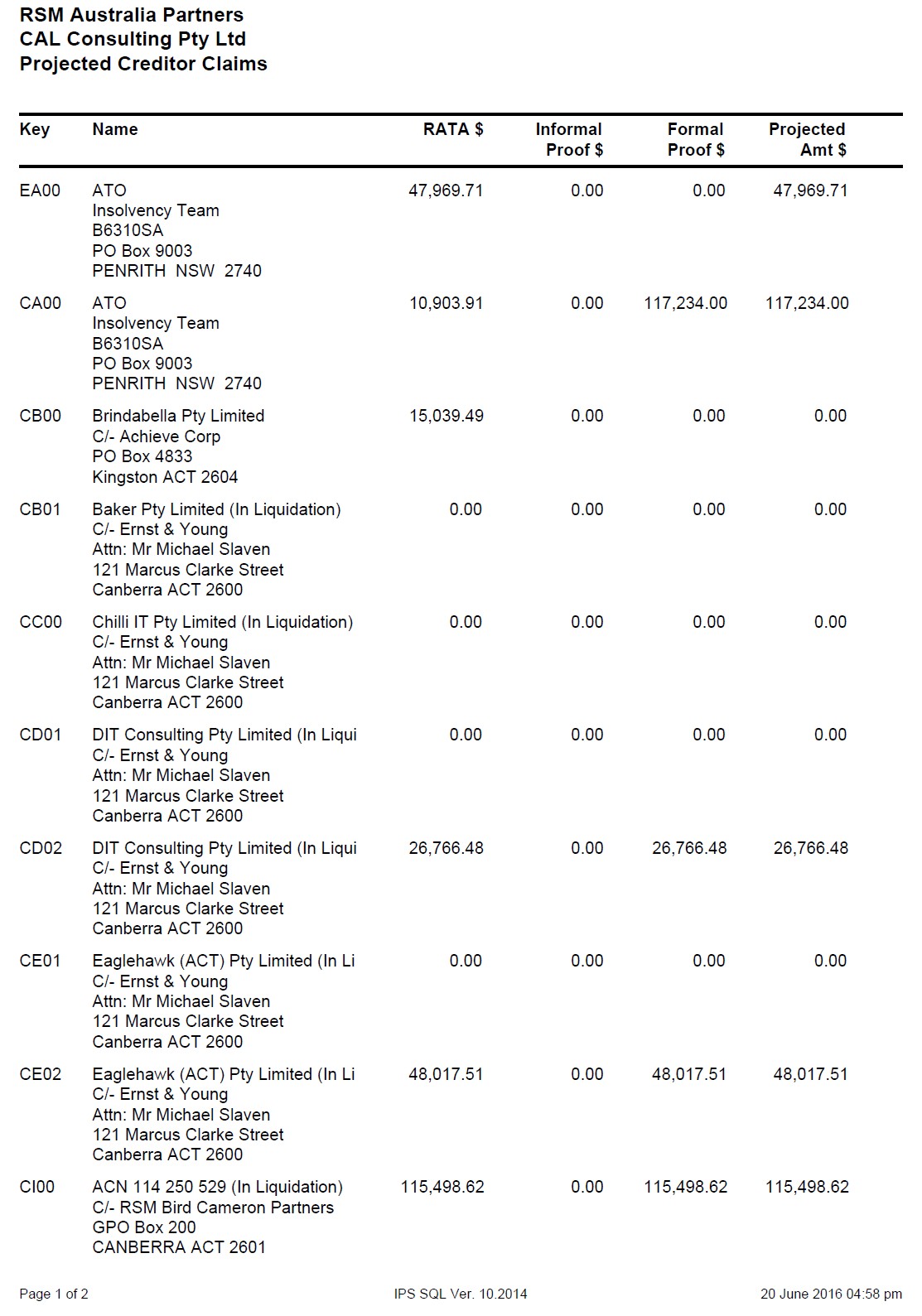

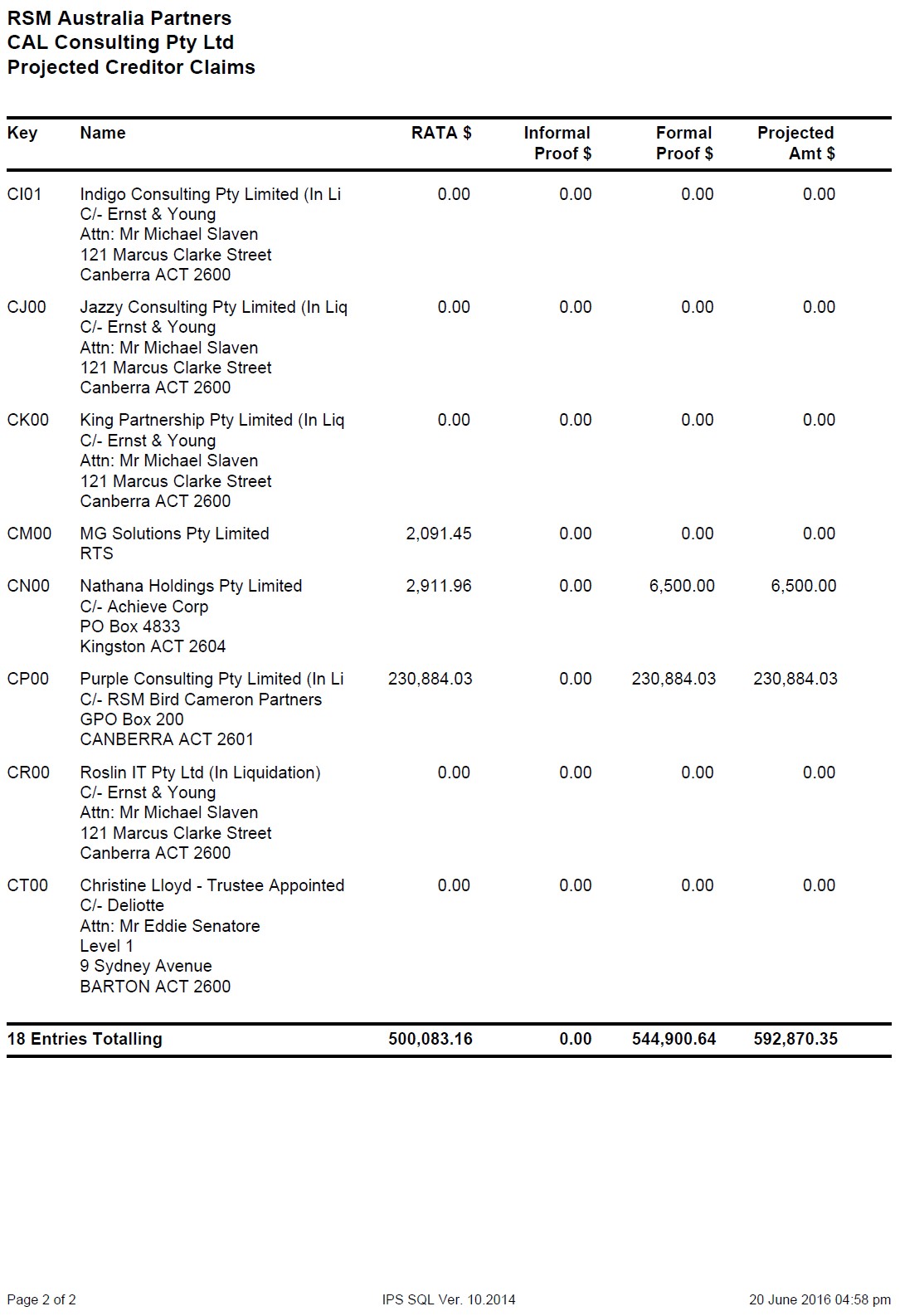

SCHEDULE A

JAGOT J:

1 The plaintiff, Frank Lo Pilato, the liquidator of CAL Consulting Pty Limited (In Liquidation) (CAL), seeks directions that he is justified in not engaging an independent liquidator for two other companies, in admitting certain formal proofs of debt, and to continue with the winding up of CAL, and that his costs of and incidental to the application be taken to be costs properly incurred in the liquidations of CAL.

2 The application is accompanied by a number of affidavits which disclose that, in addition to being the liquidator of CAL, Mr Lo Pilato was previously appointed as liquidator of two companies, Purple Consulting Pty Limited (In Liquidation) (Purple) and ACN 114 250 529 Pty Limited (In Liquidation) (Ignetik). Purple and Ignetik have both submitted proofs of debt in the winding up of CAL (for the sums of $230,884.03 and $115,498.62).

3 As liquidator of CAL, Purple and Ignetik, if Mr Lo Pilato accepts the proofs of debt from and then pays out money to Purple and Ignetik in the liquidation of CAL, Purple and Ignetik will have funds to pay Mr Lo Pilato’s fees as a liquidator of those two companies. Accordingly, seeking directions is appropriate as Mr Lo Pilato is subject to a conflict of interest.

4 The alternative, in order to avoid this conflict, would be the appointment of another liquidator to review the debts alleged to be owed by CAL to Purple and Ignetik. However, Mr Lo Pilato’s evidence (which I accept) is that the costs of appointing another liquidator will be substantial. Further, given the state of the accounts of the companies and other related companies, it appears unlikely that another liquidator would be able to obtain any further information than Mr Lo Pilato has done to assist in reconciling the books of the companies. Accordingly, the appointment of another liquidator will be of doubtful utility at significant cost.

5 To explain further, CAL was originally incorporated as a vehicle through which a sole director could undertake contracting activities within the information technology (IT) sector. CAL subsequently expanded its business to provide payroll solutions for other contractors in the IT sector. These contractors were employed by a company that entered a management agreement with CAL. Mr Lo Pilato’s investigations have disclosed that there were ultimately approximately 30 companies associated with and incorporated by CAL involved in these arrangements. Approximately eight of these related companies have been wound up and Michael Slaven has been appointed as a liquidator of those companies, referred to as the “MS companies”.

