FEDERAL COURT OF AUSTRALIA

Australian Securities and Investments Commission v GE Capital Finance Australia, in the matter of GE Capital Finance Australia [2014] FCA 701

|

IN THE FEDERAL COURT OF AUSTRALIA |

|

IN THE MATTER OF GE CAPITAL FINANCE AUSTRALIA ACN 008 583 588

|

AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff | |

|

AND: |

GE CAPITAL FINANCE AUSTRALIA ACN 008 583 588 Defendant |

|

DATE OF ORDER: |

|

|

WHERE MADE: |

THE COURT DECLARES THAT:

1. In the period from 5 January 2012 to 27 May 2012, GE Capital Finance Australia:

(a) required cardholders seeking to activate their credit card by telephone (Activation Cardholders) to follow instructions spoken by a pre-recorded automated voice (Activation Scripts), which:

(i) informed them that by activating their credit card they gave their consent to GE Capital Finance Australia sending them credit card limit increase invitations (CCLI Invitations); and

(ii) did not inform them that they could activate their credit card irrespective of whether they gave their consent to GE Capital Finance Australia sending them CCLI Invitations; and

(b) represented that an Activation Cardholder could not activate their credit card unless they consented to GE Capital Finance Australia sending them CCLI Invitations (First Activation Representation), which representation was false or misleading:

(i) in that it was not a requirement or condition of the activation of a credit card that the Activation Cardholder give their consent to GE Capital Finance Australia sending them CCLI Invitations; and also

(ii) in that a credit card could be activated irrespective of whether the Activation Cardholder consented to GE Capital Finance Australia sending them CCLI Invitations;

and thereby, in trade or commerce, in connection with the supply or possible supply of financial services, made false or misleading representations concerning the existence, exclusion or effect of a condition or right, in contravention of section 12DB(1)(i) of the Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act).

2. In the period from 5 January 2012 to 27 May 2012, GE Capital Finance Australia represented to Activation Cardholders that the only way to activate their credit card was for them to consent to GE Capital Finance Australia sending them CCLI Invitations (Second Activation Representation), which representation was false or misleading:

(a) in that it was not a requirement or condition of the activation of a credit card that the Activation Cardholder give their consent to GE Capital Finance Australia sending them CCLI Invitations; and also

(b) in that a credit card could be activated irrespective of whether the Activation Cardholder consented to GE Capital Finance Australia sending them CCLI Invitations;

and thereby, in trade or commerce, in connection with the supply or possible supply of financial services, made false or misleading representations concerning the existence, exclusion or effect of a condition or right, in contravention of section 12DB(1)(i) of the ASIC Act.

3. In the period from 19 March 2012 to 27 May 2012, GE Capital Finance Australia:

(a) required cardholders who telephoned GE Capital Finance Australia seeking to increase the credit limit on their credit card (Telephone CCLI Cardholders) to follow the instructions spoken by a pre-recorded automated voice (CLI Eligible Scripts), which:

(i) informed them that by accepting a new credit limit, the Telephone CCLI Cardholder gave consent to GE Capital Finance Australia sending them CCLI Invitations; and

(ii) did not inform them that the credit limit on their credit card could be increased irrespective of whether they gave consent to GE Capital Finance Australia sending them CCLI Invitations; and

(b) represented that to obtain the new or increased credit limit on their credit card the Telephone CCLI Cardholder was required to consent to GE Capital Finance Australia sending them CCLI Invitations (First CLI Eligible Representation), which representation was false or misleading:

(i) in that it was not a requirement or condition of obtaining the new or increased credit limit on their credit card that the Telephone CCLI Cardholder give their consent to GE Capital Finance Australia sending them CCLI Invitations; and also

(ii) in that the Telephone CCLI Cardholder could obtain the new or increased credit limit on their credit card irrespective of whether they consented to GE Capital Finance Australia sending them CCLI Invitations;

and thereby, in trade or commerce, in connection with the supply or possible supply of financial services, made false or misleading representations concerning the existence, exclusion or effect of a condition or right, in contravention of section 12DB(1)(i) of the ASIC Act.

4. In the period from 19 March 2012 to 27 May 2012, GE Capital Finance Australia represented to Telephone CCLI Cardholders that the only way to obtain the new or increased credit limit on their credit card was for them to consent to GE Capital Finance Australia sending them CCLI Invitations (Second CLI Eligible Representation), which representation was false or misleading:

(a) in that it was not a requirement or condition of obtaining the new or increased credit limit on their credit card that the Telephone CCLI Cardholder give their consent to GE Capital Finance Australia sending them CCLI Invitations; and also

(b) in that the Telephone CCLI Cardholder could obtain the new or increased credit limit on their credit card irrespective of whether they consented to GE Capital Finance Australia sending them CCLI Invitations;

and thereby, in trade or commerce, in connection with the supply or possible supply of financial services, made false or misleading representations concerning the existence, exclusion or effect of a condition or right, in contravention of section 12DB(1)(i) of the ASIC Act.

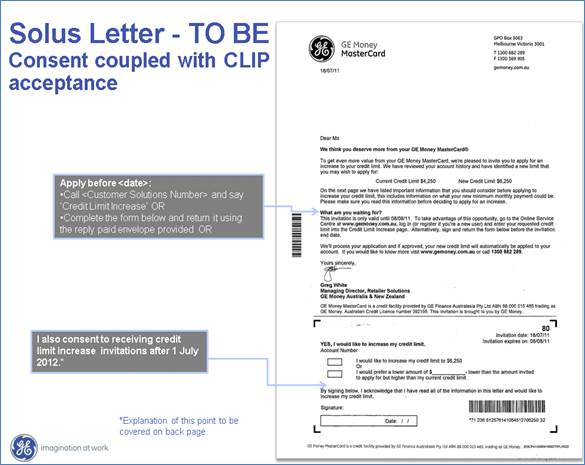

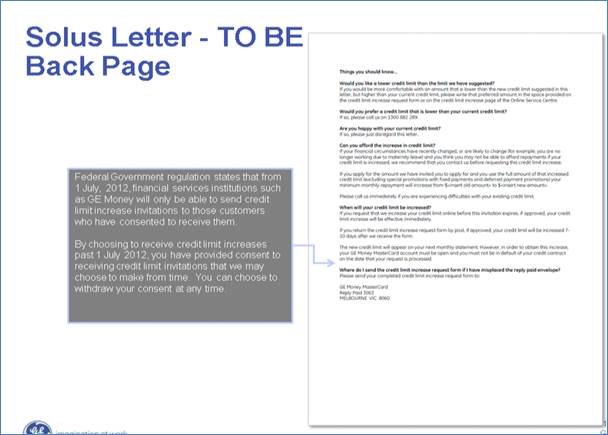

5. In the period 1 from February 2012 to 27 May 2012, GE Capital Finance Australia:

(a) sent letters (CLI Letters) to the holders of credit cards (CLI Letter Cardholders) inviting them to apply for an increase in the credit limit on their credit card, which letters contained an application form which informed them that when they signed the application form, they consented to receiving CCLI Invitations; and

(b) at no time informed CLI Letter Cardholders, via the CLI Letter or the application form, that they could apply for an increase in the credit limit on their credit card irrespective of whether they consented to receiving CCLI Invitations; and

(c) represented that to apply for an increase in the credit limit on their credit card, the CLI Letter Cardholder was required to consent to GE Capital Finance Australia sending them CCLI Invitations (the First Letter Representation), which representation was false or misleading:

(i) in that it was not a requirement or condition of applying for an increase in the credit limit on their credit card that the CLI Letter Cardholder consent to receiving CCLI Invitations; and also

(ii) in that the CLI Letter Cardholder could apply for an increase in the credit limit on their credit card irrespective of whether they gave their consent to receiving CCLI Invitations;

and thereby, in trade or commerce, in connection with the supply or possible supply of financial services, made false or misleading representations concerning the existence, exclusion or effect of a condition or right, in contravention of section 12DB(1)(i) of the ASIC Act.

6. In the period from 1 February 2012 to 27 May 2012, GE Capital Finance Australia represented that the only way for a CLI Letter Cardholder to apply for an increase in the credit limit on their credit card was for them to consent to GE Capital Finance Australia sending them CCLI Invitations (the Second Letter Representation), which representation was false or misleading:

(a) in that it was not a requirement or condition of applying for an increase in the credit limit on their credit card that the CLI Letter Cardholder consent to receiving CCLI Invitations; and also

(b) in that the CLI Letter Cardholder could apply for an increase in the credit limit on their credit card irrespective of whether they gave their consent to receiving CCLI Invitations;

and thereby, in trade or commerce, in connection with the supply or possible supply of financial services, made false or misleading representations concerning the existence, exclusion or effect of a condition or right, in contravention of section 12DB(1)(i) of the ASIC Act.

