FEDERAL COURT OF AUSTRALIA

Lewis v Orchid Avenue Pty Ltd [2014] FCA 739

| QUEENSLAND DISTRICT REGISTRY | |

| GENERAL DIVISION | QUD 135 of 2012 |

| BETWEEN: | ANDREW PETER LEWIS First Applicant MIA TERESA LEWIS Second Applicant |

| AND: | ORCHID AVENUE PTY LTD (ACN 118 752 346) Respondent |

| JUDGE: | DOWSETT J |

| DATE: | 11 JULY 2014 |

| PLACE: | BRISBANE |

REASONS FOR JUDGMENT

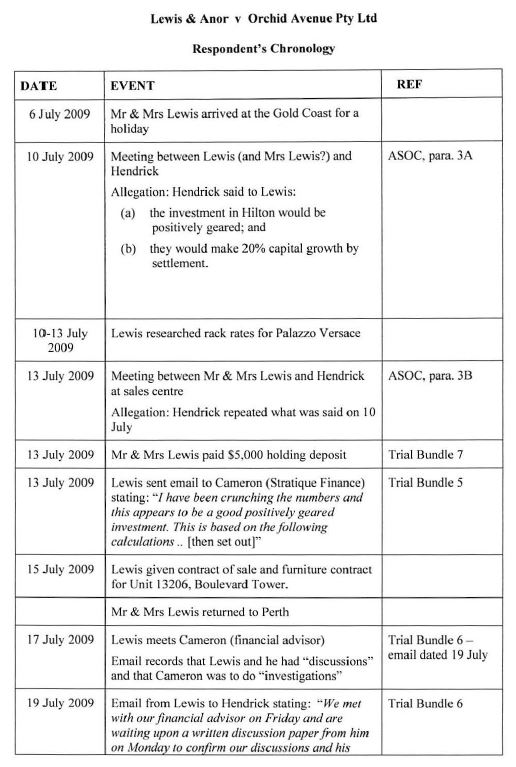

THE CONTRACTS

1 On 16 October 2009, the applicants (“Mr Lewis” and “Ms Lewis”) entered into a contract (the “unit contract”) with the respondent (“Orchid Avenue”) for the purchase of a residential unit (the “unit”) in a block of units then being built on the corner of Surfers Paradise Boulevard and Orchid Avenue at the Gold Coast. The unit was identified in the unit contract as Lot 22506 on an attached plan. At or about the same time, they also entered into a furniture package contract with Orchid Avenue (the “furniture package contract”). In these reasons, I need not, in general, distinguish between the two contracts. I shall refer to them collectively as the “contracts”.

RESCISSION, DETERMINATION, AVOIDANCE AND REPUDIATION

2 On 9 September 2011 the Lewises purported to terminate or avoid the contracts pursuant to nominated statutes and/or other unspecified grounds. They also purported to reserve their rights in respect of unspecified false and/or misleading statements which had allegedly induced them to enter into the contracts.

3 On 16 September 2011 Orchid Avenue purported to terminate the contracts upon the basis that Mr and Ms Lewis had defaulted in performance of both. Orchid Avenue also purported to forfeit the deposit paid pursuant to the unit contract, and to reserve its right to recover from Mr and Ms Lewis any deficiency between the purchase price and any price on re-sale.

THE PROCEEDINGS

4 On 23 February 2012 Mr and Ms Lewis commenced proceedings in this Court, seeking an order pursuant to s 87 of the Trade Practices Act 1974 (Cth) (the “Trade Practices Act”), declaring the unit contract void ab initio, and related relief. They also sought an order that Orchid Avenue release, or authorise the release of the deposit to them. In the alternative they claimed compensation for loss or damage pursuant to s 87 of the Trade Practices Act, interest pursuant to s 51A of the Federal Court of Australia Act 1976 (Cth) (the “Federal Court Act”) and costs.

5 On 13 April 2012 Orchid Avenue filed a notice of cross-claim, seeking an order that Mr and Ms Lewis direct the stakeholder to release the deposit to it, damages for breach of the contracts, interest (either pursuant to the terms of the contracts or pursuant to s 51A of the Federal Court Act) and costs.

6 Mr and Ms Lewis now allege that they entered into the contracts in reliance upon representations made to them by, or on behalf of Orchid Avenue, by Gary Ronald Hendrick (“Mr Hendrick”). Mr and Ms Lewis claim that all of the representations were representations with respect to future matters within the meaning of s 51A of the Trade Practices Act. They plead that such representations constituted misleading and deceptive conduct pursuant to s 52 of the Trade Practices Act, having regard to the operation of s 51A, and accordingly claim the relief identified above.

7 By its further amended statement of cross-claim Orchid Avenue asserts that it determined the contracts for breach in that Mr and Ms Lewis failed to perform their obligations pursuant to those contracts. It therefore seeks the relief outlined above. I turn to the evidence.

ANDREW PETER LEWIS

8 Mr and Ms Lewis have two sons who, in May 2013, were nearly 12 and nearly 14 years of age respectively. The family lives in Western Australia, occupying a home which they completed in late 2008. In 2009 they came to the Gold Coast for a vacation, leaving Perth on 6 July 2009 and returning on 15 July 2009. On one previous occasion they had acquired an investment property when they purchased a home unit from Mr Lewis’s grandparents. They were moving into a retirement village. Mr and Ms Lewis had never purchased an investment property on the open market, nor had they ever purchased “off the plan” meaning, as I understand it, to purchase a unit in a residential building which is not yet completed. Mr Lewis claims to have known nothing about the real estate market on the Gold Coast. He said that they did not go to the Gold Coast with the purpose of acquiring a property, but rather to enable their sons to enjoy the theme parks. The building in which the unit was located was part of the “Hilton” development. Mr and Ms Lewis became aware of that development when they walked past the construction site, noticing the building and various signs. At a later stage they passed a sales office (the “Hilton sales office”) and saw a large model of the development which contained two towers. They stopped to look at the model and were approached by a Ms Frances Barlow (“Ms Barlow”) who, Mr Lewis understood, was a sales person employed by Three Sixty Project Marketing Pty Ltd (“Three Sixty”), a company which was marketing the Hilton development. After some preliminary discussion she pointed out that the apartments in the development were selling “really quickly”, that the first tower, the “Boulevard Tower”, was sold out and that the second tower, the “Orchid Tower”, was about 50% sold. A sale had just “fallen through” in the Boulevard Tower. That unit was now available for sale at $932,000. It was on the top level and was, in that sense, a “penthouse”.

9 Later that day the Lewis family was walking down the main mall in Surfers Paradise. At the corner of Cavill Avenue and Orchid Avenue they saw a Ray White real estate agency (the “Ray White office”). There they saw another model of the Hilton development on a trolley. They stopped to look at it and were approached by Mr Hendrick who introduced himself as being from Ray White. They had a general discussion about why the Lewis family was in Surfers Paradise. Mr Hendrick asked whether they were interested in property. They said that they were not, and that they were “just window shopping”. They said that they had previously walked past the Hilton sales office, and that a sales person there had told them that they could get an apartment for $932,000. Mr Hendrick said that they would be “crazy” not to take an apartment for under $1 million, as all of the apartments were now being offered or sold at over $1.1 million. He also said that it would be a perfect opportunity because there was nothing else available at that price. He said that an apartment under $1 million would be, “a positively geared investment”, and that there would be good capital growth in it. Mr Hendrick then asked them if they would like to go back to the Hilton sales office, offering to go with them in order to assist them in speaking with the sales people. They agreed to do so. Mr Lewis said that on that day, they were just “wandering around” as it was their “day off”.

10 At the sales office they again met Ms Barlow and were taken to a sales area where they could sit down. Their sons were taken to an adjoining area where there were Play Stations, videos and other forms of entertainment. Mr and Ms Lewis were shown a promotional video, depicting images of the Hilton development, and providing information about it. There was then a discussion about the quality of the building. Mr Hendrick was, “continually telling us how lucky we were to get the opportunity to get an apartment under $1 million”. He asked if they had ever previously bought off the plan. He said that one of the real benefits of buying off the plan was that the price would be “locked in”, without their having to settle for one and a half years, and that they would get capital growth over that time. He said that they could expect 20% in capital growth. There were two reasons for that. Firstly, the building still had to be constructed. The development was originally to be built “through Raptis”, which company had gone into receivership. The ANZ Bank had stepped in to finish the development, and the prices had been reset. Multiplex had been “brought on board” because of the global financial crisis, “and all that sort of stuff”, so that, with the construction time, they could easily get 20% capital growth.

11 They asked about the “development’s competition”. They were told that it would be operated as a five star hotel in the heart of Surfers Paradise, and that the only other five star hotel was the Palazzo Versace which was in Surfers Paradise but “out of the town”. They enquired as to likely room rates and were told that it was in competition with the Palazzo Versace, and that they could expect around $500 a night. It was said that Palazzo Versace was, “up in the mid-thousands”. It was also said that the Hilton development was looking more to the Middle Eastern tourist market, and that it was a “five star service” hotel. When people from places such as Kuwait visited in their hot season, they could get silver service, be picked up from the airport, and have their baggage dropped off at the hotel. Such visitors were often surprised at the absence of services of that kind in Australia. The Hilton development was being marketed to that “high-end Middle Eastern market”. Mr and Ms Lewis were also given information concerning incoming tourists, Queensland and Surfers Paradise. As to occupancy they were told that there was, at that time, an 80 per cent occupancy rate for five star accommodation.