6 CAL had also entered into management agreements with two other companies, one now deregistered and another, Nathana Holdings Pty Ltd, which is also a creditor of CAL. Each company had outsourced its payroll obligations to CAL which was responsible for invoicing, collecting debts, and making salary, superannuation and novated lease payments on behalf of those contractors, as well as remitting PAYG tax and superannuation to the Australian Taxation Office for the employees.

7 The books and records of CAL, Purple and Ignetik have not been properly maintained, and it has not been possible for Mr Lo Pilato to reconcile the accounts of those companies in circumstances where a number of the books and records are simply not available. Mr Lo Pilato has undertaken substantial work in the liquidation of CAL, including meeting with the sole director at creditors’ meetings on four occasions, corresponded with the sole director seeking further information, and issuing a summons for examination to a former employee of CAL as well as the company’s external accountant. The examinations did not proceed due to a settlement being reached.

8 In summary, investigations revealed the following (taken from the written submissions in support of the application):

(a) the debts to Purple and Ignetik were acknowledged by the sole director in her summary of affairs;

(b) the debts are reflected in the financial records of each company; and

(c) some documents support the existence of the debts, each of which is attached to the proofs of debt submitted by Purple and Ignetik.

9 The sole director is now bankrupt and has confirmed in the summary of affairs the identity of each creditor and the amounts of debt. The sole director also confirmed that the debts to Purple and Ignetik existed and remained unsatisfied. No challenge has been made to the list of creditors attached to the report to creditors which was issued on 5 December 2014.

10 In addition, Mr Slaven, liquidator of the MS companies, has lodged proof of debt against CAL for each MS company, including a now withdrawn claim for damages for failing to provide the agreed management services. Two proofs of debt remain for MS companies that concern loans, and not any claim for damages.

11 In respect of the other proofs of debt, there is in existence documentation substantiating the debt.

12 The main creditor in each company is the Deputy Commissioner of Taxation who lodged a proof of debt which was partly rejected and partly admitted. The Deputy Commissioner of Taxation has not challenged the decision of the liquidator in this regard.

13 Importantly, on 22 October 2015 Mr Lo Pilato wrote to each of the creditors setting out the circumstances of the liquidation and his proposal:

(a) not to engage an independent liquidator in relation to the Ignetik and Purple proofs of debt;

(b) admit the proofs of debt for those companies, notwithstanding that the books are not reconciled; and

(c) admit the formal proofs of the other identified creditors for dividend purposes.

14 Mr Lo Pilato invited all creditors to comment on the proposed directions. In response, the liquidator of the MS companies did not object. The Deputy Commissioner of Taxation did not respond. Another of the creditor companies agreed with the course of action. The sole director’s trustee in bankruptcy initially indicated that he did not have enough information to form a view, however, a further letter was forwarded to the trustee on 15 June 2016, and no response has been received.

15 The liquidator of the MS companies has been served with this application and Mr Lo Pilato’s primary affidavit. The trustee in bankruptcy of the sole director of CAL has also been served with the same information.

16 Pursuant to orders made by a Registrar of the Court, the Australian Taxation Office has been notified of these proceedings, including by letters dated 18 August 2016 and 13 September 2016 and has not responded. The other creditor, Nathana Holdings Pty Ltd, has been advised of the proceedings by letters dated 18 August 2016 and 14 September 2016.

17 As submitted, the creditors of CAL are not unsophisticated. They have been notified of the effect of the orders proposed, including the amounts of money that will be paid out to Purple and Ignetik and the amounts that will thereafter remain in order for the payment of a dividend to other creditors. They have not objected to this proposed course.

18 Section 511 of the Corporations Act 2001 (Cth) enables a liquidator of a company in voluntary liquidation to apply to the Court to determine any question arising in the winding up, and the Court may accede to the application on such terms it thinks fit or just, if satisfied that the determination of the question or the exercise of the power will be just and beneficial. The effect of any direction or order under the provision is to sanction a course of conduct proposed by the liquidator so as to protect the liquidator from liability subsequently in respect of anything the liquidator does in accordance with the direction.

19 As I have said, I accept that there is in this matter an issue that calls for the making of this application, being the conflict of interest of Mr Lo Pilato. I am also satisfied that the giving of the directions sought will be just and beneficial in the circumstances which have been identified in the evidence and written submissions in support of the application. They are as follows:

(a) the sole director of CAL identified that the debts were due and owing in the summary of her affairs;

(b) the financial statements, evidenced by the proof of debts for each company, show the debt owing by CAL, with ledgers showing adjustments to the debt over a period of years;

(c) the cost of engaging an independent liquidator to assess the proofs of debt of Purple and Ignetik are likely to be substantial and will not benefit the liquidation because investigations, including correspondence and a number of meetings with the director, have been carried out, and the director has confirmed that no further books and records exist, enabling an effective reconciliation of the accounts;

(d) the other major unsecured creditor is the Deputy Commissioner of Taxation; and

(e) the creditors are sophisticated and would appreciate the circumstances and have been advised of these proceedings, and since 22 October 2015 have been on notice of what is sought and have either consented to what is sought or have not responded.

20 In these circumstances, I am satisfied that it is just and beneficial to make the orders sought.

I certify that the preceding twenty (20) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justice Jagot. |