THE COURT ORDERS THAT:

7. Pursuant to section 12GBA of the ASIC Act, the Defendant pay to the Commonwealth a pecuniary penalty of $1,500,000.

8. Pursuant to section 12GLA(2)(c) or 12GLB(1) of the ASIC Act, and subject to the exceptions noted below, the Defendant:

(a) within 14 days of the date of these orders, send by email, or pre-paid ordinary mail if the Defendant does not know the email address, a communication in the form of Annexure A to each Cardholder who registered to receive future CCLI Invitations only in response to one or more of the First Activation Representation, the Second Activation Representation, the First CLI Eligible Representation or the Second CLI Eligible Representation;

(b) within 14 days of the date of these orders, send by email, or pre-paid ordinary mail if the Defendant does not know the email address, a communication in the form of Annexure B to each Cardholder who registered to receive future CCLI Invitations both:

(i) in response to one or more of the First Activation Representation, the Second Activation Representation, the First CLI Eligible Representation or the Second CLI Eligible Representation; and

(ii) in response to the First Letter Representation or the Second Letter Representation;

(c) within 14 days of the date of these orders, send by pre-paid ordinary mail a communication in the form of Annexure C to each Cardholder who registered to receive future CCLI Invitations only in response to the First Letter Representation or the Second Letter Representation;

(d) within 7 days of the date of these orders, place a notice in the form of Annexure D on the homepage of its website for a period of 1 month.

Despite the requirements of paragraphs 8(a) to (c), the Defendant is not required to send a communication in the form of Annexure A, B or C to a Cardholder:

(iii) who is now deceased; or

(iv) who has since been determined by the Defendant to have been fraudulently named as a Cardholder and so not to have been a person with whom the Defendant contracted; or

(v) in respect of any account that the Cardholder held with the Defendant that has since been closed by agreement with the Defendant or terminated by the Defendant in accordance with its contractual rights.

9. Within 21 days of the date Order 8 is made, the Defendant provide to the Plaintiff a statement from the Chief Executive Officer of the Defendant setting out the steps taken by the Defendant to comply with that order.

10. The Defendant pay the Plaintiff's costs fixed in the amount of $50,000.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ANNEXURE A – EMAIL OR LETTER TO EACH REGISTRANT

[In the usual form of email or on letterhead of defendant]

MISLEADING STATEMENT ABOUT CONSENTING TO RECEIVE CREDIT CARD LIMIT INCREASE INVITATIONS

The Federal Court has ordered us to write to you about your consent to receive credit card limit increase invitations.

In proceedings brought by the Australian Securities and Investments Commission, the Federal Court of Australia (Federal Court) found that a message we played to you when you:

telephoned us and activated your credit card between 5 January 2012 and 27 May 2012; and/or

applied over the phone for a credit card limit increase between 19 March 2012 and 27 May 2012,

contained false or misleading representations.

The message advised you that by activating your credit card or accepting a new credit limit, you gave us consent to potentially send you credit limit increase invitations from time to time.

The Federal Court found that our message contained false or misleading representations because it represented that you could not activate your credit card or obtain an increased credit limit unless you consented to us sending you invitations to increase your credit card limit, when the correct position was that your credit card could be activated or you could obtain your new credit limit increase whether or not you agreed to receive invitations for credit card limit increases.

This means that your consent to receive credit card limit increase invitations was not validly given.

How This Affects You

If you do not want to receive credit card limit invitations in the future you do not need to do anything. You can still apply for a credit card limit increase at any time.

If, after 30 June 2012, you have provided a subsequent consent to us in relation to receiving a credit limit increase invitations, this letter does not affect that subsequent consent.

If you have any queries please contact us on [insert address] or [insert telephone number].

ANNEXURE B –EMAIL OR LETTER TO EACH REGISTRANT

[In the usual form of email or on letterhead of defendant]

MISLEADING STATEMENT ABOUT CONSENTING TO RECEIVE CREDIT CARD LIMIT INCREASE INVITATIONS

The Federal Court has ordered us to write to you about your consent to receive credit card limit increase invitations.

In proceedings brought by the Australian Securities and Investments Commission, the Federal Court of Australia (Federal Court) has made the following findings.

1. A message we played to you when you:

telephoned us and activated your credit card between 5 January 2012 and 27 May 2012; and/or

applied over the phone for a credit card limit increase between 19 March 2012 and 27 May 2012

contained false or misleading representations.

2. Our conduct when we sent you an invitation to apply to increase your credit card limit between 1 February 2012 and 27 May 2012 contained false or misleading representations.

Some time ago, we sent you a letter inviting you to change your credit card limit. That letter contained an application form to change your credit limit. Both the letter and the application form said that by signing the form authorising us to action your application to increase your credit limit, you also gave us consent to send you credit card limit increase invitations in the future.

The Federal Court found that our messages contained false or misleading representations because they represented that you could not activate your credit card, or obtain an increased credit limit, unless you consented to us sending you invitations to increase your credit limit, when the correct position was that your credit card could be activated or you could obtain your credit limit increase whether or not you agreed to receive invitations for credit card limit increases.

This means that your consent to receive credit card limit increase invitations was not validly given.

How This Affects You

If you do not want to receive credit card limit invitations in the future you do not need to do anything. You can still apply for a credit card limit increase at any time.

If, after 30 June 2012, you have provided a subsequent consent to us in relation to receiving a credit limit increase invitations, this letter does not affect that subsequent consent.

If you have any queries please contact us on [insert address] or [insert telephone number].

ANNEXURE C – LETTER TO EACH REGISTRANT

[Letterhead of defendant]

MISLEADING STATEMENT ABOUT CONSENTING TO RECEIVE CREDIT CARD LIMIT INCREASE INVITATIONS

The Federal Court has ordered us to write to you about your consent to receive credit card limit increase invitations.

In proceedings brought by the Australian Securities and Investments Commission, the Federal Court of Australia (Federal Court) found that our conduct when we sent you an invitation to apply to increase your credit card limit between 1 February 2012 and 27 May 2012 contained false or misleading representations.

Some time ago, we sent you a letter inviting you to change your credit card limit. That letter contained an application form to change your credit limit. Both the letter and the application form said that by signing the form authorising us to action your application to increase your credit limit, you also gave us consent to send you credit card limit increase invitations in the future.

The Federal Court found that our message contained false or misleading representations because it represented that, in order to apply for an increase in your credit card limit, you were required to consent to us sending you credit card limit increase invitations in the future, when the correct position was that you could apply to change your credit card limit whether or not you agreed to receive invitations for credit limit increases in the future.

This means that your consent to receive credit card limit increase invitations was not validly given

How This Affects You

If you do not want to receive credit card limit invitations in the future you do not need to do anything. You can still apply for a credit card limit increase at any time.

If, after 30 June 2012, you have provided a subsequent consent to us in relation to receiving a credit limit increase invitations, this letter does not affect that subsequent consent.

If you have any queries please contact us on [insert address] or [insert telephone number].

ANNEXURE D – NOTICE ON HOMEPAGE

[In the usual form of the Defendant's notice to customers. 25% of homepage]

MISLEADING STATEMENT ABOUT CONSENTING TO RECEIVE CREDIT CARD LIMIT INCREASE INVITIONS

The Federal Court has ordered us to display this message on our homepage because of what we told our customers about receiving credit card limit increase invitations.

In proceedings brought by the Australian Securities and Investments Commission (ASIC), the Federal Court of Australia (Federal Court) found that we made false or misleading representations in relation to obtaining customers' consent to receiving credit card limit increase invitations after 1 July 2012.

This happened when:

we sent letters to customers about changing their credit card limits between 1 February 2012 and 27 May 2012;

played telephone messages to customers who activated their credit card over the telephone between 5 January 2012 and 27 March 2012;

played telephone messages to customers who applied for an increase to their credit card limit over the phone between 19 March 2012 and 27 May 2012.

The Federal Court found that our messages and letters were misleading because the letters and messages represented that you could not activate your credit card or apply for a change in credit card limit unless you consented to receiving credit card limit increase invitations in the future, when the correct position was that you could activate your credit card or apply for a change in credit card limit without giving consent.

How This Affects You

If we made these representations to you, your consent to receive credit card limit increase invitations was not validly given.

If you do not want to receive credit card limit invitations in the future you do not need to do anything. You can still apply for a credit card limit increase at any time.

If, after 30 June 2012, you have provided a subsequent consent to us in relation to receiving a credit limit increase invitations, this letter does not affect that subsequent consent.