12 Mr and Ms Lewis were told that there would be a management fee of “33.2 per cent, 33.8 per cent or thereabouts”, a letting fee to manage the apartment which was “13 point something per cent”, a body corporate fee of about $140 a week, and taxes. Those amounts all added up to 47% of receipts. It was said that, “whatever revenue you earn – well, you know, from the room rates … that’s taken off automatically and handed across to us”. They were told that another hotel development known as the “Soul” was on the market at that time. The Hilton development was significantly cheaper than the Soul where units were starting at about $1.8 million. It was also said that the Hilton development would be a fully managed service, so that, notwithstanding the fact that the Lewises were in Western Australia, they would not have to worry about it. It was, “a set and forget type investment in terms of hands-on management”. Mr Hendrick, “continually reminded us how lucky we were to have the opportunity to purchase under $1 million”. They were told that if they could pay a $5,000 holding fee, it would give them a few days to think about it. Such sum would secure the unit but would be fully refundable if they decided not to go ahead. They were told that contracts would not be “subject to finance”. They had concerns about finance as they had only recently completed their house, and had done a substantial amount of further work, so that they were “at the top” of their borrowing capacity against the house. They did not believe that they would be in a position to finance the purchase from their own resources. For this reason Mr Hendrick’s assurance as to positive gearing was important to Mr Lewis. They decided to think about the matter. They had not come to the Gold Coast to purchase an apartment.

13 Between 10 and 13 July Mr Lewis conducted research on the internet, checking the Hilton development and the Palazzo Versace websites. The latter’s daily room rates were between $1,350 or $1,450 and $1,700 for a two bedroom apartment. This led Mr Lewis to believe that the $500 figure for the Hilton had “a level of reality to it”. They otherwise went about their vacation.

14 On 13 July, following a couple of telephone calls from Mr Hendrick, they went back to meet him at the sales office. They had previously told him that they would not be available again until the 13th. At the second meeting both Ms Barlow and Mr Hendrick were present, with Mr and Ms Lewis and their sons. Their sons again went to the play area. The second meeting was similar to the first, although they did not again see the video presentation. They again discussed the building, the costs and the fees. Mr Hendrick repeatedly told them how lucky they were to have the opportunity to acquire the apartment for less than $1 million. Again, the two towers were identified. They were told that in the Boulevard Tower, everything was sold, save for the unit which was being offered to them. In the Orchid Tower all of the apartments were being offered at prices above $1.1 million. A number of the lower level apartments had been sold.

15 One of the key points for Mr Lewis was that he and his wife were at their maximum borrowing level on their existing home. Mr Hendrick stressed that because they would not have to pay for some time, and because the prices had been recently set to reflect the global financial crisis, they could expect a 20% capital growth. He asked if they had arrangements for finance. They said that they had a mortgage broker in Perth whom they had used in the past. Mr Hendrick said that if they had difficulty getting finance in Perth he would be able to put them in touch with Surfers Paradise banks which had special package rates for the Hilton development. A 10% deposit was payable within 14 days of signing the contract. Mr and Ms Lewis did not have that amount available, and so they discussed the possibility of a bank guarantee. They said that they did not want to put their property at risk. Mr Hendrick told them that they could provide, “a deposit bond, which didn’t tie up your property”.

16 Mr and Ms Lewis were told that the apartment was not, “going to last long”. It was again suggested that they pay a $5,000 holding fee to give them time to return to Perth in order to see if they could arrange finance. They decided to do so. Mr Hendrick told them that in Queensland they needed to use a solicitor for the settlement of the contract and gave them a list of lawyers. The first name on the list was Nelson Wockner from Wockner Legal Services. Mr Lewis said that he would be satisfactory. Mr Hendrick put them in contact with Mr Wockner and arranged a meeting for 15 September at 10 am. Although Mr Lewis said “September”, he probably meant “July”. They were flying back to Perth on that day.

17 In his evidence-in-chief Mr Lewis was then taken to Tab 5 in exhibit 1, the tender bundle of documents. That document is an email from Mr Lewis to Mr Troy Cameron who was the Lewises’ mortgage broker. The email is of considerable importance in this case as it seems to set out Mr Lewis’s understanding of this project as derived from his discussions with Mr Hendrick. I shall therefore set out its content in full:

Hi Troy,

As discussed Mia and I are considering purchasing a Strata Titled apartment in Surfers Paradise. There is a new 5 star Hilton Hotel and Residences development going up. The apartments are for purchase to live in or rent out either through the Hilton or privately. If going through the Hilton the apartment are treated as an extension of the hotel with all of the same services. The development is currently under construction by Brookfield Multiplex and ANZ are the financier. Nearly 80% of the apartments have been sold. There are two towers. The first “The Boulevard Tower” is 32 levels and is due for completion late 2010 and the second “The Orchid Tower” is 57 levels and due for completion mid to late 2011. The complex will comprise of around 169 hotel rooms and 410 apartments. At least half the apartments are likely to be owner occupied. The project had been on hold as the developer “Raptis” has gone in to receivership. The project has now appointed Brookfield Multiplex as the developer and construction is now well underway. See the attached link below and the BMC/ANZ media release.

http://www.surfersparadiseresidences.com/

This will be the only 5 star hotel in the centre of Surfers Paradise. The only other 5 star hotel “Versace” is out near Sea World approx 10min from the centre of Surfers Paradise.

The apartment we have made an offer on is on level 32 of The Boulevard Tower. This is the top level of this tower. The agreed price is $932,000.00 including the furnishings to the Hiltons requirements. It is 107sqm. I have attached a floor plan for your information.

We have paid a $5K fully refundable holding fee and if we sign contracts then we will have 28 Business Days to come up with the balance of a 10% deposit ($88,200). There is nothing further to pay until construction is complete (late Dec 2010).

I have been crunching the numbers and this appears to be a good positively geared investment. This is based on the following calculations.

Assume an average nightly room rate of $550/night with a 70% Occupancy Rate (256 days/year). Surfers Paradise is currently sitting at around 80% and I am confirming this data via independent reports.

• Income- $140,800

Less

• Hilton Management Fees @ 47% (13.2% Letting Fee & 33.8% Services Fee) - $66,176

• Body Corporate Fees@ $140/week - $7,280

• Rates (no land tax in QLD) - $1,800

• Loan Repayments (P&I $970K@ 5.11%) - $63,276

I have checked with the other 5 star hotel Versace and their current rate for a 2 bedroom apartment currently is $1,300 per night and this is the low season! Any improvement on the assumed $550/night is more money in the bank so to speak.

Mia and I currently have a combined income of $237K ($35K Mia).

Our house was valued last Sept by the bank at around $970-980K when we took out the loan to finish off the house. I assume you have that on file. Now that the house is completely finished I would suggest it is worth well over $1M however the bank will decide this one!!

Current loans are:

House - $792K (current repayments $4.9K per month)

Car Lease 1 $25K (current repayments $677 per month)

Car Lease 2 $45K (current repayments $777 per month)

I have attached a copy of our current budget for your info.

I have also attached a copy of the form we have signed today and a depreciation schedule. I also have a copy of the Hilton Management Agreement however this is only in hard copy.

Let me know if you need any further information.

Regards,

18 The media release is also at Tab 5 of exhibit 1. It demonstrates that the ANZ Bank, Brookfield Multiplex, the Gold Coast City Council and Hilton Hotels were supporting the project.

19 Concerning the figures which appear on the first page of the email Mr Lewis said that they had been told that the figure of $500 to $550 per night would be the average room rate. They had checked the room rate for the Palazzo Versace which, in the email, he identified as $1,300 per night for a two bedroom apartment. He said that Mr Hendrick had indicated that five star apartments had about an 80% occupancy rate. Mr Lewis discounted this to 70% in order to do his calculations, yielding an annual income of $140,800. He then calculated the management fees on the basis of the figures provided by Mr Hendrick and the other outgoings. He had also worked out the annual cost of borrowing from the ANZ Bank. He concluded that income from the unit would adequately cover its expenses. He was then taken to a “budget” which was attached to the email. It appears to be a household budget for the Lewis family. It shows an excess of income over expenses of $23,900.26. It is surprisingly detailed.

20 There is some inconsistency in Mr Lewis’s evidence as to the information provided concerning room rates. In giving his evidence concerning the first meeting, he said that they were told that the room rate would be “around $500 a night” (ts 23 l 11; ts 24 l 24). When asked about his calculations (in which he adopted the figure of $550) he said that they had been told, “… in the order of 500, 550 thereabouts on average nightly room rate.”. Mr Hendrick said that Ms Barlow had offered the figure of $1,000, but that he had offered the more “conservative” figure of $500 (ts 143 ll 1 – 4). The matter is of some importance. It may go to the accuracy of the evidence of the relevant witnesses. It may also go to the question of reliance. I should add that Ms Lewis said that they were given the figure of $500 (ts 85 l 28). The Lewises do not plead that the representation as to room rates was misleading or deceptive, but it must have been a significant element in calculating the alleged representations as to positive gearing and, perhaps, capital appreciation.

21 Mr and Ms Lewis and Mr Hendrick met Mr Wockner on 15 July. They met at the sales office. Ms Barlow also attended. Mr Wockner had a “guide” to the Hilton development and seemed to be familiar with it. He took them through it. Ms Barlow then produced a bundle of contract documents, a disclosure statement and body corporate documents. Mr Hendrick and Ms Barlow asked Mr and Ms Lewis to sign the documents in the presence of Mr Wockner. The Lewises said that as the agreement would not be subject to finance, and as they had not yet organized finance, they could not sign them. They asked Mr Hendrick and Ms Barlow to give them some time to consult with Mr Wockner privately. In their private meeting, Mr Wockner advised them not to sign the documents at that time, but rather to take them away and read them. He also reminded them that if executed, the contracts would not be subject to finance. They should therefore make sure that they were “finance proof” before they signed them. The meeting lasted for only half an hour or 45 minutes. The documents were not signed on that day. Mr and Ms Lewis took them back to Perth.

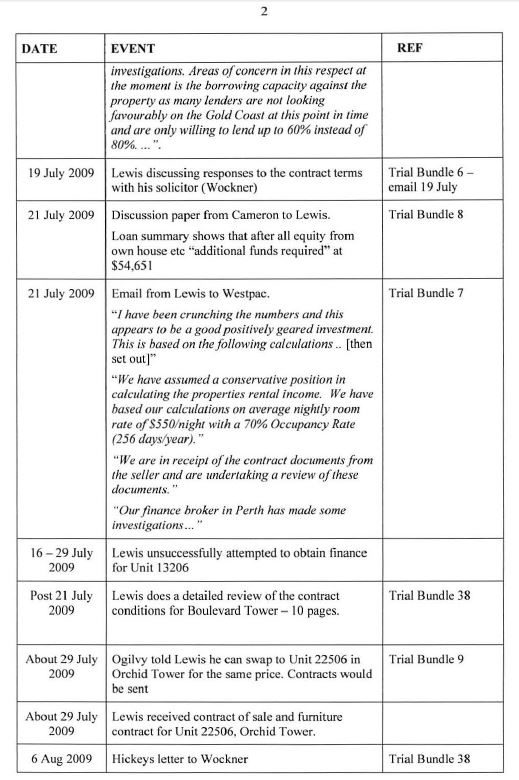

22 When they returned to Perth they contacted Mr Cameron who, a couple of days later, came to their home to discuss the matter with them. He subsequently sent them a “discussion paper” which appears at Tab 8 of exhibit 1. It is not entirely clear whether the heading “Loan Requirements” refers to the requirements prescribed by Mr and Ms Lewis, or whether such requirements reflected options which Mr Cameron knew were available from the ANZ Bank, with whom Mr and Ms Lewis wished to deal. It seems that he recommended that there be two loans: one to cover the deposit, with repayment of interest only for the first five years of a thirty year term; and the other to cover the balance of the purchase price, with the same arrangements as to repayment. Mr Cameron subsequently discovered that lenders were not prepared to lend on Gold Coast properties at lending ratios above 80%.

23 At this time Mr Hendrick was “continually on the phone” and was sending them:

… emails with brochures and just general information on what was happening on the Gold Coast, calling us every couple of days to see if we had signed the contracts and telling us that the sellers were really keen to get the contract signed because it was the last apartment that now remained unsold.

24 He had previously mentioned to them that they might have difficulty in getting finance in Western Australia because lenders there were not familiar with the Gold Coast market. On or about 21 July, Mr Lewis raised with Mr Hendrick the possibility of contacting the bank manager from Westpac in Surfers Paradise. Mr Hendrick had previously suggested that he might be able to assist in contacting possible financial sources on the Gold Coast. Mr Hendrick suggested that they contact a Mr Heath Mohi who was with the Surfers Paradise branch of Westpac. Mr Mohi was Mr Hendrick’s own personal banker and a good friend who knew the Surfers Paradise market, and had special deals for the Hilton development. At Tab 7 of exhibit 1 is an email sent by Mr Lewis to Mr Mohi on 21 July 2009. Again, because the document presumably reflects Mr Lewis’s state of knowledge at that time, I shall set it out in full:

Hello Heath,

Further to our telephone discussion last week Gary Hendrick of Ray White suggested we discuss our finance options with you. My wife Mia and I are considering purchasing a Strata Titled apartment at Lot 13206 “Boulevard Tower” 3113 Surfers Paradise Boulevard Surfers Paradise QLD 4217. This is in the proposed new 5 star Hilton Hotel and Residences development going up.

The apartment we have placed a gold on is on level 32 of The Boulevard Tower. This is the top level of this tower. The agreed price is $932,000.00 including the furnishings to the Hiltons requirements. It is 107sqm. I have attached a floor plan for your information.

We have paid a $5K fully refundable holding fee and if we sign contracts then we will have 21 Business Days to come up with the balance of a 10% deposit ($88,200). There is nothing further to pay until construction is complete (late Dec 2010).

I have been crunching the numbers and this appears to be a good positively geared investment. This is based on the following calculations.

We have assumed a conservative position in calculating the properties rental income. We have based our calculations on average nightly room rate of $550/night with a 70% Occupancy Rate (256 days/year).

• Income - $140,800

Less

• Hilton Management Fees@ 47% (13.2% Letting Fee & 33.8% Services Fee) - $66,176

• Body Corporate Fees@ $140/week - $7,280

• Rates/Taxes - $1,800

• Loan Repayments (P&I $970K @ 5.11%) - $63,276

I have checked with the other 5 star hotel Versace and their current rate for a 2 bedroom apartment currently is $1,300 per night and this is the low season! Any improvement on the assumed $550/night is more money in the bank so to speak.

Mia and I currently have a combined income of $237K ($35K Mia).

We currently owner/occupy a property (with assistance from the bank) in Woodvale 6026 Western Australia. The property is a new construction (completed Sept 2008) in an established suburb 19km north of the CBD. We suggest the value of the property is between $1M to $1.1M. The property was valued last September at approx $980K by ANZ immediately following construction but prior to any internal and external finishes/improvements being undertaken. The property is now complete with a high standard of finish.

Current loans are:

Property- $792K (current repayments $4.9K per month)

Car Lease 1 $25K (current repayments $677 per month)

Car Lease 2 $45K (current repayments $777 per month). This is covered by a $15K p/a car allowance.

We have attached a copy of our current budget for your Information.

We have also attached a copy of the form we have signed to place a hold on the property in Surfers Paradise. We are in receipt of the contract documents from the seller and are undertaking a review of these documents.

We would like you to confirm whether Westpac would considering providing finance for us to purchase this property? We expect that the total funds we require will amount to approx $980K (which includes stamp duty/legal fees/registration etc). We need to know what the maximum borrowing limit is against this property. Can you also please provide a quote for a long term Deposit Bond for an amount of $93.2K to satisfy the contractual requirement for a 10% deposit?

Our finance broker in Perth has made some investigations and was advising us that lenders are only prepared to lend up to 60% against this property. Given this is a strata title we would expect this to be upwards of 80%.

If you need any further information please give me a call on 0420 308 063 to discuss this further.

Regards,

25 Originally, the Lewises were considering the purchase of a unit in the Boulevard Tower. Eventually, they agreed to acquire a unit in the Orchid Tower. Mr Lewis was asked to explain how this “switch” had come about. It seems that Mr Mohi took some time to respond to their enquiry. At that time, the Lewises were under pressure to sign the contract so that Orchid Avenue could advertise the sale of all units in the Boulevard Tower. Mr Hendrick said that the $5,000 holding deposit was only effective for a period of some days. As a result of those matters they decided to investigate the possibility of acquiring a unit in the Orchid Tower. On or about 30 or 31 July 2009 Mr Lewis had a conversation with a Mr Jamie Ogilvie, apparently from Orchid Avenue. Had they agreed to buy the unit in the Boulevard Tower, settlement would have been due in October 2011. Mr Ogilvie indicated that the Orchid Tower would not be completed for another year, so that Mr and Ms Lewis would have the benefit of an extra year of capital growth. It is common ground that evidence of Mr Ogilvie’s statement is not admissible in these proceedings. It hardly matters. Mr Lewis said that he was willing to change from the Boulevard Tower to the Orchid Tower because it gave him more certainty and an additional window of time to allow for capital growth. Having regard to subsequent aspects of Mr Lewis’s evidence, it seems that Mr Lewis saw the anticipated capital growth as important in his quest to raise sufficient finance to enable him and his wife to acquire the unit. In the course of giving his evidence concerning this matter, Mr Lewis said:

So to buy time essentially we sent a whole lot of questions off back to the seller.

As I understand this statement, it related to the period from 21 July 2009 until about 21 August 2009, during which time the Lewises were under pressure to sign the contract and were awaiting a reply from Mr Mohi as to finance. I understand the “questions” to be the matters identified in the schedule at Tab 38 of exhibit 1. They seem to have arisen out of the documents given to the Lewises on 15 July 2009, relating to the proposed acquisition of the Boulevard Tower unit. Tab 9 of exhibit 1 contains a letter dated 29 July 2009 from Three Sixty to Mr and Ms Lewis. The letter enclosed the conveyancing documents for the sale and purchase of the unit in the Orchid Tower. It seems likely that Mr Lewis’s “questions” were sent prior to the receipt of those documents. However it seems to be common ground that the contracts were in substantially the same terms.

26 There is a further difficulty with Mr Lewis’s evidence. He said that the “swap” of units occurred after he had spoken to Mr Ogilvie on 30 or 31 July 2009. However the letter of 29 July refers to the Orchid Tower unit, so that the proposed “swap” must have been arranged on or before that date. The matter is of little moment other than in connection with any assessment of the reliability of Mr Lewis’s recollections.

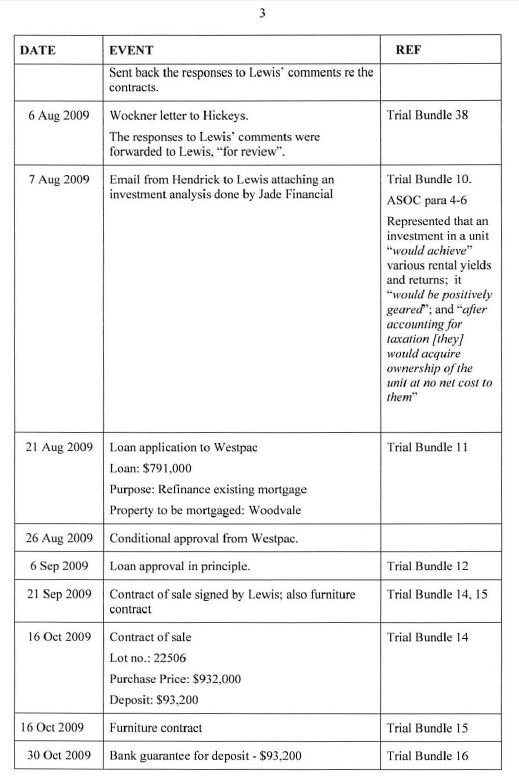

27 Mr Lewis was taken to Tab 10 of exhibit 1, an email dated 7 August 2009, and an attachment sent by Mr Hendrick. The email is addressed to Mr Lewis and reads:

I thought you might like to see the attached investment scenario on a higher priced unit than yours, it was done for a client this week who bought another unit from us.

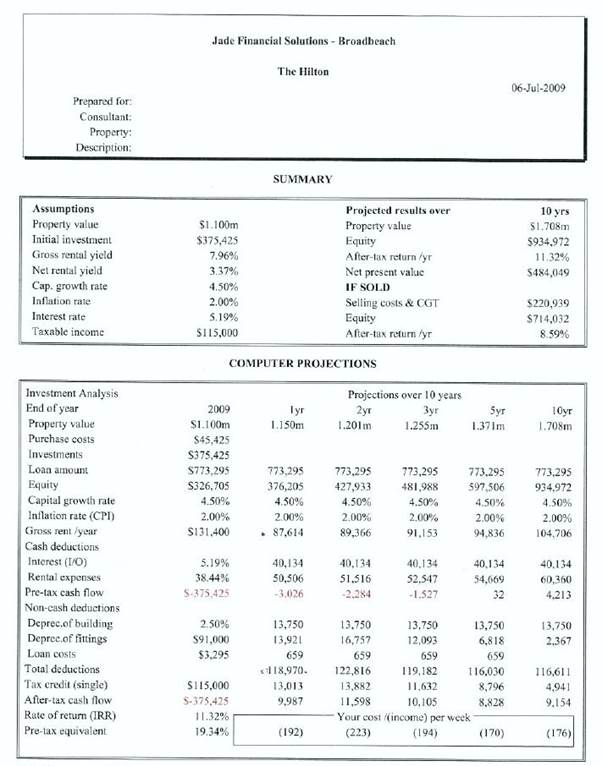

The attached document (the “Jade document”) was prepared by Jade Financial Solutions. This document is the document referred to in para 4 of the amended statement of claim. At a later stage I shall discuss the Jade document in some detail.

28 I have previously referred to the questions which Mr and Ms Lewis sent to Orchid Avenue as a delaying mechanism. On 6 August they received a response through Mr Wockner. Mr Lewis said that the response was “pretty disappointing”. The document at Tab 38 of exhibit 1 contains both Mr Lewis’s questions and Orchid Avenue’s responses. At about this time Mr Lewis sent an email to Mr Hendrick, suggesting that they would have to assess their options, although the document is not in evidence. Subsequently, they had various conversations. Mr Lewis asserted that Mr Hendrick was concerned that they might “walk away” from the purchase. He tried to persuade them to continue with it. Mr Hendrick sent them various emails containing information which might have re-inforced the apparent attractiveness of acquiring the unit, the last of which documents were the Jade document and covering email. As that email suggested, the Jade document was prepared for an unknown person and concerned a different unit. The document is of some importance to the Lewises’ case. I shall therefore attach a copy of it to these reasons, including the covering email, as attachment A. I draw particular attention to the disclaimer at the foot of p 1.

29 Mr Lewis was asked what he “thought” about the email. He said that it was:

… validation of what Gary had been telling us about the apartment being positively geared, and that we wouldn’t have to put in any funds.

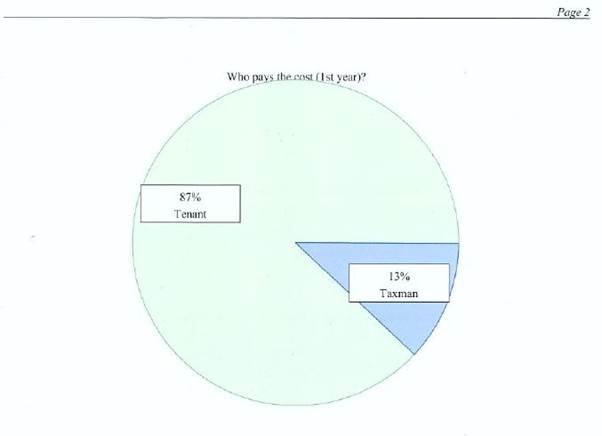

… (the document demonstrated that the) tenant was paying 87% of the costs and the tax man, 13%.

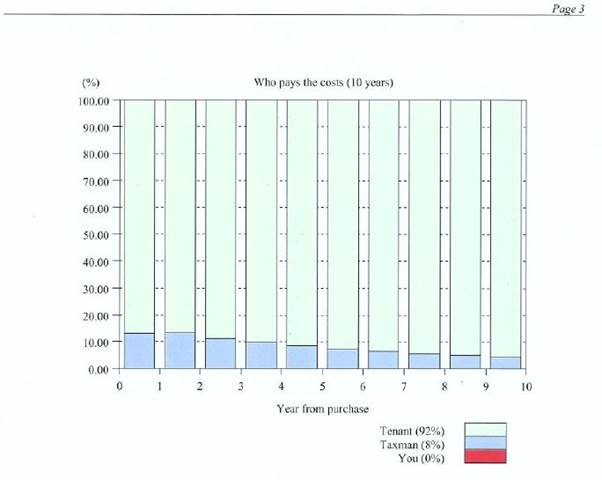

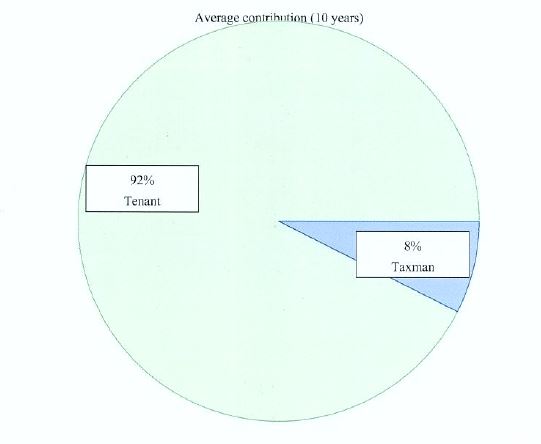

… (that p 3 showed that the) tenant was paying 92% and the tax man, 8%, and you – meaning us, was zero.

He considered that the scenario addressed in the Jade document seemed to be “a reasonable match” with their proposed transaction. He said that a transaction of about $1.1 million appeared to be:

… consistent with the apartment that we were purchasing, given that we were purchasing it for $932,000. And if we were expecting the 20% capital growth when we signed the contract – when we had to pay the money, it would be approximately a $1.1 million apartment.

30 Mr Lewis seems not to have considered the possibility that the unknown purchaser might also have been relying upon such capital appreciation. The notional gross rental in the Jade document was $131,400, which Mr Lewis considered to be roughly consistent with the advice given by Mr Hendrick concerning likely room rates. I am not sure that this was a reasonable conclusion. Mr Lewis had calculated notional gross rental in the amount of $140,800 and his outgoings, including loan repayments and interest at $138,532. Thus his margin was a little over $2,000. The estimated expenses in the Jade document were lower than that produced by Mr Lewis but, again, the margin was narrow, at least in the absence of the estimated tax credit. Mr Lewis seems not to have seriously investigated the availability of such credit to him and Ms Lewis. The “bottom line” on p 1 showed “cost” or “(income)” to the investor. Mr Lewis understood the figures to suggest that he and Ms Lewis would be:

Earning an income. So it was positively geared. We didn’t have to spend any of our own money to put into this.

He said that the assumed interest rate was slightly higher than that which he had derived from the ANZ website.

31 He discussed the document with his wife. At that stage they had not progressed very far in obtaining finance. He said that the overall effect was to reinforce their view that they should, “do what we can to get this apartment because it would pay for itself”. He said that they subsequently submitted an application for finance to Westpac and received a conditional approval, subject to valuation and evidence of income. Mr Lewis understood that they were given an unconditional approval on or about 18 September. They signed the contracts on 21 September. Other evidence suggests that the circumstances surrounding any application for finance were rather more complicated than Mr Lewis suggested.

32 Mr Lewis said that had he not been told by Mr Hendrick that the unit would be positively geared, he would not have signed the agreement:

We didn’t have the capacity. We were fully committed on our own property. This was why this opportunity was good because it was going to be self-sufficient. We didn’t have any other funds to put into it.

He also said that had he not been told by Mr Hendrick that there would be a 20% capital growth he would not have signed the agreement:

Because [of] the capital growth - we could only borrow 80%, so the capital growth was – when we had to pay for it in 2011 or when it was finished, the capital growth would cover that 20%. So our borrowing would have been what our purchase price was. So we wouldn’t have had to pay.

Thus it seems that the alleged positive gearing representation and the alleged capital appreciation representation were closely linked, at least from the Lewises’ point of view.

33 Mr Lewis was asked whether the enquiries which he had made caused him to disregard the information given to him by Mr Hendrick. Mr Lewis said that such enquiries had “validated” Mr Hendrick’s information. In particular, he said that his investigation of the Versace room rates and the rates in the Jade document supported the figures given by Mr Hendrick. Mr Lewis also said that:

The contracts they gave us had the fee breakdowns in it. So that was correct. It just reinforced what we had been told.

34 There is some difficult with this evidence. As far as I can see, there is no documentary evidence of any application to Westpac, in August or September 2009, for finance covering the purchase price of the unit. There is a finance application dated 21 August 2009 for the purpose of refinancing the Lewises’ existing mortgage over their Perth house. At a later stage I shall say more about that application. There is also an approval dated 6 September 2009. These documents are at Tabs 11 and 12 of exhibit 1 respectively. There is a loan application dated 7 August 2011, relating to the acquisition of the unit, but there is no documentary evidence as to the outcome.

35 Mr Lewis was cross-examined in some detail about his employment. He is an associate director of the “Appian Group”, a group of companies which is involved in property development. As I understand it the group manages major construction projects, mainly for “clients”, presumably meaning the owners for whom buildings are being constructed. Most are government agencies. The group has managed various substantial projects. Mr Lewis’s current curriculum vitae is exhibit 4. He was taken to a number of entries in it, including his “special fields of competence” on p 1. The document indicates that his competence is in the following areas:

• land acquisition and assembly for major projects;

• statutory approvals and authority liaison;

• contract management for major projects;

• design management;

• construction management;

• security and risk management consultation;

• operational procedure development; and

• holder of the security agent’s licence on behalf of Appian Group.

He agreed that his areas of competence include contract management, but distinguished such experience from experience in making contracts. However he agreed that he had some experience in that area. Under the heading “Overview of Experience” the CV asserts that he has worked in the construction industry for 22 years, including 16 years in project and general management roles, and that he has:

… excelled in the management of significant major projects through undertaking diverse tasks from project definition and business case development, design and stakeholder management, project approvals and major land amalgamation processes, through to contract formation and negotiations, contract management and operational process development phases of major projects.

36 He was originally an electrician but his background is “security”, particularly electronic security. He was engaged in preparation of the business case for the Metropolitan Prison Precinct in Perth, particularly in working out how the security environment worked. He was referred to other parts of the document and was asked whether or not he agreed that his experience as set out in the document:

… would suggest that you have a deal of talent and a deal of experience in being methodical, careful and diligent when it comes to analysing a project … .

Mr Lewis agreed and also agreed that he had deployed those talents in relation to the proposed purchase of the unit, “to the extent of the information I had available”. He had read the contracts and, “validated what was told to me”, by checking the figures given to him. He also sought to assess the likelihood that the project would be successful, “based on the information I was given”. He agreed that he understood the need to record important matters, and that in the present case, he had done so in emails and notes. He did not recall keeping notes of the alleged oral representations. He agreed that he knew that things said in the course of negotiations were not always reliable.

37 When he met Mr Hendrick he understood that he was a real estate agent, and that he had an interest in selling something. He agreed that he had told Mr Hendrick about his involvement in a hospital project, and that he had been dealing with Brookfield Multiplex in Perth. In general discussion he told Mr Hendrick that he was an electrician. He said in evidence that he was proud of the fact that he had, “come up through the ranks, so to speak to where I am now”. He agreed that before he spoke to Mr Hendrick, he had heard that a contract had fallen through for a unit in the Boulevard Tower and the price. Mr Hendrick repeated that information. He had particularly focussed on Mr Hendrick’s remarks about positive gearing and capital growth. He understood that the term, “positively geared” meant that, “it would pay for itself”.

38 He and his wife would have to borrow in order to buy the unit, and they were geared to the maximum amount available against the security of their house. He discovered from his mortgage broker that there was no point in applying for a bank loan because, “banks weren’t going to borrow an 80% limit”. The broker also said that the ANZ Bank would only lend up to 60% of valuation for units in the Hilton development. He agreed that if they had borrowed 60% of the sale price of $932,000, “there wouldn’t have been sufficient capital growth”, meaning that they could not have found the balance of the sale price. At p 43 l 44 to p 44 to l 37 the following passage appears:

Yes. And you knew, didn’t you, that if something was to be paying for itself it would depend upon the amount of equity you put in; in other words, the amount of money you put into it? --- If the capital growth was there – and this was the discussions we had, if the capital growth was there, we wouldn’t have to put in the money. The 80 per cent loan value of when the apartment would settle would have covered that, so we may have had to – I think in the stuff that Troy gave us that showed $54,000 or something, they had worked out on his calculations from our discussion paper it had about a $54,000 amount which would have been manageable over two years.

You knew, didn’t you … that if you were going to buy this and it was to pay for itself, that fact would depend on how much you put into it - how much money you yourself put into it? --- How much - - -

That’s one of the factors? --- No.

It’s not? --- How much equity we would have against it.

Did you think you would not have to put any money at all into it? ---Very little, if any. Yes.

Sorry. What do you mean by very little? --- Again, the initial discussion paper we got from Stratique Finance, Troy Cameron, indicated a $54,000 shortfall from memory, thereabouts.

Yes? --- So we may have had to put in something but the information we were told that we wouldn’t have to put in anything, and we were expecting not to put in anything.

It would also depend upon the amount that was borrowed, wouldn’t it? Whether it would pay for itself, how much you borrow and at what rate? --- Yes.

Right. It would depend upon the income from the rentals, wouldn’t it? --- Correct.

It would also depend on the level of the outgoings? --- Correct.

It would also depend in part upon the tax regime that applied to you, at what level of tax you were paying? --- Correct.

Right. Anything else? --- Basically just what the costs and – the likely costs and the likely expenses.

39 Mr Lewis said that he had told Mr Hendrick that they could not pay any part of the deposit from their own funds. He could not recall whether he had ever actually said to Mr Hendrick that he would have to borrow 100% of the purchase price. He did not show Mr Hendrick the budget which he had prepared. He agreed that he knew that the mere fact that a real estate agent made a comment about a property did not mean that he could rely upon it. He also agreed that given his own training, skills and experience he would not normally rely on something said by a real estate agent. He would rather do his own work. He agreed that in July 2009, he knew that the Boulevard Tower was to be completed in December 2010. He also knew that the Orchid Tower was to be completed about one year after that. He understood Mr Hendrick to have said that there would be a 20% capital growth over an 18 month period. He was then asked about the “factors” which might affect the achievement of such capital growth. He identified time, demand and interest rates.

40 He was then asked if he and his wife had raised the question of room rates with Mr Hendrick. He said that they had. It was a logical question to ask in order to ascertain the income from the unit. This was the beginning of his inquiries concerning any possible acquisition. The figures quoted by Mr Hendrick and Ms Barlow for the Versace Hotel room rates were substantially below the rates which he discovered online. In searching for those rates, he was trying to validate the information which he had been given. These rates were nightly rates for a two bedroom apartment. He also used an online calculator to calculate relevant figures concerning any loan. He calculated that he would have to borrow $970,000, of which $932,000 would be for the purchase price. The balance was estimated stamp duty. He then checked online to identify the terms upon which such an amount could be borrowed. In so doing, he was seeking to determine the feasibility of the project. It was suggested to him that he understood that anything Mr Hendrick said as to his capacity, and that of his wife to make the investment would be unreliable because Mr Hendrick was largely ignorant of the Lewises’ personal circumstances. Mr Lewis disagreed with that proposition. On the night of 13 July 2009, after the second meeting (of which Mr Lewis did not keep notes), Mr Lewis sent to Mr Cameron the email which appears at Tab 5 of exhibit 1.

41 It was put to him that the reference to, “crunching the numbers” suggested that he had been crunching the numbers since 10 July. Mr Lewis disagreed, saying that he had done so on the night of the 13th. He agreed that his conclusion that the proposal looked like, “a good positively geared investment”, was based upon the information included on p 1 of his email to Mr Cameron, including the assumed nightly room rate of $550, a variation from the figure provided by Mr Hendrick. The occupation rate was also different from that provided by Mr Hendrick from the “independent report” (the “Midwood report”) Mr Hendrick was to supply a copy of this report. The income figure of $140,800 was derived by Mr Lewis using the nightly rate of $550 and an occupancy rate which he had chosen for himself. He said that the information concerning body corporate fees, rates and information concerning land tax all came from the “agents”, presumably Mr Hendrick and Ms Barlow. The loan repayments were derived from Mr Lewis’s own analysis. He said that his analysis led him to the conclusion that it was a good, positively geared investment. It was suggested to him that his own calculations were the basis for this view, and not anything that had been said to him by the agents. He disagreed.

42 With respect to the budget (at Tab 5 of exhibit 1) which was forwarded to Mr Cameron, Mr Lewis said that it was an “ongoing” yearly budget which had not been prepared specifically for the purposes of the proposed investment. Mr Lewis agreed that it was, “quite detailed”. It was suggested to him that this epitomised:

… the way in which you approached this proposal to buy a unit: you wanted to satisfy yourself based on your own analysis.

He replied:

I did analysis based on the information I had to satisfy myself … I wouldn’t go into something if I didn’t believe that it would work out.

43 He agreed that he trusted his own work, his own analysis and his own judgment. He expected a decision from Mr Cameron as to whether he and his wife would be able to borrow the money. Mr Lewis agreed that he had not told Mr Wockner, his solicitor, about the representations which he now alleges were made by Mr Hendrick. Mr Lewis agreed that the extra time for settlement of purchases in the Orchid Tower would have had an impact on whatever capital growth was available, and that occupation rates and interest rates might change. He said that he did not appreciate those matters at the time.

44 On 20 and 21 July 2009 Mr Hendrick and Mr Lewis exchanged emails. They are at Tab 6 of exhibit 1. On 20 July Mr Lewis emailed to Mr Hendrick as follows:

Are you able to provide a copy of the following documents as soon as possible?

• Valuation Report for the development (the Form 30(c) Warning Statement clearly identifies that we should obtain an independent valuation of the property. There is no doubt that one would already have been prepared for the Seller/Developer). A copy of this will save us time having to obtain a new property valuation.

• Midwood Queensland Investment Report (you advised previously that you would provide a copy of this).

• Confirmation that Hilton has entered into the 20 year management agreement for the development as reported in news articles (surely there is something on Hilton letterhead).

Mr Lewis agreed that in seeking the valuation obtained by Orchid Avenue, he was trying to save time and money. He agreed that confirmation that Hilton was committed to the project for 20 years was one of his most important concerns.

45 In the email Mr Lewis then referred to discussions with Mr Cameron and identified areas of concern, particularly the extent of any borrowing which would be available, using the unit as security. Mr Lewis suggested that lenders would discount any valuation by the “$32K rebate”, further reducing the borrowing capacity. He said that lenders were not “looking favourably” on the Gold Coast and were only willing to lend up to 60% on Gold Coast properties. He enquired as to whether Mr Hendrick was aware of any lenders “having a specific lending guideline for this development … .”.

46 On 21 July Mr Hendrick replied, attaching, “some pages from the Midwood report February 2009”, and indicating that he was awaiting a copy of the May 2009 report, “ which show, the accommodation rates increasing back up to an average 74.7% across all types of accommodation units.”. He also included material concerning changes to air services to the Gold Coast Airport, including, “larger planes for international visitors”. He asserted that:

… what you are investing in is the first 24 hour room service 5 star Hotel to be located in the heart of Surfers Paradise. The Westpac and ANZ will lend up to 80% for Australian purchasers conditions apply of course. When I receive the updated report hopefully tomorrow I will send the necessary pages.

Also check out the Gold Coast Airport website below for more routes to be announced.

Mr Lewis agreed that according to his email of 20 July, he was to meet Mr Cameron on the following Monday to confirm, “our discussions and his investigations”. In cross-examination he said that the investigations involved his looking for finance. Mr Cameron had told him that lenders were not looking favourably on the Gold Coast at that time. Mr Lewis understood this to be a reflection of the market situation. He said:

That’s why we were buying it at what we were told was the low end of the market, because the building had gone into receivership.

It was then put to him, “Low end of the market, with the GFC in full flow?” He replied “Correct”. He agreed that the effect of Mr Cameron’s advice was that lenders were lending at 60% of valuation instead of 80%. It was put to him that the email of 20 July was, “a perfect time”, to obtain confirmation from Mr Hendrick as to the representations allegedly made by him. Mr Lewis said that the purpose of the email was to obtain information rather than to confirm other information. He agreed that he understood the Midwood report to be an independent report in the sense that it did not come from Mr Hendrick or his principals. He also understood that the other documents sent by Mr Hendrick were from independent sources. He said that he did not understand Mr Hendrick’s suggestion, that Westpac and ANZ were lending at up to 80%, to be inconsistent with Mr Cameron’s indication that the ANZ in Western Australia would not lend at 80%. He thought that there would be a difference between what the ANZ in Western Australia would do, and what the ANZ in Surfers Paradise would do. He said that Mr Cameron had forewarned them that they would probably have to get finance through lenders on the Gold Coast.

47 On 21 July 2009 Mr Lewis sent an email to Mr Heath Mohi of Westpac Bank at the Gold Coast, apparently at the instigation of Mr Hendrick. It is at Tab 7 of exhibit 1. I have previously set out the terms of that document. Mr Lewis said that he did not believe, at that time, that he would not be able to get finance, or that the Westpac application was his last chance. He said that it was rather, “the next stage of getting finance”. He agreed that the reference to “crunching” the numbers indicated that he had been making his own assessment as to whether this was a worthwhile investment. His conclusion, as he put it to Mr Mohi, was that, “… this appears to be a good positively geared investment”. The excess of income over outgoings would be about $2,268. It was suggested to him that such amount was, “a very, very skinny investment”. Mr Lewis said that he did not know. He had been conservative with respect to occupancy rates and income.

48 I have previously referred to a discussion paper prepared by Mr Cameron (at Tab 8 of exhibit 1). Mr Cameron’s proposal was, as Mr Lewis agreed, “geared to the hilt”. The net effect of the figures seems to have been that they would need an additional $54,651 in order to fund the deposit and acquisition expenses. Subsequently, Mr Lewis had a conversation with Mr Jamie Ogilvie representing the vendor. As I have previously explained, this conversation led to the “swap” of the Boulevard Tower unit for a unit in the Orchid Tower. It was to be completed later, so that Mr Lewis would have more time to find the funds. The unit was not a penthouse unit (as was the unit in the Boulevard Tower), and it was smaller than the Boulevard Tower unit. However both were two bedroom units. Mr Lewis was asked whether it occurred to him that these differences might have had an impact upon the ability to self-fund the project and its capital growth prospects. Mr Lewis denied this, saying that the Orchid Tower was the “premium tower”. It had all of the services and the price was the same. It was said to be a “like swap”. The listed price was $15,000 more than that of the Boulevard Tower unit, but Mr Ogilvie said that he would see if it could not be supplied at the same price. In the event, this occurred. Mr Lewis agreed that the statements made to him by Mr Hendrick had related to the Boulevard Tower unit, and not to the Orchid Tower unit.

49 The witness was then taken to Tab 38 of exhibit 1, to which I have previously referred. This document contains comments by Mr Lewis upon the terms of the contract for the Boulevard Tow unit, and responses from Orchid Avenue. Those responses suggest that when they were prepared, Orchid Avenue knew that the Lewises were to acquire the Orchid Tower unit, and not the remaining Boulevard Tower unit. Thus it seems that Mr Lewis prepared the questions prior to the swap, but that they were answered after the swap. The questions raised by Mr Lewis concerning the terms of the contracts are of interest largely because of the terms which he did not question. Some of them appear to be quite inconsistent with the Lewises’ case, and so one might have expected Mr Lewis to have questioned them.

50 Clause 4.4 of the unit contract was a recital of the intention that stage 2 of the project comprise a residential development on the “residential land”, a retail/commercial development on the “retail land” and a hotel development on the “hotel land”. The three parcels of land were identified elsewhere in the contract. The Tab 38 document suggests that Mr Lewis was concerned that land described as “lot 2” was not referred to in the unit contract. Orchid Avenue pointed out that the clause was merely a reiteration of intention. I doubt whether this aspect of the evidence has any relevance at all, save that Mr Lewis seems to have read the relevant clause, understood it and questioned it. Concerning cl 13.1, Mr Lewis sought to ensure that the unit to be acquired in the Boulevard Tower was a penthouse unit. Mr Lewis expressed a similar concern arising out of clause 13.2. Orchid Avenue responded, pointing out that the Lewises were no longer acquiring that unit. Again, the matter is relevant only to the extent that it shows that Mr Lewis carefully considered the terms of the contracts.

51 Clause 25.7(a) recited the intention that Hilton operate the hotel but indicated that it might be operated by a different operator, or using a different brand. Mr Lewis asserted that it had been represented to him that Hilton would be the operator for a period of 20 years. He asked that the clause be amended to reflect this arrangement. Orchid Avenue refused to do so. Clause 25.7(g) recorded that the purchaser had not relied upon any statement or representation regarding the management of the unit development, under any brand or by any entity. Mr Lewis asserted that:

In order for this clause to stand the Seller must provide documentation that substantiates all of the representations that have been made to date in respect of the operator.

The developer indicated that this was, “Not agreed.”. Again, it seems that Mr Lewis had read and understood these clauses and questioned them.

52 Clauses 29.1 and 29.2 provide:

29.1 The contract sets out the entire agreement between you and us, and supersedes all prior negotiations.

29.2 You warrant that you have not relied on any statement made by us (other than one contained in the contract), nor any real estate agent or other consultant appointed by us, and that you have signed the contract after making your own investigations and enquiries. You agree that you do not have any right to make any objection on the ground of any such alleged statements.

Mr Lewis did not take issue with those clauses. However he took issue with cll 29.5 and 29.6 which relate to amendments to the contract, suggesting amendments to which the vendor did not agree.

53 Clause 31.2 provides that:

[The vendor] may elect not to proceed with one or more of the stages in the development.

Mr Lewis commented:

For clarity we request the seller to confirm which stages they have committed to. We are buying into a development that needs to generally reflect what has been represented, i.e. 2 towers, including hotel and 5 star services.

The vendor responded that it was only responsible for stage 2.

54 In cross-examination, the witness was taken to the “special conditions” at Tab 14 of exhibit 1, p 199. Under the heading “No Representations” the following clauses appear:

1.1 Without limiting clause 29 of the contract, you agree that you have not relied on any statement made by us or any real estate agent or other consultant appointed by us except those statements in this contract.

1.2 In particular, you warrant and agree that neither we or any real estate agent who acts as our agent has made any statement or representation to you in relation to:

(a) any potential capital growth of the lot or any other lot in the development; and/or

(b) any expected or projected return from the letting of the lot or any other lot in the development for residential purposes; and/or

(c) the potential for resale of the lot at a profit prior to the completion of this contract.

1.2(sic) You confirm to us that you have made your own enquiries in relation to the matters referred to in this special condition and you are satisfied with your own enquiries in that regard.

Mr Lewis agreed that he had not taken issue with those clauses. The following passage appears in his cross-examination at ts 67 ll 29 - 33:

Now, can I suggest to you or put this to you, if in truth, Hendrick had said what you now say he said, that is unquestionably the time at which you would have said, “Hang on. You’re asking me to promise something that isn’t true because Hendrick told me this and that and the other.” But you said nothing about that did you? --- No. I didn’t say anything about that.

It was then suggested to him that he had not said anything because the representations had not been made. Mr Lewis said that this suggestion was incorrect. The following passage appears at ts 67 ll 38 – 39:

And even if they were said to you, you were happy to promise that you were placing no reliance on them. Isn’t that right? --- That’s correct.

55 The witness was then taken back to the Jade document (at Tab 10 of exhibit 1). Mr Lewis agreed that it was clear that the document had not been prepared by Ray White or by Mr Hendrick. He agreed that he had appreciated that fact at the time. He understood that it had not been prepared for him, that it did not relate to his unit, and that it was for a different unit, at a higher purchase price and for a different client. He did not seek to find out about Jade Consulting or Jade Financial Solutions. He noted at the time that the document dealt with a unit valued at $1.1 million as at July 2009. He agreed that it assumed an initial investment of approximately $375,000 and the borrowing of $773,295, with an “equity” of $326,705. The amount of the borrowing was 70% of the purchase price. Mr Lewis agreed that none of these figures matched his own proposed arrangements. He said that he did not, at the time, consider that the scenario under consideration in the Jade document was different from his own. He accepted that he was always going to be borrowing, “a couple of hundred thousand dollars more than this scenario.”. It was pointed out to him that the document assumed capital growth of 4.5% per annum in 2009, and in each of years 1, 2, 5 and 10. It was put to him that having read the document carefully, he must have noticed the capital growth of 4.5% per annum, and that it was inconsistent with the figure of 20% over 18 months. He said that he had looked at the property value, the gross rent and the interest rate, and that the graphs on the table in the document had “stood out”. It was pointed out to him that the capital growth figure was also mentioned in the summary at the top of p 1. He was asked whether he had noticed it, or whether he did not remember whether he had done so. He replied:

No. I don’t – I’m not a financial person. That didn’t quite stick out to me. The things that stuck out to me in this document was the property value, the gross rent and the interest rate.

He was asked:

Not interested in capital growth obviously?

He replied:

Interested in capital growth.

It was suggested to him that:

… it could not have been plainer but that this financial person was suggesting a capital growth rate of 4.5 per cent per annum and nothing remotely like 20 per cent over 18 months.

He replied:

If you look at that, yes.

56 Mr Lewis agreed that he had looked at the gross rental of $131,400, and that this was nine odd thousand dollars less than the figure which he had calculated. The following passage then appears at ts 70 ll 27 - 29:

So lower loan, lower rent, bigger equity, leave aside capital growth for the moment. Alright, now you say you focussed then on the final line which is cost/(income). Is that what you are saying? --- Yes.

And you would know, wouldn’t you, that any figure in brackets like that means a negative? --- No. It said – in here in brackets it said it was income.

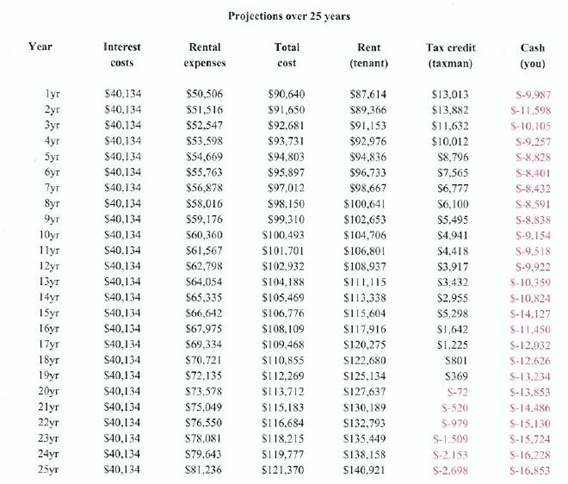

Although counsel persisted in putting this proposition to Mr Lewis, and returned to the matter at a later stage, I consider that Mr Lewis was correct in his reading of that part of the document. He was then taken to p 2 of the document. It shows projections over 25 years. The entry for the first year shows interest of $40,134 and expenses of $50,506, a total of $90,640, with rent amounting to $87,614, a tax credit of $13,013 and a cash contribution by the owner of $9,987. He agreed that the expenses totalled more than the rent, thus creating the need for the contribution of funds by the owner.

57 At ts 70 – 71, referring to p 2 of the Jade document, counsel pointed out that the total of interest payments and rental expenses was $90,640 and the rental income, $87,614, showing a shortfall of $3,026. A “tax credit” of $13,013 was applied against that amount, yielding a net figure of “- $9,987”. Again, I accept that the negative figure shows an excess of income over outgoings for the owner, as opposed to the need for a cash contribution by the owner. This figure is then shown on p 1, for year 1, as “after-tax cashflow” and, if divided by 52, yields the weekly “income” figure of $192. Thus it seems that at least in the Jade document, any excess of rental income over outgoings depended upon the availability of a tax credit, the basis of which is not explained in that document. Although the Lewises’ counsel sought to explain the tax position, there is no suggestion that Mr Lewis investigated the availability of such a benefit before entering into the contracts, particularly as to its applicability to him and his wife. No doubt there would have been some available deductions, but any income could presumably have been divided equally between Mr and Ms Lewis. Presumably, the outgoings would have been similarly apportioned. Her other income was only about $35,000. However the point is that Mr Lewis seems not to have considered any tax benefit in reaching his decision to buy the unit, save to the extent that it was identified in the Jade document.

58 Mr Lewis agreed that the capital growth rate shown on p 1 of the Jade document (4.5%) was inconsistent with his assumed 20% over 18 months. Counsel suggested that, having seen the document, he could not possibly have continued to think that the figure of 20% was true or reliable. Mr Lewis disagreed. He suggested that:

The capital growth, I think from this, was about trying to sell the place, what the property was going to be ending. We were looking to keep an investment for the long-term. This was about just the growth that was happening during the construction because it is not an operating entity. Because we were buying at the low end of the market and because we were buying off the plan this was, from my understanding, from when the facility, or the unit, became operational. That 2009 was an operational facility, not something that was under construction for two years prior.

In this answer Mr Lewis seems to distinguish between long-term and short-term capital appreciation, at least implying that the Jade document showed short-term capital appreciation, probably over the construction period, whilst he and his wife were interested in long-term appreciation, during the construction period and also during the operation of the hotel. However that approach sits uneasily with Mr Lewis’s view that he understood that there would be a capital appreciation of 20% during the construction phase. Indeed, he seems to have been depending upon such appreciation for his finance. Mr Lewis asserted that the Jade document backed up:

[E]xactly what we were told and the purpose of it being sent to us, from my discussion with Gary in the morning, in that morning on the 7th, was that he was sending us this because it reflected what we would be doing.

59 It is a little difficult to accept that Mr Lewis did not note the difference between the allegedly represented capital growth rate and that adopted in the Jade document. It is also unlikely that he would have read that document in the selective way which he suggests unless, of course, he did not consider it to be of any particular importance to his decision. Such a view would be quite consistent with the fact that the document addresses the acquisition of a different unit, by a different person, at a different price, with a different financial arrangement, and was subject to a complete abnegation of any responsibility for its content. It is difficult to accept that it supported the proposition that the Lewises’ investment would be self-funding or the representation as to capital appreciation. Mr Lewis’s failure to address the family’s tax position suggests that he did not really seek to draw a parallel between the scenario described in the Jade document and the transaction being contemplated by him and his wife. There is no plea that Mr Hendrick made any other representation as to a tax benefit.

60 The witness was taken to Tab 11 of exhibit 1, a Westpac loan application made by Mr and Ms Lewis. The purpose of the loan was said to be to refinance an existing mortgage. Mr Lewis said that the ultimate purpose was to finance the deposit on the purchase of the unit by way of bank guarantee. The total amount of the loan sought was $791,000. Other documents at Tab 11 suggest that this figure represented the balance then owing to the ANZ Bank and secured on the Perth house. The witness was then taken to Tab 12 of exhibit 1 which contains a document headed “Loan Entitlement”. It is dated 6 September 2009. It advises approval of an advance in the amount of $745,600. The witness agreed that he needed in excess of $230,000 more than that figure in order to cover the whole of the purchase price of the unit. He said that he had not seen this document until late 2011 (just before the due date for settlement) when he requested confirmation from Westpac that the loan had been approved. In fact, the cross-examination and answers concerning those documents may have been based on the confusion which seems to surround Mr Lewis’s attempts to obtain finance. As I have said, the Westpac loan was sought in order to refinance the existing debt owed to the ANZ Bank and was to be secured on the Perth house. The bulk of the funds were, no doubt, to be applied in discharging the ANZ debt. However Westpac also agreed, at some point, to provide a bank undertaking to pay the amount of the deposit on the purchase of the unit, in the amount of $92,300. It may be that such contingent liability was also to be secured by the anticipated Westpac mortgage over the Perth house.

61 At ts 74 ll 19 - 22, Mr Lewis seems to have said that until late 2011 he understood Westpac had approved a loan application for the acquisition of the unit, as opposed to having approved refinancing of the ANZ debt secured on the Perth house and perhaps, having undertaken to guarantee the amount of the deposit pursuant to the unit contract. As the deposit was not to be paid at the time of signing the contract (the bank undertaking being accepted in lieu), the deposit was presumably to be paid as part of the full purchase price on settlement. The reference to late 2011 suggests that Mr Lewis was referring to approval of finance for the payment of the purchase price on settlement. He agreed that the documents at Tabs 11 and 12 did not give approval, “to invest in the property”, presumably meaning to pay the purchase price for the unit. However he said that he had, nonetheless, received a document evidencing such approval. Mr Lewis understood that with regard to such approval, Westpac was to value the unit in 2009. He claimed not to have been aware that there would be a further valuation of the unit when finished. It was put to him that:

You’re telling us Westpac were prepared to lend on the valuation 18 months out from when they were going to actually advance the money? …

Mr Lewis replied:

My understanding is, that was the purpose of getting approval. We went and got an approval so that we had comfortable – that we knew we could move ahead. I wasn’t of the understanding that that then had to get reassessed in two years time, because in my world, that’s not an approval.

Mr and Ms Lewis signed the contracts on 21 September 2009. Orchid Avenue appears to have signed on 16 October 2009. The bank undertaking concerning the deposit was dated 30 October 2009. Mr Lewis said that Westpac forwarded loan documents over the Perth house, but no such documents were provided in relation to the unit. Mr Mohi told Mr Lewis that those documents would be provided at a later stage. It was put to Mr Lewis that they then looked for finance from lenders other than Westpac. Mr Lewis said that they had not made any other applications for finance.

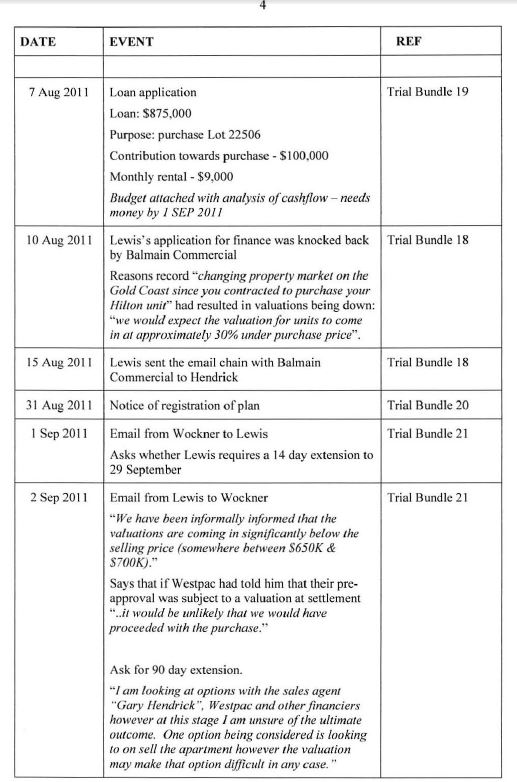

62 He was taken to Tab 18 of exhibit 1, an email chain between Mr Lewis and Mr David Farrant of “Balmain Commercial”, apparently an organization which specialized in the “funding of Hilton Surfers Paradise Apartments.”. The emails were sent in August, 2011. The documents suggest that Balmain Commercial was not, itself, a lender. One email refers to, “a unique, tailored funding package via the ANZ which has been specifically designed to support purchasers within the Hilton hotel.”. The package provided for funding up to 80% of the purchase price. Mr Farrant suggested that the “key benefit” of the package was that purchasers could, “borrow the maximum amount in light of current property values.” Mr Lewis seems to have understood that the borrowing limit would not be reduced in the event that the market price declined to a level below the purchase price. Both Mr Hendrick and Brookfield Multiplex/Hilton had referred Mr Lewis to Balmain Commercial.

63 On 8 August 2011 Mr Lewis provided Mr Farrant with relevant financial information and documents. On 10 August Mr Farrant advised that the maximum loan would be in the amount of $521,920, being 80% of an assumed valuation of the unit at $652,400. It seems that Mr and Ms Lewis did not meet ANZ’s requirements for the “tailored funding package” pursuant to which it would fund up to 80% of the purchase price rather than of valuation. It was put to Mr Lewis that the assumed valuation was inconsistent with his expectation of 20% capital growth over 18 months. Mr Lewis said that it raised “significant alarm bells”. He nonetheless inquired as to why he and Ms Lewis did not meet the criteria. Mr Farrant said that although the ANZ was offering to lend up to 80% of the purchase price, its lending policy was otherwise quite restrictive. ANZ was the only lender lending at 80% of purchase price. This was the only reason for Mr Farrant’s dealing with it. Mr Lewis copied the response to Mr Hendrick. In cross-examination it was put to Mr Lewis that he had not said anything to Mr Hendrick about the disappointment of his capital growth expectations. Mr Lewis said that they had “a lot of discussions” at that time.

64 It seems that in late August or early September 2011, Mr Lewis asked his solicitor, Mr Wockner, to obtain an extension of time for settlement. On 1 September 2011, Mr Wockner wrote to Mr and Ms Lewis, asking if they required a 14 day extension until 29 September 2011. On 2 September 2011 Mr Lewis emailed Mr Wockner, as follows:

We have been informally advised that the valuations are coming in significantly below the selling price (somewhere between $650K& $700K).

Westpac with whom we obtained pre-approval before signing the contract originally are now advising that their pre-approval was subject to the valuation of the property upon completion. Westpac did not advise me at the time that their pre-approval was subject to the valuation of the property upon completion. If they had done this it would have been unlikely that we would have proceeded with the purchase.

Westpac have advised me that they have not yet received the formal valuation as yet.

Can you please request an extension for the settlement date of 90 days?

I am looking at options with the sales agent “Gary Hendrick”, Westpac and other financiers however at this stage I am unsure of the ultimate outcome. One option being considered is looking to on sell the apartment however the valuation may make that option difficult in any case.

I would be grateful for any advice that you may be able to offer us on the best way forward.

In cross-examination, Mr Lewis said that had he been told that Westpac would only lend 80% of valuation as at the date of completion, he would not have gone ahead with the contracts. It was put to him that such proposition was inconsistent with his claimed belief that there would be 20% capital growth. As I understand this line of questioning, counsel was suggesting that on the one hand, Mr Lewis claimed that he had entered into the contracts in reliance upon the representation as to anticipated capital growth in order to enable him to borrow the requisite funds. On the other hand, he was asserting that he entered into the contracts in reliance upon his understanding that Westpac had agreed to finance the acquisition on the basis of the unit’s value as at the time at which the Lewises entered into the contract or, perhaps, the purchase price. The assertion of inconsistency arises out of the Lewises’ claims that the alleged representation as to capital growth led them to believe that they would be able to borrow the full purchase price on the basis that the value at settlement would induce a financier to lend that full amount. In other words the valuation at settlement would be well above the purchase price.

65 Counsel then put to Mr Lewis that he had not, at that time, said anything to Mr Wockner about earlier representations concerning capital growth. Mr Lewis said that he had been dealing with Mr Wockner as a settlement agent. I understood him to mean that he had not retained Mr Wockner to give legal advice. It was pointed out to him that in the email chain to Mr Hendrick, he said nothing about earlier representations concerning capital growth. Mr Lewis said that he had a number of telephone conversations with Mr Hendrick and that, “This was discussed.”. Mr Hendrick suggested that they sell the unit. One might have expected rather more detailed evidence from Mr Lewis as to any such confrontation concerning the alleged misrepresentations.

66 Mr Wockner had advised Mr Lewis that he knew a lawyer who claimed to be terminating contracts in the Hilton development, leading Mr Lewis to consult their present solicitors. These proceedings were commenced on 23 February 2012. A statement of claim was filed on that day. Counsel pointed out to Mr Lewis that in that statement of claim, there was no reference to the oral representations allegedly made on 10 and 13 July. The only pleaded representation concerned the email of 7 August 2009 with the attached Jade document. Mr Lewis said that he had supplied “the information” to his lawyer.