FEDERAL COURT OF AUSTRALIA

Atkinson v Commissioner of Taxation [2015] FCAFC 18

IN THE FEDERAL COURT OF AUSTRALIA | |

First Appellant PETER PAALVAST Second Appellant | |

AND: | Respondent |

DATE OF ORDER: | 23 february 2015 |

WHERE MADE: |

THE COURT ORDERS THAT:

2. The appellants pay the costs of the appeal.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

NEW SOUTH WALES DISTRICT REGISTRY | |

GENERAL DIVISION | NSD 1280 of 2014 |

ON APPEAL FROM THE FEDERAL COURT OF AUSTRALIA |

BETWEEN: | PHILLIP GORDON ATKINSON First Appellant PETER PAALVAST Second Appellant |

AND: | COMMISSIONER OF TAXATION Respondent |

JUDGES: | FOSTER, YATES AND GLEESON JJ |

DATE: | 23 February 2015 |

PLACE: | SYDNEY |

REASONS FOR JUDGMENT

THE COURT:

1 This is an appeal from a decision of a single judge of this Court (Atkinson v Commissioner of Taxation [2014] FCA 1217) dismissing the appellants’ claim for damages against the respondent (“Commissioner”) with costs.

2 This appeal was heard immediately after the appeal in Wilmink v Westpac Banking Corporation [2015] FCAFC 17 (“Wilmink”).

3 Each case involves the same underlying issue, namely, whether a party receiving a particular document from a creditor can unilaterally alter that document to create a bill of exchange within the meaning of the Bills of Exchange Act 1909 (Cth) (“Act”).

4 In this case, the appellants argue that a purported bill of exchange entitles them to the following relief:

(1) A declaration that Mr Atkinson’s indebtedness to the Commissioner for an amount of tax of $112,500 has been discharged by law by operation of the Act;

(2) An order that the Commissioner pay $450,000 to the appellants.