If you have any queries please contact us on [insert address] or [insert telephone number].

|

NEW SOUTH WALES DISTRICT REGISTRY |

||

|

GENERAL DIVISION |

NSD 2136 of 2013 | |

IN THE MATTER OF GE CAPITAL FINANCE AUSTRALIA ACN 008 583 588

|

BETWEEN: |

AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff |

|

AND: |

GE CAPITAL FINANCE AUSTRALIA ACN 008 583 588 Defendant |

|

JUDGE: |

JACOBSON J |

|

DATE: |

1 JULY 2014 |

|

PLACE: |

SYDNEY |

REASONS FOR JUDGMENT

Introduction and Overview

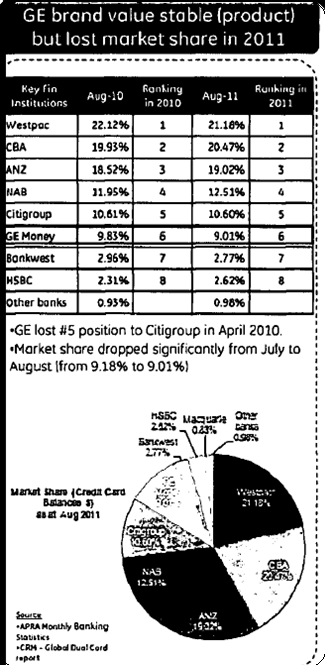

1 The defendant (GE Capital) is a specialist financial services provider operating in Australia as part of the global business of the well-known American conglomerate, General Electric. GE Capital’s business includes issuing credit cards to consumers under a variety of brand names, including cards bearing the GE name, as well as cards supplied under the Master Card and Visa brand names. The business of GE Capital is large and profitable, holding approximately 7.7% of the credit card market in Australia.

2 In March 2011, the Commonwealth proposed certain amendments to the National Consumer Credit Protection Act 2009 (Cth) (the NCCP Act). The effect of the proposed amendments was, relevantly, to prevent a credit provider under a credit card contract from making an invitation to a cardholder to increase his or her credit limit unless the credit provider had previously obtained express consent from the cardholder to the making of the invitation.

3 In addition, the proposed amendments included a provision that, with effect from 1 July 2012, written invitations made to credit cardholders to increase their credit limit were required to seek the consumer’s consent only in relation to whether or not to receive such invitations. In particular, the invitations could not be coupled (or in the industry jargon, “bundled”) with requests for consent to other services.

4 The expression written invitation for a credit limit increase is sometimes referred to in these reasons by the acronym CCLI. Consents to such an increase are referred to as a CCLI Consent. The prohibition against an invitation without prior consent, and the prohibition against bundling, are together referred to as the Prohibition.

5 The Prohibition was proposed as part of the then Commonwealth Government’s tightening regulatory environment for consumer credit transactions. The problem which it posed for GE Capital was a loss in the growth of revenue from its credit card business. GE Capital sought to mitigate its losses by establishing a strategy that was intended to capture CCLI Consents in advance of the cut-off date of the proposed Prohibition.

6 The strategy, as ultimately implemented, involved a range of communications with cardholders designed to obtain their consents to credit limit increases, that is to say CCLI Consents, by bundling a request from GE Capital to the cardholders to give such consents as part of an application for another service.

7 The effect of the communications was that GE Capital represented to its customers that by activating a credit card, or obtaining a new or increased limit on an existing credit card, it was a requirement that they consent to receiving invitations in the future to increase their credit limits.

8 In fact there was no such requirement but the communications were intended to capture consents from existing customers ahead of the introduction of the Prohibition. The intention was to mitigate losses expected to be suffered by GE Capital as a result of not having express consents from customers after the new regulatory regime became effective on 1 July 2012.

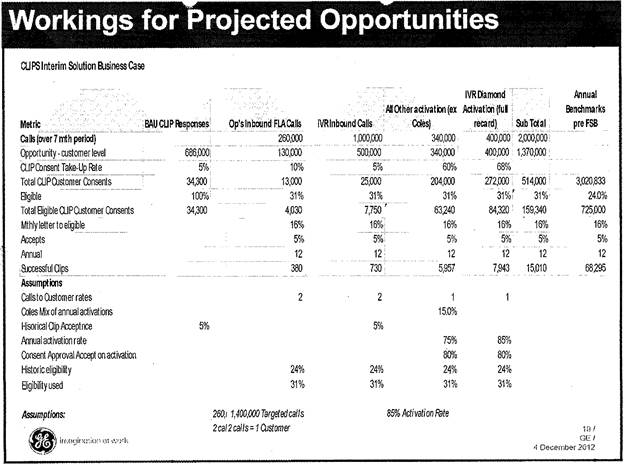

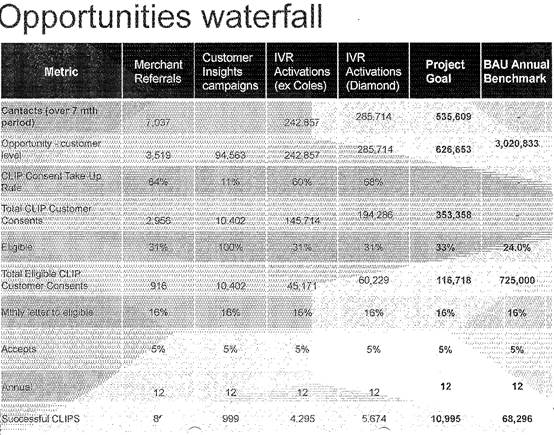

9 The strategy, which was implemented and approved by a steering committee established by GE Capital, was intended to avoid between $5.27 million and $6 million of losses which would otherwise have been expected to be suffered by GE Capital in the period from 2012 to 2015 under the new regulatory regime.

10 GE Capital’s strategy for avoiding those losses is referred to as the Pre-FSB Consent Project. A number of concerns were expressed within GE Capital by persons working on that project in the period prior to its implementation. The initial concerns were expressed in November 2011. Another very perceptive remark was made in an internal email dated 5 January 2012 from a Compliance Analyst as follows:

I have a concern that the wording of this message could be seen to be misleading and/or pressuring customers to accept in order to be able to use their card.

11 The message to which the Compliance Analyst referred in the email was contained in a customer communication described as an Activation Script.

12 Notwithstanding the concerns expressed in the email, GE Capital commenced using the Activation Scripts on 5 January 2012 and continued to do so until 27 May 2012.

13 The other communications which are the subject of these proceedings are described as the CLI Letters and the CLI Eligible Scripts. I will refer to them in more detail later. GE Capital commenced sending CLI Letters to its customers on 1 February 2012 and continued to do so until 27 May 2012. GE Capital commenced using the CLI Eligible Scripts on 19 March 2012 and continued to do so until 27 May 2012.

14 Each of the forms of communication used by GE Capital in its pre-FSB Consent Project resulted in a large number of consents from customers to receive CCLI Invitations

15 In late April 2012, ASIC communicated to GE Capital its concerns that GE Capital was not informing its customers of the option not to receive the CCLI invitation. GE Capital ceased to use each of the forms of communication with cardholders described above on 27 May 2012. Subsequently, GE Capital informed ASIC that, given its concerns, GE Capital had not relied and did not intend to rely on the CCLI Consents obtained through each of the forms of communication with cardholders referred to above.

16 ASIC commenced this proceeding on 16 October 2013. It seeks six declarations under s 21 of the Federal Court of Australia Act 1976 (Cth) that GE Capital has contravened s 12DB(1)(i) of the Australian Securities and Investments Commission Act 2001 (Cth) (the ASIC Act) by making false or misleading representations in its communications with cardholders.

17 GE Capital acknowledges the contraventions and consents to the making of the declarations sought by ASIC. The parties have agreed upon a proposed pecuniary penalty of $1 million to be imposed upon GE Capital pursuant to s 12GBA of the ASIC Act.

18 However, the agreement between the parties does not absolve the Court from its duty to consider the appropriateness of the proposed penalty, or the appropriateness of the declarations. As Barrett J observed in Australian Securities and Investments Commission v Elm Financial Services Pty Ltd (2005) 55 ACSR 411 at [9], this is made clear by a number of well-known decisions of the Full Federal Court to which I will refer later. The effect of those authorities has not been altered by more recent decisions.

19 I have received comprehensive joint submissions from the parties in relation to the proposed relief. I have also received a detailed Statement of Agreed Facts (SOAF). For convenience, I have annexed the SOAF as Annexure “A” to my reasons for judgment. The comprehensive and detailed nature of these documents has enabled me to reduce the length of my reasons.

20 After I reserved my judgment, my Associate wrote to the parties at my request to inform them that I was considering whether to impose a higher penalty than the sum which had been agreed between them. I gave the parties an opportunity to file further submissions addressing the question of a higher pecuniary penalty.

21 The supplementary submissions emphasised the public interest in giving effect to the settlement which is for a substantial sum that the regulator considers to be appropriate. The submissions also reiterated the need for judicial caution in these circumstances, and the weight to be given to GE Capital’s cooperation with ASIC.

Agreed Facts

22 GE Capital’s credit card business (the Business) is described in the SOAF at paragraphs 4 to 7. The Business issues a range of credit cards bearing 14 different brands. For the financial year ending 31 December 2011 GE Capital had issued more than 1.6 million credit cards to its customers and was the sixth largest provider of credit cards in the Australian market.

23 GE Capital’s income for the 2011 year was over $494 million and it had a profit after tax of $116,759,000.

24 The Commonwealth Government’s exposure draft of 4 March 2011 containing proposed amendments to the NCCP Act is described in the SOAF at paragraphs 8 to 12. The amendments formed part of the Government’s “Fairer, Simpler, Banking” (FSB) reforms. The Prohibition contained in the NCCP Act commenced with effect on 1 July 2012. Contravention of the Prohibition attracted a civil penalty or was capable of constituting a criminal offence of strict liability.

25 GE Capital was aware of the proposed Prohibition when the exposure draft was released in 4 March 2011. It was also aware from that time that the Prohibition was likely to commence on 1 July 2012.

26 The FSB Steering Committee and the Pre-FSB Consent Project were established by GE Capital with a view to mitigating the losses that were expected to flow from the introduction of the Prohibition. As I said earlier, one of the strategies was bundling consents with the acquisition of other services. The strategy was described in minutes of the FSB Steering Committee on 8 September 2011. The minutes were circulated to GE Capital directors and senior executives and stated that the intention of bundling choice of credit card activation with consent to receive invitations for credit limit increases was that:

... the committee understands that it will be less straightforward for customers to activate cards without consenting.

27 The minutes of 8 September 2011 went on to state that Legal Counsel, who was named in the minutes, had “endorsed this”.

28 The Pre-FSB Consent Project was an important one for GE Capital. It was a project in which John Malcolm, the President and CEO of GE Capital’s operations in Australia took an active interest.

29 The objective of GE Capital in implementing the Pre-FSB Consent Project was reflected in various documents referred to in paragraph 19 of the SOAF. The documents included a description of FSB reforms and stated that the key requirement by 1 July 2012 was that unsolicited credit limit extension offers were not allowed unless the consumer had agreed to the service.

30 As I said earlier, GE Capital’s objective in the Pre-FSB Consent Project was to establish a process to obtain CCLI Consents from existing customers ahead of the introduction of the Prohibition and to mitigate losses expected to follow from it. This objective was set out in one of the documents referred to in the SOAF at paragraph 19.

31 GE Capital’s objective of optimising the number of pre-FSB consents with a view to avoiding $5 million to $6 million of potential losses is described in the SOAF at paragraphs 20 to 22. GE Capital proposed to use Activation Scripts to reach over 800,000 cardholders, and CLI Letters to reach more than 680,000 cardholders.

32 The project sponsors of the Pre-FSB Consent Project comprised three senior executives of GE Capital, two of whom were directors. They are described in the SOAF at paragraph 25.

33 The development of the documentation and requirements for implementing the Pre-FSB Consent Project are described in the SOAF at paragraph 26 ff. A large number of persons worked on the Project. They included Ms Debra Kruse who held the position of Deputy General Counsel in GE Capital’s Legal Department, Mr Scott French who was the head of the Compliance Department and Mr David Gelbak, the Marketing Director.

34 On 26 August 2011 Mr Gelbak sent an email to Ms Kruse and others stating:

... we all agreed with coupling express consent with CLIP offers prior to July 1 ... we also agreed that coupling express consent with card activation represents a significant opportunity given the number of reissues we have before July.

35 In the period from August to September 2011 GE Capital contemplated an option for cardholders to tick a separate box in the CLI Letters which would indicate consent to receiving CCLI Invitations. The intention of this was to give cardholders a choice to either “opt- in” or “opt-out” of the choice to receive CCLI Invitations.

36 However, the proposed separate tick box was not adopted. Instead, GE Capital decided to advise cardholders in the CLI Letters that by making an application to increase their credit limit they also consented to receive further CCLI Invitations.

37 In adopting this process, GE Capital’s intention was that the CLI Letters would not inform the cardholders of the option to choose not to receive CCLI Invitations.

38 It was also initially contemplated that there would be a similar “opt-in/opt-out” option in the Activation Scripts but GE Capital did not proceed with this option.

39 GE Capital’s decision to remove the option of choosing not to give CCLI Consents was reflected in various documents set out in paragraph 59 of the SOAF. One of the documents is the draft of the Activation Script dated 29 September 2011 which is set out in the SOAF at paragraph 59(c).

40 The concerns with the form of the Activation Script expressed within GE Capital during November 2011, are set out at paragraphs 71-73 of the SOAF. In the email from Mr French dated 16 November 2011 set out at paragraph 73, he stated that it was not clear that the customer had the option of not proceeding and asked that this be made clear in the communication.

41 The perceptive comment in the email of 5 January 2012, that is to say that the wording of the message could be seen to be misleading, was sent by Mr Sam Sharples, Compliance Consultant – Consumer Lending and Operations, to two employees who had the title of Communication Stream Leader. The email was referred to Mr French on 9 January 2012. He was the most senior non-legal person to receive the email.

42 A response to the email was provided by GE Capital’s Legal Department but the content of that response has not been included in the SOAF.

43 The Communication Stream Leaders replied to Mr Sharples’ email on 5 January 2012. The reply forms part of Appendix 31 to the SOAF. The effect of the reply was to assert that the customers had a choice because they could talk to an operator at any time. Notably, the email apparently refers to legal advice but the content of the advice has been redacted to claim legal professional privilege.

44 The final form of the Activation Scripts is set out at paragraph 99 of the SOAF. It included a statement that:

Before we proceed, by activating your card, you also give us consent to potentially send you credit limit increase invitations from time to time. ... Please press 1 to proceed.

45 If the cardholder pressed 1 within five seconds of the instruction to “press 1 to proceed”, the card was activated and the cardholder was recorded as giving consent to GE Capital sending them CCLI Invitations.

46 However, if the cardholder did not press 1 within five seconds after the instruction “press 1 to proceed” and waited on the line to receive the instruction “please hold”, or spoke to a customer service representative, the cardholder’s credit card was activated but he or she was not recorded as giving consent to GE Capital sending CCLI Invitations.

47 Accordingly, it was not a requirement or condition of the activation of a credit card that the cardholder give his or her consent to GE Capital sending them CCLI Invitations. Rather, a credit card could be activated irrespective of whether the cardholder consented to receiving CCLI Invitations from GE Capital.

48 Moreover, GE Capital did not inform cardholders, either in the Activation Script, or otherwise, that they had the option to choose not to give their consent to the receipt of CCLI Invitations.

49 The admission contained in paragraph 105 of the SOAF is pertinent and I will set it out in full:

By its conduct referred to in paragraphs 97-104 above, GE Capital represented that an Activation Cardholder could not activate their Credit Card unless the Activation Cardholder consented to GE Capital sending them CCLI Invitations and that the only way to activate their Credit Card was for the Activation Cardholder to consent to GE Capital sending them CCLI Invitations.

50 The Activation Scripts had a very high measure of success in procuring the consent of cardholders. This can be seen in the figures contained in paragraph 106 of the SOAF. Over 187,000 of the 202,000 cardholders who telephoned GE Capital and were told to “press 1” provided their consent to receiving credit limit increases.

51 The form of application to receive credit limit increases contained in the CLI Letters is set out at paragraph 111 of the SOAF. The CLI Letters also contained the acknowledgment set out in paragraph 113 of the SOAF as follows:

By signing this form authorising us to action your application to increase (or decrease) your current credit limit, you will also be giving us consent to send you invitations to apply to increase your credit limit from 1 July 2012.

52 However, for the reasons explained at paragraph 105 of the SOAF, GE Capital acknowledges at paragraph 116 that it was not a requirement or condition of applying for an increase in a credit limit that the cardholder consent to receive CCLI Invitations.

53 The admission which GE Capital makes at paragraph 118 of the SOAF in relation to CLI Letters is to the same effect as that contained in paragraph 105 of the SOAF, which I have set out at [49] above.

54 The CLI Letters were very successful in obtaining the consent of cardholders to receive CCLI Invitations. The figures are set out at paragraph 119 of the SOAF.

55 The methodology for Eligible Scripts was similar to that which was used for Activation Scripts. Cardholders were advised by letter that they could increase their credit limit by telephoning GE Capital. If they telephoned they were told to follow the instructions in the Eligible Scripts set out in the SOAF at paragraph 124.

56 The Eligible Scripts included the statement that by accepting the new credit limit “you are also giving us consent to potentially send you credit limit increase invitations”. The cardholder was instructed to press the number 2 in order to change the credit limit as explained in the Eligible Script.

57 If the cardholder followed the instructions as explained at paragraph 126(a) of the SOAF he or she was recorded as giving consent to GE Capital sending CCLI Invitations.

58 However, for the reasons set out in the SOAF at paragraph 128 it was not a requirement or condition of obtaining an increased credit limit that the cardholder consent to receive CCLI Invitations.

59 The admission at paragraph 130 of the SOAF is to the same effect as that contained in paragraph 105 of the SOAF.

60 The use of Eligible Scripts had a similar success rate to that which resulted from the Activation Scripts and the CLI Letters. The figures are set out at paragraph 131 of the SOAF.

61 Senior management monitored the implementation and progress of the Pre-FSB Consent Project from the time when telephone activation through the Activation Scripts commenced on 5 January 2012.

62 The matters set out at paragraphs 134 to 142 of the SOAF indicate that senior management was aware of the Project and wanted it to succeed.

63 The total cost of the Pre-FSB Consent Project was $366,000.

64 Details of ASIC’s intervention, and GE Capital’s cooperation, commencing in late April 2012 are set out at paragraphs 144 to 154 of the SOAF. I will refer to this in more detail later.

65 GE Capital’s financial position for the year ending 31 December 2013 is set out at paragraphs 156-157 of the SOAF. The figures contained in those paragraphs show some measure of growth in performance since 31 December 2011, including an after tax profit of more than $122 million.

66 There is an important public interest in the settlement of litigation brought by a regulator to enforce a civil penalty, particularly where a proceeding is likely to be lengthy and expensive: NW Frozen Foods Pty Ltd v Australian Competition and Consumer Commission (1996) 71 FCR 285 at 291; Minister for Industry, Tourism & Resources v Mobil Oil Australia Pty Ltd [2004] ATPR 41-993 at 48,626.

67 It is unnecessary to consider in the present case whether a different approach to that stated in NW Frozen Foods should be applied because the parties accept that I should not impose the agreed penalty unless I am satisfied that it is appropriate in all the circumstances: cf Australian Securities and Investments Commission v Ingleby [2013] VSCA 49.

68 Nor is my approach to the question of penalty affected by the decision of the High Court in Barbaro v R (2014) 305 ALR 323. I respectively adopt the observations made in a number of recent authorities that, in Barbaro, the Court did not intend to exclude, in the civil context, the making of submissions by a regulator as to the penalty: Australian Competition and Consumer Commission v Energy Australia Pty Ltd [2014] FCA 336; Australian Competition and Consumer Commission v Mandurvit Pty Ltd [2014] FCA 464.

69 In determining the appropriate pecuniary penalty in the present case, I must have regard to all relevant matters, including those which are set out in s 12GBA(2)(a) to (c) of the ASIC Act.

70 The three mandatory considerations contained in s 12GBA are relevantly identical to those in ss 76 and 76E of the former Trade Practices Act 1974 (Cth). The “French factors” stated in Trade Practices Commission v CSR Limited (1991) ATPR 41-076 therefore provide a guide to the determination of the appropriate penalty.

71 The factors identified by French J in TPC v CSR are to similar effect to those stated by Santow J in Re HIH Insurance Ltd (in prov liq); Australian Securities and Investments Commission v Adler (2002) 42 ACSR 80 at [125]-[126] as providing guidance in the exercise of the discretion to impose a pecuniary penalty.

72 The overriding principle is that the Court must weigh all the relevant circumstances. The guiding principles stated by French J in TPC v CSR and by Santow J in ASIC v Adler may be applied to inform the exercise of the discretion but they should not be treated as a rigid catalogue of matters to be applied in every case.

73 The principal purpose of the imposition of a pecuniary penalty is to act as a specific deterrent and as a general deterrent to others who might be tempted to contravene the law: TPC v CSR at 52,152; ASIC v Adler at [125]; see also the authorities cited in Registrar of Aboriginal and Torres Strait Islander Corporations v Matcham (No 2) (2014) 97 ACSR 412 at [225]-[228].

74 Nevertheless, the role of deterrence in determining the amount of a pecuniary penalty is subject to the qualification that the amount should not be greater than is necessary to achieve the objective of deterrence. An appropriate balance must be struck to avoid oppression: NW Frozen Foods at 293; ASIC v Adler at [125].

75 The process of fixing the quantum of a penalty is not an exact science. The approach which should be adopted is one of “instinctive synthesis”: Markarian v The Queen (2005) 228 CLR 357. All of the circumstances must be weighed so as to mark the Court’s view of the seriousness of the offence. Attention must be paid to the maximum penalty fixed by the statute so as to compare the worst possible case with the one before the Court. The exercise is not a mathematical one, and there is no single correct penalty: see ATSIC v Matcham at [126]-[128].

76 In determining the appropriate penalty the Court should not leave room for any impression of weakness. Nor should there be any suggestion that the quantum of the penalty may be treated as an acceptable risk of doing business: Australian Competition and Consumer Commission v TPG Internet Pty Ltd (2013) 304 ALR 186 at [65]-[66].

77 Separate contraventions arising from separate acts should ordinarily attract the imposition of a separate penalty appropriate for each contravention. The course of conduct principle is to be applied according to the facts of each case. The general objective of the course of conduct principle is to ensure that the penalty reflects the substance of the offending conduct, rather than a mathematical total for each separate offence: see the authorities cited in ATSIC v Matcham at [195]-[201].

78 The totality principle is to be applied as a final check to ensure that the penalty is appropriate for all of the offences: see Mill v The Queen (1988) 166 CLR 59 at 62-63; Mornington Inn Pty Ltd v Jordan (2008) 168 FCR 383 at [5] ff.

Consideration

79 The contraventions were serious and the reach of GE Capital’s conduct was extensive and substantial.

80 This is not a case of inadvertence but is part of a carefully developed and implemented strategy which was intended to have far reaching effect. The parties are agreed that the conduct was systematic and deliberate in a number of material respects.

81 In particular, the joint submissions acknowledged that:

the misrepresentations were part of a project that was carefully developed, implemented and monitored from mid-2011 to June 2012;

the Pre-FSB Consent Project was an important one which was intended to avoid projected losses of up to $6 million;

GE Capital knew that by coupling or bundling requests for CCLI Consents with other cardholder processes, it was “less straightforward” for customers to activate cards or increase credit limits without consenting to the receipt of invitations to receive future credit limit invitations;

GE Capital contemplated an option to include separate tick boxes but deliberately chose not to give cardholders the opportunity to exercise that degree of freedom of choice; and

serious concerns were expressed within GE Capital as to whether the Project was likely to mislead or pressure cardholders, but GE Capital proceeded with its strategy notwithstanding those misgivings.

82 The importance of the Project is plain from the fact that GE Capital’s President and CEO took an active interest in it. Also, it was sponsored by senior executives who had day to day oversight and responsibility for its development and management. Two of those persons were directors of GE Capital.

83 The seriousness of the contraventions is mitigated by the fact that GE Capital has co-operated with ASIC during its investigations and in the efficient resolution of the proceeding.

84 GE Capital’s cooperation has been prompt and, subject to two qualifications, may be fairly described as comprehensive. The steps taken by GE Capital are set out in the annexed SOAF and in the joint submissions at paragraphs 125-126.

85 In particular, GE Capital’s cooperation includes the voluntary provision of documents to ASIC to assist its investigations and by agreeing not to rely on any of the consents obtained through the various forms of communication identified above.

86 The first qualification is, that as ASIC notes at paragraph 127 of the joint submissions, there was some delay in notifying cardholders that GE Capital would not rely on the CCLI Consents. The relevant dates are set out at paragraphs 147 to 150 of the SOAF.

87 The second qualification is one that is not directly noted in the joint submissions or the SOAF. It is that GE Capital received in-house legal advice in relation to the concerns expressed about the misleading nature of the communications but it has claimed privilege for the advice.

88 The content of that advice would have been a matter bearing upon the assessment of the seriousness of the contraventions but neither ASIC nor the Court has the benefit of seeing the advice that was given.

89 I have taken into account the fact that cardholders did not suffer any loss because GE Capital has agreed not to rely on any of the consents that were given.

90 Accordingly, GE Capital did not profit, in the sense that it was unable to mitigate its losses of up to $6 million which was the fundamental objective of its strategy. Nevertheless, it is well established that a substantial penalty may be imposed even though the strategy did not ultimately cause loss to consumers: Singtel Optus Pty Ltd v Australian Competition and Consumer Commission (2012) 287 ALR 249 at [57].

91 I have also taken into account the fact that GE Capital has not previously been found by the Court to have engaged in conduct which is similar to the conduct that is the subject of this proceeding: see s 12GBA(2)(c) of the ASIC Act.

92 The parties are agreed that six declarations of contravention should be made. I am satisfied that it is appropriate to make those declarations. They also agree that there were three classes of contravention. I am satisfied that I should accept that approach. It follows that the maximum penalty for each of the categories is $1.1 million which provides for a total penalty of $3.3 million.

93 Whilst in my view it is appropriate to give real credit for the prompt and comprehensive nature of GE Capital’s cooperation, the seriousness and deliberate nature of each of the contraventions must be fully reflected in the assessment of an appropriate penalty.

94 This was a systematic and deliberate attempt to mislead cardholders into giving their consent to receive invitations for future credit increases so as to avoid losses of up to $6 million which were projected to be suffered by GE Capital as a result of the tightening regulatory environment.

95 And it was a strategy which was pursued notwithstanding the concerns expressed by responsible senior employees. The concerns which they expressed, even if not communicated directly to the executives who were ultimately responsible for the project, raised matters which should have been clear to those who had the overall responsibility for its implementation.

96 The penalty to be imposed for each category of contravention should not be assessed at the lower end of the range when the seriousness of the offences is compared with the maximum penalty.

97 The penalty for the contravention reflected in the Activation Scripts should fall in the upper level of the range. Giving the maximum possible credit for GE Capital’s cooperation, it seems to me that the appropriate penalty is $600,000.

98 There is no real distinction to be drawn in the seriousness of the contravention reflected in the CLI Letters even though they were put into effect approximately three weeks after GE Capital commenced to use the Activation Scripts. In my opinion the appropriate penalty for this contravention should also be fixed at $600,000.

99 Nor is there any real distinction between the contravention reflected in the CLI Eligible Scripts and those which followed from the Activation Scripts and the CLI Letters. Nevertheless, I would be inclined to fix a figure of $500,000 for this contravention to take into account the shorter time period and the lesser number of cardholders potentially affected by the conduct.

100 The total penalty which follows from these assessments is therefore $1.7 million. However, taking into account the totality principle as a final check, it seems to me that the appropriate pecuniary penalty is $1.5 million.

101 In coming to this view, I have taken into account the need to address specific and general deterrence. It is true that GE Capital is not the largest participant in the market but it is a very substantial and profitable company. This is a matter which is relevant to achieving specific deterrence: see Australian Competition and Consumer Commission v Rural Press (2001) ATPR 41-833 at [56]; see also Australian Competition and Consumer Commission v Telstra Corporation Limited (2010) 188 FCR 238 at [209].

102 I have also taken into account the absence of a compliance program because it follows that specific deterrence is to be achieved solely through the imposition of a pecuniary penalty.

103 Here, ASIC submits that a compliance program is unnecessary because there is said to be little risk of repetition. This is because the contravening conduct was engaged in to take advantage of the opportunity to seek bundled consents before the FSB legislation came into force. In those circumstances, ASIC submits that the opportunity is no longer available to GE Capital.

104 However, in my opinion, the contravening conduct should be looked at more broadly. What was involved was an attempt to obtain consents in an unlawful manner, and the adoption of a cynical approach by seeking to make the cardholders’ choices less straightforward. This is an approach which should be marked with the Court’s disapproval of the conduct so as to deter the contravener from repeating it in any circumstances in which a cardholder is asked to consent to a course of conduct proposed by GE Capital.

Orders

105 I will therefore make the orders proposed by the parties except that order 7 which provided for a pecuniary penalty of $1 million is to be replaced by an order imposing a penalty of $1.5 million.

|

I certify that the preceding 105 (one hundred and five) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justice Jacobson. |

Associate:

Dated: 1 July 2014

Annexure A to Reasons for Judgment

Statement of Agreed Facts

Federal Court of Australia NSD2136/2013

District Registry: New South Wales

Division: General

IN THE MATTER OF GE CAPITAL FINANCE AUSTRALIA ACN 008 583 588

Australian Securities and Investments Commission

Plaintiff

GE Capital Finance Australia ACN 008 583 588

Defendant

STATEMENT OF AGREED FACTS

Incoming legislative prohibition on credit limit increase invitations 4

GE Capital's awareness of and reaction to the Prohibition 5

Development of the Pre-FSB Consent Project 11

Pre-FSB Consent Project documents and approvals 12

Development of the Pre-FSB Consent Project documents in the period up to September 2011 15

Further concerns raised in relation to Activation Scripts in January 2012 33

Activation Scripts commence 5 January 2012 35

CLI Letters commence 1 February 2012 38

CLI Eligible Scripts commence 19 March 2012 41

Monitoring of the Pre-FSB Consent Project 45

ASIC investigation and GE Capital co-operation 48

GE Capital’s current financial position 49

1. The Plaintiff (ASIC) is a body corporate:

(a) established by section 7 of the Australian Securities Commission Act 1989 (Cth);

(b) continued by section 261 of the Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act); and

(c) entitled to sue in its corporate name, pursuant to section 8 of the ASIC Act.

2. The Defendant (GE Capital) is a body corporate entitled to be sued in its own name.

3. GE Capital has since 1 March 2011 held Australian Credit Licence number 392145.

4. GE Capital is a specialist financial services provider operating in Australia and part of the global GE Capital business, which operates in 55 countries around the world and is one of the eight main businesses of General Electric. GE Capital offers retail customers in Australia credit cards. As at April 2014, GE Capital has approximately 1,624,159 retail customers and 7.7% of the credit card market in Australia, employs over 137 staff and had a profit after tax of $122,449,000 for the financial year ended 31 December 2013.

5. In the period from 5 January 2012 to 27 May 2012 (the Relevant Period), GE Capital carried on the business of providing credit to consumers (the GE Business), which business included but was not limited to:

(a) issuing the following credit cards to consumers (the Credit Cards):

(ii) GE CreditLine;

(iii) AFS CreditLine;

(iv) Buyer's Edge;

(v) Coles Group Source MasterCard (Standard and Gold Cards), rebranded as Coles MasterCard (Standard and Platinum Cards) in February 2012;

(vi) GE Money Eco MasterCard;

(vii) GE Money MasterCard;

(viii) Gem Visa;

(ix) GO MasterCard;

(x) GE Money Low Rate MasterCard;

(xi) Myer Card;

(xii) Myer Visa Card (Standard and Gold Cards);

(xiii) Care Credit;

(xiv) Coles Group Card;

(b) enabling consumers issued with Credit Cards (Cardholders) to activate their Credit Card;

(c) allowing Cardholders to change the credit limits on their Credit Card (subject to lending parameters); and

(d) providing credit to Cardholders.

6. The GE Business was undertaken in trade and commerce and was a financial service within the meaning of the ASIC Act.

7. As at the financial year ending 31 December 2011, GE Capital had:

(a) 1,685,735 customers in the GE Business (measured by the number of credit cards issued);

(b) approximately 8% of the credit card market in Australia (measured by the outstanding balances on the credit cards issued);

(c) a ranking of 6th largest credit provider in terms of Australian credit card market share;

(d) a total capital base of $939,341,663;

(e) a credit card business gross exposure (i.e. the total balance on all credit cards issued) of $4,226,378,213; and

(f) a finance income of $494,471,000 and a profit after income tax for the year of $116,759,000.

Incoming legislative prohibition on credit limit increase invitations

8. On 4 March 2011, an exposure draft of the National Consumer Credit Protection (Home Loans and Credit Cards) Bill 2011 (Cth) was released, which Bill was part of the Commonwealth Government’s “Fairer, Simpler Banking” (FSB) reforms. The Bill proposed various amendments to the National Consumer Credit Protection Act 2009 (Cth) (NCCP Act), including ss 133BE and 133BF prohibiting a credit provider under a credit card contract from making a credit limit increase invitation by way of written communication (CCLI Invitation) in relation to the contract, unless the credit provider has first obtained express consent from the debtor to the making of CCLI Invitations (CCLI Consent) (the Prohibition).

9. In addition and as part of the Prohibition, if express consent was to be provided on or after 1 July 2012 to the making of CCLI Invitations, the written communication was required to seek the consumer's consent only in relation to whether or not to receive CCLI Invitations (and could not be coupled with other requests for consent in the same communication).

10. The Bill was assented to on 25 July 2011. According to the Explanatory Memorandum, its purpose was to “assist consumers to actively choose whether to increase their credit limit, rather than being prompted to do so by written letters from their credit provider. A consumer who accepts these types of offers can, over time, have a high credit limit and find they are unable to repay the debt in full within a relatively short period of time…”.

11. Contravention of the Prohibition by an Australian Credit Licence holder could attract a civil penalty (s 133BE(1)) or be a criminal or strict liability offence (s 133BE(2) and (3)). The Explanatory Memorandum explained the reason for the strict liability offence in the following terms: "this punishment applies regardless of fault. This is to encourage strict compliance with the prohibition on sending out credit limit increase invitations, given the potentially adverse consequences for consumers."

12. The Prohibition commenced on 1 July 2012, as did the requirement (described in paragraph 9 above) not to couple requests for CCLI Consent with other requests. The proceeding concerns breaches of the ASIC Act which occurred prior to the commencement of the Prohibition. ASIC does not allege a breach of the Prohibition or the NCCP Act itself.

GE Capital's awareness of and reaction to the Prohibition

13. By at least 4 March 2011, when the exposure draft referred to in paragraph 8 above was released, GE Capital was aware of the likely commencement of the Prohibition on 1 July 2012.

14. On 23 May 2011, GE Capital provided a submission to the House of Representatives Standing Committee on Economics in respect of the Bill introducing the Prohibition. The submission was signed by John Alexander Malcolm (also known as Skander Malcolm, President and CEO of GE Capital’s operations in Australia and New Zealand) and Debra Kruse (Deputy General Counsel and Government Relations Manager, who reported to the General Counsel, GE Australia and New Zealand).

15. GE Capital implemented a steering committee to determine strategies for, among other things, marketing and customer communications prior to and following commencement of the Prohibition (FSB Steering Committee). Those strategies included a range of communications with Cardholders to seek CCLI Consents from them in the period before commencement of the Prohibition, some of which involved coupling (also known as "bundling") requests for these CCLI Consents with other Cardholder processes ("Pre-FSB Consent Project"). The Pre-FSB Consent Project was also variously referred to in documents as the CLIPS Project, the CLIPS Interim Solution, and the Pre-FSB CLIPS, with "CLIPS" being a reference to "credit limit increase promotional invites". The three coupling strategies implemented by GE Capital during the Relevant Period and the subject of the proceeding were as follows:

(a) requiring Cardholders seeking to use their Credit Card to first activate their Credit Card (Activation Cardholders) by following instructions spoken by a pre-recorded automated voice (Activation Scripts) which informed them that by activating their Credit Card they gave CCLI Consent (as described further in paragraphs 97 to 107 below);

(b) requiring Cardholders who telephoned GE Capital seeking to increase the credit limit on their Credit Card (Telephone CCLI Cardholders) and where GE Capital offered the Cardholder a credit limit increase, to follow the instructions spoken by a pre-recorded automated voice (CLI Eligible Scripts) which informed them that by accepting a new credit limit they gave CCLI Consent (as described further in paragraphs 120 to 132 below); and

(c) sending letters (CLI Letters, also variously referred to in documents as solus letters and CLIPS letters) to the holders of credit cards referred to in paragraphs 5(a)(i) to 5(a)(xii) above (CLI Letter Cardholders) inviting them to apply for an increase in the credit limit on their Credit Card and including in the CLI Letters an application form (the Application Form) which required the Cardholder to give CCLI Consent (as described further in paragraphs 108 to 119(b) below).

16. The intention of GE Capital in coupling CCLI Consent with the Credit Card activation process was described in the minutes of the FSB Steering Committee meeting of 8 September 2011, which were prepared and distributed by Adrian Caminiti (Regulatory Program Manager) to GE Capital directors and senior executives including Greg White (Managing Director, Retailer Solutions), Rachel Cobb (General Manager, Myer), Paul Varro (Head of Finance – Retailer Solutions), David Gelbak (Marketing Director), and Matt Mansour (Chief Information Officer). The minutes stated:

“David Gelbak cleared up intention of process to bundle choice on IVR for card activation with wording added for consent by doing so. Subject to wording the committee understands that it will be less straightforward for customers to activate cards without consenting. Gavin Byrnes [Legal Counsel] endorsed this. FSB Working Group had assumed a separate choice in the activations process.”

17. David Gelbak was, at all relevant times until 27 November 2011, Marketing Director, and from 28 November 2011, General Manager – Retail Partners and the Marketing Leader. He reported at all relevant times to Rachel Cobb (Managing Director, Retailer Solutions). A copy of the email recording the minutes of the FSB Steering Committee meeting of 8 September 2011 is at Appendix 6.

18. The Pre-FSB Consent Project was an important project for GE Capital at the relevant time, and one in which John Malcolm (President and CEO of GE Capital's operations in Australia and New Zealand) took an active interest.

19. The objective of GE Capital in implementing the Pre-FSB Consent Project was reflected in various documents including the following:

(a) a document titled "Project Fairer Simpler Banking (FSB) CLIPs Interim Solution Process Business Functional Specification" issued on 12 August 2011 (the draft specification), as follows:

"2 Project Information

2.1 Project Overview

The National Consumer Credit Protection Amendment (Home Loans and Credit Cards) Act 2011, otherwise known as Fairer, Simpler Banking (FSB), introduces six separate reforms, listed below. Industry has until 1st July 2012 to comply.

The key requirements to be compliant with the Regulation by 1st July 2012 in scope are:

1. Unsolicited credit limit extension offers are not allowed unless the consumer has agreed to the service.

…

In consequence of requirement #1, because lenders can no longer offer unsolicited credit limit extensions unless the consumers' consent is received beforehand, an interim solution will take place to try getting the customers consent sooner rather than later and allow enough time for the customers consent to be received before July 1st, which solution will be the focus of this document…"

A copy of this document is at Appendix 2.

(b) a document titled "CLIP Update: 1) Turning CLIPS Back On 2) Pre FSB CLIP Activity", dated 16 August 2011 (the CLIP Update presentation), as follows:

"2) Pre FSB CLIP Activity

Background FSB regulation takes effect from July 2012.

From this date, CLIP offers can only be made to customers who have provided 'consent'.

Our Brief Identify what we can do now to capture CLIP 'consent' before the end of 2011"

A copy of the CLIP Update presentation is at Appendix 3.

(c) a draft presentation titled "Limit Impacts of FSB CLI reforms GET early CLIPS consents PRC-1 Pitch", circulated on 16 September 2011 (draft PRC-1 Pitch presentation), contained the following statement:

"Problem Statement

The objective is enable [sic] an early process to capture CLIPS consents from existing customers ahead of the introduction of FSB to mitigate the expected losses from not having express consents to leverage for CLIPS campaign post the introduction of new laws under FSB from 1 July 2012."

A copy of the draft PRC-1 Pitch presentation is at Appendix 9.

(d) the final version of the PRC-1 Pitch presentation dated 20 September 2011, as follows:

"Synopsis

Problem

Post FSB (1 July 2012) GE needs customer consents prior to sending CLIPS.

…

Opportunity

In the interim, consents can be coupled with other business activities e.g, BAU CLIP campaigns, combine with card activation calls."

A copy of this document is at Appendix 10.

(e) a presentation titled "Interim CLIPS Proposal", attached to an email dated 14 September 2011 from Adrian Caminiti (Regulatory Program Manager) to GE Capital directors and senior executives including Rachel Cobb (General Manager, Myer), Scott French (Head of Compliance – Consumer Lending), Matt Mansour (Chief Information Officer), Gavin Byrnes (Legal Counsel), Paul Varro (Head of Finance – Retailer Solutions) and others as follows:

"…

The objective is to assess the feasibility of capturing consents from existing customers ahead of the introduction of FSB to mitigate the expected losses from not having express consents to leverage for CLIPS campaigns post the introduction of new laws under FSB from 1 July 2012."

A copy of this document is at Appendix 8.

(f) the following statements in a document titled "Pre FSB CLIPs Consents PRC-2 Pitch" dated 13 December 2011:

"Problem Statement

Part of the Federal Government's Fairer, Simpler, Banking reforms requires that express consents are obtained before CLIPs can be offered. This law will take effect from 1 July 2012.

GE would send approx. 720,000 CLIPs in 2H 2012. The RACV terms, this is estimated to be worth approx. $27MM over 4 years.

This asset growth and revenue opportunity will be lost completely unless efforts are made to capture consents prior to 1 July 2012.

Opportunity

The following strategy has been agreed with the FSB Steering Committee to maximise the number of consents obtained before the implementation of FSB. It is estimated that these investments will avoid losing approx. $5MM of projected BAU RACV stated above over 4 years.

• Customer insights driven campaign (Pre Christmas)

• Merchant referral CLI calls

• CLIPs Letters

• Inbound IVR Activation calls"

A copy of this document is at Appendix 29.

20. GE Capital wanted to optimise the number of CCLI Consents that were to be obtained from existing Cardholders since at least 40% of growth in GE Capital’s credit card business was generated from those existing (not new) Cardholders using their credit limit or obtaining an increase in their credit limit and using it.

21. GE Capital projected that the Pre-FSB Consent Project would involve approximately 2.7 million Cardholder contacts over 7 months, to attract an estimated 5% to 10% (or 137,200 to 274,400) CCLI Consents. Those projections included:

(a) the proposed use of Activation Scripts to reach over 800,000 Cardholders, including the following:

(i) 184,000 Credit Cards issued on new accounts;

(ii) 216,000 Credit Cards re-issued on existing accounts after expiry or as an additional card; and

(iii) 400,000 Credit Cards issued as replacement cards in respect of “Project Diamond”, an extensive card re-issue for Coles branded Credit Cards;

(b) the proposed use of the CLI Letters to between 684,000 and 686,000 Cardholders.

22. The Pre-FSB Consent Project was intended to mitigate:

(a) $5.27 to $6.00 million, or about 22%, of projected losses of $27 million rate adjusted contributed value (RACV) for the period 2012 to 2015; and

(b) up to $1 million of the projected losses for 2012 alone.

23. Copies of the presentations containing the projections referred to in paragraphs 21 and 22 above are at Appendices 8, 10 and 29.

Development of the Pre-FSB Consent Project

24. The development of the Pre-FSB Consent Project was managed by Retailer Solutions. Retailer Solutions was responsible for the credit card business. For the financial years ending 31 December 2011 and 31 December 2012, Retailer Solutions was responsible for almost all of GE Capital's net income.

25. The project sponsors of the Pre-FSB Consent Project, in the period mid-2011 to June 2012, were the following people in the following positions, each of whom was either the Head of Retailer Solutions at the relevant time or a senior executive within that division:

(a) Greg White, at all relevant times until 30 September 2011, Managing Director - Retailer Solutions (which position, at all relevant times, included a directorship of GE Capital) and from 1 October 2011, Managing Director - Fleet and Equipment Finance. Mr White was formally appointed as a director of GE Capital between 30 March 2010 and 11 October 2011. At all relevant times, Mr White reported to the President and CEO;

(b) Rachel Cobb, at all relevant times until 2 October 2011, General Manager, Myer during which time she reported to Greg White, and from 3 October 2011, Managing Director - Retailer Solutions where she reported to John Malcolm (President and CEO). Ms Cobb was formally appointed as a director of GE Capital on 13 October 2011 and continues to hold that role; and

(c) Paul Varro, at all relevant times Head of Finance – Retailer Solutions, reporting to the Managing Director – Retailer Solutions (initially Greg White and subsequently Rachel Cobb).

Pre-FSB Consent Project documents and approvals

26. The business requirements for implementing the Pre-FSB Consent Project, including the requirements for the Activation Scripts, CLI Eligible Scripts and CLI Letters, were recorded in specification documents (specification documents) as follows:

(a) The draft versions of the Activation Scripts and CLI Eligible Scripts referred to in paragraphs 65-68 below, and the final version of the CLI Letters referred to in paragraphs 67 and 108 - 119 below, were outlined in a specification document titled “Project Fairer Simpler Banking (FSB) FS04-01 CLIPS Consent Interim Solution Process Business/Functional Specification” issued 15 November 2011 (the first specification document). In the case of the draft Activation Scripts and CLI Eligible Scripts, this was done by including an appendix titled "Appendix F:IVR Script Samples" which contained electronic copies of the draft Activation Scripts and the CLI Eligible Scripts;

(b) The draft Activation Scripts and CLI Eligible Scripts were also contained in a specification document titled “Project Fairer Simpler Banking (FSB) FS04-02 IVR Interim CLIPS Consent Solution Business/Functional Specification" issued 2 February 2012 (the second specification document).

27. There were several drafts of each of the first specification document and the second specification document. Agreed final versions of these documents for the purposes of the proceeding are at Appendices 26 and 33.

28. Each of the specification documents recorded the names of all "stakeholders" (approvers, recommendatory persons, contributors, enablers and general reviewers), and indicated whether each stakeholder was to be a "reviewer" and/or a "signatory". The specification documents were to be approved by the persons identified as "signatories" and who represented the various divisions of GE Capital. These signatories included:

(a) In relation to the first specification document, the following persons holding the following positions:

|

Name |

Department |

Title |

|

Adrian Caminiti |

Project Management Office |

Regulatory Program Manager |

|

Lorna Sneddon |

Product |

General Manager – Product and Card Direct |

|

Debra Kruse |

Legal |

Deputy General Counsel |

|

Scott French |

Compliance |

Head of Compliance – Consumer Lending |

|

David Gelbak |

Marketing |

Marketing Director |

|

Elise Heslop |

Marketing |

Marketing Leader |

|

Tracey Banson |

Credit Card Operations |

Process Improvement Leader |

(b) In relation to the second specification document, the following persons holding the following positions:

|

Name |

Department |

Title |

|

Adrian Caminiti |

Project Management Office |

Regulatory Program Manager |

|

Blessie Javellana |

Product |

Product Manager |

|

Debra Kruse |

Legal |

Deputy General Counsel |

|

Scott French |

Compliance |

Compliance Leader (Global Growth and Operations) |

|

Elise Heslop |

Marketing |

Marketing Leader |

|

Tracey Banson |

Credit Card Operations |

Process Improvement Leader |

|

Dale Sadler |

Business Solutions & Readiness |

Business Analyst Lead, FSB Project |

29. The specification documents and relevant approvals are described in further detail in paragraphs 64 to 70 and 90 to 96 below.

Development of the Pre-FSB Consent Project documents in the period up to September 2011

30. From mid-2011 to March 2012, GE Capital developed the Activation Scripts, the CLI Eligible Scripts and the CLI Letters.

31. On 1 August 2011, Debra Kruse (Deputy General Counsel) provided the following legal advice concerning the requirements to be met with respect to obtaining CCLI Consents from customers "on book" before 1 July 2012:

"This is what is required:

1. We must obtain express consent by no later than 30 June 2012 (no need for it to be written, but cannot be implied by failure to opt out)

…

What happens if the customer just does not respond to our request to provide consent, before 1 July 2012? In my view, we are entitled to continue ask for the consent as many times as we want to – up until 30 June 2012."

32. The advice was discussed by Ms Kruse with Ms Houston (Consumer and Product Manager), and set out in a memorandum emailed to Ms Houston and Adrian Caminiti (Regulatory Program Manager), which email was copied to Lorna Sneddon (General Manager – Product and Card Direct) and Scott French (Head of Compliance – Consumer Lending who reported to the Head of Compliance, GE Australia and New Zealand until on 9 January 2012 he was promoted to Compliance Leader (Global Growth and Operations), General Electric Australia and New Zealand and reported to the General Counsel, General Electric Australia and New Zealand).

33. Copies of Debra Kruse's email and memorandum, both dated 1 August 2011, are at Appendix 1.

34. In the period from August to early September 2011, GE Capital contemplated coupling requests for CCLI Consent with CLI Letters and with Credit Card activation. This was reflected in an email sent on 26 August 2011 by David Gelbak (Marketing Director) to Debra Kruse and Brendan Barrett (Product Manager), copied to Ms Sneddon, Mr Caminiti, Jonnathan Creet (Operations Project Lead), Elise Heslop (Marketing Leader) and Sonali Senaratna (Business Solutions Readiness Leader). David Gelbak (Marketing Director) stated: "…we all agreed with coupling express consent with CLIP offers prior to July 1, at D-Day we also agreed that coupling express consent with card activation represents a significant opportunity given the number of reissues we have before July."

35. A copy of Mr Gelbak's email is at Appendix 4.

36. In the period from August to early September 2011, GE Capital also contemplated an option to include a separate tick box in the CLI Letters by which a CLI Letter Cardholder could indicate consent to receiving CCLI Invitations. The intention was to seek a response from each customer as to whether they wanted to "opt-in" or "opt-out" of CCLI Invitations. This response was to be sought separately from any response concerning whether or not customers wanted to change the credit limit on their Credit Card.

37. The intention referred to in paragraph 36 above was reflected in various documents, including the following: