FEDERAL COURT OF AUSTRALIA

Australian Securities and Investments Commission v Newcrest Mining Limited [2014] FCA 698

FEDERAL COURT OF AUSTRALIA

Australian Securities and Investments Commission v Newcrest Mining Limited [2014] FCA 698

CORRIGENDUM

1. In paragraph 53 the first word “This” should be replaced with the word “The”, after the word “requirement” the text “in s 1317E(2)(e)” should be inserted, and after the words “not a contravention of a” the words “corporation/scheme” should be inserted.

| I certify that the preceding one (1) numbered paragraph is a true copy of the Corrigendum to the Reasons for Judgment herein of the Honourable Justice Middleton. |

Dated: 11 July 2014

| IN THE FEDERAL COURT OF AUSTRALIA | |

| AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff | |

| AND: | NEWCREST MINING LIMITED (ABN 20 005 683 625) Defendant |

| DATE OF ORDER: | |

| WHERE MADE: |

THE COURT DECLARES THAT:

1. The defendant (Newcrest) contravened section 674(2) of the Corporations Act 2001 (Cth) (‘the Act’) at and from 12.05pm on 28 May 2013 to 9.19am on 7 June 2013 by failing to notify the Australian Securities Exchange (‘the ASX’) that Newcrest management expected total gold production for financial year 2014 to be approximately 2.2 to 2.3 million ounces.

2. Newcrest contravened section 674(2) of the Act at and from 5 June 2013 to 9.19am on 7 June 2013 by failing to notify the ASX that Newcrest management expected Newcrest’s capital expenditure figure for financial year 2014 to be approximately AU$1 billion.

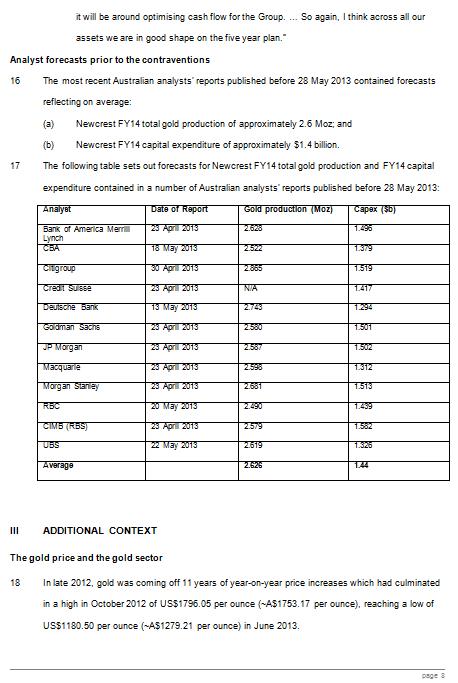

AND THE COURT ORDERS THAT:

3. Newcrest pay the Commonwealth a pecuniary penalty pursuant to section 1317G(1A) of the Act in respect of the first declared contravention of $800,000.

4. Newcrest pay the Commonwealth a pecuniary penalty pursuant to section 1317G(1A) of the Act in respect of the second declared contravention of $400,000.

5. Newcrest pay the plaintiff’s party and party costs of the proceeding.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

| VICTORIA DISTRICT REGISTRY | |

| GENERAL DIVISION | VID 292 of 2014 |

| BETWEEN: | AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff |

| AND: | NEWCREST MINING LIMITED (ABN 20 005 683 625) Defendant |

| JUDGE: | MIDDLETON J |

| DATE: | 2 JULY 2014 |

| PLACE: | MELBOURNE |

REASONS FOR JUDGMENT

BACKGROUND

1 In this proceeding, the Plaintiff (‘ASIC’) alleges against the Defendant (‘Newcrest’) two contraventions of s 674(2) of the Corporations Act 2001 (Cth) (‘the Act’) as follows:

(a) The defendant (Newcrest) contravened s 674(2) of the Act on and from 12.05pm on 28 May 2013 continuing until 9.19am on 7 June 2013 by failing to notify the Australian Stock Exchange (the ASX) that Newcrest management expected total gold production for financial year 2014 to be approximately 2.2 to 2.3 Moz (the total production information) (‘the First Contravention’).

(b) Newcrest contravened s 674(2) of the Act on and from 5 June 2013 continuing until 9.19am on 7 June 2013 by failing to notify the ASX that Newcrest management expected Newcrest’s capital expenditure figure for financial year 2014 to be approximately AU$1 billion (the capex information) (‘the Second Contravention’).

2 Newcrest admits both contraventions and consents to appropriate declarations being made, the imposition of pecuniary penalties and for it to pay ASIC’s costs of this proceeding.

3 ASIC and Newcrest jointly make submissions in relation to the disposition of these proceedings.

4 Agreed Statement of Facts and Admissions are annexed to these reasons as Annexure ‘A’.

5 On the basis that each contravention is “serious” for the purposes of s 1317G(1A)(c)(iii) of the Act, ASIC and Newcrest submit that the following proposed penalties are appropriate:

(a) $800,000 for the First Contravention; and

(b) $400,000 for the Second Contravention.

6 Not infrequently, a regulator and a company (or individual) may reach an agreement whereby the company concedes a contravention and the company and the regulator jointly propose a figure (or a range) as the appropriate penalty to be imposed by the court. The approach to be taken by the court in such circumstances has been the subject of some judicial consideration in recent years.

7 I have already considered the Court’s role in relation to joint submissions proposing penalties: see Australian Competition and Consumer Commission v Energy Australia [2014] FCA 336 at [113] to [152]. Other judges of the Court have adopted a similar approach: see for a recent example Australian Competition and Consumer Commission v Mandurvit Pty Ltd [2014] FCA 464 per McKerracher J.

8 Specifically, as to the Court’s role and the need to scrutinise agreed statements of facts and law, in Australian Competition and Consumer Commission v AGL Sales Pty Limited [2013] FCA 1030; at [40] to [44], I made the following observations:

(a) the Court must form its own opinion about the penalty, undertaking its constitutional role;

(b) in carrying out its constitutional role, statements of agreed fact may, as long as in the circumstances they are adequate, form a sound basis for a Court determination as to the appropriate orders to make, including as to penalty;

(c) there is a danger that the Court becomes blinkered by approaching the determination by reference to an agreed position;

(d) the Court should have an “overall view of the considerations relevant to the making of appropriate orders”;

(e) the Court has an “onerous responsibility” in determining appropriate orders;

(f) a court will necessarily rely heavily upon the parties, which will include the regulator, to “appropriately inform the court of all relevant matters for deliberation” and there are risks if “the parties do not put all relevant matters before the court”;

(g) a court will be “astute” to identifying whether or not the agreed facts and admissions “do not truly characterise the nature and event of the contravention”;

(h) in such circumstances the “trial judge can and should insist upon a ‘fuller and more realistic set of agreed facts’”, or proceed to hear the matter as a contested hearing.

9 As is clear from the authorities, the Court itself must determine the appropriate penalty in all the circumstances. This is not a process of ‘approving’ a settlement reached between the regulator and defendant. It may be convenient for parties to inform the public that for their part they have agreed upon what they consider be an appropriate outcome; but is by no means a ‘settlement’ that is being placed before the Court for its ‘approval’.

10 The parties have agreed certain facts and Newcrest has made certain admissions for the purposes of s 191 of the Evidence Act 1995 (Cth). I am satisfied that the agreed facts and admissions are sufficient for the Court to determine the appropriate relief to grant in this proceeding, and provide a sound and proper basis upon which to proceed to impose appropriate penalties: see generally Australian Competition and Consumer Commission v Avitalb Pty Ltd [2014] FCA 222; and Australian Competition and Consumer Commission v P&N Pty Ltd [2014] FCA 6. I do not consider I need any fuller set of agreed facts.

11 At the hearing, Earglow Pty Ltd (‘Earglow’) sought leave to participate in the proceeding as an intervener. Earglow has agreed to become a participant in proposed Part IVA proceedings which could raise related issues to this proceeding. Earglow did not seek to contest the appropriateness of the declarations and penalties sought by ASIC. Earglow wished the opportunity to place before the Court all relevant details as to when Newcrest first became aware of information which was materially different to information previously disclosed to the ASX concerning Newcrest’s expected total gold production for FY14 and its expected capex expenditure figure of FY14. I gave Earglow that opportunity, it not seeking to play any further role in this proceeding.

12 Earglow contended that the Court needed further information going back in time to the matters alleged in the two contraventions. It proposed that ASIC file evidence to address four questions:

(a) when did an officer, or officers, of Newcrest first become aware of information (relevant information) which was materially different to information previously disclosed to the ASX concerning:

(i) its expected total gold production for FY14; and

(ii) its expected capex expenditure figure of FY14?

(b) who was that officer(s)?

(c) what were the circumstances in which the officer or officers became aware of the relevant information?

(d) when was it apparent that the relevant information would have a material effect on the price or value of Newcrest securities (notwithstanding that at that time the financial impact of the relevant information could not be calculated)?

13 I do not regard this as necessary.

14 I am satisfied that the budget process (as described in detail in the agreed statement of facts) was ongoing, and the information contained therein was insufficiently definite. This is a factual characterisation, but one I consider can be definitely made on the basis of the agreed facts.

15 There is no dispute in this proceeding that there was a relatively lengthy budgeting process from May to early June 2013. The facts before the Court sufficiently describe that process, and demonstrate that up to the relevant time the information in the budgets did not need to be disclosed. This is not to say that information, in appropriate circumstances, generated for internal management purposes only, may not be protected from disclosure. It will all depend on the context. In this proceeding, the context has been sufficiently explained by the parties.

16 As is apparent from the agreed facts, the total production information and the capex information were management expectations as to production levels and capital expenditure. They were at all relevant times matters for the Board to determine. It was not information in the sense of an existing fact affecting Newcrest’s production capacity, but rather an expectation which was subject to Board deliberation and approval before it would come to fruition.

17 The relevant context is that Newcrest engaged in a process of planning its future production activities and related expenditure.

18 The plan, developed and recorded in drafts of the budget, had to be reviewed and approved by the Board before it was anything more than a proposal from management conveying their recommendation as to what Newcrest should do and spend in the future.

19 Management’s expectations necessarily related to a proposal that was incomplete in the sense that the budget had, as at 28 May, not been provided to the Board, and, at 5 June, had not been approved by the Board.

20 I then proceed to consider the appropriate relief to grant based upon the evidence before the Court.

STATUTORY PROVISIONS

21 It is important to recall the statutory setting of the continuous disclose regime.

22 The continuous disclosure regime is set out in Ch 6CA of the Act. Section 674(2) imposes a statutory obligation on listed companies whose securities are listed on the financial market known as “ASX”, and operated by ASX, to comply with Listing Rules of the ASX where the information required by the Listing Rules to be disclosed also meets the statutory requirements that it is price-sensitive and not already “generally available”.

23 Section 674(2) is a civil penalty provision (s 1317E) and provides as follows:

If:

(a) this subsection applies to a listed disclosing entity;

(b) the entity has information that those provisions require the entity to notify to the market operator; and

(c) that information:

(i) is not generally available; and

(ii) is information that a reasonable person would expect, if it were generally available, to have a material effect on the price or value of ED securities of the entity;

the entity must notify the market operator of that information in accordance with those provisions.

24 Newcrest is a “listed disclosing entity” to which s 674(2) applies and the relevant rules are the Listing Rules of the ASX.

25 In order for there to be a contravention of s 674(2), three criteria must be satisfied:

(a) the Listing Rules must require notification of the information to the ASX;

(b) the information must not be “generally available”; and

(c) the information must be price-sensitive, namely, it must be information that a reasonable person would expect, if it were generally available, to have a material effect on the price or value of enhanced disclosure securities (‘ED securities’) of the entity.

26 The determination of whether or not information is generally available is governed by s 676, which provides that:

(2) Information is generally available if:

(a) it consists of readily observable matter; or

(b) without limiting the generality of paragraph (a), both of the following subparagraphs apply:

(i) it has been made known in a manner that would, or would be likely to, bring it to the attention of persons who commonly invest in securities of a kind whose price or value might be affected by the information; and

(ii) since it was so made known, a reasonable period for it to be disseminated among such persons has elapsed.

(3) Information is also generally available if it consists of deductions, conclusions or inferences made or drawn from either or both of the following:

(a) information referred to in paragraph (2)(a);

(b) information made known as mentioned in subparagraph (2)(b)(i).

27 The concept of information having a “material effect on price or value” is also subject to further statutory elaboration. Section 677 provides that:

For the purposes of sections 674 and 675, a reasonable person would be taken to expect that information to have a material effect on the price or value of ED securities of a disclosing entity if the information would, or would be likely to, influence persons who commonly invest in securities in deciding whether to acquire or dispose of the ED securities.

28 There is no contravention of s 674 unless the Listing Rules require disclosure of the information.

29 Listing Rule 3.1 provides that:

Once an entity becomes aware of any information concerning it that a reasonable person would expect to have a material effect on the price or value of the entity’s securities, the entity must immediately tell ASX that information.

30 However, the continuous disclosure obligation in Listing Rule 3.1 is subject to exceptions set out in Listing Rule 3.1A. Relevantly, Listing Rule 3.1 does not apply to particular information while:

(a) one or more of the five situations set out in Listing Rule 3.1A.1 applies:

It would be a breach of a law to disclose the information;

The information concerns an incomplete proposal or negotiation;

The information comprises matters of supposition or is insufficiently definite to warrant disclosure;

The information is generated for the internal management purposes of the entity; or

The information is a trade secret; and

(b) the information “is confidential and ASX has not formed the view that the information has ceased to be confidential”; and

(c) “a reasonable person would not expect the information to be disclosed”.

31 The requirements in Listing Rule 3.1A are cumulative. Accordingly, if any of the conditions in Listing Rule 3.1A is no longer satisfied, Listing Rule 3.1 applies to require disclosure of the relevant information.

32 In this matter, absent the loss of confidentiality in the total production information and the capex information (which information is the subject of the First and Second Contraventions), Listing Rule 3.1 would not have required Newcrest to make any announcement of that information to the ASX. While management developed expectations in relation to those matters as drafts of the budget were prepared, its expectations of those matters, which were subject to final determination by the board, would not, in the circumstances of this proceeding, ordinarily be disclosed to the ASX. It is only because confidentiality in the total production information and the capex information was lost that the obligation arose to disclose those matters to the ASX.

33 There are agreed facts that confidentiality was lost:

(a) over the total production information, when Newcrest’s employee, Mr Spencer Cole had discussions with several analysts between 28 and 31 May 2013 and presented at the Gold Day conference in which he disclosed the total gold production information; and,

(b) over the capex information, when Mr Cole had discussions with analysts from two houses (RBC and Commonwealth Bank) on 5 June 2013 in which he disclosed the capex information.

34 Upon the loss of confidentiality, the exemption from disclosure previously afforded by Listing Rule 3.1A no longer applied and Newcrest was required to tell the ASX each piece of information.

PENALTY PROVISIONS

35 Section 674(2) of the Act is a civil penalty provision, contravention of which requires that the Court make a declaration of contravention (s 1317E)(1)). Section 674(2) is also a “financial services civil penalty provision” (s 1317DA), permitting the Court to impose a pecuniary penalty of up to $1,000,000 if the contravention (s 1317G)(1A)(c)):

(i) materially prejudices the interests of acquirers or disposers of the relevant financial products; or

(ii) materially prejudices the issuer of the relevant financial products or, if the issuer is a corporation or scheme, the members of that corporation or scheme; or

(iii) is serious.

36 ASIC alleges, and Newcrest accepts, that each contravention was “serious”.

37 It is relevant for the Court to assess the contravening conduct in light of the statutory provisions and the objectives sought to be served by the continuous disclosure regime.

38 The statutory and regulatory history of the continuous disclosure regime was considered and conveniently summarised by French J (as he then was) in Australian Securities and Investments Commission v Chemeq Ltd (2006) 58 ACSR 169 (‘Chemeq’).

39 In Chemeq at [43], French J (dealing with the Chapter 6CA regime) quoted from the 1991 report of the Australian Companies and Securities Advisory Committee, which set out the ways in which that committee considered a system of continuous disclosure would promote confidence in the integrity of the Australian capital markets.

40 The Committee considered that continuous disclosure would:

overcome the inability of general market forces to guarantee adequate and timely disclosure by disclosing entities;

encourage greater securities research by investors and advisors, ensuring that securities prices would more closely, and quickly, reflect underlying economic values;

ensure that equity and loan resources in the Australian market are more effectively channelled into appropriate investments and that funds are withheld or withdrawn from poorly performing disclosing entities, promoting capital market efficiency;

assist debt holders in monitoring performance of disclosing entities and thereby determine whether, or when, to exercise any right to withdraw or reinvest their loan funds, or convert debt to equity;

act as a further, or substitute, warning device for holders of charges over corporate assets, that breaches in covenants may have taken place, or the risk of default has increased;

assist potential equity or debt holders of disclosing entities to better evaluate their investment alternatives;

lessen the possible distorting effects of rumour on securities prices;

minimise the opportunities for insider trading or similar market abuses;

improve managerial performance and accountability by giving the market more timely indicators of corporate performance;

encourage the growth of information systems within disclosing entities, thereby assisting directors to make decisions and to comply with their fiduciary duties; and

reduce the time and costs involved in preparing takeover and prospectus documents.

THE CONTRAVENTIONS

41 I now turn briefly to the elements of the First and Second Contraventions.

The existence of “information” requiring disclosure under Listing Rule 3.1

42 There are agreed facts that:

(a) as at 28 May 2013, Newcrest was aware of the total production information; and

(b) as at 5 June 2013, Newcrest was aware of the capex information.

43 The information would not have been required to be disclosed (absent loss of confidentiality) because of Listing Rule 3.1A:

(a) as at 28 May 2013, Newcrest’s management was still working on the company’s draft Budget, and no draft Budget had yet been proposed by management to Newcrest’s board of directors (the budget was provided to the board in draft on 31 May 2013); and

(b) as at 5 June 2013, Newcrest’s board of directors had not yet considered and approved the draft Budget presented to it by management on 31 May 2013.

44 In the context of the budget process in this proceeding, I accept that the draft Budget was a work in progress.

45 There are also agreed facts that both the total production information and the capex information constituted information that “a reasonable person would expect to have a material effect on the price or value of the entity’s securities”.

46 At the time of the First Contravention, the reports of analysts indicated a consensus forecast gold production for FY14 in the order of 2.60 million ounces. The total production information was materially lower than this figure and was market sensitive. The relevant fall in price between 28 May 2013 and 6 June 2013, and in the days after 7 June 2013 was attributable (may be only in part) to statements regarding gold production in FY14 being disseminated following the briefings by Mr Cole and then to the ASX by Newcrest through its 7 June 2013 announcement.

47 The capex information was also market sensitive. In August 2012, Newcrest published a five year outlook for capital expenditure. A specific range of $1.8 to $2 billion was provided for FY13 and a bar chart set out a continuing decline (without specific numbers) over the years from FY14 to FY17. Later, in presentations given by Newcrest the same chart was provided, with an axis giving readers a more specific indication that capex in FY14 was likely to be between $1.3 and $1.5 billion, depending on whether or not approximately $215 million in contingent funding for the pre-feasibility Wafi-Golpu exploration project in Papua New Guinea was included. Although Newcrest’s public statements (particularly Mr Robinson’s remarks in the March Quarterly Q&A) suggested that capital expenditure was being closely scrutinised and might have been expected to decline, the specific figure of $1 billion was market sensitive, particularly in view of the company’s prior indications of the likely level of capital expenditure in FY14 and the analysts’ consensus forecast in the order of $1.4 billion.

The loss of confidentiality and loss of protection of Listing Rule 3.1A

48 Confidentiality over the total production information was lost when Mr Cole disclosed the substance of that information in a telephone call with Credit Suisse analysts at approximately 12.05pm on 28 May 2013. Mr Cole similarly disclosed the total production information in discussions with analysts and the audience at the Gold Day conference on 29, 30 and 31 May 2013. When the total production information ceased to be confidential, Listing Rule 3.1A no longer applied and notification to the ASX was accordingly required from that time. Mr Cole’s understanding that he was at liberty to disclose the total production information arose from a belief (on his part and that of his superior, Mr Warner) that the information had already been disclosed.

49 Confidentiality over the capex information was lost when Mr Cole disclosed this information to analysts from RBC and CBA on 5 June 2013. When the capex information ceased to be confidential, Listing Rule 3.1A no longer applied and notification to the ASX was accordingly required from that time.

The information was not “generally available” and was price-sensitive

50 The total production information and the FY14 capex information was confidential prior to Mr Cole’s disclosures referred to above. Neither piece of information was already “generally available” for the purposes of s 674(2)(c)(i) of the Act. Further, both pieces of information constituted information which a “reasonable person would expect, if it were generally available, to have a material effect on the price or value of the ED Securities” for the purposes of s 674(2)(c)(ii) of the Act.

The information was not notified to the ASX prior to 7 June 2013

51 Newcrest did not notify the ASX of either the total production information or the capex information prior to 7 June 2013.

DECLARATIONS OF CONTRAVENTION

52 Provided the Court is satisfied that the First and Second Contraventions occurred, it must make declarations of contravention pursuant to s 1317E(1). The declarations are required to specify:

(a) the Court that made the declaration;

(b) the civil penalty provision that was contravened;

(c) the person who contravened the provision;

(d) the conduct that constituted the contravention; and

(e) if the contravention is of a corporation/scheme civil penalty provision - the corporation or registered scheme to which the conduct related.

53 The requirement in s 1317E(2)(e) does not apply as breach of s 674(2) (being item 14 in the table in s 1317E(1)) is not a contravention of a corporation/scheme civil penalty provision under s 1317DA.

THE APPROPRIATE PENALTIES IN THIS CASE

54 Section 674(2) is a “financial services civil penalty provision” pursuant to s 1317DA(b). Accordingly, for each contravention, a pecuniary penalty may be imposed by the Court under s 1317G(1A) on the basis that Newcrest contravened a financial services civil penalty provision and a declaration of contravention has been made under s 1317E.

55 The maximum penalty for each contravention by Newcrest as a body corporate is $1,000,000 (s 1317G(1B)).

56 It is important to stress that as this is the maximum penalty currently considered appropriate by the legislature, the Court must assess, with this maximum penalty in mind, the possible range of conduct that may be involved in a contravention. In a circumstance where conduct is deliberate, undertaken at a high level of management, and there is no co-operation made with the regulator, then a penalty close to or at the maximum penalty of $1,000,000 may be appropriate. That is not this case.

The First and Second Contraventions were “serious”

57 Newcrest admits that the First and Second Contraventions were “serious” within the meaning of s 1317G(1A)(c)(iii) of the Act. I consider that the reference to a contravention being “serious” in subparagraph (iii) is a question of fact, and I accept the admission.

58 The First Contravention and the Second Contravention meet the statutory threshold of being serious contraventions for the following reasons:

(a) The First Contravention arises from the disclosure of information concerning Newcrest’s expected gold production in FY14, derived from the budget process. For resources companies, which do not typically publish earnings guidance, production estimates are market-sensitive. What Newcrest’s management expected gold production in FY14 to be was a sensitive piece of information, particularly in light of the surrounding circumstances including the discrepancy between analyst consensus forecasts and management expectations and the market’s, interest in how major gold miners such as Newcrest, would respond to the new, lower gold price environment.

(b) Although the loss of confidentiality over the total production information arose from Mr Cole and Mr Warner’s belief that they were able to disclose the total production information, Newcrest’s senior management was nevertheless put on notice early on 29 May 2013 that Mr Cole proposed to disclose the total production information to analysts when he met with them in Sydney and that the total production information had ceased to be confidential from 30 May 2013.

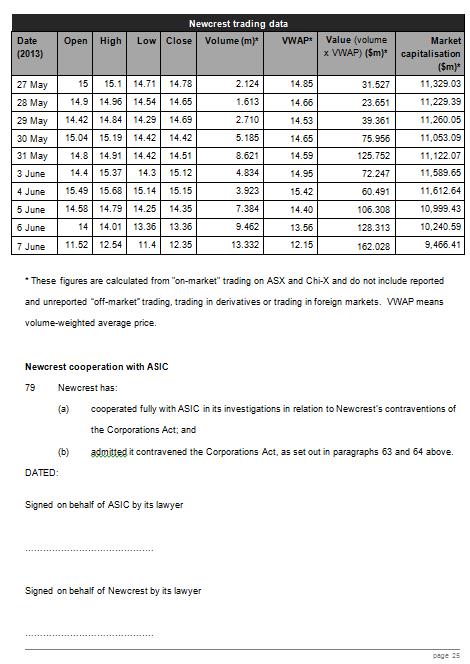

(c) During the period of the First Contravention over 40 million shares in Newcrest were traded on market with a total value of over $600 million (being the daily volume-weighted average price (‘VWAP’) multiplied by the volume of shares).

(d) Mr Cole disclosed the total production information to more than 10 firms of analysts or investors over a period of days. This was apt to create market “[s]peculation and rumour” and “to cause a loss of confidence in the market”: see Australian Securities and Investments Commission v Southcorp Ltd (No 2) (2003) 130 FCR 406 (‘Southcorp’) at [36].

(e) The Second Contravention was serious because Newcrest had made statements previously indicating a significantly higher capex figure for FY14 (which was reflected in analyst consensus) and because of Newcrest’s public statements commencing with the March Quarterly regarding a focus on free cash flow generation. Newcrest’s lowered capex expectations were significant to the market in an environment where maximising cash flow was paramount, and where there was a direct relationship between capital expenditure and the approach Newcrest was to take to production (in particular, processing stockpiles at Lihir).

Applicable principles in the assessment of penalty

59 The principles applicable to the assessment of civil penalties for breach of regulatory regimes have been considered in a number of cases, including (in the context of s 674(2)) the decision of French J in Chemeq at [90]. As his Honour there stated :

The pecuniary penalties which the Act applies are punitive in nature. Their character is not adequately described by the rather anodyne term ‘protective’ - Rich v Australian Securities and Investments Commission [2004] HCA 42; (2004) 220 CLR 129 at [35] - [37], [41] - [43] and [99]. Consistently with the characterisation as punitive the object of the penalties is general and specific deterrence. That is the deterrence of those who might be tempted not to comply with the law and the deterrence of the particular contravenor who might be tempted to re-offend - Australian Securities and Investments Commission v Donovan (1998) 28 ACSR 583 at 608 (Cooper J), Australian Securities and Investments Commission v Adler [2002] NSWSC 483; (2002) 42 ACSR 80 at 114 (Santow J).

60 There is an emphasis on specific and general deterrence in fixing civil penalties for contravention of regulatory provisions.

61 In fixing penalty, it is relevant to enquire whether the company has cooperated with the regulator and whether it has acknowledged contraventions. Where there has been cooperation and acknowledgement of wrongdoing, that bears upon the evaluation of the need for specific deterrence in fixing the level of the penalty. Further, it has also been recognised in many cases that, where contraventions are admitted, court resources have been saved and public resources (in the form of the regulators’ resources) then become available to be deployed in further regulatory activity.

Penalties imposed in other cases for contravention of s 674(2)

62 Whilst a court may be assisted by an awareness of the penalties imposed in other cases for contravention of the same provisions, the magnitude of a proposed penalty is fact-dependent. Nevertheless, three cases were brought to my attention involving contraventions of s 674(2): Chemeq, Southcorp, and Australian Securities and Investments Commission v Macdonald (No 12) (2009) 259 ALR 116; 73 ACSR 638 (‘Macdonald (No 12)’).

Australian Securities and Investments Commission v Chemeq (2006) 58 ACSR 169

63 In Chemeq, French J considered the penalties to be imposed for two contraventions of s 674(2) of the Act. At the time of the first contravention, the statutory maximum penalty was $200,000 but, at the time of the second contravention, the statutory maximum had been increased to $1,000,000. The parties jointly submitted, and French J accepted, that a penalty of $150,000 (equivalent to 75% of the maximum penalty) was appropriate for the first contravention and a penalty of $350,000 (equivalent to 35% of the statutory maximum) was appropriate for the second contravention.

64 The first contravention in Chemeq arose from the company’s failure to notify the ASX that the costs of constructing a commercial facility had increased from the originally budgeted $25 million to over $50 million. As is evident from the declarations in Chemeq, the company had knowledge of specific cost increases on various dates within a period of just over a year but failed to disclose that information to the ASX. While not disclosing information regarding the increased cost of the facility beyond the level initially announced, the company continued to make announcements concerning the progress of construction.

65 The second contravention in Chemeq arose from the company’s failure to tell the ASX information about the limited significance of a patent (which meant that the company’s commercial position had not been materially changed by the grant of that patent). The failure to disclose that information occurred against the backdrop of the company having made an announcement to the ASX that the patent had been obtained.

66 In considering the appropriateness of the penalties proposed by the parties, French J stressed, in finding that a penalty at the higher end of the range was appropriate for the first contravention:

(a) the importance of the construction of the relevant facility to the company, which could not produce commercial quantities of its product until that facility was complete;

(b) the context in which the information concerning construction costs was not disclosed, which included the public announcement of the original cost and the making of further announcements regarding the progress of construction (ie use of the ASX to announce good, but not bad, news);

(c) the contravention, while not the result of deliberate or reckless conduct, could not be dismissed as mere carelessness;

(d) the absence of effective compliance systems; and

(e) responsibility for the contraventions being found at the most senior levels of the company (directors and officers were kept informed of cost overruns and announcements concerning construction progress, but not cost overruns, were made).

67 The second contravention was less serious. The contravention arose from the company’s initial announcement regarding the patent overstating its significance, contributing to an increase of 58% in the market price of Chemeq’s shares. A corrective announcement was made two days later, but not until after a query was received from the ASX.

Australian Securities and Investments Commission v Southcorp Ltd (No 2) (2003) 130 FCR 406

68 In Southcorp, the company contravened s 674(2) when an employee sent an email to several analysts disclosing information about the company’s likely sales and gross profit during the 2003 financial year. The email was sent at about 4.29-4.30pm on 18 April 2002, and several analysts then issued updated reports before trade opened on 19 April. The company’s securities were placed in a trading halt (at the company’s request) at 1.07pm on 19 April. A corrective announcement was made after the market closed on 19 April. ASIC and Southcorp jointly submitted that a penalty of $100,000 was appropriate. At the time the maximum penalty was $200,000. The Court imposed a penalty at the proposed level.

Australian Securities and Investments Commission v Macdonald (No 12) (2009) 73 ACSR 638

69 In Macdonald (No 12), the Court considered the penalties to be imposed on two companies in the James Hardie group, JHIL and JHINV. Amongst other contraventions, JHIL was found to have contravened the former continuous disclosure provisions (s 1001A(2)) in February 2001 by negligently failing to notify the ASX of information concerning aspects of the restructure of the James Hardie group and its asbestos liabilities. ASIC did not seek pecuniary penalties against JHIL. The other company, JHINV, was found (again, amongst other contraventions) to have breached the new continuous disclosure provision, s 674(2), from late March to the end of June 2003 by failing to disclose to the ASX information concerning the transfer of JHIL out of the James Hardie group of companies.

70 In considering the pecuniary penalty to be imposed on JHINV, the Court determined that a pecuniary penalty of $80,000 would be imposed, negligent conduct being involved.

FACTORS CONSIDERED

71 I have taken the following significant factors into account in determining penalty.

Newcrest’s size and financial position

72 Newcrest is the one of the world’s largest gold mining companies. The financial position of Newcrest as at 30 June 2013 was as follows:

(a) total sales revenue was $3.775 billion;

(b) earnings before interest, tax, depreciation and significant items was $1.367 billion;

(c) net assets were $10.085 billion;

(d) number of issued shares was 766,510,971; and

(e) market capitalisation was approximately $7.565 billion (based on a closing price of $9.87).

73 It could be argued that even a $1,000,000 penalty for each contravention (the maximum this Court could impose) may not be sufficient specific deterrence, in view of Newcrest’s size and financial position. However, in considering penalty, as I have indicated, the Court must view the potential range of conduct that may occur, including mitigating factors. This is not a case where ASIC has alleged that Newcrest (the corporate defendant) knowingly or intentionally contravened its continuous disclosure obligations. I am also satisfied that Newcrest took its continuous disclosure responsibility seriously. Further, there is no suggestion that there was a systemic problem within Newcrest as to continuous disclosure obligations.

Market impact and prejudice to investors

74 During the period of the First Contravention:

(a) The volume of Newcrest shares traded on market was over 40 million shares; and

(b) The value of Newcrest shares traded on market was over $600 million (being the daily VWAP multiplied by the volume of shares traded).

75 The announcement that Newcrest expected gold production to be at a level which was materially lower than analysts’ consensus figures would have led to a fall in the share price.

76 In relation to the Second Contravention, disclosure of the capex information by itself would have had only a limited impact on the price of Newcrest’s shares. The price impact of disclosure of that information to the market by the 7 June announcement cannot be isolated from the price impact of the disclosure of other information by that announcement, including very significant asset impairments.

77 As price-falls referable to each piece of information were delayed by reason of the two contraventions, it may be inferred that some persons may have acquired securities in the period between 28 May (First Contravention) or 5 June (Second Contravention) and 7 June at a price that was higher than the price the securities would have traded at had the total production information been disclosed on 28 May and the capex information on 5 June. Disposers of shares in this period would not have suffered any damage as it is not suggested that the price of the securities was depressed in that period.

Impact on market integrity

78 Selective disclosure to analysts can generate confusion and a loss of faith in market integrity: other material information was also disclosed in the 7 June announcement, including significant asset impairments. Newcrest’s disclosures involved many of the large broker firms, created market “[s]peculation and rumour” (see Southcorp at [36]), during the period of the contravention from 28 May 2014 to the morning of 7 June 2014. This resulted in significant media attention following the 7 June announcement, which was apt to cause a loss of confidence in the market.

Compliance policies and procedures

79 Prior to the contraventions occurring, Newcrest had written policies and procedures to manage its continuous disclosure obligations. The continuous disclosure policy provided for the Head of Investor Relations to be the sole point of contact with analysts and investment advisers, on a day to day basis, subject always to the Managing Director and the Finance Director having authority to do so. Although the situation arose by reason of Mr Warner being located in New York, Mr Cole’s contact with analysts was not consistent with this aspect of Newcrest’s policy. Newcrest’s policy also provided that “[a]ll significant meetings and briefings conducted pursuant to the Investor Relations program must be attended by at least one Newcrest person in addition to the presenter so that the nature and content of what was discussed can be verified”, and required that a record be kept of all substantive discussions, meetings and briefings and placed on file with the Head of Investor Relations. These aspects of the policy were also not complied with.

80 After the events in question, Newcrest recognised the need to examine its continuous disclosure and investor relations processes and practices. Newcrest commissioned an independent review of its disclosure and investor relations policies and practices. Newcrest released the independent review to ASX on 5 September 2013, and has since made changes to its policies and procedures following the recommendations contained in the report. That process led to:

(a) the establishment of the Disclosure Committee (comprised of the Managing Director, Finance Director, General Counsel and Company Secretary, and Executive General Manager of External Affairs), which has delegated authority for making and executing disclosure decisions (save for matters expressly reserved to the board and approval of routine or incidental releases) and overseeing investor relations functions; and,

(b) the approval by the board on 13 February 2014 of revised and restructured policies, in the form of the publicly available Market Disclosure Policy and the internal Market Releases and Investor Relations Policy and Media and External Communications Policy.

The level of management involved and circumstances in which the contraventions occurred

81 Newcrest’s senior management was put on notice that Cole intended to disclose the total production information to analysts. Similarly, Newcrest’s senior management was put on notice that Cole had disclosed market sensitive information that was not public. ASIC does not allege that Newcrest knowingly or intentionally contravened its continuous disclosure obligations.

Cooperation with the regulator and the making of admissions

82 Newcrest has cooperated fully with ASIC in its investigations in relation to Newcrest’s contraventions and has admitted the First and Second Contraventions.

CONCLUSION

Penalty

83 I consider that a penalty of $800,000 for the First Contravention is appropriate. A penalty at that level lies towards the higher end of the scale of contraventions, while accepting that there are mitigating factors that make a penalty at the statutory maximum inappropriate.

84 As to the proposed penalty of $400,000 for the Second Contravention, at the hearing I raised with the parties whether this figure was appropriate or within the appropriate range. I am satisfied that the penalty of $400,000 is appropriate. The second contravention lies far lower on the scale than the First Contravention. It involved the disclosure of information that was less sensitive, the disclosure was only made to two analysts, the time between the contravention, the release of the 7 June announcement was shorter, and, senior management did not receive any emails that might have alerted Newcrest to the contravention at an earlier point in time.

85 I do consider the penalty reflects the importance of a system of continuous disclosure to promote confidence in the integrity of the Australian capital markets. It is particularly important to encourage the giving to the market timely indicators of corporate performance. Mindful that the maximum penalty is $1,000,000, and the mitigating factors in favour of Newcrest, I consider that $400,000 penalty is the appropriate penalty. This amount provides a general deterrence, whilst at the same time recognising the mitigating factors relied upon by Newcrest (and ASIC).

86 I have also considered the ‘totality principle’. I consider that the combined penalty of $1,200,000 for both Contraventions is appropriate in light of my consideration of the factors to take into account in assessing the overall conduct of Newcrest. It is important to recall the maximum penalty for the two contraventions is $2,000,000. Further, the penalty is in excess of any previously imposed for conduct under the continuous disclosure provisions.

87 Both penalties give appropriate weight to general deterrence as the primary consideration in fixing the penalty. These are significant penalties keeping in mind the maximum penalty available. The legislature has prescribed the maximum penalty. Within the confines of the maximum penalty of $1,000,000 for each contravention, the penalties are such to send a strong message to market participants to be mindful of the care and caution needed when interacting with analysts. These penalties also reinforce the message that equal access to market sensitive information is paramount in ensuring that markets operate on an informed, and equally informed, basis.

88 Therefore, for the foregoing reasons, I will make orders as follows:

THE COURT DECLARES THAT:

1. The defendant (‘Newcrest’) contravened section 674(2) of the Corporations Act 2001 (Cth) (‘the Act’) at and from 12.05pm on 28 May 2013 to 9.19am on 7 June 2013 by failing to notify the Australian Securities Exchange (‘the ASX’) that Newcrest management expected total gold production for financial year 2014 to be approximately 2.2 to 2.3 million ounces.

2. Newcrest contravened section 674(2) of the Act at and from 5 June 2013 to 9.19am on 7 June 2013 by failing to notify the ASX that Newcrest management expected Newcrest’s capital expenditure figure for financial year 2014 to be approximately AU$1 billion.

AND THE COURT ORDERS THAT:

3. Newcrest pay the Commonwealth a pecuniary penalty pursuant to section 1317G(1A) of the Act in respect of the first declared contravention of $800,000.

4. Newcrest pay the Commonwealth a pecuniary penalty pursuant to section 1317G(1A) of the Act in respect of the second declared contravention of $400,000.

5. Newcrest pay the plaintiff’s party and party costs of the proceeding.

| I certify that the preceding eighty-eight (88) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justice Middleton. |

Associate:

ANNEXURE ‘A’