Background to the appeal

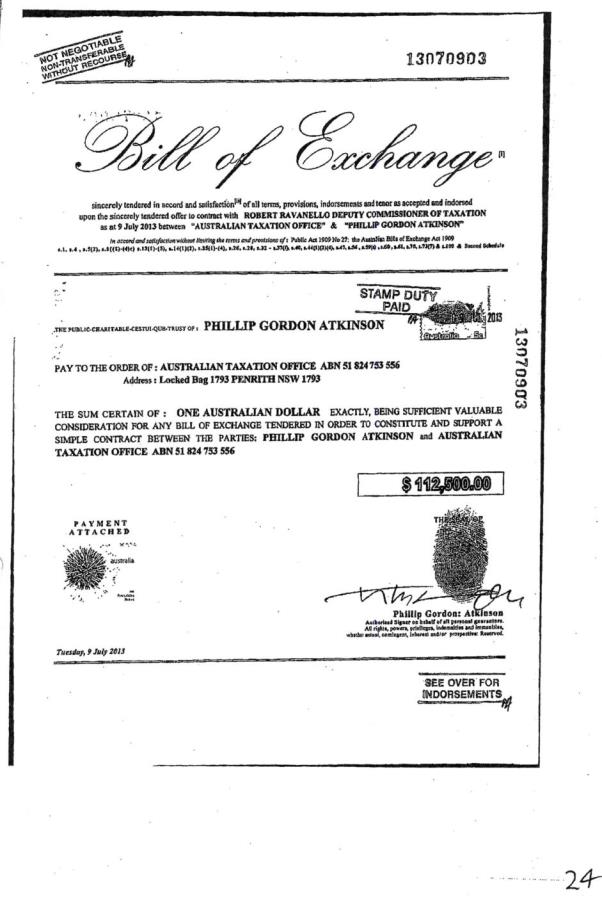

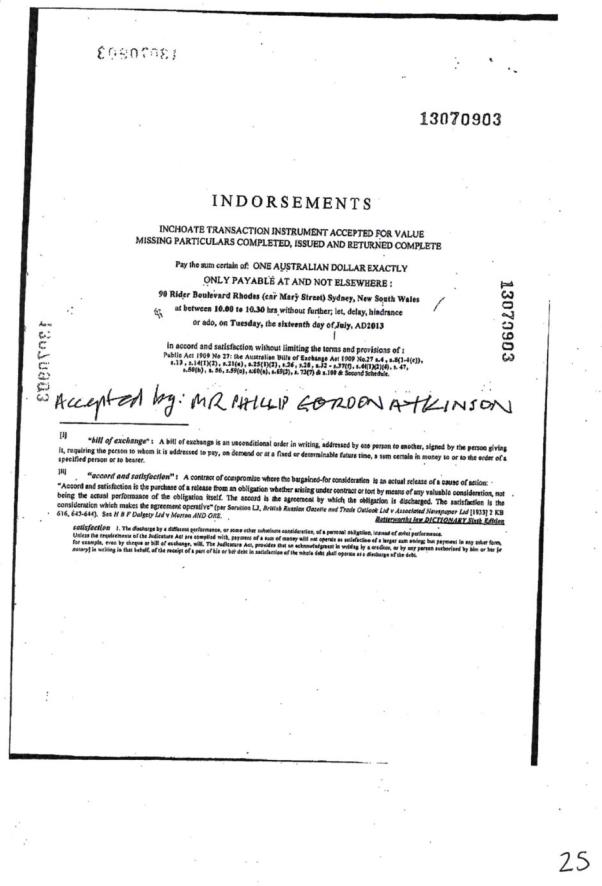

5 The Commissioner commenced debt recovery proceedings against the first appellant (“Mr Atkinson”) in the Local Court seeking tax owing in the amount of $99,608.46.

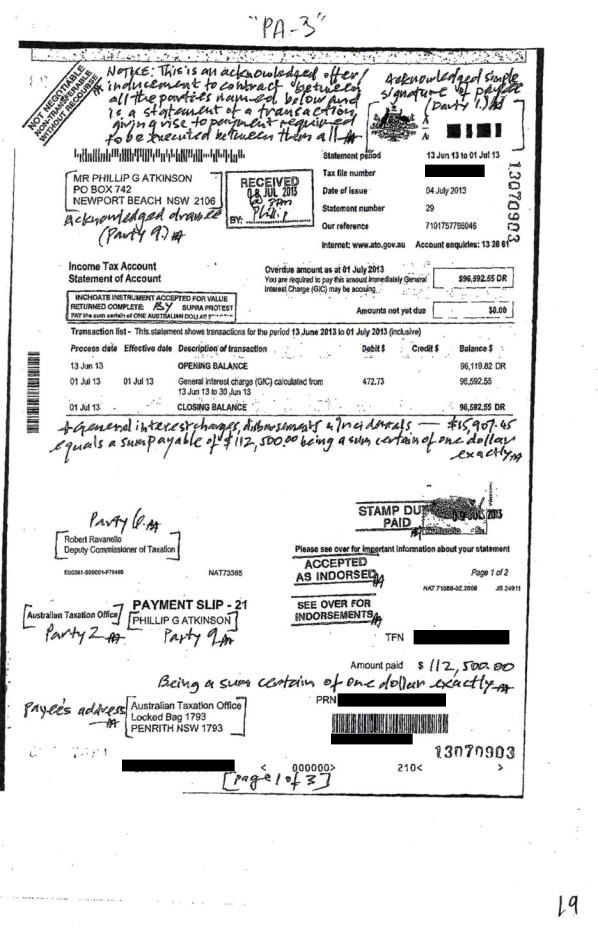

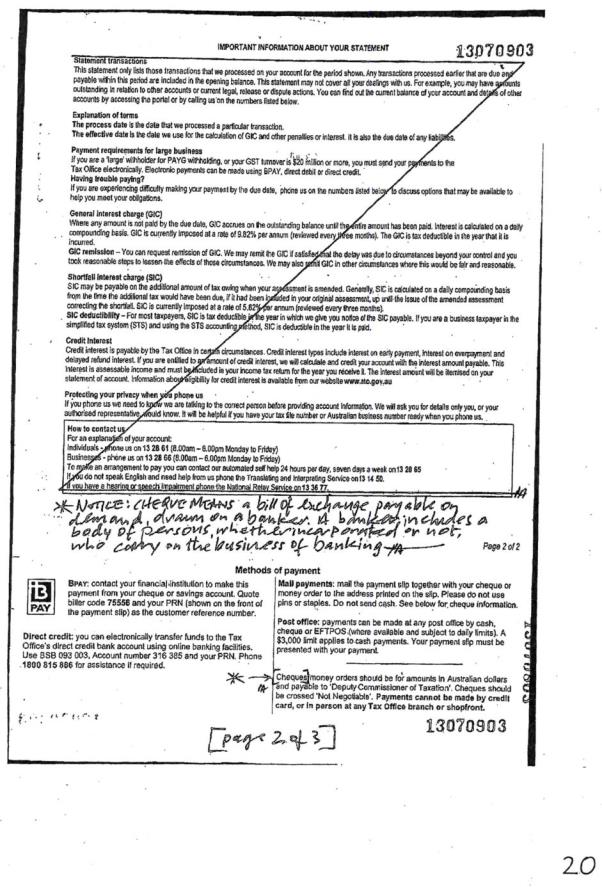

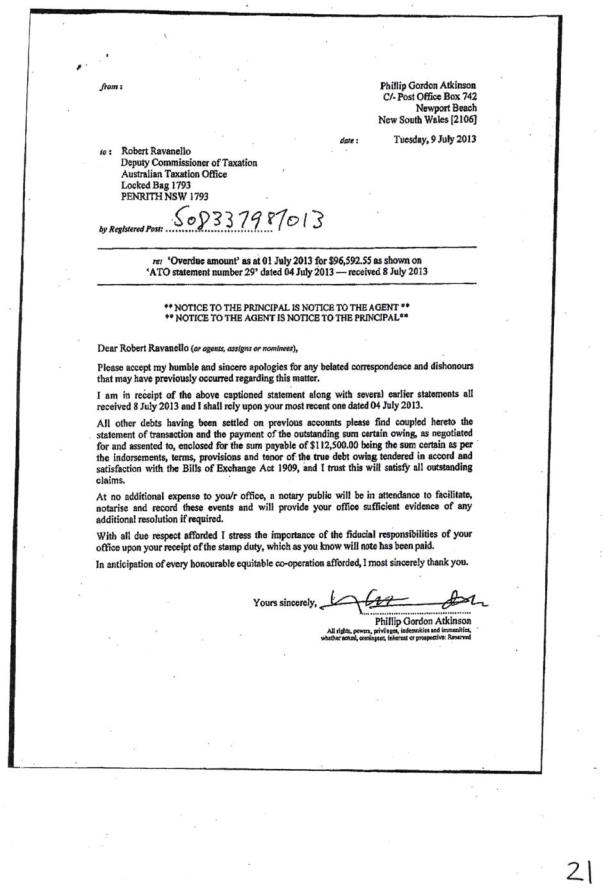

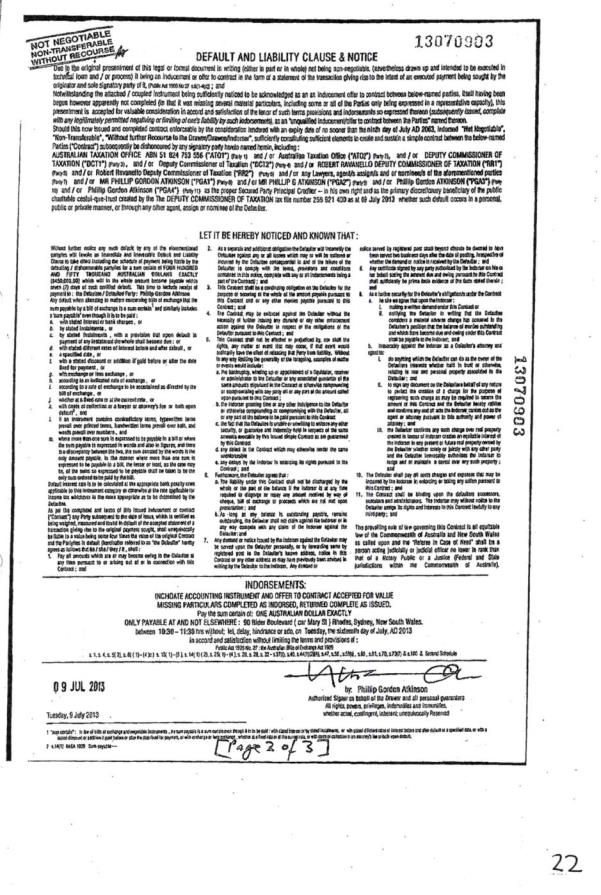

6 On 4 July 2013, the Australian Taxation Office (“ATO”) sent Mr Atkinson a statement of account in respect of his income tax debt. The statement required Mr Atkinson to pay immediately an amount of $96,592.55. The statement of account contained a payment slip at the bottom and, on the notes on the back, specified methods of payment being BPay, direct credit, mail payments of cheque or money order and post office payment by cash, cheque or EFTPOS.

7 On 7 July 2013, the ATO received from Mr Atkinson a purported bill of exchange. A copy of the bill is attached to our Reasons. The purported bill comprises several documents including the statement of account, to which alterations and additions were made by the affixing of certain stamps and by handwritten annotations; a letter from Mr Atkinson to the Deputy Commissioner of Taxation; a page entitled “Default and Liability Clause and Notice”; a page headed “Bill of Exchange” and a page headed “Indorsements”.

8 On 12 August 2014, the primary judge made an order pursuant to s 20A of the Federal Court of Australia Act 1976 (Cth) (“Federal Court Act”) that the proceedings be dealt with without an oral hearing because she was satisfied that the proceedings were frivolous or vexatious.

Primary judge’s reasons

9 Her Honour summarised the applicants’ case as follows (at [45]):

It is apparent that Mr Paalvast’s case depends on the proposition that the ATO, by sending a statement of account to [Mr Atkinson], engaged s 50(1) of the Act. [Mr Atkinson], then, it is said, had authority under that section to “fill up” the statement of account so that it became a complete bill of exchange. As the drawer of the bill of exchange, [Mr Atkinson], then limited (or negatived) his own liability in accordance with s 21. [Mr Atkinson] then delivered the filled up bill of exchange to the ATO. By some mechanism not apparent, by filling up the statement of account and purportedly making it a bill of exchange which ordered the recipient to pay the original amount owed to the ATO plus interest and other charges (totalling $112,500), delivering it to the ATO and the ATO not objecting thereto, the ATO defaulted in respect of some obligation said to arise and thereby became liable to [Mr Atkinson], (or, properly, to Mr Paalvast as an assignee from [Mr Atkinson]) in that amount.

10 She concluded that none of the propositions put by Mr Paalvast made sense, saying (at [47]):

The statement of account is not a bill of exchange as defined in s 8(1) of the Act. The first applicant was not authorised to do anything with the statement of account under the Act. Writing and putting various stamps on the statement of account had no legal effect under the Act. Nor did delivering that statement of account back to the ATO. The Act is simply not engaged at all by the facts of this case. The notion that a person who owes the ATO money for non-payment of tax can transform the ATO’s statement of account into a bill of exchange and then deliver the statement of account back to the ATO and, in so doing, discharge the person’s own indebtedness for some nominal amount ($1) and render the ATO liable to pay the original amount owed to the ATO plus interest and other charges is some form of fantasy, unconnected to the operation of the Act.

Grounds of appeal

11 The Notice of Appeal contains five grounds of appeal.

Ground 1: denial of procedural fairness

12 The appellants complain that they were denied procedural fairness because they were not given an opportunity to cross-examine the respondent’s witness.

13 The primary judge did not rely upon the respondent’s evidence to dismiss the proceeding. Accordingly, the appellants were not disadvantaged by not being allowed to cross-examine that individual and there was no relevant procedural unfairness.

Ground 2: paragraph 45 (first complaint)

14 The appellants complain that the primary judge erred in saying that Mr Paalvast’s case depended on the proposition that the ATO, by sending a statement of account to Mr Atkinson, engaged s 50(1) of the Act.

15 The basis for the complaint is that s 50 “does not apply at this point”. However, the originating process referred to s 50(1) and there is no doubt that the appellants’ success depended upon them demonstrating that s 50(1) applied to produce the result that the purported bill of exchange had been duly presented thereby discharging Mr Atkinson’s liability to the Commissioner. Her Honour plainly appreciated that the appellants first needed to demonstrate that there was a bill of exchange, having regard to her reference to s 8(1) of the Act at [38] of her Reasons, her observation (at [39] of her Reasons) that the other provisions on which Mr Paalvast relied depended upon there being a bill of exchange within the meaning of s 8 and her reference to s 25 at [42] of her Honour’s Reasons. Thus, the primary judge did not make any error in her appreciation of Mr Paalvast’s case in the first sentence of [45] of her Reasons.

Ground 3: paragraph 45 (second complaint)

16 The complaint is that her Honour erred in the second sentence of [45].

17 The complaint, as particularised in the Notice of Appeal, appears to be that the relevant authority was derived from s 25(1) of the Act rather than from s 50(1). We accept that her Honour made a mistake in her identification of the provision relied upon by the appellants for the alleged authority to “fill up” the statement of account.

18 However, for the reasons explained in our decision in Wilmink, the receipt of a document such as a statement of account did not confer any authority upon Mr Atkinson whether under s 25(1) of the Act, or otherwise, to “fill up” the statement of account so that it became a completed bill of exchange or to impose a liability upon the Commissioner to pay damages.

19 Her Honour’s mistake therefore does not involve appellable error.

Ground 4: paragraph 45 (third complaint)

20 The complaint is that her Honour erred in the third sentence of paragraph 45.

21 The appellants say that this finding is incorrect because Mr Atkinson “(as Drawer), after making an unconditional order in writing to pay a sum certain of money….. then signed and delivered the Bill of Exchange without indorsements coupled to the Statement of the Transaction”. The appellants’ submission presupposes that there was a bill of exchange but, for the reasons explained in Wilmink, no such bill of exchange was ever created. Therefore, this ground of appeal also fails.

Ground 5

22 Ground 5 is in the following terms:

Her Honour appears to have erred in Fact and in Law contrary to clear Submissions and Affidavits filed and relied upon by the Appellants. These Affidavits remaining unrebutted, having been either ignored or the correct meaning and import of the relevant clear, concise Statute and Sections of Law misunderstood. An Oral hearing would almost certainly have averted this and a number of other misapprehensions.

23 The appellants’ evidence was not “unrebutted” and their arguments about the meaning and import of the Act were not misunderstood. The primary judge correctly concluded that the appellants’ case did not make sense and that the Act was not engaged at all by the facts.

Written submissions provided at the hearing

24 At the hearing, the appellants submitted a five page written outline of argument, addressing three issues, namely:

(1) The effect of s 50 of the Act and the steps asserted to “enliven” that section;

(2) The effect of s 20A(2) of the Federal Court Act; and

(3) The claim that, following the discharge of the purported bill of exchange, a right to damages arose under the Default and Liability Clause of the purported bill of exchange.

25 As to issue (1), although nine steps are identified, it is not necessary to go beyond step 2 which reads:

[Mr Atkinson] recognised that [the statement of account] was (in terms of Section 25) an incomplete document inter alia in respect of there being no Sum Certain apparent on its face. This fact then permitted [Mr Atkinson] observing the document was missing several material particulars proceeded to add (fill up as per Section 25(1)&(2) these material particulars) by virtue of Section 25 and he added by indorsement a number of particulars by hand as evident on the face and rear of the Statement of Account document.

26 The language of “incomplete document” does not appear in s 25 of the Act. In order to invoke s 25, Mr Atkinson did not need an “incomplete document”. He needed a “simple signature on a blank stamped paper stamped with an impress duty stamp… delivered by the signer in order that it may be converted into a bill”. The statement of account did not answer that description. Accordingly, Mr Atkinson was not able to invoke s 25.

27 As to issue (2), the appellants contended that “none of the possible justifications for obviating an oral hearing afforded by Section 20A(2) apply” having regard to the following three matters:

(1) The question of who ends up owning a property worth over $400,000 is not frivolous. “And it is not vexatious in any wise recognised in Law which clearly requires there must be a repetition, without grounds, usually on several occasions before a litigant or a proceeding may properly be held to be (serially) vexatious”;

(2) There is no authoritative case law on the issues raised by the appellants before the primary judge;

(3) The failure to afford an oral hearing led the primary judge to misapprehend the sequence of events and misconstrue the legislation.

28 The question of who ends up owning a property worth over $400,000 is not an issue in the proceeding. The appellants’ case being hopeless, there is no basis for claiming that the ownership of any property was ever at stake. The proceeding is “frivolous” in the sense that no reasonable person could properly treat it as genuine and contend that he had a grievance which he was entitled to bring before the Court: cf Norman v Mathews (1916) 85 LJKB 857 at 859.

29 As the appellants’ submissions implicitly recognised, a single proceeding can be “vexatious”. Section 37AM of the Federal Court Act defines “vexatious proceeding” to include:

(a) a proceeding that is an abuse of the process of a court or tribunal; and

(b) a proceeding instituted in a court or tribunal to harass or annoy, to cause delay or detriment, or for another wrongful purpose; and

(c) a proceeding instituted or pursued in a court or tribunal without reasonable ground; and

(d) a proceeding conducted in a court or tribunal in a way so as to harass or annoy, cause delay or detriment, or achieve another wrongful purpose.

30 The proceeding below was vexatious and this appeal is vexatious, at least in the sense that the claims made therein have been pursued without reasonable ground. The proposition that there is “no authoritative case law” on the issues raised has no weight because no reasonable person could properly treat those issues as genuine.

31 For the reasons given earlier, we reject the contention that the primary judge was under any misapprehension which caused her to make any error of fact or law. An oral hearing could not have advanced the appellants’ case and would have exacerbated the vexatious nature of the proceeding.

32 Issue (3) does not arise in the absence of a bill of exchange.

Costs

33 The appeal will be dismissed with costs.

Other matters

34 We repeat the matters set out at [47] to [48] of our Reasons in Wilmink.

35 The position is particularly serious in this case because the first appellant has sought, by the stratagem described above, to deny an existing liability to pay tax to the Commonwealth and to put the Commonwealth to the unwarranted expense of defending the proceedings, at the ultimate cost of taxpayers. A question arises as to whether the appeal has been pursued for the wrongful purpose of avoiding the payment of tax liabilities.

36 The Court will refer these proceedings to the Registrar of this Court to consider whether to apply for a vexatious proceedings order.

I certify that the preceding thirty-six (36) numbered paragraphs are a true copy of the Reasons for Judgment herein of the Honourable Justices Foster, Yates and Gleeson. |

Associate: